Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVAYA INC | form8-kforearnings5x7x2014.htm |

| EX-99.2 - AVAYA PRESENTATION - AVAYA INC | exhibit992avayapresentat.htm |

Exhibit 99.1 Media Inquiries: Investor Inquiries: Deb Kline Matthew Booher John Nunziati 908-953-6179 (office) 908-953-7500 (office) 408-562-3780 (office) klined@avaya.com mbooher@avaya.com jfnunziati@avaya.com Avaya Reports Second Fiscal Quarter 2014 Financial Results Ongoing improvement in operational execution Initiated redemption of unsecured notes due in 2015 Second Quarter 2014 Highlights: - Revenue of $1,060 million - Gross Margin of 56.3% of revenue, non-GAAP Gross Margin of 58.6% of revenue - Adjusted EBITDA(1) of $185 million, 17.5% of revenue Santa Clara, Calif. — Wednesday, May 7, 2014 – Avaya Inc., a global provider of business communications and collaboration systems, software and services, reported results for the second fiscal quarter ended March 31, 2014. Total revenue for the second quarter was $1,060 million, down 6.3% when compared to the prior quarter. On a year over year basis revenue was down 2.4% compared to the second quarter of fiscal 2013. For the second fiscal quarter, adjusted EBITDA was $185 million which compares to adjusted EBITDA of $237 million for the prior quarter and $167 million for the second quarter of fiscal 2013. GAAP operating income was breakeven and Non-GAAP operating income was $142 million compared to non-GAAP operating income of $193 million for the prior quarter and $108 million for the second quarter of fiscal 2013. Cash and cash equivalents increased $84 million from the prior quarter and totaled $384 million as of March 31, 2014. Subsequent to the end of the second fiscal quarter, the company also announced the redemption of its senior unsecured notes due 2015 for approximately $150 million, representing the aggregate principal amount of those notes, plus accrued and unpaid interest through the May 15, 2014 redemption date.

“Avaya delivered second quarter results which reflected better than recent historical revenue seasonality. While revenue was slightly below our outlook, backlog increased and we demonstrated ongoing improvement in operational execution” said Kevin Kennedy, president and CEO. “We believe the overall market environment continues to provide growth opportunities for Avaya. Our portfolio is aligned to customers’ needs and we are tuning our organization to deliver a broad set of products, software, and services.” Second Fiscal Quarter Highlights Revenue of $1,060 million decreased 6.3% compared to the prior quarter and decreased 2.4% compared to the second quarter of fiscal 2013 Product revenue of $532 million decreased by 7.3% compared to the prior quarter and increased 0.6% compared to the second quarter of fiscal 2013. Product book-to-bill was greater than 1.0 Avaya Global Services revenue of $528 million decreased 5.2% compared to the prior quarter and also decreased 5.2% when compared to the second quarter of fiscal 2013 Gross margin was 56.3% compared to 56.6% for the prior quarter and 53.3% for the second quarter of fiscal 2013. Operating income was breakeven ($0 million) compared to operating income of $87 million for the prior quarter and compared to $12 million for the second quarter of fiscal 2013 Non-GAAP gross margin(1) was 58.6% compared to 58.1% for the prior quarter and 54.6% for the second quarter of fiscal 2013. Non-GAAP operating income was $142 million compared to non- GAAP operating income of $193 million for the prior quarter and $108 million for the second quarter of fiscal 2013 Adjusted EBITDA was $185 million or 17.5% of revenue compared to $237 million or 21.0% of revenue for the prior quarter and $167 million or 15.4% of revenue for the second quarter of fiscal 2013 Second fiscal quarter 2014 non-GAAP gross margin and adjusted EBITDA percentage were record levels in the second quarter of any fiscal year for the company. Second fiscal quarter 2014 cash and cash equivalents totaled $384 million compared to $300 million for the prior quarter and $302 million for the second quarter of fiscal 2013 For the second fiscal quarter, percentage of revenue by geography was: ‐ U.S. – 50% - EMEA – 29% ‐ Asia-Pacific – 11% - Americas International – 10%. As previously, disclosed, the IT Professional Services business (“ITPS”) was sold on March 31, 2014 and is reported in discontinued operations Conference Call and Webcast Avaya will discuss these results at 5:00 a.m. PDT on Wednesday, May 7, 2014 in a live webcast and conference call. To join the webcast, listeners should access the investor page of our website (www.avaya.com/investors). Supplementary materials will be available at the same location. Following the live webcast, a replay will be available at the same web address in our event archives. To access the webcast by phone, dial 800-882-9327 in the U.S. or Canada and 706-645-9730 for international callers using the conference passcode number of 24442437. To ensure you are connected prior to the start, we suggest you access the website or the call 10-15 minutes before the start time.

For those unable to participate during the live event, a replay of the conference call will be available beginning at 5:00 p.m. PDT on May 7, 2014 through June 7, 2014 by dialing 855-859- 2056 or 800-585-8367 within the United States and 404-537-3406 outside the United States. The replay access code is 24442437. About Avaya Avaya is a global provider of business collaboration and communications solutions, providing unified communications, contact centers, networking and related services to companies of all sizes around the world. For more information please visit www.avaya.com. Certain statements contained in this press release may be forward-looking statements. These statements may be identified by the use of forward-looking terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "should" or "will" or other similar terminology. We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these are reasonable, such forward looking statements involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors may cause our actual results to differ materially from any future results expressed or implied by these forward-looking statements. For a list and description of such risks and uncertainties, please refer to Avaya's filings with the SEC that are available at www.sec.gov. Avaya disclaims any intention or obligation to update or revise any forward-looking statements. 1 Refer to Supplemental Financial Information accompanying this press release for a reconciliation of GAAP to non-GAAP numbers and for reconciliation of adjusted EBITDA for the first quarter of fiscal 2014 see our Form 8-K/A filed with the SEC on April 25, 2014 at www.sec.gov.

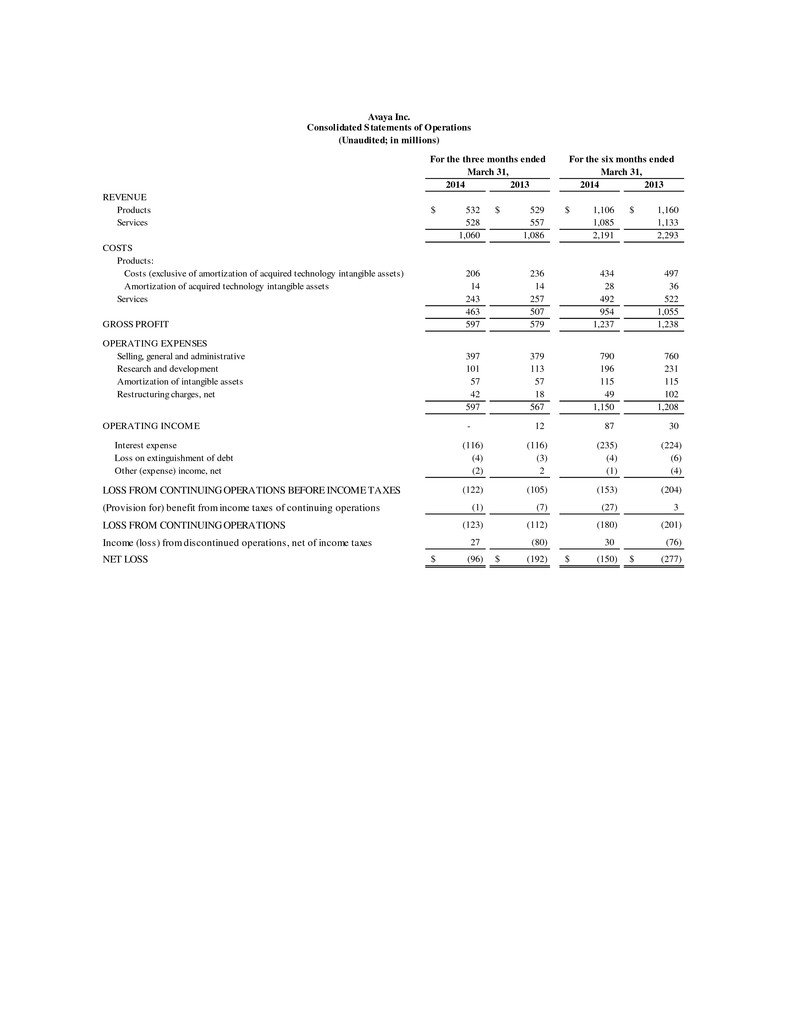

2014 2013 2014 2013 REVENUE Products 532$ 529$ 1,106$ 1,160$ Services 528 557 1,085 1,133 1,060 1,086 2,191 2,293 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 206 236 434 497 Amortization of acquired technology intangible assets 14 14 28 36 Services 243 257 492 522 463 507 954 1,055 GROSS PROFIT 597 579 1,237 1,238 OPERATING EXPENSES Selling, general and administrative 397 379 790 760 Research and development 101 113 196 231 Amortization of intangible assets 57 57 115 115 Restructuring charges, net 42 18 49 102 597 567 1,150 1,208 OPERATING INCOME - 12 87 30 Interest expense (116) (116) (235) (224) Loss on extinguishment of debt (4) (3) (4) (6) Other (expense) income, net (2) 2 (1) (4) LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (122) (105) (153) (204) (Provision for) benefit from income taxes of continuing operations (1) (7) (27) 3 LOSS FROM CONTINUING OPERATIONS (123) (112) (180) (201) Income (loss) from discontinued operations, net of income taxes 27 (80) 30 (76) NET LOSS (96)$ (192)$ (150)$ (277)$ For the three months ended March 31, Avaya Inc. Consolidated Statements of Operations (Unaudited; in millions) For the six months ended March 31,

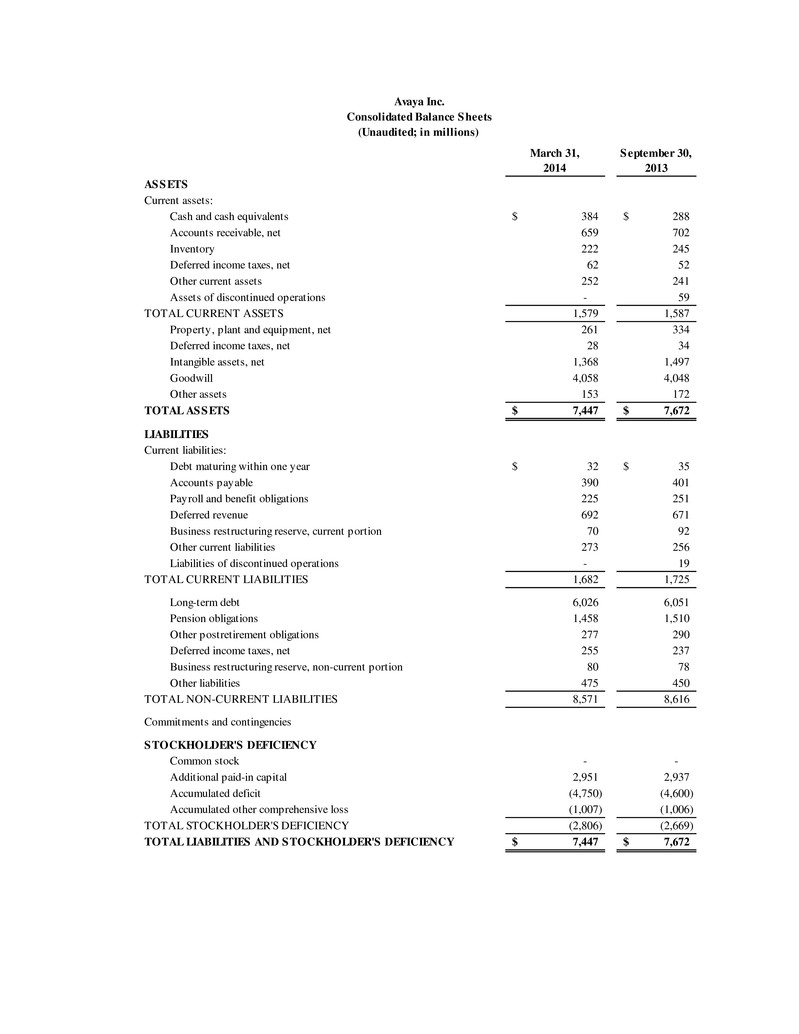

March 31, 2014 September 30, 2013 ASSETS Current assets: Cash and cash equivalents 384$ 288$ Accounts receivable, net 659 702 Inventory 222 245 Deferred income taxes, net 62 52 Other current assets 252 241 Assets of discontinued operations - 59 TOTAL CURRENT ASSETS 1,579 1,587 Property, plant and equipment, net 261 334 Deferred income taxes, net 28 34 Intangible assets, net 1,368 1,497 Goodwill 4,058 4,048 Other assets 153 172 TOTAL ASSETS 7,447$ 7,672$ LIABILITIES Current liabilities: Debt maturing within one year 32$ 35$ Accounts payable 390 401 Payroll and benefit obligations 225 251 Deferred revenue 692 671 Business restructuring reserve, current portion 70 92 Other current liabilities 273 256 Liabilities of discontinued operations - 19 TOTAL CURRENT LIABILITIES 1,682 1,725 Long-term debt 6,026 6,051 Pension obligations 1,458 1,510 Other postretirement obligations 277 290 Deferred income taxes, net 255 237 Business restructuring reserve, non-current portion 80 78 Other liabilities 475 450 TOTAL NON-CURRENT LIABILITIES 8,571 8,616 Commitments and contingencies STOCKHOLDER'S DEFICIENCY Common stock - - Additional paid-in capital 2,951 2,937 Accumulated deficit (4,750) (4,600) Accumulated other comprehensive loss (1,007) (1,006) TOTAL STOCKHOLDER'S DEFICIENCY (2,806) (2,669) TOTAL LIABILITIES AND STOCKHOLDER'S DEFICIENCY 7,447$ 7,672$ Avaya Inc. (Unaudited; in millions) Consolidated Balance Sheets

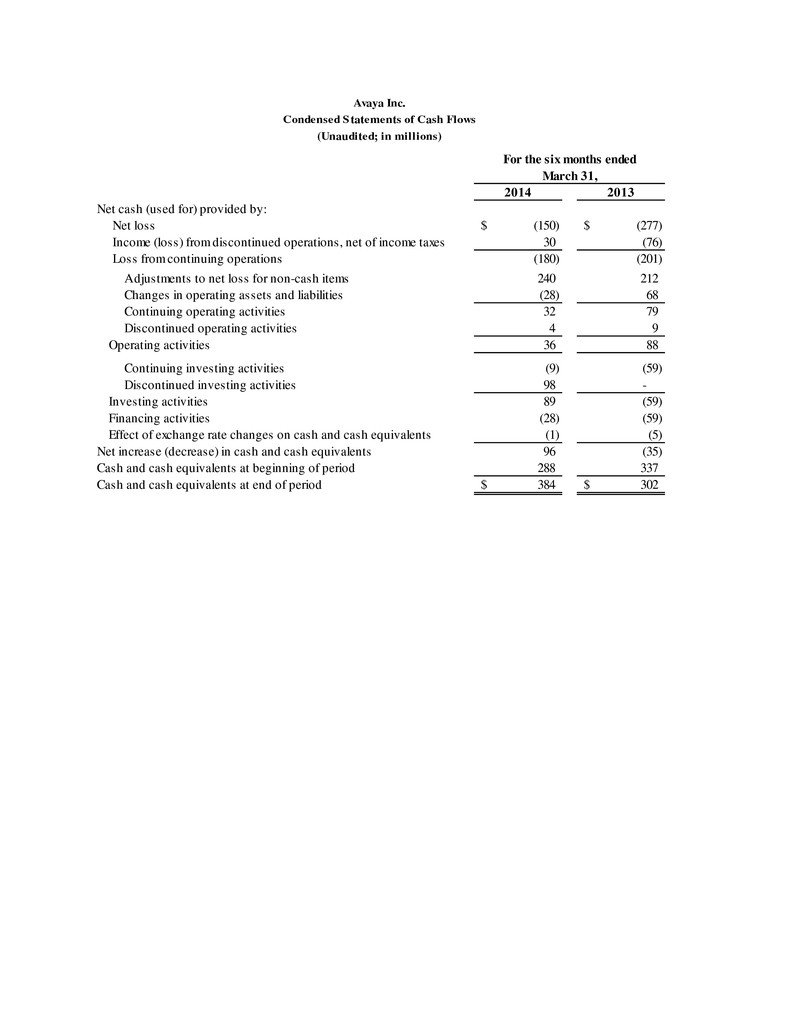

2014 2013 Net cash (used for) provided by: Net loss (150)$ (277)$ Income (loss) from discontinued operations, net of income taxes 30 (76) Loss from continuing operations (180) (201) Adjustments to net loss for non-cash items 240 212 Changes in operating assets and liabilities (28) 68 Continuing operating activities 32 79 Discontinued operating activities 4 9 Operating activities 36 88 Continuing investing activities (9) (59) Discontinued investing activities 98 - Investing activities 89 (59) Financing activities (28) (59) Effect of exchange rate changes on cash and cash equivalents (1) (5) Net increase (decrease) in cash and cash equivalents 96 (35) Cash and cash equivalents at beginning of period 288 337 Cash and cash equivalents at end of period 384$ 302$ Avaya Inc. Condensed Statements of Cash Flows (Unaudited; in millions) For the six months ended March 31,

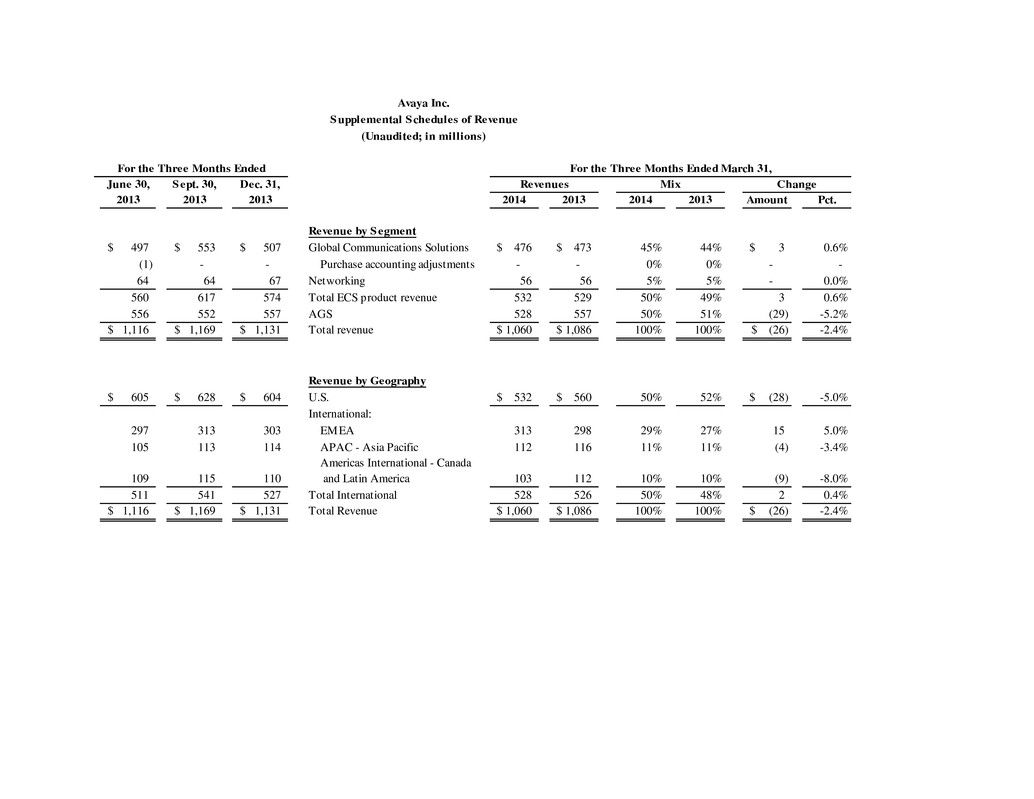

Avaya Inc. Supplemental Schedules of Revenue (Unaudited; in millions) June 30, Sept. 30, Dec. 31, 2013 2013 2013 2014 2013 2014 2013 Amount Pct. Revenue by Segment 497$ 553$ 507$ Global Communications Solutions 476$ 473$ 45% 44% 3$ 0.6% (1) - - Purchase accounting adjustments - - 0% 0% - - 64 64 67 Networking 56 56 5% 5% - 0.0% 560 617 574 Total ECS product revenue 532 529 50% 49% 3 0.6% 556 552 557 AGS 528 557 50% 51% (29) -5.2% 1,116$ 1,169$ 1,131$ Total revenue 1,060$ 1,086$ 100% 100% (26)$ -2.4% Revenue by Geography 605$ 628$ 604$ U.S. 532$ 560$ 50% 52% (28)$ -5.0% International: 297 313 303 EMEA 313 298 29% 27% 15 5.0% 105 113 114 APAC - Asia Pacific 112 116 11% 11% (4) -3.4% 109 115 110 103 112 10% 10% (9) -8.0% 511 541 527 Total International 528 526 50% 48% 2 0.4% 1,116$ 1,169$ 1,131$ Total Revenue 1,060$ 1,086$ 100% 100% (26)$ -2.4% For the Three Months Ended For the Three Months Ended March 31, Mix Americas International - Canada and Latin America Revenues Change

Use of non-GAAP (Adjusted) Financial Measures The information furnished in this release includes non-GAAP financial measures that differ from measures calculated in accordance with generally accepted accounting principles in the United States (GAAP), including adjusted EBITDA, non-GAAP gross margin as a percentage of revenue, and non-GAAP operating income. EBITDA is defined as net income (loss) before income taxes, interest expense, interest income and depreciation and amortization and excludes the results of discontinued operations for all periods presented. Adjusted EBITDA is EBITDA further adjusted to exclude certain charges and other adjustments permitted in calculating covenant compliance under our debt agreements as further described in our SEC filings. We believe that including supplementary information concerning Adjusted EBITDA is appropriate to provide additional information to investors to demonstrate compliance with our debt agreements and because it serves as a basis for determining management compensation. In addition, we believe Adjusted EBITDA provides more comparability between our historical results and results that reflect purchase accounting and our current capital structure. Accordingly, Adjusted EBITDA measures our financial performance based on operational factors that management can impact in the short-term, namely the Company’s pricing strategies, volume, costs and expenses of the organization. Adjusted EBITDA has limitations as an analytical tool. Adjusted EBITDA does not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and does not necessarily indicate whether cash flows will be sufficient to fund cash needs. While adjusted EBITDA and similar measures are frequently used as measures of operations and the ability to meet debt service requirements, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation. Adjusted EBITDA does not reflect the impact of earnings or charges resulting from matters that we consider not to be indicative of our ongoing operations. In particular, based on our debt agreements the definition of Adjusted EBITDA allows us to add back certain non-cash charges that are deducted in calculating net income (loss). Our debt agreements also allow us to add back restructuring charges, certain fees payable to our private equity sponsors and other specific cash costs and expenses as defined in the agreements and that portion of our pension costs, other post-employment benefits costs, and non-retirement post-employment benefits costs representing the amortization of pension service costs and actuarial gain or loss associated with these employment benefits. However, these are expenses that may recur, may vary and are difficult to predict. Further, our debt agreements require that Adjusted EBITDA be calculated for the most recent four fiscal quarters. As a result, the measure can be disproportionately affected by a particularly strong or weak quarter. Further, it may not be comparable to the measure for any subsequent four-quarter period or any complete fiscal year. Non-GAAP gross margin excludes the amortization of acquired technology intangible assets, share based compensation, impairment of long lived assets and purchase accounting adjustments. We have included non-GAAP gross margin because we believe it provides additional useful information to investors regarding our operations by excluding those charges that management does not believe are reflective of the Company’s ongoing operating results when assessing the performance of the business. Non-GAAP operating income excludes the amortization of technology intangible assets, restructuring and impairment charges, acquisition and integration related costs, share based compensation, impairment of long lived assets and purchase accounting adjustments. We have included non-GAAP operating income because we believe it provides additional useful information to investors regarding our operations by excluding those charges that management does not

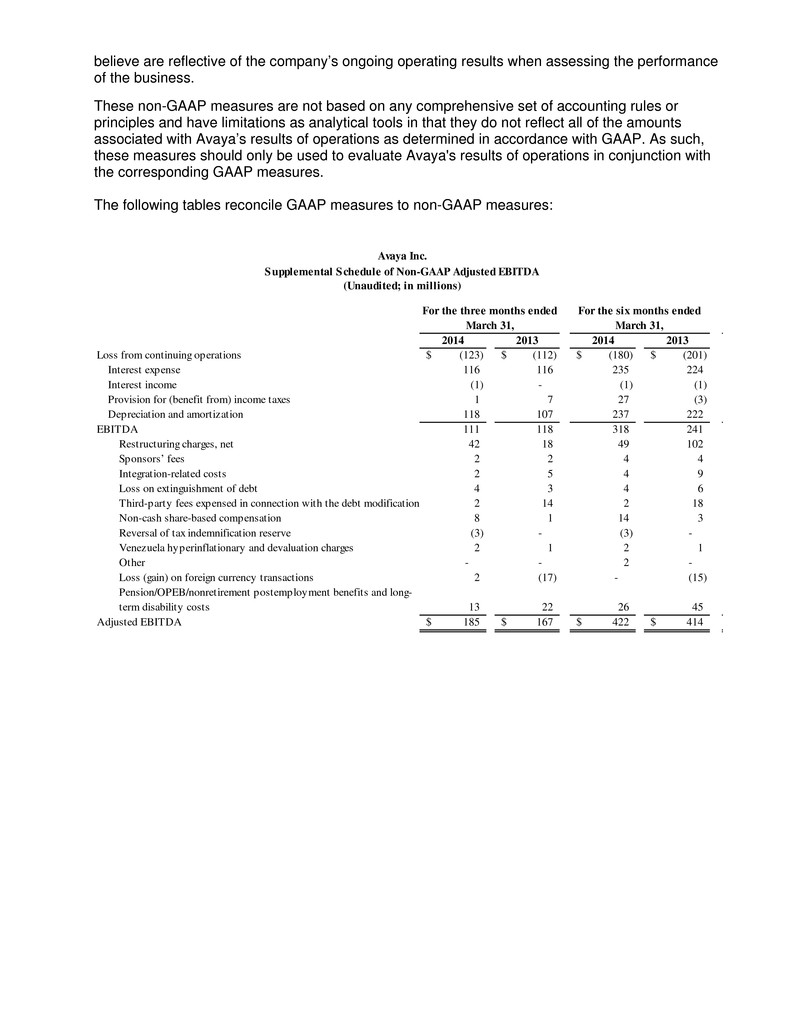

believe are reflective of the company’s ongoing operating results when assessing the performance of the business. These non-GAAP measures are not based on any comprehensive set of accounting rules or principles and have limitations as analytical tools in that they do not reflect all of the amounts associated with Avaya’s results of operations as determined in accordance with GAAP. As such, these measures should only be used to evaluate Avaya's results of operations in conjunction with the corresponding GAAP measures. The following tables reconcile GAAP measures to non-GAAP measures: 2014 2013 2014 2013 Loss from continuing operations (123)$ (112)$ (180)$ (201)$ Interest expense 116 116 235 224 Interest income (1) - (1) (1) Provision for (benefit from) income taxes 1 7 27 (3) Depreciation and amortization 118 107 237 222 111 118 318 241 Restructuring charges, net 42 18 49 102 Sponsors’ fees 2 2 4 4 Integration-related costs 2 5 4 9 Loss on extinguishment of debt 4 3 4 6 Third-party fees expensed in connection with the debt modification 2 14 2 18 Non-cash share-based compensation 8 1 14 3 Reversal of tax indemnification reserve (3) - (3) - Venezuela hyperinflationary and devaluation charges 2 1 2 1 Other - - 2 - Loss (gain) on foreign currency transactions 2 (17) - (15) Pension/OPEB/nonretirement postemployment benefits and long- term disability costs 13 22 26 45 Adjusted EBITDA 185$ 167$ 422$ 414$ EBITDA For the three months ended March 31, Avaya Inc. Supplemental Schedule of Non-GAAP Adjusted EBITDA (Unaudited; in millions) For the six months ended March 31,

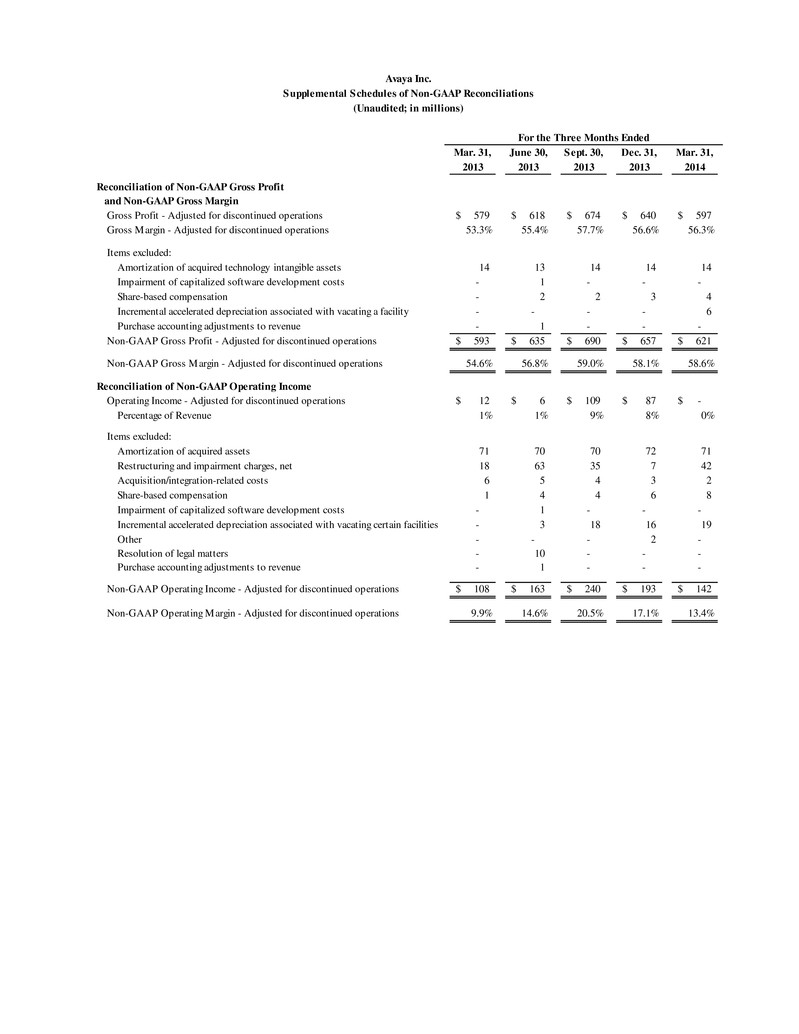

Mar. 31, June 30, Sept. 30, Dec. 31, Mar. 31, 2013 2013 2013 2013 2014 Gross Profit - Adjusted for discontinued operations 579$ 618$ 674$ 640$ 597$ Gross Margin - Adjusted for discontinued operations 53.3% 55.4% 57.7% 56.6% 56.3% Items excluded: Amortization of acquired technology intangible assets 14 13 14 14 14 Impairment of capitalized software development costs - 1 - - - Share-based compensation - 2 2 3 4 Incremental accelerated depreciation associated with vacating a facility - - - - 6 Purchase accounting adjustments to revenue - 1 - - - Non-GAAP Gross Profit - Adjusted for discontinued operations 593$ 635$ 690$ 657$ 621$ Non-GAAP Gross Margin - Adjusted for discontinued operations 54.6% 56.8% 59.0% 58.1% 58.6% Reconciliation of Non-GAAP Operating Income Operating Income - Adjusted for discontinued operations 12$ 6$ 109$ 87$ -$ Percentage of Revenue 1% 1% 9% 8% 0% Items excluded: Amortization of acquired assets 71 70 70 72 71 Restructuring and impairment charges, net 18 63 35 7 42 Acquisition/integration-related costs 6 5 4 3 2 Share-based compensation 1 4 4 6 8 Impairment of capitalized software development costs - 1 - - - Incremental accelerated depreciation associated with vacating certain facilities - 3 18 16 19 Other - - - 2 - Resolution of legal matters - 10 - - - Purchase accounting adjustments to revenue - 1 - - - Non-GAAP Operating Income - Adjusted for discontinued operations 108$ 163$ 240$ 193$ 142$ Non-GAAP Operating Margin - Adjusted for discontinued operations 9.9% 14.6% 20.5% 17.1% 13.4% Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliations (Unaudited; in millions) For the Three Months Ended

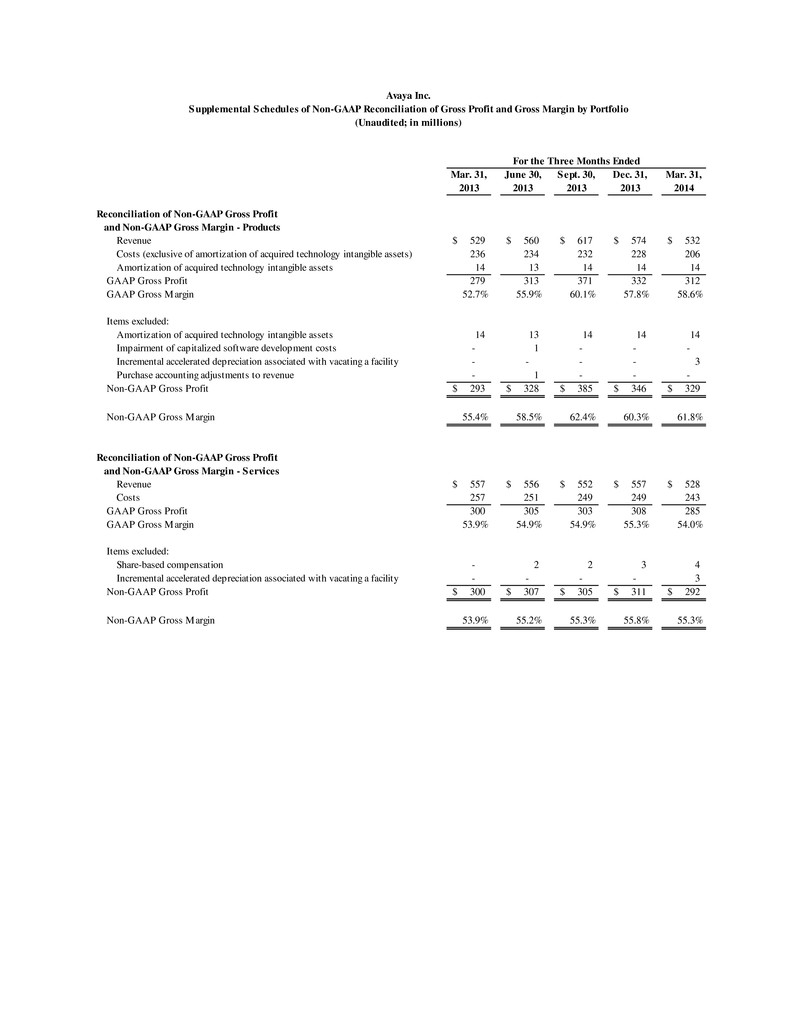

Mar. 31, June 30, Sept. 30, Dec. 31, Mar. 31, 2013 2013 2013 2013 2014 Revenue 529$ 560$ 617$ 574$ 532$ Costs (exclusive of amortization of acquired technology intangible assets) 236 234 232 228 206 Amortization of acquired technology intangible assets 14 13 14 14 14 GAAP Gross Profit 279 313 371 332 312 GAAP Gross Margin 52.7% 55.9% 60.1% 57.8% 58.6% Items excluded: Amortization of acquired technology intangible assets 14 13 14 14 14 Impairment of capitalized software development costs - 1 - - - Incremental accelerated depreciation associated with vacating a facility - - - - 3 Purchase accounting adjustments to revenue - 1 - - - Non-GAAP Gross Profit 293$ 328$ 385$ 346$ 329$ Non-GAAP Gross Margin 55.4% 58.5% 62.4% 60.3% 61.8% Revenue 557$ 556$ 552$ 557$ 528$ Costs 257 251 249 249 243 GAAP Gross Profit 300 305 303 308 285 GAAP Gross Margin 53.9% 54.9% 54.9% 55.3% 54.0% Items excluded: Share-based compensation - 2 2 3 4 Incremental accelerated depreciation associated with vacating a facility - - - - 3 Non-GAAP Gross Profit 300$ 307$ 305$ 311$ 292$ Non-GAAP Gross Margin 53.9% 55.2% 55.3% 55.8% 55.3% Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Services Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliation of Gross Profit and Gross Margin by Portfolio (Unaudited; in millions) Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Products For the Three Months Ended