Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EXELON CORP | d733724d8k.htm |

Sanford C. Bernstein Strategic

Decisions Conference

May 29, 2014

Exhibit 99.1 |

1

Cautionary Statements Regarding Forward-Looking

Information

This presentation contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, that

are subject to risks and uncertainties. The factors that could cause

actual results to differ materially from the forward-looking statements made by Exelon

Corporation, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas

and Electric Company and Exelon Generation Company, LLC (Registrants)

include those factors discussed herein, as well as the items discussed

in (1) Exelon’s 2013 Annual Report on Form 10-K in (a) ITEM 1A. Risk

Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations and (c) ITEM 8. Financial Statements

and Supplementary Data: Note 22; (2) Exelon’s First Quarter 2014

Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b)

Part 1, Financial Information, ITEM 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations and (c) Part

I, Financial Information, ITEM 1. Financial Statements: Note 15; (3) the

cautionary statements regarding the proposed merger with Pepco Holdings, Inc.

included in Exelon’s Current Reports on Form 8-K regarding the

transaction filed on April 30, 2014; (4) PHI’s 2013 Annual Report

on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations and (c) ITEM 8. Financial

Statements and Supplementary Data: Note 15; (5) PHI’s First Quarter

2014 Quarterly Report on Form 10-Q in (a) PART I, ITEM 1. Financial

Statements, (b) PART I, ITEM 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operations and (c) PART II, ITEM

1A.and (6) other factors discussed in filings with the SEC by the

Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements,

which apply only as of the date of this presentation. None of the Registrants

undertakes any obligation to publicly release any revision to its

forward-looking statements to reflect events or circumstances after the

date of this presentation.

|

2

Exelon Overview

Power Generation

Constellation

ComEd, PECO & BGE

Competitive Business

Regulated Business

Exelon is one of the largest competitive integrated energy companies in the

U.S. •

One of the largest merchant

fleets in the nation (~35 GW of

capacity)

•

One of the largest and best

managed nuclear fleets in the

world (~19 GW)

•

Significant gas generation

capacity (~10 GW)

•

Renewable portfolio (~1.5 GW),

mostly contracted

•

Leading competitive energy

provider in the U.S.

•

Customer-facing business, with

~1.1 M competitive customers

and large wholesale business

•

Top-notch portfolio and risk

management capabilities

•

Extensive suite of products

including Load Response,

RECs, Distributed Solar

•

One of the largest electric and

gas distribution companies in

the nation (~7.8 M customers)

•

Diversified across three utility

jurisdictions –

Illinois, Maryland

and Pennsylvania

•

Significant investments in

Smart Grid technologies

•

Transmission infrastructure

improvement at utilities

Exelon Generation

Exelon Utilities

2014 Sanford C. Bernstein Strategic Decisions Conference

|

3

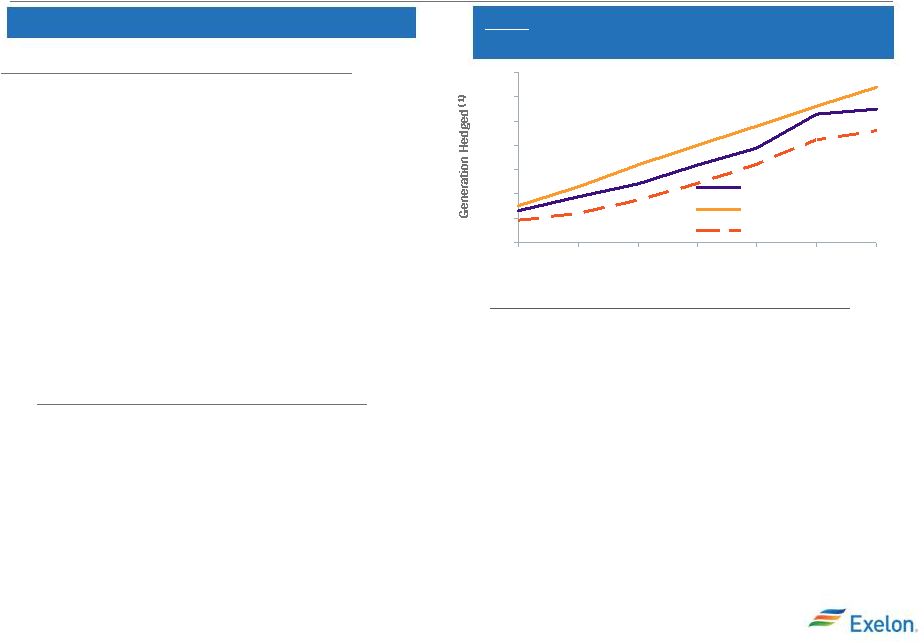

Spot and Forward Market Volatility

Q1 2014 Saw Increased Volatility

Forward Markets Reacted To Spot Prices

Impacts

on

Forward

Markets

•

Forward market power prices and heat rates have

pushed higher year to date due to:

Higher prices in the spot markets that are now beginning

to be reflected in the forward markets as the stack has

changed and there is more reliance on non-baseload,

higher priced resources

Expectation of another 15 GW of coal-fired generation to

be retired between now and 2016

PJM Market design changes that are intended to improve

price formation and locational marginal pricing (LMP)

signals

Spot Market Volatility

•

Spot prices in 2014 have been high and have

started to reflect the changing nature of the grid

and reliance on different resources such as natural

gas supply, demand response, and oil peakers

•

Seeing

higher

prices

at

NiHub

in

2014

than

previous years for similar load conditions

$90

$80

$70

$60

$50

$40

$30

$0

$100

Daily Heating Degree Days (HDD)

Q1 2014

Q1 2013

Q1 2012

NiHub LMP per Daily HDD

(Days below $100/MWh)

10.0

9.5

10.5

11.0

12.0

13.0

11.5

9.0

0.0

4/1/2014

1/1/2014

10/1/2013

7/1/2013

4/1/2013

12.5

Whub On Peak HR -

2016

Whub On Peak HR -

2015

NiHub On Peak HR -

2015

NiHub On Peak HR -

2016

2014 Sanford C. Bernstein Strategic Decisions Conference

|

4

Portfolio Value and Positioning

Changes to Gross Margin Through 4/30/14

Power

prices

continued

to

increase

in

April

•

Since the end of Q1 and thru 4/30/2014, power prices

in Mid-Atlantic and Midwest regions increased nearly

$5.00 per MWh in 2015 and 2016

•

Open gross margin increase from this power price move

and the removal of DOE nuclear disposal fee (~$150M

annually) is over $1B per year for 2015 and 2016

•

Net of hedges the hedged gross margin increase is

$350M

and

$600M

to

$7,800M

and

$8,000M

in

2015

and

2016,

respectively,

between end of Q1 and

04/30/2014

•

Impact of incremental changes in power prices in May

on gross margin can be approximated using the updated

portfolio sensitivities given below

2015: Open Power Position Creating Value From

Higher Prices

(1)

2015-Actual (excl NG hedges)

2015-Ratable

2015-Actual

10%

20%

30%

40%

50%

60%

70%

80%

4Q13

3Q13

2Q13

1Q13

4Q12

3Q12

1Q14

Impacts

of

our

view

on

our

hedging

activity

•

With the move higher in forward power prices and

market implied heat rates, our behind ratable and

cross commodity hedge strategies have created value.

•

As of 3/31/2014, when considering both strategies,

we had a significant amount of our portfolio open to

moves in the power market:

•

Approximately 45% open in 2015

•

Approximately 70% open in 2016

Sensitivities

(2)

($MM)

2015

2016

NiHub ATC Energy Price

+$5/MWh

$235

$360

-$5/MWh

$(230)

$(360)

PJM-W ATC Energy Price

+$5/MWh

$90

$195

-$5/MWh

$(85)

$(190)

2014 Sanford C. Bernstein Strategic Decisions Conference

(2)

As of 4/30/2014

(1)

As of 3/31/2014

•

We are evaluating the latest market moves and the

impact on our view of upside in the market. Where the

market has increased, we are taking action to lock in the

value that has been created from our strategies |

5

Capacity Markets Better –

Opportunity for Improvement

New England Auction

PJM Auction

Higher clearing prices led to higher total revenues year over year, but not

enough to clear financially challenged nuclear units

Market design and rule changes impacted auction results

–

Limited product reached constraint of 2,322 MW

What’s next?

2014 Sanford C. Bernstein Strategic Decisions Conference

•

Nuclear Asset Rationalization –

continue to work regulatory and stakeholder process to bring reforms

•

Exelon’s nuclear units Quad Cities (U1 & U2); Byron

(U1&U2) and Oyster Creek did not clear the auction

•

Clearing

prices

higher

but

not

adequate

to

provide

incentives

to

keep

these

clean

generation

assets

operational

•

Incremental

auctions

or

incremental

PJM

or

local

market

reforms

could

provide

avenues

for

incremental

capacity

revenues for these units

•

Exelon has committed not to make any retirement decisions about IL plants

before June 2015 •

IL House has joined effort by introducing resolution (HR1146) that calls for

urgent reforms that recognize value of nuclear energy for its

reliability and carbon free benefits 2016/2017

2017/2018

PJM

Rest of Pool

$59

$120

MAAC

$119

$120

SWMAAC

$119

$120

Average EXC

$92

$120

New England

NEMA

$219

$493

Rest of Pool

$90

$230

Average EXC

$186

$425

Capacity prices $/MW-Day

Capacity market results

Financial Implications

Planning Year

17/'18 vs '16/'17

PJM

$150M

New England

$250M

Total

$400M

(1)

PJM numbers include adjustments for PPA roll-offs

(1)

~

~

~

In Q1, 17/18 auction cleared much higher than expected indicative of

tighter supply/demand after unit retirement announcements

Demand response cleared 10,975 MW; ~1,400 MW lower year over year

(YoY)

Limits on imports into RTO drove imports lower–

4,526 MW cleared;

~3,000 MW lower YoY

DR

rules:

Court

opinion

raises

questions

regarding

demand

response’s

Speculation:

FERC

rejected

PJM’s

reforms

to

address

speculation,

but

agreed that PJM has identified a reliability problem. FERC instituted a

proceeding to determine the appropriate changes to the PJM tariff

(DR) ability to participate as a resource in the future

|

6

Pepco Holdings Acquisition

Potomac Electric Power Service Territory

Atlantic City Electric Co. Service Territory

Delmarva Power & Light Service Territory

Baltimore Gas and Electric Co. Service Territory

PECO Energy Service Territory

ComEd Service Territory

IL

Chicago

DE

MD

PA

NJ

VA

Philadelphia

Baltimore

Dover

Wilmington

Trenton

Washington, DC

2014 Sanford C. Bernstein Strategic Decisions Conference

On April 30, 2014, Exelon announced the acquisition of Pepco Holdings Inc.

in an all cash transaction

Strategic Rationale

A strategic

acquisition with a good geographic fit and economies of scale,

creates opportunities for cost savings, improved customer reliability

and accelerated storm response.

Purchase price of

$27.25 per share.

Earnings composition supports incremental leverage

and

is

expected

to

be

highly

accretive

to

operating

earnings starting in the first full year post-close with

steady-state accretion of $0.15-$0.20 per share starting

in 2017

Increases Exelon’s

utility derived earnings and cash

flows,

providing

a

solid

base

for

the

dividend

and

maintaining

the

upside

from

a

recovery

in

power

markets.

Balanced financing mix allows Exelon to maintain

balance sheet strength

and provides flexibility to

continue

to

invest

in

opportunities

aligned

with

our

growth strategy.

The combination of Exelon and Pepco Holdings (PHI)

will offer

significant benefits to customers.

The combined utility businesses will serve nearly 10 million

customers, with a rate base of ~$26 billion. |

7

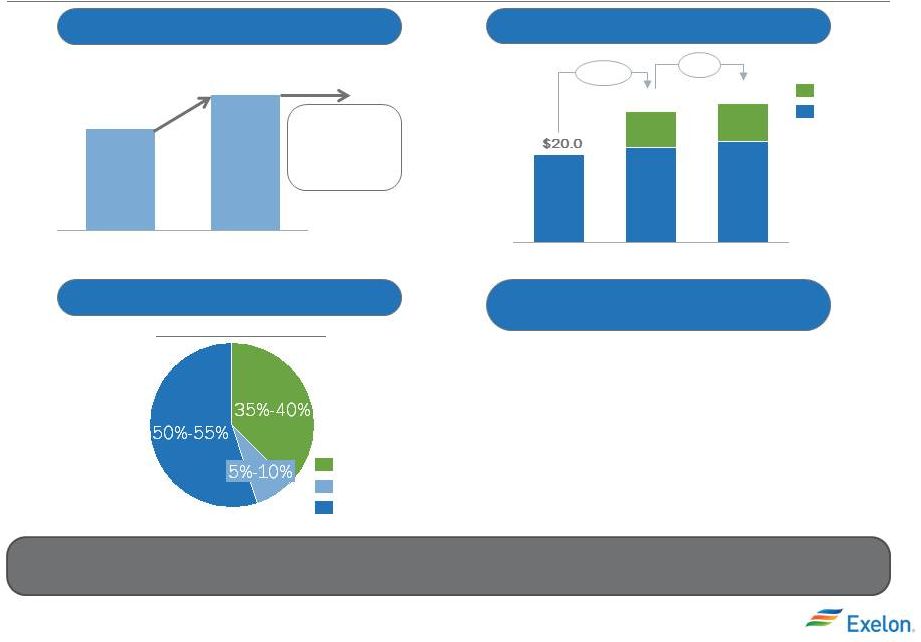

Earnings

Accretive

First

Full

Year

(1)

Transaction Economics

Provides tangible benefits to the

customers and shareholders

The transaction is significantly EPS accretive, adds to rate base growth and

further strengthens our financials

2015-2016 Operating Earnings

(3)

Pro Forma Business Mix

PHI

Unregulated

PECO/BGE/ComEd

Rate Base Growth ($B)

(2)

+6%

+50%

2016

$31.8

$23.0

$8.8

2015

$30.0

$21.7

$8.3

2014

Exelon

PHI

2017

2016

$0.10 -

$0.15

$0.15 -

$0.20

•

Run-rate synergies of roughly $120 -

$140 million per year

•

Expect 60% of synergies to return to

ratepayers through rate case process

•

Expect 40% to flow through to

shareholders

•

$100M customer investment fund for

rate credits, low income assistance and

energy efficiency programs

2014 Sanford C. Bernstein Strategic Decisions Conference

(1)

Assumes funding mix of assumed debt, new debt, asset sales and equity issuance

with appropriate discount to market price

(2)

Reflects year end rate base

(3)

Business mix as of 3/31/14

Achieve run-rate

accretion of

$0.15-$0.20

starting in 2017 |

8

Exelon is positioned for a strong future

Power Market Upside

Balance sheet flexibility

Asset Optimization and

Rationalization

Public policy Advocacy

Strong integrated business

model

Our clean, world class, merchant nuclear fleet has unparalleled upside

to the current power market recovery

We maintain flexibility in our balance-sheet to allow for incremental

regulated and merchant investments

We continue to review our asset portfolio and make decisions to

optimize the value of each one of them

Advocate for policies that strengthen competitive markets, limit

subsidies and enhance the value of clean generation.

With Pepco Holdings acquisition, we will have an even stronger

regulated base of earnings that provides dividend support and potential

increase in the future

Core Strength

Implications and Actions

2014 Sanford C. Bernstein Strategic Decisions Conference

Diversification in assets, regions, businesses and keeping abreast of emerging

technologies and macro trends in our industry is central to our long

term strategy |