Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MAM SOFTWARE GROUP, INC. | v379163_8-k.htm |

Introduction to MAM Software Group, Inc Michael G. Jamieson President & Chief Executive Officer Charles F. Trapp Executive Vice President & Chief Financial Officer May 2014 Driving Business Performance 1031 10am cm

Driving Business Performance Statements and/or figures included in this presentation that are not historical facts (including any statements or projection s c oncerning plans and objectives of management for future operations or economic performance, or assumptions or forecasts related thereto ), are forward - looking statements. These statements can be identified by the use of forward - looking terminology including “forecast,” “ may,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “continue” or other similar words. These statements discuss future exp ect ations, contain projections of results of operations or of financial condition or state other “forward - looking” information. We and our representatives may from time to time make other oral or written statements that are also forward - looking statements. These forward - looking statements are made based upon management’s current plans, and best expectations, estimates, assumptions and beliefs concerning future events that may impact the company’s future prospects and therefore involve a number of risks a nd uncertainties. MAM Software Group, Inc cautions that forward - looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward - looking statements. Because these forward - looking statements involve risks and uncertainties, actual results could differ materially from those expr essed or implied by these forward - looking statements for a number of important reasons. MAM Software Group, Inc. expressly disclaims any intention or obligation to revise or update any forward - looking statements whether as a result of new information, future events , or otherwise. Safe harbor statement

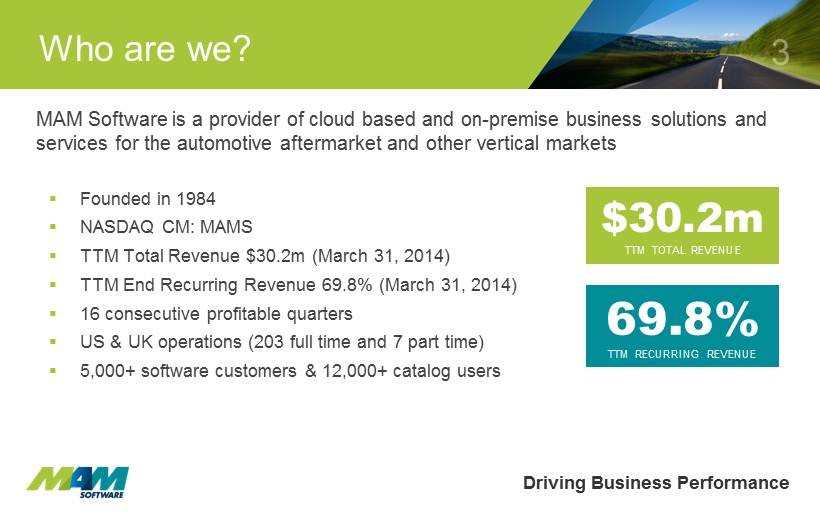

Driving Business Performance MAM Software is a provider of cloud based and on - premise business solutions and services for the automotive aftermarket and other vertical markets Who are we? ▪ Founded in 1984 ▪ NASDAQ CM: MAMS ▪ TTM Total Revenue $30.2m (March 31, 2014) ▪ TTM End Recurring Revenue 69.8% (March 31, 2014) ▪ 16 consecutive profitable quarters ▪ US & UK operations ( 203 full time and 7 part time) ▪ 5,000+ software customers & 12,000+ catalog users $30.2m TTM TOTAL REVENUE 69.8% TTM RECURRING REVENUE

Driving Business Performance ▪ Dominant UK aftermarket position (70% Market share ) ▪ Industry leader with high barriers to entry: ▪ Proven technology ▪ Widespread market acceptance ▪ Mature relationships with leading groups ▪ Comprehensive product portfolio comprising modern complementary solutions ▪ Significant customer base with strong recurring revenues ▪ High levels of customer retention ▪ Growth opportunity in cloud solutions (SaaS, DaaS , iPaaS ) ▪ Expansion opportunities into multiple international markets ▪ Exceptional staff with extensive knowledge and experience What are our strengths? 70 % CLOUD OPPORTUNITIES UK PENETRATION

Driving Business Performance MAM Software develops a range of business management, data and e - commerce solutions (SaaS, DaaS , iPaaS ) that help companies conduct their business more efficiently, encourage customer loyalty and increase revenue What do we do? Business Management Software ▪ Wholesale & retail sales ▪ Purchasing & inventory ▪ Warehouse management ▪ Integrated accounting ▪ Business intelligence & CRM e - Commerce Solutions ▪ B2B web portals ▪ B2C web sites ▪ Internet EDI Mobile Applications ▪ Vehicle health check ▪ Damage inspection ▪ Inventory control ▪ Reps module Data Products & Services ▪ Data as a Service ( DaaS ) ▪ All - makes auto parts catalog ▪ Supplier d ata management tools ▪ Licence plate lookup Delivery ▪ Cloud ▪ Browser - based SaaS ▪ Hosted SaaS ▪ On - premise Integration Platform as a Service ( iPaaS )

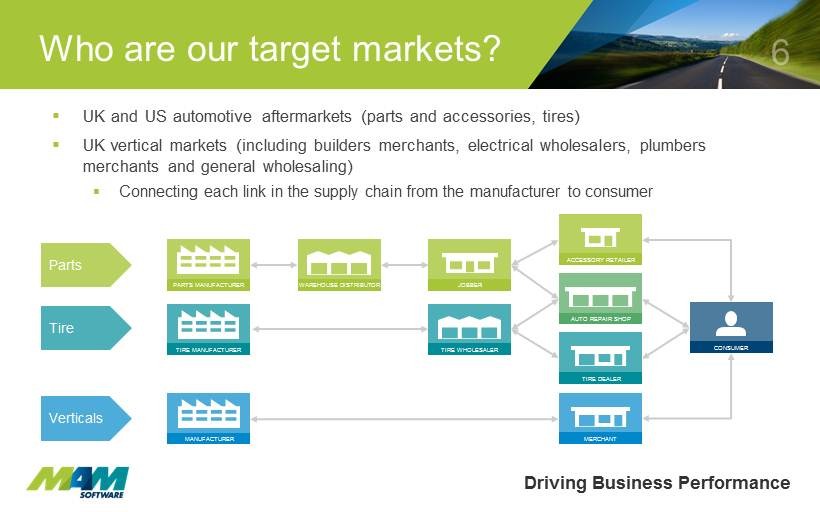

Driving Business Performance ▪ UK and US automotive aftermarkets ( parts and accessories , tires) ▪ UK vertical markets (including builders merchants, electrical wholesalers, plumbers merchants and general wholesaling ) ▪ Connecting each link in the supply chain from the manufacturer to consumer Who are our target markets ? MANUFACTURER MERCHANT ACCESSORY RETAILER AUTO SHOP (SIGLE SITE) AUTO REPAIR SHOP TIRE DEALER CONSUMER PARTS MANUFACTURER WAREHOUSE DISTRIBUTOR JOBBER Parts Verticals TIRE MANUFACTURER TIRE WHOLESALER Tire

Driving Business Performance Who are our customers? UK Parts UK Verticals US Auto Repair & Tire US Parts

Driving Business Performance ALLDATA Strategic Agreement ▪ Successful launch of white - label MAM cloud shop management system (SMS) ▪ Encouraging early adoption rates ▪ ALLDATA is a leading provider of manufacturers’ automotive repair information and solutions, owned by AutoZone ▪ Current customer base of 80,000 automotive repair and collision shop subscribers ▪ Cloud platform simplifies deployment and management ▪ SMS will help shops enhance profitability and strengthen customer relationships “MAM Software is a major provider of shop management solutions and an excellent fit for ALLDATA.” Jeff Lagges , President, ALLDATA Business highlights

Driving Business Performance ▪ United Kingdom ▪ Continued growth in automotive sector – SaaS & DaaS solutions ▪ New products – mobile, big data ▪ Growth in the tire sector ▪ Growth in vertical markets ▪ Acquisitions Growth o pportunities * Includes legacy software users ** Source = Experian B2B Prospector Sector Customers Addressable Total Market (Businesses) Avg. Annual SaaS Revenue per Business Avg. Annual DaaS Revenue per Business Potential Annual XaaS Market Value Warehouse Distributors & Auto Parts Stores 1,224 1,806 ** $11,000 $4,500 $28m Wholesale & Retail Tire Dealers 28 1,773 ** $6,000 $2,500 $15m Auto Repair Shops 3,646* 25,000 ** $634 n/a $16m Verticals (merchants) 63 1,576 ** $12,000 n/a $19m

Driving Business Performance ▪ North America ▪ Continued growth in parts distribution sector – SaaS & DaaS solutions ▪ Increased penetration in tire sector ▪ Growth in auto repair shop sector – SaaS based shop management system (SMS) ▪ Long term - expansion into vertical markets ▪ Acquisitions Growth o pportunities * Source = AAIA 2013 Factbook (2011 data) Adjusted for large companies with internal developed systems Sector Customers / Outlets Addressable Total Market (Outlets) Avg. Annual SaaS Revenue per Outlet Avg. Annual DaaS Revenue per Outlet Potential Annual XaaS Market Value Warehouse Distributors & Auto Parts Stores 115 / 574 12,500 * $11,000 $4,500 $194m Wholesale & Retail Tire Dealers 137 / 468 17,500 * $6,000 $2,500 $159m Auto Repair Shops 247 / 1490 71,700 * $1,550 n/a $111m

Driving Business Performance S aaS progress KPIs 2 % CHURN RATE +11.0% YEAR ON YEAR QUARTERLY INCREASE IN CUSTOMERS +103% YEAR ON YEAR QUARTERLY INCREASE IN REVENUE $ 6 MONTHS CUSTOMER ACQUISITION COSTS (CAC) RECOVERY PERIOD Software as a Service progress - Key Performance Indicators

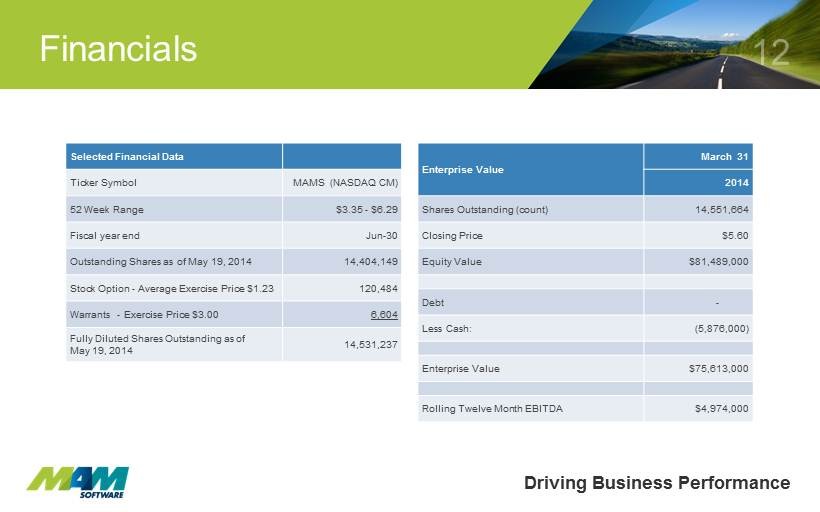

Selected Financial Data Ticker Symbol MAMS (NASDAQ CM) 52 Week Range $3.35 - $6.29 Fiscal year end Jun - 30 Outstanding Shares as of May 19, 2014 14,404,149 Stock Option - Average Exercise Price $1.23 120,484 Warrants - Exercise Price $3.00 6,604 Fully Diluted Shares Outstanding as of May 19, 2014 14,531,237 Enterprise Value March 31 2014 Shares Outstanding (count) 14,551,664 Closing Price $5.60 Equity Value $81,489,000 Debt - Less Cash : (5,876,000) Enterprise Value $75,613,000 Rolling Twelve Month EBITDA $4,974,000 Driving Business Performance Financials

Driving Business Performance Financials Q3 Financial Highlights Q3 2014 Q3 YoY Change Total Revenue $ 7,868,000 + 15.3 % Total Recurring Revenue $ 5,570,000 + 15.3 % Total XaaS Revenue $3,138,000 + 19.9 % Total SaaS Revenue $ 938,000 + 102.6 % Total DaaS Revenue $ 2,200,000 + 2.1 % Total Earnings $ 659,000 - 18.8 % Third Quarter Highlights

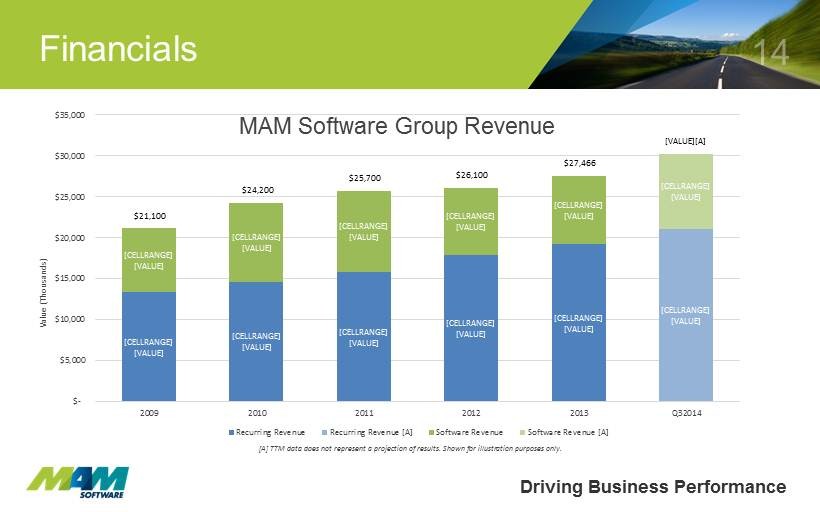

Driving Business Performance Financials [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] [CELLRANGE] [VALUE] $21,100 $24,200 $25,700 $26,100 $27,466 [VALUE] [A] $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2009 2010 2011 2012 2013 Q32014 Value (Thousands) MAM Software Group Revenue Recurring Revenue Recurring Revenue [A] Software Revenue Software Revenue [A] [A] TTM data does not represent a projection of results. Shown for illustration purposes only.

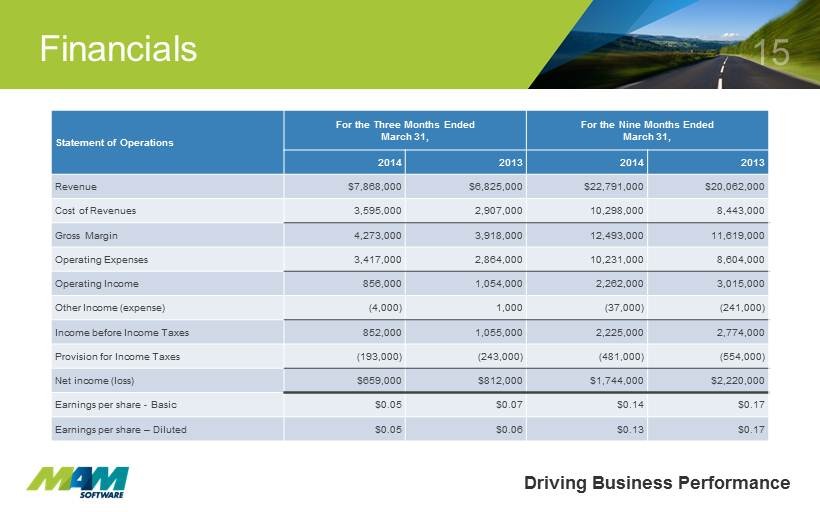

Statement of Operations For the Three Months Ended March 31, For the Nine Months Ended March 31 , 2014 2013 2014 2013 Revenue $7,868,000 $6,825,000 $22,791,000 $20,062,000 Cost of Revenues 3,595,000 2,907,000 10,298,000 8,443,000 Gross Margin 4,273,000 3,918,000 12,493,000 11,619,000 Operating Expenses 3,417,000 2,864,000 10,231,000 8,604,000 Operating Income 856,000 1,054,000 2,262,000 3,015,000 Other Income (expense) (4,000) 1,000 (37,000) (241,000) Income before Income Taxes 852,000 1,055,000 2,225,000 2,774,000 Provision for Income Taxes (193,000) (243,000) (481,000) (554,000) Net income (loss) $659,000 $812,000 $1,744,000 $2,220,000 Earnings per share - Basic $ 0.05 $0.07 $ 0.14 $ 0.17 Earnings per share – Diluted $ 0.05 $ 0.06 $ 0.13 $ 0.17 Driving Business Performance Financials

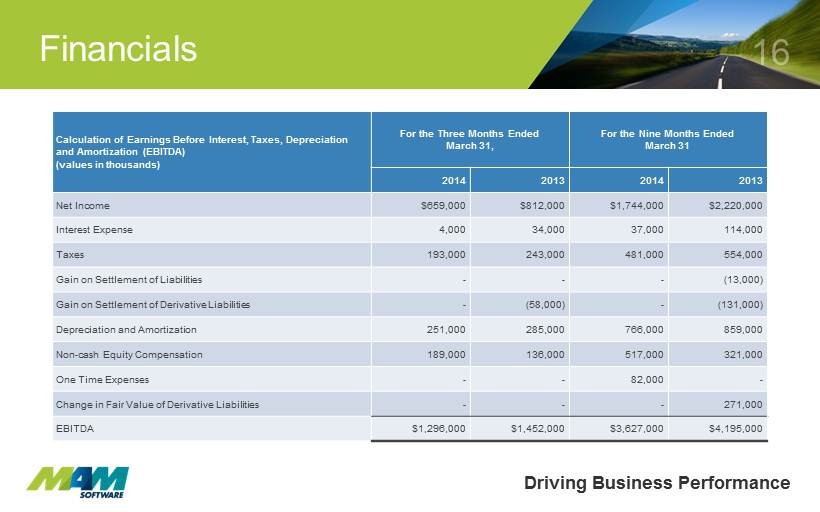

Calculation of Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (values in thousands) For the Three Months Ended March 31, For the Nine Months Ended March 31 2014 2013 2014 2013 Net Income $659,000 $812,000 $1,744,000 $2,220,000 Interest Expense 4,000 34,000 37,000 114,000 Taxes 193,000 243,000 481,000 554,000 Gain on Settlement of Liabilities - - - (13,000) Gain on Settlement of Derivative Liabilities - (58,000) - (131,000) Depreciation and Amortization 251,000 285,000 766,000 859,000 Non - cash Equity Compensation 189,000 136,000 517,000 321,000 One Time Expenses - - 82,000 - Change in Fair Value of Derivative Liabilities - - - 271,000 EBITDA $1,296,000 $1,452,000 $3,627,000 $4,195,000 Driving Business Performance Financials

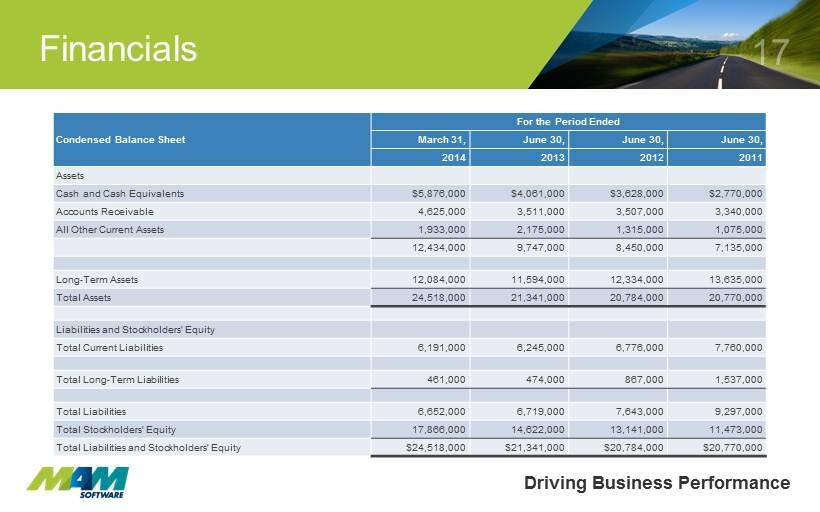

Condensed Balance Sheet For the Period Ended March 31, June 30, June 30, June 30, 2014 2013 2012 2011 Assets Cash and Cash Equivalents $5,876,000 $4,061,000 $3,628,000 $2,770,000 Accounts Receivable 4,625,000 3,511,000 3,507,000 3,340,000 All Other Current Assets 1,933,000 2,175,000 1,315,000 1,075,000 12,434,000 9,747,000 8,450,000 7,135,000 Long - Term Assets 12,084,000 11,594,000 12,334,000 13,635,000 Total Assets 24,518,000 21,341,000 20,784,000 20,770,000 Liabilities and Stockholders' Equity Total Current Liabilities 6,191,000 6,245,000 6,776,000 7,760,000 Total Long - Term Liabilities 461,000 474,000 867,000 1,537,000 Total Liabilities 6,652,000 6,719,000 7,643,000 9,297,000 Total Stockholders' Equity 17,866,000 14,622,000 13,141,000 11,473,000 Total Liabilities and Stockholders' Equity $24,518,000 $21,341,000 $20,784,000 $20,770,000 Driving Business Performance Financials

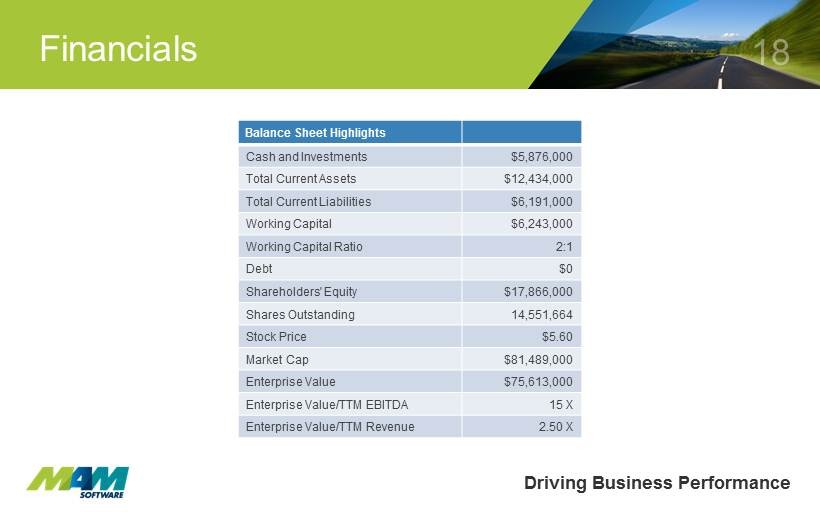

Driving Business Performance Financial s Balance Sheet Highlights Cash and Investments $5,876,000 Total Current Assets $12,434,000 Total Current Liabilities $6,191,000 Working Capital $ 6,243,000 Working Capital Ratio 2:1 Debt $0 Shareholders' Equity $17,866,000 Shares Outstanding 14,551,664 Stock Price $5.60 Market Cap $81,489,000 Enterprise Value $75,613,000 Enterprise Value/TTM EBITDA 15 X Enterprise Value/TTM Revenue 2.50 X

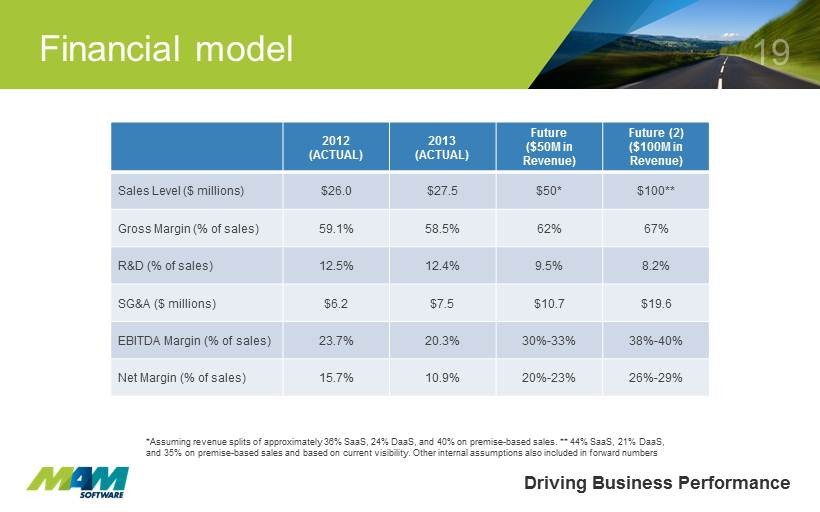

Driving Business Performance Financial model 2012 (ACTUAL) 2013 (ACTUAL) Future ($50M in Revenue) Future (2) ($100M in Revenue) Sales Level ($ millions) $26.0 $27.5 $50* $100** Gross Margin (% of sales) 59.1% 58.5% 62% 67% R&D (% of sales) 12.5% 12.4% 9.5% 8.2% SG&A ($ millions) $6.2 $7.5 $10.7 $19.6 EBITDA Margin (% of sales) 23.7% 20.3% 30% - 33% 38% - 40% Net Margin (% of sales) 15.7% 10.9% 20% - 23% 26% - 29% *Assuming revenue splits of approximately 36% SaaS, 24% DaaS , and 40% on premise - based sales. ** 44% SaaS, 21% DaaS , and 35% on premise - based sales and based on current visibility. Other internal assumptions also included in forward numbers

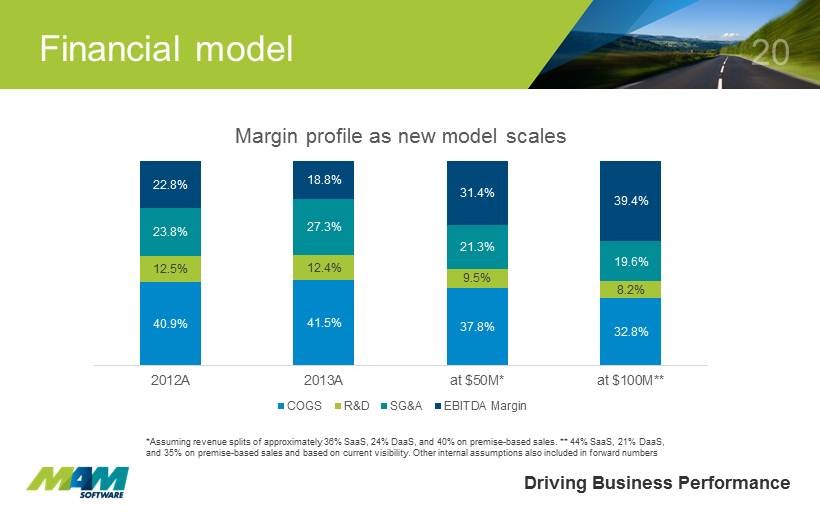

Driving Business Performance Financial model 40.9% 41.5% 37.8% 32.8% 12.5% 12.4% 9.5% 8.2% 23.8% 27.3% 21.3% 19.6% 22.8% 18.8% 31.4% 39.4% 2012A 2013A at $50M* at $100M** Margin profile as new model scales COGS R&D SG&A EBITDA Margin *Assuming revenue splits of approximately 36% SaaS, 24% DaaS , and 40% on premise - based sales. ** 44% SaaS, 21% DaaS , and 35% on premise - based sales and based on current visibility. Other internal assumptions also included in forward numbers

Driving Business Performance Questions Thank you. Any Questions? Michael G. Jamieson President & Chief Executive Officer Email : mikej@mamsoft.co.uk Tel: +44 (0) 1226 352900 Charles F. Trapp Executive Vice President & Chief Financial Officer Email: charlie.trapp@mamsoftwaregroup.com Tel: (610) 336 9045 x 240