Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ICAHN ENTERPRISES L.P. | v378476_8k.htm |

Icahn Enterprises L.P. Investor Presentation May 2014

Forward - Looking Statements and Non - GAAP Financial Measures Forward - Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements included herein, other than statements that relate solely to historical fact, are “forward - looking statements . ” Such statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events, or any statement that may relate to strategies, plans or objectives for, or potential results of, future operations, financial results, financial condition, business prospects, growth strategy or liquidity, and are based upon management’s current plans and beliefs or current estimates of future results or trends . Forward - looking statements can generally be identified by phrases such as “believes,” “expects,” “potential,” “continues,” “may,” “should,” “seeks,” “predicts,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “could,” “designed,” “should be” and other similar expressions that denote expectations of future or conditional events rather than statements of fact . Our expectations, beliefs and projections are expressed in good faith and we believe that there is a reasonable basis for them . However, there can be no assurance that these expectations, beliefs and projections will result or be achieved . There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward - looking statements contained in this presentation . These risks and uncertainties are described in our Annual Report on Form 10 - K for the year ended December 31 , 2013 and our Quarterly Report on Form 10 - Q for the quarter ended March 31 , 2014 . There may be other factors not presently known to us or which we currently consider to be immaterial that may cause our actual results to differ materially from the forward - looking statements . All forward - looking statements attributable to us or persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the cautionary statements included in this presentation . Except to the extent required by law, we undertake no obligation to update or revise forward - looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events . Non - GAAP Financial Measures This presentation contains certain non - GAAP financial measures, including EBITDA, Adjusted EBITDA, Indicative Net Asset Value and Adjusted Net Income . The non - GAAP financial measures contained herein have limitations as analytical tools and should not be considered in isolation or in lieu of an analysis of our results as reported under U . S . GAAP . These non - GAAP measures should be evaluated only on a supplementary basis in connection with our U . S . GAAP results, including those reported in our consolidated financial statements and the related notes thereto contained in our Annual Report on Form 10 - K for the year ended December 31 , 2013 and our Quarterly Report on Form 10 - Q for the quarter ended March 31 , 2014 .

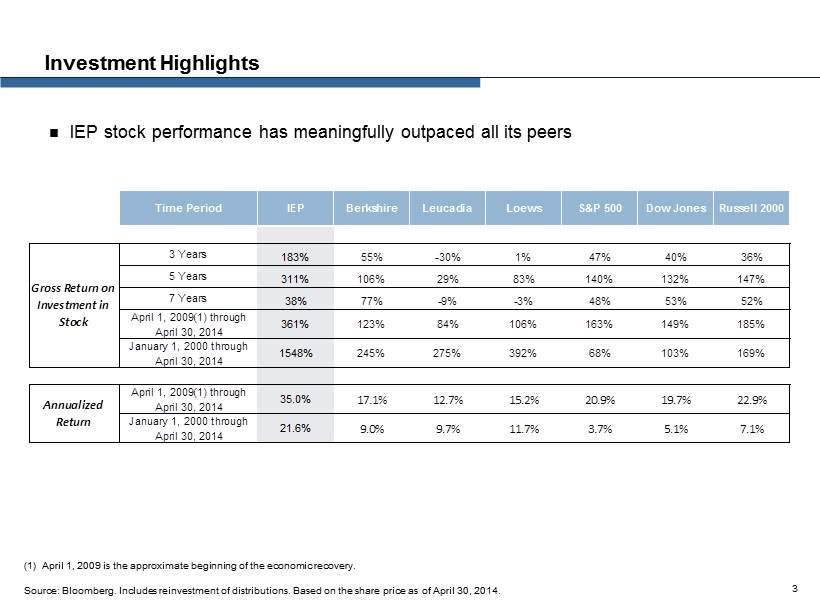

Investment Highlights IEP stock performance has meaningfully outpaced all its peers 3 (1) April 1, 2009 is the approximate beginning of the economic recovery. Source : Bloomberg. Includes reinvestment of distributions. Based on the share price as of April 30, 2014. Time Period IEP Berkshire Leucadia Loews S&P 500 Dow Jones Russell 2000 3 Years 183% 55% -30% 1% 47% 40% 36% 5 Years 311% 106% 29% 83% 140% 132% 147% 7 Years 38% 77% -9% -3% 48% 53% 52% April 1, 2009(1) through April 30, 2014 361% 123% 84% 106% 163% 149% 185% January 1, 2000 through April 30, 2014 1548% 245% 275% 392% 68% 103% 169% April 1, 2009(1) through April 30, 2014 35.0% 17.1% 12.7% 15.2% 20.9% 19.7% 22.9% January 1, 2000 through April 30, 2014 21.6% 9.0% 9.7% 11.7% 3.7% 5.1% 7.1% Gross Return on Investment in Stock Annualized Return

Investment Highlights 4 Mr . Icahn believes there has never a better time for activist investing, if practiced properly, than today. – Several factors are responsible for this: 1) low interest rates, which make acquisitions much less costly and therefore much more attractive, 2) abundance of cash rich companies that would benefit from making synergistic acquisitions, and 3) the current awareness by many institutional investors that the prevalence of mediocre top management and non - caring boards at ma ny of America's companies must be dealt with if we are ever going to end high unemployment and be able to compete in world marke ts – But an activist catalyst is often needed to make an acquisition happen – We, at IEP, have spent years engaging in the activist model and believe it is the catalyst needed to drive highly accretive M &A and consolidation activity – As a corollary, low interest rates will greatly increase the ability of the companies IEP controls to make judicious, friendl y o r not so friendly, acquisitions using our activist expertise Proven track record of delivering superior returns IEP total stock return of 1,548% (1) since January 1, 2000 – S&P 500, Dow Jones Industrial and Russell 2000 indices returns of approximately 68%, 103% and 169% respectively over the same period Icahn Investment Funds performance since inception in November 2004 – Total return of approximately 255% (2) – Compounded average annual return of approximately 14% (2) – Returns of 33.3%, 15.2%, 34.5%, 20.2% (3) , 30.8% and (0.4%) in 2009, 2010, 2011, 2012, 2013, and Q1 2014 respectively – Returns are especially compelling in light of the fact that the portfolio was substantially hedged during this period. As a lon g only portfolio, returns would have been even higher. Recent Financial Results – Adjusted Net Income attributable to Icahn Enterprises of $92 million in Q1 2014 – Indicative Net Asset Value of $8.9 billion as of March 31, 2014 – LTM March 31, 2014 Adjusted EBITDA attributable to Icahn Enterprises of approximately $1.6 billion $6.00 annual distribution (5.9 % yield as of April 30, 2014) (1) Source: Bloomberg. Includes reinvestment of distributions. Based on the share price as of April 30, 2014. (2) Returns calculated as of March 31, 2014. (3) Return assumes that IEP’s holdings in CVR Energy remained in the Investment Funds for the entire period. IEP obtained a majority stake in CVR Energy in May 2012. Inv est ment Funds returns were ~6.6% when excluding returns on CVR Energy after it became a consolidated entity .

The Icahn Strategy Across all of our businesses, our success is based on a simple formula: we seek to find undervalued companies in the Graham & Do dd tradition, a methodology for valuing stocks that primarily looks for deeply depressed prices. However, while the typical Graham & Dodd value investor purc has es undervalued securities and waits for results, we often become actively involved in the companies we target. That activity may involve a broad range of approac hes , from influencing the management of a target to take steps to improve shareholder value, to acquiring a controlling interest or outright ownership of the target com pany in order to implement changes that we believe are required to improve its business, and then operating and expanding that business. This activism has brought ab out very strong returns over the years. Today, we are a diversified holding company owning subsidiaries engaged in the following operating businesses: Investment, Au tom otive, Energy, Metals, Railcar, Gaming, Food Packaging, Real Estate and Home Fashion. Through our Investment segment, as of April 30, 2014, we have significa nt positions in various investments, which include Apple Inc. (AAPL), Forest Laboratories (FRX), eBay Inc. (EBAY), Chesapeake Energy (CHK), Herbalife Ltd. (HLF), Netflix (NFLX), Transocean Ltd. (RIG), Nuance Communications, Inc. (NUAN), Talisman Energy Inc. (TLM), Hologic Inc. (HOLX) and Navistar International Corp. ( NAV ). Several of our operating businesses started out as investment positions in debt or equity securities, held either directly by ou r Investment segment or Mr. Icahn. Those positions ultimately resulted in control or complete ownership of the target company. Most recently, we acquired a controllin g i nterest in CVR Energy, Inc. (‘‘CVR’’) which started out as a position in our Investment segment and is now an operating subsidiary that comprises our Energy segmen t. As of April 30, 2014, based on the closing sale price of CVR stock and distributions since we acquired control, we had a gain of approximately $2.4 billion on o ur purchase of CVR. The recent acquisition of CVR, like our other operating subsidiaries, reflects our opportunistic approach to value creation, through which returns m ay be obtained by, among other things, promoting change through minority positions at targeted companies in our Investment segment or by acquiring control of those tar get companies that we believe we could run more profitably ourselves. In 2000, we began to expand our business beyond our traditional real estate activities, and to fully embrace our activist str ate gy. On January 1, 2000, the closing sale price of our depositary units was $7.625 per depositary unit. On April 30, 2014, our depositary units closed at $100.98 per d epo sitary unit, representing an increase of approximately 1,548% since January 1, 2000 (including reinvestment of distributions into additional depositary units and taki ng into account in - kind distributions of depositary units). Comparatively, the S&P 500, Dow Jones Industrial and Russell 2000 indices increased approximately 68%, 103 % a nd 169%, respectively, over the same period (including reinvestment of distributions into those indices). During the next several years, we see a favorable opportunity to follow an activist strategy that centers on the purchase of tar get stock and the subsequent removal of any barriers that might interfere with a friendly purchase offer from a strong buyer. Alternatively, in appropriate circumsta nce s, we or our subsidiaries may become the buyer of target companies, adding them to our portfolio of operating subsidiaries, thereby expanding our operations through s uch opportunistic acquisitions. We believe that the companies that we target for our activist activities are undervalued for many reasons, often including inept managem ent . Unfortunately for the individual investor, in particular, and the economy, in general, many poor management teams are often unaccountable and very difficult t o r emove. 5

The Icahn Strategy (continued) Unlike the individual investor, we have the wherewithal to purchase companies that we feel we can operate more effectively th an incumbent management. In addition, through our Investment segment, we are in a position to pursue our activist strategy by purchasing stock or debt positions an d t rying to promulgate change through a variety of activist approaches, ranging from speaking and negotiating with the board and CEO to proxy fights, tender offers a nd taking control. We work diligently to enhance value for all shareholders and we believe that the best way to do this is to make underperforming management teams an d b oards accountable or to replace them. The Chairman of the Board of our general partner, Carl C. Icahn, has been an activist investor since 1980. Mr. Icahn believes th at he has never seen a time for activism that is better than today. Many major companies have substantial amounts of cash. We believe that they are hoarding cas h, rather than spending it, because they do not believe investments in their business will translate to earnings. We believe that one of the best ways for many cash - rich companies to achieve increased earnings is to use their large amounts of excess cash, together with advantageous borrowing opportunities, to purchase other companies in their industries and take advantage of the meaningful sy ner gies that could result. In our opinion, the CEOs and Boards of Directors of undervalued companies that would be acquisition targets are the major road blocks to this lo gical use of assets to increase value, because we believe those CEOs and boards are not willing to give up their power and perquisites, even if they have done a poo r j ob in administering the companies they have been running. In addition, acquirers are often unwilling to undertake the arduous task of launching a hostile campa ign . This is precisely the situation in which a strong activist catalyst is necessary. We believe that the activist catalyst adds value because, for companies with strong balance sheets, acquisition of their weak er industry rivals is often extremely compelling financially. We further believe that there are many transactions that make economic sense, even at a large premium ov er market. Acquirers can use their excess cash, that is earning a very low return, and/or borrow at the advantageous interest rates now available, to acquire a tar get company. In either case, an acquirer can add the target company’s earnings and the income from synergies to the acquirer’s bottom line, at a relatively low cost. But for these potential acquirers to act, the target company must be willing to at least entertain an offer. We believe that often the activist can step in and remove the obs tacles that a target may seek to use to prevent an acquisition. It is our belief that our strategy will continue to produce strong results into the future, and that belief is reflected in t he action of the board of directors of our general partner, which announced in March 2014, a decision to modify our distribution policy to increase our annual distribution to $ 6.0 0 per depositary unit. We believe that the strong cash flow and asset coverage from our operating segments will allow us to maintain a strong balance sheet and ample li qui dity. In our view Icahn Enterprises is in a virtuous cycle. We believe that our depositary units will give us another powerful acti vis t tool, allowing us both to use our depositary units as currency for tender offers and acquisitions (both hostile and friendly) where appropriate. All of these factors will , i n our opinion, contribute to making our activism even more efficacious, which we expect to enhance our results and stock value. 6

Company Overview 7

Overview of Icahn Enterprises Icahn Enterprises L.P. is a diversified holding company with operating segments in Investment, Automotive, Energy, Gaming, Ra ilc ar, Food Packaging, Metals, Real Estate and Home Fashion IEP is majority owned and controlled by Carl Icahn – Over the last several years, Carl Icahn has contributed most of his businesses to and executed transactions primarily through IE P – Approximately $600 million of equity raised in 2013 to broaden our shareholder base and improve liquidity – Issued $5 billion of new senior notes in January 2014 which refinanced $3.5 billion of existing senior notes and provided $1. 3 b illion of additional liquidity. – As of March 31, 2014, affiliates of Carl Icahn owned approximately 88% of IEP’s outstanding depositary units IEP benefits from increasing cash flows from its subsidiaries: – CVR Energy: $3.00 annual dividend, $12.00 in special dividends paid in 2013 – CVR Refining: $3.68 dividends declared in 2013 and $0.98 dividend declared in Q1 2014 – American Railcar Inc: $1.60 annual dividend – American Railcar Leasing will generate recurring cash flows IEP has daily liquidity through its ability to redeem its investment in the funds on a daily basis (1) Investment segment total assets represents book value of equity. 8 ($ millions) Segment Total (% of Total) Total (% of Total) Total (% of Total) Total (% of Total) Investment (1) $ 9,339 31.81% $ 1,474 7.3% $ 1,361 45.0% $ 607 37.1% Automotive 7,621 25.96% 6,985 34.4% 615 20.3% 487 29.8% Energy 5,936 20.22% 9,281 45.7% 742 24.5% 446 27.3% Metals 331 1.13% 855 4.2% (16) -0.5% (16) -1.0% Railcar 2,468 8.41% 763 3.8% 331 10.9% 155 9.5% Gaming 1,039 3.54% 615 3.0% 66 2.2% 45 2.8% Food Packaging 442 1.51% 331 1.6% 67 2.2% 51 3.1% Real Estate 790 2.69% 88 0.4% 47 1.6% 47 2.9% Home Fashion 224 0.76% 184 0.9% 3 0.1% 3 0.2% Holding Company 1,169 3.98% (273) -1.3% (191) -6.3% (191) -11.7% Total $ 29,359 100.0% $ 20,303 100.0% $ 3,025 100.0% $ 1,634 100.0% As of March 31, 2014 LTM March 31, 2014 Assets Revenue Adjusted EBITDA Adj. EBITDA Attrib. to IEP

71% CVR Energy Inc. (NYSE: CVI) Summary Corporate Organizational Chart WestPoint Home LLC PSC Metals Inc. AREP Real Estate Holdings, LLC Tropicana Entertainment Inc. (OTCPK:TPCA) Federal - Mogul Holdings Corp. (NasdaqGS:FDML) Icahn Enterprises G.P. Inc. Icahn Enterprises L.P. (NasdaqGS: IEP) Icahn Enterprises Holdings L.P . 1% 1% 99% LP Interest 53% 73% 81% 82% American Railcar Industries, Inc. (NasdaqGS:ARII) Icahn Capital LP Viskase Companies Inc. (OTCPK:VKSC) As of March 31, 2013, Icahn Enterprises had investments with a fair market value of approximately $4.7 billion in the Investment Funds One of the largest independent metal recycling companies in the US Consists of rental commercial real estate, property development and associated resort activities Provider of home textile products for nearly 200 years One of the worldwide leaders in cellulosic, fibrous and plastic casings for processed meat industry Holding company that owns majority interests in two separate operating subsidiaries Multi - jurisdictional gaming company with eight casinos in New Jersey, Indiana, Nevada, Mississippi, Louisiana and Aruba Leading North American manufacturer of hopper and tank railcars and provider of railcar repair and maintenance services 68% 100% 100% 56% Producer and distributer of nitrogen fertilizer products CVR Partners, LP (NYSE: UAN) CVR Refining, LP (NYSE: CVRR) 185,000 bpd oil refining company in the mid - continent region of the United States 100% 100% 4% Leading global supplier to the automotive, aerospace, energy, heavy duty truck, industrial, marine, power generation and auto aftermarket industries Note : Percentages denote equity ownership as of March 31, 2014. Excludes intermediary and pass through entities. American Railcar Leasing LLC Leading North American lessor of approximately 31,000 hopper and tank railcars 75% 9

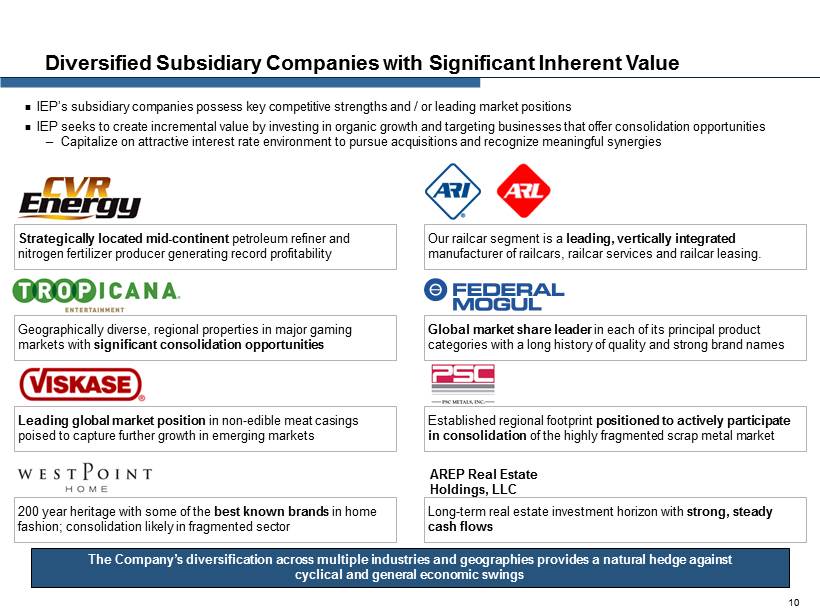

Diversified Subsidiary Companies with Significant Inherent Value The Company’s diversification across multiple industries and geographies provides a natural hedge against cyclical and general economic swings Global market share leader in each of its principal product categories with a long history of quality and strong brand names Geographically diverse, regional properties in major gaming markets with significant consolidation opportunities 200 year heritage with some of the best known brands in home fashion; consolidation likely in fragmented sector Leading global market position in non - edible meat casings poised to capture further growth in emerging markets Established regional footprint positioned to actively participate in consolidation of the highly fragmented scrap metal market Our railcar segment is a leading, vertically integrated manufacturer of railcars, railcar services and railcar leasing. Strategically located mid - continent petroleum refiner and nitrogen fertilizer producer generating record profitability Long - term real estate investment horizon with strong, steady cash flows AREP Real Estate Holdings, LLC IEP’s subsidiary companies possess key competitive strengths and / or leading market positions IEP seeks to create incremental value by investing in organic growth and targeting businesses that offer consolidation opportunities ─ Capitalize on attractive interest rate environment to pursue acquisitions and recognize meaningful synergies 10

IEP began as American Real Estate Partners, which was founded in 1987, and has grown its diversified portfolio to nine operating segments and approximately $35 billion of assets as of March 31, 2014 IEP has demonstrated a history of successfully acquiring undervalued assets and improving and enhancing their operations and fin ancial results IEP’s record is based on a long - term horizon that can enhance business value and facilitate a profitable exit strategy ─ In 2006, IEP sold its oil and gas assets for $1.5 billion, resulting in a net pre - tax gain of $0.6 billion ─ In 2008, IEP sold its investment in American Casino & Entertainment Properties LLC for $1.2 billion, resulting in a pre - tax gain of $0.7 billion Acquired partnership interest in Icahn Capital Management L.P . in 2007 ─ IEP and certain of Mr. Icahn's wholly owned affiliates are the sole investors in the Investment Funds IEP also has grown the business through organic investment and through a series of bolt - on acquisitions Evolution of Icahn Enterprises Timeline of Recent Acquisitions and Exits (1) Market capitalization as of April 30, 2014 and balance sheet data as of March 31, 2014. (2) Oil and gas assets included National Energy Group, Inc., TransTexas Gas Corporation and Panaco, Inc . (3) Percentages represents weighted - average composite of the gross returns, net of expenses for the Investment Funds. (4) Return assumes that IEP’s holdings in CVR Energy remained in the Investment Funds for the entire period. IEP obtained a majority stake in CVR Energy in May 2012. Investment Fu nds returns were ~6.6% when excluding returns on CVR Energy after it became a consolidated entity . As of December 31, 2005 Mkt. Cap: $2.4bn Total Assets: $4.0bn Current (1) Mkt. Cap: $12.0bn Total Assets: $35.2bn 2006 37.8% American Casino & Entertainment Properties 2/20/08: Sale of the casinos resulted in proceeds of $1.2 billion and a pre - tax gain of $0.7 b illion American Railcar Industries 1/15/10: 54.4% of ARI’s shares outstanding were contributed by Carl Icahn in exchange for IEP depositary units PSC Metals 11/5/07: Acquired 100% of the equity of PSC Metals from companies wholly owned by Carl Icahn Tropicana Entertainment 11/15/10: Received an equity interest as a result of a Ch.11 restructuring and subsequently acquired a majority stake CVR Energy, Inc. 5/4/12: Acquired a majority interest in CVR via a tender offer to purchase all outstanding shares of CVR Federal - Mogul 7/3/08: Acquired a majority interest in Federal - Mogul from companies wholly owned by Carl Icahn Investment Management 8/8/07: Acquired investment advisory business, Icahn Capital Management Viskase 1/15/10: 71.4 % of Viskase’s shares outstanding were contributed by Carl Icahn in exchange for IEP depositary units Oil and Gas Assets (2) 11/21/06: S old oil and gas assets to a strategic buyer for $1.5 billion resulting in a pre - tax gain of $0.6 billion Year / Icahn Capital Returns: (3) 11 CVR Refining & CVR Partners 2013: CVR Refining completed IPO and secondary offering on 1/16/13 and 5/14/13, respectively. CVR Partners completed a secondary offering on 5/22/13. Q1 2014 (0.4%) 2007 12.3% 2008 (35.6%) 2009 33.3% 2010 15.2 % 2011 34.5% 2012 20.2% (4) American Railcar Leasing LLC 10/2/13: Acquired a 75% interest in ARL from companies wholly owned by Carl Icahn 2013 30.8 %

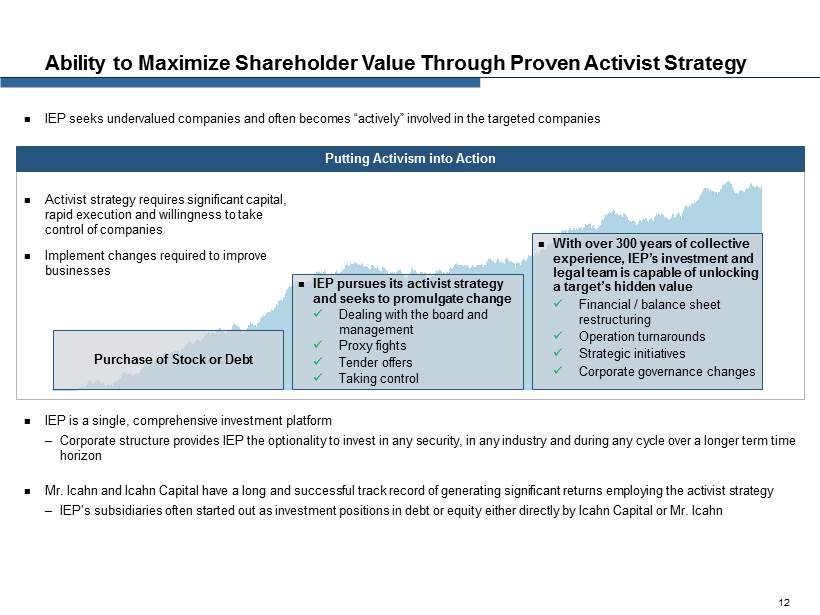

IEP seeks undervalued companies and often becomes “actively” involved in the targeted companies Activist strategy requires significant capital, rapid execution and willingness to take control of companies Implement changes required to improve businesses Ability to Maximize Shareholder Value Through Proven Activist Strategy Purchase of Stock or Debt IEP pursues its activist strategy and seeks to promulgate change x Dealing with the board and management x Proxy fights x Tender offers x Taking control With over 300 years of collective experience, IEP’s investment and legal team is capable of unlocking a target’s hidden value x Financial / balance sheet restructuring x Operation turnarounds x Strategic initiatives x Corporate governance changes IEP is a single, comprehensive investment platform ─ Corporate structure provides IEP the optionality to invest in any security, in any industry and during any cycle over a longe r t erm time horizon Mr. Icahn and Icahn Capital have a long and successful track record of generating significant returns employing the activist str ategy ─ IEP’s subsidiaries often started out as investment positions in debt or equity either directly by Icahn Capital or Mr. Icahn Putting Activism into Action 12

Situation Overview Historically, two businesses had a natural synergy ─ Aftermarket benefitted from OEM pedigree and scale Review of business identified numerous dis - synergies by having both under one business ─ Different customers, methods of distribution, cost structures, engineering and R&D, and capital requirements Structured as a C - Corporation ─ Investors seeking more favorable alternative structures Review of business identifies opportunity for significant cash flow generation ─ High quality refiner in underserved market ─ Benefits from increasing North American oil production ─ Supported investment in Wynnewood refinery and UAN plant expansion Strong investor appetite for yield oriented investments Strategic / Financial Initiative Adjust business model to separate OEM Powertrain and Vehicle Component Systems into two separate segments Contributed assets to a separate MLP and subsequently launched CVR Refining IPO and secondary offering; completed CVR Partners secondary offering Result Separation will improve management focus and maximize value of both businesses CVR Energy stock up 114%, including dividends, from tender offer price of $30.00 (1) Significant Experience Optimizing Business Strategy and Capital Structure IEP’s management team possesses substantial strategic and financial expertise ─ Maintains deep knowledge of capital markets, bankruptcy laws, mergers and acquisitions and transaction processes Active participation in the strategy and capital allocation for targeted companies ─ Not involved in day - to - day operations IEP w ill make necessary investments to ensure subsidiary companies can compete effectively Select Examples of Strategic and Financial Initiatives (1) Based on CVR Energy’s current stock price as of April 30, 2014. 13

Deep Team Led by Carl Icahn Led by Carl Icahn ─ Substantial investing history provides IEP with unique network of relationships and access to Wall Street Team consists of approximately 20 professionals with diverse backgrounds ─ Well rounded team with professionals focusing on different areas such as equity, distressed debt and credit Name Title Years at Icahn Years of Industry Experience Keith Cozza President & Chief Executive Officer , Icahn Enterprises L.P. 10 13 SungHwan Cho Chief Financial Officer , Icahn Enterprises L.P. 8 16 Vincent J. Intrieri Senior Managing Director, Icahn Capital 16 30 Samuel Merksamer Managing Director, Icahn Capital 6 11 Brett Icahn Portfolio Manager, Sargon Portfolio 11 11 David Schechter Portfolio Manager, Sargon Portfolio 10 17 Keith Schaitkin General Counsel, Icahn Enterprises L.P. 14 35 Jonathan Christodoro Managing Director, Icahn Capital 2 13 14

Overview of Operating Segments 15

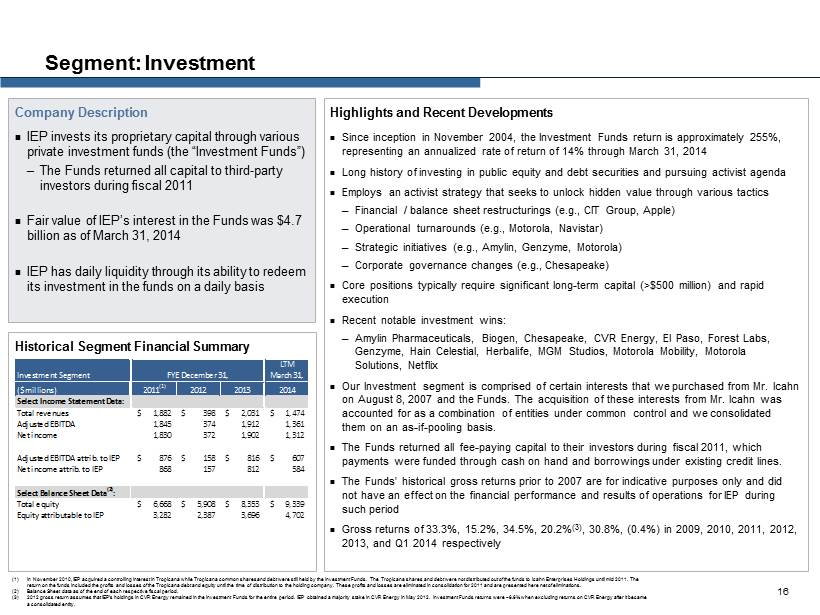

Highlights and Recent Developments Since inception in November 2004, the Investment Funds return is approximately 255%, representing an annualized rate of return of 14% through March 31, 2014 Long history of investing in public equity and debt securities and pursuing activist agenda Employs an activist strategy that seeks to unlock hidden value through various tactics ─ Financial / balance sheet restructurings (e.g., CIT Group, Apple) ─ Operational turnarounds (e.g., Motorola, Navistar) ─ Strategic initiatives (e.g., Amylin , Genzyme , Motorola) ─ Corporate governance changes (e.g., Chesapeake) Core positions typically require significant long - term capital (>$500 million) and rapid execution Recent notable investment wins: ─ Amylin Pharmaceuticals, Biogen , Chesapeake, CVR Energy, El Paso, Forest Labs, Genzyme , Hain Celestial, Herbalife , MGM Studios, Motorola Mobility, Motorola Solutions, Netflix Our Investment segment is comprised of certain interests that we purchased from Mr. Icahn on August 8, 2007 and the Funds. The acquisition of these interests from Mr. Icahn was accounted for as a combination of entities under common control and we consolidated them on an as - if - pooling basis. The Funds returned all fee - paying capital to their investors during fiscal 2011, which payments were funded through cash on hand and borrowings under existing credit lines. The Funds’ historical gross returns prior to 2007 are for indicative purposes only and did not have an effect on the financial performance and results of operations for IEP during such period Gross returns of 33.3%, 15.2%, 34.5%, 20.2% (3) , 30.8%, (0.4%) in 2009, 2010, 2011, 2012, 2013, and Q1 2014 respectively Segment: Investment Company Description IEP invests its proprietary capital through various private investment funds (the “Investment Funds”) ─ The Funds returned all capital to third - party investors during fiscal 2011 Fair value of IEP’s interest in the Funds was $4.7 billion as of March 31, 2014 IEP has daily liquidity through its ability to redeem its investment in the funds on a daily basis Historical Segment Financial Summary 16 (1) In November 2010, IEP acquired a controlling interest in Tropicana while Tropicana common shares and debt were still held by the Investment Funds. The Tropicana shares and debt were not distributed out of the funds to Icahn Enterprises Holdings until m id 2011. The return on the funds included the profits and losses of the Tropicana debt and equity until the time of distribution to the ho ldi ng company. These profits and losses are eliminated in consolidation for 2011 and are presented here net of eliminations. (2) Balance Sheet data as of the end of each respective fiscal period. (3) 2012 gross return assumes that IEP’s holdings in CVR Energy remained in the Investment Funds for the entire period. IEP obta ine d a majority stake in CVR Energy in May 2012. Investment Funds returns were ~6.6% when excluding returns on CVR Energy after it became a consolidated entity. Investment Segment LTM March 31, ($ millions) 2011 (1) 2012 2013 2014 Select Income Statement Data: Total revenues 1,882$ 398$ 2,031$ 1,474$ Adjusted EBITDA 1,845 374 1,912 1,361 Net income 1,830 372 1,902 1,312 Adjusted EBITDA attrib. to IEP 876$ 158$ 816$ 607$ Net income attrib. to IEP 868 157 812 584 Select Balance Sheet Data (2) : Total equity 6,668$ 5,908$ 8,353$ 9,339$ Equity attributable to IEP 3,282 2,387 3,696 4,702 FYE December 31,

Significant Holdings As of March 31, 2014 (3) As of December 31, 2013 (3) As of December 31, 2012 (3) Company Mkt. Value ($mm) (4) % Ownership (5) Company Mkt. Value ($mm) (4) % Ownership (5) Company Mkt. Value ($mm) (4) % Ownership (5) $4,046 0.8% $2,654 0.5% $1,083 11.5% $2,829 11.3% $1,841 11.4% $992 9.0% $1,702 10.0% $1,803 10.0% $514 10.0% $1,536 2.2% $1,335 16.8% $393 15.6% $1,044 19.2% $1,061 6.0% $274 14.3% Icahn Capital (1) Represents a weighted - average composite of the gross returns, net of expenses for the Investment Funds. (2) Return assumes that IEP’s holdings in CVR Energy remained in the Investment Funds for the entire period. IEP obtained a majority stake in CVR Energy in May 2012. Inv est ment Funds returns were ~ 6.6% when excluding returns on CVR Energy after it became a consolidated entity . (3) Aggregate ownership held directly by IEP, as well as Carl Icahn and his affiliates. Based on most recent 13F Holdings Reports , 1 3D flings or other public filings available as of specified date. (4) Based on closing share price as of specified date. (5) Total shares owned as a percentage of common shares issued and outstanding. 17.9% 37.8% 12.3% 33.3% 15.2% 34.5% 20.2% 30.8% (0.4%) 2005 2006 2007 2008 2009 2010 2011 2012 2013 Q1 2014 Historical Gross Returns (1) (35.6%) (2) 17

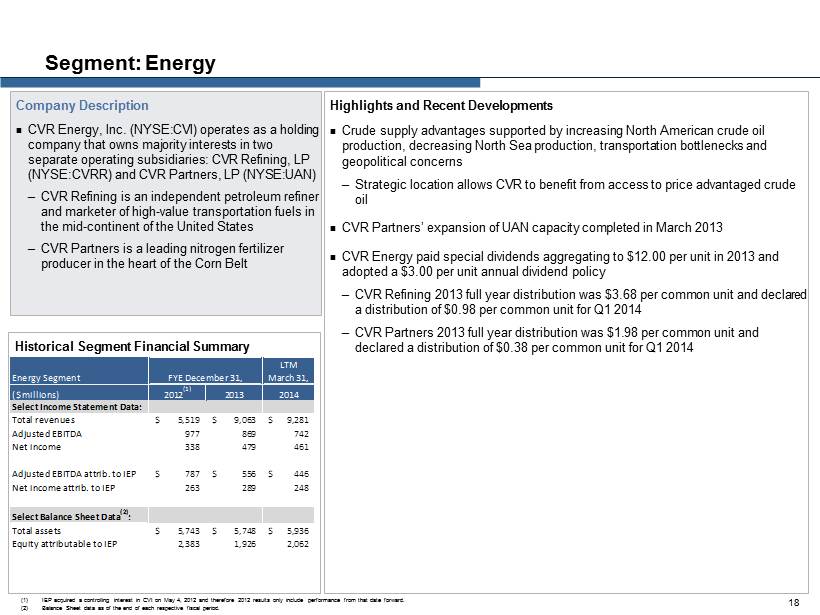

Highlights and Recent Developments Crude supply advantages supported by increasing North American crude oil production, decreasing North Sea production, transportation bottlenecks and geopolitical concerns ─ Strategic location allows CVR to benefit from access to price advantaged crude oil CVR Partners’ expansion of UAN capacity completed in March 2013 CVR Energy paid special dividends aggregating to $12.00 per unit in 2013 and adopted a $3.00 per unit annual dividend policy ─ CVR Refining 2013 full year distribution was $3.68 per common unit and declared a distribution of $0.98 per common unit for Q1 2014 ─ CVR Partners 2013 full year distribution was $1.98 per common unit and declared a distribution of $0.38 per common unit for Q1 2014 Segment: Energy Company Description CVR Energy, Inc. (NYSE:CVI) operates as a holding company that owns majority interests in two separate operating subsidiaries: CVR Refining, LP (NYSE:CVRR) and CVR Partners, LP ( NYSE:UAN ) ─ CVR Refining is an independent petroleum refiner and marketer of high - value transportation fuels in the mid - continent of the United States ─ CVR Partners is a leading nitrogen fertilizer producer in the heart of the Corn Belt Historical Segment Financial Summary 18 (1) IEP acquired a controlling interest in CVI on May 4, 2012 and therefore 2012 results only include performance from that date for ward. (2) Balance Sheet data as of the end of each respective fiscal period. Energy Segment LTM March 31, ($ millions) 2012 (1) 2013 2014 Select Income Statement Data: Total revenues 5,519$ 9,063$ 9,281$ Adjusted EBITDA 977 869 742 Net income 338 479 461 Adjusted EBITDA attrib. to IEP 787$ 556$ 446$ Net income attrib. to IEP 263 289 248 Select Balance Sheet Data (2) : Total assets 5,743$ 5,748$ 5,936$ Equity attributable to IEP 2,383 1,926 2,062 FYE December 31,

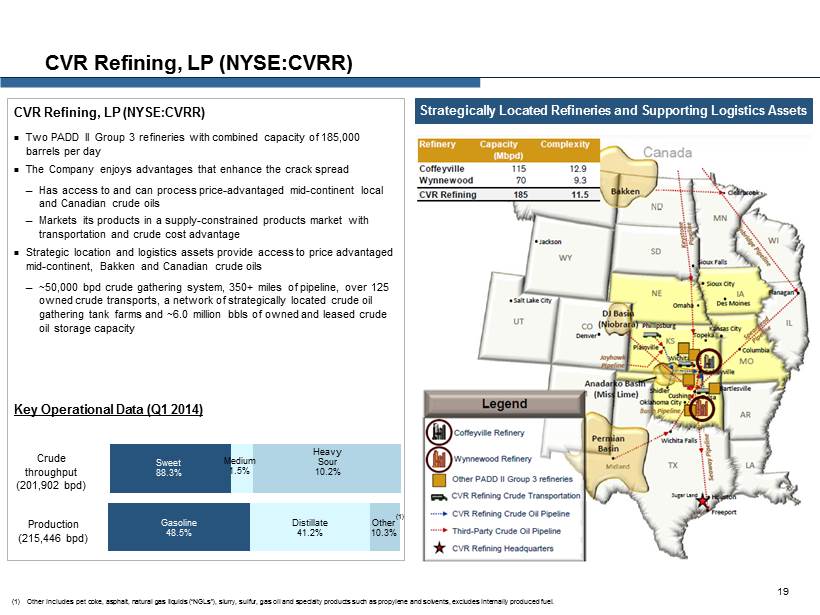

Gasoline 48.5% Distillate 41.2% Other 10.3% CVR Refining, LP (NYSE:CVRR ) Two PADD II Group 3 refineries with combined capacity of 185,000 barrels per day The Company enjoys advantages that enhance the crack spread ─ Has access to and can process price - advantaged mid - continent local and Canadian crude oils ─ Markets its products in a supply - constrained products market with transportation and crude cost advantage Strategic location and logistics assets provide access to price advantaged mid - continent , Bakken and Canadian crude oils ─ ~ 50,000 bpd crude gathering system, 350+ miles of pipeline, over 125 owned crude transports, a network of strategically located crude oil gathering tank farms and ~ 6.0 million bbls of owned and leased crude oil storage capacity Key Operational Data (Q1 2014) CVR Refining, LP (NYSE:CVRR) Crude throughput (201,902 bpd) Production (215,446 bpd ) (1) Other includes pet coke, asphalt, natural gas liquids (“NGLs”), slurry, sulfur, gas oil and specialty products such as propylene an d s olvents, excludes internally produced fuel . Strategically Located Refineries and Supporting Logistics Assets Sweet 88.3% Medium 1.5% Heavy Sour 10.2% 19 (1)

CVR Partners, LP (NYSE:UAN ) Attractive market dynamics for nitrogen fertilizer ─ Decreasing world farmland per capita ─ Increasing demand for corn (largest use of nitrogen fertilizer) and meat ─ Nitrogen represents ~62% of fertilizer consumption ─ Nitrogen fertilizers must be applied annually, creating stable demand Expansion of UAN capacity completed in Q1 2013 United States imports a significant amount of its nitrogen fertilizer needs Cost stability advantage ─ 87% fixed costs compared to competitors with 80 - 90% variable costs tied to natural gas Strategically located assets ─ 53% of corn planted in 2013 was within $45/UAN ton freight rate of plant ─ ~$15/UAN ton transportation advantage to Corn Belt vs. U.S. Gulf Coast CVR Partners, LP (NYSE:UAN ) Strategically Located Assets 20

Segment: Automotive Company Description Federal Mogul Holdings Corporation (NasdaqGS:FDML) operates in two business segments: Powertrain and Vehicle Component Systems ─ Powertrain focuses on original equipment powertrain products for automotive, heavy duty and industrial applications ─ Vehicle Component Systems sells and distributes a broad portfolio of products for the global light vehicle aftermarket, while also servicing original equipment manufacturers with certain products Historical Segment Financial Summary Powertrain Highlights Industry - leading powertrain products to improve fuel economy, reduce emission and enhance durability Over 1,700 patents for powertrain technology and market leading position in many product categories Investing in emerging markets where there are attractive opportunities for growth Introduced enhanced restructuring initiative to lower cost structure, improve manufacturing footprint and drive emerging market growth 2012 results impacted by severe drop in European light vehicle and global heavy duty production Vehicle Component Systems Highlights Aftermarket benefits from the growing number of vehicles on the road globally and the increasing average age of vehicles in Europe and North America Leader in each of its product categories with a long history of quality and strong brand names including Champion, Wagner, Ferodo, MOOG, Fel - Pro Global distribution channels evolving Restructuring business with a focus on building low cost manufacturing footprint and sourcing partnerships Continually looking to make progress strengthening its product portfolio, enhancing its service levels and improving its cost structure ▪ Completed purchase of Affinia chassis business ▪ Acquisition of Honeywell friction business is pending 21 Corporate Highlights and Recent Developments $500 million rights offering completed in July 2013 Secured $2.6 billion to refinance maturing debt in April 2014, strengthening the liquidity and financial profile of the company (1) Balance Sheet data as of the end of each respective fiscal period. Automotive Segment LTM March 31, ($ millions) 2011 2012 2013 2014 Select Income Statement Data: Total revenues 6,937$ 6,677$ 6,876$ 6,985$ Adjusted EBITDA 679 513 587 615 Net income 168 (22) 263 337 Adjusted EBITDA attrib. to IEP 512$ 390$ 459$ 487$ Net income attrib. to IEP 121 (24) 250 310 Select Balance Sheet Data (1) : Total assets 7,288 7,282 7,545 7,621$ Equity attributable to IEP 967 860 1,660 1,690 FYE December 31,

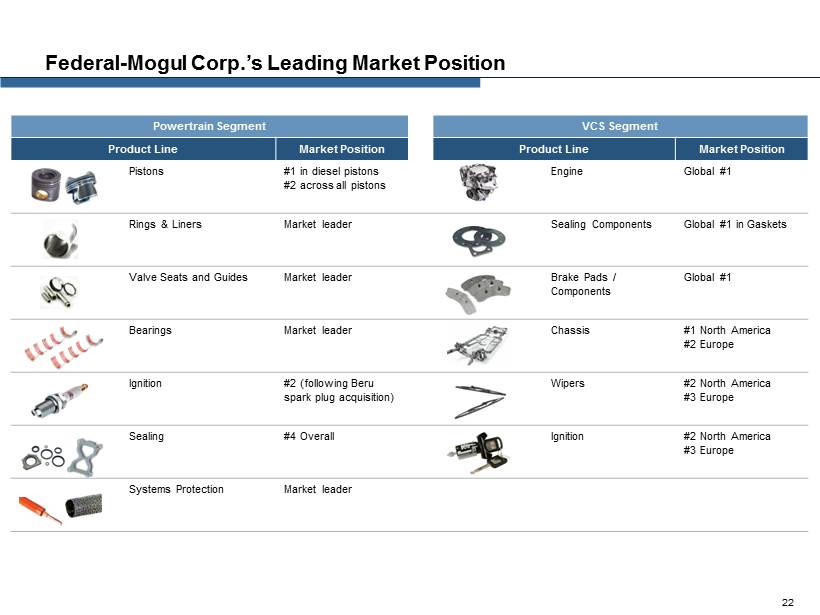

Powertrain Segment VCS Segment Product Line Market Position Product Line Market Position Pistons #1 in diesel pistons #2 a cross all pistons Engine Global #1 Rings & Liners Market leader Sealing Components Global #1 in Gaskets Valve Seats and Guides Market leader Brake Pads / Components Global #1 Bearings Market leader Chassis #1 North America #2 Europe Ignition #2 (following Beru spark plug acquisition) Wipers #2 North America #3 Europe Sealing #4 Overall Ignition #2 North America #3 Europe Systems Protection Market leader Federal - Mogul Corp.’s Leading Market Position 22

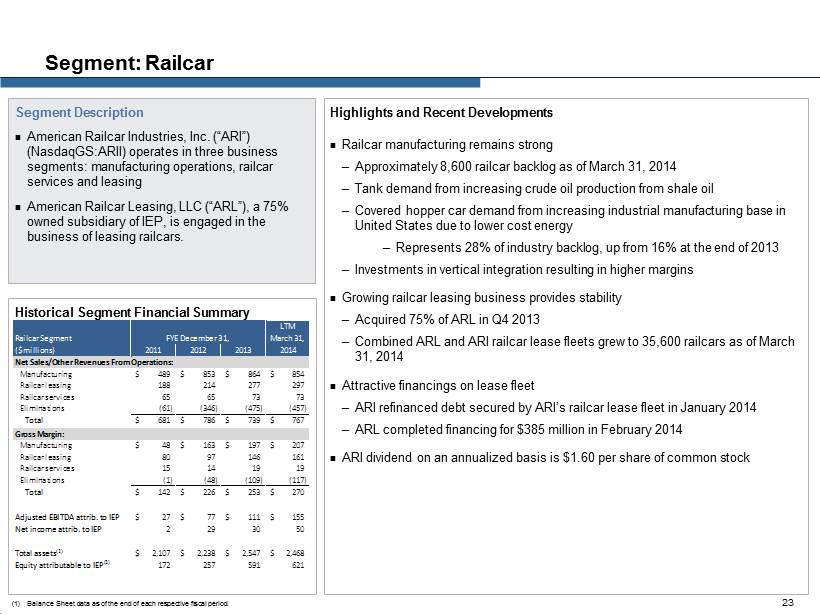

Highlights and Recent Developments Railcar manufacturing remains strong ─ Approximately 8,600 railcar backlog as of March 31, 2014 ─ Tank demand from increasing crude oil production from shale oil ─ Covered hopper car demand from increasing industrial manufacturing base in United States due to lower cost energy ─ Represents 28% of industry backlog, up from 16% at the end of 2013 ─ Investments in vertical integration resulting in higher margins Growing railcar leasing business provides stability ─ Acquired 75% of ARL in Q4 2013 ─ Combined ARL and ARI railcar lease fleets grew to 35,600 railcars as of March 31, 2014 Attractive financings on lease fleet ─ ARI refinanced debt secured by ARI’s railcar lease fleet in January 2014 ─ ARL completed financing for $385 million in February 2014 ARI dividend on an annualized basis is $1.60 per share of common stock Segment: Railcar Segment Description American Railcar Industries, Inc. (“ARI”) ( NasdaqGS:ARII ) operates in three business segments: manufacturing operations, railcar services and leasing American Railcar Leasing, LLC (“ARL”), a 75% owned subsidiary of IEP, is engaged in the business of leasing railcars. Historical Segment Financial Summary . 23 (1) Balance Sheet data as of the end of each respective fiscal period. Railcar Segment LTM March 31, ($ millions) 2011 2012 2013 2014 Net Sales/Other Revenues From Operations: Manufacturing 489$ 853$ 864$ 854$ Railcar leasing 188 214 277 297 Railcar services 65 65 73 73 Eliminations (61) (346) (475) (457) Total 681$ 786$ 739$ 767$ Gross Margin: Manufacturing 48$ 163$ 197$ 207$ Railcar leasing 80 97 146 161 Railcar services 15 14 19 19 Eliminations (1) (48) (109) (117) Total 142$ 226$ 253$ 270$ Adjusted EBITDA attrib. to IEP 27$ 77$ 111$ 155$ Net income attrib. to IEP 2 29 30 50 Total assets (1) 2,107$ 2,238$ 2,547$ 2,468$ Equity attributable to IEP (1) 172 257 591 621 FYE December 31,

Highlights and Recent Developments Management uses a highly analytical approach to enhance marketing, improve utilization, optimize product mix and reduce expenses ─ Established measurable, property specific, customer service goals and objectives to meet customer needs ─ Utilize sophisticated customer analytic techniques to improve customer experience ─ Reduced corporate overhead by approximately 50% since acquiring Tropicana Selective reinvestment in core properties including upgraded hotel rooms, refreshed casino floor products tailored for each regional market and pursuit of strong brands for restaurant and retail opportunities ─ Tropicana Atlantic City: $25 million investment plan ─ Trop Evansville: hotel room renovation in 2012 ─ Consolidated Lighthouse Point & Jubilee in Greenville, MS Capital structure with ample liquidity for synergistic acquisitions in regional gaming markets ─ Refinanced debt at attractive rates ─ Purchased Lumière Place in St. Louis from Pinnacle for $260 million Pursuing opportunities in Internet gaming as states legalize online gaming ─ Partnership announced with Gamesys Ltd in New Jersey ─ NJ Internet gaming launched November 2013 Segment: Gaming Company Description Tropicana Entertainment Inc. (OTCPK:TPCA) operates eight casino facilities featuring approximately 371,600 square feet of gaming space with approximately 6,900 slot machines, 220 table games and 6,000 hotel rooms as of March 31, 2014 ─ Eight casino facilities located in New Jersey, Indiana, Nevada, Mississippi, Louisiana and Aruba ─ Successful track record operating gaming companies, dating back to 2000 Historical Segment Financial Summary 24 (1) Balance Sheet data as of the end of each respective fiscal period. Gaming Segment LTM March 31, ($ millions) 2011 2012 2013 2014 Select Income Statement Data: Total revenues 624$ 611$ 571$ 615$ Adjusted EBITDA 72 79 66 66 Net income 24 30 19 48 Adjusted EBITDA attrib. to IEP 37$ 54$ 45$ 45$ Net income attrib. to IEP 13 21 13 33 Select Balance Sheet Data (1) : Total assets 770$ 852$ 996$ 1,039$ Equity attributable to IEP 402 379 392 416 FYE December 31,

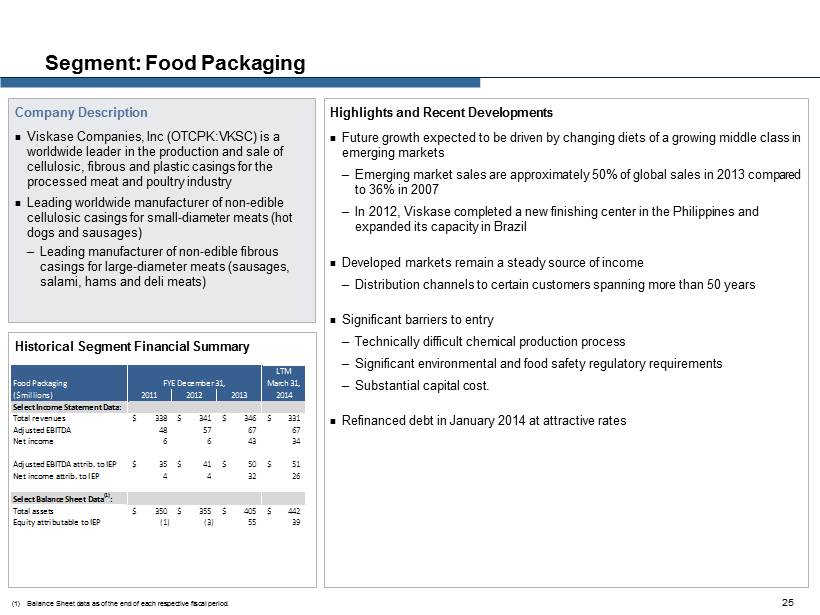

Highlights and Recent Developments Future growth expected to be driven by changing diets of a growing middle class in emerging markets ─ Emerging market sales are approximately 50% of global sales in 2013 compared to 36% in 2007 ─ In 2012, Viskase completed a new finishing center in the Philippines and expanded its capacity in Brazil Developed markets remain a steady source of income ─ Distribution channels to certain customers spanning more than 50 years Significant barriers to entry ─ Technically difficult chemical production process ─ Significant environmental and food safety regulatory requirements ─ Substantial capital cost. Refinanced debt in January 2014 at attractive rates Segment: Food Packaging Company Description Viskase Companies, Inc (OTCPK:VKSC) is a worldwide leader in the production and sale of cellulosic, fibrous and plastic casings for the processed meat and poultry industry Leading worldwide manufacturer of non - edible cellulosic casings for small - diameter meats (hot dogs and sausages) ─ Leading manufacturer of non - edible fibrous casings for large - diameter meats (sausages, salami, hams and deli meats) Historical Segment Financial Summary 25 (1) Balance Sheet data as of the end of each respective fiscal period. Food Packaging LTM March 31, ($ millions) 2011 2012 2013 2014 Select Income Statement Data: Total revenues 338$ 341$ 346$ 331$ Adjusted EBITDA 48 57 67 67 Net income 6 6 43 34 Adjusted EBITDA attrib. to IEP 35$ 41$ 50$ 51$ Net income attrib. to IEP 4 4 32 26 Select Balance Sheet Data (1) : Total assets 350$ 355$ 405$ 442$ Equity attributable to IEP (1) (3) 55 39 FYE December 31,

Highlights and Recent Developments NAFTA steel demand growth is forecasted to be 3.1% in 2014 (1) Increasing global demand for steel and other metals drives demand for U.S. scrap exports PSC is in attractive regional markets ─ $1.8 billion of steel capacity additions in PSC’s geographic area including: V&M Star ($1.0 billion), Republic ($85 million), US Steel ($500 million) and Timken ($225 million) Scrap recycling process is “greener” than virgin steel production ─ Electric arc furnace drive scrap demand and are significantly more energy efficient than blast furnaces ─ Electric arc furnace steel mills are 60% of U.S. production Highly fragmented industry with potential for further consolidation ─ Capitalizing on consolidation and vertical integration opportunities ─ PSC is building a leading position in its markets Product diversification will reduce volatility through cycles ─ Expansion of non - ferrous share of total business (30% of total revenues in 2012) ─ Opportunities for market extension: auto parts, e - recycling, wire recycling Segment: Metals Company Description PSC Metals, Inc. is one of the largest independent metal recycling companies in the U.S. Collects industrial and obsolete scrap metal, processes it into reusable forms and supplies the recycled metals to its customers Strong regional footprint (Upper Midwest, St. Louis Region and the South) ─ Poised to take advantage of Marcellus and Utica shale energy driven investment Historical Segment Financial Summary 26 (1) World Steel Association. (2) Balance Sheet data as of the end of each respective fiscal period. Metals Segment LTM March 31, ($ millions) 2011 2012 2013 2014 Select Income Statement Data: Total revenues 1,096$ 1,103$ 929$ 855$ Adjusted EBITDA 26 (16) (18) (16) Net income 6 (58) (28) (27) Adjusted EBITDA attrib. to IEP 26$ (16)$ (18)$ (16)$ Net income attrib. to IEP 6 (58) (28) (27) Select Balance Sheet Data (2) : Total assets 476$ 417$ 334$ 331$ Equity attributable to IEP 384 338 273 261 FYE December 31,

Highlights and Recent Developments Business strategy is based on long - term investment outlook and operational expertise Rental Real Estate Operations Net lease portfolio overview ─ Single tenant (over $100 billion market cap, A - credit) for two large buildings with leases through 2020 – 2021 ─ 27 additional properties with 2.8 million square feet: 14% Retail, 55% Industrial, 31% Office Maximize value of commercial lease portfolio through effective management of existing properties ─ Seek to sell assets on opportunistic basis Property Development and Resort Operations New Seabury in Cape Cod, Massachusetts and Grand Harbor and Oak Harbor in Vero Beach, Florida each include land for future residential development of approximately 271 and 1,325 units, respectively ─ Both developments operate golf and resort activities Opportunistically acquired Fontainebleau (Las Vegas casino development) in 2009 for $150 million Segment: Real Estate Company Description Consists of rental real estate, property development and associated resort activities Rental real estate consists primarily of retail, office and industrial properties leased to single corporate tenants Property development and resort operations are focused on the construction and sale of single and multi - family houses, lots in subdivisions and planned communities and raw land for residential development Historical Segment Financial Summary 27 (1) Balance Sheet data as of the end of each respective fiscal period. Real Estate Segment LTM March 31, ($ millions) 2011 2012 2013 2014 Select Income Statement Data: Total revenues 90$ 88$ 85$ 88$ Adjusted EBITDA 47 47 46 47 Net income 18 19 17 19 Adjusted EBITDA attrib. to IEP 47$ 47$ 46$ 47$ Net income attrib. to IEP 18 19 17 19 Select Balance Sheet Data (1) : Total assets 1,004$ 852$ 780$ 790$ Equity attributable to IEP 906 763 711 719 FYE December 31,

Highlights and Recent Developments One of the largest providers of home textile goods in the United States Largely completed restructuring of manufacturing footprint ─ Transitioned majority of manufacturing to low cost plants overseas Streamlined merchandising, sales and customer service divisions Focus on core profitable customers and product lines ─ WPH implemented a more customer - focused organizational structure during the first quarter of 2012 with the intent of expanding key customer relationships and rebuilding the company’s sales backlog ─ Realizing success placing new brands with top retailers ─ Continued strength with institutional customers Consolidation opportunity in fragmented industry Segment: Home Fashion Company Description WestPoint Home LLC is engaged in manufacturing, sourcing, marketing, distributing and selling home fashion consumer products WestPoint Home owns many of the most well - know brands in home textiles including Martex, Grand Patrician, Luxor and Vellux WPH also licenses brands such as IZOD, Under the Canopy, and Southern Tide Historical Segment Financial Summary 28 (1) Balance Sheet data as of the end of each respective fiscal period. Home Fashion Segment LTM March 31, ($ millions) 2011 2012 2013 2014 Select Income Statement Data: Total revenues 325$ 231$ 187$ 184$ Adjusted EBITDA (31) (3) 1 3 Net income (66) (27) (16) (14) Adjusted EBITDA attrib. to IEP (24)$ (3)$ 1$ 3$ Net income attrib. to IEP (56) (27) (16) (14) Select Balance Sheet Data (1) : Total assets 319$ 291$ 222$ 224$ Equity attributable to IEP 283 256 191 190 FYE December 31,

Financial Performance 29

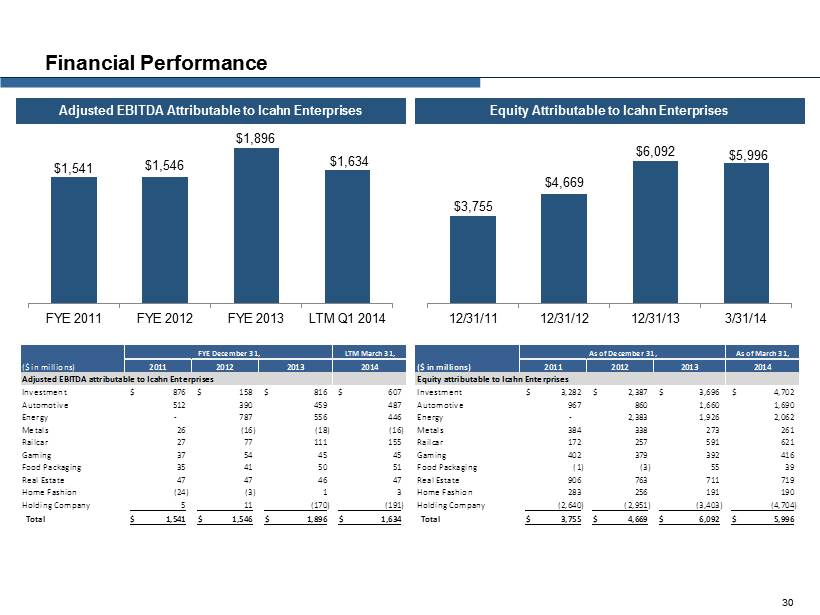

Financial Performance Adjusted EBITDA Attributable to Icahn Enterprises Equity Attributable to Icahn Enterprises 30 $1,541 $1,546 $1,896 $1,634 FYE 2011 FYE 2012 FYE 2013 LTM Q1 2014 $3,755 $4,669 $6,092 $5,996 12/31/11 12/31/12 12/31/13 3/31/14 LTM March 31, As of March 31, ($ in millions) 2011 2012 2013 2014 ($ in millions) 2011 2012 2013 2014 Adjusted EBITDA attributable to Icahn Enterprises Equity attributable to Icahn Enterprises Investment 876$ 158$ 816$ 607$ Investment 3,282$ 2,387$ 3,696$ 4,702$ Automotive 512 390 459 487 Automotive 967 860 1,660 1,690 Energy - 787 556 446 Energy - 2,383 1,926 2,062 Metals 26 (16) (18) (16) Metals 384 338 273 261 Railcar 27 77 111 155 Railcar 172 257 591 621 Gaming 37 54 45 45 Gaming 402 379 392 416 Food Packaging 35 41 50 51 Food Packaging (1) (3) 55 39 Real Estate 47 47 46 47 Real Estate 906 763 711 719 Home Fashion (24) (3) 1 3 Home Fashion 283 256 191 190 Holding Company 5 11 (170) (191) Holding Company (2,640) (2,951) (3,403) (4,704) Total 1,541$ 1,546$ 1,896$ 1,634$ Total 3,755$ 4,669$ 6,092$ 5,996$ FYE December 31, As of December 31,

Consolidated Financial Snapshot ($Millions) 31 LTM March 31, 2011 2012 2013 2014 Revenues: Investment 1,896$ 398$ 2,031$ 1,474$ Automotive 6,937 6,677 6,876 6,985 Energy - 5,519 9,063 9,281 Metals 1,096 1,103 929 855 Railcar 691 799 744 763 Gaming 624 611 571 615 Food Packaging 338 341 346 331 Real Estate 90 88 85 88 Home Fashion 325 231 187 184 Holding Company 36 29 (150) (273) Eliminations (14) - - - 12,019$ 15,796$ 20,682$ 20,303$ Adjusted EBITDA: Investment 1,845$ 374$ 1,912$ 1,361$ Automotive 679 513 587 615 Energy - 977 869 742 Metals 26 (16) (18) (16) Railcar 187 279 311 331 Gaming 72 79 66 66 Food Packaging 48 57 67 67 Real Estate 47 47 46 47 Home Fashion (31) (3) 1 3 Holding Company 5 11 (170) (191) Consolidated Adjusted EBITDA 2,878$ 2,318$ 3,671$ 3,025$ Less: Adjusted EBITDA attrib. to NCI (1,337) (772) (1,775) (1,391) Adjusted EBITDA attrib. to IEP 1,541$ 1,546$ 1,896$ 1,634$ Capital Expenditures 494$ 936$ 1,161$ 1,164$ FYE December 31,

Strong Balance Sheet ($Millions) 32 InvestmentAutomotive Energy Metals Railcar Gaming Food Packaging Real Estate Home Fashion Holding Company Consolidated Assets Cash and cash equivalents 4$ 652$ 962$ 15$ 215$ 394$ 41$ 49$ 15$ 995$ 3,342$ Cash held at consolidated affiliated partnerships and restricted cash 655 - - 4 26 31 1 3 6 3 729 Investments 14,413 265 4 - 30 31 - - - 103 14,846 Accounts receivable, net - 1,402 259 80 74 10 66 3 33 - 1,927 Inventories, net - 1,099 543 73 106 - 77 - 66 - 1,964 Property, plant and equipment, net - 2,059 2,693 128 1,955 447 156 652 77 3 8,170 Goodwill and intangible assets, net - 1,717 1,302 9 7 67 11 65 3 - 3,181 Other assets 94 427 173 22 55 59 90 18 24 65 1,027 Total Assets 15,166$ 7,621$ 5,936$ 331$ 2,468$ 1,039$ 442$ 790$ 224$ 1,169$ 35,186$ Liabilities and Equity Accounts payable, accrued expenses and other liabilities 1,076$ 1,810$ 1,550$ 66$ 224$ 142$ 76$ 21$ 34$ 388$ 5,387$ Securities sold, not yet purchased, at fair value 898 - - - - - - - - - 898 Due to brokers 3,853 - - - - - - - - - 3,853 Post-employment benefit liability - 1,053 - 1 4 - 32 - - - 1,090 Debt - 2,597 676 3 1,683 297 276 50 - 5,485 11,067 Total liabilities 5,827 5,460 2,226 70 1,911 439 384 71 34 5,873 22,295 Equity attributable to Icahn Enterprises 4,702 1,690 2,062 261 621 416 39 719 190 (4,704) 5,996 Equity attributable to non-controlling interests 4,637 471 1,648 - (64) 184 19 - - - 6,895 Total equity 9,339 2,161 3,710 261 557 600 58 719 190 (4,704) 12,891 Total liabilities and equity 15,166$ 7,621$ 5,936$ 331$ 2,468$ 1,039$ 442$ 790$ 224$ 1,169$ 35,186$ As of March 31, 2014

IEP Summary Financial Information Significant Valuation demonstrated by market value of IEP’s public subsidiaries and Holding Company interest in Funds and book value or market comparables of other assets 33 ($ Millions) Note: Indicative net asset value does not purport to reflect a valuation of IEP. The calculated Indicative net asset value d oes not include any value for our Investment Segment other than the fair market value of our investment in the Investment Funds. A valuation is a subjective exercise and Indicative net asset value does not necessarily co nsider all elements or consider in the adequate proportion the elements that could affect the valuation of IEP. Investors may reasonably differ on what such elements are and their impact on IEP. No represen tat ion or assurance, express or implied is made as to the accuracy and correctness of indicative net asset value as of these dates or with respect to any future indicative or prospective results which may vary. (1) Fair market value of Holding Company's interest in the Funds and Investment segment cash as of each respective date. (2) Based on closing share price on each date and the number of shares owned by the Holding Company as of each respective date. (3) Amounts based on market comparables due to lack of material trading volume. Tropicana valued at 9.0x Adjusted EBITDA for the tw elve months ended September 30, 2013, June 30, 2013 and March 31, 2013 and 8.0x Adjusted EBITDA for the twelve months ended March 31, 2014 and December 31, 2013. Viskase valued at 10.0x Adjusted EBIT DA for the twelve months ended September 30, 2013, 9.5x Adjusted EBITDA for the twelve months ended June 30, 2013 and December 31, 2013 ,11.0x for the twelve months ended March 31, 2013 and 9.0x for t he twelve months ended March 31, 2014. (4) Represents equity attributable to us as of each respective date. (5) From March 31, 2013 to September 30, 2013, represents book value of AEP Leasing. For December 31, 2013 and March 31, 2014, AR L v alue assumes the present value of cash flows from leased railcars plus working capital. (6) Holding Company’s balance as of each respective date. (7) Holding Company’s other net asset balance as of each respective date . March 31 June 30 Sept 30 Dec 31 March 31 2013 2013 2013 2013 2014 Market-valued Subsidiaries: Holding Company interest in Funds (1) $2,607 $2,543 $3,573 $3,696 $4,702 CVR Energy (2) 3,675 3,375 2,743 3,092 3,008 CVR Refining (2) 139 180 150 136 140 Federal-Mogul (2) 462 783 2,033 2,383 2,266 American Railcar Industries (2) 555 398 466 543 831 Total market-valued subsidiaries $7,438 $7,279 $8,965 $9,850 $10,947 Other Subsidiaries Tropicana (3) $546 $566 $528 $444 $467 Viskase (3) 283 237 278 290 252 Real Estate Holdings (4) 696 717 723 711 719 PSC Metals (4) 334 322 302 273 261 WestPoint Home (4) 207 205 205 191 190 AEP Leasing / ARL (5) 112 142 214 754 810 Total - other subsidiaries $2,178 $2,189 $2,250 $2,663 $2,699 Add: Holding Company cash and cash equivalents (6) 755 1,412 958 782 995 Less: Holding Company debt (6) (3,525) (3,525) (4,017) (4,016) (5,485) Add: Other Holding Company net assets (7) 137 (133) (72) (147) (214) Indicative Net Asset Value $6,983 $7,222 $8,084 $9,132 $8,942 As of

Appendix — Adjusted EBITDA & Adjusted Net Income Reconciliations 34

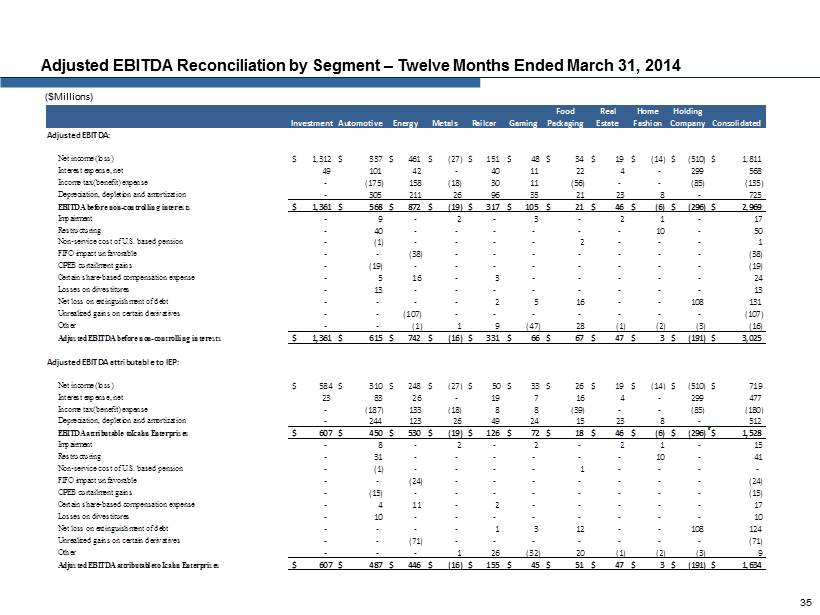

Adjusted EBITDA Reconciliation by Segment – Twelve Months Ended March 31, 2014 ($Millions) 35 Investment Automotive Energy Metals Railcar Gaming Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $ 1,312 $ 337 $ 461 $ (27) $ 151 $ 48 $ 34 $ 19 $ (14) $ (510) $ 1,811 Interest expense, net 49 101 42 - 40 11 22 4 - 299 568 Income tax (benefit) expense - (175) 158 (18) 30 11 (56) - - (85) (135) Depreciation, depletion and amortization - 305 211 26 96 35 21 23 8 - 725 EBITDA before non-controlling interests $ 1,361 $ 568 $ 872 $ (19) $ 317 $ 105 $ 21 $ 46 $ (6) $ (296) $ 2,969 Impairment - 9 - 2 - 3 - 2 1 - 17 Restructuring - 40 - - - - - - 10 - 50 Non-service cost of U.S. based pension - (1) - - - - 2 - - - 1 FIFO impact unfavorable - - (38) - - - - - - - (38) OPEB curtailment gains - (19) - - - - - - - - (19) Certain share-based compensation expense - 5 16 - 3 - - - - - 24 Losses on divestitures - 13 - - - - - - - - 13 Net loss on extinguishment of debt - - - - 2 5 16 - - 108 131 Unrealized gains on certain derivatives - - (107) - - - - - - - (107) Other - - (1) 1 9 (47) 28 (1) (2) (3) (16) Adjusted EBITDA before non-controlling interests $ 1,361 $ 615 $ 742 $ (16) $ 331 $ 66 $ 67 $ 47 $ 3 $ (191) $ 3,025 Adjusted EBITDA attributable to IEP: Net income (loss) $ 584 $ 310 $ 248 $ (27) $ 50 $ 33 $ 26 $ 19 $ (14) $ (510) $ 719 Interest expense, net 23 83 26 - 19 7 16 4 - 299 477 Income tax (benefit) expense - (187) 133 (18) 8 8 (39) - - (85) (180) Depreciation, depletion and amortization - 244 123 26 49 24 15 23 8 - 512 EBITDA attributable to Icahn Enterprises $ 607 $ 450 $ 530 $ (19) $ 126 $ 72 $ 18 $ 46 $ (6) $ (296) $ 1,528 Impairment - 8 - 2 - 2 - 2 1 - 15 Restructuring - 31 - - - - - - 10 - 41 Non-service cost of U.S. based pension - (1) - - - - 1 - - - - FIFO impact unfavorable - - (24) - - - - - - - (24) OPEB curtailment gains - (15) - - - - - - - - (15) Certain share-based compensation expense - 4 11 - 2 - - - - - 17 Losses on divestitures - 10 - - - - - - - - 10 Net loss on extinguishment of debt - - - - 1 3 12 - - 108 124 Unrealized gains on certain derivatives - - (71) - - - - - - - (71) Other - - - 1 26 (32) 20 (1) (2) (3) 9 Adjusted EBITDA attributable to Icahn Enterprises $ 607 $ 487 $ 446 $ (16) $ 155 $ 45 $ 51 $ 47 $ 3 $ (191) $ 1,634

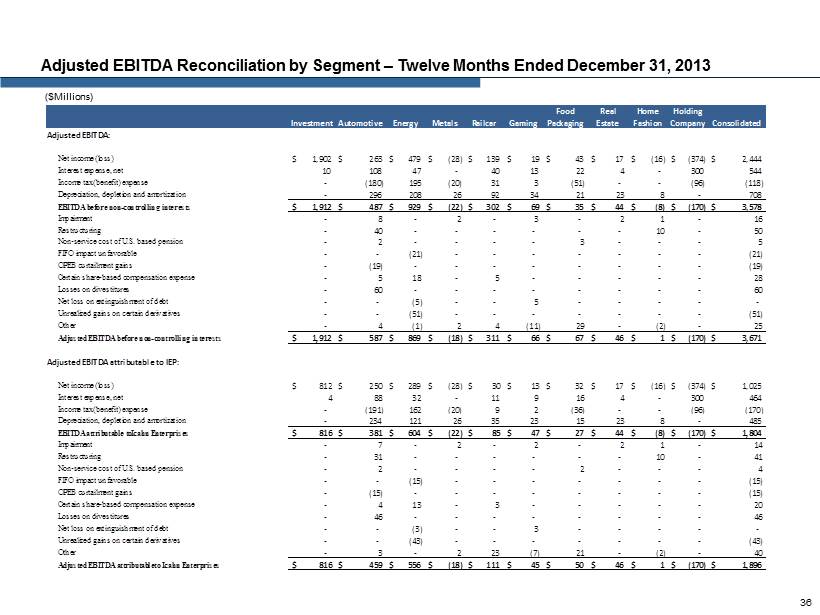

Adjusted EBITDA Reconciliation by Segment – Twelve Months Ended December 31, 2013 ($Millions) 36 Investment Automotive Energy Metals Railcar Gaming Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $ 1,902 $ 263 $ 479 $ (28) $ 139 $ 19 $ 43 $ 17 $ (16) $ (374) $ 2,444 Interest expense, net 10 108 47 - 40 13 22 4 - 300 544 Income tax (benefit) expense - (180) 195 (20) 31 3 (51) - - (96) (118) Depreciation, depletion and amortization - 296 208 26 92 34 21 23 8 - 708 EBITDA before non-controlling interests $ 1,912 $ 487 $ 929 $ (22) $ 302 $ 69 $ 35 $ 44 $ (8) $ (170) $ 3,578 Impairment - 8 - 2 - 3 - 2 1 - 16 Restructuring - 40 - - - - - - 10 - 50 Non-service cost of U.S. based pension - 2 - - - - 3 - - - 5 FIFO impact unfavorable - - (21) - - - - - - - (21) OPEB curtailment gains - (19) - - - - - - - - (19) Certain share-based compensation expense - 5 18 - 5 - - - - - 28 Losses on divestitures - 60 - - - - - - - - 60 Net loss on extinguishment of debt - - (5) - - 5 - - - - - Unrealized gains on certain derivatives - - (51) - - - - - - - (51) Other - 4 (1) 2 4 (11) 29 - (2) - 25 Adjusted EBITDA before non-controlling interests $ 1,912 $ 587 $ 869 $ (18) $ 311 $ 66 $ 67 $ 46 $ 1 $ (170) $ 3,671 Adjusted EBITDA attributable to IEP: Net income (loss) $ 812 $ 250 $ 289 $ (28) $ 30 $ 13 $ 32 $ 17 $ (16) $ (374) $ 1,025 Interest expense, net 4 88 32 - 11 9 16 4 - 300 464 Income tax (benefit) expense - (191) 162 (20) 9 2 (36) - - (96) (170) Depreciation, depletion and amortization - 234 121 26 35 23 15 23 8 - 485 EBITDA attributable to Icahn Enterprises $ 816 $ 381 $ 604 $ (22) $ 85 $ 47 $ 27 $ 44 $ (8) $ (170) $ 1,804 Impairment - 7 - 2 - 2 - 2 1 - 14 Restructuring - 31 - - - - - - 10 - 41 Non-service cost of U.S. based pension - 2 - - - - 2 - - - 4 FIFO impact unfavorable - - (15) - - - - - - - (15) OPEB curtailment gains - (15) - - - - - - - - (15) Certain share-based compensation expense - 4 13 - 3 - - - - - 20 Losses on divestitures - 46 - - - - - - - - 46 Net loss on extinguishment of debt - - (3) - - 3 - - - - - Unrealized gains on certain derivatives - - (43) - - - - - - - (43) Other - 3 - 2 23 (7) 21 - (2) - 40 Adjusted EBITDA attributable to Icahn Enterprises $ 816 $ 459 $ 556 $ (18) $ 111 $ 45 $ 50 $ 46 $ 1 $ (170) $ 1,896

Adjusted EBITDA Reconciliation by Segment – Twelve Months Ended December 31, 2012 ($Millions) 37 Investment Automotive Energy Metals Railcar Gaming Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $ 372 $ (22) $ 338 $ (58) $ 92 $ 30 $ 6 $ 19 $ (27) $ 12 $ 762 Interest expense, net 2 136 38 - 57 12 21 5 - 283 554 Income tax (benefit) expense - (29) 182 (1) 42 4 5 - - (284) (81) Depreciation, depletion and amortization - 289 128 26 83 32 18 23 8 - 607 EBITDA before non-controlling interests $ 374 $ 374 $ 686 $ (33) $ 274 $ 78 $ 50 $ 47 $ (19) $ 11 $ 1,842 Impairment - 98 - 18 - 2 - - 11 - 129 Restructuring - 26 - - - - 1 - 4 - 31 Non-service cost of U.S. based pension - 35 - - - - 3 - - - 38 FIFO impact unfavorable - - 71 - - - - - - - 71 OPEB curtailment gains - (51) - - - - - - - - (51) Certain share-based compensation expense - (4) 33 - 5 - - - - - 34 Major scheduled turnaround expense - - 107 - - - - - - - 107 Expenses related to certain acquisitions - - 6 - - - - - - - 6 Net loss on extinguishment of debt - - 6 - 2 2 - - - - 10 Unrealized loss on certain derivatives - - 68 - - - - - - - 68 Other - 35 - (1) (2) (3) 3 - 1 - 33 Adjusted EBITDA before non-controlling interests $ 374 $ 513 $ 977 $ (16) $ 279 $ 79 $ 57 $ 47 $ (3) $ 11 $ 2,318 Adjusted EBITDA attributable to IEP: Net income (loss) $ 157 $ (24) $ 263 $ (58) $ 29 $ 21 $ 4 $ 19 $ (27) $ 12 $ 396 Interest expense, net 1 105 31 - 8 8 15 5 - 283 456 Income tax (benefit) expense - (22) 149 (1) 23 3 4 - - (284) (128) Depreciation, depletion and amortization - 224 105 26 13 22 13 23 8 - 434 EBITDA attributable to Icahn Enterprises $ 158 $ 283 $ 548 $ (33) $ 73 $ 54 $ 36 $ 47 $ (19) $ 11 $ 1,158 Impairment - 76 - 18 - 1 - - 11 - 106 Restructuring - 20 - - - - 1 - 4 - 25 Non-service cost of U.S. based pension - 27 - - - - 2 - - - 29 FIFO impact unfavorable - - 58 - - - - - - - 58 OPEB curtailment gains - (40) - - - - - - - - (40) Certain share-based compensation expense - (3) 27 - 3 - - - - - 27 Major scheduled turnaround expense - - 88 - - - - - - - 88 Expenses related to certain acquisitions - - 4 - - - - - - - 4 Net loss on extinguishment of debt - - 5 - 1 1 - - - - 7 Unrealized loss on certain derivatives - - 57 - - - - - - - 57 Other - 27 - (1) - (2) 2 - 1 - 27 Adjusted EBITDA attributable to Icahn Enterprises $ 158 $ 390 $ 787 $ (16) $ 77 $ 54 $ 41 $ 47 $ (3) $ 11 $ 1,546

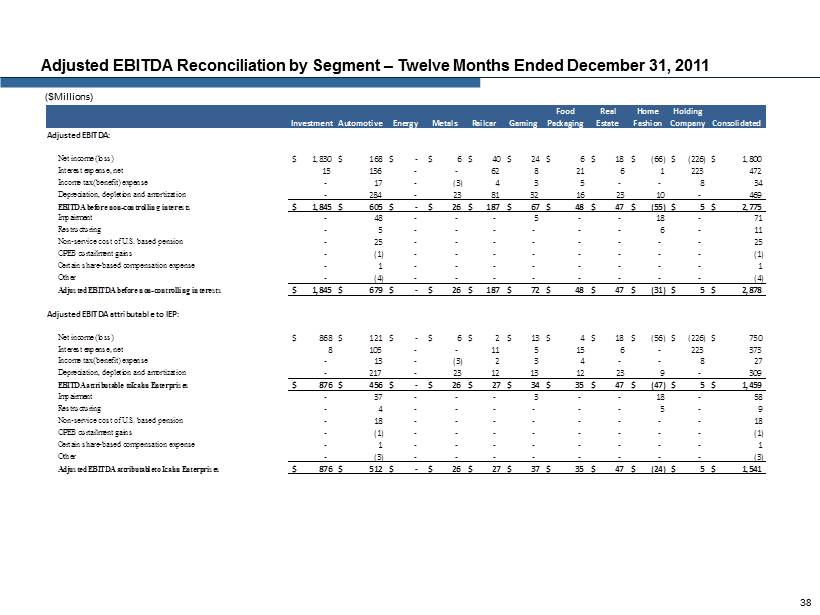

Adjusted EBITDA Reconciliation by Segment – Twelve Months Ended December 31, 2011 ($Millions) 38 Investment Automotive Energy Metals Railcar Gaming Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $ 1,830 $ 168 $ - $ 6 $ 40 $ 24 $ 6 $ 18 $ (66) $ (226) $ 1,800 Interest expense, net 15 136 - - 62 8 21 6 1 223 472 Income tax (benefit) expense - 17 - (3) 4 3 5 - - 8 34 Depreciation, depletion and amortization - 284 - 23 81 32 16 23 10 - 469 EBITDA before non-controlling interests $ 1,845 $ 605 $ - $ 26 $ 187 $ 67 $ 48 $ 47 $ (55) $ 5 $ 2,775 Impairment - 48 - - - 5 - - 18 - 71 Restructuring - 5 - - - - - - 6 - 11 Non-service cost of U.S. based pension - 25 - - - - - - - - 25 OPEB curtailment gains - (1) - - - - - - - - (1) Certain share-based compensation expense - 1 - - - - - - - - 1 Other - (4) - - - - - - - - (4) Adjusted EBITDA before non-controlling interests $ 1,845 $ 679 $ - $ 26 $ 187 $ 72 $ 48 $ 47 $ (31) $ 5 $ 2,878 Adjusted EBITDA attributable to IEP: Net income (loss) $ 868 $ 121 $ - $ 6 $ 2 $ 13 $ 4 $ 18 $ (56) $ (226) $ 750 Interest expense, net 8 105 - - 11 5 15 6 - 223 373 Income tax (benefit) expense - 13 - (3) 2 3 4 - - 8 27 Depreciation, depletion and amortization - 217 - 23 12 13 12 23 9 - 309 EBITDA attributable to Icahn Enterprises $ 876 $ 456 $ - $ 26 $ 27 $ 34 $ 35 $ 47 $ (47) $ 5 $ 1,459 Impairment - 37 - - - 3 - - 18 - 58 Restructuring - 4 - - - - - - 5 - 9 Non-service cost of U.S. based pension - 18 - - - - - - - - 18 OPEB curtailment gains - (1) - - - - - - - - (1) Certain share-based compensation expense - 1 - - - - - - - - 1 Other - (3) - - - - - - - - (3) Adjusted EBITDA attributable to Icahn Enterprises $ 876 $ 512 $ - $ 26 $ 27 $ 37 $ 35 $ 47 $ (24) $ 5 $ 1,541

Adjusted EBITDA Reconciliation by Segment – Three Months Ended March 31, 2014 ($Millions) 39 Investment Automotive Energy Metals Railcar Gaming Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net (loss) income $ (15) $ 40 $ 204 $ (5) $ 36 $ 33 $ (6) $ 7 $ (1) $ (216) $ 77 Interest expense, net 39 24 10 - 11 2 5 1 - 74 166 Income tax expense (benefit) - 16 63 (3) 11 10 (3) - - 9 103 Depreciation, depletion and amortization - 80 53 6 26 9 5 6 2 - 187 EBITDA before non-controlling interests $ 24 $ 160 $ 330 $ (2) $ 84 $ 54 $ 1 $ 14 $ 1 $ (133) $ 533 Impairment - 1 - - - - - - - - 1 Restructuring - 8 - - - - - - - - 8 Non-service cost of U.S. based pension - (2) - - - - - - - - (2) FIFO impact unfavorable - - (22) - - - - - - - (22) Certain share-based compensation expense - (1) 4 - 4 - - - - - 7 Net loss on extinguishment of debt - - - - 2 - 16 - - 108 126 Unrealized gains on certain derivatives - - (88) - - - - - - - (88) Other - - - (1) 3 (36) (1) (2) - (3) (40) Adjusted EBITDA before non-controlling interests $ 24 $ 166 $ 224 $ (3) $ 93 $ 18 $ 16 $ 12 $ 1 $ (28) $ 523 Adjusted EBITDA attributable to IEP: Net (loss) income $ 5 $ 31 $ 110 $ (5) $ 21 $ 23 $ (4) $ 7 $ (1) $ (216) $ (29) Interest expense, net 19 19 6 - 9 1 4 1 - 74 133 Income tax expense (benefit) - 13 53 (3) 6 7 (2) - - 9 83 Depreciation, depletion and amortization - 65 31 6 18 6 4 6 2 - 138 EBITDA attributable to Icahn Enterprises $ 24 $ 128 $ 200 $ (2) $ 54 $ 37 $ 2 $ 14 $ 1 $ (133) $ 325 Impairment - 1 - - - - - - - - 1 Restructuring - 6 - - - - - - - - 6 Non-service cost of U.S. based pension - (2) - - - - - - - - (2) FIFO impact unfavorable - - (14) - - - - - - - (14) Certain share-based compensation expense - (1) 3 - 2 - - - - - 4 Net loss on extinguishment of debt - - - - 1 - 12 - - 108 121 Unrealized gains on certain derivatives - - (55) - - - - - - - (55) Other - - - (1) 2 (25) (1) (2) - (3) (30) Adjusted EBITDA attributable to Icahn Enterprises $ 24 $ 132 $ 134 $ (3) $ 59 $ 12 $ 13 $ 12 $ 1 $ (28) $ 356

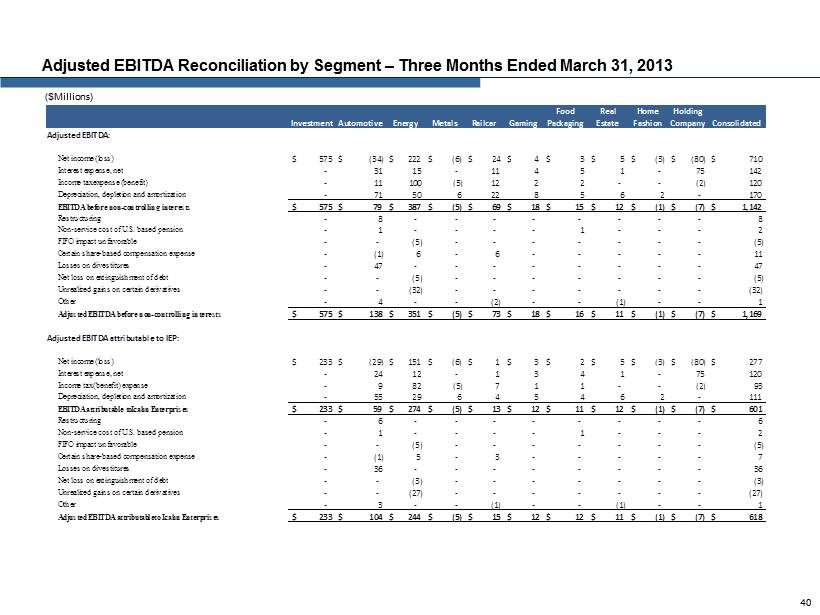

Adjusted EBITDA Reconciliation by Segment – Three Months Ended March 31, 2013 ($Millions) 40 Investment Automotive Energy Metals Railcar Gaming Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $ 575 $ (34) $ 222 $ (6) $ 24 $ 4 $ 3 $ 5 $ (3) $ (80) $ 710 Interest expense, net - 31 15 - 11 4 5 1 - 75 142 Income tax expense (benefit) - 11 100 (5) 12 2 2 - - (2) 120 Depreciation, depletion and amortization - 71 50 6 22 8 5 6 2 - 170 EBITDA before non-controlling interests $ 575 $ 79 $ 387 $ (5) $ 69 $ 18 $ 15 $ 12 $ (1) $ (7) $ 1,142 Restructuring - 8 - - - - - - - - 8 Non-service cost of U.S. based pension - 1 - - - - 1 - - - 2 FIFO impact unfavorable - - (5) - - - - - - - (5) Certain share-based compensation expense - (1) 6 - 6 - - - - - 11 Losses on divestitures - 47 - - - - - - - - 47 Net loss on extinguishment of debt - - (5) - - - - - - - (5) Unrealized gains on certain derivatives - - (32) - - - - - - - (32) Other - 4 - - (2) - - (1) - - 1 Adjusted EBITDA before non-controlling interests $ 575 $ 138 $ 351 $ (5) $ 73 $ 18 $ 16 $ 11 $ (1) $ (7) $ 1,169 Adjusted EBITDA attributable to IEP: Net income (loss) $ 233 $ (29) $ 151 $ (6) $ 1 $ 3 $ 2 $ 5 $ (3) $ (80) $ 277 Interest expense, net - 24 12 - 1 3 4 1 - 75 120 Income tax (benefit) expense - 9 82 (5) 7 1 1 - - (2) 93 Depreciation, depletion and amortization - 55 29 6 4 5 4 6 2 - 111 EBITDA attributable to Icahn Enterprises $ 233 $ 59 $ 274 $ (5) $ 13 $ 12 $ 11 $ 12 $ (1) $ (7) $ 601 Restructuring - 6 - - - - - - - - 6 Non-service cost of U.S. based pension - 1 - - - - 1 - - - 2 FIFO impact unfavorable - - (5) - - - - - - - (5) Certain share-based compensation expense - (1) 5 - 3 - - - - - 7 Losses on divestitures - 36 - - - - - - - - 36 Net loss on extinguishment of debt - - (3) - - - - - - - (3) Unrealized gains on certain derivatives - - (27) - - - - - - - (27) Other - 3 - - (1) - - (1) - - 1 Adjusted EBITDA attributable to Icahn Enterprises $ 233 $ 104 $ 244 $ (5) $ 15 $ 12 $ 12 $ 11 $ (1) $ (7) $ 618

Adjusted Net Income attributable to Icahn Enterprises reconciliation 41