Attached files

| file | filename |

|---|---|

| EX-4.2 - EXHIBIT 4.2 - First Choice Healthcare Solutions, Inc. | v380283_ex4-2.htm |

| EX-5.1 - EXHIBIT 5.1 - First Choice Healthcare Solutions, Inc. | v380283_ex5-1.htm |

| EX-1.1 - EXHIBIT 1.1 - First Choice Healthcare Solutions, Inc. | v380283_ex1-1.htm |

| EX-4.3 - EXHIBIT 4.3 - First Choice Healthcare Solutions, Inc. | v380283_ex4-3.htm |

| EX-23.1 - EXHIBIT 23.1 - First Choice Healthcare Solutions, Inc. | v380283_ex23-1.htm |

As filed with the Securities and Exchange Commission on June 10, 2014

Registration No. 333-195632

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

Amendment No. 1

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8741 | 90-0687379 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

709 S. Harbor City Boulevard, Suite 250

Melbourne, Florida 32901-1932

(321) 725-0090

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Christian C. Romandetti, Chief

Executive Officer

First Choice Healthcare Solutions, Inc.

709 S. Harbor City Boulevard, Suite

250

Melbourne, Florida 32901-1932

(321) 725-0090

(Name, address and telephone number, including area code, of agent for service)

Copies to:

| Richard G. Satin, Esq. | Barbara A. Jones, Esq. |

| Meyer, Suozzi, English & Klein, P.C. | Greenberg Traurig, LLP |

| 1350 Broadway, Suite 501 | One International Place |

| New York, NY 10018 | Boston, MA 02110 |

| (212) 239-4999 | (617) 310-6000 |

| (212) 239-4111 (fax) | (617) 310-6001 (fax) |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this registration statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED JUNE 10, 2014 |

[*] Units

Each Unit Consisting of Two Shares of

Common Stock

and

One Warrant to Purchase One Share of Common Stock

This is a firm commitment public offering of the securities of First Choice Healthcare Solutions, Inc. (the “Offering”). We are offering an aggregate of [*] units, each of which consists of two (2) shares of our common stock, par value $0.001 per share, and one (1) warrant to purchase one (1) share of our common stock for the purchase price per unit of [*]. The last reported sale price of our common stock on June 6, 2014 on the OTCQB was $1.75 per share. The warrants will have an initial exercise price of [*] per share, or 150% of the public offering price per share of common stock in the Offering (the “Warrant”). The Warrants will be immediately exercisable for one share of common stock and will expire on the fifth anniversary of the date of issuance. The units will not be certificated and the common stock and the Warrants may be transferred separately immediately upon issuance.

The shares of common stock issuable from time to time upon the exercise of the Warrants are also being offered pursuant to this prospectus.

We intend to apply to have our shares of common stock listed on NYSE MKT LLC under the symbol “FCHS.” No assurance can be given that such application will be approved. Our common stock is currently quoted on the OTCQB under the symbol “FCHS.” We do not intend to list the Warrants on any securities exchange or other trading market and we do not expect that a public trading market will develop for any of the Warrants.

Investing in our securities involves a high degree of risk. Before making any investment in our securities, you should read and carefully consider the risks described in this prospectus under “Risk Factors” beginning on page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit (1) | Total | |

| Public offering price | ||

| Underwriting discounts and commissions (2) | ||

| Offering proceeds to us, before expenses (3) |

| (1) | The public offering price is [*] per unit, and each unit consists of two shares of our common stock and one warrant to purchase one share of our common stock. If broken down, the public offering price consists of $[*] per share of common stock and $[*] per warrant to purchase one share of common stock, though the common stock and the warrants included in the units can only be purchased together as a unit. |

| (2) | The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 82 of this prospectus for a description of compensation payable to the underwriters. |

| (3) | Assumes no exercise of the warrants being issued in this Offering. |

We have granted a 45-day option to the underwriters to purchase additional units in an amount equal to 15% of the units sold in the Offering to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $[*], and the total proceeds to us, before expenses, will be $[*].

It is anticipated that delivery of the securities sold in this Offering will be made on or about [*], 2014. The shares included in the units will be delivered through the book-entry facilities of The Depository Trust Company.

Sole

Book-Running Manager

Laidlaw & Company (UK) Ltd.

The date of this prospectus is [*], 2014.

TABLE OF CONTENTS

| Page | |||

| Special Note Regarding Forward-Looking Statements | 5 | ||

| Prospectus Summary | 6 | ||

| Risk Factors | 12 | ||

| Use of Proceeds | 29 | ||

| Dividend Policy | 30 | ||

| Dilution | 31 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 33 | ||

| Business | 42 | ||

| Description of Properties | 55 | ||

| Legal Proceedings | 56 | ||

| Market Price and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | 57 | ||

| Management | 58 | ||

| Executive Compensation | 64 | ||

| Certain Relationships and Related Transactions | 67 | ||

| Security Ownership of Certain Beneficial Owners and Management | 69 | ||

| Description of Capital Stock | 71 | ||

| Description of Securities We Are Offering | 74 | ||

| Shares Eligible for Future Sale | 76 | ||

| Material U.S. Federal Income Tax Consequences | 78 | ||

| Underwriting | 82 | ||

| Legal Matters | 91 | ||

| Experts | 91 | ||

| Where You Can Find More Information | 91 | ||

| Index to Financial Statements | F-1 | ||

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer is not permitted. The information contained in this prospectus and any free writing prospectus that we have authorized for use in connection with this Offering is accurate only as of the date of those respective documents, regardless of the time of delivery of this prospectus or any authorized free writing prospectus or the time of issuance or sale of any securities. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus and any free writing prospectus that we have authorized for use in connection with this Offering in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the section of this prospectus entitled “Where You Can Find More Information.”

Unless the context otherwise requires, references in this prospectus to “we,” “us,” “our,” and the “Company” refer to First Choice Healthcare Solutions, Inc. and its subsidiaries.

| 4 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (“Exchange Act”). Forward-looking statements reflect the current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results, and our liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, the execution of our strategy to grow our business by hiring additional physicians to create Medical Centers of Excellence that fit our defined criteria; evolving healthcare laws and regulations; changes in the rates or methods of third-party reimbursements for medical services; accelerated pace of consolidation in the hospital industry; changes in our medical technology as it relates to our services and procedures; any failures in our information technology systems to protect the privacy and security of protected information and other similar cybersecurity risks; our ability to raise capital to fund continuing operations; and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry, our operations and results of operations and any new Medical Centers of Excellence that we may open. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

| 5 |

PROSPECTUS SUMMARY

This summary highlights information contained throughout this prospectus and is qualified in its entirety to the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that should be considered before investing in our securities. Investors should read the entire prospectus carefully, including the more detailed information regarding our business, the risks of purchasing our securities discussed in this prospectus under “Risk Factors” beginning on page 12 of this prospectus and our financial statements and the accompanying notes beginning on page F-7 of this prospectus.

Our Business

Overview

First Choice Healthcare Solutions, Inc. (“FCHS,” the “Company,” “we,” “our” or “us”) is engaged in the creation of state-of-the-art, multi-specialty “Medical Centers of Excellence” in select markets primarily in the southeastern and western parts of the United States. We intend to own and operate these “Medical Centers of Excellence” under the FCHS brand.

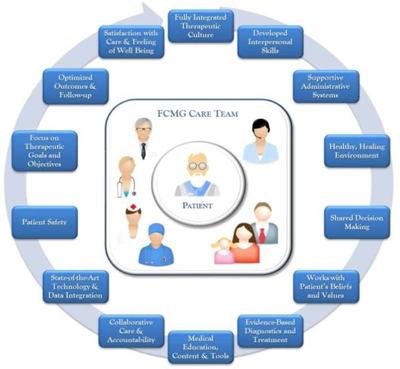

We believe by integrating the synergistic mix of orthopaedic, neurology and interventional pain specialties with related diagnostic and ancillary services and state-of-the-art equipment and technologies all in one location or “Medical Center of Excellence,” we are able to:

| · | provide patients with convenient access to musculoskeletal and rehabilitative care via orthopaedic, neurology and interventional pain medicine treatment, diagnostics and ancillary care services, including, but not limited to magnetic resonance imaging (“MRI”), x-ray (“X-ray”), durable medical equipment (“DME”) and physical therapy (“PT”); |

| · | empower physicians to collaborate as a unified care team, optimizing care coordination and improving outcomes; |

| · | advance the quality and cost effectiveness of our patients’ healthcare; and |

| · | achieve strong, sustainable financial performance that serves to create long-term value for our stockholders. |

Our goal is to build a network of non-physician-owned and operated Medical Centers of Excellence in diverse locations, primarily throughout the southeastern and western parts of the United States. By centralizing current and future centers’ business management functions, including call center operations, scheduling, billing, compliance, accounting, marketing, advertising, legal, information technology and record-keeping, at our corporate headquarters, we will maintain efficiencies and scales of economies. We believe our structure will enable our staff physicians to focus on the practice of medicine and the delivery of quality care to the patients we serve, as opposed to having their time and attention focused on business administration responsibilities. We currently have 44 employees, including physicians and physician assistants.

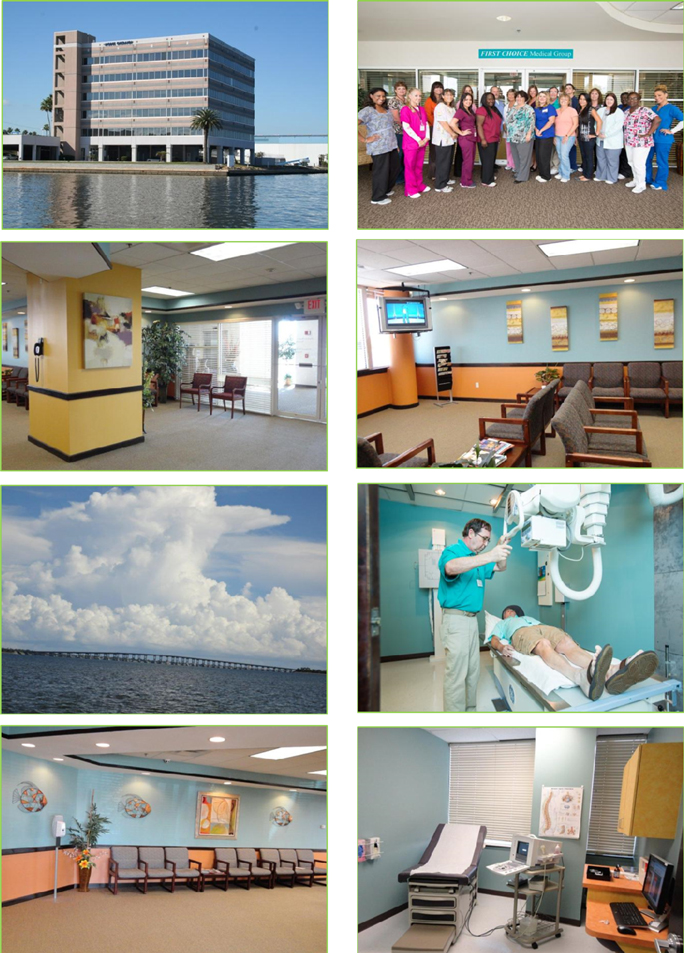

We currently own and operate First Choice Medical Group of Brevard, LLC (“FCMG”), our model multi-specialty Medical Center of Excellence. FCMG will serve as the model for replicating our “Medical Center of Excellence” strategy in our target expansion markets. Located in Melbourne, Florida, FCMG specializes in the delivery of musculoskeletal medicine, via our strategically aligned sub-specialties in orthopaedics, neurology and interventional pain medicine, coupled with on-site diagnostic and ancillary services, including MRI, X-ray, DME and rehabilitative care with multiple quality-focused goals centered on enriching our patients’ care experiences.

| 6 |

We also currently own and manage Marina Towers, LLC, a 78,000 square foot, Class A, six-story building located in Melbourne, Florida, which, among other tenants, houses our corporate headquarters and our model Medical Center of Excellence, FCMG.

Our Definition of a “Medical Center of Excellence”

As there are numerous definitions of a “Medical Center of Excellence,” we have strictly defined what we believe qualifies as a “Medical Center of Excellence” to ensure that our high standards for patient care and attention can be fostered and preserved. More specifically, each of our proprietary Medical Centers of Excellence will:

| • | be limited to eight to ten specialty physicians – all of whom are subject to our rigorous qualification and hiring process; |

| • | provide for the combination of synergistic medical disciplines in orthopaedics, neurology and interventional pain medicine, while supported by related in-house diagnostic and ancillary services, including, but not limited to MRI, X-ray, DME and PT using advanced technologies; |

| • | be capable of generating revenues of up to $20 million when operating at full capacity, based on current reimbursement rates; |

| • | be housed in a commercial building, in close geographic proximity to a primary hospital(s); and |

| • | allow for 12,000-16,000 square feet of usable space for build-out consideration. |

Our Strategy

We aim to distinguish our Medical Centers of Excellence from our competition by designing our Centers as premier destinations for clinically superior, patient-centric care that is coordinated across a patient’s entire care continuum. By doing so, we expect to deliver more meaningful and collaborative doctor-patient experiences, more accurate diagnoses due to the care coordination, effective treatment plans, faster recoveries and materially reduced costs. Our strategic focus is to grow primarily in select southeastern and western U.S. markets by hiring additional physicians to create FCHS-branded Medical Centers of Excellence that fit our defined criteria. Our criteria includes the following:

| • | opportunities for us to introduce additional revenue channels (i.e. synergistic musculoskeletal medical disciplines; on-site MRI, X-ray, DME and PT; related health and wellness products, etc.) that will support and promote enhanced, well-coordinated, patient-centric care while supporting and promoting profitable business operations; |

| • | opportunities that support economies of scale in billing, collections, purchasing, advertising and compliance which can be fully leveraged to reduce expenses and fuel income growth; and |

| • | opportunities to increase awareness of our brand by aligning with patients, referring physicians, medical institutions, insurers, employers and other healthcare stakeholders in local markets that share our values of patient care. |

Our business model is to employ all of our multi-specialty physicians, thereby permitting us to optimize revenue generation from both physician and ancillary services, while also providing our employed care providers with the ability to refer patients to our on-site diagnostic services. Physician-owned practices, on the other hand, may be subject to prevailing federal regulations (e.g. The Ethics in Patient Referral Act of 1989, as amended) which may limit their ability to refer patients for certain healthcare services provide by entities in which the physician-owner(s) has a financial interest.

| 7 |

Our centralized system of back office operations will allow us to achieve measurable cost and productivity efficiencies as we expand the number of Centers we own and operate. We have specifically designed our centralized system to alleviate our staff physicians from business administration responsibilities associated with operating a medical practice or clinic, enabling them to focus on caring for the patients we serve. Physicians who own and manage their own private practices or clinics typically have to devote valuable time and resources to addressing business concerns, time and resources that might otherwise be spent on treating their patients.

Medical Service Mix

Like other business models for professional medical services, our Medical Center of Excellence model is designed to offer the most synergistic and profitable medical service mix. By their nature, some combinations of medical specialties can generate more revenue than others. Physicians need access to diagnostic equipment and ancillary services, such as MRI, X-ray, DME and PT. Moreover, patients expect their physicians to have access to the best diagnostic and service delivery equipment. Without diagnostic services, many medical practices would find it difficult to maintain their current margins of profitability.

We integrate both medical specialties and diagnostic services in our Center to maintain or enhance our profits. While one medical specialty may have high reimbursements for their professional services but insufficient volume to profitably support the necessary diagnostic equipment, another medical specialty may have lower professional service reimbursements but a higher volume of diagnostic equipment use. Operating independently, each specialty group would face retreating profit margins and confront significant challenges to maintaining high service levels with adequate and technologically advanced equipment. However, operating together, they create the optimal mix of professional service fee income and diagnostic equipment procedure income. Since the combination is more profitable than either of its components, there is a favorable opportunity to sustain profit margins that will allow each Center to maintain high service levels with state-of-the-art equipment.

Scalable Back Office and Economies of Scale

Fixed cost legacy administrative functions have subjected many established medical centers to a downward spiral of diminishing profit margins and losses. In legacy medical centers, administrative management, billing, compliance, accounting, marketing, advertising, scheduling, customer service and record keeping functions represent fixed overhead for the practice. The fixed administrative overhead of a practice has the effect of reducing profit margins if the practice experiences declining revenues as a result of lower patient volumes from increasing competition, lower pricing, lower reimbursements or patient migration to competitors.

A key to our success will be our ability to continue to employ a highly experienced team of business managers supported by an array of professional, experienced and compliant subcontractors. Using project management best practices, our corporate team manages all billing, compliance, accounting, marketing, advertising, legal, information technology and record keeping functions on behalf of FCMG and will do so on behalf of our future Centers. It is our plan that the cost of our “back office operations” will not increase in direct relation to the growth of our Medical Centers of Excellence, which will allow us to sustain profit margins across our entire business operations with a cost effective and scalable back office. As the number of employed physicians and operated Medical Centers of Excellence increases, the economies of scale for our back office operations will also increase. The economies of scale support selecting the best and not the lowest cost subcontractors, while allowing FCMG and our other future Medical Centers of Excellence to operate cost effectively with higher service levels.

High Technology Infrastructure Supporting High Touch Patient Experiences

Successful retail models in other industries already effectively use telecommunications, remote computing, mobile computing, cloud computing, virtual networks and other leading-edge technologies to manage geographically diverse operating units. These technologies create the infrastructure to allow a central management team to monitor, direct and control geographically dispersed operating units and subcontractors, including national operations.

| 8 |

We believe that our business model incorporates the best of these technologies. A central management team monitors, directs and controls FCMG, and will control our future multi-specialty Medical Centers of Excellence, and all the necessary support subcontractors required by the operations. Our administrative operations center uses a secure paperless practice management platform. We utilize a state-of-the-art, cloud-based electronic medical record (“EMR”) management system, which provides ready access to each patient’s test results from anywhere in the world where there is Internet connectivity, including X-ray and MRI images, diagnoses, patient and doctor notes, visit reports, billing information, insurance coverage, patient identification and personalized care delivery requirements. Our EMR system fully complies with Stage 1 and 2 Meaningful Use standards defined by the Centers for Medicare & Medicaid Services Incentive Programs. These programs govern the use of electronic health records and allow us to earn incentive payments from the U.S. government, pursuant to the Health Information Technology for Economic and Clinical Health (HITECH) Act, which was enacted as part of the American Recovery and Reinvestment Act of 2009.

We intend to grow by replicating the successful model currently in place by FCMG, supported by our standardized policies, procedures and clinic setup guidelines. The administrative functions can be quickly scaled to handle multiple additional Centers. As we roll out our business model, we expect our administrative core and retail clinic model to maintain the economies of scale for all of our future multi-specialty Medical Centers of Excellence.

Our Real Estate Business

FCID Holdings, Inc. (“FCID Holdings”) is our wholly owned subsidiary which operates our real estate interests. Currently, FCID Holdings has one real estate holding, Marina Towers, LLC, a 78,000 square foot, Class A, six-story building located on the Indian River in Melbourne, Florida. In addition to housing our corporate headquarters and FCMG, the building, which averages 95% annual occupancy, also leases approximately 63,200 square feet of commercial office space to tenants.

Our Corporate History

We were incorporated in the State of Colorado on May 30, 2007 as Medical Billing Assistance, Inc. to act as a holding corporation for I.V. Services Ltd., Inc. (“IVS”), a Florida corporation engaged in providing billing services to providers of medical services. IVS was incorporated in the State of Florida on September 28, 1987, and on June 30, 2007, we issued 2,429,000 shares of common stock to Mr. Michael West and other IVS shareholders in exchange for 100% of the capital stock of IVS. In the second quarter of 2011, we disposed of IVS, which, at the time, was an inactive, wholly-owned subsidiary of Medical Billing Assistance, Inc.

On December 29, 2010, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with FCID Medical, Inc., a Florida corporation (“FCID Medical”), FCID Holdings, Inc., a Florida corporation (“FCID Holdings”), and the shareholders of FCID Medical and FCID Holdings (the “FCID Shareholders”). Pursuant to the terms of the Share Exchange Agreement, the FCID Shareholders exchanged 100% of the outstanding common stock of FCID Medical and FCID Holdings for 10,000,000 shares of our common stock, resulting in FCID Medical and FCID Holdings becoming 100% owned subsidiaries of Medical Billing Assistance, Inc.

On February 13, 2012, Medical Billing Assistance, Inc. merged with First Choice Healthcare Solutions, Inc., (“FCHS”), a Delaware corporation formed exclusively for the merger, pursuant to which (a) our state of incorporation changed from Colorado to Delaware, (b) our name changed from Medical Billing Assistance, Inc. to First Choice Healthcare Solutions, Inc., (c) every four shares of Medical Billing Assistance Inc.’s common stock was exchanged for one share of FCHS common stock (effectively resulting in a four-to-one reverse split of our common stock), and (d) FCHS inherited the rights and property of Medical Billing Assistance, Inc. and assumed its liabilities. The effective date for the reincorporation and the reverse split was April 4, 2012. We now operate as First Choice Healthcare Solutions, Inc.

Our address is 709 S. Harbor City Blvd., Suite 250, Melbourne, Florida, 32901 and our phone number is (321) 725-0090. Our website address is www.myfchs.com. We have not incorporated by reference into this prospectus the information on our website, and you should not consider it to be a part of this prospectus.

| 9 |

THE OFFERING

| Securities we are offering: | [*] units, with each unit consisting of two shares of our common stock and one Warrant to purchase one share of our common stock, at a purchase price per unit of $[*]. The last reported sale price of our common stock on June 6, 2014 on the OTCQB was $1.75 per share. The units will not be certificated and the shares of common stock and Warrants may be transferred separately immediately upon issuance. The Warrants will be immediately exercisable for one share of common stock at an initial exercise price of $[*] per share, or 150% of the public offering price per share of common stock in the Offering, and will expire on the fifth anniversary of the issuance date.

The shares of common stock issuable from time to time upon the exercise of the Warrants are also being offered pursuant to this prospectus. | |

| Public offering price: | $[*] per unit. | |

| Common stock outstanding before this Offering: | 17,081,248 shares. | |

| Common stock included in the units: | [*] shares, which assumes no exercise of the Warrants; or [*] shares, which assumes the full exercise of the Warrants sold in this Offering. | |

| Common stock to be outstanding immediately after this Offering: | [*] shares, which assumes no exercise of the Warrants. | |

Over-allotment option |

We have granted a 45-day option to the representative of the underwriters to purchase additional units in an amount equal to 15% of the units sold in this Offering, solely to cover over-allotments, if any. | |

| Use of proceeds: | We estimate that the net proceeds from this Offering will be approximately $[*], or approximately $[*] if the underwriters exercise their over-allotment option in full, after deducting the underwriting discounts and commissions and estimated Offering expenses payable by us. We intend to use the net proceeds to create FCHS-branded Medical Centers of Excellence in the southeastern and western United States, and for general corporate purposes, including working capital and operating purposes. For a more complete description of our intended use of proceeds from this Offering, see the “Use of Proceeds” section of this prospectus on pg. 29. | |

| Market symbol and listing: | We intend to apply to list our common stock on the NYSE MKT LLC under the symbol “FCHS.” Our common stock is currently quoted on the OTCQB under the same symbol. There will be no established trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to apply for listing of the units or the Warrants on any national securities exchange or other trading market. |

| 10 |

| Risk factors: | Investing in our securities involves substantial risks. You should carefully review and consider the “Risk Factors” section beginning on page 12 of this prospectus for a discussion of factors to consider before deciding to invest in our securities. |

The number of shares of our common stock outstanding prior to and to be outstanding immediately after this Offering, as set forth in the table above, is based on 17,081,248 shares outstanding as of June 6, 2014 and excludes as of that date:

| • | up to 4,195,000 shares of common stock issuable upon the exercise of warrants outstanding at June 6, 2014 with a weighted average exercise price of $2.36 per share; | |

| • | 4,653,333 shares of common stock issuable upon the conversion of certain outstanding securities at a weighted average conversion price of $0.90 per share; | |

| • | 500,000 shares of common stock reserved for future grants, awards and issuance under our equity compensation plan as of June 6, 2014; | |

| • | up to [*] shares of common stock issuable upon the full exercise of the Warrants offered hereby; and | |

| • | [*] shares of common stock underlying the warrants to be issued to the representative of the underwriters in connection with this Offering. For a more complete description of the representative’s warrants, please see “Underwriting” beginning on page 82 of this prospectus. |

Unless otherwise indicated, all information in this prospectus assumes:

| · | no exercise of the representative’s warrants described above; and |

| · | no exercise by the representative of the underwriters of its option to purchase additional units in an amount equal to 15% of the units sold in this Offering to cover over-allotments, if any. |

| 11 |

RISK FACTORS

An investment in our securities has a high degree of risk. Before making an investment decision, you should carefully consider the risks and uncertainties described below and other information in this prospectus. The occurrence of any of the adverse developments described in the following risk factors could materially and adversely harm our business, operating results, financial conditions, or prospects. In that case, the value of our stock could go down and you could lose all or a part of your investment.

GENERAL RISKS REGARDING OUR HEALTHCARE SERVICES BUSINESS

We have a limited operating history that impedes our ability to evaluate our potential future performance and strategy.

We have only owned and operated our model Medical Center of Excellence, FCMG, since 2012 and have experienced net losses to date. Using FCMG as our model “Medical Center of Excellence,” we plan to hire additional physicians to create state-of-the-art Medical Centers of Excellence committed to delivering patient-centric care in select markets in the United States. Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on estimates of our future performance. To address these risks and uncertainties, we must do the following:

| · | Successfully execute our business strategy to establish and extend the “First Choice Healthcare Solutions” brand and reputation as a profitable, well-managed enterprise committed to delivering quality and cost-effective health care primarily in parts of the southeastern and western United States and then pursue select other U.S. markets; |

| · | Respond to competitive developments; |

| · | Effectively and efficiently integrate new Medical Centers of Excellence; and |

| · | Attract, integrate, retain and motivate qualified personnel. |

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition and results of operations may be materially and adversely affected.

We are implementing a strategy to grow our business by hiring additional physicians to create FCHS-branded Medical Centers of Excellence in select U.S. markets, which requires significant additional capital and may not generate income.

We intend to grow our business by hiring additional physicians to create FCHS-branded Medical Centers of Excellence in select U.S. markets. We estimate the cost to create each additional Medical Center of Excellence to be approximately $4-5 million. Although we are taking steps to raise funds through equity offerings to implement our growth strategy, these funds may not be adequate to offset all of the expenses we incur in expanding our business. We will need to generate revenues to offset expenses associated with our growth, and we may be unsuccessful in achieving sufficient revenues, despite our attempts to grow our business. If our growth strategies do not result in sufficient revenues and income, we may have to abandon our plans for further growth and/or cease operations, which could have a material and adverse effect on our business, prospects and financial condition.

| 12 |

In order to pursue our business strategy, we will need to raise additional capital. If we are unable to raise additional capital, our business may fail.

We will need to raise additional capital to pursue our business plan, which includes hiring additional physicians in order to expand our business operations and develop our FCHS brand of Medical Centers of Excellence. We believe that we have access to capital resources through possible public or private equity offerings, debt financings, corporate collaborations or other means. If the economic climate in the United States does not improve or further deteriorates, our ability to raise additional capital could be negatively impacted. If we are unable to secure additional capital, we may be required to curtail our initiatives and take additional measures to reduce costs in order to conserve our cash in amounts sufficient to sustain operations and meet our obligations.

We may not be able to achieve the expected benefits from opening new Medical Centers of Excellence, which would adversely affect our financial condition and results.

We plan to rely on hiring additional physicians to create FCHS-branded Medical Center of Excellence as a method of expanding our business. If we do not successfully integrate such new Medical Centers of Excellence, we may not realize anticipated operating advantages and cost savings. The integration of these new Medical Centers of Excellence into our business operations involves a number of risks, including:

| · | Demands on management related to the increase in our Company’s size with the establishment of each new Medical Center of Excellence, which is crucial to our business plan; |

| · | The diversion of management’s attention from the management of daily operations to the integration of operations of the new Medical Centers of Excellence; |

| · | Difficulties in the assimilation and retention of employees; |

| · | Potential adverse effects on operating results; and |

| · | Challenges in retaining patients from the new physicians. | |

Further, the successful integration of the new physicians will depend upon our ability to manage the new physicians and to eliminate redundant and excess costs. Difficulties in integrating new physicians may not be able to achieve the cost savings and other size-related benefits that we hoped to achieve, which would harm our financial condition and operating results.

| 13 |

If we are unable to attract and retain qualified medical professionals, our ability to maintain operations at our existing Medical Center of Excellence, attract patients or open new multi-specialty Medical Centers of Excellence could be negatively affected.

We generate our revenues through physicians and medical professionals who work for us to perform medical services and procedures. The retention of those physicians and medical professionals is a critical factor in the success of our medical multi-specialty Centers, and the hiring of qualified physicians and medical professionals is a critical factor in our ability to launch new multi-specialty Medical Centers of Excellence successfully. However, at times it may be difficult for us to retain or hire qualified physicians and medical professionals. If we are unable consistently to hire and retain qualified physicians and medical professionals, our ability to open new Centers, maintain operations at existing medical multi-specialty Centers, and attract patients could be materially and adversely affected.

We may have difficulties managing our Company’s growth, which could lead to higher operating losses, or we may not grow at all.

Rapid growth could strain our human and capital resources, potentially leading to higher operating losses. Our ability to manage operations and control growth will be dependent upon our ability to raise and spend capital to successfully attract, train, motivate, retain and manage new employees and continue to update and improve our management and operational systems, infrastructure and other resources, financial and management controls, and reporting systems and procedures. Should we be unsuccessful in accomplishing any of these essential aspects of our growth in an efficient and timely manner, then management may receive inadequate information necessary to manage our operations, possibly causing additional expenditures and inefficient use of existing human and capital resources or we otherwise may be forced to grow at a slower pace that could slow or eliminate our ability to achieve and sustain profitability. Such slower than expected growth may require us to restrict or cease our operations and go out of business.

Since a significant percentage of our operating expenses are fixed, a relatively small decrease in revenues could have a significant negative impact on our financial results.

A significant percentage of our expenses are currently fixed, meaning they do not vary significantly with our increase or decrease in revenues. Such expenses include, but will not be limited to, debt service and capital lease payments, rent and operating lease payments, salaries, maintenance and insurance. As a result, a small reduction in the prices we charge for our services or procedure volume could have a disproportionately negative effect on our financial results.

Loss of key executives, limited experience in operating a public company and failure to attract qualified managers and sales persons could limit our growth and negatively impact our operations.

We depend upon our management team to a substantial extent. In particular, we depend upon Christian C. Romandetti, our President and Chief Executive Officer, for his skills, experience and knowledge of our Company and industry contacts. The loss of Mr. Romandetti or other members of our management team could have a material adverse effect on our business, results of operations or financial condition.

Our limited experience in dealing with the increasingly complex laws pertaining to public companies could be a significant disadvantage to us in that it is likely that an increasing amount of management’s time will be devoted to these activities which will result in less time being devoted to the management and growth of our Company. It is possible that we will be required to expand our employee base and hire additional employees to support our operations as a public company which will increase our operating costs in future periods.

We require medical clinic managers, medical professionals and marketing persons with experience in our industry to operate and market our medical clinic services. It is impossible to predict the availability of qualified persons or the compensation levels that will be required to hire them. The loss of the services of any member of our senior management or our inability to hire qualified persons at economically reasonable compensation levels could adversely affect our ability to operate and grow our business.

| 14 |

We may be subject to medical professional liability risks, which could be costly and could negatively impact our business and financial results.

We may be subject to professional liability claims. Although there currently are no known hazards associated with any of our procedures or technologies when performed or used properly, hazards may be discovered in the future. For example, there is a risk of harm to a patient during an MRI if the patient has certain types of metal implants or cardiac pacemakers within his or her body. Although patients are screened to safeguard against this risk, screening may nevertheless fail to identify the hazard. There also is potential risk to patients treated with therapy equipment secondary to inadvertent or excessive over- or under- exposure to radiation. We maintain professional liability insurance with coverage that we believe is consistent with industry practice and appropriate in light of the risks attendant to our business. However, any claim made against us could be costly to defend against, resulting in a substantial damage award against us and divert the attention of our management team from our operations, which could have an adverse effect on our financial performance.

The healthcare regulatory and political framework is uncertain and evolving.

Healthcare laws and regulations may change significantly in the future which could adversely affect our financial condition and results of operations. We continuously monitor these developments and modify our operations from time to time as the legislative and regulatory environment changes.

In March 2010, President Barack Obama signed a health care reform measure, which provides healthcare insurance for approximately 30 million more Americans. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (collectively, the “PPACA”), which includes a variety of healthcare reform provisions and requirements that will become effective at varying times through 2018, substantially changes the way health care is financed by both governmental and private insurers, including several payment reforms that establish payments to hospitals and physicians based in part on quality measures, and may significantly impact our industry. The PPACA requires, among other things, payment rates for services using imaging equipment that costs over $1 million to be calculated using revised equipment usage assumptions and reduced payment rates for imaging services paid under the Medicare Part B fee schedule. Many of the provisions of the PPACA will phase in over the course of the next several years, and we are unable to predict what effect the PPACA or other healthcare reform measures that may be adopted in the future will have on our business.

The healthcare industry is highly regulated, and government authorities may determine that we have failed to comply with applicable laws or regulations.

The healthcare industry and physicians’ medical practices, including the healthcare and other services that we and our affiliated physicians provide, are subject to extensive and complex federal, state and local laws and regulations, compliance with which imposes substantial costs on us. Of particular importance are the provisions summarized as follows:

| · | federal laws (including the federal False Claims Act) that prohibit entities and individuals from knowingly or recklessly making claims to Medicare and other government programs that contain false or fraudulent information or from improperly retaining known overpayments; |

| 15 |

| · | a provision of the Social Security Act, commonly referred to as the “anti-kickback” law, that prohibits the knowing and willful offer, payment, solicitation or receipt of any bribe, kickback, rebate or other remuneration, in cash or in kind, in return for the referral or recommendation of patients for items and services covered, in whole or in part, by federal healthcare programs, such as Medicare; |

| · | a provision of the Social Security Act, commonly referred to as the Stark Law, that, subject to limited exceptions, prohibits physicians from referring Medicare patients to an entity for the provision of certain “designated health services” if the physician or a member of such physician’s immediate family has a direct or indirect financial relationship (including a compensation arrangement) with the entity; |

| · | similar state law provisions pertaining to anti-kickback, fee splitting, self-referral and false claims issues, which typically are not limited to relationships involving federal payors; |

| · | provisions of HIPAA that prohibit knowingly and willfully executing a scheme or artifice to defraud a healthcare benefit program or falsifying, concealing or covering up a material fact or making any material false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services; |

| · | state laws that prohibit general business corporations from practicing medicine, controlling physicians’ medical decisions or engaging in certain practices, such as splitting fees with physicians; |

| · | federal and state laws that prohibit providers from billing and receiving payment from Medicare and TRICARE for services unless the services are medically necessary, adequately and accurately documented and billed using codes that accurately reflect the type and level of services rendered; |

| · | federal and state laws pertaining to the provision of services by non-physician practitioners, such as advanced nurse practitioners, physician assistants and other clinical professionals, physician supervision of such services and reimbursement requirements that may be dependent on the manner in which the services are provided and documented; and |

| · | federal laws that impose civil administrative sanctions for, among other violations, inappropriate billing of services to federally funded healthcare programs, inappropriately reducing hospital care lengths of stay for such patients, or employing individuals who are excluded from participation in federally funded healthcare programs. |

In addition, we believe that our business will continue to be subject to increasing regulation, the scope and effect of which we cannot predict.

We may in the future become the subject of regulatory or other investigations or proceedings, and our interpretations of applicable laws, rules and regulations may be challenged.

Regulatory authorities or other parties may assert that our arrangements with our affiliated professional contractors constitute fee splitting or the corporate practice of medicine and seek to invalidate these arrangements. Such parties also could assert that our relationships, including fee arrangements, among our affiliated professional contractors, hospital clients or referring physicians violate the anti-kickback, fee splitting or self-referral laws and regulations or that we have submitted false claims or otherwise failed to comply with government program reimbursement requirements.

| 16 |

Such investigations, proceedings and challenges could result in substantial defense costs to us and a diversion of management’s time and attention. In addition, violations of these laws are punishable by monetary fines, civil and criminal penalties, exclusion from participation in government-sponsored healthcare programs, and forfeiture of amounts collected in violation of such laws and regulations, any of which could have a material adverse effect on our business, financial condition, results of operations, cash flows and the trading price of our common stock.

Federal and state laws that protect the privacy and security of protected health information may increase our costs and limit our ability to collect and use that information and subject us to penalties if we are unable to fully comply with such laws.

Numerous federal and state laws and regulations govern the collection, dissemination, use, security and confidentiality of individually identifiable health information. These laws include:

| · | Provisions of HIPAA that limit how healthcare providers may use and disclose individually identifiable health information, provide certain rights to individuals with respect to that information and impose certain security requirements; |

| · | HITECH, which strengthens and expands the HIPAA Privacy Standards and Security Standards; |

| · | Other federal and state laws restricting the use and protecting the privacy and security of protected information, many of which are not preempted by HIPAA; |

| · | Federal and state consumer protection laws; and |

| · | Federal and state laws regulating the conduct of research with human subjects. |

As part of our medical record keeping, third-party billing, research and other services, we collect and maintain protected health information in paper and electronic format. New protected health information standards, whether implemented pursuant to HIPAA, HITECH, congressional action or otherwise, could have a significant effect on the manner in which we handle healthcare-related data and communicate with payors, and compliance with these standards could impose significant costs on us or limit our ability to offer services, thereby negatively impacting the business opportunities available to us.

If we do not comply with existing or new laws and regulations related to protected health information we could be subject to remedies that include monetary fines, civil or administrative penalties or criminal sanctions.

Changes in the rates or methods of third-party reimbursements for medical services could result in reduced demand for our services or create downward pricing pressure, which would result in a decline in our revenues and harm to our financial position.

Third-party payors such as Medicare, TRICARE and commercial health insurance companies, may change the rates or methods of reimbursement for the services we currently provide or plan to provide and such changes could have a significant negative impact on those revenues. At this time, we cannot predict the impact that rate reductions will have on our future revenues or business. Moreover, patients on whom we currently depend, and expect to continue to depend on, for the majority of our medical clinic revenues generally rely on reimbursement from third-party payors for the payment of medical services. If our patients begin to receive decreased reimbursement from third-party payors for their medical services and as such are forced to pay for the remainder of their medical services out of pocket, then a reduced demand for our services or downward pricing pressures could result, which could have a material impact on our financial position.

| 17 |

Future requirements limiting access to or payment for medical services may negatively impact our future revenues or business. If legislation substantially changes the way healthcare is reimbursed by both governmental and commercial insurance carriers, it may negatively impact payment rates for certain medical services. We cannot predict at this time whether or the extent to which other proposed changes will be adopted, if any, or how these or future changes will affect the demand for our services.

Managed care organizations may prevent their members from using our services which would cause us to lose current and prospective patients.

Healthcare providers participating as providers under managed care plans may be required to refer medical services to specific medical clinics depending on the plan in which each covered patient is enrolled. These requirements may inhibit their members from using our medical services in some cases. The proliferation of managed care may prevent an increasing number of their members from using our services in the future which would cause our revenues to decline.

We may need to restructure our services and practices if our methods are determined not to comply with the Stark Law.

The Ethics in Patient Referral Act of 1989, as amended (the "Stark Law"), is a civil statute that generally (i) prohibits physicians from making referrals for designated health services to entities in which the physicians have a direct or indirect financial relationship and (ii) prohibits entities from presenting or causing to be presented claims or bills to any individual, third-party payor, or other entity for designated health services furnished pursuant to a prohibited referral. Under the Stark Law, a physician may not refer patients for certain designated health services to entities with which the physician has a direct or indirect financial relationship, unless allowed under an enumerated exception. Under the Stark Law, there are numerous statutory and regulatory exceptions for certain otherwise prohibited financial relationships. A transaction must fall entirely within an exception to be lawful under the Stark Law.

We believe that any referrals between or among our Company, the physicians providing services and the facilities where procedures are performed will be for services compliant under the Stark Law. If these arrangements are found to violate the Stark Law, we may be required to restructure such services or be subject to civil or criminal fines and penalties, including the exclusion of our Company, the physicians, and the facilities from the Medicare programs, any of which events could have a material adverse effect on our business, financial condition and results of operations.

Some states have enacted statutes, similar to the federal Anti-Kickback Statute and Stark Law, applicable to our operations because they cover all referrals of patients regardless of the payer or type of healthcare service provided. These state laws vary significantly in their scope and penalties for violations. Although we have endeavored to structure our business operations to be in material compliance with such state laws, authorities in those states could determine that our business practices are in violation of their laws, which would have a material adverse effect on our business, financial condition and results of operations.

| 18 |

We are subject to federal and state restrictions on advertising that may adversely affect our ability to advertise our Centers and services.

The growth of our healthcare business is dependent on advertising, which is subject to regulation by the Federal Trade Commission ("FTC"). We believe that we have structured our advertising practices to be in material compliance with FTC regulations and guidance. However, we cannot be certain that the FTC will not determine that our advertising practices are in violation of such laws and guidance.

In addition, the laws of many states restrict certain advertising practices by and on behalf of physicians. Many states do not offer clear guidance on the bounds of acceptable advertising practices or on the limits of advertising provided by management companies on behalf of physicians. Although we have endeavored to structure our advertising practices to be in material compliance with such state laws, authorities in those states could determine that our advertising practices are in violation of those laws.

Fee-splitting prohibitions in some states may limit our financial prospects.

Many states prohibit medical professionals from paying a portion of a professional fee to another individual unless that individual is an employee or partner in the same professional practice. If we violate a state's fee-splitting prohibition, we may be subject to civil or criminal fines, and the physician participating in such arrangements may lose his or her licensing privileges. Many states do not offer clear guidance on what relationships constitute fee-splitting, particularly in the context of providing management services for doctors. We have endeavored to structure our business operations in material compliance with these laws. However, state authorities could find that fee-splitting prohibitions apply to our business practices in their states. If any aspect of our operations were found to violate fee-splitting laws or regulations, this could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Facility licensure requirements in some states may be costly and time-consuming, thereby limiting or delaying our operations.

State Departments of Health may require us to obtain licenses in the various states in which we will establish our future multi-specialty Medical Centers of Excellence or other business operations. We intend to obtain the necessary material licensure in states where required. However, not all of the regulations governing the need for licensure are clear and there is limited guidance available regarding certain interpretative issues. Therefore, it is possible that a state regulatory authority could determine that we are improperly conducting business operations without a license in that state. This could subject us to significant fines or penalties, result in our being required to cease operations in that state or otherwise have a material adverse effect on our business, financial condition and results of operations. Although we currently have no reason to believe that we will be unable to obtain the necessary licenses without unreasonable expense or delay, there can be no assurance that we will be able to obtain any required licensure.

Health Insurance Portability and Accountability Act (“HIPAA”) compliance is critically import to our continuing operations.

Our Company and our physicians are covered entities under HIPAA if we or our physicians provide services that are reimbursable under Medicare or other third-party payors (e.g., orthopedic services). Although the covered health care providers themselves are primarily liable for HIPAA compliance, as a "business associate" to these covered entities we are bound indirectly to comply with the HIPAA privacy regulations, and we are directly bound to comply with certain of the HIPAA security regulations. Although we cannot predict the total financial or other impact of these privacy and security regulations on our business, compliance with these regulations could require us to incur substantial expenses, which could have a material adverse effect on our business, financial condition and results of operations. In addition, we will continue to remain subject to any state laws that are more restrictive than the privacy regulations issued under the Administrative Simplification Provisions.

| 19 |

Our medical business may be reliant upon direct-to-patient marketing.

The effectiveness of our marketing programs and messages to patients can have a significant impact on our financial performance. The effectiveness of marketing may fluctuate, resulting in changes in the cost of marketing per procedure, and variations in our margins. Less effective marketing programs could materially and adversely affect our business, financial condition and results of operations.

If technological changes occur rendering our equipment or services obsolete, or increase our cost structure, we may need to make significant capital expenditures or modify our business model, which could cause our revenues or results of operations to decline.

Industry competitive or clinical factors, among others, may require us to introduce alternate medical technology for the services and procedures we offer than those that may currently be in use in our medical multi-specialty Centers. Introducing such technology could require significant capital investment or force us to modify our business model in such a way as to make our revenues or results of operations decline. An increase in costs could reduce our ability to maintain our margins. An increase in prices could adversely affect our ability to attract new patients. If we are unable to obtain or maintain state of the art equipment that is essential to the professional medical services provided by our clinics, our business, prospects, results of operations and financial condition could be materially and adversely affected.

We rely significantly on information technology and any failure, inadequacy, interruption or security lapse of that technology, including any cybersecurity incidents, could harm our ability to operate our business effectively.

Our internal computer systems and those of third parties with which we contract may be vulnerable to damage from cyber-attacks, computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures despite the implementation of security measures. System failures, accidents or security breaches could cause interruptions in our operations, and could result in a material disruption of our business operations, in addition to possibly requiring substantial expenditures of resources to remedy. To the extent that any disruption or security breach were to result in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and our collections from third-party payors could be delayed.

If we are forced to lower our procedure prices in order to compete with a better-financed or lower-cost provider of medical healthcare services, our medical revenues and results of operations could decline.

FCMG and our future multi-specialty Medical Centers of Excellence will compete with medical clinics and other technologies currently under development. Competition comes from other clinics and from hospitals, hospital-affiliated group entities and physician group practices.

Some of our current competitors, or other companies which may choose to enter the industry in the future, may have substantially greater financial, technical, managerial, marketing or other resources and experience than we do and may be able to compete more effectively. Similarly, competition could increase if the market for healthcare services does not experience growth, and existing providers compete for market share. Additional competition may develop, particularly if the price for services or reimbursement decreases. Our management, operations, strategy and marketing plans may not be successful in meeting this competition.

| 20 |

If more competitors begin to offer healthcare services in our geographic markets, we might find it necessary to reduce the prices we charge, particularly if competitors offer the services at lower prices than we do. If that were to happen or we were not successful in cost effectively acquiring patients for our procedures, we may not be able to make up for the reduced gross profit margin by increasing the number of procedures that we perform, and our business, financial condition and results from operations could be adversely affected.

A decline in consumer disposable income could adversely affect the number of procedures performed which could have a negative impact on our financial results.

After payments by commercial healthcare insurance companies or government programs, including Medicare and TRICARE, the remaining portion of the cost of medical care is paid by the patient. Some of our patients may not have the financial resources to pay for the services they receive at FCMG, or services they may receive at our future Medical Centers of Excellence, which are ultimately not reimbursed by their healthcare provider. Accordingly, our operating results may vary based upon the impact of changes in the disposable income of patients using our services, among other economic factors. A significant decrease in consumer disposable income in a weak economy may result in a decrease in the number of elective medical procedures performed by FCMG or our future Centers, and a related decline in our revenues and profitability. In addition, weak economic conditions may cause some of our patients to experience financial distress or declare bankruptcy, which may negatively impact our accounts receivable collection experience.

Adverse changes in general domestic and worldwide economic conditions and instability and disruption of credit markets could adversely affect our operating results, financial condition, or liquidity.

We are subject to risks arising from adverse changes in general domestic and global economic conditions, including recession or economic slowdown and disruption of credit markets. We continue to see domestic and global weakness due to economic uncertainties and volatility in financial markets. We believe our healthcare clinics may be impacted by unemployment rates, the number of under-insured or uninsured patients and other conditions arising from the global economic conditions described above. At this time, it is unclear what impact this might have on our future revenues or business.

The cost and availability of credit has been and may continue to be adversely affected by illiquid credit markets and wider credit spreads. Concern about the stability of the markets generally and the strength of counterparties specifically has led many lenders and institutional investors to reduce, and in some cases, cease to provide funding to borrowers.

Turbulence in the United States and international markets and economies may adversely affect our liquidity and financial condition, and the liquidity and financial condition of our patients. Deterioration in market conditions could limit our ability, and the ability of our patients, to timely pay expenses, and access the capital markets to meet liquidity needs, resulting in material and adverse effects on our business, prospects, financial condition and results of operations.

| 21 |

Risks related to our real estate BUSINESS

Our performance and value are subject to risks associated with our real estate asset and with the real estate industry.

Since approximately 16% of our current revenue is derived from our real estate asset, we are subject to the risk that if our property does not generate revenues sufficient to meet our operating expenses, including debt service and capital expenditures, our ability to operate and grow could be materially and adversely affected. The following factors, among others, may adversely affect the revenues generated by our property:

| · | Competition from other office and commercial properties; |

| · | Local real estate market conditions, such as oversupply or reduction in demand for office or other commercial space; |

| · | Costs to comply with new local, state and federal laws; |

| · | Changes in interest rates and availability of financing; |

| · | Vacancies, changes in market rental rates and the need to periodically repair, renovate and re-let space; |

| · | Increased operating costs, including insurance expense, utilities, real estate taxes, state and local taxes and heightened security costs; |

| · | Civil disturbances, hurricanes and other natural disasters, or terrorist acts or acts of war which may result in uninsured or undermined losses; and |

| · | Declines in the financial condition of our tenants and our ability to collect rents from our tenants. |

We may face risks associated with the use of debt, including refinancing risk.

We are subject to the risks normally associated with debt financing, including the risk that our cash flow will be insufficient to meet required payments of principal and interest. Our wholly owned subsidiary, Marina Towers, LLC, is a party to a loan agreement with Guggenheim Life and Annuity Company in the principal aggregate amount of $7,550,000 that matures on September 16, 2016 as more fully described in the section titled “Certain Relationships and Related Transactions.” We anticipate that only a small portion of the principal of our debt will be repaid prior to maturity. Therefore, we are likely to need to refinance at least a portion of our outstanding debt as it matures. There is a risk that we may not be able to refinance existing debt or that the terms of any refinancing will not be as favorable as the terms of our existing debt. If principal payments due at maturity cannot be refinanced, extended or repaid with proceeds from other sources, such as new equity capital, our cash flow may not be sufficient to repay all maturing debt when a significant "balloon" payment come due. There is a risk that we may be unable to refinance on favorable terms or at all. This risk is currently heightened because of tightened underwriting standards and increased credit risk premiums. These conditions, which may increase the cost and reduce the availability of debt, may continue or worsen in the future.

The risks associated with the physical effects of weather could have a material adverse effect on our property.

The physical effects of weather could have a material adverse effect on our property, operations and business. For example, our property is located on the riverfront in Brevard County, Florida. To the extent weather patterns change, our market could experience increases in storm intensity or rising sea-levels that would make the property less desirable to tenants. Over time, these conditions could result in declining demand for office space in our building or the inability of us to operate the building at all. These conditions may also have indirect effects on our business by increasing the cost of (or making unavailable) property insurance on terms we find acceptable, increasing the cost of energy and increasing the cost of snow removal at our properties. There can be no assurance that weather will not have a material adverse effect on our properties, operations or business.

| 22 |

Risks related to our common stock.

There has been a limited trading market for our common stock to date.

While our common stock is currently quoted on OTC Markets, Inc., the trading volume is limited. We are quoted on the OTCQB under the trading symbol “FCHS.” It is anticipated that there will continue to be a limited trading market for our common stock on the OTCQB. We intend to apply to list our common stock on the NYSE MKT LLC (“NYSE MKT”) and trading is expected to start following the effectiveness of this registration statement and upon completion of this Offering. Although we believe that this Offering and the listing of our common stock on the NYSE MKT, if our application is so approved, will improve the liquidity of our common stock, our trading volume may not improve, our volatility may not be reduced and our share price may not be stabilized. A lack of an active market may impair your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of your shares. An inactive market may also impair our ability to raise capital by selling shares of capital stock and may impair our ability to acquire other companies or technologies by using common stock as consideration.

The NYSE MKT may not list our securities for quotation on its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions.

We intend to apply for, and anticipate that, our securities will be listed on the NYSE MKT, a national securities exchange, upon consummation of this Offering. Although, after giving effect to this Offering, we expect to meet, on a pro forma basis, the NYSE MKT’s minimum initial listing standards, which generally only mandate that we meet certain requirements relating to stockholders’ equity, market capitalization, aggregate market value of publicly held shares and distribution requirements, we cannot assure you that we will be able to meet those initial listing requirements. If the NYSE MKT does not list our securities for trading on its exchange, we could face significant material adverse consequences, including:

| · | a limited availability of market quotations for our securities; |

| · | reduced liquidity with respect to our securities; |

| · | a determination that our shares of common stock are “penny stock,” which will require brokers trading in our shares of common stock to adhere to more stringent rules, possibly reducing in a reduced level of trading activity in the secondary trading market for our shares of common stock; |

| · | a limited amount of news and analyst coverage for our Company; and |

| · | a decreased ability to issue additional securities or obtain additional financing in the future. |

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as “covered securities.” Because we expect that our units consisting of common stock and common stock issuable upon exercise of the warrants will be listed on the NYSE MKT, such securities will be covered securities. Although the states are preempted from regulating the sale of our securities, the federal statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. Further, if we were no longer listed on the NYSE MKT, our securities would not be covered securities and we would be subject to regulation in each state in which we offer our securities.

| 23 |

Our failure to meet the continued listing requirements of the NYSE MKT could result in a delisting of our common stock.