Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEPHROS INC | v379665_8k.htm |

EXHIBIT 99.1

1 Nephros, Inc. From a ncient Greek meaning “kidney” – a f ilter Management Presentation May 2014 www.nephros.com Ticker Symbol: NEPH

2 Safe Harbor Statement Certain statements in this management presentation constitute “forward - looking statements” . Such statements include statements regarding the efficacy and intended use of our technologies under development, the timelines for bringing such products to market and the availability of funding sources for continued development of such products and other statements that are not historical facts, including statements which may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words . Forward - looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond our control . Actual results may differ materially from the expectations contained in the forward - looking statements . Factors that may cause such differences include, but are not limited to, the risks that : ( i ) we may not be able to find a strategic partner to successfully market our HDF system ; (ii) our HDF system may not be accepted by patients or health care providers in the U . S . marketplace ; (iii) we may not be able to continue as a going concern ; (iv) the voluntary recalls of point of use and DSU in - line ultrafilters used in hospital water treatment applications announced on October 30 , 2013 and the related circumstances could subject us to claims or proceedings by consumers, the FDA or other regulatory authorities which may adversely impact our sales and revenues ; (v) we face significant challenges in obtaining market acceptance of our products, which could adversely affect our potential sales and revenues ; (vi) there are product - related deaths or serious injuries or product malfunctions, which could trigger recalls, class action lawsuits and other events that could cause us to incur expenses and may also limit our ability to generate revenues from such products ; (vii) we face potential liability associated with the production, marketing and sale of our products, and/or the expense of defending against claims of product liability, could materially deplete our assets and generate negative publicity which could impair our reputation ; (viii) to the extent our products or marketing materials are found to violate any provisions of the FDC Act or any other statutes or regulations then we could be subject to enforcement actions by the FDA or other governmental agencies ; (ix) we may not be able to obtain funding if and when needed or on terms favorable to us in order to continue operations ; (x) we may not have sufficient capital to successfully implement our business plan ; (xi) we may not be able to effectively market our products ; (xii) we may not be able to sell our water filtration products or chronic renal failure therapy products at competitive prices or profitably ; (xiii) we may encounter problems with our suppliers, manufacturers and distributors ; (xiv) we may encounter unanticipated internal control deficiencies or weaknesses or ineffective disclosure controls and procedures ; (xv) we may not obtain appropriate or necessary regulatory approvals to achieve our business plan ; (xvi) products that appeared promising to us in research or clinical trials may not demonstrate anticipated efficacy, safety or cost savings in subsequent pre - clinical or clinical trials ; (xvii) we may not be able to secure or enforce adequate legal protection, including patent protection, for our products ; and (xviii) we may not be able to achieve sales growth in key geographic markets . More detailed information about the Company and the risk factors that may affect the realization of forward - looking statements, including the forward - looking statements in this management presentation, is set forth in our filings with the SEC, including our Annual Report on Form 10 - K for the fiscal year ended December 31 , 2013 and our other periodic reports filed with the SEC . We urge you to read those documents free of charge at the SEC’s web site at www . sec . gov . We do not undertake to publicly update or revise our forward - looking statements as a result of new information, future events or otherwise, except as required by law .

3 Introduction We are a commercial stage medical device company that develops and sells high - performance liquid purification filters in North America and the EU ▪ Our ultrafilters are currently used primarily in dialysis centers and healthcare facilities for the production of ultrapure water and bicarbonate − Eliminate a wide variety of bacteria, viruses, fungi, parasites, biotoxins and endotoxins ▪ Proprietary hollow fiber technology simultaneously optimizes: − Filtration – as low as 5 nanometers − Flow rate – minimal disruption − Filter life – up to 12 months ▪ Founded in 1997 by healthcare professionals affiliated with Columbia University Medical Center/New York - Presbyterian Hospital

4 Proprietary hollow fiber filtration technology Commercial stage with several ultrafilter types on the market Significant addressable markets Exceed independent accreditation standards, FDA cleared, and CE Mark approved Strong IP protection and know - how Experienced management team Investment Highlights

5 ▪ Our proprietary hollow fiber technology allows our ultrafilters to optimize the three elements critical to filter performance: ▪ Ultrafilters produced by Medica S.p.A under a 10 - year mutually exclusive license Filtration As low as 5 nm Filter Life Up to 12 Months Flow Rate Minimal Disruption Competitive Advantage

6 ▪ We currently offer ultrafilters for sale to customers in four markets ▪ Surpass independent accreditation standards set by AAMI/ANSI/ISO ▪ Dialysis ultrafilters have regulatory clearances in the US, EU, and Canada Target Markets Dialysis Water and Bicarbonate Dialysis Blood Military and Outdoor Recreation Water Commercial Water

7 Dialysis Water and Bicarbonate

8 Dialysis Water and Bicarbonate Market ▪ Aging population, with increasing incidence/prevalence of obesity and diabetes − 26 million American adults have c hronic k idney disease − Approximately 600,000 with chronic renal failure; 4% CAGR projected ▪ Approximately 400,000 patients receiving hemodialysis (HD ) annually − Total expenditure on HD in 2011 - $49.3 billion − HD – 4 hours per session, 3 sessions per week, 52 weeks per year − HD performed either in stand - alone clinic, hospital setting or at home − Approximately 6,000 dialysis centers; 100,000 HD machines; 20,000 Portable RO machines; 20 million dialyzers ▪ Approximately 60 % of patients receive dialysis from two companies − Fresenius (30%), DaVita (27%) ▪ Medicare reimbursement bundle has heightened awareness to minimizing costs Source: United States Renal Data System (USRDS) and external market research

9 Ultrapure Liquid Critical to Dialysis ▪ Water and bicarbonate are essential ingredients in dialysate ▪ Water and bicarbonate purity are a requirement for Medicare reimbursement 1 − Higher standards established in 2009 by AAMI/ANSI/ISO 13959:2009 − We anticipate adherence will be required in the near future ▪ Multiples studies demonstrate the benefits of ultrapure dialysate: 2,3 − Reduces complications from increased systemic inflammation - decrease in markers of inflammation and oxidative stress, an increase in serum albumin and hemoglobin − Reduce usage of ESA – an expensive drug used in conjunction with HD ▪ Challenges for dialysis facilities: − Continue to operate within the Medicare reimbursement bundle − Comply with newly proposed water and bicarbonate purity requirements (1) Association for the Advancement of Medical Instrumentation (AAMI), American National Standards Institute (ANSI) and International Standards Organization (ISO) produced the ANSI/AAMI/ISO 13959:2009 – Water for Hemodialysis and ANSI/AAMI/ISO 11663:2009 – Quality of Dialysate for Hemodialysis (2) Susantitaphong, P et al. (2013). “ Effect of ultarpure dialysate on markers of inflammation, oxidative stress, nutrition and anemia paramaters: a meta analysis ” Nephrol Dial Transplant 1 - 9 (3) Sitter, T. et al. (2000 ). “Dialysate related cytokine induction and response to recombinant human erythropoietin in hemodialysis patients.” Nephrol Dial Transplant, 15 : 1207 - 1211

10 In - line Ultrafilter Solution ▪ Our ultrafilters purify water and bicarbonate: − Exceed currently approved and newly proposed purity standards − May assist in reducing the costs associated with correcting complications caused by the inflammatory response to unwanted contaminants in the blood ▪ We provide 2 types of in - line ultrafilters: − DSU (Dual Stage Ultrafilter) – to polish water − SSU (Single Stage Ultrafilter) – to polish bicarbonate ▪ Provide proven durability: 6 to 12 months filter life ▪ Cleared by the FDA and approved as a medical device under a CE mark DSU SSU

11 Easy to Install ▪ 1 DSU and 1 SSU inserted into the piping between the wall and each dialysis machine DSU Wall Box Configuration S SU Wall Box Configuration

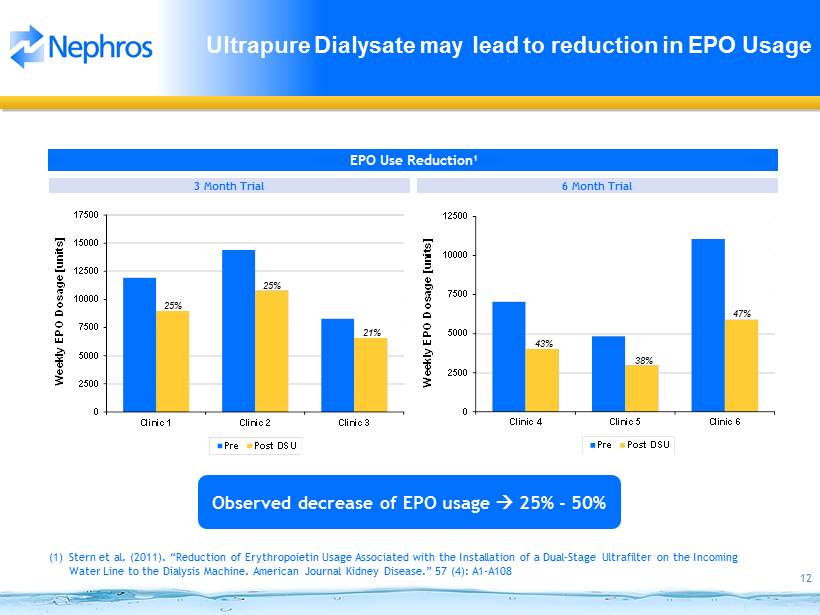

12 0 2500 5000 7500 10000 12500 Clinic 4 Clinic 5 Clinic 6 Weekly EPO Dosage [units] Pre Post DSU 0 2500 5000 7500 10000 12500 15000 17500 Clinic 1 Clinic 2 Clinic 3 Weekly EPO Dosage [units] Pre Post DSU Ultrapure Dialysate may lead to reduction in EPO Usage 3 Month Trial Observed decrease of EPO usage 25 % - 50% 6 Month Trial EPO Use Reduction 1 47% 43% 38% 25% 21% 25% (1) Stern et al. (2011). “Reduction of Erythropoietin Usage Associated with the Installation of a Dual - Stage Ultrafilter on the Incoming Water Line to the Dialysis Machine. American Journal Kidney Disease.” 57 (4): A1 - A108

13 Dialysis Blood

14 Dialysis Blood Market Dialysis Treatment Options ▪ Hemodialysis (HD) clears solutes via diffusion - c urrent therapy standard in US ▪ Hemofiltration ( HF) clears solutes via convection ▪ Hemodiafiltration (HDF ) combines the benefits of both HD and HF − Enhanced clearance of middle and large molecular weight toxins − Improved survival – up to a 35% reduction in mortality risk 1 − Reduction in the occurrence of dialysis - related amyloidosis − Reduction in inflammation − Reduction in medication such as ESA and phosphate binders − Improved patient quality of life − Reduction in number of hospitalizations and overall length of stay (1) Source: Canaud B, et al. Mortality risk for patients receiving hemodiafiltration versus hemodialysis: European results from the DOPPS. Kidney Int. 70(8), 1524 - 1525 (2006)

15 HDF Solution ▪ The only FDA - cleared on - line mid - dilution HDF system ▪ Labeled for all chronic renal failure patients ▪ Provides all the clinical/patient benefits of on - line HDF in one system ▪ Unsurpassed clinical performance in a single - filter design − Improved clearance of toxins (especially middle molecules) as compared to HD − Possible improvement to patient quality of life ▪ A simple modular upgrade to all existing dialysis machines ▪ Recently we announced the first commercial placement of our on - line HDF system in a DaVita clinic in Colorado Springs ▪ DaVita Kidney Care is now delivering HDF treatments to select patients as part of a six - month trial program OLPūr MD220 OLPūr H2H Module

16 0 50 100 150 200 250 300 350 400 Whole Blood Clearance [ml/min] High Flux HD Mid-Dilution HDF Improved Clearance In Vivo Clearance Comparison 1 (n= 20 patients) (1) Santoro A, et al. (2005). “Mid - Dilution: The Perfect Balance Between Convection and Diffusion”, Contrib Nephrol . 149: 107 - 14

17 Military and Outdoor Recreation Water

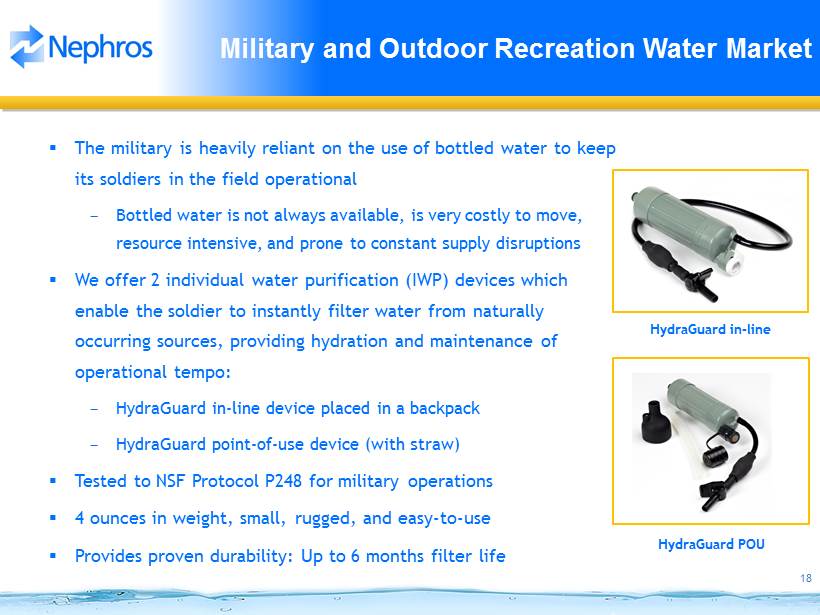

18 Military and Outdoor Recreation Water Market ▪ The military is heavily reliant on the use of bottled water to keep its soldiers in the field operational − Bottled water is not always available, is very costly to move, resource intensive, and prone to constant supply disruptions ▪ We offer 2 i ndividual w ater purification (IWP) devices which enable the soldier to instantly filter water from naturally occurring sources, providing hydration and maintenance of operational tempo: − HydraGuard in - line device placed in a backpack − HydraGuard point - of - use device (with straw) ▪ Tested to NSF Protocol P248 for military operations ▪ 4 ounces in weight, small, rugged, and easy - to - use ▪ Provides proven durability: Up to 6 months filter life HydraGuard in - line HydraGuard POU

19 Commercial Water

20 Commercial Water Market ▪ According to the United States Environmental Protection Agency (EPA), public drinking water systems consist of community and non - community systems ▪ Non - community, non - transient water systems regularly supply water to at least 25 of the same people at least six months per year, but not year - round (e.g . office buildings, hospitals, schools, hotels and factories which have their own water systems)

21 Sources of Contamination ▪ Incoming municipal water supply − Water treatment plants only need to meet EPA guidelines for potable water which allows for up to 500 CFU/ml of bacteria ▪ Age and/or complexity of plumbing − Several miles of piping with numerous areas where water can stagnate − Sinks and showers; many go unused for long periods of time ▪ Biofilm − Over time, all pipes become coated with a thin, slimy film of bacteria − Biofilm continually releases contaminants into passing water

22 NanoGuard - D and NanoGuard - S ▪ The Nephros NanoGuard - D and NanoGuard - S in - line ultrafilters are for the filtration of water which is to be used for drinking and washing in non - transient, non - community water systems (i.e . commercial properties) ▪ The NanoGuard - D and NanoGuard - S are to be used as a component of a properties water treatment system and also for filtering water to be used in ice machines ▪ The NanoGuard - D and NanoGuard - S trap particulates greater than 5nm in size ▪ The water permeability (the ease at which water can pass through a membrane at a given pressure) of the membrane is higher than membranes with a similar pore size, providing improved flow performance relative to the physical size of the filter NanoGuard - D NanoGuard - S

23 ▪ Laboratory Water: Experimentation ▪ Disaster Relief: Emergency Response ▪ Consumer: Home Use Potential Future Markets ▪ Hospitality: Cruise Ships, Hotels, and Spas

24 Patents and Approvals We have a total of 22 patent inventions; 7 for water applications and 15 for blood applications Water Applications ▪ Patent on DSU – Issued in US, Mexico, Israel, Japan and Australia (expires in 2026), in application rest of world ▪ Additional two patents have been issued covering portable filter designs with integral pump ▪ Three applications pending related to integrity testing, filter design, and a flush pump feature ▪ Ultrafilters contain “trade secret formula and know how” developed by Medica ▪ 510(k) clearance (US), Health Canada and CE mark approval for dialysis water Blood Applications ▪ Patents issued in US, EU, Japan, Canada and BRIC specifically for MD220 filter and H2H Module ▪ 12 additional patents have been issued covering aspects of Mid - dilution, HDF, and Infusion Fluid ▪ 510(k) clearance ( US), Health Canada and CE mark approval

25 Senior Executive Team John Houghton President & CEO ▪ 25+ years experience in Med Device, Pharma , and Biotech industries ▪ Launched and commercialized products globally at Aventis and Stryker Corp. ▪ Public IPO and financing experience ▪ Previously served as President and CEO of CorMedix , Inc. Greg Collins, Ph.D. VP of R&D ▪ Biomedical Engineer ▪ Significant experience in design and development of medical devices ▪ Previously served as R&D Product Manager with National Medical Care (Fresenius Medical Care) Shane Sullivan Director of North American Sales ▪ Proven Sales, Sales Management and Business Development experience ▪ Life Science sales expertise ▪ Strategic planning and territory optimization ▪ Previously led sales team at Saxton Bradley

26 Board Members and Consultants Lawrence Centella Director ▪ Director of Nephros since January 2001 ▪ President of Renal Patient Services LLC ▪ Executive VP and COO of Gambro Healthcare, Inc. ▪ Senior executive dialysis company experience Daron Evans Director ▪ Director of Nephros since December 2013 ▪ Partner at Highland Group ▪ CFO at Nile Therapeutics ▪ Public company board experience Paul Mieyal, Ph.D. Director ▪ Director of Nephros since September 2007 ▪ Vice President of Wexford Capital LP ▪ Ph.D. in Pharmacology ▪ Public company board experience Arthur Amron Director ▪ Director of Nephros since September 2007 ▪ Partner of Wexford Capital LP ▪ SEC registered advisor and General Counsel ▪ Capital markets and public company board experience Matthew Rosenberg, M.D. Director ▪ Director of Nephros since May 2014 ▪ Formerly with McKinsey & Company ▪ Strategic, organizational and operational improvements in Healthcare experience ▪ A.B. in Economics from Harvard and M.D. from Yale Leonard Stern, MD Assistant Professor of Clinical Medicine – Consultant ▪ Nephrologist at Columbia University Medical Center/New York - Presbyterian Hospital ▪ Board - certified in Internal Medicine and Nephrology, Fellow of the American College of Physicians Joseph Cervia , MD Professor of Clinical Medicine and Pediatrics - Consultant ▪ Previous Medical Director and Senior Vice President for Pall Corporation ▪ Professor of Clinical Medicine and Pediatrics at Albert Einstein College of Medicine ▪ Board - certified internist, pediatrician, and infectious diseases specialist

27 Conclusion ▪ High performance liquid filters ▪ Commercial stage – selling in North America and EU ▪ Current focus on healthcare markets - technology transferable into other markets ▪ Attractive gross margins ▪ E xperienced team

28 Nephros, Inc. From a ncient Greek meaning “kidney” – a filter