Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - XCel Brands, Inc. | v380820_8k.htm |

June 2014 INVESTOR UPDATE

SAFE HARBOR THIS PRESENTATION CONTAINS FORWARD - LOOKING STATEMENTS BASED ON CURRENT EXPECTATIONS, ESTIMATES, AND PROJECTIONS ABOUT THE COMPANY'S OPERATIONS, INDUSTRY, FINANCIAL CONDITION, PERFORMANCE, AND RESULTS OF OPERATIONS. STATEMENTS CONTAINING WORDS SUCH AS "GUIDANCE , " " MAY ," " BELIEVE," "ANTICIPATE," " EXPECT," "INTEND," "PLAN ,"“PROJECT," " COULD,“ "WOULD,“ "SHOULD,“ "PROJECTIONS," AND " ESTIMATE," OR SIMILAR EXPRESSIONS CONSTITUTE FORWARD - LOOKING STATEMENTS . IN ADDITION, ANY STATEMENTS THAT REFER TO EXPECTATIONS, PROJECTIONS, OR OTHER CHARACTERIZATIONS OF FUTURE EVENTS OR CIRCUMSTANCES INCLUDING ANY UNDERLYING ASSUMPTIONS ARE FORWARD - LOOKING STATEMENTS. STATEMENTS REGARDING OUR CURRENT EXPECTATIONS ABOUT THE COMPANY'S FUTURE OPERATIONS, FINANCIAL CONDITIONS, PERFORMANCE, SERVICES, AND THE INDUSTRY IN WHICH WE OPERATE ARE FORWARD - LOOKING STATEMENTS THAT ARE SUBJECT TO A NUMBER OF RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD - LOOKING STATEMENTS. MORE INFORMATION ABOUT POTENTIAL RISK FACTORS THAT COULD AFFECT THE COMPANY'S BUSINESS AND ITS FINANCIAL RESULTS ARE INCLUDED IN THE COMPANY'S ANNUAL REPORT ON FORM IO - K FOR THE YEAR ENDED DECEMBER 31, 2013. PROJECTIONS ARE PROVIDED BY MANAGEMENT IN THIS PRESENTATION AND ARE BASED ON INFORMATION AVAILABLE TO US AT THIS TIME AND MANAGEMENT EXPECTS THAT INTERNAL PROJECTIONS AND EXPECTATIONS MAY CHANGE OVER TIME.

3 Differentiate by Design OUR MISSION: TO DESIGN AND PRODUCE THE BEST PRODUCTS FOR OUR FOLLOWERS AND PARTNERS

4 OUR BUSINESS MODEL IS BUILT FOR TODAY’S NEW SOCIAL ERA WE ARE A TOTAL OMNICHANNEL COMPANY

5 OUR BRANDS

6 x 56 Licenses x 5 DTR Partnerships x 150 Product Categories x 1,000+ Better Department Store Doors x 3 Lifestyle Stores (1) x USA , Mexico, Canada, Middle East, Philippines (1) Includes e - commerce at www.isaacmizrahi.com

7 x 2 DTR’s x 30 Product Categories x 2 Direct Response TV Networks x USA, Canada, UK x 1 DTR x 20 Product Categories x 1 Direct Response TV Network x USA, UK

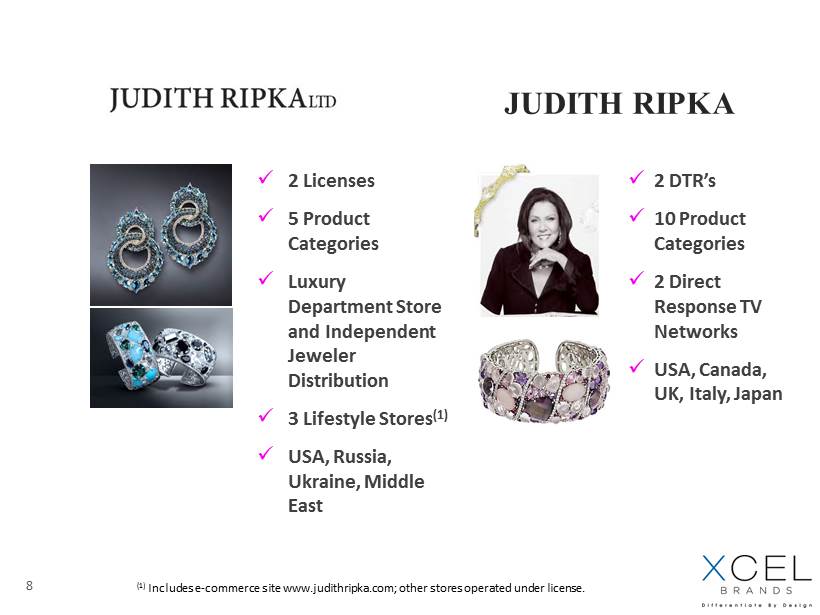

8 x 2 Licenses x 5 Product Categories x Luxury Department Store and Independent Jeweler Distribution x 3 Lifestyle Stores (1) x USA , Russia, Ukraine, Middle East x 2 DTR’s x 10 Product Categories x 2 Direct Response TV Networks x USA, Canada, UK, Italy, Japan JUDITH RIPKA (1) Includes e - commerce site www.judithripka.com; other stores operated under license.

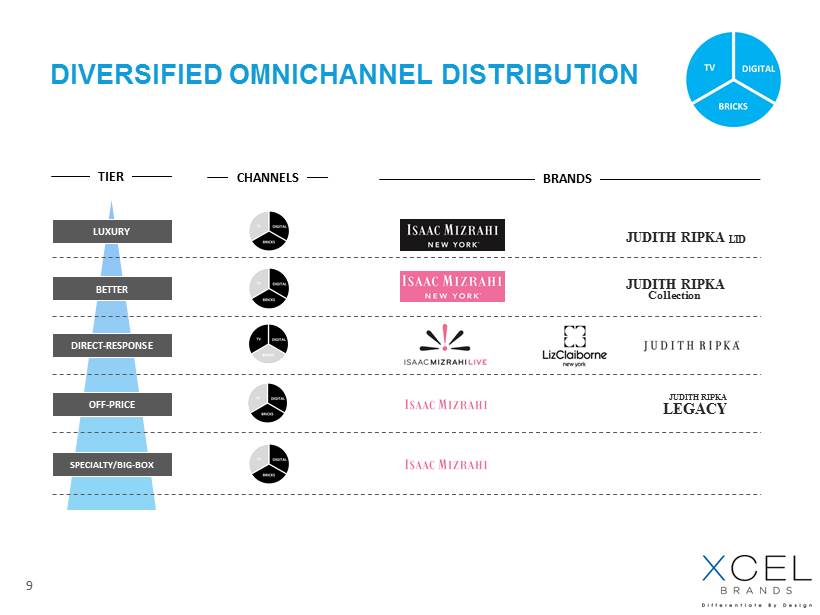

9 DIVERSIFIED OMNICHANNEL DISTRIBUTION LTD JUDITH RIPKA LUXURY BETTER DIRECT - RESPONSE OFF - PRICE SPECIALTY/BIG - BOX TIER CHANNELS BRANDS Collection JUDITH RIPKA LEGACY JUDITH RIPKA

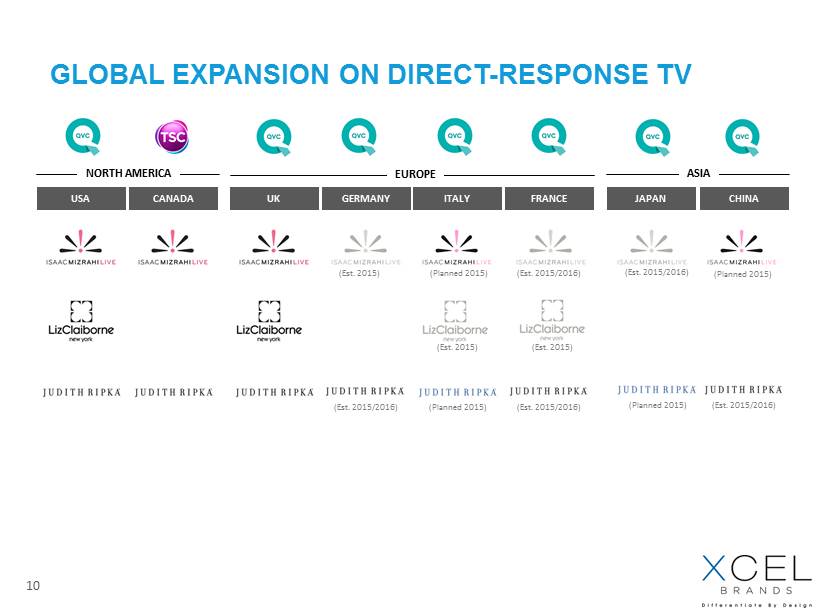

10 GLOBAL EXPANSION ON DIRECT - RESPONSE TV USA CANADA UK GERMANY ITALY FRANCE JAPAN CHINA (Planned 2015) (Est. 2015/2016) (Planned 2015) (Est. 2015/2016) (Est. 2015) (Est. 2015) (Est. 2015) (Planned 2015) (Est. 2015/2016) (Est. 2015/2016) (Est. 2015/2016) NORTH AMERICA EUROPE ASIA (Planned 2015)

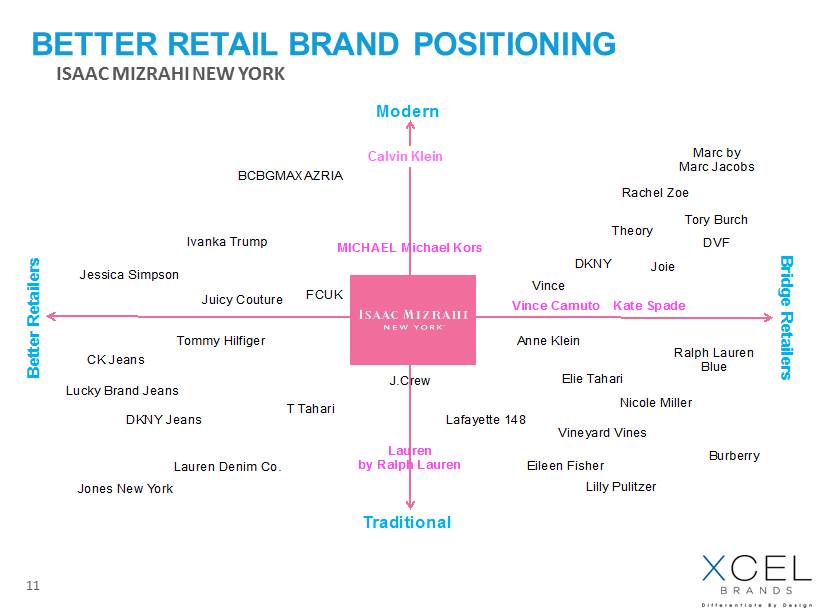

11 Modern Traditional B e t t e r R e t a i l e r s B r i d g e R e t a i l e r s MICHAEL Michael Kors Lauren by Ralph Lauren Tommy Hilfiger Elie Tahari Vince Tory Burch DVF Marc by Marc Jacobs Lilly Pulitzer Rachel Zoe Kate Spade Vineyard Vines J.Crew Juicy Couture BCBGMAXAZRIA Eileen Fisher Anne Klein Nicole Miller T Tahari Lucky Brand Jeans Jessica Simpson Ivanka Trump FCUK Ralph Lauren Blue Burberry Lafayette 148 Theory DKNY Joie Jones New York CK Jeans DKNY Jeans Lauren Denim Co. Vince Camuto Calvin Klein Calvin Klein BETTER RETAIL BRAND POSITIONING ISAAC MIZRAHI NEW YORK

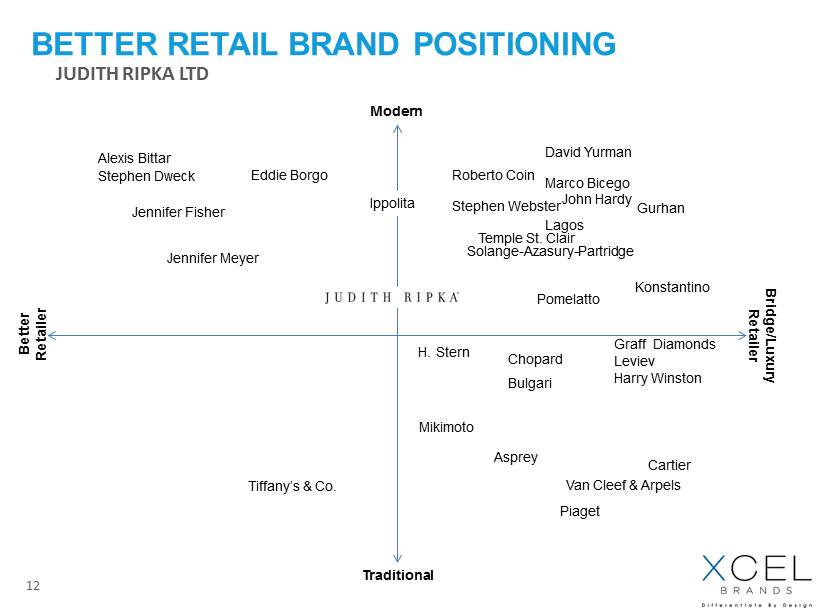

12 Tiffany’s & Co. Modern Better Retailer Bridge/Luxury Retailer Traditional David Yurman Ippolita Cartier Van Cleef & Arpels Harry Winston Bulgari Asprey Mikimoto Piaget Eddie Borgo Alexis Bittar Jennifer Meyer Jennifer Fisher Stephen Dweck Solange - Azasury - Partridge Konstantino Stephen Webster Pomelatto H. Stern Chopard Graff Diamonds Leviev Roberto Coin Marco Bicego John Hardy Lagos Gurhan Temple St. Clair BETTER RETAIL BRAND POSITIONING JUDITH RIPKA LTD

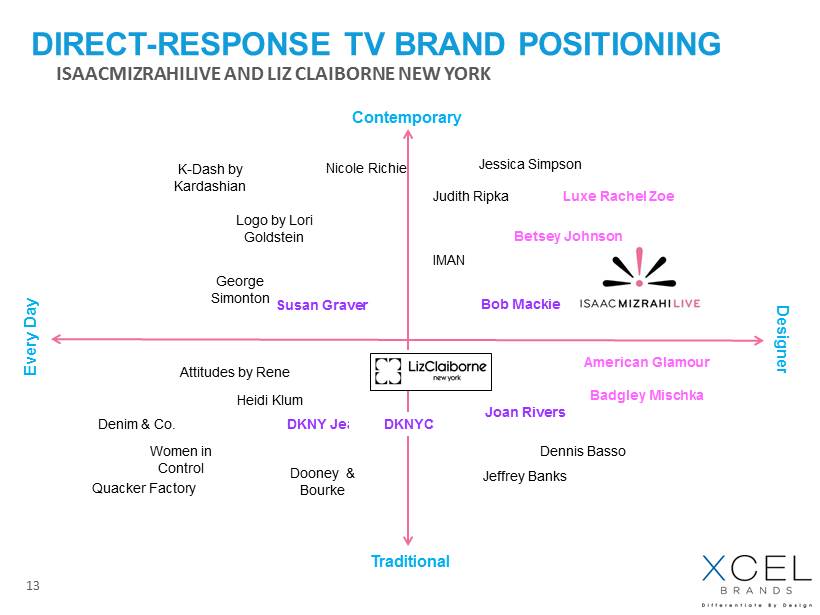

13 Traditional Every Day Designer Contemporary Luxe Rachel Zoe Bob Mackie Susan Graver Joan Rivers George Simonton Women in Control Quacker Factory Denim & Co. Attitudes by Rene Logo by Lori Goldstein K - Dash by Kardashian Dennis Basso American Glamour Badgley Mischka DKNY Jeans IMAN Jeffrey Banks Jessica Simpson DKNYC Betsey Johnson Judith Ripka Dooney & Bourke Nicole Richie Heidi Klum DIRECT - RESPONSE TV BRAND POSITIONING ISAACMIZRAHILIVE AND LIZ CLAIBORNE NEW YORK

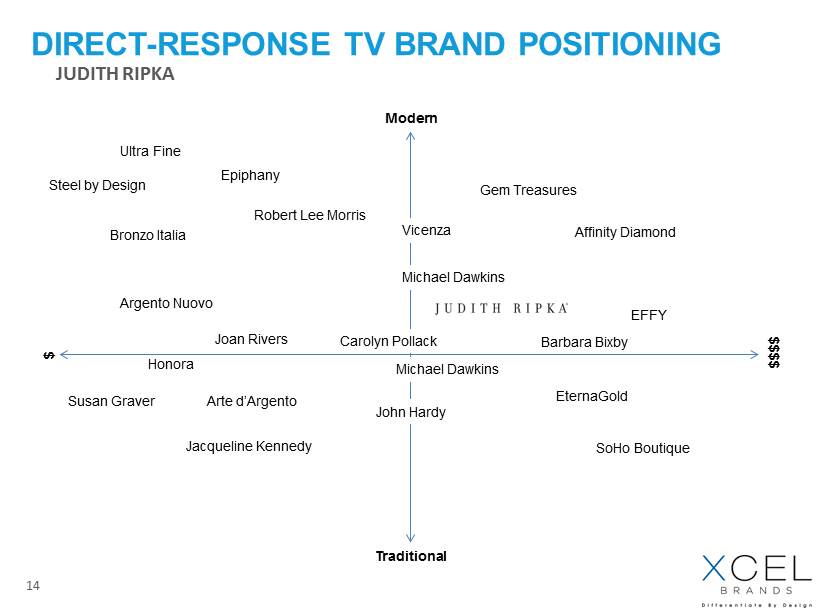

14 DIRECT - RESPONSE TV BRAND POSITIONING JUDITH RIPKA Modern $ $$$$ Traditional Robert Lee Morris John Hardy Michael Dawkins Jacqueline Kennedy Affinity Diamond Steel by Design Arte d’Argento Argento Nuovo Joan Rivers Honora EternaGold Epiphany Bronzo Italia Ultra Fine Susan Graver Vicenza SoHo Boutique EFFY Gem Treasures Carolyn Pollack Barbara Bixby Michael Dawkins

15 KEY GROWTH OPPORTUNITIES: Grow Existing Business Category Extensions Direct - to - Consumer (Retail) Acquisitions

16 KEY GROWTH OPPORTUNITIES: Grow Existing Business Category Extensions Direct - to - Consumer (Retail) Acquisitions

17 ▪ Key Strategies : x Continue to Increase Productivity x Launch New Categories x Expand Geographies x Increase On - Air Hours x Increase % of Online Sales x Engage direct - response TV customers DIRECT - RESPONSE TV IS A STRONG AND GROWING DISTRIBUTION CHANNEL WITH EXTRAORDINARY CUSTOMER ENGAGEMENT GROW EXISTING BUSINESS

18 ▪ Key Strategies: x Grow distribution of existing categories (stores and doors) x Continue to bring signed licensed categories to market x Enter into licenses for new categories x Enter into international license and distribution agreements ISAAC MIZRAHI NEW YORK AND JUDITH RIPKA LTD GROW EXISTING BUSINESS

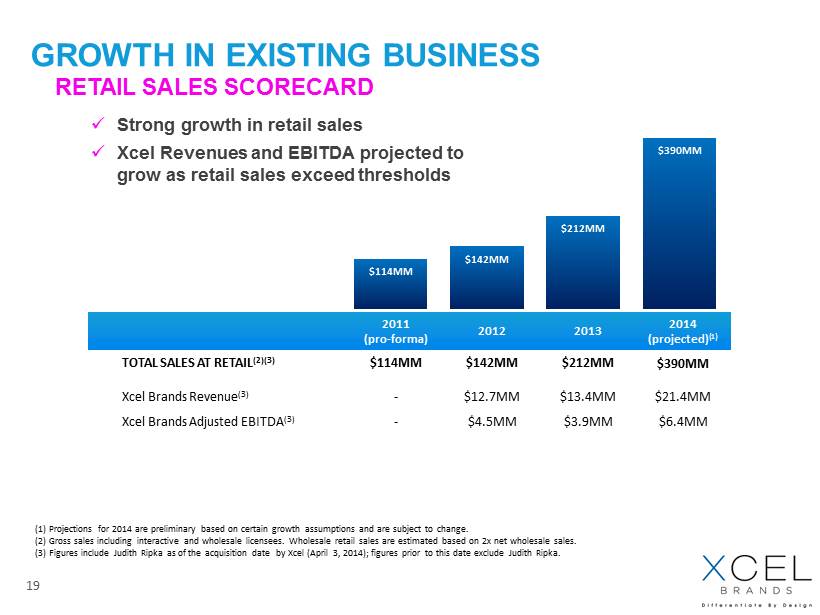

19 2011 (pro - forma) 2012 2013 2014 (projected) (1) TOTAL SALES AT RETAIL (2)(3) $114MM $142MM $212MM $390MM Xcel Brands Revenue (3) - $12.7MM $13.4MM $21.4MM Xcel Brands Adjusted EBITDA (3) - $4.5MM $3.9MM $6.4MM (1) Projections for 2014 are preliminary based on certain growth assumptions and are subject to change. (2) Gross sales including interactive and wholesale licensees. Wholesale retail sales are estimated based on 2x net wholesale sa les. (3) Figures include Judith Ripka as of the acquisition date by Xcel (April 3, 2014); figures prior to this date exclude Judi th Ripka. x Strong growth in retail sales x Xcel Revenues and EBITDA projected to grow as retail sales exceed thresholds GROWTH IN EXISTING BUSINESS RETAIL SALES SCORECARD $114MM $142MM $212MM $390MM

20 KEY GROWTH OPPORTUNITIES: Grow Existing Business Category Extensions Direct - to - Consumer (Retail) Acquisitions

21 DIRECT - TO - RETAIL AND PROMOTIONAL OPPORTUNITIES CATEGORY EXTENSIONS ▪ Key Strategies: x Sign new Direct - to - Retail (“DTR”) Partnerships with retailers in key categories x Sign new partnership/spokesperson deals for our designers/celebrities x DTR licenses and partnership/spokesperson deals leverage our reach via Direct - Response TV, social media, and other media to grow businesses with our DTR and promotional partners

22 x New Licenses under our B rands x New International Licenses for Wholesale and ITV x New Collaborations/Co - Branding Opportunities x New Market Segments x Increased Door Count CATEGORY EXTENSIONS OPERATING METRICS SCORECARD 2011 2012 2013 2014 (proj.) (1) ▪ Categories Signed: Signed Licenses Categories Launched Est. Retail Doors Market Segments 40 18 0 0 6 120 40 8 125+ 9 150 59 25 1,000+ 12 170 65 40 1,500+ 12 ▪ Collaborations/Co - Branding: 0 1 5 6 40 1 5 150 120 6 170 150 (1) Figures include Judith Ripka as of the acquisition date by Xcel (April 3, 2014); figures prior to this date exclude Judith R ipk a.

23 KEY GROWTH OPPORTUNITIES: Grow Existing Business Category Extensions Direct - to - Consumer (Retail) Acquisitions

24 DIRECT - TO - CONSUMER DISTRIBUTION ▪ Key Strategies: x Retail stores opened under the Isaac Mizrahi New York Brand (1 st store opened May 2013, 2 nd store opened February 2014) x E - commerce for IMNY launched May 2014 x E - commerce for Judith Ripka LTD acquired April 2014; 2 additional Judith Ripka LTD retail stores currently operated under license x Up to 6 additional stores planned for 2014

25 KEY GROWTH OPPORTUNITIES: Grow Existing Business Category Extensions Direct - to - Consumer (Retail) Acquisitions

26 ACQUISITIONS - GATES MUST MEET ALL OF THE FOLLOWING CRITERIA TO BE CONSIDERED: Strategic Synergistic Accretive x x x

27 We Believe: The Way People Shop will continue to Change The Acceleration of Change will continue to increase The Way We Need to Reach our Customers will continue to Change Our focus o n Design and OmniChannel d istribution in this New Social Era positions us well to benefit from the Changes that are Coming We Know: One Thing r emains Constant – Sales and customer satisfaction are achieved through great products! POSITIONED FOR THE FUTURE

28 APPENDIX A - NON - GAAP FINANCIAL INFORMATION Statements included in the presentation include non - GAAP measures and should be read along with the accompanying tables which provide a reconciliation of non - GAAP measures to GAAP measures . Adjusted EBITDA is a non - GAAP measure and excludes interest, income taxes, depreciation and amortization expenses, and other oncash expense including stock - based compensation, gain on reduction of contingent obligations and gain loss on extinguishment of debt, from net income . Management believes that these non - GAAP measures provide additional useful information to allow readers to compare the financial results between periods . Non - GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP , and investors should consider the company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the company . Non - GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the company’s results or financial condition as reported under GAAP . A reconciliation of Net Income to Adjusted EBITDA is included in Item 7 of the Company’s 10 K filing made as of April 11 , 2014 .

June 2014