Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Worldpay, Inc. | form8k.htm |

| EX-99.1 - PRESS RELEASE - Worldpay, Inc. | exhibit991.htm |

Vantiv to Acquire Mercury Payments May 12, 2014 © Copyright 2014 Vantiv, LLC. All rights reserved. Vantiv, and the Vantiv logo, and all other product or service names and logos are registered trademarks or trademarks of Vantiv, LLC in the USA and other countries. ®indicates USA registration. Exhibit 99.2

Notice to Investors This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 related to Vantiv, Mercury and the acquisition of Mercury, including the potential benefits of the acquisition. Forward-looking statements involve risks and uncertainties, and actual events or results could differ materially from those discussed. Statements that are not historical facts, including management's expectations regarding future events and developments, are forward-looking statements and are subject to significant risks and uncertainties. Factors that could cause actual events or results to differ materially from those expressed in or implied by these forward-looking statements include general economic conditions, future performance and integration of acquisitions including Mercury, the ability to keep pace with rapid developments and change in our industry and provide new services to our clients, competition within our industry, reductions in overall consumer, business and government spending, a decline in the use of credit, debit or prepaid cards, failures of our systems or the systems of our third party providers, unauthorized data or security breaches, inability to expand our market share in existing markets or expand into new markets, increased attrition of merchants, independent sales organizations, dealers, developers or referral partners, and the factors discussed under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Vantiv's Annual Report for the year ended December 31, 2013 and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 and in Vantiv's other filings made from time to time with the SEC, copies of which may be obtained by visiting the company's Investor Relations web site at http://investors.vantiv.com/ or the SEC's web site at (http://www.sec.gov/). The forward-looking statements included in this press release represent Vantiv's and Mercury’s views as of the date of this press release. These forward-looking statements should not be relied upon as representing Vantiv's or Mercury’s views as of any date subsequent to the date of this press release. Neither Vantiv or Mercury undertakes any intention or obligation to publicly update or revise any forward-looking statement to conform the statement to actual results or to changes in expectations, whether as a result of new information, future events or otherwise. While Vantiv reports its results in accordance with generally accepted accounting principles in the United States, or GAAP, in an effort to provide additional useful information regarding Vantiv’s financial results, certain materials presented during this event will include non-GAAP measures. Vantiv’s management evaluates Vantiv’s results excluding certain items, such as share-based compensation expense, to assess the company’s financial performance, and believes this information is useful for investors because it provides a more complete understanding of Vantiv’s underlying operational performance, as well as consistency and comparability with past reports of financial results. In addition, Vantiv management uses earnings per share excluding these items to manage and determine effectiveness of its business managers and as a basis for incentive compensation. The non-GAAP measures presented during this event should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. A reconciliation of these non-GAAP measures to comparable GAAP measures and other related information is included in the portion of these presentation materials entitled “Non-GAAP Reconciliation” and is available on the Investor Relations page of Vantiv’s website at www.vantiv.com. Descriptions of many of these non-GAAP measures, including free cash flow, also are included in Vantiv’s SEC reports. These charts and the associated remarks are integrally related and are intended to be presented and understood together. 2

3 + A Winning Combination of Technology, Distribution and Scale

Mark Heimbouch Chief Financial Officer, Vantiv Presenters Charles Drucker President and Chief Executive Officer, Vantiv 4 + Matt Taylor Chief Executive Officer, Mercury Payments

Transaction Overview 5 Attractive Financial Profile Key Metrics and Timeline A Winning Combination Vantiv and Mercury create a winning combination of technology, distribution and scale Mercury is a pioneer in integrated payments and has one of the largest networks of developers and dealers that provides the reach of a large direct sales force The acquisition of Mercury continues Vantiv’s expansion in high-growth channels and deepens our penetration into the integrated payments channel Given Mercury’s strong double-digit growth, we expect that this transaction will be accretive to Vantiv’s net revenue growth by 1-2% annually The transaction is accretive to adjusted earnings per share in 2014, accelerating in 2015 In 2013, Mercury generated net revenue of $237 million, growing by 17% year-over- year, and Adjusted EBITDA of $93 million, growing by 23% year-over-year Purchase price of $1.65 billion; implied purchase multiple (net of tax benefits and synergies) of low-to-mid teens Adjusted EBITDA $1.65 billion of committed financing resulting in pro forma leverage of 4.6x net debt / Adjusted EBITDA at closing The transaction is expected to close in the second quarter of 2014, subject to U.S. antitrust clearance and other customary closing conditions

3% 65% 32% 15% 56% 29% Mercury Accelerates Our Growth Strategy 6 30% 47% 23% Strategic Channels(1) Traditional Merchant Financial Institutions Prior to Litle Prior to Mercury Vantiv and Mercury (1) Strategic Channels consists of E-commerce, Merchant Bank relationships and Integrated Payments channels. The acquisition of Mercury transforms Vantiv’s channel mix by dramatically expanding our distribution in high-growth Strategic Channels We continue to deliver on our stated strategic objectives We continue to build on our core advantages to grow our traditional Merchant and Financial Institutions businesses while executing on our strategy to expand into high-growth strategic channels We continue to develop referral relationships with strategic partners We continue to invest in our technology capabilities to drive growth in online and omni-channel, including the acquisitions of Litle and Element Combined, our strategic channels are growing 20% annually and will represent 30% or more of our net revenue

Vantiv and Mercury is a Winning Combination 7 We continue to execute on our strategy of being a leading payments company and expanding into high-growth channels Integrated payments is a high-growth and strategically important channel that is expected to represent over 30% of payments volume by 2017(1) Mercury is a leader in the integrated payments channel with distribution and technology that are complimentary to Vantiv’s and Element’s capabilities Opportunity to expand Mercury’s network of software developers and dealers as well as to further penetrate its existing network, where we estimate that current penetration rate is near 10% SaaS model will allow for rapid delivery of new features and payments functionality to merchants Technology innovation and expertise creates high client retention and revenue visibility Combined management team has a track record of successful execution and integration Accelerates Vantiv’s long-term net revenue and earnings growth profile (1) Management estimates and McKinsey. Combined Company has Leading Technology, Distribution and Scale

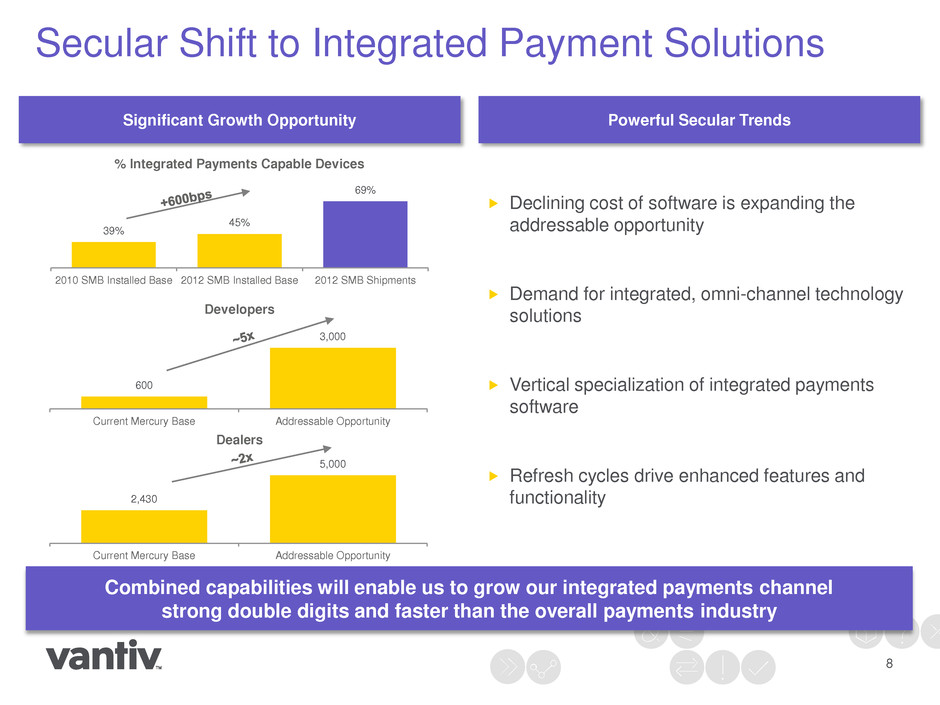

Secular Shift to Integrated Payment Solutions 8 Declining cost of software is expanding the addressable opportunity Demand for integrated, omni-channel technology solutions Vertical specialization of integrated payments software Refresh cycles drive enhanced features and functionality Significant Growth Opportunity Powerful Secular Trends Combined capabilities will enable us to grow our integrated payments channel strong double digits and faster than the overall payments industry 600 3,000 Current Mercury Base Addressable Opportunity 39% 45% 69% 2010 SMB Installed Base 2012 SMB Installed Base 2012 SMB Shipments 2,430 5,000 Current Mercury Base Addressable Opportunity Developers Dealers % Integrated Payments Capable Devices

Third largest merchant acquirer differentiated by a single, integrated technology platform Leading portfolio of technology with diversified distribution capabilities Integrated security and fraud technology with EMV solutions Significant scale and superior cost structure Pioneer in integrated payments Leading distribution capabilities with largest network of dealers and developers Complementary technologies and verticals Unique approach to capture significant SMB opportunity Winning Combination Leading Technology, Distribution and Scale Our comprehensive technology platform provides software developers and dealers the ability to seamlessly integrate our payment solutions across all verticals 9

$14 $28 $46 $66 $87 $116 $155 $203 $237 2005 2006 2007 2008 2009 2010 2011 2012 2013 63 134 223 329 477 647 828 1,025 1,189 2005 2006 2007 2008 2009 2010 2011 2012 2013 Mercury Payments Overview 10 11th Largest Merchant Acquirer 45th Largest Merchant Acquirer Track Record of Growth Industry leading growth with net revenue and Adj. EBITDA growing 17% and 23%, respectively, in 2013 Pioneered integrated payments by developing an innovative distribution model SMB-specific, with feature-rich functionality and best-in-class customer service Specialized solutions and services built for integrated payments integration delivery Mercury has realized significant growth, transitioning the business to become the 11th largest Merchant Acquirer Transactions (millions) Net Revenue ($ in millions)(1) (1) Net revenue prior to 2010 unaudited.

Largest Base of Integrated Payments Developers and Dealers Creates Powerful Distribution Network 11 Superior Integrated Solutions Differentiated Merchant Experience Mercury’s payment services are integrated into Developers’ software [ Powerful Distribution Network Mercury’s payment services are sold via Developer & Dealer channel Mercury’s merchants benefit from specialized solutions and leading customer support 110 600 2005 2013 1,110 2,430 2005 2013 7,800 88,700 2005 2013 Developers Dealers Merchants

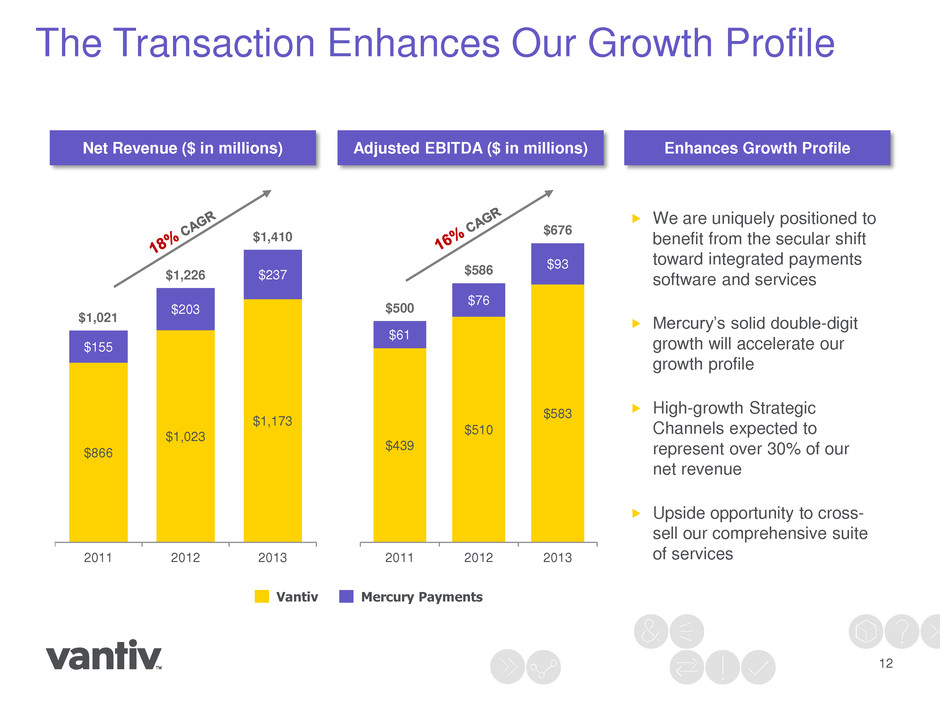

Net Revenue ($ in millions) Adjusted EBITDA ($ in millions) $866 $1,023 $1,173 $155 $203 $237 $1,021 $1,226 $1,410 2011 2012 2013 $439 $510 $583 $61 $76 $93 $500 $586 $676 2011 2012 2013 Vantiv Mercury Payments Enhances Growth Profile We are uniquely positioned to benefit from the secular shift toward integrated payments software and services Mercury’s solid double-digit growth will accelerate our growth profile High-growth Strategic Channels expected to represent over 30% of our net revenue Upside opportunity to cross- sell our comprehensive suite of services 12 The Transaction Enhances Our Growth Profile

Financial Considerations 13 Vantiv has received committed financing from JP Morgan, BofA Merrill Lynch and Credit Suisse to fund the transaction Vantiv to maintain a strong capital structure post-transaction • Pro forma leverage of 4.6x Net Debt / LTM 3/31/2014 Adjusted EBITDA, delevering up to 1.0x annually • Strong free cash flow generation supports delevering Financing Structure Financial Impact Vantiv will benefit from 1-2% of incremental net revenue growth as well as cost synergies and annual tax benefits Accretive to adjusted earnings per share in 2014, accelerating in 2015 Ample liquidity available through cash on hand, revolver and cash from operations

Conclusion 14 Compelling strategic acquisition that positions Vantiv to capture the secular shift toward integrated payments Combination of technology, distribution and scale creates a leading player in the integrated payments channel Delivers a comprehensive portfolio of innovative technology solutions with expanded cross-selling opportunities Transforms Vantiv’s channel mix and growth profile Combines strong management teams with track record of successful execution of its strategy and integration of acquisitions