Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - AMAYA Global Holdings Corp. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - AMAYA Global Holdings Corp. | v380481_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - AMAYA Global Holdings Corp. | v380481_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - AMAYA Global Holdings Corp. | v380481_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - AMAYA Global Holdings Corp. | v380481_ex31-1.htm |

| EX-21 - EXHIBIT 21 - AMAYA Global Holdings Corp. | v380481_ex21.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

AMENDMENT NO. 1

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Fiscal Year Ended September 30, 2013. |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________to ___________ |

Commission file number: 333-174874

General Agriculture Corporation

(Exact name of Registrant as specified in its charter)

| Delaware | 35-2379917 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| Room 801, Plaza B, Yonghe Building, | |

| No.28 AnDingMen East Street | |

| Dongcheng District | |

| Beijing, China | 100007 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number:

Phone: 86-10-64097316

Fax: 86-10-64097026

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

* The registrant is a voluntary filer of reports required to be filed by certain companies under Section 13 or 15(d) of the Securities Exchange Act of 1934 and has filed all reports that would have been required to have been filed by the registrant during the preceding 12 months had it been subject to such filing requirements during the entirety of such period.

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).* Yes x No ¨ *The registrant has not completed the construction of its corporate Web site.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained herein, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

As of March 31, 2013, the aggregate market value of the voting stock held by non-affiliates of the Registrant (3,754,849 shares of common stock held by non-affiliate shareholders) was $ 4,505,818.

On December 15, 2013, we had 15,918,940 shares of common stock issued and outstanding. On July 12, 2013, the Company effected the 1 for 8 reverse split of the Company’s common stock

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

We are filing this Amendment No. 1 to amend the Form 10-K (the “Report”) of General Agriculture Corporation (the “Company”) for the fiscal year ended September 30, 2013, as filed with the Securities and Exchange Commission on December 27, 2013, to correct the cover page to indicate that the Company is a voluntary filer, to add exhibits in Item 15, to conform signatures on the signature page and to insert a new audit opinion for the following reason:

On April 3, 2014, the Company engaged Friedman LLP as its independent registered public accounting firm to re-audit the consolidated financial statements for the years ended September 30, 2013 and 2012, in order to replace the report issued by the predecessor auditors. Friedman LLP’s report dated June 4, 2014 is included in this amended Form 10-K. The re-audit of our consolidated financial statements by Friedman LLP for these two years did not find any material misstatements to warrant any restatements of the previously issued financial statements audited by the predecessor auditors for the same periods. We have also updated Item 9 and Item 14 to reflect this change of auditors.

Other than as discussed in this Explanatory Note, no other changes have been made in this Amendment No. 1 and does not reflect events that may have occurred subsequent to the original filing date and does not modify or update in any way other disclosures made in the original Report, except as disclosed in Note 15 to our financial statements. However, for the convenience of the reader, this Amendment No. 1 sets forth the original Report in its entirety as amended by the corrections discussed above.

| 1 |

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. In evaluating such statements, prospective investors should carefully review various risks and uncertainties identified in this Report on Form 10-K (“Report”), including the matters set forth under the captions “Risk Factors” and in the Company’s other SEC filings. These risks and uncertainties could cause the Company’s actual results to differ materially from those indicated in the forward-looking statements.

Although forward-looking statements in this Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Relating to Our Business” below, as well as those discussed elsewhere in this Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. We file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549 on official business days during the hours of 10 a.m. to 3 p.m. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including the Company.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Report. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

| 2 |

References to “GELT” shall refer to General Agriculture Corporation. References to the “Company” “we,” “our,” “ours” and “us,” shall refer to General Agriculture Corporation, and include our operating subsidiaries in the PRC, Xingguo General Fruit Industry Development Co., Ltd. (“General Fruit”) and its wholly owned subsidiary Xingguo General Red Navel Orange Preservation Company Ltd. (“General Preservation”).

BUSINESS

Company Background

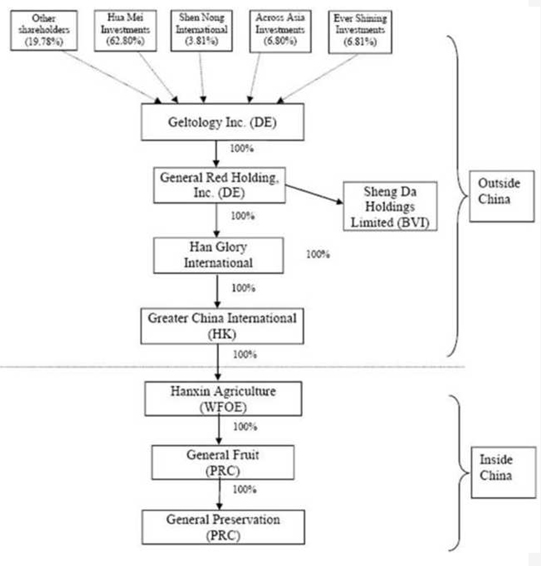

General Agriculture Corporation (“GELT”) was established under the laws of the State of Delaware on March 24, 2010. On July 12, 2013, GELT filed with the Secretary of State, Delaware a Certificate of Amendment to change its name to General Agriculture Corporation. GELT, through its direct operating subsidiaries General Fruit and General Preservation, is primarily engaged in planting, preserving, packaging and marketing premium navel oranges for distribution and sale throughout the People’s Republic of China (“PRC”).

On July 11, 2012, GELT completed a reverse acquisition of General Red Holding, Inc. (“GRH”), which was established under the laws of the State of Delaware on January 18, 2011. To accomplish the Share Exchange Agreement, GELT issued to GRH an aggregate of 125,112,803 shares of the common stock of GELT, at par value of $0.0001 per share. GELT was delivered with zero assets and zero liabilities at time of closing. Immediately prior to the Share Exchange, GELT had 6,750,000 shares of Common Stock issued and outstanding. Simultaneously with the transaction, the two principal shareholders of GELT surrendered for cancellation an aggregate of 4,513,252 shares of Common Stock beneficially owned by them. The transaction was regarded as a reverse merger whereby GRH was considered to be the accounting acquirer. Although the Company is a legal parent company, the share exchange was treated as a recapitalization of GRH. Thus, GRH is the continuing entity for financial reporting purposes. The financial statements have been prepared as if GRH had always been the reporting company and then on the share exchange date, had reorganized its capital stock.

On September 30, 2011, GRH entered into a Share Transfer and Issuance Agreement (the “Agreement”) with Han Glory International Investment Limited (“Han Glory International”), a company incorporated on April 28, 2011 under the laws of British Virgin Islands and Hua Mei Investments Limited (“Hua Mei”), a company incorporated on April 26, 2011 under the laws of the British Virgin Islands. Under the Agreement, GRH issued 74,814,862 shares to Hua Mei, the sole stockholder of Han Glory International, in exchange for all shares and beneficial interest of Han Glory International. This transaction is treated as a reverse merger, and therefore, after the share exchange, Han Glory International became the wholly owned subsidiary of GRH.

On May 18, 2011, Han Glory International purchased all shares of Greater China International Investment Limited (“Greater China International”), a company incorporated on December 4, 2009 under the laws of Hong Kong, from Zhihao Zhang, the sole stockholder of Greater China International, for $1,290 (HK$10,000). As a result, Greater China International became the wholly owned subsidiary of Han Glory International.

On January 13, 2010, Greater China International formed Nanchang Hanxin Agriculture Technology Co., Ltd, a wholly foreign-owned enterprise (“WFOE”) in the city of Nanchang, Jiangxi Province, the PRC.

On February 5, 2010, WFOE purchased all shares of Xingguo General Fruit Industry Development Co., Ltd (“General Fruit”) from Jiangjun Hong Group Co., Ltd., Xingping Hou and Jiefeng Ren for $293,400. As a result, WFOE acquired 100% interest in General Fruit. This transaction was a capital transaction in substance. That is, the transaction was a reverse recapitalization, equivalent to the issuance of stock by General Fruit for the net monetary assets of WFOE accompanied by a recapitalization.

| 3 |

General Fruit was formed in Xingguo County, Jiangxi Province, under the corporate laws of PRC on March 5, 2003. The primary business of General Fruit is to grow and sell navel oranges. On July 14, 2008, after a series of equity transfer agreements, General Fruit acquired 90% interest in Xingguo General Red Navel Orange Preservation Company, Ltd. (“General Preservation”). On July 25, 2010, General Fruit purchased the remaining 10% interest in General Preservation from Xingping Hou, the minority stockholder, for $295,000 (RMB 2,000,000) and owns 100% of General Preservation thereafter.

Our current corporate structure is as follows:

| 4 |

Our Current Business and Products

We are one of the leading companies engaged in the planting, post-harvest processing and temperature controlled preservation and storage of navel oranges in China. We contract with approximately 30 farmers to plant and harvest oranges in our orchards and provide them with not only the raw materials necessary to plant, but also technical guidance and services to monitor quality of the crops. When navel oranges are harvested, we preserve, store and subsequently sell them throughout many regions in the PRC. In addition to contracting with local farmers for the planting and harvesting work in our orchards, we purchase oranges from farmers and cooperatives who do not use our land. The oranges purchased from other farmers and cooperatives are not necessarily planted and harvested as organic navel oranges. However, once purchased we commercially process and preserve them according to the standards of organic navel oranges. Even though we plant navel oranges in our orchards certified as organic, we do not market any of our navel oranges as organic to the consumer market. All of the navel oranges we sell use the “General Red” brand name. We have received numerous honors and certifications due to the quality of our branded navel oranges, including “High Quality Navel Orange” awarded by China (Ganzhou) Navel Orange Festival committee, and “China Famous Fruit” awarded by China Fruit Distribution Association.

Our goal is to become the largest integrated grower, packager and distributor of navel oranges in China. We have invested in our business by devoting resources to the establishment of significant orange orchards, by building a state of the art storage and preservation facility and by marketing and advertising our products. Currently, we have 701,864 orange trees in 20,112.84 mu of land (approximately 3,313.3 acres) in Ganzhou of Jiangxi Province. We acquired 10,027.94 mu of the land (approximately 1,651.97 acres) from the local government, and developed our own orange orchards on that land, in which about 228,606 orange trees were planted. In addition, we leased from individual farmers 10,084.9 mu of orange orchards (approximately 1,661.36 acres and 473,258 orange trees).

There are four models that our company implements to operate our business of the orange production and procurement. In the company owned orchards, we have direct employees working in the orchards, and there is no involvement of unrelated third parties in production. In other orchards that we own, we hire local farmers to take care of orchards at a fixed fee per tree, which has been in the range of approximately $ 8.0 to $ 9.0 per tree since 2011. We provide local farmers with raw materials, such as seedlings and fertilizer, as well as production tools, electricity and irrigation facilities necessary for planting and harvesting the oranges. Our in-house fruit forest management and protection team provide technical support and guidance to the farmers to optimize cultivation, irrigation, fertilization, water and soil conservation, administration of organic pesticides for weed and pest control, and protection against frost and rain. We instruct farmers on how to implement these quality control measures. For the leased orange orchards, we adopt a different model. Prior to the growing season, the farmers enter into short-term sales contracts with us, which provide that we will purchase a specified quantity of oranges from the farmers, based on weight, at a specified purchase price. We divide the production yield with farmers, so that 60% of all product is for us, and 40% is for the farmers. These contracts further provide that we are only obligated to purchase those oranges that meet our quality specifications. We believe that this is an attractive model for farmers, as it allows them to bypass the logistics and added costs of going through wholesale or retail markets to sell their oranges. This model is also beneficial to us because we have an ongoing supply of oranges, which we know are grown according to our specifications, enabling us to consistently maintain our high level of quality. In addition to production in our owned and leased orchards, we buy navel oranges from outside parties. However, the production volume from our owned and leased orchards has increased from 35% of total sales in fiscal year 2009, to 72% in fiscal year 2012, and 77% in fiscal year 2013.

In Ganzhou, Jiangxi, we constructed one of the largest navel orange temperature-controlled preservation facilities in the Southern Jiangxi region of China on 19,176.31 square meters of land (approximately 4.74 acres), of which 14,907.92 square meters (approximately 3.68 acres) is the construction area of the main structure for the preservation facility. We have approximately 4,268.39 square meters (approximately 1.05 acres) of administrative offices, dormitories and power supply rooms next to the facility. The maximum storage capacity is 7,000 tons. Currently, most of the navel orange storage facilities in the Southern Jiangxi region are cold storage, with few that are temperature controlled facilities. The temperature-controlled storage and preservation technology used in our facility comes from Beijing Furui Ventilation Protection Company (“Beijing Furui”), which was previously a subsidiary of China Agricultural University and Chinese Academy of Agricultural Sciences. Beijing Furui was the construction contractor in the design and build of our temperature-controlled preservation facility, and provided the main equipment used in the facility. We purchased our post-harvest processing equipment, which includes our selection and packaging lines, from MAF RODA Group of Spain (“MAF RODA”). As part of the purchasing contract, MAF RODA provides us with technical training on how to operate the equipment, which includes educating our employees about the automatic control technology used in the equipment. We have two modern sorting lines at our Ganzhou facility. The sorting line has a sorting capacity of 40 tons/hour. These sorting lines clean, disinfect and apply wax coating to the oranges, and then select, classify, and send the naval oranges to pre-storage.

| 5 |

Industry and Market Overview

There are three primary areas of business operations in the navel orange industry: production, post-harvest processing and preservation.

Navel Orange Production

The navel orange industry has been growing rapidly in China due to governmental support and an increase in demand for navel oranges. The Ministry of Agriculture and the Municipal Government of Ganzhou have provided incentives to encourage the production of navel oranges, including tax reduction, subsidies, free education, seedling promotion, and production standardization.

Navel orange production requires stringent climate conditions, therefore, there are limited areas in the world where navel oranges can be produced. As a result, production is primarily concentrated in warmer climates, such as California, Spain, South Africa, Australia, and “Gannan – Southern Hunan – Northern Guangxi” in China. The Chinese government has identified the Gannan area as "the hometown of the navel orange in China", and has been supportive of local producers. The Ministry of Agriculture named Gannan navel oranges as one of the nine competitive agricultural products in the country, and listed Gannan as one of the key developing areas.

General Fruit is one of six leading enterprises in Gannan and plays a decisive role in Gannan’s navel orange industry. “Ganan Navel Orange” is the common brand shared by all producers in Gannan area. We believe that “General Red” stands out among all of the Gannan brands because of the measures we take to ensure quality along with our consistent branding strategy.

We anticipate that the demand for navel oranges in China will continue to increase. According to the Ministry of Agriculture of China, the per capita consumption of fresh oranges is 12.7 kg in China, compared to 17.2 kg worldwide. Approximately 98% of navel oranges produced in China are sold in the domestic market, with only 2% exported to other countries. More than 95% of citrus fresh fruit is sold domestically in China, with less than 5% of such fruit exported. A large portion of raw materials for orange juice is imported from Brazil and the US. We believe that such data indicates there is a significant room for growth in this industry in China.

Post-harvest processing

The post-harvest processing of harvested fruits also has broad prospects in China. Post-harvest processing includes selecting, grading, cleaning, pre-cooling, waxing and packaging. Proper processing can minimize post-harvest loss, maintain the high nutritional content and freshness, slow down the metabolic process of fruit in its natural state, enhance the appearance of the fruit and extend the life of the fruit. Currently, 95% of citrus fresh fruit are sold in domestic market in China with the rest of about 5% exported overseas, and 10% of fresh fruit are processed in the post-harvesting period in China, lower than the average level of 35% worldwide.

Preservation

The storaging and preserving technology in China lags behind that of developed countries in the citrus exports area due to grossly inadequate storage and preservation facilities. According to data published in the “Agricultural Product Cold-Chain Logistics Development Plan” formulated by China National Development and Reform Commission, the rate of cold chain distribution of fruits and vegetables is only 5%, and the rate of refrigerated transportation hardly reaches 15%, which is much lower than in developed countries. Cold chain distribution is a temperature controlled distribution supply chain, resulting in an uninterrupted series of storage and distribution activities by maintaining a given temperature. It is used to help extend and ensure the shelf life of products, including agricultural products. According to China National Development and Reform Commission, the loss rate in distribution of oranges in China is 20-30%, compared with less than 5% in developed countries. The National Development and Reform Commission of China developed a "cold chain logistics development plan" in 2010, to improve the cold chain distribution rate to 20% and refrigerated transportation rate to 30%, and reduce loss rate in distribution to 15%.

| 6 |

Most navel oranges mature in October and November, and are distributed during the months of October through January. General Fruit can extend its sales cycle to June of the following year due to its strong preservation abilities, which enables us to sell navel oranges at a higher price during the off-season when other distributors may not have sufficient supply.

Our Competitive Strengths

Our competitive strengths include:

Quality of Oranges and Brand Name. We are committed to distributing oranges that our management believes meet high quality standards. Our agreements with the farmers and suppliers provide that each orange must have a solid shape, even stem and a smooth surface, and be free of any black spots, fertilizer spots, cracks or worms. For the farmers we contract with, our agreements further provide that oranges may not be picked when it is raining, or within three days of rain, when it is foggy or before the dew on the orange tree has dried. Pursuant to the terms of our supply contracts, we will not buy navel oranges if the quality standards are not met. For the orchards that we farm with our own employees, we apply the same quality standards described above. The Company has received more than 20 honors related to navel oranges and the Company’s preservation facility. Among the honors the Company has received are the titles of “Chinese Famous Brand” by the Fruits Logistics Association of China, “Famous Agricultural Brand of Jiangxi” by the Jiangxi provincial government, and “Key Leading Enterprise of Ganzhou in Agricultural Industrialization” by the Ganzhou municipal government.

Geographical Advantage. Compared to navel orange competitors located outside of our region, the location of our planting area affords us numerous advantages, including proximity to China’s transportation network of highways, desirable climate conditions and soil for cultivating organic oranges. Our planting area is close to the Beijing-Kowloon railroad, 105 state road, 323 national highway, 319 state road, Kunsha Highway, and Quannan Highway. Using these roads, Jinggangshan airport is approximately one hour drive while the port cities of Shenzhen, Guangzhou and Xiamen are all within five hours by car. Our planting area is located in a subtropical monsoon climate, with abundant rainfall, sunshine and four distinct seasons. The average annual temperature is 18.9°C with a low of -3°C and relative humidity of 70-80%. There is an average annual sunshine exposure of 1,992.3 hours and approximately 1,600 mm of annual rainfall making it very suitable for growing oranges. The soil at our planting area is rich in organic matter with soil pH levels of 6-6.3 (optimal for orange cultivation). Soil sample tests are conducted by experts to comply with the provisions of the Chinese government’s NY5016-2001 standard. In July 2007, Jiangxi Province Academy of Agricultural Sciences Green Food Environment Test Center conducted tests on the soil, irrigation water and air quality of the Company’s navel orange planting base located in Chongxian Township, Xingguo County, Jiangxi Province and concluded that the planting base was suitable for the production of organic products.

Top of the Line Sorting Machines. Our processing facilities utilize top of the line sorting machines purchased from leading manufacturers in this industry, such as MAF RODA Group and Yantai Sinclair Economic and Trade Co., Ltd. MAF Roda is the world's largest fresh produce procurement, processing, and packaging equipment manufacturer, leading the world in the development of agricultural products packaging industry, and its products represent the top of the line in the field. Yantai Sinclair Economic and Trade Co., Ltd., is the world's leading provider of fresh fruits and vegetables labeling systems. All of the world's major fruit producing areas are served by Sinclair's systems, which meet European specifications and regulations regarding fruits and vegetables, the U.S. Food and Drug Administration (FDA), and the world's leading supermarket chain requirements. Sinclair currently has tens of thousands of devices running worldwide.

| 7 |

Technology Advantage. Our controlled atmosphere storage and preservation technology allows us to maintain a storage period of up to 6-8 months, improve orange appearance and color, and retain a fresh flavor. This is necessary for our oranges to achieve the status of "Gannan navel orange" that meets the national standard (Standard No. GB/T200355-2006). Our controlled atmosphere storage equipment is primarily provided by the China Agricultural University, Chinese Academy of Agricultural Sciences, and its affiliated company, Beijing Furuitong Technology Ltd. Beijing Furuitong Technology Ltd. specializes in the research and development of fruit and vegetable storage and preservation technology, manufacturing of cold atmosphere equipment, and construction of controlled atmosphere storage projects.

Management and Expert Team. We have established a specialized fruit forest management and expert team, who work with the contract farmers to optimize cultivation, irrigation, fertilization, water and soil conservation, administration of pesticides for weed and pest control, and to educate about protection against frost and rain. Our team has learned through various lectures taught by a professor of Huazhong Agricultural University, a member of the Chinese Academy of Engineering, and by other fruit experts in China. These lectures were part of an agricultural technology promotional series, provided by the Chinese government for free in support of the planting of navel oranges in the Southern Jiangxi region. In these seminars and lectures, our team received introduction of some high-yield (in terms of quantity) and high-quality (in terms of quality) navel orange varieties suitable for the Southern Jiangxi region, and our team was taught standardized production, pollution-free cultivation and other cultivation techniques.

Growth Strategy

We intend to leverage our existing operations to create a fully integrated business that grows, preserves and distributes high-quality navel oranges, other fruits and vegetables. Our growth strategy will be focused on the increase of orchard and orange trees in the short term, and then distribution of general fruits and vegetables in the long term, and our approach includes:

Increasing Navel Orange Orchards in Gannan. Within the next 2 years, we will continue to build, acquire and lease navel orange orchards in Gannan region, because of the geographic advantage of Gannan we discussed earlier. During the year ended September 30, 2013, we leased 165,278 orange trees in Gannan. We aim to increase the number of orange trees in our own and leased orange orchards by 150,000 trees within the next 1 to 2 years. We plan to spend approximately $8.3 million (about RMB50 million) to implement this strategy, financed through cash flow of existing operations or outside financing.

Developing Planting Areas in Key Sales Regions. In the long term, our fully integrated business model begins with the planting and growing of fruits and vegetables. To that end, we plan on establishing planting areas in each of the major fruit producing areas in the PRC.

Establishing Temperature Controlled Warehouses and Distribution Centers in Key Sales Regions. In the long term, we plan to purchase or construct modern, temperature-controlled preservation warehouses in major fruit and vegetable consumer markets, including the Yangtze River Delta, Pearl River Delta, Beijing-Tianjin region, and the provincial capital cities. We also plan to build fruit and vegetable distribution centers with cold-storage services.

Promoting General Red Brand Name. As part of continuous efforts in the next few years, we plan to promote and enhance the “General Red” brand by placing General Red trademark signs and advertisements in member stores and in the target markets, employing consistent product management system and high standards for product quality, conducting customer feedback surveys, and bringing added convenience to end-customers. During the years ended September 30, 2013 and 2012, the Company spent advertising expenses of $31,833 and $250,647, respectively. For the next 12 months (October 1, 2013 through September 30, 2014), we anticipate spending approximately $83,333 (about RMB500,000) to promote our brand name, primarily through stores, Internet, TV and radio advertisements. The implementation of this strategy is to be financed through cash flow of existing operations.

Competition

To our knowledge, we are one of the largest integrated navel orange companies with both growing areas and post-harvest processing and preservation facilities in China. Our competitors are pure navel orange growers, pure post-harvest processors, or both. The largest competitor in navel orange growing is Jiangxi Wangpin Agricultural Science and Technology Development Co. Ltd. with 6,880 mu of navel orange groves. The largest competitors in post-harvest processing and preservation are Anyuan Shengda Fruit Industrial Co. Ltd with 20,000 metric ton of preservation capacity, and Xinfeng Yuhe Agricultural Development Co. Ltd. with 7,000 metric tons of preservation capacity.

| 8 |

The following table lists our competitors in China and their profiles, based upon information accessible to us:

| Planting Base (mu) | ||||||||||||||||||

| Company Name | Total Area (mu) | Area of Organic Planting Base for Navel Orange | Sorting Line Capacity (ton/hour) | Storage Facility Capacity (tons) | Leading Enterprise Qualification1 | |||||||||||||

| Anyuan County Anshengda Fruit Industry Co., Ltd. | 5,000 | None | 40 | 20000 | Provincial Level | |||||||||||||

| Jiangxi Gannan Fruit Industry Holdings Co., Ltd. | 3,250 | None | 20 | None | None | |||||||||||||

| Jiangxi Yangshi Nanbei Fresh Fruit Co., Ltd. | None | None | 60 | None | Provincial Level | |||||||||||||

| Jiangxi Wangpin Agricultural Science and Technology Development Co., Ltd. | 6,880 | 1,000 | 80 | None | Provincial Level | |||||||||||||

| Jiangxi Shengwei Fruit Industry Co., Ltd. | None | None | 20 | 6000 | None | |||||||||||||

| Jiangxi Shengdi Fruit Industry Development Co., Ltd. | 3,000 | None | None | None | None | |||||||||||||

| Xinfeng County Yuhe Agricultural Development Co., Ltd. | None | None | 40 | 10000 | Provincial Level | |||||||||||||

| Xunwu County Yuanxing Fruit Industry Co., Ltd. | 3,000 | None | 25 | 5000 | Provincial Level | |||||||||||||

| Huichang County Lvfeng Fruit Industry Co., Ltd. | None | None | 15 | 3000 | Provincial Level | |||||||||||||

| Anyuan County Jinfeng Linong Products Co., Ltd. | None | None | 15 | None | None | |||||||||||||

(1) The Leading Enterprise Qualification is designated by the government based on the company’s operational scale, economic benefits, and influence in the region. It represents a company’s prestigious status in the industry and in the region. There are three levels of Leading Enterprise Qualifications, National, Provincial and Municipal, designated by central government, provincial government and municipal government respectively.

Our competitive advantages are that we are an integrated player and one of the largest growers of navel oranges in China. We control the source of the navel oranges with our company’s high quality standards. In addition, our preservation facility is an air-controlled facility in which we control not only the temperature but also the composition of the air. A nitrogen rich air environment slows down the oxidation process and prolongs the reservation life of the fruits. Our competitors in orange preservation space mostly use temperature controlled facility instead of the more advanced air controlled technology.

Suppliers

In addition to the production of oranges in our own and leased orchards, we source oranges from outside parties. We are supplied with what is referred to as “raw navel oranges,” which are oranges prior to post-harvest processing.

Set forth below is a list of our top four suppliers during the year ended September 30, 2013:

| Supplier | Percentage of total supply | |||

| Ningdu County Qingtang Township Xiangyun Fruits Professional Cooperative | 20.30 | % | ||

| Ningdu County Anfu Township Shuoguomanyuan Professional Cooperative | 16.27 | % | ||

| Ningdu County Qingtang Township Qinglong Fruits Professional Cooperative | 10.40 | % | ||

| Yudu Xinyuan Fruits development Co., Ltd. | 10.12 | % | ||

| 9 |

In a typical supply contract that we enter into with an outside party, we require the supplier to supply a certain amount of navel oranges at a predefined price pursuant to our quality standards during the harvest season. The suppliers are responsible for the cost of transportation to our facility. Upon execution of purchase contracts with local farmer collectives, as a measure to secure title in the navel oranges to be purchased, the Company usually makes an advance payment equivalent to approximately 10% to 20% of the total contract price when executing purchase contracts with local farmer collectives. Upon receipt of navel oranges, these advance payments will be applied against related invoices.

The ratio of outside supplies of navel oranges has declined from approximately 55% in fiscal year 2011, 28% in fiscal year 2012 to 23% in fiscal year 2013, due to the increase in navel orange trees that we own and lease.

When we initially develop the orange groves, our fruit seedlings are sourced from seedling cultivation centers, which are typically the result of the joint efforts among the agriculture research institutes, and government agency in agriculture technology promotion.

We purchase the fertilizers, other production materials and tools from the public market. We have not had any problems in sourcing the supplies.

Significant Customers

Our products are currently sold through distributors in over 11 provinces of China including Jiangxi, Beijing, Shanghai, Zhejiang, Guangxi, Shandong, Guangdong, Anhui, Helongjiang, Inner Mongolia and Jiangsu. We currently do not sell directly to consumers or retail markets.

Set forth below is a list of our top five customers during the year ended September 30, 2013:

| Customer | Percentage of total sales | |||

| Beijing laoliao Fruit Trade Co., Ltd. | 9.79 | % | ||

| Sichun Huaxinghongcheng Investment Co., Ltd. | 9.78 | % | ||

| Fen Xin | 8.47 | % | ||

| Shenzhen Jialun Xingnong Fruit Trade Co., Ltd. | 7.89 | % | ||

| Beijing Yuanhen Xingye Fruit Trade Co., Ltd. | 7.15 | % | ||

Our sales contract usually provides that our distributors will buy from us a certain minimum amount of navel oranges during a predefined period of the year, at market price. Each distributor is assigned to a geographic region for sales of our branded navel oranges to end consumers. Within its assigned region, a distributor must execute our company’s sales strategy, and protect our company’s brand name. We split the long-distance transportation cost with distributors equally. Some distributors deposit a small amount with us as a security deposit, and settle the payment to us on a monthly basis.

PRC Government Regulation

Agriculture Laws

On July 2, 1993, the Standing Committee of National People's Congress of the PRC promulgated the Agriculture Law, which sets forth certain principles and various measures designed to ensure the steady development of the agricultural industry. For example, the production or operation of agricultural products that affect the health of people or animals, such as seeds, must meet registration and approval requirements of the PRC laws and regulations. The Agriculture Law regulates the planting, processing, selling, preservation and transportation of agricultural products. Agricultural Law stipulates that farmers and organizations for production and operation of agriculture products shall keep good maintenance of their lands, make a rational use of chemical fertilizers and pesticides, increase their application of organic fertilizers so as to improve soil fertility and prevent the land from pollution, destruction and soil fertility declination. The Company believes it is in material compliance with the Agricultural Law.

| 10 |

According to Law of the People's Republic of China on Quality and Safety of Agricultural Products passed by Standing Committee of National People’s Congress on April 29, 2006, effective on November 1, 2006, the administrative departments for agriculture under the governments at or above the county level shall be responsible for supervision and control of the quality and safety of agricultural products; and the relevant departments of the people's governments at or above the county level shall, in compliance with the division of their duties, be responsible for the work related to the quality and safety of agricultural products. Agricultural production enterprises and specialized cooperative economic organizations of farmers shall test the quality and safety of their products themselves or entrust the testing to a testing agency. The Company has engaged a testing agency to test soil, cultivating water and air for certain planting areas to ensure the quality and safety of its products.

According to Law of the People's Republic of China on Quality and Safety of Agricultural Products, when agricultural products is marketed by agricultural production enterprises, specialized cooperative economic organizations of farmers, and by units or individuals engaged in the purchase of agricultural products, then such agriculture products will be required to be packed or labeled in case the packing and labeling is necessary according to related regulations and shall be marketable only after they are packaged or labeled. The Company believes that it has packed and labeled its orange products as in compliance with the relevant laws and regulations.

New Plant Varieties Regulation

The Regulation for the Protection of New Plant Varieties of was promulgated by the State Council on March 20, 1997 and became effective on October 1, 1997. The administrative departments of the State Council in charge of agriculture and forestry are, according to their respective functions, jointly responsible for the acceptance and examination of applications for the rights to new varieties of plants and the grant of such rights. A person that has completed the production, sale or dissemination of a new variety of plant which has been granted a variety right will have an exclusive right in its protected variety. Unless otherwise provided in the regulations, no other person may use such variety for commercial purposes without a license from the owner of the rights to the variety. The Company does not currently have the exclusive rights of a protected variety to any brand of navel orange. As its business develops, the Company may file for protection of its own orange variety in the future.

Forest Laws

The PRC Forestry Law passed by the Standing Committee of the National People’s Congress on April 29, 1998 and effective as of July 1, 1998, as well as its implement promulgated by State Council on January 29, 2000 (“Forest Law”), is enacted to protect, cultivate and reasonably use of forest resources. It governs the afforestation, cultivation, felling, utilization, management and administration of forests within the PRC territory. PRC Forestry Law divided the forests into the following five categories: (1) Protection forests: forests, trees and bushes mainly aimed at protection, inclusive of water source storage forests, forests for water and soil conservation, wind protection and sand bind forests, forests for farmland and grassland protection, river bank protective belts and road protection belts; (2) Timber stands: forests and trees mainly at timber production, inclusive of bamboo groves mainly aimed at bamboo production; (3) Economic forests: trees mainly aimed at the production of fruits; edible oils, soft drinks and ingredients; industrial raw materials; and medicinal materials; (4) Firewood forests: trees mainly aimed at the production of fuels; (5) Forests for special uses: forests and trees mainly aimed at national defense, environmental protection and scientific experiments, inclusive of national defense forests, experimental forests, parent stands, environmental protection forests, scenic beauty forests, trees for sites of historical interests and the forests of natural protection areas. Forest Law prohibits land reclamation at the expense of deforestation, rock quarrying, sand quarrying, soil extracting and other activities at the expense of deforestation. The Company believes it is in material compliance with the Forestry Law.

PRC Quarantine Law on the Import and Export of Plants and relevant rules and regulations

The PRC Quarantine Inspection Law on the Import and Export of Plants passed by the Standing Committee of the National People’s Congress on October 30, 1991, and effective as of April 1, 1992, is aimed at preventing diseases, insect pests and harmful organisms from spreading into or out of the country, protecting the production of agriculture, forestry, animal husbandry and fishery as well as human health, and promoting the development of foreign economic relations and trade. The implement rule of PRC Quarantine Inspection Law on the Import and Export of Plants was promulgated by State Council on December 2, 1996 and effective as of January 1, 1997. Administration Rule of Quarantine Inspection of Exporting Fruits was promulgated by General Administration of Quality Supervision, Inspection and Quarantine of PRC (“AQSIQ”) on December 25, 2006 and effective on February 1, 2007.

| 11 |

Pursuant to PRC Quarantine Inspection Law on the Import and Export of Plants and its implementing regulations, (i) the Ministry of Agriculture shall be responsible for the import and export quarantine of animal and plant; and (ii) enterprises importing plant seeds, seedlings or other propagating materials must submit an application in advance and go through the formalities of quarantine inspection. In addition, according to Administration Rule of Quarantine Inspection of Exporting Fruits, the fruits may export after the pass of quarantine inspection.

We believe that we have taken reasonable measures to ensure material compliance with PRC Quarantine Law and its related implementing regulations. We have obtained registration certificates issued by Jiangxi Entry-Exit Inspection and Quarantine Bureau for the export by our orchard and packaging factory of navel oranges in accordance with the Administration Rule of Quarantine Inspection of Exporting Fruits promulgated by AQSIQ. The Administration Rule of Quarantine Inspection of Exporting Fruits also provides that the Bureau for Inspection and Quarantine execute the inspection and quarantine for exporting fruits and the goods shall be permitted for export if the exporting fruits pass such inspection and quarantine and obtain related certificates issued accordingly. Our exported oranges have passed the inspection and quarantine.

Foreign Currency Exchange

Pursuant to the Foreign Currency Administration Rules promulgated on January 29, 1996 and amended on August 1, 2008, as well as various regulations issued by State Administration of Foreign Exchange (“SAFE”) and other relevant PRC government authorities, the RMB is freely convertible into a foreign currency for current account items, including trade-related receipts and payments, interest and dividends, but not for capital account items, such as direct equity investments, loans and repatriation of investment, unless prior approval from SAFE or a local branch has been obtained. Transactions that occur within the PRC must be settled in RMB. Unless otherwise approved, PRC companies must repatriate foreign currency payments received from abroad and domestic enterprises must convert all of their foreign currency receipts into RMB. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by SAFE or its local branch.

Intellectual Property

The PRC Trademark Law, adopted on August 23, 1982 and revised on October 27, 2001, protects the proprietary rights of registered trademarks. The State Administration for Industry and Commerce’s Trademark Office handles trademark registrations and grants an initial term of rights of ten years to registered trademarks. Upon the initial term’s expiration, a second term of ten years may be granted under a renewal. Trademark license agreements must be filed with the Trademark Office or a regional office. In addition, if a registered trademark is recognized as a well-known trademark in a specific case, the proprietary right of the trademark holder may be extended beyond the registered sphere of products and services to which the trademark relates.

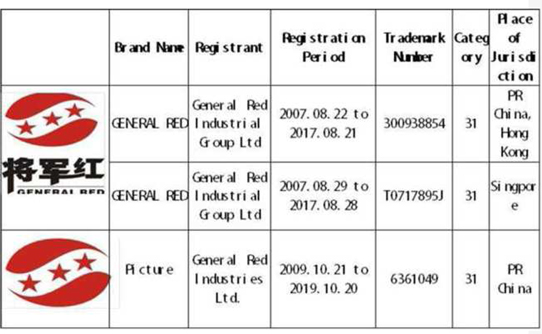

We own and utilize the domain of www.jiangjunhong.com and the trademarks listed below. We continuously look to increase the number of our trademarks where necessary to protect valuable intellectual property. We regard our trademarks and other intellectual property as valuable assets and believe that they have significant value in the marketing of our products. We vigorously protect our trademarks against infringement, including through the use of cease and desist letters, administrative proceedings and lawsuits.

We rely on trademark, and trade secret protection, non-disclosure agreements and licensing arrangements to establish, protect and enforce intellectual property rights in our logos, trade names and in the marketing of our products. In particular, we believe that our future success will largely depend on our ability to maintain and protect the “General Red” trademark. Despite our efforts to safeguard and maintain our intellectual property rights, we cannot be certain that we will be successful in this regard. Furthermore, we cannot be certain that our trademarks, products and promotional materials or other intellectual property rights do not or will not violate the intellectual property rights of others, that our intellectual property would be upheld if challenged or that we would, in such an event, not be prevented from using our trademarks or other intellectual property rights. Such claims, if proven, could materially and adversely affect our business, financial condition and results of operations. In addition, although any such claims may ultimately prove to be without merit, the necessary management attention to, and legal costs associated with, litigation or other resolution of future claims concerning trademarks and other intellectual property rights could materially and adversely affect our business, financial condition and results of operations.

| 12 |

The laws of certain foreign countries do not protect intellectual property rights to the same extent or in the same manner as do the laws of the PRC. Although we continue to implement protective measures and intend to defend our intellectual property rights vigorously, these efforts may not be successful or the costs associated with protecting our rights in certain jurisdictions may be prohibitive. From time to time we may discover products in the marketplace that are counterfeit reproductions of our products or that otherwise infringe upon intellectual property rights held by us. Actions taken by us to establish and protect our trademarks and other intellectual property rights may not be adequate to prevent imitation of our products by others or to prevent others from seeking to block sales of our products as violating trademarks and intellectual property rights. If we are unsuccessful in challenging a third party’s products on the basis of infringement of our intellectual property rights, continued sales of such products by that or any other third party could adversely impact the “General Red” brand, result in the shift of consumer preferences away from our products and generally have a material adverse effect on our business, financial condition and results of operations.

Trademarks

Through General Fruit and General Preservation, we are licensed to use the following trademarks registered with the Trademark Office, State Administration for Industry and Commerce in the PRC:

We plan to file for an extension with the appropriate trademark offices before expiration of the trademarks listed above.

Employees

Currently, we have 99 employees and temporary staff. Set forth below is a breakdown of our employees by category:

| 13 |

| Category | Number of employees | |

| Administrative and finance | 32 | |

| Sales and marketing | 4 | |

| Technician | 6 | |

| Workers* | 57 |

| * | The number of workers we hired for seasonal work was 57 as the peak of seasonal picking was postponed to November during 2013. It was in October last year. |

General Fruit and General Preservation, our operating companies in PRC, have signed employment contracts with all employees, either full-time or part-time. Pursuant to the labor regulations in PRC, we are required to pay social insurance for full-time employees, but not for part-time employees.

Corporation Information

Our principal executive offices are located at Room 801, Plaza B, Yonghe Building, No.28 AnDingMen East Street, Dongcheng District, Beijing, China. Postal Code: 100007

Our telephone number is + 86-10-64097316.

Any investment in our common stock involves a high degree of risk. You should consider carefully the specific risk factors described below in addition to the other information contained in this Report, including our consolidated financial statements and related notes included elsewhere in the report, before making a decision to invest in our common stock. If any of these risks actually occurs, our business, financial condition, results of operations or prospects could be materially and adversely affected. This could cause the trading price of our common stock to decline and a loss of all or part of your investment.

Risks Related to Our Business

We have a relatively short operating history and are subject to the risks of a new enterprise, any one of which could limit growth, or market development.

Our short operating history makes it difficult to predict how our businesses will develop. Accordingly, we face all of the risks and uncertainties encountered by early-stage companies, such as:

| · | uncertain growth in the market for our products; and | |

| · | competition or evolving customer preferences that could harm sales of our products. |

If we are not able to meet the challenge of building our business, our growth may be slowed, which could result in lower margins, additional operational costs and lower income.

Because we face significant competition, we could lose market share and may need to respond by lowering our prices, which could materially and adversely affect our results of operations.

The agricultural citrus business in China is highly fragmented and competitive, and we expect competition in this sector to persist and intensify. We face competition in each geographic market in which we operate. While we are trying to enter into agreements with additional farmers, we face competition from other producers and may not succeed in our efforts.

| 14 |

We have agreements with a limited number of farmers to grow and supply us with oranges. Any disruption in supply, breach of our agreements, or failure to deliver products, could adversely impact our distribution capabilities or increase our costs, which could harm our reputation or materially and adversely affect our business, results of operations and financial condition.

We purchase our products from farmers with whom we enter into seasonal contracts. The failure of our farmers to supply oranges that satisfy our quality, quantity and cost requirements, the decision by farmers not to re-enter into contracts with us, or a breach of the contracts, could have an adverse effect on our ability to maintain our distribution network. If we fail to maintain our relationships with these farmers or fail to develop new relationships with other farmers, our business, results of operations and financial condition would be materially adversely impacted.

We derive most of our sales from the PRC.

Most of our sales are generated from the PRC. Although we have explored the exportation of oranges outside of the PRC, at this time we anticipate that sales of our oranges in the PRC will continue to represent a substantial proportion of our total sales in the near future. Any significant decline in the condition of the PRC economy could adversely affect consumer demand of our products, among other things, which in turn would have a material adverse effect on our business and financial condition.

If our land use rights are revoked, we would have no operational capabilities or ability to conduct our business.

Under Chinese law, land is owned by state or rural collective economic organizations. The state issues tenants the rights to use property. Rights to use property can be revoked and tenants can be forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted broadly and the process of land appropriation may be less than transparent. Since production of oranges is dependent on having land to grow, we rely on these land use rights as the cornerstone of our operations, and the loss of such rights would have a detrimental effect on our business.

Weather and other environmental factors may affect our harvesting season, and a reduction in the quality or quantity of our orange supplies may have a detrimental effect on our revenues.

Our business may be adversely affected by weather and environmental factors beyond our control, such as adverse weather conditions during the growing season. We have no control over such forces of nature. A significant reduction in the quantity or quality of oranges harvested resulting from adverse weather conditions, disease to the crops or other factors could result in increased per unit processing costs and decreased production, with adverse financial consequences to us.

Concerns over food safety and public health may affect our operations by increasing our costs and negatively impacting demand for our products.

We could be adversely affected by diminishing confidence in the safety and quality of certain food products or ingredients, even if our practices and procedures are not implicated. As a result, we may also elect or be required to incur additional costs aimed at increasing consumer confidence in the safety of our products. For example, a crisis in China over melamine-contaminated milk in 2008 adversely impacted overall Chinese food exports since October 2008, as reported by the Chinese General Administration of Customs, even though most foods exported from China were not implicated by the melamine-contaminated milk. Our success depends on our ability to maintain the quality of our products. Product quality issues, real or imagined, or allegations of product contamination, even if false or unfounded, could tarnish our image and may cause consumers to choose other products.

We have limited insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited insurance products and the cost of such insurance is high. We have determined that the risks of disruption or liability from our business, the loss or damage to our property, including our facilities, equipment and office furniture, the cost of insuring for these risks, and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us purchase. As a result, we only carry insurance on some company owned vehicles. Any uninsured occurrence of loss or damage to property, or litigation or business disruption may result in the incurrence of substantial costs and the diversion of resources, which could have an adverse effect on our operating results.

| 15 |

We may be subject to product quality or liability claims, which may cause us to incur litigation expenses and to devote significant management time to defending such claims and, if determined adversely to us, could require us to pay significant damage awards.

Unlike the United States and many other countries, product liability claims and lawsuits in the PRC are rare. Furthermore, we cannot guaranty that product liability exposures and litigation will not become more commonplace in the PRC or that we will not face product liability exposure or actual liability as we expand our sales into international markets, like the United States, where product liability claims are more prevalent. In addition to the genetic traits and the quality of our products, the performance marketability of our fruits depends on climate, geographical areas, cultivation method, farmers’ degree of knowledge and other factors. At the same time, the viability of some farmland in China has deteriorated due to toxic and hazardous materials from farmers’ overuse of herbicides. These factors are beyond our control and can result in sub-optimal production yields. However, farmers generally attribute sub-optimal production yields to poor seed quality. We may be required from time to time to recall products. Product recalls could adversely affect our profitability and our brand image.

We may be subject to legal proceedings and claims from time to time relating to our seed quality. The defense of these proceedings and claims could be both costly and time-consuming and significantly divert the efforts and resources of our management personnel. An adverse determination in any such proceedings could subject us to significant liability. In addition, any such proceeding, even if ultimately determined in our favor, could damage our market reputation and prevent us from maintaining or increasing sales and market share. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase of our products.

While we have not experienced any credible product liability litigation to date, there is no guarantee that we will not experience such litigation in the future. In the event we do experience product liability claims or a product recall, our financial condition and business operations could be materially adversely affected.

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injury.

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries. Significant industry-related accidents and natural disasters may cause interruptions to various parts of our operations, or could result in property or environmental damage, increase in operating expenses or loss of revenue. The occurrence of such accidents and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than our automobiles. Losses or payments incurred may have a material adverse effect on our operating performance if such losses or payments are not fully insured.

Risks Related to Our Corporate Governance and Controls

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our Common Stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. As a public company, we have significant additional requirements for enhanced financial reporting and internal controls. However, as a result of the Share Exchange, we have a newly acquired business, which may not have been subject to the same control systems as public company must maintain. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We expect that there will be a period of transition as we begin to integrate our new business and implement internal controls over financial reporting and disclosure controls and procedures necessary for a public company’s business.

| 16 |

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting, and disclosure controls and procedures. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our Common Stock.

We will incur increased costs as a result of acquiring a new operating business in the Share Exchange.

As a result of the Share Exchange, we now have an active operating business. We anticipate that we will incur significant legal, accounting and other expenses that we did not incur as a prior shell company. In addition, the Sarbanes-Oxley Act, as well as rules subsequently implemented by the SEC, has required changes in corporate governance practices of public companies. We expect these rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Relating to Regulation of our Business

Restrictions on currency exchange may limit our ability to utilize our revenues effectively.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive all of our revenues in RMB. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiaries to remit sufficient foreign currency to pay dividends or other payments to the US parent company, or other subsidiaries outside of the PRC, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our shareholders

Under the PRC Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China, and such classification would likely result in unfavorable tax consequences to us and our non-PRC stockholders.

On March 16, 2007, the National People’s Congress or the NPC, approved and promulgated the PRC Enterprise Income Tax Law, which we refer to as the New EIT Law. The New EIT Law took effect on January 1, 2008. Under the New EIT Law, Foreign Investment Enterprises (FIEs) and domestic companies are subject to a uniform tax rate of 25%. The New EIT Law provides a five-year transition period starting from its effective date for those enterprises which were established before the promulgation date of the New EIT Law and which were entitled to a preferential lower tax rate under the then-effective tax laws or regulations.

| 17 |

On December 26, 2007, the State Council issued a Notice on Implementing Transitional Measures for Enterprise Income Tax, or the Notice, providing that the enterprises that have been approved to enjoy a low tax rate prior to the promulgation of the New EIT Law will be eligible for a five-year transition period since January 1, 2008, during which time the tax rate will be increased step by step to the 25% unified tax rate set out in the New EIT Law. From January 1, 2008, for the enterprises whose applicable tax rate was 15% before the promulgation of the New EIT Law , the tax rate will be increased to 18% for year 2008, 20% for year 2009, 22% for year 2010, 24% for year 2011, 25% for year 2012. For the enterprises whose applicable tax rate was 24%, the tax rate will be changed to 25% from January 1, 2008.

Under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. Because the New EIT Law and its implementing rules are new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that we are “resident enterprises” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

Under the Corporate Income Tax Law of the PRC, the corporate income tax rate is 25%. However, as an agricultural company engaged in cultivation, General Fruit has been approved for tax exemption since its formation. General Preservation was also approved for such exemption from income tax for the years 2013 and 2012. As a result, for the years ended September 30, 2013 and 2012, there was no income tax provision for the Company.

Dividends we receive from General Fruit may be subject to PRC withholding tax.

The New EIT Law provides that an income tax rate of 20% may be applicable to dividends payable to non-PRC investors that are “non-resident enterprises” and that do not have an establishment or place of business in the PRC, or which have such establishment or place of business in the PRC but the relevant income is not effectively connected with the establishment or place of business, to the extent such dividends are derived from sources within the PRC. The income tax for non-resident enterprises shall be subject to withholding at the income source, with the payer acting as the obligatory withholder under the New EIT Law, and therefore such income taxes are generally called withholding tax in practice. The State Council of the PRC has reduced the withholding tax rate from 20% to 10% through the Implementation Rules of the New EIT Law. It is currently unclear in what circumstances a source will be considered as located within the PRC. We are an offshore holding company. Thus, if we are considered as a “non-resident enterprise” under the New EIT Law and the dividends paid to us by our subsidiary in the PRC are considered income sourced within the PRC, such dividends may be subject to a 10% withholding tax.

The new tax law provides only a framework of the enterprise tax provisions, leaving many details on the definitions of numerous terms as well as the interpretation and specific applications of various provisions unclear and unspecified. Any increase in our combined company’s tax rate in the future could have a material adverse effect on our financial conditions and results of operations.

Under PRC laws, General Fruit and General Preservation, are obligated to withhold and pay individual income tax on behalf of our employees who are subject to PRC individual income tax. If the PRC Subsidiary fails to withhold and/or pay such individual income tax in accordance with PRC laws, it may be subject to certain sanctions and other penalties and may become subject to liability under PRC laws.

| 18 |

In addition, the State Administration of Taxation has issued several circulars concerning employee stock options. Under these circulars, our employees working in the PRC (which could include both PRC employees and expatriate employees subject to PRC individual income tax) who exercise stock options will be subject to PRC individual income tax. Our PRC subsidiaries have obligations to file documents related to employee stock options with relevant tax authorities and withhold and pay individual income taxes for those employees who exercise their stock options. While tax authorities may advise us that our policy is compliant, they may change their policy, and we could be subject to sanctions.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Risks Related to our Securities

Because we became a public company by means of a reverse merger, we may not be able to attract the attention of major brokerage firms.

Additional risks may exist since we became public through a “reverse merger.” Securities analysts of major brokerage firms may not provide coverage of our securities since there is little incentive to brokerage firms to recommend the purchase of our Common Stock. No assurance can be given that brokerage firms will want to conduct any secondary offerings on our behalf in the future.

If we become directly subject to the recent scrutiny involving U.S. Chinese companies, we may have to expend significant resources to investigate and/or defend the matter, which could harm our business operations, stock price and reputation.

Recently, many U.S. reverse merger public companies that have substantially all of their operations in China have been the subject of intense scrutiny by investors, financial commentators and regulatory agencies. Much of the scrutiny has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial reporting and, in many cases, allegations of fraud. As a result of the scrutiny, the publicly traded stock of many U.S. listed China-based companies that have been the subject of such scrutiny has sharply decreased in value. Many of these companies are now subject to shareholder lawsuits and/or SEC enforcement actions that are conducting internal and/or external investigations into the allegations. If we become the subject of any such scrutiny, whether any allegations are true or not, we may have to expend significant resources to investigate such allegations and/or defend our company. Such investigations or allegations will be costly and time-consuming and distract our management from our business plan and could result in our reputation being harmed and our stock price could decline as a result of such allegations, regardless of the truthfulness of the allegations.