Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BANCORPSOUTH INC | d725041d8k.htm |

BancorpSouth, Inc.

Gulf South Bank Conference

May 12-14, 2014

Exhibit 99.1 |

Forward Looking Information

2

Certain statements contained in this presentation and the accompanying slides may not be based on

historical facts and are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements may be identified by reference

to a future period or by the use of forward-looking terminology, such as “anticipate,” “believe,” “estimate,” “expect,” “foresee,” “may,” “might,” “will,”

“intend,” “could,” “would” or “plan,” or future or

conditional verb tenses, and variations or negatives of such terms. These forward-looking statements include, without limitation, statements relating to non-

accrual loans, revenue estimates for the Company’s operations in Houston, Texas following the

closing of the transaction with GEM Insurance Agencies, LP, the terms and closing of the

proposed transactions with Ouachita Bancshares Corp. and Central Community Corporation, acceptance by customers of Ouachita Bancshares Corp. and Central Community

Corporation of the Company’s products and services, the opportunities to enhance market share in

certain markets and market acceptance of the Company generally in new markets, pro forma loan,

deposit and market share information, the impact of and the Company’s ability to implement cost-saving initiatives, our ability to improve efficiency, and future growth,

expansion, and consolidation opportunities. We caution you not to place undue reliance on

the forward-looking statements contained in this presentation in that actual results could

differ materially from those indicated in such forward-looking statements because of a variety of

factors. These factors may include, but are not limited to, the ability to obtain required

regulatory approval for the proposed mergers with Ouachita Bancshares Corp. and Central Community

Corporation, the ability of the Company, Ouachita Bancshares Corp. and Central Community

Corporation to close the mergers, the ability of the Company to retain key personnel after the pending mergers and the Knox acquisition, conditions in the financial

markets and economic conditions generally, the adequacy of the Company’s provision and allowance

for credit losses to cover actual credit losses, the credit risk associated with real estate

construction, acquisition and development loans, losses resulting from the significant amount of the Company’s other real estate owned, limitations on the Company’s ability to

declare and pay dividends, the impact of legal or administrative proceedings, the availability of

capital on favorable terms if and when needed, liquidity risk, governmental regulation,

including the Dodd Frank Act, and supervision of the Company’s operations, the short-term and

long-term impact of changes to banking capital standards on the Company’s regulatory

capital and liquidity, the impact of regulations on service charges on the Company’s core deposit

accounts, the susceptibility of the Company’s business to local economic or environmental

conditions, the soundness of other financial institutions, changes in interest rates, the impact of monetary policies and economic factors on the Company’s ability to

attract deposits or make loans, volatility in capital and credit markets, reputational risk, the

impact of hurricanes or other adverse weather events, any requirement that the Company write

down goodwill or other intangible assets, diversification in the types of financial services the Company offers, the Company’s ability to adapt its products and services to evolving

industry standards and consumer preferences, competition with other financial services companies,

risks in connection with completed or potential acquisitions, the Company’s growth

strategy, interruptions or breaches in the Company’s information system security, the failure of

certain third party vendors to perform, unfavorable ratings by rating agencies, dilution caused

by the Company’s issuance of any additional shares of its common stock to raise capital or acquire other banks, bank holding companies, financial holding companies and

insurance agencies, other factors generally understood to affect the financial results of financial

services companies and other factors detailed from time to time in the Company’s press

releases and filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they were made, and, except as required by law, we

do not undertake any obligation to update or revise forward-looking statements to reflect events

or circumstances after the date of this presentation. Certain tabular presentations may not

reconcile because of rounding. Unless otherwise noted, any quotes in this presentation can be attributed to company management. |

About

BancorpSouth, Inc. (NYSE:BXS) Total assets of $13.1 billion

Headquartered in Tupelo, MS

256 full-service banking locations reaching throughout an 8-state

footprint

Customer-focused business model with comprehensive line of

financial products and banking services for individuals and small to

mid-size businesses

Strong core capital base consisting of 100% common equity

Market capitalization of $2.4 billion

3

Data as of March 31, 2014 |

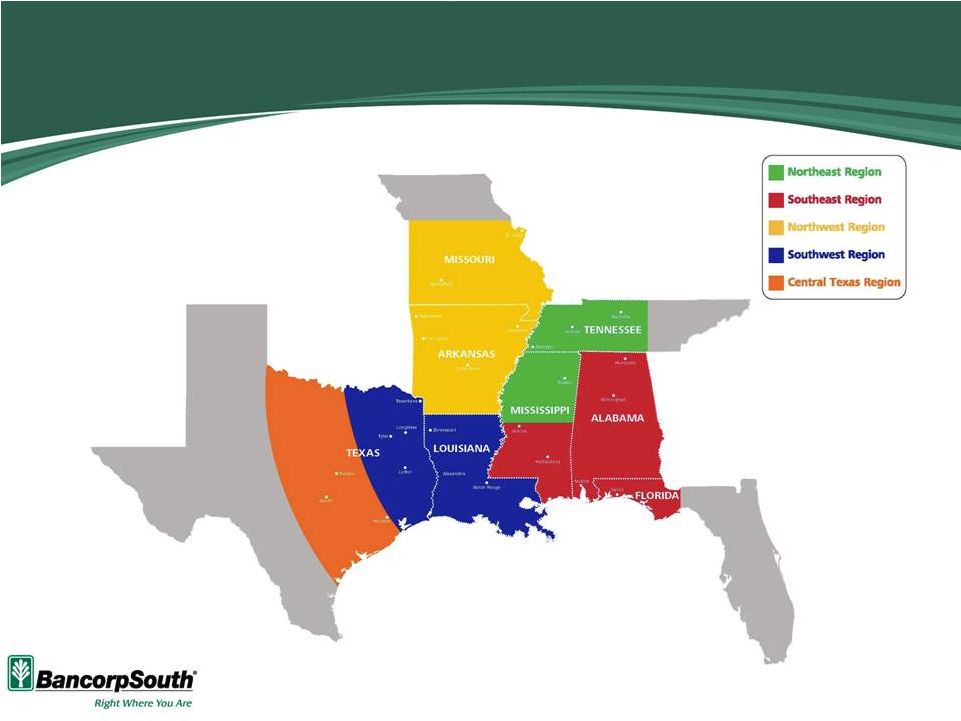

Community Bank Structure –

8 State Footprint

4

*

*The Central Texas Region will be added in conjunction with the Central Community Corporation pending

merger. |

COMMUNITY BANK

Personal Banking

Business Banking

Deposit Offerings

Business Loans

Consumer Lending

Full Range of Deposit Products

Home Equity Lending

Treasury Management

Mobile/Internet Banking

Merchant Services

Prepaid Cards

Payroll and HR Management

Insurance

168 Licensed Producers in 30 Locations

Commercial, P&C, and Life Insurance

Trust and Wealth Management

$7 Billion Total Assets Under Management

17 Locations

Mortgage

109 Originators in 84 Locations

$197 million in Production for Q1

($1.4 Billion in Production for 2013)

5

Equipment Finance and Leasing

Territory Managers Covering 14 States

Portfolio Balance of $500+ Million

Wide Range of Product Offerings

As of and for the quarter ended March 31, 2014 |

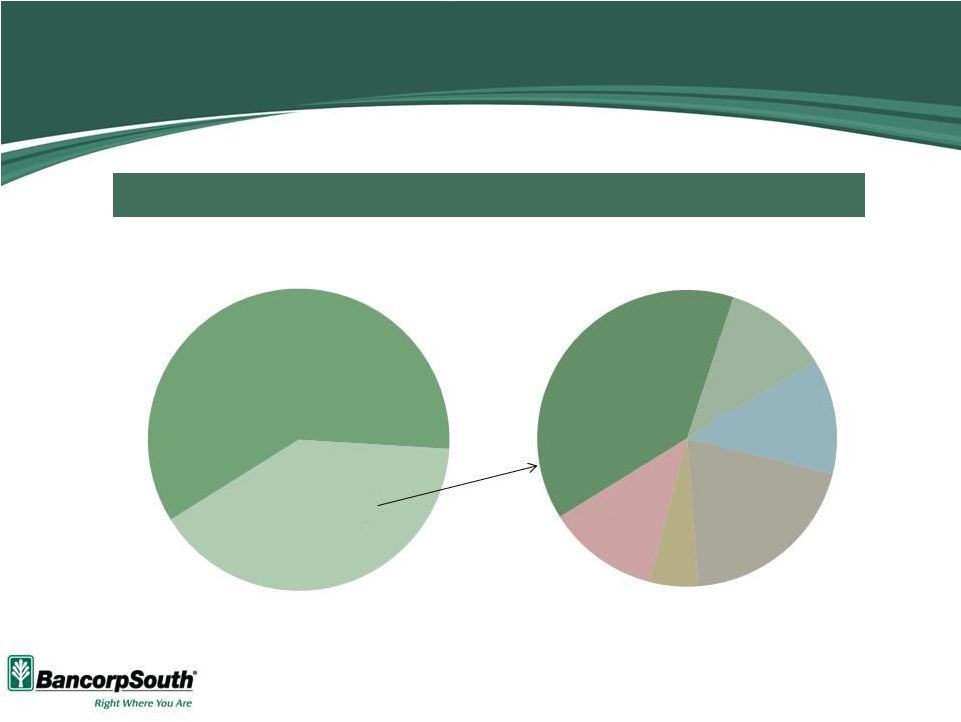

Diversified Revenue Stream

Approximately 40% of Total Revenue is Derived from Noninterest Sources

Total Noninterest Revenue of $263.9M*

6

Total Revenue of $666.3M*

Net Interest

Revenue

60%

Noninterest

Revenue

40%

Insurance

Commissions

39%

Mortgage

lending

11%

Card and

merchant fees

13%

Deposit service

charges

20%

Trust income

5%

Other

12%

Percentages and amounts based on data for rolling 12 month period ended March 31, 2014 *Excludes negative MSR

valuation adjustment of $6.4 million |

Q1

2014 Highlights Net income of $28.4 million, or $0.30 per diluted share

Announced the signing of two definitive merger agreements

Ouachita Bancshares Corp. (Ouachita Independent Bank)

Central Community Corporation (First State Bank Central Texas)

Produced $31.6 million of insurance commission revenue

Generated net loan growth of $110.4 million, or 5.0% annualized

Net interest margin remained relatively stable at 3.54%

Continued progress toward reducing non-interest expense

Subsequent acquisition announcement

Knox Insurance Group, LLC*

7

At and for the three months ended March 31, 2014 *Closed on April 9,

2014 |

Diluted EPS

8

Fiscal Year

Quarter Ended

Growth in Earnings Per Share

$0.99

$0.27

$0.45

$0.90

$0.99

$0.30

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

2009

2010

2011

2012

2013

Q1 14 |

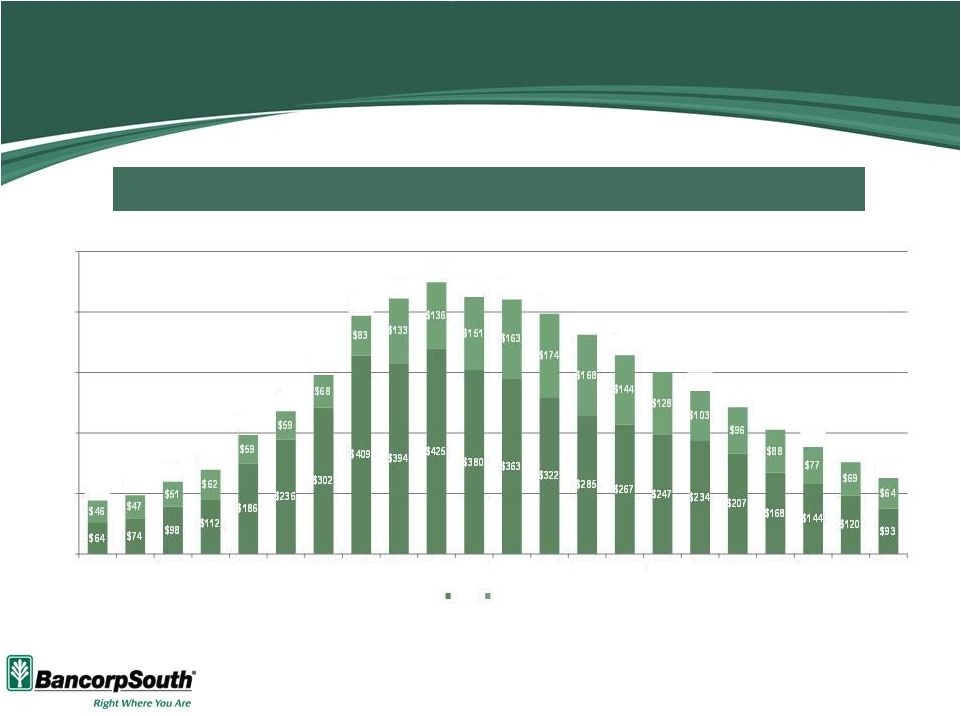

NPA

Improvement Total NPAs Have Declined 48% in the Last 12 Months

9

Dollars in millions

NPLs consist of nonaccrual loans, loans 90+ days past due and restructured loans NPAs consist of NPLs

and other real estate owned

$110

$121

$149

$174

$246

$295

$370

$492

$528

$561

$531

$525

$496

$453

$411

$376

$337

$303

$256

$221

$190

$157

$0

$125

$250

$375

$500

$625

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

4Q 12

1Q 13

2Q 13

3Q 13

4Q 13

1Q 14

NPLs

OREO |

Loan

Growth Dollars in millions

Produced net loan growth for 4 consecutive quarters

10

Fiscal Year

Quarter Ended

$9,691

$9,775

$9,333

$8,870

$8,637

$8,582

$8,679

$8,773

$8,958

$9,068

$7,500

$8,000

$8,500

$9,000

$9,500

$10,000

4Q 08

4Q 09

4Q 10

4Q 11

4Q 12

1Q 13

2Q 13

3Q 13

4Q 13

1Q 14 |

Recent Transaction Announcements -

Bank

Ouachita Bancshares Corp. (Ouachita Independent Bank)

Assets -

$650 million; Loans -

$475 million; Deposits -

$550 million

In-market expansion –

enhance presence along I-20 corridor

•

Footprint overlap in Shreveport and Monroe

•

Meaningful cost saving opportunities

Low-risk opportunity

•

Similar cultures and operating styles

•

Clean credit quality

Accretive to earnings per share

Central Community Corporation (First State Bank Central Texas)

Assets -

$1.3 billion; Loans -

$550 million; Deposits -

$1.1 billion

Footprint

expansion

–

high

growth

Austin,

TX

market

and

other

markets

along

I-35

corridor

•

Austin, TX ranked No. 1 economy in the U.S. based on the economic rankings of The

Business Journals’

On Numbers report

•

Foundation for growth in Texas, both organically and future consolidation

opportunities Similar business models with community and customer

focus Accretive to earnings per share

11

Financial data as of December 31, 2013 |

Recent Transaction Announcements -

Insurance

GEM Insurance Agencies, LP

Announced and closed December 18, 2013

Located in Houston, TX

Platform expansion in high growth market

•

Annual revenues of approximately $9 million

•

Diverse customer base including CRE, manufacturing, distribution, and service

companies Operates under leadership of Ed Schreiber

Legacy BXS office consolidated into GEM location

Knox Insurance Group, LLC

Announced and closed April 9, 2014

Located in Lafayette, LA

•

Annual revenues of approximately $3 million

•

Specialties include workers comp, business auto, P&C, and general/umbrella

liability Operates under leadership of Dwayne David and Randall

Bonaventure 12 |

Footprint Expansion

13

BancorpSouth (256)

Ouachita* (12)

First State Bank* (31)

Source: SNL Financial *Transactions

pending |

14

Deposit Market Share

Source: SNL Financial

Note: Deposit market share data as of June 30, 2013.

Pro forma information excludes purchase accounting adjustments

Ouachita Bancshares Corp. and Central Community Corporation transactions

pending All three institutions funded with 100% core deposits

Market

BXS Market

Share Rank

6/30/13

Total BXS

Deposits

6/30/13

Percentage

of Total

Company

Deposits

BXS Market

Share 2013

(%)

Ouachita

Bancshares

Corp.

Deposits

6/30/13

Central

Community

Corp.

Deposits

6/30/13

Pro Forma

Deposits

6/30/13

Pro Forma

Percentage of

Total

Company

Deposits

Pro Forma

Market Share Market Share

Rank 6/30/13

Pro Forma

2013 (%)

Market YoY

Deposit

Growth

2013 (%)

Mississippi

3

5,069,157

$

46.4%

10.6%

-

$

-

$

5,069,157

$

40.7%

3

10.6%

2.6%

Texas

826,576

7.6%

0.1%

-

977,625

1,804,201

14.5%

29

0.3%

8.9%

Arkansas

7

1,733,083

15.9%

3.3%

-

-

1,733,083

13.9%

7

3.3%

-0.5%

Louisiana

11

955,359

8.7%

1.0%

533,685

-

1,489,044

12.0%

7

1.6%

5.3%

Tennessee

15

1,184,566

10.8%

1.0%

-

-

1,184,566

9.5%

15

1.0%

0.1%

Alabama

13

824,116

7.5%

1.0%

-

-

824,116

6.6%

13

1.0%

1.8%

Missouri

66

317,286

2.9%

0.2%

-

-

317,286

2.6%

66

0.2%

6.2%

Florida

246

19,351

0.2%

0.0%

-

-

19,351

0.2%

246

0.0%

4.1%

Total

10,929,494

$

100.0%

533,685

$

977,625

$

12,440,804

$

100.0%

6/30/13 Deposit Market Share ($ in thousands)

65 |

Summary

Focus on growth

Meaningful net loan growth during 2013 and Q1 2014

Insurance agency acquisitions

GEM

Insurance

Agencies,

LP

–

Houston,

TX

(December

18,

2013)

Knox

Insurance

Group,

LLC

–

Lafayette,

LA

(April

9,

2014)

Recent additions to mortgage production team

Profitability and performance improvement

Continued progress in improving asset quality

Bank transaction announcements

Expand market share in Louisiana along I-20 corridor

Enter Austin, TX market and other high growth markets along I-35

corridor 15 |

Investor Inquiries:

Will Fisackerly

Director of Corporate Finance

BancorpSouth, Inc.

-

-2475

will.fisackerly@bxs.com

contained on the website and is not, and should not, be deemed a part of this presentation

662

*Reference to BancorpSouth’s website does not constitute incorporation by reference of the

information 680

BancorpSouth’s common stock is listed on the New York Stock

Exchange under the symbol BXS. Additional information can

be found at

www.bancorpsouth.com

.* |