Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SPARTON CORP | d722960dex991.htm |

| 8-K - 8-K - SPARTON CORP | d722960d8k.htm |

Third Quarter Financial

Results Conference Call

May 7, 2014

Exhibit 99.2 |

2

Safe Harbor Statement

Safe Harbor Statement

Certain statements herein constitute forward-looking statements within the

meaning of the Securities Act of 1933, as

amended

and

the

Securities

Exchange

Act

of

1934,

as

amended.

When

used

herein,

words

such

as

“believe,”

“expect,”

“anticipate,”

“project,”

“plan,”

“estimate,”

“will”

or “intend”

and similar words or expressions as they relate

to the Company or its management constitute forward-looking statements. These

forward-looking statements reflect our

current

views

with

respect

to

future

events

and

are

based

on

currently

available

financial,

economic

and

competitive data and our current business plans. The Company is under no obligation

to, and expressly disclaims any obligation to, update or alter its

forward-looking statements whether as a result of such changes, new

information, subsequent events or otherwise. Actual results could vary materially

depending on risks and uncertainties that may affect our operations,

markets, prices and other factors. Important factors that could cause actual

results to differ materially from those forward-looking statements include those contained under the heading

of risk factors and in the management’s discussion and analysis contained from

time-to-time in the Company’s filings with the Securities and

Exchange Commission. Adjusted EBITDA and related reconciliation presented

here represents earnings before interest, taxes, depreciation and

amortization as adjusted for restructuring/impairment charges, gross profit effects of capitalized profit in

inventory from acquisition and acquisition contingency settlement, and gain on sale

of investment. The Company believes Adjusted EBITDA is commonly used by

financial analysts and others in the industries in which the Company

operates and, thus, provides useful information to investors. The Company does not intend, nor should

the reader consider, Adjusted EBITDA an alternative to net income, net cash

provided by operating activities or any other items calculated in accordance

with GAAP. The Company's definition of Adjusted EBITDA may not be comparable

with Adjusted EBITDA as defined by other companies. Accordingly, the measurement has limitations

depending on its use. |

3

•

3

Quarter

Highlights

•

3

Quarter

Segmented

Operating

Results

•

Liquidity & Capital Resources

•

Acquisition Update

•

Fiscal 2014 Outlook

•

Investor Activities

•

Q & A

Today’s Agenda

Today’s Agenda

rd

rd |

4

•

Quarterly revenue grew 29% to $84 million as compared to the same

quarter of the prior year

–

Organic growth, net of acquisitions, was 11% from the same quarter of the

prior year.

•

Adjusted EBITDA grew 120% in the quarter and 73% YTD as compared

to the prior year periods

•

20

new

business

programs

awarded

with

potential

annualized

sales

of

$6.1 million

•

Completed the acquisition of Aubrey Group, Inc.

3 Quarter Highlights

3 Quarter Highlights

rd |

5

Consolidated Financial Results

Consolidated Financial Results

Fiscal 2014 YTD

Fiscal 2014 YTD

(Adjusted)

2014

2013

2014

2013

Net Sales

$ 242,691

$ 183,203

$ 242,691

$ 183,203

$ 59,488

Gross Profit

43,597

30,220

43,853

30,786

13,067

18.0%

16.5%

18.1%

16.8%

Selling and Administrative Expense

25,139

19,650

25,139

19,650

(5,489)

10.4%

10.7%

10.4%

10.7%

Internal R&D Expense

1,004

889

1,004

889

(115)

Amortization of intangible assets

2,323

984

2,323

984

(1,339)

Restructuring/impairment charges

188

-

-

-

-

Other operating expense, net

(14)

16

(14)

16

30

Operating Income

14,957

8,681

15,401

9,247

6,154

6.2%

4.7%

6.3%

5.0%

Income Before Provision For Income Tax

14,873

8,665

15,317

9,231

6,086

Provision For Income Taxes

4,857

831

5,002

3,086

(1,916)

Net Income

$ 10,016

$ 7,834

$ 10,315

$ 6,145

$ 4,170

4.1%

4.3%

4.3%

3.4%

Income per Share (Basic)

$ 0.99

$ 0.77

$ 1.02

$ 0.60

$ 0.42

Income per Share (Diluted)

$ 0.99

$ 0.77

$ 1.02

$ 0.60

$ 0.42

($ in 000’s, except per share)

(adjusted removes certain gains and charges)

(Reported)

(Adjusted)

9 months ended Mar 31,

9 months ended Mar 31,

Total YoY

Variance |

6

Consolidated Financial Results

Consolidated Financial Results

Adjusted EBITDA

Adjusted EBITDA

2014

2013

2014

2013

Variance

Net Income

$ 4,246

$ 1,536

$ 10,016

$ 7,834

$ 2,182

Interest expense

187

136

547

390

157

Interest income

- (48)

(2)

(99)

97

Provision for income taxes

2,014

832

4,857

831

4,026

Depreciation and amortization

2,270

1,564

5,910

3,036

2,874

Restructuring/impairment charges

-

- 188

- 188

Capitalized profit in inventory from acquisition

148

- 256

566

(310)

Adjusted EBITDA

$ 8,865

$ 4,020

$ 21,772

$ 12,558

$ 9,214

10.6%

6.2%

9.0%

6.9%

3 months ended Mar 31,

9 months ended Mar 31, |

7

Operating Results

Operating Results

Revenue & Gross Profit

Revenue & Gross Profit

SEGMENT

2014

% of Total

2013

% Change

2014

% of Total

2013

% Change

Medical

$ 37,215

44%

$ 39,139

-5%

$ 123,539

51%

$ 102,002

21%

Complex Systems

23,563

28%

16,482

43%

60,132

25%

42,888

40%

DSS

28,853

34%

14,186

103%

72,824

30%

51,850

40%

Inter-company

(5,700)

-6%

(4,659)

22%

(13,804)

-6%

(13,537)

2%

Totals

$ 83,931

100%

$ 65,148

29%

$ 242,691

100%

$ 183,203

32%

SEGMENT

2014

GP %

2013

GP %

2014

GP %

2013

GP %

Medical

$ 5,332

14.3%

$ 5,339

13.6%

$ 19,134

15.5%

$ 14,443

14.2%

Complex Systems

2,555

10.8%

1,890

11.5%

6,367

10.6%

4,414

10.3%

DSS

8,687

30.1%

2,896

20.4%

18,352

25.2%

11,929

23.0%

Totals

$ 16,574

19.7%

$ 10,125

15.5%

$ 43,853

18.1%

$ 30,786

16.8%

($ in 000’s)

3 months ended Mar 31,

3 months ended Mar 31,

9 months ended Mar 31,

9 months ended Mar 31,

REVENUE

ADJUSTED GROSS PROFIT |

8

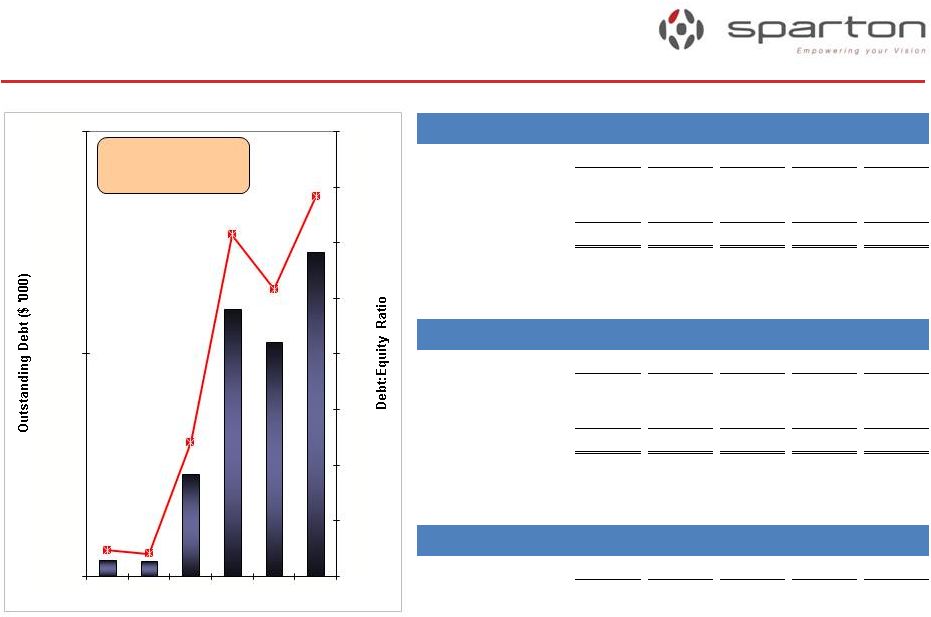

Liquidity & Capital Resources

Liquidity & Capital Resources

1,796

1,669

11,539

30,006

26,331

36,437

0.26

0.34

-

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0

25,000

50,000

Net Debt-to-EBITDA

Leverage = 0.9x

($ in '000)

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Cash and equivalents

4,358

6,085

2,719

1,009

7,502

LOC Availability*

87,000

90,000

71,000

75,000

65,000

Total

91,358

96,085

73,719

76,009

72,502

* Includes a $35 million accordian feature as part of the existing credit

facility. ($ in '000)

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Credit Revolver

13,000

10,000

28,500

25,000

35,000

IRB (Ohio)

1,572

1,539

1,506

1,472

1,437

Total

14,572

11,539

30,006

26,472

36,437

($ in '000)

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Net Inventory

46,928

46,334

55,658

52,393

51,466

Cash Availability

Debt

Inventory

Jun-11

Jun-12

Jun-13

Sep-13

Dec-13

Mar-14 |

9

•

Aubrey Group

–

Closed transaction on March 17, 2014

–

Located in Irvine, CA

–

Design and contract manufacturing company using state-of-the-art

technologies to develop new products for OEMs in the Medical and

Biotechnological markets –

Over 20 years of experience and expertise in a number of core platforms: Medical

Device Controllers, RF Generation, and Pumps and Disposables

–

$8 million of revenue

–

Financials reported within Medical segment

–

Minimal integration activities required

–

Accretive to earnings within 12 months

Acquisition Update

Acquisition Update |

10

•

Implementation of the strategic growth plan

–

Continue to grow organically

–

Maintain our level of investment in internal research & development to

commercially extend our product lines

–

Continue to enable our engineering workforce to develop new and innovative

proprietary solutions for our end markets

–

Continue to seek out complementary and compatible acquisitions

–

Further leverage Viet Nam as a low cost country alternative and in-region

provider •

Focus on sustained profitability

–

Continue margin improvements across the entire company

–

Increase capacity utilization

–

Continue additional improvements in operating performance through lean and quality

efforts

•

Complete the integration of Beckwood Services & Aubrey Group

Fiscal 2014/2015 Outlook

Fiscal 2014/2015 Outlook |

11

•

Sidoti

Conference

in

NYC

on

May

9

th

•

B.

Riley

Investor

Conference

in

Santa

Monica

on

May

19

th

-21st

•

Barrington’s

Spring

Investor

Day

in

Chicago

on

May

22

nd

in

Chicago

•

KeyBanc

Capital

Markets

Conference

in

Boston

on

May

27

th

-28

th

•

East

Coast

Ideas

Conference

in

Boston

on

June

5

th

•

CJS New Ideas Conference in July

•

Midwest

Ideas

Conference

in

Chicago

from

August

26

th

-27

th

•

Sparton

Investor

Day

in

Orlando

on

October

8

th

–

Progress to the 2015 Vision

–

Communicate our new 2020 Vision

–

Provide access to senior management

–

Tour our DSS operation in DeLeon Springs, FL.

Investor Activities

Investor Activities |

12

Q & A |