Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Time Inc. | d727780d8k.htm |

Analyst

Presentation May 14, 2014

Exhibit 99.1 |

2

Disclaimer

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995; particularly statements regarding future

financial and operating results of Time Inc. (the “Company”) and its

business. These statements are based on management’s current expectations or

beliefs, and are subject to uncertainty and changes in circumstances. Actual results

may vary materially from those expressed or implied by the statements in this presentation due to

changes in economic, business, competitive, technological, strategic and/or regulatory

factors, and other factors affecting the operation of the Company’s business. More

detailed information about these factors may be found in the Company’s filings

with the Securities and Exchange Commission, including its Quarterly Report on Form

10-Q filed on May 14, 2014 and its Registration Statement on Form 10 and related

exhibits originally filed on November 22, 2013 and most recently amended on May 8, 2014.

The Company is under no obligation to, and expressly disclaims any such obligation to, update

or alter its forward-looking statements, whether as a result of new information,

future events or otherwise. Non-GAAP financial measures such as operating income

before depreciation and amortization (“OIBDA”), Adjusted OIBDA and Free Cash

Flow, as included in this Presentation, are supplemental measures that are not calculated in accordance with Generally

Accepted Accounting Principles (“GAAP”). We define Adjusted OIBDA as OIBDA

adjusted for asset impairments, restructuring and severance costs, gains or losses on

operating assets, and external costs related to mergers, acquisitions or dispositions. We define

Free Cash Flow as cash provided by operations less capital expenditures. We believe that

the presentation of OIBDA, Adjusted OIBDA and Free Cash Flow helps investors analyze

underlying trends in our business, evaluate the performance of our business both on an

absolute basis and relative to our peers and the broader market, provides useful information to both management

and investors by excluding certain items that may not be indicative of the core operating

results and operational strength of our business and helps investors evaluate our

ability to service our debt. Please see the Appendix hereto for reconciliations of

these Non-GAAP financial measures to their comparable GAAP financial

measures. These non-GAAP financial measures have limitations as analytical and

comparative tools and you should consider OIBDA, Adjusted OIBDA and Free Cash Flow in

addition to, and not as a substitute for, operating income, cash provided by operations or

any other measure of financial performance or liquidity reported

in accordance with GAAP.

Throughout the presentation, certain numbers will not sum to the

total due to rounding. |

3

Introduction

Pages 4-7

Executive Summary

Pages 8-20

Overview of Time Inc.

Pages 21-42

Financial Overview

Pages 43-51

Appendix

Pages 52-55

Agenda |

INTRODUCTION

4 |

5

•

Time

Inc.

is

the

largest

magazine

publisher

in

the

U.S.

based

on

both

readership

and

print

advertising

revenues

with

over

90

magazine

titles

globally,

including

PEOPLE,

Sports

Illustrated,

InStyle,

TIME

and

Real

Simple

•

On March 6, 2013 Time Warner announced plans for the complete legal and structural separation

of Time Inc. from

Time

Warner

in

a

tax-free

spin-off,

which

is

scheduled

to

be

completed

on

June

6

th

–

The

distribution

ratio

will

be

1

Time

Inc.

share

per

8

Time

Warner

Inc.

shares,

or

approximately

110MM

diluted shares outstanding

–

The Company will be listed on the New York Stock Exchange under the ticker

‘TIME’ •

Time

Inc.

generated

FY

2013

revenue

of

$3.4B,

Adjusted

OIBDA

of

$587MM

1

,

and

Free

Cash

Flow

of

$384MM

2

•

The Company is targeting an initial dividend payout of approximately 30% of Free Cash Flow

•

In connection with the spin-off, Time Inc. has raised $1.4 billion of funded debt, in the

form of a $700MM 1st lien Term Loan B (subject to closing conditions) and $700MM of

Senior Unsecured Notes –

Net proceeds from the financing will be used to purchase U.K. publishing operations from Time

Warner and pay a special dividend to Time Warner

–

The Company also has access to an undrawn $500MM 1st lien Revolving Credit Facility (subject

to closing conditions)

Spin-Off Overview

Adjusted OIBDA is OIBDA excluding asset impairments, restructuring and severance costs, gains

or losses on operating assets, and external costs related to mergers, acquisitions or dispositions;

See Appendix for Reconciliation of Operating Income to Adjusted OIBDA

Free Cash Flow is defined as cash provided by operations less capital expenditures; See

Appendix for Reconciliation of Net Income to Free Cash Flow. FY 2013 Free Cash Flow of $384MM does

not give pro forma effect to the interest expense associated with the $1.4 billion of debt

raised in 2014 1

2 |

6

The spin-off will enable Time Inc. to benefit from the flexibility and focus of being a

stand-alone public company

Spin-Off Transaction Rationale

Provides strategic clarity and flexibility

Aligns incentives for management and employees

Creates shareholder flexibility

•

Better able to execute on strategic plans and respond to industry dynamics

•

Increased flexibility to pursue growth opportunities and direct resources

•

Incentives tied to business performance and stockholder expectations

•

Increased ability to attract and retain personnel

•

Shareholders can make independent decisions about business ownership

•

Over time, Time Inc. will align with a natural shareholder base

|

7

Spin Timeline

•

Debt financing was completed in April 2014 (subject to closing conditions for Term

Loan B and Revolver)

•

Spin-off targeted for completion on June 6

•

Form 10 declared effective (5/9)

•

Announced Record Date,

Distribution Date and Share

Distribution Ratio

•

Distribution Date (6/6)

•

Ex-Dividend Date / Regular Way

Trading (6/9)

Transaction timeline

Holiday

May 2014

June 2014

S

M

T

W

T

F

S

S

M

T

W

T

F

S

1

2

3

1

2

3

4

5

6

7

4

5

6

7

8

9

10

8

9

10

11

12

13

14

11

12

13

14

15

16

17

15

16

17

18

19

20

21

18

19

20

21

22

23

24

22

23

24

25

26

27

28

25

26

27

28

29

30

31

29

30

Week of May 5th

May 19

Early June

•

When-Issued Trading begins (5/21)

•

Record Date (5/23)

th

th |

EXECUTIVE

SUMMARY 8 |

9

Presenters

Time Inc.’s New Senior Leadership Team

Norman Pearlstine, EVP and Chief Content Officer

Jeffrey J. Bairstow, EVP and Chief Financial Officer

Joseph A. Ripp, Chief Executive Officer

•

Mr. Pearlstine became Chief Content Officer in November 2013

•

Mr. Pearlstine is responsible for driving development of new content experiences, consumer

products and lines of business across Time Inc. brands. He also oversees the

company’s editorial policies and standards •

Mr. Pearlstine served as Time Inc.’s Editor-in-Chief from 1995 through

2005 •

From 2006 to 2008, Mr. Pearlstine served as a Senior Advisor to the Telecom and Media group

at The Carlyle Group •

Mr. Pearlstine returned to Time Inc. following a five-year stint at Bloomberg L.P., where

as Chief Content Officer, he was responsible for developing growth opportunities for

Bloomberg’s television, radio, magazine, and online products to make the most of

the company’s news operations •

Mr. Bairstow became CFO in September 2013

•

Mr. Bairstow is responsible for leading Time Inc.’s financial functions and strategies.

He also oversees Time Inc.’s Customer Service, and Production operations

•

Prior affiliations include President of Digital First Media, a leading newspaper chain, where

he helped extend the reach of the company’s core media brands across all

platforms •

Mr. Ripp became CEO in September 2013

•

As a former top Time Inc. and Time Warner executive, Mr. Ripp spent the past decade immersed

in the intersection of digital, advertising and publishing

•

Prior affiliations include CEO of OneSource Information Services, Inc. and Cannondale

Investments, Inc. •

Mr. Ripp began his media career at Time Inc. in 1985, and held several executive level

positions there and at Time Warner including Senior Vice President, CFO and Treasurer

of Time Inc., Executive Vice President and CFO of Time Warner, CFO of America Online,

and Vice Chairman of America Online |

Time Inc.

Overview 10

1

U.S. based on both readership and print advertising revenues

2

U.K. based on print newsstand revenues

Industry-leading collection of media brands

Largest

magazine

publisher

in

the

U.S.

and

the

U.K.

~100MM U.S. consumers in print per month

23 magazines published in the U.S.

70+ magazines published internationally (U.K., Mexico)

50+ licensed print and digital editions in 30+ countries

~70MM consumers online monthly

45+ websites globally

Offers digital magazine, websites with mobile viewing

and mobile applications for U.S. titles

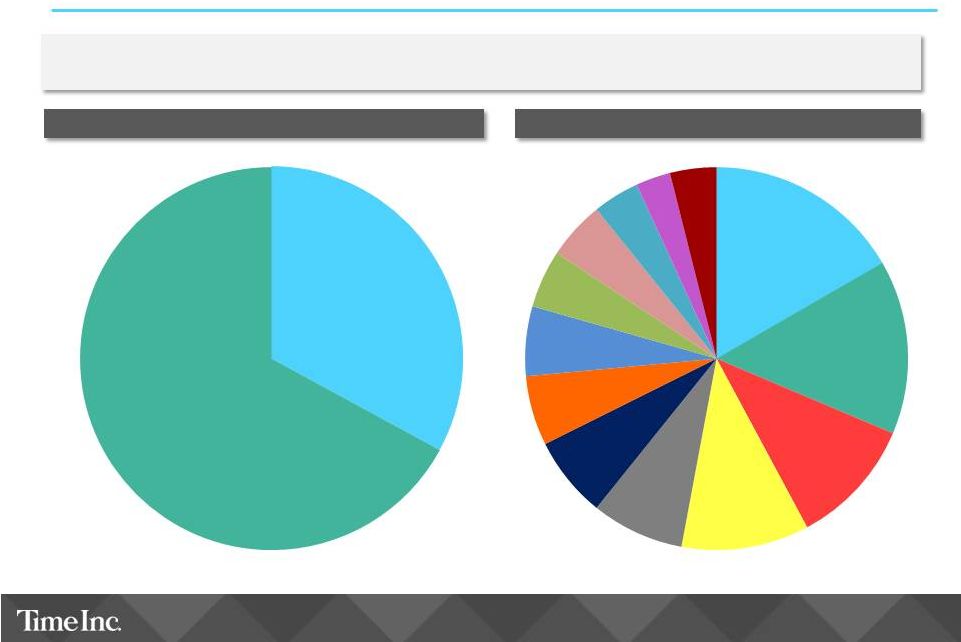

2013 Revenue by Type ($MM)

2013A Revenue: $3,354MM

Advertising

$1,807

54%

Circulation

$1,129

34%

Other

$418

12%

1

2 |

Oct 17,

2001 Acquisition of IPC

Media (U.K.), a

leading magazine

publisher with 90+

titles

11

Time Inc. Timeline

Oct 1, 2013

Acquisition of Affluent Media

Group (formerly American

Express Publishing)

1930

1930

1980

1980

1940

1940

1923

1930

1936

1954

1972

1974

1985

1987

1990

1994

2000

2004

1990

1990

2000

2000

2010

2010

Nov 28, 1922

Time Inc.

incorporated

1950

1950

1960

1960

1970

1970

Jan 1990

Merger with

Warner

Communications

2011

Time Inc. launched

tablet editions for

all U.S. titles

Mar 6, 2013

Time Warner

announced plans

to separate Time

Inc.

2014

2014

2013

2013

1996 |

12

Investment Highlights

•

Industry leading scale and brands

•

Passionate subscriber base that can be monetized

across platforms and provides extensive consumer data

•

Strong Free Cash Flow profile

•

New management team with proven track record of

business transformation

•

Clear path to creating long-term value

–

Drive efficiencies to protect cash flows and free up

resources for reinvestment

–

Unleash entrepreneurship and create P&L

accountability

–

Extend brands and better leverage scalability of

content

–

Balanced approach to capital allocation |

U.S. Consumer

Magazine Publishing: $24.3B Annual Revenue 13

Advertising made up 67% of all magazine industry revenue in 2013

Total: $24.3B

Magazine Publishing Revenue 2013

1

($MM)

2013 Top Magazine Industry Ad Categories

2

Beauty, 17%

Fashion/Retail

/Jewelry, 15%

Food & Bev,

11%

DTC/OTC

Drugs &

Remedies,

11%

DR, Misc &

Local Svcs, 8%

Home, 7%

Media &

Movies, 6%

Tech &

Telecom/CE,

6%

Automotive,

5%

Financial,

5%

Travel,

4%

Industry, Govt

& Org, 3%

Other,

4%

Ad Revenue

$16.3B

67%

Circ Revenue

$8.0B

33%

1

2

Source: PWC Global Entertainment and Media Outlook 2013-2017, Publishers Information

Bureau as provided by Kantar Media (“PIB”) Note: Percentages may not add to

100% due to rounding “Other” ad category includes Sporting Goods, Toys &

Hobbies, Alcoholic Beverage and Tobacco Reflects U.S. consumer magazine publishing

revenue; |

14

Source: MPA Factbook 2013/2014

91% of all adult Americans read magazines

Print magazines rank #1 in commanding consumer attention and advertising acceptance

Magazine ads outperform other media with regard to credibility and influence

>25% of digital readers say they have increased time spent with magazines

Magazines Have a Large, Highly Engaged Audience

59% of readers took action or plan to take action as a result of exposure to specific print ads

|

Top Magazine

Publishers are Taking Share 15

The share for the top four publishers has increased from 64% in 2009 to 68% in 2013

PIB-Measured Publishers Share of Advertising Revenue

+370bps

1

20.0%

16.4%

18.0%

13.9%

15.6%

13.2%

11.1%

36.5%

31.6%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2009

2013

All Other

Meredith

Condé

Nast

Hearst

Time Inc.

23.7%

Reflects Time Inc.’s 2013 acquisition of Affluent Media Group, which represents 170 bps

of the increase Source: PIB

1 |

16

Key Challenges and Transformational Progress

Secular Headwinds

•

Advertising revenues migrating to digital

•

Newsstand declines

•

Digital monetization underperformance

Protect the Core

•

Dissolved complex operating matrix

•

Launched program to attack processes and

structural costs

•

Developing cross-brand digital strategy

Key Challenges

Cultural and Organizational Barriers

•

Leadership transitions

•

Decentralization and bureaucracy slowed

decision-making and execution

•

Structural costs were not addressed

•

Creative misalignment with the business

Position For a Changing Marketplace

•

Hired

or

promoted

transformational

figures

1

•

Eliminated

“Church

and

State”

2

barriers

•

Designed new incentive and compensation

plans

1

EVP, Chief Content Officer Norm Pearlstine, EVP of Consumer Marketing Lynne Biggar, EVP of

Advertising Sales Mark Ford, and Chief Technology Officer Colin Bodell and others

2

“Church and State”

in magazine parlance speaks to the separation between a publication’s editorial and

business interests, defining an arms-length relationship, similar to the separation of

organized religion and the government guaranteed by the First Amendment to the

Constitution Transformational Progress

•

Manage Portfolio of Brands, Titles, Assets

•

Acquisition of Affluent Media Group (formerly

American Express Publishing)

•

Co-founder of 120 Sports (key mobile asset)

Underinvestment in Business and Brands

Underinvested in digital platforms and

infrastructure |

17

Strategic Priorities –

Leverage Content and Brands

Drive efficiencies to protect cash flows and free up resources for reinvestment

Better align editorial function with business opportunities

Enhance effectiveness of advertising sales

Optimize subscription offers and consumer pay strategies

Maximize value of brands and scale via adjacent monetization opportunities

Innovate technology platform for consumers, advertisers and creative staff

|

18

Adjacent Opportunities

•

Continue to invest in digital media, including mobile and video,

as well as social extensions of our brands

Monetizing audience

scale across platforms

•

Extend brands beyond print and digital magazines

•

E.g., direct sales or licensing agreements related to consumer

products and services

New consumer

products and services

•

Leverage our extensive consumer data and insights and extend

services to marketers

Data collection and

targeting

•

Expand our events and conferences

•

E.g., the

Essence

Festival

is

in

its

20

th

Year

and

is

one

of

the

largest

live consumer events in the U.S.

Experiential media

•

Expand ancillary services including end-to-end fulfillment and direct

marketing expertise to third parties

B2B services |

Todd Larsen,

EVP Evelyn Webster, EVP

Lynne Biggar, EVP, Consumer Marketing & Revenue

Key Prior Affiliations:

American Express

Mark Ford, EVP, Advertising

19

Accomplished Management Team Driving Change

Management Team

Management Team

Colin Bodell –

EVP and Chief Technology Officer

Key Prior Affiliations:

Amazon

Greg Giangrande –

EVP and Chief Human Resources Officer

Current Role:

Oversees all aspects of Human Resources

Key Prior Affiliations:

News Corporation, Hearst Corporation

Lawrence Jacobs –

EVP, General Counsel and Secretary

Key Prior Affiliations:

News Corporation

Current

Role:

Oversees

operations

including

PEOPLE,

Sports Illustrated

and

TIME

Key

Prior

Affiliations:

Dow

Jones

&

Company

Current role:

Oversees operations including InStyle,

Real Simple

and Southern

Living and has oversight of IPC Media

Key Prior Affiliations:

IPC Media

Current Role:

Oversees consumer revenue and

supervises direct marketing company Synapse, retail

specialist Time/Warner Retail, and book publisher

Time Home Entertainment Inc.

Current Role:

Responsible for driving overall

advertising sales revenue and for building Time

Inc.’s leadership in the marketplace; oversees Time

Inc. Branded Solutions, Time Inc. Content Solutions,

and

MNI

(“Media

Networks

Inc.”)

Targeted

Media

Key Prior Affiliations:

Time Inc.

Current Role:

Responsible for shaping the company’s strategic

technology direction, day-to-day operations and acquiring and

leveraging best in breed technology

Current Role:

Responsible for leading Time Inc.'s legal affairs

and overseeing public company governance and compliance

issues

•

•

•

•

•

•

•

•

•

•

•

•

•

• |

20

Accomplished Board of Directors Guiding Us into the Future

•

David A. Bell -

Chairman and Chief Executive Officer, Slipstream Communications, LLC

•

John M. Fahey, Jr. -

Non-Executive Chairman, National Geographic Society

•

Manuel A. Fernandez -

Former Executive Chairman, Sysco Corporation

•

Dennis J. Fitzsimons -

Chairman, Robert R. McCormick Foundation

•

Betsy D. Holden -

Senior Advisor, McKinsey & Company

•

Kay Koplovitz -

Chairman and Chief Executive Officer, Koplovitz & Company LLC

•

J. Randall MacDonald -

Former Senior Vice President, Human Resources, IBM Corporation

•

Joseph A. Ripp -

Chairman and Chief Executive Officer, Time Inc.

•

Ronald S. Rolfe, Esq. -

Retired Partner, Litigation, Cravath, Swaine & Moore LLP

•

Sir Howard Stringer -

Retired Chairman of the Board, Sony Corporation

Board of Directors

Note:

The

above

Director

slate

will

be

in

effect

on

the

spin-off

distribution

date

(June

6

th

,

2014) |

21

OVERVIEW OF TIME INC. |

22

Source: AAM 1H13, MRI Fall 2013, PIB, ComScore Dec. 2013

Note: Magazines Sold/Year calculated based on frequency multiplied by print circ as reported

to AAM in 1H13 and Time Inc. doesn’t include Time for Kids or SI Kids, Time Inc.

2013 PIB share includes Affluent Media Group 1

Excludes CNN/Money

Time Inc. is the across the board

industry leader

•

#1 Print Audience

•

#1 in Online Audience

•

#1 in Print Ad Share

PIB Advertising Revenue Share

Category-Leading Portfolio of U.S. Brands

MRI Print Audience (000)

Multiplatform Unique Visitors (MM)

73.9

61.5

57.3

52.3

Hearst

Meredith

Condé

Nast

1

104,665

80,730

66,470

50,313

Net Hearst

(19 titles)

Net Meredith

(12 titles)

Net Condé

Nast

(16 titles)

23.7%

18.0%

15.6%

11.1%

31.6%

5%

10%

15%

20%

25%

30%

35%

2009

2010

2011

2012

2013

Time Inc.

Hearst

Condé

Nast

Meredith

All Other

AMEX (20 titles)

+ |

Time Inc.

titles rank #1 or #2 in advertising revenue share in 15 of the 18 PIB categories in which

we compete BRANDS

CATEGORY

2013 AD RANK

CATEGORY SHARE

Celebrity Weekly

#1

58%

Sports –

General

#1

66%

Women’s Fashion

#1

19%

Weekly news magazine

#1

74%

Women’s Lifestyle

#2

19%

Entertainment

#1

41%

Sports –

Golf

#1

55%

Travel

#1

35%

Epicurean

#1

21%

Personal Finance

#1

85%

African American

#1

56%

Hispanic

#1

51%

Business –

Corporate

#2

30%

Regional

#2

33%

Kids

#2

39%

Source: PIB

Category-Leading Portfolio of U.S. Brands (Cont’d.)

23 |

Time Inc. Has

Diverse Ad Categories and Accounts in the U.S. Key Advertisers

No single advertiser represents more than 5% of domestic revenues

Time Inc.’s Portfolio Draws a Diverse Ad Base

No single advertising category represents more than 16% of domestic revenues

24

•

Female-oriented brands are the financial engine of Time

Inc.’s portfolio

PEOPLE

(71%

female

audience),

InStyle

(91%), Real

Simple (88%), Southern Living

(79%), and Cooking

Light (84%)

1974:

PEOPLE

1987: Cooking

Light 1990: Entertainment Weekly

1994: InStyle

2000: Real Simple

2004: All

You Unparalleled advertiser opportunity to reach target

audiences across key categories

•

Investments in lucrative categories draw advertisers:

entertainment, fashion, and women’s lifestyle •

Reaches ~50% of all U.S. adults each month and more

women than Hearst or Meredith |

Strong ROI

Drives Advertiser Loyalty Source: Results based impact from the halo effect of 14

campaigns measuring both subscribers and newsstand buyers •

Nielsen Catalina Pinpoint establishes the ROI magazines present to advertisers:

–

Leverages shopper data from over 60MM households to measure the sales impact of print

and digital advertising

–

Created a single source approach to measuring cross platform (TV, Print, and Digital) sales

impact

–

Demonstrated that a combined Print/Digital campaign can add a significant incremental

sales impact to a large TV effort

18

11%

Studies Time Inc. has conducted with Nielsen

Catalina Solutions to date

Average incremental sales lift, proving positive

impact on in-store sales

25 |

Magazine

Effectiveness Case Study – Top 5 Beauty Advertiser

26

Note: Data is Delta=Control-Exposed; number of respondents: magazine n=49,965, online =

119.901, TV = n-79,375 Source: ORC Caravan, Feb 2013; Adobe Click Here Study, 2012;

InsightExpress, 2013 Anti-Wrinkle +

Firming Eye

Cream

Foundation Liquid

Face Makeup

Vivid Lip

Color

Collection

Cream Lip Color

Product type

Outcome

Campaign

Print:

Entertainment

Weekly,

Essence,

InStyle, PEOPLE, People StyleWatch

Print:

Health,

InStyle,

PEOPLE,

Real

Simple

Print:

All

You,

Essence,

InStyle,

PEOPLE,

PEOPLE en Español, PEOPLE StyleWatch

Print:

Essence,

InStyle,

PEOPLE,

PEOPLE

en Español, PEOPLE StyleWatch, Real

Simple, Time

•

Sales

Lift:

5%

•

Payback:

9.4x

•

Sales driven by HH penetration &

purchase frequency

•

Share gain from key competitors

•

Sales

Lift:

5%

•

Payback:

14.2x

•

Share gain from key competitors

•

Sales

Lift:

2%

•

Payback:

7.7x

•

Sales driven by HH penetration &

purchase frequency

•

Sales

Lift:

5%

•

Payback:

11.5x

•

Share gain from key competitors |

ranks

#1

among

women

Exceptional Content & Access

27

Frequency

53x

per

year

8.3MM

followers

2.8MM

likes

19MM

monthly

multiplatform

unique visitors

43MM

audience

per week

$101.54

annual

subscription

price

47%

over average

of top peers

Circulation and audience

40 years since its inception, PEOPLE remains the leading celebrity news

and entertainment magazine brand in the U.S.

Reaches

1 in 5

women

each week

Photo credit: Johnny Vy/©A.M.P.A.S

Other takeaways

Editorial

Director

of

PEOPLE

and

EW

Jess

Cagle

co-hosted

ABC’s

Oscars

Red

Carpet

Live

PEOPLE’S

Royal

Baby

Collector’s

issue

was

the

only

celebrity

magazine

to

feature

a

photo

of

William

and

Kate

with

their

newborn

son

Adjacent

Adjacent

Opportunities

Opportunities

Digital Scale

New Franchises

Events

Multimedia

Unparalleled

access

to

celebrity

and

red

carpet

events

Product Sales

Publishes

six

annual

special

double-issues

–

World’s

Most Beautiful, Sexiest Man Alive, Celebrity Body

Slimdown, Best & Worst Dressed, Best (& Worst!) of the

Year, and Half Their Size

Source: MRI Fall 2013; ComScore Multiplatform February 2014; AAM Circulation Report December

2013 |

20MM

audience

per week

Exceptional Content & Access

28

•

New Franchises

•

Events

•

Multimedia

Frequency

56x

per

year

14MM

monthly

multiplatform

unique visitors

$41.55

annual

subscription

price

58%

over average

of top peers

Other takeaways

•

In

2013,

Sports

Illustrated

was

ranked

among

the

industry’s

hottest

brands

by

Advertising

Age

and

AdWeek

•

SI

franchises

and

extensions

include

Swimsuit,

Sportsman of the Year, Extra Mustard, The MMQB

and Swim Daily

•

SI’

s Peter

King

was

named

2013

Sportswriter

of

the

Year

by

the

National

Association

of

Sportswriters

and

Sportscasters.

An

SI

writer

has

won

the

award

four

years

in

a

row

and

nine

times

in

the

last

12

years

Circulation and audience

SI’s

readers are more loyal

than any other men’s sports

magazine

1.2MM

followers

4.1MM

likes

SI is the most respected voice in sports journalism, and has been published continuously since

1954 Adjacent

Adjacent

Opportunities

Opportunities

Source: MRI Fall 2013; ComScore Multiplatform February 2014; AAM Circulation Report December

2013 |

Exceptional

Content & Access 29

Source: GfK MRI Fall 2013; comScore Multiplatform March 2014; AAM Circulation Report December

2013 Frequency

13x

per

year

Circulation and audience

Other takeaways

•

InStyle

is known for driving product sales

•

InStyle

readers

purchase

an

average

of

8

advertised

items

per

issue

•

Offers

360-degree

experience:

monthly

magazine,

bespoke

supplements, InStyle.com, social media, reader events, celebrity

parties and awards

•

InStyle’s

Best

Beauty

Buys

are

the

Oscars

of

the

beauty

world

•

Significant

brand

licensing

opportunities

(e.g.

InStyle’s

2014

shoe

collection for Nine West)

2.7MM

followers

3.3MM

likes

InStyle

was

launched

in

1994

as

a

spin-out

of

PEOPLE

magazine’s

“Star

Tracks”

column.

It emphasizes celebrity and style.

Adjacent

Adjacent

Opportunities

Opportunities

•

Product Sales

•

Digital

Innovation

•

E-Commerce

•

Events

9.6MM

audience

per month

88%

over average

of top peers

2.5MM

monthly

multiplatform

unique visitors

$22.74

annual

subscription

price

20MM

consumers

worldwide |

Exceptional

Content & Access 30

1

Includes Populist App and LIFE App

Adjacent

Opportunities

•

Contributor

Network

•

Events

•

Time for Kids

Extension

Frequency

53x

per

year

5.6MM

followers

3.4MM

likes

Other takeaways

•

In

the

past

six

months,

TIME

has

had

exclusive,

rare

interviews

with Prince Charles, Janet Yellen, Edward

Snowden and French President Francois Hollande

•

TIME

was

featured

75

times

on

the

major

network

Sunday

shows in 2013, with 42 guest appearances

•

Contributors

to

TIME

in

2013

included:

President

Barack

Obama, Hillary Clinton, Claire Danes, Bono, Jon Stewart

•

TIME

recently

launched

Red

Border

Films,

a

documentary

film

unit

hosted

on

Time.com

Circulation and audience

TIME magazine was ranked as America’s #1 trusted news brand in 2013 (GFK/Roper), and has

been published continuously since 1923

18.7MM

audience

per week

24MM

monthly

multiplatform

unique visitors

11MM

mobile unique visitors

and

7MM

App download

1

$29.35

annual

subscription

price

Source: MRI Fall 2013; ComScore Multiplatform February 2014; AAM Circulation Report December

2013 |

Exceptional

Content & Access 31

Frequency

12x

per

year

Other takeaways

•

Bed Bath & Beyond carries 900 nationwide SKUs branded as

Real Simple Solutions

•

Real

Simple

apps

include

“No

Time

to

Cook?,”

which

offers

850+

easy-to-prepare

recipes,

“To

Do

Lists”

and

a

“Gift

Guide”

featuring Real Simple editor gift picks

•

Real

Simple

programs

and

events

include

the

Beauty

&

Balance

Weekend

in

partnership

with

Exhale

Spa,

Pops

on

Nantucket in partnership with Coastal Living, and Big Apple

Barbeque

Circulation and audience

Real Simple, launched in 2000, offers today’s time-pressured woman a guide she can

trust to make her life a little easier

661K

followers

1.1MM

likes

8.1MM

audience

per week $20.02

annual

subscription

price

41%

over average

of top peers 5.4MM

monthly

multiplatform

unique visitors Affluent audience: $97.8K median household

income (vs. $62.8K for Better

Homes and Gardens)

National Magazine

Awards for

General

Excellence Finalist

since 2010 Adjacent

Opportunities

•

E-Commerce

•

Product Sales

•

Contributor

Network

Source: MRI Fall 2013; ComScore Multiplatform February 2014; AAM Circulation Report December

2013 |

IPC

– U.K.’s Leading Consumer Multi-Platform Publisher

Source: ABC Jan-Jun 2013, Nielsen Ad Dynamix Jan-Dec 2012, NRS JD 2012, Comscore

March 2013, NRS PADD Jan-Jun 2013 32

#1

#1

#2

•

Acquired in 2001

•

56 titles in 20 sectors; #1 or #2 in 18

sectors

•

Main business segments

#1

#2

Multi-platform publisher measured by de-

duped online and print reach

Connect: Mass market women

Southbank: Upmarket women

Inspire: Affluent men and young men

Marketforce: Magazine distribution

ABC volume share (28.3%) & value share (21.9%)

Print advertising share: 30.4% paging

Subscription volumes

Online publisher vs. other consumer magazine publishers

Reach

nearly

half

of U.K.

population

63 Brands

across print, web,

mobile, tablet and

events

4.5MM unique

Users

10% reach of U.K.

Internet population

Reach

Almost

60%

Upscale

women |

33

Brand Extension Case Study |

•

Live streaming network delivered to mobile devices

•

Access to original sports programming in two-minute

segments 24 hours a day:

Hosted programming

Interactive narratives

Game footage

Analysis

Conversation

Social commentary from players, newsmakers

and fans

•

Partners:

NHL, NBA, MLB.com, NASCAR

Leading collegiate conferences via Campus

Insiders, IMG College and Silver Chalice

Brand Extension Case Study

34

Overview

120 Sports will be a Unique Platform

•

Multi-sport:

The

first

time

leagues

have

joined

together for a multi-sport digital experience

•

Digital

first:

Not

repurposed

TV

content

•

No

authentication:

No

cable

subscription

required (unlike Watch ESPN)

•

Social

&

community:

Deep

social

integration

using patented technology

•

Personalization:

Customizable

based

on

personal team & athlete preferences

•

Estimated launch is Spring 2014

Expected to be an ‘always-on’

product to provoke fan engagement |

•

Essence

was created as a forum that would enrich and improve the day-to-day lives of

women •

Essence Festival now hosts nearly 550,000 attendees, making it one of the largest live

consumer events in the country •

Past Festival performing artists and speakers have included PRINCE, Beyoncé, Aretha

Franklin, John Legend, Kanye West, Lionel Richie, Rihanna, Stevie Wonder, Usher, Bill

Cosby, Tyler Perry, Steve Harvey, Reverend Al Sharpton, Vanessa Williams and Hillary

Rodham Clinton •

Essence

now touches an audience of over 3B with our rich media and PR campaign and strategic

partnerships with media networks

•

The

first

official

Festival

App

garnered

over

15,000

downloads

and

tripled

Essence

mobile

consumption

•

In

2013,

Essence

partnered

with

MSNBC

for

live

coverage

throughout

the

weekend,

with

a

content

partnership

continuing into the 20

th

anniversary

•

Essence

Festival trended across social media with ~55,000 Instagram posts and more than 24,000 uses

of #essencefest on Twitter

•

The Festival provides our nearly 35 sponsoring partners rich consumer engagement

opportunities, with over 25 minutes spent engaging with their brands

35

Brand Extension Case Study

Source: 2013 Attendance and Impressions Report

It’s one of the largest Live

Events

in the U.S. |

36

Strategic Rationale

•

Acquisition of iconic, premium brands with opportunities to leverage growth

through new platforms

•

Ad sales opportunity based on expanded reach with Food & Wine

and Departures

•

Broadens exposure to the important luxury category

Cost / Operational Reasons

•

Operational synergies identified upfront through back office functions

•

Time Inc. was previously providing operational support, though the Company still

expects to achieve multi-million dollar run-rate synergies

Benefits

of

Scale

–

Affluent

Media

Group

Acquisition

Case

Study |

37

Benefits

of

Scale

–

Vertical

Integration

•

Vertically integrated with best-in-class subscriber acquisition, fulfillment and

distribution operations •

Ability to offer third party services to publishers and other sub-scale businesses

•

Fixed costs of operating scale provide real synergies for acquisitions

•

Third party services include:

Production (e.g., direct mail materials, premiums, wraps)

Corporate and digital ad sales and books and digital publishing

Customer service and consumer marketing

Magazine fulfillment services for

publishers

•

Subscription management

•

Credit card processing

•

Circulation statistics

Multichannel marketing of

subscriptions

through

3

rd

parties

Customer targeting to increase

circulation for publishers

Wholesale retail marketing and

distribution services to publishers

•

Logistics

•

Consumer insight

•

Retail strategy

•

Category management

•

PoS analytics

Built For Scale |

Subscriber

Relationships Provide Extensive Consumer Insight and Data 38

•

Transaction database of 150MM U.S. individuals

•

Offline

transaction and demographic information

•

20 years

of magazine subscribers and book buyers

•

Digital

direct and opt-in 3

rd

party data

•

Clickstream data

from digital properties

•

Third party data used for demographic, behavioral, and

geographic targeting

Time Inc. Database

Data Currently Leveraged for…

Consumer Marketing

Modeled direct mail and email campaigns

Segmentation & targeting for retention efforts

Customized marketing (e.g., SI

Favorite Team)

Targeted advertising (print)

Selective binding for print ad campaigns

ROI analysis to determine campaign effectiveness

Offline to online targeting segments

And Will Drive Future Monetization Strategies

Smarter Online

Marketing

•

Behavioral and website engagement data drives enhanced subscription targeting and Paid

Content strategies •

Explore

modeling

efforts

to

drive

more

effective

lead

generation

campaigns

Enhanced Offline

Marketing

•

Incorporate new data into direct mail, email and retention models and marketing efforts

•

Move toward multi-channel marketing for customers interacting with our content on

multiple platforms “Portfolio Marketing”

•

Target customers by profitability potential across Time Inc. portfolio, rather than

individual brands •

Adopt “portfolio”

marketing across areas of interest; offer products from multiple brands

•

Enhanced cross-selling/up-selling by prioritizing offers based on lifetime value for

Time Inc. Targeted Advertising

•

Combine data, context and content to drive addressable media opportunities for clients

•

Offline to online targeting

Time Inc. understands what people like and what they engage with |

39

•

Enhance portfolio of digital products and drive

digital magazine revenue

•

Increase recurring/automated billing and drive

online/credit card purchases

•

Reduce costs in traditional circulation acquisition

efforts

•

Maintain premium pricing

•

Modernize customer communications

•

Improve customer targeting

•

Consumer shift from print to digital

•

Continued pressure on conversion rates and

economics of circulation acquisition

•

Rising median age of magazine subscriber

•

Limitation of digital magazine “all access replica”

strategy

Tactics

Challenges

Time Inc. Subscription Overview

Subscription Revenue ($MM)

$754

$748

$721

2011A

2012A

2013A

Note: 2013A includes Affluent Media Group for the portion of the year after which it was

acquired |

40

•

Aggressively pursue consumer activation

–

Consumer marketing techniques (value added

promotions, register messaging, couponing)

•

Continue to grow bookazine publishing unit at

newsstand

•

Implement selective price increases

•

Expand All You magazine nationally

•

Focus on local market interests

•

Inventory management

–

Reduce marginal draw

–

Maintain prior issue remnant inventory to

produce a longer on sale period

•

Declining channel, sales and profit

•

Supply chain faces declining revenues against a

largely fixed cost base

•

Regional business interruptions are possible if a

wholesaler exits the market suddenly

•

The loss of publishers could further erode

wholesaler overhead contribution until costs can

be rationalized to reflect lower outbound volume

•

Continued sales declines could affect publisher

rate base

•

Magazine SKU’s are increasingly facing

competition including other products at

checkout, such as soda and gum

Tactics

Challenges

Time Inc. Newsstand Overview

Newsstand Revenue ($MM)

$498

$447

$389

2011A

2012A

2013A

Note: 2013A includes Affluent Media Group for the portion of the year after which it was

acquired |

41

•

Re-focus on selling and communicating benefits

of print

•

Improve ease of access for agencies and other

large advertisers

•

Continued growth in programmatic advertising

as demand for ultra-premium inventory grows

•

Ad rates (CPM) for ultra-premium digital

inventory growing in concert with rising demand

•

More effective utilization of first-party data

proving to be a critical competitive advantage

over other ad networks and content publishers

•

Shift toward digital with subsequent decline in

demand for print

•

Premium inventory levels are decreasing as

advertiser's ability to measure viewable ad

impressions improves and they demand higher

levels of viewable inventory

•

As mobile page views continue to grow rapidly

and at the expense of desktop, premium

inventory levels are declining

•

A lack of optimization technology impedes Time

Inc. from attracting the largest performance

advertisers

•

Mobile monetization rates do not sufficiently

replace web display

Tactics

Challenges

Time Inc. Advertising Overview

Advertising Revenue ($MM)

$1,923

$1,819

$1,807

2011A

2012A

2013A

Note: 2013A includes Affluent Media Group for the portion of the year after which it was

acquired |

Digital

Strategy for Growth 42

•

1.1B monthly pageviews with 915MM minutes spent on our sites

•

45+ websites with 73.9MM

1

monthly unique visitors in the U.S., 42MM of which were mobile

•

Database

of

150MM

U.S.

individuals

including

offline

transaction

and

demographic

information

•

Tablet versions and mobile apps for all U.S. magazines

•

Digital

and

mobile

unique

visitors

grew

17%

and

72%

in

the

last

10

months

2

,

respectively

Digital and

Mobile

Foundation

Source: ComScore

1

Excludes CNN/Money

2

Through February 2014; ComScore began providing YOY comparisons for multiplatform audiences

in April 2013 Multi-media

Strategy

•

Investment in video drove 50% YOY growth in in-house original production and more than 75%

YOY growth in user initiated streams

•

Hiring entrepreneurial digital talent

•

Developing cross-brand video aggregator that brings together the best content from across

the Time Inc. portfolio

Scaling for

Mobile and the

Social Web

•

Brand presence across all major social networking platforms

•

Preferred partners with Facebook and Twitter for launching and testing new products

•

Driving increased engagement by enabling “contributor”

platforms across many of our brands

Monetization

and Innovation

•

Opportunities exist for product extensions including new mobile-first brands,

e-commerce, etc. •

Build on strength of: a) high-touch direct, custom and native advertising sales programs;

and b) benefits of scale and access to data for exchange/programmatic sales

•

2014 innovation runway includes testing new social networks and developing next-gen

Apps •

Fostering an “Innovation Hub / Council”

and a digital-first culture |

FINANCIAL

OVERVIEW 43 |

44

Ability to Transform Cost Base to Maintain Profitability

Strong Free Cash Flow Profile to Fund Transformation

Strong Balance Sheet

Focused on Balance Between Reinvestment in the Business

and Returning Capital to Shareholders

Key Financial Highlights

Increase Monetization of Adjacent Opportunities |

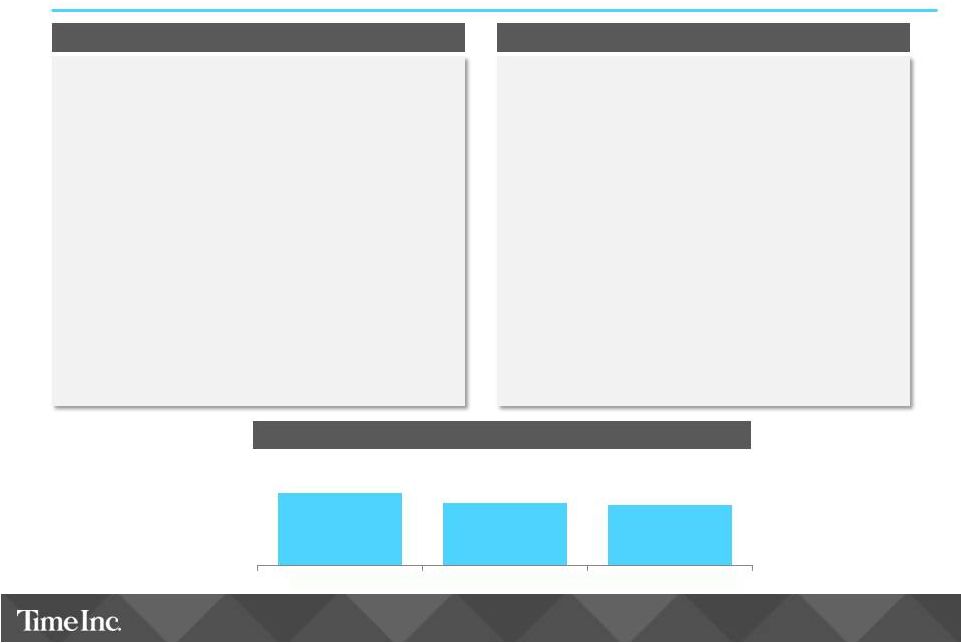

45

Historical Financials

Revenue ($MM)

Adjusted OIBDA

1

($MM)

Note:

2013A

includes

Affluent

Media

Group

for

the

portion

of

the

year

after

which

it

was

acquired

1

Adjusted

OIBDA

is

OIBDA

excluding

asset

impairments,

restructuring

and

severance

costs,

gains

or

losses

on

operating

assets,

and

external

costs

related

to

mergers,

acquisitions

or

dispositions;

See

Appendix for Reconciliation of Operating Income to Adjusted OIBDA

2

Adj. OIBDA margin is defined as Adjusted OIBDA divided by revenue

2

$1,923

$1,819

$1,807

$754

$748

$721

$498

$447

$389

$502

$422

$437

$3,677

$3,436

$3,354

2011A

2012A

2013A

Advertising

Subscription

Newsstand

Other

$740

$617

$587

20.1%

18.0%

17.5%

2011A

2012A

2013A

Adj. OIBDA margin |

•

Streamline the edit process and eliminate duplication across brands

46

Ability to Transform the Cost Base

Our operating plan includes substantial cost efficiencies

Organizational restructure

Editorial

Process re-engineering and global sourcing

•

Dissolve complex operating structure into a single portfolio of U.S. brands

•

Drive efficiencies and take out layers of overhead

•

Realign compensation and incentive policies

•

Synergy from Affluent Media Group acquisition

•

Review of functional areas (finance, consumer marketing, operations, research and IT)

Procurement

•

$500MM of annual addressable spending

•

Renegotiation of multi-year print contracts in the U.S. and U.K.

Real Estate

•

Time

&

Life

Building

lease

ends

2017;

expect

annual

real

estate-related

savings

of

~$50MM

1

•

Anticipate incurring ~$120MM in costs primarily related to tenant improvements in order to

achieve such annual savings

•

Vacate existing floors in current space

1

Exploring potential scenario to accelerate real estate move and potential savings into

2016 |

Strong Free

Cash Flow Profile 47

Capital Expenditures ($MM)

Free cash flow

1

($MM)

Note:

2013A

includes

Affluent

Media

Group

for

the

portion

of

the

year

after

which

it

was

acquired

1

Free Cash Flow is defined as cash provided by operations less capital expenditures; See

Appendix for Reconciliation of Net Income to Free Cash Flow 2

Adjusted

OIBDA

is

OIBDA

excluding

asset

impairments,

restructuring

and

severance

costs,

gains

or

losses

on

operating

assets

and

external

costs

related

to

mergers,

acquisitions

or

dispositions;

See

Appendix for Reconciliation of Operating Income to Adjusted OIBDA

•

Minimal ongoing operating capital expenditure requirement excluding

approximately $120MM of tenant improvements related to new lease

•

Substantial capacity to reinvest in the business and adjacent opportunities

•

Significant cash conversion to fund return of capital to shareholders

Low capital requirements provide

flexibility for deleveraging,

reinvestment in the business and

capital distribution to shareholders

2

$48

$34

$34

2011A

2012A

2013A

$426

$427

$384

57.6%

69.1%

65.4%

2011A

2012A

2013A

Cash Conversion (% of Adj. OIBDA) |

48

•

In connection with the spin-off, Time Inc. has raised $1.4 billion of funded debt, in the

form of a $700MM 1st lien Term Loan B (subject to closing conditions) and $700MM of

Senior Unsecured Notes Net proceeds from the financing will be used to purchase U.K.

publishing operations from Time Warner and pay a special dividend to Time Warner

The Company also has access to an undrawn $500MM 1st lien Revolving Credit Facility (subject

to closing conditions)

•

Moody’s and S&P credit ratings

Corporate ratings of Ba3 and BB, respectively, both with stable outlook

Senior Secured Credit Facilities ratings of Ba1 and BBB-, respectively

Senior Unsecured Notes ratings of B1 and BB, respectively

Capital Structure

($MM)

Amount

x 2013 Adj. OIBDA

Cash (estimate)

$150

$500MM Revolving Credit Facility

-

Term Loan B

700

Secured Debt

$700

1.2x

Senior Notes

700

Total Debt

$1,400

2.4x

Net Debt

$1,250

2.1x

2013

Adj.

OIBDA¹

$587

Pro Forma Capitalization as of December 31, 2013 (unaudited)

Note:

2013A

includes

Affluent

Media

Group

for

the

portion

of

the

year

after

which

it

was

acquired;

Time

Warner

will

retain

liability

of

the

This

Old

House

Note

maturing

in

2017

1

Adjusted

OIBDA

is

OIBDA

excluding

asset

impairments,

restructuring

and

severance

costs,

gains

or

losses

on

operating

assets,

and

external

costs

related

to

mergers,

acquisitions

or

dispositions;

See

Appendix for Reconciliation of Operating Income to Adjusted OIBDA

|

49

•

Maintaining strategic flexibility and adequate access to debt capital markets

2.4x gross leverage and 2.1x net leverage at spin with no significant

maturities before 2019

Target 2.0x -

2.5x long-term leverage

Maintain ample liquidity from strong Free Cash Flow and committed

revolving credit facility

•

Allocating capital to create value

Investment in the business

Strategic acquisitions

Direct returns to shareholders

Repayment of debt

Balanced Approach to Capital Allocation

Conservative balance sheet

Balanced capital policy |

50

Time Inc. Outlook for 2014

($MM)

2013 ACTUAL

2013 ACTUAL

2014 RANGE

2014 RANGE

Revenue –

as reported

$3,354

Flat to +2%

Revenue ex. Time Inc. Affluent Media Group

$3,282

(3%) to (5%)

Adjusted

OIBDA

1

margin

(%)

17.5%

16.25% to 17.0%

Public company costs

$8

$27 to $32

Share-based compensation expense

$18

$35 to $40

Interest expense, net

$3

~$45

Depreciation

and

amortization

2

$127

$160 to $165

Capital

expenditures

2

$34

$35 to $40

1

We

define

Adjusted

OIBDA

as

OIBDA

adjusted

for

asset

impairments,

restructuring

and

severance

costs,

gains

or

losses

on

operating

assets,

and

external

costs

related

to

mergers,

acquisitions

or

dispositions

2

Does

not

reflect

any

impacts

from

(a)

the

anticipated

relocation

of

our

headquarters

building,

(b)

possible

future

sales

of

operating

assets,

(c)

possible

future

acquisitions

and

dispositions

(including

costs

related

thereto)

or

(d)

restructuring

and

severance

actions

that

may

be

initiated

in

the

future |

51

•

Industry leading collection of media brands

•

Large, highly engaged audience

•

Brands represent consumer passions that can be monetized across platforms

•

Subscriber relationships provide extensive consumer insight and data

•

Experienced management team with proven track record to drive

transformation

•

Unleashing entrepreneurship and driving P&L accountability

•

Focus on brand extension and content scale opportunities

•

Strong Free Cash Flow profile to fund our transformation

•

Balanced approach to capital allocation

Summary Highlights |

APPENDIX

52 |

53

Reconciliation of Operating Income to OIBDA and Adjusted OIBDA

Note:

2013A

includes

Affluent

Media

Group

(AMG)

for

the

post-acquisition

period;

1

Asset

impairments

for

each

year

are

primarily

trade

name

impairments;

2

Restructuring

and

severance

costs

for

each

year

primarily

reflect

headcount

reductions

and

lease

exit

costs;

3

For

the

year

ended

December

31,

2012,

the

$36MM

pretax

loss

relates

to

the

sale

of

our

school

fundraising

business,

QSP.

For

the

year

ended

December

31,

2013,

the

$13MM

pretax

gain

relates

to

the

settlement

of

a

contractual

arrangement

with

AMG

that

pre-dated

the

acquisition;

4

For

the

year

ended

December

31,

2012,

the

$1MM

charge

relates

to

unconsummated

acquisitions.

For

the

year

ended

December

31,

2013,

the

$1MM

charge

relates

to

the

AMG

acquisition

($MM)

2011

2012

2013

Actual

Actual

Actual

Operating Income

$563

$420

$330

Depreciation

100

91

85

Amortization

42

36

42

OIBDA

$705

$547

$457

Asset impairments

1

17

6

79

Restructuring and severance

2

18

27

63

Gains/losses on operating assets

3

—

36

(13)

External costs related to mergers, acquisitions or dispositions

4

—

1

1

Adjusted OIBDA

$740

$617

$587 |

54

Reconciliation

of

Operating

Income

to

Adjusted

OIBDA

-

2014

Outlook

Note: When providing a projection for a non-GAAP measure, a reconciliation to the most

directly comparable GAAP measure is required to the extent available without unreasonable efforts. In such reconciliations, we may indicate an

amount or range for GAAP measures that are components of and that arithmetically add up to the

non-GAAP financial measure. Our indications of the GAAP components must not be interpreted as explicit or implicit projections of those

components. We have made numerous assumptions in preparing our projections, including those

described on the 2014 Outlook slide. These assumptions, including the amounts of the

various components that comprise a financial measure, may or may not prove to be

correct. We will consider our projection of a non-GAAP financial measure to have been achieved if the statement we

make about that non-GAAP measure is satisfied, even if the GAAP components

differ materially from those indicated in an earlier reconciliation

($MM)

2013 Actual

Low

High

Operating Income

$330

$204

$231

Depreciation

85

85

89

Amortization

42

76

76

OIBDA

$457

$365

$396

Asset impairments, restructuring and severance,

gains/losses on operating assets, and external costs related

to mergers, acquisitions and dispositions

130

180

186

Adjusted OIBDA

$587

$545

$582

2014 Guidance |

55

Free Cash Flow Reconciliation

1

Note: 2013A includes Affluent Media Group for the post-acquisition period

($MM)

2011

2012

2013

Actual

Actual

Actual

Net income

$368

$263

$201

Depreciation and amortization

142

127

127

Asset impairments

17

6

79

Loss on disposal of QSP Business

—

36

—

Equity-based compensation

41

39

18

All other, net, including working capital charges

(94)

(10)

(7)

Cash provided by operations

1

$474

$461

$418

Capital expenditure

(48)

(34)

(34)

Free Cash Flow

$426

$427

$384

Includes foreign net income taxes paid of $7MM, $12MM and $13MM for the years ended December

31, 2011, 2012 and 2013 |