Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bank of New York Mellon Corp | d730955d8k.htm |

POWERING GLOBAL INVESTMENTS

May 20, 2014

UBS Global Financial Services Conference 2014

Gerald Hassell

Chairman and Chief Executive Officer

Todd Gibbons

Chief Financial Officer

Exhibit 99.1 |

UBS

Global Financial Services Conference 2014 Cautionary Statement

A number of statements in our presentations, the accompanying slides and the

responses to your questions are “forward-looking

statements.”

These statements relate to, among other things, The Bank of New York Mellon

Corporation’s (the “Corporation”) expectations regarding:

Investment Management’s positioning for growth; the Fed Funds Effective rate and impact of increases on

our business; signs of an abatement in Corporate Trust run-off and the return

of the private housing market and impact on business; the long-term

growth potential of Investment Management; the benefits to having investment management and investment services

under one company; investing in our franchise for organic growth; projected margin

impacts of investment management initiatives; the challenging operating

environment and impact on the investment services business; expense control plans and annual run-rate of

savings;

changes

in

technology

and

staffing;

possible

gains

relating

to

real

estate

sales;

expected

severance

charges;

our

strong

capital position; our ability to perform well in stress scenarios and maintain our

high payout ratios; our 2014 capital plan; the impact of new capital

regulations; the outlook for Corporate Trust, including exploration of options and timing of process; our business model’s

ability

to

drive

shareholder

value

and

our

growth

position;

and

statements

regarding

the

Corporation's

aspirations,

as

well

as

the

Corporation’s overall plans, strategies, goals, objectives, expectations,

estimates, intentions, targets, opportunities and initiatives. These

forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change

based

on

various

important

factors

(some

of

which

are

beyond

the

Corporation’s

control).

Actual results may differ materially from those expressed or implied as a result of

the factors described under “Forward Looking Statements”

and

“Risk

Factors”

in

the

Corporation’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2013

(the

“2013

Annual

Report”),

and

in

other

filings

of

the

Corporation

with

the

Securities

and

Exchange

Commission

(the

“SEC”).

Such

forward-looking statements speak only as of May 20, 2014, and the Corporation

undertakes no obligation to update any forward- looking statement to

reflect events or circumstances after that date or to reflect the occurrence of unanticipated events.

Non-GAAP Measures:

In this presentation we may discuss some non-GAAP adjusted measures in

detailing the Corporation’s performance.

We believe these measures are useful to the investment community in analyzing the

financial results and trends of ongoing operations.

We believe they facilitate comparisons with prior periods and reflect the

principal basis on which our management monitors financial

performance. Additional disclosures relating to non-GAAP adjusted

measures are contained in the Corporation’s reports filed with the SEC,

including the 2013 Annual Report and our Quarterly Report on Form 10-Q for the quarter

ended

March

31,

2014,

available

at

www.bnymellon.com/investorrelations.

1 |

UBS

Global Financial Services Conference 2014 The Investments Company for the

World Expertise Across the Investment Lifecycle

2

See page 25 in Appendix for sources. |

UBS

Global Financial Services Conference 2014 3

The Investments Company for the World

Global Market Leadership

Corporate

Trust

#1 Global corporate trust service provider

Treasury

Services

Top 5 in U.S.D. payments

Global Markets

Client driven trading

Global Collateral

Services

Leveraging the breadth of Investment

Services

* Consolidated revenue and pretax income include the Other segment.

LTM = Last twelve months

Pretax

income

for

Investment

Services

and

Investment

Management

exclude

amortization

of

intangible

assets.

See

Appendix

for

revenue

and

pretax

income

reconciliation.

Rankings reflect BNY Mellon’s size in the markets in which it operates and are

based on internal data as well as BNY Mellon’s knowledge of those markets.

For additional details regarding these rankings, see Appendix and / or pages 17,

20-21 of our Form 10-Q for the quarter ended March 31, 2014, available at

www.bnymellon.com/investorrelations.

Asset Servicing

Largest global custodian ranked by Assets

Under Custody / Administration

Alternative

Investment Services

#3 fund administrator

Broker-Dealer

Services

#1 (U.S.), growing globally

Pershing

#1 clearing firm U.S., U.K., Ireland,

Australia

Depositary

Receipts

#1 in market share (~60%)

Asset

Management

#8 global asset manager

Consolidated

Revenue

of

~$15.1B

and

Pretax

Income

of

~$3.9B*

–

LTM

3/31/14

Investment Management

(46% non-U.S. revenue)

Investment Services

(36% non-U.S. revenue)

Wealth

Management

#7 U.S. wealth manager

Revenue: ~$10.1B

Pretax Income: ~$2.9B

Revenue: ~$4.0B

Pretax Income: ~$1.1B |

UBS

Global Financial Services Conference 2014 Growth

Year-over-Year

Pretax Income

+12%

Net income (16%)

+9% (excluding disallowance of certain tax credits)

2

Investment Management Fees

1

+7%

AUM +$197 billion (+14%)

Net AUM inflows of $100 billion

Investment Services Fees

+4%

AUC/A +$1.3 trillion (+5%)

Estimated new AUC/A wins of $639 billion

Net Interest Revenue

+1%

Mix of interest-earning assets, lower funding costs and higher

interest-earning assets offset by lower yields

Operating Expenses

0%

Lower litigation provision, offset by higher core expenses in

support of fee growth and increasing regulatory / risk / compliance

costs

2013 Highlights

4

2013

Total Shareholder Return

39%

Return on Tangible Common

Equity

2

20%

Share Repurchases

$1B

83% total payout ratio

Repurchased ~3% of shares outstanding

Quarterly Dividend Increase

15%

1

Includes Performance fees.

2

Represents a non-GAAP adjusted measure. See Appendix for reconciliation.

Additional disclosure regarding this measure and other non-GAAP adjusted measures

are

available

in

the

Corporation’s

reports

filed

with

the

SEC,

including

our

2013

Annual

Report,

available

at

www.bnymellon.com/investorrelations. |

UBS

Global Financial Services Conference 2014 2013 --

Solid Pretax Income Growth Despite Factors Unique to BNY Mellon

Pretax Income +12%

5

Money Market

Fee Waivers Pretax Trend

($millions)

Corporate Trust

Pretax Income ¹

($millions)

•

Pretax decline partially

driven by structured

debt run-off

•

Structured debt run-off

expected to abate in the

next 18 to 24 months

Combined pretax margin

dilution of ~260 bps from

2009 to 2013

1 Excludes the impact of intangible amortization and money market fee

waivers. 2 Assumes no change in client behavior.

Rapid Recovery of Fee

Waivers With Rising

Short-Term Interest Rates |

UBS

Global Financial Services Conference 2014 Growth

1Q14 vs. 1Q13

Pretax Income

+12%

Net income +12% (excluding disallowance of certain tax

credits)

2

Investment Management Fees

1

+3%

AUM +$197 billion (+14%)

Net AUM inflows of $87 billion –

LTM

Investment Services Fees

+3%

AUC/A +$1.6 trillion (+6%)

Estimated new AUC/A wins of $595 billion –

LTM

Net Interest Revenue

+1%

Change in mix of interest-earning assets and higher

average deposits, partially offset by lower investment

yields

Operating Expenses

(3%)

Lower litigation provision in 1Q14 as well as an

administrative error and cost of generating tax credits in

1Q13, partially offset by higher compensation,

professional, legal & other purchased service expenses

1Q14 Highlights

6

1Q14

Total Shareholder Return –

LTM

29%

Return on Tangible Common

Equity

2

17%

Share Repurchases

$375MM

~83% total payout ratio

Common Dividend Paid

$174MM

1

Includes Performance fees.

LTM = Last twelve months

2

Represents a non-GAAP adjusted measure. See Appendix for reconciliation.

Additional disclosure regarding this measure and other non-GAAP adjusted measures are available

in

the

Corporation’s

reports

filed

with

the

SEC,

including

our

Form

10-Q

for

the

quarter

ended

March

31,

2014,

available

at

www.bnymellon.com/investorrelations. |

UBS

Global Financial Services Conference 2014 7

Investment

Management

–

Driving

Organic

Growth

Multi-Boutique

Model

&

Wealth

Management

NEWTON

CIS

SIGULER

GUFF*

MELLON

CAPITAL

THE

BOSTON

COMPANY

CENTER-

SQUARE

STANDISH

EACM

HAMON*

INSIGHT

ALCENTRA

BNY

MELLON

WESTERN

FMC*

WALTER

SCOTT

BNY

MELLON

ARX

MERITEN

Highly successful contributor to earnings

Minimal balance sheet usage

Positive to BNY Mellon’s credit ratings and

stress test performance –

diverse revenue

streams and fee-generating business

Corporate brand and excellent credit ratings are

attractive to large, sophisticated investors

Strong long-term growth potential

Highly complementary to Investment Services

business

Investment Management Attributes

* Minority ownership or joint venture. See additional disclosures on pages

26-27 in Appendix. + |

UBS

Global Financial Services Conference 2014 Investment

Management

–

Investing

in

Our

Franchise

8

Projected

Margin Impact (%)

0.2

(0.7)

(1.1)

(0.3)

0.5

1.5+

2.0+

NOTE: Illustrative scenario based on current estimates.

Investing for Organic Growth

Investment Management

Individuals as Investors

•

Intermediaries

Expand and enhance distribution, marketing

and solutions development

•

Direct

Increase Wealth Management presence,

sales, private banking and related services

APAC Strategy

•

Develop local solutions, marketing, sales and operations capabilities

Projected Margin Impact of

Investment Management Initiatives |

UBS Global Financial Services Conference 2014

Investment Services –

Facing Challenging Operating Environment

9

Business Performance Dynamics

Longer Term Trends

Current Operating Environment

•

Solid demand for custody-

and clearing-

related solutions

•

Net new business wins

•

Organic growth initiatives

•

Strong pipelines, particularly relative to

middle-

and back-office solutions

•

Lower short-term interest rates

Pressure on net interest revenue /

margin

Money market fee waivers

(significant for BNY Mellon due to

large money funds business)

•

Lower volatility and trading volumes

•

Reduced structured debt market activity

High margin structured debt

securitizations run-off (Corporate

Trust)

•

Expense pressure from compliance / risk /

control functions and legal / litigation

BNY Mellon-specific (e.g. Tri-Party

Reform) |

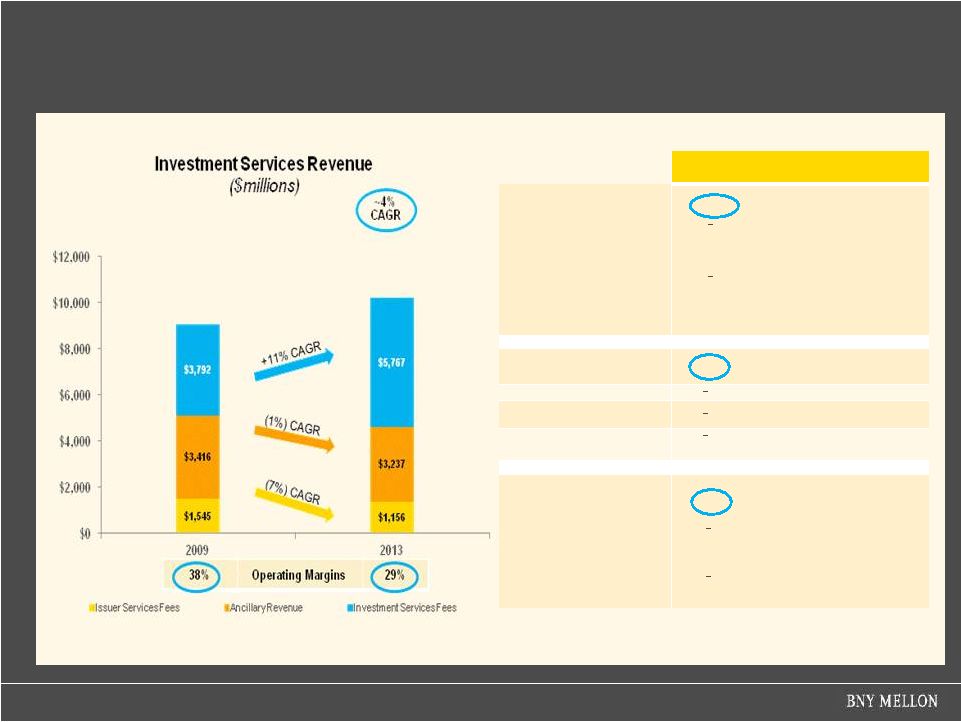

UBS Global Financial Services Conference 2014

Investment Services –

Facing Challenging Operating Environment

10

Performance Drivers

Investment

Services Fees

(adjusted)

•

~11%

CAGR reflects:

Ancillary Revenue:

•

~1% CAGR decline reflects lower:

Net Interest Revenue

Market rates and narrower spreads

Foreign Exchange

Volumes and volatility

Securities Lending

Short-term interest rates and

volumes

Issuer

Services Fees

(ex. money

market

fee waivers)

•

~7%

CAGR decline reflects:

NOTE: Adjusted Investment Services fees excludes Issuer Services, Securities

Lending revenue and the impact of money market fee waivers.

higher core Asset Servicing fees

--

acquisitions, net new business

and higher market values

higher Clearing services –

mutual fund, asset-based fees

and new business

lower corporate trust fees --

run-off in structured debt

securitizations

divestiture of Shareowner

Services

$10,160

$8,753 |

UBS Global Financial Services Conference 2014

Investment Services –

Investing in Our Franchise

11

Investing for Organic Growth

Investment Services

Leveraging Investment Services scale

•

Develop strategic platform solutions; attractive to broader range of

large institutional clients

Global Collateral Services

•

Enhance collateral systems; supporting liquidity, global collateral

management and evolving European custody infrastructure

Foreign Exchange trading platform

•

Enhance electronic platform; increase connectivity to clients on

third-party communication networks

HedgeMark

•

Provider of hedge fund managed account and risk analytics

services

Measuring our Success

•

Investment Services fees growing faster

than AUC/A

•

FX volume growth outpacing industry

•

Continued improvement in Investment

Services coverage ratio*

* Coverage ratio represents Investment

Services fees as a percentage of noninterest

expense. Noninterest expense excludes

amortization of intangible assets, support

agreement charges and litigation expense. |

UBS Global Financial Services Conference 2014

Focused on Expense Control and Operating Leverage

12

Bending the Cost Curve

Technology

•

Getting more out of existing investment

•

Insourcing application development and lowering unit cost

Managing

Real Estate

•

Consolidating our space –

net reduction of ~700,000 square

feet in New York City

Consolidating

Platforms

•

Custody: three platforms to one

•

Fund accounting: five platforms to three

Re-engineering

•

Rationalizing our staffing

•

Simplifying and automating global processes

•

~$80-100MM severance charge in 2Q14; >$100MM

annual

run-rate savings

1

~50% of run-rate savings expected to be achieved in 2H14

1

Total Corporation actual operating expense may increase or decrease due to other

factors. |

UBS Global Financial Services Conference 2014

Provides Financial Flexibility…

Strong Capital Position and Returns

(At 3/31/14)

Estimated Common Equity Tier 1

Ratio, fully phased-in

(Non-GAAP)

1

Standardized

Advanced

11.1%

10.7%

Return on Tangible Common

Equity

(Non-GAAP)

1

17%

13

2011

2012

2013

2014 CCAR Plan

Share Repurchases

2

$873MM or 36MM shares

(3% of shares outstanding)

$1.1B or 51MM shares

(4% of shares outstanding)

$1B or 35MM shares

(3% of shares outstanding)

$1.74B

(4% of shares outstanding)

3

Quarterly Dividend Increase

+44%

+0%

+15%

+13%

Payout Ratio

58%

73%

83%

93%

4

Well Positioned

for Stress Scenarios

Strong Capital Generation Provides Financial Flexibility

1

Represents

a

non-GAAP

adjusted

measure.

See

Appendix

for

a

reconciliation.

Additional

disclosure

regarding

this

measure

and

other

non-GAAP

adjusted

measures

are

available

in

the

Corporation’s

reports

filed

with

the

SEC,

including

our

Form

10-Q

for

the

quarter

ended

March 31,

2014,

available

at

www.bnymellon.com/investorrelations.

SOURCE:

Federal

Reserve

–

Dodd-Frank

Act

Stress

Test

(DFAST)

2014:

Supervisory Stress Test Methodology and Results

See Appendix for additional detail.

Least

Impact

2 Percent of outstanding shares repurchased is based on shares outstanding at the

beginning (January 1) of each year, respectively. 3 Assumes shares

repurchased at closing stock price of $35.27 (on 4/2/14) and total common shares outstanding of 1,142MM at 1/1/14.

4

Ratio

calculated

using

Full

Year

2014

First

Call

consensus

net

income

estimates

as

a

benchmark.

Most

Impact

Impact of DFAST Stress Test

Severely Adverse Scenario

on Basel I Tier 1 Common Ratio |

UBS Global Financial Services Conference 2014

Impact of New Capital Regulations

Business Models Have Different Capital Constraints

14

Spot Capital

Stress Capital

Sample

Institutions

Leverage

Bound Banks

•

Trust Banks

•

Securities Lenders

•

Broker-Dealers

Risk-Based

Capital

Bound Banks

•

Regional Banks

•

Universal Banks

•

Super-Regional

Banks

Potential Actions to Increase

Return on Equity

Increase deposits, lower funding costs

Invest in fee-based businesses that

generate deposits

Reduce risk-weighted assets

Potential Actions to Increase

Return on Equity

Reduce balance sheet

Increase risk-weighted assets

Invest in balance sheet-lite revenue streams

Low yielding assets

Expensive deposits

More yield on same balance sheet |

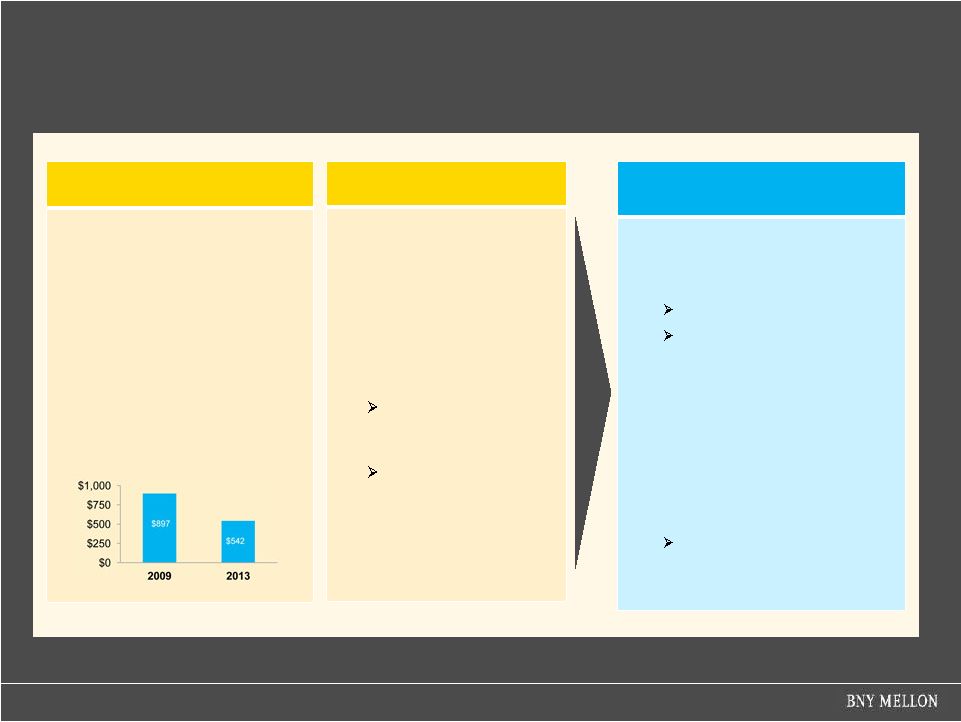

UBS Global Financial Services Conference 2014

Corporate Trust

Near-Term Pressure, Positive Long-Term Outlook, Evaluating Options

15

Near-Term

Profitability / Returns Negatively Impacted by:

•

Money market fee waivers

•

Reduced net interest

revenue (lower deposit

values)

•

Higher capital requirements

given balance sheet usage

Longer-Term

Outlook Positive

•

Structured debt run-off

expected to abate in

next 18-24 months

•

Stronger earnings and

operating margins with

normalized monetary

policy

Increased NIR due to

higher investment

yields on deposits

Reduced money-

market fee waivers

•

Potential recovery in

non-agency mortgage-

backed market

What are we Doing?

•

Exploring whether the business

is worth significantly more to

someone else

If yes, we may pursue sale

If no, we will retain and

continue to invest in the

business and benefit

from the anticipated upside

Includes the potential

redeployment of capital --

investments in our businesses;

dividends; share repurchases

Corporate Trust

Pretax Income

1

($millions)

1 Excludes the impact of intangible amortization and money market fee

waivers. •

The process is expected to

conclude in the third quarter

•

A sale and any subsequent use

of proceeds would be subject to

regulatory clearances |

UBS Global Financial Services Conference 2014

Actively realigning the business model for the new regulatory

environment

Investing in our franchise to drive organic growth

Bending the cost curve and driving positive operating leverage

Generating strong returns on tangible capital, enabling:

Investments in our businesses

Dividend increases

Share repurchases

Driving Shareholder Value

16

Positioned for Growth |

|

APPENDIX

*******

*******

*******

*******

*******

*******

*******

*******

*******

*******

******* |

UBS Global Financial Services Conference 2014

Reconciliation Schedule

Business -

Revenue and Pretax Income

*

Totals

exclude

the

Other

segment.

Pretax

metrics

exclude

the

impact

of

intangible

amortization.

INVESTMENT SERVICES

INVESTMENT MANAGEMENT

TOTAL

INVESTMENT SERVICES

REVENUE

$ MILLION

INVESTMENT MANAGEMENT

TOTAL

2,603

975

778

2Q13

310

PRETAX INCOME

$ MILLION

2,568

949

804

3Q13

260

2,470

1,061

650

4Q13

301

2,477

970

700

1Q14

277

10,118

3,955

2,932

LTM

1Q14

14,073

1,148

4,080

19 |

UBS Global Financial Services Conference 2014

Reconciliation Schedule

Return on Tangible Common Equity and Net Income

Net Income ($millions)

(Ex. Intangible Amortization)

2013

Net income –

continuing operations

$2,047

Intangible amortization –

after-tax

220

M&I, litigation and restructuring

45

Net charge related to the

disallowance of certain tax credits

593

Adjusted Net Income

1

$2,905

($millions)

Average

Tangible

Common

Shareholders’

Equity

2013

Average Common Shareholders’

Equity

$34,832

Average Goodwill

(17,988)

Average Intangible Assets

(4,619)

Deferred Tax Liability –

tax deductible goodwill

1,302

Deferred Tax Liability –

non-tax deductible intangible

assets

1,222

Average Tangible Common Shareholders’

Equity

$14,749

Return

on

Tangible

Common

Equity

1

19.7%

20

1

Represents a non-GAAP adjusted measure. Additional disclosure regarding this and

other non-GAAP adjusted measures is available in the Corporation’s reports filed with the SEC, including our

Annual

Report

for

the

year

ended

December

31,

2013,

available

at

www.bnymellon.com/investorrelations.

Net Income ($millions)

2013

2012

Net income –

continuing

operations

$2,047

$2,427

Net charge related to the

disallowance of certain tax

credits

593

-

Adjusted Net Income

1

$2,640

$2,427

Adjusted Net Income

8.8% |

UBS Global Financial Services Conference 2014

Reconciliation Schedule

Return on Tangible Common Equity and Net Income

Net Income ($millions)

(Ex. Intangible Amortization)

1Q14

Net income –

continuing operations

$661

Intangible amortization –

after-tax

49

M&I, litigation and restructuring

(7)

Adjusted Net Income

1

$703

($millions)

Average Tangible Common Shareholders’

Equity

1Q14

Average

Common

Shareholders’

Equity

$36,289

Average Goodwill

(18,072)

Average Intangible Assets

(4,422)

Deferred Tax Liability –

tax deductible goodwill

1,306

Deferred Tax Liability –

non-tax deductible intangible

assets

1,259

Average

Tangible

Common

Shareholders’

Equity

$16,360

Return on Tangible Common Equity

1

17.4%

21

1

Represents a non-GAAP adjusted measure. Additional disclosure regarding this

and other non-GAAP adjusted measures is available in the Corporation’s reports filed with the

SEC,

including

our

Form

10-Q

for

the

quarter

ended

March

31,

2014,

available

at

www.bnymellon.com/investorrelations.

Net Income ($millions)

1Q14

1Q13

Net income –

continuing

operations

$661

($266)

Net charge related to the

disallowance of certain

tax credits

-

854

Adjusted Net Income

1

$661

$588

Adjusted Net Income

12.4% |

UBS Global Financial Services Conference 2014

Reconciliation Schedule

Estimated Common Equity Tier 1 Ratio, Fully Phased-in

($millions)

Basel III Capital Components and Ratios at March 31, 2014

Fully phased-in

Basel III

Common Equity

$36,424

Goodwill and Intangible Assets

(19,915)

Net Pension Fund Assets

(104)

Equity Method Investments

(426)

Deferred Tax Assets

(18)

Other

(10)

Total Common Equity Tier 1

$15,951

Risk-weighted

Assets

–

Standardized

Approach

$143,882

Risk-weighted

Assets

–

Advanced

Approach

$148,736

Estimated

Basel

III

CET1

ratio

–

Standardized

Approach

(Non-GAAP)

1

11.1%

Estimated

Basel

III

CET1

ratio

–

Advanced

Approach

(Non-GAAP)

1

10.7%

22

1Represents a non-GAAP adjusted measure. Additional disclosure regarding

this measure and other non-GAAP adjusted measures are available in the Corporation’s

reports

filed

with

the

SEC,

including

our

Form

10-Q

for

the

quarter

ended

March

31,

2014,

available

at

www.bnymellon.com/investorrelations.

At March 31, 2014, the estimated fully phased-in Basel III CET1 ratio is based

on our interpretation of the final rules released by the Federal Reserve on July 2, 2013, which

will be gradually phased-in over a multi-year period. Consistent with

historic practice, the risk-based capital ratios do not include the impact of the total consolidated assets

of certain consolidated investment management funds. If the Company is required to

include the net impact of such total consolidated assets, it would decrease the fully

phased-in CET1 ratio under the Standardized Approach by approximately 60 basis

points and the Advanced Approach by approximately 90 basis points at March 31, 2014.

See

additional

disclosures

in

our

Form

10-Q

for

the

quarter

ended

March

31,

2014,

available

at

www.bnymellon.com/investorrelations. |

UBS Global Financial Services Conference 2014

Dodd-Frank Act Stress Test –

Severely Adverse Scenario

Impact on Tier 1 Common Equity Ratio

Bank Holding Company

Ticker/

Identifier

Tier 1 Common Ratio (%)

Stress

Impact

Actual Q3 2013

Ending

Minimum

American Express Company

AXP

12.8

14.0

12.1

0.7

BNY Mellon

BK

14.1

16.1

13.1

1.0

BB&T Corporation

BBT

9.4

8.4

8.4

1.0

SunTrust Banks

STI

9.9

9.0

8.8

1.1

U.S. Bancorp

USB

9.3

8.3

8.2

1.1

PNC Financial Services Group

PNC

10.3

9.0

9.0

1.3

Northern Trust Corporation

NTRS

13.1

11.7

11.7

1.4

Discover Financial Services

DFS

14.7

13.7

13.2

1.5

Fifth Third Bancorp

FITB

9.9

8.4

8.4

1.5

Ally Financial

ALLY

7.9

6.3

6.3

1.6

KeyCorp

KEY

11.2

9.3

9.2

2.0

Regions Financial Corporation

RF

11.0

9.0

8.9

2.1

Comerica Incorporated

CMA

10.7

8.6

8.6

2.1

State Street Corporation

STT

15.5

14.7

13.3

2.2

Wells Fargo & Company

WFC

10.6

8.2

8.2

2.4

M&T Bank Corporation

MTB

9.1

6.2

6.2

2.9

UnionBanCal Corporation

UNB

11.1

8.1

8.1

3.0

BBVA Compass Bancshares

BBVA

11.6

8.5

8.5

3.1

RBS Citizens Financial Group

RBS

13.9

10.7

10.7

3.2

BMO Financial Corp.

BMO

10.8

7.6

7.6

3.2

Huntington Bancshares Incorporated

HBAN

10.9

7.4

7.4

3.5

JPMorgan Chase & Co.

JPM

10.5

6.7

6.3

4.2

Capital One Financial Corporation

COF

12.7

7.8

7.8

4.9

Bank of America Corporation

BAC

11.1

6.0

5.9

5.2

Citigroup

C

12.7

7.2

7.2

5.5

Santander Holdings USA

SC

13.7

7.3

7.3

6.4

Morgan Stanley

MS

12.6

7.6

6.1

6.5

Zions Bancorporation

ZB

10.5

3.6

3.6

6.9

Goldman Sachs Group

GS

14.2

9.2

6.9

7.3

HSBC North America Holdings

HSBC

14.7

6.6

6.6

8.1

SOURCE:

Federal Reserve –

Dodd-Frank Act Stress

Test (DFAST) 2014: Supervisory Stress

Test Methodology and Results

23 |

UBS Global Financial Services Conference 2014

Asset Servicing:

Largest global custodian ranked by

Assets Under Custody and / or Administration

Source: Globalcustody.net, 2013, data as of June 30, 2013 or as

otherwise noted by relevant ranked entity.

Broker-Dealer Services: #1 (U.S.), growing globally

Leading provider of U.S. Government Securities clearance services

Source: Federal Reserve Bank of New York -

Fedwire Securities High

Volume Customer Report, March 2013

Alternative Investment Services: #3 fund administrator

Based on single manager funds and funds of hedge fund assets under

administration combined.

Source:

HFMWeek

20th Biannual AuA Survey -

June 2013

Corporate Trust: #1 Global Corporate Trust Service

Provider

Source:

Thomson Reuters and Dealogic, first quarter, 2013

Depositary Receipts:

#1 in market share (~60%)

Leader in sponsored global depositary receipts programs

Source: BNY Mellon.

Data as of December 31, 2013

Pershing: #1 U.S. clearing firm

Pershing LLC., ranked by number of broker-dealer customers

Source: Investment News, 2012

Treasury Services:

Top 5 in USD payments

Fifth largest participant in CHIPS funds transfer volume

Fifth largest Fedwire payment processor

Source: CHIPS High Volume Customer Report, June 2013 and

Fedwire High Volume Customer Report, June 2013

Asset Management

Eighth largest global asset manager

Source: Pensions & Investments, November 2013

Wealth Management

Seventh largest U.S. wealth manager

Source: Barron’s, Sept 2013

Disclosures

24 |

UBS Global Financial Services Conference 2014

Disclosures

All statistics are global and represent the minimum number of BNY Mellon client

relationships in each category. •

Fortune 500 (as of 12/31/13)

// Fortune

magazine, May 2013; Global 500 data

•

Central Banks (as of June 2013)

// CIA World Factbook, IMF, annual reports

•

Pensions & EB Funds (as of 2/26/14)

// Reprinted with permission of Pensions & Investments, Copyright 2013 //

Metric is Plan Assets, Millions (converted in thousands) •

Endowments (as of 2/26/14)

//

Reprinted

with

permission

of

NACUBO,

Copyright

2013

//

Metric

is

Total

Market

Value

of

Endowments,

in

thousands,

as

of

FYE

2011

// Data source used by P&I Magazine

•

Life & Health Insurance Companies (as of 2/26/14)

// Reprinted with permission of A.M. Best Company, Inc., Copyright 2013 // Metric

is 2012 Total Admitted Assets, in thousands •

QS World Universities Top 50 (of 400 listed) (as of 12/31/2013)

//

www.topuniversities.com/university-rankings/world-university-rankings/2013

25 |

UBS Global Financial Services Conference 2014

Disclosures

BNY

Mellon

Investment

Management

is

one

of

the

world’s

leading

investment

management

organizations

and

one

of

the

top

U.S.

wealth

managers,

encompassing BNY Mellon’s affiliated investment management firms, wealth

management organization and global distribution companies. BNY

Mellon

is

the

corporate

brand

of

The

Bank

of

New

York

Mellon

Corporation

and

may

also

be

used

as

a

generic

term

to

reference

the

Corporation

as

a whole or its various subsidiaries generally. Products and services may be

provided under various brand names and in various countries by subsidiaries,

affiliates and joint ventures of The Bank of New York Mellon Corporation where authorized and regulated as required within each

jurisdiction.

Products or services described herein are provided by BNY Mellon, its subsidiaries,

affiliates or related companies and may be provided in various

countries

by

one

or

more

of

these

companies

where

authorized

and

regulated

as

required

within

each

jurisdiction.

Certain

investment

vehicles

may

only

be

offered

through

regulated

entities

or

licensed

individuals,

such

as

a

bank,

a

broker-dealer

or

an

insurance

company.

However,

this

material

is

not intended, nor should be construed, as an offer or solicitation of services or

products or an endorsement thereof in any jurisdiction or in any

circumstance that is otherwise unlawful or unauthorized. The investment products

and services mentioned here are not insured by the FDIC (or any

other state or federal agency), are not deposits of or guaranteed by any bank, and may lose value.

This

material

is

not

intended

as

an

offer

to

sell

or

a

solicitation

of

an

offer

to

buy

any

security,

and

it

is

not

provided

as

a

sales

or

advertising

communication

and

does

not

constitute

investment

advice.

MBSC

Securities

Corporation,

a

registered

broker-dealer,

FINRA

member

and

wholly

owned subsidiary of BNY Mellon, has entered into agreements to offer securities in

the U.S. on behalf of certain BNY Mellon Investment Management firms.

Securities in Canada are offered through BNY Mellon Asset Management Canada Ltd.,

registered as a Portfolio Manager and Exempt Market Dealer in all provinces

and territories of Canada, and as an Investment Fund Manager and Commodity

Trading Manager in Ontario. The value of investments and the income from them

is not guaranteed and can fall as well as rise due to stock market and currency movements.

When you sell your investment you may get back less than you originally

invested. Rankings include assets managed by BNY Mellon’s investment

boutiques and BNY Mellon Wealth Management. Each ranking may not include the

same mix of firms.

Unless otherwise noted, all references to assets under management (which are

approximate) are as of 3/31/14. Assets under management (AUM) /

overlay under management (OUM) for The Boston Company Asset Management, EACM

Advisors, Mellon Capital Management Corporation and Standish

Mellon

Asset

Management

Company

LLC

includes

assets

managed

by

those

individual

firms’

officers

as

associated

persons,

dual

officers

or employees of The Dreyfus Corporation. In addition, AUM/OUM for the

following firms includes assets managed by them as non-discretionary

investment

manager

for,

or

by

the

individual

firms’

officers

as

dual

officers

or

employees

of,

The

Bank

of

New

York

Mellon:

The

Dreyfus

Corporation

and its BNY Mellon Cash Investment Strategies division, The Boston Company Asset

Management, LLC, CenterSquare Investment Management, Inc, Mellon Capital

Management Corporation, Newton Capital Management Limited (part of The Newton Group) and Standish Mellon Asset

Management Company LLC.

Alcentra

Limited,

Insight

Investment

Management

Limited,

Newton

Capital

Management

Limited,

Newton

Investment

Management

Limited

and

Walter Scott & Partners Limited are authorized and regulated by the Financial

Conduct Authority. The registered address for Alcentra Limited is 10

Gresham

Street,

London,

EC2V7JD,

England.

The

registered

address

for

Insight

Investment

and

Newton

is

BNY

Mellon

Centre,

160

Queen

Victoria

Street, London, EC4V 4LA, England. The registered address for Walter Scott is One

Charlotte Square, Edinburgh, EH2 4DR, Scotland. Assets under

management include assets managed by both Alcentra Ltd. and Alcentra NY, LLC.

BNY

Mellon

Cash

Investment

Strategies

(CIS)

is

a

division

of

The

Dreyfus

Corporation.

26 |

UBS Global Financial Services Conference 2014

Disclosures

BNY Mellon Investment Strategy & Solutions Group (“ISSG”) is part of

The Bank of New York Mellon (“Bank”). In the US, ISSG offers products and

services through the Bank, including investment strategies that are developed by

affiliated BNY Mellon Investment Management advisory firms and managed by

officers of such affiliated firms acting in their capacities as dual officers of the Bank.

BNY Mellon Western FMC, Insight Investment Management Limited and Meriten

Investment Management GmbH do not offer services in the U.S.

This

presentation

does

not

constitute

an

offer

to

sell,

or

a

solicitation

of

an

offer

to

purchase,

any

of

the

firms’

services

or

funds

to

any

U.S.

investor,

or where otherwise unlawful.

BNY Mellon Western Fund Management Company Limited is a joint venture between The

Bank of New York Mellon Corporation (49%) and China- based Western

Securities Company Ltd (51%). The firm does not offer services outside of the People's Republic of China.

BNY Mellon owns 90% of The Boston Company Asset Management, LLC and the remainder

is owned by employees of the firm. BNY Mellon owns a 19.9% minority interest

in The Hamon Investment Group Pte Limited, the parent company of Blackfriars Asset Management

Limited and Hamon Asian Advisors Limited which both offer investment services in

the U.S. Insight

investment's

assets

under

management

are

represented

by

the

value

of

cash

securities

and

other

economic

exposure

managed

for

clients.

Services offered in the U.S., Canada and Australia by Pareto Investment Management

Limited under the Insight Pareto brand. Mellon Capital Management Corporation

AUM includes $6.1 billion in overlay strategies. Meriten Investment

Management GmbH does not offer services in the U.S It was formerly known as WestLB Mellon Asset Management KAG mbH.

The Newton Group (“Newton”) is comprised of the following affiliated

companies: Newton Investment Management Limited, Newton Capital Management

Limited (NCM Ltd) and Newton Capital Management LLC (NCM LLC). NCM LLC personnel are supervised persons of NCM Ltd and

NCM

LLC

does

not

provide

investment

advice,

all

of

which

is

conducted

by

NCM

Ltd.

Only

NCM

LLC

and

NCM

Ltd

offer

services

in

the

U.S.

AUM

for

the Newton Group include assets managed by all of these companies (except NCM LLC).

In addition, AUM for the Firm may include assets managed by the firm's

officers as dual officers or employees of The Bank of New York Mellon and

assets of wrap fee account(s) and high net worth client model(s) for which

Newton Capital Management Limited provides advice in the form of non-discretionary model portfolios.

BNY Mellon owns a 20% interest in Siguler Guff & Company, LP and

certain related entities (including Siguler Guff Advisers, LLC).

Walter Scott’s AUM excludes advisory-only assets of $3.4 billion.

Securities transactions are effected, where required, only through registered

broker-dealers. Pershing is the umbrella name for Pershing LLC

(member FINRA, SIPC and NYSE), Pershing Advisor Solutions (member FINRA and SIPC),

Pershing Prime Services (a service of Pershing LLC), Pershing Limited (UK),

Pershing Securities Limited, Pershing Securities International Limited (Ireland), Pershing (Channel Islands) Limited, Pershing

Securities Canada Limited, Pershing Securities Singapore Private

Limited and Pershing Securities Australia Pty. Ltd. SIPC

protects securities in customer accounts of its members up to $500,000 in

securities (including $250,000 for claims for cash). Explanatory brochure available upon

request or at www.sipc.org. SIPC does not protect against loss due to market

fluctuation. SIPC protection is not the same as, and should not be

confused with, FDIC insurance. Investment products (other than deposit products)

referenced in this brochure (including money market funds) are not insured

by the FDIC (or any other state or federal agency), are not deposits of or guaranteed by BNY Mellon or any bank or non-bank subsidiary

thereof, and are subject to investment risk, including the loss of principal amount

invested. 27 |