Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Physicians Realty Trust | a14-11807_18k.htm |

| EX-10.8 - EX-10.8 - Physicians Realty Trust | a14-11807_1ex10d8.htm |

| EX-10.6 - EX-10.6 - Physicians Realty Trust | a14-11807_1ex10d6.htm |

| EX-10.4 - EX-10.4 - Physicians Realty Trust | a14-11807_1ex10d4.htm |

| EX-10.5 - EX-10.5 - Physicians Realty Trust | a14-11807_1ex10d5.htm |

| EX-10.2 - EX-10.2 - Physicians Realty Trust | a14-11807_1ex10d2.htm |

| EX-10.9 - EX-10.9 - Physicians Realty Trust | a14-11807_1ex10d9.htm |

| EX-10.3 - EX-10.3 - Physicians Realty Trust | a14-11807_1ex10d3.htm |

| EX-10.1 - EX-10.1 - Physicians Realty Trust | a14-11807_1ex10d1.htm |

| EX-10.7 - EX-10.7 - Physicians Realty Trust | a14-11807_1ex10d7.htm |

| EX-99.1 - EX-99.1 - Physicians Realty Trust | a14-11807_1ex99d1.htm |

Exhibit 99.2

March 2014

TABLE OF CONTENTS

|

COMPANY OVERVIEW |

|

|

|

|

|

COMPANY INFORMATION |

5 |

|

|

|

|

FIRST QUARTER HIGHLIGHTS |

7 |

|

|

|

|

FINANCIAL HIGHLIGHTS |

8 |

|

|

|

|

FINANCIAL INFORMATION |

|

|

|

|

|

FUNDS FROM OPERATIONS (FFO), NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO), AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD) |

9 |

|

|

|

|

NET OPERATING INCOME AND ADJUSTED EBITDA |

10 |

|

|

|

|

MARKET CAPITALIZATION AND DEBT SUMMARY |

11 |

|

|

|

|

FINANCIAL STATISTICS |

12 |

|

|

|

|

FIRST QUARTER ACQUISITION ACTIVITY AND TENANT OCCUPANCY |

13 |

|

|

|

|

PORTFOLIO INFORMATION |

|

|

|

|

|

PORTFOLIO LEASE EXPIRATIONS AND HISTORICAL OCCUPANCY |

14 |

|

|

|

|

PORTFOLIO DISTRIBUTION BY STATE |

15 |

|

|

|

|

PORTFOLIO DIVERSIFICATION BY TYPE |

16 |

|

|

|

|

TOP 10 HEALTH SYSTEM RELATIONSHIPS |

17 |

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

18 |

|

|

|

|

CONSOLIDATED AND COMBINED STATEMENTS OF OPERATIONS |

19 |

|

|

|

|

REPORTING DEFINITIONS |

20 |

FORWARD LOOKING STATEMENTS:

Certain statements made in this supplemental information package constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, our pro forma financial statements and our statements regarding anticipated market conditions are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

· general economic conditions;

· adverse economic or real estate developments, either nationally or in the markets in which our properties are located;

· our failure to generate sufficient cash flows to service our outstanding indebtedness;

· fluctuations in interest rates and increased operating costs;

· the availability, terms and deployment of debt and equity capital, including our senior secured revolving credit facility;

· our ability to make distributions on our shares of beneficial interest;

· general volatility of the market price of our common shares;

· our limited operating history;

· our increased vulnerability economically due to the concentration of our investments in healthcare properties;

· a substantial portion of our revenue is derived from our five largest tenants and thus, the bankruptcy, insolvency or weakened financial position of any one of them could seriously harm our operating results and financial condition;

· our geographic concentrations in Texas and greater Atlanta, Georgia metropolitan area causes us to be particularly exposed to downturns in these economies or other changes in real estate market conditions;

· changes in our business or strategy;

· our dependence upon key personnel whose continued service is not guaranteed;

· our ability to identify, hire and retain highly qualified personnel in the future;

· the degree and nature of our competition;

· changes in governmental regulations, tax rates and similar matters;

· defaults on or non-renewal of leases by tenants;

· decreased rental rates or increased vacancy rates;

· difficulties in identifying healthcare properties to acquire and complete acquisitions;

· competition for investment opportunities;

· our failure to successfully develop, integrate and operate acquired properties and operations;

· the impact of our investment in joint ventures;

· the financial condition and liquidity of, or disputes with, joint venture and development partners;

· our ability to operate as a public company;

· changes in accounting principles generally accepted in the United States (or GAAP);

· lack of or insufficient amounts of insurance;

· other factors affecting the real estate industry generally;

· our failure to qualify and maintain our qualification as a REIT for U.S. federal income tax purposes;

· limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT for U.S. federal income tax purposes; and

· changes in governmental regulations or interpretations thereof, such as real estate and zoning laws and increases in real property tax rates and taxation of REITs.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. You should not place undue reliance on any forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes after the date of this prospectus, except as required by applicable law. For a further discussion of these and other factors that could impact our future results, performance or transactions, see Part I, Item 1A (Risk Factors) of our Annual Report on Form 10-K for the fiscal year December 31, 2013 and Part II, Item1A (Risk Factors) of our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2014.

ADDITIONAL INFORMATION

The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, earnings press release dated May 7, 2014 and other information filed with, or furnished to, the SEC. You can access the Company’s SEC reports and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.docreit.com) under the tab “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into this supplemental information package. You also can review these SEC filings and other information by accessing the SEC’s website at http://www.sec.gov.

ABOUT PHYSICIANS REALTY TRUST

Physicians Realty Trust (NYSE:DOC) (the “Trust,” the “Company,” “DOC,” “we,” “our” and “us”) is a self-managed healthcare real estate company organized in 2013 to acquire, selectively develop, own and manage healthcare properties that are leased to physicians, hospitals and healthcare delivery systems.

We invest in real estate that is integral to providing high quality healthcare services. Our properties typically are on a campus with a hospital or other healthcare facilities or strategically located and affiliated with a hospital or other healthcare facilities.

Our management team has significant public healthcare REIT experience and long established relationships with physicians, hospitals and healthcare delivery system decision makers that we believe will provide quality investment opportunities to generate attractive risk-adjusted returns to our shareholders.

We are a Maryland real estate investment trust and will elect to be taxed as a real estate investment trust (REIT) for U.S. federal income tax purposes beginning with our short taxable year ending December 31, 2013 upon the filing of our federal income tax return for such year. We conduct our business through an UPREIT structure in which our properties are owned by Physicians Realty L.P., a Delaware limited partnership (the “operating partnership”), directly or through limited partnerships, limited liability companies or other subsidiaries. We are the sole general partner of the operating partnership and as of March 31, 2014, own approximately 85.4% of the partnership interests in the operating partnership.

We had no business operations prior to completion of our initial public offering (the “IPO”) on July 24, 2013. Our predecessor, which is not a legal entity, is comprised of the four healthcare real estate funds managed by B.C. Ziegler & Company (“Ziegler”), which are referred to as the Predecessor Ziegler Funds, that owned directly or indirectly interests in entities that owned the initial properties we acquired through the operating partnership on July 24, 2013 in connection with completion of the IPO and related formation transactions.

COMPANY SNAPSHOT

|

|

|

As of |

| |

|

Gross real estate investments (thousands) |

|

$ |

412,011 |

|

|

Total buildings |

|

40 |

| |

|

Occupancy |

|

93.5 |

% | |

|

Total portfolio gross leasable area |

|

1,452,013 |

| |

|

|

|

|

| |

|

% of MOB GLA on-campus / affiliated |

|

75 |

% | |

|

Average remaining lease term for all buildings (years) |

|

10.1 |

| |

|

|

|

|

| |

|

Cash and cash equivalents (thousands) |

|

$ |

10,092 |

|

|

Total debt to total capitalization |

|

34.6 |

% | |

|

Weighted average interest rate per annum on portfolio debt |

|

3.97 |

% | |

|

Equity market cap (thousands) |

|

$ |

301,129 |

|

|

Quarterly dividend |

|

$ |

0.225 |

|

|

Quarter end stock price |

|

$ |

13.92 |

|

|

Dividend yield |

|

6.5 |

% | |

|

Shares and units outstanding (1) |

|

25,331,740 |

| |

|

Total enterprise value (thousands) (2) |

|

$ |

512,000 |

|

(1) In conjunction with our IPO, we issued 2,744,000 common units in our operating partnerships in connection with our acquisition of our initial portfolio of 19 medical office buildings and assumed the debt related to such properties. In connection with our purchase of the Crescent City Surgical Centre, we issued 954,877 common units in our operating partnership as well as additional cash consideration to the physician sellers.

(2) Represents the value of outstanding shares and units based on the closing stock price on March 31, 2014 plus the amount of outstanding debt at March 31, 2014.

ABOUT PHYSICIANS REALTY TRUST CONTINUED

Board of Trustees

|

Tommy G. Thompson Chairman |

William A. Ebinger, M.D. |

Richard A. Weiss |

|

|

|

|

|

Albert C. Black |

Mark A. Baumgartner |

Stanton D. Anderson |

|

Compensation, Nominating and Governance Committee Chair |

Finance and Investment Committee Chair |

Audit Committee Chair |

|

|

|

|

|

John T. Thomas |

|

|

|

Chief Executive Officer, President |

|

|

|

|

|

|

|

Management Team |

|

|

|

John T. Thomas |

John W. Sweet |

|

Chief Executive Officer, President |

Executive Vice President - Chief Investment Officer |

|

|

|

|

John W. Lucey |

Mark D. Theine |

|

Senior Vice President — Principal Accounting and Reporting Officer |

Senior Vice President — Asset & Investment Management |

|

|

|

|

Location & Contact Information |

|

|

|

|

|

Corporate Headquarters |

Transfer Agent |

|

735 N. Water Street, Suite 1000 |

Registrar and Transfer Company |

|

Milwaukee, WI 53202 |

10 Commerce Drive |

|

(414) 978-6494 |

Cranford, NJ 07010 |

|

|

(908) 497-2300 |

|

|

|

|

Corporate & REIT Tax Counsel |

Investor Relations |

|

Baker & McKenzie |

The Ruth Group |

|

Richard Lipton |

Stephanie Carrington |

|

Partner |

Senior Vice President |

|

300 E Randolph Street |

757 Third Avenue, 22nd Floor |

|

Chicago, IL 60601 |

New York, NY 10017 |

|

(312) 861-8000 |

(646) 536-7017 |

|

|

|

|

|

|

|

External Auditor |

|

|

Ernst & Young |

|

|

155 N. Upper Wacker Drive |

|

|

Chicago, IL 60606 |

|

|

(312) 879-2000 |

|

FIRST QUARTER HIGHLIGHTS

Operating

· First quarter 2014 total revenue of $8.0 million, up 141.0% over the prior year period

· First quarter 2014 rental revenue of $6.8 million, an increase of 172.6% over the prior year period

· Generated quarterly funds from operations (Normalized FFO) of $0.12 on a fully diluted basis

· Closed on seven acquisitions comprising 13 buildings totaling 550,670 square feet for approximately $147.4 million in the aggregate

· Declared quarterly dividend of $0.225 per share for the first quarter

· Surpassed 93.5% portfolio wide occupancy based on square footage as of March 31, 2014

· Increased gross leasable square footage by 61.1% to 1,452,013 square feet, as of March 31, 2014, from 901,343 at end of fourth quarter 2013

First Quarter Acquisitions

· Foundations San Antonio Surgical Hospital and MOB, San Antonio, TX

· Eagles Landing Family Practice, GA

· 21st Century Oncology, Sarasota, FL

· Peachtree Dunwoody MOB, Atlanta, GA

· LifeCare, Pittsburgh, PA and Fort Worth, TX

Company Announcements

· January 2, 2014: Announced that it closed its previously announced mezzanine loan of approximately $6.9 million to affiliates controlled by MedProperties Holdings, LLC a leading Dallas-based private investor in healthcare real estate (Global Rehab-Rehabilitation Hospital, Scottsdale, AZ, featured on the cover)

· January 27, 2014: Announced tax reporting information for dividends paid to its shareholders during the year ended December 31, 2013

· February 3, 2014: Entered into an Agreement of Sale and Purchase to purchase an approximately 45,200 square foot medical office building known as South Bend Orthopaedics Medical Office Building

· February 11, 2014: Entered into an Agreement of Sale and Purchase to purchase four medical office buildings located in Sarasota, Venice, Engelwood and Port Charlotte, Florida

· February 19, 2014: Announced that it closed on the purchase and leaseback of the Eagles Landing Family Practice medical office buildings. The four medical facilities located in Jackson, Conyers and McDonough (2), Georgia total approximately 68,711 square feet and are 100% leased

· February 20, 2014: Entered into and closed an Agreement of Sale and Purchase to purchase a surgical hospital located in San Antonio, Texas

· February 27, 2014: Announced financial results for the fourth quarter and year ended December 31, 2013

· March 3, 2014: Announced the execution and closing of a contract to purchase the Peachtree Dunwoody Medical Center, a premier multi-tenant medical office building located in the heart of Atlanta’s “Pill Hill” hospital market

· March 31, 2014: Announced the execution and closing of an Agreement of Sale and Purchase to purchase and leaseback two long-term acute care hospitals located in Pittsburgh, Pennsylvania and Fort Worth, Texas

|

FINANCIAL HIGHLIGHTS |

|

|

(Unaudited and in thousands, except per share data) |

See Glossary for definition of terms. |

|

|

|

Three Months Ended |

| |

|

|

|

|

| |

|

INCOME ITEMS |

|

|

| |

|

Revenues |

|

$ |

7,991 |

|

|

NOI |

|

6,399 |

| |

|

Annualized Adjusted EBITDA |

|

18,632 |

| |

|

Normalized FFO |

|

3,104 |

| |

|

Normalized FAD |

|

2,953 |

| |

|

Net loss Available to Common Shareholders per common share |

|

$ |

(0.15 |

) |

|

Normalized FAD per common share and unit |

|

$ |

0.12 |

|

|

Fixed Charge Coverage Ratio (EBITDA/Int Exp, net) |

|

0.08 |

x | |

|

|

|

As of |

| |

|

|

|

March 31, 2014(1) |

| |

|

ASSETS |

|

|

| |

|

Gross Real Estate Investments (including gross lease intangibles) |

|

$ |

412,011 |

|

|

Total Assets |

|

401,851 |

| |

|

CAPITALIZATION |

|

|

| |

|

Total Debt |

|

$ |

159,382 |

|

|

Total Shareholder’s Equity |

|

231,803 |

| |

|

Total Market Capitalization (1) |

|

352,618 |

| |

|

Total Debt / Total Market Capitalization |

|

45 |

% | |

(1) Represents outstanding shares and units at quarter end multiplied by the share price at quarter end.

RECONCILIATION OF NON-GAAP MEASURES

See Glossary for definition of terms.

FUNDS FROM OPERATIONS (FFO),

NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO)

AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD)

(Unaudited and in thousands, except share and per share data)

|

|

|

Three Months Ended |

| |

|

Net loss |

|

$ |

(3,558 |

) |

|

Depreciation and amortization expense |

|

2,416 |

| |

|

FFO |

|

$ |

(1,142 |

) |

|

FFO per share and unit |

|

$ |

(0.05 |

) |

|

Acquisition related expenses |

|

4,287 |

| |

|

Net change in fair value of derivative financial instrument |

|

(41 |

) | |

|

Normalized FFO |

|

$ |

3,104 |

|

|

Normalized FFO per share and unit |

|

$ |

0.12 |

|

|

|

|

|

| |

|

Normalized FFO |

|

$ |

3,104 |

|

|

Non-cash share compensation expense |

|

273 |

| |

|

Straight-line rent adjustments |

|

(652 |

) | |

|

Amortization of acquired above market leases |

|

46 |

| |

|

Amortization of lease inducements |

|

34 |

| |

|

Amortization of deferred financing costs |

|

148 |

| |

|

Normalized FAD |

|

$ |

2,953 |

|

|

Normalized FAD per share and unit |

|

$ |

0.12 |

|

|

|

|

|

| |

|

Weighted average number of shares and units outstanding |

|

25,274,626 |

| |

NET OPERATING INCOME AND ADJUSTED EBITDA

|

(Unaudited and in thousands) |

See Glossary for definition of terms. |

Net Operating Income (NOI)

|

|

|

Three Months Ended |

| |

|

Net loss |

|

$ |

(3,558 |

) |

|

General and administrative |

|

2,014 |

| |

|

Acquisition related expenses |

|

4,287 |

| |

|

Depreciation and amortization |

|

2,416 |

| |

|

Interest expense, net |

|

1,281 |

| |

|

Change in fair value of derivative liability |

|

(41 |

) | |

|

NOI |

|

$ |

6,399 |

|

|

|

|

|

| |

|

NOI |

|

$ |

6,399 |

|

|

Straight-line rent adjustments |

|

(652 |

) | |

|

Amortization of acquired above market leases |

|

46 |

| |

|

Amortization of lease inducement |

|

34 |

| |

|

Cash NOI |

|

$ |

5,827 |

|

|

Cash NOI percentage growth over 4th quarter 2013 |

|

20.6 |

% | |

Adjusted EBITDA

|

|

|

Three Months Ended |

| |

|

Net loss |

|

$ |

(3,558 |

) |

|

|

|

|

| |

|

Depreciation and amortization |

|

2,416 |

| |

|

Interest expense, net |

|

1,281 |

| |

|

Change in fair value of derivative liability |

|

(41 |

) | |

|

EBITDA |

|

98 |

| |

|

Acquisition related expenses |

|

4,287 |

| |

|

Non-cash share compensation |

|

273 |

| |

|

Adjusted EBITDA |

|

$ |

4,658 |

|

|

|

|

|

| |

|

Adjusted EBITDA Annualized (1) |

|

$ |

18,632 |

|

(1) We have been operating as a public REIT for less than a full year and can make no assurances that our actual EBITDA or Adjusted EBITDA in future periods will be consistent with the annualized amount shown above and may differ significantly.

MARKET CAPITALIZATION AND DEBT SUMMARY

(In thousands, except share and per share data)

Market Capitalization

|

Revolving Credit Facility Debt |

|

$ |

80,000 |

|

|

|

Senior Notes and Term Loans |

|

79,382 |

| ||

|

Total Debt |

|

$ |

159,382 |

| |

|

|

|

|

| ||

|

Stock price (closing price as of March 31, 2014) |

|

$ |

13.92 |

| |

|

Total Common Shares Outstanding |

|

21,632,863 |

| ||

|

Equity Market Capitalization |

|

$ |

301,129 |

| |

|

|

|

|

| ||

|

Total Capitalization (Debt + Equity) |

|

$ |

460,511 |

| |

|

|

|

|

| ||

|

Total Debt / Total Capitalization |

|

34.6 |

% | ||

|

Total Debt / Total Assets |

|

39.7 |

% | ||

|

Total Debt / Total Enterprise Value |

|

31.1 |

% | ||

Debt Summary

|

|

|

Balance as of |

|

Stated Interest |

|

Interest |

|

Maturity Date: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Revolving Credit Facility |

|

$ |

80,000 |

|

LIBOR + 2.65 |

% |

|

|

8/29/2016 |

|

|

Senior Notes and Term Loans: |

|

|

|

|

|

|

|

|

| |

|

Canton MOB |

|

6,282 |

|

5.94 |

% |

5.94 |

% |

06/06/17 |

| |

|

Firehouse Square |

|

2,812 |

|

6.58 |

% |

6.58 |

% |

09/06/17 |

| |

|

Hackley Medical Center |

|

5,486 |

|

5.93 |

% |

5.93 |

% |

01/06/17 |

| |

|

MeadowView Professional Center |

|

10,538 |

|

5.81 |

% |

5.81 |

% |

6/06/17 |

| |

|

Mid Coast Hospital MOB |

|

8,023 |

|

LIBOR + 2.25 |

% |

4.82 |

% |

05/16/16 |

| |

|

Remington Medical Commons |

|

4,499 |

|

LIBOR + 2.75 |

% |

2.93 |

% |

09/28/17 |

| |

|

Valley West Hospital MOB |

|

4,957 |

|

4.83 |

% |

4.83 |

% |

11/10/20 |

| |

|

Oklahoma City, OK MOB |

|

7,771 |

|

4.71 |

% |

4.71 |

% |

01/01/20 |

| |

|

Crescent City Surgical Center |

|

18,750 |

|

5.00 |

% |

5.00 |

% |

02/01/19 |

| |

|

San Antonio Hospital |

|

10,264 |

|

5.00 |

% |

5.00 |

% |

06/01/22 |

| |

|

Total: |

|

$ |

159,382 |

|

|

|

|

|

|

|

(1) Weighted average interest rate per annum on portfolio debt: 5.26%

(2) Weighted average interest rate per annum on portfolio debt: 3.97%

FINANCIAL STATISTICS

(Unaudited and in thousands, except share and per share data)

|

|

|

March 31, 2014 |

| |

|

Weighted Average Shares and Units Outstanding |

|

|

| |

|

Weighted average common shares |

|

21,298,597 |

| |

|

Weighted average unvested restricted shares |

|

334,266 |

| |

|

Weighted average units |

|

3,698,877 |

| |

|

Weighted Average Shares and Units - Diluted |

|

25,331,740 |

| |

|

|

|

|

| |

|

Outstanding Common Shares and OP Units at Quarter End |

|

25,331,740 |

| |

|

|

|

|

| |

|

Common Dividend Yield |

|

|

| |

|

Annualized dividend rate (1) |

|

$ |

0.90 |

|

|

Price per share (2) |

|

$ |

13.92 |

|

|

Annualized dividend yield |

|

6.47 |

% | |

|

|

|

|

| |

|

Net Debt / Adjusted EBITDA Ratio |

|

|

| |

|

Total debt |

|

$ |

159,382 |

|

|

Net debt (less cash) |

|

$ |

149,290 |

|

|

Adjusted EBITDA (annualized)* |

|

$ |

18,632 |

|

|

Net Debt / Adjusted EBITDA Ratio |

|

8.01x |

| |

|

|

|

|

| |

|

Interest Coverage Ratio |

|

|

| |

|

Adjusted EBITDA (annualized)* |

|

$ |

18,632 |

|

|

Cash interest expense (annualized)* |

|

$ |

4,532 |

|

|

Interest Coverage Ratio |

|

4.11x |

| |

|

|

|

|

| |

|

Quarterly Fixed Charge Coverage Ratio |

|

|

| |

|

Total interest |

|

$ |

1,281 |

|

|

Secured debt principal amortization |

|

384 |

| |

|

Total fixed charges |

|

$ |

1,665 |

|

|

Adjusted EBITDA |

|

$ |

4,658 |

|

|

Adjusted fixed charge coverage ratio |

|

2.80x |

| |

|

|

|

|

| |

|

Enterprise Value |

|

|

| |

|

Outstanding shares and units multiplied by stock price (3/31/14) |

|

$ |

352,618 |

|

|

Total debt |

|

159,382 |

| |

|

Total Enterprise Value |

|

$ |

512,000 |

|

|

|

|

|

| |

|

Leverage |

|

|

| |

|

Total debt |

|

$ |

159,382 |

|

|

Total assets |

|

$ |

401,851 |

|

|

Total Debt / Total Assets |

|

39.7 |

% | |

|

Total Debt / Total Enterprise Value |

|

31.1 |

% | |

(1) Annualized rate based on $0.225 quarterly dividend for the quarter ending March 31, 2014. Actual dividend amounts will be determined by the Trust’s board of trustees based on a variety of factors.

(2) Closing share price of $13.92 as of March 31, 2014

* Amounts are annualized and actual amounts may differ significantly from the annualized amounts shown.

FIRST QUARTER ACQUISITION ACTIVITY AND TENANT OCCUPANCY

Acquisition Activity

|

Property |

|

Property Location |

|

Date Acquired |

|

Percent Leased |

|

Purchase |

|

GLA |

| |

|

Foundations San Antonio Hospital |

|

San Antonio, TX |

|

2/19/2014 |

|

100 |

% |

$ |

25,555,555 |

|

45,954 |

|

|

Eagles Landing Family Practice |

|

GA |

|

2/19/2014 |

|

100 |

% |

$ |

20,800,000 |

|

68,711 |

|

|

21st Century Oncology |

|

Sarasota, FL |

|

2/26/2014 |

|

100 |

% |

$ |

17,486,000 |

|

46,895 |

|

|

Foundations San Antonio MOB |

|

San Antonio, TX |

|

2/28/2014 |

|

100 |

% |

$ |

6,800,000 |

|

22,832 |

|

|

Peachtree Dunwoody MOB |

|

Atlanta, GA |

|

2/28/2014 |

|

96 |

% |

$ |

36,726,000 |

|

131,368 |

|

|

LifeCare Ft. Worth |

|

Fort Worth, TX |

|

3/31/2014 |

|

100 |

% |

$ |

27,160,493 |

|

80,000 |

|

|

LifeCare Pittsburgh |

|

Pittsburgh, PA |

|

3/31/2014 |

|

100 |

% |

$ |

12,839,507 |

|

154,910 |

|

|

Total |

|

|

|

|

|

|

|

$ |

147,367,555 |

|

550,670 |

|

Tenant Occupancy

|

Total Portfolio |

|

|

|

|

Total GLA at beginning of quarter |

|

901,343 |

|

|

Occupied GLA beginning of quarter |

|

820,895 |

|

|

Occupancy percentage beginning of quarter |

|

91.1 |

% |

|

|

|

|

|

|

Occupied GLA from leasing |

|

|

|

|

Expirations: |

|

|

|

|

Expiring GLA |

|

(47,643 |

) |

|

Leasing: |

|

|

|

|

Renewal leases in Q1 |

|

38,098 |

|

|

New leases commencing in Q1 |

|

0 |

|

|

Lease terminations in Q1 |

|

0 |

|

|

Total leasing activity |

|

38,098 |

|

|

|

|

|

|

|

GLA change from acquisitions/dispositions |

|

|

|

|

Occupied acquisitions square feet added |

|

545,491 |

|

|

Vacant square feet acquired |

|

5,179 |

|

|

Total acquisitions square feet added |

|

550,670 |

|

|

|

|

|

|

|

Occupied disposition square feet |

|

0 |

|

|

|

|

|

|

|

Total square feet end of quarter |

|

1,452,013 |

|

|

Occupied square feet end of quarter |

|

1,356,841 |

|

|

Occupancy percentage end of quarter |

|

93.5 |

% |

PORTFOLIO LEASE EXPIRATIONS AND HISTORICAL OCCUPANCY

as of March 31, 2014

Portfolio Lease Expirations

|

Expiration |

|

Number |

|

Total |

|

Percent of |

|

Annualized |

|

Percent of |

|

Annualized |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

2014 |

|

9 |

|

21,336 |

|

1.5 |

% |

$ |

552,983 |

|

1.6 |

% |

25.92 |

| |

|

2015 |

|

8 |

|

24,770 |

|

1.7 |

% |

482,320 |

|

1.4 |

% |

19.47 |

| ||

|

2016 |

|

11 |

|

68,254 |

|

4.7 |

% |

1,586,613 |

|

4.7 |

% |

23.25 |

| ||

|

2017 |

|

6 |

|

30,301 |

|

2.1 |

% |

881,951 |

|

2.6 |

% |

29.11 |

| ||

|

2018 |

|

16 |

|

146,019 |

|

10.1 |

% |

3,152,757 |

|

9.3 |

% |

21.59 |

| ||

|

2019 |

|

8 |

|

99,329 |

|

6.8 |

% |

2,234,756 |

|

6.6 |

% |

22.50 |

| ||

|

2020 |

|

6 |

|

17,957 |

|

1.2 |

% |

433,500 |

|

1.3 |

% |

24.14 |

| ||

|

2021 |

|

6 |

|

44,814 |

|

3.1 |

% |

1,090,090 |

|

3.2 |

% |

24.32 |

| ||

|

2022 |

|

3 |

|

13,517 |

|

0.9 |

% |

288,034 |

|

0.8 |

% |

21.31 |

| ||

|

2023 |

|

1 |

|

52,000 |

|

3.6 |

% |

1,248,000 |

|

3.7 |

% |

24.00 |

| ||

|

Thereafter: |

|

36 |

|

836,944 |

|

57.6 |

% |

21,948,686 |

|

64.7 |

% |

26.22 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

MTM |

|

1 |

|

1,600 |

|

0.1 |

% |

9,000 |

|

0.0 |

% |

5.63 |

| ||

|

Vacant |

|

26 |

|

95,172 |

|

6.6 |

% |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Total/Average: |

|

137 |

|

1,452,013 |

|

100.0 |

% |

$ |

33,908,690 |

|

100.0 |

% |

$ |

24.99 |

|

(1)Calculated by multiplying (a) base rent payments for the month ended March 31, 2014, by (b) 12.

Historical Occupancy

|

|

|

As of |

| ||||||||

|

|

|

3/31/2014 |

|

12/31/2013 |

|

9/30/2013 |

|

6/30/2013 |

|

3/31/2013 |

|

|

Total Portfolio Occupancy, end of period |

|

93.5 |

% |

91.1 |

% |

90.3 |

% |

84.6 |

% |

82.5 |

% |

|

|

|

PORTFOLIO DISTRIBUTION BY STATE

as of March 31, 2014

|

Market |

|

GLA |

|

% of Portfolio |

|

|

Texas |

|

364,012 |

|

25.07 |

% |

|

Georgia |

|

347,632 |

|

23.94 |

% |

|

Pennsylvania |

|

154,910 |

|

10.67 |

% |

|

Michigan |

|

92,210 |

|

6.35 |

% |

|

Ohio |

|

76,433 |

|

5.26 |

% |

|

Illinois |

|

74,912 |

|

5.16 |

% |

|

Florida |

|

69,214 |

|

4.77 |

% |

|

Tennessee |

|

64,200 |

|

4.42 |

% |

|

Louisiana |

|

60,000 |

|

4.13 |

% |

|

Oklahoma |

|

52,000 |

|

3.58 |

% |

|

Maine |

|

44,677 |

|

3.08 |

% |

|

Wisconsin |

|

26,377 |

|

1.82 |

% |

|

Arizona |

|

12,800 |

|

0.88 |

% |

|

Montana |

|

12,636 |

|

0.87 |

% |

|

Total |

|

1,452,013 |

|

100 |

% |

PORTFOLIO DIVERSIFICATION BY TYPE

as of March 31, 2014

Portfolio Diversification by Type

|

|

|

Number |

|

GLA |

|

% of |

|

Occupancy |

|

Number |

|

|

Medical office buildings: |

|

|

|

|

|

|

|

|

|

|

|

|

Single-tenant |

|

17 |

|

354,830 |

|

24.4 |

% |

91.9 |

% |

8 |

|

|

Multi-tenant |

|

17 |

|

603,877 |

|

41.6 |

|

89.0 |

|

9 |

|

|

Other facilities that serve healthcare industry: |

|

|

|

|

|

|

|

|

|

|

|

|

Hospitals |

|

3 |

|

182,954 |

|

12.6 |

|

100.0 |

|

2 |

|

|

Post-acute |

|

3 |

|

310,352 |

|

21.4 |

|

100.0 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

40 |

|

1,452,013 |

|

100.0 |

% |

|

|

|

|

Campus Proximity and Asset Type

|

|

|

|

|

|

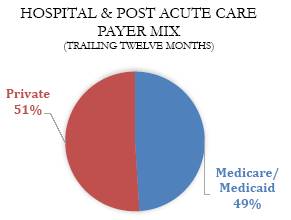

Hospital and Post-Acute Care Coverage Ratio (EBITDAR / Rent) for March 31, 2014 is 3.21x.

TOP 10 HEALTH SYSTEM RELATIONSHIPS (TENANTS)

as of March 31, 2014

|

Tenant |

|

Weighted |

|

Total Leased |

|

Percent of |

|

Annualized Base |

|

Percent of |

|

|

LifeCare |

|

13.76 |

|

310,352 |

|

21.37 |

% |

4,697,063 |

|

13.85 |

% |

|

East El Paso Physicians Medical Center |

|

14.43 |

|

77,000 |

|

5.30 |

% |

3,282,377 |

|

9.68 |

% |

|

Crescent City Surgical Centre |

|

14.51 |

|

60,000 |

|

4.13 |

% |

3,000,000 |

|

8.85 |

% |

|

Foundation Bariatric Hospital |

|

11.23 |

|

68,786 |

|

4.74 |

% |

2,884,873 |

|

8.51 |

% |

|

Northside Hospital |

|

8.81 |

|

72,102 |

|

4.97 |

% |

1,817,889 |

|

6.60 |

% |

|

Eagles Landing Family Practice |

|

14.93 |

|

68,711 |

|

4.73 |

% |

1,560,000 |

|

4.60 |

% |

|

21st Century |

|

11.92 |

|

44,295 |

|

3.05 |

% |

1,454,839 |

|

4.29 |

% |

|

Foundation Surgical Affiliates, LLC |

|

9.51 |

|

52,000 |

|

3.58 |

% |

1,248,000 |

|

3.68 |

% |

|

Holston Medical Group |

|

5.16 |

|

42,220 |

|

2.91 |

% |

895,498 |

|

2.64 |

% |

|

Peachtree Orthopaedics |

|

9.34 |

|

27,573 |

|

1.90 |

% |

810,066 |

|

2.39 |

% |

CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data)

|

|

|

March 31, |

|

December 31, |

| ||

|

|

|

2014 |

|

2013 |

| ||

|

|

|

(Unaudited) |

|

(Audited) |

| ||

|

ASSETS |

|

|

|

|

| ||

|

Investment properties: |

|

|

|

|

| ||

|

Land and improvements |

|

$ |

44,419 |

|

$ |

26,088 |

|

|

Building and improvements |

|

313,985 |

|

192,959 |

| ||

|

Tenant improvements |

|

5,498 |

|

5,458 |

| ||

|

Acquired lease intangibles |

|

39,712 |

|

31,236 |

| ||

|

Property under development |

|

225 |

|

225 |

| ||

|

|

|

403,839 |

|

255,966 |

| ||

|

Accumulated depreciation |

|

(30,858 |

) |

(28,427 |

) | ||

|

Net real estate property |

|

372,981 |

|

227,539 |

| ||

|

Real estate loan receivable |

|

6,855 |

|

— |

| ||

|

Investment in unconsolidated entity |

|

1,317 |

|

— |

| ||

|

Net real estate investments |

|

381,153 |

|

227,539 |

| ||

|

Cash and cash equivalents |

|

10,092 |

|

56,478 |

| ||

|

Tenant receivables, net |

|

1,403 |

|

837 |

| ||

|

Deferred costs, net |

|

2,690 |

|

2,105 |

| ||

|

Other assets |

|

6,513 |

|

5,901 |

| ||

|

Total assets |

|

$ |

401,851 |

|

$ |

292,860 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

| ||

|

Liabilities: |

|

|

|

|

| ||

|

Debt |

|

$ |

159,382 |

|

$ |

42,821 |

|

|

Accounts payable |

|

722 |

|

836 |

| ||

|

Dividend payable |

|

5,699 |

|

5,681 |

| ||

|

Accrued expenses and other liabilities |

|

3,889 |

|

2,288 |

| ||

|

Derivative liability |

|

356 |

|

397 |

| ||

|

Total liabilities |

|

170,048 |

|

52,023 |

| ||

|

Equity: |

|

|

|

|

| ||

|

Common shares, $0.01 par value, 500,000,000 shares authorized, 21,632,863 and 21,548,597 shares issued and outstanding as of March 31, 2014 and December 31, 2013, respectively. |

|

216 |

|

215 |

| ||

|

Additional paid-in capital |

|

213,833 |

|

213,359 |

| ||

|

Accumulated deficit |

|

(16,630 |

) |

(8,670 |

) | ||

|

Total shareholders’ equity |

|

197,419 |

|

204,904 |

| ||

|

Noncontrolling interests: |

|

|

|

|

| ||

|

Operating partnership |

|

33,749 |

|

35,310 |

| ||

|

Partially owned properties |

|

635 |

|

623 |

| ||

|

Total noncontrolling interest |

|

34,384 |

|

35,933 |

| ||

|

Total equity |

|

231,803 |

|

240,837 |

| ||

|

Total liabilities and equity |

|

$ |

401,851 |

|

$ |

292,860 |

|

CONSOLIDATED STATEMENTS OF OPERATION

(In thousands, except share and per share data)

|

|

|

Three Months Ended |

| ||||

|

|

|

March 31, 2014 |

| ||||

|

|

|

|

|

Predecessor |

| ||

|

|

|

2014 |

|

2013 (1) |

| ||

|

Revenues: |

|

|

|

|

| ||

|

Rental revenues |

|

$ |

6,808 |

|

$ |

2,497 |

|

|

Expense recoveries |

|

1,070 |

|

814 |

| ||

|

Interest income on real estate loans and other |

|

113 |

|

5 |

| ||

|

Total revenues |

|

7,991 |

|

3,316 |

| ||

|

Expenses: |

|

|

|

|

| ||

|

Interest expense, net |

|

1,281 |

|

1,166 |

| ||

|

General and administrative |

|

2,014 |

|

120 |

| ||

|

Operating expenses |

|

1,609 |

|

1,188 |

| ||

|

Depreciation and amortization |

|

2,416 |

|

979 |

| ||

|

Acquisition expenses |

|

4,287 |

|

— |

| ||

|

Management fees |

|

— |

|

238 |

| ||

|

Total expenses |

|

11,607 |

|

3,691 |

| ||

|

Other income: |

|

|

|

|

| ||

|

Change in fair value of derivative |

|

41 |

|

74 |

| ||

|

Equity in income of unconsolidated entity |

|

17 |

|

— |

| ||

|

Net loss |

|

(3,558 |

) |

$ |

(301 |

) | |

|

Less: Net loss attributable to noncontrolling interests — operating partnership |

|

531 |

|

|

| ||

|

Less: Net income attributable to noncontrolling interests — partially owned properties |

|

(66 |

) |

|

| ||

|

Net loss attributable to common shareholders |

|

$ |

(3,093 |

) |

|

| |

|

Net loss per share: |

|

|

|

|

| ||

|

Basic and diluted |

|

$ |

(0.15 |

) |

|

| |

|

Weighted average common shares: |

|

|

|

|

| ||

|

Basic and diluted |

|

21,298,597 |

|

|

| ||

|

|

|

|

|

|

| ||

|

Dividends and distributions declared per common share and unit |

|

$ |

0.225 |

|

|

| |

(1) The results of operation for the three months ended March 31, 2013 reflect the results of operations of the Predecessor Ziegler Funds.

GLOSSARY

Adjusted Earnings Before Interest Taxes, Depreciation and Amortization (Adjusted EBITDA): We define Adjusted EBITDA for DOC as net (loss) income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, net (loss) included from discontinued operations, stock based compensation, and acquisition-related expenses. We consider Adjusted EBITDA an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt.

Annualized Base Rent: Annualized base rent is calculated by multiplying contractual base rent for December 2013 by 12 (but excluding the impact of concessions and straight-line rent).

Earnings Before Interest Taxes, Depreciation, Amortization and Rent (EBITDAR): We define EBITDAR for DOC as net (loss) income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, net (loss) included from discontinued operations, stock based compensation, acquisition-related expenses and lease expense. We consider EBITDAR an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our tenants ability to fund their rent obligations.

Funds From Operations (FFO): Funds from operations, or FFO, is a widely recognized measure of REIT performance. Although FFO is not computed in accordance with generally accepted accounting principles, or GAAP, we believe that information regarding FFO is helpful to shareholders and potential investors because it facilitates an understanding of the operating performance of our initial properties without giving effect to real estate depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time. Because real estate values have historically increased or decreased with market conditions, we believe that FFO provides a more meaningful and accurate indication of our performance. We calculate FFO in accordance with the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts, or NAREIT, which we refer to as the “White Paper.” The White Paper defines FFO as net income (computed in accordance with GAAP) before noncontrolling interests of holders of OP units, excluding gains (or losses) on sales of depreciable operating property and extraordinary items (computed in accordance with GAAP), plus real estate related depreciation and amortization (excluding amortization of deferred financing costs). Our FFO computation may not be comparable to FFO reported by other REITs that do not compute FFO in accordance with the White Paper definition or that interpret the White Paper definition differently than we do. The GAAP measure that we believe to be most directly comparable to FFO, net income (loss), includes depreciation and amortization expenses, gains or losses on property sales and noncontrolling interests. In computing FFO, we eliminate these items because, in our view, they are not indicative of the results from the operations of our properties. To facilitate a clear understanding of our historical operating result, FFO should be examined in conjunction with net income (determined in accordance with GAAP) as presented in our financial statements. FFO does not represent cash generated from operating activities in accordance with GAAP, should not be considered to be an alternative to net income (loss) (determined in accordance with GAAP) as a measure of our liquidity and is not indicative of funds available for our cash needs, including our ability to make cash distributions to shareholders.

Gross Leasable Area (GLA): Gross leasable area (in square feet)

Gross Real Estate Investments: Based on acquisition price (and includes lease intangibles).

Health System-Affiliated: Properties are considered affiliated with a health system if one or more of the following conditions are met: 1) the land parcel is contained within the physical boundaries of a hospital campus; 2) the land parcel is located adjacent to the campus; 3) the building is physically connected to the hospital regardless of the land ownership structure; 4) a ground lease is maintained with a health system entity; 5) a master lease is maintained with a health system entity; 6) significant square footage is leased to a health system entity; 7) the property includes an ambulatory surgery center with a hospital partnership interest; or (8) a significant square footage is leased to a physician group that is either employed, directly or indirectly by a health system, or has a significant clinical and financial affiliation with the health system.

Hospitals: Hospitals generally include acute care hospitals, inpatient rehabilitation hospitals and long-term acute care hospitals. Acute care hospitals provide a wide range of inpatient and outpatient services, including, but not limited to, surgery, rehabilitation, therapy and clinical laboratories. Long-term acute care hospitals provide inpatient services for patients with complex medical conditions who require more intensive care, monitoring or emergency support than that available in most skilled nursing facilities.

Medical Office Building: Medical office buildings are office and clinic facilities, often located near hospitals or on hospital campuses, specifically constructed and designed for use by physicians and other health care personnel to provide services to their patients. They may also include ambulatory surgery centers that are used for general or specialty surgical procedures not requiring an overnight stay in a hospital. Medical office buildings may contain sole and group physician practices and may provide laboratory and other patient services.

Net Operating Income (NOI): NOI is a non-GAAP financial measure that is defined as net income or loss, computed in accordance with GAAP, generated from DOC’s total portfolio of properties before general and administrative expenses, acquisition-related expenses, depreciation and amortization expense, REIT expenses, interest expense and net change in the fair value of derivative financial instruments, and gains or loss on the sale of discontinued properties. DOC believes that NOI provides an accurate measure of operating performance of its operating assets because NOI excludes certain items that are not associated with management of the properties. Additionally, DOC’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount.

Cash Net Operating Income (NOI): Cash NOI is a non-GAAP financial measure which excludes from NOI straight-line rent adjustments, amortization of acquired below and above market leases and other non-cash and normalizing items. Other non-cash and normalizing items include items such as the amortization of lease inducements. DOC believes that Cash NOI provides an accurate measure of the operating performance of its operating assets because it excludes certain items that are not associated with management of the properties. Additionally, DOC believes that Cash NOI is a widely accepted measure of comparative operating performance in the real estate community. However, DOC’s use of the term Cash NOI may not be comparable to that of other real estate companies as such other companies may have different methodologies for computing this amount.

GLOSSARY CONTINUED

Normalized Funds Available for Distribution (Normalized FAD): DOC defines Normalized FAD, a non-GAAP measure, which excludes from Normalized FFO, non-cash compensation expense, straight-line rent adjustments, amortization of acquired above market leases, amortization of deferred financing costs and amortization of lease inducements. DOC believes Normalized FAD provides a meaningful supplemental measure of its ability to fund its ongoing distributions. In order to understand and analyze DOC’s liquidity, Normalized FAD should be compared with cash flow (computed in accordance with GAAP). Normalized FAD should not be considered as an alternative to net income or loss attributable to controlling interest (computed in accordance with GAAP) as an indicator of DOC’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of DOC’s liquidity. Normalized FAD should be reviewed in connection with other GAAP measurements.

Normalized Funds From Operations (Normalized FFO): Changes in the accounting and reporting rules under GAAP have prompted a significant increase in the amount of non-operating items included in FFO, as defined. Therefore, DOC uses Normalized FFO, which excludes from FFO acquisition-related expenses, net change in fair value of derivative financial instruments, non-controlling income from operating partnership units included in diluted shares, acceleration of deferred financing costs, and other normalizing items. However, DOC’s use of the term Normalized FFO may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized FFO should not be considered as an alternative to net income or loss attributable to controlling interest (computed in accordance with GAAP) as an indicator of DOC’s financial performance or to cash flow operating activities (computed in accordance with GAAP) as an indicator of DOC’s liquidity, nor its indicative of funds available to fund DOC’s cash needs, including its ability to make distributions. Normalized FFO should be reviewed in connection with other GAAP measurements.

Occupancy: Occupancy represents the percentage of total gross leasable area that is leased, including month-to-month leases and leases that are signed but not yet commenced, as of the date reported.

Off-Campus: A building portfolio that is not located on or adjacent to key hospital based-campuses and is not affiliated with recognized healthcare systems.

On-Campus / Affiliated: On-campus refers to a property that is located on or within a quarter mile to a healthcare system. Affiliated refers to a property that is not on the campus of a healthcare system, but anchored by a healthcare system.