Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Allegiant Travel CO | a2220506z8-k.htm |

QuickLinks -- Click here to rapidly navigate through this document

EXCERPTS FROM PRELIMINARY PROSPECTUS SUPPLEMENT

Excerpt from "Prospectus Summary"

Recent Developments

During the first two months of second quarter 2014 (the period from April 1, 2014 through May 31, 2014), we generated approximately $178.9 million in total revenue and $28.1 million in operating income compared to $160.8 million of total revenue and $23.0 million of operating income for the same period in 2013. During the first two months of second quarter 2014, the number of our scheduled service passengers carried increased by 11 percent over the same period in 2013. Our scheduled service available seat miles ("ASMs") increased by 5.6 percent over the same period of the prior year on a 10.1 percent increase in scheduled service departures and a 3.9 percent decrease in scheduled service average stage length. As a result, our scheduled service load factor was essentially flat, 88.8 percent in the first two months of second quarter 2014 compared to 88.9 percent in the same period in 2013. We estimate our total revenue per scheduled service ASM during the first two months of second quarter 2014 to be up 5.7 percent over the same period in 2013. We estimate our CASM for the first two months of second quarter 2014 to have increased approximately 3.9 percent over the same period in 2013. All revenue and cost numbers for the quarter to date period are preliminary and are subject to adjustment based on quarter end reconciliations. In addition, the financial results for our two months ended May 31, 2014 may not be indicative of our actual results for the second quarter ending June 30, 2014. Our actual results for the second quarter ending June 30, 2014 may differ materially from these results due to the completion of our financial closing procedures, final adjustments and other developments that may arise between now and quarter end.

The below financing transactions (the "Second Quarter Finance Transactions") would have materially impacted our March 31, 2014 balance sheet had they occurred in the first quarter of 2014.

In April 2014, we prepaid in full the $121.1 million balance of our secured term loan due in March 2017. At the same time, we borrowed $45.3 million secured by 53 MD-80 aircraft under an amortizing variable rate note due in installments through April 2018, when a balloon payment would be due. In April and May 2014, we also prepaid the $8.5 million balance of a secured note originally due in June 2016.

In May 2014, we borrowed $40.0 million secured by all of our Boeing 757 aircraft under an amortizing variable rate note due in installments through May 2018 when a balloon payment would be due.

See "Capitalization" for further detail of the effect of the Second Quarter Finance Transactions.

Contemplated Aircraft Transactions

We have entered into separate agreements to acquire the ownership interests in special purpose companies owning twelve Airbus A320 series aircraft currently on lease to a European carrier until 2018 (the "SPC Aircraft Acquisitions"). The purchase price for these aircraft is estimated to be approximately $236.1 million of which approximately $142.0 million will be by assumption of debt secured by the aircraft. The closing of each of the acquisitions is not conditioned upon the closing of the other acquisitions and such closings may occur at various dates in the future. A portion of the proceeds from the sale of the notes offered hereby will be used to fund the cash portion of the purchase price of each of these aircraft (estimated to be approximately $94.2 million if we close all twelve purchases in the second quarter of 2014 as currently planned). The total purchase price for the SPC Aircraft Acquisitions and the respective amounts to be paid in cash or through debt assumption will be subject to adjustment based on the timing of each of the transactions. Our intention is to bring

1

these aircraft into our operating fleet upon the expiration of the current leases in 2018. During the term of the leases of these aircraft, we currently anticipate we would recognize other revenue of approximately $30.8 million per year from operating lease payments under the existing leases if we close all twelve purchases.

We have also entered into purchase agreements or letters of intent to purchase an additional 12 Airbus A320 series aircraft. These include two aircraft already on lease to us, six aircraft we had previously contracted to lease in the future, two aircraft under previously announced purchase agreements and two additional aircraft under contracts entered into in 2014. Other than those two aircraft already in our possession and one aircraft to be purchased in 2016, we expect these aircraft to be purchased by us in 2014 and 2015. The total purchase price and estimated induction costs for the 11 aircraft to be purchased in 2014 and 2015 are estimated to be approximately $213.1 million. We intend to use a portion of the net proceeds from the sale of the notes offered hereby together with cash on hand to acquire these aircraft.

The closings of the transactions contemplated by the letters of intent referred to above are subject to definitive documentation and closing conditions which may not be satisfied. In addition, the closing of the acquisition of the aircraft under purchase agreements are subject to customary closing conditions, which may not be satisfied. The issuance of the notes offered hereby is not contingent on the closing of these transactions.

Excerpts from "Summary Financial and Operating Data"

| |

Three Months ended March 31, |

Year ended December 31, | Twelve Months ended March 31, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013

|

2014

|

2011

|

2012

|

2013

|

2014

|

|||||||||||||

| |

(unaudited) |

|

|

|

(unaudited) |

||||||||||||||

| |

(in thousands) |

||||||||||||||||||

OTHER FINANCIAL DATA |

|||||||||||||||||||

EBITDAR(2) |

69,701 | 85,275 | 128,529 | 190,089 | 234,115 | 249,687 | |||||||||||||

EBITDA(2) |

69,398 | 75,846 | 127,428 | 190,089 | 224,888 | 231,334 | |||||||||||||

Total Lease Adjusted Debt(3) |

153,775 | 150,852 | 298,888 | 357,808 | |||||||||||||||

As Further Adjusted EBITDAR(4) |

279,627 | ||||||||||||||||||

As Further Adjusted EBITDA(4) |

261,274 | ||||||||||||||||||

As Further Adjusted Interest Expense(4) |

27,295 | ||||||||||||||||||

As Further Adjusted Cash, Cash Equivalents and Investments(1)(4) |

524,421 | ||||||||||||||||||

As Further Adjusted Total Debt(4) |

627,211 | ||||||||||||||||||

As Further Adjusted Lease Adjusted Debt(3)(4) |

755,680 | ||||||||||||||||||

Ratio of As Further Adjusted Total Debt / As Further Adjusted EBITDA(4) |

2.40x | ||||||||||||||||||

Ratio of As Further Adjusted Net Debt / As Further Adjusted EBITDA(4)(5) |

0.39x | ||||||||||||||||||

Ratio of As Further Adjusted EBITDA / As Further Adjusted Interest Expense(4) |

9.57x | ||||||||||||||||||

- (2)

- "EBITDA" represents earnings before interest expense, income taxes, depreciation and amortization. "EBITDAR" represents EBITDA plus aircraft lease rentals. EBITDA and EBITDAR are not calculations based on generally accepted accounting principles and should not be considered as alternatives to net income (loss) or operating income (loss) as indicators of our financial performance or to cash flow as measures of liquidity. In addition, our calculation may not be comparable to other similarly titled measures of other companies. EBITDA and EBITDAR are included as supplemental disclosures because we believe they are useful indicators of our operating performance. We use EBITDA and EBITDAR to evaluate our operating performance and liquidity and they are among the primary measures used by management for planning and forecasting of future periods. We believe the presentation of these measures is relevant and useful for investors because it allows investors to view results in a manner similar to the method used by management and makes it easier to compare our results with other companies that have different financing and capital structures.

2

- •

- EBITDA and EBITDAR do not reflect our capital expenditures, future requirements for

capital expenditures or contractual commitments to purchase capital equipment;

- •

- EBITDAR does not reflect amounts paid to lease aircraft;

- •

- EBITDA and EBITDAR do not reflect interest expense or the cash requirements

necessary to service principal or interest payments on our debt;

- •

- although depreciation and amortization are non cash charges, the assets that we

currently depreciate and amortize will likely have to be replaced in the future, and EBITDA and EBITDAR do not reflect the cash required to fund such replacements; and

- •

- other companies in our industry may calculate EBITDA and EBITDAR differently than

we do, limiting their usefulness as comparative measures.

The following represents the reconciliation of net income to EBITDA and EBITDAR for the periods indicated below.

EBITDA and EBITDAR have important limitations as analytical tools. These limitations include the following:

| |

Three Months ended March 31, |

Year ended December 31, | Twelve Months ended March 31, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013

|

2014

|

2011

|

2012

|

2013

|

2014

|

|||||||||||||

| |

(unaudited) |

|

|

|

(unaudited) |

||||||||||||||

| |

(in thousands) |

||||||||||||||||||

EBITDA & EBITDAR |

|||||||||||||||||||

Reconciliations: |

|||||||||||||||||||

Net income attributable to Allegiant |

$ | 31,932 | $ | 34,222 | $ | 49,398 | $ | 78,597 | $ | 92,273 | $ | 94,563 | |||||||

Plus (minus): |

|||||||||||||||||||

Interest expense, net |

1,926 | 2,923 | 5,939 | 7,756 | 8,450 | 9,447 | |||||||||||||

Income tax expense |

18,648 | 20,270 | 30,116 | 46,233 | 54,901 | 56,523 | |||||||||||||

Depreciation and amortization |

16,892 | 18,431 | 41,975 | 57,503 | 69,264 | 70,803 | |||||||||||||

EBITDA |

$ | 69,398 | $ | 75,846 | $ | 127,428 | $ | 190,089 | $ | 224,888 | $ | 231,334 | |||||||

Plus: |

|||||||||||||||||||

Aircraft lease rentals |

303 | 9,429 | 1,101 | — | 9,227 | 18,353 | |||||||||||||

EBITDAR |

$ | 69,701 | $ | 85,275 | $ | 128,529 | $ | 190,089 | $ | 234,115 | $ | 249,687 | |||||||

EBITDA |

231,334 |

||||||||||||||||||

Pro forma Net Revenue from SPC Aircraft Acquisitions |

29,940 | ||||||||||||||||||

As Further Adjusted EBITDA |

261,274 | ||||||||||||||||||

Aircraft Lease Rentals |

18,353 | ||||||||||||||||||

As Further Adjusted EBITDAR |

279,627 | ||||||||||||||||||

- (3)

- Lease adjusted debt equals the amount of total debt as of the end of the period plus seven times the amount of lease rental expense during the period. We use lease adjusted debt to illustrate the amount of debt we would have had if aircraft lease rental expense were considered to be debt based on a multiple of seven times the amount of aircraft lease rental expense in the applicable period. The following is a reconciliation of lease adjusted debt to the most directly comparable GAAP measure, which we believe is total debt.

| |

As of December 31, | As of March 31, 2014 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

2011

|

2012

|

2013

|

||||||||||

| |

|

|

|

(unaudited) |

|||||||||

Total long-term debt |

146,069 | 150,852 | 234,300 | 229,339 | |||||||||

Aircraft lease rental expense x7 |

7,706 | — | 64,588 | 128,469 | |||||||||

| | | | | | | | | | | | | | |

Lease Adjusted Debt |

153,775 | 150,852 | 298,888 | 357,808 | |||||||||

Increase in Debt from Second Quarter Finance Transactions, SPC Aircraft Acquisitions and notes offered hereby |

397,872 | ||||||||||||

As further adjusted lease adjusted debt |

755,680 | ||||||||||||

- (4)

- The as further adjusted data gives effect to the Second Quarter Finance Transactions, the SPC Aircraft Acquisitions, the issuance of the notes offered hereby (after underwriting discounts and other estimated fees and expenses associated with this offering) and the use of net proceeds therefrom. The net proceeds from the sale of the notes are estimates only. In determining as further adjusted EBITDAR, EBITDA and interest expense, we have given pro forma effect to the other revenue and related administrative expenses we would have recognized in the twelve-month period ended March 31, 2014 had the SPC Aircraft Acquisitions been closed as of the beginning of such period or, if later, the date as of which each aircraft was acquired by the respective entity and the amount of

3

interest expense we estimate we would have recognized during such period under the debt from the Second Quarter Finance Transactions, under the debt assumed as part of the SPC Aircraft Acquisitions and under the notes offered hereby, as if all of such debt had been in effect since the beginning of such twelve-month period or, if later, the date as of which debt was incurred on aircraft acquired by the respective entity. In determining as further adjusted cash, cash equivalents and investments, total debt, net debt and lease adjusted debt as of March 31, 2014, we have given pro forma effect to the Second Quarter Finance Transactions, the SPC Aircraft Acquisitions, the offering of the notes hereby and the use of net proceeds therefrom as if closed on March 31, 2014. The as further adjusted financial data included in this prospectus supplement is for illustrative purposes only and does not purport to represent or be indicative of what our financial results or financial condition would have been had the Second Quarter Finance Transactions and SPC Aircraft Acquisitions been closed and the notes been issued on the dates indicated.

We use "as further adjusted EBITDAR," "as further adjusted EBITDA," "as further adjusted cash, cash equivalents and investments," "as further adjusted interest expense," "as further adjusted total debt" and "as further adjusted lease adjusted debt" to illustrate how each of these measures would have been calculated based on our actual performance during the twelve months ended March 31, 2014 and giving pro forma effect to the Second Quarter Finance Transactions, the SPC Aircraft Acquisitions, the notes offered hereby and the use of net proceeds therefrom as indicated above. A reconciliation of net income to "as further adjusted EBITDA" and "as further adjusted EBITDAR" for the twelve months ended March 31, 2014 is included in footnote 2 above. The reconciliation of "as further adjusted cash, cash equivalents and investments" and "as further adjusted debt" are reflected in the capitalization table. See "Capitalization." The reconciliation of "as further adjusted lease adjusted debt" is included in footnote 3 above.

The following represents the reconciliation of "as further adjusted interest expense" to the most comparable GAAP measure for the twelve months ended March 31, 2014:

| |

Twelve months ended March 31, 2014 |

|||

|---|---|---|---|---|

Reconciliation |

||||

Interest expense, net (actual) |

$ |

9,446 |

||

Plus: Pro forma additional interest expense from Second Quarter Finance Transactions, SPC Aircraft Acquisitions and the notes offered hereby |

17,849 | |||

| | | | | |

As further adjusted interest expense |

$ | 27,295 | ||

A one-eighth of one percent change in the interest rate associated with the notes offered hereby would result in an additional annual interest expense (if the interest rate increases) or a reduction to annual interest expense (if the interest rate decreases) of approximately $0.4 million.

- (5)

- Net debt is equal to our total debt, including current maturities, less cash, cash equivalents and investments (excluding restricted cash) as of March 31, 2014.

Excerpts from "Risk Factors"

Increased labor costs could result in the long-term from unionization and labor-related disruptions.

Labor costs constitute a significant percentage of our total operating costs. In general, unionization has increased costs in the airline industry. We have three employee groups (pilots, flight attendants and flight dispatchers) who have elected union representation. We are currently in negotiations for initial collective bargaining agreements with the unions representing each of these employee groups.

The International Brotherhood of Teamsters ("IBT") was elected, and certified by the National Mediation Board ("NMB"), to represent Allegiant Air's pilots in August 2012. Collective bargaining negotiations commenced in December 2012. In November 2013, IBT commenced an action in federal court on behalf of the pilots claiming that we unilaterally changed existing work rules in violation of the Railway Labor Act ("RLA"). The suit focuses in large part on our implementation of a new flight crew scheduling system to comply with revised Federal Aviation Administration ("FAA") pilot flight, duty and rest regulations that became effective in January 2014. The proceeding seeks injunctive and make-whole relief requiring us to return to the "status quo" as it existed before the implementation of the FAA compliant work rules pending negotiations on this issue and other collateral issues. See "Business—Legal Proceedings." A hearing on IBT's motion for a preliminary injunction was held in early June 2014. After this hearing, the court preliminarily indicated in a request for supplemental

4

briefing that it is inclined to issue an injunction requiring us to make certain changes to our policies to be consistent with prior practices with the pilots, including as-of-yet unspecified changes to our FAA compliant crew scheduling system. Although this indication by the court is not yet included in any final order, we do not believe we would be materially adversely affected by an injunction in the form suggested by the court. However, there are inherent risks in any litigation, and there could be material consequences if an injunction is issued which imposes greater obligations on us or if other relief is granted.

Regardless of the outcome of the IBT proceeding, if we are unable to reach agreement on the terms of collective bargaining agreements in the future, or we experience wide-spread employee dissatisfaction, we could be subject to work slowdowns or stoppages. Any of these events could have an adverse effect on our operations and future results.

The supply of pilots to the airline industry may be limited.

On July 8, 2013, as was directed by the U.S. Congress, the FAA issued more robust, new pilot qualification standards, granting recognition of historical FAA and airline industry crew member flight training standards. With the application of the new rules, the supply of qualified pilot candidates eligible for hiring by the airline industry has been dramatically reduced. If, we are unable to secure the services of sufficient eligible pilots to staff our routes, our operations and financial results could be materially affected.

New student pilot certificates have decreased dramatically, especially in the past three years, and subsequently the pool of eligible pilots qualified to be new hires into the airline industry has been diminishing significantly. In addition, the major network air carriers have done only minimal pilot hiring in the past several years because of the industry capacity reduction following the events of September 11, 2001, the most recent economic recession that began in the fall of 2008, and the increase in statutory mandatory retirement age for pilots from age 60 to age 65. Due to revised pilot duty time rules that became effective in January 2014, there has been an acceleration of pilot staffing in recent months. Also effective January 2014, mandatory pilot retirement rules will again begin to force major network carriers to hire replacement pilots.

The current pilot shortage may increase training costs and we may not have enough pilots to conduct our operations. The lack of qualified pilots to conduct our operations would negatively impact our operations and financial condition.

Excerpt from "Capitalization"

CAPITALIZATION

The following table sets forth our consolidated cash, cash equivalents and investments and capitalization as of March 31, 2014:

- •

- on an actual basis;

- •

- on an as adjusted basis to give effect to the Second Quarter Finance Transactions; and

- •

- on an as further adjusted basis to also give effect to the SPC Aircraft Acquisitions and the issuance and sale of the notes offered hereby and the use of net proceeds therefrom.

You should read the data set forth in the table below in conjunction with "Use of Proceeds," "Selected Financial and Operating Information" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" appearing elsewhere in this prospectus supplement, as well as our audited consolidated financial statements and unaudited consolidated financial statements,

5

each with the accompanying notes, included and incorporated by reference in this prospectus supplement.

| |

As of March 31, 2014, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual

|

As Adjusted

|

As Further Adjusted |

|||||||

| |

(unaudited) |

|||||||||

| |

(in thousands) |

|||||||||

Cash, cash equivalents and investments |

$ | 365,811 | (1) | $ | 321,725 | (1) | $ | 524,421 | (1)(2) | |

Capitalization: |

||||||||||

Term loan |

$ | 120,944 | — | — | ||||||

Debt secured by aircraft, including current maturities |

98,511 | $ | 175,369 | $ | 175,369 | |||||

Debt secured by real estate, including current maturities |

9,884 | 9,884 | 9,884 | |||||||

Debt from SPC aircraft acquisition |

— | — | 141,958 | |||||||

Notes offered hereby(2) |

— | — | 300,000 | |||||||

| | | | | | | | | | | |

Total debt |

$ | 229,339 | $ | 185,253 | $ | 627,211 | ||||

| | | | | | | | | | | |

Shareholders' equity |

$ | 342,869 | $ | 342,869 | $ | 342,869 | ||||

| | | | | | | | | | | |

Total capitalization |

$ | 572,208 | $ | 528,122 | $ | 970,080 | ||||

- (1)

- Excludes

$10.8 million of restricted cash but includes investment securities classified as long-term on our balance sheet.

- (2)

- Assumes the notes are issued at par.

Excerpts from "Business"

BUSINESS

Business Overview

We are a leisure travel company focused on providing travel services and products to residents of small, underserved cities in the United States. We were founded in 1997 and, in conjunction with our initial public offering in 2006, we incorporated in the state of Nevada. We operate a low-cost passenger airline marketed to leisure travelers in small cities, allowing us to sell air travel both on a stand-alone basis and bundled with hotel rooms, rental cars and other travel related services. In addition, we provide air transportation under fixed-fee flying arrangements. Our developed route network, pricing philosophy, advertising and diversified product offering built around relationships with premier leisure companies are all intended to appeal to leisure travelers and make it attractive for them to purchase air travel and related services from us. For the twelve months ended March 31, 2014, we had total operating revenues of $1.03 billion, EBITDA of $231.3 million, net income of $94.0 million and carried 7.4 million passengers across 227 routes covering 100 cities. For a reconciliation of EBITDA to its most comparable GAAP measure (which we believe is net income), see "Summary Financial and Operating Data."

Our business model provides for the following diversified revenue streams, which we believe distinguish us from other U.S. airlines and travel companies:

- •

- Scheduled service revenue consists of the base air fare for our nonstop flights between our small city markets and our leisure destinations. We set our base prices at attractive levels to stimulate travel, and we have achieved a scheduled service load factor of approximately 88.8 percent or more in each of the last six years.

6

- •

- Ancillary revenue consists of optional air-related charges and third-party

products. These optional air-related charges include baggage fees, advance seat assignments, our own travel protection product, change fees, use of our call center for purchases, priority boarding,

food and beverage purchases on board and other air-related services. We also generate revenue from the sale of third-party products such as hotel rooms, ground transportation (rental cars and hotel

shuttle products) and attraction and show tickets. We recognize our ancillary revenue net of amounts paid to service providers, travel agent commissions and credit card processing fees.

- •

- Fixed-fee contract revenue consists of air transportation that we provide

through fixed-fee agreements and charter service on a year-round and ad hoc basis.

- •

- Other revenue consists principally of lease payments on aircraft or engines that we own and are being leased to third parties. We may temporarily act as lessor when we have opportunistically acquired an aircraft or engine while it was on lease to a third party. Upon the expiry of the lease, we will seek to operate the asset ourselves.

Our strategy is to profitably serve the leisure travel market in small, underserved cities by providing nonstop, low fare, scheduled service to leisure destinations at low prices that stimulate demand. We manage our capacity with a goal of being profitable on each route. We have established a route network with a national footprint, providing service on 231 routes between 85 small cities and 13 leisure destinations, and serving 40 states based on our published schedule as of June 1, 2014. We currently provide service to popular leisure destinations including Las Vegas, Orlando, and Phoenix, as well as other Florida, California and Hawaii destinations. Our focus on the leisure customer allows us to eliminate the costly complexity burdening others in our industry in their goal to serve a wide variety of customers, particularly most other airlines who target business customers.

Our business strategy has evolved as our experienced management team has looked differently at the traditional business model used in the airline and travel industry. We have consciously developed a different approach:

Traditional Airline Approach

|

Allegiant Approach

|

|

|---|---|---|

• Focus on business and leisure customers |

• Focus on leisure traveler |

|

• Provide high frequency service from big cities |

• Provide low frequency service from small cities |

|

• Use smaller aircraft to provide connecting service from smaller markets through hubs |

• Use larger jet aircraft to provide nonstop service from small cities direct to leisure destinations |

|

• Bundled pricing |

• Unbundled pricing of air-related services and products |

|

• Sell through various intermediaries |

• Sell only directly to travelers |

|

• Offer flight connections |

• No connecting flights offered |

|

• Use code-share arrangements to increase passenger traffic |

• Do not use code-share arrangements |

General Information

Our principal executive offices are located at 8360 South Durango Drive, Las Vegas, Nevada 89113. Our telephone number is (702) 851-7300. Our website address is http://www.allegiant.com. We have not incorporated by reference into this prospectus supplement the information on or accessible through our website and you should not consider it to be a part of this document. Our website address is included in this document for reference only.

7

Our Competitive Strengths

We have developed a unique business model that focuses on leisure travelers in small cities. We believe the following strengths allow us to maintain a competitive advantage in the markets we serve:

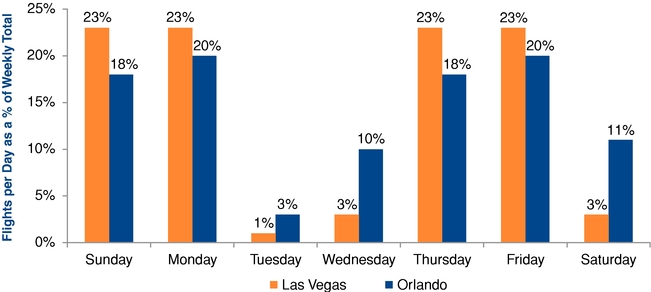

Focus on Transporting Customers From Small Cities to Leisure Destinations. Based on our published schedule as of June 1, 2014, we provide nonstop low fare scheduled air service (including seasonal service) from 85 small cities to 13 leisure destinations including Las Vegas, Orlando, and Phoenix, as well as other Florida, California and Hawaii destinations. We have a nationwide footprint providing service in 40 states in every region in the country. Generally, when we enter a new market, there is no existing nonstop service to such leisure destination in that market. We believe small cities represent a large underserved market, especially for leisure travel. We believe this nonstop service, along with our low prices and premier leisure company relationships, makes it attractive for leisure travelers to purchase air travel and related services from us. The size of these markets and our focus on the leisure customer allow us to adequately serve our markets with less frequency and to vary our capacity to match seasonal and day of the week demand patterns.

By focusing on small cities, we believe we avoid the intense competition presently seen in high traffic domestic air corridors. In our typical small city market, travelers faced high airfares and cumbersome connections or long drives to major airports to reach our leisure destinations before we started providing service. Based on our published schedule as of June 1, 2014, we are the only carrier providing nonstop service on over 90 percent of our 231 routes. We believe our market strategy has had the benefit of not appearing hostile to either legacy carriers, whose historical focus has been connecting small cities to business markets, or traditional LCCs, which have tended to focus more on larger markets than the small city markets we serve.

Low Operating Costs. We believe low costs are essential to competitive success in the airline industry. Our CASM was 10.33¢ in 2013 and 10.30¢ for first quarter of 2014. Excluding the cost of fuel, our operating CASM was 5.60¢ for 2013 and 5.72¢ for the first quarter of 2014.

Our low operating costs are the result of our focus on the following:

- •

- Cost-Driven Schedule. We design

our flight schedule to concentrate our aircraft each night in our crew bases. This concentration allows us to better utilize personnel, airport facilities, aircraft, spare parts inventories and other

assets. We can do this because we believe leisure travelers are generally less concerned about departure and arrival times than business travelers. Therefore, we are able to schedule flights at times

that enable us to reduce our costs but are desirable for our leisure customer base.

- •

- Low Aircraft Ownership Costs. We

believe we properly balance low aircraft ownership costs and operating costs to minimize our total costs. As of June 1, 2014, our operating fleet consists of 53 MD-80 series aircraft, ten

Airbus A320 series aircraft and six Boeing 757-200 aircraft. We plan to use the proceeds from this offering and cash on hand to acquire 21 additional A320 series aircraft which we are expecting to

bring into operation through 2018. See "Prospectus Supplement Summary — Contemplated Aircraft Transactions." Our fleet has been substantially less expensive to acquire than newer narrow

body aircraft allowing us to maintain low aircraft ownership costs consistent with our business model.

- •

- Highly Productive Workforce. We believe we have one of the most productive workforces in the U.S. airline industry with approximately 32 full-time equivalent employees per operating aircraft as of June 1, 2014. We believe this compares favorably with the same ratio for other airlines based on recent publicly available industry data. Our high level of employee productivity is created by fleet commonality, fewer unproductive labor work rules, cost-driven scheduling, and the effective use of automation and part-time employees. We outsource heavy maintenance,

8

- •

- Simple Product. We believe

offering a simple product is critical to achieving low operating costs. As such, we sell only nonstop flights; we do not code-share or interline with other carriers; we have a single class cabin; we

do not provide any free catered items — everything on board is for sale; we do not overbook our flights; we do not provide cargo or mail services; and we do not offer other perks

such as airport lounges.

- •

- Low Distribution Costs. Our

nontraditional approach results in very low distribution costs. We do not sell our product through outside sales channels and, as such, avoid the fees charged by travel web sites (such as Expedia,

Orbitz or Travelocity) and the traditional GDS (such as Sabre or Worldspan). Our customers can only purchase travel at our airport ticket counters or, for a fee, through our telephone reservation

center or website. We actively encourage sales on our website and had 29 million unique visitors in 2013. This is the least expensive form of distribution and accounted for approximately

92 percent of our scheduled service revenue in 2013. We believe our percentage of website sales is among the highest in the U.S. airline industry.

- •

- Small city market airports. Our business model focuses on residents of small cities in the United States. Typically the airports in these small cities have lower operating costs than airports in larger cities. These lower costs are driven by less expensive passenger facilities, landing and ground service charges. In addition to inexpensive airport costs, many of our small cities provide marketing support which results in lower marketing costs.

stations and other functions where desirable in an effort to reduce costs using reliable third-party service providers.

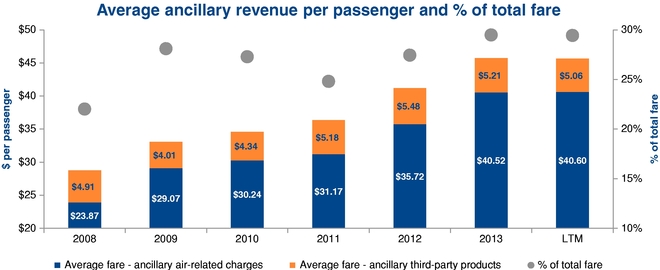

Strong Ancillary Revenues. We believe most leisure travelers are concerned primarily with purchasing air travel for the least expensive price. As such, since 2005, we have unbundled the air transportation product by charging fees for services many U.S. airlines historically bundled in their product offering. We offer a simple base product at an attractive low fare which enables us to stimulate demand and we generate incremental revenue as customers pay additional amounts for conveniences they value. In addition, our third-party product offerings allow our customers the opportunity to purchase hotels, rental cars, show tickets, and tickets to other attractions. Our ancillary revenues have grown from $114.6 million in 2008, to $324.9 million in 2013, representing 22.7 percent and 32.6 percent of total operating revenues, respectively. We recorded $96.1 million of ancillary revenue in first quarter 2014. We believe ancillary revenue will continue to be a key component in our total average fare as we believe leisure passengers are less sensitive to ancillary fees than average base fare. We have proven during 2009 that we can sustain our ancillary revenue per-passenger levels even in a difficult economic environment.

The following chart shows the breakdown of our ancillary revenue between air-related revenue and third-party revenue and the percentage of our total fare represented by ancillary revenue each year. We believe our ancillary revenue per passenger and percentage of total fare represented by ancillary charges are one of the highest in our industry and provide a consistent source of revenue.

9

- *

- LTM figures are for twelve months ended March 31, 2014.

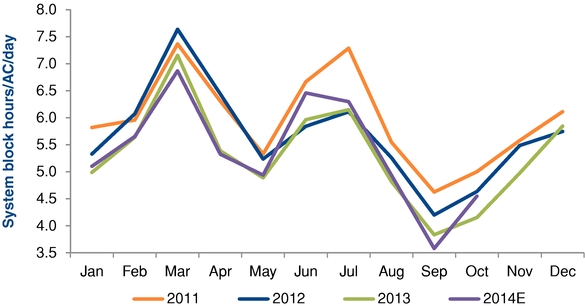

Capacity Management. We actively manage our seat capacity to match leisure demand patterns. We believe our ability to quickly adjust capacity allows us to operate profitably throughout a changing environment. During 2013, our average system block hours per aircraft per day, was 5.5 system block hours for the full year. During our peak demand period in March 2013 we averaged 7.1 system block hours per aircraft per day while in September 2013, our lowest month for demand, we averaged 3.9 system block hours per aircraft per day. We averaged 6.9 system block hours per aircraft per day during March 2014.

The following chart illustrates how we manage our capacity based on the seasonality of leisure demand with our highest aircraft utilization rate in the peak demand months each year and a substantially lower aircraft utilization rate in low leisure demand months, such as September. This is in contrast to other airlines which we believe provide more consistent levels of service from month to month.

- Source:

- Company filings and published schedule.

- Note:

- Block hours per aircraft per day for 2014 are based on our published schedule through October 28, 2014.

10

Our management of seat capacity also includes changes in weekly frequency of certain markets based on identified peak and off-peak travel demand throughout the year. The following chart illustrates how we focus our scheduled service on the days of week customers desire to begin or end their leisure travel. Unlike other carriers which provide a fairly consistent number of flights every day of the week, we concentrate our flights on high demand leisure travel days and fly only a very small portion of our schedule on low demand days such as Tuesdays and Wednesdays.

- Source:

- Company filings and published schedule.

With our ability to generate strong ancillary revenue and the ability to spread out our costs over a larger number of passengers, we price our fares and actively manage our capacity to target a 90 percent load factor which has allowed us to operate profitably throughout periods of high fuel prices and economic recessions. In addition, we believe our low cost aircraft facilitate our ability to adjust service levels quickly and maintain profitability during difficult economic times.

Strong Financial Position. We have a strong financial position with significant cash balances. On March 31, 2014, we had $365.8 million of cash, cash equivalents and investment securities (excluding restricted cash) and $229.3 million of total debt. As adjusted for this transaction, the Second Quarter Finance Transactions (defined herein) and the SPC Aircraft Acquisitions (defined herein), we would have had $524.4 million of cash, cash equivalents and investments (excluding restricted cash) and $627.2 million of total debt. We also have a history of growing profitably, having 45 consecutive quarters with positive pre-tax earnings(1) and positive EBITDA. We also prudently manage our capital deployments through conservative fleet growth and modest leverage. We believe our strong financial position and discipline regarding use of capital allows us to have greater financial flexibility to grow the business and weather sudden industry disruptions.

Proven Management Team. We have a strong management team comprised of experienced and motivated individuals. Our management team is led by Maurice J. Gallagher, Jr. and Andrew C. Levy, each of whom has an extensive background in the airline industry. Mr. Gallagher was the president of WestAir Holdings, Inc. and built WestAir into one of the largest regional airlines in the U.S. prior to its sale in 1992 to Mesa Air Group. He was also one of the founders of ValuJet, Inc., which is known today as AirTran Holdings, Inc. Mr. Levy was a former manager of ValuJet where he quickly advanced into roles of increasing responsibility and later worked for an airline investment and advisory firm.

- (1)

- Excluding non-cash mark to market hedge adjustments prior to 2008.

11

Our Business Strategy

To continue the growth of our business and increase our profitability, our strategy will be to continue to offer air travel service at low fares, while maintaining high quality standards, keeping our operating costs low and pursuing ways to make our operations more efficient. We intend to grow by entering additional small cities, connecting our existing small cities to more of our leisure destinations, providing service to more leisure destinations and expanding our relationships with premier leisure companies.

The following are the key elements of our strategy:

Capitalize on Significant Growth Opportunities in Transporting Customers from Small Cities to Leisure Destinations. We believe small cities represent a large underserved market, especially for leisure travel. We believe small city travelers have limited travel options to leisure destinations as existing carriers are generally focused on connecting the small city "spokes" to their business hubs. We aim to become the premier travel brand for leisure travelers in the small cities we serve. Since the beginning of 2004, we have expanded our scheduled air service (including seasonal service) from six to 85 small cities based on our published schedule as of June 1, 2014. In most of these cities, we provide service to more than one of our leisure destinations. We believe our business plan would be sustainable through the addition of new cities in the U.S., Canada, Mexico and the Caribbean.

Develop New Sources of Revenue. We have identified three key areas where we have built and believe we can continue to grow our ancillary revenues:

- •

- Unbundling the Traditional Airline

Product. We believe most leisure travelers are concerned primarily with purchasing air travel for the least expensive price. As such, we

have created new sources of revenue by charging fees for services many U.S. airlines historically bundled in their product offering (such as baggage fees, including fees for carry ons). We believe by

offering a simple base product at an attractive low fare we can drive demand and generate incremental revenue as customers pay additional amounts for conveniences they value. For example, we do not

offer complimentary advance seat assignments; however, any customer can purchase advance seat assignments for a small incremental cost. We also sell snacks and beverages on board the aircraft so our

customers can pay for only the items they value. We aim to continue to increase ancillary revenue by optimizing existing products and adding new products in the future.

- •

- Expand and Add Partnerships with Premier Leisure

Companies. We currently work with many premier leisure companies in our leisure destinations that provide ancillary products and

services we sell to our customers. For example, we have arrangements with approximately 650 hotel and casino resort properties throughout the country, which allow us to provide hotel rooms in packages

sold to our customers. In addition, we have an agreement with Enterprise Holdings Inc. for the sale of rental cars packaged with air travel. During 2013, we generated revenue from the sale of

595,697 hotel rooms and we generated revenue from the sale of 143,760 hotel rooms in the first quarter of 2014. By expanding our existing relationships and seeking additional partnerships with premier

leisure companies, we believe we can increase the number of products and services offered to our customers and generate more ancillary revenue.

- •

- Leverage Direct Relationships With Our Customers. Since approximately 92 percent (during 2013) and 94 percent (in the first quarter of 2014) of our bookings are purchased directly through our website, we are able to establish direct relationships with our customers by capturing their email addresses for our database. This information provides us multiple opportunities to market products and services, including at the time they purchase their travel, between the time they purchase and initiate their travel, and after they have completed their travel. In addition, we market products and services to our customers during the flight. We believe the breadth of

12

options we can offer them allows us to provide a "one-stop" shopping solution to enhance their travel experience.

Continue to Focus on Reducing Our Operating Costs. We intend to continue to focus on reducing our costs to remain one of the lowest cost airlines in the world, which we believe is instrumental to increasing profitability. We expect to drive operational efficiency and reduce costs in part by growing our network and adding Airbus A320 series aircraft to our fleet which we expect will reduce our unit costs due primarily to higher fuel efficiency. For example, the fuel cost per passenger for our entire fleet for the twelve months ended March 31, 2014, was approximately $52 as compared to the per passenger fuel cost for our Airbus A320 series aircraft of approximately $44. The proceeds from the sale of the notes offered hereby will be used to fund the purchase of additional Airbus A320 series aircraft.

Minimize Fixed Costs to Increase Strategic Flexibility. We believe our low aircraft ownership costs and the lower costs associated with our small city market strategy provide us with a lower level of fixed costs than other U.S. airlines. We believe our low level of fixed costs provides us with added flexibility in scheduling our services and controlling our profitability. For example, with lower fixed costs we are better able to quickly adjust capacity to suit market, fuel or economic conditions, enter or exit markets and match the size and utilization of our fleet to limit unprofitable flying and increase profitability.

Routes and Schedules

Our current scheduled air service (including seasonal service) predominantly consists of limited frequency, nonstop flights into Las Vegas, Orlando, Phoenix and other Florida, California and Hawaii destinations from small cities across the continental United States. Our scheduled service route network as of June 1, 2014 is summarized below.

Routes to Orlando |

53 | |||

Routes to Las Vegas |

43 | |||

Routes to Phoenix |

33 | |||

Routes to Tampa Bay/St. Petersburg |

32 | |||

Routes to Punta Gorda |

23 | |||

Routes to Los Angeles |

16 | |||

Other routes |

31 | |||

| | | | | |

Total routes |

231 | |||

| | | | | |

| | | | | |

Marketing and Distribution

Our website is our primary distribution method, which provided 92.0 percent of scheduled service air transportation bookings for 2013 and 94.3 percent in the three months ended March 31, 2014. We also sell through our call center and at our airport ticket counters. This distribution mix creates significant cost savings and enables us to continue to build loyalty with our customers through increased interaction with them.

We do not sell through Expedia, Travelocity, Orbitz or any other online travel agency nor is our product displayed and sold through the GDS which include Sabre, Galileo, Worldspan and Amadeus. This distribution strategy results in reduced expenses by avoiding the fees associated with the use of GDS distribution points. This distribution strategy also permits us to closely manage ancillary product offerings and pricing while developing and maintaining a direct relationship with our customers. The direct relationship enables us to engage continuously in communications with our customers which we believe will result in substantial benefits over time. With our own automation system, we have the ability to continually change our ancillary product offerings and pricing points which allows us to

13

experiment to find the optimal pricing levels for our various offerings. We believe this would be difficult and impractical to achieve through the use of the global distribution systems.

We continue to make progress on our automation projects including the upgrade of our current distribution platform. We have fully integrated all internet traffic to our new booking engine. We expect the continuous improvement to our new website and other automation enhancements will create additional revenue opportunities by allowing us to capitalize on customer loyalty with additional product offerings.

Competition

The airline industry is highly competitive. Passenger demand and fare levels have historically been influenced by, among other things, the general state of the economy, international events, industry capacity and pricing actions taken by other airlines. The principal competitive factors in the airline industry are price, schedule, customer service, routes served, types of aircraft, safety record and reputation, code-sharing relationships and frequent flyer programs.

Our competitors include legacy airlines, LCCs, regional airlines and new entrant airlines. Many of these airlines are larger, have significantly greater financial resources and serve more routes than we do. In a limited number of cases, following our entry into some markets, competitors have chosen to add service, reduce their fares or both. In a few cases, other airlines have entered after we have developed a market.

We believe our small city strategy has reduced the intensity of competition we might otherwise face. As of June 1, 2014, we are the only domestic scheduled carrier operating out of the Orlando Sanford International Airport, Phoenix-Mesa Gateway Airport, St. Petersburg-Clearwater International Airport, and Punta Gorda Airport. Although no other domestic scheduled carriers operate in these four airports, virtually all U.S. airlines serve the nearby major airports serving Orlando, Phoenix, Tampa and Ft. Myers. On the other hand, virtually all U.S. airlines serve Las Vegas, Los Angeles, Ft. Lauderdale, the San Francisco Bay area, San Diego and Honolulu, as a result, there is potential for increased competition on these routes.

Based on our published schedule as of June 1, 2014, we face mainline competition on less than ten percent of our 231 routes. Our entrance into the Hawaii market in 2012 and the recent addition of service to a number of new small cities on the east coast increased the amount of routes on which we face direct competition. We compete with Southwest on 11 routes; six routes into Las Vegas, one route into Phoenix, two routes into Orlando and two routes into Tampa. We compete with Frontier on one route into Orlando and with American on three routes into Phoenix. We compete with Alaska Airlines on our route between Honolulu and Las Vegas. We compete with Hawaiian Airlines on three routes into Honolulu, including our Los Angeles-Honolulu route, where we also compete with American, Delta and United. We compete with Delta on one route into Orlando. We also compete on one route with Spirit (Plattsburgh-Ft. Lauderdale). In addition, we compete with smaller regional jet aircraft on several routes, including Fresno-Las Vegas (United), Eugene-Los Angeles (American), Medford-Los Angeles (United), Northwest Arkansas-Los Angeles (American) and Wichita-Los Angeles (United).

Indirectly, we compete with Southwest/Airtran, American, Delta and other carriers that provide nonstop service to our leisure destinations from airports near our small city markets. For example, we fly from Bellingham, Washington, which is a two-hour drive from Seattle-Tacoma International Airport, where travelers can access nonstop service to Las Vegas, Los Angeles, Phoenix, San Diego, Palm Springs and San Francisco on various other carriers. We also face indirect competition from legacy carriers offering hub-and-spoke connections to our markets. For example, travelers can travel to Las Vegas from Peoria on United, American or Delta, although all of these legacy carriers currently utilize regional aircraft to access their hubs and mainline jets to access Las Vegas. Legacy carriers offering

14

hub-and-spoke service with connecting flights tend to charge substantially higher, restrictive fares and have a much longer elapsed time of travel.

We also face indirect competition from automobile travel in our short-haul markets, primarily in our Florida leisure destinations. We believe our low cost pricing model and the convenience of air transportation help us compete favorably against automobile travel.

In our fixed-fee operations, we compete with other scheduled airlines in addition to independent passenger charter airlines. We also compete with aircraft owned or controlled by large tour companies. The basis of competition in the fixed-fee market is cost, equipment capabilities, service and reputation.

Aircraft Fleet

Operating Fleet

The following table sets forth the number and type of aircraft in service and operated by us as of the dates indicated:

| |

As of March 31, 2014 |

As of December 31, 2013 |

As of December 31, 2012 |

As of December 31, 2011 |

|||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Own(b)

|

Lease

|

Total

|

Own(b)

|

Lease

|

Total

|

Own(b)

|

Lease

|

Total

|

Own(b)

|

Lease

|

Total

|

|||||||||||||||||||||||||

MD82/83/88s(a) |

53 | — | 53 | 52 | — | 52 | 56 | — | 56 | 52 | 2 | 54 | |||||||||||||||||||||||||

MD87s(c) |

— | — | — | — | — | — | 2 | — | 2 | 2 | — | 2 | |||||||||||||||||||||||||

B757-200 |

6 | — | 6 | 6 | — | 6 | 5 | — | 5 | 1 | — | 1 | |||||||||||||||||||||||||

A319 |

1 | 2 | 3 | 1 | 2 | 3 | — | — | — | — | — | — | |||||||||||||||||||||||||

A320 |

7 | — | 7 | 5 | — | 5 | — | — | — | — | — | — | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total |

67 | 2 | 69 | 64 | 2 | 66 | 63 | — | 63 | 55 | 2 | 57 | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- (a)

- Includes

the following number of MD-80 aircraft (MD-82/83/88s) modified to a 166-seat configuration: March 31, 2014 — 53;

December 31, 2013 — 51; December 31, 2012 — 45; December 31, 2011 — seven.

- (b)

- Excludes

aircraft acquired but not yet in revenue service or temporarily stored as of the date indicated.

- (c)

- Used almost exclusively for fixed-fee flying.

MD-80 aircraft

As of March 31, 2014, 53 MD-80 aircraft had been modified to 166 seats as part of our seat reconfiguration program. We expect our MD-80 aircraft fleet to remain at 53 aircraft during 2014.

Airbus aircraft

In August 2012, we entered into operating lease agreements for nine used Airbus A320 series aircraft with expected deliveries through the third quarter of 2015. As of December 31, 2013, we have inducted two of these leased Airbus A320 series aircraft into revenue service. We expect to take possession of the remaining aircraft under these lease agreements in 2014 and 2015. In June 2014, we entered into a letter of intent to purchase the two aircraft already on lease to us and six additional aircraft to be delivered to us in the future. When we enter into a definitive agreement to document these transactions, the lease for the ninth aircraft will be cancelled.

In December 2012 and August 2013, we entered into purchase agreements for nine used Airbus A320 aircraft. Of the nine Airbus A320 series aircraft under contract, two were acquired in the second quarter of 2013 and five were acquired in the third quarter of 2013. Five of the Airbus A320 series aircraft were placed into our operating fleet in the fourth quarter of 2013 and two additional Airbus A320 series aircraft were placed in revenue service as of February 1, 2014. The final two Airbus A320

15

series aircraft under contract are expected to be acquired in the fourth quarter of 2014 and placed in revenue service in 2015.

In June 2014, we entered into contracts to purchase two additional Airbus A320 series aircraft in 2015 and 2016.

Fleet plan

The following table provides the expected number of operating aircraft in service at the end of the respective year based on scheduled contracted deliveries of Airbus aircraft:

| |

December 31, 2014 |

December 31, 2015 |

|||||

|---|---|---|---|---|---|---|---|

MD-80 (166 seats) |

53 | 53 | |||||

B757-200 |

6 | 6 | |||||

A319 |

4 | 9 | |||||

A320 |

7 | 10 | |||||

| | | | | | | | |

Total |

70 | 78 | |||||

| | | | | | | | |

| | | | | | | | |

We continually consider other aircraft acquisitions on an opportunistic basis.

The following table shows the age range for each aircraft type in our fleet as well as an average age per aircraft type as of June 1, 2014:

| |

As of June 1, 2014 | ||||||

|---|---|---|---|---|---|---|---|

| |

Age range (years) |

Average age (years) |

|||||

MD-80 |

18 - 29 | 24.5 | |||||

757 |

20 - 22 | 21.2 | |||||

A319 |

9 - 10 | 9.7 | |||||

A320 |

13 - 14 | 13.7 | |||||

Aircraft Fuel

Fuel is our largest operating expense. The cost of fuel is volatile, as it is subject to many economic and geopolitical factors we can neither control nor predict. Significant increases in fuel costs could materially affect our operating results and profitability. We do not currently use financial derivative products to hedge our exposure to jet fuel price volatility.

In an effort to reduce our fuel costs, we have a wholly-owned subsidiary which entered into a limited liability company operating agreement with an affiliate of Orlando Sanford International Airport to engage in contract fueling transactions for the provision of aviation fuel to airline users at that airport. In addition, we have invested in fuel storage units and fuel transportation facilities involved in the fuel distribution process. By reason of these activities, we could potentially incur material liabilities, including possible environmental liabilities, to which we would not otherwise be subject.

Aircraft Maintenance

We have a FAA approved maintenance program, which is administered by our maintenance department headquartered in Las Vegas. Consistent with one of our core values, safety, all technicians employed by us have appropriate experience and hold required licenses issued by the FAA. We provide them with comprehensive training and maintain our aircraft in accordance with FAA regulations. The

16

maintenance performed on our aircraft can be divided into three general categories: line maintenance, heavy maintenance, and component and engine overhaul and repair. Scheduled line maintenance is generally performed by our personnel. We contract with outside organizations to provide heavy maintenance, component and engine overhaul and repair. We have chosen not to invest in facilities or equipment to perform our own heavy maintenance, engine overhaul or component work. Our management closely supervises all maintenance functions performed by our personnel and contractors employed by us, and by outside organizations. In addition to the maintenance contractors we presently utilize, we believe there are sufficient qualified alternative providers of maintenance services that we can use to satisfy our ongoing maintenance needs.

Insurance

We maintain insurance policies we believe are of types customary in the industry and as required by the DOT and are in amounts we believe are adequate to protect us against material loss. The policies principally provide coverage for public liability, passenger liability, baggage and cargo liability, property damage, including coverages for loss or damage to our flight equipment, directors and officers, and workers' compensation insurance. There is no assurance, however, that the amount of insurance we carry will be sufficient to protect us from material loss.

The U.S. government has agreed to provide commercial war-risk insurance for U.S.-based airlines through September 30, 2014, covering losses to employees, passengers, third parties and aircraft. If the U.S. government ceases to provide such insurance beyond that date, or reduces the coverage provided by such insurance, we will attempt to purchase insurance coverage, likely with a narrower scope, from commercial insurers at an additional cost. To the extent this coverage is not available at commercially reasonable rates, we could be adversely affected.

Ground Facilities

We lease facilities at the majority of our leisure destinations and several of the other airports we serve. Our leases for terminal passenger services facilities, which include ticket counter and gate space, and operations support areas, generally have a term ranging from month-to-month to two years and may be terminated with a 30 to 60-day notice. We have also entered into use agreements at each of the airports we serve that provide for non-exclusive use of runways, taxiways and other facilities. Landing fees under these agreements are based on the number of landings and weight of the aircraft.

We have operational bases at airports at each of the major leisure destinations we serve. In addition, we have an operational base in Wendover, Nevada to support our fixed-fee flying under our agreement with Peppermill Resorts Inc. and an operational base in Bellingham, Washington. During 2013, we established operational bases at Oakland International Airport and Punta Gorda Airport, which required the leasing of additional facilities to support operations. We served these airports prior to the establishment of these operational bases.

We use leased facilities at our operational bases to perform line maintenance, overnight parking of aircraft, and other operations support. We lease additional space in cargo areas at the McCarran International Airport, Orlando Sanford International Airport and the Phoenix-Mesa Gateway Airport for our primary line maintenance operations. We also lease additional warehouse space in Las Vegas, Sanford and Mesa for aircraft parts and supplies.

17

The following details the airport locations we utilize as operational bases:

Airport

|

Location

|

|

|---|---|---|

McCarran International Airport |

Las Vegas, Nevada | |

Orlando Sanford International Airport |

Orlando, Florida | |

Phoenix-Mesa Gateway Airport |

Mesa, Arizona | |

St. Petersburg-Clearwater International Airport |

St. Petersburg, Florida | |

Ft. Lauderdale-Hollywood International Airport |

Ft. Lauderdale, Florida | |

Los Angeles International Airport |

Los Angeles, California | |

Oakland International Airport |

Oakland, California | |

Punta Gorda Airport |

Punta Gorda, Florida | |

Honolulu International Airport |

Honolulu, Hawaii | |

Myrtle Beach International Airport |

Myrtle Beach, South Carolina | |

Bellingham International Airport |

Bellingham, Washington | |

Wendover Airport |

Wendover, Nevada |

We believe we have sufficient access to gate space for current and presently contemplated future operations at all airports we serve.

Our primary corporate offices are located in Las Vegas, where we lease approximately 70,000 square feet of space under a lease that expires in April 2018 with an early termination option exercisable by us in May 2015. We also lease approximately 10,000 square feet of office space in a building adjacent to our corporate offices which is utilized for training and other corporate purposes. In addition to base rent, we are also responsible for our share of common area maintenance charges. In both leases, the landlord is a limited liability company in which our Chief Executive Officer and one other director own a significant interest as non-controlling members.

During the second quarter 2013, we purchased approximately 10 acres of property in northwest Las Vegas on which there are five office buildings containing approximately 130,000 square feet of office space. The total price for the purchase was approximately $12.3 million. We expect to begin to move our corporate headquarters to the new facility after improvements to the space are completed in third quarter 2014.

Employees

As of March 31, 2014, we employed 2,146 full-time equivalent employees, which consisted of 1,974 full-time and 333 part-time employees. Full-time equivalent employees consisted of 391 pilots, 641 flight attendants, 176 airport operations personnel, 218 mechanics, 138 reservation agents, 47 flight dispatchers and 535 management and other personnel.

Salaries and benefits expense represented approximately 19 percent of total operating expenses during 2013 and the three months ended March 31, 2014 and 17 percent during 2012 and 2011. We have three employee groups which have voted for union representation, consisting of approximately 50 percent of our total employees. We are in various stages of negotiations for collective bargaining agreements with the labor organizations representing these employee groups.

Our relations with these labor organizations are governed by the RLA. Under the RLA, if direct negotiations do not result in an agreement, either party may request the NMB to appoint a federal mediator. If no agreement is reached via mediated negotiations, the NMB may offer binding arbitration to the parties. If either party rejects binding arbitration, a 30-day "cooling-off" period begins. At the end of this "cooling-off" period, the parties may engage in self-help, including work interruptions or stoppages or strike by the affected employees and our hiring replacements. We have never previously experienced any work interruptions or stoppages from our nonunionized employee groups or from

18

these employee groups which have voted for union representation. The table below identifies the status of these initial collective bargaining agreements:

Employee Group

|

Representative

|

Status of Agreement

|

||

|---|---|---|---|---|

Pilots |

International Brotherhood of Teamsters, Airline Division | Elected representation in August 2012. In mediation phase of the negotiation process as of April 2014. | ||

Flight Attendants |

Transport Workers Union | Elected representation in December 2010. In mediation phase of the negotiation process. | ||

Flight Dispatchers |

International Brotherhood of Teamsters, Airline Division | Elected representation in December 2012. |

Government Regulations

We are subject to federal, state and local laws affecting the airline industry and to extensive regulation by the DOT, the FAA and other governmental agencies.

DOT. The DOT primarily regulates economic issues affecting air transportation such as certification and fitness of carriers, insurance requirements, consumer protection, competitive practices and statistical reporting. The DOT also regulates requirements for accommodation of passengers with disabilities. The DOT has the authority to investigate and institute proceedings to enforce its regulations and may assess civil penalties, suspend or revoke operating authority and seek criminal sanctions. The DOT also has authority to restrict or prohibit a carrier's cessation of service to a particular community if such cessation would leave the community without scheduled airline service.

We hold a DOT certificate of public convenience and necessity authorizing us to engage in (i) scheduled air transportation of passengers, property and mail within the United States, its territories and possessions and between the United States and all countries that maintain a liberal aviation trade relationship with the United States (known as "open skies" countries), and (ii) charter air transportation of passengers, property and mail on a domestic and international basis. We also hold DOT authority to engage in scheduled air transportation of passengers, property and mail between Las Vegas, Cabo San Lucas and Hermosillo, Mexico (a non "open skies" country).

FAA. The FAA primarily regulates flight operations and safety, including matters such as airworthiness and maintenance requirements for aircraft, pilot, mechanic, dispatcher and flight attendant training and certification, flight and duty time limitations and air traffic control. The FAA requires each commercial airline to obtain and hold an FAA air carrier certificate. This certificate, in combination with operation specifications issued to the airline by the FAA, authorizes the airline to operate at specific airports using aircraft certificated by the FAA. We have and maintain in effect FAA certificates of airworthiness for all of our aircraft, and we hold the necessary FAA authority to fly to all of the cities we currently serve. Like all U.S. certificated carriers, our provision of scheduled service to certain destinations may require specific governmental authorization. The FAA has the authority to investigate all matters within its purview and to modify, suspend or revoke our authority to provide air transportation, or to modify, suspend or revoke FAA licenses issued to individual personnel, for failure to comply with FAA regulations. The FAA can assess civil penalties for such failures and institute proceedings for the collection of monetary fines after notice and hearing. The FAA also has authority to seek criminal sanctions. The FAA can suspend or revoke our authority to provide air transportation on an emergency basis, without notice and hearing, if, in the FAA's judgment, safety requires such action. A legal right to an independent, expedited review of such FAA action exists. Emergency suspensions or revocations have been upheld with few exceptions. The FAA monitors our compliance with maintenance, flight operations and safety regulations on an ongoing basis, maintains a continuous

19

working relationship with our operations and maintenance management personnel, and performs frequent spot inspections of our aircraft, employees and records.

The FAA also has the authority to promulgate rules and regulations and issue maintenance directives and other mandatory orders relating to, among other things, inspection, repair and modification of aircraft and engines, increased security precautions, aircraft equipment requirements, noise abatement, mandatory removal and replacement of aircraft parts and components, mandatory retirement of aircraft and operational requirements and procedures. Such rules, regulations and directives are normally issued after an opportunity for public comment, however, they may be issued without advance notice or opportunity for comment if, in the FAA's judgment, safety requires such action.

We believe we are operating in compliance with applicable DOT and FAA regulations, interpretations and policies and we hold all necessary operating and airworthiness authorizations, certificates and licenses.

Security. Within the United States, civil aviation security functions, including review and approval of the content and implementation of air carriers' security programs, passenger and baggage screening, cargo security measures, airport security, assessment and distribution of intelligence, threat response, and security research and development are the responsibility of the Transportation Security Administration ("TSA") of the Department of Homeland Security. The TSA has enforcement powers similar to the DOT's and FAA's described above. It also has the authority to issue regulations, including in cases of emergency, the authority to do so without advance notice, including issuance of a grounding order as occurred on September 11, 2001.

Aviation Taxes. The statutory authority for the federal government to collect most types of aviation taxes, which are used, in part, to finance the nation's airport and air traffic control systems, and the authority of the FAA to expend those funds must be periodically reauthorized by the U.S. Congress. In 2012, Congress adopted the FAA Modernization and Reform Act of 2012, which extends most commercial aviation taxes through September 30, 2015. In addition to FAA-related taxes, there are additional federal fees related to the Department of Homeland Security. These taxes do not need to be reauthorized periodically. However, in an effort to reduce the federal deficit and generate more government revenue, Congress approved legislation in December 2013 that will generate more net federal revenue by (i) increasing the Transportation Security Fee paid by passengers from $2.50 per passenger segment to $5.60 per one-way passenger trip, effective July 2014; and (ii) eliminating a security fee paid by airlines directly, called the Aviation Security Infrastructure Fee, effective October 2014. In 2014, Congress may consider legislation that could increase one or more of the passenger-paid fees used to support the operations of U.S. Customs and Border Protection. Grants to airports and/or airport bond financing may also be affected through future deficit reduction legislation, which could result in higher fees, rates, and charges at many of the airports the Company serves.

Environmental. We are subject to various federal, state and local laws and regulations relating to the protection of the environment and affecting matters such as aircraft engine emissions, aircraft noise emissions, and the discharge or disposal of materials and chemicals, which laws and regulations are administered by numerous state and federal agencies. These agencies have enforcement powers similar to the DOT's and FAA's described above. In addition, we may be required to conduct an environmental review of the effects projected from the addition of our service at airports.

Federal law recognizes the right of airport operators with special noise problems to implement local noise abatement procedures so long as those procedures do not interfere unreasonably with interstate and foreign commerce and the national air transportation system. These restrictions can include limiting nighttime operations, directing specific aircraft operational procedures during takeoff and initial climb, and limiting the overall number of flights at an airport. None of the airports we serve

20

currently imposes restrictions on the number of flights or hours of operation that have a meaningful impact on our operations. It is possible one or more such airports may impose additional future restrictions with or without advance notice, which may impact our operations.

Foreign Ownership. To maintain our DOT and FAA certificates, our airline operating subsidiary and we (as the airline's holding company) must qualify continuously as a citizen of the United States within the meaning of U.S. aeronautical laws and regulations. This means we must be under the actual control of U.S. citizens and we must satisfy certain other requirements, including that our president and at least two-thirds of our board of directors and other managing officers must be U.S. citizens, and that not more than 25 percent of our voting stock may be owned or controlled by non-U.S. citizens. The amount of non-voting stock that may be owned or controlled by non-U.S. citizens is strictly limited as well. We believe we are in compliance with these ownership and control criteria.

Other Regulations. Air carriers are subject to certain provisions of federal laws and regulations governing communications because of their extensive use of radio and other communication facilities, and are required to obtain an aeronautical radio license from the Federal Communications Commission ("FCC"). To the extent we are subject to FCC requirements, we intend to continue to comply with those requirements.

The quality of water used for drinking and hand-washing aboard aircraft is subject to regulation by the EPA. To the extent we are subject to EPA requirements, we intend to continue to comply with those requirements.

Working conditions of cabin crewmembers while onboard aircraft are subject to regulation by the Occupational Safety and Health Administration ("OSHA") of the Department of Labor. To the extent we are subject to OSHA requirements, we intend to continue to comply with those requirements.

We are responsible for collection and remittance of federally imposed and federally approved taxes and fees applicable to air transportation passengers. We believe we are in compliance with these requirements, and we intend to continue to comply with them.

Our labor relations are covered under Title II of the RLA and are subject to the jurisdiction of the NMB.

Our operations may become subject to additional federal requirements in the future under certain circumstances. During a period of past fuel scarcity, air carrier access to jet fuel was subject to allocation regulations promulgated by the Department of Energy. Changes to the federal excise tax and other government fees imposed on air transportation have been proposed and implemented from time to time and may result in an increased tax burden for airlines and their passengers.

We are also subject to state and local laws, regulations and ordinances at locations where we operate and to the rules and regulations of various local authorities that operate the airports we serve. None of the airports in the small cities in which we operate have slot control, gate availability or curfews that pose meaningful limitations on our operations. However, some small city airports have short runways that require us to operate some flights at less than full capacity.