Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TECUMSEH PRODUCTS CO | q120148-kformpressrelease.htm |

| EX-99.1 - PRES RELEASE DATED MAY 12, 2014 - TECUMSEH PRODUCTS CO | a2014fyearningsex991.htm |

©2014 Tecumseh Products Company Q1 2014 Shareholder Update May 12, 2014 These slides should be reviewed in connection with the Q1 2014 audio presentation Exhibit 99.2

Agenda Operational Overview Q1 2014 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 2 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

Disclaimer 3 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to the safe harbor provisions created by that Act. In addition, forward-looking statements may be made orally in the future by or on behalf of us. Forward-looking statements can be identified by the use of terms such as “expects,” “should,” “may,” “believes,” “anticipates,” “will,” and other future tense and forward-looking terminology, or by the fact that they appear under the caption “Business Update.” Our forward-looking statements generally relate to our future performance, including our anticipated operating results and liquidity sources and requirements, our business strategies and goals, and the effect of laws, rules, regulations, new accounting pronouncements and outstanding litigation, on our business, operating results, and financial condition. Readers and listeners are cautioned that actual results may differ materially from those projected as a result of certain risks and uncertainties, including, but not limited to, i) our history of losses and our ability to maintain adequate liquidity in total and within each foreign operation; ii) our ability to develop successful new products in a timely manner; iii) the success of our ongoing effort to improve productivity and restructure our operations to reduce costs and bring them in line with projected production levels and product mix; iv) the extent of any business disruption that may result from the restructuring and realignment of our manufacturing operations and personnel or system implementations, the ultimate cost of those initiatives and the amount of savings actually realized; v) loss of, or substantial decline in, sales to any of our key customers; vi) current and future global or regional political and economic conditions and the condition of credit markets, which may magnify other risk factors; vii) increased or unexpected warranty claims; viii) actions of competitors in markets with intense competition; ix) financial market changes, including fluctuations in foreign currency exchange rates and interest rates; x) the ultimate cost of defending and resolving legal and environmental matters, including any liabilities resulting from the regulatory antitrust investigations commenced by the United States Department of Justice Antitrust Division and the Secretariat of Economic Law of the Ministry of Justice of Brazil, both of which could preclude commercialization of products or adversely affect profitability and/or civil litigation related to such investigations; xi) local governmental, environmental, trade and energy regulations; xii) availability and volatility in the cost of materials, particularly commodities, including steel, copper and aluminum, whose cost can be subject to significant variation; xiii) significant supply interruptions or cost increases; xiv) loss of key employees; xv) the extent of any business disruption caused by work stoppages initiated by organized labor unions; xvi) risks relating to our information technology systems; xvii) impact of future changes in accounting rules and requirements on our financial statements; xviii) default on covenants of financing arrangements and the availability and terms of future financing arrangements; xix) reduction or elimination of credit insurance; xx) potential political and economic adversities that could adversely affect anticipated sales and production; xxi) in India, potential military conflict with neighboring countries that could adversely affect anticipated sales and production; xxii) weather conditions affecting demand for replacement products; and xxiii) the effect of terrorist activity and armed conflict. These forward-looking statements are made only as of the date of this presentation, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Agenda Operational Overview Q1 2014 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 4 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

Operational Overview Q1 2014 Sales -- $179.3m Q1 2013 -- $207.6m Q1 2014 Gross Profit -- $17.1m or 9.5% of net sales Q1 2013 -- $22.1m or 10.6% of net sales Q1 2014 S & A expense -- $23.0m or 12.8% of net sales Q1 2013 – $29.1m or 14.0% of net sales March 31, 2014 cash and cash equivalents -- $43.1m March 31, 2013 -- $41.9m December 31, 2013 -- $55.0m 5 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

Operational Overview - Key Objectives Focused product portfolio (value add) Focused market approach Rationalize manufacturing capacity Fixed cost containment efforts Advanced technology Improved profitability Enhanced liquidity 6 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Celseon ® Low Profile AJ AE2 Compressor “Midi” TA Compressor “Mini” Masterflux 48V Variable Speed Compressor

Operational Overview 7 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

Operational Overview 8 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

Operational Overview 9 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

Negative FX impact of $7.8m 9.9% decrease excluding FX Primarily net decreases in volume & mix partially offset by price increases 10 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Operational Overview - Sales 179.3 22.0 7.8 1.5 207.6 0 50 100 150 200 250 Q1 2013 Price Volume/Mix FX Q1 2014 Sales

Commercial 64% R&F 21% Air Conditioning 15% Sales % by Market Q1 2014 115.3 26.0 38.0 118.6 47.0 42.0 - 20.0 40.0 60.0 80.0 100.0 120.0 140.0 Commercial Air Conditioning R&F Sales by Market Q1 2014 Q1 2013 Commercial 57% R&F 20% Air Conditioning 23% Sales % by Mark t Q1 2013 11 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Operational Overview - Sales 115.3 3.2 0.2 0.1 118.6 0 25 50 75 100 125 Q1 2013 Volume/Mix Price FX Q1 2014 Commercial Market Sales

Commercial 64% R&F 21% Air Conditioning 15% Sales % by Market Q1 2014 115.3 26.0 38.0 118.6 47.0 42.0 - 20.0 40.0 60.0 80.0 100.0 120.0 140.0 Commercial Air Conditioning R&F Sales by Market Q1 2014 Q1 2013 Commercial 57% R&F 20% Air Conditioning 23% Sales % by Mark t Q1 2013 12 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Operational Overview - Sales 38.0 5.5 0.4 1.1 42.0 0 25 50 Q1 2013 Volume/Mix Price FX Q1 2014 R&F Market Sales

Commercial 64% R&F 21% Air Conditioning 15% Sales % by Market Q1 2014 115.3 26.0 38.0 118.6 47.0 42.0 - 20.0 40.0 60.0 80.0 100.0 120.0 140.0 Commercial Air Conditioning R&F Sales by Market Q1 2014 Q1 2013 Commercial 57% R&F 20% Air Conditioning 23% Sales % by Mark t Q1 2013 13 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Operational Overview - Sales 26.0 19.2 2.1 0.3 47.0 0 25 50 Q1 2013 Volume/Mix Price FX Q1 2014 A/C & Other Market Sales

Agenda Operational Overview Q1 2014 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 14 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

15 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Q1 2014 Financial Overview Q1 2014 – 9.5% of net sales Q1 2013 – 10.6% of net sales 17.1 22.1 2.2 1.5 4.3 4.2 0.2 0 5 10 15 20 25 30 Q1 20 13 FX Pric e Oth mt rl & mf g Vol um e / mix Com mo diti es Q1 20 14 Gross Profit

16 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Q1 2014 Financial Overview 23.0 29.1 - 10.0 20.0 30.0 Q1 2014 Q1 2013 Selling and administrative expenses 4.2 5.0 - 2.0 4.0 6.0 8.0 10.0 Q1 2014 Q1 2013 Other Income (expense), net 4.1 3.4 - 2.0 4.0 6.0 8.0 10.0 Q1 2014 Q1 2013 Impairments, restructuring charges, and other items

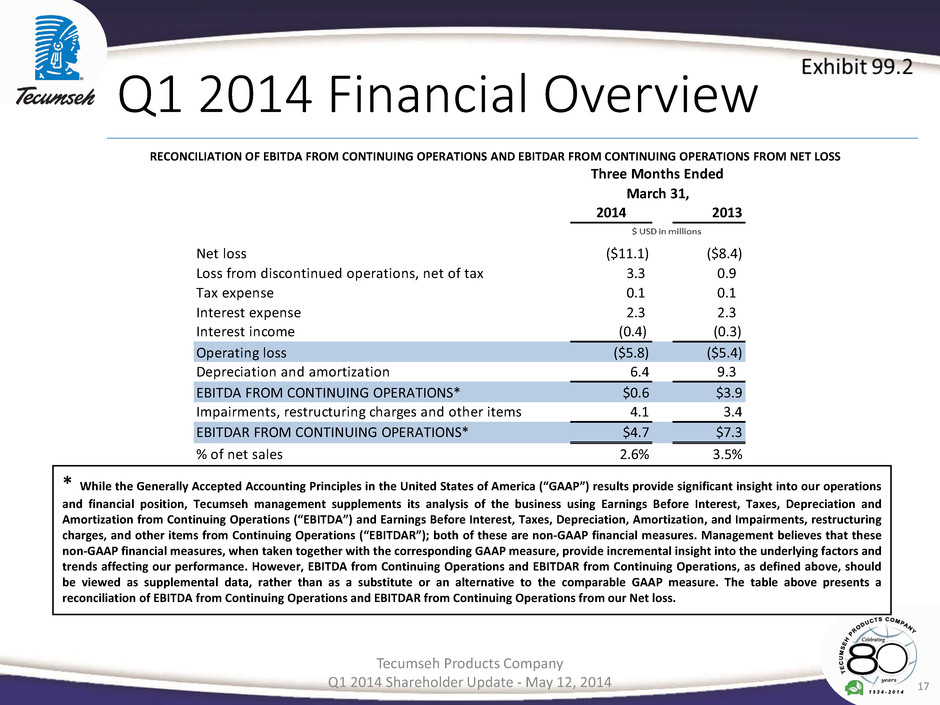

17 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Q1 2014 Financial Overview * While the Generally Accepted Accounting Principles in the United States of America (“GAAP”) results provide significant insight into our operations and financial position, Tecumseh management supplements its analysis of the business using Earnings Before Interest, Taxes, Depreciation and Amortization from Continuing Operations (“EBITDA”) and Earnings Before Interest, Taxes, Depreciation, Amortization, and Impairments, restructuring charges, and other items from Continuing Operations (“EBITDAR”); both of these are non-GAAP financial measures. Management believes that these non-GAAP financial measures, when taken together with the corresponding GAAP measure, provide incremental insight into the underlying factors and trends affecting our performance. However, EBITDA from Continuing Operations and EBITDAR from Continuing Operations, as defined above, should be viewed as supplemental data, rather than as a substitute or an alternative to the comparable GAAP measure. The table above presents a reconciliation of EBITDA from Continuing Operations and EBITDAR from Continuing Operations from our Net loss. RECONCILIATION OF EBITDA FROM CONTINUING OPERATIONS AND EBITDAR FROM CONTINUING OPERATIONS FROM NET LOSS 2014 2013 Net loss ($11.1) ($8.4) Loss from discontinued operations, net of tax 3.3 0.9 Tax expense 0.1 0.1 Interest expense 2.3 2.3 Interest income (0.4) (0.3) Operating loss ($5.8) ($5.4) Depreciation and amortization 6.4 9.3 EBITDA FROM CONTINUING OPERATIONS* $0.6 $3.9 Impairments, restructuring charges and other items 4.1 3.4 EBITDAR FROM CONTINUING OPERATIONS* $4.7 $7.3 % of net sales 2.6% 3.5% Three Months Ended March 31,

18 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Q1 2014 Liquidity NOTE: The reader should review this slide in connection with our Form 10-Q and related disclosures for 2014 filed today Mar-14 Dec-13 Mar-13 Unrestricted Cash 43.1$ 55.0$ 41.9$ Borrowing Availability 26.2 22.0 16.3 Total Cash and Borrowing Availability 69.3$ 77.0$ 58.2$ % Sales - Trailing Four Quarters 8.7% 9.3% 6.9% Weighted Average Interest 8.8% 8.1% 8.3%

19 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Q1 2014 Liquidity NOTE: The above cash flow statement is a condensed format. The reader should review this slide in connection with our Form 10-Q and related disclosures for 2014 filed today Cash used in operating activities: $19.2m use of cash primarily related to net losses & working capital (AR & inventory offset somewhat by payables) Cash provided by investing activities: $13.4m source of cash mainly related to release of restricted funds pertaining to the PNC term loan & proceeds from asset sales somewhat offset by capital expenditures Cash used in financing activities: $5.9m use of cash mainly related to the pay down of debt utilizing the asset sale proceeds and the PNC term loan amortization 2014 2013 Net loss ($11.1) ($8.4) Depreciation and amortization 6.4 9.3 Non-cash employee retirement benefits 0.1 (3.5) Other non-cash items (3.7) 0.5 Changes in operating assets and liabilities: Accounts receivable (5.0) (8.7) Inventories (9.4) (24.5) Payables and accrued expenses 3.8 21.9 Recoverable non-income taxes (1.0) 4.7 Other 0.7 (1.5) Cash used in operating activities (19.2) (10.2) Cash provided by (used in) investing activities 13.4 (1.4) Cash used in financing activities (5.9) (2.2) Effect of exchange rate changes on cash (0.2) 0.4 Decrease in cash and cash equivalents ($11.9) ($13.4) Cash and cash equivalents - Beginning of Period 55.0 55.3 Cash and cash equivalents - End of Period 43.1 41.9 Cash paid for interest 2.1 2.3 Cash paid for taxes 0.1 0.2 Three Months Ended March 31,

Agenda Operational Overview Q1 2014 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 20 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

21 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Business Update • Share recapitalization approved – one share class now trading as TECU • Continued focus on lean manufacturing initiatives, quality improvements, and manufacturing process improvements • New strategic restructuring process commenced with the hiring of CRO • 2015 targets outlined in May 2013 are not achievable

Agenda Operational Overview Q1 2014 Financial Overview, Liquidity & Outlook Business Update Closing Remarks / Q&A 22 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014

23 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Closing Remarks / Q & A • Continue the turnaround process • Revamp our strategic restructuring • Continue to expand and improve the product line • Thank you for attending Tecumseh Products Company’s Q1 2014 Shareholder Update • We will now take any questions you might have

24 Tecumseh Products Company Q1 2014 Shareholder Update - May 12, 2014 Contact Information – Today’s Speakers Ms. Janice Stipp Executive Vice President, CFO & Treasurer Tecumseh Products Company 5683 Hines Drive Ann Arbor, MI 48108 Mr. Jim Connor President & Chief Executive Officer Tecumseh Products Company 5683 Hines Drive Ann Arbor, MI 48108 E-Mail: investor.relations@tecumseh.com Phone: 1 (734) 585 9507