Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - ESH Hospitality, Inc. | d731978dex51.htm |

| EX-23.1 - EX-23.1 - ESH Hospitality, Inc. | d731978dex231.htm |

| EX-23.2 - EX-23.2 - ESH Hospitality, Inc. | d731978dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 10, 2014

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Extended Stay America, Inc. (Exact name of registrant as specified in its charter) |

ESH Hospitality, Inc. (Exact name of registrant as specified in its charter) |

| Delaware | Delaware | |

| (State or other jurisdiction of incorporation or organization) |

(State or other jurisdiction of incorporation or organization) | |

| 7011 | 6798 | |

| (Primary Standard Industrial Classification Code Number) |

(Primary Standard Industrial Classification Code Number) | |

| 46-3140312 | 27-3559821 | |

| (I.R.S. Employer Identification Number) |

(I.R.S. Employer Identification Number) |

11525 N. Community House Road, Suite 100

Charlotte, North Carolina 28277

(980) 345-1600

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Ross W. McCanless, Esq.

Chief Legal Officer

11525 N. Community House Road, Suite 100

Charlotte, North Carolina 28277

(980) 345-1600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Stuart H. Gelfond, Esq. Paul D. Tropp, Esq. Joshua Wechsler, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 (212) 859-8000 |

David J. Goldschmidt, Esq. Laura A. Kaufmann Belkhayat, Esq. Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price per Share(1)(2) |

Propose Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common Stock, par value $0.01 per share, of Extended Stay America, Inc. and Class B Common Stock, par value $0.01 per share, of ESH Hospitality, Inc., which are attached and trade together as a Paired Share |

24,150,000 | $22.13 | $534,439,500 | $68,836 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes Paired Shares that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | These figures are estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) of the Securities Act of 1933, as amended, based on the average high and low prices of the Paired Shares on June 3, 2014 as reported on the New York Stock Exchange. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor do we or the selling shareholders seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated June 10, 2014

Preliminary Prospectus

21,000,000 Paired Shares

Extended Stay America, Inc.

ESH Hospitality, Inc.

The selling shareholders identified in this prospectus are offering 21,000,000 shares of paired common stock, each comprised of one share of common stock of Extended Stay America, Inc. and one share of Class B common stock of ESH Hospitality, Inc., which are attached and trade together. We refer to these paired shares collectively in this prospectus as the “Paired Shares.” The selling shareholders will receive all of the net proceeds from this offering and we will not receive any of the proceeds from the sale of the Paired Shares being sold by the selling shareholders.

ESH Hospitality, Inc. has elected and intends to continue to qualify to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes. The Paired Shares offered by this prospectus are subject to restrictions on ownership and transfer that are intended to, among other purposes, assist us in qualifying for and in maintaining ESH Hospitality, Inc.’s qualification as a REIT. The charters of Extended Stay America, Inc. and ESH Hospitality, Inc. generally limit ownership (actual or constructive) to no more than 9.8% of the outstanding shares of any class or series of capital stock. The 250,303,494 shares of ESH Hospitality, Inc.’s Class A common stock held entirely by Extended Stay America, Inc., are excluded from the ownership restrictions. See “Description of Our Capital Stock—Limits on Ownership of Stock and Restrictions on Transfer.”

The Paired Shares are listed on the New York Stock Exchange (the “NYSE”) under the symbol “STAY.” The last reported sale price of the Paired Shares on the NYSE on June 9, 2014 was $23.54 per share.

Investing in the Paired Shares involves a high degree of risk. See “Risk Factors” beginning on page 22 of this prospectus and beginning on page 6 in our combined annual report on Form 10-K for the year ended December 31, 2013 to read about the factors you should consider before buying the Paired Shares.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholders |

$ | $ | ||||||

| (1) | See “Underwriting” for a detailed description of compensation payable to the underwriters. |

The underwriters have the option to purchase up to an additional 3,150,000 Paired Shares from the selling shareholders at the public offering price less the underwriting discount within 30 days from the date of this prospectus. The selling shareholders will receive all of the proceeds from the sale of any such additional Paired Shares to the underwriters.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Paired Shares against payment in New York, New York on , 2014.

| Deutsche Bank Securities | Goldman, Sachs & Co. | J.P. Morgan |

Prospectus dated , 2014.

Table of Contents

Table of Contents

| Page | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| iv | ||||

| 1 | ||||

| 22 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| Unaudited Pro Forma Condensed Consolidated and Combined Statement of Operations of the Company |

36 | |||

| Unaudited Pro Forma Condensed Consolidated Statement of Operations of ESH REIT |

40 | |||

| 44 | ||||

| 49 | ||||

| Investment Policies and Policies With Respect to Certain Activities of ESH REIT |

53 | |||

| 55 | ||||

| 59 | ||||

| 69 | ||||

| 71 | ||||

| 98 | ||||

| 103 | ||||

| 103 | ||||

| 103 | ||||

| 104 | ||||

You should rely only on the information contained or incorporated by reference in this prospectus and any free writing prospectus that we authorize to be delivered to you. Neither we, the selling shareholders, nor the underwriters have authorized any person to provide you with any additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell, nor is it an offer to buy, these securities in any jurisdiction where an offer or sale is not permitted. The information contained or incorporated by reference in this prospectus is current only as of its date.

i

Table of Contents

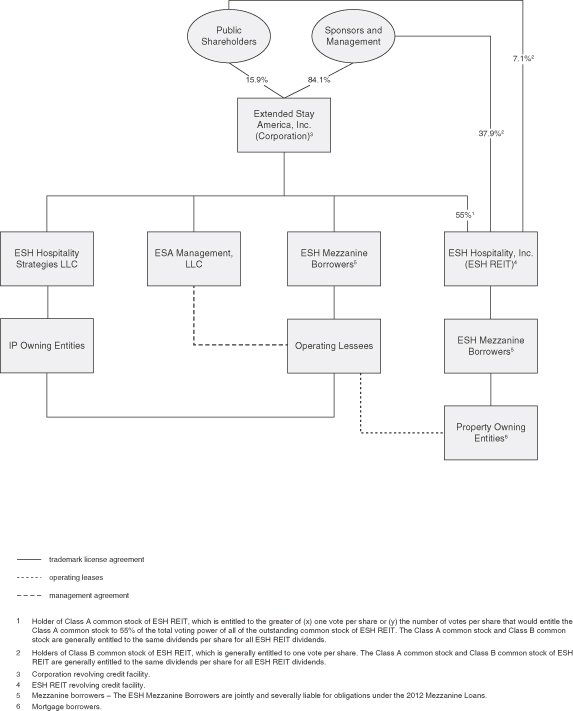

On November 18, 2013, the Corporation (as defined below) and ESH REIT (as defined below) completed their initial public offering of Paired Shares. Prior to the initial public offering, we completed the Pre-IPO Transactions (as defined in “Prospectus Summary—The Pre-IPO Transactions”), which restructured and reorganized our existing business. As further discussed below, unless otherwise indicated or the context requires, the terms the “Company,” “Extended Stay,” “Extended Stay America,” “we,” “our” and “us” refer to the Corporation, ESH REIT and their respective subsidiaries considered as a single enterprise. Unless otherwise indicated or the context requires:

| • | Company. Subsequent to the Pre-IPO Transactions, the term “Company” refers to the Corporation, ESH REIT and their respective subsidiaries considered as a single enterprise. For the period from October 8, 2010 (the “Acquisition Date”) through the Pre-IPO Transactions, the term “Company” refers to ESH REIT, ESH Strategies (as defined below), HVM (as defined below) and their respective subsidiaries considered as a single enterprise. |

| • | Corporation. The term “Corporation” refers to Extended Stay America, Inc., a Delaware corporation, and its subsidiaries (excluding ESH REIT and its subsidiaries), which include the Operating Lessees (as defined below), ESH Strategies (as defined below) and ESA Management (as defined below). The Corporation controls ESH REIT through its ownership of ESH REIT’s Class A common stock, which represents approximately 55% of the outstanding common stock of ESH REIT. |

| • | ESH REIT. Subsequent to the Pre-IPO Transactions, the term “ESH REIT” refers to ESH Hospitality, Inc., a Delaware corporation that has elected to be taxed as a REIT, and its subsidiaries. For the period from the Acquisition Date through the Pre-IPO Transactions, the term “ESH REIT” refers to ESH Hospitality LLC, a Delaware limited liability company that elected to be taxed as a REIT, its subsidiaries, which prior to the Pre-IPO Transactions, included three taxable REIT subsidiaries (the “Operating Lessees”) and HVM (as defined below), a consolidated variable interest entity. ESH REIT is a majority-owned subsidiary of the Corporation. For the period from the Acquisition Date through the Pre-IPO Transactions, ESH REIT was indirectly owned by the Sponsors (as defined below). |

| • | ESH Strategies. The term “ESH Strategies” refers to ESH Hospitality Strategies LLC, a Delaware limited liability company, and its subsidiaries. ESH Strategies owns the intellectual property related to our business and is a wholly-owned subsidiary of the Corporation as a result of the Pre-IPO Transactions. For the period from the Acquisition Date through the Pre-IPO Transactions, ESH Strategies was indirectly owned by the Sponsors (as defined below). |

| • | ESA Management and HVM. The term “ESA Management” refers to ESA Management LLC, a Delaware limited liability company, and its subsidiaries. ESA Management manages the leased hotel properties on behalf of the Operating Lessees, and is a wholly-owned subsidiary of the Corporation as a result of the Pre-IPO Transactions. ESH REIT leases its hotel properties to the Operating Lessees. For the period from the Acquisition Date through the Pre-IPO Transactions, the Operating Lessees engaged HVM LLC (“HVM”) as an eligible independent contractor within the meaning of Section 856(d)(9) of the Internal Revenue Code of 1986, as amended (the “Code”), to manage the leased hotel properties on behalf of the Operating Lessees. |

| • | Paired Shares. The term “Paired Shares” means the shares of common stock, par value $0.01 per share, of the Corporation together with the shares of Class B common stock, par value $0.01 per share, of ESH REIT, which are attached and trade as a single unit. |

| • | Sponsors. The term “Sponsors” collectively refers to Centerbridge Partners, L.P., Paulson & Co. Inc. and the Blackstone Group, L.P. and their affiliates, which prior to this offering, each owned approximately 27.2% of the outstanding Paired Shares. See “Prospectus Summary—Our Sponsors.” |

See “Prospectus Summary—Corporate Structure” for a simplified structure chart reflecting our current corporate structure.

ii

Table of Contents

For ease of presentation:

| • | When we refer to our ownership of hotel properties, we are referring to the hotel properties owned by subsidiaries of ESH REIT. |

| • | When we refer to the management and operation of our hotel properties, we are referring to the management of hotel properties by ESA Management, which is owned by the Corporation, with respect to periods subsequent to the Pre-IPO Transactions, and the management of hotel properties by HVM with respect to periods through the Pre-IPO Transactions. |

| • | When we refer to our brands, we are referring to intellectual property related to our business owned by ESH Strategies. |

| • | When we refer to our management team, our executives or officers, we are referring to the management team (and executives and officers) of the Corporation and ESH REIT. With respect to periods prior to the Pre-IPO Transactions, when we refer to our management team, our executives or officers, we are referring to HVM’s management team (and executives and officers). |

As required by FASB ASC 810, “Consolidations,” due to the Corporation’s controlling financial interest in ESH REIT, the Corporation is required to consolidate ESH REIT’s financial position, results of operations, comprehensive income and cash flows with those of the Corporation. As such, selected financial data, management’s discussion and analysis of financial condition and results of operations and financial statements are presented herein for each of the Company, on a consolidated and combined basis, and ESH REIT. The Corporation’s stand-alone financial condition and related information is discussed herein where applicable.

The data included or incorporated by reference in this prospectus regarding the lodging industry, including trends in the market and our position and the position of our competitors within the lodging industry, are based on a variety of sources, including independent industry publications, government publications and other published independent sources, information obtained from customers, distributors, suppliers, trade and business organizations and publicly available information (including the reports and other information our competitors file with the Securities and Exchange Commission, which we did not participate in preparing), as well as our good faith estimates, which have been derived from management’s knowledge and experience in the areas in which our business operates. We have not verified the accuracy or completeness of the data or any assumptions underlying the data. Estimates of market size and relative positions in a market are difficult to develop and inherently uncertain. Accordingly, investors should not place undue weight on the industry and market share data presented or incorporated by reference in this prospectus.

Certain information included or incorporated by reference in this prospectus is provided by STR, Inc. (f/k/a Smith Travel Research, Inc.), an independent company that tracks historical hotel performance in most markets throughout the world (“STR”), and The Highland Group, an independent company that provides research on the overall hotel and extended stay hotel markets (“The Highland Group”). STR and The Highland Group are not parties to this offering and do not endorse or provide any guidance to this transaction or any proposed investment in Extended Stay America, Inc. or ESH Hospitality, Inc.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

The Corporation owns a number of registered trademarks, service marks, trade names and logos in connection with our business in the United States and in certain foreign jurisdictions, including but not limited to Extended Stay America®, Extended Stay Canada™ and Crossland®. Solely for convenience, the trademarks, service marks, trade names and logos referred to or incorporated by reference in this prospectus are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that the Corporation will not

iii

Table of Contents

assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This prospectus contains or incorporates by reference additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing or incorporated by reference in this prospectus are, to our knowledge, the property of their respective owners.

The following are definitions of certain key lodging and Company operating metrics used or incorporated by reference in this prospectus:

| • | “ADR” or “average daily rate” means hotel room revenues divided by total number of rooms sold in a given period. |

| • | “Extended stay market” means the market of hotels with a fully equipped kitchenette in each guest room, which accept reservations and do not require a lease, as defined by The Highland Group. |

| • | “Hotel operating profit” means the sum of room and other hotel revenues less hotel operating expenses (excluding loss on disposal of assets) and “hotel operating margin” means the ratio of hotel operating profit divided by the sum of room and other hotel revenues. |

| • | “Mid-price extended stay segment” means the segment of the extended stay market that generally operates at a daily rate between $45 and $95, as defined by The Highland Group. |

| • | “Occupancy” or “occupancy rate” means the total number of rooms sold in a given period divided by the total number of rooms available at a hotel or group of hotels. |

| • | “RevPAR” or “revenue per available room” means the product of average daily room rate multiplied by the average daily occupancy achieved for a hotel or group of hotels in a given period. RevPAR does not include other ancillary revenues, such as food and beverage revenues or parking, telephone or other guest service revenues generated by a hotel. |

| • | “RevPAR Index” is stated as a percentage and is calculated for a hotel by comparing the hotel’s RevPAR to the aggregate RevPAR of a group of competing hotels generally in the same market. RevPAR Index is a weighted average of the individual property results. We subscribe to STR, which collects and compiles the data used to calculate RevPAR Index. We select the competing hotels included in the RevPAR Index, subject to STR’s guidelines. |

The following terms when used in connection with our company-wide initiatives to renovate and make improvements to our hotel properties have the following meanings in this prospectus (in all cases, unless the context otherwise requires or where otherwise indicated):

| • | “Hotel renovations” or “Platinum renovation package” refer to upgrades that typically include remodeling of common areas, new paint, carpet, signage, tile or vinyl flooring and counters in bathrooms and kitchens, as well as the refurbishment of furniture, replacement of aged mattresses and installation of new flat screen televisions, artwork, lighting and bedspreads. |

| • | “Post-Renovation Period” means the twelve-month period starting the month after the completion of the Ramp-Up Period. |

| • | “Pre-Renovation Period” means the twelve-month period ending the month prior to the commencement of renovations. |

| • | “Ramp-Up Period” means, typically, the additional three-month period for a renovated hotel to return to occupancy levels approximating Pre-Renovation Period levels following the Renovation Period. |

iv

Table of Contents

| • | “Renovation Period” or “Displacement Period” mean the approximately three-month period required to complete a Platinum hotel renovation, during which the hotel experiences temporary disruption and weakened performance. |

| • | “Room refreshes” or “Silver refresh package” refer to upgrades that typically include the replacement of aged mattresses and installation of new flat screen televisions, lighting, bedspreads and signage. |

v

Table of Contents

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in, or incorporated by reference into, this prospectus, is not complete and does not contain all of the information you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the section entitled “Risk Factors” and the financial statements and related notes and the other documents that we incorporate by reference into this prospectus, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements as a result of certain factors, including those set forth in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” When making an investment decision, you should also read the discussion under “Basis of Presentation” and “Certain Defined Terms” above for the definition of certain terms used in this prospectus and a description of certain transactions and other matters described and incorporated by reference in this prospectus.

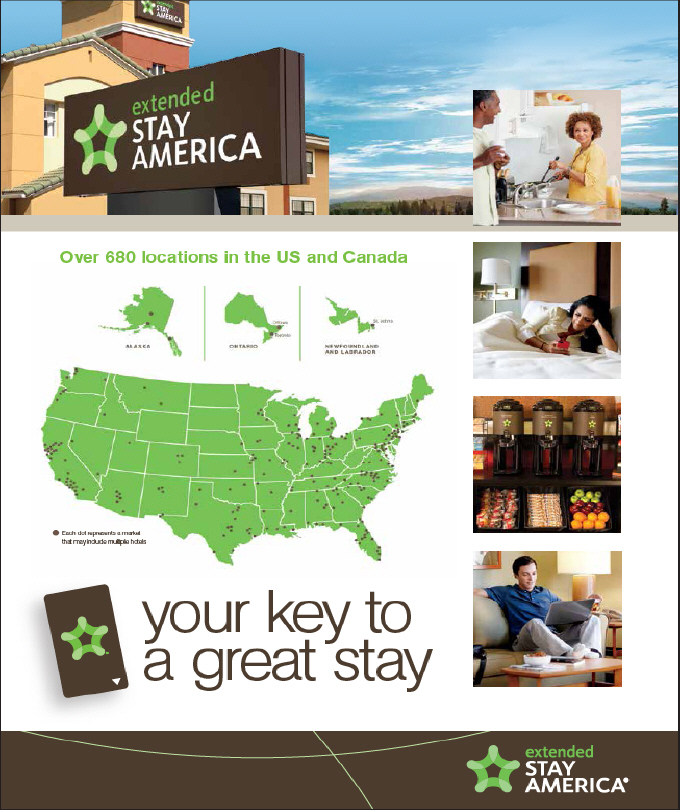

Our Company

We are the largest owner/operator of company-branded hotels in North America. Our business operates in the extended stay lodging industry, and we own and operate 684 hotel properties comprising approximately 76,200 rooms located in 44 states across the United States and in Canada. We own and operate 632 of our hotels under the core brand, Extended Stay America, which serves the mid-price extended stay segment, and accounts for approximately half of the segment by number of rooms in the United States. In addition, we own and operate three Extended Stay Canada hotels and 49 hotels in the economy extended stay segment under the Crossland Economy Studios and Hometown Inn brands. For the year ended December 31, 2013, the Company had revenues of approximately $1.1 billion, Adjusted EBITDA of approximately $518.6 million and net income of approximately $82.7 million. See “—Summary Historical and Unaudited Pro Forma Consolidated and Combined Financial and Other Data” for a definition of Adjusted EBITDA and a reconciliation to net income.

Our extended stay hotels are designed to provide an affordable and attractive alternative to traditional lodging or apartment accommodations and are targeted toward self-sufficient, value-conscious guests. Our hotels feature fully-furnished rooms with in-room kitchens, complimentary grab-and-go breakfast, free WiFi, flat screen TVs and limited housekeeping service, which is typically provided on a weekly basis. Our guests include business travelers, professionals on temporary work or training assignments, persons relocating, temporarily displaced or purchasing a home and anyone else in need of temporary housing. These guests generally rent accommodations on a weekly or longer term basis.

We believe that extended stay hotels generally have higher operating margins and lower occupancy break-even thresholds compared to traditional hotels, primarily as a result of the efficiencies of a longer average length of stay with lower guest turnover and lower operating expenses. In 2013, our average length of stay was approximately 26 days, our occupancy was 74.2% and our hotels generated property-level hotel operating margins greater than 50%.

We were founded in January 1995 as a developer, owner and operator of extended stay hotels. Following a period focused primarily on new development, we became a consolidator of hotel properties by selectively acquiring extended stay companies and hotels, ultimately creating the largest mid-price extended stay company in the United States. We were acquired out of bankruptcy by the Sponsors on October 8, 2010. We now operate an extended stay hospitality platform with approximately 10,000 employees and are led by a management team with extensive public company experience in hospitality, consumer retail and service businesses.

1

Table of Contents

Our Recent Operating History

When they acquired us, our Sponsors recognized that despite our unparalleled scale in the mid-price extended stay segment, national footprint and high quality, predominantly coastal locations, our RevPAR was significantly lower than our nearest competitors in the mid-price extended stay segment. Our Sponsors believed this difference was due to several factors, including (i) under-capitalized hotels across the portfolio due to the severe constraints on our access to capital prior to the Acquisition Date as a result of financial distress and an over-leveraged capital structure, (ii) a lack of brand awareness and strategy as a result of no clear, national brand identity with five disparate brands and limited marketing initiatives and (iii) an operating platform that lacked industry standard practices, including sophisticated revenue management systems. In response, we recruited a highly qualified management team with extensive experience in real estate, hospitality, consumer-facing and brand-based businesses.

Our Chief Executive Officer, James L. Donald, has over 35 years of experience in multiple-unit consumer-facing and brand-based industries, including as the president and chief executive officer of Starbucks. Our Chief Financial Officer, Peter J. Crage, has over 20 years of experience in the leisure industry, including most recently as the chief financial officer of Cedar Fair Entertainment Company, a regional amusement-resort company. Our Chief Marketing Officer, Thomas Seddon, has over 20 years of experience in the hospitality industry, including most recently as the chief marketing officer of InterContinental Hotels Group. Our Chief Operating Officer, Jonathan Halkyard, has over 13 years of experience in the hospitality industry, serving in various positions including as the executive vice president and chief financial officer of Caesars Entertainment Corporation (formerly known as Harrah’s Entertainment, Inc.).

Our new management team has implemented significant improvements in the business, including improving the quality of our hotels through significant capital investment, initiating and substantially completing the rebranding of our mid-price extended stay hotel properties under the core Extended Stay America brand, increasing marketing to improve brand awareness and developing a company-wide culture and processes around service excellence. Together, we believe these initiatives will increase demand and attract guests who are willing to pay a higher rate for an improved product and service offering, will enable us to narrow the significant RevPAR difference that exists between us and our nearest competitors in the mid-price extended stay segment and continue to position us to grow our business.

Our performance has improved significantly since the Acquisition Date, which we believe is in large part due to the industry recovery. However, we are beginning to realize the benefits of our recently implemented capital, brand, service and marketing initiatives, and we believe these initiatives will continue to drive our internal growth. Since the Acquisition Date, we have:

| • | Increased our ADR 29.5% from $41.63 to $53.90 for the twelve months ended September 30, 2010 and March 31, 2014, respectively; |

| • | Increased our RevPAR 31.1% from $31.00 to $40.63 for the twelve months ended September 30, 2010 and March 31, 2014, respectively; |

| • | Invested $363.9 million of renovation capital into our properties as of March 31, 2014 as part of our hotel reinvestment program that, to date, includes the renovation of 633 properties; and |

| • | Realized Adjusted EBITDA growth of 54.7% for the twelve months ended March 31, 2014 compared to the year ended December 31, 2010 and Adjusted EBITDA growth of 0.4% for the three months ended March 31, 2014 compared to the three months ended March 31, 2013. |

Prior to the initial public offering, we restructured and reorganized our then-existing business through a series of transactions (collectively, as described more fully below, the “Pre-IPO Transactions”). We believe that our business is now more operationally efficient because all of the assets, operations and management of our

2

Table of Contents

business, other than ownership of the hotel properties, are housed in one entity. Ownership of Paired Shares gives investors an ownership interest in our hotel properties through ESH REIT and in the operation of our business through the Corporation. The structure permits us to retain some, though not all, of the REIT benefits of our prior structure (i.e., while ESH REIT continues to be taxed as a REIT for U.S. federal income tax purposes, all distributions paid by ESH REIT to the Corporation are subject to corporate level tax, effectively eliminating a majority of the tax benefit of REIT status for the consolidated and combined Company taken as a whole).

Our Competitive Strengths

We believe that our scale, national footprint, high quality portfolio, low cost operating model and highly qualified management team differentiate us from other lodging competitors and position us to execute our business and growth strategies. Our competitive strengths include the following:

The Market Leader in the Mid-Price Extended Stay Segment. We are the largest owner/operator by number of hotel rooms in the mid-price extended stay segment, which we believe is an underserved segment in the overall U.S. lodging industry with a meaningful share of extended stay demand staying in traditional hotels. The extended stay segment has experienced continued growth, even through several economic downturns, as evidenced by 20 consecutive years of growth in rooms sold. In 2013, the overall extended stay market represented approximately 7.4% of U.S. room supply. We own approximately 69,600 mid-price extended stay hotel rooms in the United States, which account for approximately half of the mid-price extended stay rooms and over two times the number of rooms than our next largest mid-price extended stay competitor. We believe our scale, combined with our recent branding and marketing initiatives focused on our core Extended Stay America brand, enables us to operate with a clear national brand identity. We also believe that we are uniquely positioned to benefit from economies of scale that translate into advantages in revenue generation, purchasing goods and services and leveraging central operating costs efficiently.

National Footprint with High Quality Locations. We believe we have high quality real estate locations with strong demand drivers, with more than 50% of our portfolio located in the 25 most populated metropolitan statistical areas (“MSAs”) in the United States. For the twelve months ended March 31, 2014, we generated approximately two-thirds of our hotel operating profit from hotels in coastal states, which we consider to be supply-constrained markets. For example, we own and operate 85 hotel properties in California, while our next largest operating competitor in the mid-price extended stay segment had only 15 hotels in California as of December 31, 2013. Our broad and diversified footprint, with no single property representing more than 1.0% of our total revenues, also reduces the risk of volatility due to local market conditions.

Fully Integrated Business Provides Significant Operational Control. Our fully integrated owner/operator model is unique relative to our main lodging competitors, which are primarily franchise businesses that generally own and control only a small portion of their hotels. We believe that our ability to control our real estate and operate nearly all of our hotels under a single brand allows us to adapt more rapidly than our competitors to meet the ongoing needs of our guests and drive performance throughout economic cycles. Importantly, we are able to implement brand and service enhancements across our portfolio without the lengthy consultation process common to a typical franchise model, allowing for a higher speed of change. For example, we have completed a rebranding of 633 hotels in less than two years, which we believe represents one of the largest hotel rebrandings over such a short time period. Our decision to strategically invest in unifying our brands and improving our amenity offering early in the current lodging cycle allows for an extended period in which we can benefit from our investment. We believe our model provides a sustainable competitive advantage for growth and has proven successful for leading consumer branded companies, such as Starbucks, Walmart or Target, that have demonstrated the strength of an integrated owner/operator model in delivering a consistent customer experience.

High Operating Margins Drive Attractive Cash Flow Characteristics. We have historically generated high hotel operating margins and attractive cash flows. Our revenues are principally room revenues, which typically

3

Table of Contents

have higher margins relative to ancillary revenues, such as food and beverage revenues. Our hotels also have low fixed operating costs, including low fixed overhead and labor costs, compared to traditional hotels that have higher guest turnover and/or larger public and meeting spaces, and as a result have higher fixed operating costs. Our high hotel operating margins drive strong free cash flow, which we can use to reinvest in our business, distribute to shareholders or repay debt. Furthermore, we expect that our revenue enhancing strategies, which are primarily directed toward improving ADR, will produce revenues with high incremental operating margins.

Highly Qualified Management Team. Our executive management team has extensive experience in real estate, hospitality and consumer-facing and brand-based companies, including Starbucks, Cedar Fair Entertainment Company, InterContinental Hotels Group, La Quinta Inns, Morgans Hotels, Caesars Entertainment, Subway, Albertson’s, Pathmark, Safeway, Walmart and Lowe’s. Our Chief Executive Officer, James L. Donald, has over 35 years of experience in consumer-facing and brand-based industries, including as the president and chief executive officer of Starbucks. Our Chief Financial Officer, Peter J. Crage, has over 20 years of experience in the leisure industry, including most recently as the chief financial officer of Cedar Fair Entertainment Company, a regional amusement-resort company. Our Chief Marketing Officer, Thomas Seddon, has over 20 years of experience in the hospitality industry, including most recently as the chief marketing officer of InterContinental Hotels Group. Our chief operating officer, Jonathan Halkyard, has over 13 years of experience in the hospitality industry, serving in various positions including as the executive vice president and chief financial officer of Caesars Entertainment Corporation (formerly known as Harrah’s Entertainment, Inc.).

Our Business and Growth Strategies

We have three main goals: improving the overall experience for our customers; creating an exceptional workplace for our associates; and increasing shareholder value. Our first goal is to become the most recognized and popular brand in the extended stay market by combining great practical value in our hotels with a passionate service attitude that makes customers feel like a guest in our home. Our second goal is to provide an exceptional workplace for our associates, operating with a set of shared values. These two goals are essential to achieving our third goal of creating superior value for shareholders. We believe that accomplishing these goals will enable us to increase ADR and to narrow the significant RevPAR difference that exists between us and our nearest competitors in the mid-price extended stay segment, which we believe will result in higher hotel operating margins and profitability. We estimate that in 2013 each $1 increase in ADR across our portfolio would have increased our EBITDA by approximately $17 to $19 million, assuming all other variables remained constant. We strive to achieve these goals through the following strategies:

Capitalize on Strategic Investment in Portfolio. Since the third quarter of 2011, we have been performing significant hotel renovations and room refreshes and have been executing a phased capital investment program across our portfolio in order to seek to drive incremental market share gains. This program is dedicated to our revenue enhancing Platinum renovation and Silver refresh programs to upgrade 633, or approximately 93% of our hotels. We have spent in excess of $363 million in connection with our hotel reinvestment program as of March 31, 2014. In total, from the Acquisition Date through the end of the first quarter of March 31, 2014, we have incurred capital expenditures of approximately $609 million, which include capital investments related to our hotel reinvestment program and maintenance and deferred capital expenditures. Given the capital spend to date, we believe we have addressed the most significant deferred maintenance needs of our hotels.

We believe that our capital investments are driving significant room rate and EBITDA growth and incremental RevPAR market share gains. For example, as of March 31, 2014, we owned 124 hotels for which we had results for the Post-Renovation Period. These hotels demonstrated RevPAR growth of 21.9% and RevPAR Index growth of 9.6% in the Post-Renovation Period as compared to the Pre-Renovation Period. Furthermore, the majority of the growth was achieved through increases in ADR, which grew 23.3% over the time period. As such, we believe that our capital investment program is not only improving the quality of our hotels and allowing us to increase market share, but also yielding attractive financial returns.

4

Table of Contents

While we have already begun to realize the benefits of these initiatives, as demonstrated by the improved performance in the Post-Renovation Period, we expect that a significant amount of the return from our capital investments will still be realized. Additionally, we may have additional opportunities to expand our hotel reinvestment program as we identify additional hotels for upgrade. While we attribute this growth primarily to our capital reinvestment program, we also believe that this improvement has benefited from the implementation of our other initiatives, including the rebranding, increased marketing and service initiatives. The primary focus of this expansionary investment has been on our mid-price Extended Stay America hotels and we will continue to invest in our economy-price Crossland Economy Studios hotels as appropriate.

Implement Marketing Strategy and Increase Brand Awareness. We have made strategic investments in marketing initiatives, which we believe have increased awareness and the market penetration of our brands. Since 2011, we have tripled our marketing spend by spending in excess of $30 million in 2013 compared to approximately $9 million in 2011, and we have also invested in excess of $15 million for signage replacement. The consolidation under a single Extended Stay America banner, redesigning of our logo and anticipated launch of our customer loyalty program in late 2014 are examples of our strategy to attract new guests. Additionally, our brand consolidation has allowed us to concentrate our advertising efforts on a single brand rather than spreading them across several brands, which we believe will improve our ability to raise awareness of our product offering among both individual travelers and corporations. Over time, we believe our strengthened brand awareness will allow us to further build customer loyalty and increase demand. The strategic brand investment has focused and will continue to focus on improvements for our Extended Stay America brand, while our Crossland Economy Studios hotels are largely supported by company-wide initiatives, including local sales activity and online promotional spending.

Increase Revenues through Optimized Customer Mix. We believe there is an opportunity to increase ADR by optimizing customer mix and increasing the proportion of shorter duration guests (those with an average length of stay of less than 30 days). Such guests typically generate higher ADR as compared to our guests who have longer duration stays. This strategy involves both building demand for our hotels and optimizing the yield from our room inventory. We will also target more corporate customers who are willing to pay a higher rate for our improved portfolio and value proposition. In order to facilitate these initiatives, we plan to invest in new technology platforms, including automated revenue management systems, a customer relationship management (“CRM”) program and a loyalty program. During the second quarter of 2014, we selected a vendor for an automated revenue management system to further improve our pricing and inventory decisions.

The following table illustrates how our customer mix and discount level changed from 2007 to 2013, and what our 2013 ADR would have been if customer mix and discount had been at 2007 levels, all other factors being equal:

| 2007 | 2013 | 2013 with 2007 mix and discount |

||||||||||

| 30+ night mix(2) |

44 | % | 52 | % | 44 | % | ||||||

| Discount for 30+ nights(2) |

16 | % | 20 | % | 16 | % | ||||||

| Average ADR |

$ | 56.23 | (1) | $ | 54.15 | $ | 56.14 | |||||

| (1) | Overall ADR data for 2007 represents all 684 comparable operated hotels |

| (2) | Customer mix data and discount data calculated for comparable 684 operated hotels in each period |

Improve Margins by Upgrading Our Operational Practices. We intend to drive profitability and cash flows by improving operating efficiencies in our business and continuing to implement industry standard practices in areas in which we have been less sophisticated than some of our competitors across both our Extended Stay America and Crossland Economy Studios brands. We have identified specific areas for operating improvements that include enhancement of our central reservation system, procurement systems, human resources management

5

Table of Contents

tools and technology to manage back office administration and workflow. We have tightened cost controls and implemented strict cash management practices at our hotel properties to significantly reduce cash leakage and to improve overall property margins and flow-through to cash flow. We believe implementing these industry-tested techniques offers a low risk path to margin improvement.

Pursue Disciplined Expansion of Our Footprint through Select Acquisitions and Conversions. We believe extended stay hotel ownership is highly fragmented. We believe we can increase our scale by opportunistically acquiring hotels after careful evaluation of potential returns, condition of the hotels, duration of current license agreements and the anticipated capital requirements to upgrade or convert the hotels to meet our brand standards. Our growth and expansion is not limited by radius restrictions associated with franchise agreements, which allows us to add new hotels to meet additional demand within existing markets in which we already operate. In addition, we believe that our scale and experience in the mid-price extended stay segment will allow us to achieve operational and overhead cost synergies in hotel properties that we acquire. We believe these growth opportunities will be primarily in the mid-price extended stay segment with our Extended Stay America brand.

STR’s hotel census database divides the United States into 628 sub-markets, or tracts. Our analysis of this data shows that an Extended Stay America hotel is currently present in only 50% of these tracts, while our competitors are present as follows:

| Extended Stay America present |

313 | 50 | % | |||||

| Extended Stay America not present, other mid-price extended stay brand present |

153 | 24 | % | |||||

| No mid-price extended stay hotel, but other segment extended stay hotel present |

86 | 14 | % | |||||

| No extended stay hotel present |

76 | 12 | % | |||||

|

|

|

|

|

|||||

| Total U.S. Sub-Markets (“Tracts”) |

628 | 100 | % | |||||

|

|

|

|

|

Source: STR, Company analysis

We believe this indicates that there are many markets that we are not currently in that may support extended stay hotels, in addition to the opportunities we have to grow further in markets where we are already present.

Build a Culture Centered Around Executional Excellence. We have undertaken several company-wide initiatives to improve our guest experience and establish an employee culture centered on high quality and differentiated customer service. We have focused our efforts toward attracting, engaging and retaining a high quality workforce across our platform that we believe will allow us to achieve sustainable long-term success. Our culture is built around motivating and inspiring associate behavior through open communication with senior management that we believe fosters a high performance environment designed to meet our business objectives. Management believes these initiatives have started to produce a very positive response from our guests. For example, we have seen an increase in the quantity and an improvement in sentiment of reviews posted about our hotels, with a thirteen-fold increase in the number of our hotels receiving Trip Advisor’s Certificate of Excellence from 2012 to 2013.

Our Industry

U.S. Lodging Industry

The lodging industry is a significant part of the U.S. economy, generating over $122.3 billion of room revenues in 2013 and comprising approximately 4.9 million hotel rooms as of December 31, 2013, according to STR. Lodging industry performance is generally tied to both macro-economic and micro-economic trends in the

6

Table of Contents

United States and, similar to other industries, experiences both positive and negative operating cycles. Since the 2008 to 2009 recession, demand in the U.S. lodging industry has begun to recover while supply growth has remained at historically low rates. According to PricewaterhouseCoopers (“PwC”), room supply grew 0.7% in 2013 and is expected to grow 1.0% in 2014, which is still well below historical annual supply growth of 1.7% over the last 15 years. RevPAR has grown in the U.S. lodging industry for each year starting in 2010 and according to PwC, RevPAR for the overall U.S. lodging industry grew 5.4% in 2013 and is expected to grow 6.4% in 2014.

U.S. Extended Stay Segment

Extended stay hotels represent a growing segment within the U.S. lodging industry with approximately 360,925 rooms that generated approximately $7.9 billion of revenues for the year ended December 31, 2013, according to The Highland Group. The extended stay segment tends to follow the cyclicality of the overall lodging industry.

Extended stay hotels are further differentiated by price point into economy, mid-price and upscale segments. Our business is focused primarily on the mid-price extended stay segment, which comprised approximately 39% of the supply of extended stay rooms in 2013. RevPAR growth for the mid-price extended stay segment has outpaced the U.S. lodging industry as a whole since 2009 as well as the economy and upscale extended stay segments. The mid-price extended stay segment rebounded from an industry trough with RevPAR growth of 33.4% between 2009 and 2013, which was higher than the overall U.S. lodging industry as well as the economy and upscale extended stay segments, each of which grew at 28.2%, 21.5% and 22.2%, respectively, for the same period.

We believe the extended stay segment is an underserved segment of the overall U.S. lodging industry with the majority of extended stay demand served by traditional hotels. In 2013, the overall extended stay market represented approximately 7.4% of U.S. room supply; however, stays longer than five nights represented approximately 22% of total U.S. room demand in 2012. Furthermore, the extended stay segment has experienced continued growth, even through several economic downturns, as evidenced by 20 consecutive years of growth in rooms sold. As the extended stay segment continues to increase in size and customer awareness, we believe that more guests will opt for extended stay hotels as an alternative to traditional hotels.

Based on industry sources, we believe that the lodging industry will experience continued industry growth for at least the next several years as a result of moderate demand growth combined with historically low levels of room supply growth. We believe that we are well-positioned to benefit from this industry and overall economic growth, which should drive revenue and cash flow growth for us.

Recent Developments

On May 27, 2014, the Company announced that ESH REIT is seeking to raise a $375 million senior secured term loan (the “Term Loan”) to refinance its remaining outstanding mezzanine loans. On June 9, 2014, the Company announced that ESH REIT had priced the Term Loan at LIBOR plus 4.25%, with a minimum LIBOR of 0.75% and a five year term with an expected closing date of June 23, 2014, subject to the execution of definitive documentation and customary closing conditions. The net proceeds from the ESH REIT term loan will primarily be used to retire $365 million of existing mezzanine debt that has a weighted average interest rate of 9.4%. The Company anticipates annual interest savings of approximately $16 million on the refinanced mezzanine debt. The Term Loan will be issued to investors at a price equal to 99.5% of the principal amount thereof. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Indebtedness—ESH REIT Mezzanine Loans” in our combined quarterly report on Form 10-Q for the three months ended March 31, 2014 incorporated by reference in this prospectus for a description of the mezzanine loans. The consummation of the Term Loan and proposed refinancing of the mezzanine loans are subject to a number of factors, and we cannot assure you that we will consummate the Term Loan or refinance the mezzanine loans on favorable terms or at all.

7

Table of Contents

Our Sponsors

Centerbridge Partners, L.P. (“Centerbridge”), which was established in 2005 and commenced operations in 2006, is a private investment firm focused on traditional private equity and credit investing and is headquartered in New York City. The firm employs over 50 investment professionals and, as of April 30, 2014, managed approximately $20 billion in capital. The Centerbridge team has in-depth industry experience across a variety of sectors, including hospitality, restaurants, retail, consumer, business services, communications, financial institutions, healthcare, industrial, media, real estate and transportation. Limited partners in Centerbridge’s funds include many of the world’s most prominent endowments, state and corporate pension funds and charitable trusts.

Paulson & Co. Inc. (“Paulson”) is an investment management firm specializing in event-driven strategies, including merger arbitrage, bankruptcy reorganizations and distressed credit, structured credit, recapitalizations, restructurings and other corporate events. As of April 30, 2014, Paulson managed approximately $20 billion in assets and employed approximately 120 employees in offices located in New York, London and Hong Kong.

The Blackstone Group, L.P. (“Blackstone”) is one of the world’s leading investment and advisory firms. Blackstone’s alternative asset management businesses include the management of corporate private equity funds, real estate funds, hedge fund solutions, credit-oriented funds and closed-end mutual funds. Blackstone also provides various financial advisory services, including financial and strategic advisory, restructuring and reorganization advisory and fund placement services. Through its different investment businesses, as of March 31, 2014, Blackstone had assets under management of approximately $272 billion.

The Pre-IPO Transactions

The Corporation was formed for the purpose of effecting the Pre-IPO Transactions. Prior to the Pre-IPO Transactions, ESH Hospitality Holdings LLC, a Delaware limited liability company (“Holdings”), owned all of ESH REIT’s then-outstanding common units. Prior to the Pre-IPO Transactions, the Sponsors owned an approximate 99% interest in Holdings and the remaining interests were owned by certain members of the board of managers of Holdings and employees of HVM. Prior to the Pre-IPO Transactions, the Operating Lessees were each taxable REIT subsidiaries that leased the hotel properties from ESH REIT pursuant to operating leases. HVM was an eligible independent contractor, within the meaning of Section 856(d)(9) of the Code, that managed the hotel properties pursuant to management agreements with the Operating Lessees. Subsidiaries of ESH Strategies owned the trademarks and licensed their use to the Operating Lessees pursuant to trademark license agreements.

Through the Pre-IPO Transactions, the existing business was restructured and reorganized such that Holdings was liquidated and substantially all of the common stock of ESH REIT was distributed to the Sponsors; the Operating Lessees, ESH Strategies and the assets and obligations of HVM were transferred to the Corporation; the shareholders of ESH REIT transferred all of the Class A common stock of ESH REIT to the Corporation; and 100% of the common stock of the Corporation and all of the Class B common stock of ESH REIT were paired, forming the Paired Shares.

The Corporation, through its direct wholly-owned subsidiaries, now leases the 684 hotel properties from ESH REIT, owns the trademarks related to the business and self-manages the hotel properties. In addition, the Corporation owns all of the Class A common stock of ESH REIT, which represents approximately 55% of the outstanding shares of common stock of ESH REIT. The Corporation used the majority of the proceeds it received in the initial public offering to satisfy a promissory note it issued to purchase a sufficient number of additional shares of Class A common stock of ESH REIT to ensure that, upon the completion of the initial public offering, the Class A common stock of ESH REIT owned by the Corporation comprised approximately 55% of the outstanding common stock of ESH REIT.

8

Table of Contents

Corporate Structure

The chart below summarizes our corporate structure as of March 31, 2014:

9

Table of Contents

Distribution Policies

We have made and intend to continue to make distributions of $0.15 per Paired Share per quarter. We intend to continue to make our expected distributions in respect of the common stock of ESH REIT. In the event distributions in respect of the common stock of ESH REIT are not sufficient to meet our expected distributions, the expected distributions may be completed through distributions in respect of the common stock of the Corporation using funds distributed to the Corporation as distributions on the Class A common stock of ESH REIT, after allowance for tax, if any, on those funds. The Corporation’s and ESH REIT’s boards of directors are independent of one another and owe separate fiduciary duties to the Corporation and ESH REIT. Each board of directors will separately determine the form, timing and amount of any distributions to be paid by the respective entities for any period.

Corporation Distribution Policy

The Corporation’s board of directors has not declared any distributions on the Corporation’s common stock and currently has no intention to do so, except as described above. The payment of any distributions will be at the discretion of the Corporation’s board of directors. Any such distributions will be made subject to the Corporation’s compliance with applicable law and will depend on, among other things, the receipt by the Corporation of dividends from ESH REIT in respect of the Class A common stock, the Corporation’s results of operations and financial condition, level of indebtedness, capital requirements, capital contributions to ESH REIT, contractual restrictions, restrictions in any existing or future debt agreements of the Corporation or ESH REIT and in any preferred stock and other factors that the Corporation’s board of directors may deem relevant. See “Distribution Policies—Corporation Distribution Policy” for a discussion of the distribution policies of the Corporation.

ESH REIT Distribution Policy

Subsequent to the initial public offering, ESH REIT has made and intends to continue to make distributions of $0.15 per share per quarter to its shareholders (including the Corporation). To qualify as a REIT, ESH REIT must distribute annually to its shareholders an amount at least equal to:

| • | 90% of its REIT taxable income, computed without regard to the deduction for dividends paid and excluding any net capital gain; plus |

| • | 90% of the excess of its net income, if any, from foreclosure property over the tax imposed on such income by the Code; less |

| • | the sum of certain items of non-cash income that exceeds a percentage of ESH REIT’s income. |

ESH REIT is subject to income tax on its taxable income that is not distributed and to an excise tax to the extent that certain percentages of its taxable income are not distributed by specified dates. ESH REIT generally expects to distribute approximately 95% of its REIT taxable income. ESH REIT will be subject to U.S. federal corporate income tax on its undistributed REIT taxable income and net capital gain and may be subject to U.S. federal excise tax. See “Material United States Federal Income Tax Considerations.” Taxable income as computed for purposes of the forgoing tax rules will not necessarily correspond to ESH REIT’s income before income taxes as determined under accounting principles generally accepted in the United States (“GAAP”) for financial reporting purposes.

ESH REIT’s ability to pay distributions is restricted by the terms of its indebtedness. In cases in which the terms of any of ESH REIT’s existing or future indebtedness prohibits the payment of cash dividends, ESH REIT may declare and pay taxable stock dividends in order to maintain its REIT status.

10

Table of Contents

ESH REIT’s distributions will be authorized by the ESH REIT board of directors and declared based on a variety of factors. See “Distribution Policies—ESH REIT Distribution Policy” for a discussion of the distribution policies of ESH REIT.

On April 22, 2014, the board of directors of ESH REIT declared a cash distribution of $0.15 per share on its Class A common stock and Class B common stock with respect to the three months ended March 31, 2014. The dividend was paid on May 22, 2014.

Risks Related to the Lodging Industry and Our Business

Investing in the Paired Shares involves a high degree of risk. You should carefully consider the following risks as well as the risks described under “Risk Factors” and the other information contained in, or incorporated by reference into, this prospectus, including the financial statements and related notes, before investing in the Paired Shares.

| • | We are subject to the operating risks common to the lodging industry, including events beyond our control that disproportionately affect the travel industry, such as war, terrorist attacks, travel-related health concerns, transportation and fuel prices, interruptions in transportation systems, travel-related accidents, fires, natural disasters and severe weather. |

| • | As of March 31, 2014, we had total indebtedness of approximately $3.0 billion. The agreements governing our existing indebtedness, and any future indebtedness may, restrict us, reduce operational flexibility and create default risks, including precluding the payment of cash dividends. |

| • | Mortgage and mezzanine debt obligations expose us to the possibility of foreclosure, which could result in the loss of any hotel property subject to mortgage or mezzanine debt. |

| • | Our business depends on the quality and reputation of our brands, and any deterioration in the quality or reputation of our brands or the lodging industry could materially adversely affect our market share, reputation, business, financial condition and results of operations. |

| • | We could incur significant costs related to government regulation and litigation over environmental, health and safety matters. |

| • | Compliance with the laws and regulations that apply to our hotel properties could materially adversely affect our ability to make future acquisitions or renovations, result in significant costs or delays and adversely affect our business strategies. |

| • | We operate in a highly competitive industry. |

| • | The lodging industry is cyclical and a worsening of general economic conditions or low levels of economic growth could materially adversely affect our business, financial condition, results of operations and our ability to pay dividends to our shareholders. |

| • | If we fail to implement our business strategies, our business, financial condition and results of operations could be materially adversely affected. |

| • | Our capital expenditures and business strategies may not result in our expected improvements in our business. |

| • | We are exposed to the risks resulting from real estate ownership, which could increase our costs, reduce our profitability and limit our ability to respond to market conditions. |

| • | Economic and other conditions may materially adversely affect the valuation of our hotel properties resulting in impairment charges that could have a material adverse effect on our business, results of operations and earnings. |

11

Table of Contents

| • | Failure of ESH REIT to qualify as a REIT or remain qualified as a REIT would cause it to be taxed as a regular C corporation, which would expose it to substantial tax liability and could substantially reduce the amount of cash available to pay dividends to its shareholders. |

| • | Our structure has been infrequently utilized by public companies and has not been employed by a public company since a similar structure was employed by a public company in 2006, and the IRS could challenge ESH REIT’s qualification as a REIT. |

| • | ESH REIT’s board of directors could terminate its status as a REIT, subjecting ESH REIT’s taxable income to U.S. federal income taxation, which would increase its liabilities for taxes. |

| • | ESH REIT has a limited operating history as a publicly traded REIT and may not be successful in operating as a publicly traded REIT, which may adversely affect its ability to make distributions to its shareholders. |

| • | When this offering is completed, affiliates of Centerbridge, Paulson and Blackstone will each beneficially own approximately 23.8% of Paired Shares (23.3%, if the underwriters’ option to purchase additional Paired Shares is exercised in full), and their interests may conflict with or differ from your interests as a shareholder. |

| • | The Sponsors have the right to nominate four of the seven directors of the Corporation and three of the five directors of ESH REIT and therefore have significant control over the operation of our business. The Sponsors interests may conflict with or differ from your interests as a shareholder. |

| • | We are a “controlled company” within the meaning of the NYSE rules and, as a result, qualify for, and rely on, exemptions from certain corporate governance guidelines, including, the requirements that a majority of the boards of directors of the Corporation and ESH REIT consist of independent directors, the requirement that each of the Corporation and ESH REIT have a nominating/corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, and the requirement that each of the Corporation and ESH REIT have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. |

| • | Future sales or the possibility of future sales of a substantial amount of the Paired Shares by the Sponsors may depress the price of the Paired Shares. |

Corporate Information

The Corporation was incorporated in the state of Delaware on July 8, 2013. ESH REIT was formed as a limited liability company in the state of Delaware on September 16, 2010 and was converted to a corporation on November 5, 2013. The formation of the Corporation and the conversion of ESH REIT into a Delaware corporation were completed as part of the Pre-IPO Transactions. Our principal executive offices are located at 11525 N. Community House Road, Suite 100, Charlotte, North Carolina 28277, and our telephone number is (980) 345-1600. We maintain a website at www.extendedstayamerica.com. The information contained on, or that can be accessed through our website is not incorporated by reference in, and is not a part of, this prospectus.

12

Table of Contents

THE OFFERING

| Issuers |

Extended Stay America, Inc. (the “Corporation”) |

| ESH Hospitality, Inc. (“ESH REIT”) |

| Description of Paired Shares |

Each Paired Share consists of one share of common stock, par value $0.01 per share, of the Corporation that is attached to and trades as a single unit with one share of Class B common stock, par value $0.01 per share, of ESH REIT. See “Description of Our Capital Stock.” |

Paired Shares offered by the

| selling shareholders |

21,000,000 Paired Shares. |

Underwriters’ option to purchase

additional Paired Shares from the

| selling shareholders |

3,150,000 Paired Shares. |

Percentage of outstanding Paired

Shares to be owned by the Sponsors

| immediately after the offering |

71.4%. |

| Use of proceeds |

The selling shareholders will receive all of the net proceeds from the sale of the Paired Shares in this offering, including upon the sale of shares if the underwriters exercise their option to purchase additional shares, from the selling shareholders in this offering. We will not receive any of the proceeds from the sale of the Paired Shares by the selling shareholders. See “Use of Proceeds.” |

| NYSE symbol |

“STAY.” |

| Ownership limitation |

The Paired Shares are subject to ownership limitations. See “Description of Our Capital Stock—Limits on Ownership of Stock and Restrictions on Transfer.” |

13

Table of Contents

| Risk factors |

See “Risk Factors” included in our combined annual report on Form 10-K for the year ended December 31, 2013 and “Risk Factors” herein for a discussion of factors that you should carefully consider before deciding to invest in Paired Shares. |

Unless otherwise indicated or the context requires, all information in this prospectus assumes an offering of 21,000,000 Paired Shares by the selling shareholders and no exercise of the underwriters’ option to purchase additional shares.

14

Table of Contents

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA CONSOLIDATED AND COMBINED FINANCIAL AND OTHER DATA

The following table sets forth summary financial and operating data on a historical basis for the Company and, for the year ended December 31, 2013, on a pro forma basis after giving effect to the Pre-IPO Transactions and the application of the net proceeds of the initial public offering.

The summary historical consolidated and combined financial data of the Company for the years ended December 31, 2013, 2012 and 2011 and as of December 31, 2013 and 2012 have been derived from the audited consolidated and combined financial statements of the Company incorporated by reference in this prospectus. The summary historical consolidated and combined financial data of the Company as of December 31, 2011 has been derived from the audited consolidated and combined financial statements of the Company not incorporated by reference in this prospectus. The summary historical consolidated and combined financial data of the Company for the three months ended March 31, 2014 and 2013 and as of March 31, 2014 have been derived from the unaudited condensed consolidated and combined financial statements of the Company incorporated by reference in this prospectus. The unaudited condensed consolidated and combined financial statements have been prepared on the same basis as the audited consolidated and combined financial statements, and in the opinion of our management, reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results for those periods. The results for any interim period are not necessarily indicative of the results that may be expected for a full year. The following information should be read in conjunction with, and is qualified by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical audited and unaudited consolidated and combined financial statements and related notes and other financial information included in our combined annual report on Form 10-K for the year ended December 31, 2013 and in our combined quarterly report on Form 10-Q for the three months ended March 31, 2014 incorporated by reference in this prospectus.

The summary unaudited pro forma condensed consolidated and combined financial data for the year ended December 31, 2013 is derived from the Company’s unaudited pro forma condensed consolidated and combined statement of operations included elsewhere in this prospectus and is presented as if the Pre-IPO Transactions and the initial public offering had occurred on January 1, 2013 for the purposes of the unaudited pro forma condensed statement of operations. The summary unaudited pro forma condensed consolidated and combined financial data presented below is that of the Company and its consolidated subsidiaries, including ESH REIT, after giving effect to the Pre-IPO Transactions and the application of the net proceeds of the initial public offering, and therefore the summary unaudited pro forma condensed consolidated and combined financial data is comparable to the consolidated and combined financial data of the Company and not ESH REIT on a stand-alone basis. The summary unaudited pro forma condensed consolidated and combined financial data is not necessarily indicative of what the actual results of operations of the Company would have been assuming the Pre-IPO Transactions and the initial public offering had been completed on January 1, 2013, nor for the period presented is it indicative of the results of operations of future periods. See “Unaudited Pro Forma Condensed Consolidated and Combined Statement of Operations of the Company” for a complete description of the adjustments and assumptions underlying the summary unaudited pro forma condensed consolidated and combined financial data.

15

Table of Contents

| Company | Company | |||||||||||||||||||||||

| Pro Forma | Historical | |||||||||||||||||||||||

|

(Dollars in millions, other than ADR, |

Year Ended December 31, 2013 |

Three Months Ended March 31, 2014 |

Three Months Ended March 31, 2013 |

Year Ended December 31, 2013 |

Year Ended December 31, 2012 |

Year Ended December 31, 2011 |

||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||||||

| Room revenues |

$ | 1,114.0 | $ | 266.2 | $ | 252.8 | $ | 1,114.0 | $ | 984.3 | $ | 913.0 | ||||||||||||

| Other hotel revenues |

17.8 | 4.1 | 3.7 | 17.8 | 16.9 | 18.7 | ||||||||||||||||||

| Management fees, license fees and other revenues |

1.0 | — | 0.3 | 1.0 | 10.3 | 11.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenues |

1,132.8 | 270.3 | 256.8 | 1,132.8 | 1,011.5 | 942.7 | ||||||||||||||||||

| Total operating expenses |

808.3 | 210.3 | 190.1 | 821.8 | 727.5 | 677.3 | ||||||||||||||||||

| Income before income tax (benefit) expense |

160.8 | 21.1 | 14.6 | 77.7 | 26.9 | 53.7 | ||||||||||||||||||

| Net income |

119.8 | 16.1 | 13.9 | 82.7 | 22.3 | 46.6 | ||||||||||||||||||

| Net income attributable to common shareholders or members |

38.3 | 10.8 | 13.4 | 86.2 | 20.7 | 45.6 | ||||||||||||||||||

| Net income per share - basic |

$ | 0.19 | $ | 0.05 | $ | 0.08 | $ | 0.49 | $ | 0.12 | $ | 0.27 | ||||||||||||

| Net income per share - diluted |

$ | 0.19 | $ | 0.05 | $ | 0.08 | $ | 0.49 | $ | 0.12 | $ | 0.26 | ||||||||||||

| Other financial data: |

||||||||||||||||||||||||

| Cash flows provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | 72.5 | $ | 83.0 | $ | 311.3 | $ | 201.1 | $ | 180.6 | ||||||||||||||

| Investing activities |

(141.1 | ) | (109.7 | ) | (165.3 | ) | (223.8 | ) | (43.4 | ) | ||||||||||||||

| Financing activities |

23.6 | (1.0 | ) | (189.0 | ) | 27.6 | (50.1 | ) | ||||||||||||||||

| Capital expenditures |

(49.4 | ) | (36.2 | ) | (172.5 | ) | (271.5 | ) | (106.1 | ) | ||||||||||||||

| EBITDA (a) |

493.8 | 103.0 | 107.9 | 480.2 | 414.2 | 386.0 | ||||||||||||||||||

| Adjusted EBITDA (a) |

518.6 | 112.3 | 111.9 | 518.6 | 434.9 | 409.8 | ||||||||||||||||||

| Hotel Operating Profit (b) |

594.1 | 130.2 | 128.4 | 594.1 | 508.5 | 468.9 | ||||||||||||||||||

| Hotel Operating Margin (b) |

52.5 | % | 48.2 | % | 50.0 | % | 52.5 | % | 50.8 | % | 50.3 | % | ||||||||||||

| Paired Share Income (c) |

119.7 | 16.1 | 13.4 | 81.9 | 20.7 | 45.6 | ||||||||||||||||||

| Adjusted Paired Share Income (c) |

136.6 | 22.4 | 15.9 | 98.8 | 34.4 | 62.2 | ||||||||||||||||||

| Adjusted Paired Share Income per Paired Share—basic (c) |

$ | 0.67 | $ | 0.11 | $ | 0.09 | $ | 0.57 | $ | 0.20 | $ | 0.37 | ||||||||||||

| Adjusted Paired Share Income per Paired Share—diluted (c) |

$ | 0.67 | $ | 0.11 | $ | 0.09 | $ | 0.56 | $ | 0.20 | $ | 0.36 | ||||||||||||

| Operating data: |

||||||||||||||||||||||||

| Rooms (at period end)(1) |

76,265 | 75,928 | 76,219 | 75,928 | 73,657 | |||||||||||||||||||

| Average occupancy rate |

70.0 | % | 70.6 | % | 74.2 | % | 73.3 | % | 75.1 | % | ||||||||||||||

| ADR |

$ | 55.39 | $ | 52.41 | $ | 54.15 | $ | 49.77 | $ | 45.20 | ||||||||||||||

| RevPAR |

$ | 38.79 | $ | 36.99 | $ | 40.18 | $ | 36.46 | $ | 33.96 | ||||||||||||||

| Company | ||||||||||||||||||||||||

| Historical | ||||||||||||||||||||||||

| (Dollars in millions) |

March 31, 2014 |

December 31, 2013 |

December 31, 2012 |

December 31, 2011 |

||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Balance sheet data: |

||||||||||||||||||||||||

| Cash and cash equivalents(2) |

$ | 15.5 | $ | 60.5 | $ | 103.6 | $ | 98.6 | ||||||||||||||||

| Restricted cash |

140.3 | 47.3 | 61.6 | 236.7 | ||||||||||||||||||||

| Property and equipment, net |

4,134.3 | 4,127.3 | 4,110.6 | 3,844.1 | ||||||||||||||||||||

| Total assets |

4,516.9 | 4,449.7 | 4,491.7 | 4,357.3 | ||||||||||||||||||||

| Mortgage loans payable |

2,519.8 | 2,519.8 | 2,525.7 | 1,980.2 | ||||||||||||||||||||

| Mezzanine loans payable |

365.0 | 365.0 | 1,080.0 | 700.0 | ||||||||||||||||||||

| Revolving credit facilities |

60.0 | 20.0 | — | — | ||||||||||||||||||||

| Mandatorily redeemable preferred stock |

21.2 | 21.2 | — | — | ||||||||||||||||||||

| Total liabilities |

3,173.7 | 3,108.5 | 3,738.9 | 2,805.9 | ||||||||||||||||||||

| Total equity |

1,343.2 | (2) | 1,341.2 | (2) | 752.8 | 1,551.4 | ||||||||||||||||||