Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MELINTA THERAPEUTICS, INC. /NEW/ | d737502d8k.htm |

Developing Well-

Differentiated Antibiotics

to Meet Medical Needs

Cempra Corporate

Presentation

Prabhavathi Fernandes, Ph.D.

President & CEO

June 2014

Exhibit 99.1 |

Forward Looking Statement

2

This presentation contains forward-looking statements regarding future events. These

statements are just predictions and are subject to risks and uncertainties that could cause

the actual events or results to differ materially. These risks and uncertainties include,

among others: risks related to the costs, timing, regulatory review and results of our studies

and clinical trials; our need to obtain additional funding and our ability to obtain future

funding on acceptable terms; our anticipated capital expenditures and our estimates

regarding our capital requirements; our and our strategic partners’ ability to obtain FDA and

foreign regulatory approval of our product candidates; our dependence on the success of

solithromycin and TAKSTA; the possible impairment of, or inability to obtain, intellectual

property rights and the costs of obtaining such rights from third parties; the unpredictability

of the size of the markets for, and market acceptance of, any of our products, including

solithromycin and TAKSTA; our ability to produce and sell any approved products and the

price we are able to realize for those products; our ability to retain and hire necessary

employees and to staff our operations appropriately; our ability to compete in our industry;

innovation by our competitors; and our ability to stay abreast of and comply with new or

modified laws and regulations that currently apply or become applicable to our business.

Please refer to the documents that we file from time to time with the Securities and

Exchange Commission. |

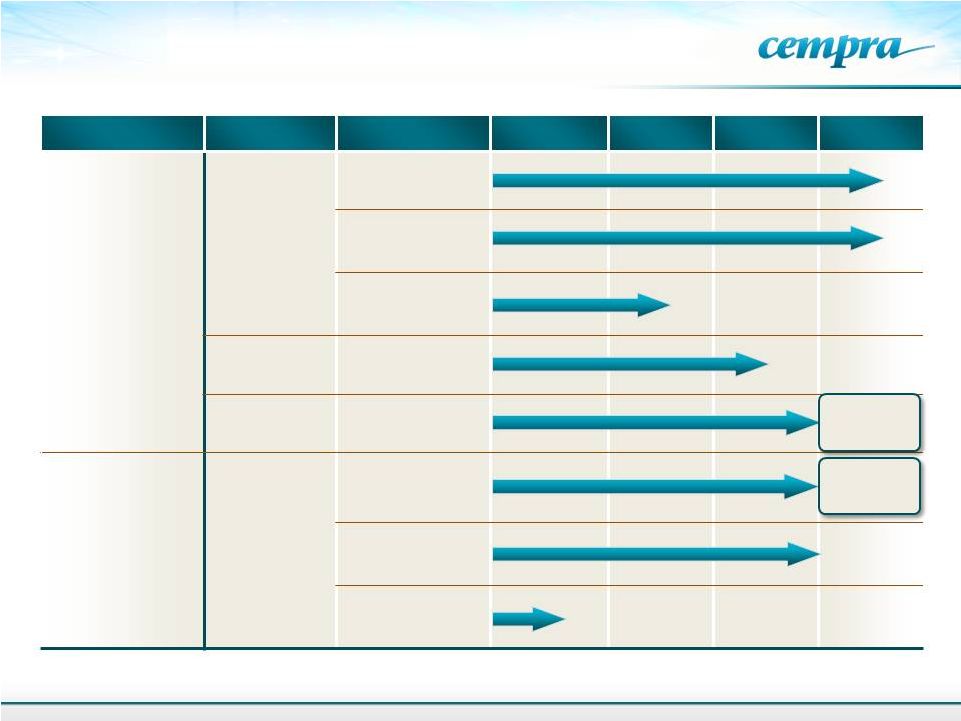

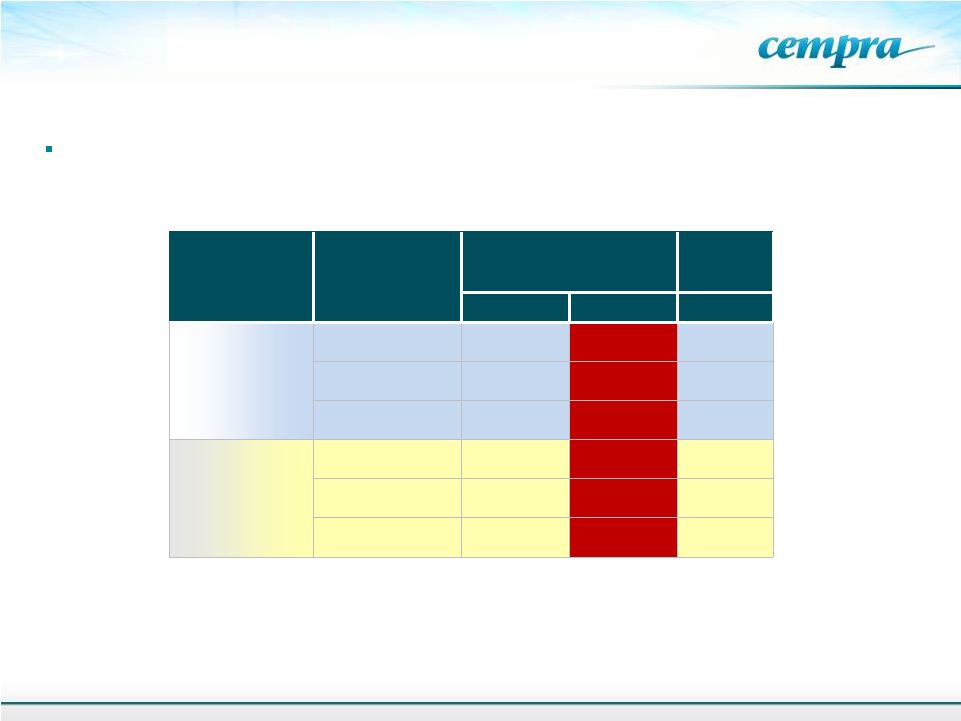

Product

Indication

Formulation

Preclinical

Phase 1

Phase 2

Phase 3

Solithromycin

(CEM-101)

Community

Acquired

Bacterial

Pneumonia

(CABP)

Oral

IV-to-Oral

Oral Pediatric

Biodefense

Animal Rule

Urethritis

Oral

TAKSTA

Fusidic Acid

Acute and

Chronic

Treatment of

Staph

(MRSA)

Oral –

Chronic

Prosthetic Joint

Infections

Oral –

ABSSSI

Oral Suspension/

Pediatric

Cempra’s Antibiotic Portfolio

3

Phase 3

to be

initiated

FDA

Discussions

TM |

Gary

Horwith, MD EVP Regulatory

David Moore, MBA

CCO

Mark Hahn, CPA

CFO

David Oldach, MD

SVP Clinical

Prabhavathi Fernandes, PhD

President & CEO

David Pereira, PhD

SVP Chemistry

Azactam

(aztreonam)

Biaxin

(clarithromycin)

Dificid

(fidaxomicin)

Levaquin

Topamax

Ultram

Nucynta

Proven Management Team

4

IPO and M&A

Athenix-Bayer CropScience

Charles

&

Colvard

(CTHR)

E&Y

S. aureus vaccine

Abelcet

Viread

GS-9190

Combinations against HCV

Injectable penicillins

Dobutamine HCl injection

Ranitidine injection |

Broad

Hospital and Primary Care Indications

Due to resistance recurring, increasing need –

Global antibiotic sales over $40B

Safe

antibiotics

with

broad

use

potential

have

historically

been

blockbusters,

e.g.,

Biaxin

®

,

Z-Pak

®

,

Cipro

®

,

Levaquin

®

,

Amoxicillin

Broad use requires hospital and primary care sales and marketing

About

1

antibiotic

prescription

is

written

in

the

hospital

for

9

prescriptions

in

the

community

Retail sales can be carried by large company partners

More and more patients will need hospital admissions for IV therapy as out

patient treatment fails owing to resistance to generic antibiotics

Hospitalization is expensive and exposure to hospital acquired infections is

costly and not reimbursed to hospitals

Therefore there is a very important role for a new primary care antibiotic for

respiratory tract infections (RTIs) that is safe and effective

5 |

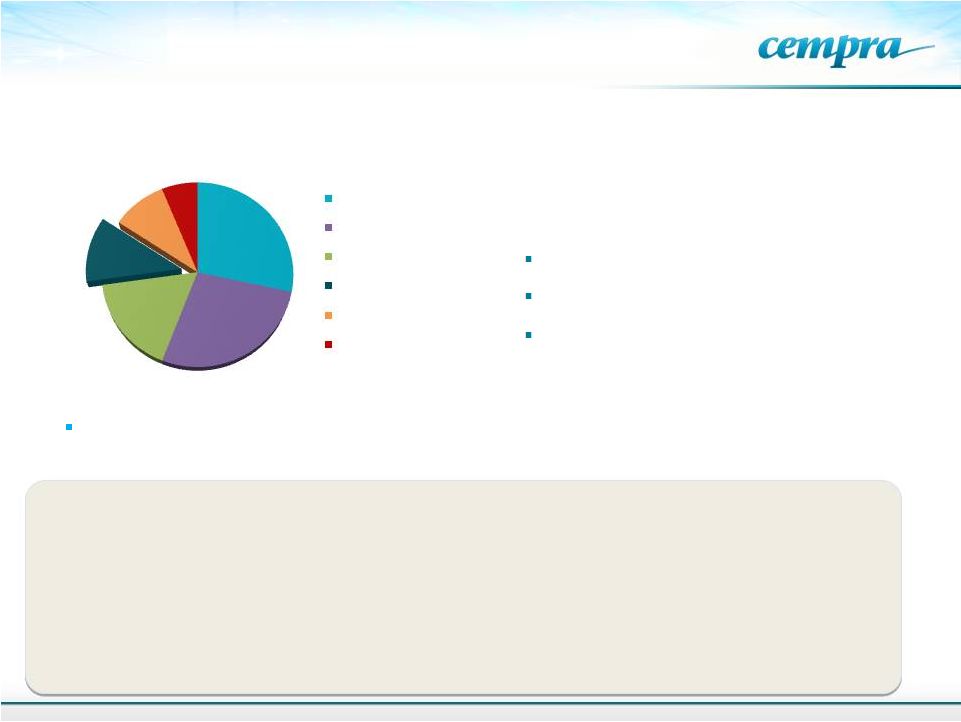

Large

Macrolide Market Opportunity 6

From Hamad, B. IMS Health: Nature Drug Discovery, 9:675-676, 2010.

Azithromycin, a macrolide, is the

most widely prescribed treatment

for CABP and other RTIs –

>60% of

market

Global Antibiotic Sales in 2009

Total $42B

Increasing

resistance

(40%

of

U.S.

pneumococci

a

;

96.4%

in

China

b

a

Jones,

RN.

DMID.

2013;75:107-109;

b

Kim,

SH.

AAC.

2012;56:1418-1426..

51 Million prescriptions were written in the US for azithromycin in the US. in

2013

Antimicrobial Resistance and Infection Control 2014: 3:16

Treatment failure of macrolide resistant pneumonia is attributed to

increased cost and heathcare utilization and hospital admission

Study by the Health Policy Institute, Univ. of California, Irvine.

$11.9B

$11.5B

$7.1B

$4.8B

$4B

$2.6B

Excellent tissue/intracellular distribution

and anti-inflammatory activity

Good safety

Cephalosporins

beta-lactams

Fluoroquinolones

Macrolides

Other antibacterials

Tetracyclines /

aminoglycosides

Broad spectrum of activity

2013

IMS

New

Prescription

Audit)

( |

What

is Solithromycin? Basic characteristics

A

4

generation

macrolide

antibiotic,

the

first

fluoroketolide

–

2

Phase

3

trials

Active against macrolide resistant pathogens

Inhibits

bacterial

protein

synthesis

–

binds

three

regions

of

the

bacterial

ribosome,

overcoming

resistance to azithromycin (Zithromax) which binds to one site only

Extended spectrum of activity

Best

orally

bioavailable

macrolide,

best

distribution

into

cells

and

tissues

Chemically stable

Strong anti-inflammatory properties

Clinical

New

oral

and

IV

antibiotic

in

development

in

CABP

–

Well

tolerated

to

date

IV switch to oral provides flexibility for dosing and a pharmacoeconomic advantage

TQT negative-

advantage over older macrolides

Demonstrated

efficacy

and

safety

in

Phase

2

CABP

trial

–

132

patients

Oral

capsules,

intravenous

formulation

and

pediatric

suspension

in

development

–

first

in

>20

years

An

antibiotic

for

all

age

groups,

hospital

as

well

as

outpatient

use

7

th |

Solithromycin Highlights

8

Clinical Trials

Phase 3 Oral, CABP study enrolling; Enrollment

expected to complete Q4 2014, data

expected – Q1 2015

Phase 3 intravenous-oral step down study; enrolling

Phase 2 in gonorrhea completed with 100% cure

in culture proven cases. Phase 3 planned to start 2H 2014

Phase 1 in pediatrics, enrolling

Strategic

Partnerships

BARDA

HHS:

$58MM

contract

–

Development

of

Soli

for

pediatric

use

and against bioterror pathogens

Toyama Chemical (FujiFilm): Global development program –

exclusive license for Japan. $10MM upfront; up to $60MM in

milestones; tiered royalties based on sales

Regulatory & IP

Qualified Infectious Disease Products (QIDP) granted by FDA

designations; oral and IV formulations for CABP

Provides

priority

review

–

8

months

Only QIDP drug in CABP

QIDP for gonorrhea

NCE patent to 2025, additional patents and PTEs |

Solithromycin’s Broad Use Potential

HAP, Simple RTI’s, Pharyngitis, Sinusitis, Bronchitis,

Acute Exacerbation of Chronic Bronchitis (AECB)

Respiratory Tract Infections (RTI)

Antibacterial and Anti-inflammatory

COPD, Cystic fibrosis, Panbronchiolitis, NASH

Special

Populations

BARDA funded

Pediatrics and Pregnancy

No pediatric drug with broad potential

in development

Infections

in

pregnancy

–

neonatal

sepsis

Infections

In

Utero

–

Premature,

Cerebral

palsy,

Autism

Biodefense

BARDA funded

Multiple Unidentified Pathogens

Anthrax, Tularemia

Sexually

Transmitted

Diseases

Genital Infections

Major

public

health

crisis

–

multi

drug

resistance,

no

oral

therapy. Most common reportable infectious diseases

Primary cause of infertility in white women

Infertility, PID

GI & Others

Ophthalmic

Helicobacter gastritis, Campylobacteria, tick and insect

borne diseases, diarrhea, and ophthalmic drops

CABP

Primary

Indication

Other Infections

9 |

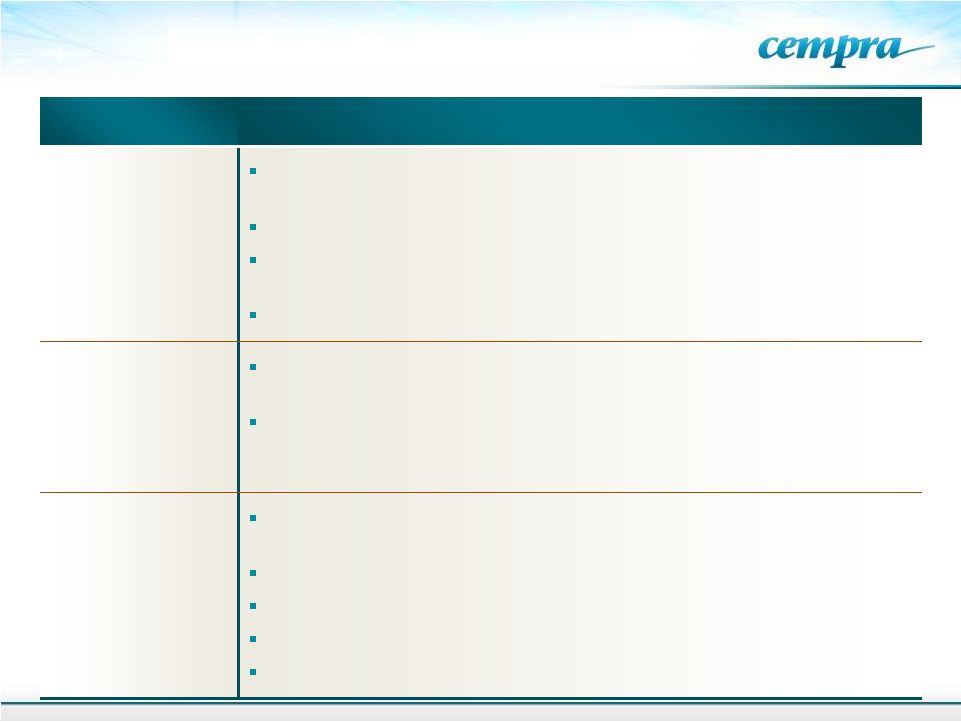

10

Why is a New Antibiotic Needed for CABP?

Current IDSA/ATS recommendation to give broad spectrum coverage:

In clinical practice a definitive microbial diagnosis of CABP is not feasible

leading to empiric therapy to provide broad spectrum coverage

Requires intravenous

cephalosporin

(e.g., ceftriaxone)

and hospitalization

Azithromycin added to treat

Legionella

and

Mycoplasma.

Pneumoccocci can be resistant

Mortality rates

in hospitalized

CABP patients

is 23%

–

30-day rate

a

a

Freeman, MK. CABP: A Primer for

Pharmacists: US Pharmacist. July 1, 2013.

IV

and

Oral

available

–

and

have

broad

spectrum

activity,

however, they are not in favor for treating CABP because:

Treatment failures from resistant strain selection

Kill

bowel

flora

–

associated

with

C.difficile

colitis

Adverse tendonitis, Achilles tendon rupture, hepatotoxicity and

peripheral neuritis, retinal detachment

Not approved for use in pediatrics

Or

1)

A ß-lactam plus

a macrolide

2)

A fluoroquinolone

(e.g., Levaquin,

Avelox) |

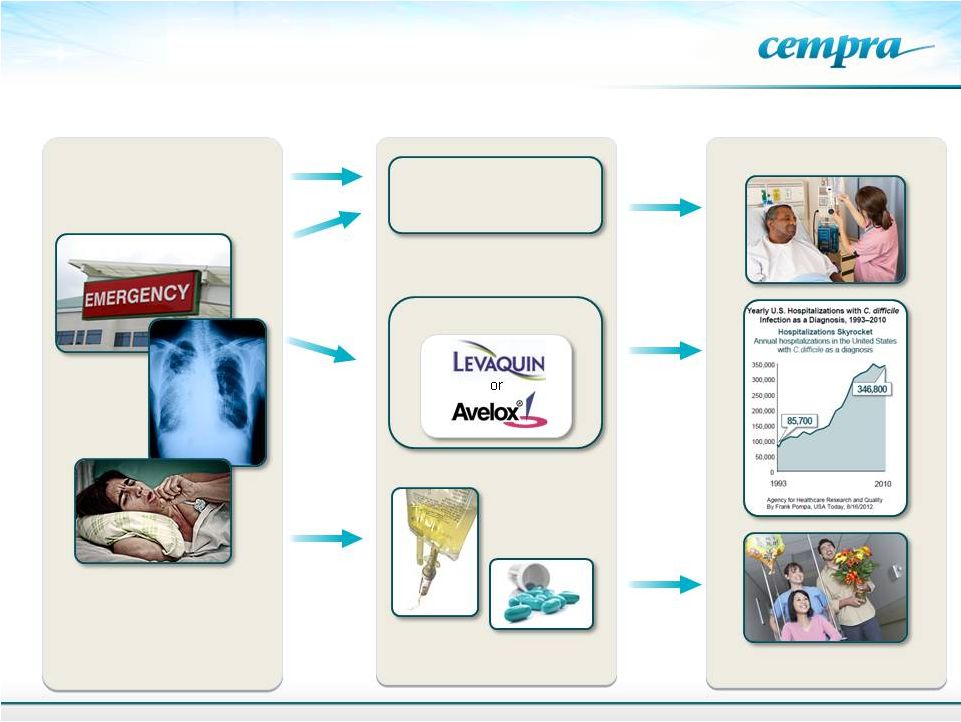

A

Fluoroquinolone Current and Future Treatment of CABP

11

Hospital / IV 7–10 Days

or

Indication

Treatment

Implication

Ceftriaxone plus

Azithromycin

Current

Treatment

Options

Future

Options

With Soli

IV-Oral Step-down Therapy

Fewer Hospital Days

Use Leads

to Higher

C. diff

Incidence |

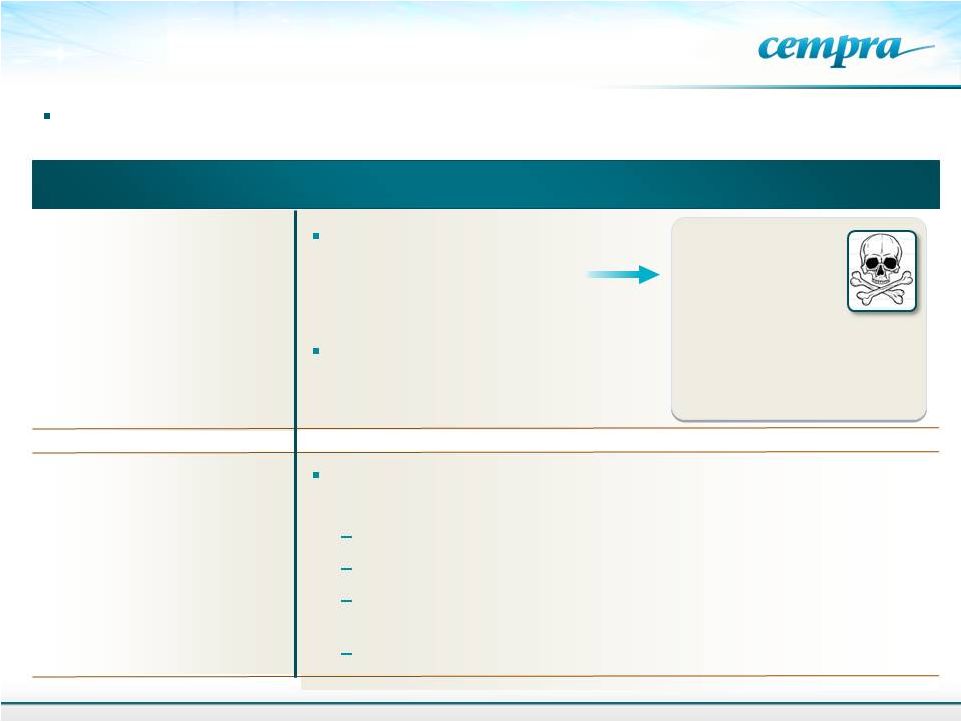

Problem of Hospital

Acquired Infections 12

NEJM 2014. 1198-1208, 2014

Magill, SS. And CDC and Emory Authors

2013 National Prevention Target –

30%

reduction

in

C.

difficile

(

Srinivasan,

CID

2012;

55426-31

-

Not on target

Of

all

health-care

associated

infections-

C.

difficile

caused

by

fluoroquinolone

and

broad

spectrum

antibiotics

was

ranked

#1 |

13

Large VA study -

14 million unique persons, between Sept. 1999, and April 2012.

Veterans who received azithromycin 48% higher death rate and a 77% higher risk

of cardiac arrhythmias in the first 5 days of treatment when compared to

amoxicillin.

Those who received levofloxacin had a 149% and 143% higher risk of death and

cardiac arrhythmia than amoxicillin–treated patients in the first 5 day with

higher rates as the duration of treatment increased.

Reports

of

Cardiac

Arrhythmias

-

Azithromycin

and

Levofloxacin are No Longer Preferred Options

Ann.Fam Med 12:121-127, 2014

Gowtham A. Rao, M.D.., Ph.D., MPH, et al. |

Community

Acquired

Bacterial

Pneumonia

(CABP)

–

#1

cause

of

death

from an infection

The 6th most common cause of death from all causes in the U.S. and a leading

cause of death worldwide

5 to10 million CABP cases annually, 1.1 million patients hospitalized per year

More common in older adults (

>65 years) and young children (CABP infection rate ranges

from 74–92 (

<2yrs) and 33–52 (3–6 yrs) per 1,000 children

a, b

)

Appropriate empiric therapy is critical to positive outcomes

Multiple

pathogens

can

be

involved

-

Pneumococcus

–

the

most

frequent

cause

CABP –

Most Frequent Infectious Disease in

the U.S.

14

Pneumococcal infections cause more deaths per year in

U.S. than breast or prostate cancer.

Xu, et al. Deaths: Final Data for 2007. Natl Vital Stat Rep.

2010;58:1-51. Respiratory disease incidence is increasing;

growing numbers of COPD and asthma patients.

Drug Discovery News, May 2012.

a

Freeman, MK. CABP: A Primer for Pharmacists.:US Pharmacist. July1, 2013.

b

Ostapchuk,

M.

et.al.

American

Family

Physician.

2004;70:899-908

.

a |

Solithromycin –

Spectrum of Activity

that Addresses CABP Pathogens

Solithromycin has class leading potency and spectrum in vitro against CABP

pathogens

15

Interacts

with

bacterial

ribosome

at

three

sites

–

Resistance

rare

and

it

could

only

occur if mutations occur at three distinct sites

Gram

Positive

Negative

Positive

Atypical

Atypical

Atypical

Streptococcus

pneumoniae

Haemophilus

influenzae

Staphylococcus

aureus

Legionella

pneumophila

Mycoplasma

pneumoniae

Chlamydophila

pneumoniae

Organisms

Solithromycin

Azithromycin

Cephalosporin

Fluoroquinolone |

Why We Need a New

Macrolide 16

Susceptibility data for solithromycin and comparators against 927 S.

pneumoniae

from RTI Samples Collected in 2012-2013.

Morrissey, I. ECCMID 2014. Abstr. P1584.

Antibiotic

Region

Percentage

MIC

(µg/mL)

S

R

90%

Solithromycin

Europe (418)

100

0

0.06

NA (380)

100

0

0.25

Asia (129)

100

0

0.5

Azithromycin

Europe (418)

71.3

28.0

> 1

NA (380)

56.3

42.6

> 1

Asia (129)

28.7

70.5

> 1 |

Solithromycin: Phase 3 CABP Studies

Combined safety and efficacy data from two CABP Phase 3

studies is expected to be sufficient for capsules and

intravenous NDA

Phase 3 study 1: SOLITAIRE Oral study currently enrolling

Initiated Dec 2012, enrollment expected to complete 4Q 2014

800mg

LD/400mg

–

total

5

days

vs.

Avelox

400

mg

7

days

Top line results expected in Q1 2015

Phase 3 study 2: SOLITAIRE Intravenous to step down oral

Initiated 4Q 2013. Enrolling

400 mg IV followed by oral 800 mg LD/400 mg for up to 7 days

vs. Avelox 400 mg IV to oral 7 days

Both Phase 3 studies are global studies

Plan to enroll ~800 patients

Comparator

Avelox

(moxifloxacin)

–

A

fluoroquinolone

that

is

used

worldwide at same dose

17 |

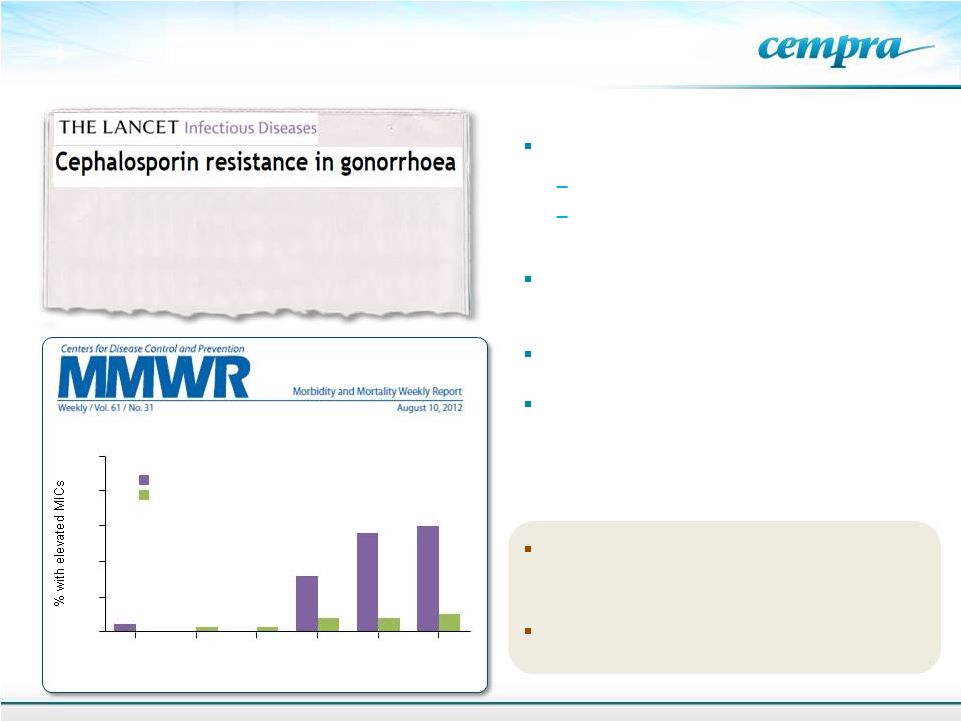

Gonococcal Surveillance Project, US. 2006-2011.

Expanding Solithromycin Use

Gonorrhea Studies

Current treatment

–

IM ceftriaxone

No oral drug to treat partners

The second most common

communicable disease

QIDP granted for solithromycin for

gonorrhea treatment

CDC and WHO list as urgent need

Soli Phase 2 results: culture negative

cure in 100% (all body sites) of

evaluable patients

Phase 3 planned to be initiated 2H 2014

–

Shared costs of study by Australian

public health

A single Phase 3 study is expected to be

sufficient for FDA approval

Oral Cephalosporins No Longer a Recommended

Treatment for Gonococcal Infections

2006

2007*

2008*

2009

2010

2011

†

0

0.5

1.0

1.5

2.0

2.5

Cefixime

Ceftriaxone

Year

18

Lancet ID 13: 728-730, 2013

…….A new drug on the horizon is the

fluoroketolide solithromycin, to which N

gonorrhoeae

is

very

sensitive

in

vitro,

and

this

agent is currently in pneumonia trials……

The second most common

communicable disease |

Pediatrics Studies

–

Suspension

formulation Developed (BARDA funded)

19

First NCE since azithromycin to be developed as a suspension formulation for

pediatric

Oral drugs are even more important in pediatrics. About 80M prescriptions are

written for pediatrics in the US alone

When children get MDR infections, most commonly respiratory infections, what do

we have left? Amoxicillin 1972, Azithromycin 1988

Solithromycin is being developed for pediatric use because of its oral

bioavailability, safety and tolerability profile, stability in suspension

Otitis

media

is

the

most

common

reason

for

pediatric

antibiotic

prescription

2013 IMS New Prescription Audit

Solithromycin is effective in the chinchilla model of experimental otitis media

which has been found to consistently correlate with subsequent clinical trials

in children |

TAKSTA™

(Fusidic Acid)

20

An

Oral

Antibiotic

for

MRSA

Infections

Being

Developed

for

Chronic

Use

in

Prosthetic

Joint

Infections

in

the

U.S. |

TAKSTA

Cempra’s proprietary fusidic acid dosing regimen

Fusidic acid approved in Western Europe, Australia, and other countries

40

years

of

established

safety

and

efficacy

profile

in

acute

and

chronic

use

in

staph

infections

ex-U.S.

Unique structure, no known cross resistance with any other antibiotic

Orally bioavailable

Targeted

against

gram-positive

pathogens,

including

MRSA

–

pathogens

that

causes

bone

and joint infections requiring long-term treatment

Exclusivity

NCE in the U.S.: Hatch Waxman exclusivity, 5 years obtained by Cempra, exclusive

supply agreement

of

drug

substance

–

a

fermentation

product

GAIN

Act

adds

an

additional

5

years

of

data exclusivity –

A minimum of 10 years of data exclusivity

or 12 years if Orphan

Loading dose patent Protects U.S. Market Exclusivity to 2029 + patent term

extension Orphan

Drug

Designation

for

PJI

granted

–

October

2013

What is TAKSTA™?

21 |

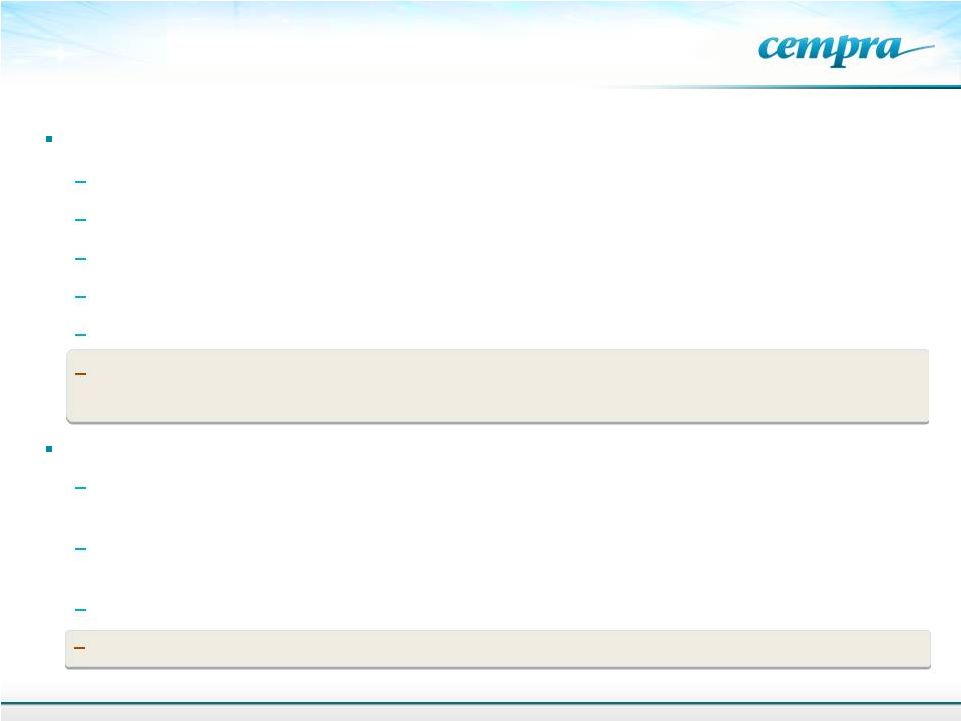

Current and Future Treatment of

Prosthetic Joint Infections

22

IV Vancomycin and Oral

Antibiotics –

4–6 Weeks

Surgery

Spacers In

Surgery New

Prosthesis Inserted

Cempra’s

Trial

Current U.S.

Treatments

Surgery

Sterile Joint

Potential for Cost Savings, Surgery

Decrease, Patient Comfort and

Pharmacoeconomic Advantages Gain

Physician, Payor Acceptance

Cempra Aims to Bring the Lower Cost, More Effective

European PJI Treatment Paradigm to the U.S.

Debride

and Treat

Two-stage

Revision

Debride, IV

Vancomycin

for 1–7 Days

Oral Fusidic

Acid Plus Oral

Rifampin for

6–12 Months

Orthopedic

Surgery |

Taksta Update

23

0

20

40

60

80

100

120

European dosing

Cempra’s loading

dose

0

24

48

72

96

120

Time (hrs)

EU Dose 500 mg dose

Cempra dose 1200 mg Q12h

Day followed by 600 mg Q12h

Clinical Trials

Phase 2 PJI study data reported, study stopped

New strategy for the pivotal study is being designed

No PJI guidance

-

Discussion with FDA planned

Regulatory

Orphan Drug Designation for PJI granted by FDA (October 2013)

Orphan Drug designation benefits

7 year exclusivity

Tax credit for 50% of clinical trial cost and PDUFA fees exempted

GAIN

pathogen

MRSA-Potential

QIDP

Intellectual

Property

Loading dose patent protection

into 2029 and PTEs

Well

tolerated

in

ABSSSI

Phase

2

study;

no resistance seen |

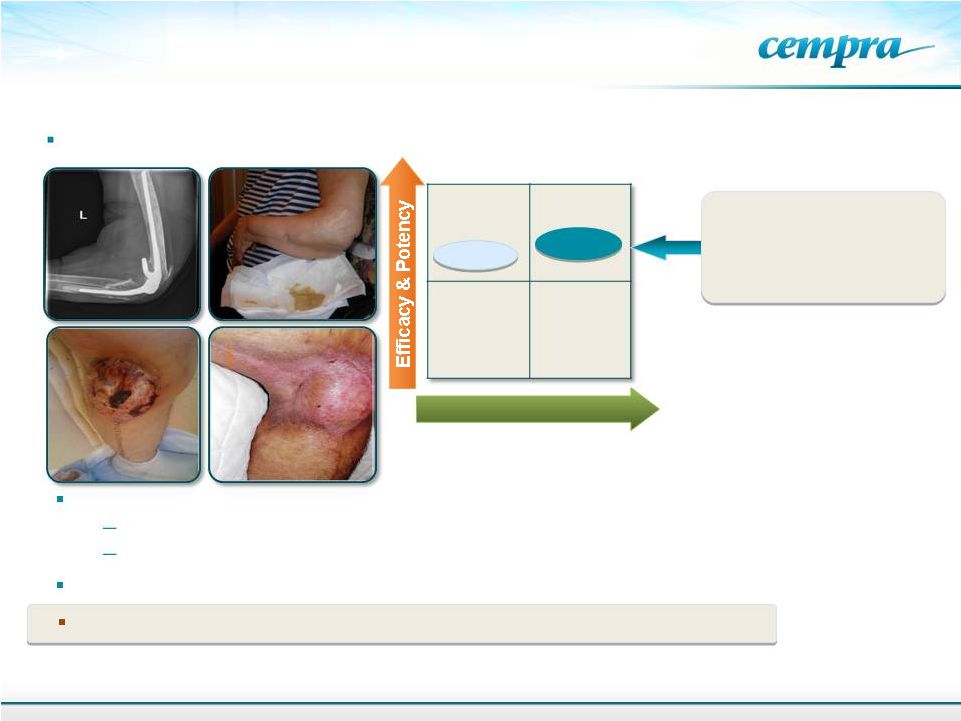

Two

compassionate use cases of bone/prosthesis infections in North America

Safety

Linezolid

TAKSTA

Prosthetic surgery facts

20,000

hip

and

knee

PJIs

in

2007

a

Total

joint

and

hardware

procedures

–

3,286,000/year

b,c

Potential use in osteomyelitis, septic arthritis, and diabetic foot

TAKSTA for Chronic Use in Prosthetic

Joint Device (PJI) Infections

24

a

N Engl J Med 2009;361:787-794.

b

Life Science Intelligence market research report. U.S. Markets for Large

Replacement Technologies in 2012. March, 2012. c

Life Science Intelligence market research report. U.S. Markets for Small Joint

Implants and Hardware for the Extremities. January, 2012. Cempra’s Phase

2 PJI study closed- strategizing for pivotal study

Useful for Oral Chronic

Use in All Patient

Populations |

Achieved and Projected Milestones

1Q 14: QIDP designation by FDA for solithromycin for

gonorrhea 1Q 14: Negative TQT results for

solithromycin 1Q 14: Pediatric trial initiated

for solithromycin 2H 14: Meet with FDA to define

pivotal study for Taksta 2H 14:

Initiate Phase 3 gonorrhea study

1Q 15: Data expected SOLITAIRE Oral Phase 3 CABP

25 |

Take

Away Notes Solithromycin is being developed as adult oral, intravenous and

pediatric formulations. If Phase 3 data shows safety and efficacy, it

could allow broad use of solithromycin like older macrolides

Last antibiotic with oral, intravenous and pediatric suspension is azithromycin

51 million prescriptions were written last year in the US for azithromycin

A new macrolide with activity against resistant strains and improved safety is

needed Solithromycin –

4

th

generation macrolide antibiotic, the first fluoroketolide

Unlike azithromycin, monotherapy for CABP

Well tolerated to date. Negative in TQT study

IV switch to oral provides flexibility for dosing and a pharmacoeconomic advantage

Late-stage clinical development -Enrollment in the oral Phase 3 trial

expected to complete in 2014

26 |

Cash & Equivalents (3/31/14)

$79.6MM

Long-Term Debt (3/31/14)

$12.5MM

Shares Outstanding (6/2/14)

33.2MM

Capitalization

27 |

Pricing Models: U.S. & EU Countries

A 4

th

generation macrolide

Branding –

Product Recognition

Clinical trial name is SOLITAIRE

Mono-therapy

Commercialization Activities

28

Solithromycin Value

Proposition;

Activity, Safety, different

dosing formulations

Market-specific Evidence

Requirements for Access

and Reimbursement

Marketing

&

Sales

U.S.:

Co-promote with Partner

EU: Partner

Japan: Toyama/Fujifilm

Pharmacoeconomic

Advantages |