Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED MAY 29, 2014 - DAKOTA PLAINS HOLDINGS, INC. | dakota141969_8k.htm |

Exhibit 99.1

WWW.DAKOTAPLAINS.COM WWW.DAKOTAPLAINS.COM OTCQB: DAKP OTCQB: DAKP BENCHMARK COMPANY ONE-ON- ONE INVESTOR CONFERENCE MAY 29, 2014 BENCHMARK COMPANY ONE-ON- ONE INVESTOR CONFERENCE MAY 29, 2014

FORWARD LOOKING STATEMENTS Statements made by representatives of Dakota Plains Holdings, Inc. (“Dakota Plains”or the “Company”) during the course of this presentation that are not historical f acts, are forward-looking statements. These statements are based on certain assumptions and expectatio ns made by the Company which reflect management’s experience, estimates and perception of historical trends, cur rent conditions, anticipated future developments and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, man y of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to global economics or politics, our ability to obtain additional capital needed to implement our business pl an, minimal operating history, loss of key personnel, lack of business diversification, reliance on str ategic, third-party relationships, financial performance and results, prices and demand for oil, our ability to make acquisitions on economically acceptable terms, and other factors described from time to time in the Company’s periodic reports filed with the SEC that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Dakota Plains undertakes no obligation to p ublicly update any forward- looking statements, whether as a result of new information or future events. 2

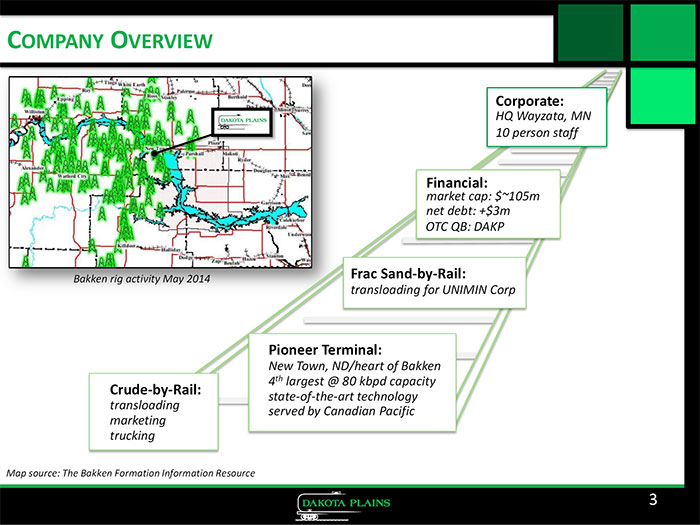

COMPANY OVERVIEW 3 Bakken rig activity May 2014 Map source: The Bakken Formation Information Resource Crude-by-Rail: trucking transloading marketing Pioneer Terminal: state-of-the-art technology New Town, ND/heart of Bakken 4 th largest @ 80 kbpd capacity served by Canadian Pacific Frac Sand-by-Rail: transloading for UNIMIN Corp Financial: market cap: $~105m net debt: +$3m OTC QB: DAKP Corporate: HQ Wayzata, MN 10 person staff

NORTH DAKOTA PRODUCTION & TRANSPORTATION 4 Sources: North Dakota Pipeline Authority (NDPA) with data through March 2014 and the Energy Information Administration (EIA) Brent/WTI spread $/bbl Rail displacing pipeline North Dakota production bbl/day total rail volume Pipeline volumes Pipeline capacity Rail volumes

RAIL TERMINAL COMPETITIVE LANDSCAPE FOR 2014 5 Source: Lipow Oil Associates and DAKP management throughput capacity forecast for 2014, bpd DAKP 2014E is 45,000 bpd or about 60% of nameplate capacity

PIONEER LOCATION –HEART OF THE BAKKEN 6 Bakken Heat Map –January 2014 publication avg. service radius 25 miles key competitors

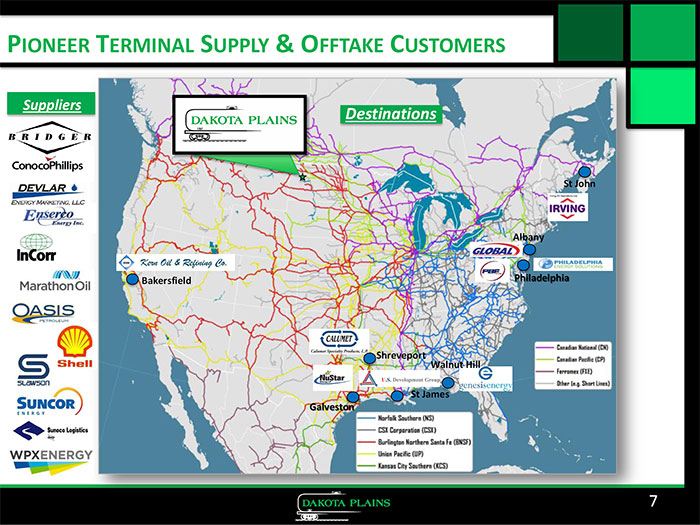

PIONEER TERMINAL SUPPLY & OFFTAKE CUSTOMERS 7 Bakersfield St James Walnut Hill Shreveport Albany St John Philadelphia Philadelphia Galveston Galveston Destinations Suppliers

8 PIONEER TERMINAL IN NEW TOWN, ND 10 STATION RAIL LOADING 10 STATION RAIL LOADING 10 STATION RAIL LOADING 70 ACRE INDUSTRIAL YARD SPACE 70 ACRE 70 ACRE INDUSTRIAL INDUSTRIAL YARD SPACE YARD SPACE DOUBLE LOOP TRACK FOR TWO 120-UNIT TRAINS DOUBLE LOOP TRACK FOR TWO 120 DOUBLE LOOP TRACK FOR TWO 120 - - UNIT TRAINS UNIT TRAINS FOUR LADDER TRACKS FOR FUTURE INBOUND FOUR LADDER TRACKS FOUR LADDER TRACKS FOR FUTURE FOR FUTURE INBOUND INBOUND UNIMIN FRAC SAND STORAGE SILOS UNIMIN FRAC SAND UNIMIN FRAC SAND STORAGE SILOS STORAGE SILOS INBOUND PIPELINES INBOUND PIPELINES INBOUND PIPELINES 10 TRUCK OFFLOAD STATIONS 10 TRUCK OFFLOAD STATIONS 10 TRUCK OFFLOAD STATIONS 180K BBLS STORAGE, 270K PERMITTED 180K BBLS STORAGE, 180K BBLS STORAGE, 270K PERMITTED 270K PERMITTED

9 PIONEER TERMINAL IN NEW TOWN, ND

UNIMIN Frac Sand Business 10 □750,000 t.p.y. frac sand storage & transloading terminal □8,000 tons of fixed storage, quad high-speed truck loadouts, and new track capacity for 70 loaded railcars (fully funded by UNIMIN Corp) □Operations start-up begins in June 2014 □DAKP joint venture responsible for transloading frac sand from train to storage and from storage to trucks Construction area –north side of Pioneer Terminal

JOINT VENTURE CRUDE OIL VOLUMES 11 Millions of barrels per year SUSTAINABLE TRANSLOADING CAPACITY Today with 2 storage tanks add 3 rd storage tank

2013 RECAP 12 2013 □ Delivered Pioneer Terminal expansion project under $50 million budget and on-time (9 months construction); increased nameplate capacity from 30,000 bpd to 80,000 bpd □ Funded Pioneer via restricted cash and new project credit facility □ Completed $15 million equity offering, reducing senior notes from $26.6 million to $7.7 million; ended year with positive working capital □ Secured UNIMIN frac sand venture to launch new inbound business □ Expanded trucking fleet to 27 units & captured new 3 rd party business □ Became managing partner for transloading operations □ Began consolidating reporting of transloading JV at EOY, increasing total assets to ~$87 million stockholders’equity ~$62 million. □ Business suffered from narrow Brent/WTI pricing spread & legal costs associated with Lac Megantic rail incident

STRATEGIC OBJECTIVES 5/28/2014 13 2014 □ Increase Pioneer transloading gross throughput to 45,000 bpd on average, including 3 rd party volumes beyond 30,000 bpd estimate for marketing □ Haul 6 million barrels of crude oil with trucking joint venture □ Facilitate 3 rd parties laying inbound gathering pipelines □ Start-up UNIMIN frac sand terminal operations by June 2014 □ Capture new inbound businesses □ Increase Pioneer tank storage from 180,000 bbls to 270,000 bbls to increase sustainable throughput from 50,000 bpd to 80,000 bpd □ Ramp up Pioneer throughput to 70,000+ bpd by year-end 2015 □ Expand Pioneer throughput to 100,000+ bpd □ Increase Pioneer tank storage beyond 270,000 bbls □ Accommodate Paradigm Midstream pipeline volumes □ Capture NGL outbound business □ Expand frac sand terminal based on increased frac sand demand □ Improve financial framework of the company □ Improve predictability of marketing profits □ Consider M & A opportunities □ Mitigate any legal exposure to Lac Megantic incident Ongoing:

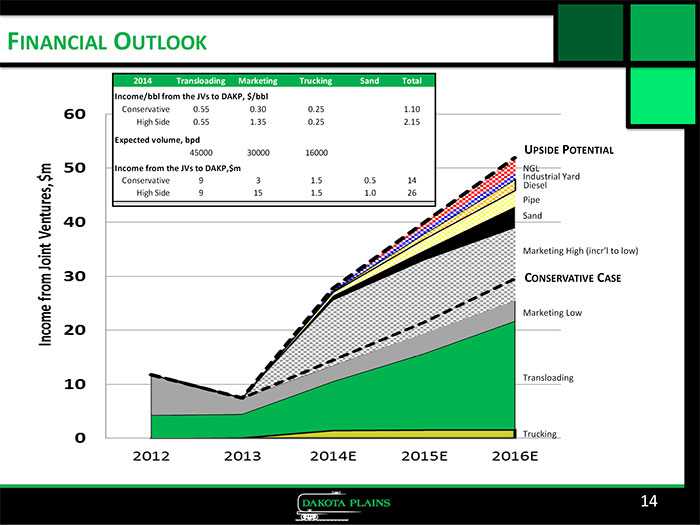

FINANCIAL OUTLOOK 14 CONSERVATIVE CASE UPSIDE POTENTIAL 2014 Transloading Marketing Trucking Sand Total Income/bbl from the JVs to DAKP, $/bbl Conservative 0.55 0.30 0.25 1.10 High Side 0.55 1.35 0.25 2.15 Expected volume, bpd 45000 30000 16000 Income from the JVs to DAKP,$m Conservative 9 3 1.5 0.5 14 High Side 9 15 1.5 1.0 26 Trucking Transloading Marketing Low Marketing High (incr’l to low) Sand Pipe Diesel Industrial Yard NGL

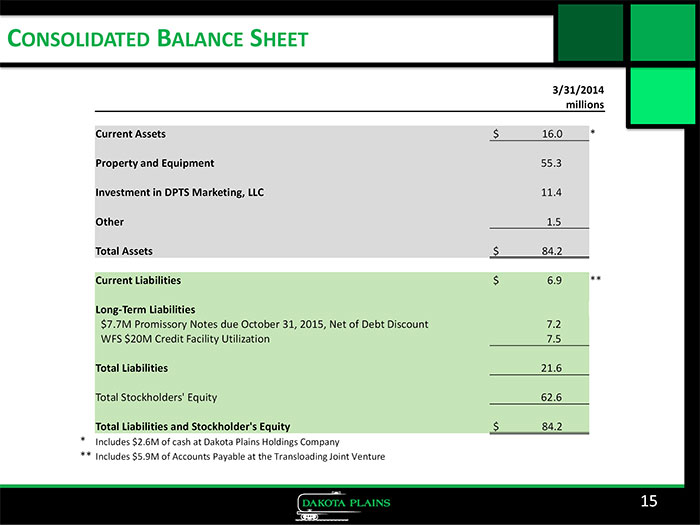

CONSOLIDATED BALANCE SHEET 15 3/31/2014 millions Current Assets $ 16.0 * Property and Equipment 55.3 Investment in DPTS Marketing, LLC 11.4 Other 1.5 Total Assets $ 84.2 Current Liabilities $ 6.9 ** Long-Term Liabilities $7.7M Promissory Notes due October 31, 2015, Net of Debt Discount 7.2 WFS $20M Credit Facility Utilization 7.5 Total Liabilities 21.6 Total Stockholders' Equity 62.6 Total Liabilities and Stockholder's Equity $ 84.2 * Includes $2.6M of cash at Dakota Plains Holdings Company ** Includes $5.9M of Accounts Payable at the Transloading Joint Venture

CONCLUSIONS □ Dakota Plains and its partners have created an efficient, state-of-the-art rail terminal and integrated midstream operation in New Town, ND, in the heart of the Bakken/Williston Basin □ Pioneer Terminal is the fourth largest in the Williston Basin □ Through the strength of its joint ventures and service agreements, Dakota Plains is poised to grow dramatically in the coming years □ Business segments that include trucking, transloading, marketing, and frac sand today are expected to expand to include other commodity-related storage and logistics services to local producers □ Business and competitive dynamics underpin a view that crude-by-rail is a long-term proposition 16

APPENDIX

AT A GLANCE 5/28/2014 18 Strategic Location □ Serves top producing counties in North Dakota -Mountrail and McKenzie counties □ At terminus of Canadian Pacific line, which offers enhanced railaccess and reduced congestion □ Unique road access to highway infrastructure, providing the onlyMissouri River bridge crossing for approximately 70 miles Unique Infrastructure Capabilities □ Pioneer Terminal double loop tracks capable of transloading a 120 car unit train per day □ 180,000 bbls of existing onsite storage, with expansion to 270,000 bbls permitted & designed □ Capacity for five gathering pipelines (one online and one has been announced) □ Four ladder tracks expanding to eight for inbound commodity products □ 70 acre industrial yard site secured inside loop track World Class Joint Ventures □ Transloading joint venture oversight provided by DAKP (DAKP consolidates the transloading JV financials as of EOY 2013) □ Strobel Starostka Transfer provides terminal logistics service □ Crude oil marketing joint venture; joint venture has 1,000+ leased rail cars □ Trucking joint venture provides vertical integration and greatercontrol of crude delivery to Pioneer Experienced Management & Board □ Management has extensive expertise in the midstream and upstreamsegments, project construction, finance, legal, and entrepreneurial growth □ Board expertise in the fields of rail, logistics, finance, and the Williston Basin Experienced and High-Performing Team □ Pioneer expansion built on time and under budget for $50 millionto increase throughput capacity from 30,000 bpd to 80,000 bpd; Pioneer enables further growth in2014 and 2015 □ Frac sand terminal project underway with UNIMIN (largest supplier to Bakken); other expected projects include diesel inbound, NGL outbound, drill pipe yard, and industrial yard Growth Inventory

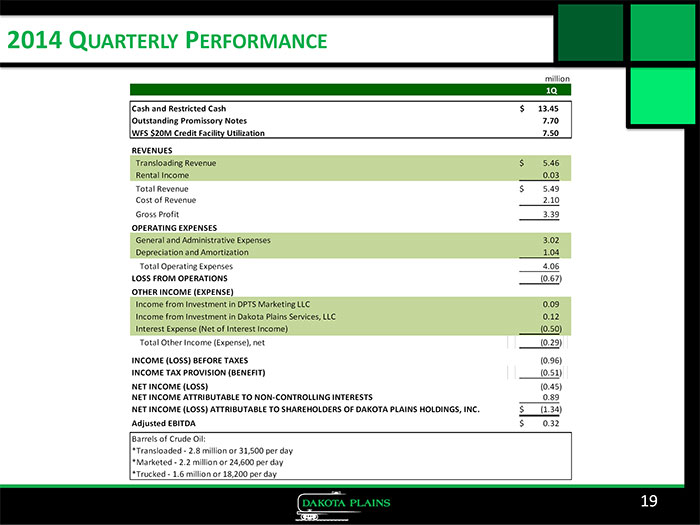

19 2014 QUARTERLY PERFORMANCE 1Q Cash and Restricted Cash 13.45$ Outstanding Promissory Notes 7.70 WFS $20M Credit Facility Utilization 7.50 REVENUES Transloading Revenue 5.46$ Rental Income 0.03 Total Revenue 5.49$ Cost of Revenue 2.10 Gross Profit 3.39 OPERATING EXPENSES General and Administrative Expenses 3.02 Depreciation and Amortization 1.04 Total Operating Expenses 4.06 LOSS FROM OPERATIONS (0.67) OTHER INCOME (EXPENSE) Income from Investment in DPTS Marketing LLC 0.09 Income from Investment in Dakota Plains Services, LLC 0.12 Interest Expense (Net of Interest Income) (0.50) Total Other Income (Expense), net (0.29) INCOME (LOSS) BEFORE TAXES (0.96) INCOME TAX PROVISION (BENEFIT) (0.51) NET INCOME (LOSS) (0.45) NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS 0.89 NET INCOME (LOSS) ATTRIBUTABLE TO SHAREHOLDERS OF DAKOTA PLAINS HOLDINGS, INC. (1.34)$ Adjusted EBITDA 0.32$ Barrels of Crude Oil: *Transloaded - 2.8 million or 31,500 per day *Marketed - 2.2 million or 24,600 per day *Trucked - 1.6 million or 18,200 per day million

ADJUSTED EBITDA 20 Adjusted EBITDA is a non-GAAP measure. A reconciliation of this measure to its most directly comparable GAAP measure is included in the accompanying financial tables above. Management believes the use of this non -GAAP financial measure provides useful information to investors to gain an overall unde rstanding of current financial performance. Specifically, management believes the non-GAAP results included herein provide useful information to both management and investors by excluding certain expenses and gains and losses on the exting uishment of debt that management believes are not indicative of Dakota Plains’core operating results. In addition, this non-GAAP financial measure is used by management for budgeting and forecasting as well as subsequently measuring Dako ta Plains’performance, and management believes it is providing investors with a financial measure that most closely aligns to its internal measurement processes. March 31, 2014 Net Loss (445,399)$ Add Back: Income Tax Provision (Benefit) (514,885) Depreciation and Amortization 1,035,215 Share Based Compensation - Employees and Directors 1,128,932 Share Based Compensation - Consultants - Interest Expense 502,136 Adjusted EBITDA 1,705,999$ Adjusted EBITDA Attributable to Non-Controlling Interests 1,384,417 Adjusted EBITDA Attributable to Shareholders of DAKP 321,583$ Dakota Plains Holdings, Inc. Reconciliation of Adjusted EBITDA

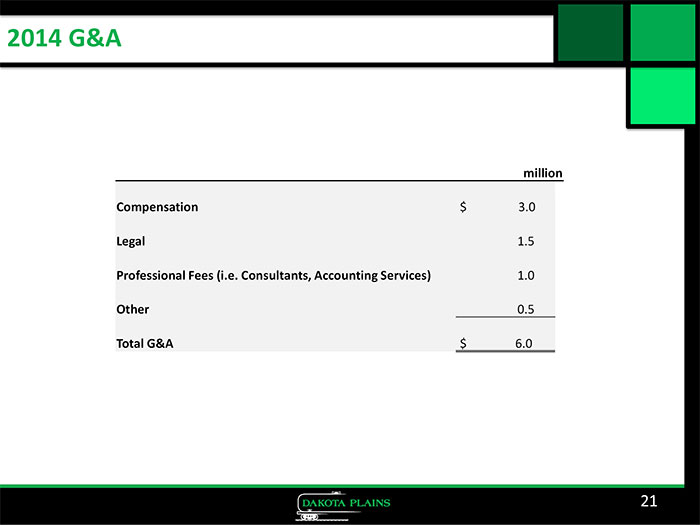

2014 G&A 21 million Compensation $ 3.0 Legal 1.5 Professional Fees (i.e. Consultants, Accounting Services) 1.0 Other 0.5 Total G&A $ 6.0

22 50% Petroleum Transport Solutions, LLC Petroleum Transport Solutions, LLC 50% Petroleum Transport Solutions, LLC Petroleum Transport Solutions, LLC JPND II, LLC JPND II, LLC 50% Dakota Plains Marketing, LLC (Minnesota) Dakota Plains Marketing, LLC (Minnesota) DPTS Marketing, LLC (Minnesota) DPTS Marketing, LLC (Minnesota) Dakota Petroleum Transport Solutions, LLC (Minnesota) Dakota Petroleum Transport Solutions, LLC (Minnesota) Dakota Plains Transloading, LLC (Minnesota) Dakota Plains Transloading, LLC (Minnesota) Dakota Plains Services, LLC (Minnesota) Dakota Plains Services, LLC (Minnesota) Dakota Plains Trucking, LLC (Minnesota) Dakota Plains Trucking, LLC (Minnesota) Dakota Plains Holdings, Inc (Nevada) Dakota Plains Holdings, Inc (Nevada) Trading & Transportation Transloading Oil From Trucks To Rail Cars; Sand From Rail Cars To Silos / Trucks Trucking 50% 50% 50% Joint Venture Entities Crude Oil CORPORATE STRUCTURE

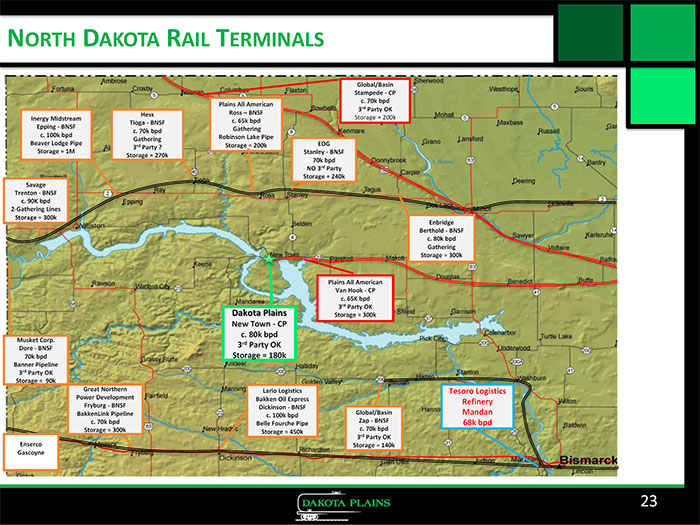

23 NORTH DAKOTA RAIL TERMINALS Dakota Plains Dakota Plains New Town -CP c. 80k bpd 3 rd Party OK Storage = 180k Lario Logistics Bakken Oil Express Dickinson -BNSF c. 100k bpd Belle Fourche Pipe Storage ≈450k Global/Basin Zap -BNSF c. 70k bpd 3 rd Party OK Storage ≈ 140k Savage Trenton -BNSF c. 90K bpd 2-Gathering Lines Storage ≈300k Inergy Midstream Epping -BNSF c. 100k bpd Beaver Lodge Pipe Storage ≈1M Hess Tioga -BNSF c. 70k bpd Gathering 3 rd Party ? Storage ≈270k Global/Basin Stampede -CP c. 70k bpd 3 rd Party OK Storage ≈200k Musket Corp. Dore -BNSF 70k bpd Banner Pipeline 3 rd Party OK Storage ≈90k Great Northern Power Development Fryburg -BNSF BakkenLink Pipeline c. 70k bpd Storage ≈300k Plains All American Van Hook -CP c. 65K bpd 3 rd Party OK Storage ≈300k Plains All American Ross –BNSF c. 65k bpd Gathering Robinson Lake Pipe Storage ≈200k EOG Stanley -BNSF 70k bpd NO 3 rd Party Storage ≈240k Enbridge Berthold -BNSF c. 80k bpd Gathering Storage ≈300k Tesoro Logistics Refinery Mandan 68k bpd Enserco Gascoyne