Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RADIANT LOGISTICS, INC | d729885d8k.htm |

Exhibit 99.1

| (NYSE-MKT: RLGT) 15th Annual B Riley Investor Conference May 19, 2014 |

| This presentation may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 as amended, and Section 21E of the Securities Exchange Act of 1934. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us and our affiliate companies, that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to such a discrepancy include, but are not limited to, those identified in our other Securities and Exchange Commission filing and other public documents, including our Annual Report on Form 10-K , which can be found on our corporate Web site, www.radiantdelivers.com. |

| Our Mission To build a global transportation and logistics company through organic growth and the strategic acquisition of best-of-breed non- asset based transportation and logistics providers. |

| Overview |

| What We Do Non-Asset based 3rd Party Logistics Provider (3PL) As we don't own the transportation assets, our ongoing CAPEX requirements are minimal Providing customized time critical domestic and int'l transportation and logistics solutions Shipments are generally larger than shipments handled by integrated carriers of primarily small parcels such as UPS or Federal Express From 90+ Company-owned and exclusive independent agent offices across North America One of the largest network footprints in our industry Servicing a diversified account base including manufactures, distributors and retailers No single account is greater than 5% of our revenue Leveraging a proprietary dedicated line haul network Reaching 25 airports with regularly scheduled service Using a network of independent carriers and international agents around the world Resulting in an attractive business model with high level of operating flexibility With relatively no direct or fixed operating costs, we enjoy a scalable business model that allows us to respond quickly in economic downtowns We also enjoy significant operating leverage in an economic recovery |

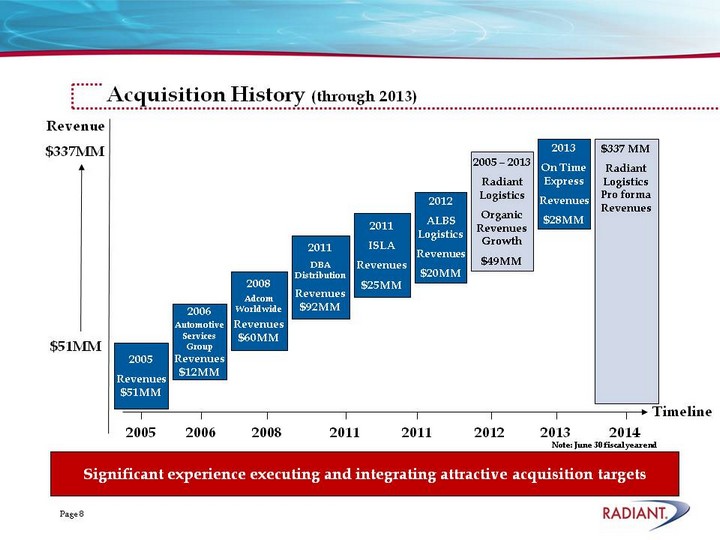

| Background In October of 2005, we launched Radiant Logistics, Inc. as a public company (OTC:RLGT) and in January of 2006, acquired Airgroup Corporation, then generating +/- $50.0M in freight forwarding revenues through a network of 34 exclusive agent offices across North America Through organic expansion we generated run-rate revenues of +/- $100.0M for FYE June 30, 2008 from an expanded 40 location network Acquired additional network brands in September of 2008, with Adcom Worldwide adding another 30 stations and +/- $60.0M in revenues and again in April of 2011, with Distribution By Air, adding another 26 stations and +/- $90.0M in revenues Acquired large individual station locations participating in competitor networks, with Laredo, TX-based, Isla International, Ltd in December of 2011 adding +/- $30.0 million in revenues and providing our gateway to Mexico and again in February of 2012 and with New York-JFK based, ALBS adding $20.0 million in revenues and serving as our strategic international gateway at JFK In January of 2012, we completed our up-listing to the NYSE Marketplace (NYSE MKT: RLGT) In late 2012, we began converting agent stations to company-owned stores , acquiring operating partners Marvir Logistics (Los Angeles, CA) and International Freight Systems (Portland, OR) In October of 2013, we acquired Phoenix, AZ- based On Time Express giving us a proprietary dedicated line-haul network with regularly scheduled service to 25 airports across the country. In March of 2014, we opened company owned operations in Philadelphia and completed transaction with Phoenix Cartage and Airfreight, a large agent station of a competing network. |

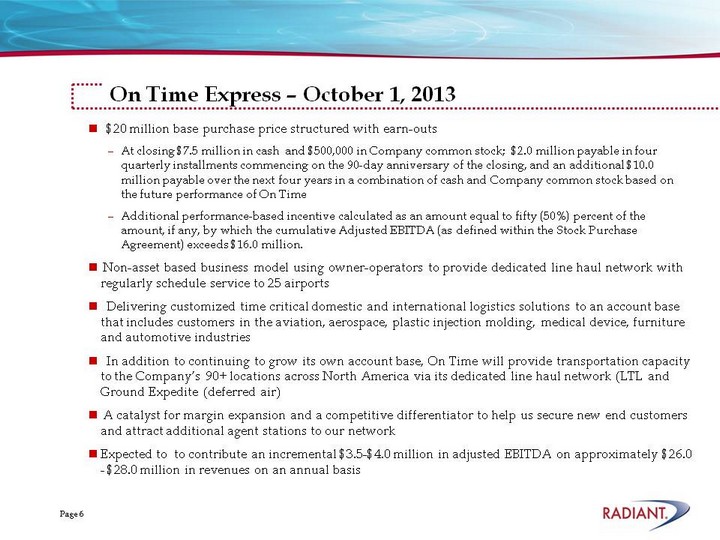

| On Time Express - October 1, 2013 $20 million base purchase price structured with earn-outs At closing $7.5 million in cash and $500,000 in Company common stock; $2.0 million payable in four quarterly installments commencing on the 90-day anniversary of the closing, and an additional $10.0 million payable over the next four years in a combination of cash and Company common stock based on the future performance of On Time Additional performance-based incentive calculated as an amount equal to fifty (50%) percent of the amount, if any, by which the cumulative Adjusted EBITDA (as defined within the Stock Purchase Agreement) exceeds $16.0 million. Non-asset based business model using owner-operators to provide dedicated line haul network with regularly schedule service to 25 airports Delivering customized time critical domestic and international logistics solutions to an account base that includes customers in the aviation, aerospace, plastic injection molding, medical device, furniture and automotive industries In addition to continuing to grow its own account base, On Time will provide transportation capacity to the Company's 90+ locations across North America via its dedicated line haul network (LTL and Ground Expedite (deferred air) A catalyst for margin expansion and a competitive differentiator to help us secure new end customers and attract additional agent stations to our network Expected to to contribute an incremental $3.5-$4.0 million in adjusted EBITDA on approximately $26.0 - $28.0 million in revenues on an annual basis |

| On Time Express - Line Haul Network Dedicated Line Haul Network supporting Radiant's 90+ locations across North America. |

| Acquisition History (through 2013) Significant experience executing and integrating attractive acquisition targets 2008 Adcom Worldwide Revenues $60MM Revenue $337MM $51MM 2005 Revenues $51MM 2006 Automotive Services Group Revenues $12MM 2011 DBA Distribution Revenues $92MM 2012 ALBS Logistics Revenues $20MM Timeline 2005 2006 2012 2008 2011 2011 2011 ISLA Revenues $25MM 2013 2013 On Time Express Revenues $28MM $337 MM Radiant Logistics Pro forma Revenues 2014 2005 - 2013 Radiant Logistics Organic Revenues Growth $49MM Note: June 30 fiscal year end |

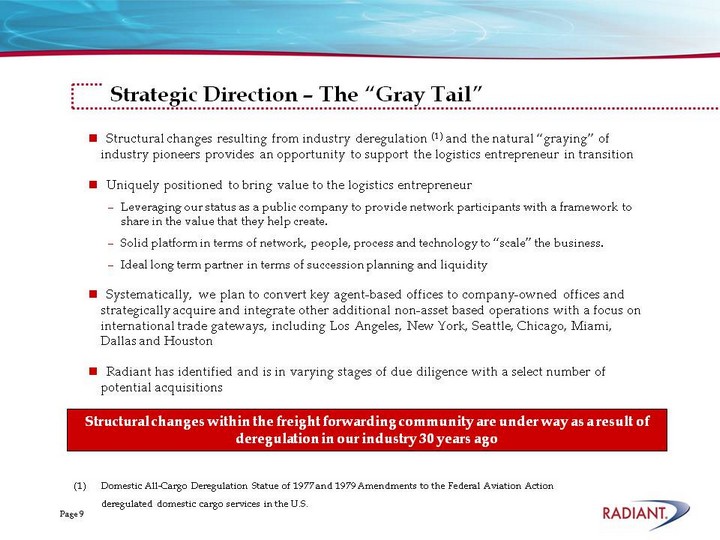

| Strategic Direction - The "Gray Tail" Structural changes resulting from industry deregulation (1) and the natural "graying" of industry pioneers provides an opportunity to support the logistics entrepreneur in transition Uniquely positioned to bring value to the logistics entrepreneur Leveraging our status as a public company to provide network participants with a framework to share in the value that they help create. Solid platform in terms of network, people, process and technology to "scale" the business. Ideal long term partner in terms of succession planning and liquidity Systematically, we plan to convert key agent-based offices to company-owned offices and strategically acquire and integrate other additional non-asset based operations with a focus on international trade gateways, including Los Angeles, New York, Seattle, Chicago, Miami, Dallas and Houston Radiant has identified and is in varying stages of due diligence with a select number of potential acquisitions Structural changes within the freight forwarding community are under way as a result of deregulation in our industry 30 years ago Domestic All-Cargo Deregulation Statue of 1977 and 1979 Amendments to the Federal Aviation Action deregulated domestic cargo services in the U.S. |

| $21.0M in Non-Dilutive Growth Capital - December 2013 Redeemable, Perpetual Preferred Stock; publically traded as RLGT-PA Dividends - 9.75%, quarterly cash pay Maturity - Perpetual Redemption - Non-call 5 years, thereafter at par plus accrued and unpaid dividends Use of Proceeds - Retired 13.5% mezzanine debt and substantially reduced amounts outstanding under the Company's $30.0M senior credit facility with Bank of America. The Company has meaningful access to low-cost capital via its senior facility with Bank of America to continue to execute its growth strategy. |

| The Network |

| The Radiant Network Brands |

| Dense Geographical Footprint - Over 90 Stations in the US 13 Company owned stations in major port and logistics centers 79 Agent owned stations in 27 states Radiant's growing critical mass and market reputation makes it increasingly attractive to new agents looking to join its network Conversion of agent locations to company owned stores (through agent buyouts) represents high quality growth opportunity Company Owned Agency Owned |

| Highly Diversified Customer Base Industries Served Aviation & Automotive Military & Government Manufacturing & Consumer Goods Industrial & Farm Medical, Healthcare & Pharmaceuticals Electronics & High Tech Oil & Gas/Energy Trade Shows, Events & Advertising Retail Radiant serves over 3,000 individual customers No single agency station accounts for more than 5% of net revenues Top 5 agency stations account for less than 20% of net revenues Top 10 customers account for only 20% of net revenues Best in class customer service |

| Network Attributes Net Revenues by Geography Net Revenues by Location Ownership Strong margin expansion potential in company-owned locations through agent conversions and reaching critical mass in international markets |

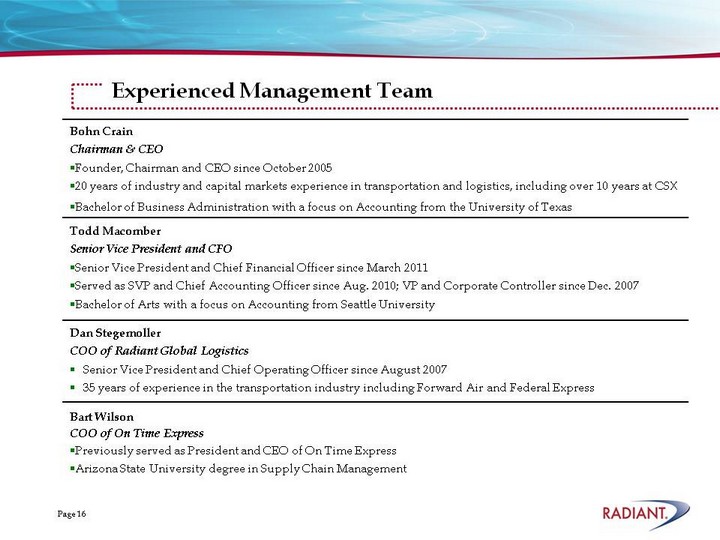

| Experienced Management Team Bohn Crain Chairman & CEO Founder, Chairman and CEO since October 2005 20 years of industry and capital markets experience in transportation and logistics, including over 10 years at CSX Bachelor of Business Administration with a focus on Accounting from the University of Texas Todd Macomber Senior Vice President and CFO Senior Vice President and Chief Financial Officer since March 2011 Served as SVP and Chief Accounting Officer since Aug. 2010; VP and Corporate Controller since Dec. 2007 Bachelor of Arts with a focus on Accounting from Seattle University Dan Stegemoller COO of Radiant Global Logistics Senior Vice President and Chief Operating Officer since August 2007 35 years of experience in the transportation industry including Forward Air and Federal Express Bart Wilson COO of On Time Express Previously served as President and CEO of On Time Express Arizona State University degree in Supply Chain Management |

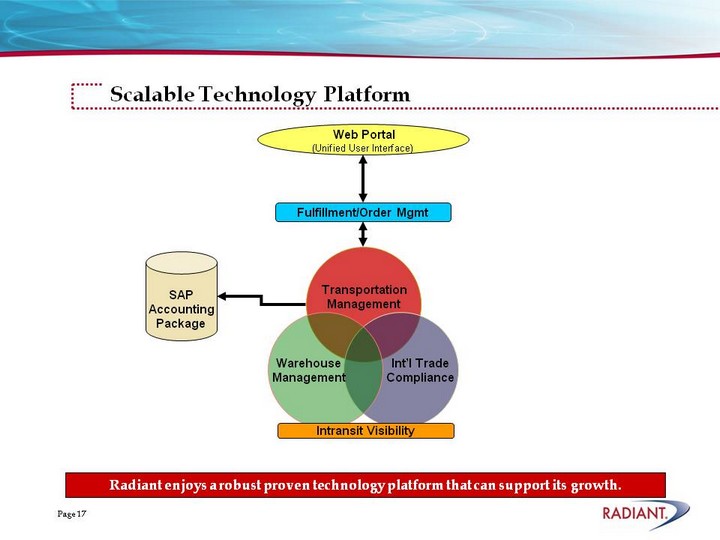

| Scalable Technology Platform Scalable Technology Platform Scalable Technology Platform Scalable Technology Platform Web Portal (Unified User Interface) SAP Accounting Package Radiant enjoys a robust proven technology platform that can support its growth. |

| Financial Highlights |

| Consistent Revenue and Earnings Growth Radiant Logistics business model drives strong earnings and Adjusted EBITDA growth Adjusted EBITDA2 CAGR - 47% Revenue CAGR - 42% Note: June 30 fiscal year end Pro forma for the acquisition of On Time Express See "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Company's public filings for a reconciliation of EBITDA and Adjusted EBITDA to net income. 1 2 2 |

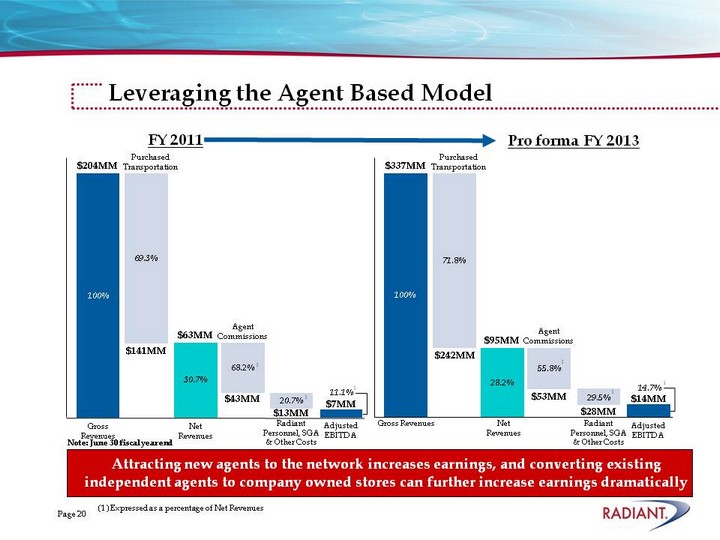

| Agent Commissions $43MM Leveraging the Agent Based Model Attracting new agents to the network increases earnings, and converting existing independent agents to company owned stores can further increase earnings dramatically $141MM Purchased Transportation $63MM Net Revenues $13MM Radiant Personnel, SGA & Other Costs Gross Revenues $204MM FY 2011 Agent Commissions $53MM $242MM Purchased Transportation $95MM $28MM $337MM Pro forma FY 2013 $7MM Adjusted EBITDA Radiant Personnel, SGA & Other Costs $14MM Adjusted EBITDA Net Revenues Gross Revenues 69.3% 30.7% 68.2% 20.7% 11.1% 71.8% 28.2% 55.8% 29.5% 14.7% 100% 100% (1) Expressed as a percentage of Net Revenues 1 1 1 1 1 1 Note: June 30 fiscal year end |

| The Benefits of Acquiring Agent Forwarders Radiant's network of agents provides a pool of attractive acquisition opportunities Agent Financials $20MM $242MM Purchased Transportation $95MM Radiant Net Revenues $28MM Radiant Personnel, SGA & Other Costs Illustrative Example Radiant Revenues $337MM $53MM Commissions Revenue $53MM Agent Commissions $40MM SG&A $13MM Agent Profit Benefit of the acquisition of independent agents: Target well known to Radiant through longstanding relationship Purchase multiple typically very accretive Significant percentage of purchase price structured as an earn-out Radiant captures agent profits and eliminates duplicative overhead Retiring agent realizes a liquidity event Duplicative back office costs $14MM Adjusted EBITDA |

| Adjusted EBITDA |

| Adjusted Net Income and Adjusted EPS |

| Understanding our Debt |

| Valuing Our Stock - EBITDA (1) Excludes contingent purchase on acquisitions. (1) |

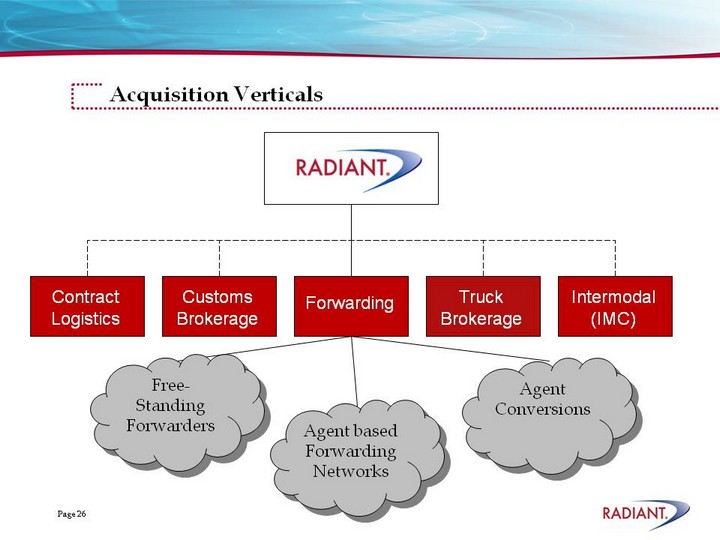

| Contract Logistics Customs Brokerage Truck Brokerage Intermodal (IMC) Forwarding Agent based Forwarding Networks Agent Conversions Acquisition Verticals Free- Standing Forwarders |

| Leveraging the Platform to Create Shareholder Value (1) Excludes contingent purchase on acquisitions. (1) |

| Radiant Logistics - Investment Highlights Over 90 Stations in the USA: 13 Company owned locations 79 Agent owned locations Dense Geographical Footprint Radiant serves over 3,000 individual customers No single agency station accounts for more than 5% of net revenues Best in class customer service Highly Diversified Customer Base Radiant continues to be led by its founder and CEO, Bohn Crain Senior management team has over 50 years of combined logistics experience Significant insider ownership of ~30% Experienced Management Team and Professional Staff +/- $16.0 Million in run-rate EBITDA Very low leverage with access to low cost capital to fund its growth strategy Prudent Financial Management Completed 9 acquisitions since January 2006 Demonstrated ability to utilize an acquisition strategy for growth Proven M&A Capability Low capital intensity offers strong cash flow characteristics and significant flexibility in responding to, changing industries, and economic conditions Non-asset based Transportation and Logistics Service Provider It's the Network that Delivers! (r) |

| THANK YOU It's the Network that Delivers! (r) |