Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d731880d8k.htm |

The PNC

Financial Services Group, Inc. Investor Meetings

Second Quarter 2014

Exhibit 99.1 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

Our presentation includes “snapshot”

information about PNC used by way of illustration. It is not intended as a full business or

financial review and should be viewed in the context of all of the information made

available by PNC in its SEC filings. The presentation also contains forward- looking

statements regarding our outlook for earnings, revenues, expenses, capital and

liquidity levels and ratios, asset levels, asset quality, financial

position,

and

other

matters

regarding

or

affecting

PNC

and

its

future

business

and

operations.

Forward-looking

statements

are

necessarily subject to numerous assumptions, risks and uncertainties, which change over time.

The forward-looking statements in this presentation are qualified by the factors

affecting forward-looking statements identified in the more detailed Cautionary Statement included in

the

Appendix

that

follows

and

in

our

SEC

filings.

We

provide

greater

detail

regarding

these

as

well

as

other

factors

in

our

2013

Form

10-K

and

our first quarter 2014 Form 10-Q, including in the Risk Factors and Risk Management

sections and in the Legal Proceedings and Commitments and Guarantees Notes of the Notes

To Consolidated Financial Statements in those reports, and in our subsequent SEC filings. Our forward-

looking statements may also be subject to other risks and uncertainties, including those we

may discuss in this presentation or in SEC filings, accessible on the SEC’s

website at www.sec.gov and on PNC’s corporate website at www.pnc.com/secfilings. We have included web addresses in

this presentation as inactive textual references only. Information on those websites is not

part of this presentation. Future events or circumstances may change our outlook and

may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking

statements are subject. Forward-looking statements in this presentation speak only as of

the date of this presentation. We do not assume any duty and do not undertake to update

those statements. Actual results or future events could differ, possibly materially, from those anticipated in

forward-looking statements, as well as from historical performance.

In

this

presentation,

we

may

sometimes

refer

to

adjusted

results

to

help

illustrate

the

impact

of

certain

types

of

items.

This

information

supplements our results as reported in accordance with GAAP and should not be viewed in

isolation from, or as a substitute for, our GAAP results. We believe that this

additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others

to help evaluate the impact of these respective items on our operations. We may also provide

information on tangible book value per common share (calculated based on tangible

common shareholders’ equity (common shareholders’

equity less goodwill and other intangible assets, other

than servicing rights, net of deferred tax liabilities on such intangible assets) divided by

common shares outstanding). Where applicable, we provide

GAAP

reconciliations

for

such

additional

information,

including

in

the

Appendix

and/or

other

slides

and

materials

on

our

corporate

website

at

www.pnc.com/investorevents

and

in

our

SEC

filings.

In

certain

discussions,

we

may

also

provide

information

on

yields

and

margins

for all interest-earning assets calculated using net interest income on a

taxable-equivalent basis by increasing the interest income earned on tax-exempt

assets to make it fully equivalent to interest income earned on taxable investments. We believe this adjustment may be useful when

comparing

yields

and

margins

for

all

earning

assets.

We

may

also

use

annualized,

pro

forma,

estimated

or

third

party

numbers

for

illustrative

or comparative purposes only. These may not reflect actual results.

This presentation may also include discussion of other non-GAAP financial measures, which,

to the extent not so qualified therein or in the Appendix,

is

qualified

by

GAAP

reconciliation

information

available

on

our

corporate

website

at

www.pnc.com

under

“About

PNC

–

Investor

Relations.”Appendix,

is qualified by GAAP reconciliation information available on our corporate website at www.pnc.com under “About PNC–Investor Relations.” |

3

Agenda

Performance overview

Executing our strategic priorities

Continued focus on expense management

and capital strength |

4

Corporate & Institutional

A leader in serving middle-market,

large corporate, government and

non-profit entities

A top 10 U.S. bank-held wealth

manager

Asset Management

Residential Mortgage

A primary consumer product

National distribution capabilities

(1) Rankings source: SNL DataSource; Holding companies (for assets) or Banks (for deposits,

branches and ATMs) headquartered in U.S. Assets rank excludes Morgan Stanley and

Goldman Sachs. Both Residential Mortgage Banking and Corporate & Institutional

Banking offices located in these states.

CO

TX

KS

BlackRock

A leader in investment management, risk

management and advisory services

worldwide

March 31, 2014

U.S. Rank

(1)

Deposits

$222B

7

th

Assets

$323B

7

th

Branches

2,703

4

th

ATMs

8,001

3

rd

Footprint covering nearly half of the U.S.

population

Retail Banking

PNC’s Leading Franchise |

5

Significant Tangible Book Value Growth

12/31/2009

PNC

data

has

been

updated

to

reflect

the

first

quarter

2014

adoption

of

Accounting

Standards

Update

(ASU)

2014-01

related

to

investments

in

low

income

housing

tax

credits.

See

Note

A

and

PNC

reconciliation

in

Appendix

for

further

details.

PNC’s

book

value

per

common

share

was

$47.64

at

12/31/2009

and

$73.73

at

3/31/2014.

(1)

Peer

source:

SNL

Datasource.

% change 12/31/2009 to 3/31/2014

(1)

Tangible Book Value Per Common Share

$26.15

$56.33

PNC

3/31/14

12/31/09 |

6

Strong Financials

Financial Drivers

FY13 vs. FY12 Growth

Revenue

3%

Noninterest

Income

(3)

17%

Noninterest

Expense

(3)

(8%)

Pretax Pre-Provision

Earnings

(4)

26%

(

1)

Net

income

from

continuing

operations.

For

FY10,

this

excludes

income

from

discontinued

operations

of

$373

million.

For

the

other

periods

in

the

chart,

net

income

equals

income

from

continuing

operations

as

PNC

did

not

have

discontinued

operations

for

those

periods.

(2)

ROAA

is

return

on

average

assets.

ROAA

is

calculated

as

net

income

from

continuing

operations

divided

by

average

total

assets.

(3)

Prior

period

amounts

have

been

updated

to

reflect

the

first

quarter

2014

adoption

of

Accounting

Standards

Update

(ASU)

2014-01

related

to

investments

in

low

income

housing

tax

credits.

(4)

See

Note

B

and

PNC

reconciliation

in

the

Appendix

for

additional

details.

Up 40%

Y/Y

(1)

(2) |

7

1Q14 Highlights

1Q14 financial

summary

Net income

Diluted EPS from

net income

Return on average

assets

$1.1 billion

$1.82

1.35%

Successful first quarter

–

Continued loan and deposit growth

–

Reduced expenses

–

Improved credit quality

–

Seasonal trends impact

Stronger capital position

–

Pro

forma

fully

phased-in

Basel

III

common

equity

Tier

1

capital

ratio

of

9.7%

(1)

–

Capital actions

Increased quarterly common stock dividend by 9% to $0.48 for 2Q14

Executing on strategic priorities

(1)

As

of

March

31,

2014

and

calculated

based

on

the

Basel

III

standardized

approach.

We

previously

referred

to

the

Basel

III

common

equity

Tier

1

capital

ratio

as

the

Basel

III

Tier

1

common

capital

ratio.

Calculated

on

a

pro

forma

basis

without

the

benefit

of

the

Basel

III

phase-in

provisions.

See

Transitional

Basel

III

and

Pro

forma

Fully

Phased-

In

Basel

III

Common

Equity

Tier

1

Capital

Ratios

and

related

information

in

the

Appendix

for

further

details.

(2)

Through

1Q15,

subject

to

factors

such

as

market

and

general

economic

conditions,

economic

and

regulatory

capital

conditions,

alternative

uses

of

capital,

regulatory

and

contractual

limitations,

issuances

related

to

employee

benefit

plans

and

the

potential

impact

on

credit

ratings.

Plan

to

repurchase

up

to

$1.5

billion

of

common

stock

over

the

four

quarter

period

starting

in

2Q14

(2) |

8

JPM

PNC

BAC

RF

WFC

CMA

FITB

KEY

COF

BBT

STI

1Q13-1Q14

Expense growth

(2)

1Q13-1Q14

Loan growth

(1)

Strong First Quarter Business Drivers and Results

1Q13-1Q14

Noninterest income growth

Peer

Source:

SNL

Datasource.

(1)

Loan

balances

as

of

3/31/2013

and

3/31/2014.

(2)

PNC

prior

period

amounts

have

been

updated

to

reflect

the

first

quarter

2014

adoption

of

Accounting

Standards

Update

(ASU)

2014-01

related

to

investments

in

low

income

housing

tax

credits.

(3)

PNC’s

adjusted

noninterest

income

growth

excludes

Residential

Mortgage.

See

Appendix

for

PNC

reconciliation.

BAC

WFC

COF

MTB

1Q14

Return on avg. assets

BAC

KEY

CMA

USB

MTB

BAC

BBT

STI

RF

FITB

WFC

JPM

Adjusted

noninterest

income

growth was

7%

(3) |

9

Redefine the Retail

Banking business

Drive growth in

acquired &

underpenetrated

markets

Capture more

investable assets

Build a stronger

Residential

Mortgage business

Bolster

infrastructure &

Streamline

processes

Revenue Growth and Efficiency Improvement

Opportunities

Targeted Outcomes

(1)

Increase

fee income

Expand

market share

Deepen

relationships

Improve

operating

efficiencies

Strategic Priorities

(1) Refer to Cautionary Statement in the Appendix, including economic and other assumptions.

Does not take into account impact of potential legal and regulatory contingencies.

|

10

Deeper Penetration in Underpenetrated and Acquired

Markets

Total Corporate Banking and AMG sales

Total Corporate Banking and AMG cross-sales

AMG refers to Asset Management Group. 2014 sales and cross-sales through March 31, 2014

annualized. (1) Southeast markets defined as Alabama, Georgia, North Carolina, South

Carolina and Florida. Includes the impact of RBC Bank (USA), which we acquired on March 2, 2012.

(2)

Southeast

2012

sales

and

cross

sales

reflect

10

months

annualized.

(3)

See

Note

D

in

Appendix

for

additional

details.

Deepening client relationships

Northeast

Midwest

Northeast

Midwest

New client

Year 1

New client

Year 2

Existing

clients

(3)

Southeast

(1)

Southeast

(1)

Product Growth

Corporate Banking Primary Clients

Actual

Actual

Annualized

Annualized

Actual

Actual

Annualized

Annualized

Annualized

Annualized

(2)

(2) |

11

Strong Performance in Demographically Attractive

Southeast Markets

(1)

(1)

Southeast

markets

defined

as

Alabama,

Georgia,

North

Carolina,

South

Carolina

and

Florida.

Includes

the

impact

of

RBC

Bank (USA), which we acquired on March 2, 2012. (2) Total DDA households refers to consumer

and small business relationships. (3) A mortgage with a borrower as part of a

residential real estate purchase transaction. Asset Management Group

Residential Mortgage Banking

Retail Banking

Corporate & Institutional Banking

Purchase

(3)

Total DDA Households

(2)

Assets Under

Management

Refinance

Average Total Loans

Average Total Loans

Referral Sales

$5.8

$6.3

$369

$231

Loan Origination Volume

19% |

12

Capturing More Investable Assets

1Q14 Highlights

Retail Banking -

Brokerage Managed Account Assets

Asset Management Group

Continued momentum in asset

growth

AUA increased 3% linked quarter

Discretionary AUM core net flows

(3)

strength continues:

Noninterest income increased 9% for

1Q14 compared to 1Q13

8%

CAGR

AMG -

Assets Under Administration (AUA)

40%

CAGR

AMG

refers

to

Asset

Management

Group.

AUM

refers

to

assets

under

management.

(1)

Represents

the

potential

households’

investable

assets

across

PNC’s

Retail

Bank

footprint

held

by

PNC’s

existing

customers.

Personal

investable

assets

excludes

principal

residence

and

relates

only

to

PNC’s

personal

investments

business

and

is

not

incremental.

(2)

Represents

the

value

of

investments

by

individuals

in

the

states

represented

by

the

RBC

Banks

(USA)

acquisition

even

where

it

overlaps

with

prior

PNC

states

such

as

Florida.

Source:

Data

Analytics

Research

using

IXI

household

data.

(3)

After

adjustment to total net flows for cyclical client activities.

Retail Banking Brokerage

Total investable assets opportunity of

$1.9 trillion across our existing Retail

Banking clients

(1)

Southeast market represents

$800B

(2)

potential high net worth

investable assets

–

$1.6 billion in 1Q14

–

$4.7 billion in FY13

–

Managed Account sales increased

15% in 1Q14

–

Total quarter-end Brokerage assets

of $41 billion, up 6% compared to

end of 1Q13 |

13

Old Model

Outcomes

New Model

Responses

Transforming our Retail Banking Model

Transitioning model based on innovation and premium value

Expectations of “free”

Changing customer preferences

Reduced revenue sources

Expensive distribution

New checking continuum

Enhance customer experience

and brand

Value-based revenue model

Redefine the branch network |

14

Retail Banking –

Redefining the Branch Network

Digital Consumer Customers

(1)

Retail Banking Headcount (HC)

12 month change

Investment Professionals

Call Center Sales Reps.

Tellers

Total HC

(Dec. 2012 vs. Dec. 2013)

(1)

Digital

Consumer

Customers

represents

consumer

checking

relationships

that

process

the

majority

of

their

transactions

through

non-branch channels.

Successfully migrating customers to self-service –

ATM/Mobile usage increasing

1Q13

1Q14

Total deposit transactions |

15

Retail Banking –

Redefining the Branch

Current technology initiatives

Investing in technology

New branch formats

–

Flexible spaces

–

New sales and

services focus

Future technology initiatives

Research –

PNC Center for Financial

Services Innovation joint effort with

Carnegie Mellon University

–

Video advisor

–

Video wall

–

Assisted ATM

–

Instant card

issuance

–

Employee tablet

–

DepositEasy

SM

ATMs

–

Video teller

–

Mobile tablet

account opening |

16

Building a Stronger Residential Mortgage Banking

Business

2014 industry volume

(1)

expected to be lowest since 1997

PNC outpacing industry

(4)

Closing purchase applications faster than industry

Continued upward trend in customer loyalty

(1)

Source:

Mortgage

Bankers

Association

(MBA),

April

2014

publication

(2)

A

mortgage

with

a

borrower

as

part

of

a

residential

real

estate

purchase

transaction.

(3)

Source:

Form

10-Q

filings

for

period

ended

March

31,

2014.

(4)

Chase

Retail.

(5)

Source:

Icon-

Lendershare

report,

May

2014.

(6)

See

Note

C

in

Appendix

for

details

on

PNC’s

mortgage

origination

customer

loyalty.

1Q13 vs. 1Q14 Change in Total Fundings

(3)

(5)

(6)

(2) |

17

Building Best In Class Technology & Operations

Focused Priorities

Establishing a foundation to support our scale and effectively

respond to rapidly changing environments

Providing ability to grow with existing investments

Creating a competitive advantage –

improved operational efficiency

and business agility

Retail transformation

Cyber security

Modernize applications

Infrastructure enhancements |

18

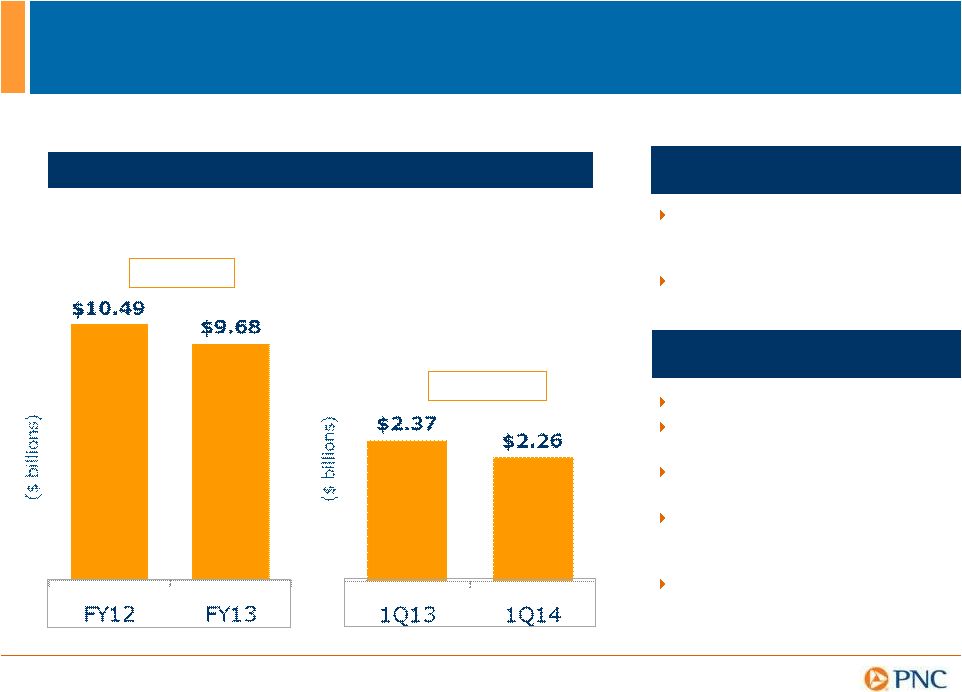

Noninterest Expense Trends

(1)

Continued Focus on Expense Management

2014 Expense Management

Opportunities

(1)

Prior

period

amounts

have

been

updated

to

reflect

the

first

quarter

2014

adoption

of

Accounting

Standards

Update

(ASU)

2014-01

related

to

investments

in

low

income

housing

tax

credits.

(2)

Percentage

decline

is

calculated

based

on

numbers

rounded

to

three

decimals.

(3)

See

Note

E

in

the

Appendix

for

further

details.

(4)

CIP

refers

to

PNC’s

Continuous

Improvement

Program.

Lowering service delivery costs

Branch reconfiguration and

consolidations

Re-engineering mortgage

servicing business

Enhancing online investment

platform and centralized

services

CIP

(4)

goal of $500 million

Down 4%

(2)

Down 8%

Highlights

Decreased expense reflected

our disciplined expense

management

Efficiency ratio

(3)

of 60% in

1Q14 |

19

Capital Strength Reflected in Stress Test

Source:

The

Board

of

Governors

of

the

Federal

Reserve

Dodd-Frank

Act

Stress

Test,

March

2014:

Supervisory

Stress

Test

Methodology

and

Results,

March

2014

(as

corrected).

(1)

The

variance

reflects

the

difference

under

the

Federal

Reserve’s

supervisory

stress

test

between

the

Basel

I

Tier

1

common

capital

ratios

reported

as

of

September

30,

2013

and

the

minimum

Basel

I

Tier

1

common

capital

ratio

reached

under

the

supervisory

severely

adverse

scenario

between

the

periods

4Q13

and

4Q15.

Ratios

were

calculated

using

the

capital

action

assumptions

contained

in

the

Federal

Reserve’s

Dodd-Frank stress testing rules.

Company Reported

Basel I Tier 1 Common Ratio (9/30/13)

Basel I Tier 1

Common Ratio Variance

(1)

BBT

USB

STI

PNC

FITB

KEY

CMA

RF

WFC

MTB

JPM

COF

BAC |

20

Strong Capital Build

Strong Capital Position Provides Capital Flexibility

Highlights

Capital priorities:

Increased quarterly common

stock dividend by 9% to

$0.48 for 2Q14

Plan to repurchase up to $1.5

billion of common stock

through 1Q15

(3)

(1)

We

previously

referred

to

the

Basel

III

common

equity

Tier

1

capital

ratio

as

the

Basel

III

Tier

1

common

capital

ratio.

(2)

Calculated

on

a

pro

forma

basis

without

the

benefit

of

the

Basel

III

phase-in

provisions.

For

both

1Q14

and

4Q13,

the

resulting

pro

forma

fully

phased-in

Basel

III

common

equity

Tier

1

ratios

were

calculated

based

on

the

Basel

III

standardized

approach.

Advanced

approaches

RWAs

and

related

rules

were

utilized

for

1Q13.

See

Transitional

Basel

III

and

Pro

forma

Fully

Phased-In

Basel

III

Common

Equity

Tier

1

Capital

Ratios

and

related

information

in

the

Appendix

for

further

details.

(3)

See

Note

2

on slide 7 above.

–

Build capital to support

client growth and

business investment

–

Maintain appropriate

capital in light of

economic uncertainty

–

Return excess capital to

shareholders, subject to

the CCAR process |

21

Relative Returns and Valuation

21

ROACE

(2)

3/31/14

USB

14.4%

WFC

14.2

COF

10.8

PNC

10.4

BBT

10.3

JPM

9.7

KEY

9.4

FITB

8.9

STI

8.1

RF

8.0

MTB

8.0

CMA

7.6

BAC

-0.9

Current

Price/TBV

(3)

USB

2.76x

MTB

2.23

WFC

2.01

BBT

1.98

COF

1.58

FITB

1.51

PNC

1.48

STI

1.39

RF

1.31

KEY

1.29

JPM

1.29

CMA

1.27

BAC

1.07

ROAA

(1)

3/31/14

WFC

1.59%

COF

1.57

USB

1.55

PNC

1.35

BBT

1.27

RF

1.08

KEY

1.07

MTB

1.06

FITB

0.99

STI

0.93

JPM

0.88

CMA

0.86

BAC

-0.05

Peer Average

1.07%

Peer Average

1.63x

Peer Average

9.0%

Based on closing price as of 5/7/2014. Tangible book value (TBV)

as of 3/31/2014.

Peer

Source:

SNL

Datasource.

Peer

Average

is

average

of

peers

listed

in

table.

(1)

See

Note

2

on

slide

6

above.

(2)

ROACE

is

return

on

average

common

shareholders’

equity.

(3)

Price

to

tangible

book

value

(P/TBV)

based

on

closing

price

as

of

5/19/2014

and

TBV

as

of

3/31/2014.

PNC’s

tangible

book

value

(TBV)

as

of

3/31/2014

was

$56.33

and

its

book

value

was

$73.73.

See

Note

A

and

PNC

reconciliation

in

Appendix

for

further

details. |

22

Key Takeaways

Strong financial results

Strategic priorities provide opportunities for

continued profitability driven by revenue growth and

improved efficiencies

Capital flexibility positions us well for returning

capital to shareholders |

*

*

*

*

* |

24

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This

presentation

includes

“snapshot”

information

about

PNC

used

by

way

of

illustration

and

is

not

intended

as

a

full

business

or

financial

review.

It

should not be viewed in isolation but rather in the context of all of the information made

available by PNC in its SEC filings. We also make statements in this presentation, and

we may from time to time make other statements, regarding our outlook for earnings, revenues,

expenses,

capital

and

liquidity

levels

and

ratios,

asset

levels,

asset

quality,

financial

position,

and

other

matters

regarding

or

affecting

PNC

and

its

future

business and operations that are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act. Forward-looking statements

are

typically

identified

by

words

such

as

“believe,”

“plan,”

“expect,”

“anticipate,”

“see,”

“look,”

“intend,”

“outlook,”

“project,”

“forecast,”

“estimate,”

“goal,”

“will,”

“should”

and other similar words and expressions. Forward-looking statements are subject to

numerous assumptions, risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date made. We do not assume any duty

and do not undertake to update forward-looking statements. Actual results or

future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical

performance.

Our forward-looking statements are subject to the following principal risks and

uncertainties. –

Changes in interest rates and valuations in debt, equity and other financial markets.

–

Disruptions in the liquidity and other functioning of U.S. and global financial

markets. –

The impact on financial markets and the economy of any changes in the credit ratings of U.S.

Treasury obligations and other U.S. government-backed debt, as well as issues

surrounding the levels of U.S. and European government debt and concerns regarding the

creditworthiness of certain sovereign governments, supranationals and financial institutions

in Europe. –

Actions by the Federal Reserve, U.S. Treasury and other government agencies, including those

that impact money supply and market interest rates.

–

Changes

in

customers’,

suppliers’

and

other

counterparties’

performance

and

creditworthiness.

–

Slowing or reversal of the current U.S. economic expansion.

–

Continued

residual

effects

of

recessionary

conditions

and

uneven

spread

of

positive

impacts

of

recovery

on

the

economy

and

our

counterparties, including adverse impacts on levels of unemployment, loan utilization rates,

delinquencies, defaults and counterparty ability to meet credit and other

obligations. –

Changes in customer preferences and behavior, whether due to changing business and economic

conditions, legislative and regulatory initiatives, or other factors.

•Our forward-looking financial statements are subject to the risk that economic and

financial market conditions will be substantially different than we are currently

expecting. These statements are based on our current view that the U.S. economic expansion will speed up to an above trend growth

rate near 2.8 percent in 2014 as drags from Federal fiscal restraint subside and that

short-term interest rates will remain very low and bond yields will

rise

only

slowly

in

2014.

These

forward

looking

statements

also

do

not,

unless

otherwise

indicated,

take

into

account

the

impact

of

potential

legal

and

regulatory contingencies.

•Our businesses, financial results and balance sheet values are affected by business and

economic conditions, including the following: |

25

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

PNC’s ability to take certain capital actions, including paying dividends and any plans

to increase common stock dividends, repurchase common stock under current or future

programs, or issue or redeem preferred stock or other regulatory capital instruments,

is subject to the review of such proposed actions by the Federal Reserve as part of PNC’s comprehensive capital plan

for

the

applicable

period

in

connection

with

the

regulators’

Comprehensive

Capital

Analysis

and

Review

(CCAR)

process

and

to

the

acceptance of such capital plan and non-objection to such capital actions by the Federal

Reserve. PNC’s regulatory capital ratios in the future will depend on, among other

things, the company’s financial performance, the scope and terms of final capital

regulations then in effect (particularly those implementing the Basel Capital Accords), and management

actions affecting the composition of PNC’s balance sheet. In addition, PNC’s

ability to determine, evaluate and forecast regulatory capital ratios, and to take

actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent on

the ongoing development, validation and regulatory approval of related models.

Legal and regulatory developments could have an impact on our ability to operate our

businesses, financial condition, results of operations, competitive position,

reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect

matters such as business generation and retention, liquidity, funding, and ability to attract

and retain management. These developments could include:

–

Changes resulting from legislative and regulatory reforms, including major reform of the

regulatory oversight structure of the financial services industry and changes to laws

and regulations involving tax, pension, bankruptcy, consumer protection, and other

industry aspects, and changes in accounting policies and principles. We will be impacted by extensive reforms

provided for in the Dodd-Frank Wall Street Reform and Consumer Protection Act (the

“Dodd-Frank Act”) and otherwise growing out of the most recent financial

crisis, the precise nature, extent and timing of which, and their impact on us,

remains uncertain.

–

Changes to regulations governing bank capital and liquidity standards, including due to the

Dodd-Frank Act and to Basel- related initiatives.

–

Unfavorable resolution of legal proceedings or other claims and regulatory and other

governmental investigations or other inquiries.

In

addition

to

matters

relating

to

PNC’s

business

and

activities,

such

matters

may

include

proceedings,

claims,

investigations, or inquiries relating to pre-acquisition business and activities of

acquired companies, such as National City. These

matters

may

result

in

monetary

judgments

or

settlements

or

other

remedies,

including

fines,

penalties,

restitution

or

alterations in our business practices, and in additional expenses and collateral costs, and

may cause reputational harm to PNC.

–

Results of the regulatory examination and supervision process, including our failure to

satisfy requirements of agreements with governmental agencies.

–

Impact

on

business

and

operating

results

of

any

costs

associated

with

obtaining

rights

in

intellectual

property

claimed

by

others and of adequacy of our intellectual property protection in general.

|

26

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

Business and operating results are affected by our ability to identify and effectively manage

risks inherent in our businesses, including, where appropriate,

through

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

to

meet

evolving

regulatory

capital and liquidity standards. In particular, our results currently depend on our ability to

manage elevated levels of impaired assets. Business

and

operating

results

also

include

impacts

relating

to

our

equity

interest

in

BlackRock,

Inc.

and

rely

to

a

significant

extent

on

information provided to us by BlackRock. Risks and uncertainties that could affect

BlackRock are discussed in more detail by BlackRock in its SEC filings.

We grow our business in part by acquiring from time to time other financial services

companies, financial services assets and related deposits and other liabilities.

Acquisition risks and uncertainties include those presented by the nature of the business acquired, including in some

cases

those

associated

with

our

entry

into

new

businesses

or

new

geographic

or

other

markets

and

risks

resulting

from

our

inexperience

in

those new areas, as well as risks and uncertainties related to the acquisition transactions

themselves, regulatory issues, and the integration of the acquired businesses into PNC

after closing. Competition can have an impact on customer acquisition, growth and

retention and on credit spreads and product pricing, which can affect market share,

deposits and revenues. Industry restructuring in the current environment could also impact our business and financial

performance

through

changes

in

counterparty

creditworthiness

and

performance

and

in

the

competitive

and

regulatory

landscape.

Our

ability

to

anticipate

and

respond

to

technological

changes

can

also

impact

our

ability

to

respond

to

customer

needs

and

meet

competitive

demands.

Business and operating results can also be affected by widespread natural and other disasters,

dislocations, terrorist activities, cyberattacks or international hostilities through

impacts on the economy and financial markets generally or on us or our counterparties specifically.

We provide greater detail regarding these as well as other factors in our 2013 Form 10-K

and our first quarter 2014 Form 10-Q, including in the Risk Factors and Risk

Management sections and the Legal Proceedings and Commitments and Guarantees Notes of the Notes To

Consolidated Financial Statements in those reports, and in our subsequent SEC filings.

Our forward-looking statements may also be subject to other risks and

uncertainties, including those we may discuss elsewhere in this presentation or in SEC filings, accessible on the SEC’s website

at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included

these web addresses as inactive textual references only. Information on these

websites is not part of this document. Any annualized, pro forma, estimated, third party

or consensus numbers in this presentation are used for illustrative or comparative purposes

only

and

may

not

reflect

actual

results.

Any

consensus

earnings

estimates

are

calculated

based

on

the

earnings

projections

made

by

analysts

who cover that company. The analysts’

opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs

alone, are not those of PNC or its management, and may not reflect PNC’s or other

company’s actual or anticipated results. |

27

Notes

Appendix

Explanatory Notes

(A) Tangible book value per common share calculated based on tangible common shareholders'

equity (common shareholders' equity less goodwill and other intangible assets, other

than servicing rights, net of deferred tax liabilities on such intangible assets)

divided by period-end common shares outstanding. PNC's book value per share was $47.64 and $73.73 at 12/31/09

and 3/31/14, respectively. See Appendix, Slide 30 for PNC reconciliation.

(C) Originations customer loyalty three month rolling average. Measure of customer loyalty

based on survey responses of customers who have recently closed a loan with PNC, and

their responses to three questions: Overall satisfaction, likelihood to recommend,

likelihood to use again. Responses are given a rating of 1-5 (5 being the best) and all 5s are considered to

be a “loyal customer”.

(B) Pretax pre-provision earnings is defined as total revenue less noninterest expense. We

believe that pretax pre-provision earnings, a non-GAAP measure, is useful as a

tool to help evaluate the ability to provide for credit costs through operations. (E)

Efficiency ratio calculated as noninterest expense divided by total revenue. (D)

Represents PNC's Corporate Banking clients excluding new clients of less than three years as of 12/31/13. A Corporate

Banking primary client is defined as a corporate banking relationship with annual revenue

generation of $50,000 or more or, within corporate banking, a commercial banking client

relationship with annual revenue generation of $10,0000 or more. |

28

Transitional Basel III and Pro forma Fully Phased-In Basel III

Common Equity Tier 1 Capital Ratios

Appendix

As a result of the staggered effective dates of the final U.S. capital rules issued in July

2013, as well as the fact that PNC remains in the parallel run qualification phase for

the advanced approaches, PNC’s regulatory risk-based capital ratios in 2014

are based on the definitions of, and deductions from, capital under Basel III (as such

definitions and deductions are phased-in for 2014) and Basel I risk-weighted assets (but subject to

certain

adjustments

as

defined

by

the

Basel

III

rules).

We

refer

to

the

capital

ratios

calculated

using

these

Basel III phased-in provisions and Basel I risk-weighted assets as the Transitional

Basel III ratios. These capital ratios became effective for PNC on January 1, 2014.

We provide information on the next slide regarding PNC’s Transitional Basel III

common equity Tier 1 ratio and PNC’s pro forma fully phased-in Basel III

common equity Tier 1 ratio. We previously referred to the Basel III common equity Tier

1 ratio as the Basel III Tier 1 common ratio. In addition, on the next slide we

provide information regarding PNC’s Basel I Tier 1 common capital ratio, which

was applicable to PNC through 2013 under the U.S. regulatory capital rules.

Common equity Tier 1 capital as defined under the Basel III rules adopted by the U.S. banking

agencies differs materially from Basel I. For example, under Basel III, significant

common stock investments in unconsolidated financial institutions, mortgage servicing

rights and deferred tax assets must be deducted from capital to the extent they

individually exceed 10%, or in the aggregate exceed 15%, of the institution’s

adjusted common equity Tier 1 capital. Also, Basel I regulatory capital excludes

accumulated other comprehensive income related to securities currently and previously

held as available for sale, as well as pension and other postretirement plans, whereas

under Basel III these items are a component of PNC's capital. |

29

Transitional Basel III and Pro forma Fully Phased-In Basel III

Common Equity Tier 1 Capital Ratios

Appendix

Transitional Basel

III

Dollars in millions

Mar. 31, 2014

Mar. 31, 2014

Dec. 31, 2013(a)

Mar. 31, 2013(a)

Common stock, related surplus, and retained earnings, net of treasury

stock

$38,722

$38,722

$38,031

$35,305

Less regulatory capital adjustments:

Goodwill and disallowed intangibles, net of deferred tax liabilities

(8,932)

(9,291)

(9,321)

(9,412)

Basel III total threshold deductions

(214)

(1,186)

(1,386)

(2,076)

Accumulated other comprehensive income (b)

82

410

196

289

All other adjustments (c)

(16)

(106)

(64)

(580)

Estimated Common equity Tier 1 capital

29,642

28,549

27,456

23,526

Estimated Basel I risk-weighted assets calculated in accordance with

transition rules for 2014 (d)

273,826

N /A

N /A

N /A

Estimated Basel III standardized approach risk-weighted assets (e)

N /A

293,310

291,977

N /A

Estimated Basel III advanced approaches risk-weighted assets (f)

N /A

289,441

290,080

293,810

Estimated Basel III Common equity Tier 1 capital ratio

10.8%

9.7%

9.4%

8.0%

Risk-weight and associated rules utilized

Basel I (with 2014

transition adjustments)

Standardized

Standardized

Advanced

(b) Represents

net

adjustments

related

to

accumulated

other

comprehensive

income

for

securities

currently

and

previously

held

as

available

for

sale,

as

well

as

pension and other postretirement plans.

(c) Includes adjustments as required based on whether the standardized approach or advanced

approaches is utilized. (d) Includes credit and market risk-weighted assets.

(e)

Estimated

based

on

Basel

III

standardized

approach

rules

and

includes

credit

and

market

risk-weighted

assets.

(f) Estimated based on Basel III advanced approaches rules and includes credit, market and

operational risk-weighted assets. 2013 Basel I Tier 1 Common Capital Ratios (a)

(b) Dollars in millions

Dec. 31, 2013

Mar. 31, 2013

Basel I Tier 1 common capital

$28,484

$25,680

Basel I risk-weighted assets

272,169

261,491

Basel I Tier 1 common capital ratio

10.5%

9.8%

(a)

Effective

January

1,

2014,

the

Basel

I

Tier

1

common

capital

ratio

no

longer

applies

to

PNC

(except

for

stress

testing purposes). Our 2013 Form 10-K included additional information regarding our Basel I

capital ratios. Pro forma Fully Phased-In Basel III

PNC utilizes the pro forma fully phased-in Basel III capital ratios to assess its capital

position (without the benefit of phase-ins), including comparison to similar

estimates made by other financial institutions. Our Basel III capital ratios and estimates may be impacted by additional regulatory guidance or

analysis and, in the case of those ratios calculated using the advanced approaches, the ongoing

evolution, validation and regulatory approval of PNC’s models integral to the

calculation of advanced approaches risk-weighted assets. (b) Amounts have not been

updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments

in low income housing tax credits.

(a) Amounts have not been updated to reflect the first quarter 2014 adoption of Accounting

Standards Update (ASU) 2014-01 related to investments in low income housing tax

credits. |

30

Tangible Book Value per Common Share

Appendix

Tangible Book Value per Common Share Ratio

3/31/14 vs.

12/31/09

Dollars in millions, except per share data

Mar. 31, 2014

Dec. 31, 2009

(b)

Book value per common share

73.73

$

47.64

$

55%

Tangible book value per common share

Common shareholders' equity

39,378

$

21,995

$

Goodwill and Other Intangible Assets (a)

(9,621)

(10,650)

Deferred tax liabilities on Goodwill and Other Intangible Assets (a)

331

738

Tangible common shareholders' equity

30,088

$

12,083

$

Period-end common shares outstanding (in millions)

534

462

Tangible book value per common share (Non-GAAP)

56.33

$

26.15

$

115%

(a) Excludes the impact from mortgage servicing rights of $1.6 billion at March 31, 2014 and

$2.3 billion at December 31, 2009. Tangible book value per common share is a

non-GAAP financial measure and is calculated based on tangible common

shareholders’ equity divided by period-end common shares outstanding. We believe this

non-GAAP financial measure serves as a useful tool to help evaluate the strength

and discipline of a company's capital management strategies and as an additional,

conservative measure of total company value.

(b) Prior period amounts have been updated to reflect the first quarter 2014 adoption of

Accounting Standards Update (ASU) 2014-01 related to investments in low income

housing tax credits. % Change |

31

Non-GAAP to GAAP Reconcilement

Appendix

$ in millions

Dec. 31, 2013

Dec. 31, 2012

% Change

Net interest income

$9,147

$9,640

-5%

Noninterest income

$6,865

$5,872

17%

Total revenue

$16,012

$15,512

3%

Noninterest expense (1)

($9,681)

($10,486)

-8%

Pretax pre-provision earnings (2)

$6,331

$5,026

26%

Net income (1)

$4,212

$2,994

41%

(1) Prior period amounts have been updated to reflect the first quarter 2014 adoption of

Accounting Standards Update (ASU) 2014-01 related to investments in low income

housing tax credits.

(2) PNC believes that pretax, pre-provision earnings, a non-GAAP measure, is useful as

a tool to help evaluate the ability to provide for credit costs through

operations. For

the year ended |

32

Non-GAAP to GAAP Reconcilement

Appendix

$ in millions

Mar. 31, 2014

Mar. 31, 2013

% change

Asset management

$364

$308

Consumer services

$290

$296

Corporate services

$301

$277

Residential mortgage

$161

$234

Deposit service charges

$147

$136

Net securities gains

$10

$14

Net other-than-temporary impairments

($2)

($10)

Other

$311

$311

Total noninterest income, as reported

$1,582

$1,566

1%

Less Residential mortgage

$161

$234

$1,421

$1,332

7%

Noninterest income, adjusted for Residential mortgage

For

the three months ended |

33

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC |