Attached files

| file | filename |

|---|---|

| 8-K - 8-K - People's United Financial, Inc. | d730530d8k.htm |

Investor Presentation

May 2014

Investor Contact:

Peter Goulding, CFA

203-338-6799

peter.goulding@peoples.com

Exhibit 99.1 |

1

Forward-Looking Statement

Certain statements contained in this release are forward-looking in

nature. These include all statements about People's United

Financial's plans, objectives, expectations and other statements that

are not historical facts, and usually use words such as

"expect," "anticipate," "believe," "should" and

similar expressions. Such statements represent management's current

beliefs, based upon information available at the time the

statements are made, with regard to the matters addressed. All forward-

looking statements are subject to risks and uncertainties that could

cause People's United Financial's actual results or financial

condition to differ materially from those expressed in or implied by such

statements. Factors of particular importance to People’s United

Financial include, but are not limited to: (1) changes in

general, national or regional economic conditions; (2) changes in interest rates; (3)

changes in loan default and charge-off rates; (4) changes in

deposit levels; (5) changes in levels of income and expense in

non-interest income and expense related activities; (6) residential mortgage

and secondary market activity; (7) changes in accounting and regulatory

guidance applicable to banks; (8) price levels and conditions in

the public securities markets generally; (9) competition and its effect

on pricing, spending, third-party relationships and revenues; (10)

the successful integration of acquisitions; and (11) changes in

regulation resulting from or relating to financial reform legislation.

People's United Financial does not undertake any obligation to update

or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. |

2

Table of Contents

1.

Strategic Position

2.

Financial Performance

3.

Summary

4.

Appendix |

3

Strategic Position |

4

Corporate Overview

Snapshot as of March 31, 2014

People’s United Financial, Inc.

NASDAQ (PBCT)

Headquarters:

Bridgeport, CT

Chief Executive Officer:

Jack Barnes

Chief Financial Officer:

(1)

Kirk Walters

Market Capitalization (5/12/14):

$4.5 billion

Assets:

$33.1 billion

Loans:

$24.6 billion

Deposits:

$23.7 billion

Branches:

406

In-store Branches:

(2)

140

ATMs:

622

Standalone ATMs:

(3)

106

Founded:

1842

Notes:

1.

On April 16, 2014 People’s United announced the transition of CFO Kirk Walters for family

reasons. Walters will continue as CFO of People’s United Financial, Inc., the bank’s

holding company, and former Treasurer David Rosato has been appointed CFO of People’s

United Bank. Walters will continue to serve as CFO of People’s United Financial, Inc.

through December 31, 2014, when Rosato is expected to assume that position

2.

Exclusive relationship with Stop & Shop, a subsidiary of Ahold (ENXTAM:AH) 3.

Includes 20 ATMs in Stop & Shop locations where a branch is not present

|

5

Compelling Investment Opportunity

Leading

market

position

in

the

best

commercial

banking

market

in

the

US

Significant

growth

runway

within

existing

markets

–

expanding

in

two

of

the

largest MSAs in the US (New York City, #1, Boston, #10)

Dividend yield in excess of 4.5%

Ability

to

maintain

pristine

credit

quality

–

no

credit

“events”

Improving profitability

Strong liquidity

Continued capital deployment via organic growth and dividends

|

6

Retail & Business Banking Franchise

Distribution

400+ branches over 6 states

•

~33% of branches are in-store

600+ ATMs

Online & mobile banking

Call center operations located in Bridgeport,

CT and Burlington, VT

Scale

5 in deposit market share in New England *

Customer base

Approximately 850,000 commercial, business

banking, consumer and wealth management

relationships

* Source: SNL Financial

th |

7

Strategic Focus of Deposit Franchise

Growth

Core customers and deposits

Multiple product households

Leverage employee expertise to drive sales

Brand execution

Employee expertise

Superior customer experience

In-store supermarket strategy

Leveraging the Citizen’s branch acquisition

Navigating a low rate environment

Balancing growth, retention and cost of funds

Constant evaluation of branch-level profitability

•

Consolidated 35 branches since the beginning of 2011, or ~9% of our

franchise |

8

Strong Deposit Market Positions

Connecticut

Massachusetts

Vermont

New York

New Hampshire

Maine

#1 in Fairfield County, CT, 64 branches, $6.3BN deposits, 18.2% market share

Source: SNL Financial; FDIC data as of June 30, 2013; excludes trust institutions

Notes: PBCT branch count updated as of March 31, 2014

Branches

$BN

%

1

B of A

148

25.9

24.5

2

Webster

126

12.8

12.1

3

People's United

162

11.3

10.7

4

Wells Fargo

75

7.8

7.4

5

TD Bank

76

6.1

5.8

6

JPM Chase

54

4.8

4.5

7

First Niagara

85

4.3

4.1

8

Citi

21

3.0

2.9

9

Liberty

49

2.9

2.7

10

RBS

46

2.5

2.4

Branches

$BN

%

1

B of A

244

57.5

19.9

2

RBS

252

29.0

10.1

3

Santander

225

18.1

6.3

4

TD Bank

152

11.5

4.0

5

Eastern Bank

96

6.9

2.4

6

Independent Bank

83

4.9

1.7

7

Middlesex

30

3.5

1.2

8

People's United

54

3.1

1.1

9

Boston Private

11

3.0

1.0

10

First Republic

4

3.0

1.0

Branches

$BN

%

1

People's United

42

2.6

22.5

2

TD Bank

35

2.6

22.0

3

Merchants

32

1.3

10.8

4

RBS

21

0.8

7.0

5

KeyCorp

13

0.7

6.1

6

Northfield

13

0.5

4.4

7

Community

14

0.4

3.8

8

Union

12

0.4

3.5

9

Passumpsic

6

0.3

2.8

10

Berkshire Hills

7

0.3

2.7

Branches

$BN

%

1

RBS

74

6.7

23.9

2

TD Bank

73

5.8

20.5

3

B of A

27

4.6

16.3

4

People's United

28

1.3

4.6

5

NH Mutual

18

1.0

3.7

6

BNH

22

0.9

3.2

7

Santander

20

0.9

3.0

8

NH Thrift

21

0.8

2.8

9

Mascoma

19

0.7

2.6

10

Eastern

7

0.7

2.6

Branches

$BN

%

1

TD Bank

52

18.1

48.3

2

KeyCorp

54

2.5

6.6

3

Bangor Bancorp

60

2.2

5.8

4

Camden National

44

1.8

4.9

5

B of A

19

1.4

3.8

6

First Bancorp

16

1.0

2.7

7

Machias

17

0.9

2.3

8

People's United

26

0.9

2.3

9

Bar Harbor

16

0.9

2.3

10

Norway

22

0.8

2.1

Branches

$BN

%

1

JPM Chase

803

424.5

37.5

2

Citi

269

76.1

6.7

3

B of A

318

60.6

5.4

4

HSBC

157

59.0

5.2

5

Capital One

272

41.2

3.6

6

M&T

297

35.5

3.1

7

TD Bank

236

24.2

2.1

8

KeyCorp

254

19.6

1.7

9

First Niagara

203

17.2

1.5

10

Signature

28

15.3

1.4

28

People's United

94

2.7

0.2 |

9

Large and Attractive Markets

NYC-Northern NJ-PA

Population: 19.7MM

Median HH Income: $62,660

Businesses: 810,883

Population Density (#/sq miles): 2,383

Unemployment Rate (%): 7.3

$100K+ Households (%): 32.4

Boston, MA

Population: 4.6MM

Median HH Income: $68,376

Businesses: 203,770

Population Density (#/sq miles): 1,321

Unemployment Rate (%): 5.7

$100K+ Households (%): 34.8

Hartford, CT

Population: 1.2MM

Median HH Income: $62,802

Businesses: 52,315

Population Density (#/sq miles): 804

Unemployment Rate (%): 7.3

$100K+ Households (%): 30.5

Bridgeport-Stamford, CT

Population: 926,000

Median HH Income: $78,297

Businesses: 49,392

Population Density (#/sq miles): 1,482

Unemployment Rate (%): 6.8

$100K+ Households (%): 40.1

New Haven, CT

Population: 863,000

Median HH Income: $57,071

Businesses: 36,800

Population Density (#/sq miles): 1,428

Unemployment Rate (%): 8.1

$100K+ Households (%): 28.2

Burlington, VT

Population: 215,000

Median HH Income: $59,264

Businesses: 10,846

Population Density (#/sq miles): 172

Unemployment Rate (%): 3.5

$100K+ Households (%): 25.2

Notes: The current national unemployment rate is 6.3%

The current national population density is 89 (#/sq miles)

Source: SNL Financial, US Census data

The population densities of NYC, Boston, Bridgeport and New Haven MSAs are each

over ten times the national average |

10

Strong Market Demographic Profile

Source: SNL Financial, US Census data

Weighted Average Median Household Income

$68,013

$56,908

$51,314

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

PBCT

Peer Median

US |

11

Attractive Market Demographics

Source: SNL Financial; FDIC data as of June 30, 2013

73% of People’s franchise deposits are in its top 5 MSAs, which are some of the most

densely populated and wealthy markets in the US

1.

Excludes deposits from trust institutions and branches with over $750MM deposits; excludes branches

and deposits located outside each

MSA 2.

Rank weighted by percentage of franchise deposits

People's

Franchise

Metrics

¹

MSA Rank out of 917 Nationwide MSAs

Market Size

Population

Median

% Households

Total Deposits

Market

% Deposit

Number of

Deposits

% of

Density

Household

with $200k+

People's United Top 5 MSAs

($MM)

Rank

Market Share

Branches

($MM)

Franchise

(# / sq. mile)

Income

Income

Bridgeport-Stamford-Norwalk, CT

$33,849

1

18.4%

65

$6,241

28.9

6

7

1

Boston-Cambridge-Newton, MA-NH

124,602

11

2.2

52

2,772

12.6

9

16

10

New York-Newark-Jersey City, NY-NJ-PA

594,328

31

0.5

97

2,716

12.4

2

33

8

Hartford-West Hartford-East Hartford, CT

26,227

4

8.1

45

2,119

9.6

20

32

28

New Haven-Milford, CT

17,868

4

11.4

34

2,032

9.2

7

70

41

Top 5 MSAs

$796,873

–

2.0%

293

$15,879

72.7

–

–

–

Weighted

Average

Rank

²

–

–

–

–

–

8

24

12

Rank / Nationwide MSAs (917 MSAs)

–

–

–

–

–

0.9%

2.7%

1.4% |

12

Connecticut

In-store

Versus

Traditional

Branch

Business

(Last

Twelve

Months

Through

3/31/14)

In-store Versus Traditional Branches

Connecticut

On average, in-store locations are open 37% more hours per week than traditional

branches (56 hours vs. 41 hours) but are 30% less expensive to operate

Partnership allows us to leverage our brand with the ~1.8 million shoppers who

visit Connecticut Stop & Shop stores every week

In-store locations operate under the same business model as traditional branches

and sell all the Bank’s products and services

Mortgages, Home Equity Loans, Business Loans and Investments*

Connecticut in-store branches accounted for a significant portion of the new

branch business booked in the market

58%

56%

43%

30%

32%

28%

29%

42%

44%

57%

70%

68%

72%

71%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Consumer

Checking Accounts

Opened

Savings Accounts

Opened

Business Checking

Accounts Opened

Home Equity Loan

Originations

Mortgage Loan

Originations

Business Banking

Loan Originations

Investment Sales

In-store Branches

Traditional Branches

* Sold by employees who are also licensed representatives of our brokerage affiliate |

Financial Performance |

14

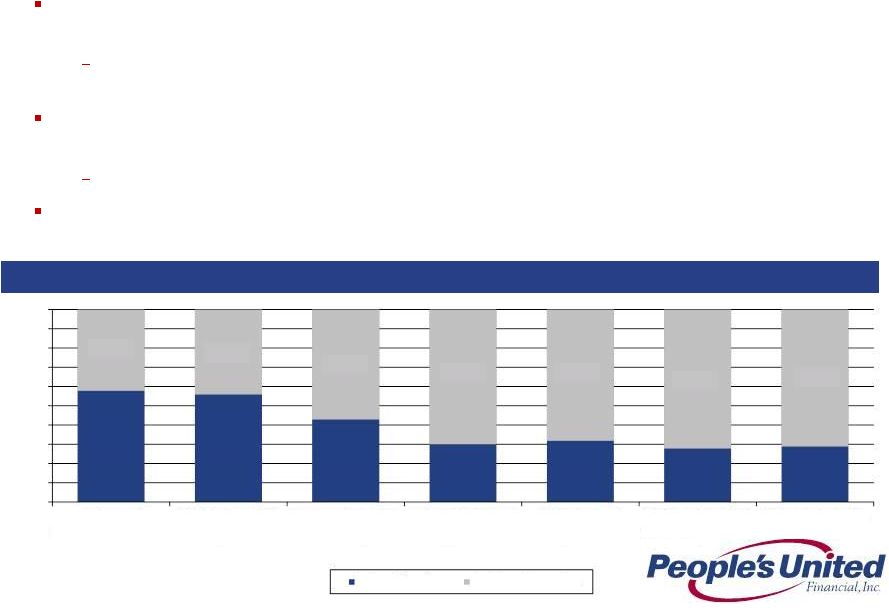

Consistent Loan Growth

Since the end of 2010, People’s United is one of only six banks within the top 50 by

assets that have grown loans in each quarter

¹

Source:

SNL Financial. Excludes trust banks. Statements based on Total Gross Loans and Finance Leases, as

reported, net of unearned discounts and gross of loss reserves. Does not include

accrued interest on loans

Notes:

1

Top 50 banks by assets as of most recent year end; includes People’s United, First Niagara, First

Republic, Signature, UMB and Investors

2

Reflects completion of Danvers Bancorp acquisition in 2Q 2011

3

Based on 48 of the top 50 banks reporting

Quarterly Loan Growth Since 1Q 2011

PBCT Median = 1.52%

Top 50 Median = 1.28

1.23%

0.64%

1.04%

1.97%

0.78%

1.86%

1.38%

1.97%

0.35%

1.28%

0.90%

1.51%

1.33%

0.75%

1.04%

1.52%

0.21%

0.57%

2.20%

3.38%

1.82%

3.25%

1.40%

4.98%

0.95%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

2011Q1

2011Q2

2011Q3

2011Q4

2012Q1

2012Q2

2012Q3

2012Q4

2013Q1

2013Q2

2013Q3

2013Q4

2014Q1

13.86%

2

3

Top 50 Median

PBCT |

15

Revenue Opportunities

Continue to deepen our presence in heritage markets such as Connecticut and

Vermont

Substantial growth prospects in larger markets such as New York metro and

greater Boston

New York:

•

18 commercial relationship managers up from zero in 1Q 2010

•

94 branches up from 5 in 1Q 2010; 57 branches, or ~60%, are in-store locations

•

Total deposit growth of $2.7BN, or 77% compound annual growth, since 1Q 2010

Massachusetts:

•

33 commercial relationship managers up from 14 since 2010

•

54 branches up from 19 in 1Q 2010

•

Total deposit growth of $2.3BN, or 37% compound annual growth, since 1Q 2010

Notes:

1

Data as of March 31, 2014

1

1 |

16

Under-represented asset classes ramping up

Bolstered commercial banking presence in greater Boston and Long Island

Building mid-corporate and government banking productivity

New

York

Commercial

Real

Estate

gaining

traction

as

evidenced

by

strong

growth

Increased Private Banking activity with initial focus on CT, metro New York and

greater Boston Steady asset-based lending and mortgage warehouse lending

progress Enhancing wealth management offering

Added seasoned wealth management team in Hartford area

Proprietary asset allocation and risk management strategies are implemented both

internally and with a suite of external managers who represent our "best

in class" recommendations •

Unified

Managed

Account

technology

allows

us

to

“rent”

intellectual

capital

–

no

customer

funds

leave

the

bank

Increasing momentum in other fee income businesses with a focus on

cross-sell Delivering interest rate swaps and foreign exchange products

to corporate customers Expanding international trade finance with the recent

hire of a senior executive Growing cash management, merchant and payroll

services Revenue Opportunities

Multiple Levers for Growth |

17

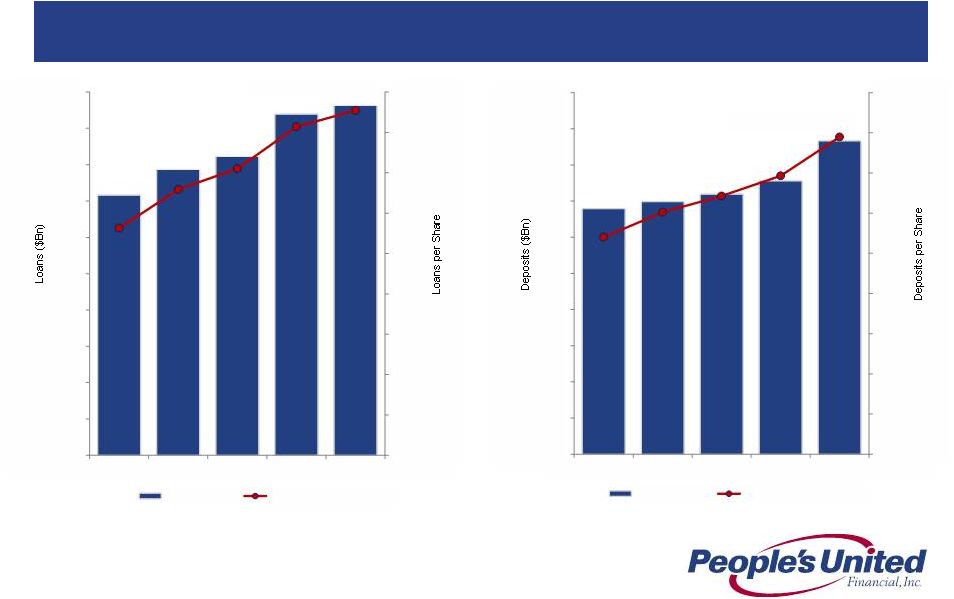

Growing Future Earnings Per Share

Loans and Deposits per Share

$82.73

$40

$45

$50

$55

$60

$65

$70

$75

$80

$85

$15

$16

$17

$18

$19

$20

$21

$22

$23

$24

$25

1Q13

2Q13

3Q13

4Q13

1Q14

Loans ($BN)

Loans per Share

$79.49

$40

$45

$50

$55

$60

$65

$70

$75

$80

$85

$15

$16

$17

$18

$19

$20

$21

$22

$23

$24

$25

1Q13

2Q13

3Q13

4Q13

1Q14

Deposits ($BN)

Deposits per Share

We have made substantial progress over the past year, growing loans and deposits at

compound annual growth rates of 21% and 19%, respectively

|

18

EMOC has been fully operational since November 2011

Three person committee comprised of the CFO of the Bank, Chief Administrative

Officer and Chief HR Officer

EMOC oversees PBCT’s non-interest expense management, implements strategies

to ensure attainment of expense management targets and oversees revenue

initiatives that require expenditures

Provides a horizontal view of the organization

Expense Management Units (EMUs) established to facilitate EMOC functions

Defined EMUs include:

•

Technology

•

Operations

•

Real Estate Services

Spending requests above $25,000 are submitted by EMU owners for approval

Staffing models, staffing replacements and additions for mid-level positions and

above require approval by the Committee

Introduction to EMOC

Expense Management Oversight Committee (EMOC)

•

Employment/Benefits

•

Marketing

•

Regulatory/Institutional

•

Depreciation/Equipment

•

Decentralized

•

Intangible Amortization |

19

Expense Progress

Estimated Cost Savings Analysis

Source:

SNL Financial

Notes:

“Pro Forma / Actual”

represents PBCT operating non-interest expense and the actual expenses at the acquired

institutions Acquisition target costs fall away as the acquisitions are completed

“Without Expense Initiatives”

represents PBCT operating non-interest expense and the actual expenses at the acquired

institutions in 4Q09, and then applies the peer median expense growth rate in each subsequent

quarter Our 1Q 2014 operating expense base of $212MM reflects $22MM (~$90MM annualized)

savings from successfully-executed expense initiatives

212

234

200

210

220

230

240

250

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Operating Noninterest Expense ($MM)

Pro Forma / Actual

Without Expense Initiatives

$22MM

Cost

Savings |

20 234

212

7

15

$0

$50

$100

$150

$200

$250

Without Expense

Initiatives

Announced Acquisition

Savings

Other Initiatives

Pro Forma / Actual

Operating Noninterest Expense ($MM)

Expense Progress

Estimated Cost Savings Analysis

The $22MM in quarterly cost reductions is attributable to efforts related to

acquisition cost savings and other initiatives

Source: SNL Financial

Notes:

“Pro Forma / Actual” represents PBCT operating non-interest expense and the actual

expenses at the acquired institutions Acquisition target costs fall away as the

acquisitions are completed “Without Expense Initiatives” represents PBCT operating non-interest expense and

the actual expenses at the acquired institutions in 4Q09, and then applies the peer median

expense growth rate in each subsequent quarter |

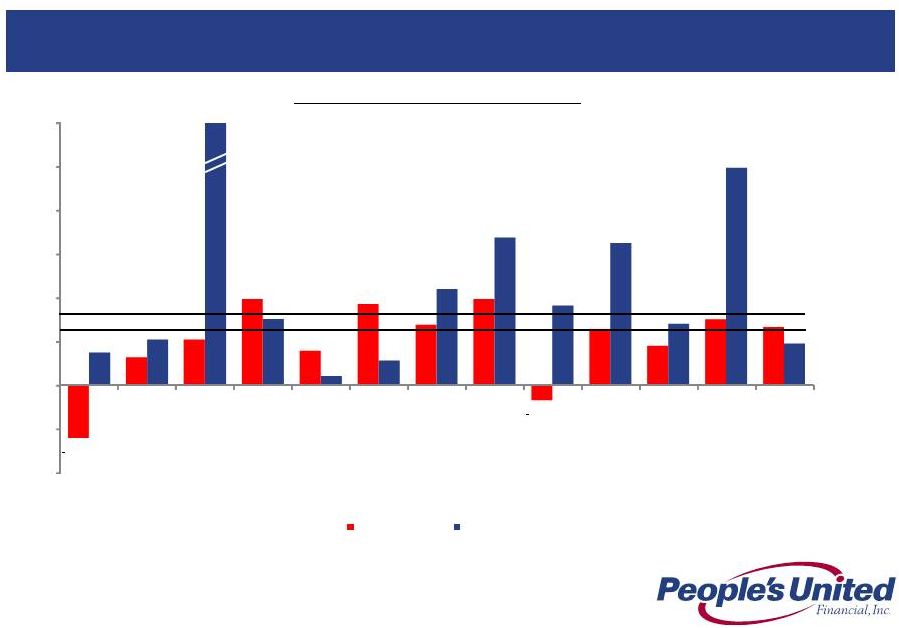

21

Average Annual Net Charge Offs / Average Loans (%)

Peer Group Comparison, 2009-2013

Conservative underwriting is a hallmark of this institution

Median, excluding PBCT = 0.95%

Source: SNL Financial

0.28

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

PBCT |

22

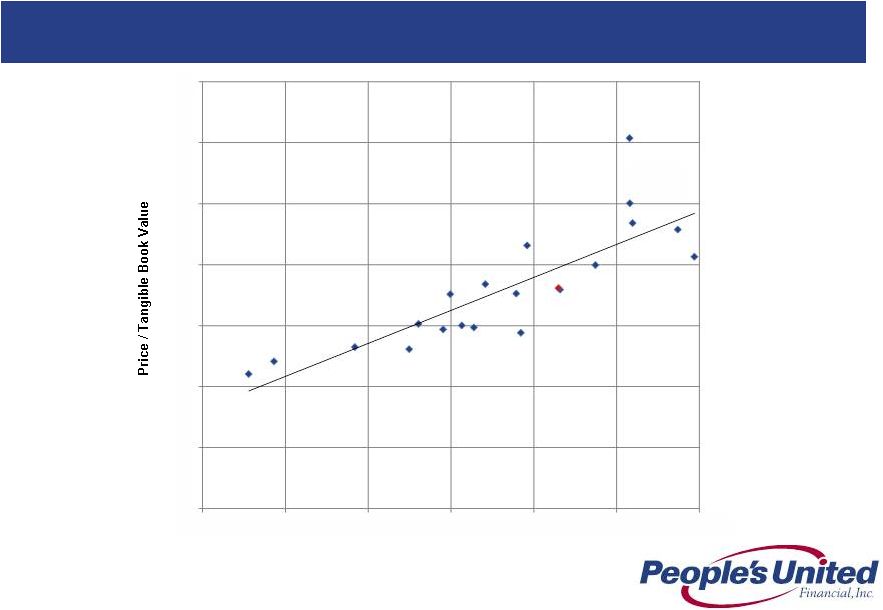

P/TBV vs. ROATE

Peer Group Regression Analysis

Source: SNL Financial

Note: Analysis utilizes SNL 3 Year Betas, as of May 12, 2014

R²

= 0.69

0

50

100

150

200

250

300

350

-5.0%

-3.0%

-1.0%

1.0%

3.0%

5.0%

7.0%

2015E Return on Average Tangible Equity Less Cost of Equity

PBCT

Improved profitability, predictability of earnings and a strong dividend will create

additional shareholder value |

Summary |

24

Summary

Sustainable Competitive Advantage

Premium brand built over 170 years

High quality Northeast footprint characterized by wealth, density and

commercial activity

Strong leadership team

Solid net interest margin

Superior asset quality

Focus on relationship-based banking

Growing

loans

and

deposits

within

footprint

-

in

two

of

the

largest

MSAs

in

the country (New York City, #1 and Boston, #10)

Improving profitability

Consistently returning capital to shareholders

Strong capital base |

Appendix |

26

Net Interest Income (Fully Taxable Equivalent)

Linked Quarter Change

(in $ millions)

229.5

231.8

(3.4)

(3.1)

(0.3)

2.4

6.7

4Q 2013

Calendar

Days

Acquired

Loans

Borrowings

Originated

Loans

Investments

1Q 2014 |

27

Net Interest Margin (%)

Linked Quarter Change

3.24%

(0.05%)

(0.05%)

(0.01%)

0.03%

0.01%

3.17%

4Q 2013

Calendar

Days

New Loan

Volume

Loan

Mix

Investments

Deposits

1Q 2014 |

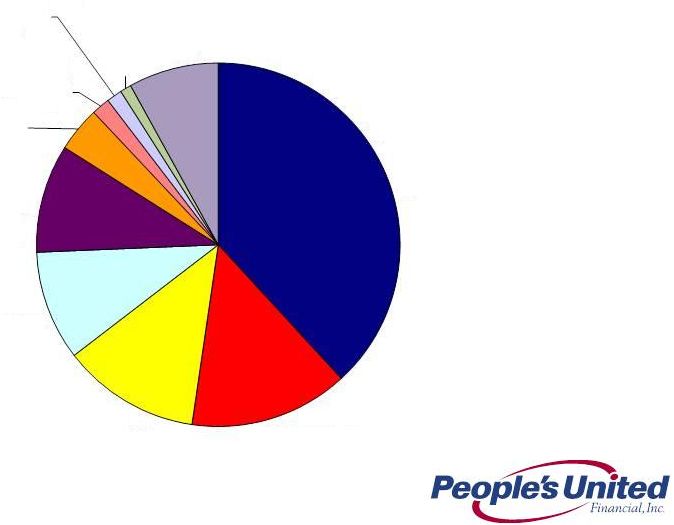

28

Agency MBS and Agency CMOs comprised of 10 year and 15 year collateral

constitute ~80% of the portfolio. $600MM municipal bond portfolio has an

underlying weighted average credit rating above AA

Securities Portfolio Detail

1Q14 Total Securities Portfolio

$4.7 BN

($ in billions)

Note:

Agency CMO's, $2.3,

49%

Agency MBS, $1.4, 30%

Municipal

-

HTM, $0.6,

13%

FHLB Stock, $0.2, 4%

Bonds, Notes and

Debentures -

AFS, $0.1,

2%

Corporate

-

HTM, $0.1,

2%

Duration of the securities portfolio is ~4 years

Securities portfolio does not contain CLOs, CDOs, trust preferred, or private-label

mortgage-backed securities |

29

Loans

Linked Quarter Change

(in $ millions)

Annualized Linked QTD change

3.9%

24,390

257

96

(114)

24,629

Dec 31, 2013

Commercial

Retail

Acquired

Mar 31, 2014 |

30

1Q14 Total Loan Portfolio

$24.6 BN

Loans by Business Line

Note:

Commercial represents Commercial & Industrial and Equipment Finance

CRE

$9.0

37%

Commercial

$9.0

36%

Residential

Mortgage

$4.5

18%

Consumer

$2.1

9% |

31

Loans by Geography

Excluding equipment

finance loans, ~95%

of our 1Q14 loan

portfolio is within the

Northeast

1Q14 Total Loan Portfolio

$24.6 BN

Connecticut

$7.0

28%

New York

$4.5

18%

Massachusetts

$4.3

18%

Vermont

$1.8

7%

New Hampshire

$1.3

6%

Maine

$0.9

4%

New Jersey

$0.8

3%

Other

$4.0

16% |

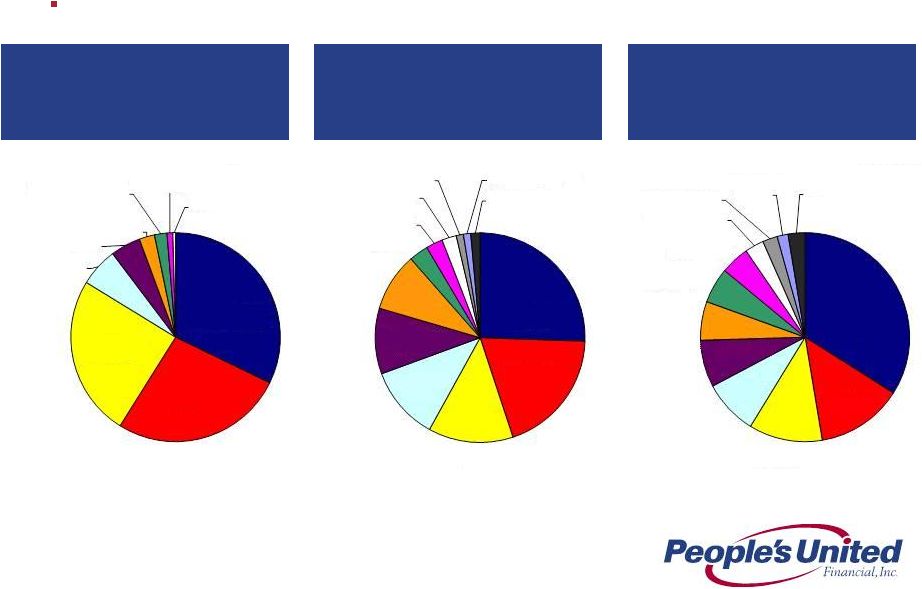

32

Commercial Real Estate,

$9.0BN, 37% of Total

Equipment Financing,

$2.6BN, 10% of Total

Commercial & Industrial,

$6.4BN, 26% of Total

($ in billions)

($ in billions)

($ in billions)

Commercial Loan Portfolio Detail

1Q 2014

73% of total loan portfolio

Residential (Multi-

family), $2.9, 32%

Retail, $2.4, 27%

Office Buildings,

$2.2, 25%

Industrial/Manufact.,

$0.5, 6%

Hosp. &

Entertainment, $0.4,

5%

Mixed/Special

Use, $0.2, 2%

Self Storage, $0.2, 2%

Land, $0.1, 1%

Healthcare, $0.1, 0%

Finance, Ins. & RE,

$1.6, 26%

Service, $1.2, 19%

Manufacturing, $0.8,

13%

Health, $0.7,

11%

Wholesale Dist.,

$0.7, 10%

Retail

Sales,

$0.6, 9%

Construction, $0.2, 3%

Transp/Utility, $0.2,

3%

Arts/Ent./Recr., $0.1,

2%

Public Admin,

$0.1, 1%

Agriculture, $0.1, 1%

Other, $0.1, 2%

Transp/Utility, $0.9,

34%

Construction,

$0.3, 13%

Finance, Ins. & RE,

$0.3, 11%

Printing,

$0.2, 9%

Waste, $0.2, 7%

Manufacturing,

$0.2, 6%

Packaging, $0.1, 6%

Wholesale

Dist., $0.1, 4%

Mining, Oil & Gas,

$0.1, 3%

Service, $0.1, 2%

Health Services,

$0.0, 2%

Other, $0.1, 3% |

33

Residential Mortgage,

$4.5BN, 18% of Total

1Q 2014 originated weighted average LTV of 68%

1Q 2014 originated weighted average FICO score of 754

Hybrid ARMs represent ~90% of the portfolio

($ in billions)

Retail Loan Portfolio Detail

1Q 2014

Consumer,

$2.1BN, 9% of Total

1Q 2014 originated weighted average CLTV of 58%

1Q 2014 originated weighted average FICO score of 765

~60% of originations during last 3 years are in a first lien position

($ in billions)

27% of total loan portfolio

CT, $2.2, 49%

MA, $1.2, 27%

NY, $0.4, 9%

VT,

$0.3,

7%

NH, $0.2, 4%

ME, $0.1, 3%

Other, $0.1, 1%

CT, $1.3, 61%

VT, $0.2, 11%

MA, $0.2, 8%

NY, $0.2,

8%

NH,

$0.1,

6%

ME, $0.1, 6% |

34

Net Interest Income (NII) Sensitivity

Interest Rate Risk Profile

Notes:

1.

Yield curve twist pivot point is 18 month point on yield curve.

Short

End defined as overnight to 18 months. Long End defined

as terms greater than 18 months

1

-1.0%

3.4%

7.5%

10.9%

14.3%

-1.2%

3.1%

7.3%

10.7%

14.1%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

Dn25

Up100

Up200

Up300

Up400

Immediate Parallel Shock

3/31/14

12/31/13

-0.1%

1.0%

2.9%

-3.7%

2.5%

4.8%

-0.4%

0.7%

2.7%

-3.7%

2.3%

4.7%

-6.0%

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

Short End -25

Short End +100

Short End +200

Long End -100

Long End +100

Long End +200

Yield Curve Twist

3/31/14

12/31/13

34 |

35

Acquired Loan Portfolio

Acquired loans initially recorded at fair value (inclusive of related credit mark)

without carryover of historical ALLL

Accounting model is cash-flow based:

Contractual

cash

flows

(principal

&

interest)

less

expected

cash

flows

(principal

&

interest)

=

non-accretable

difference (effectively utilized to absorb actual portfolio losses)

Expected cash flows (principal & interest) less fair value = accretable

yield Expected cash flows are regularly reassessed and compared to actual cash

collections As of 3/31/14

(in $ millions)

Carrying

Amount

a, b

Carrying Amount Component

b

NPLs

Non-Accretable

Difference/NPLs

Charge-offs

Incurred Since

Acquisition

d

Accretable

Yield

Non-Accretable

Difference

Danvers (7/1/11)

$712.8

$245.1

$13.2

$46.1

29%

$23.9

Smithtown (11/30/10)

445.9

203.9

95.2

76.3

125%

128.4

Others (various dates)

252.0

75.4

21.2

23.3

91%

32.4

Total

$1,410.7

$524.4

$129.6

$145.7

(a)

Initial carrying amounts of acquired portfolios are as follows: FinFed, $1.2BN;

Butler, $141MM; RiverBank, $518MM; Smithtown, $1.6BN; and Danvers, $1.9BN.

(b)

Carrying amount and related components reflect loan sale, settlement and payoff

activity which have occurred since acquisition. (c)

Represent contractual amounts; loans meet People’s United Financial’s

definition of a non-performing loan but are not subject to classification as non-accrual in the same manner as

originated loans. Rather, these loans are considered to be accruing loans because

their interest income relates to the accretable yield recognized at the pool level and not to

contractual interest payments at the loan level.

(d)

Includes approximately $8.7MM of charge-offs applied against reserves

established subsequent to acquisition. c |

36

Acquired Loan Portfolio

Amortization of Original Discount on Acquired Loan Portfolio

Notes:

1.

Excluding FinFed, the weighted average coupon on the acquired loan portfolio is

4.39% 2.

Adjusted to include the discount on acquired loans (the difference between the

outstanding balance of the acquired loan portfolio and the carrying amount

of the acquired loan portfolio) $ in millions, except per share data

Impact on Net Interest Margin

Impact on Earnings Per Share

1Q14 Total Accretion (All interest income on acquired loans)

23

Interest Income from Amortization of Original Discount on Acq. Loan

Portfolio 6.4

4Q13 Acquired Loan Portfolio Carrying Amount

1,525

1Q14 Effective Tax Rate

34.3%

1Q14 Acquired Loan Portfolio Carrying Amount

1,411

1Q14 Average Acquired Loan Portfolio

1,468

1Q14 Earnings from Amortiz. of Original Discount on Acq. Loan Portfolio

4.2

Effective Yield on Acquired Loan Portfolio

6.35%

1Q14 Weighted Average Shares Outstanding

297.7

Weighted Average Coupon on Acquired Loan Portfolio

4.61%

1Q14 EPS Impact from Amortiz. of Discount on Acq. Loan Portfolio

$0.01

Incremental Yield Attributable to Amortiz. of Discount on Acq. Loan Portfolio

1.74%

Incremental Interest Income from Amortiz. of Discount on Acq. Loan Portfolio

6.4

1Q14 Average Earning Assets

29,277

Adjusted 1Q14 Average Earning Assets

29,440

Impact on Overall Net Interest Margin (bps)

9

Net Interest Margin

3.17%

Adjusted Net Interest Margin

3.08%

Amortization of Original Discount on Acquired Loan Portfolio

Amortization of Original Discount on Acquired Loan Portfolio

2

1 |

37

Summary of Acquired Loan Accounting Events

(in $ millions)

Period

Cost Recovery Income

Gain (Loss) on Sale of

Acquired Loans

Acquired Loan Impairment

Net Impact

2011

Q1

0.0

5.5

0.0

5.5

Q2

0.0

7.2

0.0

7.2

Q3

0.0

(4.8)

0.0

(4.8)

Q4

5.0

(0.4)

(7.4)

(2.8)

2012

Q1

0.0

0.0

(0.3)

(0.3)

Q2

4.7

0.7

0.2

5.6

Q3

4.1

0.0

(5.7)

(1.6)

Q4

0.0

0.3

0.0

0.3

2013

Q1

0.0

0.0

(2.6)

(2.6)

Q2

0.0

5.8

0.9

6.7

Q3

3.0

0.0

(2.6)

0.4

Q4

0.2

(0.1)

0.1

0.2

2014

Q1

0.0

0.0

(1.5)

(1.5)

Total

$17.0

$14.2

($18.9)

$12.3

Since 2010, we have acquired $5.4BN of loans, approximately 26% of which remain

in our portfolio. We did not recognize cost recovery income, gains (losses) on

sale or impairment in 2010. Since 1Q 2011, the net impact of such

activity is +$12.3MM |

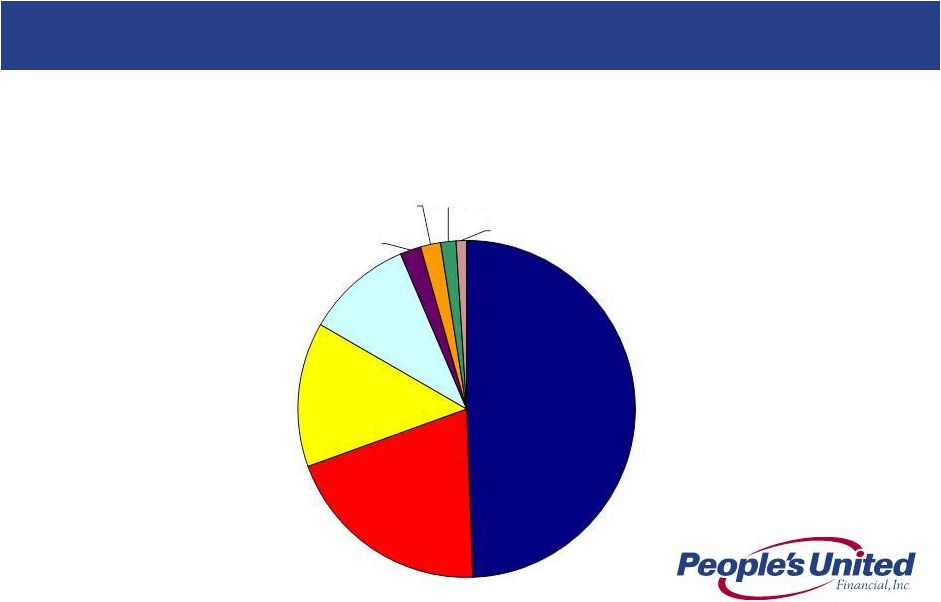

38

Balance Sheet Funding Detail

1Q14 Balance Sheet Funding

$33.1 BN

($ in billions)

85% funded by organic deposits, customer repurchase agreements and

common equity

Retail Deposits, $16.4,

49%

Commercial Deposits,

$6.6, 20%

Stockholders' Equity,

$4.6, 14%

Fed Funds & FHLB

Borrowings, $3.4, 10%

Brokered Deposits, $0.7,

2%

Subordinated

Borrowings & Sr Notes,

$0.6, 2%

Customer Repurchase

Agreements, $0.5, 2%

Other Liabilities, $0.3,

1% |

39

Deposits

Linked Quarter Change

(in $ millions)

Total

23,666

Retail ^

Annualized Linked QTD change

19.7%

Commercial

22,557

16,195

17,029

6,362

6,637

275

834

Dec 31, 2013

Retail

Commercial

Mar 31, 2014

^ Retail includes brokered deposits of $115MM and $663MM at December

31, 2013 and March 31, 2014, respectively |

40

Non-Interest Income

Linked Quarter Change

(in $ millions)

82.5

79.9

1.9

1.0

(2.4)

(0.9)

(0.5)

(0.2)

(1.3)

(0.2)

4Q 2013

Operating

Lease

Income

Insurance

Customer Int.

Rate Swap

Income

Bank Service

Charges

Loan

Prepayment

Fees

Brokerage

Commissions

Gain on Resi

Mtg Loan

Sales

Other

1Q 2014 |

41

Non-Interest Income by Category

(in $ millions)

1Q14 Total Non-Interest Income

$79.9MM

Bank Service

Charges

$30.5

38%

Operating Lease

Income

$11.3

14%

Investment

Management Fees

$9.8

12%

Commercial

Banking Fees

$7.8

10%

Insurance

Revenue

$7.7

10%

Brokerage

Commissions

$3.2

4%

BOLI

$1.3

2%

Merchant

Services

Income, Net

$1.1

1%

Net GOS

of Loans

$0.8

1%

Other

$6.4

8% |

42

Total

Non-Operating

Operating

Non-Interest Expense

Linked Quarter Change

(in $ millions)

208.7

216.7

207.7

4.2

(0.4)

2.7

2.3

1.5

(2.3)

211.5

1.0

5.2

4Q 2013

Non-

Operating

Prof. &

Outside

Operating

Lease

Comp. &

Benefits

Occ. &

Equip.

Other

1Q 2014 |

43

Non-Interest Expense by Category

(in $ millions)

1Q14 Non-Interest Expense

Total: $216.7MM; Operating: $211.5MM

Comp. & Benefits

$110.4

51%

Occupancy &

Equipment

$38.0

18%

Professional &

Outside Services

$15.3

7%

Operating Lease

Expense

$11.1

5%

Regulatory

Assessments

$8.7

4%

Amort. Of Acq.-

related Intangible

Assets

$6.2

3%

Stationery,

Printing, Postage &

Telephone

$5.4

2%

Advertising and

Promotion

$2.5

1%

Other

$19.1

9% |

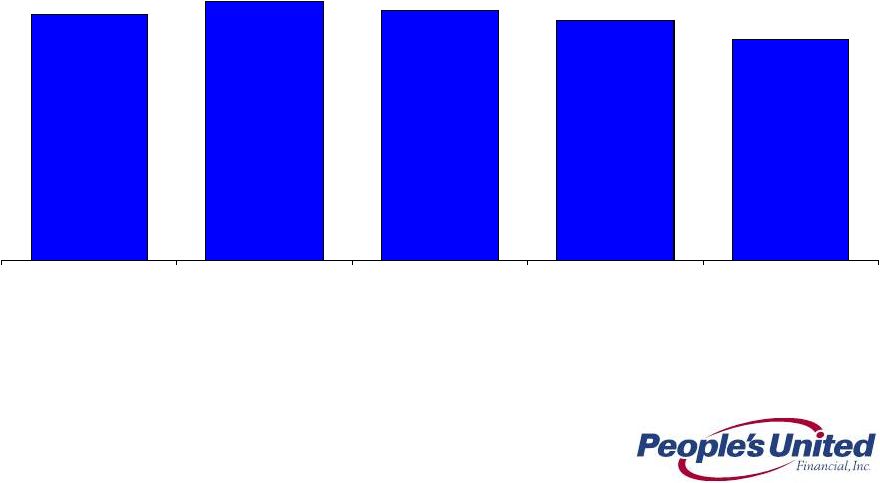

44

Efficiency Ratio* (%)

Last Five Quarters

62.7%

61.4%

62.2%

62.8%

63.9%

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

Note: * Operating lease expense excluded from non-interest expense and offset against operating

lease income within non-interest income. Amortization of investments in affordable housing

projects excluded from non-interest income and included as a component of income tax

expense |

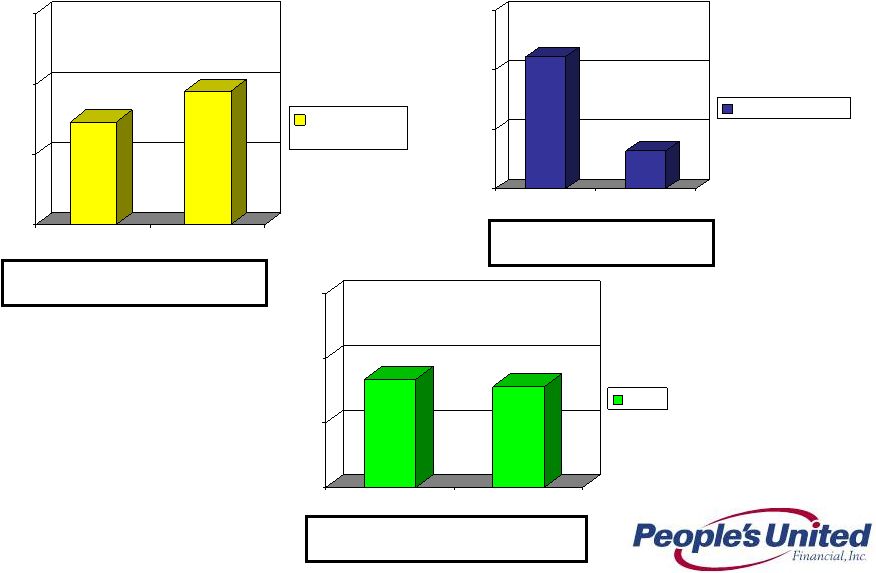

45

Operating ROAA (%)

Last Five Quarters

0.77%

0.81%

0.78%

0.75%

0.69%

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014 |

46

Operating ROATE (%)

Last Five Quarters

8.1%

9.3%

9.8%

9.8%

9.3%

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014 |

47

Operating Dividend Payout Ratio (%)

Last Five Quarters

91%

83%

83%

83%

86%

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014 |

48

Substantial Progress Over the Last Five Years

Growing Loans, Deposits and Returning Capital to Shareholders

Growth has outpaced peers on the key metrics of loans per share and

deposits per share

This has occurred while we have returned $2.2BN to shareholders

during this period. Returns of capital were in the form of both

dividends ($1.1BN) and share repurchases ($1.1BN) which represents

approximately 50% of our current market capitalization

Line Item

PBCT

Peer

Median

PBCT Vs.

Peers

5-Year Loans Per Share CAGR

14.3%

-0.4%

+14.7%

5-Year Deposits Per Share CAGR

13.0%

1.0%

+12.0%

Notes:

5-Year CAGR figures based on 1Q 2009 to 1Q 2014 data

|

49

Attractive Risk Profile

Ability to maintain strong credit quality

Conservative credit culture marked by no credit “events”

Median net charge-offs / average loans since 2007 have been 19 bps

Well-diversified commercial and retail banking portfolios

Low operating risk profile

Consistently profitable throughout the credit cycle

Straightforward

portfolio

of

products

–

no

complex

financial

exposures

Held credit ratings of A3 / BBB+ / A-

/ A throughout the credit crisis as rated by Moody’s,

S&P, Fitch and DBRS, respectively

Robust liquidity

Strong deposit market share in most core markets

Unused FHLB of Boston borrowing capacity of $4.1BN

1Q 2014 loan-to-deposit ratio of 104.1% |

50

Commercial Credit Culture and Approval Process

Well-defined credit culture and underwriting standards

Cash flow –

deal specific and global

Collateral / limited unsecured exposure with equity investment requirements and

guarantees No speculative real estate projects

Credit

structure

includes

meaningful

covenants,

appropriate

LTVs

and

monitored

advance

rates

Industry knowledge and expertise (i.e. basic industries and property types)

Seasoned relationship managers with considerable local market knowledge

Experienced senior credit officers (SCO) average 25+ years of commercial banking

experience Approval authority

Local, regional and corporate credit committee structure

>$25MM also requires Executive Risk Oversight Committee (EROC) approval

Due

diligence

begins

prior

to

the

issuance

of

a

proposal

(market

manager

&

SCO)

and

independent credit associates in Risk Management are utilized

Credit analyst / relationship manager complete detailed loan submission

Stress test cash flow for interest rate sensitivities, vacancy and rental rates

Independent field exams and appraisal review |

51

1.00

1.24

1.32

0.50

1.00

1.50

2.00

2.50

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

PBCT

Peer Group Median

Top 50 Banks

Last Five Quarters

Asset Quality

NPAs / Loans & REO* (%)

*

Non-performing assets (excluding acquired non-performing loans) as a percentage of

originated loans plus all REO and repossessed assets; acquired non-performing

loans excluded as risk of loss has been considered by virtue of (i) our estimate of

acquisition-date fair value, (ii) the existence of an FDIC loss sharing agreement, and/or (iii)

allowance for loan losses established subsequent to acquisition Source: SNL Financial and

Company filings Notes: Top 50 Banks represents the largest 50 banks by total assets in each

respective quarter 18 of 20

Peers and 42 of Top 50 Banks reporting for 1Q 2014 |

52

0.12

0.22

0.23

0.00

0.10

0.20

0.30

0.40

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

PBCT

Peer Group Median

Top 50 Banks

Asset Quality

Net Charge-Offs / Avg. Loans* (%)

*

Excluding acquired loan charge-offs, PBCT’s charge-off ratio was

0.09%, 0.17%, 0.16%, 0.18% and 0.18% in 1Q 2014, 4Q 2013, 3Q 2013, 2Q

2013 and 1Q 2013, respectively Last Five Quarters

Source: SNL Financial and Company filings

Notes: Top 50 Banks represents the largest 50 banks by total assets in each respective

quarter

49 of Top 50 Banks reporting for 1Q 2014 |

53

Notes:

Capital Ratios

Last Five Quarters

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

People’s United Financial

Tang. Com. Equity/Tang. Assets

9.6%

8.7%

8.5%

7.9%

8.0%

Leverage Ratio

1, 5

10.0%

9.3%

9.2%

8.3%

8.4%

Tier 1 Common

²

12.4%

11.6%

11.4%

10.2%

10.1%

Tier 1 Risk-Based Capital

3, 5

12.5%

11.6%

11.4%

10.2%

10.1%

Total Risk-Based Capital

4, 5

13.7%

12.8%

12.6%

11.3%

11.2%

People’s United Bank

Leverage Ratio

1, 5

9.7%

9.5%

9.5%

9.1%

9.1%

Tier 1 Risk-Based Capital

3, 5

12.1%

11.9%

11.8%

11.1%

11.0%

Total Risk-Based Capital

4, 5

13.5%

13.2%

13.2%

12.4%

12.2%

1.

Leverage (core) Capital represents Tier 1 Capital (total stockholder’s equity, excluding: (i)

after-tax net unrealized gains (losses) on certain securities classified as available for

sale; (ii) goodwill and other acquisition-related intangibles; and (iii) the amount recorded in accumulated other comprehensive income (loss)

relating to pension and other postretirement benefits), divided by Adjusted Total Assets (period end

total assets less goodwill and other acquisition-related intangibles) 2.

Tier 1 Common represents Common Equity Tier 1 Capital (calculated in accordance with the Basel III

Final Rule issued in July 2013) divided by Total Risk- Weighted Assets 3.

Tier 1 Risk-Based Capital represents Tier 1 Capital divided by Total Risk-Weighted Assets 4.

Total Risk-Based Capital represents Tier 1 Capital plus subordinated notes and debentures, up to

certain limits, and the allowance for loan losses, up to 1.25% of total risk weighted assets,

divided by Total Risk-Weighted Assets

5.

Well capitalized limits under current capital rules for the Bank are: Leverage Ratio, 5%; Tier 1

Risk-Based Capital, 6%; and Total Risk-Based Capital, 10% |

54

Allowance for Loan Losses

Originated Portfolio Coverage Detail as of March 31, 2014

(in $ millions)

0.73%

0.95%

0.00%

0.50%

1.00%

1.50%

NPLs:Loans

ALLL:Loans

Commercial

Banking

1.11%

0.32%

0.00%

0.50%

1.00%

1.50%

NPLs:Loans

ALLL:Loans

Retail Banking

Commercial ALLL -

$160.0 million

129% of Commercial NPLs

Retail ALLL -

$20.0 million

28% of Retail NPLs

Total ALLL -

$180.0 million

93% of Total NPLs

0.84%

0.78%

0.00%

0.50%

1.00%

1.50%

NPLs:Loans

ALLL:Loans

Total |

55

Name

Position

Years in

Banking

Professional

Experience

Jack Barnes

President & CEO, Director

30+

People’s United Bank (SEVP, CAO),

Chittenden, FDIC

Kirk Walters

SEVP & CFO (People’s United

Financial, Inc.), Director

25+

People’s United Bank, Santander, Sovereign,

Chittenden, Northeast Financial

Galan Daukas

SEVP Wealth Management

25+

Washington Trust, The Managers Funds,

Harbor Capital Mgmt

Sara Longobardi

SEVP Retail & Business Banking

20+

People’s United Bank

Dave Norton

SEVP & Chief HR Officer

3+

People’s United Bank, New York Times,

Starwood, PepsiCo

Lee Powlus

SEVP & Chief Administrative Officer

25+

People’s United Bank, Chittenden, Alltel

David Rosato

SEVP & CFO (People’s United Bank)

25+

People’s United Bank, Webster, Allfirst

Chantal Simon

SEVP & Chief Risk Officer

20+

People’s United Bank, Merrill Lynch US Bank,

Lazard Freres & Co.

Jeff Tengel

SEVP Commercial Banking

30+

People’s United Bank, PNC, National City

Bob Trautmann

SEVP & General Counsel

20+

People’s United Bank, Tyler Cooper & Alcorn

Management Committee |

56

Solid Governance Structure

Board of Directors

People’s United

Financial, Inc.

Board of Directors

People’s United Bank

The Management

Committee

Management

Committees

Enterprise

Risk

Committee

Compensation,

Nominating &

Governance Committee

Audit

Committee

Treasury &

Finance

Committee

Regulatory

Steering

Committee

Executive Risk

Oversight Committee

Asset and Liability

Committee

Capital Management

Committee

Credit Policy

Committee

Asset

Quality

Committee

Expense Management

Oversight

Committee

Model Risk

Management

Committee

Disclosure

Committee

New Product

Approval

Committee

Senior Trust

Management

Committee

Transactions with

Affiliates Committee

HR

Administrative

Committee

CRA and Community

Development

Committee

Executive Technology

Committee

Real Estate

Committee

Marketing

Committee

Loan Review

Committee

Trust

Committee

Fraud Risk

Management

Committee |

57

Peer Group

Firm

Ticker

City

State

1

Associated

ASBC

Green Bay

WI

2

BancorpSouth

BXS

Tupelo

MS

3

City National

CYN

Los Angeles

CA

4

Comerica

CMA

Dallas

TX

5

Commerce

CBSH

Kansas City

MO

6

Cullen/Frost

CFR

San Antonio

TX

7

East West

EWBC

Pasadena

CA

8

First Niagara

FNFG

Buffalo

NY

9

FirstMerit

FMER

Akron

OH

10

Fulton

FULT

Lancaster

PA

11

Huntington

HBAN

Columbus

OH

12

M&T

MTB

Buffalo

NY

13

New York Community

NYCB

Westbury

NY

14

Signature

SBNY

New York

NY

15

Susquehanna

SUSQ

Lititz

PA

16

Synovus

SNV

Columbus

GA

17

Valley National

VLY

Wayne

NJ

18

Webster

WBS

Waterbury

CT

19

Wintrust

WTFC

Lake Forest

IL

20

Zions

ZION

Salt Lake City

UT |

58

Non-GAAP Financial Measures and Reconciliation to GAAP

In addition to evaluating People’s United Financial’s results

of operations in accordance with U.S. generally accepted

accounting principles (“GAAP”), management routinely supplements this evaluation with an analysis of

certain non-GAAP financial measures, such as the efficiency and

tangible equity ratios, tangible book value per share and

operating earnings metrics. Management believes these non-GAAP financial measures provide

information useful to investors in understanding People’s United

Financial’s underlying operating performance and trends,

and facilitates comparisons with the performance of other banks and thrifts. Further, the efficiency ratio and

operating earnings metrics are used by management in its assessment of

financial performance, including non- interest expense

control, while the tangible equity ratio and tangible book value per share are used to analyze the

relative strength of People’s United Financial’s capital

position. The efficiency ratio, which represents an approximate measure of the

cost required by People’s United Financial to generate a

dollar of revenue, is the ratio of (i) total non-interest expense (excluding goodwill impairment charges,

amortization of other acquisition-related intangible assets, losses

on real estate assets and non-recurring expenses) (the

numerator) to (ii) net interest income on a fully taxable equivalent ("FTE") basis plus total non-interest income

(including the FTE adjustment on bank-owned life insurance

("BOLI") income, and excluding gains and losses on sales

of assets other than residential mortgage loans and acquired loans, and non-recurring income) (the

denominator). In addition, operating lease expense is excluded from

total non-interest expense and netted against operating

lease income within non-interest income to conform with the reporting approach applied to our other fee-

based businesses that are already presented on a net basis.

People’s United Financial generally considers an item of

income or expense to be non-recurring if it is not similar to an

item of income or expense of a type incurred within the last two

years and is not similar to an item of income or expense of a type reasonably expected to be incurred

within the following two years. |

59

Non-GAAP Financial Measures and Reconciliation to GAAP

Operating earnings exclude from net income those items that management

considers to be of such a non-recurring or infrequent nature

that, by excluding such items (net of income taxes), People’s United Financial’s results can

be measured and assessed on a more consistent basis from period to

period. Items excluded from operating earnings, which include,

but are not limited to, merger-related expenses (including acquisition integration and

other costs), charges related to executive-level management

separation costs, severance-related costs and writedowns of

banking house assets, are generally also excluded when calculating the efficiency ratio. Operating

earnings per share is derived by determining the per share impact of

the respective adjustments to arrive at operating earnings and

adding (subtracting) such amounts to (from) GAAP earnings per share. Operating return

on average assets is calculated by dividing operating earnings

(annualized) by average assets. Operating return on average

tangible stockholders' equity is calculated by dividing operating earnings (annualized) by average

tangible stockholders' equity. The operating dividend payout ratio is

calculated by dividing dividends paid by operating earnings for

the respective period. The tangible equity ratio is the ratio of (i) tangible

stockholders’ equity (total stockholders’ equity less goodwill

and other acquisition-related intangible assets) (the numerator) to

(ii) tangible assets (total assets less goodwill and other

acquisition-related intangible assets) (the denominator). Tangible book value per share is calculated by

dividing tangible stockholders’ equity by common shares (total

common shares issued, less common shares classified as treasury

shares and unallocated Employee Stock Ownership Plan ("ESOP") common shares).

In light of diversity in presentation among financial institutions, the

methodologies used by People’s United Financial for

determining the non-GAAP financial measures discussed above may differ from those used by other

financial institutions. Please refer to People’s United

Financial’s latest Form 10-Q regulatory filing for detailed

reconciliations to GAAP figures. |

For

more information, investors may contact: Peter Goulding, CFA

203-338-6799

peter.goulding@peoples.com |