Attached files

| file | filename |

|---|---|

| EX-10.7 - EX-10.7 - U.S. RARE EARTHS, INC | a2220153zex-10_7.htm |

| EX-21.1 - EX-21.1 - U.S. RARE EARTHS, INC | a2220153zex-21_1.htm |

| EX-23.1 - EX-23.1 - U.S. RARE EARTHS, INC | a2220153zex-23_1.htm |

| EX-10.5 - EX-10.5 - U.S. RARE EARTHS, INC | a2220153zex-10_5.htm |

| EX-10.38 - EX-10.38 - U.S. RARE EARTHS, INC | a2220153zex-10_38.htm |

| EX-10.39 - EX-10.39 - U.S. RARE EARTHS, INC | a2220153zex-10_39.htm |

| EX-10.37 - EX-10.37 - U.S. RARE EARTHS, INC | a2220153zex-10_37.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on May 14, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

U.S. RARE EARTHS, INC.

(Exact name of registrant as specified in its charter)

Nevada |

7310 (Primary Standard Industrial Classification Code Number) |

87-0638338 (I.R.S. Employer Identification No.) |

5600 Tennyson Parkway, Suite 240,

Plano, Texas, 75024

(972)-294-7116

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Kevin Cassidy

Chief Executive Officer

U.S. Rare Earths, Inc.

5600 Tennyson Parkway, Suite 240,

Plano, Texas, 75024

(972)-294-7116

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to: |

||

Jeffrey J. Fessler, Esq. |

Robert H. Cohen, Esq. |

|

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o |

Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) |

||

|---|---|---|---|---|

Common Stock, $0.00001 par value per share(3) |

$23,000,000 | $2,962.40 | ||

Representative's Warrants to Purchase Common Stock(4) |

— | — | ||

Total |

$23,000,000 | $2,962.40 | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes

the offering price of additional shares that the underwriters have the option to purchase from the registrant to cover over-allotments, if any.

- (2)

- Calculated

pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

- (3)

- Pursuant

to Rule 416 under the Securities Act, the shares of common stock registered hereby also include an indeterminate number of additional shares

of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions.

- (4)

- No registration fee pursuant to Rule 457(g) under the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities or the solicitation of an offer to buy these securities in any state in which such offer, solicitation or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED MAY 14, 2014 |

Shares

Common Stock

This is a firm commitment public offering of shares of our common stock.

Our common stock is quoted on the OTCQB under the symbol "UREE". We have applied for listing of our common stock on NYSE MKT under the symbol " ". No assurance can be given that our application will be approved. On May 13, 2014, the last reported sale price for our common stock was $2.00 per share.

Investing in our securities involves a high degree of risk. See the section entitled "Risk Factors" beginning on page 10 in this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share | Total | ||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds to us, before expenses |

$ | $ |

- (1)

- The underwriters will receive compensation in addition to the underwriting discount and commissions. See "Underwriting" beginning on page 77 for a description of compensation payable to the underwriters.

We have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in the offering on or about , 2014.

Aegis Capital Corp

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our common stock, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our common stock means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy the shares of common stock in any circumstances under which the offer or solicitation is unlawful.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in "Risk Factors." These and other factors could cause our future performance to differ materially from our assumptions and estimates. See "Special Note Regarding Forward-Looking Statements."

U.S. Rare Earths is our trademark that is used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

GLOSSARY OF SELECTED MINING TERMS

For convenience, this glossary includes selected mining terms used in this prospectus that may be technical in nature:

"AEC" means the United States Atomic Energy Commission.

"Adit" means an opening driven horizontally into the side of a mountain or hill for providing access to a mineral deposit.

"Assay" means a measure of the valuable mineral content.

"BLM" means the United States Bureau of Land Management and any successor entity having authority with respect to our claims.

"Claims" means the approximately 1,300 unpatented mining claims on approximately 25,000 acres of land in Colorado, Idaho and Montana held by us.

"Core" means the long cylindrical piece of a rock, about an inch in diameter, brought to the surface by diamond drilling.

"Deposit" means an informal term for an accumulation of mineral ores.

"Development stage" means the U.S. Securities and Exchange Commission's descriptive category applicable to public mining companies which are engaged in the preparation of established commercially minable deposits and ore reserves but which are not in the production stage.

"Diamond drilling" means a drilling method in which the cutting is done by abrasion using diamonds embedded in a matrix rather than by percussion. The drill cuts a core of rock, which is recovered in long cylindrical sections.

"Exploration stage" means the U.S. Securities and Exchange Commission's descriptive category applicable to public mining companies which are engaged in the search for mineral deposits and ore reserves and which are neither in the development or production stage.

"Feasibility Study" means an engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability.

"General Mining Law" means the General Mining Law of 1872, as amended.

"Grade" means the metal content of ore, usually expressed in troy ounces per ton (2,000 pounds) or in grams per ton or metric tonnes that contain 2,204.6 pounds or 1,000 kilograms.

"Lanthanide elements" mean the 15 chemical (metallic) elements known as rare earth elements.

"Lode" means a mineral deposit in a solid rock.

"Mineral reserve" means that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of "Ore" when dealing with metalliferous mineral.

"Ore" means naturally occurring material from which a mineral or minerals of economic value can be extracted profitably or to satisfy social or political objectives. The term is generally but not always used to refer to metalliferous material, and is often modified by the names of the valuable constituent; e.g., iron ore.

"Ore body" means continuous, well-defined mass of material of sufficient ore content to make extraction economically feasible.

"Probable reserves" means reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and

1

measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

"Production stage" means the U.S. Securities and Exchange Commission's descriptive category applicable to public mining companies which are engaged in the exploitation of mineral deposits and ore reserves.

"Project" means an identified group of claims consolidated for exploration activities, the value of which has not been determined by exploration.

"Prospect" means a geological area which is believed to have the potential for rare earth production.

"Proven reserves" means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

"Rare Earth Elements" or "REEs" include 16 chemical (metallic) elements consisting of the 15 "lanthanide elements" (cerium, lanthanum, neodymium, praseodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium) and yttrium.

"Reserve" means that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

"Trend" means a general term for the direction or bearing of the outcrop of a geological feature of any dimension, such as a layer, vein, ore body, or fold.

"Unpatented mining claim" means a parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim.

"Vein" means a mineralized zone having a more or less regular development in length, width, and depth, which clearly separates it from neighboring rock.

2

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the "Risk Factors" section of this prospectus and our financial statements and the related notes appearing at the end of this prospectus, before making an investment decision.

As used in this prospectus, unless the context otherwise requires, references to "we," "us," "our," "our company" and "USRE" refer to U.S. Rare Earths, Inc. and its consolidated subsidiaries.

We are a rare earth elements exploration company seeking to identify and ultimately mine commercially-viable sources of domestic rare earth elements.

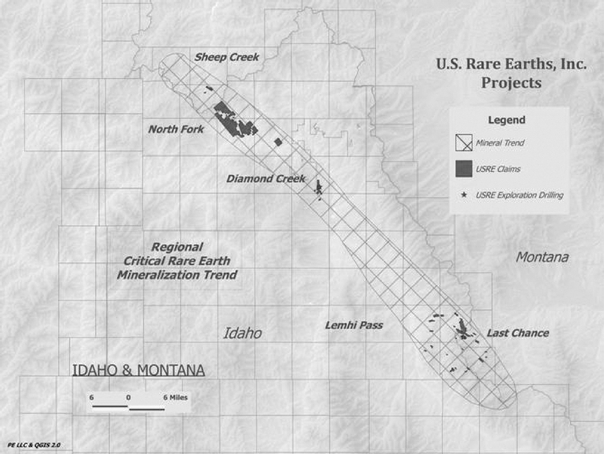

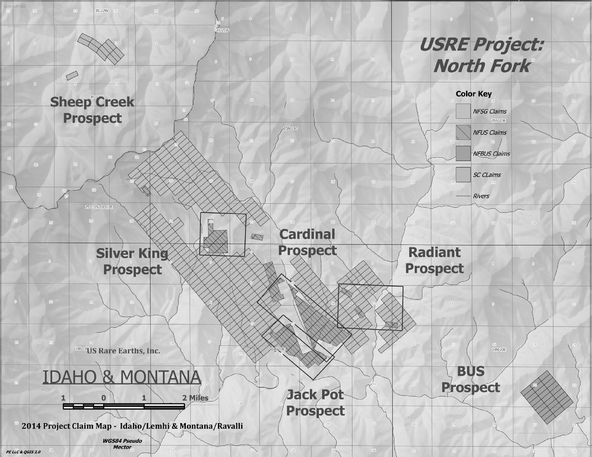

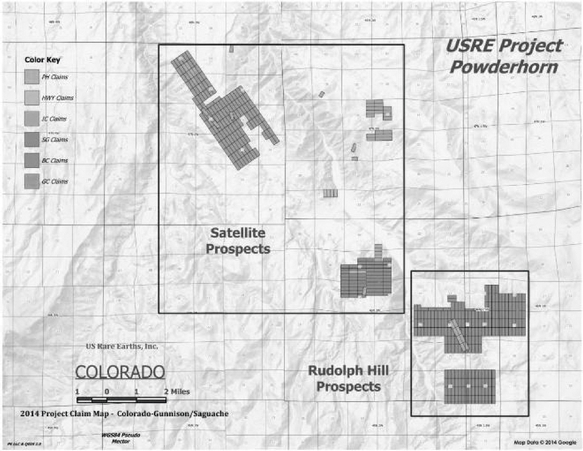

Currently, our operations are exploratory in nature. We hold over 1,300 unpatented lode mining claims located on approximately 25,000 acres of land in Idaho, Montana and Colorado. In Idaho and Montana, our claims are located in the Lemhi Pass mineral trend in Lemhi County, Idaho, and Beaverhead and Ravalli Counties, Montana. These claims are grouped into projects that include the Last Chance and Sheep Creek Projects in Montana and the North Fork, Lemhi Pass and Diamond Creek Projects in Idaho. In Colorado, the claims include the Powderhorn Project in Gunnison County, and Wet Mountain Project in Fremont County. We are not producing rare earth elements from any of our claims and further exploration will be required in order to evaluate and identify the commercial viability of producing rare earth elements from any of our claims. As a result, we have no probable or proved reserves of rare earth elements.

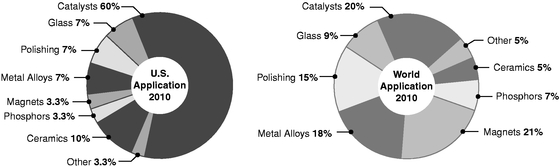

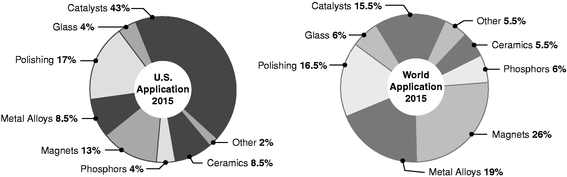

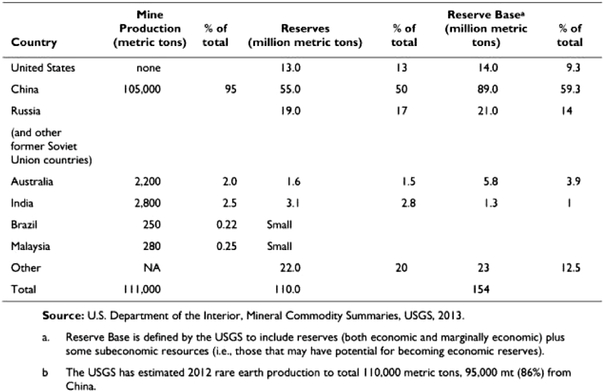

Global demand for rare earth elements, or REEs, has experienced an upward trend. This is projected to continue to grow as a result of the developing rare earth elements supply chain as more high-tech and green industry applications come to market. During this time, China has been the primary producer and refiner of rare earth elements. With China's dominance of the production and refinement of REEs, the rest of the world is currently dependent on Chinese exports to meet its own growing needs specifically related to heavy rare earth elements and critical rare earth elements.

According to the Industrial Mineral Company of Australia Pty Ltd., or IMCOA and the Office of Research & Development at Curtin University, or Curtin University, global demand for rare earth oxides, or REOs, in 2013 was estimated to be between 120,000 and 130,000 metric tons growing to between 140,000 and 150,000 metric tons in 2015. At the same time, IMCOA and Curtin University estimate that Chinese rare earth oxide production in 2013 was 100,000 metric tons growing to 110,000 metric tons in 2015 with an estimated domestic Chinese demand of approximately 80,000 metric tons in 2013 growing to 90,000 metric tons in 2015. Therefore, with global demand growing at a faster pace than Chinese excess supply, we believe greater rare earth supply sources outside of China will be needed to make up the shortfall to meet global demand.

While production from new operations such as Mountain Pass in California and Mt. Weld in Western Australia may be able to make up some of the shortfall between demand and supply, according to the Congressional Research Service Report entitled Rare Earth Elements: The Global Supply Chain by Marc Humphries dated December 16, 2013, or CRS Report, several forecasts show that there may be shortfalls of some rare earth elements.

As we hold nearly all of the historically known rare earth element mineralization occurrences in the Lemhi Pass District of East-Central Idaho and South-Western Montana, we believe we can play an important role in addressing this increasing supply/demand disparity.

3

Our goal is to become the leading rare earth elements supplier in the United States. We intend to achieve our goal by implementing the following strategies:

- •

- expansion of our exploration activities at our Idaho, Montana and Colorado properties with a view to completing a

feasibility study and developing a production plan;

- •

- focus on heavy rare earth elements that command higher sales prices on a per kilogram basis;

- •

- create a rare earth separation facility in the continental United States;

- •

- assemble a world-class management team; and

- •

- review opportunities and acquire additional rare earth mining claims with meaningful exploration potential.

We hold more than 1,300 unpatented mining claims located on approximately 25,000 acres of land in Colorado, Idaho, and Montana. These claims have been filed pursuant to the General Mining Law of 1872, as amended, or General Mining Law, on lands where both the surface and mineral interest are owned by the United States government.

Montana and Idaho

We have more than 700 claims in Beaverhead and Ravalli Counties, Montana, and in Lemhi County, Idaho, located on more than 14,000 acres of land. These claims are grouped into projects that include the Last Chance and Sheep Creek Projects in Montana and the North Fork, Lemhi Pass and Diamond Creek Projects in Idaho. All of these claims are located on properties that are part of the Lemhi Pass mineral trend. This trend extends for about 60 miles through Montana and Idaho and contains known anomalous rare earth mineralization.

Colorado

Our mining claims in Colorado are located in Fremont, Gunnison, and Saguache Counties, and include over 600 unpatented claims located on more than 12,000 acres of land, which we have identified as the Powderhorn and Wet Mountain Projects. The Powderhorn Project is in an area surrounding, but excluding, Iron Hill. Iron Hill is recognized as the largest exposed carbonatite mass in the United States. Carbonatite is a rock type known to be highly associated with rare earth element deposits worldwide. Given its proximity to Iron Hill, we believe our mining claims in the Powderhorn Project may contain rare earth element mineralized trends or veins.

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the "Risk Factors" section of this prospectus beginning on page 10. These risks include, but are not limited to, the following:

- •

- We have incurred operating losses since our inception and anticipate that we will continue to incur substantial operating

losses for the foreseeable future.

- •

- Our history of net losses has raised substantial doubt regarding our ability to continue as a going concern. If we do not continue as a going concern, investors could lose their entire investment.

4

- •

- The mining industry is capital intensive, and we will require substantial additional financing to achieve our goals. A

failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our exploration activities.

- •

- The restatement of our financial statements may result in litigation or government enforcement actions. Any such action

would likely harm our business, prospects, financial condition and results of operations.

- •

- Our management has concluded that we have material weaknesses in our internal controls over financial reporting and that

our disclosure controls and procedures are not effective.

- •

- We recently settled litigation regarding the composition of our board of directors. Litigation or the actions of

regulatory authorities may harm our business or otherwise distract our management.

- •

- We may become subject to tax assessments, penalties and interest for historically processing compensation as independent

contractors rather than as payroll.

- •

- All of our projects are in the exploration stage. There is no assurance that we can establish the existence of any mineral

reserve on any of our projects in commercially exploitable quantities. As a result, we do not know if our claims contain rare earth elements that can be mined at a profit and, consequently, we face a

high risk of business failure.

- •

- We are a junior exploration company with no operating mining activities, and we may never have any mining activities in

the future.

- •

- Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of

business failure.

- •

- Conditions in the rare earth industry have been, and may continue to be, extremely volatile, which could have a material

impact on our company.

- •

- Our business is subject to extensive environmental regulations that may make exploring, mining or related activities

prohibitively expensive, and which may change at any time.

- •

- The government licenses and permits which we need to explore on our property may take too long to acquire or cost too much to enable us to proceed with exploration.

We were incorporated in the State of Delaware on July 27, 1999 and changed our domicile to the State of Nevada in December 2007. Our principal executive offices are located at 5600 Tennyson Parkway, Suite 240, Plano, Texas 75024. The telephone number is 972-294-7116. Our principal website address is located at www.usrareearths.com. The information contained on, or that can be accessed through, our website is not incorporated into and is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

5

Common stock offered by us |

shares |

|

Common stock to be outstanding after this offering |

shares |

|

Over-allotment option |

The underwriters have an option for a period of 45 days to purchase up to additional shares of our common stock to cover over-allotments. |

|

Use of proceeds |

We expect to receive net proceeds from this offering of approximately $ million after deducting the underwriting discounts and commissions and estimated offering expenses. We intend to use the net proceeds from this offering for general corporate purposes, including working capital, as well as for reimbursement of certain costs in the amount of $295,000 in connection with certain contingent agreements reached in a Settlement Agreement described in the section entitled "Transactions with Related Persons". See "Use of Proceeds". We may also use a portion of the net proceeds to acquire or invest in complementary businesses, products and technologies. Although we have no specific agreements, commitments, or understandings with respect to any acquisition, we evaluate acquisition opportunities and engage in related discussions with other companies from time to time. Pending the use of the net proceeds of this offering, we intend to invest the net proceeds in short-term investment-grade, interest-bearing securities. |

|

Risk factors |

You should read the "Risk Factors" section starting on page 10 of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

|

OTCQB Symbol |

UREE |

|

Proposed listing on NYSE MKT |

We have applied for listing of our common stock on the NYSE MKT under the symbol " ". No assurance can be given that our application will be approved. |

The number of shares of our common stock outstanding after this offering is based on shares of our common stock outstanding as of , 2014, and excludes:

- •

- shares of our common stock issuable upon the exercise of stock options outstanding as

of ,

2014 at a weighted-average exercise price of $ per share;

- •

- shares of our common stock issuable upon the exercise of warrants outstanding as

of , 2014

at a weighted-average exercise price of $ per share;

- •

- additional shares of our common stock available for future issuance as

of , 2014 under our

2013 Stock Incentive Plan;

- •

- shares of our common stock issuable upon exercise of the underwriters' option to purchase additional shares of our common stock to cover over-allotments; and

6

- •

- shares of common stock issuable upon exercise of a warrant to be issued to the representative in connection with this offering, at an exercise price per share equal to 125% of the public offering price.

Unless otherwise indicated, all information in this prospectus assumes:

- •

- no exercise of the outstanding options or warrants described above;

- •

- no exercise by the underwriters of their option to purchase additional shares of our common stock to cover

over-allotments, if any; and

- •

- no exercise of the representative's warrant.

7

You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the "Capitalization," "Selected Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections in this prospectus. We have derived the statements of operations data for the years ended December 31, 2013 and 2012 and the balance sheet data as of December 31, 2013 from our audited financial statements included in this prospectus. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period.

Statements of Operations data:

| |

Years Ended, | ||||||

|---|---|---|---|---|---|---|---|

| |

December 31, 2013 |

December 31, 2012 |

|||||

Operating Expenses |

$ | $ | |||||

Selling, general and administrative expenses |

3,428,718 | 6,012,089 | |||||

Exploration expense |

1,330,162 | 422,904 | |||||

Impairment expense |

326,000 | — | |||||

| | | | | | | | |

Total operating expenses |

5,084,880 | 6,434,993 | |||||

| | | | | | | | |

(Loss) from operations |

(5,084,880 | ) | (6,434,993 | ) | |||

| | | | | | | | |

Other income (expense) |

|||||||

Interest income |

— | 46 | |||||

Interest expense |

(19,190 | ) | (138,806 | ) | |||

Loss on debt settlement |

(1,282,650 | ) | — | ||||

Loss on derivative liability option |

(429,000 | ) | — | ||||

Loss on legal settlement |

(10,923,600 | ) | — | ||||

Other income (expense) |

(40,000 | ) | — | ||||

| | | | | | | | |

Total other income (expense) |

(12,694,440 | ) | (138,760 | ) | |||

| | | | | | | | |

(Loss) before income taxes |

(17,779,320 | ) | (6,573,753 | ) | |||

Income tax expense |

— | — | |||||

| | | | | | | | |

(Loss) from continuing operations |

(17,779,320 | ) | (6,573,753 | ) | |||

| | | | | | | | |

(Loss) from discontinued operations |

(57,942 | ) | (186,788 | ) | |||

| | | | | | | | |

Net loss |

$ | (17,837,262 | ) | $ | (6,760,541 | ) | |

| | | | | | | | |

| | | | | | | | |

Per share data: |

|||||||

Net loss per share before discontinued operations Attributable to UREE common shareholders |

$ | (0.61 | ) | $ | (0.28 | ) | |

| | | | | | | | |

| | | | | | | | |

Discontinued operations attributable to UREE common shareholders |

$ | (0.00 | ) | $ | (0.01 | ) | |

| | | | | | | | |

| | | | | | | | |

Net loss per share attributable to UREE common shareholders |

$ | (0.61 | ) | $ | (0.29 | ) | |

| | | | | | | | |

| | | | | | | | |

Weighted average number of shares outstanding—basic and diluted |

29,154,812 | 23,441,689 | |||||

| | | | | | | | |

| | | | | | | | |

8

Balance Sheet Data:

| |

As of December 31, 2013 |

As Adjusted December 31, 2013(1) |

|||||

|---|---|---|---|---|---|---|---|

Summary Balance Sheet Information: |

$ | $ | |||||

Current assets |

2,266,202 | ||||||

Assets from discontinued operations |

111,519 | ||||||

Total assets |

2,491,253 | ||||||

Current liabilities |

4,299,292 | ||||||

Liabilities from discontinued operations |

180,699 | ||||||

Total liabilities |

4,479,991 | ||||||

Total stockholders' deficit |

(1,988,738 | ) | |||||

- (1)

- As adjusted amounts give effect to the issuance and sale of shares of common stock by us in this offering at an assumed public offering price of $ per share and the application of the net proceeds of the offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, as set forth under "Use of Proceeds." See "Use of Proceeds" and "Capitalization."

9

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of the following risks actually occur, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Financial Position and Capital Requirements

We have incurred operating losses since our inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future.

We are an exploration stage company. To date, we have primarily focused on obtaining mining claims that are believed to contain rare earth elements and exploring for such elements. We have financed our operations exclusively through private placements of common stock and convertible debt and have incurred losses in each year since inception. We have historically incurred substantial net losses, including net losses of $17,837,262 and $6,760,541 in 2013 and 2012, respectively. From our inception in 1999 through December 31, 2013, we had an accumulated deficit in excess of $66.6 million. We do not know whether or when we will become profitable. To date, we have not commenced mining operations or generated any revenues from mining and, accordingly, we do not have a revenue stream to support our cost structure. Our losses have resulted principally from costs incurred in exploration activities, impairment and acquisition charges, legal settlements, and the issuance of company stock for consulting and employment services. Total cash losses of $3,157,163 and $58,219 in 2013 and 2012, respectively, were largely reflective of exploration activities, legal fees and consulting expenses.

We anticipate that our operating losses will substantially increase over the next several years as we execute our plan to expand our exploration and mining activities. Because of the numerous risks and uncertainties associated with exploration and mining of rare earth elements, we are unable to predict the extent of any future losses or when we will become profitable, if at all. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial condition, results of operations and cash flows.

Our history of net losses has raised substantial doubt regarding our ability to continue as a going concern. If we do not continue as a going concern, investors could lose their entire investment.

Our history of net losses has raised substantial doubt about our ability to continue as a going concern, and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2013 with respect to this uncertainty. We have no current source of revenue to sustain our exploration activities, and we do not expect to generate revenue until, and unless, we commence mining operations, which we do not expect to occur for several years. Accordingly, our ability to continue as a going concern will require us to seek alternative financing to fund our operations. This going concern opinion could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. Future reports on our financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern.

The restatement of our financial statements may result in litigation or government enforcement actions. Any such action would likely harm our business, prospects, financial condition and results of operations.

In connection with the preliminary preparation of our audited financial statements for the fiscal year ended December 31, 2013, management determined that previously issued unaudited financial statements

10

issued for the quarterly periods ended June 30, 2013 and September 30, 2013 contained errors which were non-cash in nature. Consequently, we restated our unaudited financial statements for the quarterly periods ended June 30, 2013 and September 30, 2013 and filed with the SEC restated financial statements on March 28, 2014. A description of the items restated can be found in each of the Forms 10-Q/A filed for the three months ended June 30, 2013 and September 30, 2013. The restatement of our financial statements may expose us to risks associated with litigation, regulatory proceedings and government enforcement actions. In addition, securities class action litigation has often been brought against companies which have been unable to provide current public information or which have restated previously filed financial statements. Any of these actions could result in substantial costs, divert management's attention and resources, and harm our business, prospects, results of operation and financial condition.

Our management has concluded that we have material weaknesses in our internal controls over financial reporting and that our disclosure controls and procedures are not effective.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of a company's annual or interim financial statements will not be prevented or detected on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of the company's financial reporting. During the audit of our financial statements for the year ended December 31, 2013, our management identified material weaknesses in our internal control over financial reporting related to the lack of coordination of duties between our executive officers and the need for stronger financial reporting oversight. Specifically, our material weaknesses include the fact that during fiscal years 2013 and 2012, our accounting function was comprised only of our part-time chief financial officer, we did not have an audit committee and our executive management was changed. This lack of sufficient personnel and management change has resulted in our failure to establish the desired internal control over financial reporting and accounting. In addition, our Chief Executive Officer and Chief Financial Officers determined as of December 31, 2013, that our disclosure controls and procedures were not effective due to the material weaknesses in our internal controls over financial reporting. If these weaknesses continue, investors could lose confidence in the accuracy and completeness of our financial reports and other disclosures.

The mining industry is capital intensive, and we will require substantial additional financing to achieve our goals. A failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our exploration activities.

Our current operating funds are less than necessary to complete all intended exploration of our prospects. As of December 31, 2013, we had cash of $2.2 million and a working capital deficit of $2.0 million. We have spent approximately $3.8 million on exploring our mining claims since acquiring them. We believe that we will continue to expend substantial resources for the foreseeable future in the exploration of our mining claims. These expenditures will include costs associated with exploration, permitting, landholding, and general and administrative costs. Because the outcome of our exploration activities is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the exploration of our properties. In addition, other unanticipated costs may arise. As a result of these and other factors currently unknown to us, we will need to seek additional funds, through public or private equity or debt financings or other sources, such as strategic partnerships and alliances and licensing arrangements. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. Additional funds may not be available when we need them, on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate our exploration activities or other activities that may be necessary to commercialize our rare earth mineral deposits.

11

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our mining claims.

We may seek additional capital through a combination of private and public equity offerings, debt financings, strategic partnerships and alliances, and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of existing stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect stockholder rights. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring debt, making capital expenditures or declaring dividends. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our mining claims, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our exploration activities or grant rights to commercialize our rare earth element deposits that we would otherwise prefer to commercialize ourselves.

Risks Related to Our Business

We recently settled litigation regarding the composition of our board of directors. Litigation or the actions of regulatory authorities may harm our business or otherwise distract our management.

In March 2013, we entered into a Settlement Agreement settling a series of claims and counter-claims raised in September 2012 regarding the composition of our board of directors. Please see "Transactions with Related Persons—Stockholder Litigation Settlement" for a detailed explanation of this litigation. Even though the litigation has terminated, the litigation caused us to incur significant expenditures and was a distraction to our management. In addition, subsequent to the termination of the litigation, certain of our former directors have made claims involving, among other things, up to 1,250,000 shares of our common stock that were previously authorized for issuance by our board of directors but not issued. We are currently negotiating a settlement with respect to these claims; however, there is no assurance that these claims will be settled without recourse to litigation or upon terms favorable to us. Any substantial, complex or extended litigation could cause us to incur major expenditures and would distract our management. Lawsuits or actions could from time to time be filed against us and/or or our executive officers and directors. For example, lawsuits by directors, employees, former employees, stockholders, partners, customers, or others, or actions taken by regulatory authorities, could be very costly and substantially disrupt our business. Such lawsuits and actions are not uncommon, and we may not be able to resolve such disputes or actions on terms favorable to us. In addition, there may not be sufficient capital resources available to defend such actions effectively, or at all.

We may become subject to tax assessments, penalties and interest for historically processing compensation as independent contractors rather than as payroll.

We historically processed compensation to certain former officers and employees as independent contractors under Form 1099 instead of processing it as payroll under Form W-2. In addition, we did not report stock based compensation on the Form 1099 or W-2. We recorded $250,000 as accounts payable as of December 31, 2013 for FICA costs for the years ended December 31, 2011-2013 and have not accrued any potential interest or penalties related to any taxes due to the IRS. If we become subject to tax assessment, penalties and interest by federal and state tax authorities in the future, our results of operations, financial performance and cash flows could be materially adversely affected.

12

All of our mining claims are in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on any of our mining claims in commercially exploitable quantities. As a result, we do not know if our claims contain rare earth elements that can be mined at a profit and face a high risk of business failure.

We started exploring our mining claims in the summer of 2011 and have not yet established that such claims contain any proved or probable reserves of rare earth elements or whether commercially viable quantities of rare earth elements exist. The lack of identified reserves of rare earth elements on our mining claims could prohibit us from development of, a sale of, or joint venture arrangement with respect to, our mining claims. If we are unable to develop, sell or enter into a joint venture arrangement with respect to our mining claims, we will not be able to realize any profit from our mining claims which would materially adversely affect our financial position and results of operations.

If rare earth elements are identified in commercially viable quantities on our mining claims, there is still the risk that identified deposits cannot be mined at a profit. This depends on many factors, including: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of the rare earth elements (which is highly volatile); and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection. Accordingly, we have no way to evaluate the likelihood that our business will be successful. There is no history upon which to base any assumption as to the likelihood that we will prove successful in locating and mining commercially viable quantities of rare earth elements from our mining claims. Therefore, we cannot provide any assurance that we will generate any operating revenues or ever achieve profitable operations. Exploring for rare earth elements is an inherently speculative activity. There can be no assurance that our existing or future mining claims will be successfully placed into production, produce rare earth elements in commercial quantities or otherwise generate operating earnings. If we are unsuccessful in addressing these risks, our business will most likely fail.

We are a junior exploration company with no operating mining activities, and we may never have any mining activities in the future.

Our primary business is exploring for rare earth elements. Should we identify commercially viable quantities of rare earth elements, we will need to commence mining operations which are capital intensive. Accordingly, we will need to seek additional capital through debt or equity financing to conduct mining operations or venture with another entity to mine our prospects or operate mining facilities on our behalf, or sell or lease our mining claims to third parties. Mine development projects typically require a number of years and significant expenditures during the development phase before production is possible. Such projects could experience unexpected problems and delays during development, construction and the start-up of mining operations. Mining operations in the United States are subject to many different federal, state and local laws and regulations, including stringent environmental, health and safety laws. If and when we assume operational responsibility for mining on our properties, it is possible that we will be unable to comply with current or future laws and regulations, which can change at any time. It is possible that changes to these laws will be adverse to any potential mining operations. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, adversely affecting any potential mining operations. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. It is possible that we will choose to not be insured against this risk because of high insurance costs or other reasons.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the

13

exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of REEs may not result in the discovery of REE deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mining, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

The legal title to our mining claims may be challenged. We are not insured against any such challenges, impairments or defects to our mining claims.

Our mining claims are primarily unpatented lode mining claims located on federal lands owned by the United States government and maintained in accordance with the federal General Mining Law of 1872, as amended. Unpatented lode mining claims are unique property interests and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations with which the owner of an unpatented mining claim must comply in order to locate and maintain a valid claim. If we discover real earth elements mineralization that is close to the claim boundaries, it is possible that some or all of the mineralization may occur outside the boundaries of our claims. In such a case, we would not have the right to extract those elements and the associated minerals. The uncertainty resulting from not having title opinions for all of our mining claims or having detailed claim surveys with respect to all of our mining claims leaves us exposed to potential title defects. Defending challenges to our mining claims would be costly, and may divert funds that could otherwise be used for exploration activities and other business purposes.

In addition, unpatented lode mining claims are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting any discovery of commercially extractable gold. Challenges to our title may increase our costs of operation or limit our ability to explore on certain portions of our property. We are not insured against challenges, impairments or defects to our property title.

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, estimates of mineralized material presented in our press releases and regulatory filings are based upon estimates made by our consultants and us. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates if and when determined will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing properties into production and such properties' return on capital. There can be no assurance that minerals recovered in small scale metallurgical tests will be recovered at production scale.

The success of our business will depend, in part, on the establishment of new uses and markets for rare-earth elements.

The success of our business will depend, in part, on the establishment of new markets for certain rare-earth elements that may be in low demand. The success of our business depends on creating new

14

markets and successfully commercializing rare-earth elements in existing and emerging markets. Any unexpected costs or delays in the exploration and development of our mining claims could have a material adverse effect on our financial condition or results of operations.

We have limited insurance coverage and may incur losses in excess of any claims which we are obligated to pay.

We have limited director and officer insurance and commercial insurance policies. Any significant claims against us from operations, stockholder litigation or other disputes in excess of our insurance coverage would have a material adverse effect on our business, financial condition and results of operations.

If we are unable to hire qualified personnel, our business and financial condition may suffer.

Although we do not know that any key employee has plans to retire or leave our company, our success and achievement of our growth plans depend on our ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. In this regard, we have limited resources and as such we may not able to provide an employee with the same amount of compensation that he or she would likely receive at a larger company and, as a result, we may face difficulty in finding qualified employees. The inability to attract, retain and motivate any additional highly skilled employees required for the expansion of our activities, could have a materially adverse effect on our ability to conduct our business and as such can impair our operations.

We may encounter difficulties in managing our growth and expanding our operations successfully.

As we seek to advance our exploration activities, we will need to expand our internal capabilities or contract with third parties to provide these capabilities for us. As our operations expand, we expect that we will need to manage additional relationships with various strategic partners and other third parties. Future growth will impose significant added responsibilities on members of management. Our future financial performance and our ability to commercialize our rare earth elements claims and to compete effectively will depend, in part, on our ability to manage any future growth effectively. To that end, we must be able to manage our exploration and commercialization efforts effectively and hire, train and integrate additional management, administrative and technical personnel. The hiring, training and integration of new employees may be more difficult, costly and/or time-consuming for us because we have less resources than a larger organization. We may not be able to accomplish these tasks, and our failure to accomplish any of them could prevent us from successfully growing.

Risks Related to Our Industry

We may be adversely affected by fluctuations in demand for, and prices of, rare earth products.

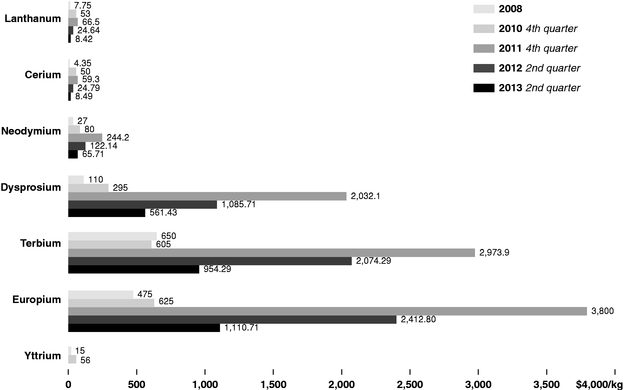

Because our primary source of revenue is the sale of rare earth minerals and products, changes in demand for, and the market price of, rare earth minerals and products could significantly affect our profitability. The value and price of our stock and our financial results may be adversely affected by declines in the prices of rare earth minerals and products. Rare earth minerals and product prices fluctuate and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the U.S. dollar against foreign currencies on the world market, global and regional supply and demand for rare earth minerals and products, and the political and economic conditions of countries that produce rare earth minerals and products. According to the Congressional Research Report on Rare Earth Elements dated December 16, 2013, prices of rare earth elements rose rapidly in 2010 and 2011 but declined in the first half of 2012 and declined further by the second quarter in 2013.

In contrast, extended periods of high commodity prices may create economic dislocations that may be destabilizing to rare earth minerals supply and demand and ultimately to the broader markets. Periods of

15

high rare earth mineral market prices generally are beneficial to our financial performance. However, strong rare earth mineral prices, as well as real or perceived disruptions in the supply of rare earth minerals, also create economic pressure to identify or create alternate technologies that ultimately could depress future long-term demand for rare earth minerals and products, and at the same time may incentivize development of otherwise marginal mining properties. We believe this occurred recently, when rising prices in 2011 and the first half of 2012 prompted such industrial substitution. For example, automobile manufacturers have recently announced plans to develop motors for electric and hybrid cars that do not require rare earth metals due to concerns about the available supply of rare earths. If the automobile industry or other industries reduce their reliance on rare earth products, the resulting change in demand could have a material adverse effect on our business.

Conditions in the rare earth industry have been, and may continue to be, extremely volatile, which could have a material impact on our company.

Conditions in the rare earth elements industry have been extremely volatile, and prices, as well as supply and demand, have been significantly impacted by a number of factors, principally changes in economic conditions and demand for rare earth materials and changes, or perceived changes, in Chinese quotas for export of rare earth elements. If conditions in our industry remain volatile, our stock price may continue to exhibit volatility as well. In particular, if prices or demand for rare earths were to decline, our stock price would likely decline and our ability to find purchasers for our products at prices acceptable to us could be impaired.

The potential for profitability of our operations, the value of our mining claims and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market price of rare earth elements. Any future decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of rare earth elements may prevent our mining claims from being economically mined or result in the write-off of assets whose value is impaired as a result of lower rare earth element prices. The volatility of mineral prices represents a substantial risk, which no amount of planning or technical expertise can fully eliminate. In the event that rare earth element prices decline or remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for economically viable amounts of rare earth elements and other minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. Certain risks remains regarding any undisclosed or unknown liabilities associated with the assets may remain with respect to the assets acquired by us in connection with the merger transactions with Seaglass Holding Corp. and U.S. Rare Earths, Inc., a Delaware corporation. The payment of any claims with respect to such assets may have a material adverse effect on our financial position.

Weather and location challenges may restrict and delay our work on our properties.

Snow or rain or other inclement weather could restrict and delay work on the properties to a significant degree. Our properties are located in relatively remote locations, which create additional transportation and energy costs and challenges.

16

Market forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for rare earth elements.

Mineral exploration, in general, is a very competitive business. Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of our planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for our exploration program. Fuel prices are extremely volatile as well. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower become available. Any such disruption in our activities may adversely affect our exploration activities and financial condition.

As we face intense competition in the rare-earth elements industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

We compete with other exploration and mining companies for the exploration and commercialization of a limited number of exploration rights. Our competitors may have greater financial resources, as well as other strategic advantages to maintain, improve and possibly expand their facilities. Additionally, the Chinese producers have historically been able to produce at relatively low costs due to domestic economic factors. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

Risks Related to Regulation

Our business is subject to extensive environmental regulations that may make exploring, mining or related activities prohibitively expensive, and which may change at any time.

All of our operations are subject to extensive environmental regulations that can substantially delay exploration and make exploration expensive or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of exploring and other related activities on our properties. We may have to pay to remedy environmental pollution, which may reduce the amount of money that we have available to use for exploration or other activities, and adversely affect our financial position. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. If a decision is made to mine on properties on which we have mining claims and we retain any operational responsibility for doing so, our potential exposure for remediation may be significant, and this may have a material adverse effect upon our business and financial position. We have not purchased insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from our exploration activities) and such insurance may not be available to us on reasonable terms or at a reasonable price.

All of our exploration activities may be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate

17

under all material operating permits, increases in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws. We may be required to post a substantial bond under various laws relating to mining and the environment and may in the future be required to post a larger bond to pursue additional activities. For example, we must provide BLM additional financial assurance (reclamation bonds) to guarantee reclamation of any new surface disturbance required for drill roads, drill sites, or mine expansion. We have a total of approximately $25,000 deposited with government agencies to insure work against reclamation of our 2013 and 2014 exploration activities.

The government licenses and permits which we need to explore our mining claims may take too long to acquire or cost too much to enable us to proceed with exploration. In the event that we conclude that rare earth element deposits located on our claims can be profitably mined, or discover other commercially exploitable deposits, we may face substantial delays and costs associated with securing the additional government licenses and permits that could preclude our ability to develop the mine.

Exploration activities usually require the granting of permits from various governmental agencies. We currently hold approved plans of operation and permits needed for certain exploration and related reclamation activities. These include a Montana State exploration license, an approved plan of operations to conduct drilling for the North Fork Project, an approved plan of operations for continued reclamation for the Last Chance Project, and an approved notice of intent for continued reclamation for the Powderhorn Project. Collectively, these permits allow us to continue drilling on the North Fork Project in accordance with the plan of operations through the end of 2014, conduct reclamation on the Last Chance Project through November 2016 and Powderhorn Project through August 2016, conduct non-mechanized exploration on the Last Chance and Sheep Creek Projects through May 2015 and non-mechanized exploration on the North Fork, Lemhi Pass and Diamond Creek Projects which are not time-limited. We have submitted for approval a new plan of operations to expand exploration on the Last Chance Project for 2014. As we prioritize exploration goals and obtain funding, we intend to submit further plans of operation to initiate drilling programs on our properties. To the extent that we do not presently hold an approved plan or operation or permit for future exploration, we intend to obtain such approvals on an as-needed basis.

Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Native American graves, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. As with all permitting processes, there is substantial uncertainty about when and if the permits will be issued. There is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. The needed permits may not be granted, could be challenged by third parties that could result in protracted litigation that could cause substantial delays, or may be granted in an unacceptable timeframe or cost too much. Additionally, proposed mineral exploration and mining projects can become controversial and be opposed by nearby landowners and communities, which can substantially delay and interfere with the permitting process. Delays in or inability to obtain necessary permits would result in unanticipated costs, which may result in serious adverse effects upon our business.

Land reclamation requirements with respect to the properties on which our mining claims are located may be burdensome and expensive.

We are currently subject to land reclamation requirements with respect to our exploration activities and will be subject to far more extensive and burdensome reclamation requirements if we are successful with proceeding with our planned mining activities. Typically, mine reclamation plans require permanent controls of potentially deleterious effluents, treatment of ground and surface water to drinking water standards and reestablishment of pre-disturbance land forms and vegetation. It is conceivable that

18

reclamation requirements imposed in mine permits could be sufficiently burdensome to preclude profitable operation.

Future changes in existing laws or the creation of new laws could significantly add to the cost of conducting our business or prevent us from doing so altogether.

Members of the U.S. Congress have in the past introduced bills which would supplant or alter the provisions of the Mining Law of 1872. If enacted, such legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on our claims. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Passage of such a bill could have a dramatic negative effect on our ability to operate or could prevent it altogether.

Similarly, there have been several efforts in the federal legislature to introduce and pass enhanced regulation focused upon climate changes and other environmentally focused issues. While we are unable to predict the course of future environmental regulation, it seems certain to become more stringent and this will affect our ability to operate profitably.

Risks Related to Our Common Stock and this Offering

Our executive officers and directors maintain significant influence over matters submitted to stockholders for approval.

As of March 31, 2014, our executive officers and directors, in the aggregate, beneficially own shares representing approximately 44% of our common stock. Beneficial ownership includes shares over which an individual or entity has investment or voting power and includes shares that could be issued upon the exercise of options and warrants within 60 days after the date of determination. As a result, if these persons were to choose to act together, they would be able to significantly influence all matters submitted to our stockholders for approval, as well as our management and affairs. For example, these persons, if they choose to act together, could significantly influence the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of voting power could delay or prevent an acquisition of us on terms that other stockholders may desire.

There is currently a very limited trading market for our common stock, and we cannot ensure that one will ever develop or be sustained.

Our shares of common stock are very thinly traded. Only a small percentage of our common stock is available to be traded and is held by a small number of holders. As a result, the price, if traded, may not reflect our actual or perceived value. There can be no assurance that there will be an active market for our common stock either now or in the future. The market liquidity of our common stock will be dependent on the perception of our operating business, among other things. We may, in the future, take certain steps, including utilizing investor awareness campaigns, press releases, road shows and conferences to increase awareness of our business, and any steps that we might take to bring us to the awareness of investors may require that we compensate consultants with cash and/or stock. There can be no assurance that there will be any awareness generated or that the results of any efforts will result in any impact on our trading volume. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business, and trading may be at an inflated price relative to the performance of our company due to, among other things, availability of sellers of our shares. If a market should develop, the price may be highly volatile. Because there may be a low price for our common stock, many brokerage firms or clearing firms may not be willing to effect transactions in the securities or accept our shares for deposit in an account. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other

19

selling costs may exceed the selling price. Further, many lending institutions will not permit the use of low priced shares of common stock as collateral for any loans.

We may be unable to list our common stock on the NYSE MKT or on any other securities exchange.

Trading in our common stock continues to be conducted on the OTCQB in the over-the-counter market, and our common stock currently does not meet all of the requirements for initial listing on a registered stock exchange. Although we have applied to list our common stock on the NYSE MKT, we cannot assure you that we will be able to meet the initial listing standards, including the minimum bid price per share and minimum capitalization requirements, or that we will be able to maintain a listing of our common stock on either of those markets or any other trading venue. Until such time as we qualify for listing on the NYSE MKT or another trading venue, our common stock will continue to be quoted on the OTCQB.

The price of our common stock is volatile, which may cause investment losses for our stockholders.

The market for our common stock is highly volatile, having ranged from a low of $1.50 to a high of $4.35 on the OTCQB during the 12-month period ended March 31, 2014. The trading price of our common stock on the OTCQB is subject to wide fluctuations in response to, among other things, quarterly variations in operating and financial results, and general economic and market conditions. In addition, statements or changes in opinions, ratings, or earnings estimates made by brokerage firms or industry analysts relating to our market or relating to us could result in an immediate and adverse effect on the market price of our common stock. The highly volatile nature of our common stock price may cause investment losses for our stockholders. In the past, securities class action litigation has often been brought against companies following periods of volatility in the market price of their securities. If securities class action litigation is brought against us, such litigation could result in substantial costs while diverting management's attention and resources.

Shares eligible for future sale may adversely affect the market.

From time to time, certain of our stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations. In general, pursuant to amended Rule 144, non-affiliate stockholders may sell freely after six months subject only to the current public information requirement. Affiliates may sell after six months subject to the Rule 144 volume, manner of sale (for equity securities), current public information, and notice requirements. Any substantial sales of our common stock pursuant to Rule 144 may have a material adverse effect on the market price of our common stock.

If our common stock remains subject to the SEC's penny stock rules, broker-dealers may experience difficulty in completing customer transactions and trading activity in our securities may be adversely affected.