Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SunCoke Energy, Inc. | d724158d8k.htm |

| EX-99.2 - EX-99.2 - SunCoke Energy, Inc. | d724158dex992.htm |

Exhibit 99.1

|

|

SunCoke Energy, Inc.

Post-Dropdown

Business Update Call

May 12, 2014

|

|

Forward-Looking Statements

This slide presentation should be reviewed in conjunction with the SunCoke Energy, Inc. (SunCoke) post-dropdown business update conference call held on May 12, 2014 at 12:00 p.m. ET.

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke or the Partnership, in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SunCoke and the Partnership, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SunCoke and the Partnership has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SunCoke and the Partnership. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SunCoke and the Partnership do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

Post-Dropdown Business Update—May 2014

2

|

|

Transaction and Business Update

First Dropdown Drives Significant Value to SXC

Acquisition multiple of 8.3x EBITDA plus additional value through retained SXCP LP units and GP cash flows

Tax efficient structure and delevering of SXC

SXC transition to “pure play GP” underway

Business Update

Received permit for new U.S. coke plant

Q2 Domestic Coke production back to prior year levels

Coal sale process launched

Update Guidance

Re-affirm FY 2014 consolidated Adj. EBITDA guidance

Q2 and FY 2014 EPS lower due to dropdown transaction impact

Post-Dropdown Business Update—May 2014

|

|

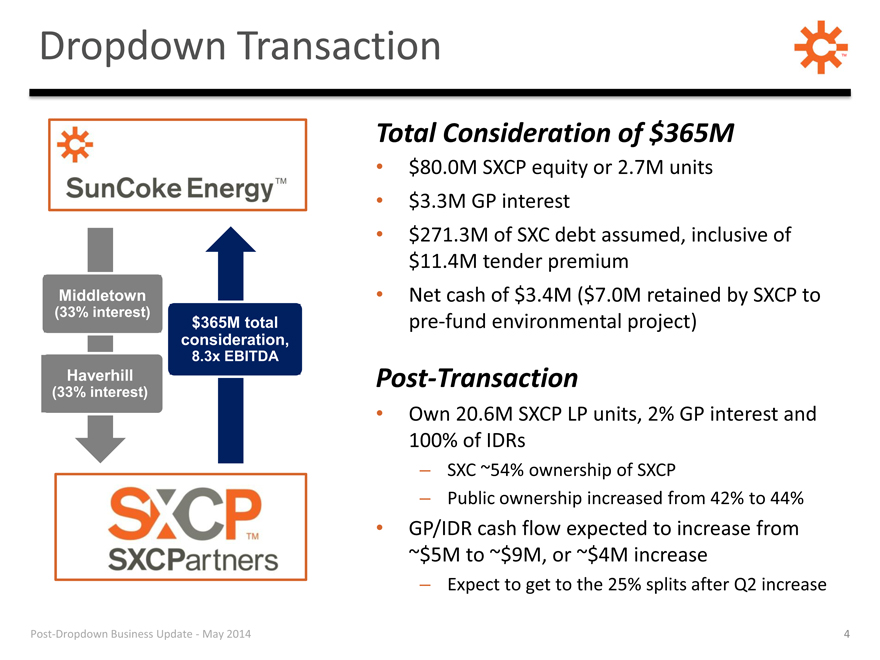

Dropdown Transaction

Middletown

(33% interest)

Haverhill

(33% interest)

$365M total consideration,

8.3x EBITDA

Total Consideration of $365M

$80.0M SXCP equity or 2.7M units

$3.3M GP interest

$271.3M of SXC debt assumed, inclusive of $11.4M tender premium

Net cash of $3.4M ($7.0M retained by SXCP to pre-fund environmental project)

Post-Transaction

Own 20.6M SXCP LP units, 2% GP interest and 100% of IDRs

– SXC ~54% ownership of SXCP

– Public ownership increased from 42% to 44%

GP/IDR cash flow expected to increase from

~$5M to ~$9M, or ~$4M increase

– Expect to get to the 25% splits after Q2 increase

Post-Dropdown Business Update—May 2014

4

|

|

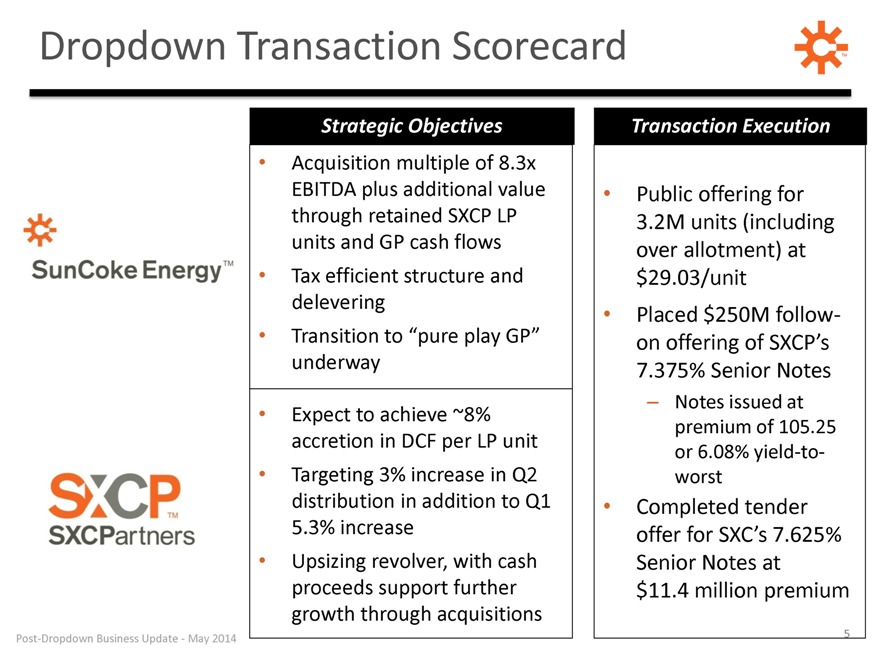

Dropdown Transaction Scorecard

Strategic Objectives Transaction Execution

Acquisition multiple of 8.3x

EBITDA plus additional value • Public offering for through retained SXCP LP 3.2M units (including units and GP cash flows over allotment) at

Tax efficient structure and $29.03/unit delevering

Placed $250M follow-

Transition to “pure play GP” on offering of SXCP’s underway 7.375% Senior Notes

Expect to achieve ~8% – Notes issued at

premium of 105.25 accretion in DCF per LP unit or 6.08% yield-to-

Targeting 3% increase in Q2 worst distribution in addition to Q1 Completed tender

5.3% increase offer for SXC’s 7.625%

Upsizing revolver, with cash Senior Notes at proceeds support further $11.4 million premium growth through acquisitions

5

Post-Dropdown Business Update—May 2014

|

|

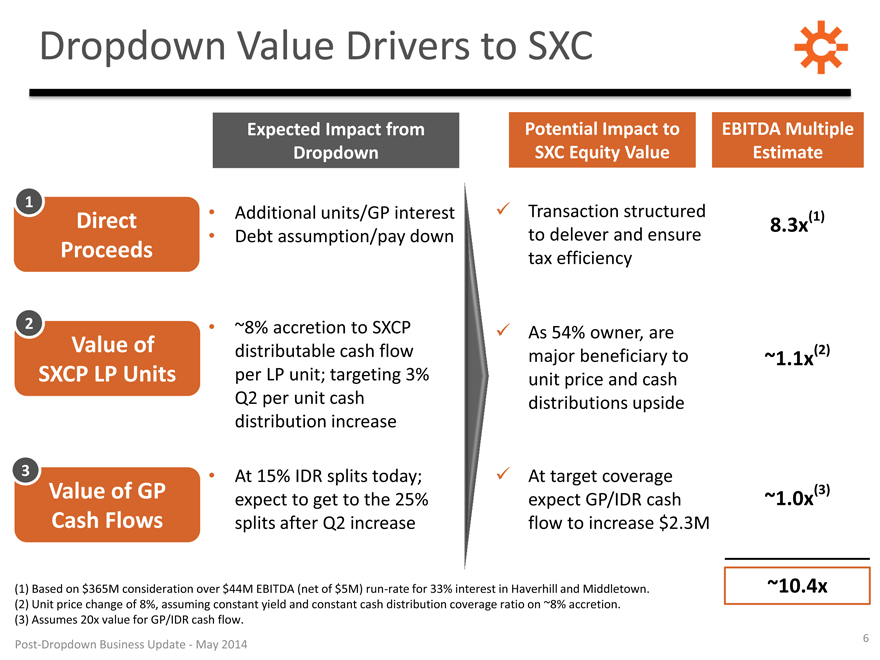

Dropdown Value Drivers to SXC

Expected Impact from Dropdown

1 2 3

Direct Proceeds

2

Value of SXCP LP Units

3

Value of SXCP LP Units

Value of GP Cash Flows

Additional units/GP interest

Debt assumption/pay down

~8% accretion to SXCP distributable cash flow per LP unit; targeting 3% Q2 per unit cash distribution increase

At 15% IDR splits today; expect to get to the 25% splits after Q2 increase

Potential Impact to SXC Equity Value

EBITDA Multiple Estimate

Transaction structured to delever and ensure tax efficiency

As 54% owner, are major beneficiary to unit price and cash distributions upside

At target coverage expect GP/IDR cash flow to increase $2.3M

(1)

8.3x

~1.1x(2)

(3)

~1.0x

~10.4x

(1) Based on $365M consideration over $44M EBITDA (net of $5M) run-rate for 33% interest in Haverhill and Middletown. (2) Unit price change of 8%, assuming constant yield and constant cash distribution coverage ratio on ~8% accretion. (3) Assumes 20x value for GP/IDR cash flow.

Post-Dropdown Business Update—May 2014

6

|

|

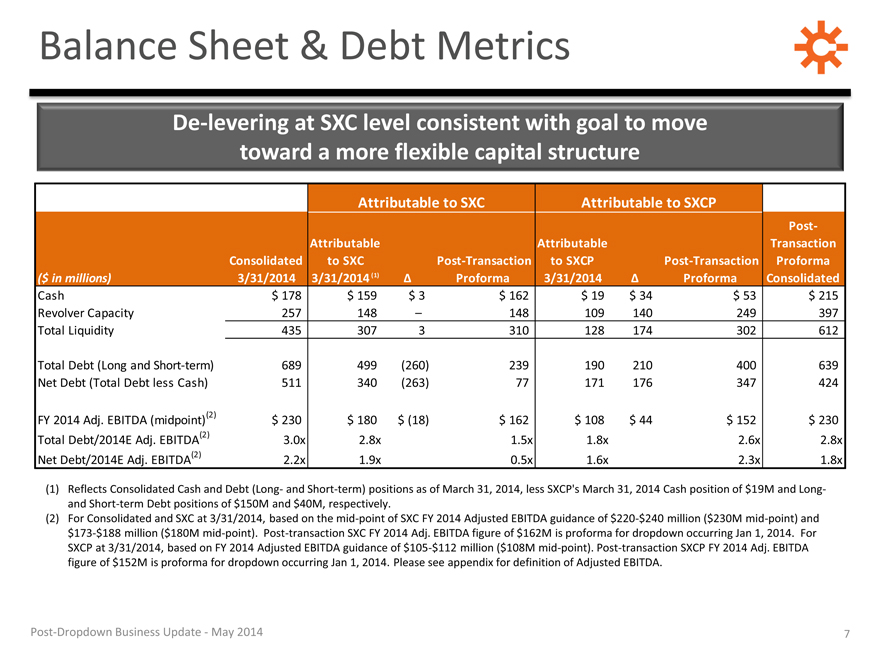

Balance Sheet & Debt Metrics

De-levering at SXC level consistent with goal to move toward a more flexible capital structure

Attributable to SXC Attributable to SXCP

Post-

Attributable Attributable Transaction

Consolidated to SXC Post-Transaction to SXCP Post-Transaction Proforma

($ in millions) 3/31/2014 3/31/2014 (1) Proforma 3/31/2014 Proforma Consolidated

Cash $ 178 $ 159 $ 3 $ 162 $ 19 $ 34 $ 53 $ 215

Revolver Capacity 257 148 – 148 109 140 249 397

Total Liquidity 435 307 3 310 128 174 302 612

Total Debt (Long and Short-term) 689 499 (260) 239 190 210 400 639

Net Debt (Total Debt less Cash) 511 340 (263) 77 171 176 347 424

FY 2014 Adj. EBITDA (midpoint)(2) $ 230 $ 180 $ (18) $ 162 $ 108 $ 44 $ 152 $ 230

Total Debt/2014E Adj. EBITDA(2) 3.0x 2.8x 1.5x 1.8x 2.6x 2.8x

Net Debt/2014E Adj. EBITDA(2) 2.2x 1.9x 0.5x 1.6x 2.3x 1.8x

Reflects Consolidated Cash and Debt (Long- and Short-term) positions as of March 31, 2014, less SXCP’s March 31, 2014 Cash position of $19M and Long- and Short-term Debt positions of $150M and $40M, respectively.

For Consolidated and SXC at 3/31/2014, based on the mid-point of SXC FY 2014 Adjusted EBITDA guidance of $220-$240 million ($230M mid-point) and $173-$188 million ($180M mid-point). Post-transaction SXC FY 2014 Adj. EBITDA figure of $162M is proforma for dropdown occurring Jan 1, 2014. For SXCP at 3/31/2014, based on FY 2014 Adjusted EBITDA guidance of $105-$112 million ($108M mid-point). Post-transaction SXCP FY 2014 Adj. EBITDA figure of $152M is proforma for dropdown occurring Jan 1, 2014. Please see appendix for definition of Adjusted EBITDA.

Post-Dropdown Business Update—May 2014

7

|

|

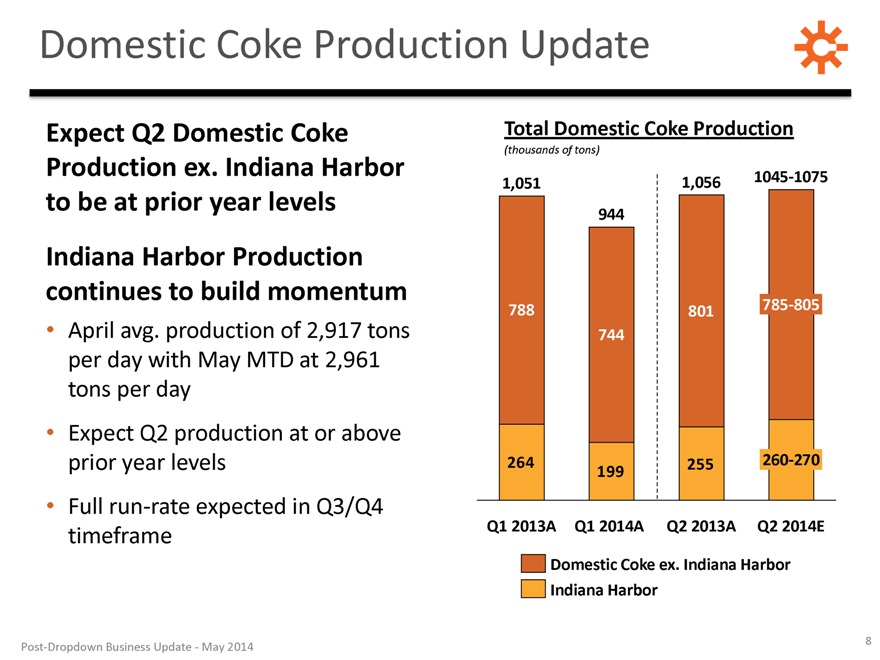

Domestic Coke Production Update

Expect Q2 Domestic Coke Production ex. Indiana Harbor to be at prior year levels

Indiana Harbor Production continues to build momentum

April avg. production of 2,917 tons per day with May MTD at 2,961 tons per day

Expect Q2 production at or above prior year levels

Full run-rate expected in Q3/Q4 timeframe

Total Domestic Coke Production

(thousands of tons)

1,051 1,056 1045-1075 944

788 801 785-805 744

264 255 260-270

199

Q1 2013A Q1 2014A Q2 2013A Q2 2014E

Domestic Coke ex. Indiana Harbor Indiana Harbor

Post-Dropdown Business Update—May 2014

8

|

|

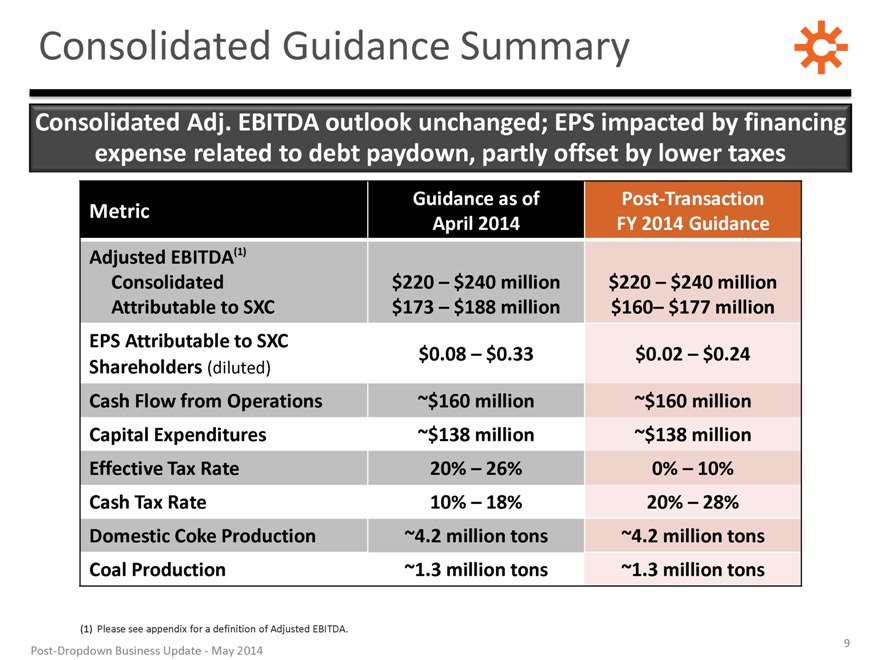

Consolidated Guidance Summary

Consolidated Adj. EBITDA outlook unchanged; EPS impacted by financing expense related to debt paydown, partly offset by lower taxes

Guidance as of Post-Transaction

Metric

April 2014 FY 2014 Guidance

Adjusted EBITDA(1)

Consolidated $220 – $240 million $220 – $240 million

Attributable to SXC $173 – $188 million $160– $177 million

EPS Attributable to SXC

| $0.08 |

|

– $0.33 $0.02 – $0.24 |

Shareholders (diluted)

Cash Flow from Operations ~$160 million ~$160 million

Capital Expenditures ~$138 million ~$138 million

Effective Tax Rate 20% – 26% 0% – 10%

Cash Tax Rate 10% – 18% 20% – 28%

Domestic Coke Production ~4.2 million tons ~4.2 million tons

Coal Production ~1.3 million tons ~1.3 million tons

| (1) |

|

Please see appendix for a definition of Adjusted EBITDA. |

Post-Dropdown Business Update—May 2014

9

|

|

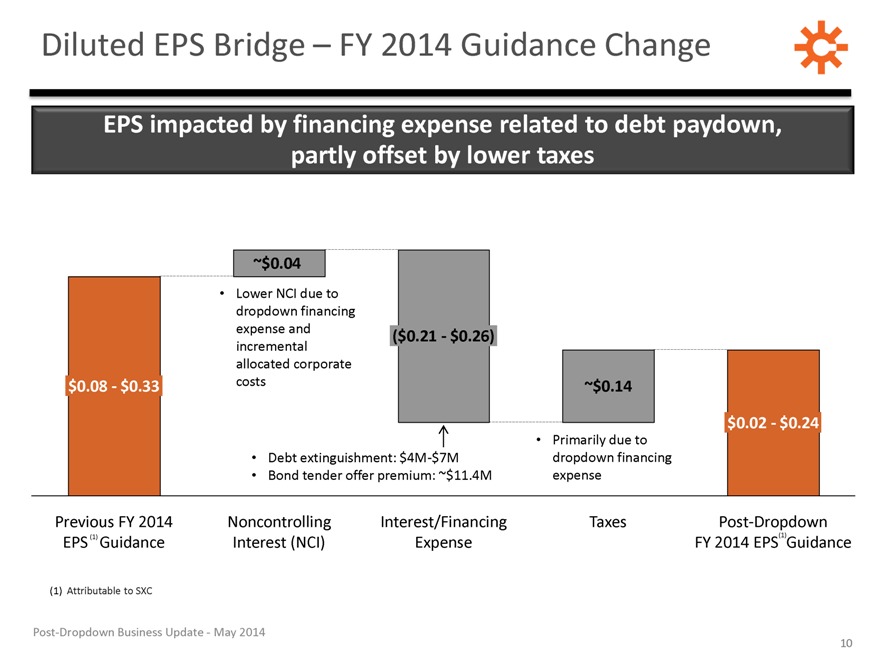

Diluted EPS Bridge – FY 2014 Guidance Change

EPS impacted by financing expense related to debt paydown, partly offset by lower taxes

~$0.04

Lower NCI due to dropdown financing expense and

($0.21—$0.26)

incremental allocated corporate

$0.08—$0.33 costs ~$0.14

$0.02—$0.24

Primarily due to

Debt extinguishment: $4M-$7M dropdown financing

Bond tender offer premium: ~$11.4M expense

Previous FY 2014 Noncontrolling Interest/Financing Taxes Post-Dropdown

(1) (1)

EPS Guidance Interest (NCI) Expense FY 2014 EPS Guidance

(1) Attributable to SXC

Post-Dropdown Business Update—May 2014

10

|

|

QUESTIONS

Post-Dropdown Business Update—May 2014

11

|

|

Investor Relations: 630-824-1907 www.suncoke.com

|

|

APPENDIX

Post-Dropdown Business Update—May 2014

13

|

|

Definitions

Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity method investment. EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the Company’s net assets and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP.

Calculations of Adjusted EBITDA may not be comparable to those reported by other companies.

EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization.

Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold.

Post-Dropdown Business Update—May 2014

14

|

|

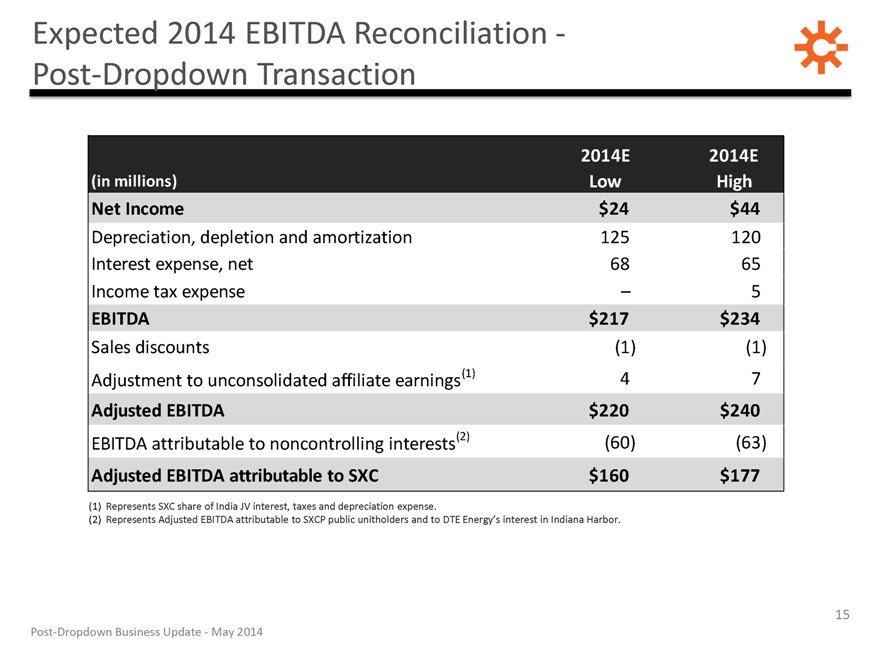

Expected 2014 EBITDA Reconciliation—Post-Dropdown Transaction

2014E 2014E

(in millions) Low High

Net Income $24 $44

Depreciation, depletion and amortization 125 120

Interest expense, net 68 65

Income tax expense – 5

EBITDA $217 $234

Sales discounts(1)(1)

Adjustment to unconsolidated affiliate earnings(1) 4 7

Adjusted EBITDA $220 $240

EBITDA attributable to noncontrolling interests(2)(60)(63)

Adjusted EBITDA attributable to SXC $160 $177

(1) Represents SXC share of India JV interest, taxes and depreciation expense.

(2) Represents Adjusted EBITDA attributable to SXCP public unitholders and to DTE Energy’s interest in Indiana Harbor.

Post-Dropdown Business Update—May 2014

15