Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VEREIT, Inc. | v379375_8k.htm |

Exhibit 99.1

American Realty Capital Properties Portfolio Information May 21, 2014

2 Information set forth herein (including information included or incorporated by reference herein) may contain “forward looking statements” (as defined in Section 21 E of the Securities Exchange Act of 1934 , as amended), which reflect American Realty Capital Properties, Inc . ’s (“ARCP”) expectations regarding future events . The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements . Such forward - looking statements include, but are not limited to, the ARCP's plans, market and other expectations, objectives, intentions and other statements that are not historical facts, including the potential sale of its multi - tenant shopping center business and the consummation of the Red Lobster acquisition . Additional factors that may affect future results are contained in the prospectus supplement and ARCP's other filings with the SEC, which are available at the SEC's website at www . sec . gov . ARCP disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise . Forward Looking Statements

3 Portfolio Overview ARCP (3/31/14) Red Lobster Portfolio ARCP Pro Forma Red Lobster (2) ARCP Pro Forma, Post ARCenters Sale (2) Properties: 3,809 507 4,316 4,238 Total Square Feet: 101.7 million 3.8 million 105.5 million 93.9 million Investment Grade (1) : 48.5% 0.0% 43.3% 44.9% Occupancy (1) : 99.7% 100% 99.8% 99.8% Average Remaining Net Lease Term (1) : 10.8 years 24.6 years 12.3 years 12.3 years Number of Tenants: 1,164 1 1,165 719 Number of Industries: 93 1 93 88 Number of States: 49 + DC + PR 42 + DC + CAD 49 + DC + PR + CAD 49 + DC + PR + CAD (1) Weighted by percent of straight - line rent. (2) Pro forma for the Red Lobster transaction and potential sale of ARCenters. The Red Lobster transaction is subject to closing con ditions including Golden Gate Capital’s acquisition from Darden. The ARCenters sale is subject to execution of definitive documentation, which will include closing conditions. There can be no assurances that eit her transaction will be completed on the terms described or not at all. The sale - leaseback of Red Lobster demonstrates ARCP’s competitive advantage in the marketplace and continued ability to make complementary acquisitions

4 Pro Forma National Footprint Nationally diversified portfolio with properties located at highly trafficked, ‘Main and Main” locations (1) Weighted by percent of straight - line rent. (2) Pro forma for the Red Lobster transaction and potential sale of ARCenters. The Red Lobster transaction is subject to closing con ditions including Golden Gate Capital’s acquisition from Darden. The ARCenters sale is subject to execution of definitive documentation, which will include closing conditions. There can be no assurances that eit her transaction will be completed on the terms described or not at all. Pacific Northwest, 2% Pacific Southwest, 13% Southwest, 17% Southeast, 23% Other, 1% Mid - Atlantic, 15% Northeast, 9% Midwest, 21% ARCP Pro Forma Red Lobster and ARCenters Sale (1) (2) HI MI 3.1% FL 5.9% DE 0.2% MD 1.4% KY 1.5% ME 0.6% NY 2.5% PA 4.4% VT 0.0% NH 0.3% MA 2.2% RI 0.3% CT 0.4% VA 2.6% WV 0.5% OH 4.2% IN 3.5% IL 6.4% NC 3.1% TN 2.6% SC 2.2% AL MS 1.2% WI 1.4% NJ 2.9% GA 5.1% NM 1.1% TX 12.3% OK 1.8% KS 1.1% NE 1.3% SD 0.1% ND 0.2% MT 0.1% WY 0.1% CO 2.2% UT 0.2% ID 0.4% AZ 4.0% NV 0.8% WA 0.9% CA 4.9% OR 0.3% AR 0.9% LA 1.6% MO 2.0% IA 1.0% MN 0.6% >10% of SLR 6% - 10% 4% - 6% 2% - 4% <2% AK 0.1%

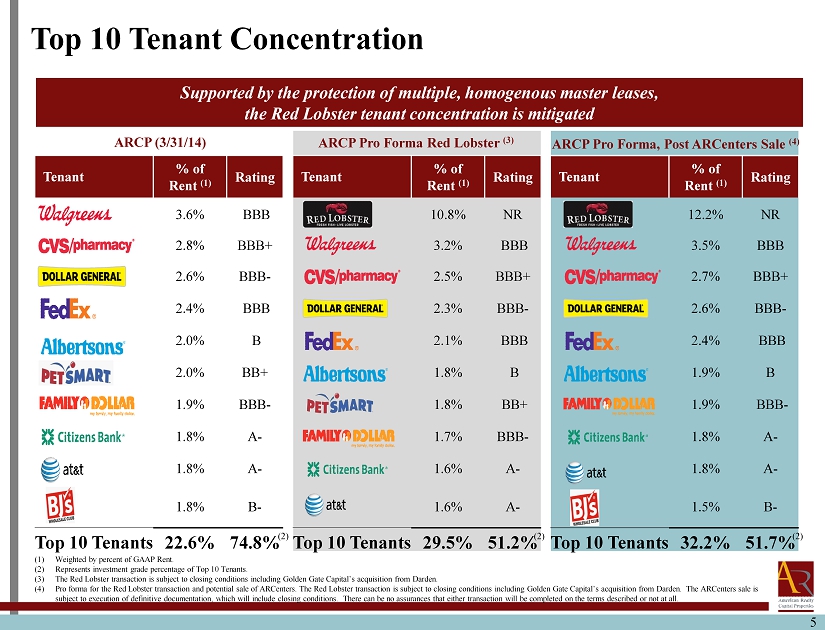

5 ARCP Pro Forma, Post ARCenters Sale (4) ARCP Pro Forma Red Lobster (3) Tenant % of Rent (1) Rating 10.8% NR 3.2% BBB 2.5% BBB+ 2.3% BBB - 2.1% BBB 1.8% B 1.8% BB+ 1.7% BBB - 1.6% A - 1.6% A - Top 10 Tenants 29.5% 51.2% Top 10 Tenant Concentration Supported by the protection of multiple, homogenous master leases, the Red Lobster tenant concentration is mitigated Tenant % of Rent (1) Rating 3.6% BBB 2.8% BBB+ 2.6% BBB - 2.4% BBB 2.0% B 2.0% BB+ 1.9% BBB - 1.8% A - 1.8% A - 1.8% B - Top 10 Tenants 22.6% 74.8% ARCP (3/31/14) Tenant % of Rent (1) Rating 12.2% NR 3.5% BBB 2.7% BBB+ 2.6% BBB - 2.4% BBB 1.9% B 1.9% BBB - 1.8% A - 1.8% A - 1.5% B - Top 10 Tenants 32.2% 51.7% (1) Weighted by percent of GAAP Rent. (2) Represents investment grade percentage of Top 10 Tenants. (3) The Red Lobster transaction is subject to closing conditions including Golden Gate Capital’s acquisition from Darden. (4) Pro forma for the Red Lobster transaction and potential sale of ARCenters. The Red Lobster transaction is subject to closing con ditions including Golden Gate Capital’s acquisition from Darden. The ARCenters sale is subject to execution of definitive documentation, which will include closing conditions. There can be no assurances that eit her transaction will be completed on the terms described or not at all. (2) (2) (2)

6 Industry Exposure (1) Weighted by percent of straight - line rent. (2) Restaurant category includes restaurants at multi - tenant assets. (3) The Red Lobster transaction is subject to closing conditions including Golden Gate Capital’s acquisition from Darden. (4) Pro forma for the Red Lobster transaction and potential sale of ARCenters. The Red Lobster transaction is subject to closing con ditions including Golden Gate Capital’s acquisition from Darden. The ARCenters sale is subject to execution of definitive documentation, which will include closing conditions. There can be no assurances that eit her transaction will be completed on the terms described or not at all. Highly diversified business model 31% 18% 23% 15% 11% 28% 27% 20% 3% 12% 10% 31% 30% 23% 4% 2% 11% 28% 27% 20% 13% 12% 31% 30% 23% 15% 2% Multi - tenant retail Industrial / Distribution Office Restaurants Retail ARCP Pro Forma Red Lobster (1) (2) (3) ARCP Pro Forma, ARCenters Sale (1) (4) ARCP (3/31/14) (1) (2)

7 Deleveraging Net Debt / Adj. EBITDA Pro forma for the Red Lobster transaction and offering, ARCP is deleveraging Unencumbered Assets / Unsecured Debt 7.5x 7.0x 6.2x ARCP Current ARCP Pro Forma Red Lobster ARCP Pro Forma, Post ARCenters Sale 1.67x 1.80x 1.80x ARCP Current ARCP Pro Forma ARCP Pro Forma, Post Spin Net Debt / Total Enterprise Value (2) 46% 44% 42% ARCP Current ARCP Pro Forma Red Lobster ARCP Pro Forma, Post ARCenters Sale (1) Net Debt as of 3/31/14. (2) Total Enterprise Value assumes closing stock price of $12.90 on of 5/20/14. (3) ARCP Pro Forma assumes issuance of 100 million shares at $12.90 per share less offering expenses and the acquisition of Red L obs ter for $1.5 billion. The Red Lobster transaction is subject to closing conditions including Golden Gate Capital’s acquisition from Darden. (4) Pro forma for the Red Lobster transaction and potential sale of ARCenters. The Red Lobster transaction is subject to closing con ditions including Golden Gate Capital’s acquisition from Darden. The ARCenters sale is subject to execution of definitive documentation, which will include closing conditions. There can be no assurances that eit her transacton will be completed on the terms described or not at all. (3) (3) (4) (3) (3) (4) (1) (1)

8 Sources & Uses and Capitalization Sources & Uses Net Debt / Total Enterprise Value (2) ($ in millions) Sources Equity Offering (1) $1,290 Total Sources $1,290 Uses Repayment of Revolver $1,242 Offering Costs 48 Total Uses $1,290 (1) Assumes 100 million shares based on closing stock price of $12.90 on 5/20/14. (2) Annualized Adj. EBITDA for Red Lobster assumes 9.9% GAAP cap rate. The Red Lobster transaction is subject to closing conditi ons including Golden Gate Capital’s acquisition from Darden. (3) The ARCenters sale is subject to execution of definitive documentation, which will include closing conditions. There can be no assurances that either transaction will be completed on the terms described or not at all. 3/31/14 Equity Red Pro Forma Sale of Pro Forma ARCP Offering (1) Lobster (2) ARCP ARCenters (3) ARCP Fully diluted shares and units outstanding 817 100 917 917 Stock price (As of 5/20/2014) $12.90 $12.90 $12.90 $12.90 Equity Market Capitalization 10,533 1,290 11,823 11,823 Series F perpetual preferred $1,073 $1,073 $1,073 Mortgage Debt $4,128 $4,128 ($567) $3,561 Credit Facilities 2,416 (1,242) 1,535 2,708 (1,408) 1,300 Unsecured Notes 3,600 0 0 3,600 0 3,600 Total Debt $10,144 ($1,242) $1,535 $10,437 ($1,975) $8,462 Total Capitalization $21,750 $48 $1,535 $23,333 ($1,975) $21,358 Cash & equivalents (181) (181) (181) Enterprise Value $21,569 $23,151 $21,176 Annualized adjusted EBITDA $1,322 $152 $1,473 ($129) $1,344 Net Debt / Annualized Adj. EBITDA 7.5x 7.0x 6.2x Net Debt / Enterprise Value 46.2% 44.3% 42.0%

9 EBITDA and Adjusted Annualized EBITDA are not calculated in accordance with GAAP . ARCP believes these measures are important supplemental measures of operating performance as they allow comparisons of ARCP’s operating results without regard to financing methods and capital structure . Accordingly, ARCP believes it is useful for investors to review net income (a GAAP measure) and EBITDA and Adjusted Annualized EBITDA (together, non - GAAP measures) together in order to (a) understand and evaluate current operating performance and future prospects in the same manner as management does through this non - GAAP measure and (b) understand the adjustments made to net income, which is a GAAP measure, to arrive at these non - GAAP measures . Neither EBITDA nor Adjusted Annualized EBITDA should be considered in isolation of, or as a substitute for, net income or operating income as indicators of operating performance . EBITDA and Adjusted Annualized EBITDA, as calculated by ARCP, may not be comparable to similarly titled measures of other companies . In addition, these measures do not necessarily represent funds available for discretionary use and are not necessarily measures of ARCP’s ability to fund its cash needs . These measures exclude financial information that is included in net income, the most directly comparable GAAP financial measure . Users of this information should consider the types of events and transactions that are excluded . Non - GAAP Measures