Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ONE Group Hospitality, Inc. | v379550_8k.htm |

Exhibit 99.1

Cautionary Statements 2 Forward - Looking Statements In addition to historical information, this presentation contains statements relating to the Company’s future business and financial performance and future events or developments that may constitute “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . These st

atements are based on current expectations and assumptions that are subject to certain risks and uncertainties . These statements include forward - looking statements with respect to the Company’s business and industry in general . Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward - looking nature identify forward - looking statements for purposes of the federal securities laws or otherwise . A variety of factors, many of which are beyond the Company’s control, affect the Company’s operations, performance, business strategies and results and there can be no assurance that the Company’s actual results will not differ materially from those indicated in these statements . These factors include, but are not limited to, continued compliance with governmental regulation, the ability to manage growth, requirements or changes affecting the business in which the Company is engaged, general economic and business conditions and the Company’s ability to open new restaurants and food and beverage locations in current and additional markets . More detailed information about these factors may be found in the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10 - K for the year ended December 31 , 2013 . The statements made herein speak only as of the date of this presentation . The Company undertakes no obligation to update its forward - looking statements to reflect evens or circumstances after the date of this presentation . Non - GAAP Financial Measures This presentation contains certain non - GAAP financial measures. A “non - GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable mea sur e calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of th e Company. These measures are presented because management uses this information to monitor and evaluate financial results and tre nds and believes this information to also be useful for investors. The Company has both wholly - owned and partially - owned subsidiarie s. Total food and beverage sales at owned and managed units represents our total revenue from our owned operations as well as the reve nue reported to us with respect to sales at our managed locations, where we earn management and incentive fees at these locations . EBITDA is defined as net income before interest expense, provision for income taxes and depreciation and amortization. Adjusted EBIT DA represents net income before interest expense, provision for income taxes, depreciation and amortization, non - cash impairment lo ss, deferred rent, pre - opening expenses, non - recurring gains and losses and losses from discontinued operations. Adjusted net incom e represents net income before loss from discontinued operations, non - recurring gains, non - cash impairment losses, and non - recurri ng acceleration of depreciation. The disclosure of EBITDA, Adjusted EBITDA and Adjusted Net Income and other non - GAAP financial measures may not be comparable to similarly titled measures reported by other companies. EBITDA, Adjusted EBITDA and Adjusted Ne t Income should be considered in addition to, and not as a substitute, or superior to, net income, operating income, cash flows , r evenue, or other measured of financial performance prepared in accordance with GAAP. For a reconciliation of Total food and beverage sal es at owned and managed units, EBITDA, Adjusted EBITDA and Adjusted Net Income to the most directly comparable financial measures presented in accordance with GAAP and a discussion of why we consider them useful, see the Appendix to this presentation. .

The ONE Group, LLC 3 We are a global hospitality company that develops and operates upscale, high - energy restaurants and turn - key food & beverage services for hospitality venues including boutique hotels, casinos and other high - end locations

Investment Highlights 4 Strong Performance and Industry - Leading Growth Metrics STK is a Category Leading Restaurant Brand with Global Reach International Platform for Future Growth Attractive Food & Beverage Offerings Tailored for Hospitality Venues Capital Efficient Model Drives Positive Returns Premier and Differentiated High - Energy Restaurant and Hospitality Concepts

Our Company Founded in 2004 Launched STK – Meatpacking in NYC, September 2006 Including STK – Miami, company operates 8 STK’s Unique Hospitality Food & Beverage Services Business Growing global footprint Approximately 1,500 employees Entered public market through a reverse merger in 2013 5 Our International Footprint The Perry – Miami, FL Gansevoort – Park Ave, NY Hippodrome Casino Londo

n ME Hotel – London Corporate & Regional Office STK Hospitality Services The Cosmopolitan (1) The One Group has both wholly - owned and partially - owned subsidiaries. Total Food & Beverage Sales at O wned & Managed U nits refers to a non - GAAP measure of revenue, which represents our total revenue from owned operations as well as the revenue reported to us with respect to sales at our managed un its where we earn management and incentive fees at these locations .For a reconciliation of GAAP Revenue to Total Food & Beverage Sales at Owned and Managed Units see the Appen dix in this presentation. Total Food & Beverage Sales at Owned & Managed Units (1) $6.3 mil $126.2 mil 2006 2013

Operating Cities Operational Landscape Corporate Landscape New York Restaurants 15 Offices Miami Hospitality 4 New York Los Angeles Roof - Pools & Bars 6 London Atlanta Casino Venues 2 Las Vegas Washington DC Management & Employees Orlando 1500 London General Information 6

STK - Restaurants F & B Restaurants Roofs - Pools & Bars Hospitality STK – Atlanta Asellina – NY Radio – London The Perry – S. Beach, FL STK – Los Angeles Cucina Asellina - Atlanta The Rooftop – Miami Gansevoort – Park Ave, NY STK – Las Vegas Cucina Asellina - London Plunge – Midtown NY Hippodrome Casino – UK STK – Miami Bagatelle – New York STK Rooftop – NY ME - London STK – Downtown NY Bagatelle – Los Angeles M

arconi - London STK – Midtown NY Heliot Steak - London Lola’s Bar - London STK – London STK – DC STK - Disney 25 Venues Open & Under Construction 7

8

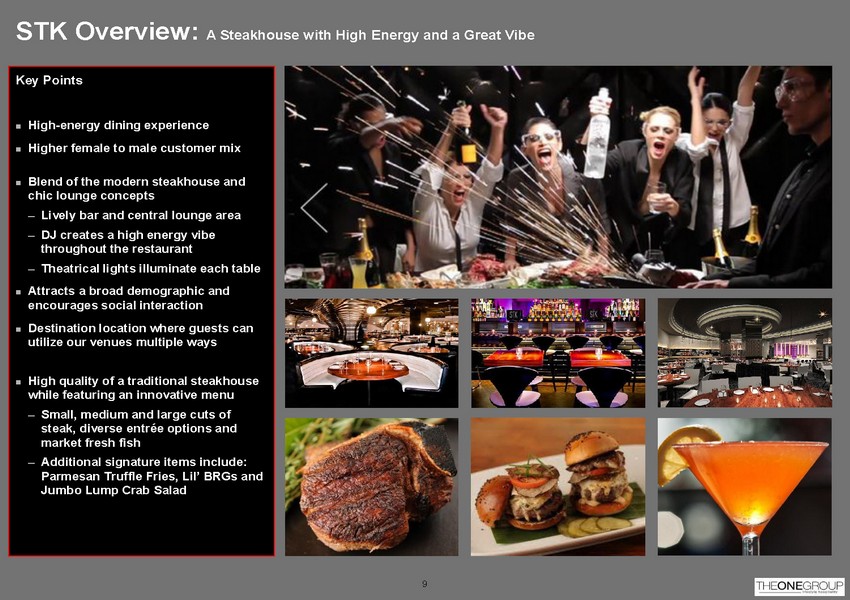

STK Overview: A S teakhouse with High E nergy and a G reat V ibe Key Points High - energy dining experience Higher female to male customer mix Blend of the modern steakhouse and chic lounge concepts ─ Lively bar and central lounge area ─ DJ creates a high energy vibe throughout the restaurant ─ Theatrical lights illuminate each table Attracts a broad demographic and encourages social interaction Dest

ination location where guests can utilize our venues multiple ways High quality of a traditional steakhouse while featuring an innovative menu ─ Small, medium and large cuts of steak, diverse entrée options and market fresh fish ─ Additional signature items include: Parmesan Truffle Fries, Lil’ BRGs and Jumbo Lump Crab Salad 9

STK Experience 10

11

Rebel by STK Overview: 12 • Rebel’s menu priced to appeal to a broader market • Maintains the unique features, the vibe and energy that have proven so successful for STK • Rebel will initially target some primary cities • Main focus on markets where a smaller footprint and a more casual restaurant is appropriate • Lower build - out cost will provide greater opportunity for expansion • Expect to open first locatio

n in 12 - 18 months

13 Rebel by STK Images:

14 Rebel by STK Images:

15

F & B Hospitality Overview: ME Hotel - London Gansevoort Park – New York The Cosmopolitan – LV Hippodrome - London 16 Manage turn - key food and beverage services and operate several restaurant/hospitality concepts for luxury hotels and casinos Generates high margin management and incentive fee income driving incremental profitability and cash flow Allows for expansion and ability to test new concepts w

ith minimal capital expenditures ME Hotel is a true testament of our ability to develop and effectively operate multiple concepts and services in one venue

17 Turn - Key F & B Solutions for Hospitality Clients (1) Hospitality locations open for a full year include The Cosmopolitan Hotel, Gansevoort Park, ME London, The Hippodrome Casino and The Perry Hotel (temporarily closed in 2013). (2) Total food and beverage sales at managed units represents the revenue reported to us with respect to sales at our managed locations where we earn management and incentive fees at

these locations. The sales presented in this table are not included in our GAAP revenues. Hospitality Services Hospitality Services Hospitality Services Hospitality Services Hospitality Locations Open For a Full Year (1) 1 4 0 1 2 3 4 2010 2013 Total Food & Beverage Sales at Managed Units (2) $ 19.6 mil $ 84.4 mil $0.0 $30.0 $60.0 $90.0 2010 2013

18 A Leading Hospitality Company – The ONE Experience Note: Bagatelle, Gansevoort Park Rooftop, Marconi, Radio M, Asellina , Cucina Asellina and Heliot are jointly - owned and / or licensed brands .

19 ONExperience ™

20 A Clear Market Leader 20 “ Best Steakhouse on the Strip” – Las Vegas Review - Journal “Best Places to Party this Summer ” “A saucy spin on the steakhouse formula” – Zagat “Top 5 Steakhouse in NYC – STK New York “…You’re only young once, people, so STK while you still can” – Blue Tomato Reviews “The Best New Restaurant in New York” “ Best American Restaurant” AWARDS 2013 Best in Category CUCINA ASELLINA Best Res

taurant or Bar in a Hotel & Overall Best Bar ATRIUM by FOSTER + PARTNERS

21 Targeted Unit Economics TARGETED STK Rebel Hospitality F&B Services Revenue $9.0 mil $5.0 mil -- EBITDA $2.0 mil $1.0 mil -- Average Cash Investment (1) $3.8 mil $2.5 mil <$500,000 ROI 53% 40% -- Management Fees -- -- 5.0% to 6.5% Incentive Fees -- -- >15% Management & Incentive Fee Revenues -- -- >$500,000 (1) Excludes pre - opening expenses and net of tenant improvements allowances Current Same

Store Sales Growth 1% to 2% Food & Beverage Costs 26.5% to 27.0% Unit Operating Expense 59% to 60%

22

Significant Global Opportunities 23 Existing Locations Potential Expansion Locations Corporate & Regional Offices Existing and Potential Expansion Countries

Expansion Goals 24 Expect to open as many as two to three STKs per year over the next three years Launch Rebel by STK as a secondary growth vehicle Plan to launch at least one hospitality contract every 12 - 18 months 2014 development STK Washington opened on April 25 STK Miami scheduled to open in 4Q14 2015 development STK Disney Multiple other development projects in negotiation

Seasoned Management Team with Proven Track Record Name Position Previous Experience Michael Serruya Non - Executive Chairman Co - founder, past Chairman, President, Chief Executive Officer and Director of CoolBrands Former President, Chief Executive Officer and Chairman of Yogen Früz World - Wide Director of Jamba, Inc. (parent company of Jamba Juice Company), a Director and member of the Audit C

ommittee of Response Genetics, and Chairman and Co - CEO of Kahala Corp Jonathan Segal Founder, CEO Over 35 years experience in hospitality industry Co - founder of The International Travel Group through a successful merger of Expotel Hotel Reservations and Room Center Developed and expanded The Modern Group, a UK based Hospitality company Ernst & Young Entrepreneur of the Year 2013 (New York) Sam Goldfinger CFO Over 23 years experience in hospitality industry and over 3 years with The ONE Group Previously CFO of The Smith & Wollensky Restaurant Group Prior public company experience having taken Smith & Wollensky public in 2001 John Inserra COO Over 25 years experience in food and beverage operations Previously EVP of Restaurant Group of Kimpton Hotels Oversaw 60 restaurants, bars and lounges in 24 cities across the United States, managing all aspects of day - to - day restaurant operations, marketing, finance and public relations, as well as new restaurant development Celeste Fierro Senior Vice President Over 15 years experience in hospitality industry 9 years with The ONE Group 6 years experience in events management Sharon Segal Corporate Director (Europe) 2 years with The ONE Group Joined the Company to head its European expansion with responsibilities for finance, strategy and development Over 15 years experience in investment markets at Fitzwilliam, Aviva Investors and Deutsche Bank Quincy Fitzwater Senior Director of Operations (Europe) Over 23 years experience in hospitality industry 7 years with The ONE Group Jon Yantin Commercial Director (Europe) Over 20 years experience in hospitality industry 4 years with The ONE Group Previous public and private company experience at Novus Leisure and Chicago Rib Shack focusing on strategy, commercial and brand development, sales and operations 25

Board Members with Deep Industry Experience Name Name Previous Experience Michael Serruya Co - founder, past Chairman, President, Chief Executive Officer and Director of CoolBrands Former President, Chief Executive Officer and Chairman of Yogen Früz World - Wide Director of Jamba, Inc. (parent company of Jamba Juice Company), a Director and member of the Audit Committee of Response Genetics, and Chairman and Co - CEO of Kahala Corp Jonathan Segal Over 35 years experience in hospitality industry Co - founder of The International Travel Group through a successful merger of Expotel Hotel Reservations and Room Center Developed and expanded The Modern Group, a UK based Hospitality company Ernst & Young Entrepreneur of the Year 2013 (New York) Richard Perlman Executive Chairman of ExamWorks Group, Inc. and former Co - Chairman, Co - Chief Executive Officer and Director of ExamWorks Former Chairman and Director of TurboChef Technologies, Inc., Chairman of PracticeWorks , Inc. and Chairman and Treasurer of AMICAS, Inc. (formerly VitalWorks Inc.) until the spin - off of PracticeWorks in March 2001 Nick Giannuzzi Founder and Managing Partner of the Giannuzzi Group LLP, a boutique law firm f

ocusing on corporate, general business and M&A matters (1) Leads Giannuzzi Group’s Consumer Brand Development Practice, which provides strategic legal counsel to consumer brand companies Began practice at Winthrop, Stimson, Putnam and Roberts and became the first outside counsel for Glaceau ( Vitaminwater and Smartwater ) 26 (1) The Giannuzzi Group LLP provides certain legal service to The ONE Group .

27

Strong Revenue Performance ($Millions) GAAP Revenue Total Food & Beverage Sales at Owned & Managed Units (2) $41.5 $81.0 $107.2 $0.0 $45.0 $90.0 $135.0 $180.0 2010 2011 2012 2013 28 $38.7 $46.1 $60.1 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 2010 2011 2012 2013 (1) STK SSS includes all STK restaurants that have been open for 18 months as of that date but excludes STK Miami. (2) See footnote 1 on slide 5 for definition o

f Total Food & Beverage Sales at Owned and Managed Units $46.0 $126.2 STK SSS (0.2%) 11.1% 10.8% (1.8%) (1) $0.2 $2.4 $3.7 $7.3 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 2010 2011 2012 2013 Management & Incentive Fee Revenue ($Millions) ($Millions)

$0.5 $1.6 $6.1 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 2010 2011 2012 2013 $3.3 $5.2 $6.7 $0.0 $3.0 $6.0 $9.0 $12.0 $15.0 2010 2011 2012 2013 Adjusted EBITDA and Net Income TOG Adjusted Net Income (1) TOG Adjusted EBITDA (1) 29 (1) See Appendix for definition of Adjusted EBITDA and Adjusted Net Income and for reconciliation to GAAP Net Income (Loss) . $7.5 $4.4

Delivering Potential Value For Shareholders Strong STK Growth / Launch Rebel Growth in Hospitality Food and Beverage Services Business Solid Margin Leverage 30 Attractive Earnings Growth Attractive Business Model Strong Top Line Growth

31

32

Historical GAAP Income Statement 33 ($ Millions ) FYE December 31, 2011A 2012A 2013A Revenues: Owned unit net revenues $ 43.7 $ 56.4 $ 38.6 Management and incentive fee revenue 2.4 3.7 7.3 Total revenue $ 46.1 $ 60.1 $ 46.0 Cost and expenses: Owned operating expenses: Food and beverage costs 10.5 14.3 10.0 Unit operating expenses 26.9 32.6 24.7 General and administrative 1.9 2.2 10.8 Depreciation and amortization

1.7 7.4 1.6 Management and royalty fees 0.4 0.3 0.1 Pre - opening expenses 1.2 0.1 0.8 Transaction costs -- -- 4.6 Equity in (income) loss of investee companies 0.1 0.1 (0.9) Derivative expense -- -- 10.1 Interest expense, net of interest income 0.4 0.7 0.8 Other expense (income) 0.1 (4.8) (0.7) Total costs and expenses $ 43.1 $ 52.9 $ 62.0 Income (loss) from continuing operations before provision for income taxes $ 3.0 $ 7.2 $ (16.0) Provision for income taxes 0.2 0.0 0.5 Income (loss) from continuing operations $ 2.8 $ 7.2 $ (16.5) Loss from discontinued operations, net of taxes 0.9 10.0 5.4 Net (loss) income $ 1.9 $ (2.8) $ (21.9) Less: net (loss) attributable to non - controlling interest 0.9 (0.4) (0.4) Net (loss) income attributable to THE ONE GROUP $ 1.0 $ (2.3) $ (21.5) Other comprehensive income (loss) Currency translation adjustment 0.0 (0.0) 0.1 Comprehensive (loss) income $ 1.0 $ (2.4) $ (21.4)

Historical GAAP Balance Sheet ($ Millions ) 34 FYE December 31, 2011A 2012A 2013A Assets: Cash and cash equivalents $ 1.7 $ 1.0 $ 11.7 Accounts receivable, net 2.3 3.4 2.9 Inventory 1.2 1.4 1.0 Other current assets 0.1 0.3 0.8 Due from related parties 0.2 0.1 0.2 Total Current Assets $ 5.5 $ 6.2 $ 16.7 Property, plant & equipment, net 19.0 13.6 13.4 Investments 1.8 1.9 2.5 Deferred tax assets 0.1 0.3 0.2 Other asset

s 0.3 0.9 1.3 Security deposits 0.8 1.0 1.0 Total Assets $ 27.6 $ 24.0 $ 35.2 Liabilities & Equity: Cash overdraft 0.1 0.6 0.3 Member loans, current portion 0.0 5.0 Notes payable, curretn portion 0.3 0.3 0.0 Line of Credit 1.3 2.5 4.3 Accounts payable 3.3 4.4 2.7 Accrued expenses 2.2 2.4 3.1 Debt to related parties 0.0 0.5 0.0 Deferred revenue 0.1 0.0 0.0 Total Current Liabilities $ 7.4 $ 15.8 $ 10.5 Capital leases, net of current portion 0.0 -- -- Notes payable, net of current portion 0.0 0.0 -- Member loans, net of current portion 4.5 -- -- Other long - term liabilities 0.0 0.0 0.0 Derivative liability -- -- 10.1 Deferred rent payable 6.7 5.7 6.3 Total Liabilities $ 18.7 $ 21.5 $ 27.0 Stockholders’ Equity: Total stockholders’ equity 1.8 (1.1) 7.9 Non - controlling interest 7.1 3.5 0.3 Total Stockholders' Equity including non - controlling interest $ 8.9 $ 2.5 $ 8.2 Total Liabilities and Stockholders' Equity $ 27.6 $ 24.0 $ 35.2

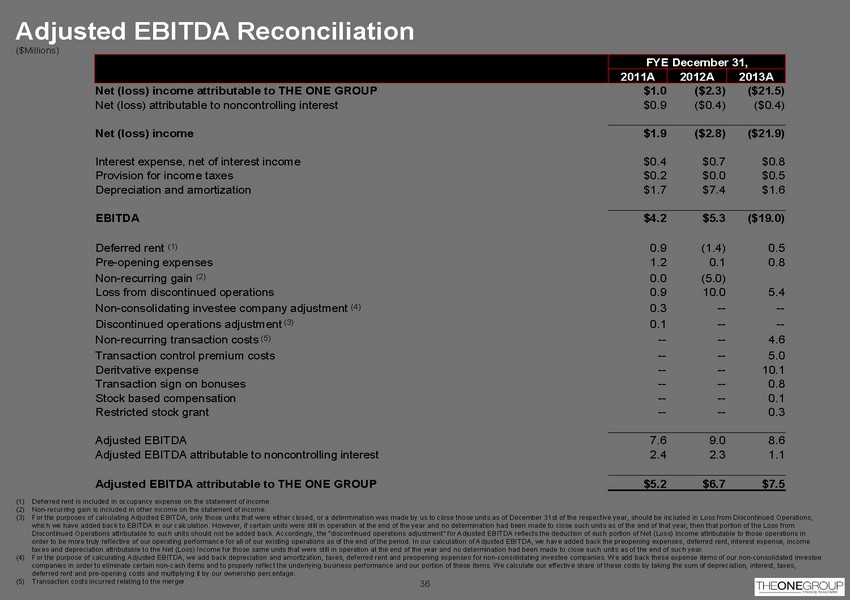

Reconciliations of Non - GAAP Measures – Cautionary Statements 35 ADJUSTED EBITDA : We define adjusted EBITDA as net income before interest expense, provision for income taxes, depreciation and amortization, n on - cash impairment loss, deferred rent, pre - opening expenses, non - recurring gains and losses and losses from discontinued operations. Adjusted EBITDA is a supplemental measure of financial performa

nce that is not required by, or presented in accordance with, GAAP. We believe that adjusted EBITDA is a more appropriate measure of operating performance, as it provides a clearer picture of o ur operating results by eliminating certain non - cash expenses that are not reflective of the underlying business performance. We use this metric to faci litate a comparison of our operating performance on a consistent basis from period to period and to analyze the factors and trends affecting our busines s a s well as evaluate the performance of our units. Adjusted EBITDA has limitations as an analytical tool and our calculation thereof may not be compar abl e to that reported by other companies; accordingly, you should not consider it in isolation or as a substitute for analysis of our results as reported un der GAAP. Adjusted EBITDA is included because it is a key metric used by management. Additionally, adjusted EBITDA is frequently used by analysts, investo rs and other interested parties to evaluate companies in our industry. We use adjusted EBITDA, alongside other GAAP measures such as net income (loss), to measu re profitability, as a key profitability target in our annual and other budgets, and to compare our performance against that of peer companies. We belie ve that adjusted EBITDA provides useful information facilitating operating performance comparisons from period to period and company to company. ADJUSTED NET INCOME : We define adjusted net income as net income before loss from discontinued operations, non - recurring gains, non - cash impairment l osses, and non - recurring acceleration of depreciation. Adjusted net income is a supplemental measure of financial performance that is not required by, or presented in accordance with, GAAP. Adjusted net income has limitations as an analytical tool and our calculation thereof may not be comparable to that rep ort ed by other companies; accordingly, you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. We believe that adjusted net income provides a clearer picture of our operating results by eliminating certain non - cash expenses that are not reflective of the underlying business performance. We use this metric to facilitate a comparison of our operating performance on a consistent b asi s from period to period and to analyze the factors and trends affecting our business. TOTAL FOOD AND BEVERAGE SALES AT OWNED AND MANAGED UNITS: Total food and beverage sales at owned and managed units represents our total revenue from our owned operations as well as th e r evenue reported to us with respect to sales at our managed locations, where we earn management and incentive fees at these locations. We believe that th is measure represents a useful internal measure of performance as it identifies total sales associated with our brands and hospitality services that we prov ide . We believe that this measure also represents a useful internal measure of performance. Accordingly, we include this non - GAAP measure so that investors can re view financial data that management uses in evaluating performance, and we believe that it will assist the investment community in assessing performan ce of restaurants and other services we operate, whether or not the operation is owned by us. However, because this measure is not determined in accordan ce with GAAP, it is susceptible to varying calculations and not all companies calculate these measures in the same manner. As a result, this measure as prese nte d may not be directly comparable to a similarly titled measure presented by other companies. This non - GAAP measure is presented as supplemental inform ation and not as an alternative to any GAAP measurements.

Adjusted EBITDA Reconciliation ($ Millions ) 36 (1) Deferred rent is included in occupancy expense on the statement of income. (2) Non - recurring gain is included in other income on the statement of income. (3) For the purposes of calculating Adjusted EBITDA, only those units that were either closed, or a determination was made by us to close those units as of December 31st of the respective year, should be incl

uded in Loss from Discontinued Operations, which we have added back to EBITDA in our calculation. However, if certain units were still in operation at the end of the year and no determination had been made to close such units as of the end of that year, then that portion of the Loss from Discontinued Operations attributable to such units should not be added back. Accordingly, the “discontinued operations adjustment” for Adjusted EBITDA reflects the deduction of such portion of Net (Loss) Income attributable to those operations in order to be more truly reflective of our operating performance for all of our existing operations as of the end of the period. In our calculation of Adjusted EBITDA, we have added back the preopening expenses, deferred rent, interest expense, income taxes and depreciation attributable to the Net ( Loss) Income for those same units that were still in operation at the end of the year and no determination had been made to close such units as of the end of such year . (4) For the purpose of calculating Adjusted EBITDA, we add back depreciation and amortization, taxes, deferred rent and preopening expenses for non - consolidating investee companies. We add back these expense items of our non - consolidated investee companies in order to eliminate certain non - cash items and to properly reflect the underlying business performance and our portion of these items. We calculate our effective share of these costs by taking the sum of depreciation, interest, taxes, deferred rent and pre - opening costs and multiplying it by our ownership percentage . (5) Transaction costs incurred relating to the merger FYE December 31, 2011A 2012A 2013A Net (loss) income attributable to THE ONE GROUP $1.0 ($2.3) ($21.5) Net (loss) attributable to noncontrolling interest $0.9 ($0.4) ($0.4) Net (loss) income $1.9 ($2.8) ($21.9) Interest expense, net of interest income $0.4 $0.7 $0.8 Provision for income taxes $0.2 $0.0 $0.5 Depreciation and amortization $1.7 $7.4 $1.6 EBITDA $4.2 $5.3 ($19.0) Deferred rent (1) 0.9 (1.4) 0.5 Pre - opening expenses 1.2 0.1 0.8 Non - recurring gain (2) 0.0 (5.0) Loss from discontinued operations 0.9 10.0 5.4 Non - consolidating investee company adjustment (4) 0.3 -- -- Discontinued operations adjustment (3) 0.1 -- -- Non - recurring transaction costs (5) -- -- 4.6 Transaction control premium costs -- -- 5.0 Deritvative expense -- -- 10.1 Transaction sign on bonuses -- -- 0.8 Stock based compensation -- -- 0.1 Restricted stock grant -- -- 0.3 Adjusted EBITDA 7.6 9.0 8.6 Adjusted EBITDA attributable to noncontrolling interest 2.4 2.3 1.1 Adjusted EBITDA attributable to THE ONE GROUP $5.2 $6.7 $7.5

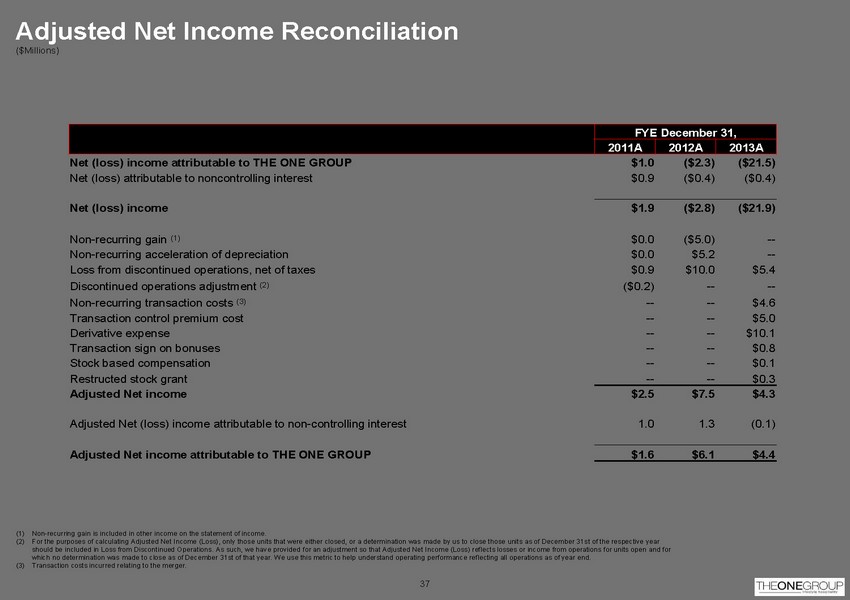

Adjusted Net Income Reconciliation ($ Millions ) 37 (1) Non - recurring gain is included in other income on the statement of income. (2) For the purposes of calculating Adjusted Net Income (Loss), only those units that were either closed, or a determination was mad e by us to close those units as of December 31st of the respective year should be included in Loss from Discontinued Operations. As such, we have pro

vided for an adjustment so that Adjusted Net Inc ome (Loss) reflects losses or income from operations for units open and for which no determination was made to close as of December 31st of that year. We use this metric to help understand operating performance reflecting all operations as of year end . (3) Transaction costs incurred relating to the merger. FYE December 31, 2011A 2012A 2013A Net (loss) income attributable to THE ONE GROUP $1.0 ($2.3) ($21.5) Net (loss) attributable to noncontrolling interest $0.9 ($0.4) ($0.4) Net (loss) income $1.9 ($2.8) ($21.9) Non - recurring gain (1) $0.0 ($5.0) -- Non - recurring acceleration of depreciation $0.0 $5.2 -- Loss from discontinued operations, net of taxes $0.9 $10.0 $5.4 Discontinued operations adjustment (2) ($0.2) -- -- Non - recurring transaction costs (3) -- -- $4.6 Transaction control premium cost -- -- $5.0 Derivative expense -- -- $10.1 Transaction sign on bonuses -- -- $0.8 Stock based compensation -- -- $0.1 Restructed stock grant -- -- $0.3 Adjusted Net income $2.5 $7.5 $4.3 Adjusted Net (loss) income attributable to non - controlling interest 1.0 1.3 (0.1) Adjusted Net income attributable to THE ONE GROUP $1.6 $6.1 $4.4

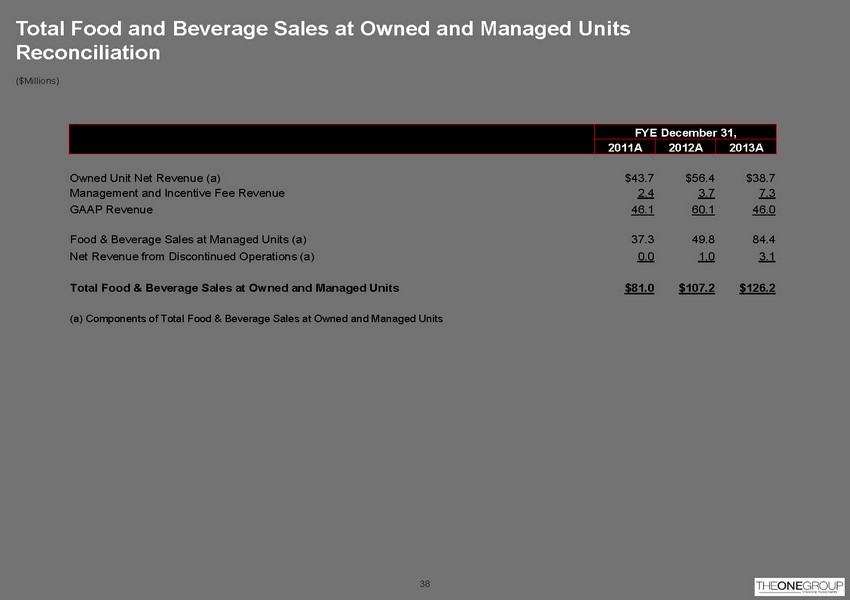

Total Food and Beverage Sales at Owned and Managed Units Reconciliation ($ Millions ) 38 FYE December 31, 2011A 2012A 2013A Owned Unit Net Revenue (a) $43.7 $56.4 $38.7 Management and Incentive Fee Revenue 2.4 3.7 7.3 GAAP Revenue 46.1 60.1 46.0 Food & Beverage Sales at Managed Units (a) 37.3 49.8 84.4 Net Revenue from Discontinued Operations (a) 0.0 1.0 3.1 Total Food & Beverage Sales at Owned and Managed Units

$81.0 $107.2 $126.2 (a) Components of Total Food & Beverage Sales at Owned and Managed Units