Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NORTHERN MINERALS & EXPLORATION LTD. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - NORTHERN MINERALS & EXPLORATION LTD. | f10k2013aex32i_northern.htm |

| EX-31.1 - CERTIFICATION - NORTHERN MINERALS & EXPLORATION LTD. | f10k2013aex31i_northern.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2013

Commission File Number 333-146934

|

NORTHERN MINERALS & EXPLORATION LTD.

|

||

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

98-0557171

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

|

1301 Avenue M, Cisco, Texas

|

76437

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(254) 442-2627

|

|

(Registrant’s telephone number, including area code)

|

|

Punchline Resources Ltd.

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x YES o NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o YES x NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o (Do not check if a smaller reporting company) |

Smaller reporting company

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act

o YES x NO

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court.

o YES o NO

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

5,044,484 common shares issued and outstanding as of November 13, 2013.

Explanatory Note

10-K/A Annual Report Ending July 31, 2013 (Refiled with Restated Statement of Cash Flows)

NORTHERN MINERALS & EXPLORATION LTD.

FORM 10-K/A

For the Year ended July 31, 2013

TABLE OF CONTENTS

| 3 | |

| 3 | |

| 7 | |

| 13 | |

| 22 | |

| 22 | |

| 22 | |

| 22 | |

| 24 | |

| 24 | |

| 28 | |

| 29 | |

| 42 | |

| 42 | |

| 42 | |

| 42 | |

| 42 | |

| 46 | |

| 47 | |

| 48 | |

| 48 | |

| 49 | |

| 49 | |

| 50 |

2

Our Corporate History and Background

We were incorporated on December 11, 2006 under the laws of the State of Nevada.

On November 4, 2009, our former president and director transferred all of his 30,000,000 outstanding common shares to Michael Thiessen in a stock purchase agreement for $30,000. On September 7, 2012, Ramzan Savji, our sole director and officer, acquired 30,000,000 shares of our common stock from Mr. Thiessen for $30,000, triggering a change in control of our company.

We were originally a company involved in the placing of strength testing amusement gaming machines called Boxers in venues such as bars, pubs and nightclubs in the Seattle area, in the State of Washington. We acquired one Boxer that had been placed in Lynwood, Washington. However, the machine was de-commissioned as it needed material repairs. We were not able to secure sufficient capital for these repairs and our management decided to change our business focus to mineral exploration.

Current Business

On September 7, 2012 we entered into a mineral lease agreement with MinQuest, Inc. Pursuant to the terms of the agreement, we have acquired 100% of the exploration and mining rights to 58 unpatented mining claims in Esmeralda County, Nevada approximately 26 miles south of Goldfield in the Tokop mining district for a period of 20 years known as the Empress Property.

Empress Property

On September 7, 2012, we entered into a mineral lease agreement with MinQuest. Pursuant to the terms of the agreement, MinQuest has agreed to lease us 100% of the exploration and mining rights to the Empress Property. As consideration, we are required to provide annual payments and commit work expenditures.

MinQuest will also retain a 3% net smelter royalty in the event that we enter mineral production on the Empress Property. If we are unable to fulfill any of the commitments set out above, the mineral lease agreement will terminate and all property rights will revert back to MinQuest.

As of July 31, 2013, we have paid $20,000 for the first year annual payment. As well we have incurred $150,000 in work expenditures. In late 2012, our company drilled a total of five angled RC holes totaling 2,100 feet. Three holes were drilled at Wonder and two at the Empress Mine. No high-grade gold/silver was intersected and after further study and interpretation of the results, we subsequently decided to terminate our lease on the Empress Property.

Winnemucca Mountain Property

Effective September 14, 2012, our company entered into an option agreement (as amended and restated on November 15, 2012 and February 1, 2013) with AHL Holdings Ltd., a Nevada corporation, and Golden Sands Exploration Inc., a company incorporated under the laws of British Columbia, Canada, wherein we acquired an option to purchase a 70% interest in and to certain mining claims from AHL Holdings and Golden Sands, which claims form the Winnemucca Mountain Property in Humboldt County, Nevada. This Winnemucca Mountain property is currently comprised of 208 unpatented mining claims covering an area of approximately 3,800 acres.

If the option is exercised, the amended and restated option agreement provides that AHL Holdings and Golden Sands will enter into a joint venture agreement. Our company will solely be responsible for financing the joint venture and will act as sole operator in consideration of a fee.

3

Therefore in order to exercise the right, we are now required to pay $1,715,000 in aggregate as follows:

|

|

·

|

$50,000 on signing (the Optionors acknowledge this was paid);

|

|

|

·

|

a further $25,000 ($5,000 of which is a penalty) by November 15, 2012 (which is a firm commitment, paid);

|

|

|

·

|

a further $10,000 by February 1, 2013 (which is a penalty payment, paid);

|

|

|

·

|

a further $30,000 by April 1, 2013 (which is firm commitment, paid);

|

|

|

·

|

a further $200,000 by December 15, 2013;

|

|

|

·

|

a further $300,000 by September 14, 2014;

|

|

|

·

|

a further $400,000 by September 14, 2015;

|

|

|

·

|

a further $700,000 by September 14, 2016; and

|

Issue and deliver 100,000 shares by September 30, 2012 (the Optionors acknowledge this has been done) and incur exploration expense of $4,000,000 as follows:

|

|

·

|

incur exploration expense of at least $150,000 by July 1, 2013;

|

|

|

·

|

incur cumulative exploration expense of at least $500,000 by December 31, 2013;

|

|

|

·

|

incur cumulative exploration expense of at least $1,000,000 by December 31, 2014;

|

|

|

·

|

incur cumulative exploration expense of at least $2,000,000 by December 31, 2015;

|

|

|

·

|

incur cumulative exploration expense of at least $4,000,000 by December 31, 2016;

|

As of July 31, 2013 we have paid $115,000 in option payments, issued 100,000 common shares, paid an advance royalty payment of $20,000, and advanced $21,028 for exploration expenditures as required by the agreement.

Subsequent to July 31, 2013, on August 26, 2013 our company entered into an amended and restated option agreement with AHL Holdings and Golden Sands which materially modifies and replaces the terms of the original option agreement (as amended). The amended and restated agreement increases the interest that we may purchase in the Winnemucca property to 80% from 70%, modifies the exercise price payable in respect of the option, and extends schedule for delivery of payment and performance of obligations required for exercise of the option. In that regard, the aggregate cash fee payable to exercise the option has been increased from $1,715,000 to $1,755,000 and the total number of common shares issuable to exercise the option has been increased from 100,000 to 2,100,000. The revised payment schedule also defers $1,000,000 of the total sum payable until December 31, 2017, and defers all existing exploration milestones by 1 year. Finally the agreement provides that the Canadian optionor may elect to receive shares of our common stock in lieu of any cash payments payable pursuant to the agreement at a 75% discount to the then current market price.

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Compliance with Government Regulation

The operation of mines is governed by both federal and state laws. The Empress Property and the Winnemucca Property are administered by the United States Department of Interior, Bureau of Land Management (“BLM”) in Nevada. In general, the federal laws that govern mining claim location and maintenance and mining operations on Federal Lands, including the Empress Property and Winnemucca Property, are administered by the BLM. Additional federal laws, such as those governing the purchase, transport or storage of explosives, and those governing mine safety and health, also apply.

4

The State of Nevada likewise requires various permits and approvals before mining operations can begin, although the state and federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until that time. The Nevada Division of Environmental Protection (NDEP) is the state agency that administers the reclamation permits, mine permits and related closure plans on the project. Local jurisdictions may also impose permitting requirements, such as conditional use permits or zoning approvals.

Mining activities at the Empress Property and Winnemucca Property are also subject to various environmental laws, both federal and state, including but not limited to the federal National Environmental Policy Act, CERCLA (as defined below), the Resource Recovery and Conservation Act, the Clean Water Act, the Clean Air Act and the Endangered Species Act, and certain Nevada state laws governing the discharge of pollutants and the use and discharge of water. Various permits from federal and state agencies are required under many of these laws. Local laws and ordinances may also apply to such activities as waste disposal, road use and noise levels.

We are committed to fulfilling our requirements under applicable environmental laws and regulations. These laws and regulations are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct our business in a manner that safeguards public health and mitigates the environmental effects of our business activities. To comply with these laws and regulations, we have made, and in the future may be required to make, capital and operating expenditures.

The Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (CERCLA), imposes strict, joint, and several liability on parties associated with releases or threats of releases of hazardous substances. Liable parties include, among others, the current owners and operators of facilities at which hazardous substances were disposed or released into the environment and past owners and operators of properties who owned such properties at the time of such disposal or release. This liability could include response costs for removing or remediating the release and damages to natural resources. We are unaware of any reason why our properties would currently give rise to any potential liability under CERCLA. We cannot predict the likelihood of future liability under CERCLA with respect to our properties or surrounding areas that have been affected by historic mining operations.

Under the Resource Conservation and Recovery Act (RCRA) and related state laws, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous or solid wastes associated with certain mining-related activities. RCRA costs may also include corrective action or clean up costs.

Mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, such as crushers and storage facilities, and from mobile sources such as trucks and heavy construction equipment. All of these sources are subject to review, monitoring, permitting, and/or control requirements under the federal Clean Air Act and related state air quality laws. Air quality permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the permitting conditions. Under the federal Clean Water Act and delegated state water-quality programs, point-source discharges into “Waters of the State” are regulated by the National Pollution Discharge Elimination System (NPDES) program. Section 404 of the Clean Water Act regulates the discharge of dredge and fill material into “Waters of the United States,” including wetlands. Stormwater discharges also are regulated and permitted under that statute. All of those programs may impose permitting and other requirements on our operations.

The National Environmental Policy Act (NEPA) requires an assessment of the environmental impacts of “major” federal actions. The “federal action” requirement can be satisfied if the project involves federal land or if the federal government provides financing or permitting approvals. NEPA does not establish any substantive standards. It merely requires the analysis of any potential impact. The scope of the assessment process depends on the size of the project. An “Environmental Assessment” (EA) may be adequate for smaller projects. An “Environmental Impact Statement” (EIS), which is much more detailed and broader in scope than an EA, is required for larger projects. NEPA compliance requirements for any of our proposed projects could result in additional costs or delays.

The Endangered Species Act (ESA) is administered by the U.S. Fish and Wildlife Service of the U.S. Department of Interior. The purpose of the ESA is to conserve and recover listed endangered and threatened species and their habitat. Under the ESA, “endangered” means that a species is in danger of extinction throughout all or a significant portion of its range. The term “threatened” under such statute means that a species is likely to become endangered within the foreseeable future. Under the ESA, it is unlawful to “take” a listed species, which can include harassing or harming members of such species or significantly modifying their habitat. We currently are unaware of any endangered species issues at our projects that would have a material adverse effect on our operations. Future identification of endangered species or habitat in our project areas may delay or adversely affect our operations.

5

U.S. federal and state reclamation requirements often mandate concurrent reclamation and require permitting in addition to the posting of reclamation bonds, letters of credit or other financial assurance sufficient to guarantee the cost of reclamation. If reclamation obligations are not met, the designated agency could draw on these bonds or letters of credit to fund expenditures for reclamation requirements. Reclamation requirements generally include stabilizing, contouring and re-vegetating disturbed lands, controlling drainage from portals and waste rock dumps, removing roads and structures, neutralizing or removing process solutions, monitoring groundwater at the mining site, and maintaining visual aesthetics. We are committed to maintaining all of our financial assurance and reclamation obligations.

We believe that we are currently in compliance with the statutory and regulatory provisions governing our operations. We hold or will hold all necessary permits and other authorizations to the extent that our current or future claims and the associated operations require them. During the initial phases of our exploration program there will not be any significant disturbances to the land or environment and hence, no government approval is required.

However, we may do business and own properties in a number of different geographical areas and are therefore subject to the jurisdictions of a large number of different authorities at different countries. We plan to comply with all statutory and regulatory provisions governing our current and future operations. However, these regulations may increase significant costs of compliance to us, and regulatory authorities also could impose administrative, civil and criminal penalties for non-compliance. At this time, it is not possible to accurately estimate how laws or regulations would impact our future business. We also can give no assurance that we will be able to comply with future changes in the statutes and regulations.

As we do not know the extent of the exploration program that we will be undertaking, we cannot estimate the cost of the remediation and reclamation that will be required. Hence, it is impossible at this time to assess the impact of any capital expenditures on earnings or our competitive position in the event that a potentially economic deposit is discovered.

If we are successful in identifying a commercially viable ore body and we are able to enter into commercial production, due to the increased environmental impact, the cost of complying with permit and environmental laws will be greater than in the previous phases.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Research and Development Expenditures

We have not incurred any research and development expenditures over the past two fiscal years.

6

Employees

As of July 31, 2013 we had one employee, consisting of our officer, Ramzan Savji. Mr. Savji is our Chief Executive Officer, Chief Financial Officer, Treasurer and President. He was our Secretary until September 19, 2013, at which time, Mr. Savji resigned and Mr. Roger Autrey was appointed as Secretary. Therefore as of September 19, 2013, we have two employees, consisting of our two officers, Ramzan Savji and Roger Autrey.

We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

Subsidiaries

We do not have any subsidiaries.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

Risks Related To Our Overall Business Operations

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations. As at July 31, 2013, we have an accumulated deficit of $414,115 and a total stockholders’ deficiency of $16,090. We have not generated any revenues since our inception and do not anticipate that we will generate revenues which will be sufficient to sustain our operations. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will require the successful commercialization of our mining properties. We may not be able to successfully commercialize our mines or ever become profitable.

There is doubt about our ability to continue as a going concern due to recurring losses from operations, accumulated deficit and insufficient cash resources to meet our business objectives, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended July 31, 2013 and 2012, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 1 to our financial statements for the year ended July 31, 2013, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises doubt about our ability to continue as a going concern.

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate needing significant capital to conduct further exploration and development needed to bring our existing mining properties into production and/or to continue to seek out appropriate joint venture partners or buyers for certain mining properties. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

7

Our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

Despite exploration work on our mineral properties, we have not established that our properties have sufficient mineral reserve to justify a mining operation, and there can be no assurance that we will be able to do so. If we do not, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is extremely remote; in all probability our mineral resource properties do not contain any 'reserve' and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on any of our properties, there can be no assurance that we will be able to develop any of our properties into a producing mine and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on any of our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

8

If we establish the existence of a mineral resource on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that any discovered resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, either from the sale of our mineral resource properties or from the extraction and sale of ore. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of any of our exploration properties and projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

In identifying and acquiring mineral resource properties, we compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

9

Risks Associated With Our Industry

The development and operation of our mining projects involve numerous uncertainties.

Mine development projects, including our planned projects, typically require a number of years and significant expenditures during the development phase before production is possible.

Development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

|

|

·

|

estimation of reserves;

|

|

|

·

|

anticipated metallurgical recoveries;

|

|

|

·

|

future gold and silver prices; and

|

|

|

·

|

anticipated capital and operating costs of such projects.

|

Our mine development projects may have limited relevant operating history upon which to base estimates of future operating costs and capital requirements. Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

|

|

·

|

unanticipated changes in grade and tonnage of material to be mined and processed;

|

|

|

·

|

unanticipated adverse geotechnical conditions;

|

|

|

·

|

incorrect data on which engineering assumptions are made;

|

|

|

·

|

costs of constructing and operating a mine in a specific environment;

|

|

|

·

|

availability and cost of processing and refining facilities;

|

|

|

·

|

availability of economic sources of power;

|

|

|

·

|

adequacy of water supply;

|

|

|

·

|

adequate access to the site;

|

|

|

·

|

unanticipated transportation costs;

|

|

|

·

|

government regulations (including regulations relating to prices, royalties, duties, taxes, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands);

|

|

|

·

|

fluctuations in metal prices; and

|

|

|

·

|

accidents, labor actions and force majeure events.

|

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Mineral exploration is highly speculative, involves substantial expenditures, and is frequently non-productive.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

|

|

·

|

the identification of potential economic mineralization based on superficial analysis;

|

|

|

·

|

the quality of our management and our geological and technical expertise; and

|

|

|

·

|

the capital available for exploration and development.

|

10

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

The price of gold and silver are highly volatile and a decrease in the price of gold or silver would have a material adverse effect on our business.

The profitability of mining operations is directly related to the market prices of metals. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations of metals from the time development of a mine is undertaken to the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop one or more of our mining properties at a time when the price of metals makes such exploration economically feasible and, subsequently, incur losses because the price of metals decreases. Adverse fluctuations of the market prices of metals may force us to curtail or cease our business operations.

Mining risks and insurance could have an adverse effect on our profitability.

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents. Although maintenance of insurance to ameliorate some of these risks is part of our proposed exploration program associated with those mining properties we have an interest in, such insurance may not be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our properties. Either of these events could cause us to curtail or cease our business operations.

We face significant competition in the mineral exploration industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of exploration properties and leases on prospects and properties and in connection with the recruitment and retention of qualified personnel. Such competition may result in our being unable to acquire interests in economically viable gold and silver exploration properties or qualified personnel.

Our applications for exploration permits may be delayed or may be denied in the future.

Exploration activities usually require the granting of permits from various governmental agencies. For exploration drilling on unpatented mineral claims, a drilling plan must be filed with the Bureau of Land Management or the United States Forest Service, which may then take several months or more to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian grave yards, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. With all permitting processes, there is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits or the refusal to grant required permits may not be granted at all, all of which may cause delays and unanticipated costs in conducting planned exploration activities. Any such delays or unexpected costs in the permitting process could result in serious adverse consequences to the price of our stock and to the value of your investment.

11

Risks Related To The Market For Our Stock

Trading of our stock may be restricted by the SEC's "Penny Stock" regulations, which may limit a stockholder's ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors." The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit our ability to buy and sell our stock and have an adverse effect on the market for our shares.

Trading in our common shares on the OTC Bulletin Board is limited and sporadic making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common shares are currently listed for public trading on the OTC Bulletin Board under the stock symbol “NMEX”. The trading price of our common shares has been subject to wide fluctuations. Trading prices of our common shares may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced by our common shares will be matched or maintained. These broad market and industry factors may adversely affect the market price of our common shares, regardless of our operating performance.

In the past, following periods of volatility in the market price of a company's securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of management's attention and resources.

12

We are not likely to pay cash dividends in the foreseeable future.

We intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate. Should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions.

Our principal executive offices are located at 1301 Avenue M, Cisco, Texas, USA 76437. Our mailing address is P.O. Box 31, Cisco, Texas 76437.

As of July 31, 2013, we owned or had lease on the following properties:

Empress Property

On September 7, 2012, we entered into a mineral lease agreement with MinQuest Inc. of Reno, Nevada. Pursuant to the terms of the Agreement, MinQuest has agreed to lease us 100% of the exploration and mining rights to the Empress Property for a period of 20 years. As consideration, we are required to provide annual payments and complete work expenditures.

MinQuest will also retain a 3% net smelter return royalty in the event that we initiate mineral production on the Empress Property. If we are unable to fulfill any of the commitments set out above, the mineral lease agreement will terminate and all property rights will revert back to MinQuest.

As of July 31, 2013, the Company has paid $20,000 for the first year annual payment and incurred $150,000 in work expenditures.

Location and Access

The Empress Property is situated in southwestern Nevada. The property is located in Esmeralda County, Nevada, approximately 26 miles south of Goldfield in the Tokop mining district. Access is via 10 miles of gravel roads from the small hamlet of Gold Point. The property is located near the eastern margin of the Montezuma Range. Branch roads, some requiring 4-wheel drive vehicles, lead to most parts of the property. The town of Goldfield, the County seat, offers few services. Some supplies and services are available in Tonopah, 26 miles north of Goldfield. The property consists of 27 unpatented claims totaling 540 acres.

13

14

Ownership Interest

On September 7, 2012 we entered into a Mineral Lease Agreement with MinQuest, Inc. Pursuant to the terms of the Agreement, MinQuest, Inc., has agreed to lease us 100% of the exploration and mining rights to the Empress Property. As consideration, we are required to provide annual payments of $20,000 and commit to the following work expenditures:

|

|

·

|

$150,000 spent in the first year;

|

|

|

·

|

$200,000 spent in the second year;

|

|

|

·

|

$250,000 spent in the third year;

|

|

|

·

|

$300,000 spent in the fourth year;

|

|

|

·

|

$350,000 spent in the fifth year;

|

|

|

·

|

$400,000 in the sixth year; and

|

|

|

·

|

$650,000 in the seventh year.

|

MinQuest will also retain a 3% net smelter royalty in the event that we enter mineral production on the Empress Property. If we are unable to fulfill any of the commitments set out above, the Mineral Lease Agreement will terminate and all property rights will revert back to MinQuest, Inc.

History of Operations

Although there is little information on the early history of the area the property was likely first discovered in the 1860’s when Silver Peak, located 30 miles to the northwest, was developed. Obvious exploitation of the veins probably occurred around the turn of the century, in the 1930’s and probably intermittently thereafter. A drill program was conducted in the early 1980’s by Homestake Mining Co. Although none of the Homestake drill data is available, a brief summary from Homestake geologists confirm the presence of gold mineralization and the partial success of their drill program. At least five holes and maybe more were known to be drilled during this venture. In 2007-2008, American Consolidated drilled 6 core holes.

Below the 7 adits that make up the Empress Mine are the remnants of a mill and several stone foundations from that era. Little production is reported for the district, although the Gold Point district, immediately to the north, produced gold and silver. The Wonder Mine, located 2,000 feet southwest of Empress, was worked in the 1930’s as judged by artifacts, and probably direct shipped its ore to a mill elsewhere.

At the Wonder mine area, there is solid evidence of six existing drill holes (two holes found, one angle and one vertical, and drill chips from four others) and three probable holes (drill sites prepared for angled holes). These holes were all collared in the hanging wall of the Wonder vein irregularly spaced across some 1,500 feet of strike length.

Geology

The property lies within the southern portion of the Walker Lane structural corridor. Major mines within the lower portion of the Walker Lane include Tonopah, Goldfield and Silver Peak. Mineralization in the Tokop district occurs in quartz veins hosted by granitic rocks of the Sylvania pluton. At least 3 separate east-west trending, steeply dipping quartz veins are exposed on the property. Over the years the property owner has had several geologists sample the veins. Most of this sampling is underground as the veins are poorly exposed on the surface.

Much of southern Esmeralda County is underlain by plutonic rock, dated as Jurassic, that has intruded, assimilated, and metamorphosed a section of upper Proterozioc siliciclastics and carbonates. The Sylvania Pluton is quartz monzonite in composition, very likely an exposed southeasterly outlier of the Inyo portion of the Sierra Nevada Batholith.

Major east-west striking, faults with traceable continuity over tens of miles cross lithologic contacts and are themselves crosscut by younger faults. Brecciated, sheared quartz veins, hosting precious metal mineralization, represent repeated fault movements, probably originating during Jurassic intrusion with Tertiary overprints.

15

The historic Empress mine area is underlain by a portion of the Sylvania Pluton, a light to medium gray, medium to coarse grained biotite, k-feldspar equigranular intrusive rock that fits the quartz monzonite classification as a field designation. The intrusive typically displays “soft”, rounded shapes with abundant decomposed material, yet outcrops are normally abundant. Fine grained, dense, light to dark aplite dikes ranging from 1” to 12” wide are common.

Present Condition and Plan of Exploration

In late 2012, our company drilled a total of five angled RC holes totaling 2,100 feet. Three holes were drilled at Wonder and two at the Empress Mine. No high-grade gold/silver was intersected and after further study and interpretation of the results, the Company subsequently decided to terminate its lease on the Empress Property.

Winnemucca Mountain Property

Effective September 14, 2012, our company entered into an option agreement (as amended and restated on November 15, 2012 and February 1, 2013) with AHL Holdings Ltd., a Nevada corporation, and Golden Sands Exploration Inc., a company incorporated under the laws of British Columbia, Canada, wherein the company acquired an option to purchase a 70%, in and to certain mining claims from AHL Holdings and Golden Sands, which claims form the Winnemucca Mountain Properties in Humboldt County, Nevada. The Winnemucca Mountain Property is currently comprised of 208 unpatented mining claims covering an area of approximately 3,800 acres. As consideration our company is required to make cash and share payments and complete work expenditures.

If the option is exercised, the amended and restated option agreement provides that AHL Holdings and Golden Sands will enter into a joint venture agreement with our company. Our company will solely be responsible for financing the joint venture and will act as sole operator in consideration of a fee.

AHL Holdings and Golden Sands will also retain a 3% net smelter royalty in the event that we initiate mineral production on the Winnemucca Mountain Property. If we are unable to fulfill any of the terms of the option agreement (as amended and restated), the option agreement will terminate and all property rights will revert back to AHL Holdings and Golden Sands.

As of July 31, 2013 we have paid $115,000 in cash payments, issued 100,000 common shares, paid an advance royalty payment of $20,000, and advanced $21,028 for exploration expenditures as required by the agreement.

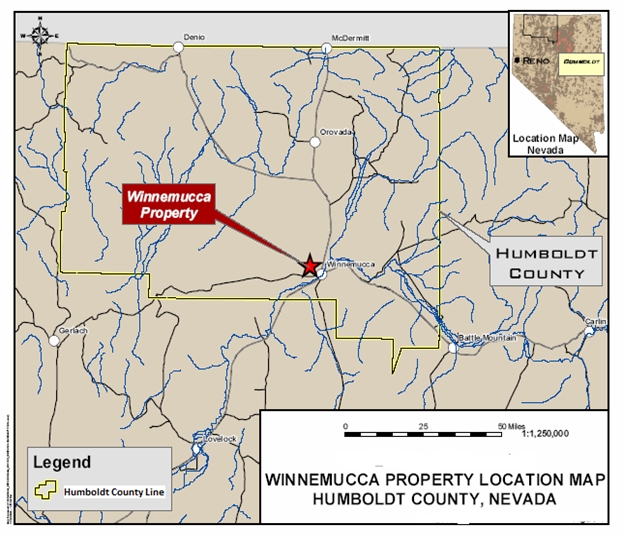

Location and Access

The Winnemucca Mountain Property is located in north-western Nevada, approximately 4 miles northwest of the municipality of Winnemucca. The property is within the Winnemucca Mountain Mining District of Humboldt County. The claims are situated on the west flank of Winnemucca Mountain. A map showing the location of and access to the Winnemucca Mountain Property is attached below

The Winnemucca Mountain Property is accessible from State Route 49, a graded gravel road from Winnemucca to Jungo. The claims that comprise the Winnemucca Mountain Property lie in an irregular, northerly trending block along the western flanks of Winnemucca Mountain. The mountain slopes are generally moderate along the west side of the claims, steepening on the east and in drainages. Pediment and alluvium cover is extensive, particularly in the western, or lower, part of the property where a classic bajada is developed. Within the claims, elevations range from approximately 4,700 feet in the southwest corner to nearly 6,600 feet in the east. The area is devoid of trees, and vegetation consists of sagebrush and sparse grass. The climate in southern Humboldt County is arid with annual rainfall averaging 8 inches and snowfall of 16 inches. The area is characterized by hot summers and short, cold winters.

16

Ownership Interest

Effective September 14, 2012, our company entered into an option agreement (as amended and restated on November 15, 2012 and February 1, 2013) with AHL Holdings Ltd., a Nevada corporation, and Golden Sands Exploration Inc., a company incorporated under the laws of British Columbia, Canada, wherein we acquired an option to purchase a 70%, in and to certain mining claims from AHL Holdings and Golden Sands, which claims form the Winnemucca Mountain Properties in Humboldt County, Nevada. The Winnemucca Mountain Property is currently comprised of 208 unpatented mining claims covering an area of approximately 3,800 acres. As consideration to earn a 70% interest, the company is required to make cash and share payments and complete work expenditures.

If the option is exercised, the amended and restated option agreement provides that AHL Holdings and Golden Sands will enter into a joint venture agreement. Our company will solely be responsible for financing the joint venture and will act as sole operator in consideration of a fee.

AHL Holdings and Golden Sands will also retain a 3% net smelter royalty in the event that we begin mineral production on the Winnemucca Mountain Property. If we are unable to fulfill any of the commitments set out above, the option agreement will terminate and all property rights will revert back to AHL Holdings and Golden Sands.

17

Therefore in order to exercise the right, as of July 31, 2013 we are required to pay $1,715,000 in aggregate as follows:

|

|

·

|

$50,000 on signing (paid);

|

|

|

·

|

a further $25,000 by November 15, 2012 ($5,000 of which is a penalty payment and is a firm commitment, paid);

|

|

|

·

|

a further $10,000 by February 1, 2013 (which is a penalty payment, paid);

|

|

|

·

|

a further $30,000 by April 1, 2013 (which is firm commitment, paid);

|

|

|

·

|

a further $200,000 by December 15, 2013;

|

|

|

·

|

a further $300,000 by September 14, 2014;

|

|

|

·

|

a further $400,000 by September 14, 2015;

|

|

|

·

|

a further $700,000 by September 14, 2016; and

|

Issue and deliver 100,000 shares by September 30, 2012 (done) and incur exploration expense of $4,000,000 as follows:

|

|

·

|

incur exploration expense of at least $150,000 by July 1, 2013;

|

|

|

·

|

incur cumulative exploration expense of at least $500,000 by December 31, 2013;

|

|

|

·

|

incur cumulative exploration expense of at least $1,000,000 by December 31, 2014;

|

|

|

·

|

incur cumulative exploration expense of at least $2,000,000 by December 31, 2015;

|

|

|

·

|

incur cumulative exploration expense of at least $4,000,000 by December 31, 2016;

|

As of July 31, 2013 we have paid $115,000 in option payments, paid an advance royalty payment of $20,000, and advanced $21,028 for exploration expenditures as required by the agreement.

Subsequent to July 31, 2013, on August 26, 2013 our company entered into an amended and restated option agreement with AHL Holdings and Golden Sands which materially modifies and replaces the terms of the original option agreement (as amended). The amended and restated agreement increases the interest that we may purchase in the Winnemucca property to 80% from 70%, modifies the exercise price payable in respect of the option, and extends schedule for delivery of payment and performance of obligations required for exercise of the option. In that regard, the aggregate cash fee payable to exercise the option has been increased from $1,715,000 to $1,755,000 and the total number of common shares issuable to exercise the option has been increased from 100,000 to 2,100,000. The revised payment schedule also defers $1,000,000 of the total sum payable until December 31, 2017, and defers all existing exploration milestones by 1 year. Finally the agreement provides that the Canadian optionor may elect to receive shares of our common stock in lieu of any cash payments payable pursuant to the agreement at a 75% discount to the then current market price.

History of Operations

The discovery of the Comstock Lode in western Nevada in 1859 spurred mineral exploration throughout Nevada. Gold and silver were first discovered in the Winnemucca Mining District in 1863 and, during the 1860’s, several smelters were constructed along the Humboldt River. The early productive lodes consisted of quartz veins containing small amounts of variably oxidized copper and lead.

The first significant gold discovery in Humboldt County was the Getchell gold deposit in 1933. The Getchell Mine began production in 1938 and has operated intermittently since. The current owners are Barrick and Newmont, The mine was reopened in 2002 with a resource of 7 million ounces of gold. Since discovery of the Getchell Deposit, Humboldt County has been the site of numerous other significant gold discoveries. Major gold deposits in the area include the Lone Tree, Marigold, Preble, Pinson, Turquoise Ridge, and Twin Creeks, all located east and northeast of Winnemucca, and the Hycroft (Crowfoot-Lewis), Sandman, Rosebud, and Sleeper deposits to the northwest.

On Winnemucca Mountain itself, the Adamson mine, located in the northeast portion of section 11, reported gold production from “rich ore” in 1911-1912 totaling $13,711 (approximately 20 kg of gold equivalent; Willden, 1964). The Pride of the Mountain mine, which reported gold and silver production during 1915, is situated just east of the Golden West claims in the northwestern portion of section 23. Both mines exploited gold-bearing quartz veins cutting metasedimentary rocks. Topographic maps indicate six ‘prospects’ and one old ‘mine’ within the boundaries of the Golden West 8 and 10 claims. These may be mercury workings referred to by Schnell & Hodges.

18

The upper slopes of Winnemucca Mountain contain dozens of prospects and several old mines. One of these, the Shively Mine on the north side of Winnemucca Mountain, exploited a west-northwest striking, moderate to steeply dipping quartz-calcite vein. In 1982, St. Joe conducted a drilling program directed at this structure. Results of their drilling included 90 feet of 0.34 g/t Au in DH1 and 30 feet of 0.69 g/t Au in DH2.

The earliest available record of exploration within the present Winnemucca Mountain property claim area is an undated map by St. Joe American Corporation that describes rock sampling over much of the claim block and soil sampling across the Golden West 6 to 13 claim area. This work was most likely done in conjunction with work in the Shively Mine area during 1982. The same map indicates that Cordilleran Exploration (Cordex) drilled seven drill holes, also on the Golden West 6 to 13 claims. However, an undated compilation map by Santa Fe places these Cordex drill holes (holes WV1 – 7, WV11 and WV16 – 18) over 4,900 feet to the east of the Golden West claims. The true location of these holes is therefore uncertain and should not be relied upon. Metzler reports that the Cordex holes were drilled in 1972; in addition, 700 feet of trenching was completed and over 3,300 feet of existing underground workings were mapped and sampled and the construction of drill access roads were completed. A map dated October 1982 indicates that induced polarization, magnetic, and VLF electromagnetic surveys were performed on the property. Details of work done by St. Joe and Cordex are not available.

The next record of exploration is by Arctic Precious Metals Inc. in 1985. Work over the next few years included rock sampling by Arctic and Tenneco Minerals in 1986, with geological mapping by Arctic in 1986 in the northern claim area. During 1987, Arctic drilled 1,916 feet in 5 reverse circulation drill holes. Results were encouraging with hole WM 5 intersecting a 5 feet interval of 1,050 ppb gold. The next year, Arctic conducted detailed rock sampling and VLF-EM and magnetic surveys over a breccia pipe target area, followed by 7 diamond drill holes for a total of 2,100 feet. Drill hole WM 7 intersected up to 1,950 ppb gold over 5 feet and WM 13 cut two large intervals (145 feet and 181 feet) of elevated gold in a breccia (164 ppb and 147 ppb respectively; SFPM data).

In late 1988, Santa Fe Pacific Mining, Inc. (now Newmont) entered into a joint venture with Arctic after recognizing the significance of anomalous gold in the breccia pipe identified by the Arctic drilling. Santa Fe became operator and, between 1988 and 1990, conducted geological mapping, rock sampling, trenching, CSAMT and induced polarization geophysical surveys, collected 286 auger hole bedrock samples, and completed a total of 52,470.8 feet in 73 reverse circulation drill holes. Three of these drill holes were re-entered with a diamond drill. The total diamond drill footage is uncertain but is in excess of 477 feet. Not all of Santa Fe’s drilling was within the boundaries of the current claim block. Santa Fe’s work outlined the Swordfish occurrence that extends approximately 2,200 feet along the western flank of Winnemucca Mountain within the current claim block.

In 1994, Anvil Resources of Vancouver, B.C., acquired the property and became the project operator. Anvil did a great deal of internal compilation work, prepared a topographic base map and collected surface samples to confirm previous gold tenors. They performed test assaying to determine optimum analytical procedures for coarse gold samples and milling tests on bulk samples to maximize gold liberation. An induced polarization (IP) survey conducted in 1996 confirmed that resistivity highs correlated well with known mineralized areas and delineated two new target zones.

In 2006-2007 Meridian Minerals Corp. acquired an option on the property from Evolving Gold Corp. Meridian conducted two separate drilling programs on the property. Twelve angled holes were drilled, totaling 7473 feet. In 2007 four additional angled holes were subsequently drilled totaling 2,659 feet. This drilling , targeted northwest and northeast striking veins to the northeast of the Swordfish Zone, and a further 3 holes targeted a vein system in the very north of the Property This drilling intersected lower grade mineralization than the moderate to high grade intercepts in the Swordfish Zone

Santa Fe Pacific Gold Corp. utilized a computer program called Geostat to calculate a cross-sectional resource estimate for the Swordfish zone area. Santa Fe estimated that the Swordfish zone contained 4.15 million metric tons grading 0.82 g/t gold (4.58 million short tons grading 0.028 opt gold) at a 0.29 g/t cutoff (0.01 opt cutoff). All resource calculations were based on arithmetic averages. This estimated resource occurs in an area 2,200 feet long and 700 feet deep.

19

In March 2013 the Company contracted consultants to study the mineralization and known resources on the Winnemucca Mountain Property. Company consultants completed mapping and geochemical sampling of the 3000 feet long Swordfish zone on the Property. Using this surface work along with historical drill results, 3D modeling of the gold/silver mineralization was completed. Based on the results of the initial work, Company consultants have recommended further exploration on the property including geophysics, core and reverse circulation (RC) drilling

Geology

Regional Geology – Nevada lies within the Basin and Range geological province. The geologic structure of this province is the result of repeated interactions between the North American Plate and oceanic plates to the west which are expressed as folds, thrust faults, strike slip faults, normal faults, igneous intrusions, volcanism, metamorphism and sedimentary basins. Every mountain range in the Basin and Range province is bounded on at least one side by a normal fault, many of which are still active. The area’s highly complex and active tectonic history has created a diversity of depositional environments, deep-seated structures, hydrothermal centers and numerous mineral deposits.

Humboldt County is underlain by rocks ranging in age from probable early Cambrian to late Miocene or early Pliocene. In general, the oldest rocks are in the southeastern portion of the county with younger rocks to the north and west, however, late Tertiary volcanic and sedimentary rocks are randomly distributed throughout the county. Five orogenic episodes have been recognized but structural and lithologic elements are not continuous between mountain ranges. The most important of the orogenic episodes in Nevada is the Antler Orogeny, the late Devonian collision of an arc terrane complex with the western margin of North America. The arc material (allochthon) was thrust over cratonic carbonates along the Roberts Mountain thrust fault. Mountain building accompanied the Antler Orogeny, resulting in a high mountain range to the west. In addition to the folding and low-angle faulting associated with orogenic compression and mountain building, high-angle reverse and strike-slip faulting were widespread, forming important wrench fault systems. These high-angle faults were crucial in localizing the fluid flow responsible for gold deposition.

Mineral deposits have been found in all rock units exposed in the county. At least three periods of epigenetic ore mineral deposition have been recognized. The oldest are the iron deposits (Cretaceousor older?) in the Jackson Mountains. Contact metamorphic tungsten and vein deposits belong to the second period, developed in conjunction with the emplacement of Cretaceous and Tertiary intrusive rocks. The third, late Tertiary (?), depositional episode includes mercury, uranium and gold-silver deposits, including the Getchell and Sleeper gold deposits. Most Tertiary mineral deposits in northern Nevada are distributed linearly as a result of deep crustal controls including the Carlin and Battle Mountain trends.

Current gold producers in Humboldt County include the Getchell, Hycroft, Marigold, Lone Tree, and Twin Creeks mines.

Property Geology- The general geology of Winnemucca Mountain is shown on two publicly available maps. The oldest unit exposed on Winnemucca Mountain is the Upper Triassic Winnemucca Formation that underlies the upper elevations. These rocks are gray to brown calcareous shale; buff and gray, thin-bedded to massive carbonate rocks, buff to light brownish-gray calcareous sandstone, gray and brown shale and slate and some light brown feldspathic quartzite.

A younger, unnamed quartzite-mudstone formation is faulted against the Winnemucca Formation on the northwest side of Winnemucca Mountain by a normal fault of uncertain displacement. This unit consists of light brown or buff, thin to thick bedded, fine-grained, feldspathic quartzite which usually weathers dark brown; buff to light brown, medium bedded mudstone; and small amounts of light brown phyllitic shale.

The sedimentary rocks are cut by several small intrusive bodies. The largest is a Jurassic (?)-Cretaceous stock which intrudes Winnemucca Formation rocks on the southern side of Winnemucca Mountain, measuring approximately 6,600 by 9,075 feet. The intrusive contains no quartz but, in general, contains more plagioclase than mafic minerals so is compositionally a diorite. A small body of Tertiary volcanic rocks has been identified on the west side of Winnemucca Mountain.

20

Tertiary basalt and andesite unconformably overlie the older units on the north side of the mountain. These also include more silicic volcanic and sedimentary rocks.

An east-northeast trending breccia body measuring 1,320 by 5,000 feet in Triassic sedimentary rocks was mapped on the west side of Winnemucca mountain.The diatreme, containing gold mineralization now known as the Swordfish zone, is described by Metzler (1994) as an ellipsoid plug of brecciated, silicic dacite and rhyolite with sharp contacts. The breccia contains angular clasts of the older siltstone and granodiorite and is considered to be a Tertiary diatreme.

Three directions of major faulting are apparent, each of which appear confined to a particular area of Winnemucca Mountain. In the northern portion of the mountain are three parallel northeast trending faults, situated approximately 2,800 feet apart. Movement on these faults is primarily dip-slip although some minor strike-slip movement was also noted. On the southern flank of the mountain are two parallel north-northeast trending faults 5,000 feet apart. Northerly and northeasterly oriented faults dominate the central part of Winnemucca Mountain. Santa Fe geologists believed that the topography of Winnemucca Mountain was in part controlled by extensional range-front faults and the dominant structural trend, especially with respect to mineralizing events, is northeast.

Present Conditions and Plan of Exploration

Though there is a significant amount of historical exploration on the Winnemucca Mountain Property, none of the previous owners have established any substantial operations on the property. Further, the data set from past exploration is not complete. In March 2013 the Company contracted consultants to study the mineralization and known resources on the Winnemucca Mountain Property. Company consultants completed mapping and geochemical sampling of the 3,000 feet long Swordfish zone on the Property. Using this surface work along with available historical drill results data, 3D modeling of the gold/silver mineralization was completed. Based on the results of the initial work, Company consultants have recommended further exploration on the property including geophysics, core and reverse circulation (RC) drilling. Subject to available funds the Company plans further exploration of the property as recommended by the company consultants.

Index of Geologic Terms

INDEX

|

TERM

|

DEFINITION

|

|

|

Aplite

|

a light-colored fine-grained igneous rock

|

|

|

Basalt

|

basalt is a dark gray to black, dense to finely grained igneous rock that is the result of lava eruptions. Basalt flows are noneruptive, voluminous, and characterized by relatively low viscosity.

|

|

|

Breccias

|

a coarse-grained sedimentary rock made of sharp fragments of rock and stone cemented together by finer material. Breccia is produced by volcanic activity or erosion, including frost shattering.

|

|

|

Biotite

|

a black, dark brown, or green silicate mineral of the mica group.

|

|

|

Equigranular

|

a material composed chiefly of crystals of similar orders of magnitude to one another.

|

|

|

Hornfels

|

(a) a fine-grained metamorphic rock composed of silicate minerals and formed through the action of heat and pressure on shale.

|

|

|

Igneous

|

(b) describes rock formed under conditions of intense heat or produced by the solidification of volcanic magma on or below the Earth's surface.

|

|

|

Lithologic

|

(c) the gross physical character of a rock or rock formation

|

|

|

Monzonite

|

a visibly crystalline, granular igneous rock composed chiefly of equal amounts of two feldspar minerals, plagioclase and orthoclase, and small amounts of a variety of colored minerals.

|

|

|

Plutonic

|

a mass of intrusive igneous rock that has solidified underground by the crystallization of magma.

|

|

|

Quartz

|

a common, hard, usually colorless, transparent crystalline mineral with colored varieties. Use: electronics, gems.

|

|

|

Silica

|

silicon dioxide found naturally in various crystalline and amorphous forms, e.g. quartz, opal, sand, flint, and agate. Use: manufacture of glass, abrasives, concrete.

|

21

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

Not applicable.

MARKET INFORMATION