Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Xylem Inc. | d726800d8k.htm |

XYLEM

INC. INVESTOR PRESENTATION

OPPENHEIMER

9

TH

ANNUAL

INDUSTRIAL

GROWTH

CONFERENCE

Exhibit 99.1 |

XYLEM PROPRIETARY / CONFIDENTIAL

FORWARD-LOOKING STATEMENTS

2

This document contains information that may constitute “forward-looking

statements.” Forward-looking statements by their nature address matters that

are, to different degrees, uncertain. Generally, the words “anticipate,” “estimate,” “expect,”

“project,” “intend,” “plan,” “believe,”

“target” and similar expressions identify forward-looking statements, which generally

are not historical in nature. However, the absence of these words or similar expressions does

not mean that a statement is not forward-looking.

These forward-looking statements include, but are not limited to, statements about the

separation of Xylem Inc. (the “Company”) from ITT Corporation in 2011,

capitalization of the Company, future strategic plans and other statements that describe

the Company’s business strategy, outlook, objectives, plans, intentions or goals, and any discussion of future

operating or financial performance. All statements that address operating performance, events or

developments that we expect or anticipate will occur in the future — including

statements relating to orders, revenues, operating margins and earnings per share growth,

and statements expressing general views about future operating results — are forward-looking

statements.

Caution should be taken not to place undue reliance on any such forward-looking statements

because they involve risks, uncertainties and other factors that could cause actual

results to differ materially from those expressed or implied in, or reasonably inferred

from, such statements. The Company undertakes no obligation to publicly update or revise any forward-

looking statements, whether as a result of new information, future events or otherwise, except

as required by law. In addition, forward-looking statements are subject to certain

risks and uncertainties that could cause actual results to differ materially from the

Company’s historical experience and our present expectations or projections. These risks and uncertainties include,

but are not limited to, those set forth in Item 1A of our Annual Report on Form 10-K, and

those described from time to time in subsequent reports filed with the Securities and

Exchange Commission. |

INVESTMENT HIGHLIGHTS |

XYLEM PROPRIETARY / CONFIDENTIAL

4

•

Focused Pure Water Play

•

Leading Market Positions

•

Fortress Brands & World Class

Distribution

•

Diverse Geographic & End

Market Exposure

•

Large Installed Base Drives

Recurring Revenue

•

Strong Financial Position &

Cash Flow Generation

$3.8B

WHY SHOULD YOU INVEST IN XYLEM?

STRONG FOUNDATION & FUNDAMENTALS WITH OPPORTUNITY TO OUTPERFORM

|

XYLEM PROPRIETARY / CONFIDENTIAL

SPECIALIZED BREADTH IN THE WATER CYCLE

5

•

Global Water Industry: $500B

•

Public Utilities

•

Design & Build Firms

•

Equipment & Service Providers

•

Industry Consists of Two Sectors

•

Water & Waste Water

Infrastructure

•

To Serve End Users

•

Xylem’s SAM: $35B

•

Technology Intensive & High

Value Equipment

•

Critical Applications

•

Knowledge-Based Services

•

Long-Term Growth Driven by

Macro Trends & Growing Water

Challenges

UNIQUELY POSITIONED TO SOLVE THE WORLD’S GROWING WATER CHALLENGES

|

XYLEM PROPRIETARY / CONFIDENTIAL

JOURNEY FROM A PORTFOLIO OF

BUSINESSES TO A SOLUTION PORTFOLIO

6

MULTITRODE

*

* Zenon is a registered trademark of GE

EVOLUTION TO A LEADING GLOBAL WATER TECHNOLGY PROVIDER

|

GLOBAL BUSINESS OVERVIEW |

XYLEM PROPRIETARY / CONFIDENTIAL

GLOBAL MARKET PRESENCE

8

REVENUE BY GEOGRAPHY

(2013 Revenue)

GLOBAL SCALE & LOCAL PRESENCE PROVIDE A COMPETITIVE ADVANTAGE

•

360+ Global Locations

•

50 Emerging Market Sales & Service Centers

•

11 Emerging Market Production Facilities

•

Reaching Customers in More Than 150 Countries

A Growing Emerging Market

Presence …

Today ~20%

United States

Europe

Asia Pac

Rest of World

38%

36%

12%

14% |

XYLEM PROPRIETARY / CONFIDENTIAL

DIVERSE CUSTOMER BASE

9

REVENUE BY END MARKET

(2013 Revenue)

UNDERSTANDING & ANTICIPATING OUR CUSTOMERS NEEDS

Industrial

45%

Public Utility

34%

Commercial

11%

Residential

7%

Agriculture

3% |

XYLEM PROPRIETARY / CONFIDENTIAL

FOCUSED ON KEY GROWTH END MARKETS

10

LEADING POSITIONS & ATTRACTIVE LONG-TERM GROWTH OPPORTUNITIES

•

Strong Brands

•

Diverse Market Applications

INDUSTRIAL ($1.7B)

PUBLIC UTILITY ($1.3B)

COMMERCIAL ($400M)

(2013 Revenue)

•

Market Leading Positions

•

Large Installed Base

•

LT Growth Opportunities

•

Market Leading Positions

•

Large Installed Base

•

LT Growth Opportunities

•

US & Europe Pent-Up

Demand

•

Emerging Market

Infrastructure

Development

•

Steady Growth from

Maintenance & Repair

Business

•

New Product Launches

•

Demand for Energy

Efficient Solutions

•

Regulatory Standards

•

Emerging Market Key

Account Strategy

•

Light Industrial

•

Energy

•

Mining

•

Construction

•

Food & Beverage

•

Marine

•

Underserved Markets

•

Adjacent Mkt Expansion

•

LT

Growth

Opportunities |

XYLEM PROPRIETARY / CONFIDENTIAL

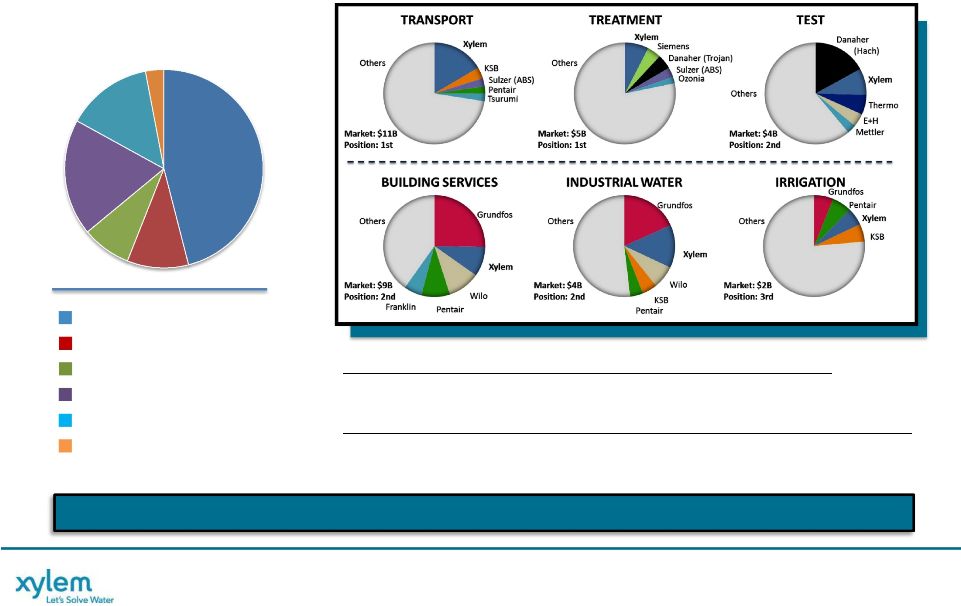

SERVING CRITICAL NEEDS

11

GLOBAL LEADER IN WATER APPLICATION SOLUTIONS

REVENUE BY APPLICATION

(2013 Revenue)

Water Infrastructure Includes Transport, Treatment and Test Applications

…

Which Are

Integrated into the Most Critical Water Infrastructure Systems for Both Public Utility and

Large Industrial Customers

Applied Water Includes Building Services, Industrial Water and Irrigation Applications

…

Which Are Key Elements Systems for Commercial, Residential, Industrial and Ag

Customers

Transport

47%

Treatment

8%

Test

8%

Building Svcs

18%

Industrial Water

16%

Irrigation

3% |

XYLEM PROPRIETARY / CONFIDENTIAL

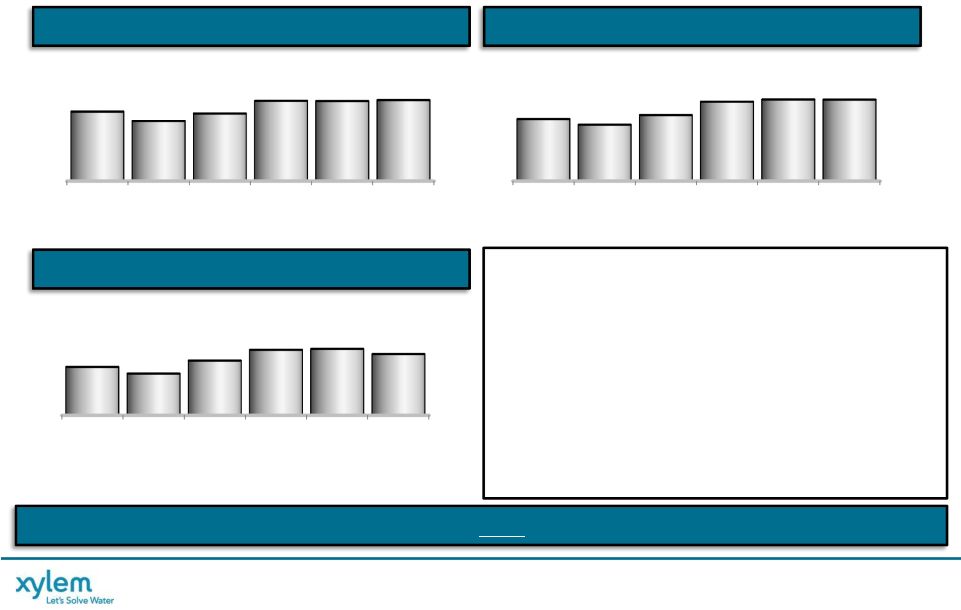

HISTORICAL XYLEM PERFORMANCE

OM%: 10.8%

10.8% 12.6% 12.7%

12.9% 11.8% OPPORTUNITY

TO

ACCELERATE

GROWTH

AND

IMPROVE

OPERATING

PERFORMANCE

$M

$M

12

REVENUE

OPERATING INCOME & MARGIN*

* See appendix for non-GAAP reconciliations

GM%: 34.7%

36.4% 37.9% 38.4%

39.6% 39.1% $M

GROSS PROFIT & MARGIN

2008

2009

2010

2011

2012

2013

3,291

2,849

3,202

3,803

3,791

3,837

2008

2009

2010

2011

2012

2013

1,141

1,037

1,214

1,461

1,502

1,499

2008

2009

2010

2011

2012

2013

356

307

403

482

489

451

‘08-’13 Revenue up 17%; 3% CAGR

•

New Product Development

•

Emerging Market Growth

•

Analytics and Dewatering Platforms

100 Bps Operating Margin Expansion

•

Pricing Improvements; Lean & Global Sourcing

•

Deployed ~$100M in Restructuring

•

Includes $33M Stand-Alone Costs

•

2013 impacted by lower Public Utility CAPEX

spending and weak European market conditions

-13%

12% 19% 1%

Organic*:

-9% 3% 7%

-1%

Growth:

0%

0% |

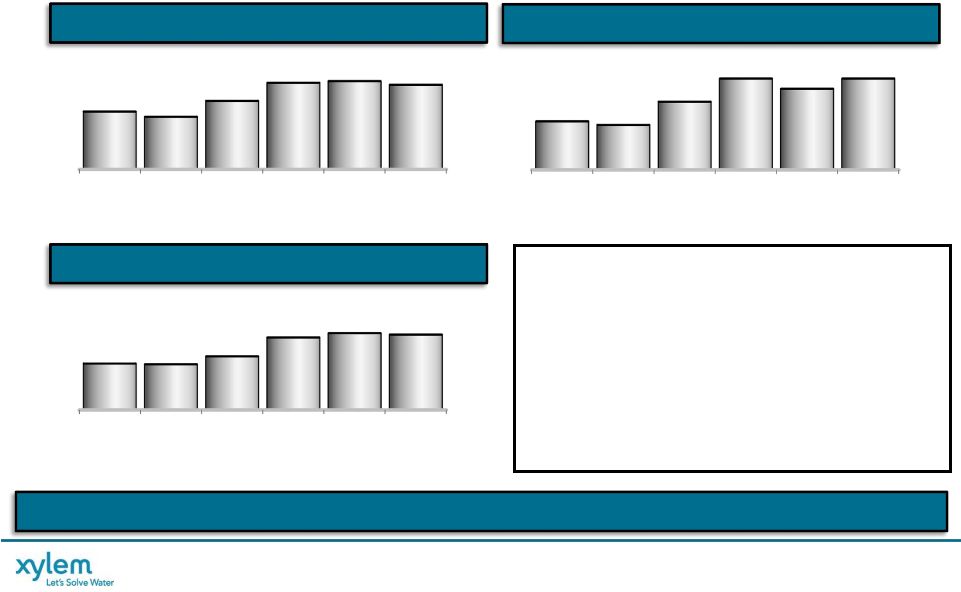

XYLEM PROPRIETARY / CONFIDENTIAL

HISTORICAL XYLEM PERFORMANCE

* See appendix for non-GAAP reconciliations

Margin %: 12.9%

13.6% 15.7% 16.7%

17.1% 16.2% $M

EBITDA*

Reinvest %:

1.2x

1.2x

1.5x

1.4x

1.2x

1.3%

Ratio

$M

CAPEX

$M

R&D

% of :

1.9%

2.2%

2.3%

2.6%

2.8% 2.7%

Revenue

STRONG CASH GENERATION FUNDS CONTINUED GROWTH INVESTMENT

2008

2009

2010

2011

2012

2013

425

387

504

637

649

622

2008

2009

2010

2011

2012

2013

64

63

74

100

106

104

2008

2009

2010

2011

2012

2013

67

62

94

126

112

126

Strong Operating Cash Flow Generation

Generate, Reinvest, Grow

•

EBITDA Up 47% Since 2008; 8% CAGR

•

Better Price Execution

•

Increase in Portfolio Profitability

•

Improved Productivity

•

Increasing R&D Investment

•

Capex Reinvestment Ratio >1

13 |

XYLEM PROPRIETARY / CONFIDENTIAL

STRONG FINANCIAL POSITION

BALANCED CAPITAL DEPLOYMENT TO ENHANCE SHAREHOLDER RETURNS

14

* See appendix for non-GAAP reconciliations

CAPITAL SUMMARY

March 31, 2014

Cash

466

Debt

1,243

Net Debt

777

Shareholders’

Equity

2,229

Net Capital

3,006

Net Debt to Net Capital

26%

Liquidity and Cash Management

•

Access to Revolver and Commercial Paper

for Short-Term Liquidity Requirements

•

No Debt Maturities Until 2016 & 2021

Pension & OPEB

•

Status: 103% (Funded Plans); 67% (Overall)

CAPITAL DEPLOYMENT STRATEGY

Return Capital to Shareholders

Invest in Organic Growth Initiatives

Inorganic Growth Investments

•

Differentiated Product Development

•

Maintenance & Investment Capex

•

Dividends

•

Share Repurchase Programs

•

Acquire Bolt-on and Close-to-Core

Companies

•

Strategic & Financial Filters Drive Disciplined

Approach

•

Proven Track Record |

REVIEW OF

1Q EARNINGS PERFORMANCE

& 2014 OUTLOOK

Note: Forward Looking information presented on slides

17 & 18 were as of April 29, 2014. Please review the

Forward Looking Statements on slide 2, and note that the

Company undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a

result of new information, future events or otherwise,

except as required by law. |

XYLEM PROPRIETARY / CONFIDENTIAL

16

BUSINESS UPDATE

SOLID 1ST QUARTER PERFORMANCE ... ON TRACK TO DELIVER 2014

* See appendix for non-GAAP reconciliations

Highlights

1st

Quarter

Financial

Summary

Strong

finish

to

the

1

Quarter

…

March

performance

offset

slow

start

Emerging Markets off to fast start, Europe slowly recovering

Volume & cost actions drive significant Op Margin expansion & Earnings growth

Operating improvements on track to deliver full year savings

Orders of $993M up 3% …

Ending Backlog $793M, 2014 Shippable Backlog up 6%

Revenue of $906M up 3%, with growth in both segments

Operating

Margin*

of

10.4%, up 150 bps; strong incremental margin performance

Earnings

Per

Share*

$0.34 up 26%

Free Cash Flow* usage $3M …

Seasonality and Working Capital investment

st |

XYLEM PROPRIETARY / CONFIDENTIAL

17

2014 GROWTH PROFILE (As of April 29, 2014)

Industrial

Public Utility

•

Emerging Market infrastructure

investment; Slow Capex recovery in

U.S./Europe

•

Opex stable in US & Europe

(34% of ’13 Revenue)

Commercial

•

Emerging Market growth & new product

launches

•

Weak U.S. institutional bldg mkt; Europe

slow to recover

(11% of ’13 Revenue)

Agriculture

•

Tough year-over-year comparison

following strong 2012 & 2013

performance

(3% of ’13 Revenue)

Residential

•

Cold winter subsides in U.S.; U.S. housing

recovery moderates; Europe stabilizes

•

Tough 2Q comp (2Q’13 U.S. +18% vs. PY)

(7% of ’13 Revenue)

Up Low

Single Digit

Up Low

Single Digit

Up Low

Single Digit

Up Low

Single Digit

Flat to Up

Low Single

Digit

Xylem 2014

Organic Growth

•

Improving global Capex environment

•

Driving market share gains

•

Mining headwinds continue

(45% of ’13 Revenue)

STABLE MARKET CONDITIONS …

EXPECTATIONS REMAIN UNCHANGED |

XYLEM PROPRIETARY / CONFIDENTIAL

18

(Dollars, In Millions, except EPS)

REVENUE

* See appendix for non-GAAP reconciliations

OPERATING INCOME*

EPS*

2014 XYLEM OUTLOOK

(As of April 29, 2014)

$3,900 to $3,980

$490 to $525

$1.85 to $2.00

Op

Margin

FREE CASH FLOW*

Higher Income, Working Cap

Improvement, and Lower Capex

Spend

ROIC

~11%

DIVIDENDS/SHARE

REPURCHASES

~225

Targeting 100 Bps Improvement

Expected 10% Annual Dividend

Increase, ~$130M for Share

Repurchases

3,837

451

1.67

198

154

10.0%

2013

2014

2013

2014

2013

2014

2013

2014E

2013

2014

2013

2014

11.8%

12.6% to 13.2%

~310-345

COST FOCUS EXPECTED TO DRIVE SOLID EARNINGS GROWTH …

MARKET RECOVERY FUELS UPSIDE |

CLOSING SUMMARY |

XYLEM PROPRIETARY / CONFIDENTIAL

20

HOW WILL XYLEM IMPROVE PERFORMANCE?

The Xylem Management System

(“XMS”) defines how we create

value.

It integrates our key strategic

operating processes to drive

superior growth and operational

excellence, efficient capital

deployment, and strong,

consistent leadership

TOP PRIORITIES

FOCUSED ON EXECUTION & DRIVING ACCOUNTABILITY

Accelerate Revenue Growth

Improve Operating Cost Position

Embed Continuous Improvement Tools

Optimize Integrated Front End

•

Invest & Implement Global CRM Tool

•

Differentiated Product Innovation

Emerging Market Expansion

•

•

Expand Global Sourcing Capabilities

Manage General & Administrative Costs

Drive Lean Six Sigma More Consistently,

Deeper and Across the Entire Organization

•

•

•

Rebalance Portfolio & Product Investments

•

REIGNITE “XMS” |

XYLEM PROPRIETARY / CONFIDENTIAL

21 |

APPENDIX |

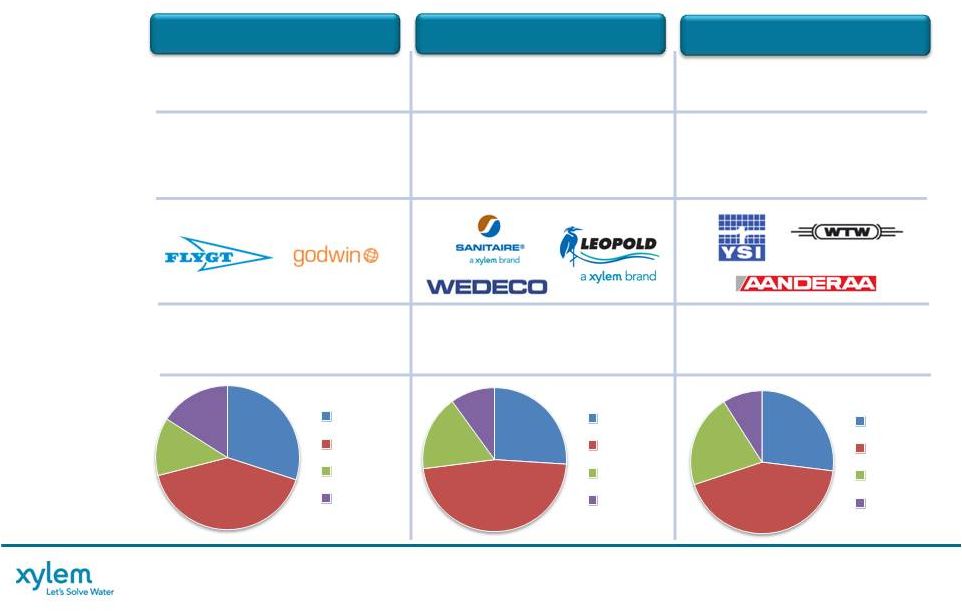

XYLEM PROPRIETARY / CONFIDENTIAL

WATER INFRASTRUCTURE

Market Size: $20B

2013 Revenues: $2.5B

2013 Op Margin*: 13.1%

APPLIED WATER

Market Size: $15B

2013 Revenues: $1.4B

2013 Op Margin*: 12.7%

23

SEGMENT OVERVIEW

64%

36%

Segment Split

(3

rd

Party Revenue)

UNIQUE PORTFOLIO PROVIDES FOR

INNOVATIVE SOLUTIONS

BROAD PRODUCT PORTFOLIO BACKED

BY APPLICATION EXPERTISE

* See appendix for non-GAAP reconciliations

•

World’s Largest Waste Water Pump

& Dewatering Services Provider

•

Broad Portfolio of Filtration,

Biological and Disinfection

Technologies

•

Industry-Leading Water &

Environment Analytics Platform

•

Leading Global Provider of a Broad

Range of Energy-Efficient Solutions

with a Large & Diverse Customer Base

•

U.S. Leader in Building Services

Equipment & Solutions

•

U.S. Leader in Industrial Water

Technologies |

XYLEM PROPRIETARY / CONFIDENTIAL

Herford, Germany;

Brown Deer, WI;

Zelienople, PA

24

WATER INFRASTRUCTURE

SEGMENT OVERVIEW

Market Size:

2013 Revenues:

Key Products

& Services:

2013 Revenues

by Geography:

Key Facilities:

Key Brands:

$11B

$1,812M

$5B

$329M

$4B

$298M

Water & Waste Water Pumps

Dewatering (Sales & Rentals)

Aftermarket Parts & Services

Biological

U.V. and Ozone Disinfection

Filtration

Analytical Instrumentation,

Doppler and Level Measurement,

Water Quality and Environmental

Monitoring Systems

Emmaboda, Sweden;

Baroda, India; Shenyang, China;

Bridgeport, NJ

Yellow Springs, OH;

Weilheim, Germany;

Bergen, Norway

U.S.

Europe

Asia

Pacific

Other

26%

U.S.

Europe

Asia

Pacific

Other

U.S.

Europe

Asia

Pacific

Other

10%

17%

47%

30%

41%

13%

16%

27%

43%

21%

9%

TRANSPORT

TREATMENT

TEST |

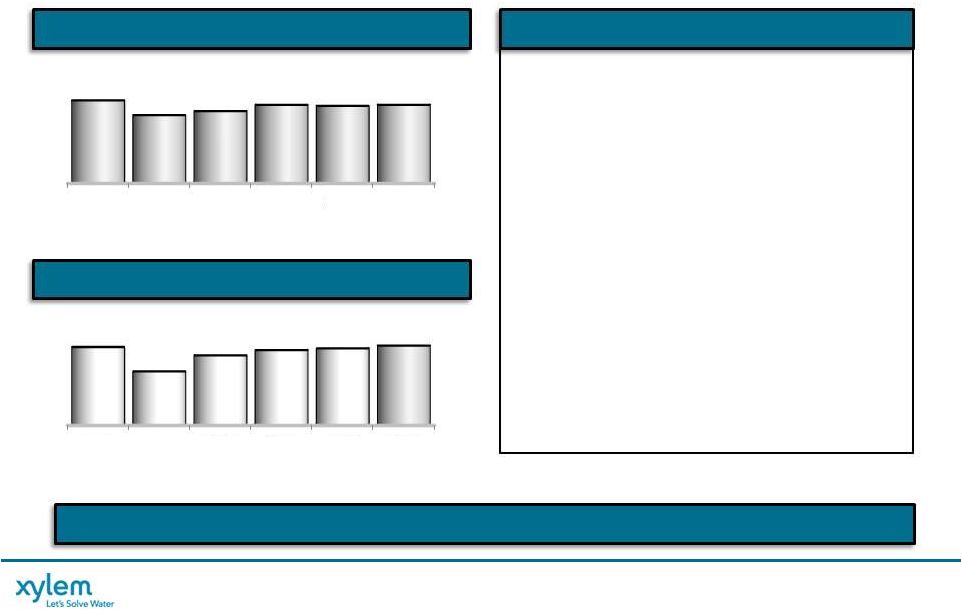

XYLEM PROPRIETARY / CONFIDENTIAL

WATER INFRASTRUCTURE

Growth:

-10%

17% 25%

0% 1%

Organic*:

-4%

2%

7%

0% -2% OM%:

13.0% 14.7%

14.9% 14.9% 15.1%

13.1%

‘08-’13 Revenue up 35%; 6% CAGR

•

Resilient Through the Downturn

•

Growth Driven by Acquisitions,

Emerging Markets & Product

Launches

•

Public Utility CAPEX Slowdown

•

European Crisis

Recent Market Conditions Negatively

Impacted Operating Margins

•

Operating Productivity Funds

Incremental Strategic Investments

•

Decline in Dewatering related to

Fracking along with weak Public

Utility CAPEX and European market

conditions impacted 2013

$M

$M

25

REVENUE

OPERATING INCOME & MARGIN*

HIGHLIGHTS

* See appendix for non-GAAP reconciliations

2008

2009

2010

2011

2012

2013

1,824

1,651

1,930

2,416

2,425

2,457

2008

2009

2010

2011

2012

2013

237

242

288

359

365

323

LEVERAGE & RECENT COST REDUCTION ACTIONS ACCELRATE LONG-TERM GROWTH

|

XYLEM PROPRIETARY / CONFIDENTIAL

26

APPLIED WATER SYSTEMS

SEGMENT OVERVIEW

Market Size:

2013 Revenues:

Key Products

& Services:

2013 Revenues

by Geography:

Key Facilities:

Key Brands:

$9B

$696M

$4B

$600M

HVAC Pumps, Valves & Heat

Exchangers, Drives & Controls,

Waste Water Pumps, Pressure

Boosters, Fire Protection

Auburn, NY; Buffalo, NY; Cegled, Hungary; Chihuahua, Mexico; Dallas, TX; Hoddesdon, UK;

Montecchio, Italy; Morton Grove, IL; Nanjing, China; Stockerau, Austria; Strzelin,

Poland; Wolverhampton, UK Pumps & Pumping Systems

Heat Exchangers, Drives & Controls

Membrane Filtration

Fire Protection

$2B

$102M

Groundwater & Surface Pumps

Packaged Systems, Drives &

Controls

BUILDING SERVICES

INDUSTRIAL WATER

IRRIGATION

58%

16%

10%

16%

U.S.

Europe

Asia Pacific

Other

45%

37%

9%

9%

U.S.

Europe

Asia Pacific

Other

52%

33%

1%

14%

U.S.

Europe

Asia Pacific

Other |

APPLIED WATER

Growth: -18%

6%

9%

-1% 1%

Organic*:

OM%:

11.8% 9.9%

12.1% 12.0%

12.4% 12.7% STRONG OPERATING PERFORMANCE DESPITE

CHALLENGED MARKETS ‘08-’13 Revenue Down 5%

•

Residential & Commercial Building

Decline

•

Growth Driven By New Product

Launches

–

Energy-Efficient Solutions

–

Emerging Markets Penetration

Strong Operating Performance

•

Margin Expansion Driven by Customer

& Operational Excellence Initiatives

•

Continued to Fund Future Growth

Investments

$M

$M

27

REVENUE

OPERATING INCOME & MARGIN*

* See appendix for non-GAAP reconciliations

HIGHLIGHTS

2008

2009

2010

2011

2012

2013

180

124

161

173

177

183

2008

2009

2010

2011

2012

2013

1,527

1,254

1,327

1,444

1,424

1,444

-15%

6%

7%

1%

0% |

XYLEM PROPRIETARY / CONFIDENTIAL

ACQUISITION SCORECARD

Completed

On Track

Not Achieved

28

Laing

$30

2009

Nova

$384

2010

Godwin

$585

2010

OI

$25

2010

YSI

$310

2011

Through

2012

MJK

$13

2012

$29

2012

PIMS

$57

2013

MultiTrode

$26

2013

Acquisition

Invested

$M

Year

Completed

Strategic

Fit

Gross

Margin

Accretive

Risk Adj.

Cost of

Capital

Mid-

Teens

ROIC

Cash

Return

7-9 Years

EPS

Accretive

After Yr 1

Added

~200 Bps

Added

~$0.45

IRR >

Heartland |

29

2014 FINANCIAL GUIDANCE SUMMARY

Q1 2014 EARNINGS RELEASE

* Excluding Restructuring & Realignment costs, and special tax items

2014 Full Year

Growth

Revenue

Total Growth

Organic

FX/Acquisition

Xylem Consolidated

$3,900 to $3,980

2% to 4%

1% to 3%

1%

Water Infrastructure

$2,500 to $2,540

2% to 4%

2% to 3%

1%

Applied Water

$1,470

to $1,490

2% to 3%

1% to 2%

1%

Segment Margin *

14.1% to 14.6%

+90 bps to +140 bps

Operating

Margin *

12.6%

to 13.2%

+80 bps to

+140 bps

EPS *

$1.85 to $2.00

Up 11% to 20%

Free Cash Flow Conversion

~100%

Guidance

Assumptions:

Operating

Tax Rate *

~21%

Unchanged from 2013

Share

Count

~185M

Q2: 185.5; ~$130M for Share Repurchases in 2014

Restructuring &

Realignment Costs

~$40 to $50

‘14

Rest. Savings ~$15M; Realignment Cost $10-$15

Financial

Outlook

2014E vs. 2013

SOLID START TO 2014 …

AFFIRMING FULL YEAR GUIDANCE

(Dollars In Millions, Except per Share Data) |

XYLEM PROPRIETARY / CONFIDENTIAL

30

NON-GAAP MEASURES

“Organic revenue" and "Organic orders”

defined as revenue and orders, respectively, excluding the impact of foreign currency

fluctuations, “Constant currency”

defined as financial results adjusted for currency translation impacts by translating current

period and prior period activity using the same currency conversion rate. This

approach is used for countries whose functional currency is not the U.S. dollar.

“EBITDA”

defined

as

earnings

before

interest,

taxes,

depreciation,

amortization

expense,

and

share-based

compensation.

“Adjusted

EBITDA”

reflects

the adjustment to EBITDA to exclude non-recurring restructuring and realignment costs.

“Adjusted

Operating

Income",

"Adjusted

Segment

Operating

Income",

and

“Adjusted

EPS”

defined

as

operating

income

and

earnings

per

share,

“Free Cash Flow”

defined as net cash from operating activities, as reported in the Statement of Cash Flow,

less capital expenditures as well as Management views key performance indicators

including revenue, gross margins, segment operating income and margins, orders growth, free cash

flow, working capital, and backlog, among others. In addition, we consider certain measures to

be useful to management and investors evaluating our operating performance for the

periods presented, and provide a tool for evaluating our ongoing operations, liquidity and management of assets. This

information can assist investors in assessing our financial performance and measures our

ability to generate capital for deployment among competing strategic alternatives and

initiatives. These metrics, however, are not measures of financial performance under GAAP and should not be considered a

substitute for revenue, operating income, net income, earnings per share (basic and diluted)

or net cash from operations as determined in accordance with GAAP. We consider the

following non-GAAP measures, which may not be comparable to similarly titled measures reported by other companies,

to be key performance indicators:

“Realignment costs”

defined as non-recurring costs not included in restructuring costs that are incurred as part of actions taken to

reposition our business, including items such as professional fees, relocation,

travel and other costs. adjusted to exclude non-recurring restructuring and realignment costs and tax-related

special items.

adjustments for other significant items that impact current results which management believes

are not related to our ongoing operations and performance. Our definition of free

cash flows does not consider non-discretionary cash payments, such as debt.

intercompany transactions, and contributions from acquisitions and divestitures.

Divestitures include sales of portions of our business that did not meet the

criteria for classification as a discontinued operation or insignificant portions of our business that we did not classify as a discontinued operation.

The period-over-period change resulting from foreign currency fluctuations assumes no

change in exchange rates from the prior period. |

XYLEM PROPRIETARY / CONFIDENTIAL

31

Constant Currency

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

(H) = (F - C) / A

Change

% Change

Change

% Change

Revenue

Revenue

CY v. PY

CY v. PY

FX Contribution

Eliminations

Adj. CY v. PY

Adj. CY v. PY

Current Year

Prior Year

Year Ended December 31, 2013

Xylem Inc.

3,837

3,791

46

1%

(82)

(3)

-

(39)

-1%

1%

Water infrastructure

2,457

2,425

32

1%

(82)

4

-

(46)

-2%

1%

Applied Water

1,444

1,424

20

1%

-

(9)

(6)

5

0%

0%

Year Ended December 31, 2012

Xylem Inc.

3,791

3,803

(12)

0%

(94)

108

-

2

0%

3%

Water infrastructure

2,425

2,416

9

0%

(94)

80

(1)

(6)

0%

4%

Applied Water

1,424

1,444

(20)

-1%

-

32

(3)

9

1%

1%

Year Ended December 31, 2011

Xylem Inc.

3,803

3,202

601

19%

(264)

(111)

-

226

7%

15%

Water Infrastructure

2,416

1,930

486

25%

(264)

(87)

2

137

7%

21%

Applied Water

1,444

1,327

117

9%

-

(28)

(1)

88

7%

7%

Year Ended December 31, 2010

Xylem Inc.

3,202

2,849

353

12%

(263)

6

-

96

3%

13%

Water infrastructure

1,930

1,651

279

17%

(247)

(8)

-

24

1%

16%

Applied Water

1,327

1,254

73

6%

(16)

15

-

72

6%

7%

Year Ended December 31, 2009

Xylem Inc.

2,849

3,291

(442)

-13%

(7)

158

-

(291)

-9%

-9%

Water infrastructure

1,651

1,824

(173)

-9%

-

109

(1)

(65)

-4%

-4%

Applied Water

1,254

1,527

(273)

-18%

(7)

53

-

(227)

-15%

-14%

Note: Due to rounding the sum of segment amounts may not agree to Xylem totals.

Acquisitions /

Divestitures

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic & Constant Currency Revenue

($ Millions)

(As Reported - GAAP)

(As Adjusted - Organic) |

XYLEM PROPRIETARY / CONFIDENTIAL

32

2008

2009

2010

2011

2012

2013

Revenue

3,291

2,849

3,202

3,803

3,791

3,837

Operating Income

315

276

388

395

443

363

Operating Margin

9.6%

9.7%

12.1%

10.4%

11.7%

9.5%

Restructuring & Realignment

41

31

15

-

24

64

Separation Costs*

-

-

-

87

22

-

Special Charges

-

-

-

-

-

24

Adjusted Operating Income

356

307

403

482

489

451

Adjusted Operating Margin

10.8%

10.8%

12.6%

12.7%

12.9%

11.8%

Standalone Costs

-

-

-

5

28

-

Adj. Operating Income, excl. Standalone Costs

356

307

403

487

517

451

Adjusted Operating Margin, excl. Standalone Costs

10.8%

10.8%

12.6%

12.8%

13.6%

11.8%

Xylem Inc. Non-GAAP Reconciliation

Adjusted Operating Income

($ Millions)

* 2013 separation costs are not excluded from adjusted operating income.

|

XYLEM PROPRIETARY / CONFIDENTIAL

33

2013

2012

2011

2010

2009

2008

Total Revenue

• Total Xylem

3,837

3,791

3,803

3,202

2,849

3,291

• Water Infrastructure

2,457

2,425

2,416

1,930

1,651

1,824

• Applied Water

1,444

1,424

1,444

1,327

1,254

1,527

Operating Income

• Total Xylem

363

443

395

388

276

315

• Water Infrastructure

271

342

343

276

227

220

• Applied Water

167

170

160

158

109

162

Operating Margin

• Total Xylem

9.5%

11.7%

10.4%

12.1%

9.7%

9.6%

• Water Infrastructure

11.0%

14.1%

14.2%

14.3%

13.7%

12.1%

• Applied Water

11.6%

11.9%

11.1%

11.9%

8.7%

10.6%

Separation Costs

• Total Xylem

-

22

87

-

-

-

• Water Infrastructure

-

4

16

-

-

-

• Applied Water

-

2

13

-

-

-

Special Charges

• Total Xylem

24

-

-

-

-

• Water Infrastructure

4

-

-

-

-

• Applied Water

-

-

-

-

-

Restructuring & Realignment Costs

• Total Xylem

64

24

-

15

31

41

• Water Infrastructure

48

19

-

12

15

17

• Applied Water

16

5

-

3

15

18

Adjusted Operating Income*

• Total Xylem

451

489

482

403

307

356

• Water Infrastructure

323

365

359

288

242

237

• Applied Water

183

177

173

161

124

180

Adjusted Operating Margin*

• Total Xylem

11.8%

12.9%

12.7%

12.6%

10.8%

10.8%

• Water Infrastructure

13.1%

15.1%

14.9%

14.9%

14.7%

13.0%

• Applied Water

12.7%

12.4%

12.0%

12.1%

9.9%

11.8%

*Adjusted Operating Income excludes non-recurring separation, restructuring &

realignment costs Xylem Inc. Non-GAAP Reconciliation

Adjusted Operating Income

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

34

2013

2012

2011

2010

2009

2008

Net Cash - Operating Activities

324

396

449

395

370

408

Capital Expenditures

(126)

(112)

(126)

(94)

(62)

(67)

Free Cash Flow, including separation costs

198

284

323

301

308

341

Cash Paid for Separation Costs (incl. Capex)

-

28

65

-

-

-

Free Cash Flow, excluding separation costs*

198

312

388

301

308

341

Net Income

228

297

279

329

263

224

Separation Costs, net of tax (incl. tax friction)

-

16

72

0

0

0

Net Income, excluding separation costs*

228

313

351

329

263

224

Free Cash Flow Conversion

87%

100%

111%

91%

117%

152%

* Separation costs are not excluded in 2013

Year Ended

Xylem Inc. Non-GAAP Reconciliation

Net Cash - Operating Activities vs. Free Cash Flow

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

35

2008

2009

2010

2011

2012

2013

Net Income

224

263

329

279

297

228

Separation Costs, Net of Tax*

-

-

-

72

16

-

Restructuring & Realignment, Net of Tax

28

22

11

-

17

46

Special Charges, Net of Tax

-

-

-

-

-

23

Adjusted Net Income before Special Tax Items

252

285

340

351

330

297

Special Tax Items

-

(61)

(43)

7

-

14

Adjusted Net Income

252

224

297

358

330

311

Diluted Earnings per Share

$1.22

$1.42

$1.78

$1.50

$1.59

$1.22

Separation Costs per Share*

$0.00

$0.00

$0.00

$0.39

$0.09

$0.00

Restructuring & Realignment Costs per Share

$0.14

$0.11

$0.06

$0.00

$0.09

$0.25

Special Charges per Share

-

-

-

-

-

$0.13

Adjusted Diluted EPS before Special Tax Items

$1.36

$1.53

$1.84

$1.89

$1.77

$1.60

Special Tax Items per Share

$0.00

($0.32)

($0.23)

$0.04

$0.00

$0.07

Adjusted Diluted EPS

$1.36

$1.21

$1.61

$1.93

$1.77

$1.67

* Separation costs are not excluded in 2013

Xylem Inc. Non-GAAP Reconciliation

Adjusted Diluted EPS

($ Millions, except per share amounts) |

XYLEM PROPRIETARY / CONFIDENTIAL

36

2008

2009

2010

2011

2012

2013

Pre-Tax Income

312

277

388

383

388

298

Interest Expense (Income),

net -

-

-

17

51

52

Depreciation

and Amortization 72

79

101

137

142

149

Stock Compensation

-

-

-

13

22

27

EBITDA

384

356

489

550

603

526

Separation Costs*

-

-

-

87

22

64

Restructuring

& Realignment 41

31

15

-

24

32

Adjusted

EBITDA 425

387

504

637

649

622

Revenue

3,291

2,849

3,202

3,803

3,791

3,837

Adjusted EBITDA Margin

12.9%

13.6%

15.7%

16.7%

17.1%

16.2%

* Separation costs are not excluded in 2013

Xylem Inc. Non-GAAP Reconciliation

EBITDA and Adjusted EBITDA

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

37

Constant Currency

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

(H) = (F -

C) / A

Change

% Change

Change

% Change

Revenue

Revenue

2014 v. 2013

2014 v. 2013

FX Contribution

Eliminations

Adj. 2014 v. 2013

Adj. 2014 v. 2013

2014

2013

Quarter Ended March 31

Xylem Inc.

906

879

27

3%

(5)

4

-

26

3%

4%

Water infrastructure

568

551

17

3%

(5)

7

1

20

4%

5%

Applied Water

355

345

10

3%

-

(3)

(1)

6

2%

2%

Note: Due to rounding the sum of segment amounts may not agree to Xylem totals.

Acquisitions /

Divestitures

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic & Constant Currency Revenue

($ Millions)

(As Reported -

GAAP)

(As Adjusted -

Organic)

Constant Currency

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

(H) = (F -

C) / A

Change

% Change

Change

% Change

Orders

Orders

2014 v. 2013

2014 v. 2013

FX Contribution

Eliminations

Adj. 2014 v. 2013

Adj. 2014 v. 2013

2014

2013

Quarter Ended March 31

Xylem Inc.

993

962

31

3%

(7)

3

-

27

3%

4%

Water infrastructure

619

601

18

3%

(7)

6

2

19

3%

4%

Applied Water

394

378

16

4%

-

(4)

(3)

9

2%

2%

Note: Due to rounding the sum of segment amounts may not agree to Xylem totals.

Acquisitions /

Divestitures

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic & Constant Currency Order Growth

($ Millions)

(As Reported -

GAAP)

(As Adjusted -

Organic) |

XYLEM PROPRIETARY / CONFIDENTIAL

38

Q1

2014

2013

Total Revenue

•

Total Xylem

906

879

•

Water Infrastructure

568

551

•

Applied Water

355

345

Operating Income

•

Total Xylem

76

66

•

Water Infrastructure

46

42

•

Applied Water

41

40

Operating Margin

•

Total Xylem

8.4%

7.5%

•

Water Infrastructure

8.1%

7.6%

•

Applied Water

11.5%

11.6%

Restructuring & Realignment Costs

•

Total Xylem

18

12

•

Water Infrastructure

12

10

•

Applied Water

6

2

Adjusted Operating Income*

•

Total Xylem

94

78

•

Water Infrastructure

58

52

•

Applied Water

47

42

Adjusted Operating Margin*

•

Total Xylem

10.4%

8.9%

•

Water Infrastructure

10.2%

9.4%

•

Applied Water

13.2%

12.2%

Xylem Inc. Non-GAAP Reconciliation

Adjusted Operating Income

($ Millions)

*Adjusted Operating Income excludes restructuring & realignment costs.

|

XYLEM PROPRIETARY / CONFIDENTIAL

39

Q1 2013

Q1 2014

As Reported

Adjustments

Adjusted

As Reported

Adjustments

Adjusted

Total Revenue

879

879

906

906

Operating Income

66

12

a

78

76

18

a

94

Operating Margin

7.5%

8.9%

8.4%

10.4%

Interest Expense

(13)

(13)

(14)

(14)

Other Non-Operating Income (Expense)

(2)

(2)

(1)

(1)

Income before Taxes

51

12

63

61

18

79

Provision for Income Taxes

(10)

(3)

b

(13)

(12)

(4)

b

(16)

Net Income

41

9

50

49

14

63

Diluted Shares

186.4

186.4

185.8

185.8

Diluted EPS

0.22

$

0.05

$

0.27

$

0.27

$

0.07

$

0.34

$

a

Restructuring & realignment costs

b

Net tax impact of restructuring & realignment costs and special tax items

Xylem Inc. Non-GAAP Reconciliation

Adjusted Diluted EPS

($ Millions, except per share amounts)

*******

*******

*******

******* |

XYLEM PROPRIETARY / CONFIDENTIAL

40

2014

2013

Net Cash - Operating Activities

22

$

20

$

Capital Expenditures

(25)

(30)

Free Cash Flow

(3)

$

(10)

$

Net Income

49

$

41

$

Free Cash Flow Conversion

-6%

-24%

Xylem Inc. Non-GAAP Reconciliation

Net Cash - Operating Activities vs. Free Cash Flow

($ Millions)

Three Months Ended

**

**

**

**

**

*****************

*****************

*****************

*****************

*****************

*****************

*****************

*****************

*****************

*****************

*****************

********* |

XYLEM PROPRIETARY / CONFIDENTIAL

41

NYSE: XYL

Phil De Sousa, Investor Relations Officer

(914) 323-5930

Dawn Powell, Investor Relations Coordinator

(914) 323-5931

http://investors.xyleminc.com

*****************************

*****************************

*****************************

***************************** |