Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VIRCO MFG CORPORATION | d727861d8k.htm |

| EX-99.06 - EX-99.06 - VIRCO MFG CORPORATION | d727861dex9906.htm |

| EX-10.01 - EX-10.01 - VIRCO MFG CORPORATION | d727861dex1001.htm |

| EX-99.04 - EX-99.04 - VIRCO MFG CORPORATION | d727861dex9904.htm |

| EX-99.03 - EX-99.03 - VIRCO MFG CORPORATION | d727861dex9903.htm |

| EX-99.02 - EX-99.02 - VIRCO MFG CORPORATION | d727861dex9902.htm |

| EX-99.01 - EX-99.01 - VIRCO MFG CORPORATION | d727861dex9901.htm |

| EX-3.01 - EX-3.01 - VIRCO MFG CORPORATION | d727861dex301.htm |

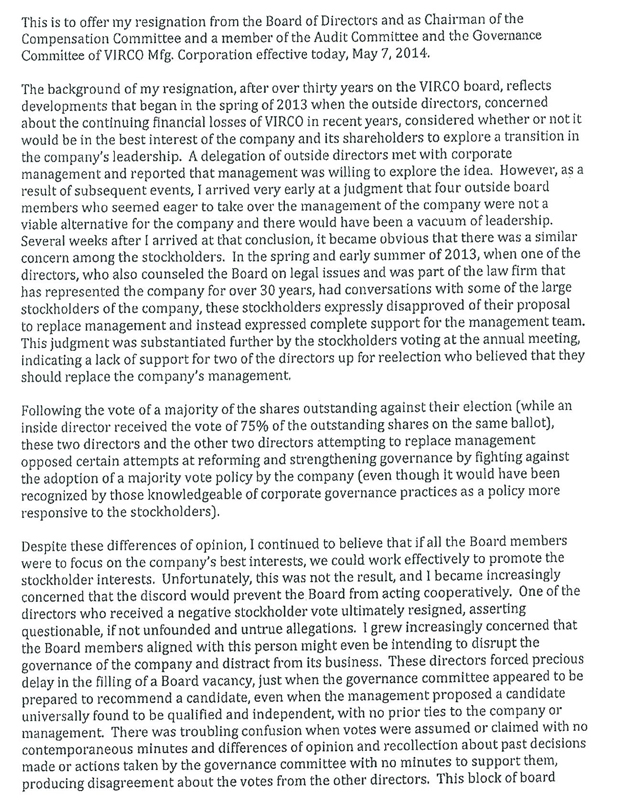

Exhibit 99.05

Resignation letter of James Wilburn

This is to offer my resignation from the Board of Directors and as Chairman of the Compensation Committee and a member of the Audit

Committee and the Governance Committee of VIRCO Mfg. Corporation effective today, May 7, 2014.

The background of my resignation, after over thirty years on the

VIRCO board, reflects developments that began in the spring of 2013 when the outside directors, concerned about the continuing financial losses of VIRCO in recent years, considered whether or not it would be in the best interest of the company and

its shareholders to explore a transition in the company’s leadership. A delegation of outside directors met with corporate management and reported that management was willing to explore the idea. However, as a result of subsequent events, I

arrived very early at a judgment that four outside board members who seemed eager to take over the management of the company were not a viable alternative for the company and there would have been a vacuum of leadership. Several weeks after I

arrived at that conclusion, it became obvious that there was a similar concern among the stockholders. In the spring and early summer of 2013, when one of the directors, who also counseled the Board on legal issues and was part of the law firm that

has represented the company for over 30 years, had conversations with some of the large stockholders of the company, these stockholders expressly disapproved of their proposal to replace management and instead expressed complete support for the

management team. This judgment was substantiated further by the stockholders voting at the annual meeting, indicating a lack of support for two of the directors up for reelection who believed that they should replace the company’s management.

Following the vote of a majority of the shares outstanding against their election (while an inside director received the vote of 75% of the outstanding shares on

the same ballot), these two directors and the other two directors attempting to replace management opposed certain attempts at reforming and strengthening governance by fighting against the adoption of a majority vote policy by the company (even

though it would have been recognized by those knowledgeable of corporate governance practices as a policy more responsive to the stockholders). Despite these differences of opinion, I continued to believe that if all the Board members were to focus

on the company’s best interests, we could work effectively to promote the stockholder interests. Unfortunately, this was not the result, and I became increasingly concerned that the discord would prevent the Board from acting cooperatively. One

of the directors who received a negative stockholder vote ultimately resigned, asserting questionable, if not unfounded and untrue allegations. I grew increasingly concerned that the Board members aligned with this person might even be intending to

disrupt the governance of the company and distract from its business. These directors forced precious delay in the filling of a Board vacancy, just when the governance committee appeared to be prepared to recommend a candidate, even when the

management proposed a candidate universally found to be qualified and independent, with no prior ties to the company or management. There was troubling confusion when votes were assumed or claimed with no contemporaneous minutes and differences of

opinion and recollection about past decisions made or actions taken by the governance committee with no minutes to support them, producing disagreement about the votes from the other directors. This block of board

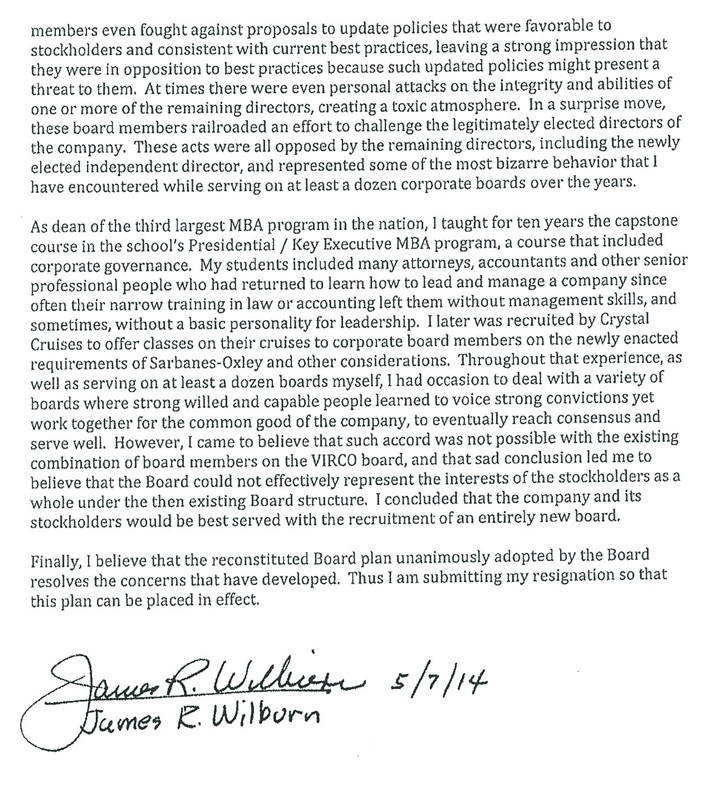

members even fought against proposals to update policies that were favorable to stockholders and consistent with current best practices, leaving a strong impression that they were in opposition to best practices because such updated policies might present a threat to them. At times there were even personal attacks on the integrity and abilities of one or more of the remaining directors, creating a toxic atmosphere. In a surprise move, these board members railroaded an effort to challenge the legitimately elected directors of the company. These acts were all opposed by the remaining directors, including the newly elected independent director, and represented some of the most bizarre behavior that 1 have encountered while serving on at least a dozen corporate boards over the years. As dean of the third largest MBA program in the nation, 1 taught for ten years the capstone course in the school’s Presidential / Key Executive MBA program, a course that included corporate governance. My students included many attorneys, accountants and other senior professional people who had returned to learn how to lead and manage a company since often their narrow training in law or accounting left them without management skills, and sometimes, without a basic personality for leadership. 1 later was recruited by Crystal Cruises to offer classes on their cruises to corporate board members on the newly enacted requirements of Sarbanes-Oxley and other considerations. Throughout that experience, as well as serving on at least a dozen boards myself, I had occasion to deal with a variety of boards where strong willed and capable people learned to voice strong convictions yet work together for the common good of the company, to eventually reach consensus and serve well. However, 1 came to believe that such accord was not possible with the existing combination of board members on the VIRCO board, and that sad conclusion led me to believe that the Board could not effectively represent the interests of the stockholders as a whole under the then existing Board structure. I concluded that the company and its stockholders would be best served with the recruitment of an entirely new board. Finally, I believe that the reconstituted Board plan unanimously adopted by the Board resolves the concerns that have developed. Thus I am submitting my resignation so that this plan can be placed in effect.

2