Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONNECTICUT WATER SERVICE INC / CT | d724448d8k.htm |

| EX-10.1 - EX-10.1 - CONNECTICUT WATER SERVICE INC / CT | d724448dex101.htm |

Connecticut Water Service, Inc.

2014 Annual Meeting

of Shareholders

May 8, 2014

Exhibit 99.1

************

************

***********

***********

*********

*********

*****************

***************** |

Carol P. Wallace

Lead Director

2

•

CTWS Shareholders

–

Registered shares held in all 50 states, except

Nebraska.

Top Ten States with CTWS Shareholders

Connecticut

California

New York

New Jersey

Massachusetts

Pennsylvania

Florida

Texas

Maine

Illinois

Information provided by the Registrar & Transfer Company |

Carol P. Wallace

Lead Director

3

•

Range of Registered Share Holdings

–

34% own fewer than 49 shares

–

44% own 50 to 500 shares

–

22% own more than 500 shares

Information provided by the Registrar & Transfer Company |

Mark Kachur

•

Director since 2002

–

Compensation Committee

–

Corporate Governance

Committee

–

Corporate Finance and

Investments Committee

4 |

Richard Forde

•

Elected Director in October 2013

–

Retired as Senior Vice President

and Chief Investment Officer

from CIGNA in 2012

–

At CIGNA responsible for $23

billion in corporate portfolio and

defined benefit pension plans

assets

5 |

Board Focus

•

Growth

•

Risk Management

•

Executive Compensation

•

Welcome Shareholder

Contact and Feedback

6 |

Connecticut Water Service, Inc.

Eric W. Thornburg

President & CEO

************

************

******************************

******************************

********************************

********************************

************

************ |

Forward Looking Statements

Except for the historical statements and

discussions, some statements contained in this

report constitute “forward looking statements”

within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. These forward

looking statements are based on current

expectations and rely on a number of

assumptions concerning future events, and are

subject to a number of uncertainties and other

factors, many of which are outside our control,

that could cause actual results to differ materially

from such statements. |

Water, the basic ingredient of Life… |

Our Mission …

•

Passionate employees delivering life sustaining, high

quality water service to families and communities

while providing a fair return to our shareholders

10 |

Our Values…

•

Honesty

•

Trust

•

Respect

•

Service

•

Teamwork

•

Positive Attitude

•

Straight Talk |

Who We Are

•

Serving families and

communities since 1849

•

Founded in 1956

•

Serving 400,000 people

•

77 cities/towns

•

261 Employees |

Company Strategy

Growth

Shareholders

Customers

Employees |

Delivering Growth

•

UConn/Mansfield water supply

•

Linebacker launched in Maine

•

WISC –

Maine

•

WICA to 10%

14 |

Delivering for Customers

•

Rate Settlement Agreement in Connecticut

•

Maine Water and Biddeford Saco merged

•

Customer Satisfaction

> 93% & 93.9%

•

Public Opinion Leader

Satisfaction > 93%

15 |

Delivering for Employees

16

•

Employee Satisfaction >86%

•

The Year of Water! |

Delivering for Shareholders

•

Record Earnings

•

Total Shareholder Value Added

•

Revenue Adjustment Mechanism (RAM)

•

Maine Rate Cases

•

Repair Tax Deduction

•

Continuous Operations

Savings Team (COST)

•

Procurement Initiative

17 |

Connecticut Water Service, Inc.

David C. Benoit

Senior Vice President, CFO & Treasurer

***********

***********

***************** |

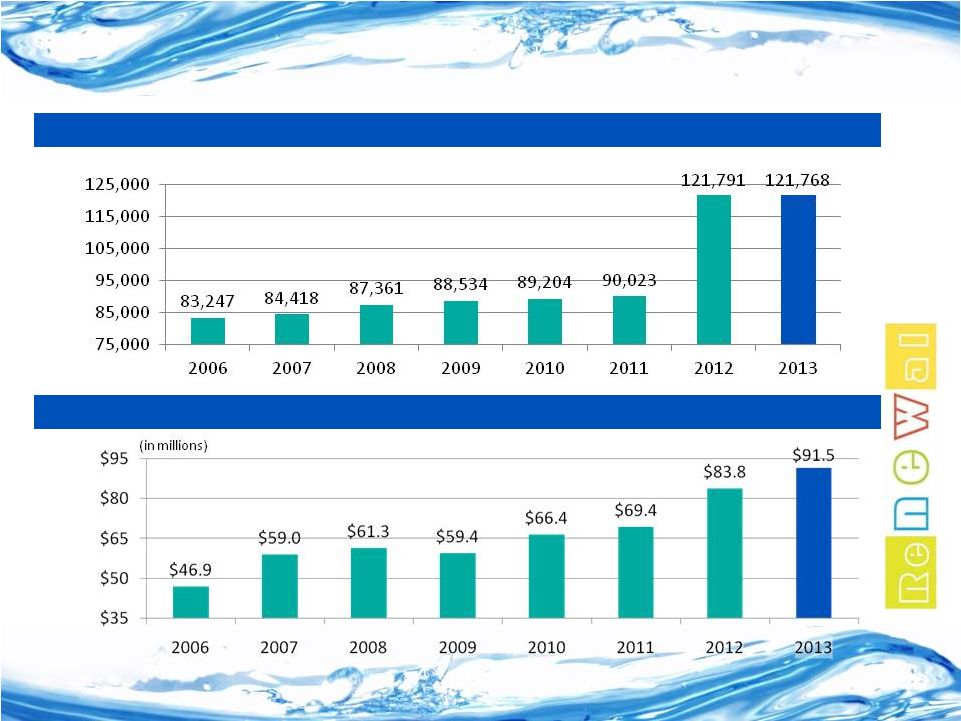

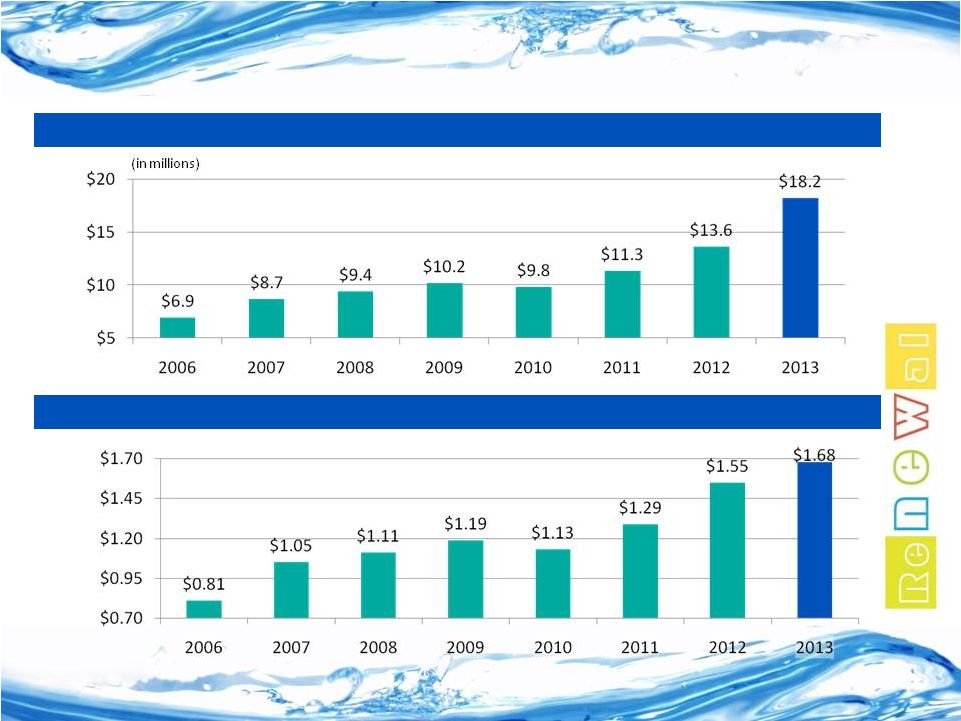

2013 Performance

2013 -

$91.5M

2012 -

$83.8M

Revenue

2013 -

$639.7M

2012 -

$611.8M

Utility Plant

Net Income

Applicable to

common stock

2012 -

$13.6M

2013 -

$18.2M |

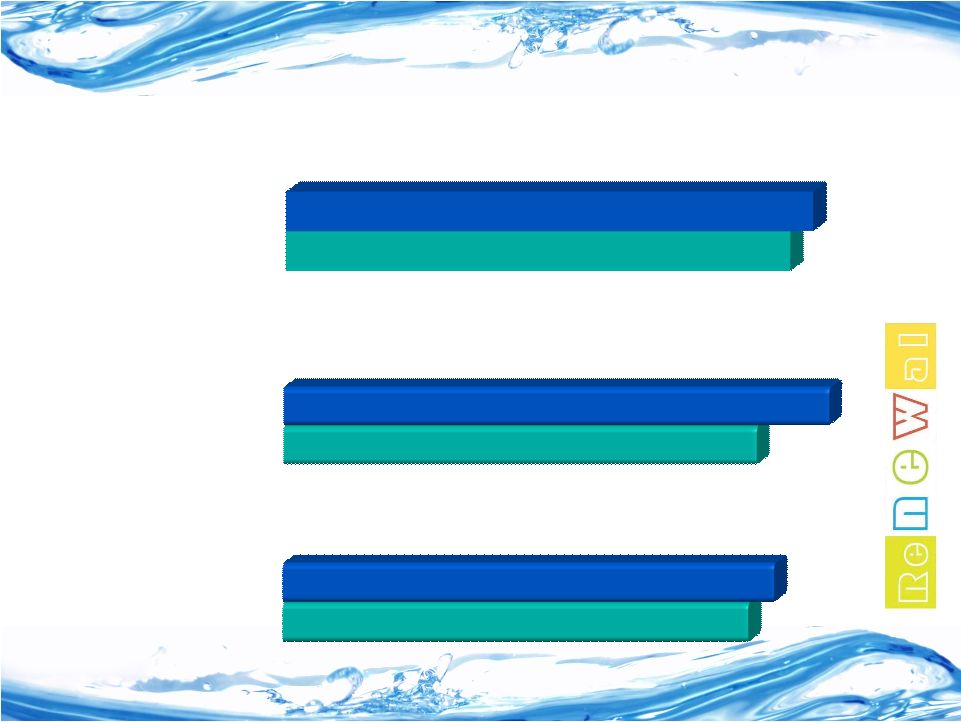

Consistent Financial Performance

Customers

Revenue |

High Quality Earnings

Net Income

Earnings Per Share |

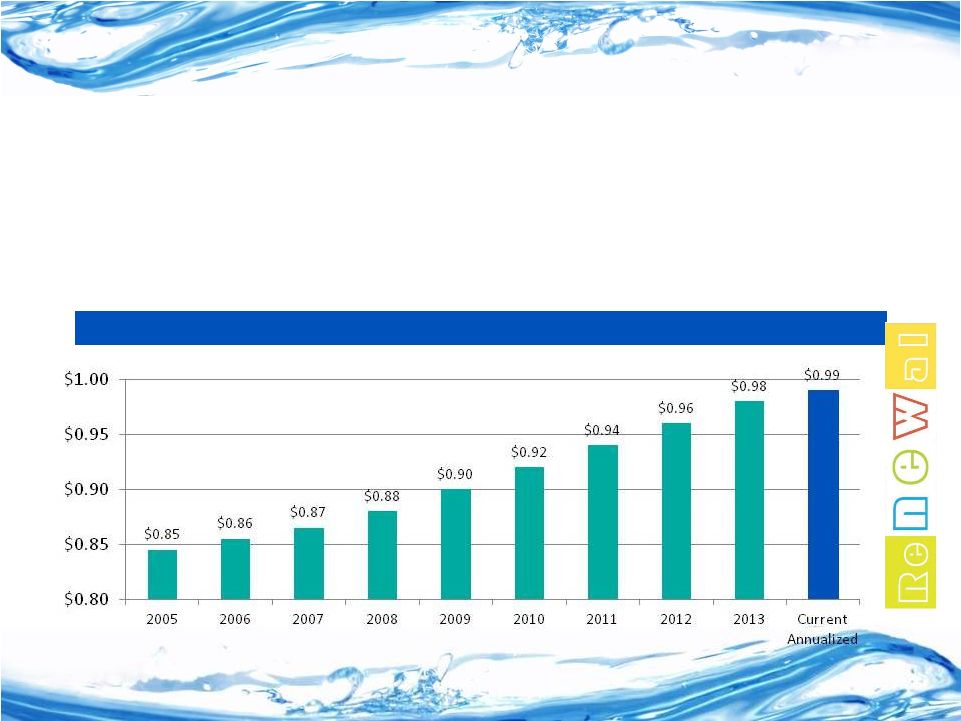

Stable & Growing Dividend

•

Current 3.1% yield

•

Dividend paid without interruption or reduction for 227

consecutive quarters

•

Increased dividend payments for 44 consecutive years

Annual Dividend |

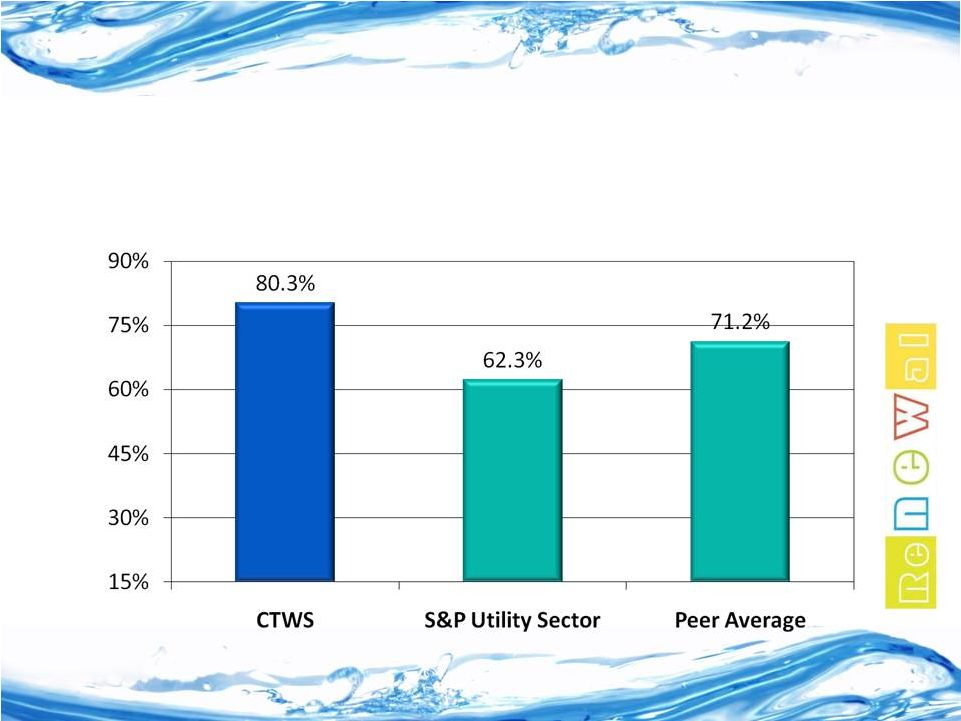

Performance

5 Year Financial Performance

Total Shareholder Return @ 12/31/13

Total Shareholder Return is a term describing the total of the Company’s stock

appreciation and dividends over a specified period of time. |

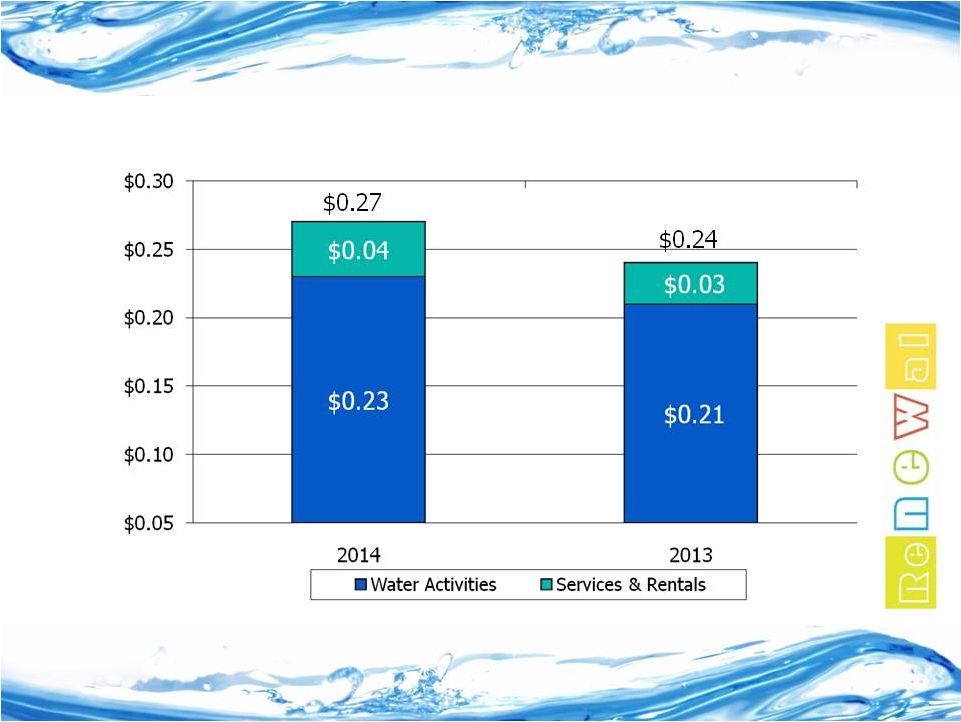

1

st

Quarter

EPS

-

2014

vs.

2013

Earnings Per Share |

Performance

•

High Earnings Quality

–

90% of Revenues and Earnings

from regulated business

•

Strong Balance Sheet

–

LTD 4.72% Embedded Cost

–

Balanced Debt-Equity ratio

–

S & P Rating “A” |

Performance

•

Total Shareholder Return

–

Exceeded Peer Average and S&P Utility Sector

•

Dividends

–

Yield 3.1%

–

Paid since 1956

–

Increased 44 years |

Analysts Remarks…

•

“Given the company's recent UConn contract and plans

to commit significant capital in Maine, we believe

Connecticut Water represents one of the most attractive

growth stories in the space.”

(Janney, January 2014).

•

“CTWS has emerged from a single state system to a

regional player in New England and continues to

methodically shepherd through improved regulatory

mechanisms separating the company from small cap

peers. The recently enacted WRA will reduce earnings

volatility from weather and conservation.”

(Boenning

and Scattergood, March 2014). |

Analysts Remarks…

•

“Labor cost inflation and declining customer usage

combined with accelerated capital investments for the

average water utility has kept earned ROEs well below

authorized ROEs, reducing the utility sector's overall EPS

growth. Connecticut Water, in comparison, has

substantially grown its top and bottom line in 2012 and

2013 by completing two meaningful platform

acquisitions. These acquisitions expanded CTWS's

operational footprint into Maine, boosting its customer

base by 35%.”

(Baird, March 2014). |

Thank you for your support

Your Questions & Feedback…

**********

********** |