Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BUCKEYE PARTNERS, L.P. | a14-14494_18k.htm |

Exhibit 99.1

|

|

Wells Fargo Kick the Tires Houston, TX June 2, 2014 |

|

|

FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” that we believe to be reasonable as of the date of this presentation. These statements, which include any statement that does not relate strictly to historical facts, use terms such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “plan,” “position,” “potential,” “predict,” “project,” or “strategy” or the negative connotation or other variations of such terms or other similar terminology. In particular, statements, express or implied, regarding future results of operations or ability to generate sales, income or cash flow, to make acquisitions, or to make distributions to unitholders are forward-looking statements. These forward-looking statements are based on management’s current plans, expectations, estimates, assumptions and beliefs concerning future events impacting Buckeye Partners, L.P. (the “Partnership” or “BPL”) and therefore involve a number of risks and uncertainties, many of which are beyond management’s control. Although the Partnership believes that its expectations stated in this presentation are based on reasonable assumptions, actual results may differ materially from those expressed or implied in the forward-looking statements. The factors listed in the “Risk Factors” sections of, as well as any other cautionary language in, the Partnership’s public filings with the Securities and Exchange Commission, provide examples of risks, uncertainties and events that may cause the Partnership’s actual results to differ materially from the expectations it describes in its forward-looking statements. Each forward-looking statement speaks only as of the date of this presentation, and the Partnership undertakes no obligation to update or revise any forward-looking statement. © Copyright 2014 Buckeye Partners, L.P. 2 |

|

|

INVESTMENT HIGHLIGHTS Over 125 years of continuous operations, with a 27-year track record as a publicly traded MLP on the NYSE Paid cash distributions each quarter since formation in 1986 Lower cost of capital realized from elimination of GP IDRs; differentiation from many MLP peers Best practices initiative implemented in 2009 to change culture, business strategies and processes More commercially focused, increased employee empowerment, more accountability and increased incentive pay for success Primarily fee-based cash flows from our transportation, terminal throughput and storage activities Investment-grade credit rating with a conservative approach toward financing growth Increased geographic and product diversity, including access to international logistics opportunities, and significant near-term growth projects, resulting from recent acquisitions Growth capital investment opportunities across our asset platform, including crude oil diversification projects utilizing existing asset footprint, to generate exceptional financial returns for our unitholders © Copyright 2014 Buckeye Partners, L.P. 3 Linden hub BORCO jetties |

|

|

ORGANIZATIONAL OVERVIEW Three Business Operating Units Domestic Pipelines & Terminals One of the largest independent liquid petroleum products pipeline operators in the United States with pipelines located primarily in the Northeast and Midwest and liquid petroleum products terminals located throughout the United States Global Marine Terminals An integrated network of marine terminals located in the Caribbean and on the U.S. East Coast Buckeye Services Merchant Services Markets liquid petroleum products in areas served by Domestic Pipelines & Terminals and Global Marine Terminals Development & Logistics Operates or maintains third-party pipelines and performs engineering and construction management services for third parties © Copyright 2014 Buckeye Partners, L.P. 4 Buckeye owns and operates a diversified network of integrated assets providing midstream logistic solutions LTM(1) Adjusted EBITDA Market and Financial Highlights LTM through March 31, 2014. See Non-GAAP Reconciliations. As of May 29, 2014 For the quarter ended March 31, 2014 Market Data (2) Unit Price $78.07 Market Capitalization $9.1 billion Yield 5.6% Financial Data (3) Adjusted EBITDA $188.6 million Distribution per Unit (Annualized) $4.40 Distribution Coverage Ratio 1.03x Leverage Ratio 4.47x |

|

|

PIPELINE AND TERMINAL SYSTEM MAP © Copyright 2014 Buckeye Partners, L.P. 5 |

|

|

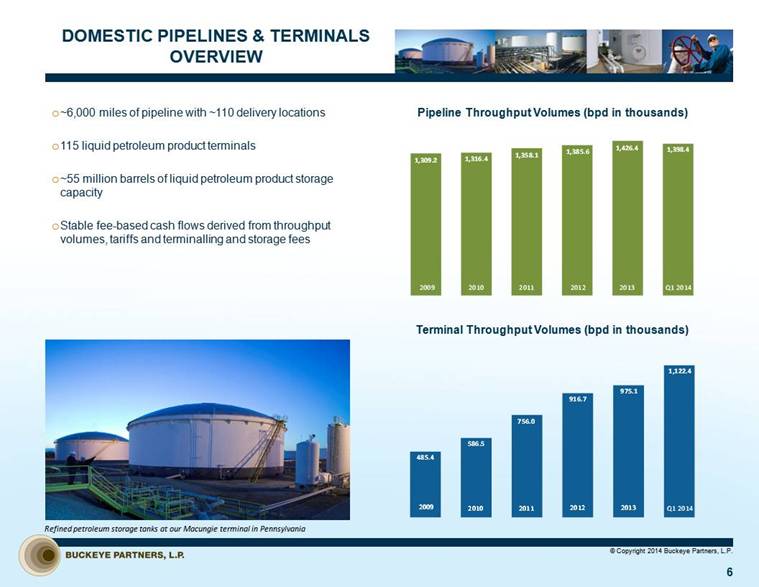

DOMESTIC PIPELINES & TERMINALS OVERVIEW ~6,000 miles of pipeline with ~110 delivery locations 115 liquid petroleum product terminals ~55 million barrels of liquid petroleum product storage capacity Stable fee-based cash flows derived from throughput volumes, tariffs and terminalling and storage fees © Copyright 2014 Buckeye Partners, L.P. 6 Pipeline Throughput Volumes (bpd in thousands) Terminal Throughput Volumes (bpd in thousands) Refined petroleum storage tanks at our Macungie terminal in Pennsylvania 485.4 586.5 756.0 916.7 975.1 1,122.4 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 Q1 2014 |

|

|

GLOBAL MARINE TERMINALS OVERVIEW CARIBBEAN BORCO, St. Lucia and Yabucoa ~41 million barrels of liquid petroleum product storage capacity Deep-water access and the ability to berth ULCCs and VLCCs in The Bahamas and St. Lucia Take or pay contracts along with capabilities for ancillary services such as berthing, blending, bunkering and transshipping NEW YORK HARBOR Perth Amboy, Port Reading and Raritan Bay ~16 million barrels of liquid petroleum products storage capacity Deep-water ports Expanded Colonial pipeline and Buckeye 6-mile interconnect pipeline to Buckeye Linden hub now in service Ship, barge, truck rack, rail and pipeline transportation capabilities © Copyright 2014 Buckeye Partners, L.P. 7 LTM(1) Leased Capacity LTM(1) Revenue Buckeye’s network of marine terminals enables it to facilitate global flows of liquid petroleum products and offer customers connectivity to some of the worlds most important bulk storage and blending hubs LTM through March 31, 2014. See Non-GAAP Reconciliations. 30% 37% 33% Fuel Oil Crude Oil Refined Products |

|

|

BUCKEYE SERVICES OVERVIEW Merchant Services Markets a wide range of liquid petroleum products and other ancillary products in areas served by Buckeye’s pipelines and terminals Includes the Caribbean fuel oil supply and distribution business and new merchant activities supporting the terminals acquired from Hess Centralizes all Buckeye merchant activities to leverage mid-and back-office support Contributed approximately $26 million(1) in revenues to Domestic Pipelines & Terminals and Global Marine Terminals Provides valuable insight on demand and pricing support for our terminalling and storage business © Copyright 2014 Buckeye Partners, L.P. 8 Development & Logistics Operates or maintains third-party pipelines under agreements with major oil and gas, petrochemical and chemical companies Performs engineering and construction management services for third parties Recent project wins provide footprint in important shale plays; potential for further growth: Operating Eagle Ford crude oil gathering pipeline Operating Permian-based pipeline system Merchant Services Development & Logistics LTM through March 31, 2014 |

|

|

CRUDE OIL DIVERSIFICATION Perth Amboy Crude by rail capability to be completed Q3 2014 Outbound transportation options include ship, barge, truck rack and pipeline Chicago Complex (CCX) Long-term storage and throughput agreement with construction of incremental 1.1 million barrels of crude oil storage; one tank placed-in-service in Q2 2014 and two tanks expected to be operational in Q3 2014 Long-term crude oil storage, throughput and rail loading services agreement; rail operations began in Q4 2013 Albany Multi-year contract providing crude oil services, including offloading unit trains, storage and throughput; rail operations began in Q4 2012 Albany terminal has two ship docks on the Hudson River, allowing transport of crude oil directly to customer’s facility BORCO ~9 million barrels of crude oil storage; includes expansion of 1.2 million barrels in Q3 2013 Project to upgrade storage capabilities to allow additional handling of heavy crude nearing completion © Copyright 2014 Buckeye Partners, L.P. Crude Oil Revenue (in millions) Buckeye is successfully leveraging its assets to provide crude oil logistics solutions to producers and refiners wherever possible 9 St. Lucia ~10 million barrels of crude oil storage 2014 & Beyond CCX Storage (Q2 & Q3) and Perth Amboy Rail (Q3) $0 $20 $40 $60 $80 $100 2011 2012 2013 BORCO Acquisition (Q1) Albany Rail (Q4) BORCO Expansion (Q3), CCX Rail (Q4) and St. Lucia (Q4) 2010 |

|

|

Cumulative Spend on Acquisitions Since 2008 GROWTH CAPITAL INVESTMENTS Nearly $6 Billion Invested Since 2008 Key Acquisitions 2013 Hess terminal network, $850.0 million 2012 Perth Amboy, NJ Marine Terminal, $260.0 million 2011 BORCO Marine Terminal, $1.7 billion BP Pipeline & Terminal Assets, $165.0 million 2010 Buy-in of general partner, 20 million units issued Yabucoa, Puerto Rico Terminal, $32.6 million 2009 Blue/Gold Pipeline and Terminal Assets, $54.4 million 2008 Farm & Home Oil Company(1), $146.2 million(2) Albany, New York Terminal, $46.9 million © Copyright 2014 Buckeye Partners, L.P. 10 2014 Internal Growth Capital Projects Transformation of Perth Amboy terminal into highly efficient, multi-product storage, blending, and throughput facility with crude rail offloading capability and pipeline access to our Linden hub Further diversification of our Chicago Complex with construction of crude oil storage tanks in addition to recently completed project that added crude oil pipeline-to-train capability Expanding storage capability through completion of bi-directional pipeline connection at our Chicago Complex along with other additional pipeline connections across our system Butane blending and vapor recovery installations for numerous terminal facilities across the domestic system and BORCO Truck loading rack upgrades and refurbishment of storage tanks across the domestic system Tank conversions at the newly acquired Hess terminals Now part of Merchant Services Buckeye sold the retail division of Farm & Home Oil Company in 2008 for $52.6 million Estimate provided is mid-point of expected internal growth capital spend range Growth Capital Spend $4.9 $1.9 $0.3 $0.9 2011 2012 2013 Cumulative In billions Prior Years Current Year $248 $277 $290 $315 In millions 2011 2012 2013 2014 (3) |

|

|

HESS TERMINALS ACQUISITION Assets Overview Buckeye purchased 20 terminals from Hess in December 2013 St. Lucia, Port Reading and Raritan Bay terminals are included in our Global Marine Terminals segment The remaining 17 terminals, which are located primarily in metropolitan locations along the U.S. East Coast, including the New York Harbor, Upstate New York, Mid-Atlantic and Southeast, are included in our Pipelines & Terminals segment ~39 million barrels of liquid petroleum products storage capacity East Coast terminals benefit from Colonial and Buckeye pipeline connectivity Access to deep-water ports Strategic Rationale Expected to be accretive to DCF per LP unit, with further potential upside from asset integration and commercialization Attractive upside exists around commercial opportunities to increase third party utilization Hess is an attractive anchor tenant with four-year storage and throughput contracts with minimum revenue commitment Enhances Buckeye's position in the Mid-Atlantic, while also providing further penetration into the Southeastern markets Creates ability to potentially capture meaningful synergies for product movements between BORCO and the East Coast Growth Opportunities Potential for future growth through tank conversion opportunities, blending activities, rail opportunities, and other expansion projects © Copyright 2014 Buckeye Partners, L.P. 11 Unique opportunity to acquire a collection of terminals that are highly complementary with Buckeye's existing operations and enhances Buckeye's vision of creating a world-class, integrated terminal network Bayonne St. Lucia |

|

|

GROWTH CAPITAL PROJECTS Domestic Pipelines & Terminals Chicago Complex—Projected investment ~$100 million Hartsdale Crude Tanks and Pipeline 1.1 million barrels of crude oil storage Two 24” pipelines about one mile in length to connect storage to crude oil pipeline and rail services Long-term storage and throughput agreement Expected to be completed in Q3 2014 Peotone Bi-Directional Pipeline ~600,000 barrels of additional storage; product will also move from Hammond to Peotone terminal; will increase utilization of existing terminal Expected to be completed in Q3 2014 Hartsdale/Hammond Crude Tank Work, Pipeline and Rail Capabilities Tank work on four tanks at Hartsdale and Hammond Pipeline connection between our Hartsdale and Hammond terminals Long-term crude oil storage, throughput, and rail loading services agreement Completed in Q4 2013 Butane Blending Blending capabilities for numerous terminal facilities across our domestic system ~$30 million projected capital costs from 2012 to 2014 © Copyright 2014 Buckeye Partners, L.P. 12 Buckeye’s ability to leverage and repurpose our existing domestic asset footprint has allowed us to successfully deliver high-return growth capital projects with low single digit multiples Chicago Complex transloading facility Storage tank |

|

|

GROWTH CAPITAL PROJECTS Global Marine Terminals BORCO—Invested ~$390 million since acquisition Tank Expansion – 4.7 million barrels 1.2 million barrels of crude oil storage capacity completed in Q3 2013; 1.6 million barrels of refined products storage capacity completed in Q1 2013; 0.8 million barrels of refined products storage capacity completed in Q4 2012 and 1.1 million barrels fuel oil storage capacity completed in Q3 2012 Long-term storage and handling agreements Significant Infrastructure Upgrades Two 42” pipelines connecting the jetties with the terminals along with cargo pumps to increase the flow rates; completed in Q3 2013 © Copyright 2014 Buckeye Partners, L.P. 13 Perth Amboy—Invested ~$180 million since acquisition Facility Transformation Tank conversions, manifolds and piping, pipeline reversal, truck rack and dock upgrades; to be completed in stages and projected overall completion in Q3 2014 Rail Capability Rail services to allow handling of Bakken-sourced crude oil; to be completed in Q3 2014 High-Speed Pipeline 6-mile high-capacity pipeline connection between Perth Amboy and our Linden hub; completed in Q2 2014 Perth Amboy BORCO jetties, inland dock and tank farm |

|

|

FINANCIAL OVERVIEW |

|

|

FINANCIAL PERFORMANCE(1) 15 Adjusted EBITDA (in millions)(2)(3) Cash Distributions per Unit – Declared Cash Distribution Coverage Ratio(2)(3)(4) LTM through March 31, 2014 2013 and 2014 amounts represent Adjusted EBITDA from continuing operations and exclude the Natural Gas Storage business, which was classified as Discontinued Operations during the fourth quarter of 2013. 2010 to 2012 Adjusted EBITDA amounts include the Natural Gas Storage business, which was previously reported as part of our continuing operations. See Non-GAAP Reconciliations Distributable cash flow divided by cash distributions declared for the respective periods Long-term debt less cash and cash equivalents divided by Adjusted EBITDA (adjusted for pro forma impacts of acquisitions); calculation as per BPL Credit Facility Leverage Ratio(5) © Copyright 2014 Buckeye Partners, L.P. $3.875 $4.075 $4.150 $4.275 $4.325 2012 2010 2013 LTM 2011 1.03x 0.91x 1.04x 0.99x 1.03x 2012 2011 2010 2013 Q1 2014 3.89x 4.55x 4.74x 4.20x 4.47x 2012 2011 2010 2013 LTM |

|

|

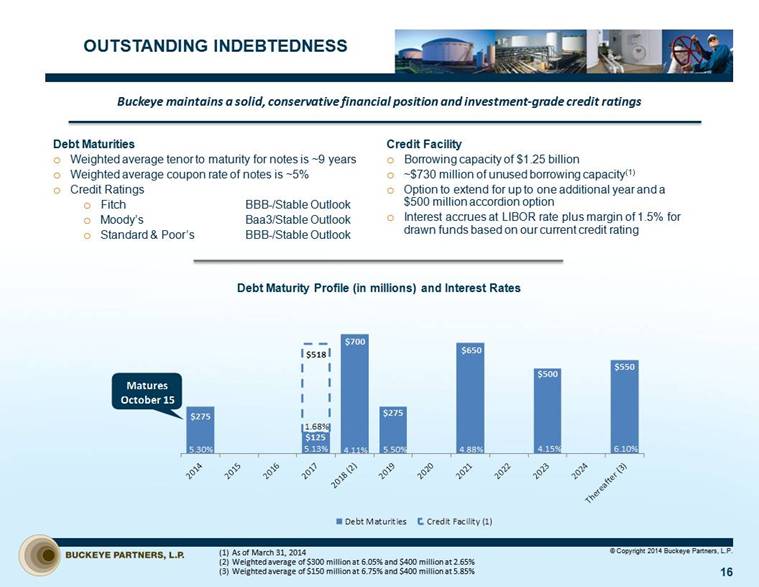

OUTSTANDING INDEBTEDNESS Debt Maturities Weighted average tenor to maturity for notes is ~9 years Weighted average coupon rate of notes is ~5% Credit Ratings Fitch BBB-/Stable Outlook Moody’s Baa3/Stable Outlook Standard & Poor’s BBB-/Stable Outlook © Copyright 2014 Buckeye Partners, L.P. 16 Buckeye maintains a solid, conservative financial position and investment-grade credit ratings Credit Facility Borrowing capacity of $1.25 billion ~$730 million of unused borrowing capacity(1) Option to extend for up to one additional year and a $500 million accordion option Interest accrues at LIBOR rate plus margin of 1.5% for drawn funds based on our current credit rating Debt Maturity Profile (in millions) and Interest Rates As of March 31, 2014 Weighted average of $300 million at 6.05% and $400 million at 2.65% Weighted average of $150 million at 6.75% and $400 million at 5.85% $275 $125 $700 $275 $650 $500 $550 $518 Debt Maturities Credit Facility (1) 5.30% 5.13% 5.50% 4.88% 4.15% 1.68% 4.11% 6.10% Matures October 15 |

|

|

INVESTMENT SUMMARY Proven 27-year track record as a publicly traded partnership through varying economic and commodity price cycles Stable fee-based cash flows derived from throughput volumes, tariffs and terminalling and storage fees Management continues to drive operational excellence through our best practices initiative Both geographic and product diversity achieved through recent acquisitions and growth capital projects Hess terminal acquisition Perth Amboy terminal acquisition BORCO Chicago Complex Buckeye is well-positioned to deliver long-term value to unitholders © Copyright 2014 Buckeye Partners, L.P. 17 Storage tank BORCO tank farm |

|

|

NON-GAAP RECONCILIATIONS |

|

|

NON-GAAP FINANCIAL MEASURES Adjusted EBITDA and distributable cash flow are measures not defined by GAAP. Adjusted EBITDA is the primary measure used by our senior management, including our Chief Executive Officer, to (i) evaluate our consolidated operating performance and the operating performance of our business segments, (ii) allocate resources and capital to business segments, (iii) evaluate the viability of proposed projects, and (iv) determine overall rates of return on alternative investment opportunities. Distributable cash flow is another measure used by our senior management to provide a clearer picture of Buckeye’s cash available for distribution to its unitholders. Adjusted EBITDA and distributable cash flow eliminate (i) non-cash expenses, including, but not limited to, depreciation and amortization expense resulting from the significant capital investments we make in our businesses and from intangible assets recognized in business combinations, (ii) charges for obligations expected to be settled with the issuance of equity instruments, and (iii) items that are not indicative of our core operating performance results and business outlook. Buckeye believes that investors benefit from having access to the same financial measures used by senior management and that these measures are useful to investors because they aid in comparing Buckeye’s operating performance with that of other companies with similar operations. The Adjusted EBITDA and distributable cash flow data presented by Buckeye may not be comparable to similarly titled measures at other companies because these items may be defined differently by other companies. Please see the attached reconciliations of each of Adjusted EBITDA and distributable cash flow to income from continuing operations. © Copyright 2014 Buckeye Partners, L.P. 19 |

|

|

NON-GAAP RECONCILIATIONS In millions, except coverage ratio © Copyright 2014 Buckeye Partners, L.P. 20 2013 and 2014 amounts exclude the Natural Gas Storage business, which was classified as Discontinued Operations during the fourth quarter of 2013. 2010 to 2012 Adjusted EBITDA amounts include the Natural Gas Storage business, which was previously reported as part of our continuing operations. Adjusted Segment EBITDA reflects adjustments to prior period information to conform to the current business segments as a result of changes to our operating structure in December 2013. LTM through March 31, 2014 On November 19, 2010, Buckeye merged with Buckeye GP Holdings L.P. Represents cash distributions declared for limited partner units (LP units) outstanding as of each respective period 2010 2011 2012 2013 1Q14 LTM (3) Adjusted EBITDA from continuing operations (1)(2) : Pipelines & Terminals $346.4 $361.0 $409.5 $471.1 $126.7 $482.4 Global Marine Terminals (4.7) 113.0 128.6 149.7 53.7 168.0 Merchant Services 5.9 1.8 1.1 12.6 3.1 9.6 Development and Logistics 5.2 7.9 13.2 15.4 5.1 17.3 Natural Gas Storage 29.8 4.2 7.1 - - Adjusted EBITDA from continuing operations $382.6 $487.9 $559.5 $648.8 $188.6 $677.3 Reconciliation of Income from continuing operations to Adjusted EBITDA and Distributable Cash Flow (1) : Income from continuing operations $201.0 $114.7 $230.5 $351.6 $101.5 $358.3 Less: Net income attributable to non-controlling interests (157.9) (6.2) (4.1) (4.2) (1.0) (4.0) Income from continuing operations attributable to Buckeye Partners, L.P. 43.1 108.5 226.4 347.4 100.5 354.3 Add: Interest and debt expense 89.2 119.6 115.0 130.9 41.2 141.9 Net income attributable to noncontrolling interests affected by merger (4) 157.5 - - - - - Income tax expense (benefit) (1.0) (0.2) (0.7) 1.1 (0.1) 0.9 Depreciation and amortization 59.6 119.5 146.4 147.6 43.0 154.9 Deferred lease expense 4.2 4.1 3.9 - - - Non-cash unit-based compensation expense 8.9 9.1 19.5 21.0 3.1 20.9 Asset impairment expense - - 60.0 - - - Equity plan modification expense 21.1 - - - - - Goodwill impairment expense - 169.6 - - - - Hess acquisition and transition expense - - - 11.8 3.6 15.4 Less: Amortization of unfavorable storage contracts - (7.6) (11.0) (11.0) (2.8) (11.0) Gain on sale of equity investment - (34.7) - - - - Adjusted EBITDA from continuing operations $382.6 $487.9 $559.5 $648.8 $188.6 $677.3 Less: Interest and debt expense, excluding amortization of deferred financing costs, debt discounts and other (84.8) (111.9) (111.5) (122.4) (38.3) Income tax expense, excluding non-cash taxes - - (1.1) (0.7) 0.1 Maintenance capital expenditures (31.2) (57.5) (54.4) (71.5) (18.6) Distributable cash flow from continuing operations $266.6 $318.5 $392.5 $454.2 $131.8 Distributions for coverage ratio (5) $259.3 $351.2 $376.2 $456.5 $128.0 Coverage Ratio 1.03x 0.91x 1.04x 0.99x 1.03x |