Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION - Heritage Insurance Holdings, Inc. | d667216dex51.htm |

| EX-23.1 - CONSENT - Heritage Insurance Holdings, Inc. | d667216dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 22, 2014

Registration No. 333-195409

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4 to

Form S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Heritage Insurance Holdings, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 6331 | 45-5338504 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

Heritage Insurance Holdings, Inc.

2600 McCormick Drive, Suite 300

Clearwater, Florida 33759

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Bruce Lucas

Chairman & Chief Executive Officer

Heritage Insurance Holdings, Inc.

2600 McCormick Drive, Suite 300

Clearwater, Florida 33759

(727) 362-7202

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

| Steven J. Gavin, Esq. Karen A. Weber, Esq. Winston & Strawn LLP 35 West Wacker Drive Chicago, Illinois 60601 (312) 558-5600 |

Edward S. Best, Esq. John P. Berkery, Esq. Mayer Brown LLP 71 South Wacker Drive Chicago, Illinois 60606 (312) 782-0600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 22, 2014

PRELIMINARY PROSPECTUS

6,000,000 Shares

Heritage Insurance Holdings, Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. Prior to this offering, there has been no public market for our common stock. We are selling 6,000,000 shares of our common stock. We currently expect the initial public offering price to be between $14.00 and $16.00 per share of our common stock.

We have granted the underwriters an option to purchase up to 900,000 additional shares of our common stock to cover over-allotments.

Ananke Ltd. (“Ananke”), an affiliate of Nephila Capital Ltd, has agreed to purchase $10.0 million of our common stock in a separate private placement (the “Concurrent Private Placement”) concurrent with, and subject to, the closing of this offering at a price per share equal to the public offering price (but not to exceed $16.00, the highest point of the price range set forth above). Poseidon Re Ltd., another affiliate of Nephila Capital Ltd, is currently a participating reinsurer in our reinsurance program. The sale of such shares will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will be conducted in accordance with Section 4(a)(2) of the Securities Act. The closing of this offering is not conditioned upon the closing of the Concurrent Private Placement.

Our shares of common stock have been approved for listing on the New York Stock Exchange under the symbol “HRTG.”

We are an “emerging growth company” as defined under the federal securities laws and are eligible for reduced public company reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discount (1) |

$ | $ | ||||||

| Proceeds to Us (before expenses) |

$ | $ | ||||||

| (1) | Exclusive of the placement fee payable in connection with the Concurrent Private Placement. See “Underwriting.” |

The underwriters expect to deliver the shares to purchasers on or about , 2014 through the book-entry facilities of The Depository Trust Company.

Sole Book-Running Manager

Citigroup

Joint Lead Managers

| SunTrust Robinson Humphrey |

Sandler O’Neill + Partners, L.P. | |||||

Co-Managers

| Dowling & Partners Securities LLC |

JMP Securities | Willis Capital Markets & Advisory | ||||

, 2014

Table of Contents

We are responsible for the information contained in this prospectus and in any free-writing prospectus we have authorized. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

| Page | ||||

| 1 | ||||

| 14 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

43 | |||

| 64 | ||||

| 82 | ||||

| 87 | ||||

| 99 | ||||

| Security Ownership by Certain Beneficial Owners and Management |

102 | |||

| 104 | ||||

| 107 | ||||

| 109 | ||||

| Material U.S. Federal Income Tax Considerations to Non-U.S. Holders |

115 | |||

| 119 | ||||

| 119 | ||||

| 119 | ||||

| F-1 | ||||

Table of Contents

This summary highlights information that we present more fully in the rest of this prospectus and does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, including the “Risk Factors” section and our consolidated financial statements and related notes. On May 22, 2014, we converted from a limited liability company to a corporation as discussed below in “—Reorganization Transactions.” Unless the context requires otherwise, as used in this prospectus, the terms “we,” “us,” “our,” “the Company,” “our company,” and similar references refer to Heritage Insurance Holdings, LLC, together with its subsidiaries, prior to our conversion to a corporation and Heritage Insurance Holdings, Inc. and its consolidated subsidiaries on and after such conversion. References in this prospectus to “stockholders” and “stockholders’ equity” refer to members and members’ equity, respectively, prior to our conversion to a corporation. References to “pro forma stockholders’ equity” or “after giving effect to this offering and the Concurrent Private Placement” mean after giving effect to this offering, assuming the sale of 6,000,000 shares at a public offering price of $15.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, and after giving effect to the Concurrent Private Placement, assuming the sale of 666,666 shares at an offering price of $15.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, in each case after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

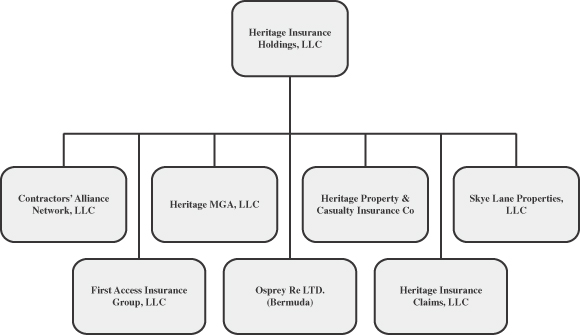

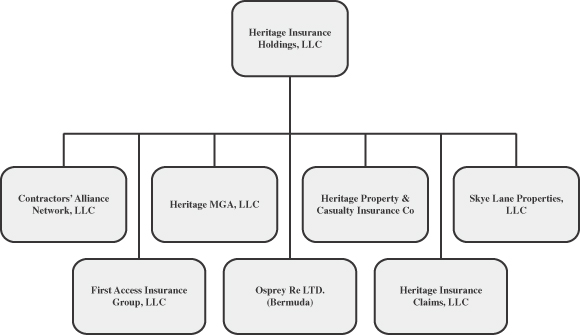

Our Business

We are a property and casualty insurance holding company headquartered in Clearwater, Florida and, through our subsidiary, Heritage Property & Casualty Insurance Company (“Heritage P&C”), we provide personal residential insurance for single-family homeowners and condominium owners in Florida. We are vertically integrated and control or manage substantially all aspects of insurance underwriting, actuarial analysis, distribution and claims processing and adjusting. We are led by an experienced senior management team with an average of 26 years of insurance industry experience. We began operations in August 2012, and in December 2012 we began selectively assuming policies from Citizens Property Insurance Corporation (“Citizens”), a Florida state-supported insurer, through participation in a legislatively established “depopulation program” designed to reduce the state’s risk exposure by encouraging private companies to assume insurance policies from Citizens. We also write policies outside the Citizens depopulation program, which we refer to as voluntary policies. Heritage P&C is currently rated “A” (“Exceptional”) by Demotech, Inc. (“Demotech”), a rating agency specializing in evaluating the financial stability of insurers.

As of March 31, 2014, we had approximately 140,000 policies in force, approximately 89% of which were assumed from Citizens. For the three months ended March 31, 2014 and the year ended December 31, 2013, we had gross premiums written of $68.9 million and $218.5 million, respectively, and net income of $7.9 million and $34.2 million, respectively. At March 31, 2014, we had total assets of $286.1 million, total stockholders’ equity of $110.1 million and pro forma stockholders’ equity, after giving effect to this offering and the Concurrent Private Placement, of $224.6 million.

As of March 31, 2014, Citizens had approximately 940,000 insurance policies, of which approximately 690,000 were personal residential policies. We selectively assumed personal residential policies from Citizens in nine separate assumption transactions between December 2012 and April 2014, and a substantial portion of our revenue since our inception has come from these policies. We intend to continue assuming policies from Citizens that meet our assumption strategy and underwriting criteria.

In order to assume a policy from Citizens, we must obtain the prior approval of the insurance agent that wrote the policy. With respect to policies written by agents that are affiliated with an insurance company or agency, we must also obtain the approval of the insurance company or agency. Currently, four large national

1

Table of Contents

insurance companies or agencies permit us to assume policies from Citizens that have been written by their agents—State Farm, Allstate, Brown & Brown and AAA (formerly the American Automobile Association). In an effort to increase the pool of Citizens policies that we may assume, we are seeking similar advance approvals from other insurance companies and agencies. We currently have advance approvals covering more than 4,500 agents. These agents were responsible for writing more than 93% of the approximately 690,000 personal residential insurance policies held by Citizens as of March 31, 2014.

We market and write voluntary policies through a network of approximately 1,100 independent agents. Of these agents, approximately 46% are affiliated with nine large agency networks with which we have entered into master agency agreements. We recently entered into an agreement with FAIA Member Services (“FMS”), the in-house, for-profit managing general agency division of the Florida Association of Insurance Agents, which gives us access to several hundred additional agents throughout the state. We intend to pursue additional voluntary business from agents in our existing independent agent network, expand our independent agent network and seek additional opportunities to use insurer-affiliated agents to offer our personal residential policies in Florida. While we had 15,417 voluntary policies (11% of our total policies in force) as of March 31, 2014, during the three months ended March 31, 2014, we wrote an average of 1,870 new voluntary policies per month. The voluntary market is a significant component of our growth strategy.

We seek to underwrite a diverse mix of geographic risks within Florida to manage the potential impact of a catastrophic event and reduce our per policy reinsurance costs. As of March 31, 2014, the geographic distribution of our policies in force and total insured values were as follows (figures may not sum to totals due to rounding):

| As of March 31, 2014 | ||||||||||||||||

| (Total Insured Value in Millions) | ||||||||||||||||

| Policy Count |

% | Total Insured Value |

% | |||||||||||||

| South Florida Counties |

||||||||||||||||

| Broward |

17,903 | 12.8% | $ | 4,623 | 12.6% | |||||||||||

| Miami-Dade |

11,742 | 8.4% | 3,297 | 9.0% | ||||||||||||

| Palm Beach |

16,856 | 12.1% | 3,945 | 10.7% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| South Florida exposure |

46,501 | 33.2% | $ | 11,865 | 32.3% | |||||||||||

| Other Significant Counties(1) |

||||||||||||||||

| Pinellas |

23,997 | 17.2% | $ | 6,478 | 17.6% | |||||||||||

| Hillsborough |

18,068 | 12.9% | 5,332 | 14.5% | ||||||||||||

| Pasco |

14,220 | 10.2% | 3,746 | 10.2% | ||||||||||||

| Hernando |

4,873 | 3.5% | 1,465 | 4.0% | ||||||||||||

| Lee |

4,148 | 3.0% | 1,076 | 2.9% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other significant counties |

65,306 | 46.7% | $ | 18,097 | 49.2% | |||||||||||

| Summary for all of Florida |

||||||||||||||||

| South Florida exposure |

46,501 | 33.2% | $ | 11,865 | 32.3% | |||||||||||

| Total other significant counties |

65,306 | 46.7% | 18,097 | 49.2% | ||||||||||||

| Other Florida counties |

28,072 | 20.1% | 6,812 | 18.5% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

139,879 | 100.0% | $ | 36,774 | 100.0% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Significant counties are defined as those counties with a policy count or total insured value greater than 2.5% of our 139,879 total policy count or $36.8 billion total insured value as of March 31, 2014. |

In order to limit our potential exposure to individual risks and catastrophic events, we purchase significant reinsurance from third party reinsurers. Purchasing reinsurance is an important part of our risk strategy, and

2

Table of Contents

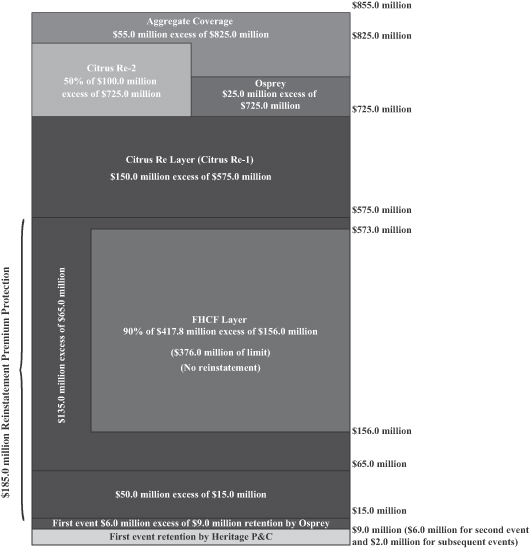

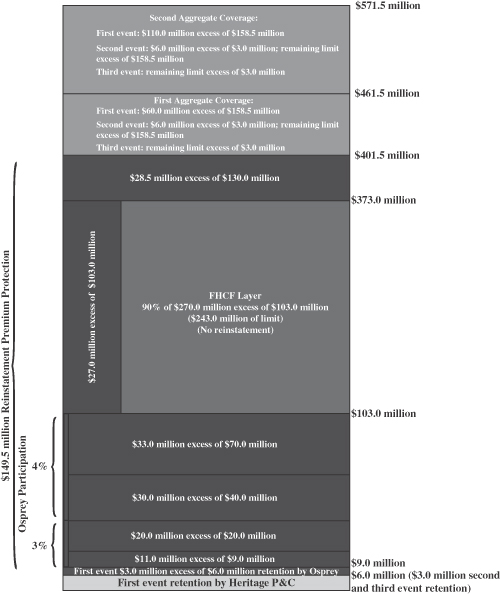

premiums paid (or ceded) to reinsurers is our single largest cost. We have strong relationships with reinsurers which we believe are a result of our management’s industry experience and reputation for selective underwriting. For the twelve months ending May 31, 2014, we purchased reinsurance from the following sources: (i) the Florida Hurricane Catastrophe Fund, a state-mandated catastrophe reinsurance fund (“FHCF”), (ii) 13 private reinsurers, all of which were rated “A-” or higher by A.M. Best Company, Inc. (“A.M. Best”) or Standard & Poor’s Financial Services LLC (“S&P”), (iii) two private reinsurers that have provided collateral to fully cover their exposure, and (iv) our wholly-owned reinsurance subsidiary, Osprey Re Ltd. (“Osprey”). We are in the process of finalizing our reinsurance program for the 2014 hurricane season, which will be effective from June 1, 2014 through May 31, 2015, and expect to purchase reinsurance from a similarly diverse and highly-rated group of third-party reinsurers as those participating in our 2013-2014 reinsurance program. See “Business—Reinsurance—2014-2015 Reinsurance Program.”

The Florida Office of Insurance Regulation (“FLOIR”) requires all insurance companies, like us, to have a certain amount of capital reserves and reinsurance coverage in order to cover losses upon the occurrence of a catastrophic event. Our reinsurance program for the twelve months ending May 31, 2014, as well as our expected program for the twelve months ending May 31, 2015, provide reinsurance in excess of FLOIR’s requirements, which are based on the probable maximum loss that we would incur from an individual catastrophic event estimated to occur once every 100 years based on our portfolio of insured risks. We also purchase reinsurance coverage to protect against the potential for multiple catastrophic events occurring in the same year.

In placing our 2014-2015 reinsurance program, we sought to obtain multiple years of coverage for certain layers of the program through multi-year commitments. We believe these arrangements allow us to capitalize on favorable pricing and contract terms and conditions and allow us to mitigate uncertainty surrounding the price of our future reinsurance coverage, our single largest cost. In the aggregate, we anticipate that multi-year coverage will account for approximately 88% of our expected purchases of private reinsurance for the 2014 hurricane season.

We test the sufficiency of our reinsurance program by subjecting our personal residential exposures to statistical testing using the AIR U.S. Hurricane Model, which replicates the most severe hurricanes to have occurred historically in Florida, individual storms of severity in excess of such historical levels, and the historical calendar years in which the most severe multiple catastrophic events occurred in Florida. In this regard, the 2004 calendar year, in which four large catastrophic hurricanes made landfall in Florida, is considered to be the worst catastrophic year in Florida’s recorded history. Assuming the reoccurrence of the 2004 calendar year events, the probable maximum net loss to us in 2014, assuming the expected coverage for our 2014-2015 reinsurance program, would be $16.3 million (after tax, net of all reinsurance recoveries and including our retention through Osprey). See “Business—Reinsurance—2014-2015 Reinsurance Program.” This loss would have represented 14.8% of our stockholders’ equity at March 31, 2014 and 7.3% of our pro forma stockholders’ equity at March 31, 2014, after giving effect to this offering and the Concurrent Private Placement.

We closely manage all aspects of our claims adjustment process. Claims are initially reviewed by our managers and staff adjusters, who determine the extent of the loss and the resources needed to adjust each claim. In the case of a catastrophic event, we have contracted with four large national claims adjusting firms to assist our adjusters with the increased volume of claims and ensure timely responses to our policyholders. We utilize our wholly-owned subsidiary, Contractors’ Alliance Network, LLC (“Contractors’ Alliance”), to manage mitigation and restoration services for our customers. Contractors’ Alliance primarily handles water damage-related claims, which comprised approximately 68% of our losses and loss adjustment expenses through March 31, 2014. In March 2014, we completed the acquisition of the assets and personnel of our main water mitigation services vendor. We believe this acquisition will allow us to better service our customers and expand our mitigation and restoration services. In addition, all of our voluntary policies and renewed Citizens policies are enrolled in our Platinum Preferred Savings Program (the “Platinum Program”). Under the Platinum Program,

3

Table of Contents

customers receive a 10% discount on their claim deductible, and we obtain control over inspection, claims adjusting and repair services. We believe our approach to claims handling results in a higher level of customer service and reduces our losses and loss adjustment expenses. As a result of our efforts, our gross loss ratio, which expresses our losses and loss adjustment expenses as a percentage of gross earned premiums, was 33.8% and 27.5% for the three months ended March 31, 2014 and the year ended December 31, 2013, respectively.

Our Market

According to the U.S. Census Bureau, at July 1, 2013, Florida was the fourth largest U.S. state with an estimated population of approximately 20 million people. The University of Florida Bureau of Economic and Business Research estimates that Florida is expected to reach a population of approximately 26 million people by 2040, an increase of 36% percent from 2010. Property ownership and development represent key drivers of the Florida economy.

Because of its location, Florida is exposed to an increased risk of hurricanes during the entire six months of Atlantic hurricane season, which spans from June 1 through November 30. While a significant hurricane has not made landfall in Florida since 2005, eight hurricanes in 2004 and 2005, including Hurricanes Charley, Katrina, Rita and Wilma, caused a combined estimated property damage of over $110 billion, a significant portion of which occurred in Florida. As a result, personal residential insurance and claims servicing are vitally important to Florida residents.

The Florida personal residential insurance market is highly fragmented and dominated by in-state insurance companies, including Citizens. Significant dislocation in the Florida property insurance market began following Hurricane Andrew in 1992 and accelerated following the 2004 and 2005 hurricane seasons. In total, national and regional insurers reduced their share of the market in Florida from 84% in 1999 to 26% in 2012. As national and regional insurance companies reduced their exposure in Florida, Citizens increased efforts to provide affordable personal residential insurance to those residents unable to obtain coverage in the private market. As a result, Citizens’ policy count grew from roughly 726,000 policies in 2005 to a peak level of approximately 1.5 million policies in late 2011. To reduce Citizens’ risk exposure, beginning in 2010, Florida elected officials encouraged Citizens to focus on reducing the size of its portfolio by returning policies to the private market. In response, Citizens instituted a number of measures to incentivize the private sector to participate in the depopulation program. Some of these initiatives include increased inspections, improved underwriting, reductions in coverage and annual rate increases.

In May 2013, Florida passed legislation to facilitate the reduction of Citizens’ policy count and establish the Property Insurance Clearinghouse (the “Clearinghouse”), which launched in January 2014. The Clearinghouse makes new and renewal business ineligible for Citizens if a participating insurance company is willing to extend comparable coverage at prescribed rates. On March 31, 2014, Heritage P&C was approved to participate in the Clearinghouse.

According to data compiled by FLOIR, Citizens was the largest personal residential insurance carrier in Florida for the year ended December 31, 2013, with a market share of approximately 19.8% based on total in force direct premiums written for personal and commercial residential insurance. As of the same date, we ranked 15th in Florida within this market, with a market share of approximately 1.8%. Assuming further access to capital and reinsurance support, we believe we have the opportunity to significantly expand the size of our personal residential insurance business in Florida and explore the expansion of our business into other complementary business lines and states.

In recent years, the property and casualty insurance market has experienced a substantial increase in the availability of property catastrophe reinsurance resulting from the increased supply of capital from non-traditional insurance providers, including private capital and hedge funds. This increased capital supply, coupled

4

Table of Contents

with a lack of recent significant catastrophic storm activity in Florida, has reduced the cost of property catastrophe reinsurance, directly benefitting purchasers of this reinsurance, including us. We believe this market trend will continue for the foreseeable future.

Our Strategy

Since our inception, a substantial portion of our revenue has come from policies we assumed from Citizens, with the balance of our revenue generated from renewal of these assumed policies and from voluntary policies. Building on these successful transactions, we intend to continue to grow profitably by undertaking the following:

Increase Our Policies in Force in Florida Through Strategic Policy Assumptions and Expansion of Our Voluntary Market Share

We intend to continue assuming policies from Citizens that meet our assumption strategy and underwriting criteria. We may also pursue opportunities to acquire policies from private insurers. Additionally, we intend to increase our policy count by participating in the Clearinghouse. We will also pursue opportunities to increase the number of our voluntary policies by expanding our independent agent distribution network, as well as obtaining approval from national insurance companies to allow their agents to offer our personal residential policies in Florida. Our recent affiliation with FMS gives us access to several hundred additional agents throughout the state and should assist us in our effort to attract high-quality agents. We also intend to increase our advertising, which we believe will allow us to more effectively penetrate areas of the state where we are not currently writing significant new business.

Opportunistically Diversify Product Offerings

We will continue to focus on writing personal residential policies, but will opportunistically expand into complementary product lines we believe we can effectively and profitably underwrite. New product lines may include commercial residential and manufactured housing policies, as well as additional non-residential coverage, such as general liability insurance. In January 2014, we hired two individuals with significant experience in Florida commercial residential insurance sales and underwriting, who will assist us in developing this new product line.

Optimize Our Reinsurance Program

We will continue to obtain what we believe to be the most appropriate levels and sources of reinsurance. We believe that the significant additional capital entering portions of the reinsurance market provides us with the opportunity to obtain favorable pricing and contract terms and conditions, including the potential for multi-year commitments, which we expect to comprise a significant portion of our 2014–2015 reinsurance program. See “Business—Reinsurance—2014–2015 Reinsurance Program.” In April 2014, we entered into two fully collateralized catastrophe reinsurance agreements funded through the issuance of $200.0 million principal amount of catastrophe bonds, and we will continue evaluating such cost-efficient alternatives to traditional reinsurance. See “—Recent Developments.” Additionally, we will continue to meet certain of our reinsurance needs through the use of our reinsurance subsidiary, Osprey, which mitigates our reinsurance expense and reduces our reliance on third party reinsurance.

Efficiently Manage Losses and Loss Adjustment Expenses

We are committed to proactively managing our losses and loss adjustment expenses through prudent underwriting and the use of internal claims adjustment and repair services. In March 2014, we acquired the largest vendor in the Contractors’ Alliance network, which we believe will allow us to expand our in-house mitigation and restoration services. We also intend to license our Contractors’ Alliance employees as adjusters, which we believe will reduce our loss adjustment expenses and shorten the length of time required to resolve claims.

5

Table of Contents

Expand to New Geographic Markets

We intend to explore opportunities to enter other coastal states where we believe the market opportunity is most similar to Florida and where we can utilize our underwriting and claims expertise to attract and manage profitable business. We believe further increasing our geographic diversification is an important factor in reducing our potential risk of loss from any catastrophic event, reducing our per policy reinsurance costs and providing an additional area for future growth beyond our expansion in Florida.

Our Competitive Strengths

We believe that our rapid growth to date and our ability to capitalize on our future growth prospects are a result of the following competitive strengths of our business:

Experienced Management Team With a Long History in the Florida Personal Residential Insurance Market

We have a deep and experienced management team led by Bruce Lucas, Chairman and Chief Executive Officer, Richard Widdicombe, President, Stephen Rohde, Chief Financial Officer, Melvin Russell, Chief Underwriting Officer, Kent Linder, Chief Operating Officer, Ernesto Garateix, Executive Vice President, Paul Nielsen, Vice President of Claims, and Joseph Peiso, Vice President of Compliance, most of whom have been with Heritage since inception. Our management team, which averages 26 years of insurance industry experience, has extensive experience in the Florida personal residential insurance market, has built longstanding relationships with key participants in the insurance industry and is supported by a group of highly qualified individuals with industry expertise, including a Chief Actuary with more than 34 years of industry experience.

Strong, Conservative Capital Structure

As of March 31, 2014, we had stockholders’ equity of $110.1 million and pro forma stockholders’ equity, after giving effect to this offering and the Concurrent Private Placement, of $224.6 million. As of March 31, 2014, Heritage P&C had policyholder surplus, as defined by statutory accounting principles, of $67.8 million. We believe that this level of surplus places us among the best capitalized insurance companies focusing primarily on the Florida personal residential insurance market and is significantly in excess of the minimum capital levels required by FLOIR and Demotech for similarly rated in-state insurance companies. In addition, unlike many of our in-state competitors, we have relied almost exclusively upon common equity to provide our capital.

Selective Underwriting and Policy Acquisition Criteria

We believe our proprietary data analytics capabilities and underwriting processes allow us to better select the insurance policies we are willing to assume from the Citizens depopulation program, leading to strong profitability and reduced risk. In addition, we choose to minimize our exposure to or avoid certain types of coverage if we believe there is significant risk of loss, including coverage for sink-hole related losses in high-risk areas. As a result of our efforts, our gross loss ratio was 33.8% and 27.5% for the three months ended March 31, 2014 and the year ended December 31, 2013, respectively.

Unique Claims Servicing Model and Superior Customer Service

We believe that the vertical integration of our claims adjustment and repair services provides us with a competitive advantage. Because we manage both claims adjusting and repair services, we are generally able to begin the adjustment and mitigation process much earlier than our competitors, thus reducing our loss adjustment expenses and ultimate loss payouts. We expect that, in the near future, a significant number of our repair technicians will participate in training and certification programs to become licensed claims adjusters, allowing us to capture additional efficiencies. We also believe our unique model provides a superior level of customer

6

Table of Contents

service for our policyholders, enhancing our reputation and increasing the likelihood that our policyholders will renew their policies with us.

Relationships with Highly Rated Reinsurers

We manage our exposure to catastrophic events through, among other things, the purchase of reinsurance. Our relationships with highly rated reinsurers have been developed as a result of our management team’s industry experience and reputation for selective underwriting. Our financial strength, underwriting results and the long-term relationships between our management team and our reinsurance partners help improve the cost-effectiveness of our reinsurance program.

Relationships with Independent Agents and National Underwriters

We have developed relationships with a network of approximately 1,100 independent insurance agents. We believe we have been able to build this network due to our reputation for financial stability, commitment to the Florida market and integrity in the underwriting and claims process. We are also exploring relationships with additional large national insurers and agencies that no longer write substantial personal residential insurance in Florida, which would give us access to their network of Florida agents.

Risks Associated with Our Business

As part of your evaluation of our company, you should take into consideration the following risks that we face in implementing or executing our growth strategies and maintaining our profitability:

| • | We have an operating history of less than two years, which makes it difficult to evaluate our business and prospects. |

| • | If claims exceed our loss reserves, our financial results could be adversely affected. |

| • | Our only line of business is personal residential insurance in Florida, which exposes us to a significant risk of loss from hurricanes and other catastrophic events, which typically occur from June 1 through November 30 each year. |

| • | A single catastrophic event or series of catastrophic events or other conditions effecting losses in Florida could adversely affect our financial condition and results of operations because our business is concentrated in Florida. |

| • | Our results of operations may fluctuate significantly due to the cyclical nature of the insurance business and our participation in the Citizens depopulation program. |

| • | To date, we have been dependent on the Citizens depopulation program for the majority of our business and we may be unable to assume further policies from Citizens on attractive terms. |

| • | In the event that the reinsurance we purchase is inadequate or a reinsurer is unable or unwilling to make timely payments, our operating results would be adversely affected. |

| • | We compete with large, well-established insurance companies, as well as other specialty insurers, some of which possess greater financial resources, larger agency networks and greater name recognition than we do. |

| • | If we are unable to underwrite and set premium rates accurately, our results of operations and financial condition will be adversely affected. |

| • | A failure to effectively manage and remediate claims could lead to material litigation, undermine our reputation in the marketplace and negatively affect our financial results. |

7

Table of Contents

| • | If we are unable to maintain our financial stability rating, which is important in establishing our competitive position, the marketability of our product offerings, and our liquidity, operating results and financial condition may be materially adversely affected. |

| • | We do not anticipate paying any dividends on our common stock in the foreseeable future. |

| • | The insurance industry is highly regulated and our failure to fully comply with these regulations could have an adverse effect on our business. Changes to the statutes and rules governing the insurance industry could have an adverse effect on our business. |

See “Risk Factors” beginning on page 14 of this prospectus for a more detailed discussion of these and other risks we face.

Recent Developments

On April 17, 2014, Heritage P&C entered into a catastrophe reinsurance agreement with Citrus Re Ltd., a newly-formed Bermuda special purpose insurer. The agreement provides for three years of coverage from catastrophe losses caused by certain named storms, including hurricanes, beginning on June 1, 2014. The limit of coverage of $150 million is fully collateralized by a reinsurance trust account for the benefit of Heritage P&C. Heritage P&C pays a periodic premium to Citrus Re during this three-year risk period. Citrus Re Ltd. issued $150 million of principal-at-risk variable notes due April 18, 2017 to fund the reinsurance trust account and its obligations to Heritage P&C under the reinsurance agreement. The maturity date of the notes may be extended up to two additional years to satisfy claims for catastrophic events occurring during the three-year term of the reinsurance agreement.

On April 24, 2014, Heritage P&C entered into a second catastrophe reinsurance agreement with Citrus Re Ltd. providing for $50 million of coverage on substantially similar terms as the agreement described above. Citrus Re Ltd. issued an additional $50 million of principal-at-risk variable notes due April 24, 2017 to fund its obligations under the reinsurance agreement.

We are in the process of finalizing the remainder of our 2014-2015 reinsurance program. See “Business—Reinsurance—2014-2015 Reinsurance Program.”

Reorganization Transactions

Warrant Exercise. Certain of our current stockholders also hold warrants to purchase an aggregate of 7,716,300 shares of the Company at an exercise price of $5.88 per share. On May 22, 2014, warrants to purchase an aggregate of 7,685,700 shares were exercised (the “Warrant Exercise” and, together with the Conversion, the “Reorganization Transactions”), including warrants to purchase an aggregate of 3,873,450 shares exercised on a cashless basis. Pursuant to the cashless exercise provisions of the warrants, each warrant holder will pay the exercise price by surrendering to the Company an amount of shares having a value equal to the aggregate exercise price of the warrants being exercised. The terms of the warrants provide that the value ascribed to each share that will be surrendered to the Company as payment for the exercise price will be equal to the initial public offering price per share of our common stock in this offering. As a result, the actual number of shares that will be issued upon the Warrant Exercise is dependent upon the initial public offering price per share of our common stock in this offering. Assuming an initial public offering price of $15.00 per share, the midpoint of the price range set forth on the cover of this prospectus, an aggregate of 6,166,700 shares will be issued in connection with the Warrant Exercise. A $1.00 increase in the assumed initial public offering price of $15.00 per share would increase the number of shares that will be issued in connection with the Warrant Exercise by 94,937 shares and a $1.00 decrease in the assumed initial public offering price would

8

Table of Contents

decrease the number of shares that will be issued in connection with the Warrant Exercise by 108,500 shares. Following the Warrant Exercise, we expect that there will remain outstanding warrants to purchase an aggregate of 30,600 shares at an exercise price of $5.88 per share.

Conversion. On May 22, 2014, we converted from a Delaware limited liability company into a Delaware corporation (the “Conversion”), and all outstanding shares of the limited liability company were converted into shares of common stock of the Company on a one-for-one basis and all outstanding warrants to purchase shares of the limited liability company were converted into warrants to purchase shares of common stock of the Company on a one-for-one basis. We expect that the tax effects of the Conversion will be immaterial.

Concurrent Private Placement

Ananke, an affiliate of Nephila Capital Ltd, has agreed to purchase $10.0 million of our common stock in the Concurrent Private Placement at a price per share equal to the public offering price (but not to exceed $16.00). Poseidon Re Ltd., another affiliate of Nephila Capital Ltd, is currently a participating reinsurer in our reinsurance program. The sale of such shares will not be registered under the Securities Act and will be conducted in accordance with Section 4(a)(2) of the Securities Act. The Concurrent Private Placement is conditioned upon the closing of this offering. The closing of this offering is not conditioned upon the closing of the Concurrent Private Placement. As a condition to the Concurrent Private Placement, Ananke will be subject to a 180-day lock-up period, as described in “Shares Eligible for Future Sale—Lock-Up Agreements.”

In addition, in connection with the Concurrent Private Placement, a reinsurer affiliated with or designated by Nephila Capital Ltd will be provided with a right of first refusal to participate in our future reinsurance programs, subject to certain exceptions. The right of first refusal terminates on May 31, 2019, subject to certain conditions. See “Business—Reinsurance—2014-2015 Reinsurance Program.”

Corporate Information

Our principal executive offices are located at 2600 McCormick Drive, Suite 300, Clearwater, Florida 33759, and our telephone number is 727-362-7200. Our website is www.heritagepci.com. Information contained on our website is not incorporated by reference into this prospectus, and such information should not be considered to be part of this prospectus.

9

Table of Contents

THE OFFERING

| Common Stock Offered |

6,000,000 shares |

| Common Stock Offered in the Concurrent Private Placement |

666,666 shares |

| Common Stock to be Outstanding After This Offering and the Concurrent Private Placement |

29,196,716 shares |

| Underwriters’ Option to Purchase Additional Shares |

We have granted the underwriters the right to purchase up to 900,000 additional shares of common stock within 30 days of the date of this prospectus. |

| Use of Proceeds |

We estimate that our net proceeds from the sale of the common stock in this offering and the Concurrent Private Placement will be approximately $92.0 million, assuming an initial public offering price of $15.00 per share, which is the midpoint of the price range on the cover page of this prospectus, and after deducting underwriting discounts and commissions and offering expenses payable by us. We intend to use $55.0 million of the net proceeds from this offering and the Concurrent Private Placement to increase our statutory capital and surplus to enable us to write additional policies and $25.0 million of the net proceeds to fund collateralized reinsurance through Osprey, our reinsurance subsidiary. We intend to use the remainder of the net proceeds to fund the growth of our business and for general corporate purposes. See “Use of Proceeds.” |

| New York Stock Exchange Symbol |

We have been approved to list our common stock on the New York Stock Exchange (“NYSE”) under the symbol “HRTG.” |

| Risk Factors |

You should read the “Risk Factors” section of this prospectus for a discussion of facts to consider carefully before deciding to invest in shares of our common stock. |

| Dividend Policy |

We do not anticipate paying any dividends on our common stock in the foreseeable future. Any future determinations relating to our dividend policies will be made at the discretion of our board of directors and will depend on various factors. See “Dividend Policy.” |

| Directed Share Program |

At our request, the underwriters have reserved up to 15% of the shares of common stock for sale at the initial public offering price to persons who are directors, officers, employees and other parties associated with us through a directed share program. The number of shares of common stock available for sale to the general public will be reduced by the number of directed shares purchased by participants in the program. Any directed shares not purchased will be offered by the underwriters to the general public on the same basis as |

10

Table of Contents

| all other shares of common stock offered. We have agreed to indemnify the underwriters against certain liabilities and expenses, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”), in connection with the sales of the directed shares. Individuals who purchase shares in the directed share program will be subject to a 180-day lock-up period, as described in “Shares Eligible for Future Sale—Lock-Up Agreements.” |

Unless otherwise indicated, all information in this prospectus relating to the number of shares of common stock to be outstanding immediately after this offering and the Concurrent Private Placement:

| • | gives effect to the 2,550-for-1 stock split effected on May 7, 2014; |

| • | gives effect to the completion of the Reorganization Transactions on May 22, 2014 as described in “—Reorganization Transactions;” |

| • | assumes no exercise by the underwriters of their option to purchase up to 900,000 additional shares from us; |

| • | excludes an aggregate of 30,600 shares of common stock issuable upon the exercise of warrants at an exercise price of $5.88 per share that will remain outstanding following the consummation of this offering; and |

| • | excludes an aggregate of 2,919,671 shares of our common stock reserved for issuance under the Heritage Insurance Holdings, Inc. Omnibus Incentive Plan (the “Plan”) that we intend to adopt in connection with this offering. |

11

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary consolidated historical financial data for the periods presented and pro forma balance sheet information as of March 31, 2014. You should read the information set forth below in conjunction with “Use of Proceeds,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto included elsewhere in this prospectus. The statements of income (loss) data for the period ended December 31, 2012 and the year ended December 31, 2013 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The statements of income (loss) data for the three months ended March 31, 2013 and 2014 and the balance sheet data as of March 31, 2014 are derived from our unaudited quarterly consolidated financial statements included elsewhere in this prospectus. The statements of income (loss) data for the three months ended June 30, 2013, September 30, 2013 and December 31, 2013 set forth below are derived from our unaudited quarterly consolidated financial statements not included in this prospectus and contain all adjustments, consisting of normal recurring adjustments, that management considers necessary for a fair presentation of our financial position and results of operations for the periods presented. See “Index to Consolidated Financial Statements.”

| Statement of Operations Data (in thousands except share |

August 7, 2012 (inception) to December 31, 2012 |

Three Months Ended | Year

Ended December 31, 2013 |

Three Months Ended March 31, 2014 |

||||||||||||||||||||||||

| March 31, 2013 |

June 30, 2013 |

September 30, 2013 |

December 31, 2013 |

|||||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||||||

| Gross premiums written |

$ | 43,384 | $ | 16,349 | $ | 81,049 | $ | 37,176 | $ | 83,963 | $ | 218,537 | $ | 68,903 | ||||||||||||||

| Gross premiums earned |

5,719 | 20,324 | 28,040 | 41,506 | 50,089 | 139,959 | 60,860 | |||||||||||||||||||||

| Ceded premium |

(120 | ) | (358 | ) | (6,416 | ) | (19,701 | ) | (18,325 | ) | (44,800 | ) | (18,624 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net premiums earned |

5,599 | 19,966 | 21,624 | 21,805 | 31,764 | 95,159 | 42,236 | |||||||||||||||||||||

| Retroactive reinsurance income(1) |

— | — | 26,072 | — | (26 | ) | 26,046 | — | ||||||||||||||||||||

| Net investment income |

27 | 212 | 125 | 302 | 410 | 1,049 | 618 | |||||||||||||||||||||

| Net realized losses |

— | (2 | ) | (46 | ) | (123 | ) | (152 | ) | (323 | ) | (42 | ) | |||||||||||||||

| Other revenue |

4 | 166 | 826 | 796 | 1,113 | 2,901 | 1,066 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenue |

$ | 5,630 | $ | 20,342 | $ | 48,601 | $ | 22,780 | $ | 33,109 | $ | 124,832 | $ | 43,878 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Expenses: |

||||||||||||||||||||||||||||

| Losses and loss adjustment expenses |

1,402 | 5,280 | 7,870 | 9,996 | 15,355 | 38,501 | 20,587 | |||||||||||||||||||||

| Policy acquisition costs |

84 | 115 | 865 | 1,740 | 3,430 | 6,150 | 4,473 | |||||||||||||||||||||

| General and administrative expenses |

7,922 | (2) | 3,988 | 5,579 | 3,373 | 11,764 | 24,704 | 6,997 | ||||||||||||||||||||

| Interest expense |

829 | 6 | 6 | 4 | — | 16 | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) before income taxes |

(4,607 | ) | 10,953 | 34,281 | 7,667 | 2,560 | 55,461 | 11,821 | ||||||||||||||||||||

| Provision for income taxes |

859 | 3,899 | 13,263 | 2,340 | 1,746 | 21,248 | 3,933 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income (loss) |

$ | (5,466 | ) | $ | 7,054 | $ | 21,018 | $ | 5,327 | $ | 814 | $ | 34,213 | $ | 7,888 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic earnings (loss) per share(3) |

$ | (0.87 | ) | $ | 0.66 | $ | 1.38 | $ | 0.35 | $ | 0.05 | $ | 2.39 | $ | 0.48 | |||||||||||||

| Diluted earnings (loss) per share(3) |

$ | (0.87 | ) | $ | 0.66 | $ | 1.38 | $ | 0.35 | $ | 0.05 | $ | 2.36 | $ | 0.42 | |||||||||||||

| Basic weighted average shares outstanding(3) |

6,280,650 | 10,763,550 | 15,203,100 | 15,254,100 | 15,955,351 | 14,313,150 | 16,360,800 | |||||||||||||||||||||

| Diluted weighted average shares outstanding(3) |

6,280,650 | 10,763,550 | 15,203,100 | 15,254,100 | 16,592,851 | 14,473,800 | 18,997,500 | |||||||||||||||||||||

12

Table of Contents

| Three Months Ended | Year

Ended December 31, 2013 |

Three Months Ended March 31, 2014 |

||||||||||||||||||||||

| March 31, 2013 | June 30, 2013 | September 30, 2013 |

December 31, 2013 |

|||||||||||||||||||||

| Selected Other Data |

||||||||||||||||||||||||

| Book value per share(3)(4) |

$ | 4.51 | $ | 5.82 | $ | 6.18 | $ | 6.17 | $ | 6.17 | $ | 6.73 | ||||||||||||

| Growth in book value per share(4) |

33.2 | % | 29.2 | % | 6.1 | % | (0.1 | )% | 82.4 | % | 9.0 | % | ||||||||||||

| Return on average equity(4) |

59.3 | % | 107.8 | % | 23.2 | % | 3.3 | % | 45.0 | % | 29.9 | % | ||||||||||||

| Selected ratios(5) |

||||||||||||||||||||||||

| Ratios to gross premiums earned |

||||||||||||||||||||||||

| Gross loss ratio |

26.0 | % | 28.1 | % | 24.1 | % | 30.7 | % | 27.5 | % | 33.8 | % | ||||||||||||

| Ceded premium ratio |

1.8 | % | 22.9 | % | 47.5 | % | 36.6 | % | 32.0 | % | 30.6 | % | ||||||||||||

| Gross expense ratio |

20.2 | % | 23.0 | % | 12.3 | % | 30.3 | % | 22.0 | % | 18.8 | % | ||||||||||||

| Combined ratio |

47.9 | % | 73.9 | % | 83.9 | % | 97.6 | % | 81.6 | % | 83.3 | % | ||||||||||||

| Ratios to net premiums earned |

||||||||||||||||||||||||

| Net loss ratio |

26.4 | % | 36.4 | % | 45.9 | % | 48.3 | % | 40.5 | % | 48.7 | % | ||||||||||||

| Net expense ratio |

20.5 | % | 29.8 | % | 23.4 | % | 47.8 | % | 32.4 | % | 27.2 | % | ||||||||||||

| Combined ratio |

47.0 | % | 66.2 | % | 69.3 | % | 96.2 | % | 72.9 | % | 75.9 | % | ||||||||||||

| March 31, 2014 | ||||||||||||

| Consolidated Balance Sheet Data (in thousands) | Actual | Pro Forma(6) | Pro Forma

As Adjusted(7) |

|||||||||

| Cash, cash equivalents and investments |

$ | 225,749 | $ | 248,174 | $ | 340,174 | ||||||

| Total assets |

$ | 286,114 | $ | 308,539 | $ | 400,539 | ||||||

| Unpaid losses and loss adjustment expenses |

$ | 28,456 | $ | 28,456 | $ | 28,456 | ||||||

| Unearned premiums |

$ | 124,285 | $ | 124,285 | $ | 124,285 | ||||||

| Total liabilities |

$ | 175,973 | $ | 175,973 | $ | 175,973 | ||||||

| Total stockholders’ equity |

$ | 110,141 | $ | 132,566 | $ | 224,566 | ||||||

| (1) | Retroactive reinsurance income of $26.0 million during the year ended December 31, 2013 represents premiums earned, net of losses, for the period from January 1, 2013 through May 31, 2013 from a retroactive reinsurance agreement entered into in connection with our assumption of approximately 39,000 policies from Citizens in June 2013. See Note 2 to our consolidated financial statements for the year ended December 31, 2013 included elsewhere in this prospectus. |

| (2) | General and administrative expenses for the year ended December 31, 2012 includes $5.5 million of stock-based compensation. |

| (3) | Share and per share data for the periods presented gives retroactive effect to the 2,550-for-1 stock split effected on May 7, 2014, but does not give retroactive effect to the Reorganization Transactions. |

| (4) | Includes the value, as of the end of each period, of the redeemable equity described in footnote 8 below. See “Selected Consolidated Financial Data.” |

| (5) | The ratios presented do not reflect the impact of the retroactive reinsurance income described in footnote 1 above. For a definition of each of the ratios presented, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Components of Our Results of Operations—Ratios.” |

| (6) | The pro forma balance sheet data gives effect to the Reorganization Transactions. |

| (7) | The pro forma as adjusted balance sheet data gives further effect to (i) the issuance of 6,000,000 shares of common stock in this offering and 666,666 shares of common stock in the Concurrent Private Placement (ii) our receipt of the estimated net proceeds from the sale of shares of common stock offered by us in this offering and the Concurrent Private Placement at an assumed initial public offering price of $15.00 per share, the midpoint of the price range set forth on the cover of this prospectus, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

13

Table of Contents

An investment in our common stock involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below together with the other information included in this prospectus before purchasing our common stock in this offering. If any of the possibilities described as risks below actually occurs, our operating results and financial condition would likely suffer and the trading price of our common stock could fall, causing you to lose some or all of your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment in our common stock.

Risks Related to Our Business

We have a limited operating history, and our business and future prospects are difficult to evaluate.

We began operations in August 2012 and wrote our first policy in November 2012. Due to our limited operating history, our ability to execute our business strategy is materially uncertain and our operations and prospects are subject to all risks inherent in a developing business enterprise. Our limited operating history also makes it difficult to evaluate our long term commercial viability. As a new business, we must work to establish and develop successful operating procedures, hire staff, tailor and fine-tune our information management and other systems, maintain adequate control of our expenses, develop business relationships, implement our marketing strategies (and adapt and modify them as needed), establish a positive image and reputation in the community, and take any other steps necessary to conduct our business. As a result of these challenges, it is possible that we may not be successful in implementing our business strategy or completing the development of the infrastructure necessary to expand our business.

Our loss reserves are estimates and may be inadequate to cover our actual liability for losses, causing our results of operations to be adversely affected.

We maintain reserves to cover our estimated ultimate liabilities for losses and loss adjustment expenses, also referred to as loss reserves. As a new company, we have a limited operating history and a limited loss history which may negatively impact our ability to accurately establish loss reserves. Our current loss reserves are based primarily on industry historical data and statistical projections of what we believe the resolution and administration of claims will cost based on facts and circumstances then known to us. As a new company, our claims experience and our experience with the risks related to certain claims is inherently limited, and we must rely heavily on industry historical data, which may not be indicative of future periods. As a result, our projections and our estimates may be inaccurate, which in turn may cause our actual losses to exceed our loss reserves. If our actual losses exceed our loss reserves, our financial results, our ability to expand our business and to compete in the property and casualty insurance industry may be negatively affected.

Factors that affect unpaid losses and loss adjustment expenses include the estimates made on a claim-by-claim basis known as “case reserves” coupled with bulk estimates known as “incurred but not yet reported” (or “IBNR”). Periodic estimates by management of the ultimate costs required to resolve all claims are based on our analysis of historical data and estimations of the impact of numerous factors such as (i) per claim information; (ii) industry and company historical loss experience and development patterns; (iii) legislative enactments, judicial decisions, legal developments in the awarding of damages and changes in political attitudes; and (iv) trends in general economic conditions, including the effects of inflation. Management revises its estimates based on the results of its analysis. This process assumes that past experience, adjusted for the effects of current developments and anticipated trends, is an appropriate basis for estimating the ultimate resolution of all claims. There is no precise method for subsequently evaluating the impact of any specific factor on the adequacy of the reserves, because the eventual redundancy or deficiency is affected by multiple factors.

Because of the inherent uncertainties in the reserving process, we cannot be certain that our reserves will be adequate to cover our actual losses and loss adjustment expenses. If our reserves for unpaid losses and loss adjustment expenses are less than actual losses and loss adjustment expenses, we will be required to increase

14

Table of Contents

our reserves with a corresponding reduction in our net income in the period in which the deficiency is identified. Future loss experience substantially in excess of our reserves for unpaid losses and loss adjustment expenses could substantially harm our results of operations and financial condition.

Because we conduct our business in Florida only, any single catastrophic event, or a series of such events, or other condition affecting losses in Florida could adversely affect our financial condition and results of operations.

We currently conduct our insurance business in Florida only. The distribution of our policies is generally consistent with that of Florida’s population and is therefore more concentrated in densely-populated coastal areas. A single catastrophic event, or a series of such events, destructive weather pattern, general economic trend, regulatory development or other condition specifically affecting Florida, particularly the more densely populated areas of the state, could have a disproportionately adverse impact on our business, financial condition and results of operations. While we actively manage our exposure to catastrophic events through our underwriting process and the purchase of reinsurance, the fact that our business is concentrated in Florida subjects us to increased exposure to certain catastrophic events and destructive weather patterns such as hurricanes, tropical storms and tornadoes. Changes in the prevailing regulatory, legal, economic, political, demographic and competitive environment, and other conditions in Florida could also make it less attractive for us to do business in Florida and would have a more pronounced effect on our business than it would on other insurance companies that are more geographically diversified than we are. Since our business is concentrated in this manner, the occurrence of one or more catastrophic events or other conditions affecting losses in Florida could have an adverse effect on our business, financial condition and results of operations.

We have exposure to unpredictable catastrophes, which can materially and adversely affect our financial results.

We write insurance policies that cover homeowners and condominium owners for losses that result from, among other things, catastrophes. We are therefore subject to losses, including claims under policies we have assumed or written, arising out of catastrophes that may have a significant effect on our business, results of operations and financial condition. A significant catastrophe, or a series of catastrophes, could also have an adverse effect on our reinsurers. Catastrophes can be caused by various events, including hurricanes, tropical storms, tornadoes, earthquakes, hailstorms, explosions, power outages, fires and by man-made events, such as terrorist attacks. The incidence and severity of catastrophes are inherently unpredictable. The extent of losses from a catastrophe is a function of both the total amount of insured exposure in the area affected and the severity of the event. Our policyholders are currently concentrated in Florida, which is especially subject to adverse weather conditions such as hurricanes and tropical storms. Therefore, although we attempt to manage our exposure to catastrophes through our underwriting process and the purchase of reinsurance protection, an especially severe catastrophe or series of catastrophes could exceed our reinsurance protection and may have a material adverse impact on our results of operations and financial condition. In total, for the period from June 1, 2013 through May 31, 2014, we have purchased $721.0 million of reinsurance coverage, including our retention, for multiple catastrophic events. We are in the process of finalizing our reinsurance program for the period from June 1, 2014 through May 31, 2015, which will include our catastrophe reinsurance agreements with Citrus Re Ltd. and its issuance of $200.0 million of catastrophe bonds. We expect to purchase $1,040.0 million of reinsurance coverage, including our retention, for the twelve months ending May 31, 2015. See “Business—Reinsurance—2014-2015 Reinsurance Program.” Our ability to access this coverage, however, is subject to the severity and frequency of such events. As of March 31, 2014, our total insured value was $36.8 billion, and we may experience significant losses and loss adjustment expenses in excess of our retention.

Our results of operations may fluctuate significantly based on industry factors as well as our participation in the Citizens depopulation program.

The insurance business historically has been a cyclical industry characterized by periods of intense price competition due to excess underwriting capacity, as well as periods when shortages of capacity permitted an increase in pricing. As premium levels increase, there may be new entrants to the market, which could then lead

15

Table of Contents

to increased competition, a significant reduction in premium rates, less favorable policy terms and fewer opportunities to underwrite insurance risks, which could have a material adverse effect on our results of operations and cash flows. In addition to these considerations, changes in the frequency and severity of losses suffered by insureds and insurers, including changes resulting from multiple and/or catastrophic hurricanes, may affect the cycles of the insurance business significantly. We cannot predict whether market conditions will improve, remain constant or deteriorate. Negative market conditions may impair our ability to write insurance at rates that we consider appropriate relative to the risk assumed. If we cannot write insurance at appropriate rates, our business would be materially and adversely affected.

In addition, the uncertainties inherent in the reserving process, together with the potential for unforeseen developments, including changes in laws and the prevailing interpretation of policy terms, may result in losses and loss adjustment expenses materially different from the reserves initially established. Changes to prior year reserves will affect current underwriting results by increasing net income if the prior year reserves prove to be redundant or by decreasing net income if the prior year reserves prove to be insufficient. We are not allowed to record contingency reserves to account for expected future losses. As a result, we expect volatility in operating results in periods in which significant loss events occur because generally accepted accounting principles do not permit insurers or reinsurers to reserve for loss events until they have occurred and are expected to give rise to a claim. We anticipate that claims arising from future events may require the establishment of substantial reserves from time to time.

Our results of operations may also vary based on our continued participation in the Citizens depopulation program. As part of a typical assumption transaction with Citizens, we acquire the unearned premium associated with the assumed policies, which, depending on the size of the transaction, may cause significant variability in our financial results from period to period. In June 2013, we entered into a retroactive quota share reinsurance agreement with Citizens that resulted in our recognition of $26.0 million of retroactive insurance income for the year ended December 31, 2013, as we realized income equal to the earned premiums, net of associated losses and loss adjustment expenses, from such policies for the period from January 1, 2013 through May 31, 2013 with no corresponding reinsurance cost. We do not expect to enter into similar retroactive arrangements in connection with future policy assumptions from Citizens. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Components of Our Results of Operations—Retroactive reinsurance income.”

Our successful participation in the Citizens depopulation program depends on the continuation of such program and our ability to select favorable policies to assume.

An important element of our growth strategy involves continued participation in the Citizens depopulation program. As of March 31, 2014, approximately 89% of our 140,000 policies in force were assumed from Citizens. Our ability to participate in this program is subject to a variety of factors, including continuation of the program. There can be no assurance that Citizens will decide to continue the depopulation program for a significant period of time, or at all. In addition, the establishment of the Clearinghouse, which launched in January 2014 and makes certain new or renewed business ineligible to be underwritten by Citizens, may substantially reduce Citizens’ policy count and, in particular, the number of policies we would like to assume. Any efforts by the Florida legislature or Citizens to curtail the depopulation program, materially modify the terms of the program as it relates to personal residential policies, or restrict our participation in the program would hurt our growth prospects and will adversely impair our financial condition and results of operations. When we enter into an assumption transaction with Citizens, we have the opportunity to review information about the policies available for assumption. We undertake a robust selection process in which we analyze various aspects of each policy’s risk profile and, based on the results, select the policies we would like to assume. Our successful participation in the depopulation program depends on our ability to select policies that will be accretive to our financial results. However, our selection process involves many different considerations, and there can be no assurances that we will appropriately assess the risks associated with each policy. As a result, we may select unfavorable policies that could result in substantial losses, which may in turn adversely impact our financial condition and results of operations.

16

Table of Contents

We may not be able to collect reinsurance amounts due to us from the reinsurers with which we have contracted.

Reinsurance is a method of transferring part of an insurance company’s risk under an insurance policy to another insurance company. To the extent that our reinsurers are unable to meet the obligations they assume under our reinsurance agreements, we remain liable for the entire insured loss. We use reinsurance arrangements to limit and manage the amount of risk we retain, to stabilize our underwriting results and to increase our underwriting capacity. Our ability to recover amounts due from reinsurers under the reinsurance treaties we currently have in effect is subject to the reinsurance company’s ability and willingness to pay and to meet its obligations to us. We attempt to select financially strong reinsurers with an A.M. Best or S&P rating of “A-” or better or we require the reinsurer to fully collateralize its exposure. While we monitor from time to time their financial condition, we also rely on our reinsurance broker and rating agencies in evaluating our reinsurers’ ability to meet their obligations to us.

Our reinsurance coverage in any given year may be concentrated with one or a limited group of reinsurers. For the twelve months ending May 31, 2014, Allianz Risk Transfer (AG) Limited reinsures 75% of each layer of our reinsurance coverage up to the $401.5 million level and 90% and 100%, respectively, of our first and second aggregate layers. We expect that our reinsurance program for the twelve months ending May 31, 2015 may have similar levels of concentration. Any failure on the part of any one reinsurance company to meet its obligations to us could have a material adverse effect on our financial condition or results of operations.

All residential and commercial insurance companies that write business in Florida, including us, are required to obtain reinsurance through FHCF, and this coverage comprises a substantial portion of our reinsurance program. The limit and retention of the FHCF coverage is subject to upward or downward adjustment based on, among other things, submitted exposures to FHCF by all participants. We have purchased private reinsurance alongside our FHCF layer to fill in gaps in coverage that may result from the adjustment of the limit or retention of our FHCF coverage; however, such reinsurance would not cover any losses we may incur as a result of FHCF’s inability to pay the full amount of our claims. If a catastrophic event occurs in Florida, FHCF may not have sufficient funds to pay all of its claims from insurance companies in full or in a timely manner. This could result in significant financial, legal and operational challenges to our Company. In the event of a catastrophic loss, FHCF’s ability to pay may be dependent upon its ability to issue bonds in amounts that would be required to meet its reinsurance obligations. There can be no assurance that FHCF will be able to do this. While we believe FHCF currently has adequate capital and financing capacity to meet its reinsurance obligations, there can be no assurance that it will be able to meet its obligations in the future, and any failure to do so could have a material adverse effect on our liquidity, financial condition and results of operations.

Reinsurance coverage may not be available to us in the future at commercially reasonable rates or at all.

The cost of reinsurance is subject to prevailing market conditions beyond our control such as the amount of capital in the reinsurance market, as well as the frequency and magnitude of natural and man-made catastrophes. We cannot be assured that reinsurance will remain continuously available to us in the amounts we consider sufficient and at prices acceptable to us. As a result, we may determine to increase the amount of risk we retain or look for other alternatives to reinsurance, which could in turn have a material adverse effect on our financial position, results of operations and cash flows.

We are in the process of finalizing our reinsurance program for the 2014 hurricane season. While we believe we have reached agreement with our reinsurers with respect to the terms, including pricing, of our reinsurance program beginning June 1, 2014, we have not yet entered into binding reinsurance agreements with respect to such coverage. There can be no assurances that the final terms of the coverage for our 2014-2015 reinsurance program will be consistent with our expectations, or that the expected coverage will be available to us at all. In addition, market conditions or other factors beyond our control may make such coverage unavailable to us on favorable pricing terms. If we are unable to purchase the expected coverage for our 2014-2015 reinsurance program at a commercially reasonable price, our financial condition and results of operation may be adversely affected.

17

Table of Contents

Increased competition, competitive pressures, industry developments and market conditions could affect the growth of our business and adversely impact our financial results.

The property and casualty insurance industry in Florida is cyclical and, during times of increased capacity, highly competitive. We compete not only with other stock companies, but also with Citizens, mutual companies, other underwriting organizations and alternative risk sharing mechanisms. Our principal lines of business are written by numerous other insurance companies. Competition for any one account may come from very large, well-established national companies, smaller regional companies, other specialty insurers in our field and other companies that write insurance only in Florida. Some of these competitors have greater financial resources, larger agency networks and greater name recognition than we do. We compete for business not only on the basis of price, but also on the basis of financial strength, types of coverages offered, availability of coverage desired by customers, commission structure and quality of service. We may have difficulty continuing to compete successfully on any of these bases in the future. Competitive pressures coupled with market conditions may affect our rate of premium growth and financial results.

In addition, industry developments could further increase competition in our industry. These developments could include:

| • | an influx of new capital in the marketplace as existing companies attempt to expand their businesses and new companies attempt to enter the insurance business as a result of better premium pricing and/or policy terms; |

| • | an increase in programs in which state-sponsored entities provide property insurance in catastrophe-prone areas; |

| • | changes in Florida’s regulatory climate; and |