Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UMPQUA HOLDINGS CORP | umpqform8-kmay2014dadcopre.htm |

UMPQUA HOLDINGS CORPORATION D.A. Davidson & Co. Financial Services Conference May 13-14, 2014

Forward-looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the SEC. You should not place undue reliance on forward-looking statements and we undertake no obligation to update any such statements. Forward-looking statements include statements that expressly or implicitly predict future results, performance or event. Statements other than statements of historical fact are forward-looking statements, which can be identified by use of words such as “anticipates,” “expects,” “believes,” “estimates,” and “intends,” and words or phrases of similar meaning. In this presentation we make forward-looking statements about size and growth potential from the merger with Sterling Financial Corporation; organic growth; net interest margin opportunities; dividends, share repurchases and capital management; opportunities for future acquisitions; loan portfolio diversification; store divestiture in connection with the Sterling merger; the mitigating effect of FDIC loss sharing agreements on the covered loan portfolio; valuations of, and the potential accelerated redemption of, junior subordinated debentures and our current intent to not redeem those securities; costs of interest bearing deposits and management’s pricing strategy; systems conversions in connection with the Sterling merger; and the Sterling merger integration. Specific risks that could cause results to differ from the forward-looking statements are set forth in our filings with the SEC and include, without limitation: changes in the discounted cash flow model used to determine the fair value of subordinated debentures; prolonged low interest rate environment; unanticipated weakness in loan demand or loan pricing; deterioration in the economy; material reductions in revenue or material increases in expenses; lack of strategic growth opportunities or our failure to execute on those opportunities; our inability to effectively manage problem credits; certain loan assets becoming ineligible for loss sharing; unanticipated increases in the cost of deposits; the consequences of a phase-out of junior subordinated debentures from Tier 1 capital; our ability to achieve the synergies and earnings accretion contemplated by the Sterling merger; our ability to promptly and effectively integrate the businesses of Sterling and Umpqua; the diversion of management time on issues related to merger integration; changes in laws or regulations; and changes in general economic conditions. 2

Umpqua – The West Coast’s Largest Community Bank > Headquarters: > Associates: > Assets: > Deposits: > Loans: > Footprint: > Ticker: > Market Capitalization: Portland, OR 5,000 $22.0bn $16.1bn $15.4bn 394 stores in 5 states UMPQ (NASDAQ) $3.5bn Deposit Franchise2 State # Stores Deposit Share Rank Oregon Washington California Idaho Nevada 128 116 99 17 4 10.22% 3.81% 0.44% 2.43% 0.59% 4 7 20 11 13 Umpqua Holdings Corporation1 > Source: Company filings, SNL Financial. > 1 Pro forma estimates based on merger with Sterling Financial Corporation. > 2 Pro forma estimates based on merger with Sterling Financial Corporation, per SNL Financial. FDIC deposit market share data as of June 30, 2013. 3

Long-term vision shared throughout organization Unique business model / innovative strategy Experienced management team Proven ability to grow loans and deposits organically Strong net interest margin relative to peers Prudent capital management, ability to deploy / return excess Portfolio diversification through long-term growth opportunities Track record of successful acquisitions, Sterling integration on target Why Invest in Umpqua 4

What is Umpqua’s Long-Term Vision “Community Bank at Any Size” Personal service and community engagement Sophisticated products and expertise We will accomplish this vision through: > Innovative product delivery system > Superior quality service > Strong brand awareness > Cutting-edge technology > Growth in market share of existing markets (and expanding into new markets) > Strategic acquisitions 5

> One of the country’s most innovative community banks > Pioneered retail model with “bank stores” • Creates distinct customer experience • Stores serve as community hubs What Makes Umpqua a Different Kind of Bank “Flagship” Store in San Francisco, CA > Unique and iconic culture > Recognized regionally and nationally as one of the country’s best companies 6

Proven Ability to Grow Organically $0.8 $1.0 $1.8 $2.0 $3.5 $3.9 $5.4 $6.1 $6.1 $6.0 $5.7 $5.9 $6.7 $7.4 $7.4 $0 $2 $4 $6 $8 $10 Non-covered Loans and Leases (Gross) $0.9 $1.1 $1.9 $2.1 $3.3 $3.7 $5.0 $5.5 $5.3 $5.8 $7.2 $7.6 $7.9 $8.1 $8.2 $0 $2 $4 $6 $8 $10 Core Deposits > Continued growth in loans and deposits, expanding market presence • Q1 2014 loan pipeline at almost $2 billion 7

Strong Net Interest Margin Relative to Peers > Umpqua’s net interest margin has performed well versus peers > Significant incremental net interest margin opportunities • Interest rates remain at historically low levels • Re-deployment of excess cash after acquisition • Retirement of higher-cost Sterling funding sources > Source: SNL Financial. > Peers include CATY, BOH, WAFD, SIVB, CYN, EWBC, and FRC. 5.30% 5.12% 5.38% 4.85% 4.68% 4.84% 4.74% 4.24% 4.07% 4.09% 4.17% 4.19% 4.02% 4.01% 4.23% 4.67% 4.16% 4.58% 4.31% 4.33% 4.62% 4.57% 4.16% 3.78% 3.76% 3.71% 3.69% 3.58% 3.40% 3.27% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% Net Interest Margin UMPQ Peer average 8

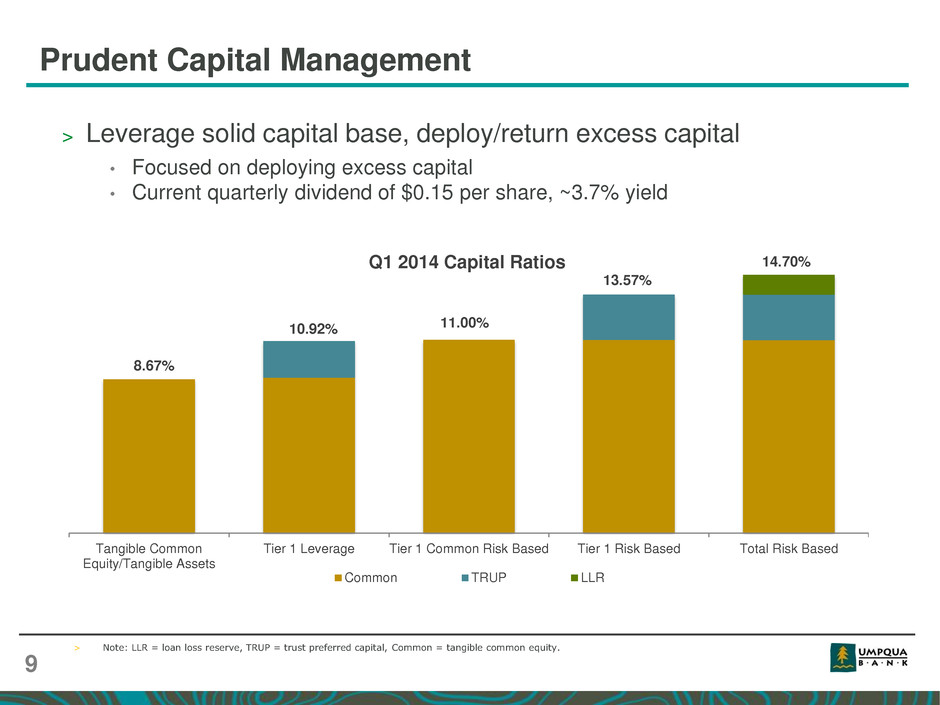

> Leverage solid capital base, deploy/return excess capital • Focused on deploying excess capital • Current quarterly dividend of $0.15 per share, ~3.7% yield Tangible Common Equity/Tangible Assets Tier 1 Leverage Tier 1 Common Risk Based Tier 1 Risk Based Total Risk Based Q1 2014 Capital Ratios Common TRUP LLR 10.92% 11.00% 13.57% 14.70% 8.67% > Note: LLR = loan loss reserve, TRUP = trust preferred capital, Common = tangible common equity. Prudent Capital Management 9

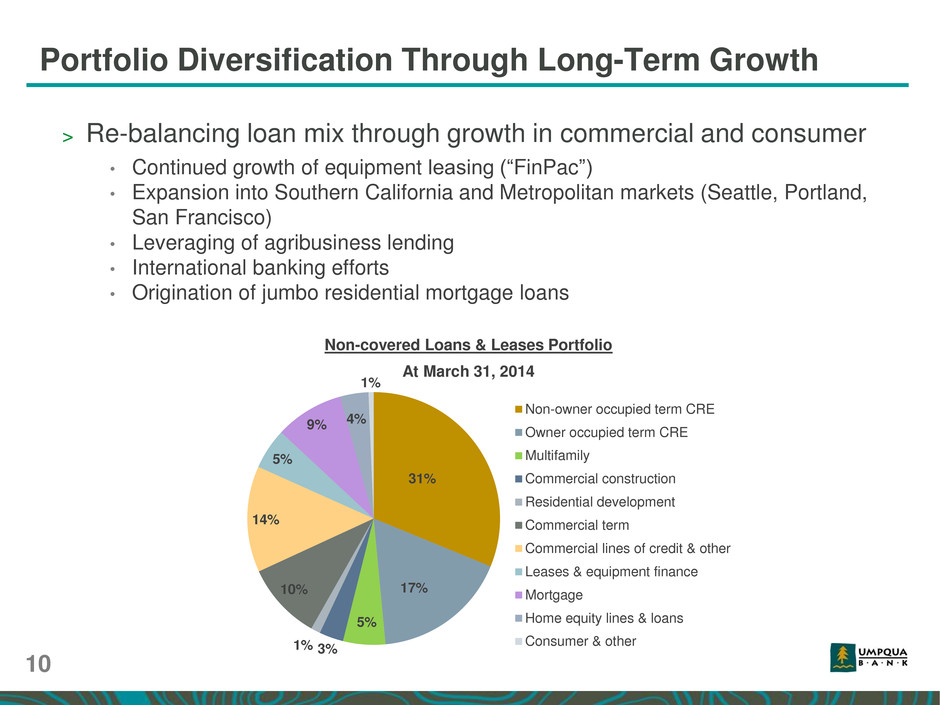

Portfolio Diversification Through Long-Term Growth > Re-balancing loan mix through growth in commercial and consumer • Continued growth of equipment leasing (“FinPac”) • Expansion into Southern California and Metropolitan markets (Seattle, Portland, San Francisco) • Leveraging of agribusiness lending • International banking efforts • Origination of jumbo residential mortgage loans 31% 17% 5% 3% 1% 10% 14% 5% 9% 4% 1% Non-owner occupied term CRE Owner occupied term CRE Multifamily Commercial construction Residential development Commercial term Commercial lines of credit & other Leases & equipment finance Mortgage Home equity lines & loans Consumer & other Non-covered Loans & Leases Portfolio At March 31, 2014 10

Sterling Integration on Target > Go-forward organization and management in place > Core system conversion plans finalized • Developed internal cross-bank transaction platform • System conversions scheduled through Q1 2015 > Signage and branding underway > Policy integration complete > Balance sheet restructuring complete 11

Sterling Integration on Target (cont’d) > Required DOJ related divestiture - June 2014 > Fair value adjustments computed in Q2 2014 • Estimated TBV dilution in line with announcement (~4.5%) > No disruption to planned organic growth expected > Store closure planning underway > Expect to exceed synergy target of $87 million > Operating EPS accretion of at least 12% with target synergy realization 12

Basel III Considerations > Under the final Basel III rules, three primary changes will take place: 1. Capital from TRUPs shifts from Tier 1 to Tier 2 (75% in 2015, 100% in 2016 and beyond) 2. Sterling net operating loss DTA picked up and will be completely excluded from Tier 1 (currently partially included in Tier 1) 3. Increase in risk-weighted assets (RWA), expected to decrease those capital ratios which use RWA by 40-50 bps Excess capital on a pro forma Basel III basis expected to be ~$150 million by early 2015 > Plan to continue to leverage through dividends, share repurchases and acquisitions / organic growth 13

Thank you