Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - AMBRX INC | d690417dex51.htm |

| EX-23.1 - EX-23.1 - AMBRX INC | d690417dex231.htm |

| EX-10.38 - EX-10.38 - AMBRX INC | d690417dex1038.htm |

| EX-10.40 - EX-10.40 - AMBRX INC | d690417dex1040.htm |

| EX-10.39 - EX-10.39 - AMBRX INC | d690417dex1039.htm |

| EX-10.36 - EX-10.36 - AMBRX INC | d690417dex1036.htm |

| EX-10.37 - EX-10.37 - AMBRX INC | d690417dex1037.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 9, 2014

Registration No. 333-195666

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Ambrx, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 2834 | 57-1147346 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) | ||

|

10975 North Torrey Pines Road La Jolla, CA 92037 (858) 875-2400 | ||||

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) | ||||

Lawson Macartney, Ph.D., B.V.M.S.

President and Chief Executive Officer

Ambrx, Inc.

10975 North Torrey Pines Road

La Jolla, CA 92037

(858) 875-2400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

| Faye H. Russell, Esq. Michael E. Sullivan, Esq. Latham & Watkins LLP 12670 High Bluff Drive San Diego, CA 92130 (858) 523-5400 |

Thomas S. Levato, Esq. Maggie L. Wong, Esq. Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, NY 10018 (212) 813-8800 | |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||||

| (Do not check if a smaller reporting company) | ||||||||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate |

Amount of Registration |

||||||

| Common Stock, $0.001 par value per share |

$ | 86,940,000 | $ | 11,198 | (3) | |||

(1) Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes offering price of shares that the underwriters have the option to purchase.

(2) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

(3) $11,109 was previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

SUBJECT TO COMPLETION, DATED JUNE 9, 2014

The information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

5,400,000 Shares

Common Stock

$ per share

This is the initial public offering of Ambrx, Inc. We are offering 5,400,000 shares of our common stock. Prior to this offering, there has been no public market for our common stock. We estimate that the initial public offering price of our common stock will be between $12.00 and $14.00 per share.

We have applied to list our common stock on The NASDAQ Global Market under the symbol “AMBX.”

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.” |

We have granted the underwriters a 30-day option to purchase up to a total of 810,000 additional shares of common stock on the same terms and conditions set forth above.

Entities affiliated with certain of our existing stockholders, directors and collaborators have indicated an interest in purchasing up to an aggregate of approximately $22.9 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these potential investors and any of these potential investors could determine to purchase more, less or no shares in this offering.

The underwriters expect to deliver the shares of common stock to purchasers on , 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Stifel |

Wells Fargo Securities | |||||

| Canaccord Genuity | Needham & Company | |||||

| Roth Capital Partners | ||||||

The date of this prospectus is , 2014.

Table of Contents

| Page | ||||

| 1 | ||||

| 13 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 58 | ||||

| 61 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

63 | |||

| 83 | ||||

| 140 | ||||

| 148 | ||||

| 167 | ||||

| 170 | ||||

| 173 | ||||

| 177 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders of Our Common Stock |

180 | |||

| 184 | ||||

| 192 | ||||

| 192 | ||||

| 192 | ||||

| F-1 | ||||

We have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Until , 2014 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read this entire prospectus carefully, especially the section entitled “Risk Factors” and our financial statements and the related notes thereto, before making an investment decision. As used in this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” “our company” and “Ambrx” refer to Ambrx, Inc.

Overview

Our Company

Ambrx is a clinical stage biotechnology company focused on discovering and developing first-in-class and best-in-class optimized protein therapeutics known as bio-conjugates. Our proprietary technology platforms enable us to attach pharmaceutically active molecules to specific sites within proteins, a process known as site-specific conjugation, and to design biologics with precision that is similar to that used to design modern small molecule drugs. We refer to this as protein medicinal chemistry. We believe our ability to target specific sites of conjugation more precisely than prior generations of bio-conjugates and produce homogeneous therapeutics allows us to discover new protein drugs and design safer, more effective versions of current therapeutics. We have developed a pipeline of novel product candidates that include antibody drug conjugates, or ADCs, bi- and multi-specific drug conjugates and long-acting therapeutic proteins. Our most advanced ADC program is ARX788, an ADC for cancers expressing human epidermal growth factor 2, or HER2, for which we intend to begin clinical trials in Australia in the first half of 2015. Our most advanced long-acting proteins are ARX201, a once-weekly human growth hormone, or hGH, that has successfully completed a Phase 2b clinical trial, and ARX328, a long-acting leptin for lipodystrophy and weight management; we intend to submit an investigational new drug application, or IND, to the U.S. Food and Drug Administration, or FDA, for ARX201 in the second half of 2014 and for ARX328 in mid-2014. In addition to our internal pipeline, we collaborate with leading pharmaceutical companies, including Bristol-Myers Squibb Company, or BMS, Merck Sharp & Dohme Corp., or Merck, Eli Lilly and Company, or Eli Lilly, Agensys, Inc., or Agensys, Zhejiang Medicine Co., Ltd., or ZMC, and Zhejiang Hisun Pharmaceutical Co., Ltd., or Hisun. Our most advanced collaboration product candidate in human health is ARX618, a long-acting Fibroblast Growth Factor 21, or FGF21, for type 2 diabetes, which our collaborator BMS has advanced through Phase 1 clinical trials and expects to begin Phase 2 clinical trials for in mid-2014. To date, our collaborations have provided us with over $200 million in non-dilutive funding and have the potential to provide milestone payments as well as royalties on the sale of collaboration products. We currently have no internal products approved for commercial sale and have not received any revenues from the sale of products.

Biologic and Bio-conjugate Market Overview

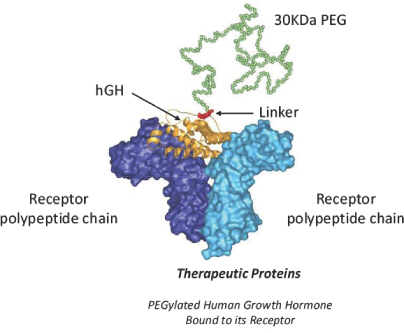

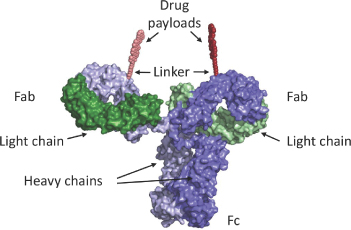

According to data from the IMS Institute for Healthcare Informatics, global sales of biologic drugs, defined as proteins, antibodies and vaccines, were approximately $157 billion in 2011. Over the past 30 years, biologic drugs have had a dramatic impact on disease therapy. Genetically engineered, or recombinant, proteins such as insulin and interferon have become mainstay therapies in the treatment of a broad range of diseases. Similarly, antibodies such as Herceptin and Humira have had a significant impact on the treatment of certain diseases, most notably cancer and autoimmune diseases. Despite their success, many biologics have limitations, including short half-life, a measure of duration of action in the body, for therapeutic proteins, and limited potency for naked antibodies. Bio-conjugate technologies have been designed to address these limitations by attaching molecules to proteins of interest. For example, for therapeutic proteins, molecules such as polyethylene glycol, or PEG, have been attached to extend their half-life, and cell killing, or cytotoxic, molecules have been attached to antibodies to increase their potency. Although an improvement on prior biologics, earlier generation bio-conjugate

1

Table of Contents

technologies generally conjugate to an amino acid that is present at multiple sites in the protein and therefore do not allow for conjugation at a specific site. As a result, drug product from the same production run may consist of proteins that are conjugated at different sites and with a different number of conjugated molecules, which is known as heterogeneity.

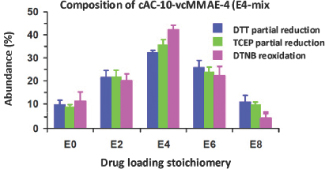

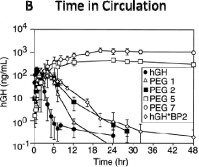

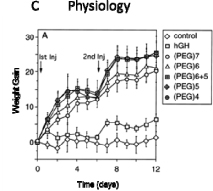

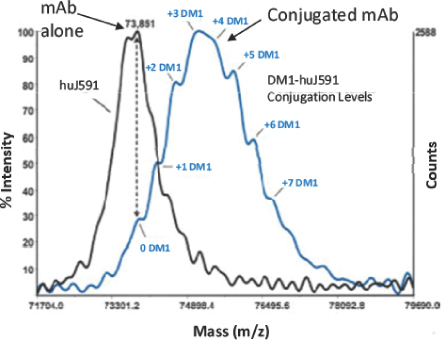

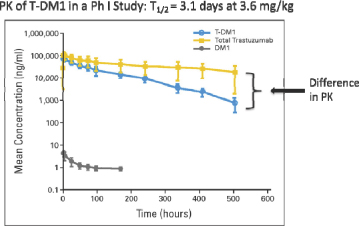

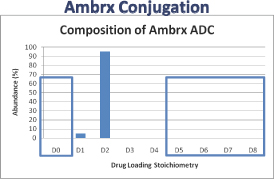

Heterogeneity can have a significant impact on the therapeutic effect of a bio-conjugate, as conjugation to the same amino acid at different sites can result in markedly different biological effects. For example, conjugating at one site may allow the protein to retain its full biological function while conjugating at another site may eliminate it. Thus, conjugation at one site may allow the protein to be pharmacologically active, while conjugation at another site may eliminate the same activity or result in toxicity. Furthermore, some sites in the protein may be critical to its overall stability and pharmacokinetics, or PK, whereas others may not. Consequently, heterogeneous mixtures of bio-conjugates often are suboptimal in terms of efficacy, safety, in vivo time-of-action, protein and linker stability and ease of manufacture. Heterogeneity is an issue for both long-acting proteins and ADCs. Independently published data show that the random conjugation of PEG to hGH gives rise to multiple PEG-conjugated, or PEGylated, variants of different sizes that, when separated, exhibit variable PK and physiological properties. For the ADCs Adcetris and Kadcyla, the conjugation of the drug payloads to monoclonal antibodies has been adapted to yield specific average drug payload to antibody ratios, or DARs, of approximately four-to-one. However, because the technique for conjugating the drug payload to the antibody involves a random conjugation process, the drug produced by the process contains molecules with DARs ranging from zero to eight and which contain the drug payload at a variety of positions within the protein. This heterogeneity likely limits patients’ exposure to truly efficacious conjugates, increases the exposure to non-efficacious, but potentially toxic conjugates, and decreases the half-life of the conjugate.

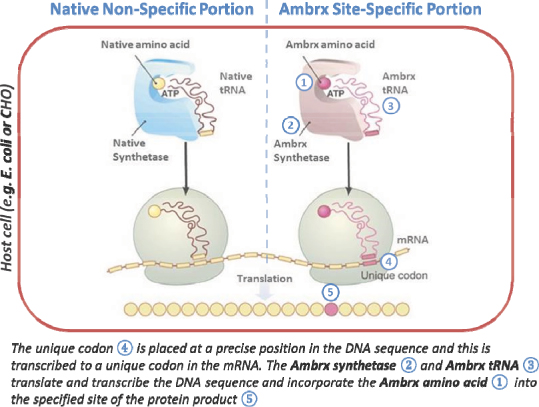

Our Bio-Conjugation Technology

We believe our technology platforms enable us to overcome the limitations of earlier generation bio-conjugates by applying our protein medicinal chemistry to consistently attach our proprietary linkers, payloads and half-life extenders to proteins at specific sites and create a homogeneous drug product. We can then test this drug product for pharmaceutical characteristics and physiological effects to develop a more precise understanding of how conjugating at different locations affects the activity of a drug. This enables us to select the optimal combination of conjugation site, linker and payload to create bio-conjugates which have the potential for increased efficacy and improved safety, resulting in a wider therapeutic index. A wider therapeutic index allows a higher dosage to increase the pharmacological effect with a similar safety profile or a lower dosage that achieves the same pharmacological effect with an improved safety profile. We can create proteins in both bacterial and mammalian cell systems, enabling us to create bio-conjugates in the system most appropriate for a given product candidate. Our bacterial platform, ReCODE, has generated our most mature programs, including several collaboration programs and several internal programs focused on long-acting therapeutic proteins. We apply our mammalian platform, EuCODE, to generate the majority of our ADC product candidates. Our technology platforms and product candidates are protected by an extensive intellectual property estate, which includes over 100 issued U.S. patents and pending U.S. patent applications and over 500 issued patents and pending patent applications in other jurisdictions.

2

Table of Contents

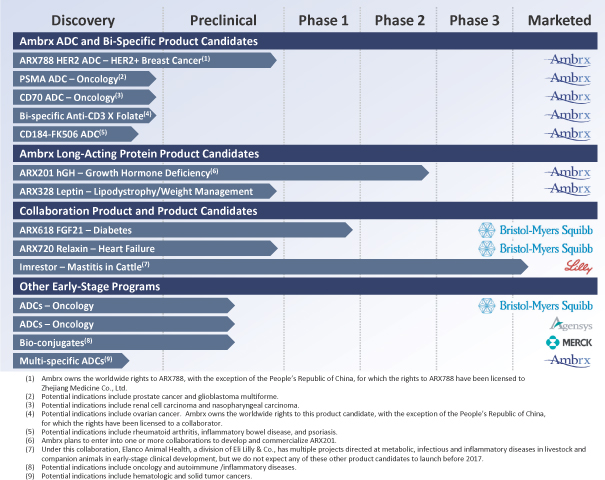

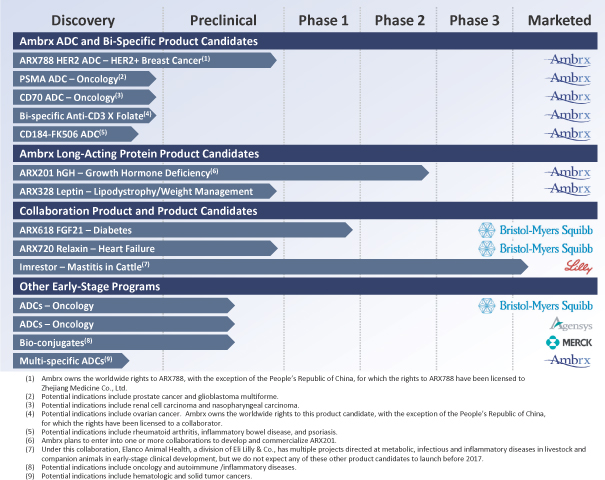

Our Product Candidates

The following chart depicts our internal and collaboration product candidates in development, as well as development programs under which discovery or preclinical development activities are being conducted. Our pipeline includes potential first-in-class as well as potential best-in-class bio-conjugate product candidates developed using our EuCODE and ReCODE platforms and includes ADCs, bi- and multi-specific drug conjugates and long-acting proteins.

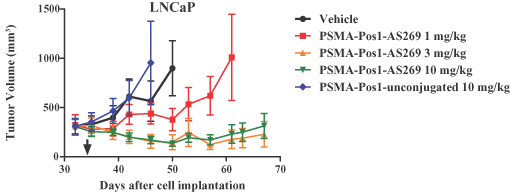

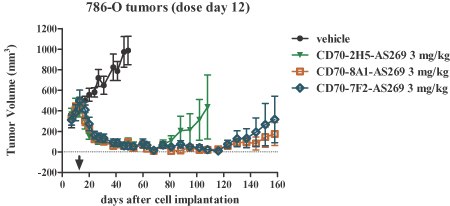

ARX788

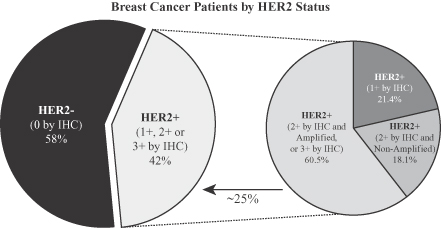

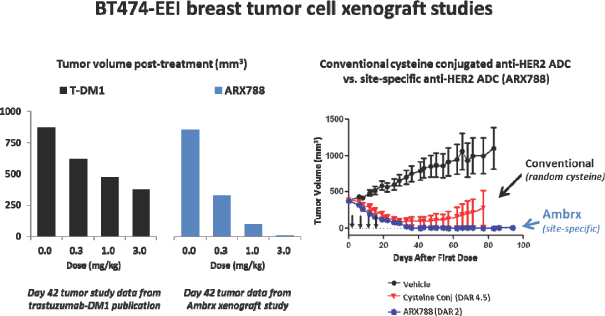

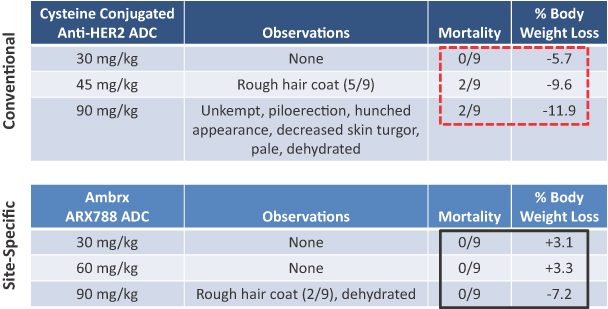

Our lead ADC program is ARX788, which is a HER2 antibody conjugated with our proprietary linker and cytotoxic drug payload, Amberstatin, or AS269. ARX788 is currently in preclinical development for the treatment of breast cancer and other solid tumors that express and overexpress HER2. While significant advances have been achieved in the treatment of cancers with HER2-targeted therapies, in many cases the cancer still progresses after multiple lines of treatment. In addition, existing HER2-targeted therapies, such as Kadcyla, are not approved for the treatment of cancers that express, but do not overexpress, HER2. Preclinical studies suggest that ARX788 may demonstrate increased potency and tolerability relative to current therapies, including Kadcyla, and therefore we believe ARX788, if approved, may have the potential to benefit a broader spectrum of cancer patients, including those whose tumors express less HER2 than those that can be treated with the currently available HER2-targeted therapies, while also improving outcomes for those patients that are eligible for current HER2-targeted therapies. We expect to submit a regulatory dossier for ARX788 in Australia

3

Table of Contents

by the end of 2014 and initiate Phase 1 clinical trials in Australia in the first half of 2015 in collaboration with ZMC, with Phase 1 clinical data expected to be available in 2016.

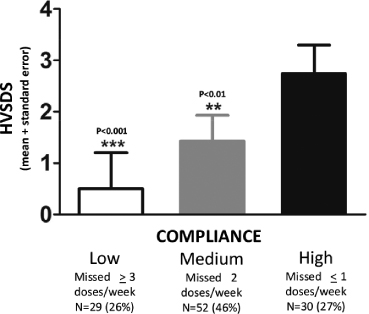

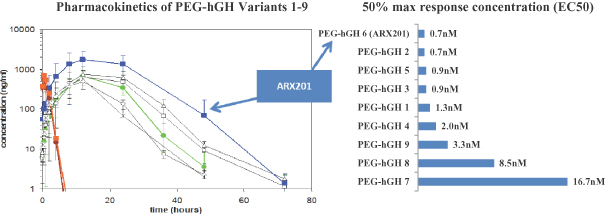

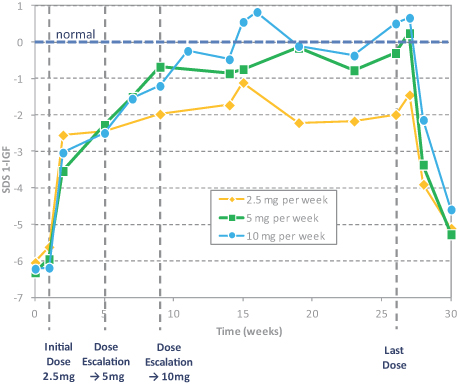

ARX201

ARX201 is a long-acting form of hGH, which has successfully completed a Phase 2b clinical trial in Europe in young adults with growth hormone deficiency, or GHD, a medical condition that results when the pituitary gland does not produce enough hGH. Global annual sales from currently marketed hGH products, which are used for the treatment of GHD as well as other related indications, were approximately $2.9 billion in 2012. We believe ARX201, which is designed to be administered once weekly, may provide considerable improvement in terms of convenience and compliance over currently available hGH products, which require once-daily dosing. We expect to submit an IND to the FDA in the second half of 2014 for ARX201 in order to expand clinical trials of ARX201 into the United States. We plan to initiate a Phase 2 clinical trial for the treatment of GHD in children in the first half of 2015 and expect to have data from this trial in 2016. With one or more collaborators, we plan to initiate a Phase 3 clinical trial for the treatment of GHD in young adults in the first half of 2015. We plan to apply for orphan drug designation for ARX201 in pediatric populations.

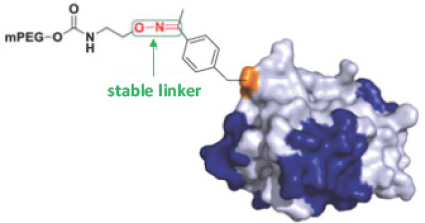

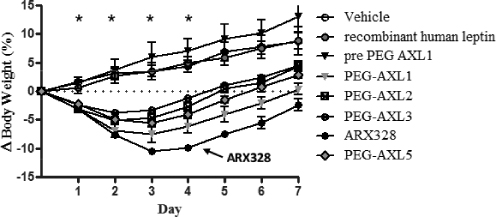

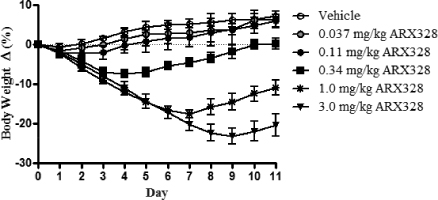

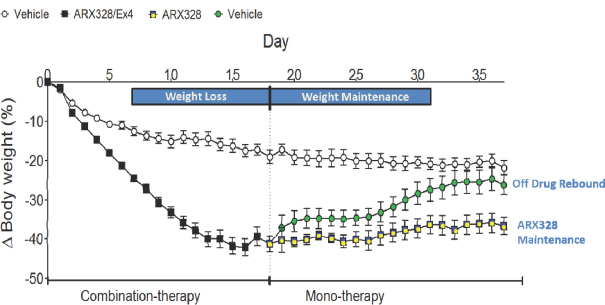

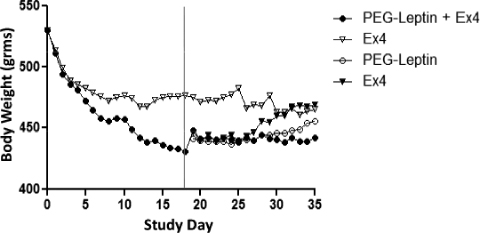

ARX328

ARX328 is a long-acting form of leptin that is currently in preclinical development as a leptin-replacement therapy in patients with lipodystrophy, a group of conditions that arise due to the defective metabolism of fat, and for weight management through the maintenance of weight loss in obese individuals. We have used our proprietary technology to incorporate a novel, non-native amino acid at a specified site in leptin that allows for the precise placement of PEG to retain leptin activity while prolonging the time of pharmacological activity. ARX328 has been shown to be tolerable and successful in stimulating and maintaining a reduction of body weight in multiple animal models, and we believe it will be able to be administered once weekly. If approved, we expect that ARX328 would be the first long-acting leptin with once-weekly, subcutaneous dosing. We expect to submit an IND for ARX328 to the FDA in mid-2014 in order to initiate Phase 1 clinical trials in the second half of 2014, and expect that Phase 1 data will be available in 2015.

Additional Product Candidates

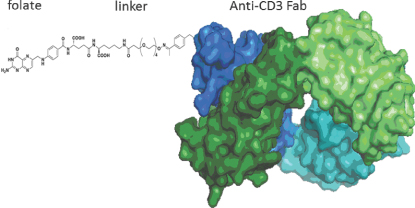

We are also completing preclinical assessments of other internally developed ADC and bi-specific product candidates, including those listed below. We expect that the preclinical datasets for these candidates will become available during 2014. Assuming positive preclinical results, we anticipate taking one or more of these molecules into preclinical development beginning in 2015.

| • | PSMA ADC for the treatment of metastatic castration-resistant prostate cancer and glioblastoma multiforme; |

| • | CD70 ADC for the treatment of renal and nasopharyngeal cancers; |

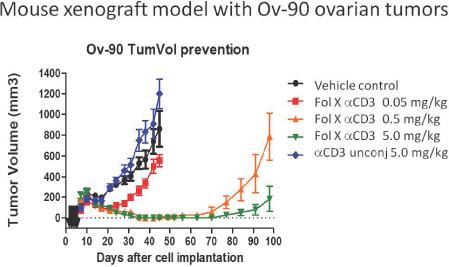

| • | Bi-specific Anti-CD3 X Folate for the treatment of ovarian cancer; and |

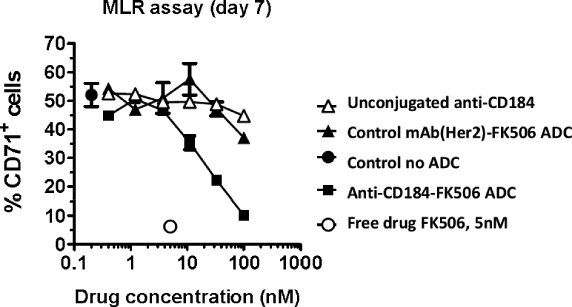

| • | CD184-FK506 ADC for the treatment of immunological diseases. |

Our Collaborations

In addition to our internal pipeline, collaborations are an important element of furthering our technologies. Our collaborations increase the number of Ambrx-enabled products in development, help validate and expand our technology platforms and provide non-dilutive funding. We have entered into several strategic collaborations for our technology platforms and product candidates, which have provided us with over $200 million in non-dilutive funding. We are eligible to receive potential milestone payments under these collaborations as well as royalties on the sale of collaboration products, if approved. We have one collaboration product, Imrestor, a long-acting

4

Table of Contents

protein for the treatment of mastitis in cattle, that is partnered with Eli Lilly’s Elanco Animal Health division and which has received regulatory approval in Mexico and Uruguay and was launched commercially in Mexico in May 2014. We expect Imrestor to reach the U.S. market by 2015.

Our collaborators include the following:

BMS. We have entered into three collaboration and license agreements with BMS. In the first two collaboration agreements, we granted to BMS exclusive, worldwide licenses to develop and commercialize product candidates for FGF21 and Relaxin, respectively. ARX618 for the treatment of type 2 diabetes is the lead product candidate under the FGF21 collaboration and ARX720 for the treatment of heart failure is the lead product candidate under the Relaxin collaboration. ARX618 has successfully completed Phase 1 clinical trials, and BMS expects to begin Phase 2 clinical trials for it in mid-2014. In the third collaboration, we granted to BMS an exclusive worldwide license to use Ambrx technology to develop and commercialize ADCs incorporating BMS’ antibodies, payloads and targets. In the aggregate, we have received upfront payments totaling $37.5 million under these collaboration agreements and are eligible to receive clinical, regulatory, and commercial milestone payments with respect to FGF21, Relaxin and each ADC target, based on the successful development and commercialization of products, as well as royalties on the net sales of such products. In addition, we are also eligible to receive research and development funding.

Merck. Our collaboration with Merck focuses primarily on the research and development of novel bio-conjugates for both oncology and non-oncology therapeutic targets. We granted to Merck an exclusive, worldwide research license to utilize our specified drug technology, patent rights and know-how, including our ReCODE and EuCODE technology platforms, to discover, identify and optimize polypeptide drug conjugates in a number of collaboration targets selected by Merck. We received an upfront payment of $15.0 million and are eligible to receive research and development funding. For each target within the collaboration, if Merck exercises its option for an exclusive license, we have the potential to receive additional preclinical, clinical, regulatory and sales-based milestones. We will also be entitled to receive tiered royalties in the single digit percentages of aggregate worldwide net sales of each licensed product.

Eli Lilly. We entered into a collaborative research, license and commercialization agreement with Eli Lilly to discover, develop and commercialize a broad portfolio of Ambrx-enabled bio-conjugates for animal health. We granted Eli Lilly an exclusive, worldwide license to utilize certain of our drug technology, trade secrets, know-how, patent rights and inventions to develop and commercialize certain product candidates in the field of animal health, as well as human and non-human food safety applications. We have received approximately $8.0 million in upfront payments and are eligible to earn specified preclinical and regulatory milestones as well as tiered royalties. Our most advanced product candidate from this collaboration is expected to reach the U.S. market by 2015. In addition, we are eligible to receive research and development funding.

Agensys. In April 2013, we entered into a research collaboration and exclusive license agreement with Agensys, a wholly owned subsidiary of Astellas Pharma, Inc., that applies our platform technology to specific antibodies and targets within the Agensys pipeline with the objective of creating Ambrx-enabled ADCs based on Agensys technology. Under our agreement with Agensys, we received an upfront payment of $15.0 million and are eligible to receive research and development funding. For each target within the collaboration, we have the potential to receive preclinical, clinical, regulatory and sales-based milestones. Additionally, we are entitled to receive tiered royalties on a target-by-target basis in the high single digit percentages of aggregate worldwide net sales of each licensed product.

ZMC. In June 2013, we entered into a co-development and license agreement with ZMC for ARX788 and other HER2 ADC products covered by our intellectual property rights, in which we granted ZMC an exclusive license to use certain of our patents and know-how to develop, manufacture and sell licensed products in the

5

Table of Contents

People’s Republic of China, or China. We have retained the rights to develop and commercialize licensed products outside of China. However, we have granted to ZMC a non-exclusive license for conducting activities in certain other mutually approved jurisdictions, including Australia, to support regulatory approval in China. Under our agreement with ZMC, we are entitled to receive tiered royalties in the low double-digit percentages of aggregate net sales of licensed products in China. In addition, we are eligible to receive research and development funding.

Hisun. In April 2014, we entered into a co-development and license agreement with Hisun for the research, development and commercialization of certain bi-specific product candidates and products for the treatment of cancer. We granted Hisun an exclusive license to use certain of our patents and know-how to develop, use, manufacture and sell certain licensed products in China. The agreement contemplates two collaboration programs with designated targets. We are entitled to receive a payment of $1.0 million each year during the initial three-year research term, and we are also entitled to receive tiered royalties in the mid to high single digit percentages of net sales of licensed products in China.

Our Strategy

We have developed proprietary platforms, and an extensive intellectual property estate, that we believe allow us to design and develop first-in-class and best-in-class bio-conjugates. We are committed to using our site-specific conjugation expertise and protein medicinal chemistry approach to identify and develop next generation bio-conjugates to fulfill unmet medical needs. We recognize the following elements as being critical to this mission:

| • | Rapidly advance the development of our proprietary product candidates. We are using our technology platforms to develop novel and differentiated proprietary product candidates. By optimizing the safety and efficacy profiles of our product candidates, we believe we will be able to expedite their development and address unmet medical needs. We anticipate submitting an IND for ARX328 in mid-2014 and a regulatory dossier for ARX788 in Australia by the end of 2014. Our goal is to submit at least one IND every 12 to 18 months beginning in 2016. In addition, we have successfully completed a Phase 2b clinical trial with ARX201, a once-weekly hGH, and we anticipate progressing ARX201 into a Phase 3 development program with one or more collaborators in the first half of 2015. |

| • | Create new product candidates that combine the therapeutic benefits of biological molecules with the precise design of small molecules. Our goal is to create novel, next-generation, targeted therapeutics using our ReCODE and EuCODE platforms. These platforms allow the integrated optimization of conjugation site, linker and payload. We have a comprehensive suite of linkers, conjugation chemistries and payloads which allow us to design targeted therapeutics with the optimal profile in terms of efficacy, safety and stability. Our current discovery focus is on targeted bio-therapeutics, such as ADCs and bi- and multi-specific drug conjugates. We are currently evaluating three ADCs, PSMA, CD70 and CD184-FK506, and one bi-specific therapeutic, anti-CD3 X Folate, for preclinical development. We anticipate taking one or more of these candidates into preclinical development in early 2015. |

| • | Leverage our technology to advance existing collaborations and selectively establish new collaborations. An important part of our strategy is to form collaborations to maximize the value of our product candidates and advance our technology. We have three different frameworks for our collaborations. Product-focused collaborations are agreements under which we grant our collaborators rights to develop and commercialize our proprietary product candidates in markets where we otherwise would not participate or where our partners’ capabilities position them to maximize the value of these candidates. Technology-focused collaborations are agreements under which we apply our proprietary technology to enable our partners to optimize their product candidates. Finally, platform expansion collaborations include agreements with research institutes and biotechnology companies that have complementary technologies. |

6

Table of Contents

| • | Strengthen our leadership position in the discovery and optimization of site-specific bio-conjugates. We intend to build on our technology platforms, methods and know-how through internal and collaborative efforts. For example, we are exploring multi-specific targeting modalities that should result in the improved delivery of payloads with greater specificity to target cells. We believe that, in the future, the ability to deliver drugs more effectively and more specifically to diseased tissues through the engagement of multiple antigens, rather than a single antigen, will enable us to develop novel bio-conjugates for use outside oncology and thus treat a broader range of diseases. We refer to this as a multi-specific approach. We are also working to discover multi-payload ADCs and novel linker chemistries and to expand our platform technology. We believe that by adding complementary technologies to our current platform base, we will maintain our leadership position in bio-conjugates. |

| • | Commercialize our product candidates independently and with collaborators. Our technology enables us to create product candidates for a wide range of diseases. We intend to develop and opportunistically commercialize our product candidates in the United States in disease areas where the majority of prescribing physicians are specialists that can be reached with a targeted sales force. We also intend to seek collaborators to co-develop and commercialize our product candidates in the United States for disease areas where the majority of prescribing physicians are general practitioners. In addition, we intend to seek collaborators to develop and commercialize our product candidates outside of the United States. |

| • | Expand our intellectual property position. We own or have rights to over 100 issued U.S. patents and pending U.S. patent applications and over 500 issued patents and pending patent applications in various other jurisdictions relating to various aspects of our technology platforms and our product candidates, as well as their manufacture and use. We intend to continue to expand our intellectual property protections by seeking and maintaining domestic and international patents on inventions that are commercially important to our business. We will also rely on know-how, continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position. |

Risks Related to Our Business

Our ability to implement our business strategy is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include, among others:

| • | Since our inception, we have incurred significant operating losses as a result of our platform development, preclinical activities and clinical activities and have an accumulated deficit of $80.1 million as of March 31, 2014, and anticipate that we will continue to incur losses for the foreseeable future. |

| • | We will require additional capital for the further development and commercialization of our product candidates, and cannot be certain that additional funding will be available on acceptable terms, or at all. If we fail to obtain additional financing, we may be unable to complete the development and commercialization of our product candidates, including ARX788, ARX201 and ARX328. |

| • | We are substantially dependent on the successful development and commercialization of our internal product candidates, including ARX788, ARX201, ARX328 and any future internal product candidates that we may identify, and we cannot give any assurance that we will receive regulatory approval for, or successfully commercialize, any of these product candidates. |

| • | Our existing collaborations, including those with BMS, Merck, Eli Lilly, Agensys, ZMC and Hisun, are important to our business, and future collaborations may also be important to us. If we are unable to maintain any of these collaborations, or if these collaborations are not successful, our business could be adversely affected. |

7

Table of Contents

| • | We may need to enter into additional collaborations for the development and commercialization of additional product candidates or to leverage our existing technology platforms, and we may not be able to do so. |

| • | Clinical drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results or the ability to successfully commercialize a product candidate, if approved. |

| • | We rely on third parties, including FujiFilm Diosynth Biotechnologies and WuXi PharmaTech, to manufacture our preclinical and clinical drug supplies and we intend to rely on third parties to produce commercial supplies of any of our product candidates, if approved. The development and commercialization of our product candidates could be stopped, delayed or made less profitable if those third parties fail to obtain and maintain regulatory approval of their facilities, fail to provide us with sufficient quantities of drug product or fail to do so at acceptable quality levels or prices. |

| • | If our efforts to protect the proprietary nature of the intellectual property related to our ReCODE and EuCODE technology platforms, including all of the patents and patent applications we have licensed from The Scripps Research Institute (representing over 20 issued U.S. patents, over 50 granted foreign patents and over 20 pending patent applications worldwide), and also including the patents and patent applications that we own, including U.S. Patent Nos. 7,632,823; 7,736,872; 7,846,689; 7,883,866; 7,838,265; 7,829,310; 7,858,344; and 8,420,792, are not adequate, we may not be able to compete effectively in our market. |

Corporate and Other Information

We were formed as a Delaware corporation on January 31, 2003. Our principal executive offices are located at 10975 North Torrey Pines Road, La Jolla, CA 92037, and our telephone number is (858) 875-2400. Our website address is www.ambrx.com. The information contained in, or accessible through, our website does not constitute part of this prospectus.

We use our registered trademark, AMBRX, in this prospectus. This prospectus also includes trademarks, trade names and service marks that are the property of other organizations. Solely for convenience, trademarks and trade names referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

Implications of being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

8

Table of Contents

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different from what you might receive from other public reporting companies in which you hold equity interests.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

9

Table of Contents

THE OFFERING

| Common stock offered by us |

5,400,000 shares | |

| Common stock to be outstanding after this offering |

17,171,371 shares | |

| Option to purchase additional shares |

The underwriters have a 30-day option to purchase up to a total of 810,000 additional shares of common stock. | |

| Use of proceeds |

We expect to use the net proceeds from this offering to fund research and development activities of our product candidates, to expand and enhance our technology platforms and for working capital and general corporate purposes. See “Use of Proceeds” for a description of the intended use of proceeds from this offering. | |

| Offering price |

$ per share | |

| Risk factors |

You should read the “Risk Factors” section of this prospectus and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. | |

| Proposed NASDAQ Global Market symbol |

AMBX | |

Entities affiliated with certain of our existing stockholders, directors and collaborators have indicated an interest in purchasing up to an aggregate of approximately $22.9 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these potential investors and any of these potential investors could determine to purchase more, less or no shares in this offering.

The number of shares of common stock to be outstanding after this offering is based on 11,771,371 shares outstanding as of March 31, 2014, after giving effect to the conversion of all of our outstanding shares of preferred stock as of March 31, 2014 into 10,238,005 shares of common stock, and excludes:

| • | 2,426,878 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2014 at a weighted average exercise price of $3.48 per share; |

| • | 1,318,179 shares of our common stock reserved for future issuance under our 2013 equity incentive plan, which includes 1,150,000 shares of our common stock which will become available for future issuance on the business day prior to the public trading date of our common stock; and |

| • | 265,000 shares of our common stock reserved for future issuance under our 2014 employee stock purchase plan, or the ESPP, which will become effective on the business day prior to the public trading date of our common stock. |

Except as otherwise indicated, all information in this prospectus assumes:

| • | no exercise by the underwriters of their option to purchase additional shares of common stock; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately prior to the completion of this offering; |

| • | the automatic conversion of all outstanding shares of our preferred stock into 10,238,005 shares of common stock immediately prior to the completion of this offering; and |

| • | a one-for-six reverse stock split of our common stock effected on June 6, 2014. |

10

Table of Contents

SUMMARY FINANCIAL DATA

The following tables set forth a summary of our historical financial data as of, and for the periods ended on, the dates indicated. We have derived the statements of operations data for the years ended December 31, 2012 and 2013 and the balance sheet data as of December 31, 2013 from our audited financial statements included elsewhere in this prospectus. We have derived the summary statements of operations data for the three months ended March 31, 2013 and 2014 and balance sheet data as of March 31, 2014 from our unaudited financial statements included elsewhere in this prospectus. The unaudited financial statements have been prepared on a basis consistent with our audited financial statements included in this prospectus and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary to fairly state our financial position as of March 31, 2014 and results of operations for the three months ended March 31, 2013 and 2014. You should read this data together with our financial statements and related notes appearing elsewhere in this prospectus and the sections of this prospectus entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results for any prior period are not necessarily indicative of our future results.

| Years Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||

| Collaboration revenues |

$ | 44,461 | $ | 17,034 | $ | 2,432 | $ | 5,032 | ||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

16,262 | 27,540 | 3,661 | 8,509 | ||||||||||||

| General and administrative |

5,735 | 6,853 | 1,509 | 1,944 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

21,997 | 34,393 | 5,170 | 10,453 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

22,464 | (17,359 | ) | (2,738 | ) | (5,421 | ) | |||||||||

| Total other income (expense) |

343 | 368 | 222 | 40 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

22,807 | (16,991 | ) | (2,516 | ) | (5,381 | ) | |||||||||

| Provision for income taxes |

242 | 53 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | 22,565 | $ | (17,044 | ) | $ | (2,516 | ) | $ | (5,381 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share attributable to common stockholders (1): |

||||||||||||||||

| Basic |

$ | 1.20 | $ | (11.40 | ) | $ | (1.68 | ) | $ | (3.58 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | 1.11 | $ | (11.40 | ) | $ | (1.68 | ) | $ | (3.58 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to compute net income (loss) per share attributable to common stockholders (1): |

||||||||||||||||

| Basic |

1,478,491 | 1,495,070 | 1,493,218 | 1,502,784 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

1,597,974 | 1,495,070 | 1,493,218 | 1,502,784 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net income (loss) per share attributable to common stockholders, basic and diluted (unaudited) (1) |

$ | (1.45 | ) | $ | (0.46 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Shares used to compute pro forma net income (loss) per share attributable to common stockholders, basic and diluted (unaudited) (1) |

11,733,075 | 11,740,789 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| (1) | See Note 1 to our audited financial statements included elsewhere in this prospectus for an explanation of the method used to calculate the historical and pro forma net income (loss) per share, basic and diluted, and the number of shares used in the computation of the per share amounts. |

11

Table of Contents

| As of March 31, 2014 | ||||||||||||

| Actual | Pro Forma(1) |

Pro Forma As Adjusted(1)(2) |

||||||||||

| (unaudited, in thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 61,555 | $ | 61,555 | $ | 124,749 | ||||||

| Working capital |

41,026 | 41,026 | 105,063 | |||||||||

| Total assets |

70,018 | 70,018 | 131,475 | |||||||||

| Convertible preferred stock |

102,503 | — | — | |||||||||

| Accumulated deficit |

(80,069 | ) | (80,069 | ) | (80,069 | ) | ||||||

| Total stockholders’ equity (deficit) |

(75,880 | ) | 26,623 | 88,923 | ||||||||

| (1) | Gives effect to the automatic conversion of all shares of our convertible preferred stock outstanding as of March 31, 2014 into an aggregate of 10,238,005 shares of common stock immediately prior to the completion of this offering and the resultant reclassification of our convertible preferred stock to additional paid-in capital, a component of stockholders’ equity (deficit). We have based our assumption regarding the conversion of preferred stock into common stock immediately prior to the completion of this offering on stockholder consents we have obtained approving the conversion. |

| (2) | Gives further effect to the issuance and sale of 5,400,000 shares of common stock in this offering at the assumed initial public offering price of $13.00 per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the assumed initial public offering price of $13.00 per share would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by approximately $5.0 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares offered by us at the assumed initial public offering price would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ (deficit) equity by approximately $12.1 million, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our common stock. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and prospects. In such an event, the market price of our common stock could decline and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Related to Our Financial Position and Capital Requirements

Since our inception, we have incurred significant operating losses as a result of our platform development, preclinical activities and clinical activities and have an accumulated deficit of $80.1 million as of March 31, 2014, and anticipate that we will continue to incur losses for the foreseeable future.

Since inception, we have incurred significant operating losses. As of March 31, 2014, we had an accumulated deficit of $80.1 million. To date, we have financed our operations primarily through private placements of preferred stock and funding from our collaborations. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on our stockholders’ equity (deficit) and working capital. Our operations to date have been limited to expanding the scope of our ReCODE and EuCODE technologies, performing pre-clinical activities on behalf of our collaborators and for our internal programs, conducting early-stage clinical trials for our programs and supporting our collaborators’ research and development. Our losses have resulted principally from costs incurred in our platform development, preclinical activities and clinical activities related to our programs.

We anticipate that our operating losses will substantially increase over the next several years as we execute our plan to expand our discovery, research, development and commercialization activities, including the clinical development and commercialization of our product candidates, and incur the additional costs of operating as a public company. In addition, if we obtain regulatory approval of any of our product candidates, we may incur significant sales and marketing expenses, as well as costs related to the manufacture of our products and the maintenance of our product supply. Because of the numerous risks and uncertainties associated with developing pharmaceutical products, we are unable to predict the extent of any future losses or whether or when we will become profitable, if ever.

We will require additional capital for the further development and commercialization of our product candidates, and cannot be certain that additional funding will be available on acceptable terms, or at all. If we fail to obtain additional financing, we may be unable to complete the development and commercialization of our product candidates, including ARX788, ARX201 and ARX328.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to continue the clinical development of our product candidates, including our planned clinical trials.

We estimate that our net proceeds from this offering will be approximately $62.3 million, based upon an assumed initial public offering price of $13.00 per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We believe that such proceeds, together with our existing cash and cash equivalents, will be sufficient to fund our operations through at least the next 24 months. However, changing circumstances may cause us to consume capital significantly faster than we currently anticipate, and we may need to spend more money than currently expected because of circumstances beyond our control. We will require

13

Table of Contents

additional capital for the further development and commercialization of our product candidates and may need to raise additional funds sooner if we choose to expand more rapidly than we presently anticipate. Our future capital requirements will depend on many factors, including:

| • | our collaboration agreements remaining in effect, our ability to achieve milestones under these agreements, our collaborators exercising their options under these agreements and our entering into additional collaboration agreements; |

| • | our ability to initiate, and the progress and results of, our planned clinical trials of ARX788, ARX201 and ARX328; as well as the progress and results of clinical trials of our product candidates that are being developed by our collaborators; |

| • | the scope, progress, results and costs of preclinical development, laboratory testing and clinical trials for our other product candidates; |

| • | the costs, timing and outcome of regulatory review of our product candidates; |

| • | the costs and timing of future commercialization activities, including product manufacturing, marketing, sales and distribution, for any of our product candidates for which we receive marketing approval and do not collaborate for commercialization; |

| • | the revenue, if any, received from commercial sales of our product candidates for which we receive marketing approval; |

| • | the costs and timing of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending any intellectual property-related claims; and |

| • | the extent to which we acquire or in-license other products and technologies. |

We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to significantly delay, scale back or discontinue the development or commercialization of our product candidates or other research and development initiatives. We also could be required to:

| • | seek collaborators for our product candidates at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available; |

| • | relinquish or license on unfavorable terms our rights to our product candidates in markets where we otherwise would seek to pursue development or commercialization ourselves; or |

| • | make additional expenditures to license or acquire additional product candidates. |

Any of the above events could significantly harm our business, prospects, financial condition and results of operations and cause the price of our common stock to decline.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

We may seek additional capital through a combination of public and private equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. The incurrence of indebtedness would result in increased fixed payment obligations and could involve certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we raise additional funds through strategic partnerships and alliances and licensing arrangements

14

Table of Contents

with third parties, we may have to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms unfavorable to us.

We have limited sources of revenues and have not generated any revenues to date from product sales. Except for 2008 and 2012, we have never been profitable in any fiscal year since our inception and we may never achieve profitability again or sustain such profitability, which could depress the market price of our common stock, and could cause you to lose all or a part of your investment.

Our ability to become profitable depends on our ability to develop and commercialize our product candidates. To date, we have no internal or collaboration products approved for commercial sale in the United States and have not generated any revenues from sales of any product candidate, and we do not know when, or if, we will generate revenues in the future. We have one collaboration product approved for sale in Mexico in the field of animal health, but we have no products approved for use in humans. Other than the trials conducted for FGF21 and our collaboration product in the field of animal health, no clinical trials have been conducted in the United States to date with respect to any of our internal or collaboration product candidates. We do not anticipate generating revenues, if any, from sales of any of our internal product candidates for at least the next several years and we will never generate sales revenues from our internal or collaboration product candidates if we or our collaborators do not obtain regulatory approval to market them. Our collaboration revenues vary significantly quarter to quarter depending on the achievement of certain milestones, and the timing and achievement of these milestones are not in our control. Our ability to generate future revenues depends heavily on our success in:

| • | developing and securing U.S. and/or foreign regulatory approvals for our product candidates; |

| • | entering into additional collaboration agreements for certain of our product candidates; |

| • | achieving milestones and royalties under our collaboration agreements; |

| • | manufacturing commercial quantities of our product candidates at acceptable cost; |

| • | achieving broad market acceptance of our product candidates in the medical community and with third-party payors and patients; |

| • | commercializing our product candidates, assuming we receive regulatory approval; and |

| • | pursuing clinical development of our product candidates in additional indications. |

Even if we do generate product sales, we may never achieve or sustain profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the market price of our common stock and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations.

Our ability to utilize our net operating loss carryforwards and certain other tax attributes may be limited.

Pursuant to Sections 382 and 383 of the U.S. Internal Revenue Code of 1986, as amended, or the Code, annual use of our net operating loss and research and development credit carryforwards may be limited in the event a cumulative change in ownership of more than 50% occurs within a three-year period. As of December 31, 2011, we have completed an analysis regarding the limitation of net operating loss and research and development credit carryforwards under Sections 382 and 383 of the Code, and determined that we experienced an ownership change in June 2006. As a result of this ownership change, our net operating losses and research and development credits generated prior to June 2006 are limited under Sections 382 and 383 of the Code. Additionally, we have removed from the deferred tax assets $3.7 million of federal net operating loss carryforwards and $18.3 million of California net operating loss carryforwards that will expire unused solely due to the ownership change in June 2006. If it is determined that we have in the past experienced one or more additional ownership changes, or if we experience one or more ownership changes as a result of this offering or future transactions in our stock, we may be further limited in our ability to use our net operating loss carryforwards and other tax attributes to reduce taxes owed on the net taxable income that we earn. As of December 31, 2013, we had federal and state net operating loss carryforwards of approximately $26.2 million and $28.8 million, respectively, and federal and state research

15

Table of Contents

and development credit carryforwards of approximately $3.9 million and $3.1 million, respectively, which are currently limited and could be limited further if we experience an “ownership change.” Any such limitations on the ability to use our net operating loss carryforwards and other tax attributes could potentially result in increased future tax liability to us. For the three-year periods ending December 31, 2013 and March 31, 2014, we have not issued significant amounts of capital stock and do not anticipate that we have experienced a cumulative change in ownership of more than 50% during that period.

Risks Related to the Development and Regulatory Approval of Our Product Candidates

We are substantially dependent on the successful development and commercialization of our internal product candidates, including ARX788, ARX201, ARX328 and any future internal product candidates that we may identify, and we cannot give any assurance that we will receive regulatory approval for, or successfully commercialize, any of these product candidates.

We currently have a limited number of product candidates in clinical development, and our business depends on their successful development and commercialization. We currently have no drug products for sale and we may never be able to develop marketable drug products. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of drug products, among other things, are subject to extensive regulation by the FDA and other regulatory authorities outside the United States.

The development of ARX788, ARX201, ARX328 and any other product candidates we develop will require substantial investment in additional clinical development, management of clinical, preclinical and manufacturing activities, regulatory approval in multiple jurisdictions, obtaining manufacturing supply capability, building a commercial organization, and significant marketing efforts before we generate any revenues from product sales. We are not permitted to market our product candidates until we receive regulatory approval from the FDA or applicable regulatory authorities outside the United States. We are substantially dependent on the success of our internal product candidates, and we cannot provide any assurance that we will obtain regulatory approval for any of these product candidates or that these product candidates will be successfully commercialized.

We have not previously submitted a biologics license application, or BLA, to the FDA, or similar drug approval filings to comparable foreign authorities, for any product candidate, and we cannot be certain that any of our product candidates will be successful in clinical trials or receive regulatory approval. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials. If we do not receive regulatory approvals for our product candidates, we may not be able to continue our operations. Even if we successfully obtain regulatory approvals to market one or more of our product candidates, our revenues will be dependent, in part, upon the size of the markets in the territories for which we gain regulatory approval and have commercial rights, and we may not generate significant revenues from sales of such products, if approved.

We plan to seek regulatory approval to commercialize our product candidates in the United States, the European Union and in additional countries. While the scope of regulatory approval is similar in other countries, to obtain separate regulatory approval in each country we must comply with numerous and varying regulatory requirements of each such country regarding safety and efficacy, as well as governing, among other things, clinical trials and commercial sales, pricing and distribution of our product candidates, and we cannot predict success in these jurisdictions.

Our existing collaborations, including those with BMS, Merck, Eli Lilly, Agensys, ZMC and Hisun, are important to our business, and future collaborations may also be important to us. If we are unable to maintain any of these collaborations, or if these collaborations are not successful, our business could be adversely affected.

We have entered into collaborations with other biopharmaceutical companies to develop several of our product candidates, and such collaborations currently represent a significant portion of our product pipeline. In addition,

16

Table of Contents

we have entered into other collaborations pursuant to which we have provided access to our technology platforms to our collaborators to enable the optimization of their own product candidates. Our collaboration and license agreements include those with BMS, Merck, Eli Lilly, Agensys, ZMC and Hisun. These collaborations have provided us with important funding for our development programs and we expect to receive additional funding under these collaborations. Our existing collaborations, and any future collaborations we enter into, may pose a number of risks, including:

| • | collaborators have significant discretion in determining the efforts and resources that they will apply to the development and commercialization of product candidates under these collaborations; |

| • | collaborators may not perform their obligations as expected; |

| • | collaborators may not pursue development and commercialization of any product candidates that achieve regulatory approval, or may elect not to continue or renew development or commercialization programs based on clinical trial results, changes in the collaborators’ strategic focus or available funding, or external factors, such as an acquisition, that divert resources or create competing priorities; |

| • | collaborators may delay clinical trials, provide insufficient funding for a clinical trial program, stop a clinical trial or abandon a product candidate, repeat or conduct new clinical trials or require a new formulation of a product candidate for clinical testing; |

| • | collaborators could independently develop, or develop with third parties, products that compete directly or indirectly with the products or product candidates that are the subject of our collaboration agreements with them, which may cause collaborators to cease to devote resources to the commercialization of the product candidates that are covered under our collaboration with them; |

| • | a collaborator with marketing and distribution rights to one or more product candidates that are subject to a collaboration agreement with us and achieve regulatory approval may not commit sufficient resources to the marketing and distribution of such product or products; |

| • | disagreements with collaborators, including disagreements over proprietary rights, contract interpretation or the preferred course of development, might cause delays or termination of the research, development or commercialization of product candidates, lead to additional responsibilities for us with respect to product candidates, or result in litigation or arbitration, any of which would be time-consuming and expensive; |

| • | collaborators may not properly maintain or defend our intellectual property rights or may use our proprietary information in such a way as to result in litigation that could jeopardize or invalidate our intellectual property rights or proprietary information; |

| • | collaborators may infringe the intellectual property rights of third parties, which may expose us to litigation and potential liability; |

| • | collaborations may be terminated and, if terminated, in certain instances, we would potentially lose the right to pursue further development or commercialization of the applicable product candidates; |

| • | collaborators may learn about our technology and use this knowledge to compete with us; |

| • | negative results in preclinical or clinical trials conducted by our collaborators could produce results that harm or impair other products using our technology; |

| • | there may be conflicts between collaborators that could negatively affect those collaborations or others; and |

| • | the number and type of our collaborations could adversely affect our attractiveness to future collaborators or acquirers. |

If our collaborations do not result in the successful development and commercialization of products or if one of our collaborators terminates its agreement with us, or if our collaborators elect not to exercise their option under their collaboration agreement, we may not receive any future research and development funding or milestone or royalty payments under the collaboration. For example, we had a collaboration with Merck Serono International S.A. for

17

Table of Contents

ARX201 that was terminated in 2010 and resulted in the return to us of all rights to ARX201. In addition, if BMS does not achieve positive results in its planned Phase 2 clinical trial of ARX618 for the treatment of type 2 diabetes, BMS may elect to terminate our collaboration with respect to ARX618, and we would not receive future milestone or royalty payments under such collaboration. If we do not receive the funding we expect under these agreements, our continued development of our product candidates could be delayed, reduced or abandoned and we may need additional resources to develop additional product candidates. All of the risks relating to product development, regulatory approval and commercialization described in this prospectus also apply to the activities of our collaborators and there can be no assurance that our collaborations will produce positive results or successful products on a timely basis or at all. In addition, if BMS terminates our collaboration with them, under certain circumstances, we may owe BMS royalties with respect to product candidates covered by our agreements with BMS that we elect to commercialize, depending on the stage of development at which such product commercialization rights reverted back to us. If Merck terminates our collaboration with them, under certain circumstances, the royalties and milestone payments owed to us by Merck may be reduced or Merck may not be obligated to pay us any further royalties or milestone payments. See “Business—Collaborations” for more information regarding the termination provisions of our collaboration agreements. Additionally, subject to its contractual obligations to us, if a collaborator of ours is involved in a business combination or otherwise changes its business priorities, the collaborator might deemphasize or terminate the development or commercialization of any product candidate licensed to it by us. If one or more of our collaborators terminates its agreement with us, we may find it more difficult to attract new collaborators and our perception in the business and financial communities, as well as our stock price, could be adversely affected.

We may need to enter into additional collaborations for the development and commercialization of additional product candidates or to leverage our existing technology platforms, and we may not be able to do so.