Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Airlines Group Inc. | d723000d8k.htm |

Bank

of America Merrill Lynch 2014 Transportation Conference

Scott Kirby

President

American Airlines Group Inc.

May 7, 2014

Exhibit 99.1 |

Cautionary Statement Regarding Forward-Looking

Statements and Information

This document includes forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements may be identified by words

such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,”

“continue,” “seek,” “target,” “guidance,”

“outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about future

financial and operating results, our plans, objectives, estimates, expectations and intentions, and

other statements that are not historical facts. These forward-looking statements are based

on the current objectives, beliefs and expectations of the Company, and they are subject to significant risks and uncertainties that may cause actual

results and financial position and timing of certain events to differ materially from the information

in the forward-looking statements. The following factors, among others, could cause actual

results and financial position and timing of certain events to differ materially from those described in the forward-looking statements: significant operating

losses in the future; downturns in economic conditions that adversely affect the Company’s

business; the impact of continued periods of high volatility in fuel costs, increased fuel

prices and significant disruptions in the supply of aircraft fuel; competitive practices in the industry, including the impact of low cost carriers, airline alliances

and industry consolidation; the challenges and costs of integrating operations and realizing

anticipated synergies and other benefits of the merger transaction with US Airways Group, Inc.;

the Company’s substantial indebtedness and other obligations and the effect they could have on the Company’s business and liquidity; an inability to

obtain sufficient financing or other capital to operate successfully and in accordance with the

Company’s current business plan; increased costs of financing, a reduction in the

availability of financing and fluctuations in interest rates; the effect the Company’s high level of fixed obligations may have on its ability to fund general corporate

requirements, obtain additional financing and respond to competitive developments and adverse economic

and industry conditions; the Company’s significant pension and other post-employment

benefit funding obligations; the impact of any failure to comply with the covenants contained in financing arrangements; provisions in credit card

processing and other commercial agreements that may materially reduce the Company’s liquidity;

the limitations of the Company’s historical consolidated financial information, which is

not directly comparable to its financial information for prior or future periods; the impact of union disputes, employee strikes and other labor-related

disruptions; any inability to maintain labor costs at competitive levels; interruptions or disruptions

in service at one or more of the Company’s hub airports; any inability to obtain and

maintain adequate facilities, infrastructure and slots to operate the Company’s flight schedule and expand or change its route network; the Company’s reliance

on third-party regional operators or third-party service providers that have the ability to

affect the Company’s revenue and the public’s perception about its services; any

inability to effectively manage the costs, rights and functionality of third-party distribution

channels on which the Company relies; extensive government regulation, which may result in

increases in the Company’s costs, disruptions to the Company’s operations, limits on the Company’s operating flexibility, reductions in the demand for air

travel, and competitive disadvantages; the impact of the heavy taxation to which the airline industry

is subject; changes to the Company’s business model that may not successfully increase

revenues and may cause operational difficulties or decreased demand; the loss of key personnel or inability to attract and retain additional qualified

personnel; the impact of conflicts overseas, terrorist attacks and ongoing security concerns; the

global scope of the Company’s business and any associated economic and political

instability or adverse effects of events, circumstances or government actions beyond its control, including the impact of foreign currency exchange rate fluctuations

and limitations on the repatriation of cash held in foreign countries; the impact of environmental

regulation; the Company’s reliance on technology and automated systems and the impact of

any failure of these technologies or systems; challenges in integrating the Company’s computer, communications and other technology systems; costs of

ongoing data security compliance requirements and the impact of any significant data security breach;

losses and adverse publicity stemming from any accident involving any of the Company’s

aircraft or the aircraft of its regional or codeshare operators; delays in scheduled aircraft deliveries, or other loss of anticipated fleet capacity, and

failure of new aircraft to perform as expected; the Company’s dependence on a limited number of

suppliers for aircraft, aircraft engines and parts; the impact of changing economic and other

conditions beyond the Company’s control, including global events that affect travel behavior such as an outbreak of a contagious disease, and volatility

and fluctuations in the Company’s results of operations due to seasonality; the effect of a

higher than normal number of pilot retirements and a potential shortage of pilots; the impact

of possible future increases in insurance costs or reductions in available insurance coverage; the effect of several lawsuits that were filed in connection with the

merger transaction with US Airways Group, Inc. and remain pending; an inability to use NOL

carryforwards; any impairment in the amount of goodwill the Company recorded as a result of the

application of the acquisition method of accounting and an inability to realize the full value of the Company’s and American Airlines’ respective

intangible or long-lived assets and any material impairment charges that would be recorded as a

result; price volatility of the Company’s common stock; delay or prevention of

stockholders’ ability to change the composition of the Company’s board of directors and the effect this may have on takeover attempts that some of the Company’s

stockholders might consider beneficial; the effect of provisions of the Company’s Certificate of

Incorporation and Bylaws that limit foreign owners’ ability to vote and own its equity

interests, including its common stock, its preferred stock and convertible notes; the effect of limitations in the Company’s Certificate of Incorporation on acquisitions

and dispositions of its common stock designed to protect its NOL carryforwards and certain other tax

attributes, which may limit the liquidity of its common stock; and other economic, business,

competitive, and/or regulatory factors affecting the Company’s business, including those set forth in the Company’s filings with the SEC, especially in

the “Risk Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of the Company’s quarterly report on Form 10-Q

for the period ended March 31, 2014, current reports on Form 8-K and other SEC filings. Any

forward-looking statements speak only as of the date hereof or as of the dates indicated in

the statements. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes

in assumptions or changes in other factors affecting these forward-looking statements except as

required by law. |

Restoring American Airlines

•

Record 1Q net profit*of $402M

•

Pretax margin* of 4.1 percent

•

Operational turnaround working

•

Increasing confidence in meeting our

synergy targets

•

Capital return has already begun

Integration Efforts

Remain on Track

Building Upon Our

Momentum with Solid

First Quarter Results

* Excludes special items |

•

Legacy American Airlines network on-time departure performance has

improved by 15.1 ppts. YOY in April

Ops

Improvement

-

April

2014

Performance

40%

45%

50%

55%

60%

65%

70%

Jan

Feb

Mar

April

2013

2014 |

Ops

Improvement

-

April

2014

Performance

•

Legacy American mainline April MTD completion factor of 99.7%

Highest monthly completion factor ever

9 zero cancellation days in April

7

days

in

a

row

with

zero

maintenance

cancellations

(10

total

in

April)

•

Legacy American mainline D0 of 69.4% highest April since 2005

•

Three operational incentive payouts to employees through April

April*

2014

YOY

Variance

B/(W)

On-time Departures

(D0)

70.3

8.6

On-time Arrivals

(A14)

82.8

6.7

Completion Factor

(CF)

99.5

0.9

Block Performance**

(B0)

68.7

(3.8)

* D0, B0, A14, and CF depict AA mainline system performance

**

Lower B0 is better: more efficient |

•

Improved check-in areas

•

Widebody Aircraft Retrofits

-

New fully lie-flat, all-aisle access Business Class seat

-

International Wi-Fi

-

AC power outlets and USB power

-

Walk-up bar

-

Enhanced in-seat entertainment

-

Main Cabin Extra seating

Investments in Our Product |

Airbus A321 Transcontinental

•

Fully lie-flat First and Business Class seats

•

All-aisle access in First Class

•

Main Cabin Extra seating

•

Wi-Fi

•

AC power outlets and USB power

•

Personal in-seat entertainment featuring

screens at every seat with up to 200 movies,

up to 180 TV programs, more than 350 audio

selections and up to 20 games |

Integration Update

•

Launched the world’s largest codeshare

•

Reciprocal benefits for Club and Elite

members

•

Enabled

AAdvantage

®

and

Dividend

Miles

®

members to earn and redeem miles when

traveling across either airline's network

•

Joined operations at 58 airports

•

US joined the oneworld alliance and joined the trans-Atlantic

joint venture

•

Began to align award travel options, checked baggage policies

and inflight services for First and Business Class customers

•

We expect our first metal swap later this summer

•

Working with the FAA to achieve a single operating certificate

|

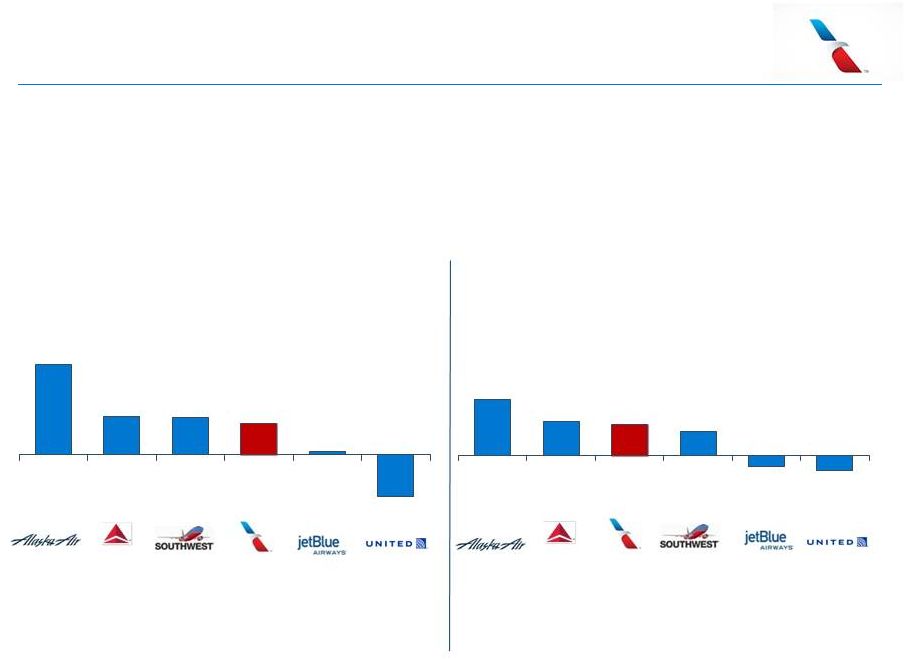

Pretax Margin

•

American’s pretax margin is already in line with peers

•

Anticipated synergy upside just beginning

Source: Company reports

11.8%

5.0%

4.8%

4.1%

0.4%

-5.6%

1Q14 Pretax Margin

(ex special items)

6.6

4.0

3.6

2.8

-1.3

-1.8

1Q14 YOY Pretax Margin (pts)

(ex special items) |

Capital Deployment Has Already Begun |

Outlook Going Forward –

2Q14

11

•

PRASM growth of 4% to 6%

•

CASM ex fuel & special items

-

Mainline: of +1% to +3%

-

Regional: +4% to +6%

•

Expected 2Q pretax margin of 10%

to 12% |

Restoring American Airlines

•

Record 1Q net profit*of $402M

•

Pretax margin* of 4.1 percent

•

Operational turnaround working

•

Increasing confidence in meeting our

synergy targets

•

Capital return has already begun

Integration Efforts

Remain on Track

Building Upon Our

Momentum with Solid

First Quarter Results

* Excludes special items |

Appendix |

GAAP to non-GAAP Reconciliation

14

Quarter

Ended

3/31/2014

Quarter

Ended

3/31/2013

¹

YoY

Change

($ millions)

Total Revenues

9,995

9,468

5.6%

Pre-Tax Income as Reported

493

(319)

Pre-Tax Margin

4.9%

-3.4%

8.3 pts.

Net Income as Reported

480

(297)

Excluding Special Items:

Mainline Special Items

(137)

110

Regional Special Items

4

3

Nonoperating Special Items

47

86

Reorganization Items

-

160

Pre-Tax Income Excluding Special Items

407

40

Pre-Tax Margin Excluding Special Items

4.1%

0.4%

3.6 pts.

Total income tax provision (benefit)

13

(22)

Excluding special non-cash income tax provision

8

-

Net Income as adjusted for special items

402

62

Notes:

Reconciliation of Pre-Tax Margin Excluding Special Items

1.) First quarter 2013 results are on a combined non-GAAP

basis. For more information regarding the methodology used to produce combined historical results,

please see our earnings press releases dated April 24, 2014 which can

be found at:

https://www.sec.gov/Archives/edgar/data/4515/000119312514155886/d714135d8k.htm

|

Questions? |