Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - FIRST COMMUNITY BANKSHARES INC /VA/ | v381113_8ka.htm |

| EX-99.3 - EXHIBIT 99.3 - FIRST COMMUNITY BANKSHARES INC /VA/ | v381113_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - FIRST COMMUNITY BANKSHARES INC /VA/ | v381113_ex99-1.htm |

Deposit Acquisition Summary June 10, 2014 www.fcbinc.com

This presentation may include forward - looking statements. These forward - looking statements include, but are not limited to, statements about (i) the benefits of merger and acquisition activity involving First Community Bancshares, Inc. and subsidiaries (the “Company”), including future financial and operating results, cost savings enhancements to revenue and accretion to reported earnings that may be realized from such activities; (ii) the Company’s plans , objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward - looking statements. These forward - looking statements are based upon the current beliefs and expectations of the management of the Company and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of the Company. In addition, these forward - looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward - looking statements because of possible uncertainties. These forward - looking statements are based on current expectations that involve risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may differ materially. These risks include: changes in business or other market conditions; the timely development, production and acceptance of new products and services; the challenge of managing asset/liability levels; the management of credit risk and interest rate risk; the difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the Company’s Securities and Exchange Commission reports, including but not limited to the Annual Report on Form 10 - K for the most recent year ended, the Quarterly Report on Form 10 - Q for the most recent quarter, and the Company’s current report filings on Form 8 - K. Pursuant to the Private Securities Litigation Reform Act of 1995, the Company does not undertake to update forward - looking statements contained within this presentation. 2 Forward - looking disclosures

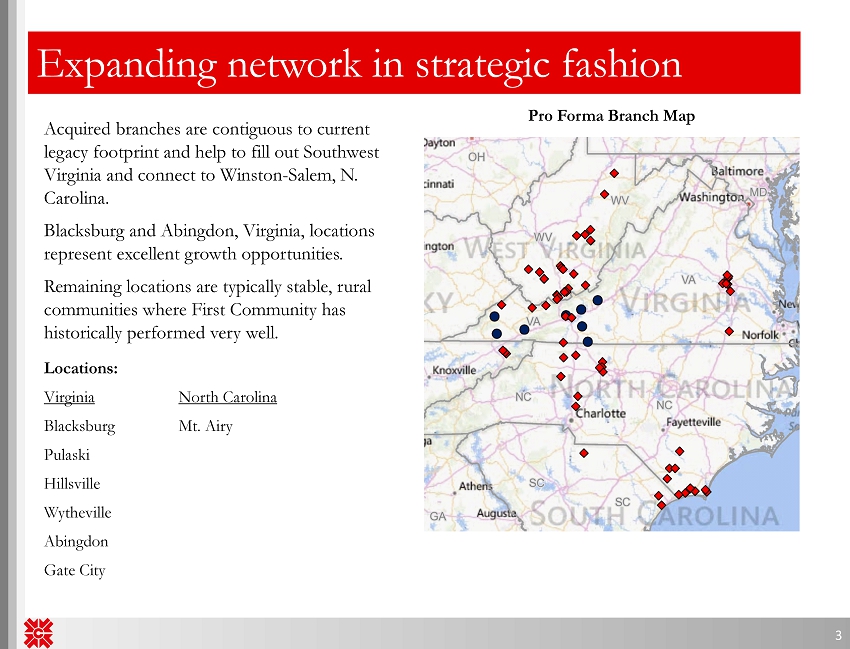

Expanding network in strategic fashion 3 Acquired branches are contiguous to current legacy footprint and help to fill out Southwest Virginia and connect to Winston - Salem, N. Carolina. Blacksburg and Abingdon, Virginia, locations represent excellent growth opportunities. Remaining locations are typically stable, rural communities where First Community has historically performed very well. Locations: Virginia North Carolina Blacksburg Mt. Airy Pulaski Hillsville Wytheville Abingdon Gate City Pro Forma Branch Map

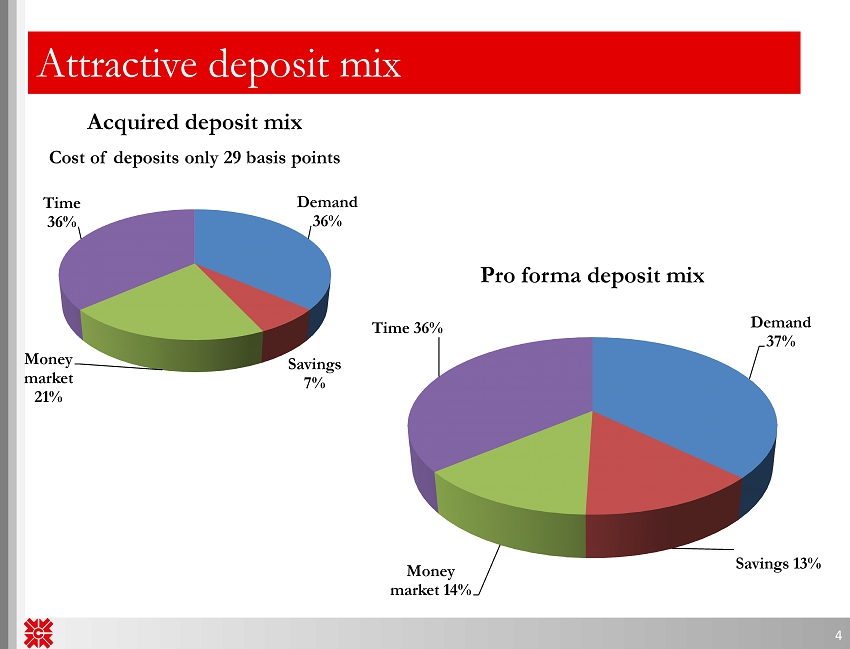

Attractive deposit mix 4 Acquired deposit mix Cost of deposits only 29 basis points Demand 36% Savings 7% Money market 21% Time 36% Pro forma deposit mix Demand 37% Savings 13% Money market 14% Time 36%

Transaction summary 5 Type: Acquisition of deposit liabilities , 7 branch properties at net book value, and 2 off - site ATM’s. Deposits: The deposit base is predominately retail oriented, highly diversified, and does not have significant concentrations. Actual deposit s at November 30, 2013, are $448 million. We model a decline of approximately 20% prior to closing. Premium: 1.75% of total deposits at closing. Expected TBV dilution: 2.8% Expected TBV dilution earn - back: Earn - back achieved in under three years. Approvals required: Regulatory

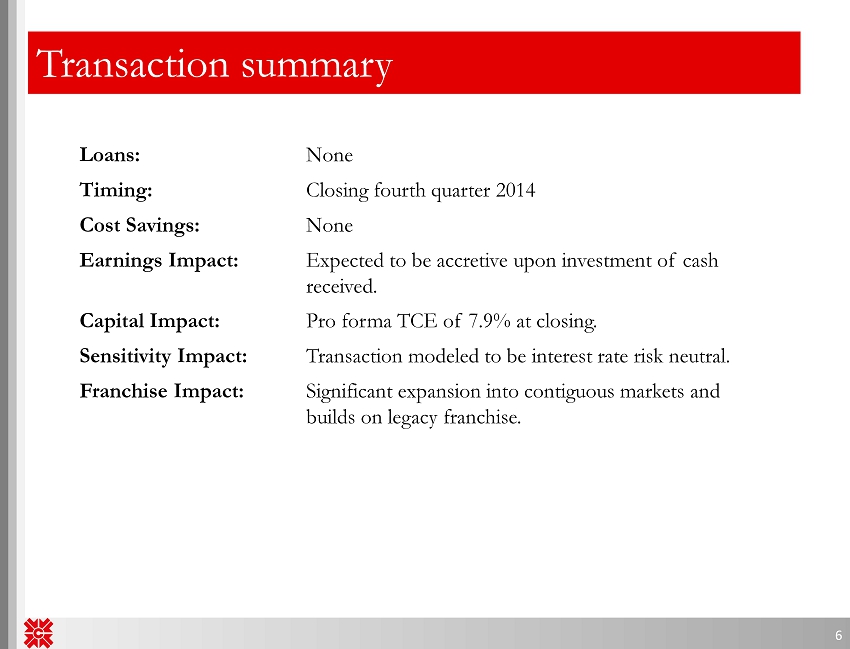

Transaction summary 6 Loans: None Timing: Closing fourth quarter 2014 Cost Savings: None Earnings Impact: Expected to be accretive upon investment of cash received. Capital Impact: Pro forma TCE of 7.9% at closing. Sensitivity Impact: Transaction modeled to be interest rate risk neutral. Franchise Impact: Significant expansion into contiguous markets and builds on legacy franchise.