Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VEREIT, Inc. | v379408_8-k.htm |

Reconciliation to May 19, 2014 8 - K • The American Realty Capital Properties, Inc.’s (“ARCP”) May 19, 2014 8 - K Filing (the “Initial Report”) demonstrated the impact on ARCP’s First Quarter 2014 Financial Statements filed therein of the expected ARCenters spin - off, which did not impact the fully diluted share count for the quarter. • The following table provides a reconciliation of the weighted average shares against those provided in the Initial Report, including the impact of the Cole acquisition for the first quarter. • The following information includes the impact of Cole Capital for the full first quarter 2014 but does not include the impact of the Red Lobster transaction, equity offering or redeployment of the proceeds expected to be received from the sale of the ARCenters portfolio. 1Q14 Weighted Average Fully Diluted Shares 573,728 Plus: Cole Impact from 1/1/14 - 2/6/14 215,438 Shares per 12/31/13 Pro Forma 8 - k 789,166 Plus: Impact of Weighted Average Issuance 3,154 Total Shares Outstanding at 3/31/14 792,320 OP Units 24,836 Total Shares & Units Outstanding at 3/31/14 817,156

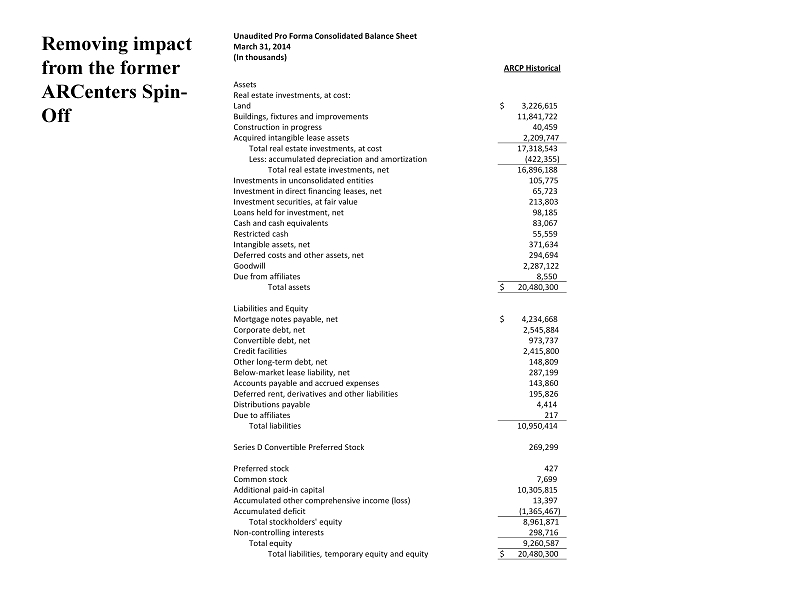

Unaudited Pro Forma Consolidated Balance Sheet March 31, 2014 (In thousands) ARCP Historical Assets Real estate investments, at cost: Land $ 3,226,615 Buildings, fixtures and improvements 11,841,722 Construction in progress 40,459 Acquired intangible lease assets 2,209,747 Total real estate investments, at cost 17,318,543 Less: accumulated depreciation and amortization (422,355) Total real estate investments, net 16,896,188 Investments in unconsolidated entities 105,775 Investment in direct financing leases, net 65,723 Investment securities, at fair value 213,803 Loans held for investment, net 98,185 Cash and cash equivalents 83,067 Restricted cash 55,559 Intangible assets, net 371,634 Deferred costs and other assets, net 294,694 Goodwill 2,287,122 Due from affiliates 8,550 Total assets $ 20,480,300 Liabilities and Equity Mortgage notes payable, net $ 4,234,668 Corporate debt, net 2,545,884 Convertible debt, net 973,737 Credit facilities 2,415,800 Other long - term debt, net 148,809 Below - market lease liability, net 287,199 Accounts payable and accrued expenses 143,860 Deferred rent, derivatives and other liabilities 195,826 Distributions payable 4,414 Due to affiliates 217 Total liabilities 10,950,414 Series D Convertible Preferred Stock 269,299 Preferred stock 427 Common stock 7,699 Additional paid - in capital 10,305,815 Accumulated other comprehensive income (loss) 13,397 Accumulated deficit (1,365,467) Total stockholders' equity 8,961,871 Non - controlling interests 298,716 Total equity 9,260,587 Total liabilities, temporary equity and equity $ 20,480,300 Removing impact from the former ARCenters Spin - Off

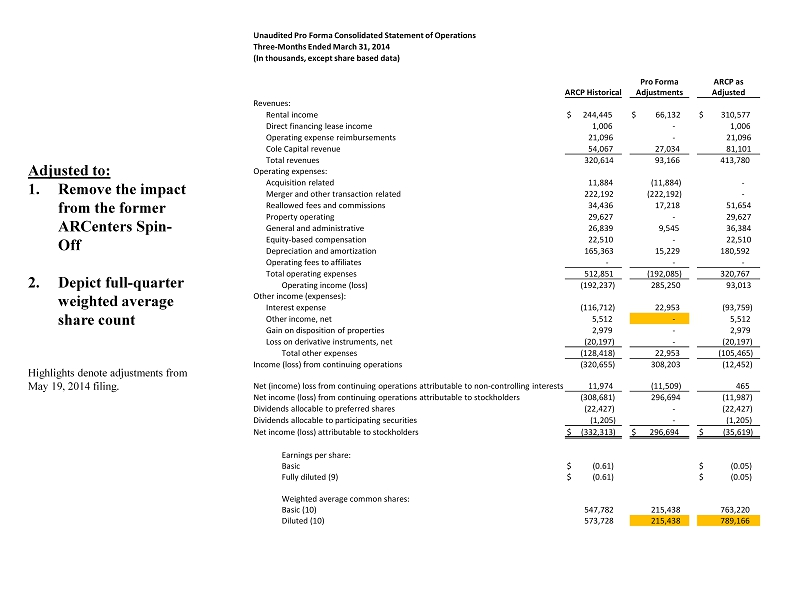

Unaudited Pro Forma Consolidated Statement of Operations Three - Months Ended March 31, 2014 (In thousands, except share based data) ARCP Historical Pro Forma Adjustments ARCP as Adjusted Revenues: Rental income $ 244,445 $ 66,132 $ 310,577 Direct financing lease income 1,006 - 1,006 Operating expense reimbursements 21,096 - 21,096 Cole Capital revenue 54,067 27,034 81,101 Total revenues 320,614 93,166 413,780 Operating expenses: Acquisition related 11,884 (11,884) - Merger and other transaction related 222,192 (222,192) - Reallowed fees and commissions 34,436 17,218 51,654 Property operating 29,627 - 29,627 General and administrative 26,839 9,545 36,384 Equity - based compensation 22,510 - 22,510 Depreciation and amortization 165,363 15,229 180,592 Operating fees to affiliates - - - Total operating expenses 512,851 (192,085) 320,767 Operating income (loss) (192,237) 285,250 93,013 Other income (expenses): Interest expense (116,712) 22,953 (93,759) Other income, net 5,512 - 5,512 Gain on disposition of properties 2,979 - 2,979 Loss on derivative instruments, net (20,197) - (20,197) Total other expenses (128,418) 22,953 (105,465) Income (loss) from continuing operations (320,655) 308,203 (12,452) Net (income) loss from continuing operations attributable to non - controlling interests 11,974 (11,509) 465 Net income (loss) from continuing operations attributable to stockholders (308,681) 296,694 (11,987) Dividends allocable to preferred shares (22,427) - (22,427) Dividends allocable to participating securities (1,205) - (1,205) Net income (loss) attributable to stockholders $ (332,313) $ 296,694 $ (35,619) Earnings per share: Basic $ (0.61) $ (0.05) Fully diluted (9) $ (0.61) $ (0.05) Weighted average common shares: Basic (10) 547,782 215,438 763,220 Diluted (10) 573,728 215,438 789,166 Adjusted to: 1. Remove the impact from the former ARCenters Spin - Off 2. Depict full - quarter weighted average share count Highlights denote adjustments from May 19, 2014 filing.

American Realty Capital Properties, Inc. Unaudited Supplementary Information (In thousands except per share data) Three Months Ended March 31, 2014 ARCP Historical ARCP Pro Forma Unaudited Pro Forma Funds From Operations and Adjusted Funds From Operations Adjusted net loss attributable to stockholders $ (332,313) $ (35,619) Loss (gain) on held for sale properties (2,979) (2,979) Depreciation and amortization on real estate assets 150,899 166,218 Depreciation and amortization on real estate assets in unconsolidated joint ventures 602 602 Total Funds from Operations (FFO) (183,791) 128,222 AFFO adjustments: Acquisition related 11,884 - Merger and other transaction costs 222,192 - Loss on derivative instruments, net 20,197 20,197 Amortization of premiums and discounts on debt and investments (18,325) (2,615) Dividends attributable to convertible preferred stock 5,053 5,053 Dividends attributable to participating securities 936 936 Amortization of above - and below - market lease asset, net 358 358 Amortization of deferred financing costs 37,940 5,610 Other amortization expense and depreciation 14,374 14,374 Loss on early extinguisment of debt 20,819 - Straight - line rent (7,520) (10,505) Non - cash equity compensation expense 22,510 22,510 Proportionate share of adjustments for unconsolidated joint ventures 762 762 Total Adjusted Funds from Operations (AFFO) $ 147,389 $ 184,902 Projected 3 - months EBITDA for PCM $ 35,500 Adjusted AFFO $ 220,402 Weighted average common shares: Basic 547,782 763,220 Fully Diluted 573,728 789,166 FFO per share: Basic $ (0.34) $ 0.17 Diluted $ (0.32) $ 0.16 AFFO per share: Basic $ 0.27 $ 0.29 Diluted $ 0.26 $ 0.28 Adjusted to: 1. Remove the impact from the former ARCenters Spin - Off 2. Include run - rate Q1 effect for Cole merger and Q1 acquisitions 3. Depict full - quarter weighted average share count Highlights denote adjustments from May 19, 2014 filing.

Forward - Looking Statements Information set forth herein (including information included or incorporated by reference herein) may contain “forward looking statements” (as defined in Section 21E of the Securities Exchange Act of 1934, as amended), which reflect ARCP’s expectations regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, the ARCP's plans, market and other expectations, objectives, intentions and other statements that are not historical facts, including the potential sale of its multi - tenant shopping center business and the consummation of the Red Lobster acquisition. Additional factors that may affect future results are contained in the prospectus supplement and ARCP's other filings with the SEC, which are available at the SEC's website at www.sec.gov. ARCP disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise.