Attached files

| file | filename |

|---|---|

| EX-31.2 - GULF RESOURCES, INC. | e612246_ex31-2.htm |

| EX-32.1 - GULF RESOURCES, INC. | e612246_ex32-1.htm |

| EX-31.1 - GULF RESOURCES, INC. | e612246_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - GULF RESOURCES, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended March 31, 2014

|

|

|

Or

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from _________ to _________

|

Commission File Number: 001-34499

GULF RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-3637458

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Level 11,Vegetable Building, Industrial Park of the East City,

Shouguang City, Shandong,

|

262700

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: +86 (536) 567 0008

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every, Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer (Do not check if a smaller reporting company) o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of May 1, 2014, the registrant had outstanding 38,726,415 shares of common stock.

|

Part I – Financial Information

|

|

|

1

|

|

|

17

|

|

|

29

|

|

|

29

|

|

|

Part II – Other Information

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

31

|

|

|

32

|

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

|

GULF RESOURCES, INC.

|

|

AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

(Expressed in U.S. dollars)

|

|

March 31, 2014

Unaudited

|

December 31, 2013

Audited

|

|||||||

|

Current Assets

|

||||||||

|

Cash

|

$

|

119,263,008

|

$

|

107,828,800

|

||||

|

Accounts receivable

|

41,335,491

|

44,885,354

|

||||||

|

Inventories

|

5,771,440

|

5,301,995

|

||||||

|

Prepayments and deposits

|

31,458

|

4,583

|

||||||

|

Prepaid land leases

|

259,419

|

50,548

|

||||||

|

Deferred tax assets

|

1,642

|

1,657

|

||||||

|

Total Current Assets

|

166,662,458

|

158,072,937

|

||||||

|

Non-Current Assets

|

||||||||

|

Property, plant and equipment, net

|

138,316,103

|

146,400,436

|

||||||

|

Property, plant and equipment under capital leases, net

|

1,597,658

|

1,701,328

|

||||||

|

Prepaid land leases, net of current portion

|

742,781

|

753,928

|

||||||

|

Deferred tax assets

|

2,295,418

|

2,316,176

|

||||||

|

Total non-current assets

|

142,951,960

|

151,171,868

|

||||||

|

Total Assets

|

$

|

309,614,418

|

$

|

309,244,805

|

||||

|

Liabilities and Stockholders’ Equity

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

$

|

6,122,164

|

$

|

5,645,831

|

||||

|

Retention payable

|

207,251

|

209,126

|

||||||

|

Capital lease obligation, current portion

|

252,842

|

202,392

|

||||||

|

Taxes payable

|

3,723,525

|

5,248,486

|

||||||

|

Total Current Liabilities

|

10,305,782

|

11,305,835

|

||||||

|

Non-Current Liabilities

|

||||||||

|

Capital lease obligation, net of current portion

|

2,917,494

|

2,943,878

|

||||||

|

Total Liabilities

|

$

|

13,223,276

|

$

|

14,249,713

|

||||

|

|

||||||||

|

Stockholders’ Equity

|

||||||||

|

PREFERRED STOCK; $0.001 par value; 1,000,000 shares authorized; none outstanding

|

$

|

$

|

||||||

|

COMMON STOCK; $0.0005 par value; 80,000,000 shares authorized; 38,911,014 and 38,765,201 shares issued; and 38,726,415 and 38,580,602 shares outstanding as of March 31, 2014 and December 31, 2013, respectively

|

19,456

|

19,383

|

||||||

|

Treasury stock; 184,599 shares as of March 31, 2014 and December 31, 2013 at cost

|

(500,000

|

)

|

(500,000

|

)

|

||||

|

Additional paid-in capital

|

80,047,808

|

80,033,981

|

||||||

|

Retained earnings unappropriated

|

170,582,681

|

166,421,427

|

||||||

|

Retained earnings appropriated

|

17,390,656

|

17,265,572

|

||||||

|

Cumulative translation adjustment

|

28,850,541

|

31,754,729

|

||||||

|

Total Stockholders’ Equity

|

296,391,142

|

294,995,092

|

||||||

|

Total Liabilities and Stockholders’ Equity

|

$

|

309,614,418

|

$

|

309,244,805

|

||||

See accompanying notes to the condensed consolidated financial statements.

GULF RESOURCES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Expressed in U.S. dollars)

(UNAUDITED)

|

Three-Month Period Ended

March 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

NET REVENUE

|

||||||||

|

Net revenue

|

$

|

25,592,176

|

$

|

22,502,580

|

||||

|

OPERATING EXPENSES/INCOME

|

||||||||

|

Cost of net revenue

|

(18,734,404

|

)

|

(17,985,472

|

)

|

||||

|

Sales, marketing and other operating expenses

|

(22,514

|

)

|

(20,303

|

)

|

||||

|

Research and development cost

|

(30,780

|

)

|

(17,702

|

)

|

||||

|

General and administrative expenses

|

(1,320,518

|

)

|

(1,969,217

|

)

|

||||

|

Other operating income

|

117,684

|

95,562

|

||||||

|

(19,990,532

|

)

|

(19,897,132

|

)

|

|||||

|

INCOME FROM OPERATIONS

|

5,601,644

|

2,605,448

|

||||||

|

OTHER INCOME (EXPENSE)

|

||||||||

|

Interest expense

|

(52,712

|

)

|

(53,006

|

)

|

||||

|

Interest income

|

106,475

|

72,843

|

||||||

|

INCOME BEFORE TAXES

|

5,655,407

|

2,625,285

|

||||||

|

INCOME TAXES

|

(1,369,069

|

)

|

(742,320

|

)

|

||||

|

NET INCOME

|

$

|

4,286,338

|

$

|

1,882,965

|

||||

|

COMPREHENSIVE INCOME:

|

||||||||

|

NET INCOME

|

$

|

4,286,338

|

$

|

1,882,965

|

||||

|

OTHER COMPREHENSIVE INCOME

|

||||||||

|

- Foreign currency translation adjustments

|

(2,904,188

|

)

|

767,766

|

|||||

|

COMPREHENSIVE INCOME

|

$

|

1,382,150

|

$

|

2,650,731

|

||||

|

EARNINGS PER SHARE:

|

||||||||

|

BASIC

|

$

|

0.11

|

$

|

0.05

|

||||

|

DILUTED

|

$

|

0.11

|

$

|

0.05

|

||||

|

WEIGHTED AVERAGE NUMBER OF SHARES:

|

||||||||

|

BASIC

|

38,598,424

|

38,367,471

|

||||||

|

DILUTED

|

39,277,957

|

38,500,958

|

||||||

See accompanying notes to the condensed consolidated financial statements.

|

GULF RESOURCES, INC.

|

|

AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

|

|

THREE-MONTH PERIOD ENDED MARCH 31, 2014

|

|

(Expressed in U.S. dollars)

|

|

Common stock

|

||||||||||||||||||||||||||||||||||||||||

|

Number

|

Number

|

Number

|

Additional

|

Statutory

|

Cumulative

|

|||||||||||||||||||||||||||||||||||

|

of shares

|

of shares

|

of treasury

|

Treasury

|

paid-in

|

common

|

Retained

|

translation

|

|||||||||||||||||||||||||||||||||

|

issued

|

outstanding

|

stock

|

Amount

|

stock

|

capital

|

reserve

|

earnings

|

adjustment

|

Total

|

|||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2013 (Audited)

|

38,765,201 | 38,580,602 | 184,599 | 19,383 | (500,000 | ) | 80,033,981 | 17,265,572 | 166,421,427 | 31,754,729 | 294,995,092 | |||||||||||||||||||||||||||||

|

Translation adjustment

|

-

|

- | - |

-

|

-

|

-

|

-

|

(2,904,188 | ) | (2,904,188 | ) | |||||||||||||||||||||||||||||

|

Common stock issued for cashless exercise of stock options

|

145,813 | 145,813 | - | 73 | (73 | ) | - | - | - | - | ||||||||||||||||||||||||||||||

|

Issuance of stock options to employees

|

- | - | - | - | - | 13,900 | - | - | - | 13,900 | ||||||||||||||||||||||||||||||

|

Net income for three-month period ended March 31, 2014

|

-

|

- | - |

-

|

- |

-

|

-

|

4,286,338 |

-

|

4,286,338 | ||||||||||||||||||||||||||||||

|

Transfer to statutory common reserve fund

|

- | - | - | - | - | - | 125,084 | (125,084 | ) | - | - | |||||||||||||||||||||||||||||

|

BALANCE AT MARCH 31, 2014 (Unaudited)

|

38,911,014 | 38,726,415 | 184,599 | 19,456 | (500,000 | ) | 80,047,808 | 17,390,656 | 170,582,681 | 28,850,541 | 296,391,142 | |||||||||||||||||||||||||||||

See accompanying notes to the condensed consolidated financial statements.

|

GULF RESOURCES, INC.

|

|

AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(Expressed in U.S. dollars)

|

|

(UNAUDITED)

|

|

Three-Month Period Ended March 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

|

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

||||||

|

Net income

|

$

|

4,286,338

|

$

|

1,882,965

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Interest on capital lease obligation

|

52,554

|

52,790

|

||||||

|

Amortization of prepaid land leases

|

104,972

|

98,215

|

||||||

|

Depreciation and amortization

|

6,938,240

|

6,807,488

|

||||||

|

Unrealized exchange (gain)/loss on translation of inter-company balances

|

(235,424

|

)

|

65,119

|

|||||

|

Stock-based compensation expense

|

13,900

|

4,900

|

||||||

|

Changes in assets and liabilities:

|

||||||||

|

Accounts receivable

|

3,165,013

|

5,165,084

|

||||||

|

Inventories

|

(519,826

|

)

|

604,499

|

|||||

|

Prepayments and deposits

|

(26,875

|

)

|

(28,125

|

)

|

||||

|

Accounts payable and accrued expenses

|

527,536

|

(584,614

|

)

|

|||||

|

Retention payable

|

-

|

(1,055,005

|

)

|

|||||

|

Taxes payable

|

(1,486,106

|

)

|

334,305

|

|||||

|

Net cash provided by operating activities

|

12,820,322

|

13,347,621

|

||||||

|

CASH FLOWS USED IN INVESTING ACTIVITIES

|

||||||||

|

Additions of prepaid land leases

|

(311,040

|

)

|

(290,017

|

)

|

||||

|

Purchase of property, plant and equipment

|

(39,586

|

)

|

-

|

|||||

|

Net cash used in investing activities

|

(350,626

|

)

|

(290,017

|

)

|

||||

|

EFFECTS OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS

|

(1,035,488

|

)

|

193,013

|

|||||

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

11,434,208

|

13,250,617

|

||||||

|

CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD

|

107,828,800

|

65,241,035

|

||||||

|

CASH AND CASH EQUIVALENTS - END OF PERIOD

|

$

|

119,263,008

|

$

|

78,491,652

|

||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

||||||||

|

Cash paid during the period for:

|

||||||||

|

Income taxes

|

$

|

2,571,399

|

$

|

536,144

|

||||

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING

AND FINANCING ACTIVITIES

|

||||||||

|

Issuance of common stock upon cashless exercise of options

|

$

|

73

|

$

|

-

|

||||

See accompanying notes to the condensed consolidated financial statements.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation and Consolidation

The accompanying condensed financial statements have been prepared by Gulf Resources, Inc. a Delaware corporation and its subsidiaries (collectively, the “Company”), without audit, in accordance with the instructions to Form 10-Q and, therefore, do not necessarily include all information and footnotes necessary for a fair statement of its financial position, results of operations and cash flows in accordance with accounting principles generally accepted in the United States (“US GAAP”).

In the opinion of management, the unaudited financial information for the quarter ended March 31, 2014 presented reflects all adjustments, which are only normal and recurring, necessary for a fair statement of results of operations, financial position and cash flows. These condensed financial statements should be read in conjunction with the financial statements included in the Company’s 2013 Form 10-K. Operating results for the interim periods are not necessarily indicative of operating results for an entire fiscal year.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts that are reported in the financial statements and accompanying disclosures. Although these estimates are based on management’s best knowledge of current events and actions that the Company may undertake in the future, actual results may be different from the estimates. The Company also exercises judgments in the preparation of these condensed financial statements in the areas including classification of leases and related party transactions.

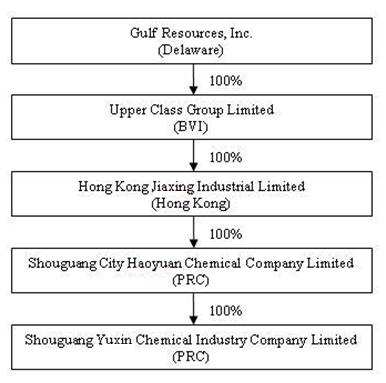

The consolidated financial statements include the accounts of Gulf Resources, Inc. and its wholly-owned subsidiary, Upper Class Group Limited, a company incorporated in the British Virgin Islands, which owns 100% of Hong Kong Jiaxing Industrial Limited, a company incorporated in Hong Kong (“HKJI”). HKJI owns 100% of Shouguang City Haoyuan Chemical Company Limited ("SCHC") which owns 100% of Shouguang Yuxin Chemical Industry Co., Limited (“SYCI”). All material intercompany transactions have been eliminated on consolidation.

(b) Nature of the Business

The Company manufactures and trades bromine and crude salt through its wholly-owned subsidiary, Shouguang City Haoyuan Chemical Company Limited ("SCHC"), and manufactures chemical products for use in the oil industry and paper manufacturing industry through its wholly-owned subsidiary, Shouguang Yuxin Chemical Industry Co., Limited ("SYCI") in The People’s Republic of China (“PRC”).

(c) Allowance for Doubtful Accounts

As of March 31, 2014 and December 31, 2013, allowances for doubtful accounts were nil. No allowances for doubtful accounts were charged to the income statement for the three-month periods ended March 31, 2014 and 2013.

(d) Concentration of Credit Risk

The Company is exposed to credit risk in the normal course of business, primarily related to accounts receivable and cash and cash equivalents. Substantially all of the Company’s cash and cash equivalents are maintained with financial institutions in the PRC, namely, Industrial and Commercial Bank of China Limited and China Merchants Bank Company Limited, which are not insured or otherwise protected. The Company placed $119,263,008 and $107,828,800 with these institutions as of March 31, 2014 and December 31, 2013, respectively. The Company has not experienced any losses in such accounts in the PRC.

Concentrations of credit risk with respect to accounts receivable exists as the Company sells a substantial portion of its products to a limited number of customers. However, such concentrations of credit risks are limited since the Company performs ongoing credit evaluations of its customers’ financial condition. About 68% and 74% of the balance of accounts receivable as of March 31, 2014 and December 31, 2013, respectively, are outstanding for less than three months. For the balances of accounts receivable aged more than 90 days as of March 31, 2014, about 68% were settled in April 2014.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

(e) Property, Plant and Equipment

Property, plant and equipment are stated at cost less accumulated depreciation and any impairment losses. Expenditures for new facilities or equipment, and major expenditures for betterment of existing facilities or equipment are capitalized and depreciated using the straight-line method at rates sufficient to depreciate such costs over the estimated productive lives. All other ordinary repair and maintenance costs are expensed as incurred.

Mineral rights are recorded at cost less accumulated depreciation and any impairment losses. Mineral rights are amortized ratably over the term of the lease, or the equivalent term under the units of production method, whichever is shorter.

Construction in progress primarily represents direct costs of construction of plant, machinery and equipment. Costs incurred are capitalized and transferred to property and equipment upon completion, at which time depreciation commences.

The Company’s depreciation and amortization policies on property, plant and equipment, other than mineral rights and construction in progress, are as follows:

|

Useful life

(in years)

|

||

|

Buildings (including salt pans)

|

8 - 20

|

|

|

Plant and machinery (including protective shells, transmission channels and ducts)

|

5 - 8

|

|

|

Motor vehicles

|

5

|

|

|

Furniture, fixtures and equipment

|

8

|

Property, plant and equipment under capital leases are depreciated over their expected useful lives on the same basis as owned assets, or where shorter, the term of the lease, which is 20 years.

(f) Retirement Benefits

Pursuant to the relevant laws and regulations in the PRC, the Company participates in a defined contribution retirement plan for its employees arranged by a governmental organization. The Company makes contributions to the retirement scheme at the applicable rate based on the employees’ salaries. The required contributions under the retirement plans are charged to the consolidated income statement on an accrual basis when they are due. The Company’s contributions totaled $125,301 and $119,755 for the three-month periods ended March 31, 2014 and 2013, respectively.

(g) Revenue Recognition

The Company recognizes revenue, net of value-added tax, when persuasive evidence of an arrangement exists, delivery of the goods has occurred, customer acceptance has been obtained, which means the significant risks and ownership have been transferred to the customer, the price is fixed or determinable and collectability is reasonably assured.

(h) Recoverability of Long-lived Assets

In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 360-10-35 “Impairment or Disposal of Long-lived Assets” , long-lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable or that the useful lives of those assets are no longer appropriate. The Company evaluates at each balance sheet date whether events and circumstances have occurred that indicate possible impairment.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

(h) Recoverability of Long-lived Assets – Continued

The Company determines the existence of such impairment by measuring the expected future cash flows (undiscounted and without interest charges) and comparing such amount to the carrying amount of the assets. An impairment loss, if one exists, is then measured as the amount by which the carrying amount of the asset exceeds the discounted estimated future cash flows. Assets to be disposed of are reported at the lower of the carrying amount or fair value of such assets less costs to sell. Asset impairment charges are recorded to reduce the carrying amount of the long-lived asset that will be sold or disposed of to their estimated fair values. Charges for the asset impairment reduce the carrying amount of the long-lived assets to their estimated salvage value in connection with the decision to dispose of such assets.

For the three-month period ended March 31, 2014 and 2013, the Company determined that there are no events or circumstances indicating possible impairment of its long-lived assets.

(i) Basic and Diluted Net Income per Share of Common Stock

Basic earnings per common share are based on the weighted average number of shares outstanding during the periods presented. Diluted earnings per share are computed using weighted average number of common shares plus dilutive common share equivalents outstanding during the period. Anti-dilutive common stock equivalents which were excluded from the calculation of number of dilutive common stock equivalents amounted to 1,593,686 and 5,096,075 shares for the three-month periods ended March 31, 2014 and 2013, respectively.

The following table sets forth the computation of basic and diluted earnings per share:

|

Three-Month Period Ended

March 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Numerator

|

||||||||

|

Net income

|

$

|

4,286,338

|

$

|

1,882,965

|

||||

|

Denominator

|

||||||||

|

Basic: Weighted-average common shares outstanding during the period

|

38,598,424

|

38,367,471

|

||||||

|

Add: Dilutive effect of stock options

|

679,533

|

133,487

|

||||||

|

Diluted

|

39,277,957

|

38,500,958

|

||||||

|

Net income per share

|

||||||||

|

Basic

|

$

|

0.11

|

$

|

0.05

|

||||

|

Diluted

|

$

|

0.11

|

$

|

0.05

|

||||

(j) Reporting Currency and Translation

The financial statements of the Company’s foreign subsidiaries are measured using the local currency, Renminbi (“RMB”), as the functional currency; whereas the functional currency and reporting currency of the Company is the United States dollar (“USD” or “$”).

As such, the Company uses the “current rate method” to translate its PRC operations from RMB into USD, as required under ASC 830 “Foreign Currency Matters”. The assets and liabilities of its PRC operations are translated into USD using the rate of exchange prevailing at the balance sheet date. The capital accounts are translated at the historical rate. Adjustments resulting from the translation of the balance sheets of the Company’s PRC subsidiaries are recorded in stockholders’ equity as part of accumulated comprehensive income. The statement of income and comprehensive income is translated at average rates during the reporting period. Gains or losses resulting from transactions in currencies other than the functional currencies are recognized in net income for the reporting periods as part of general and administrative expense. The statement of cash flows is translated at average rates during the reporting period, with the exception of issuance of shares and payment of dividends which are translated at historical rates.

(k) Foreign Operations

All of the Company’s operations and assets are located in PRC. The Company may be adversely affected by possible political or economic events in this country. The effect of these factors cannot be accurately predicted.

(l) New Accounting Pronouncements

No accounting standards and guidance with an effective date during the three-month period ended March 31, 2014 or issued during 2014 had or are expected to have a significant impact on the Company’s condensed consolidated financial statements.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 2 – ASSETS ACQUISITIONS

On November 26, 2012, the Company acquired substantially all of the assets owned by Chengyong Zhao in Guantai Village located Shouguang City Yangkou Township area (the “Chengyong Zhao Property” or “Factory No. 11”). The Chengyong Zhao Property includes a 20-year land lease covering approximately 1,727 acres of real property, with the related production facility, wells, pipelines, other production equipment, and the buildings located on the property. The total purchase price for the acquired assets was RMB 62 million (approximately $9.80 million), consisting of RMB 31 million (approximately $4.93million) in cash and 3,806,728 shares of the Company’s Common Stock valued at approximately $4.87 million (fair value). The production line of Factory No. 11 was resumed in March 2013 after certain repair and adjustments.

The bromine factory acquisition described above was not in operation when the Company acquired the factory. Production at the factory acquired had previously been halted by the government since the owners of the bromine factory did not hold the proper license for the exploration and production of bromine. The factory described above had not been in operation for more than six months at the time of the acquisitions. The Company recorded the above transaction as purchase of assets.

NOTE 3 – INVENTORIES

Inventories consist of:

|

March 31,

2014

|

December 31,

2013

|

|||||||

|

Raw materials

|

$

|

749,034

|

$

|

651,810

|

||||

|

Finished goods

|

5,028,976

|

4,656,814

|

||||||

|

Allowance for obsolete and slow-moving inventory

|

(6,570

|

)

|

(6,629

|

)

|

||||

|

$

|

5,771,440

|

$

|

5,301,995

|

|||||

NOTE 4 – PREPAID LAND LEASES

The Company prepaid for land leases with lease terms for periods ranging from one to fifty years to use the land on which the office premises, production facilities and warehouses of the Company are situated. The prepaid land lease is amortized on a straight line basis.

During the three-month periods ended March 31, 2014 and 2013, amortization of prepaid land lease totaled $104,972 and $98,215, respectively, which were recorded as cost of net revenue.

The Company has the rights to use certain parcels of land located in Shouguang, the PRC, through lease agreements signed with local townships. Such parcels of land are collectively owned by local townships and accordingly, the Company could not obtain land use rights certificates on these parcels of land. The parcels of land of which the Company could not obtain land use rights certificates covers a total of approximately 59.39 square kilometers of aggregate carrying value of $959,869 and approximately 59.39 square kilometers of aggregate carrying value of $761,496 as at March 31, 2014 and December 31, 2013, respectively.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 5 – PROPERTY, PLANT AND EQUIPMENT, NET

Property, plant and equipment, net consist of the following:

|

March 31,

2014

|

December 31,

2013

|

|||||||

|

At cost:

|

||||||||

|

Mineral rights

|

$

|

6,471,632

|

$

|

6,530,158

|

||||

|

Buildings

|

52,865,338

|

53,343,419

|

||||||

|

Plant and machinery

|

171,332,909

|

172,842,611

|

||||||

|

Motor vehicles

|

9,339

|

9,423

|

||||||

|

Furniture, fixtures and office equipment

|

4,858,688

|

4,902,627

|

||||||

|

Total

|

235,537,906

|

237,628,238

|

||||||

|

Less: Accumulated depreciation and amortization

|

(97,221,803

|

)

|

(91,227,802

|

)

|

||||

|

Net book value

|

$

|

138,316,103

|

$

|

146,400,436

|

||||

The Company has certain buildings and salt pans erected on parcels of land located in Shouguang, PRC, and such parcels of land are collectively owned by local townships. The Company has not been able to obtain property ownership certificates over these buildings and salt pans as the Company could not obtain land use rights certificates on the underlying parcels of land. The aggregate carrying values of these properties situated on parcels of the land are $38,662,731 and $39,565,302 as at March 31, 2014 and December 31, 2013, respectively.

During the three-month period ended March 31, 2014, depreciation and amortization expense totaled $6,849,327, of which $6,527,898 and $321,430 were recorded as cost of net revenue and administrative expenses, respectively. During the three-month period ended March 31, 2013, depreciation and amortization expense totaled $6,720,849, of which $6,232,602 and $488,247 were recorded as cost of net revenue and administrative expenses, respectively.

NOTE 6 – PROPERTY, PLANT AND EQUIPMENT UNDER CAPITAL LEASES, NET

Property, plant and equipment under capital leases, net consist of the following:

|

March 31,

2014

|

December 31,

2013

|

|||||||

|

At cost:

|

||||||||

|

Buildings

|

$

|

133,766

|

$

|

134,975

|

||||

|

Plant and machinery

|

2,514,394

|

2,537,133

|

||||||

|

Total

|

2,648,160

|

2,672,108

|

||||||

|

Less: Accumulated depreciation and amortization

|

(1,050,502

|

)

|

(970,780

|

)

|

||||

|

Net book value

|

$

|

1,597,658

|

$

|

1,701,328

|

||||

The above buildings erected on parcels of land located in Shouguang, PRC, are collectively owned by local townships. The Company has not been able to obtain property ownership certificates over these buildings as the Company could not obtain land use rights certificates on the underlying parcels of land.

During the three-month period ended March 31, 2014, depreciation and amortization expense totaled $88,912, which was recorded as cost of net revenue. During the three-month period ended March 31, 2013, depreciation and amortization expense totaled $86,639, which was recorded as cost of net revenue.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 7 – ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consist of the following:

|

March 31,

|

December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

Accounts payable

|

$

|

4,405,459

|

$

|

3,998,660

|

||||

|

Salary payable

|

211,559

|

212,138

|

||||||

|

Social security insurance contribution payable

|

56,663

|

57,674

|

||||||

|

Price adjustment funds

|

1,020,919

|

861,071

|

||||||

|

Other payables

|

427,564

|

516,288

|

||||||

|

Total

|

$

|

6,122,164

|

$

|

5,645,831

|

||||

NOTE 8 – RELATED PARTY TRANSACTIONS

During the three-month period ended March 31, 2014, the Company borrowed a sum of $99,974, and fully repaid later during the same period, from Jiaxing Lighting Appliance Company Limited (Jiaxing Lighting”), in which Mr. Ming Yang, a shareholder and the Chairman of the Company, had a 100% equity interest in Jiaxing Lighting. The amounts due to Jiaxing Lighting were unsecured, interest free and repayable on demand.

On September 25, 2012, the Company purchased five stories of a commercial building in the PRC, through SYCI, from Shandong Shouguang Vegetable Seed Industry Group Co., Ltd. (the “Seller”) at a cost of approximately $5.7 million in cash, of which Mr. Ming Yang, the Chairman of the Company, had a 99% equity interest in the Seller. The cost of the five stories of the commercial building was valued by an independent appraiser on September 17, 2012 to its fair value and recorded as property, plant and equipment. The Company commenced using the property as the new headquarters for the office in early January, 2013. During the fiscal year 2013, the Company entered into an agreement with the Seller to provide property management services for an annual amount of approximately $100,704 for five years from January 1, 2013 to December 31, 2017. The expense associated with this agreement for the three months ended March 31, 2014 and 2013 was approximately $25,500.

NOTE 9 – TAXES PAYABLE

|

Taxes payable consists of the following:

|

|

March 31,

|

December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

Income tax payable

|

$

|

1,433,680

|

$

|

2,653,168

|

||||

|

Mineral resource compensation fee payable

|

249,537

|

300,856

|

||||||

|

Value added tax payable

|

913,533

|

1,079,143

|

||||||

|

Land use tax payable

|

944,432

|

952,972

|

||||||

|

Other tax payables

|

182,343

|

262,347

|

||||||

|

Total

|

$

|

3,723,525

|

$

|

5,248,486

|

||||

NOTE 10 – CAPITAL LEASE OBLIGATIONS

The components of capital lease obligations are as follows:

|

Imputed

|

March 31,

|

December 31,

|

|||||||

|

Interest rate

|

2014

|

2013

|

|||||||

|

Total capital lease obligations

|

6.7%

|

$

|

3,170,336

|

$

|

3,146,270

|

||||

|

Less: Current portion

|

(252,842

|

)

|

(202,392

|

)

|

|||||

|

Capital lease obligations, net of current portion

|

$

|

2,917,494

|

$

|

2,943,878

|

|||||

Interest expenses from capital lease obligations amounted to $52,554 and $52,790 for the three-month periods ended March 31, 2014 and 2013, respectively, were charged to the income statements. See Note 19 for future minimum lease payments disclosure.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 11 –EQUITY

|

(a)

|

Authorized shares

|

During the annual general meeting held on June 18, 2013, the shareholders of the Company approved the amendment to the Certificate of Incorporation to decrease the number of the authorized shares of the Company’s comment stocks to 80,000,000. The Company has completed the filing of the amendment and restatement of the Certificate of Incorporation with the Secretary of the State of Delaware to decrease the number of authorized shares of the Company’s common stock and accordingly 80,000,000 is disclosed as the authorized shares of the Company’s common stock in the consolidated balance sheets as of March 31, 2014 and December 31, 2013.

|

(b)

|

Retained Earnings - Appropriated

|

In accordance with the relevant PRC regulations and the PRC subsidiaries’ Articles of Association, the Company’s PRC subsidiaries are required to allocate its profit after tax to the following reserve:

Statutory Common Reserve Funds

SCHC and SYCI are required each year to transfer at least 10% of the profit after tax as reported under the PRC statutory financial statements to the Statutory Common Reserve Funds until the balance reaches 50% of the registered share capital. This reserve can be used to make up any loss incurred or to increase share capital. Except for the reduction of losses incurred, any other application should not result in this reserve balance falling below 25% of the registered capital. The Statutory Common Reserve Fund as of March 31, 2014 for SCHC and SYCI is 37% and 50% of its registered capital respectively.

NOTE 12 – STOCK-BASED COMPENSATION

Pursuant to the Company’s Amended and Restated 2007 Equity Incentive Plan, the aggregate number shares of the Company’s common stock available for grant of stock options and issuance is 4,341,989 shares.

The fair value of each option award below is estimated on the date of grant using the Black-Scholes option-pricing model. The risk free rate is based on the yield-to-maturity in continuous compounding of the US Government Bonds with the time-to-maturity similar to the expected tenor of the option granted, volatility is based on the annualized historical stock price volatility of the Company, and the expected life is based on the estimated average of the life of options using the “simplified” method, as prescribed in FASB ASC 718, due to insufficient historical exercise activity during recent years as a basis from which to estimate future exercise patterns.

In early March 2014, the Company granted to an independent director an option to purchase 12,500 shares of the Company’s common stock at an exercise price of $2.55 per share and the options vested immediately. The options were valued at $10,200 fair value, with assumed 67.14% volatility, a three-year expiration term with expected tenor of 1.49 years, a risk free rate of 0.21% and no dividend yield. For the three-month period ended March 31, 2014, $10,200 was recognized as general and administrative expenses.

During the three-month period ended March 31, 2014, 145,813 shares of common stock were issued upon cashless exercise of 223,000 options.

The following table summarizes all Company stock option transactions between January 1, 2014 and March 31, 2014.

|

Number of Option

and Warrants

Outstanding and exercisable

|

Weighted- Average Exercise price of Option

and Warrants

|

Range of

Exercise Price per Common Share

|

||||||

|

Balance, January 1, 2014

|

2,470,971

|

$3.36

|

$0.95 - $12.60

|

|||||

|

Granted and vested during the year

ended March 31, 2014

|

12,500

|

$2.55

|

$ $2.55

|

|||||

|

Exercised during the year ended

March 31, 2014

|

(223,000

|

)

|

$0.95

|

$0.95

|

||||

|

Expired during the

year ended March 31, 2014

|

(37,500

|

)

|

$11.05

|

$9.16-12.00

|

||||

|

Balance, March, 2014

|

2,222,971

|

$3.45

|

$0.95 - $12.60

|

|

Stock and Warrants Options Exercisable and Outstanding

|

|||||||

|

Weighted Average

|

|||||||

|

Remaining

|

|||||||

|

Outstanding at March 31, 2014

|

Range of Exercise Prices

|

Contractual Life (Years)

|

|||||

|

Exercisable and outstanding

|

2,222,971

|

$0.95 - $12.60

|

1.92

|

||||

The aggregate intrinsic value of options outstanding and exercisable as of March 31, 2014 was $1,614,862.

The total intrinsic value of options exercised was $67,274 and $0 for the three-month periods ended March 31, 2014 and 2013.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 13 – INCOME TAXES

The Company utilizes the asset and liability method of accounting for income taxes in accordance with FASB ASC 740-10.

(a) United States

Gulf Resources, Inc. is subject to the United States of America Tax law at tax rate of 34%. No provision for the US federal income taxes has been made as the Company had no US taxable income for the three-month periods ended March 31, 2014 and 2013, and management believes that its earnings are permanently invested in the PRC.

(b) BVI

Upper Class Group Limited, a subsidiary of Gulf Resources, Inc., was incorporated in the BVI and, under the current laws of the BVI, it is not subject to tax on income or capital gain in the BVI. Upper Class Group Limited did not generate assessable profit for the three-month periods ended March 31, 2014 and 2013.

(c) Hong Kong

Hong Kong Jiaxing Industrial Limited, a subsidiary of Upper Class Group Limited, was incorporated in Hong Kong and is subject to Hong Kong profits tax. The Company is subject to Hong Kong taxation on its activities conducted in Hong Kong and income arising in or derived from Hong Kong. No provision for profits tax has been made as the Company has no assessable income for the three-month periods ended March 31, 2014 and 2013. The applicable statutory tax rates for the three-month periods ended March 31, 2014 and 2013 are 16.5%.

(d) PRC

Enterprise income tax (“EIT”) for SCHC and SYCI in the PRC is charged at 25% of the assessable profits.

The operating subsidiaries SCHC and SYCI are wholly foreign-owned enterprises (“FIE”) incorporated in the PRC and are subject to PRC Foreign Enterprise Income Tax Law.

On February 22, 2008, the Ministry of Finance (“MOF”) and the State Administration of Taxation (“SAT”) jointly issued Cai Shui [2008] Circular 1 (“Circular 1”). According to Article 4 of Circular 1, distributions of accumulated profits earned by a FIE prior to January 1, 2008 to foreign investor(s) in 2008 will be exempted from withholding tax (“WHT”) while distribution of the profit earned by an FIE after January 1, 2008 to its foreign investor(s) shall be subject to WHT at 5% effective tax rate.

As of March 31, 2014 and December 31, 2013, the accumulated distributable earnings under the Generally Accepted Accounting Principles (GAAP”) of PRC are $226,944,177 and $225,003,631, respectively. Since the Company intends to reinvest its earnings to further expand its businesses in mainland China, its foreign invested enterprises do not intend to declare dividends to their immediate foreign holding companies in the foreseeable future. Accordingly, as of March 31, 2014 and December 31, 2013, the Company has not recorded any WHT on the cumulative amount of distributable retained earnings of its foreign invested enterprises in China. As of March 31, 2014 and December 31, 2013, the unrecognized WHT are $10,240,095 and $10,133,056, respectively.

The Company’s tax returns are subject to the various tax authorities’ examination. The federal, state and local authorities of the United States may examine the Company’s tax returns filed in the United States for three years from the date of filing. The Company’s US tax returns since 2010 are currently subject to examination. Inland Revenue Department of Hong Kong may examine the Company’s tax returns filed in Hong Kong for seven years from date of filing. The Company’s Hong Kong tax returns since incorporation in year 2007 are currently subject to examination. The tax authorities of the PRC may examine the Company’s PRC tax returns for three years from the date of filing. The Company’s PRC tax returns since 2010 are currently subject to examination.

The components of the provision for income taxes from continuing operations are:

|

Three-Month Period Ended March 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Current taxes – PRC

|

$

|

1,369,069

|

$

|

742,320

|

||||

|

Deferred taxes – PRC

|

-

|

-

|

||||||

|

$

|

1,369,069

|

$

|

742,320

|

|||||

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 13 – INCOME TAXES – Continued

The effective income tax expenses differ from the PRC statutory income tax rate of 25% from continuing operations in the PRC as follows:

|

Three-Month Period Ended March 31,

|

||||||||

|

Reconciliations

|

2014

|

2013

|

||||||

|

Statutory income tax rate

|

25

|

%

|

25

|

%

|

||||

|

US federal net operating loss

|

-

|

3

|

%

|

|||||

|

Non-taxable item

|

(1

|

%)

|

-

|

|||||

|

Effective tax rate

|

24

|

%

|

28

|

%

|

||||

Significant components of the Company’s deferred tax assets and liabilities at March 31, 2014 and December 30, 2013 are as follows:

|

March 31,

|

December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

Deferred tax liabilities

|

$

|

-

|

$

|

-

|

||||

|

Deferred tax assets:

|

||||||||

|

Allowance for obsolete and slow-moving inventories

|

$

|

1,642

|

$

|

1,657

|

||||

|

Impairment on property, plant and equipment

|

474,857

|

479,151

|

||||||

|

Exploration costs

|

1,820,561

|

1,837,025

|

||||||

|

Compensation costs of unexercised stock options

|

1,799,910

|

2,053,310

|

||||||

|

US federal net operating loss

|

9,546,338

|

9,272,734

|

||||||

|

Total deferred tax assets

|

13,643,308

|

13,643,877

|

||||||

|

Valuation allowance

|

(11,346,248

|

)

|

(11,326,044

|

)

|

||||

|

Net deferred tax asset

|

$

|

2,297,060

|

$

|

2,317,833

|

||||

|

Current deferred tax asset

|

$

|

1,642

|

$

|

1,657

|

||||

|

Long-term deferred tax asset

|

$

|

2,295,418

|

$

|

2,316,176

|

||||

The increase in valuation allowance for each of the three-month periods ended March 31, 2014 and 2013 is $20,204 and $99,385, respectively.

There were no unrecognized tax benefits and accrual for uncertain tax positions as of March 31, 2014 and December 31, 2013.

NOTE 14 – BUSINESS SEGMENTS

The Company has three reportable segments: bromine, crude salt and chemical products. The reportable segments are consistent with how management views the markets served by the Company and the financial information that is reviewed by its chief operating decision maker.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 14 – BUSINESS SEGMENTS – Continued

An operating segment’s performance is primarily evaluated based on segment operating income, which excludes share-based compensation expense, certain corporate costs and other income not associated with the operations of the segment. These corporate costs (income) are separately stated below and also include costs that are related to functional areas such as accounting, treasury, information technology, legal, human resources, and internal audit. The Company believes that segment operating income, as defined above, is an appropriate measure for evaluating the operating performance of its segments. All the customers are located in PRC.

|

Three-Month Period Ended March 31, 2014

|

Bromine *

|

Crude

Salt *

|

Chemical

Products

|

Segment

Total

|

Corporate

|

Total

|

||||||||||||||||||

|

Net revenue

(external customers)

|

$

|

11,761,916

|

$

|

2,441,895

|

$

|

11,388,365

|

$

|

25,592,179

|

$

|

-

|

$

|

22,592,176

|

||||||||||||

|

Net revenue

(intersegment)

|

783,993

|

-

|

-

|

783,993

|

-

|

783,993

|

||||||||||||||||||

|

Income (loss) from operations before taxes

|

1,018,271

|

643,308

|

3,769,733

|

5,431,312

|

170,332

|

5,601,644

|

||||||||||||||||||

|

Income taxes

|

364,585

|

55,240

|

949,244

|

1,369,069

|

-

|

1,369,069

|

||||||||||||||||||

|

Income (loss) from operations after taxes

|

653,687

|

588,067

|

2,820,489

|

4,062,243

|

170,322

|

4,232,575

|

||||||||||||||||||

|

Total assets

|

187,576,805

|

53,277,324

|

68,675,614

|

309,529,743

|

84,675

|

309,614,418

|

||||||||||||||||||

|

Depreciation and amortization

|

4,550,142

|

1,494,758

|

893,340

|

6,938,240

|

-

|

6,938,240

|

||||||||||||||||||

|

Capital expenditures

|

34,378

|

5,208

|

-

|

39,586

|

-

|

39,586

|

||||||||||||||||||

|

Write-off / Impairment

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

Three-Month Period Ended March 31, 2013

|

Bromine *

|

Crude

Salt *

|

Chemical

Products

|

Segment

Total

|

Corporate

|

Total

|

||||||||||||||||||

|

Net revenue

(external customers)

|

$

|

11,734,367

|

$

|

2,450,786

|

$

|

8,317,427

|

$

|

22,502,580

|

$

|

-

|

$

|

22,502,580

|

||||||||||||

|

Net revenue

(intersegment)

|

614,730

|

-

|

-

|

614,730

|

-

|

614,730

|

||||||||||||||||||

|

Income (loss) from operations before taxes

|

327,813

|

538,220

|

2,096,679

|

2,962,712

|

(357,264

|

)

|

2,605,448

|

|||||||||||||||||

|

Income taxes

|

180,632

|

33,266

|

528,422

|

742,320

|

-

|

742,320

|

||||||||||||||||||

|

Income (loss) from operations after taxes

|

147,181

|

504,954

|

1,568,257

|

2,220,392

|

(357,264

|

)

|

1,863,128

|

|||||||||||||||||

|

Total assets

|

166,871,312

|

56,641,404

|

55,994,831

|

279,507,547

|

121,682

|

279,629,229

|

||||||||||||||||||

|

Depreciation and amortization

|

4,377,972

|

1,559,199

|

870,317

|

6,807,488

|

-

|

6,807,488

|

||||||||||||||||||

|

Capital expenditures

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

Write-off / Impairment

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||

* Certain common production overheads, operating and administrative expenses and asset items (mainly cash and certain office equipment) of bromine and crude salt segments in SCHC were split by reference to the average selling price and production volume of respective segment.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 14 – BUSINESS SEGMENTS – Continued

|

Three-Month Period Ended March 31,

|

||||||||

|

Reconciliations

|

2014

|

2013

|

||||||

|

Total segment operating income

|

$

|

5,431,312

|

$

|

2,962,712

|

||||

|

Corporate costs

|

(65,092

|

)

|

(292,145

|

)

|

||||

|

Unrealized gain(loss) on translation of intercompany balance

|

235,424

|

(65,119

|

)

|

|||||

|

Income from operations

|

5,601,644

|

2,605,448

|

||||||

|

Other income

|

53,763

|

19,837

|

||||||

|

Income before taxes

|

$

|

5,655,407

|

$

|

2,625,285

|

||||

The following table shows the major customer(s) (10% or more) for the three-month period ended March 31, 2014.

|

Number

|

Customer

|

Bromine

(000’s)

|

Crude Salt

(000’s)

|

Chemical Products

(000’s)

|

Total

Revenue

(000’s)

|

Percentage of

Total

Revenue (%)

|

|||||

|

1

|

Shandong Morui Chemical Company Limited

|

$ 1,582

|

$ 571

|

$ 1,386

|

$ 3,539

|

13.4%

|

|||||

|

TOTAL

|

$ 1,582

|

$ 571

|

$ 1,386

|

$ 3,539

|

13.4%

|

The following table shows the major customer(s) (10% or more) for the three-month period ended March 31, 2013.

|

Number

|

Customer

|

Bromine

(000’s)

|

Crude Salt

(000’s)

|

Chemical Products

(000’s)

|

Total

Revenue

(000’s)

|

Percentage of

Total

Revenue (%)

|

|||||

|

1

|

Shandong Morui Chemical Company Limited

|

$ 1,182

|

$ 743

|

$ 930

|

$ 2,855

|

12.7%

|

|||||

|

TOTAL

|

$ 1,182

|

$ 743

|

$ 930

|

$ 2,855

|

12.7%

|

NOTE 15 – MAJOR SUPPLIERS

During the three-month period ended March 31, 2014 and 2013, the Company purchased 89.8% and 83.6% of its raw materials from its top five suppliers, respectively. As of March 31, 2014 and 2013, amounts due to those suppliers included in accounts payable were $3,988,704 and $3,847,225, respectively. This concentration makes the Company vulnerable to a near-term severe impact, should the relationships be terminated.

NOTE 16 – CUSTOMER CONCENTRATION

The Company sells a substantial portion of its products to a limited number of customers. During the three-month periods ended March 31, 2014 and 2013, the Company sold 39.5% and 40.7% of its products to its top five customers, respectively. As of March 31, 2014 and 2013, amounts due from these customers were $19,258,917 and $14,093,381, respectively. This concentration makes the Company vulnerable to a near-term severe impact, should the relationships be terminated.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2014

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 17 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The carrying values of financial instruments, which consist of cash, accounts receivable and accounts payable and other payables, approximate their fair values due to the short-term nature of these instruments. There were no unrecognized financial assets and liabilities as of March 31, 2014 and December 31, 2013.

NOTE 18 – RESEARCH AND DEVELOPMENT EXPENSES

The total research and development expenses recognized in the income statements during the three-month period ended March 31, 2014 was $30,780, of which the consumption of bromine produced by the Company amounted to $8,934. The total research and development expenses recognized in the income statements during the three-month period ended March 31, 2013 was $17,702, of which the consumption of bromine produced by the Company amounted to $6,120.

NOTE 19 – CAPITAL COMMITMENT AND OPERATING LEASE COMMITMENTS

As of March 31, 2014, the Company has leased a real property adjacent to Factory No. 1, with the related production facility, channels and ducts, other production equipment and the buildings located on the property, under capital lease. The future minimum lease payments required under capital lease, together with the present value of such payments, are included in the table show below.

The Company has leased nine pieces of land under non-cancelable operating leases, which are fixed in rentals and expired through December 2021, December 2030, December 2031, December 2032, December 2040, February 2059, August 2059 and June 2060, respectively. The Company accounts for the leases as operating leases.

The Company has no purchase commitment as of March 31, 2014.

The following table sets forth the Company’s contractual obligations as of March 31, 2014:

|

Capital Lease Obligations

|

Operating Lease Obligations

|

Purchase Obligations

|

||||||||||

|

Payable within:

|

||||||||||||

|

the next 12 months

|

$

|

305,106

|

$

|

975,077

|

$

|

101,409

|

||||||

|

the next 13 to 24 months

|

305,106

|

995,265

|

101,409

|

|||||||||

|

the next 25 to 36 months

|

305,106

|

1,016,535

|

101,409

|

|||||||||

|

the next 37 to 48 months

|

305,106

|

1,038,636

|

101,409

|

|||||||||

|

the next 49 to 60 months

|

305,106

|

1,061,919

|

-

|

|||||||||

|

thereafter

|

3,661,276

|

21,454,971

|

-

|

|||||||||

|

Total

|

$

|

5,186,806

|

$

|

26,542,403

|

$

|

405,636

|

||||||

|

Less: Amount representing interest

|

(2,016,470

|

)

|

||||||||||

|

Present value of net minimum lease payments

|

$

|

3,170,336

|

||||||||||

Rental expenses related to operating leases of the Company amounted to $245,250 and $234,319, which were charged to the income statements for the three-month ended March 31, 2014 and 2013, respectively.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Note Regarding Forward-Looking Statements

The discussion below contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. We have used words such as “believes,” “intends,” “anticipates,” “expects” and similar expressions to identify forward-looking statements. These statements are based on information currently available to us and are subject to a number of risks and uncertainties that may cause our actual results of operations, financial condition, cash flows, performance, business prospects and opportunities and the timing of certain events to differ materially from those expressed in, or implied by, these statements. These risks, uncertainties and other factors include, without limitation, those matters discussed in Item 1A of Part I of our 2013 Form 10-K. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or to publicly announce the results of any of the forward-looking statements contained herein to reflect future events, developments, or changed circumstances, or for any other reason. The following discussion should be read in conjunction with our consolidated financial statements and notes thereto appearing in our 2013 Form 10-K and Item 1A, “Risk Factors” for the year ended December 31, 2013.

Overview

Gulf Resources conducts operations through its two wholly-owned China subsidiaries, SCHC and SYCI. Our business is also reported in these three segments, Bromine, Crude Salt, and Chemical Products.

Through SCHC, we produce and sell bromine and crude salt. We are one of the largest producers of bromine in China, as measured by production output. Elemental bromine is used to manufacture a wide variety of brominated compounds used in industry and agriculture. Bromine is commonly used in brominated flame retardants, fumigants, water purification compounds, dyes, medicines, and disinfectants.

Through SYCI, we manufacture and sell chemical products that are used in oil and gas field exploration, oil and gas distribution, oil field drilling, wastewater processing, papermaking chemical agents and inorganic chemicals.

Our Corporate History

We were incorporated in Delaware on February 28, 1989. From November 1993 through August 2006, we were engaged in the business of owning, leasing and operating coin and debit card pay-per copy photocopy machines, fax machines, microfilm reader-printers and accessory equipment under the name “Diversifax, Inc.”. Due to the increased use of internet services, demand for our services declined sharply, and in August 2006, our Board of Directors decided to discontinue our operations.

Upper Class Group Limited, incorporated in the British Virgin Islands in July 2006, acquired all the outstanding stock of SCHC, a company incorporated in Shouguang City, Shandong Province, PRC, in May 2005. At the time of the acquisition, members of the family of Mr. Ming Yang, our president and former chief executive officer, owned approximately 63.20% of the outstanding shares of Upper Class Group Limited. Since the ownership of Upper Class Group Limited and SCHC was then substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Upper Class Group Limited recognized the assets and liabilities transferred at their carrying amounts.

On December 12, 2006, we, then known as Diversifax, Inc., a public “shell” company, acquired Upper Class Group Limited and SCHC. Under the terms of the agreement, the stockholders of Upper Class Group Limited received 13,250,000 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of voting common stock of Gulf Resources, Inc. in exchange for all outstanding shares of Upper Class Group Limited. Members of the Yang family received approximately 62% of our common stock as a result of the acquisition. Under accounting principles generally accepted in the United States, the share exchange is considered to be a capital transaction rather than a business combination. That is, the share exchange is equivalent to the issuance of stock by Upper Class Group Limited for the net assets of Gulf Resources, Inc., accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the share exchange is identical to that resulting from a reverse acquisition, except no goodwill is recorded. Under reverse takeover accounting, the post reverse acquisition comparative historical financial statements of the legal acquirer, Gulf Resources, Inc., are those of the legal acquiree, Upper Class Group Limited. Share and per share amounts stated have been retroactively adjusted to reflect the share exchange. On February 20, 2007, we changed our corporate name to Gulf Resources, Inc.

On February 5, 2007, we acquired SYCI, a company incorporated in PRC, in October 2000. Under the terms of the acquisition agreement, the stockholders of SYCI received a total of 8,094,059 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of common stock of Gulf Resources, Inc. in exchange for all outstanding shares of SYCI's common stock. Simultaneously with the completion of the acquisition, a dividend of $2,550,000 was paid to the former stockholders of SYCI. At the time of the acquisition, approximately 49.1% of the outstanding shares of SYCI were owned by Ms. Yu, Mr. Yang’s wife, and the remaining 50.9% of the outstanding shares of SYCI were owned by SCHC, all of whose outstanding shares were owned by Mr. Yang and his wife. Since the ownership of Gulf Resources, Inc. and SYCI are substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Gulf Resources, Inc. recognized the assets and liabilities of SYCI at their carrying amounts. Share and per share amounts have been retroactively adjusted to reflect the acquisition.

To satisfy certain ministerial requirements necessary to confirm certain government approvals required in connection with the acquisition of SCHC by Upper Class Group Limited, all of the equity interest of SCHC were transferred to a newly formed Hong Kong corporation named Hong Kong Jiaxing Industrial Limited (“Hong Kong Jiaxing”) all of the outstanding shares of which are owned by Upper Class Group Limited. The transfer of all of the equity interest of SCHC to Hong Kong Jiaxing received approval from the local State Administration of Industry and Commerce on December 10, 2007.

As a result of the transactions described above, our corporate structure is linear. That is Gulf Resources owns 100% of the outstanding shares of Upper Class Group Limited, which owns 100% of the outstanding shares of Hong Kong Jiaxing, which owns 100% of the outstanding shares of SCHC, which owns 100% of the outstanding shares of SYCI.

On October 12, 2009 we completed a 1-for-4 reverse stock split of our common stock, such that for each four shares outstanding prior to the stock split there was one share outstanding after the reverse stock split. All shares of common stock referenced in this report have been adjusted to reflect the stock split figures. On October 27, 2009 our shares began trading on the NASDAQ Global Select Market under the ticker symbol “GFRE” and on June 30, 2011 we changed our ticker symbol to “GURE” to better reflection of our corporate name.

Our current corporate structure chart is set forth in the following diagram:

As a result of our acquisitions of SCHC and SYCI, our historical financial statements and the information presented below reflects the accounts of SCHC and SYCI. The following discussion should be read in conjunction with our consolidated financial statements and notes thereto appearing elsewhere in this report.

RESULTS OF OPERATIONS

The following table presents certain information derived from the consolidated statements of operations, cash flows and stockholders’ equity for the three-month periods ended March 31, 2014 and 2013.

Comparison of the Three-Month Periods Ended March 31, 2014 and 2013

|

Three-Month Period

Ended March 31, 2014

|

Three-Month Period

Ended March 31, 2013

|

% Change

|

|||||||||

|

Net revenue

|

$

|

25,592,176

|

$

|

22,502,580

|

|

14

|

%

|

||||

|

Cost of net revenue

|

$

|

(18,734,404

|

)

|

$

|

(17,985,472

|

)

|

|

4

|

%

|

||

|

Gross profit

|

$

|

6,857,772

|

$

|

4,517,108

|

|

52

|

%

|

||||

|

Sales, marketing and other operating expenses

|

$

|

(22,514

|

)

|

$

|

(20,303

|

)

|

11

|

%

|

|||

|

Research and development costs

|

$

|

(30,780

|

)

|

$

|

(17,702

|

)

|

|

74

|

%

|

||

|

General and administrative expenses

|

$

|

(1,320,518

|

)

|

$

|

(1,969,217

|

)

|

(33

|

%)

|

|||

|

Other operating income

|

$

|

117,684

|

$

|

95,562

|

|

23

|

%

|

||||

|

Income from operations

|