Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TYSON FOODS, INC. | tsn8-khillshireannouncement.htm |

| EX-99.1 - PRESS RELEASE - TYSON FOODS, INC. | tsn8-kxex991.htm |

Tyson Foods $50 per share Offer to Acquire Hillshire Brands May 29, 2014

2 MEETING PARTICIPANTS • Donnie Smith President & Chief Executive Officer • Dennis Leatherby Chief Financial Officer • Jon Kathol Vice President Investor Relations

3 FORWARD LOOKING STATEMENTS Certain information contained in this presentation may constitute forward-looking statements, such as information relating to expected performance. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results and experiences to differ materially from the anticipated results and expectations expressed in such forward-looking statements. We caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. Among the factors that may cause actual results and experiences to differ from anticipated results and expectations expressed in such forward-looking statements are the following: (i) the effect of, or changes in, general economic conditions; (ii) fluctuations in the cost and availability of inputs and raw materials, such as live cattle, live swine, feed grains (including corn and soybean meal) and energy; (iii) market conditions for finished products, including competition from other global and domestic food processors, supply and pricing of competing products and alternative proteins and demand for alternative proteins; (iv) successful rationalization of existing facilities and operating efficiencies of the facilities; (v) risks associated with our commodity purchasing activities; (vi) access to foreign markets together with foreign economic conditions, including currency fluctuations, import/export restrictions and foreign politics; (vii) outbreak of a livestock disease (such as avian influenza or bovine spongiform encephalopathy), which could have an adverse effect on livestock we own, the availability of livestock we purchase, consumer perception of certain protein products or our ability to access certain domestic and foreign markets; (viii) changes in availability and relative costs of labor and contract growers and our ability to maintain good relationships with employees, labor unions, contract growers and independent producers providing us livestock; (ix) issues related to food safety, including costs resulting from product recalls, regulatory compliance and any related claims or litigation; (x) changes in consumer preference and diets and our ability to identify and react to consumer trends; (xi) significant marketing plan changes by large customers or loss of one or more large customers; (xii) adverse results from litigation; (xiii) risks associated with leverage, including cost increases due to rising interest rates or changes in debt ratings or outlook; (xiv) compliance with and changes to regulations and laws (both domestic and foreign), including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational, health and safety laws; (xv) our ability to make effective acquisitions or joint ventures and successfully integrate newly acquired businesses into existing operations; (xvi) effectiveness of advertising and marketing programs; and (xvii) those factors listed under Item 1A. “Risk Factors” included in our September 28, 2013, Annual Report filed on Form 10-K.

4 AGENDA Transaction Overview Financial Performance Transaction Rationale

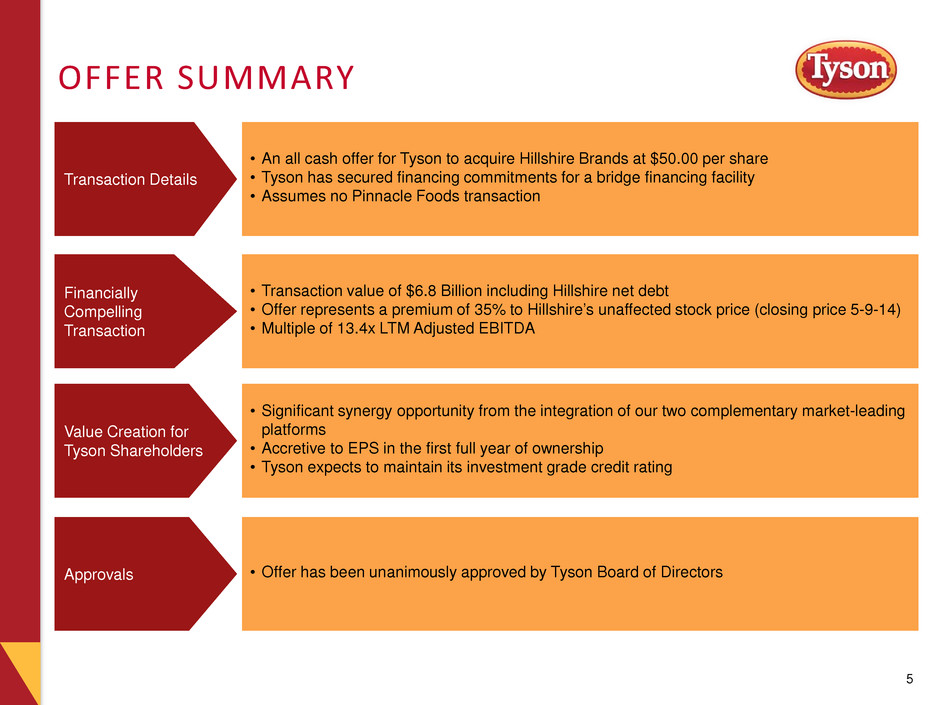

5 OFFER SUMMARY • An all cash offer for Tyson to acquire Hillshire Brands at $50.00 per share • Tyson has secured financing commitments for a bridge financing facility • Assumes no Pinnacle Foods transaction Transaction Details • Transaction value of $6.8 Billion including Hillshire net debt • Offer represents a premium of 35% to Hillshire’s unaffected stock price (closing price 5-9-14) • Multiple of 13.4x LTM Adjusted EBITDA Financially Compelling Transaction • Significant synergy opportunity from the integration of our two complementary market-leading platforms • Accretive to EPS in the first full year of ownership • Tyson expects to maintain its investment grade credit rating Value Creation for Tyson Shareholders • Offer has been unanimously approved by Tyson Board of Directors Approvals

6 GROWTH STRATEGY Accelerate • Grow domestic value-added chicken sales Grow prepared foods sales • Grow international chicken production Innovate Products and services Consumer insights Cultivate Talent development to support Tyson’s growth and long-term future This acquisition accelerates our growth strategy by growing prepared foods sales, increasing innovation and consumer insight capabilities, and adding a talented group of team members

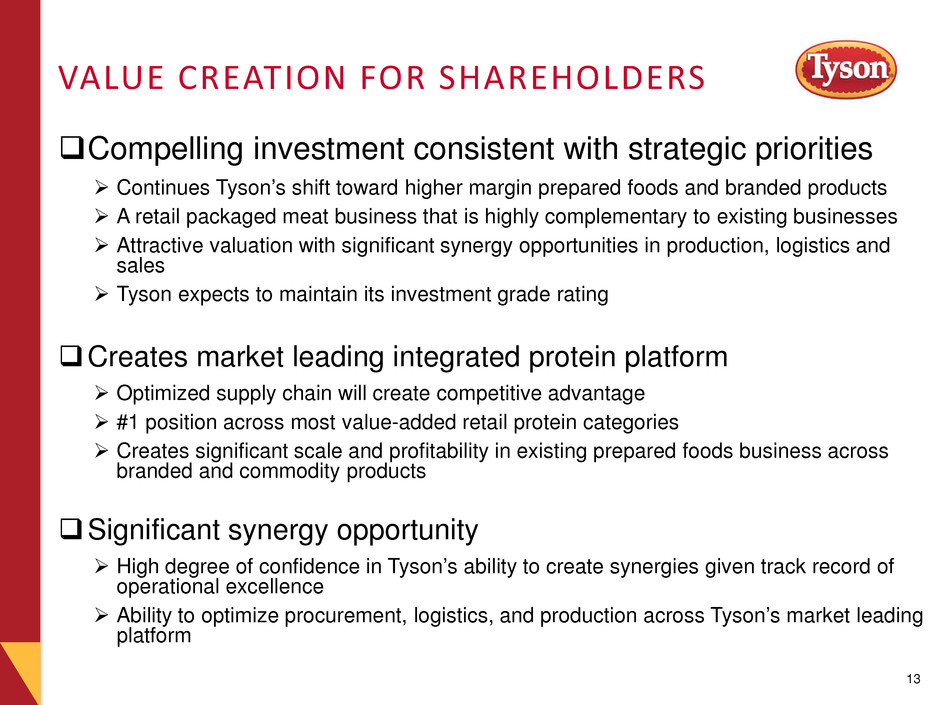

7 VALUE CREATION FOR SHAREHOLDERS Compelling investment consistent with strategic priorities Continues Tyson’s shift toward higher margin prepared foods and branded products A retail packaged meat business that is highly complementary to existing businesses Attractive valuation with significant synergy opportunities in production, logistics and sales Tyson expects to maintain its investment grade rating Creates market leading integrated protein platform Optimized supply chain will create competitive advantage #1 position across most value-added retail protein categories Creates significant scale and profitability in existing prepared foods business across branded and commodity products Significant synergy opportunity High degree of confidence in Tyson’s ability to create synergies given track record of operational excellence Ability to optimize procurement, logistics, and production across Tyson’s market leading platform

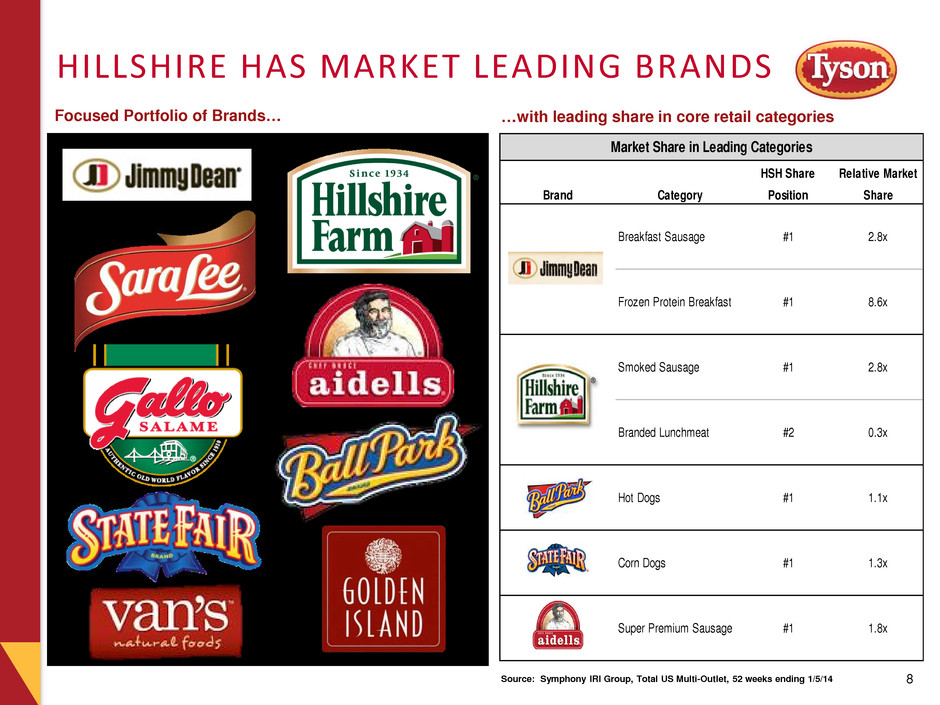

8 HILLSHIRE HAS MARKET LEADING BRANDS Focused Portfolio of Brands… …with leading share in core retail categories Source: Symphony IRI Group, Total US Multi-Outlet, 52 weeks ending 1/5/14 Market Share in Leading Categories HSH Share Relative Market Brand Category Position Share Breakfast Sausage #1 2.8x Frozen Protein Breakfast #1 8.6x Smoked Sausage #1 2.8x Branded Lunchmeat #2 0.3x Hot Dogs #1 1.1x Corn Dogs #1 1.3x Super Premium Sausage #1 1.8x

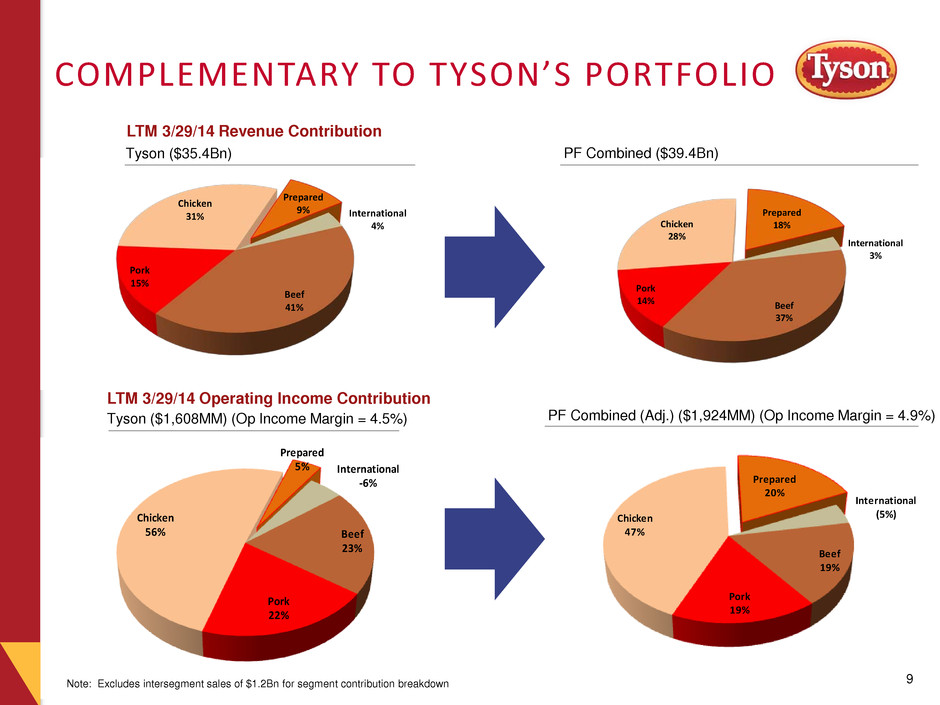

Beef 23% Pork 22% Chicken 56% Prepared 5% International -6% Beef 37% Pork 14% Chicken 28% Prepared 18% International 3% Beef 41% Pork 15% Chicken 31% Prepared 9% International 4% Beef 19% Pork 19% Chicken 47% Prepared 20% International (5%) 9 COMPLEMENTARY TO TYSON’S PORTFOLIO LTM 3/29/14 Revenue Contribution Tyson ($35.4Bn) PF Combined ($39.4Bn) LTM 3/29/14 Operating Income Contribution Tyson ($1,608MM) (Op Income Margin = 4.5%) PF Combined (Adj.) ($1,924MM) (Op Income Margin = 4.9%) Note: Excludes intersegment sales of $1.2Bn for segment contribution breakdown

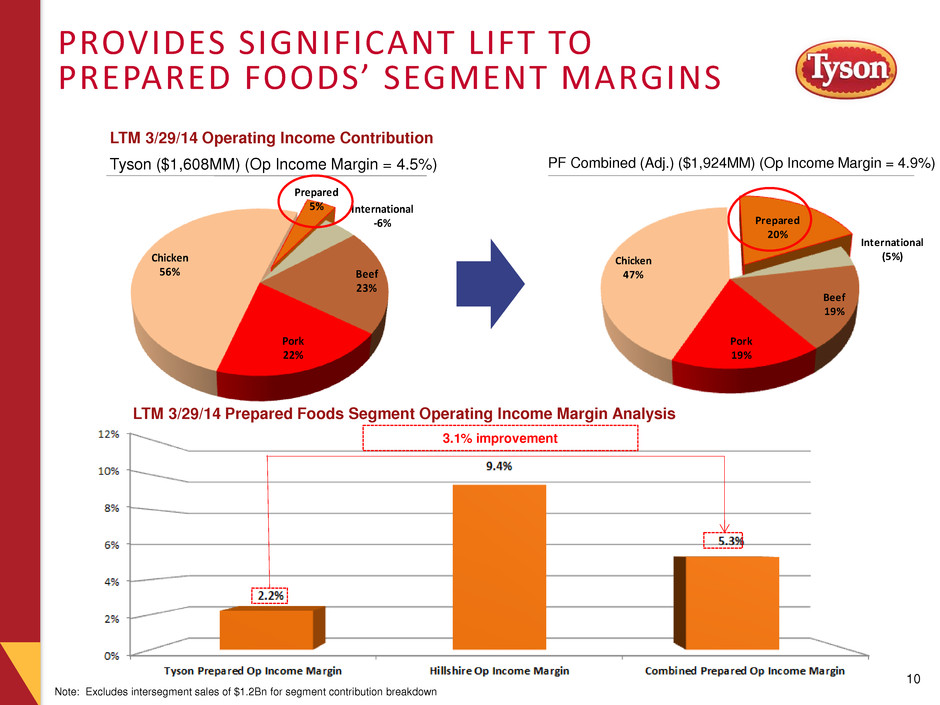

Beef 19% Pork 19% Chicken 47% Prepared 20% International (5%) Beef 23% Pork 22% Chicken 56% Prepared 5% International -6% PF Combined (Adj.) ($1,924MM) (Op Income Margin = 4.9%) LTM 3/29/14 Operating Income Contribution Tyson ($1,608MM) (Op Income Margin = 4.5%) 10 PROVIDES SIGNIFICANT LIFT TO PREPARED FOODS’ SEGMENT MARGINS LTM 3/29/14 Prepared Foods Segment Operating Income Margin Analysis 3.1% improvement Note: Excludes intersegment sales of $1.2Bn for segment contribution breakdown

11 EXPANSION OF TYSON BRANDED PORTFOLIO Tyson Brands Hillshire Brands

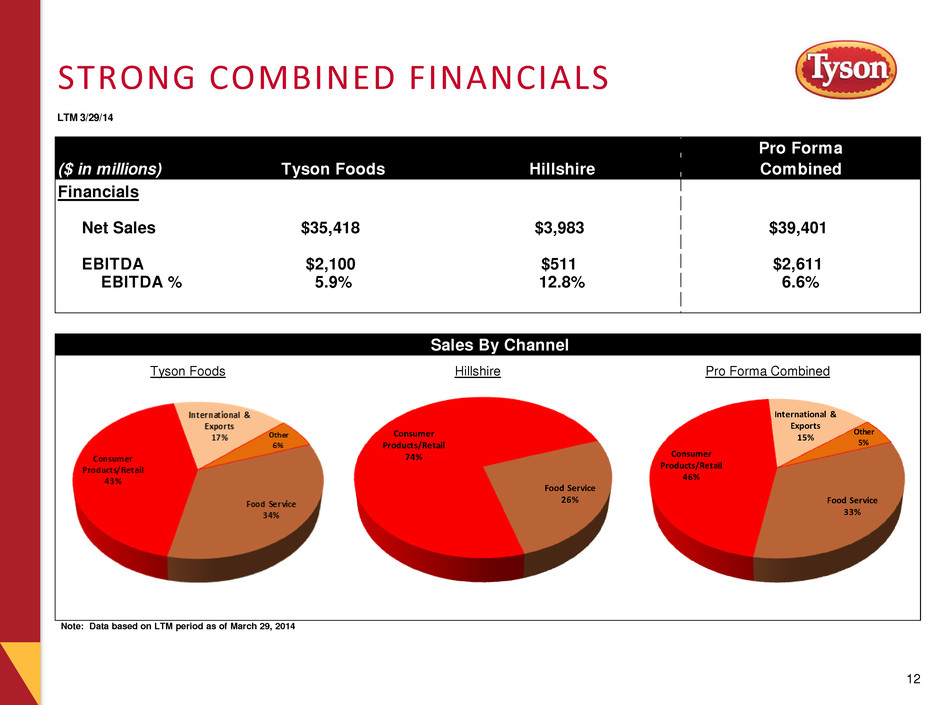

LTM 3/29/14 Pro Forma ($ in millions) Tyson Foods Hillshire Combined Financials Net Sales $35,418 $3,983 $39,401 EBITDA $2,100 $511 $2,611 EBITDA % 5.9% 12.8% 6.6% Sales By Channel 12 STRONG COMBINED FINANCIALS Food Service 26% Consumer Products/Retail 74% Food Service 33% Consumer Products/Retail 46% International & Exports 15% Other 5% Note: Data based on LTM period as of March 29, 2014 Tyson Foods Hillshire Pro Forma Combined

13 VALUE CREATION FOR SHAREHOLDERS Compelling investment consistent with strategic priorities Continues Tyson’s shift toward higher margin prepared foods and branded products A retail packaged meat business that is highly complementary to existing businesses Attractive valuation with significant synergy opportunities in production, logistics and sales Tyson expects to maintain its investment grade rating Creates market leading integrated protein platform Optimized supply chain will create competitive advantage #1 position across most value-added retail protein categories Creates significant scale and profitability in existing prepared foods business across branded and commodity products Significant synergy opportunity High degree of confidence in Tyson’s ability to create synergies given track record of operational excellence Ability to optimize procurement, logistics, and production across Tyson’s market leading platform

14 APPENDIX

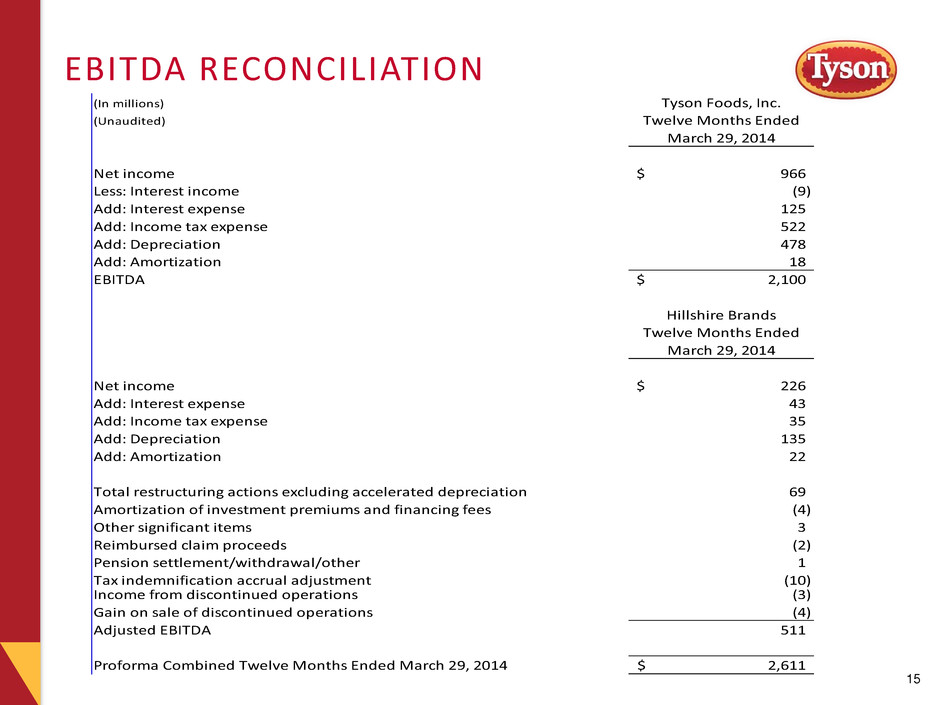

15 EBITDA RECONCILIATION (In millions) Tyson Foods, Inc. (Unaudited) Twelve Months Ended March 29, 2014 Net income 966$ Less: Interest income (9) Add: Interest expense 125 Add: Income tax expense 522 Add: Depreciation 478 Add: Amortization 18 EBITDA 2,100$ Hillshire Brands Twelve Months Ended March 29, 2014 Net income 226$ Add: Interest expense 43 Add: Income tax expense 35 Add: Depreciation 135 Add: Amortization 22 Total restructuring actions excluding accelerated depreciation 69 Amortization of investment premiums and financing fees (4) Other significant items 3 Reimbursed claim proceeds (2) Pension settlement/withdrawal/other 1 Tax indemnification accrual adjustment (10) Income from discontinued operations (3) Gain on sale of discontinued operations (4) Adjusted EBITDA 511 Proforma Combined Twelve Months Ended March 29, 2014 2,611$

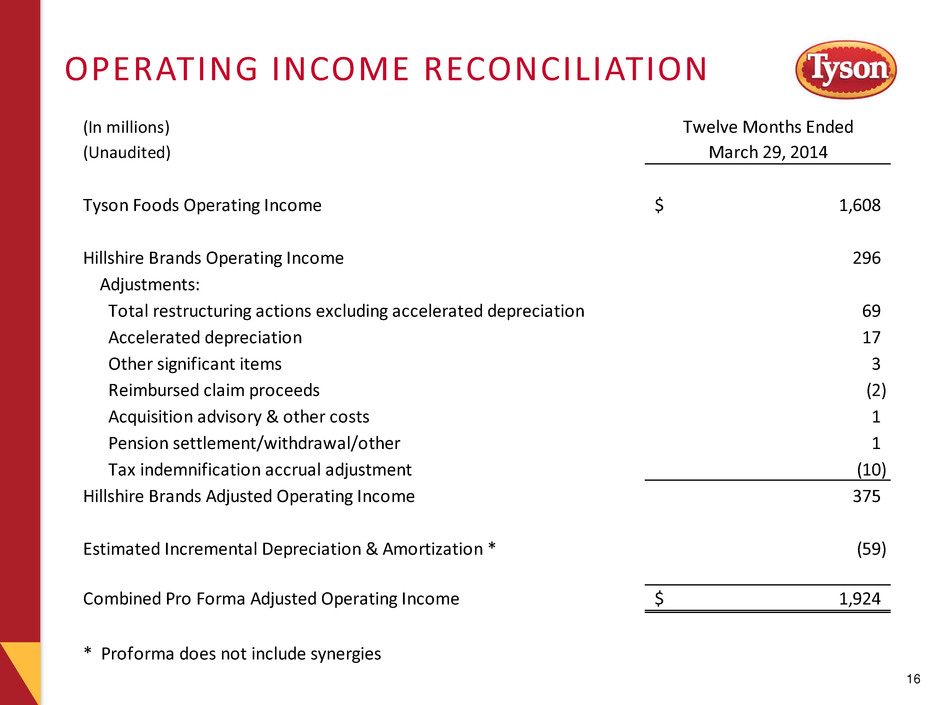

16 OPERATING INCOME RECONCILIATION (In millions) Twelve Months Ended (Unaudited) March 29, 2014 Tyson Foods Operating Income 1,608$ Hillshire Brands Operating Income 296 Adjustments: Total restructuring actions excluding accelerated depreciation 69 Accelerated depreciation 17 Other significant items 3 Reimbursed claim proceeds (2) Acquisition advisory & other costs 1 Pension settlement/withdrawal/other 1 Tax indemnification accrual adjustment (10) Hillshire Brands Adjusted Operating Income 375 Estimated Incremental Depreciation & Amortization * (59) Combined Pro Forma Adjusted Operating Income 1,924$ * Proforma does not include synergies

17 OPERATING INCOME % RECONCILIATION (In millions) (Unaudited) Operating Operating Sales Income Margin Tyson Foods - Prepared Foods 3,445$ 77$ 2.2% Hillshire Brands 3,983 296 Adjustments: Total restructuring actions excluding accelerated depreciation 69 Accelerated depreciation 17 Other significant items 3 Reimbursed claim proceeds (2) Acquisition advisory & other costs 1 Pension settlement/withdrawal/other 1 Tax indemnification accrual adjustment (10) Hillshire Brands Adjusted Operating Income 375 9.4% Estimated Incremental Depreciation & Amortization * (59) Combined Proforma (Adjusted Operating Income and Margin) 7,428$ 393$ 5.3% * Proforma does not include synergies Twelve Months Ended March 29, 2014