Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - RIVER VALLEY BANCORP | a2220341zex-1_1.htm |

| EX-5.(1) - EX-5.(1) - RIVER VALLEY BANCORP | a2220341zex-5_1.htm |

| EX-23.(1) - EX-23.(1) - RIVER VALLEY BANCORP | a2219738zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on May 29, 2014.

Registration No. 333-195361

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

AMENDMENT NO. 1

TO

REGISTRATION STATEMENT

Under

The Securities Act of 1933

River Valley Bancorp

(Exact name of Registrant as specified in its charter)

| Indiana (State or Other Jurisdiction of Incorporation or Organization) |

6022 (Primary Standard Industrial Classification Code Number) |

35-1984567 (IRS Employer Identification Number) |

430 Clifty Drive

P.O. Box 1590

Madison, IN 47250-0590

Phone: (812) 273-4949

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Matthew P. Forrester

President and Chief Executive Officer

River Valley Bancorp

430 Clifty Drive

P.O. Box 1590

Madison, IN 47250-0590

Phone: (812) 273-4949

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Claudia V. Swhier, Esq. Barnes & Thornburg LLP 11 South Meridian Street Indianapolis, IN 46204-3535 (317) 231-7231 (317) 231-7433 (Facsimile) |

Jennifer Durham King, Esq. Vedder Price P.C. 222 North LaSalle Street, Suite 2600 Chicago, IL 60601 (312) 609-7500 (312) 609-5005 (Facsimile) |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where an offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 29, 2014

PROSPECTUS

[ • ] Shares of Common Stock

We are offering [ • ] shares of our common stock, without par value. Our common stock is listed on the NASDAQ Capital Market under the symbol "RIVR." On [ • ], 2014, the last reported sale price of our common stock was $[ • ] per share.

Investing in our common stock involves risks. For additional information, see "Risk Factors" beginning on page 18 for a discussion of the factors you should consider before you make your decision to invest in our common stock.

| |

Per Share

|

Total

|

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

|||||||

Underwriting discount(1) |

|||||||

Underwriting discount in directed share program(1) |

|||||||

Proceeds to us, before expenses(1) |

|||||||

- (1)

- Shares subject to an underwriting discount of 5.5%, except that any shares sold in the directed share program will be subject to an underwriting discount of 3.5%; assumes % of the total number of shares being offered are sold in the directed share program. We have also agreed to reimburse the underwriter for certain expenses in connection with the offering. See "Underwriting."

This is a firm commitment underwriting. We have granted the underwriter a 30-day option to purchase up to [ • ] additional shares at the public offering price, less underwriting discounts and commissions, to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Shares of our common stock are not savings accounts, deposits, or other obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

The underwriter expects to deliver the shares in book-entry form through the facilities of The Depository Trust Company, against payment on or about [ • ], 2014, subject to customary closing conditions.

![]()

The date of this prospectus is [ • ]

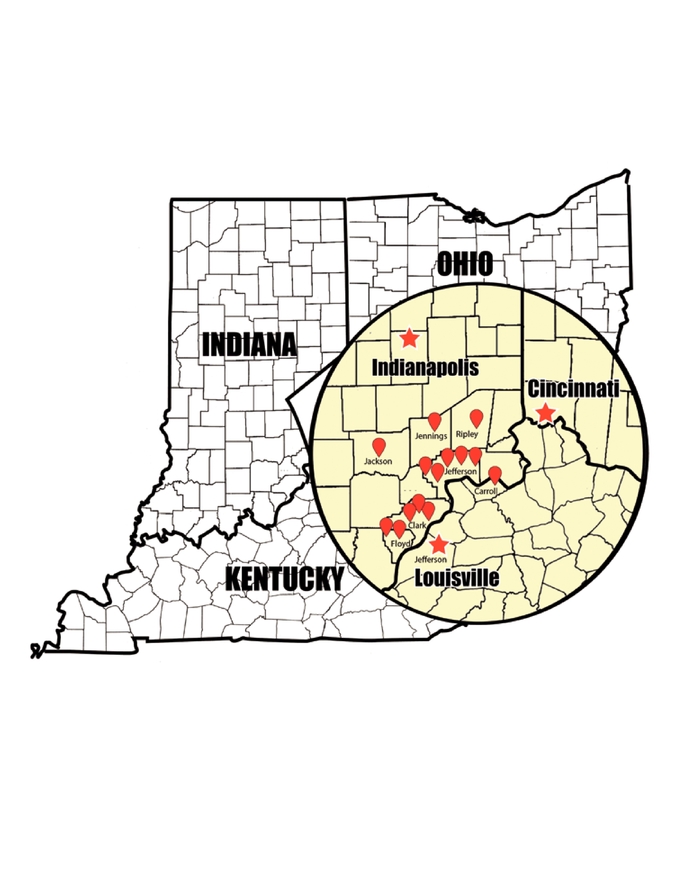

RIVER VALLEY FINANCIAL BANK

Full Service Branch Locations

i

You should rely only on the information contained in or incorporated by reference in this prospectus. We have not, and the underwriter has not, authorized anyone to provide you with any information that is different from that contained in or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where those offers and sales are permitted. The information contained in or incorporated by reference in this prospectus is accurate only as of the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus describes the specific details regarding this offering, the terms and conditions of the common stock being offered hereby and the risks of investing in our common stock. To the extent information in this prospectus is inconsistent with any of the documents incorporated by reference into this prospectus, you should rely on this prospectus. You should read this prospectus, the documents incorporated by reference in this prospectus and the additional information about us described in the section entitled "Where You Can Find More Information" before making your investment decision.

Neither we, the underwriter, nor any of our officers, directors, agents or representatives, make any representation to you about the legality of an investment in our common stock. You should not interpret the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

No action is being taken in any jurisdictions outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in those jurisdictions. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions that apply to this offering and the distribution of this prospectus applicable to those jurisdictions.

Unless otherwise expressly stated or the context otherwise requires, all information in this prospectus assumes that the underwriter will not exercise its option to purchase additional shares of our common stock to cover over-allotments, if any.

As used in this prospectus, the terms "we," "our," "us," "River Valley" and the "Company" refer to River Valley Bancorp and its consolidated subsidiaries, unless the context indicates otherwise. When we refer to "River Valley Financial" or the "Bank" in this prospectus, we are referring to River Valley Financial Bank, our wholly owned bank subsidiary.

The market data and other statistical information used throughout this prospectus are based on independent industry sources and publications. Some data is also based on our good faith estimates, which are derived from our review of internal surveys, as well as independent industry publications, government publications, reports by market research firms or other published independent sources. None of the independent industry publications referred to in this prospectus was prepared on our or our affiliates' behalf or at our expense, and we have not independently verified the data or information obtained from these sources. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding other forward-looking statements in this prospectus.

ii

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference include "forward-looking statements" within the meaning of such term in the Private Securities Litigation Reform Act of 1995, relating to such matters as our financial condition, anticipated results of operations, cash flows, credit quality, plans, expectations, objectives, future performance and business and similar matters. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of our management and on information currently available to management, are generally identifiable by the use of words such as "believe," "expect," "anticipate," "plan," "intend," "estimate," "may," "will," "would," "could," "should" or other similar expressions, although not all forward-looking statements contain these words. Additionally, all statements in this document or any document incorporated herein by reference, including forward-looking statements, speak only as of the date they are made, and we undertake no obligation to update any statement in light of new information or future events.

These forward-looking statements are subject to significant risks, assumptions and uncertainties, and could be affected by many factors. Factors that could have a material adverse effect on our financial condition, results of operations and future prospects can be found in the "Risk Factors" section of this prospectus and elsewhere in our periodic and current reports filed with the Securities and Exchange Commission (the "SEC"). The following factors, many of which are subject to change based on various other factors beyond our control, could cause our financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in the forward-looking statements:

- •

- the effects of future economic, business and market conditions and changes in the United States economy in general and the

local economies in the markets in which we operate in particular;

- •

- governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal

Reserve System (the "Federal Reserve");

- •

- legislative and regulatory changes, including changes in banking, securities and tax laws and regulations and their

application by our regulators, including the Indiana Department of Financial Institutions and changes in the scope and cost of insurance from the Federal Deposit Insurance Corporation (the "FDIC") and

other coverages;

- •

- the risks of changes in interest rates on the levels, composition and costs of deposits, loan demand, and the values and

liquidity of loan collateral, securities, and other interest-sensitive assets and liabilities;

- •

- the failure of assumptions and estimates underlying the establishment of reserves for possible loan losses and other

estimates, and the failure of assumptions and estimates used in our analysis of our capital position;

- •

- changes in borrowers' credit risks and payment behaviors;

- •

- changes in consumer spending and savings habits;

- •

- changes in the availability and cost of credit and capital in the financial markets;

- •

- changes in the prices, values and sales volumes of residential and commercial real estate;

- •

- the effects of stagnant or declining crop prices in the agricultural industry causing declining agricultural revenues and

land values generally and in our markets;

- •

- the effects of catastrophic events, including storms, droughts, tornados and flooding along the Ohio River and surrounding areas, that may affect general economic conditions, including agricultural production and demand and prices for agricultural goods and land used for agricultural purposes, generally and in our markets;

iii

- •

- the effects of competition from a wide variety of local, regional, national and other providers of financial, investment

and insurance services;

- •

- the loss of the services of members of our senior management team;

- •

- the risks of implementing our growth strategy, including, without limitation, the related time and costs of completing any

acquisition transactions, integrating operations as part of any such transactions and possible failures to achieve expected gains, revenue growth and/or expense savings from such transactions;

- •

- changes in accounting policies, rules and practices;

- •

- changes in technology or products that may be more difficult, costly, or less effective than anticipated, and failures of

or interruptions in the communications and information systems on which we rely to conduct our business;

- •

- other factors and risks described under "Risk Factors" herein.

Furthermore, forward-looking statements are subject to risks and uncertainties related to our ability to, among other things: generate loan and deposit balances at projected spreads; sustain fee generation, including through service fees and charges and gains on sales of loans; maintain asset quality and control risk; limit the amount of net loan charge-offs; adapt effectively and rapidly to changing customer deposit, investment and borrowing behaviors; control expenses; dispose of properties or other assets obtained through foreclosures at expected prices and within a reasonable period of time; attract and retain key personnel; and monitor and manage our financial reporting, operating and disclosure control environment.

You should not place undue reliance on any forward-looking statements, which speak only as of the dates on which they were made. We are not undertaking an obligation to update these forward-looking statements, even though circumstances may change in the future, except as required under federal securities law. In addition, our past results of operations are not necessarily indicative of our future results.

We qualify all of our forward-looking statements by these cautionary statements.

iv

WHERE YOU CAN FIND MORE INFORMATION

This prospectus constitutes a part of a registration statement on Form S-1 and does not contain all the information set forth in the registration statement. You should refer to the registration statement and its related exhibits and schedules for further information about us and the securities offered in this prospectus. Statements contained in this prospectus concerning the provisions of any document are not necessarily complete and, in each instance, reference is made to the copy of that document filed as an exhibit to the registration statement or otherwise filed with the SEC, and each such statement is qualified in all respects by this reference. The registration statement and its exhibits and schedules are on file at the offices of the SEC and may be inspected without charge. We file annual, quarterly, and current reports, proxy statements and other information with the SEC. You may request a copy of these filings, at no cost, by writing or calling us at the following address:

River

Valley Bancorp

430 Clifty Drive

P.O. Box 1590

Madison, Indiana 47250-0590

(812) 273-4949

Attention: Matthew P. Forrester

You can also read and copy any materials we file with the SEC at its public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about the operation of the SEC's public reference room by calling the SEC at 1-800-SEC-0330. Our SEC filings are also available to you free of charge at the SEC's website at www.sec.gov and via our Company website at www.rvfbank.com, under "About Us—Stock Price and SEC Filings." Information on the Company's website is not incorporated by reference and is not part of this prospectus.

DOCUMENTS INCORPORATED BY REFERENCE

We are allowed to incorporate by reference into this prospectus certain information that we file with the SEC. This permits us to disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus.

We filed the following documents with the SEC and incorporate them by reference into this prospectus:

- •

- Annual Report on Form 10-K for the year ended December 31, 2013, filed on March 18, 2014;

- •

- Definitive Proxy Statement on Schedule 14A for the 2014 annual meeting of shareholders, filed on March 18,

2014;

- •

- Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, filed on May 15, 2014; and

- •

- Current Reports on Form 8-K filed on April 16, 2014 and on April 17, 2014.

Nothing in this prospectus shall be deemed to incorporate information deemed furnished but not filed with the SEC. We will provide, without charge, to each person to whom this prospectus is delivered a copy of these filings upon written or oral request to River Valley Bancorp, as described in this prospectus in "Where You Can Find More Information." You may also view and print these reports and documents free of charge as described in "Where You Can Find More Information."

v

This summary highlights information contained elsewhere or incorporated by reference in this prospectus and may not contain all of the information you should consider in making your investment decision to buy shares of our common stock in this offering. You should read this summary, together with the more detailed information incorporated by reference or included elsewhere in this prospectus, before deciding to invest. You should carefully consider, among other things, the matters discussed in the section entitled "Risk Factors" beginning on page 18 of this prospectus.

Our Business

River Valley Bancorp is the bank holding company for River Valley Financial Bank, which was founded in 1875 as a federally chartered thrift institution. The Bank converted to an Indiana state chartered commercial bank in 2012 in connection with its acquisition of Dupont State Bank, an Indiana commercial bank. The Bank is headquartered in historic Madison, Indiana, located along the Ohio River, and serves clients in southeastern Indiana and northern Kentucky from its 14 full-service office locations in Clark, Floyd, Jackson, Jennings, Jefferson and Ripley Counties in Indiana, and in Carroll County in Kentucky. The Bank offers a variety of deposit and lending products and services to consumer and commercial customers, historically concentrating its lending activities on the origination of loans secured by first mortgage liens for one-to-four family residential real property.

As of March 31, 2014, we had total consolidated assets of $483.9 million, total deposits of $401.2 million and total stockholders' equity of $36.1 million.

Our company brand "Expect a difference!" captures the essence of our operating philosophy. We strive to create a financial resource and experience for our clients that set us apart from our regional and national competitors. We believe our strong client relationships, as well as our ability to attract and preserve new client relationships, form the backbone of our long-term financial success. We believe that we have developed a solid reputation among a loyal customer base because of our commitment to personal service and our strong support of the local communities in which we operate. Fueled in part by strategic acquisition and expansion, we reported record net income of $4.0 million in 2012 and $4.4 million in 2013. We believe in a commitment to building and maintaining mutually beneficial relationships with our customers, regardless of the size of those relationships. We believe that this approach differentiates us from our larger regional and national competitors and provides us with a foundation to seek to continue to grow and to create long-term shareholder value.

Our Market Area

We are located in southeastern Indiana and north central Kentucky. We consider Jefferson, Jennings, Floyd, Clark, Jackson and Ripley Counties in southeastern Indiana and adjacent Carroll and Trimble Counties in Kentucky as our primary market areas. According to published statistics, population projections among the eight core counties in which we operate remain steady with a projected median growth rate over 1% for 2013 to 2018. As of 2013, Clark and Floyd counties represent the largest populations in our primary market area, with approximately 112,000 and 76,000 people, respectively. The average median household income in our entire market area approximates $47,000, while the average median home value approximates $119,000. The larger counties of Clark and Floyd are directly across the Ohio River from Louisville, Kentucky. The Louisville metropolitan statistical area has a population of over 1.2 million people. All of our branch offices are located within 80 miles of the Louisville metro market.

The larger businesses operating in Madison, Indiana, where our headquarters and an additional two full-service branch offices are located, include Arvin Sango, which manufactures exhaust and manifold systems for the Toyota Camry line of automobiles, and Madison Precision Products, which manufactures engine products for the Honda Civic and Accord auto lines. Madison is also home to

1

Grote Industries, the largest manufacturer of safety lights in the world. Its clients include truck manufacturers, trailer manufacturers, and various car manufacturers, including Ford Motor Company. Madison is also home to a division of Dover Industries' Vehicle Services Group, which manufactures various lift products. Also located in Madison is Kings Daughter's Health, a regional hospital, which is the county's largest employer, with over 900 workers. In addition, Hanover College, a liberal arts college with approximately 1,100 students, is located in our market area in the town of Hanover.

Also located in our market area is the River Ridge Commerce Center, one of the largest metropolitan commercial developments in the country at over 6,000 acres and currently home to dozens of commercial warehousing and distribution centers, including Amazon's largest U.S. distribution center. Seymour, Indiana, located in Jackson County, is home to one of Cummins Inc.'s largest engine manufacturing plants. Cummins designs, manufactures, sells and services diesel engines and related technology globally.

Our Growth

Since 1875, we have been an Indiana institution serving primarily Indiana clients. In the last 10 years, we have expanded from five branches in only two Indiana counties (Jefferson and Clark) to 14 branches in six Indiana counties and a seventh county in Kentucky. During this period, we have grown assets from $255.1 million at December 31, 2003 to $482.8 million as of December 31, 2013, an increase of 89.3%. Since our decision to expand outside of our home market in Jefferson County in 2003, we have steadily increased our presence in our contiguous counties, including the addition of a branch across the Ohio River in Carroll County, Kentucky in 2005. We added a second location in Clark County at Sellersburg in 2006, and locations in Floyd County at Floyds Knobs in 2008 and New Albany in 2010. As a result of the 2012 acquisition of Dupont State Bank, we acquired a presence in two new strategic counties, Jennings and Jackson Counties, with branches at North Vernon and Seymour, and expanded our presence in Jefferson County with a branch in Dupont, Indiana. In 2013, we added a branch in Osgood, Indiana, extending into Ripley County, and in May 2014, we opened a new branch in Jeffersonville, Indiana, Clark County.

As a result of these growth initiatives, we have created a network that arcs around our headquarters location extending to the south, west, north and northeast. We believe this expansion strategy has created a well-established presence in the regions around our home market. While this overall expansion strategy has been guided by a focus on smaller communities in Indiana in general proximity to our home market, it has also been influenced by the competitive landscape in these markets. As the historically prominent community banks in these markets were acquired, in many cases by large out-of-state institutions, we believe River Valley's traditional community banking approach became relevant to consumers, and we believe that this provides a competitive advantage to us.

As a result, we now serve a more diverse economic region. While we operate within a relatively small geographic region of the state, our expansion strategy has provided borrower diversification by ensuring that no single industry or employer dominates our markets. In addition, we believe the metropolitan Louisville, Kentucky market that is geographically close to us presents a significant potential future opportunity to grow our presence in a larger metropolitan market where we already have some exposure and experience through several significant lending relationships.

Our Strategic Focus

The Bank's business strategy is focused on maintaining our traditional community banking approach while concurrently leveraging the strength and size of our balance sheet to compete effectively with our regional and national competitors, many of which are significantly larger. As the Chairman of the FDIC observed in an announcement on April 9, 2014, a recently released FDIC research study on long-term consolidation in the banking industry "clearly demonstrates the strength

2

and resilience of the community bank sector and supports the conclusion that community banks will continue to play a vital role in the financial system of the United States for the foreseeable future." We are focused on serving clients in the state of Indiana, and contiguous areas in the state of Kentucky, including metropolitan Louisville, with the majority of our business in southeastern Indiana. While our business encompasses all aspects of traditional community banking, including consumer lending and wealth advisory and trust services, we focus on building individual and commercial lending relationships and developing retail and commercial deposit customers. Our strategy includes the following key components:

Successfully Expand our Commercial Lending

The Bank hired two seasoned commercial loan officers in 2013 to help us develop and grow our commercial lending portfolio. These additional officers, in conjunction with our existing staff, have attracted customers and achieved increases in markets bounded by Decatur County, Indiana to the north, Jefferson County, Kentucky (which includes Louisville, Kentucky) to the south, Franklin County, Indiana to the east, and Monroe County, Indiana (which includes Bloomington, Indiana) to the west.

In addition, we are pursuing expansion in Jennings and Jackson Counties in Indiana where we acquired a presence with the 2012 purchase of Dupont State Bank. We believe the expanded array of products we offer and the larger resources provided by River Valley Financial will allow us to continue to grow the existing Dupont relationships while attracting other commercial business that could not be well served by a financial institution of Dupont State Bank's size.

The Bank's commercial loan portfolio is secured primarily by real estate, but we also have attracted loans to municipalities secured by tax revenues. In addition, our commercial loan portfolio includes loans to nationally recognized not-for-profit corporations and service organizations. We believe that, in effect, the commercial loan portfolio should be, and is, a reflection of the diversity of our market areas.

Based on our own evaluation, because commercial lending market share by county is not publicly available, we believe the Bank has a dominant market share of commercial lending in both Jefferson and Jennings Counties in Indiana and a significant market share in other counties where we maintain a branch, as well as areas like Louisville, Kentucky where we do not have a branch. We believe that personal service provided by our relationship-based bankers, local decision making, and competitive fees are differentiating us from the other banks in these areas, and that our reputation for being competitive across all lending business lines has allowed us to compete with larger regional banks for market share in large markets like the metropolitan Louisville area.

Respect our Traditional Residential Mortgage Focus (one-to-four family, multi family, and construction)

The Bank's origin as a federally chartered thrift institution is the basis for our experience in residential mortgage lending. Historically, mortgages for residential purposes have comprised in excess of 50% of our loan portfolio, with origination and servicing of these loans a primary business unit. Additionally, we originate residential mortgages for sale into the secondary market through sales to the Federal Home Loan Mortgage Corporation ("Freddie Mac"). The sale and servicing of these loans represent a significant part of our noninterest income.

The residential mortgage market was significantly impacted by the subprime lending crisis in 2008 and the resulting economic turmoil and national recession. Despite the slow demand for these products during that period, we consistently strove to make affordable mortgage products available, exemplifying our long standing practice of supporting our clients, in both good times and bad. During these difficult economic years, we were still able to grow our portfolio of one-to-four family residential mortgage loans by approximately 7.8% from December 31, 2009 to December 31, 2013, serving existing customers and capturing new business as our regional housing market expanded and improved.

3

Historically low interest rates during the period resulted in strong demand for mortgage refinancing, and borrowers turned to us for those needs. Refinance activity, primarily into the secondary market, resulted in annual sales to Freddie Mac and the Federal National Mortgage Association ("Fannie Mae") in 2008 through 2013 ranging between $45.6 million in 2009 to $22.5 million in 2013.

As the economies of our service area improve, we anticipate modest growth for origination of residential mortgage products. Conversely, we anticipate a lessening of refinancing activity and the associated secondary market sales.

Continue to Reduce our Non-performing Assets

Unlike many financial institutions during the difficult economic period of the last five years, our primary strategy for resolving troubled credit issues was to avoid termination of our credit relationships when feasible. Instead, we maintained a constant course of diligent involvement with our customers through increased and proactive collection activity, responsible revaluation of property, and sound debt restructuring to allow borrowers to regain their financial footing. Once again, we believe this reflects the "Expect a Difference" pledge we make to our customers and shareholders as part of our community banking strategy.

Non-performing assets are primarily comprised of loans 90 or more days past due, loans that are troubled and have been restructured in a formal debt restructuring, and real estate held for sale as a result of foreclosure or other legal action. Our non-performing assets have ranged between $9.1 million in 2009 to a high of $19.3 million in 2011, with levels stabilizing in 2013 at $15.6 million.

Loans 90 or more days past due are primarily comprised of loans in the lengthy process of foreclosure. The total of loans 90 or more days past due has decreased over the last five years from a high of $10.4 million as of December 31, 2010 to $3.4 million as of December 31, 2013, a 66.9% decrease. During the period of economic recession, the Bank hired a dedicated collection professional, increased precautionary collection activity by all loan officers, and increased loan review staff, all to mitigate the effects of the economy on our borrowers and ultimately the Bank. Meanwhile, net charge-offs as a percent of average loans outstanding for the period 2009 through 2013 ranged from a high of .98% in fiscal year 2011 to a low of (.01%) in fiscal year 2013.

The Bank works with troubled borrowers to restructure debt and provide opportunities for improvement in, and ultimately resolution of, credit issues. At December 31, 2013, total troubled debt restructured and included in non-performing assets was $10.4 million. These workouts are in some cases long term arrangements, and therefore will not be removed from non-performing assets until their conclusion, which most likely will be at loan maturity. Although troubled debt restructured is always reported as a non-performing asset, it can, and may, be an earning asset for the Bank.

Other real estate held for sale as a result of foreclosure or other legal action comprises the remainder of our non-performing assets. The level of these properties we held peaked during and immediately subsequent to the economic crisis. While foreclosure activity is still pending for some borrowers, we believe the level of real estate held will remain at moderate to low levels, with minimal losses associated with these holdings.

The Bank has a goal to reduce non-performing assets by 20% year over year, and we believe that the level of non-performing assets will decline as a result of sound management practices and effective legal action, in conjunction with improvement in the economies of our service areas.

Pursue New Organic and Opportunistic Growth Opportunities

Over the last ten years, from December 31, 2003 to December 31, 2013, we have grown our assets by 89.3% by both organic growth and by branch and bank acquisition. We intend to continue to

4

evaluate market data and available transactions carefully to identify attractive opportunities for growth for the Company. We will focus our efforts for growth on southeastern and south central Indiana and northern Kentucky, including the metropolitan Louisville area.

Capitalize on Our Client Service-Focused, Community Banking Model

Fulfilling client needs is a top priority for us. We believe that in order to be successful, we must offer state-of-the-art products, services and technology, and deliver them with the personal feel of a local neighborhood bank. The Bank and our team members engage actively in our communities, often through sponsorships and many dedicated volunteer hours, which fosters name recognition for River Valley and builds personal relationships with key community members. We are proud of the fact that our team builds long-term relationships with clients, many of which have maintained a deposit relationship with us since before our conversion from mutual to stock form in 1996. We also recognize that our clients expect more from us than a friendly, local bank presence. They expect us to provide technology-driven and secure solutions to their financial needs. They expect us to provide quick turnaround decisions on loan requests, as well as competitively priced loan and deposit products. In addition, they expect us to provide sound, thoughtful financial advice and practical financial planning.

Our Competitive Strengths

History of Strong Financial Performance

During the past five years, we have maintained strong profitability while continuing to grow our franchise both organically and through strategic acquisitions. Our results for the year ended December 31, 2013 highlight our strong financial performance:

- •

- Net income for 2013 of $4.4 million was the highest reported annual net income in our 139 year history,

exceeding by 10% another record-setting net income of $4.0 million for 2012.

- •

- Total assets increased to $482.8 million as of December 31, 2013, as compared to $472.9 million a

year earlier. As of December 31, 2013, deposits totaled $395.0 million, an increase from the $384.3 million as of December 31, 2012.

- •

- Net loans, including loans held for sale, were $316.6 million as of December 31, 2013, an increase of

$10.7 million from $305.9 million at the end of 2012.

- •

- Return on average assets for 2013 was 0.92% as compared to 0.96% in 2012, and return on average equity for 2013 was 12.69%

compared to 11.72% for 2012.

- •

- The allowance for loan losses totaled $4.5 million as of December 31, or 1.41% of total outstanding loans.

As of December 31, 2012, the allowance for loan losses was $3.6 million, or 1.15% of total outstanding loans.

- •

- At December 31, 2013, non-performing assets of $15.6 million represented 3.22% of total assets, while

non-performing assets at December 31, 2012 were $16.3 million, or 3.45% of total assets.

- •

- In December 2013, River Valley declared both its 67th consecutive quarterly cash dividend and an

additional special dividend in the same amount as the quarterly dividend, with the 2013 annual dividend rate at $1.05 per share and a dividend payout ratio of 39.47%. For 2012, the annual dividend

rate was $.84 per share and a dividend payout ratio of 35.00%.

- •

- Despite the severe economic recession beginning in 2008, we had no regulatory enforcement agreements or resolutions or restrictions imposed on us by the regulators during that period.

5

Over the five-year period from January 1, 2009 to December 31, 2013, our results included the following highlights:

- •

- Increased total loans outstanding (including loans held for sale, not reduced by the allowance for loan losses) from

$279.4 million at December 31, 2009 to $321.1 million at December 31, 2013, a compound annual growth rate of 2.82%;

- •

- Grew net income from $1.7 million in 2009 to $4.4 million in 2013, a compound annual growth rate of 20.95%;

- •

- Net mortgage servicing assets grew from $505,000 at December 31, 2009 to $655,000 at December 31, 2013, a

compound annual growth rate of 5.34%;

- •

- Return on average equity grew from 6.48% in 2009 to 12.69% in 2013, and return on average assets grew from 0.44% in 2009

to 0.92% in 2013.

- •

- Tangible book value per share of common stock grew from $17.03 at December 31, 2009 to $17.17 at

December 31, 2013, a compound annual growth rate of 0.16%;

- •

- Fully diluted earnings per share grew from $1.09 for 2009 to $2.66 for 2013, a compound annual growth rate of 19.53%;

- •

- Annual cash common stock dividends per share (excluding the 2013 special dividend) remained steady at $0.84 for each of

the five years in the period;

- •

- Achieved significant penetration of historical markets and built market share in newer markets; and

- •

- Actively managed our capital position, repurchasing shares when appropriate and raising capital when needed based on our strategic plans.

The table below presents key financial highlights at and for each of the years in the five-year period ended December 31, 2013, and at and for the three-month periods ended March 31, 2014 and 2013. See "Selected Historical Consolidated Financial Data" section for additional information related

6

to the source of the selected financial information and additional considerations related to the financial information for the three-month periods ended March 31, 2014 and 2013.

| |

As of and For the Three Months Ended March 31, |

As of and For the Year Ended December 31, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2013 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| |

(In thousands, except share data) |

|||||||||||||||||||||

Total assets |

$ | 483,943 | $ | 482,640 | $ | 482,837 | $ | 472,855 | $ | 406,643 | $ | 386,609 | $ | 396,162 | ||||||||

Total loans, including loans held for sale |

316,806 | 299,220 | 321,079 | 309,476 | 257,186 | 270,343 | 279,377 | |||||||||||||||

Deposits |

401,246 | 393,458 | 395,015 | 384,255 | 305,226 | 286,337 | 276,586 | |||||||||||||||

Net income |

1,066 | 1,006 | 4,440 | 4,012 | 1,772 | 2,320 | 1,696 | |||||||||||||||

Diluted earnings per share |

.63 | .60 | 2.66 | 2.40 | 0.93 | 1.29 | 1.09 | |||||||||||||||

Return on average equity(1) |

11.84 | % | 11.22 | % | 12.69 | % | 11.72 | % | 5.41 | % | 7.23 | % | 6.48 | % | ||||||||

Return on average assets(1) |

0.88 | 0.84 | 0.92 | 0.96 | 0.45 | 0.59 | 0.44 | |||||||||||||||

Net yield on interest-earning assets |

3.48 | 3.34 | 3.41 | 3.17 | 3.19 | 3.05 | 2.68 | |||||||||||||||

Non-performing assets to total assets |

3.21 | 3.49 | 3.22 | 3.45 | 4.74 | 4.53 | 2.30 | |||||||||||||||

Net charge-offs to average total loans outstanding(1) |

0.61 | — | (0.01 | ) | 0.69 | 0.98 | 0.53 | 0.94 | ||||||||||||||

Dividend payout ratio |

33.33 | 35.00 | 39.47 | 35.00 | 90.32 | 65.12 | 77.06 | |||||||||||||||

Tangible book value per share of common stock(2) |

$ | 18.52 | $ | 19.09 | $ | 17.17 | $ | 19.39 | $ | 18.39 | $ | 17.29 | $ | 17.03 | ||||||||

Tangible common equity to tangible assets(2) |

5.91 | % | 6.05 | % | 5.49 | % | 6.27 | % | 6.85 | % | 6.78 | % | 6.47 | % | ||||||||

- (1)

- Ratios

for the three months ended March 31, 2014 and 2013 are annualized.

- (2)

- See "Selected Historical Consolidated Financial Data—Non-GAAP Financial Measures" for a reconciliation of these measures to their most comparable GAAP measures.

Loan Portfolio

River Valley Financial has its origins in the savings and loan industry and, as a result, our lending focus historically has been on the origination of loans secured by first mortgage liens for the purchase, construction, or refinancing of one-to-four family residential real property, which continue to be the major focus of the Bank's loan origination activities, representing 42.1% of the Bank's total loan portfolio at December 31, 2013. Notwithstanding that focus, we also have a substantial portfolio of nonresidential real estate loans, which includes land used for agricultural production, representing 36.5% of the Bank's total loan portfolio at December 31, 2013. In addition, we offer multi-family mortgage loans, land loans, construction loans, non-mortgage commercial loans and consumer loans.

7

The following tables illustrate the composition of our loan portfolio for each of the years in the five-year period ended December 31, 2013, and for the three-month periods ended March 31, 2014 and 2013:

| |

At December 31, | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||||||

| |

Amount | % of Total |

Amount | % of Total |

Amount | % of Total |

Amount | % of Total |

Amount | % of Total |

|||||||||||||||||||||

| |

(Dollars in thousands) |

||||||||||||||||||||||||||||||

Construction/Land |

$ | 24,307 | 7.46 | % | $ | 26,506 | 8.42 | % | $ | 27,389 | 10.47 | % | $ | 27,991 | 10.32 | % | $ | 30,932 | 11.03 | % | |||||||||||

One-to-four family residential |

137,298 | 42.11 | 137,402 | 43.65 | 111,198 | 42.50 | 117,616 | 43.38 | 127,397 | 45.41 | |||||||||||||||||||||

Multi-family residential |

16,408 | 5.03 | 19,988 | 6.35 | 18,582 | 7.10 | 14,997 | 5.53 | 12,910 | 4.60 | |||||||||||||||||||||

Nonresidential |

118,946 | 36.48 | 106,433 | 33.81 | 83,284 | 31.83 | 89,607 | 33.05 | 87,483 | 31.18 | |||||||||||||||||||||

Commercial |

24,741 | 7.59 | 19,549 | 6.21 | 17,349 | 6.63 | 16,413 | 6.05 | 17,129 | 6.10 | |||||||||||||||||||||

Consumer |

4,326 | 1.33 | 4,906 | 1.56 | 3,840 | 1.47 | 4,533 | 1.67 | 4,711 | 1.68 | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross loans receivable |

326,026 | 100.00 | % | 314,784 | 100.00 | % | 261,642 | 100.00 | % | 271,157 | 100.00 | % | 280,562 | 100.00 | % | ||||||||||||||||

Add/(Deduct): |

|||||||||||||||||||||||||||||||

Deferred loan origination costs |

487 | 0.15 | 484 | 0.15 | 481 | 0.18 | 485 | 0.18 | 464 | 0.17 | |||||||||||||||||||||

Undisbursed portions of loans in process |

(5,775 | ) | (1.77 | ) | (6,186 | ) | (1.97 | ) | (5,024 | ) | (1.92 | ) | (2,388 | ) | (0.88 | ) | (1,824 | ) | (0.65 | ) | |||||||||||

Allowance for loan losses |

(4,510 | ) | (1.38 | ) | (3,564 | ) | (1.13 | ) | (4,003 | ) | (1.53 | ) | (3,806 | ) | (1.40 | ) | (2,611 | ) | (0.93 | ) | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net loans receivable |

$ | 316,228 | 97.00 | % | $ | 305,518 | 97.05 | % | $ | 253,096 | 96.73 | % | $ | 265,448 | 97.90 | % | $ | 276,591 | 98.59 | % | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

At March 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2013 | |||||||||||

| |

Amount | % of Total |

Amount | % of Total |

|||||||||

| |

(Dollars in thousands) |

||||||||||||

Construction/Land |

$ | 25,978 | 8.16 | % | $ | 23,237 | 7.53 | % | |||||

One-to-four family residential |

136,098 | 42.75 | 134,487 | 43.60 | |||||||||

Multi-family residential |

18,107 | 5.69 | 17,280 | 5.60 | |||||||||

Nonresidential |

112,067 | 35.20 | 106,555 | 34.55 | |||||||||

Commercial |

22,458 | 7.05 | 22,701 | 7.36 | |||||||||

Consumer |

3,667 | 1.15 | 4,198 | 1.36 | |||||||||

| | | | | | | | | | | | | | |

Gross loans receivable |

318,375 | 100.00 | % | 308,458 | 100.00 | % | |||||||

Add/(Deduct): |

|||||||||||||

Deferred loan origination costs |

494 | 0.16 | 487 | 0.16 | |||||||||

Undisbursed portions of loans in process |

(2,063 | ) | (0.65 | ) | (10,088 | ) | (3.27 | ) | |||||

Allowance for loan losses |

(4,196 | ) | (1.32 | ) | (3,884 | ) | (1.26 | ) | |||||

| | | | | | | | | | | | | | |

Net loans receivable |

$ | 312,610 | 98.19 | % | $ | 294,973 | 95.63 | % | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

In addition to our traditional one-to-four family and multi-family residential mortgage lending, our other areas of significant lending focus include the following:

Nonresidential Real Estate Loans. At December 31, 2013, $118.9 million, or 36.5% of our total loan portfolio, consisted of nonresidential real estate loans and land used for agricultural production. Nonresidential real estate loans are primarily secured by real estate such as churches, farms and small business properties. We generally originate nonresidential real estate as adjustable rate loans of varying rates with lock-in terms of up to 10 years indexed to the one-year U.S. Treasury securities yields adjusted to a constant maturity, written for maximum terms of 30 years. Our adjustable rate nonresidential real estate loans have maximum adjustments per year and over the life of the loan of 2% and 6%, respectively. We generally require the ratio of the

8

loan amount to the lesser of the current cost or appraised value of the property (the "Loan-to-Value Ratio") to be up to 80%, depending on the nature of the real estate collateral. We underwrite our nonresidential real estate loans on a case-by-case basis and, in addition to our normal underwriting criteria, evaluate the borrower's ability to service the debt from the net operating income of the property. As of December 31, 2013, our largest nonresidential real estate loan, for two fire houses located in Charlestown and New Albany, Indiana, was $4.9 million. Nonresidential real estate loans in the amount of $2.4 million, or 0.7% of total loans, were included in non-performing assets at December 31, 2013.

Loans secured by nonresidential real estate generally are larger than one-to-four family residential loans and involve a greater degree of risk. Nonresidential real estate loans often involve large loan balances to single borrowers or groups of related borrowers. Payments on these loans depend to a large degree on results of operations and management of the properties and may be affected to a greater extent by adverse conditions in the real estate market or the economy in general. Accordingly, the nature of the loans may make them more difficult for management to monitor and evaluate.

Construction/Land Loans. The Bank offers mortgage loans for construction, land development and undeveloped land with respect to residential and nonresidential real estate and, in certain cases, to builders or developers on a speculative basis (i.e., before the builder/developer obtains a commitment from a buyer).

Generally, construction loans are written as 12-month loans, either fixed or adjustable, with interest calculated on the amount disbursed under the loan and payable on a semi-annual or monthly basis. We generally require the Loan-to-Value Ratio to be 80% for its construction loans, although we may permit an 85% Loan-to-Value Ratio for one-to-four family residential construction loans. Inspections are generally made prior to any disbursement under a construction loan, and we do not typically charge commitment fees for construction loans. The largest single construction loan at December 31, 2013 totaled $2.3 million.

Land loans are generally written on terms and conditions similar to nonresidential real estate loans. Some of our land loans are land development loans, meaning the proceeds of the loans are used for infrastructure improvements to the real estate such as streets and sewers. At December 31, 2013, our largest single land loan, a development loan secured by residential building lots in Clark and Floyd Counties, Indiana, totaled $2.1 million.

At December 31, 2013, $24.3 million, or 7.5% of our total loan portfolio, consisted of construction, land or land development loans. Of these loans, $3.9 million, or 1.2% of total loans, were included in our non-performing assets. While providing us with a comparable, and in some cases higher, yield than a conventional mortgage loan, construction and land loans involve a higher level of risk. Borrowers who are over budget may divert the loan funds to cover cost overruns rather than direct them toward the purpose for which such loans were made. In addition, these loans are more difficult to monitor than conventional mortgage loans. As such, a defaulting borrower could cause us to take title to partially improved land that is unmarketable without further capital investment.

Commercial Loans. At December 31, 2013, $24.7 million, or 7.6% of our total loan portfolio, consisted of non-mortgage commercial loans. Commercial loans are written on either a fixed rate or an adjustable rate basis with terms that vary depending on the type of security, if any. At December 31, 2013, approximately $22.5 million, or 91.1%, of our commercial loans were secured by collateral, generally in the form of equipment, inventory, crops or, in some cases as an abundance of caution, real estate. Adjustable rate commercial loans are generally indexed to the prime rate with varying margins and terms depending on the type of collateral securing the loans and the credit quality of the borrowers. At December 31, 2013, the largest single commercial loan

9

was $3.3 million, made to a plastic molding company located in Madison, Indiana. As of the same date, commercial loans totaling $362,000, or 0.1% of total loans, were included in non-performing assets.

Commercial loans tend to bear somewhat greater risk than residential mortgage loans, depending on the ability of the underlying enterprise to repay the loan. Further, they are frequently larger in amount than the Bank's average residential mortgage loans.

A disciplined credit approval process involves the review of every new loan, with loans exceeding prescribed authority levels requiring approval by at least four members of the Bank's Board of Directors. We identify the level of risk associated with a loan type, which in turn determines the level of authority required to approve the loan. For instance, our most senior loan officer may approve mortgage loans and loans secured by readily marketable collateral for up to $500,000 and $400,000, respectively, but unsecured loans for only $50,000, and a non-senior loan officer may approve mortgage loans and loans secured by readily marketable collateral for up to $150,000, but unsecured loans for only $15,000, without action by at least four members of the Bank's Board of Directors Loan Committee. Our underwriting standards are designed specifically to evaluate collateral thoroughly and to compensate for higher risk levels inherent in certain loan types, such as consumer and commercial loans. Borrower character, paying habits and financial strength are important considerations. Management believes that our well-defined underwriting standards and the direct oversight by our Board of Directors contributes to a disciplined and consistent credit culture. As of December 31, 2013, our allowance for loan losses represented 1.41% of total outstanding loans, and non-performing assets represented 3.22% of total assets.

Asset Quality—Non-performing Assets

At December 31, 2013, $11.5 million, or 2.4% of consolidated total assets, were non-performing loans (loans 90 or more days past due and loans on nonaccrual status) compared to $10.9 million, or 2.3% of consolidated total assets, at December 31, 2012. Also included in non-performing assets was real estate owned ("REO"), comprised of real estate taken during foreclosure proceedings, held at December 31, 2013, in the amount of $155,000, as compared to $1.6 million at December 31, 2012. Troubled debt restructured that is non-performing at the time of restructuring is required to be included as a nonaccruing asset until certain requirements for payment and borrower viability are met.

The following table sets forth the amounts and categories of our non-performing assets (nonaccruing loans, loans 90 or more days past due and accruing, accruing troubled debt restructured loans, and foreclosed real estate) for the last five years and for the three-month periods ended March 31, 2014 and 2013. It is our policy that all earned but uncollected interest on all past due loans

10

is reviewed monthly to determine what portion of it should be classified as uncollectible for loans 90 or more days past due. Uncollectible interest is written off monthly.

| |

At March 31, | At December 31, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2013 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| |

(In thousands) |

|||||||||||||||||||||

Non-performing assets: |

||||||||||||||||||||||

Nonaccrual loans |

$ | 11,438 | $ | 10,874 | $ | 11,514 | $ | 10,850 | $ | 9,863 | $ | 10,381 | $ | 7,199 | ||||||||

Loans 90 or more days past due and accruing |

61 | — | 1 | — | — | — | — | |||||||||||||||

Troubled debt restructured loans |

2,758 | 4,054 | 3,898 | 3,860 | 6,939 | 6,747 | 1,651 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Total non-performing loans and troubled debt restructured loans |

14,257 | 14,928 | 15,413 | 14,710 | 16,802 | 17,128 | 8,850 | |||||||||||||||

Foreclosed real estate |

1,258 | 1,934 | 155 | 1,610 | 2,487 | 400 | 253 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Total non-performing assets |

$ | 15,515 | $ | 16,862 | $ | 15,568 | $ | 16,320 | $ | 19,289 | $ | 17,528 | $ | 9,103 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total non-performing loans to net loans |

3.68 | % | 3.69 | % | 3.64 | % | 3.55 | % | 3.90 | % | 3.91 | % | 2.60 | % | ||||||||

Total non-performing loans, including troubled debt restructured, to net loans |

4.56 | 5.06 | 4.87 | 4.81 | 6.64 | 6.45 | 3.20 | |||||||||||||||

Total non-performing loans to total assets |

2.38 | 2.25 | 2.38 | 2.29 | 2.43 | 2.69 | 1.82 | |||||||||||||||

Total non-performing assets to total assets |

3.21 | 3.49 | 3.22 | 3.45 | 4.74 | 4.53 | 2.30 | |||||||||||||||

The following table presents the detail of our nonaccrual loans as of December 31, 2013 and 2012, and as of March 31, 2014 and 2013, which includes both nonaccruing troubled debt restructured loans and loans contractually delinquent 90 days or more, unless the loan is well-secured and in the process of collection.

| |

At March 31, | At December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2013 | 2013 | 2012 | |||||||||

| |

(In thousands) |

||||||||||||

Construction/Land |

$ | 3,834 | $ | 4,381 | $ | 3,864 | $ | 4,798 | |||||

One-to-four family residential |

2,623 | 2,645 | 3,833 | 2,687 | |||||||||

Multi-family residential |

1,015 | 1,091 | 1,073 | 1,104 | |||||||||

Nonresidential and agricultural land |

3,592 | 2,187 | 2,377 | 1,678 | |||||||||

Commercial |

374 | 561 | 362 | 567 | |||||||||

Consumer and other |

— | 9 | 5 | 16 | |||||||||

| | | | | | | | | | | | | | |

Total nonaccrual loans |

$ | 11,438 | $ | 10,874 | $ | 11,514 | $ | 10,850 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

At December 31, 2013 and March 31, 2014, our classified assets (classified loans and foreclosed real estate), were as follows:

| |

At March 31, 2014 |

At December 31, 2013 |

|||||

|---|---|---|---|---|---|---|---|

| |

(In thousands) |

||||||

Substandard assets |

$ | 18,517 | $ | 19,070 | |||

Doubtful assets |

808 | 1,346 | |||||

Loss assets |

— | — | |||||

| | | | | | | | |

Total classified assets |

$ | 19,325 | $ | 20,416 | |||

| | | | | | | | |

| | | | | | | | |

11

Successful Acquisition and Integration History

Over the last ten years, we have grown our assets by 89.3% and expanded our footprint from five branches in two Indiana counties to 14 branches in seven counties in both Indiana and Kentucky. In the last two years, we acquired half of these eight new branches. Our management team has a history of successfully integrating these acquisitions and delivering strong operating results, always seeking to improve operational efficiency and credit and risk management processes while controlling expenses. We believe our management team possesses the capabilities and experience to continue to pursue strategic opportunities for River Valley in the future.

Recent Developments—First Quarter 2014 Results

Financial Condition at March 31, 2014 Compared to December 31, 2013. At March 31, 2014, our consolidated assets totaled $483.9 million, an increase of $1.1 million, or 0.2%, from December 31, 2013. The change was the result of a $7.6 million, or 74.3%, increase in cash to $17.9 million as of March 31, 2014, partially offset by decreases in investment securities of $2.6 million and in loans of $3.9 million.

Available-for-sale securities decreased $2.6 million, or 2.1%, over the period, from $119.9 million as of December 31, 2013 to $117.3 million as of March 31, 2014, as we disposed of select investments in order to mitigate future risk in the portfolio. The net unrealized loss on the portfolio was $1.5 million at March 31, 2014, compared to $2.8 million as of December 31, 2013, reflecting slight improvements in the bond markets.

Net loans, excluding loans held for sale, decreased $3.6 million, or 1.1%, from $316.2 million at December 31, 2013 to $312.6 million at March 31, 2014. Over the same period, $1.2 million in non-performing loans moved from the portfolio into real estate held for sale. Sales of conventional mortgages into the secondary market declined from the levels a year earlier with proceeds from sales to Freddie Mac for the three months ended March 31, 2014 at $2.8 million compared to $8.3 million for the three months ended March 31, 2013, approximately a 66.3% decrease. Sales into the secondary market, primarily to Freddie Mac, are a significant source of noninterest income for us.

Our consolidated allowance for loan losses totaled $4.2 million at March 31, 2014, a decrease of 7.0% from $4.5 million at December 31, 2013. The decrease was primarily due to the decline in specific reserves needed on impaired loans. For the three-month period ended March 31, 2014, $174,000 was expensed and placed in the reserve as compared to $318,000 for the same period in 2013. Charge offs for the quarter of $533,000, primarily one-to-four family residential loans, were partially offset by recoveries of $45,000. Of that amount, $312,000 was included as a specific valuation allowance at December 31, 2013. This compares to charge offs and recoveries for the three-month period ended March 31, 2013 of $332,000 and $334,000, respectively, none of which was previously provisioned.

The total allowance represented 1.32% of gross loans as of March 31, 2014, as compared to 1.41% as of December 31, 2013. Specific valuation allowances established for impaired loans totaled $878,000 at March 31, 2014, as compared to $1.1 million at December 31, 2013.

Loans past due 30 days or more as of March 31, 2014, excluding purchased credit-impaired loans, were $6.6 million, or 2.10% of net loans, as compared to $5.6 million, or 1.78%, at December 31, 2013.

Non-performing loans (defined as loans 90 or more days past due and loans on nonaccrual status, excluding purchased credit-impaired loans) were $11.5 million at March 31, 2014 and December 31, 2013. Troubled debt restructured loans that were less than 90 days past due included in total non-performing loans were $5.5 million as of March 31, 2014, as compared to $5.8 million as of December 31, 2013. Non-performing loans as a percent of net loans were 3.68% and 3.64%, respectively, at those dates.

12

Although management believes that its allowance for loan losses at March 31, 2014 was adequate based upon the available facts and circumstances, there can be no assurance that additions to such allowance will not be necessary in future periods, which could negatively affect our results of operations. Management is diligent in monitoring delinquent loans and in the analysis of the factors affecting the allowance.

Other assets decreased, period to period, a total of $1.2 million or 21.1%, primarily as a result of changes in prepaid asset balances and a decrease in the deferred tax asset relating to unrealized gains on available-for-sale securities.

Deposits totaled $401.2 million at March 31, 2014, an increase of $6.2 million, or 1.6%, from total deposits of $395.0 million at December 31, 2013. During the quarter, noninterest-bearing deposit accounts increased by 4.2%, or $2.0 million, while interest-bearing deposits increased approximately 1.2%, or $4.2 million. The fluctuations were distributed across all deposit types, with the greatest increases being in money market deposit accounts ($3.8 million), our "Vantage" checking account ($2.4 million), and savings accounts ($3.4 million). The largest decrease, period to period, was in certificate of deposit accounts, which decreased $4.5 million. In the current rate environment, borrowers still appear to be trading minimal differences in interest rates for accessibility to their funds in selecting transactional accounts over non-transactional.

Borrowings decreased period to period from $49.7 million as of December 31, 2013, to $42.7 million as of March 31, 2014, as we paid off maturing Federal Home Loan Bank of Indianapolis advances.

Other liabilities totaled $3.6 million at March 31, 2014, an increase of $256,000 from $3.4 million at December 31, 2013, primarily due to changes in escrowed balances and accrued expenses.

Stockholders' equity totaled $36.1 million at March 31, 2014, an increase of $1.6 million, or 4.8%, from $34.5 million at December 31, 2013. The increase was primarily due to the decrease in unrealized losses on available-for-sale securities, net of tax, from an unrealized loss of $1.8 million at December 31, 2013 to an unrealized loss of $944,000 at March 31, 2014. The fluctuation in unrealized gains/losses on available-for-sale securities was accompanied by net income of $1.1 million and proceeds from stock options exercised of $111,000, offset by dividends to common and preferred shareholders of $413,000. Dividends to common shareholders for the quarter were $.21 per share.

The Bank is required to maintain minimum regulatory capital pursuant to federal regulations. At March 31, 2014, the Bank's regulatory capital exceeded all applicable minimum regulatory capital requirements.

Comparison of Operating Results for the Three Months Ended March 31, 2014 and 2013. Our net income for the three months ended March 31, 2014 totaled $1.1 million, an increase of $60,000, or 6.0%, from net income of $1.0 million for the three months ended March 31, 2013. The increase in net income for the 2014 period as compared to 2013 was attributable to a combination of factors. Net interest income increased $210,000, or 5.7%, from $3.7 million for the period ended March 31, 2013 to $3.9 million for the same period in 2014, a result of both changing interest rates and decreased borrowings. Provision expense decreased $144,000 period to period, or 45.3%, from $318,000 for the three months ended March 31, 2013 to $174,000 for the three months ended March 31, 2014, based on the results of our allowance for loan losses analysis at each period end. Other income decreased $147,000, primarily the result of decreased loan sales into the secondary market partially offset by a decrease in losses on the sale of foreclosed real estate. Other expenses increased $237,000, from $3.2 million for the quarter March 31, 2013 to $3.4 million for the quarter ended March 31, 2014, primarily due to costs associated with the addition of new branches and the associated personnel.

Net Interest Income. Total interest income for the three months ended March 31, 2014 remained constant at $4.8 million compared to the prior year period.

13

Total interest expense decreased by $183,000, or 16.8%, from $1.1 million for the three months ended March 31, 2013 to $907,000 for the three months ended March 31, 2014. For the quarter ended March 31, 2014, interest expense from deposits totaled $516,000, as compared to $616,000 for the same period in 2013. The decrease was primarily attributable to interest expense on fixed-maturity deposits, as repricing of these deposits was done at continuously lowering rates, but also due somewhat to changes in the composition of the deposit base as mentioned above, as depositors moved from maturity and interest-bearing accounts to transactional and noninterest-bearing accounts. The cost of borrowings decreased $83,000, period to period, as the result of the decrease in both the average rate and the average balance of borrowings. Total borrowings as of March 31, 2014 were $42.7 million, as compared to $49.7 million at March 31, 2013. We borrow primarily from the Federal Home Loan Bank of Indianapolis. The average rate for the existing advances was 3.83% at March 31, 2013, as compared to 3.23% at March 31, 2014.

Net interest income was $3.9 million for the three-month period ended March 31, 2014, compared to $3.7 million for the same period in 2013, an increase of $210,000, or 5.7%, period to period, as slight increases in interest income were supplemented by reduced interest expense. The net interest margin for the three-month period ended March 31, 2014 was 3.48% as compared to 3.34% for the comparable period in 2013. For the years ended December 31, 2013 and 2012, the net interest margins were 3.41% and 3.17%, respectively. Included in net interest income for the three-month periods ended March 31, 2014 and 2013 was $71,000 and $106,000, respectively, of net accretion related to the purchase accounting adjustments on loans and deposits from our 2012 acquisition of Dupont State Bank. Comparably, the net accretion (amortization) included in net interest income for the years ended December 31, 2013 and 2012 was $674,000 and $(46,000), respectively. Without the accretion of these purchase accounting adjustments, the net interest margin for the three-month period ended March 31, 2014, would have been 3.42% as compared to 3.25% for the comparable period in 2013, and would have been 3.26% for the year ended December 31, 2013, as compared to 3.18% for the year ended December 31, 2012. Accretion and amortization of these purchase accounting adjustments are impacted by the estimated and actual cash flows of these financial instruments and therefore could significantly change in subsequent periods.

Provision for Loan Losses. We recorded a $174,000 provision for loan losses for the three months ended March 31, 2014, $144,000 lower than the amount expensed for the same period in 2013, reflecting improvements in the economy overall and stabilization in loan performance trends in general. At December 31, 2009, 2010 and 2011, delinquencies 30 days or more past due, as a percentage of net loans, were 3.70%, 4.63% and 4.28%, respectively. Since 2011, these percentages have declined and stabilized a level below the trends experience from December 31, 2009 to 2011. At December 31, 2012 and 2013 and March 31, 2014, these percentages were 1.82%, 1.78% and 2.10%, respectively (delinquent purchased credit-impaired loans acquired in the Dupont State Bank acquisition in 2012 with a fair value of $1.5 million, $1.6 million and $1.5 million, respectively, are excluded from the delinquent loan amounts used in this calculation). The slight increase in the delinquency percentage from December 31, 2013 to March 31, 2014 was primarily a result of an increase in loans past due 30 to 89 days. Loans past due 30 to 89 days increased $1.1 million from December 31, 2013 to March 31, 2014, while loans 90 or more days past due declined slightly period to period.

While management believes that the allowance for losses is adequate at March 31, 2014, based upon the available facts and circumstances, there can be no assurance that the loan loss allowance will be adequate to cover losses on non-performing assets in the future.

Other Income. Other income decreased by $147,000, or 12.6%, during the three months ended March 31, 2014 to $1.0 million, as compared to the $1.2 million for the 2013 period. The decrease was due primarily to a decrease in gains on the sale of loans into the secondary market, with $78,000 in gains for the three-month period ended March 31, 2014, compared to $325,000 for the same period in 2013. Losses on the sale of foreclosed real estate decreased to $21,000 for the three-month period

14

ended March 31, 2014, from $144,000 for the comparable period in 2013, a decrease of $123,000. Unlike interest income, "other income" is not always readily predictable and is subject to variations depending on outside influences.

Other Expenses. Total other expenses increased period to period, with a net increase of $237,000, or 7.4%. The most significant items affecting other expenses were:

- •

- Salaries and employee benefits increased 9.0%, period to period, reflecting increased salary costs and increased costs

associated with group insurance.

- •

- Occupancy and equipment expense increased $61,000, from $476,000 for the period ended March 31, 2013, as compared to $537,000 for the same period in 2014, primarily due to additional branches (Osgood and Jeffersonville, Indiana), as well as increased snow removal costs.

Income Taxes. Tax expense of $277,000 was recorded for the three months ended March 31, 2014, as compared to $367,000 for the comparable period in 2013. For the 2014 period, we had pre-tax income of $1.3 million, as compared to $1.4 million for the 2013 period. The effective tax rate was 20.7% for the three months ended March 31, 2014, as compared to 26.7% for the same period in 2013. The tax calculations for both periods include the benefit of tax-exempt income from loans and municipal investments and cash surrender life insurance, partially offset by the effect of nondeductible expenses. The decrease, period to period, was primarily attributable to increased tax exempt loan income in 2014 over 2013.

Liquidity Resources. As a member of the Federal Home Loan Bank system, the Bank may borrow from the Federal Home Loan Bank of Indianapolis. At March 31, 2014, the Bank had $35.5 million in such borrowings outstanding, with a $10.0 million overdraft line of credit immediately available. An additional $56.5 million in borrowing capacity, beyond the current fixed rate advances and line of credit was available, previously approved by the Bank's board of directors. Based on collateral, an additional $76.6 million could be available, if the board of directors determines the need. The Bank also has the ability to borrow from the Federal Reserve Bank Discount Window, an additional source of wholesale funding. At March 31, 2014, the Bank had commitments to fund loan originations and loans in process of $36.1 million, unused home equity lines of credit of $24.4 million and unused commercial lines of credit of $24.1 million. Commitments to sell loans as of that date were $1.2 million. Generally, a significant portion of amounts available in lines of credit will not be drawn.

Our Management

We believe that our executive management team is a reflection of the entire River Valley team as this group of eight executives brings over 230 years in financial services experience to the Bank. Collectively, the group has over 116 years of direct experience at River Valley Financial. The executive management team has managed our credit risks through multiple economic and credit cycles, including navigating the unprecedented extremes and financial turmoil in the United States since 2008. Our executive management team commits a significant portion of its time to participating in the client-driven culture of the Bank and maintains the conservative mindset associated with traditional community banking.

Our business strategy benefits from an involved Board of Directors, which is composed of experienced, community-oriented business leaders who are actively engaged in our business planning and development. Our Board actively assists in the business development and client relationship process, and we draw upon their knowledge and experience, particularly in our market areas, in executing our strategy. We also use Advisory Board members, drawn from the outlying counties to which we have expanded our services, to advise us about the unique needs and characteristics of those communities. See "Management."

15

The interests of our executive management team and directors are aligned with those of our shareholders through common stock ownership. At March 31, 2014, our directors and officers beneficially owned 16.7% of our outstanding common stock. See "Beneficial Ownership of Common Stock."

The table below highlights the key members of our management team and their relevant experience:

Name

|

Title with the Bank | Years in Banking |

Years at River Valley |

||||||

|---|---|---|---|---|---|---|---|---|---|

Matthew P. Forrester |

President and Chief Executive Officer | 31 | 14 | ||||||

Lonnie D. Collins |

Secretary | 32 | 32 | ||||||

Anthony D. Brandon |

Executive Vice President | 19 | 12 | ||||||

Jennifer J. Darnold |

Senior Vice President—Retail Banking | 17 | 3 | ||||||

Robert E. Kleehamer |

Senior Vice President—Business Development | 42 | 5 | ||||||

Mark A. Goley |

Vice President—Lending | 35 | 25 | ||||||