Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mid-Con Energy Partners, LP | mcep8-k5x5x141qearningsrel.htm |

Mid-Con Energy Partners, LP Announces First Quarter 2014 Results

DALLAS, May 5, 2014 – Mid-Con Energy Partners, LP (NASDAQ: MCEP) (“Mid-Con Energy” or the “Partnership”) today announced operating and financial results for the first quarter ended March 31, 2014.

First Quarter 2014 Highlights:

• | Increased production 3% sequentially and 4% year-over-year to an average of 2,622 barrels of oil equivalent per day (“Boe/d”) during the first quarter of 2014. |

• | Recorded Adjusted EBITDA of $12.7 million in the first quarter of 2014, versus $14.4 million in the fourth quarter of 2013 and $14.6 million in the first quarter of 2013. |

• | Completed first dropdown from a Mid-Con affiliate in February 2014 with the acquisition of 349 Boe/d net production and 1.6 MMBoe net proved reserves for $41.0 million of total consideration comprised of both cash and limited partner units. |

• | Acquired working interests in existing Southern Oklahoma waterflood units on May 1, 2014 with the acquisition of 90 Boe/d net production and 0.3 MMBoe net proved reserves for $7.4 million in cash. |

• | Raised the Partnership’s borrowing base by $20.0 million to $170.0 million via unanimous lender group approval of an amendment to Mid-Con Energy’s credit agreement on April 11, 2014. |

• | The Board of Directors of Mid-Con Energy’s general partner declared a quarterly cash distribution of $0.515 per unit, or $2.06 per unit on an annualized basis, on April 22, 2014. |

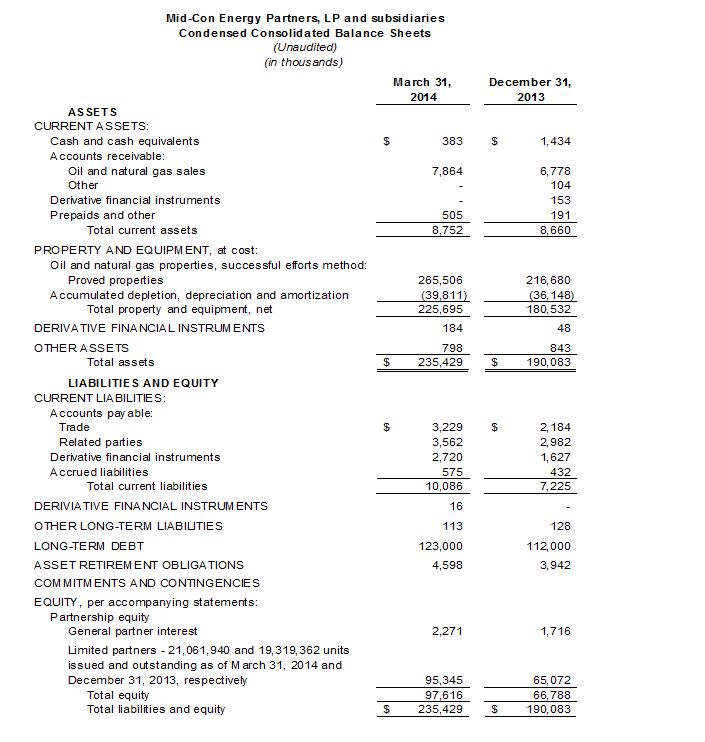

The following table reflects selected operating and financial results for the first quarter of 2014, compared to the fourth quarter of 2013 and first quarter of 2013. Mid-Con Energy’s unaudited condensed consolidated financial statements are included in the supplemental tables of this press release.

1

Randy Olmstead, Chief Executive Officer, commented, “The first quarter of 2014 was a very active time for Mid-Con Energy during which we completed our first dropdown acquisition from a Mid-Con affiliate. We look forward to continued production growth resulting from this dropdown acquisition, incremental working interests acquired on May 1, 2014 and higher output attributable to rising injections rates. Notably, we are encouraged by the positive results recorded to date from both new water injection wells as well as the conversion of producing wells to injection wells which were completed in 2013 and during the first quarter of 2014. We remain focused on developing our legacy assets as well as sourcing growth via accretive acquisitions; we continue to anticipate distribution growth in 2014 will approximate 4%.”

First Quarter 2014 Results

PRODUCTION - Production volumes for the first quarter of 2014 were 236 thousand barrels of oil equivalent (MBoe) or 2,622 Boe/d. This represents a 3% increase from the fourth quarter of 2013 and a 4% increase year-over-year. The increase in production volumes was primarily due to the recently acquired properties from our affiliate in February 2014. Our legacy assets' production declined due to natural declines and converting some producers to injectors but was offset by the production from the properties and additional working interest acquired in 2013 and 2014.

PRICE REALIZATIONS - Oil sales, excluding the effect of commodity derivatives, were $21.6 million in the first quarter of 2014 and resulted in an average realized oil price of $93.27 per Bbl. Per barrel price realizations for the fourth quarter of 2013 and the first quarter of 2013 were $92.72 and $90.90, respectively. Due to the change in market value of our hedging contracts during the period, we recorded a net loss of $2.0 million from our commodity hedging instruments for the three months ended March 31, 2014, which was comprised of a $1.1 million non-cash loss on net unsettled derivative contracts and a $0.9 million loss on net cash settlements on derivative contracts.

OPERATING REVENUES - Operating revenues, including the effect of realized commodity derivatives, were $20.9 million in the first quarter of 2014. This represents a 4% decrease from the previous quarter and is relatively unchanged from the first quarter of 2013. Higher production volumes and oil prices during the first quarter of 2014 were offset by lower contributions from commodity hedges.

LEASE OPERATING EXPENSES (“LOE”) - Lease operating expenses were $4.7 million, or $19.88 per Boe, in the first quarter of 2014, a 3% increase per Boe from the fourth quarter of 2013 and a 34% increase per Boe from the first quarter of 2013. In the aggregate, lease operating expenses have increased as a result of asset development programs, as well as, additional properties and working interests acquired during 2013 and 2014. Although these properties are long-lived and have low decline rates, the recent acquisitions within our Northeastern Oklahoma and Hugoton areas have higher water cuts and thus higher operating costs per Boe.

PRODUCTION TAXES - Production taxes in the first quarter of 2014 were $1.4 million, or $5.75 per Boe, reflecting an effective tax rate of 6.2%. The effective tax rates for the fourth quarter of 2013 and the first quarter of 2013 were 5.3% and 3.9%, respectively. The higher production tax rate during the three months ended March 31, 2014 was due to the expiration of a large majority of our properties that qualified for the Oklahoma Enhanced Recovery Project Gross Production Tax Exemption.

DEPRECIATION, DEPLETION, AND AMORTIZATION EXPENSES (“DD&A”) – DD&A for the first quarter of 2014 was $15.52 per Boe, a 5% increase over the previous quarter and a 1% increase over the first quarter of 2013. The increase in DD&A expenses was primarily due to the acquisition of additional working interests during 2013 and the recently acquired oil properties during February 2014.

GENERAL AND ADMINISTRATIVE EXPENSES (“G&A”) - Total G&A expenses during the first quarter of 2014 were $7.6 million and included $5.5 million in non-cash equity-based compensation expense related to the Partnership’s long-term incentive program. Also included in G&A expenses during the first quarter of 2014 was $0.3 million in transactional fees attributable to the February 2014 dropdown acquisition.

2

OPERATING EXPENSES - Total operating expenses per Boe for the quarter ended March 31, 2014 were 47% higher than the previous quarter and 16% higher year-over-year. The increase in expenses was primarily attributable to higher lease operating expenses and production taxes.

INTEREST EXPENSES - Interest expenses for the first quarter of 2014 were $0.8 million, a 17% decrease per Boe from the fourth quarter of 2013 and a 26% increase per Boe from the first quarter of 2013. The sequential decrease was attributable to more favorable borrowing rates and lower administrative expenses while the year-over-year increase was due to higher borrowings outstanding from our revolving credit facility during the three months ended March 31, 2014 compared to the three months ended March 31, 2013.

NET INCOME - For the first quarter of 2014, Mid-Con Energy reported net income of $1.6 million, or $0.08 per limited partner unit (basic), based on an average of 20.0 million units outstanding during the period. The negative sequential variance was mainly attributable to higher G&A expenses related to the Partnership’s long term incentive program and a net loss from commodity hedging instruments during the first quarter of 2014 while the negative year-over-year variance was due to higher operating expenses related to acquisitions in 2013 and 2014.

Non-GAAP Measures

ADJUSTED EBITDA - Adjusted EBITDA for the first quarter of 2014 was $12.7 million, 12% below Adjusted EBITDA for the fourth quarter of 2013 and 13% below Adjusted EBITDA for the first quarter of 2013. The decrease in Adjusted EBITDA was due to (i) lower average realized pricing on settled commodity derivatives, (ii) increased production taxes due to the expiration of certain tax exemptions, (iii) higher lease operating expenses, (iv) higher general and administrative expenses related to the cash portion of equity-based compensation, and (vii) increased transactional fees attributable to the February 2014 dropdown acquisition.

DISTRIBUTABLE CASH FLOW (“DCF”) - DCF for the first quarter of 2014 was $10.1 million after subtracting $0.9 million in cash interest expense and $1.8 million in estimated maintenance capital expenditures from Adjusted EBITDA. DCF for the fourth quarter of 2013 and first quarter of 2013 was $12.3 million and $12.0 million, respectively.

DCF COVERAGE – Coverage ratio for the first quarter of 2014 was 0.92x, based on 21.1 million limited partner units and 360,000 general partner units outstanding as of May 5, 2014. The coverage ratio for the fourth quarter of 2013 was 1.20x, and the coverage ratio of the first quarter of 2013 was 1.21x. The coverage ratio for the first quarter of 2014 includes the 1.5 million units issued with the February 2014 acquisition, but the cash flows attributable to the acquisition were not effective for the entire quarter ended March 31, 2014.

Quarterly Cash Distribution

On April 22, 2014, the Board of Directors of Mid-Con Energy’s general partner declared a quarterly cash distribution of $0.515 per unit, or $2.06 per unit on an annualized basis, for the quarter ended March 31, 2014. This amount is unchanged from the fourth quarter of 2013 distribution and represents a 2% increase over the first quarter of 2013 distribution. For perspective, for the past four quarters (2Q13-1Q14) MCEP Limited Partners received distributions totaling $2.06 per unit, reflecting annual growth of 5.1% versus distributions of $1.96 received during the previous four quarters (2Q12-1Q13). The first quarter 2014 cash distribution will be paid May 15, 2014 to unitholders of record at the close of business on May 8, 2014.

Hedging Update

Mid-Con Energy enters into various commodity derivative contracts intended to achieve more predictable cash flows and to reduce exposure to commodity market volatility. The objective of the Partnership’s hedging program is to secure distributable cash flows, and to be better positioned to increase quarterly distributions over time while also retaining some ability to participate in upward movements in commodity prices. Mid-Con Energy uses a phased approach to hedging, looking approximately 36 months forward while targeting a higher percentage of total production hedged within the nearest 12 months.

Complementing the primary hedging strategy described above, Mid-Con Energy intends to enter into additional commodity derivative contracts in connection with material increases in estimated production or at times when management believes market conditions or other circumstances suggest that it is prudent to do so.

3

As of May 5, 2014 the following table reflects volumes of Mid-Con Energy’s production covered by commodity derivative contracts, with the corresponding prices at which the production is hedged:

Liquidity Update and Borrowing Base Increase

As of March 31, 2014, the Partnership’s total liquidity of $27.4 million included $0.4 million in cash and cash equivalents and $27.0 million of available borrowings under the revolving credit facility.

On April 11, 2014, as part of its regularly scheduled semi-annual redetermination, Mid-Con Energy’s lender group unanimously agreed to increase the Partnership’s borrowing base by $20.0 million to $170.0 million. The next scheduled borrowing base redetermination will occur on or about October 31, 2014.

Acquisition Update

Mid-Con Energy Partners, LP through its wholly owned subsidiary, Mid-Con Energy Properties, LLC, today announced the acquisition of additional interests in four existing Mid-Con Energy waterflood units for approximately $7.4 million. The transaction, which is subject to customary post-closing adjustments, has an effective date of April 1, 2014. The acquisition closed on May 1, 2014 and was funded with available cash and borrowings under the Partnership's revolving credit facility.

Jeff Olmstead, President and Chief Financial Officer, commented, “Acquiring additional working interests in our operated Southern Oklahoma units is an example of the growth the Partnership is well positioned to capture. Although modest in size, acquisitions like this offer meaningful accretion from familiar assets. While maintaining our focus on Enhanced Oil Recovery prospects, we look to complement these bite-sized additions with opportunities of transformational scale.”

Highlights of the acquisition are as follows:

• | Mid-Con Energy acquired working interests in the following Southern Oklahoma waterflood units: SE Hewitt, Highlands, Twin Forks, and Eastman Hills |

• | Estimated net proved reserves of 0.3 MMBoe, as of March 31, 2014 at $24.67 per Boe |

• | Average net production of 90 Boe/d during the first quarter of 2014, or $82,222 per flowing Boe |

• | Reserve-to-production ratio of approximately 9.1 years |

• | Projected to be immediately accretive to Distributable Cash Flow |

4

Executive Succession Plan

Mid-Con Energy Partners, LP announced today that effective August 1, 2014, Charles R. (“Randy”) Olmstead is transitioning from his position as Chief Executive Officer to Executive Chairman of the Board of the general partner. Also effective August 1, 2014 the following changes in the board and management team will occur: S. Craig George, Executive Chairman of the Board, will serve as a Director of the general partner; Jeffrey R. Olmstead, President and Chief Financial Officer, will serve as Chief Executive Officer; Michael L. Wiggins, Executive Vice President and Chief Engineer, will serve as President and Chief Engineer; and Michael D. Peterson will serve as Chief Financial Officer. Mr. Peterson previously worked as Managing Director and Head of Energy Research at MLV & Co.

Randy Olmstead said, “I am immensely proud of the Mid-Con Energy team and the growth we have delivered over the decade since our original investment with Yorktown Partners in 2004. I have complete confidence in the new leadership structure, and I am pleased to continue to serve as part of the Mid-Con team in my new role as Executive Chairman of the Board. I am confident our organization will continue to grow, succeed and secure attractive returns for our investors.”

Quarterly Report on Form 10-Q

Certain financial results included in this press release and related footnotes will be available in Mid-Con Energy’s March 31, 2014 Quarterly Report on Form 10-Q, which will be filed on or about May 6, 2014.

Earnings Conference Call

As announced on April 23, 2014, Mid-Con Energy’s management will host a conference call on Tuesday, May 6, 2014 at 11:00 a.m. ET. Interested parties are invited to participate via telephone by dialing 1-877-847-5946 (Conference ID: 32573465) at least five minutes prior to the scheduled start time of the call, or via webcast by clicking on “Events & Presentations” in the investor relations section of the Mid-Con Energy website at www.midconenergypartners.com.

A replay of the conference call will be available through May 13, 2014 by dialing 1-855-859-2056 (Conference ID: 32573465). Additionally, a webcast archive will be available at www.midconenergypartners.com.

About Mid-Con Energy Partners, LP

Mid-Con Energy Partners, LP (“MCEP”) is a publicly held Delaware limited partnership formed in December 2011 to own, operate, acquire, exploit and develop producing oil and natural gas properties in North America, with a focus on Enhanced Oil Recovery (“EOR”). Mid-Con Energy’s core areas of operation are located in Southern Oklahoma, Northeastern Oklahoma and parts of Oklahoma, Texas and Colorado within the Hugoton area.

Forward-Looking Statements

This press release includes "forward-looking statements" — that is, statements related to future, not past, events within meaning of the federal securities laws. Forward-looking statements are based on current expectations and include any statement that does not directly relate to a current or historical fact. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate," "believe," “estimate,” "intend," "expect," "plan," “project,” “should,” “goal,” “forecast,” “guidance,” “could,” “may,” “continue,” “might,” “potential,” “scheduled,” or "will" or other similar words. These forward-looking statements involve certain risks and uncertainties and ultimately may not prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. For further discussion of risks and uncertainties, you should refer to Mid-Con Energy's filings with the Securities and Exchange Commission (“SEC”) available at www.midconenergypartners.com or www.sec.gov. Mid-Con Energy undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after this press release. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement and our SEC filings.

5

These forward–looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about our:

• | business strategies; |

• | ability to replace the reserves we produce through acquisitions and the development of our properties; |

• | oil and natural gas reserves; |

• | technology; |

• | realized oil and natural gas prices; |

• | production volumes; |

• | lease operating expenses; |

• | general and administrative expenses; |

• | future operating results; |

• | cash flow and liquidity; |

• | availability of production equipment; |

• | availability of oil field labor; |

• | capital expenditures; |

• | availability and terms of capital; |

• | marketing of oil and natural gas; |

• | general economic conditions; |

• | competition in the oil and natural gas industry; |

• | effectiveness of risk management activities; |

• | environmental liabilities; |

• | counterparty credit risk; |

• | governmental regulation and taxation; |

• | developments in oil producing and natural gas producing countries; and |

• | plans, objectives, expectations and intentions. |

6

7

8

Non-GAAP Financial Measures

This press release, financial tables and other supplemental information include “Adjusted EBITDA” and “Distributable Cash Flow”, each of which are non-generally accepted accounting principles (“Non-GAAP”) measures used by our management to describe financial performance with external users of our financial statements.

The Partnership believes the Non-GAAP financial measures described above are useful to investors because these measurements are used by many companies in its industry as a measurement of financial performance and are commonly employed by financial analysts and others to evaluate the financial performance of the Partnership and to compare the financial performance of the Partnership with the performance of other publicly traded partnerships within its industry.

9

Adjusted EBITDA and Distributable Cash Flow should not be considered an alternative to net income, net cash provided by operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP.

Adjusted EBITDA is defined as net income (loss)

Plus:

• | Interest expense; |

• | Depreciation, depletion and amortization; |

• | Accretion of discount on asset retirement obligations; |

• | Net losses on unsettled derivatives; |

• | Impairment expenses; |

• | Dry hole costs and abandonments of unproved properties; |

• | Equity-based compensation; and |

• | Loss on sale of assets; |

Less:

• | Interest income; |

• | Net gains on unsettled derivatives; and |

• | Gain on sale of assets. |

Distributable Cash Flow is defined as Adjusted EBITDA

Less:

• | Cash income taxes; |

• | Cash interest expense; and |

• | Estimated maintenance capital expenditures. |

CONTACT:

Jeff Olmstead

President and Chief Financial Officer

(972) 479-5980

jolmstead@midcon-energy.com

Krista McKinney

Investor Relations Associate

(972) 479-5980

kmckinney@midcon-energy.com

10