Attached files

| file | filename |

|---|---|

| 8-K - TRUSTCO BANK CORP NY 8-K 5-22-2014 - TRUSTCO BANK CORP N Y | form8k.htm |

Exhibit 99(a)

Welcome to the 2014 Annual Meeting

Shareholder Assembly Agenda DepositsLoan PortfolioInvestment PortfolioDividends & Capital GrowthRatio AnalysisStock PerformanceQuestions and Answers

Deposit Growth ($000)

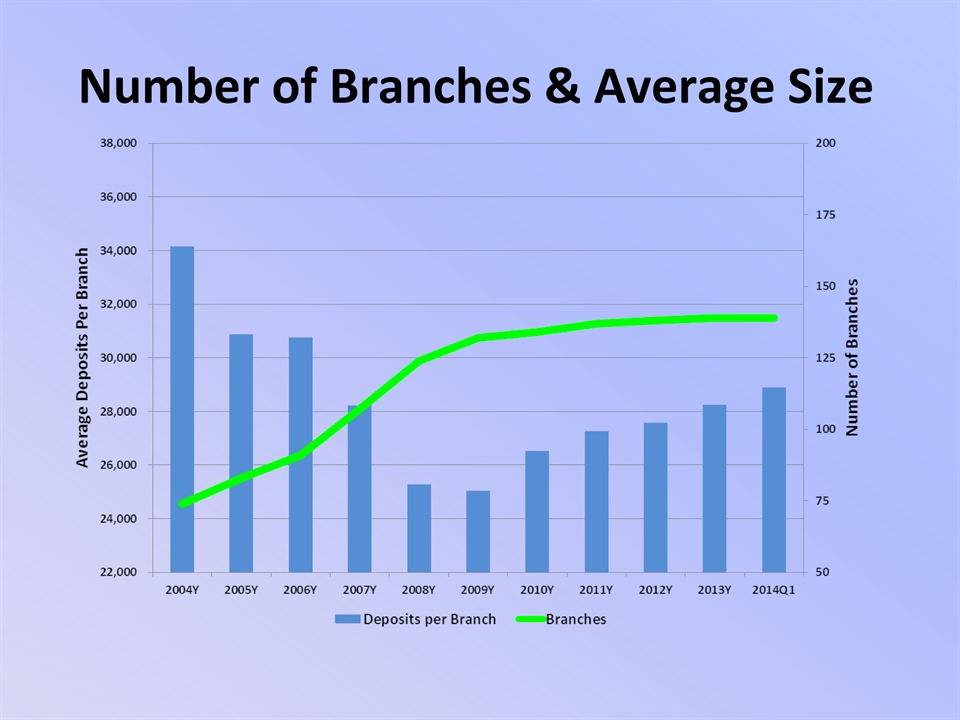

Number of Branches & Average Size

Loan Growth ($000)

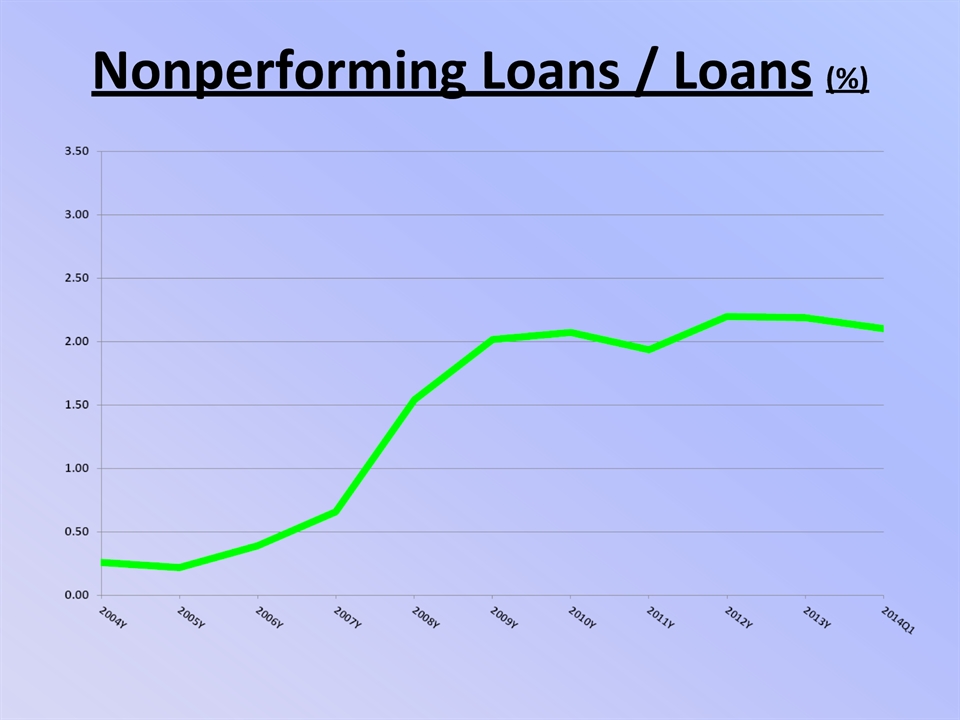

Nonperforming Loans / Loans (%)

Short-term Delinquencies* (%) *30-89 day past due loans / total loans

Investments & Cash to Assets (%)

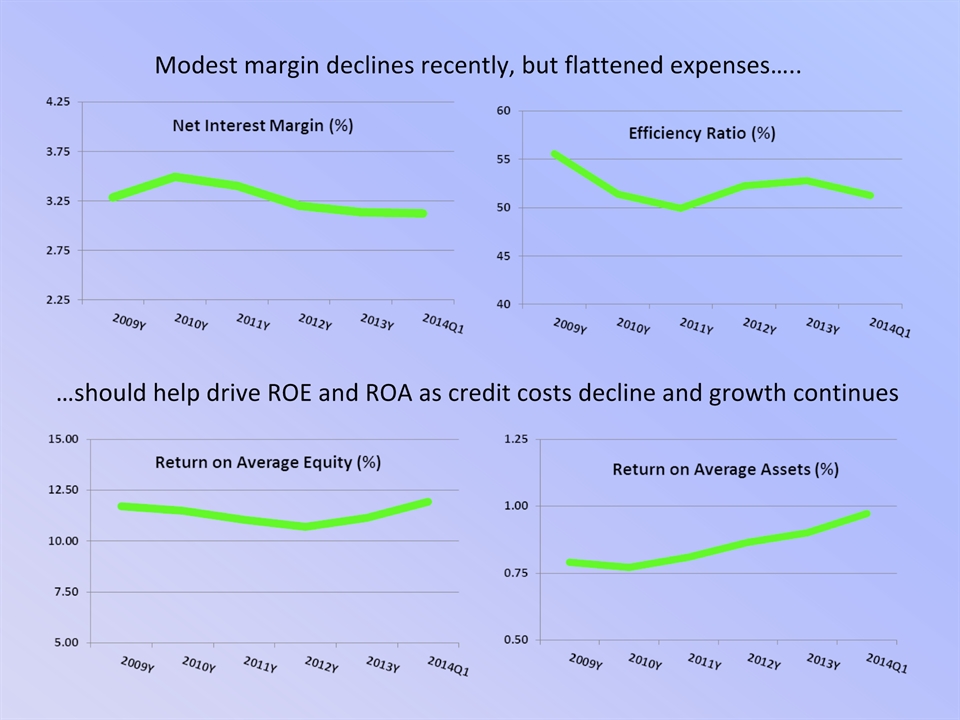

Modest margin declines recently, but flattened expenses….. …should help drive ROE and ROA as credit costs decline and growth continues

Dividends & Capital Growth2000-2013 Dividends Paid: $6.54 per shareDividends Paid: $496 million totalShareholders’ Equity: Increase of 90%

TrustCo vs. Peers *All public owned banking institutions covered by SNL Financial with assets of $2 to $10 billion as of December 31, 2013; peer numbers are the medians for the full year 2013. All ratios are as published by SNL Financial. TrustCo TrustCo TrustCo TrustCo TrustCo TrustCo Peers* 2009 2010 2011 2012 2013 Q1/14 2013 Return on Average Equity 11.7% 11.5% 11.0% 10.7% 11.2% 11.9% 8.8% Return on Average Assets 0.79% 0.77% 0.81% 0.87% 0.90% 0.97% 0.96% Net Interest Margin 3.29% 3.50% 3.40% 3.20% 3.14% 3.12% 3.64% Nonperforming Loans/ Loans 2.02% 2.07% 1.93% 2.20% 1.79% 1.83% 1.53% 30-89 Day PD Loans / Loans 0.77% 0.91% 0.48% 0.30% 0.24% 0.29% 0.48% Efficiency Ratio 56.7% 51.4% 50.0% 52.3% 52.8% 51.3% 63.5%

3 Year Stock Performance* *December 31, 2010 to December 31, 2013, Total Return

Forward Looking Statements Safe Harbor Regarding Forward-Looking StatementsThis presentation may contain forward-looking information about TrustCo Bank Corp NY (“the Company”) that is intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Actual results and trends could differ materially from those set forth in such statements due to various risks, uncertainties and other factors. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the following: credit risk, the effects of and changes in, trade, monetary and fiscal policies and laws, inflation, interest rates, market and monetary fluctuations, competition, the effect of changes in financial services laws and regulations, real estate and collateral values, changes in accounting policies and practices, changes in local market areas and general business and economic trends and the matters described under the heading “Risk Factors” in our most recent annual report on Form 10-K and our other securities filings. The statements are valid only as of the date hereof and the Company disclaims any obligation to update this information except as may be required by applicable law. Note: Data in this presentation was obtained from SNL Financial and from the Company’s SEC filings. Ratios use SNL definitions.

2014 Annual Meeting Questions and Answers

2014 Annual Meeting Thank You for Attending