Attached files

| file | filename |

|---|---|

| EX-23.3 - EX-23.3 - NEXTERA ENERGY PARTNERS, LP | d696235dex233.htm |

| EX-23.2 - EX-23.2 - NEXTERA ENERGY PARTNERS, LP | d696235dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 10, 2014

Registration No. 333-196099

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NextEra Energy Partners, LP

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 4911 | 30-0818558 | ||

| (State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

700 Universe Boulevard

Juno Beach, Florida 33408

(561) 694-4000

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Charles E. Sieving

700 Universe Boulevard

Juno Beach, Florida 33408

(561) 694-4000

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

| Richard B. Aftanas Andrea L. Nicolas Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Joshua Davidson Timothy S. Taylor Mollie Duckworth Baker Botts L.L.P. One Shell Plaza 910 Louisiana Street Houston, Texas 77002 (713) 229-1234 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated June 10, 2014

PRELIMINARY PROSPECTUS

Common Units

Representing Limited Partner Interests

This is the initial public offering of common units representing limited partner interests of NextEra Energy Partners, LP. We are selling common units.

We expect the public offering price to be between $ and $ per common unit. Currently, no public market exists for the common units. After pricing of the offering, we expect that the common units will trade on the New York Stock Exchange under the symbol “NEP.”

We are an “emerging growth company” and we are eligible for reduced reporting requirements. See “Prospectus Summary—Emerging Growth Company Status.”

Even though we are organized as a limited partnership under state law, we will be treated as a corporation for U.S. federal income tax purposes. Accordingly, we will be subject to U.S. federal income tax at regular corporate rates on our net taxable income and distributions we make to holders of our common units will be taxable as ordinary dividend income to the extent of our current and accumulated earnings and profits as computed for U.S. federal income tax purposes.

Investing in the common units involves risks that are described in the “Risk Factors” section beginning on page 30 of this prospectus.

These risks include the following:

| • | We have a limited operating history and our projects may not perform as we expect. |

| • | Initially, we will depend on certain of the projects in our initial portfolio for a substantial portion of our anticipated cash flows. |

| • | On a pro forma basis, we would not have had sufficient cash available for distributions to pay the full initial quarterly distribution on all of our common units for the twelve months ended March 31, 2014 or for the year ended December 31, 2013. |

| • | Our cash available for distribution to our unitholders may be reduced as a result of restrictions on our subsidiaries’ cash distributions to us under the terms of their indebtedness. |

| • | NextEra will exercise substantial influence over us and we are highly dependent on NextEra and its affiliates. |

| • | Our general partner and its affiliates, including NextEra, have conflicts of interest with us and limited duties to us and our unitholders, and they may favor their own interests to the detriment of us and our other holders of our common units. |

| • | Our ability to make distributions to our unitholders depends on the ability of NEE Operating LP to make cash distributions to its limited partners. |

| • | Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors. |

| • | Our partnership agreement restricts the remedies available to holders of our common units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duties. |

| • | Unitholders will experience immediate and substantial dilution in pro forma net tangible book value of $ per common unit. |

| • | Our future tax liability may be greater than expected if we do not generate NOLs sufficient to offset taxable income or if tax authorities challenge certain of our tax positions. |

| Per Common Unit |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | Excludes a structuring fee of an aggregate of % of the gross offering proceeds payable to Merrill Lynch, Pierce, Fenner & Smith Incorporated and Goldman, Sachs & Co. See “Underwriting.” |

The underwriters may also exercise their option to purchase up to an additional common units from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The common units will be ready for delivery on or about , 2014.

Joint Book-Running Managers

| BofA Merrill Lynch | Goldman, Sachs & Co. | Morgan Stanley |

The date of this prospectus is , 2014.

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

We obtained the industry, market and competitive position data used throughout this prospectus from our own internal estimates as well as from industry publications and research, surveys and studies conducted by third parties, including the U.S. Department of Energy, the U.S. Energy Information Administration, the International Energy Association, the U.S. Environmental Protection Agency, the National Energy Board (Canada), the Canadian Energy and Mines Minsters’ Conference and Bloomberg New Energy Finance. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. Estimates of historical growth rates in the markets where we operate are not necessarily indicative of future growth rates in such markets.

CURRENCY AND EXCHANGE RATE INFORMATION

In this prospectus, references to “CAD” and “Canadian dollars” are to the lawful currency of Canada and references to “$,” “U.S. $” and “U.S. dollars” are to the lawful currency of the U.S. All dollar amounts herein are in U.S. dollars, unless otherwise stated. The following chart sets forth for each of 2011, 2012 and 2013 and each completed month to date during 2014, the high, low, period average and period end noon buying rates in the City of New York for cable transfers of Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York expressed as Canadian dollars per U.S. $1.00.

| Year |

High |

Low |

Average |

Period End |

||||||||||||

| 2011 |

1.0605 | 0.9448 | 0.9887 | 1.0168 | ||||||||||||

| 2012 |

1.0417 | 0.9710 | 0.9995 | 0.9958 | ||||||||||||

| 2013 |

1.0697 | 0.9839 | 1.0300 | 1.0637 | ||||||||||||

| January 2014 |

1.1171 | 1.0612 | 1.0940 | 1.1116 | ||||||||||||

| February 2014 |

1.1137 | 1.0952 | 1.1054 | 1.1075 | ||||||||||||

| March 2014 |

1.1251 | 1.0965 | 1.1107 | 1.1251 | ||||||||||||

| April 2014 |

1.1041 | 1.0902 | 1.0992 | 1.1041 | ||||||||||||

| May 2014 |

1.0973 | 1.0837 | 1.0894 | 1.0867 | ||||||||||||

The above rates differ from the actual rates used in our predecessor’s historical financial statements and the calculation of cash available for distribution we may declare and pay, if any, described elsewhere in this prospectus. Our inclusion of these exchange rates is not meant to suggest that the U.S. dollar amounts actually represent such Canadian dollar amounts or that such amounts could have been converted into Canadian dollars at any particular rate or at all.

For information on the impact of fluctuations in exchange rates on our operations, see “Risk Factors—Risks Related to Our Financial Activities—Currency exchange rate fluctuations may affect our operations.”

ii

Table of Contents

CERTAIN TERMS USED IN THIS PROSPECTUS

Unless the context provides otherwise, references herein to “we,” “us,” “our” and “NEE Partners” or like terms, when used in a historical context, refer to the projects that NextEra (as defined below) is contributing to us in connection with the Project Transfer (as defined under “Prospectus Summary—Organizational Structure”). When used in the present tense or prospectively, such terms refer to NextEra Energy Partners, LP together with its consolidated subsidiaries, including NEE Operating LP (as defined below), after giving effect to the Organizational Transactions (as defined under “Prospectus Summary—Organizational Structure”). References herein to our general partner refer to NextEra Energy Partners GP, Inc. References herein to “NEE Operating LP” refer to NextEra Energy Operating Partners, LP and its subsidiaries and references to “NEE Operating GP” refer to NextEra Energy Operating Partners GP, LLC, the general partner of NEE Operating LP. Upon the completion of this offering, we will own a controlling non-economic general partner interest, through our ownership of NEE Operating GP, and a % limited partner interest in NEE Operating LP and NEE Equity (as defined below) will own a non-controlling % limited partner interest in NEE Operating LP. Unless otherwise specifically noted, financial results and operating data are shown on a 100% basis and are not adjusted to reflect NextEra’s non-controlling interest in NEE Operating LP. For an explanation of certain terms we use to describe our business and industry and other terms used in this prospectus see the “Glossary” beginning on page C-1 of this prospectus.

References within this prospectus to:

“Bluewater” refers to the wind project located in Huron County, Ontario, Canada, that is held by the Bluewater Project Entity and that will have a nameplate capacity of 59.9 MW upon its commencement of operations, which is expected to occur in the third quarter of 2014;

“Bluewater Project Entity” refers, when describing periods prior to the completion of the Organizational Transactions, to Varna Wind, Inc., a corporation formed under the laws of the Province of New Brunswick and, when describing periods after the completion of the Organizational Transactions, to Varna Wind, LP, a limited partnership formed under the laws of the Province of Ontario;

“Canadian Project Entities” refers to, collectively, the Conestogo Project Entity, Summerhaven Project Entity, Bluewater Project Entity, Sombra Project Entity and Moore Project Entity;

“Canyon Wind” refers to Canyon Wind, LLC, a limited liability company formed under the laws of the State of Delaware, which is the borrower under the credit agreement under which financing is provided to Perrin Ranch and Tuscola Bay;

“Conestogo” refers to the wind project located in Wellington County, Ontario, Canada, that is held by the Conestogo Project Entity and that has a nameplate capacity of 22.9 MW;

“Conestogo Project Entity” refers to Conestogo Wind, LP, a limited partnership formed under the laws of the Province of Ontario;

“Elk City” refers to the wind project located in Roger Mills and Beckham Counties, Oklahoma, that is held by Elk City Wind, LLC and that has a nameplate capacity of 98.9 MW;

“Genesis” refers to the solar project held by Genesis Solar, LLC, a limited liability company formed under the laws of the State of Delaware, that is composed of Genesis Unit 1 and Genesis Unit 2 and that has a nameplate capacity of 250 MW;

“Genesis Unit 1” refers to the Genesis Unit 1 utility-scale solar generating facility located in Riverside County, California, that has a nameplate capacity of 125 MW;

“Genesis Unit 2” refers to the Genesis Unit 2 utility-scale solar generating facility located in Riverside County, California, that has a nameplate capacity of 125 MW;

iii

Table of Contents

“Initial Portfolio” refers, collectively, to our initial portfolio of renewable energy projects, which consists of Conestogo, Elk City, Northern Colorado, Perrin Ranch, Summerhaven, Tuscola Bay, Bluewater, Genesis, Moore and Sombra;

“Logan Wind” refers to Logan Wind Energy, LLC, a limited liability company formed under the laws of the State of Delaware, an indirect wholly owned subsidiary of NextEra and the owner of a wind-powered energy production facility near Peetz, Colorado, that shares certain facilities owned by Peetz Table with Northern Colorado;

“Moore” refers to the solar project located in Lambton County, Ontario, Canada, that is held by the Moore Project Entity and that has a nameplate capacity of 20 MW;

“Moore Project Entity” refers, when describing periods prior to the completion of the Organizational Transactions, to Moore Solar, Inc., a corporation formed under the laws of the Province of Ontario, and, when describing periods after the completion of the Organizational Transactions, to Moore Solar, LP, a limited partnership formed under the laws of the Province of Ontario;

“Mountain Prairie” refers to Mountain Prairie Wind, LLC, a limited liability company formed under the laws of the State of Delaware and the issuer of notes that provide financing to Elk City and Northern Colorado;

“NECOS” refers to NextEra Energy Canadian Operating Services, Inc., a corporation existing under the laws of the Province of Alberta and an indirect wholly owned subsidiary of NextEra;

“NEE Equity” refers to NextEra Energy Equity Partners, LP, a limited partnership formed under the laws of the State of Delaware and an indirect wholly owned subsidiary of NextEra that owns the interest in NEE Operating LP we do not own;

“NEE Management” refers to NextEra Energy Management Partners, LP, a limited partnership formed under the laws of the State of Delaware and an indirect wholly owned subsidiary of NextEra;

“NEEC” refers, when describing periods prior to the completion of the Organizational Transactions, to NextEra Energy Canada Partners Holdings, ULC, an unlimited liability corporation existing under the laws of the Province of British Columbia and a wholly owned indirect subsidiary of NextEra and, when describing periods after the completion of the Organizational Transactions, to NextEra Energy Canadian Holdings, ULC, an unlimited liability corporation existing under the laws of British Columbia and an indirect wholly owned subsidiary of NextEra;

“NEECH” refers toNextEra Energy Capital Holdings, Inc., a corporation formed under the laws of the State of Florida and a direct wholly owned subsidiary of NextEra;

“NEER” refers to NextEra Energy Resources, LLC, a limited liability company formed under the laws of the State of Delaware and an indirect wholly owned subsidiary of NextEra, and its subsidiaries. Unless otherwise specifically noted, references to NEER and its affiliates exclude us and our subsidiaries, including NEE Operating LP;

“NEER ROFO Projects” refers to, collectively, the projects set forth under the heading “Business—NEER ROFO Projects” elsewhere in this prospectus owned by NextEra in which we have a right of first offer under the ROFO Agreement, defined below, should NextEra decide to sell them;

“NECIP” refers to NextEra Canadian IP, Inc., a corporation formed under the laws of the Province of New Brunswick and an indirect wholly owned subsidiary of NextEra;

“NEOS” refers to NextEra Energy Operating Services, LLC, a limited liability company formed under the laws of the State of Delaware and an indirect wholly owned subsidiary of NextEra;

iv

Table of Contents

“NextEra” refers to NextEra Energy, Inc., a corporation formed under the laws of the State of Florida, and its subsidiaries, other than us and our subsidiaries, including NEE Operating LP. Unless otherwise specifically noted, references to NextEra and its affiliates exclude us and our subsidiaries, including NEE Operating LP;

“Northern Colorado” refers to the wind project located in Logan County, Colorado, that is held by Northern Colorado Wind Energy, LLC and that has a nameplate capacity of 174.3 MW;

“Peetz Table” refers to Peetz Table Wind Energy, LLC, a limited liability company formed under the laws of the State of Delaware, an indirect wholly owned subsidiary of NextEra and the owner of certain facilities shared by Logan Wind, Northern Colorado and PLI;

“Perrin Ranch” refers to the wind project located in Coconino County, Arizona, that is held by Perrin Ranch Wind, LLC and that has a nameplate capacity of 99.2 MW;

“PLI” refers to Peetz Logan Interconnect, LLC, a limited liability company formed under the laws of the State of Delaware, an indirect wholly owned subsidiary of NextEra and the owner of the transmission line used by Northern Colorado to deliver energy output to the interconnection point;

“Project Entities” refers to the U.S. Project Entities together with the Canadian Project Entities;

“Sombra” refers to the solar project located in Lambton County, Ontario, Canada, that is held by the Sombra Project Entity and that has a nameplate capacity of 20 MW;

“Sombra Project Entity” refers, when describing periods prior to the completion of the Organizational Transactions, to Sombra Solar, Inc., a corporation formed under the laws of the Province of Ontario and, when describing periods after the completion of the Organizational Transactions, to Sombra Solar, LP, a limited partnership formed under the laws of the Province of Ontario;

“St. Clair Holding” refers, when describing periods prior to the completion of the Organizational Transactions, to St. Clair Holding, Inc., a corporation formed under the laws of the Province of Ontario, and, when describing periods after the completion of the Organizational Transactions, to St. Clair Holding, ULC, an unlimited liability company existing under the laws of the Province of British Columbia and a co-issuer issuer of notes that provide financing to Moore and Sombra;

“St. Clair LP” refers to St. Clair Solar, LP, a limited partnership formed under the laws of the Province of Ontario, and, when describing periods after the completion of the Organizational Transactions, a co-issuer of notes that provide financing to Moore and Sombra;

“St. Clair Entities” means, collectively, St. Clair Holding and St. Clair LP;

“Summerhaven” refers to the wind project located in Haldimand County, Ontario, Canada, that is held by the Summerhaven Project Entity and that has a nameplate capacity of 124.4 MW;

“Summerhaven Project Entity” refers to Summerhaven Wind, LP, a limited partnership formed under the laws of the Province of Ontario;

“Trillium” refers to Trillium Windpower, LP, a limited partnership formed under the laws of the Province of Ontario and the issuer of notes that provides financing to Conestogo and Summerhaven;

“Tuscola Bay” refers to the wind project located in Tuscola, Bay and Saginaw Counties, Michigan, that is held by Tuscola Bay Wind, LLC and that has a nameplate capacity of 120 MW;

“U.S. Project Entities” refers to the U.S. Wind Project Entities together with Genesis Solar, LLC; and

“U.S. Wind Project Entities” refers, collectively, to Elk City Wind, LLC, Northern Colorado Wind Energy, LLC, Perrin Ranch Wind, LLC and Tuscola Bay Wind, LLC, each of which is a limited liability company formed under the laws of the State of Delaware.

v

Table of Contents

Some of the information in this prospectus may contain forward-looking statements. Forward-looking statements give our current expectations, contain projections of results of operations or of financial condition or forecasts of future events. Words such as “could,” “will,” “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential” or “continue” and similar expressions are used to identify forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this prospectus include our expectations of plans, strategies, objectives, growth and anticipated financial and operational performance. Forward-looking statements can be affected by assumptions used or by known or unknown risks or uncertainties.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement, including industry data referenced elsewhere in this prospectus. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, when considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this prospectus. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

| • | the failure of our projects, including any NEER ROFO Projects or any other projects we may acquire, to perform as we expect; |

| • | risks inherent in newly constructed energy projects, including underperformance relative to our expectations, system failures and outages; |

| • | risks inherent in the operation and maintenance of energy projects; |

| • | the impairment or loss of any one or more of the projects in our Initial Portfolio, such as Genesis, or any other projects we may acquire; |

| • | terrorist or other attacks and responses to such acts; |

| • | a natural disaster or other severe weather or meteorological conditions; |

| • | the occurrence of a significant incident for which we do not have adequate insurance coverage; |

| • | the failure of a supplier to fulfill its warranty or other contractual obligations; |

| • | the inability of our projects to operate or deliver energy for any reason, including if interconnection or transmission facilities on which we rely become unavailable; |

| • | liabilities and operating restrictions arising from environmental, health and safety laws and regulations; |

| • | unfavorable U.S. and Canadian federal, state, provincial and local regulatory restrictions or legislative changes; |

| • | the existence of lienholders or leaseholders that may have rights superior to our rights on the lands on which our the projects in our Initial Portfolio or any other projects we may acquire are located; |

vi

Table of Contents

| • | risks associated with litigation and administrative proceedings; |

| • | a failure to comply with anti-corruption laws and regulations in the U.S. and Canada; |

| • | risks associated with our ownership or acquisition of projects that remain under construction; |

| • | the risk that our limited number of Energy Sale Counterparties are unwilling or unable to fulfill their contractual obligations to us or that they otherwise terminate their agreements with us; |

| • | our inability to renew or replace expiring or terminated agreements, such as our PPAs, RESOP Contracts and FIT Contracts, at favorable rates or on a long-term basis; |

| • | energy production by our U.S. projects or availability of our U.S. projects that does not satisfy the minimum obligations under the U.S. Project Entities’ PPAs; |

| • | a failure to locate and acquire interests in additional, attractive projects at favorable prices; |

| • | limits on NEE Operating LP’s ability to grow and make acquisitions because of its obligations under its partnership agreement to distribute available cash; |

| • | lower prices for fuel sources used to produce energy from other technologies, which could reduce the demand for clean energy; |

| • | risks to NextEra and third party development companies relating to project siting, financing, construction, permitting, the environment, governmental approvals and the negotiation of project development agreements, reducing opportunities available to us; |

| • | risks inherent in the acquisition of existing clean energy projects; |

| • | a failure to timely anticipate the future policy direction in each country, state and province and thereby miss the relatively infrequent, irregular and often competitive procurement windows in these countries, states and provinces; |

| • | substantial competition from utilities, IPPs and other industry participants; |

| • | conflicts arising from our general partner’s and NextEra’s relationship with us; |

| • | increases in our tax liability; and |

| • | certain factors discussed elsewhere in this prospectus. |

Each forward-looking statement speaks only as of the date of the particular statement and we undertake no obligation to publicly update or revise any forward-looking statements except as required by law.

vii

Table of Contents

The following summary highlights information contained elsewhere in this prospectus. It does not contain all the information you need to consider in making your investment decision. Before making an investment decision, you should read this entire prospectus carefully and should consider, among other things, the matters set forth under “Risk Factors,” “Selected Historical and Pro Forma Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our predecessor’s historical financial statements and the accompanying notes included elsewhere in this prospectus. Unless otherwise indicated, the information in this prospectus assumes: (i) an initial public offering price of $ per common unit (the midpoint of the price range set forth on the cover page of this prospectus); and (ii) that the underwriters do not exercise their option to purchase additional common units.

About NEE Partners

We are a growth-oriented limited partnership formed by NextEra Energy, Inc. to own, operate and acquire contracted clean energy projects with stable, long-term cash flows through our limited partner interest in NEE Operating LP. We will own a controlling, non-economic general partner interest and a % limited partner interest in NEE Operating LP. Upon the completion of this offering, we will own interests in ten wind and solar projects, nine of which will be operational and one of which is expected to be in the final stages of construction.

We intend to take advantage of favorable trends in the North American energy industry, including the ongoing trend of clean energy projects replacing aging or uneconomic projects, demand by utilities for renewable energy to meet state RPS requirements and the improving competitiveness of clean energy relative to other fuels. We plan to focus on high-quality, long-lived projects operating under long-term contracts with creditworthy counterparties that are expected to produce stable long-term cash flows. We believe our cash flow profile, geographic and technological diversity, cost-efficient business model and relationship with NextEra will provide us with a significant competitive advantage and enable us to execute our growth strategy.

Our objective is to pay stable and growing cash distributions to the holders of our common units. NEE Operating LP’s partnership agreement will provide that NEE Operating LP will distribute all cash available for distribution to its unitholders on a quarterly basis and we intend to use the amount distributed to us to pay regular quarterly distributions to holders of our common units. We intend to target a three-year annual growth rate in our cash available for distribution of 12% to 15% per common unit. This target is based on NextEra’s stated intention that it plans to offer us sufficient NEER ROFO Projects each year to produce such an increase. We believe that the acquisition opportunities associated with NEE Operating LP’s right of first offer for the NEER ROFO Projects, other NEER projects, as well as other acquisition opportunities in North America, all of which have many of the characteristics of the projects in our Initial Portfolio, will give us the opportunity to grow our cash available for distribution over time. While we believe our targeted growth rate is reasonable, it is based on estimates and assumptions regarding a number of factors, many of which are beyond our control, and we may not be able to grow our business at a rate consistent with our expectations, if at all.

NEER is not obligated to offer us the NEER ROFO Projects at prices or on terms that allow us to achieve our targeted growth rate, or at all, and even if it offers us such opportunities, we may not be able to consummate an acquisition with NEER or might not achieve our targeted growth rate. See “Provisions of the Partnership Agreements and Other Arrangements Relating to Cash Distributions” and “Our Cash Distribution Policy and Restrictions on Distributions” for additional detail on how we plan to distribute available cash to our unitholders and “Risk Factors” for risks associated with our forecast and our ability to consummate acquisitions.

1

Table of Contents

About NextEra

NextEra is one of the largest energy companies in North America, with approximately 42.8 GW of generating capacity in the U.S. and Canada as of March 31, 2014. NextEra provides retail and wholesale energy services to nearly five million customer accounts and owns generation, transmission and distribution facilities to support these services. NextEra has been recognized as the World’s Most Admired Utility eight years in a row by Fortune magazine.

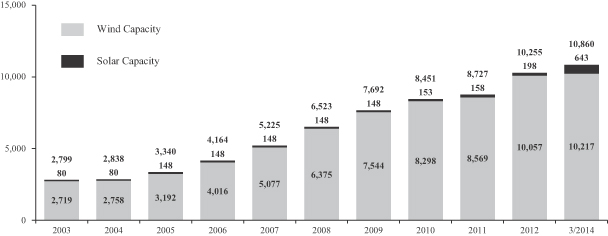

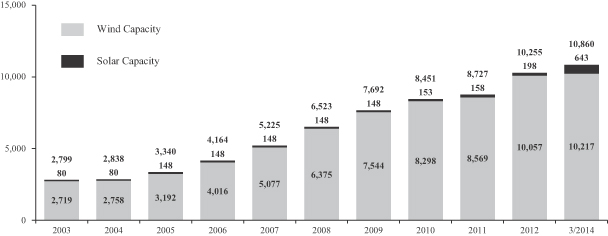

NextEra began investing in renewable energy in 1989. Since then, NextEra has deployed nearly $20 billion of capital through NEER to develop or acquire nearly 10.9 GW of renewable energy as of March 31, 2014, increasing the capacity in their portfolio at a compound average growth rate of approximately 14% per year over the past decade, as shown in the graph below.

| NEER’s North American Wind and Solar Portfolio (MW) |

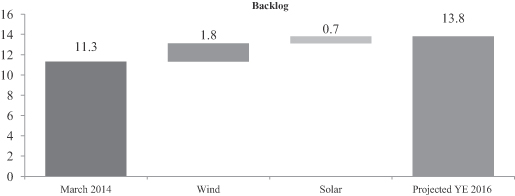

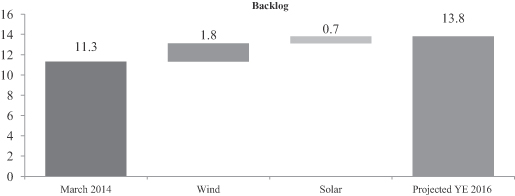

NEER had over 11.3 GW of contracted clean energy capacity as of March 31, 2014, and expects its contracted clean energy capacity to increase by approximately 7.1% per year to over 13.8 GW by the end of 2016 based on currently signed contracts for an additional 2.5 GW of contracted clean energy capacity as of March 31, 2014. We believe NextEra’s long history of developing, owning and operating clean energy projects provides us with a distinct competitive advantage in North America.

| NEER’s Contracted Clean Energy Capacity (GW)(1) |

Source: NextEra, as of March 31, 2014.

(1) Includes wind, solar, natural gas and nuclear.

2

Table of Contents

Current Operations

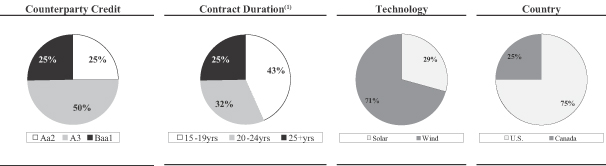

Our Initial Portfolio is composed of 989.6 MW of contracted renewable energy projects in North America with a stable cash flow profile and technological, geographic and counterparty diversification. As illustrated below, the projects in our Initial Portfolio are fully contracted to creditworthy counterparties with a capacity-weighted average Moody’s credit rating of A2 under long-term contracts that will have a capacity-weighted average remaining contract term of approximately 21 years as of June 30, 2014, after giving effect to the Bluewater FIT Contract.

Initial Portfolio

The following table provides a brief description of the projects in our Initial Portfolio:

| Project |

Commercial |

Location |

Resource |

MW |

Counterparty |

Contract | ||||||||

| Northern Colorado |

September 2009 | Colorado, USA | Wind | 174.3 | Public Service Company of Colorado | 2029 (22.5 MW) / 2034 (151.8 MW) | ||||||||

| Elk City |

December 2009 | Oklahoma, USA | Wind | 98.9 | Public Service Company of Oklahoma | 2030 | ||||||||

| Moore |

February 2012 | Ontario, Canada | Solar | 20.0 | Ontario Power Authority | 2032 | ||||||||

| Sombra |

February 2012 | Ontario, Canada | Solar | 20.0 | Ontario Power Authority | 2032 | ||||||||

| Perrin Ranch |

January 2012 | Arizona, USA | Wind | 99.2 | Arizona Public Service Company | 2037 | ||||||||

| Conestogo |

December 2012 | Ontario, Canada | Wind | 22.9 | Ontario Power Authority | 2032 | ||||||||

| Tuscola Bay |

December 2012 | Michigan, USA | Wind | 120.0 | DTE Electric Company | 2032 | ||||||||

| Summerhaven |

August 2013 | Ontario, Canada | Wind | 124.4 | Ontario Power Authority | 2033 | ||||||||

| Genesis |

November 2013 (125.0 MW) / March 2014 (125.0 MW) |

California, USA | Solar | 250.0 | Pacific Gas & Electric Co. | 2039 | ||||||||

| Bluewater |

3Q 2014 (expected) | Ontario, Canada | Wind | 59.9 | Ontario Power Authority | 2034 (estimated) | ||||||||

|

|

|

|||||||||||||

| Total |

989.6 | |||||||||||||

|

|

|

|||||||||||||

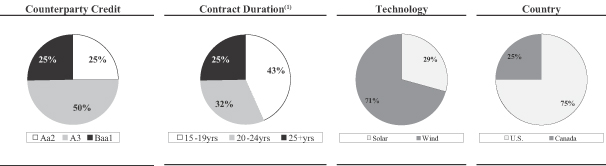

The projects in our Initial Portfolio use reliable technology and are generally located in regions characterized by favorable wind and solar resource. The following charts provide an overview of the characteristics of our Initial Portfolio by counterparty credit rating, contract duration, technology and region, in each case based on MW capacity:

| Our Initial Portfolio Characteristics (MW) |

| (1) | Remaining term as of June 30, 2014, after giving effect to the Bluewater FIT Contract. |

For additional information regarding our Initial Portfolio, see “—Current Operations” above. Our ability to achieve anticipated energy output at our projects is subject to numerous risks and uncertainties as described under “Risk Factors.”

3

Table of Contents

NEER ROFO Projects

In connection with this offering, we will enter into a ROFO Agreement with NEER that, among other things, will provide NEE Operating LP with a right of first offer to acquire the NEER ROFO Projects should NEER seek to sell any of these projects. We believe that the NEER ROFO Projects, which include wind and solar projects with a combined capacity of 1,549 MW, have or, upon commencing commercial operations, will have, many of the characteristics of the projects in our Initial Portfolio, including long-term contracts with creditworthy counterparties and recently or newly constructed, long-lived facilities that we believe will generate stable cash flows. The following table provides a brief description of the NEER ROFO Projects:

| Project |

Commercial |

Location |

Resource |

MW |

Counterparty |

Contract | ||||||||

| Story II |

December 2009 | Iowa, USA | Wind | 150.0 | Google Energy/City of Ames | 2030 | ||||||||

| Day County |

April 2010 | South Dakota, USA | Wind | 99.0 | Basin Electric Power Co-Op | 2040 | ||||||||

| Ashtabula III |

December 2010 | North Dakota, USA | Wind | 62.4 | Otter Tail Power Company | 2038 | ||||||||

| Baldwin |

December 2010 | North Dakota, USA | Wind | 102.4 | Basin Electric Power Co-Op | 2041 | ||||||||

| North Sky River |

December 2012 | California, USA | Wind | 162.0 | Pacific Gas & Electric Co. | 2037 | ||||||||

| Mountain View |

January 2014 | Nevada, USA | Solar | 20.0 | Nevada Power Company | 2039 | ||||||||

| Adelaide |

3Q 2014 (expected) | Ontario, Canada | Wind | 59.9 | Ontario Power Authority | 2034 | ||||||||

| Bornish |

3Q 2014 (expected) | Ontario, Canada | Wind | 72.9 | Ontario Power Authority | 2034 | ||||||||

| Jericho |

4Q 2014 (expected) | Ontario, Canada | Wind | 149.0 | Ontario Power Authority | 2034 | ||||||||

| East Durham |

1Q 2015 (expected) | Ontario, Canada | Wind | 22.4 | Ontario Power Authority | 2035 | ||||||||

| Goshen |

1Q 2015 (expected) | Ontario, Canada | Wind | 102.0 | Ontario Power Authority | 2035 | ||||||||

| Shafter |

2Q 2015 (expected) | California, USA | Solar | 20.0 | Pacific Gas & Electric Co. | 2035 | ||||||||

| Adelanto I and II |

3Q 2015 (expected) | California, USA | Solar | 27.0 | Southern California Edison Co. | 2035 | ||||||||

| Silver State South |

3Q 2016 (expected) | Nevada, USA | Solar | 250.0 | Southern California Edison Co. | 2036 | ||||||||

| McCoy |

4Q 2016 (expected) | California, USA | Solar | 250.0 | Southern California Edison Co. | 2036 | ||||||||

|

|

|

|||||||||||||

| Total |

1,549.0 | |||||||||||||

|

|

|

|||||||||||||

Under the ROFO Agreement, however, NEER will not be obligated to offer to sell the NEER ROFO Projects. Therefore, we do not know when, if ever, these projects will be offered to NEE Operating LP. In addition, in the event that NEER elects to sell the NEER ROFO Projects, NEER will not be required to accept any offer NEE Operating LP may make to acquire any NEER ROFO Project and, following the completion of good faith negotiations with us, may choose to sell these projects to third parties or not sell the projects at all. See “Certain Relationships and Related Party Transactions—ROFO Agreement.”

Industry Overview

U.S. Energy Industry

The energy industry is one of the largest industries in the U.S. According to Bloomberg New Energy Finance, the U.S. has a total operating energy capacity of approximately 1,016 GW as of December 2013, which is comprised of a diverse mix of fuel types, including 442 GW of natural gas-fired capacity, 234 GW of coal-fired capacity, 190 GW of renewable capacity, 99 GW of nuclear capacity and 51 GW of oil-fired capacity. Non-hydro renewable capacity increased at a compound average annual rate of approximately 15% per year from 2000 to 2013. While forecasts of future growth are dependent on a number of factors, including the rate of continued improvement in renewable energy technology and costs, government incentives, natural gas and energy prices and future emission standards regulation, industry researchers expect investment in renewable energy to continue. Bloomberg New Energy Finance, which has been analyzing the global renewable energy industry for over a decade, forecasts the U.S. renewable energy industry to grow at a compound average annual rate of approximately 10% per year from 2013 through 2020.

4

Table of Contents

U.S. Renewable Generation Market

Growth in renewable energy is largely attributable to its increasing cost competitiveness driven primarily by government incentives, improving technology and installation costs and the impact of increasingly stringent environmental rules and regulations on coal-fired generation.

Government Incentives for Renewables

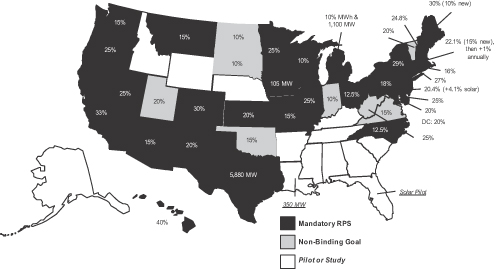

U.S. federal, state and local governments and utilities have established various incentives to support the development of renewable energy. These incentives include accelerated tax depreciation, PTCs, ITCs, cash grants and RPS programs.

| • | Wind and solar projects qualify for the U.S. federal Modified Accelerated Cost Recovery System depreciation. |

| • | The PTC is a U.S. federal incentive that provides a U.S. federal income tax credit on a ¢/kWh basis for all energy produced by a U.S. wind project during the first ten years after it commences commercial operations. |

| • | The ITC and 1603 Cash Grant Program are U.S. federal incentives that provide an income tax credit or cash grant after the project commences commercial operations of 30% of eligible installed costs. |

| • | RPS are state regulatory programs created by state legislatures to encourage the development of renewable energy. |

These incentives make the development of clean energy projects more competitive by providing tax credits or grants and accelerated depreciation for a portion of the development costs, decreasing the costs associated with developing such projects or creating demand for renewable energy assets through RPS programs.

Increasing competitiveness of renewable energy

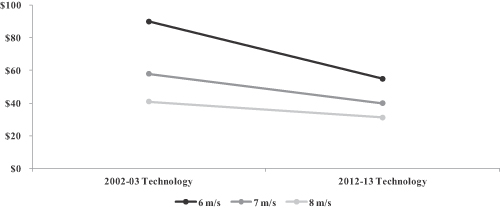

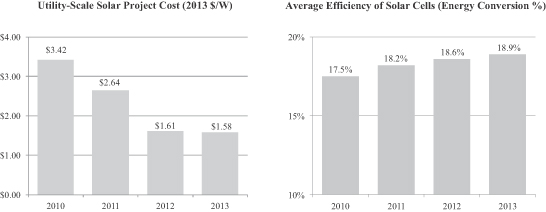

Renewable energy technology and installation costs have improved meaningfully in recent years. Wind technology is improving as a result of taller towers, longer blades and more efficient energy conversion equipment, which allow wind projects to more efficiently capture wind resource and produce more energy. Since 2002, technology improvements have decreased the cost of wind energy in the U.S. between 24% and 39% depending on wind speed, according to IEA estimates. Solar technology is also improving as solar cell efficiencies improve and installation costs decline. Since the start of 2010, the total average installed cost of utility-scale solar has declined over 50%, according to Bloomberg New Energy Finance.

Impact of increasingly stringent environmental rules and regulations on coal-fired generation

Traditional coal-fired plants emit greenhouse gases and other pollutants. The EPA is responsible for implementing rules and regulations to protect the environment, including rules and regulations that limit emissions of greenhouse gases and other pollutants from coal-fired plants. A number of new EPA rules are emerging that are expected to impact many coal-fired plants in the U.S. While there is some uncertainty as to the timing and requirements that will ultimately be imposed by these rules, we expect that the owners of some of the smaller, older or less efficient coal-fired plants will choose to decommission these facilities rather than make the significant investments that will be necessary to comply with environmental rules and regulations. In addition, the continued relatively low natural gas prices will put additional pressure on these plants. According to Bloomberg New Energy Finance, over 100 GW of coal-fired capacity will be retired in the U.S. by the end of 2020, relative to the capacity at the turn of the century.

5

Table of Contents

Canadian Energy Industry

Canada is a world leader in the production and use of clean energy as a percentage of its total energy capacity. According to a November 2013 report of the NEB, total energy capacity in Canada was expected to reach 137 GW in 2013, with hydroenergy accounting for approximately 56% of total capacity and non-hydro renewable energy accounting for approximately 7%. Capacity additions will be required throughout Canada in order to replace aging projects and meet growing demand. While a majority of Canada’s energy is produced by hydroenergy, non-hydro renewable energy is providing an increasing portion of Canada’s energy each year. According to the NEB, renewable energy generation in Canada grew at a compound average annual rate of approximately 15% between 2000 and 2013 and is projected to grow at a compound average annual rate of approximately 9.6% between 2013 and 2020.

Canadian Renewable Generation Market

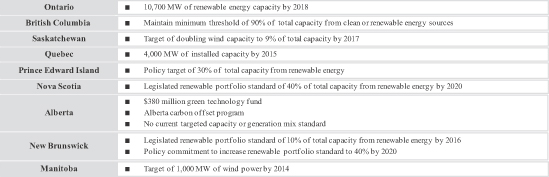

The Canadian energy industry is also benefiting from the increased competitiveness of renewable energy, due in part to improving technology and declining installation costs. In addition, government incentives make the development of clean energy projects more attractive either through renewable energy incentives and targets or by providing supportive contract prices. Furthermore, government targets and incentives at the provincial level continue to drive the growth of renewable energy in Canada.

Ontario has been a leader in supporting the development of renewable energy in Canada. The LTEP, released in December 2013 by the Ontario Ministry of Energy, suggests that by 2025, 10.7 GW of non-hydro renewable energy will be online in the province.

Our Business Strategy

Our primary business objective is to invest in contracted clean energy projects that allow us to increase our cash distributions to the holders of our common units over time. To achieve our objective, we intend to execute the following business strategy:

Focus on contracted clean energy projects. We intend to focus on long-term contracted clean energy projects that have recently commenced commercial operations with newer, more reliable technology, lower operating costs and relatively stable cash flows, subject to seasonal variances, consistent with the characteristics of our Initial Portfolio.

Focus on the U.S. and Canada. We intend to focus our investments in the U.S. and Canada, where we believe industry trends present us with significant opportunities to acquire contracted clean energy projects in diverse regions and favorable locations. By focusing on the U.S. and Canada, we believe we will be able to take advantage of NextEra’s long-standing industry relationships, knowledge and experience.

Maintain a sound capital structure and financial flexibility. We currently have limited recourse project-level financings at the projects in our Initial Portfolio. In addition, NEE Operating LP will have a $250 million revolving credit facility, the Bluewater Project Entity is expected to have a CAD 170 million limited recourse financing and Genesis Solar Funding, LLC is expected to have a $280 million limited recourse financing by the completion of this offering. We believe our cash flow profile, the long-term nature of our contracts and our ability to raise capital provide flexibility for optimizing our capital structure and distributions. We intend to continually evaluate opportunities to finance future acquisitions or refinance our existing debt consistent with NextEra’s management practices, which have sought to limit recourse, optimize leverage, extend maturities and increase cash distributions to unitholders over the long term.

6

Table of Contents

Take advantage of NEER’s operational excellence to maintain the value of the projects in our Initial Portfolio. NEER will continue to provide O&M, administrative and management services to the projects in our Initial Portfolio through existing O&M agreements, ASAs and the Management Services Agreement (as defined below). Through these agreements, we will retain the same benefits and operational expertise that NextEra currently provides across its entire portfolio. We expect that these services will maximize the operational efficiencies of our portfolio, which we believe will maintain our relatively low operating costs.

Grow our business and cash distributions through selective acquisitions of operating projects. We believe the ROFO Agreement and our relationship with NextEra will provide us with opportunities for growth through the acquisition of projects that have or, upon the commencement of commercial operations, will have similar characteristics to the projects in our Initial Portfolio. NextEra intends to use us as its primary growth vehicle for its contracted clean energy business. NEER will grant NEE Operating LP a right of first offer to acquire the NEER ROFO Projects during the first six years following the completion of this offering. See “Certain Relationships and Related Party Transactions—ROFO Agreement.” We intend to focus on acquiring projects in operation, maintaining a disciplined investment approach and taking advantage of market opportunities to acquire additional projects from NEER and third parties in the future, which we believe will allow us to increase cash distributions to our unitholders over the long term. NextEra is not required, however, to offer us the opportunity to purchase any of its projects, including the NEER ROFO Projects.

Our Competitive Strengths

We believe that we are well-positioned to execute our strategy and grow our cash available for distributions to our unitholders based on the following competitive strengths:

Our relationship with NextEra. We believe that our relationship with NextEra provides us with the following significant benefits:

| • | NextEra Management and Operational Expertise. We believe we benefit from NextEra’s experience, operational excellence, cost-efficient operations and reliability. Through our Management Services Agreement and other agreements with NextEra, our projects will receive the same benefits and expertise that NextEra currently provides across its entire portfolio. |

| • | NextEra Project Development Track Record and Pipeline. We believe that NextEra’s long history of developing, owning and operating clean energy projects provides us with a competitive advantage in North America. NextEra has deployed nearly $20 billion of capital through NEER to develop or acquire nearly 10.9 GW of renewable energy as of March 31, 2014. NEER had over 11.3 GW of contracted clean energy capacity as of March 31, 2014, and expects its contracted clean energy capacity to increase by approximately 7.1% per year to over 13.8 GW by the end of 2016, based on signed contracts for an additional 2.5 GW of contracted clean energy as of March 31, 2014. |

Contracted projects with stable cash flows from diverse, investment grade counterparties. The contracted, geographically diverse nature of our Initial Portfolio supports stable long-term cash flows. Our Initial Portfolio is composed of 989.6 MW of renewable energy capacity. Our projects are fully contracted under long term contracts with creditworthy counterparties that have a capacity-weighted average Moody’s credit rating of A2. These contracts will have a capacity-weighted average remaining contract term of approximately 21 years as of June 30, 2014, after giving effect to the Bluewater FIT Contract. These contracts generally provide for fixed price payments subject to annual escalation over the contract term.

New, well-maintained and diverse portfolio using best-in-class equipment. Over the past 25 years in the clean energy industry, NextEra has developed strong working relationships with the leading global equipment manufacturers. These manufacturers are generally recognized as industry-leaders that make equipment based on evolutionary improvements over decades of servicing the clean energy industry. Our Initial Portfolio is composed of

7

Table of Contents

renewable energy projects that have, on average, been operating for fewer than five years. Because our Initial Portfolio is relatively new and uses what we believe is industry-leading technology, we believe that we will incur relatively low operating and maintenance costs and achieve our expected levels of availability and performance.

Geographic diversification. Our Initial Portfolio is geographically diverse across the U.S. and Canada. A geographically diverse portfolio tends to reduce the magnitude of individual project or regional deviations from historical resource conditions, providing a more stable stream of cash flows over the long term than a non-diversified portfolio. In addition, we believe the geographic diversity of our Initial Portfolio helps minimize the impact of adverse regulatory conditions in any one jurisdiction.

An organizational structure that we expect will reduce taxes. We do not expect to pay meaningful U.S. federal or state income tax for a period of approximately 15 years, with the possible exception of Michigan, where we expect state income tax liability could begin after a period of five years. To the extent we pursue the NEER ROFO Projects or other acquisition opportunities, these periods may be extended depending on the tax characteristics and structure of any specific acquisition. For U.S. federal income tax purposes, however, there may be alternative minimum tax (“AMT”) liability on alternative minimum taxable income (“AMTI”) for tax years prior to any regular U.S. federal income tax liability. Some states also impose state-level AMT, typically based on federal AMTI. Thus, in a situation where AMT liability exists, some corresponding state AMT liability may result. The AMTI calculation can be complex and, as such, a reasonable estimate of potential AMT liability cannot be determined at this time. Any AMT liability due, however, is not anticipated to be significant and AMT paid in a particular tax year is available as a credit to reduce regular tax liability in a future tax year. Any AMT liability due, however, is not anticipated to be significant. Additionally, we do not expect liability for state fixed minimum taxes/fees to be significant. See, however, “Risk Factors—Risks Related To Taxation—Our future tax liability may be greater than expected if we do not generate NOLs sufficient to offset taxable income.”

Risk Factors

An investment in our common units involves risks. For more information about these risks, see “Risk Factors.” You should consider carefully these risk factors together with all of the other information included in this prospectus before you invest in our common units.

Risks Related to the Operation of Our Projects

| • | We have a limited operating history and our projects may not perform as we expect. |

| • | Our ability to make cash distributions to our unitholders will be affected by wind and solar conditions at our projects. |

| • | Initially, we will depend on certain of the projects in our Initial Portfolio for a substantial portion of our anticipated cash flows. |

| • | Our business is subject to liabilities and operating restrictions arising from environmental, health and safety laws and regulations. |

Risks Related to Our Project Agreements

| • | We rely on a limited number of counterparties in our energy sale arrangements. |

| • | We may not be able to extend, renew or replace expiring or terminated agreements, such as our PPAs, RESOP Contracts and FIT Contracts, at favorable rates or on a long-term basis. |

| • | If the energy production by or availability of our U.S. projects is less than expected, they may not be able to satisfy minimum production or availability obligations under U.S. Project Entities’ PPAs. |

8

Table of Contents

Risks Related to Our Acquisition Strategy and Future Growth

| • | Government regulations providing incentives and subsidies for clean energy could change at any time and such changes may negatively impact our growth strategy. |

| • | Our growth strategy depends on the acquisition of projects developed by NextEra and third parties, which face risks related to project siting, financing, construction, permitting, the environment, governmental approvals and the negotiation of project development agreements. |

| • | Our ability to effectively consummate future acquisitions will also depend on our ability to arrange the required or desired financing for acquisitions. |

Risks Related to Our Financial Activities

| • | Restrictions in our new credit facility could adversely affect our business, financial condition, results of operations and ability to make cash distributions to our unitholders. |

| • | Our cash available for distribution to our unitholders may be reduced as a result of restrictions on our subsidiaries’ cash distributions to us under the terms of their indebtedness. |

| • | Our subsidiaries’ substantial amount of indebtedness may adversely affect our ability to operate our business and our failure to comply with the terms of our indebtedness could have a material adverse effect on our financial condition. |

Risks Related to Our Relationship with NextEra

| • | NextEra will exercise substantial influence over us and we are highly dependent on NextEra and its affiliates. |

| • | NEER will be allowed to withdraw funds received by our subsidiaries, including NEE Operating LP, each quarter as partial consideration for its obligation to provide credit support to us. NEER will use these funds for its own account without paying additional consideration or interest to us and is obligated to return these funds only as needed to cover project costs and distributions or as demanded by NEE Operating LP. Our financial condition and ability to make distributions to our unitholders, as well as our ability to grow distributions in the future, is highly dependent on NEER’s performance of its obligations to return a portion of these funds. |

| • | Our general partner and its affiliates, including NextEra, have conflicts of interest with us and limited duties to us and our unitholders. |

| • | NextEra and other affiliates of our general partner are not restricted in their ability to compete with us. |

Risks Related to this Offering and Ownership of Our Common Units

| • | Our ability to make distributions to our unitholders depends on the ability of NEE Operating LP to make cash distributions to its limited partners. |

| • | On a pro forma basis, we would not have had sufficient cash available for distributions to pay the full initial quarterly distribution on all of our common units for the twelve months ended March 31, 2014, or for the year ended December 31, 2013. |

9

Table of Contents

| • | Holders of our common units have limited voting rights and are not entitled to elect our general partner or its directors. |

| • | Our partnership agreement restricts the remedies available to holders of our common units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duties. |

| • | Unitholders will experience immediate and substantial dilution in pro forma net tangible book value of $ per common unit. |

Risks Related to Taxation

| • | Our future tax liability may be greater than expected if we do not generate NOLs sufficient to offset taxable income or if tax authorities challenge certain of our tax positions. |

| • | Our ability to use NOLs to offset future income may be limited. |

| • | Distributions to unitholders may be taxable as dividends. |

Our Relationship with NextEra

One of our principal strengths is our relationship with NextEra. Upon the completion of this offering, NextEra will indirectly own and control our general partner and will appoint all of our general partner’s officers and directors. NEE Equity, a wholly owned subsidiary of NextEra, will own all of our Special Voting Units (as defined below), giving it effective voting control over us with respect to certain matters and a majority of the common units of NEE Operating LP.

The following is a summary of certain agreements that we will enter into with NextEra or its affiliates in connection with this offering. Because of our relationship with NextEra, our agreements with NextEra or its affiliates may not be as favorable to us as they might have been had we negotiated them with an unaffiliated third party. For a more comprehensive discussion of the agreements that we will enter into with NextEra or its affiliates, see “Certain Relationships and Related Party Transactions.” For a discussion of the risks related to our relationship with NextEra, see “Risk Factors—Risks Related to Our Relationship with NextEra.”

Management Services Agreement. We, NEE Operating LP and NEE Operating GP will enter into a management services agreement with NEE Management (the “Management Services Agreement”), under which:

| • | NEE Management will provide or arrange for the provision of operational, management and administrative services to us and our subsidiaries, including managing our day to day affairs and providing individuals to act as our general partner’s executive officers and directors, in addition to those services that are provided under existing O&M agreements and ASAs between affiliates of NextEra and our subsidiaries; |

| • | NEE Operating LP will pay on our behalf all O&M or other expenses we or our subsidiaries incur; |

| • | NEE Operating LP will pay NEE Management an annual management fee equal to the greater of 1% of NEE Operating LP’s EBITDA for the most recently ended fiscal year (calculated prior to the deduction of such fee) and $4 million, which will be paid in quarterly installments of $1 million with an additional payment each January to the extent 1% of NEE Operating LP’s annual EBITDA for the preceding fiscal year exceeds $4 million, subject to adjustment as described herein; |

10

Table of Contents

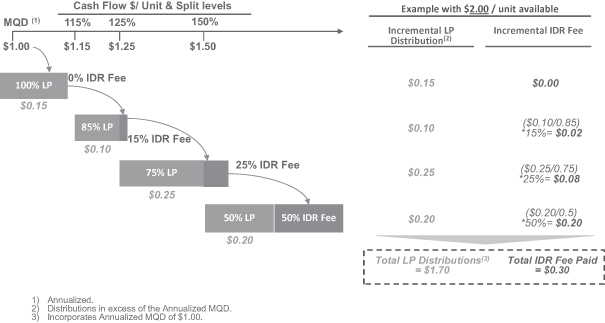

| • | NEE Operating LP will make certain payments to NEE Management based on the achievement by NEE Operating LP of certain target quarterly distribution levels to its unitholders. See “Certain Relationships and Related Party Transactions—Management Services Agreement,” “Provisions of the Partnership Agreements and Other Arrangements Relating to Cash Distributions—Incentive Distribution Right Fee” and “Our Cash Distribution Policy and Restrictions on Distributions—General—Restrictions and Limitations on Our Cash Distributions and Our Ability to Change Our Cash Distribution Policy.” |

Concurrently with the execution of the Management Services Agreement, NEE Management will enter into a second management services agreement (the “Management Sub-Contract”) with NEER, under which NEER will provide or arrange all services to us contemplated under the Management Services Agreement. Additionally, NEE Management will pay NEER a fee equal to the management fee payable under the Management Services Agreement.

Cash Sweep and Credit Support Agreement. We and NEE Operating LP will enter into a cash sweep and credit support agreement (the “CSCS Agreement”) with NEER, under which:

| • | NEER will agree to continue to provide certain existing limited credit support on behalf of our subsidiaries for the projects in our Initial Portfolio and, upon our request and at NEER’s option, may agree to provide credit support on behalf of any projects we may acquire in the future on similar terms, and we will reimburse NEER to the extent NEER or its affiliates are required to make payments under such credit support, subject to certain exceptions; |

| • | when our Project Entities receive revenues or when NEE Operating LP receives distributions from our subsidiaries, NEER or one of its affiliates will withdraw excess funds from our subsidiaries, including NEE Operating LP, and hold them in an account of NEER or one of its affiliates for the benefit of NEER and its affiliates until such funds are required to fund distributions or pay our or our subsidiaries’ expenses or NEE Operating LP otherwise demands the returns of such funds; and |

| • | NEE Operating LP will pay NEER an annual credit support fee of $1.8 million, subject to adjustment as described herein. See “Certain Relationships and Related Party Transactions—Cash Sweep and Credit Support Agreement.” |

ROFO Agreement. Under the terms of the right of first offer agreement among us, NEE Operating LP and NEER (the “ROFO Agreement”), NEER will grant NEE Operating LP a right of first offer on the NEER ROFO Projects should NEER decide to sell, transfer or otherwise dispose of any such projects. The term of the right of first offer will be six years following the completion of this offering. Under the ROFO Agreement, NEER will agree to negotiate with NEE Operating LP in good faith, for a period of 30 days, to reach an agreement with respect to any proposed sale of a NEER ROFO Project for which NEE Operating LP has a right of first offer. Under the ROFO Agreement, however, NEER will not be obligated to sell any of the NEER ROFO Projects and, therefore, we do not know when, if ever, these projects will be offered to NEE Operating LP. The likelihood and timing of our ability to acquire any NEER ROFO Projects will depend upon, among other things, the determination that the acquisition is appropriate for our business at that particular time, our ability to agree on mutually acceptable terms of purchase, including price, our ability to obtain financing on acceptable terms and our ability to obtain any necessary consents. See “Certain Relationships and Related Party Transactions—ROFO Agreement.”

Purchase Agreement. In connection with the Organizational Transactions, we will enter into a purchase agreement (the “Purchase Agreement”) with NEE Equity, under which we will use $ million of the net proceeds of this offering (or $ million if the underwriters exercise in full their option to purchase additional common units) to purchase (or if the underwriters exercise in full their option to purchase

11

Table of Contents

additional common units) NEE Operating LP common units from NEE Equity. The Purchase Agreement will require NEE Equity to make, until certain conditions are satisfied as set forth in the Purchase Agreement, certain payments to us in quarters in which NEE Equity receives distributions and NEE Operating LP does not make distributions on its common units at least equal to the minimum quarterly distribution. See “Provisions of the Partnership Agreements and Other Arrangements Relating to Cash Distributions—Purchase Price Adjustment” and “Certain Relationships and Related Party Transactions—Purchase Agreement.”

Equity Purchase Agreement. In connection with the Organizational Transactions, we will enter into an equity purchase agreement (the “Equity Agreement”) with NEE Operating LP, under which we will use $ million of the net proceeds of this offering to purchase NEE Operating LP common units from NEE Operating LP. See “Certain Relationships and Related Party Transactions—Equity Purchase Agreement.”

Exchange Agreement. In connection with the Organizational Transactions, we will enter into an exchange agreement (the “Exchange Agreement”) with NEE Operating LP and NEE Equity, under which NEE Equity can tender NEE Operating LP units to NEE Operating LP for redemption after the expiration of the purchase price adjustment period. NEE Equity has the right, subject to the approval of our conflicts committee, to receive cash, based on the market value of our common units, or our common units in exchange for the NEE Operating LP units tendered on a one-for-one basis. We have the right but not the obligation, to purchase tendered NEE Operating LP units for, subject to the approval of our conflicts committee, cash or our common units.

Summary of Conflicts of Interest and Duties. While we believe our relationship with NextEra and its subsidiaries is a significant strength, it is also a source of potential conflicts. As described above, NextEra or certain of its affiliates will provide certain services to us, including managing our day-to-day affairs and providing individuals to act as our general partner’s executive officers and directors. These executive officers may help our general partner’s board of directors evaluate potential acquisition opportunities presented by NEER under the ROFO Agreement. In addition, our general partner has a duty to manage our partnership in a manner it subjectively believes is in our best interests. However, our general partner’s executive officers and directors also have duties to manage our general partner in a manner beneficial to its owner, NextEra. As a result, conflicts of interest may arise between us and our common unitholders, on the one hand, and NextEra and our general partner, on the other hand. Delaware law provides that Delaware limited partnerships may, in their partnership agreements, expand, restrict or eliminate the fiduciary duties owed by the general partner to limited partners and the partnership. Under these provisions, our partnership agreement contains various provisions replacing the fiduciary duties that would otherwise be owed by our general partner with contractual standards governing the duties of the general partner and the methods of resolving conflicts of interest. The effect of these provisions is to restrict the remedies available to our common unitholders for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty. Our partnership agreement also provides that affiliates of our general partner, including NextEra and its other subsidiaries and affiliates, are permitted to compete with us. By purchasing a common unit, an investor agrees to be bound by the terms of our partnership agreement and each holder of our common units is treated as having consented to various actions and potential conflicts of interest contemplated in the partnership agreement that might otherwise be considered a breach of fiduciary or other duties under applicable state law. For a more detailed description of the potential conflicts of interest between us and our general partner and its affiliates, including NextEra, see “Risk Factors—Risks Related to Our Relationship with NextEra” and “Conflicts of Interest and Duties.”

Organizational Structure

NextEra Energy Partners, LP is a Delaware limited partnership formed on March 6, 2014, to own a controlling non-economic general partner interest and a % limited partner interest in NEE Operating LP, which will own and operate a portfolio of clean contracted energy projects. Even though we are organized as a limited partnership under state law, we will elect to be treated as a corporation for U.S. federal income tax purposes. See “—Estimate of Corporate Tax Liabilities and Ratio of Unitholder Taxable Income to Distributions.”

12

Table of Contents

Prior to the completion of this offering, NEE Equity will contribute, in a series of transactions, the following projects, which will constitute our Initial Portfolio, to NEE Operating LP, and NEE Operating LP will issue common units to NEE Equity (collectively, the “Project Transfer”):

| • | a 100% interest in each of the following wind projects: Conestogo, Elk City, Northern Colorado, Perrin Ranch, Summerhaven, Tuscola Bay and Bluewater and a 100% interest in each of the following solar projects: Genesis, Moore and Sombra, each as further described in the table set forth in “—Current Operations.” |

Concurrently with the completion of this offering, based on an assumed initial public offering price of $ per common unit (the midpoint of the price range set forth on the cover page of this prospectus):

| • | we will issue special non-economic voting units (the “Special Voting Units”) to NEE Equity that will be entitled to vote with our common units on a one-for-one basis on certain matters and as a separate class on other matters during the purchase price adjustment period; |

| • | we will issue of our common units (or common units if the underwriters exercise in full their option to purchase additional common units) to the investors in this offering in exchange for net proceeds of approximately $ million (or approximately $ million if the underwriters exercise in full their option to purchase additional common units), after deducting underwriting discounts and commissions and structuring fees but before offering expenses (which offering expenses will be paid by NextEra); |

| • | NEE Operating LP will enter into a new $250 million revolving credit facility, which will remain undrawn at the completion of this offering; |

| • | under the Purchase Agreement with NEE Equity, we will use approximately $ million (or approximately $ million if the underwriters exercise in full their option to purchase additional common units) of the net proceeds of this offering to purchase NEE Operating LP common units from NEE Equity, representing approximately % (or approximately % if the underwriters exercise in full their option to purchase additional common units) of the outstanding NEE Operating LP common units following the completion of this offering; |

| • | under the Equity Agreement with NEE Operating LP, we will use approximately $ million of the net proceeds from this offering to purchase NEE Operating LP common units directly from NEE Operating LP, representing % of the outstanding NEE Operating LP common units, and NEE Operating LP will use these net proceeds for general corporate purposes, including to fund future acquisition opportunities; |

| • | we, NEE Operating LP and NEE Operating GP will enter into the Management Services Agreement with NEE Management; |

| • | NEE Management will enter into the Management Sub-Contract with NEER; |

| • | we and NEE Operating LP will enter into the CSCS Agreement with NEER; |

| • | we and NEE Operating LP will enter into the ROFO Agreement with NEER; |

| • | we and NEE Operating LP will enter into the Exchange Agreement with NEE Equity; and |

13

Table of Contents

| • | we, NEE Operating LP and certain of our other subsidiaries will enter into a trademark limited licensing agreement (the “U.S. Licensing Agreement”) with NextEra and NEEC will enter into a trademark limited licensing agreement (the “Canadian Licensing Agreement”) with NECIP. |

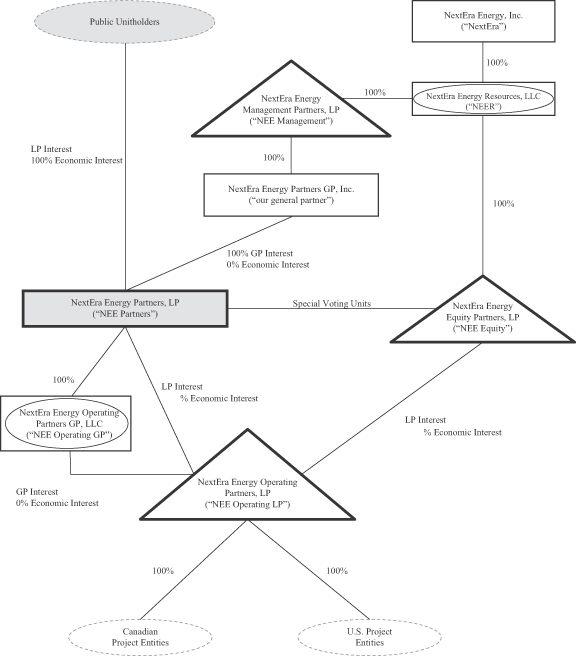

We refer to the foregoing transactions, including the Project Transfer, in this prospectus as the “Organizational Transactions.” The simplified chart below illustrates our organizational structure after the completion of the Organizational Transactions.

14

Table of Contents

15

Table of Contents

Emerging Growth Company Status

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). As such, we are eligible, for up to five years, to take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not “emerging growth companies.” These exemptions include:

| • | the option to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in the registration statement of an initial public offering of common equity securities; and |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002. |

We intend to take advantage of these exemptions. As a result, we do not know if some investors will find our common units less attractive. The result may be a less active trading market for our common units, and our unit price may become more volatile.