Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Acadia Healthcare Company, Inc. | d737216d8k.htm |

| EX-99.1 - EX-99.1 - Acadia Healthcare Company, Inc. | d737216dex991.htm |

June

2014 Investor Presentation

Exhibit 99.2

*

*

*

*

*

*

* |

| Some

of

the

statements

made

in

this

presentation

constitute

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

include

any

statements

that

address

future

results

or

occurrences.

In

some

cases

you

can

identify

forward-looking

statements

by

terminology

such

as

“may,”

“might,

“will,”

“should,”

“could”

or

the

negative

thereof.

Generally,

the

words

“anticipate,”

“believe,”

“continues,”

“expect,”

“intend,”

“estimate,”

“project,”

“plan”

and

similar

expressions

identify

forward-looking

statements.

In

particular,

statements

about

our

expectations,

beliefs,

plans,

objectives,

assumptions

or

future

events

or

performance

contained

in

this

are

forward-looking

statements.

We

have

based

these

forward-looking

statements

on

our

current

expectations,

assumptions,

estimates

and

projections.

While

we

believe

these

expectations,

assumptions,

estimates

and

projections

are

reasonable,

such

forward-looking

statements

are

only

predictions

and

involve

known

and

unknown

risks,

uncertainties

and

other

factors,

many

of

which

are

outside

of

our

control,

which

could

cause

our

actual

results,

performance

or

achievements

to

differ

materially

from

any

results,

performance

or

achievements

expressed

or

implied

by

such

forward-looking

statements.

Given

these

risks

and

uncertainties,

you

are

cautioned

not

to

place

undue

reliance

on

such

forward-looking

statements.

These

risks

and

uncertainties

may

cause

our

actual

future

results

to

be

materially

different

than

those

expressed

in

our

forward-looking

statements.

Additional

risks

and

uncertainties

are

described

more

fully

in

our

periodic

reports

and

other

filings

with

the

Securities

&

Exchange

Commission.

These

forward-looking

statements

are

made

only

as

of

the

date

of

this

presentation.

We

do

not

undertake

and

specifically

decline

any

obligation

to

update

any

such

statements

or

to

publicly

announce

the

results

of

any

revisions

to

any

such

statements

to

reflect

future

events

or

developments.

Safe Harbor

1 |

| We

have

included

certain

financial

measures

in

this

presentation,

including

Pro

Forma

EBITDA,

Pro

Forma

Adjusted

EBITDA,

Adjusted

Diluted

Earning

per

Share,

PiC

EBITDA

and

PiC

Adjusted

EBITDA,

which

are

“non-GAAP

financial

measures”

as

defined

under

the

rules

and

regulations

promulgated

by

the

U.S.

Securities

and

Exchange

Commission

(“SEC”).

We

define

Pro

Forma

EBITDA

as

pro

forma

net

income

(loss)

adjusted

for

loss

(income)

from

discontinued

operations,

net

interest

expense,

income

tax

provision

(benefit)

and

depreciation

and

amortization.

We

define

Pro

Forma

Adjusted

EBITDA

as

Pro

Forma

EBITDA

adjusted

for

equity-based

compensation

expense,

cost

savings/synergies,

rate

increases,

integration

and

closing

costs,

rent

elimination,

other

and

debt

extinguishment

costs.

We

define

PiC

EBITDA

as

PiC

loss

from

continuing

operations

adjusted

for

net

interest

expense,

income

tax

benefit

and

depreciation

and

amortization.

We

define

PiC

Adjusted

EBITDA

as

PiC

EBITDA

adjusted

for

other

costs.

For

a

reconciliation

of

pro

forma

net

income

(loss)

to

Pro

Forma

Adjusted

EBITDA,

see

page

22

(Adjusted

EBITDA

Reconciliation).

For

a

reconciliation

of

Adjusted

Diluted

Earnings

per

Share,

see

page

23

(Adjusted

EPS

Reconciliation).

For

a

reconciliation

of

PiC

loss

from

continuing

operations

to

PiC

Adjusted

EBITDA,

see

page

24

(PiC

Adjusted

EBITDA

Reconciliation).

We

may

not

achieve

all

of

the

expected

benefits

from

synergies,

cost

savings

and

recent

improvements

to

our

revenue

base.

Pro

Forma

EBITDA,

Pro

Forma

Adjusted

EBITDA

and

PiC

Adjusted

EBITDA,

as

presented

in

this

presentation,

are

supplemental

measures

of

our

performance

and

are

not

required

by,

or

presented

in

accordance

with,

generally

accepted

accounting

principles

in

the

United

States

(“GAAP”).

Pro

Forma

EBITDA,

Pro

Forma

Adjusted

EBITDA

and

PiC

Adjusted

EBITDA

are

not

measures

of

our

financial

performance

under

GAAP

and

should

not

be

considered

as

alternatives

to

net

income

or

any

other

performance

measures

derived

in

accordance

with

GAAP

or

as

an

alternative

to

cash

flow

from

operating

activities

as

measures

of

our

liquidity.

Our

measurements

of

Pro

Forma

EBITDA,

Pro

Forma

Adjusted

EBITDA

and

PiC

Adjusted

EBITDA

may

not

be

comparable

to

similarly

titled

measures

of

other

companies

and

are

not

measures

of

performance

calculated

in

accordance

with

GAAP.

We

have

included

information

concerning

Pro

Forma

EBITDA,

Pro

Forma

Adjusted

EBITDA

and

PiC

Adjusted

EBITDA

in

this

presentation

because

we

believe

that

such

information

is

used

by

certain

investors

as

measures

of

a

company’s

historical

performance.

We

believe

these

measures

are

frequently

used

by

securities

analysts,

investors

and

other

interested

parties

in

the

evaluation

of

issuers

of

equity

securities,

many

of

which

present

EBITDA

and

Adjusted

EBITDA

when

reporting

their

results.

Our

presentation

of

Pro

Forma

EBITDA,

Pro

Forma

Adjusted

EBITDA

and

PiC

Adjusted

EBITDA

should

not

be

construed

as

an

inference

that

our

future

results

will

be

unaffected

by

unusual

or

nonrecurring

items.

Use of Non-GAAP Financial Measures

2 |

Proven and Replicable Growth Strategy

Attractive Industry Trends Coupled with Favorable Legislative Environment

Key Investment Highlights

3

Leading Pure Play Behavioral Healthcare Services Provider

Strong Financial Performance and Steady Cash Flow Generation

Premier Management Team with Track Record of Success

Significant Transformation in Scale, Bed and Payor Mix

Attractive Revenue Diversification and Payor Base |

Definitive Agreement to Acquire Partnerships in Care (PiC)

PiC is the 2

nd

largest independent (private) behavioral health provider in the

UK

23 inpatient facilities with over 1,200 beds

2013 revenues of $285 million

2013 adjusted EBITDA of $75 million

Purchase price of approximately $660 million

Fully underwritten funding commitment from BofAML

Transaction expected to be significantly accretive

$0.17 to $0.20 per diluted share for 2014

$0.40 to $0.46 per diluted share for 2015

Attractive UK growth opportunities

Favorable industry dynamics

Positioned well to grow organically and through acquisitions

Transaction expected to close July 1, 2014

4 |

PiC is

a Long-Established Leading Service Provider 5

PiC Standalone Overview

Facility Locations

Established in 1985, PiC has since grown to comprise

1,244 beds in 23 facilities located across the UK

Owned by Cinven since 2005

Market leader in the provision of secure

accommodation for mentally ill patients and a leading

provider of care, in both secure and non-secure

settings. #2 UK private-sector provider with 16%

market share

The primary sources of new patient referrals are the

NHS, legal system, prisons, and other secure facilities

Over 99% of treatment is funded by the NHS, which is

predominantly funded by NHS England and Clinical

Commissioning Groups for services such as brain

injuries and rehab

Owns a portfolio of well maintained flexible mental

health hospitals with outstanding service records, with

over $150 million invested in development CapEx over

the past 7 years

Generated revenue for 2013 of $285

(1)

million and

adjusted EBITDA of $75

(1)

million

(1) Note: assumes £1 = $1.67 |

Acquisition Rationale

6

Meaningfully

increases

size

and

scale

of

the

business

–

expected

to

increase

revenue

by

37%

to

$1.1

billion

Attractive

platform

for

entry

into

UK

behavioral

health

market

Ample

opportunities

for

growth

-

bed

expansions,

de

novo

opportunities

and

acquisitions

have

been

identified

in

markets

with

pent-up

demand

PiC

has

strong

relationships

with

UK

regulators

Positive

underlying

fundamental

trends

in

the

UK

behavioral

health

industry

Demand

for

independent

acute

care

services

has

grown

significantly

as

a

result

of

reducing

bed

capacity

at

NHS

facilities

and

increased

hospitalization

rates

The

UK

independent

mental

health

market

is

a

£1.1

billion

market

(~8%

of

total

mental

health

spend)

and

is

growing

at

9.2%

per

year,

making

it

one

of

the

fastest

growing

sectors

in

the

UK

Sector

poised

for

consolidation

(largest

four

players

make

up

58%

of

the

market),

with

significant

opportunities

to

bolster

scale

and

local

presence,

a

key

driver

of

competitive

advantage

in

the

UK

behavioral

health

market

Target

has

acquisition

pipeline

in

place

that

has

been

impeded

due

to

capital

constraints

under

current

owners

Significant

shift

in

payor

mix

profile

–

diversifies

revenue

mix

away

from

U.S.

government

payors

PF

49%

US

government

/

27%

UK

government

U.S.

Medicaid

mix

declines

from

mid

45%

to

33%

Growth

and

margin

enhancement

PiC

margins

in

mid

20%

region

–

roughly

500

bps

higher

than

those

of

Acadia

Acquisition

will

be

highly

accretive

to

Acadia

EPS

Limited

integration

risk

PiC

has

long-standing

and

highly

effective

management

team

that

are

expected

to

remain

at

the

Company |

UK

Behavioral Healthcare Market 7

Source: Laing & Buisson UK Market Report.

UK Mental

Healthcare

Market

Trends

NHS vs.

Independent

Sector

Dynamics

Expenditure on mental healthcare services in the UK is roughly £14.4bn.

>70% of funding for these services is provided by the National Health Service

(NHS), with the remainder funded by local authorities

In total, ~1.3m people currently receive mental healthcare services in the UK,

with the mentally ill population expected to be almost 10mm by 2026

(growing at or greater than the rate of overall population) The flattening

budget and policy focus on mental healthcare has resulted in the identification of certain

mechanisms to ensure sustainability. These include improved operational

efficiency, a focus on outcomes and implementation of the integrated care

agenda (“care pathways”) The secure mental healthcare pathway

includes medium and low secure settings, rehabilitation and community based

care. Individuals are referred into the pathway either from the NHS (77% of referrals), often via acute

hospitals or the criminal justice system (23%)

In response to the sustainability challenge, there is growing focus on increasing

patient velocity along their care pathways

and

commissioning

integrated

pathways,

although

certain

barriers

–

including

the

division

of

mental

health

commissioning

responsibility

between

different

entities

–

exist

to

its

adoption

There is an opportunity for providers to build out services offerings in community

settings, as these are currently underdeveloped and represent a lower cost

setting close to the patient’s home The NHS is the principal provider

of secure mental healthcare services, with approximately 70% share of total beds

in the UK. The independent sector is a material provider of services, with an

overall share of approximately 30%, which rises to over 40% for secure and

rehabilitation services The

NHS

has

reduced

its

overall

capacity

by

approximately

3%

per

year

since

2006

/

2007

NHS capacity is not optimized and it does not have the capital to address specific

local demand patterns The fundamental market dynamics are expected to

broadly strengthen the market position of quality independent sector

providers, especially the increased focus on outcomes, requirement to design new care models and

requirement

for

capacity

optimization

–

all

of

which

the

independent

sector

is

better

placed

to

address

than

the

NHS |

Leading Pure Play Behavioral Healthcare Services Provider

8

Acadia is a facility-based behavioral healthcare company

established in 2005 to acquire, develop and operate

behavioral healthcare facilities

In February 2011, five members of the former Psychiatric

Solutions, Inc. (“PSI”) senior management team joined

Acadia

Goal to build the pre-eminent behavioral healthcare

company in the US and accelerate Acadia’s growth strategy

M&A strategy has created significant momentum (acquired

~$600 million in revenue over the last 3 years)

Acquired AmiCare and BCA in December 2012

Acquired Greenleaf Center in January 2013

Acquired Delta Medical Center in January 2013

In May 2013, acquired San Juan Capestrano Hospital

(Puerto Rico) and North Tampa Behavioral, under

construction that opened in the fourth quarter of 2013

Acquired The Refuge in August 2013

Acquired Longleaf Behavioral in October 2013

Acquired Cascade Behavioral in December 2013

Acquired Pacific Grove in January 2014

Pro Forma for the acquisitions of San Juan Capestrano

and Cascade, LTM 3/31/14 Revenues and Adj. EBITDA

were $766 million and $156 million, respectively

Licensed Bed Mix

Acadia Overview

Facility Locations

Existing Facilities

Headquarters

AmiCare Facilities

BCA Facilities

4,300 Total Beds at 52 Facilities

Greenleaf

Delta Medical Center

San Juan Capestrano Hospital

Puerto Rico

North Tampa

Cascade

Pacific Grove

Longleaf

The Refuge |

Premier Management Team with Track Record of Success

9

Industry Leading Management Team

Bruce Shear

Executive Vice

Chairman,

Years in Industry: 36

Brent Turner

President

Years in Industry: 19

Ron Fincher

Chief Operating

Officer

Years in Industry: 30

Steve Davidson

Chief Development

Officer

Years in Industry: 30

Chris Howard

Executive Vice

President,

General Counsel

Years in Industry: 10

Joey Jacobs

Chairman & Chief Executive Officer

Years in Industry: 40

David Duckworth

Chief Financial

Officer

Years in Industry: 10

Division V

Division I

VP Clinical

Services

Division IV

Division III

Division II

PiC |

10

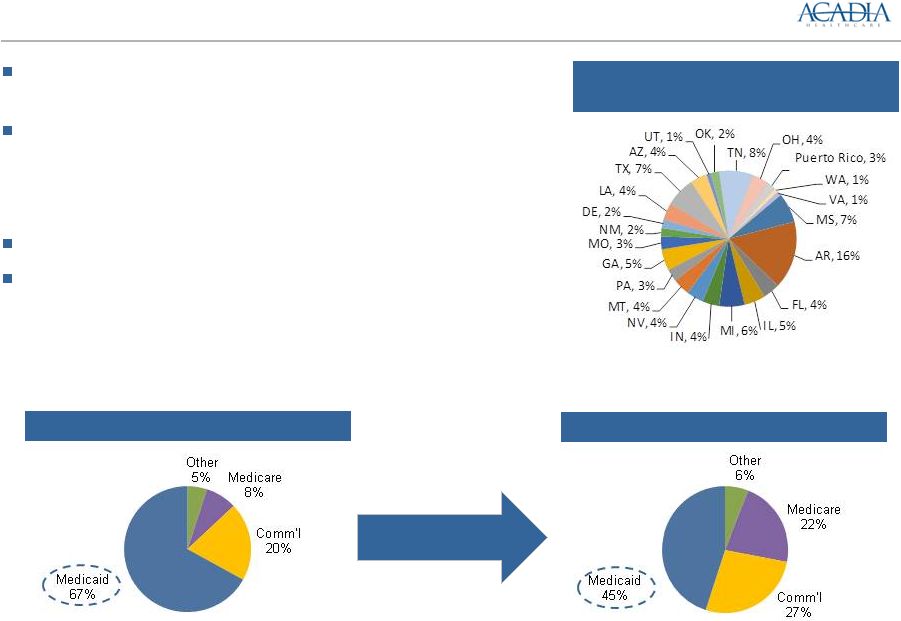

Significant Transformation in Scale, Bed and

Payor Mix over the Past Two Years

(1)

Pro forma Acadia, YFCS and PHC.

(2)

Pro forma Acadia, San Juan Capestrano and Cascade.

1,970 Beds

4,300 Beds

Pro Forma FY 2011

(1)

# of

Facilities

29

52

Revenue

($ in mil)

$333

$766

Adj. EBITDA

($ in mil)

$54

$155

Adj. EBITDA

Margin

16.2%

20.3%

# of

States

18

24

Bed

Mix

Payor

Mix

Pro Forma LTM 3/31/14

(2)

RTC /

Other

73%

Acute

27%

RTC/

Other

35%

Acute

65%

Other

5%

Medicare

8%

Comm'l

20%

Medicaid

67%

Other

6%

Medicare

22%

Comm'l

27%

Medicaid

45% |

Longleaf Hospital located in Alexandria, Louisiana

68-bed acute inpatient psychiatric facility

Closed October 1, 2013

Purchase price of approximately $8.3 million

Cascade Behavioral Hospital located in Tukwila, Washington

63-bed acute inpatient psychiatric hospital

Certificate of need for 135 total beds

Closed December 1, 2013

Purchase price of approximately $20.0 million

Pacific Grove Hospital located in Riverside, California

68-bed acute inpatient psychiatric facility

Closed January 1, 2014

Purchase price of approximately $10.5 million

11

Recent Announcements – Longleaf, Cascade and Pacific Grove |

Industry Dynamics Highly Favorable Compared to Medical/Surgical

Providers and Other Facility-Based Healthcare Businesses

General Acute Care Hospitals

Acute Hospitalization

Broad clinical focus

Focused on inpatient care with average

length of stay (ALOS) of roughly 5 days

Most intensive level of care offered

24-hour observation and care

–

Daily intervention and oversight by a

psychiatrist

10-day average length of stay

Transition to less-intensive level of care

Residential Treatment

Less intensive treatment in non-hospital

settings

Focused on children and adolescents

Physician-led multi-disciplinary treatment

addressing overall medical, psychiatric,

social and academic needs of the patient

–

Balance of therapies and activities in a

safe, structured setting

Longer length of stay –180 to 270 days

Focus

On average, hospitals have ~200 beds

Heavy competition from outpatient setting

Increasing inpatient occupancy and utilization

Limited competition from outpatient setting

Inpatient

Capabilities

More complex reimbursement system

–

670 Diagnosis Related Groups for

medical/surgical hospitals

–

Medicare reimbursement via a

prospective payment system (PPS)

Simple reimbursement system

–

Per diem based

–

15 Diagnosis Related Groups

–

Medicare PPS payment system implemented January 2005

Reimbursement

Profile

Mid-teens margin

Capex can be 4% -

6% of revenue

20 –

40% margin

Minimal maintenance capital expenditure

requirements: ~2% of revenue

15 –

25% margin

Minimal maintenance capital expenditure

requirements: ~2% of revenue

Facility Level

Profitability

Competitors

Inpatient Behavioral Healthcare

Bad debt expense as high as +10%

–

Higher level of private payors

Low bad debt exposure (~3% of Net Revenue)

–

Diverse and stable payor mix

–

Limited emergency room exposure

–

Preauthorization

12 |

Attractive Industry Fundamentals

(1)

IBISWorld report –

“Mental Health & Substance Abuse Centers in the US”, May 2011.

(2)

National Institute of Mental Health.

(3)

Based on management beliefs and/or projections.

(4)

IBISWorld report –

“Youth Programs & Miscellaneous Care Facilities in the U.S.”, August

2010. (5)

US Department of Health and Human Services.

Industry Trends Make a Compelling Growth Story

($ in billions)

Mental

Health

and

Substance

Abuse

Facilities

Market

(1)

Youth

Behavioral

Market

(4)

Highly fragmented industry with small establishments

Stable pricing and inpatient ALOS combined with increased

admissions and occupancy trends

Medicare PPS has had a positive impact to freestanding

providers

Significant barriers to entry because of high degree of

specialization

and

regulation

(1)

Large market with attractive trends

–

U.S. Behavioral Healthcare Market:

National expenditures on mental

health and substance abuse treatment are projected to reach $239bn

by

2014,

a

CAGR

of

6.4%

since

2003

(5)

–

Adult Behavioral Healthcare:

Mental health and substance abuse

facilities

market

estimated

to

grow

to

$10.2bn

in

2014

(1)

~26% of Americans aged 18 and older suffer from diagnosable

mental

disorders

(2)

Market is poised for growth due to increased awareness of

mental

health

illnesses

and

treatment

acceptance

(3)

–

Youth Behavioral Healthcare Market:

Child and Adolescent

Behavioral

Healthcare

market

estimated

to

grow

to

$11.0bn

in

2014

(4)

1

in

5

children

and

adolescents

have

a

mental

disorder

(2)

Focus on children services mitigates reimbursement pressure

from

Medicaid

(3)

–

Substance Abuse:

~2.8% of persons 12 or older are dependent on or

abuse

illicit

drugs,

and

~7%

are

dependent

on

or

abuse

alcohol

(1)

13

($ in billions)

$8.6

$8.7

$9.0

$9.4

$9.7

$10.0

$10.2

2008

2009

2010

2011E

2012E

2013E

2014E

$9.6

$9.7

$9.9

$10.1

$10.4

$10.7

$11.0

2008

2009

2010

2011E

2012E

2013E

2014E |

Favorable Legislative Environment

Enables most people who are now uninsured to get insurance through an insurance

exchange,

resulting

in

healthcare

coverage

for

more

than

90%

of

Americans

(1)

Significantly

expands

options

for

affordable

coverage

through

Medicaid

expansion

(1)

Reform is expected to provide more Americans, including low-income, single,

childless adults, with insurance and bring mental health and substance

abuse coverage on par with coverage for medical and surgical services

Healthcare Exchanges will be subject to the Federal Mental Health Parity Law

resulting in

more

individuals

having

comparable

coverage

for

mental

health

and

physical

health

(2)

(1)

IBISWorld report –

“Mental Health & Substance Abuse Centers in the US”, May 2011.

(2)

Based on management expectations.

The Mental Health Parity and Addiction Equity Act of 2008 provides for equal

coverage between psychiatric or mental health services and physical medical health

services

(1)

–

Forbids employers and insurers from placing stricter limits on mental healthcare

compared to other

health

conditions

for

group

plans

of

51

employees

or

more

(1)

–

Provides incentives and requirements for employers to provide comparable coverage

for mental health and physical health

–

Projected

to

affect

more

than

113

million

individuals

(1)

–

Promotes positive awareness of mental health issues and environment

Difficult

to

cut

reimbursement

for

coverage

that

relates

to

children

(2)

Final mental health parity regulations effective beginning in 2014

14

Mental Health

Parity Legislation

Patient

Protection and

Affordable Care

Act

Healthcare

Reform will Spur

Revenues |

15

Proven and Replicable Growth Strategy

Significant acquisition growth runway

exists given industry fragmentation and

attractive valuation

Proven strategy to identify, acquire,

integrate and improve facility operations

AmiCare and BCA (Dec. 2012)

Greenleaf Center (Jan. 2013)

Delta Medical Center (Jan. 2013)

San Juan Capestrano Hospital and

North Tampa Behavioral Health

(May 2013)

The Refuge (Aug. 2013)

Longleaf (Oct. 2013)

Cascade (Dec. 2013)

Pacific Grove (Jan. 2014)

Growth supported by positive secular demand trends, market

share gains, stable pricing and inpatient ALOS

Consistent track record of same facility revenue growth

(+10% average over the last four quarters)

Increase occupancy of existing beds and increasing mix of

higher margin services

Improve profitability at underperforming facilities by

addressing capital constraints and improving management

systems

Group purchasing, benefits and risk management savings

Expanding bed count at existing

facilities to meet demand –

significantly

cash flow accretive

In addition, opportunity from conversion

of RTC beds to acute beds

Added 76 beds to existing facilities

during 2011

Added 281 beds during 2012

Added 325 beds, including opening

two newly developed facilities with a

combined 102 licensed beds, in 2013

Added 122 beds during Q1 2014 |

Financial Review

16 |

Attractive Revenue Diversification and Payor Base

17

Limited

significant

geographic

concentration

PF LTM 3/31/14 Revenues

(1)

Payor Mix –

PF FY 2011

(2)

(1)

Pro Forma for Acadia, San Juan Capestrano Hospital and Cascade. Medicaid includes 30

state payors and other payment providers including educational departments and state governments.

(2)

Pro Forma Acadia, YFCS and PHC.

Geographic diversification with operations across 52 facilities

in 24 states and Puerto Rico, on a pro forma basis

Receive Medicaid payments from 30 states, the District of

Columbia and Puerto Rico

-

Medicaid reimbursements are primarily for services provided to

children and adolescents

No facility accounts for more than 7% of total facility revenue

Improving mix of services by increasing acute psychiatric

beds

-

Services diversified between adult and youth behavioral, in-patient,

outpatient and general psychiatric facilities, residential treatment

facilities, substance abuse facilities, and other behavioral

healthcare services

Payor Mix –

PF LTM 3/31/14

(1) |

First

Quarter 2014 Financial Summary Significant expansion of platform

52 facilities and ~4,300 beds in 24 states and Puerto

Rico in Q1 2014 vs. 44 facilities and ~3,500 beds in

21 states in Q1 2013

Room for growth and margin improvement within

existing facilities

26.0% same-facility Adjusted EBITDA margin for the

first quarter ended 3/31/14 compared with the 23.7%

Adjusted EBITDA margin for all facilities

Delivered a strong financial performance in three

months ended 3/31/14 compared to three months

ended 3/31/13

Revenues grew by 25% from $161.2 million

to $201.4 million

Same-facility revenues grew by 10% from $160.6

million to $176.4 million

Adjusted EBITDA grew by 29% from $30.5 million to

$39.3 million

Increasing facility EBITDA margin, delivered 60 bps

of margin expansion from 23.1% to 23.7%

Generated $0.28 diluted EPS

(1)

in three months

ended 3/31/14

Completed acquisition of one facility in California

with approximately 68 licensed beds

Source:

SEC filings and company press release.

Q1 2014 Performance

Revenue

($ millions)

Adjusted Diluted EPS

Adjusted EBITDA

($ millions)

Key Highlights

18

Y-O-Y Growth: 25%

Y-O-Y Growth: 29%

Y-O-Y Growth: 62%

$161.2

$201.4

Q1'13

Q1'14

$30.5

$39.3

Q1'13

Q1'14

$0.21

$0.28

Q1'13

Q1'14 |

Historical Performance

19

Revenues

($ millions)

Adjusted EBITDA

($ millions)

Adjusted Diluted EPS

2014 guidance for

adjusted diluted EPS

of $1.26 -

$1.29

$216.5

$407.5

$713.4

2011

2012

2013

$35.2

$81.0

$145.3

2011

2012

2013

$0.27

$0.66

$1.07

2011

2012

2013 |

Proven and Replicable Growth Strategy

Attractive Industry Trends Coupled with Favorable Legislative Environment

Key Investment Highlights

20

Leading Pure Play Behavioral Healthcare Services Provider

Strong Financial Performance and Steady Cash Flow Generation

Premier Management Team with Track Record of Success

Significant Transformation in Scale, Bed and Payor Mix

Attractive Revenue Diversification and Payor Base |

Appendix

21 |

Adjusted EBITDA Reconciliation

(1)

Approximately $17.3 million of equity-based compensation was

recognized

in

2011

related

to

equity

units

issued

in

conjunction

with

the acquisition of YFCS

(2)

Includes headcount reduction associated with duplicative functions

and the integration of PHC’s, AmiCare’s and BCA’s corporate

functions into Acadia’s headquarters in Franklin, TN

(3)

Represents (1) the increased revenue that would have resulted from

an increased rate on one of PHC’s contracts that became effective

in March 2011, assuming such increased rate had been effective

throughout the twelve month period ended December 31, 2011.

The increased rate was estimated by multiplying the historical plan

enrollment by the newly-contracted rate, and (2) the increased

revenue of AmiCare facilities for the Arkansas Medicaid rate

increases effective July 1, 2012

(4)

Reflects

integration

costs

incurred

through

12/31/11

for

the

acquisition of YFCS by Acadia

(5)

Represents rent expense incurred prior to the purchase of the real

estate assets of (1) PHC’s Capstone Academy, (2) the six facilities

that were previously leased by Acadia and purchased in 2012 and

(3) BCA’s Stone Crest facility purchased in December 2011

(6)

Includes run-rate effect of the expansion of an existing PHC

contract, normalized operating income for PHC’s Seven Hills

Facility, a legal settlement at PHC, the impact of start up losses for

new programs and facilities opened by PHC, AmiCare and BCA,

reimbursement adjustments, divestiture costs, policy changes,

management fees and other transaction related expenses already

incurred

(7)

In connection with the redemption of $52.5 million of the Company’s

12.875% Senior Notes, Acadia recorded a debt extinguishment

charge of $9.4 million in the first quarter ended March 31, 2013.

Description of Adjustments

22

Pro Forma Adjusted EBITDA Reconciliation

FYE December 31,

2011

2012

Pro Forma Results

Income (Loss) from Continuing Operations

$8.9

$34.3

Interest expense, net

34.6

34.9

Income tax provision (benefit)

16.6

23.2

Depreciation and amortization

11.1

12.4

Other expense, net

0.0

0.6

Pro Forma EBITDA

$71.2

$105.4

Adjustments

(1) Equity-based compensation expense

17.4

2.3

(2) Cost savings/synergies

9.8

6.9

(3) Rate increases

0.7

0.2

(4) Integration and closing costs

0.9

0.0

(6) Other

0.5

9.1

Total Pro Forma Adjusted EBITDA

$105.2

$127.2

$

millions

(5) Rent elimination

4.7

3.3

2013

$44.3

37.9

27.0

17.6

0.0

$126.8

5.2

0.0

0.0

0.0

7.2

$148.6

0.0

(7) Debt extinguishment costs

0.0

0.0

9.4

TTM

3/31/14

$52.7

38.5

31.6

19.1

0.0

$141.9

6.4

0.0

0.0

0.0

7.2

$155.5

0.0

0.0 |

Adjusted EPS Reconciliation

Description of Adjustments

(1)

Represents the management fees paid by Acadia to its equity sponsor prior to the

termination of the professional services agreement between Acadia and its

equity sponsor on November 1, 2011. (2)

In connection with the redemption of $52.5 million of the Company’s 12.875%

Senior Notes, Acadia recorded a debt extinguishment charge of $9.4 million

in the first quarter ended March 31, 2013. (3)

Represents transaction-related expenses incurred by Acadia related to

acquisitions. (4)

Represents the income tax provision adjusted to reflect the aggregate tax effect of

the adjustments to income (loss) from continuing operations described above

based on effective tax rates. Adjusted EPS Reconciliation

FYE December 31,

$ millions

2011

2012

2013

Q1 2013

Q1 2014

Income (loss) from continuing

operations

$

(33.2)

$

20.5

$

43.3

$

4.1

$

13.0

Provision (benefit) for income taxes

(5.3)

12.3

25.9

2.6

7.8

Income (loss) from continuing operations before income taxes

(38.5)

32.8

69.2

6.7

20.8

Adjustments to income (loss) from continuing operations:

Sponsor management fees (1)

1.3

—

—

—

—

Debt extinguishment costs (2)

—

—

9.4

9.4

—

Transaction-related expenses (3)

41.5

8.1

7.2

1.5

1.6

Income tax provision/benefit reflecting tax effect of

adjustments to income from continuing operations (4)

0.7

(15.3)

(32.2)

(7.0)

(8.4)

Adjusted income (loss) from continuing operations

$

5.0

$

25.6

$

53.6

$

10.6

$

14.0

Weighted-average

shares

outstanding

–

diluted

18,757

38,696

50,261

50,250

50,486

Adjusted income (loss) from continuing operations per diluted

share

$

0.27

$

0.66

$

1.07

$

0.21

$

0.28

23 |

PiC

Adjusted EBITDA Reconciliation (1)

Includes non-recurring legal and other costs incurred by PiC in the

period presented.

Description of Adjustments

24

Adjusted EBITDA Reconciliation

FYE December

31, 2013

Loss from Continuing Operations

($48.5)

Interest expense, net

103.2

Income tax benefit

(2.9)

Depreciation and amortization

19.2

EBITDA

$71.0

Adjustments

(1) Other

4.3

Adjusted EBITDA

$75.3

$ millions

(1) PiC results have been adjusted to conform to Acadia financial

statement presentation and to convert British pounds to US Dollars at a 1.67 exchange rate. |