Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HYSTER-YALE MATERIALS HANDLING, INC. | d721181d8k.htm |

INVESTOR PRESENTATON

May 2014

1

Exhibit 99.1 |

1

Safe Harbor Statement

The following information includes forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Any and all statements regarding the Company’s

expected future financial position, results of operations, cash flows, business

strategy, budgets, projected costs, capital expenditures, products, competitive

positions, growth opportunities, plans, goals and objectives of management for future operations, as well as

statements that include words such as “anticipate,” “if,”

“believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “could,” “should,” “will,” and

other similar expressions are forward-looking statements. Such forward-looking

statements are inherently uncertain, and readers must recognize that actual

results may differ materially from the expectations of the Company’s management. The Company does not

undertake a duty to update such forward-looking statements. Among the factors that

could cause plans, actions and results to differ materially from current

expectations include, without limitation, reduction in demand for lift trucks and related aftermarket parts and

service on a global basis, the ability of dealers, suppliers and end-users to

obtain financing at reasonable rates, or at all, as a result of current economic

and market conditions, the political and economic uncertainties in Eastern Europe, customer acceptance of pricing,

delays in delivery or increases in costs, including transportation costs, of raw

materials or sourced products and labor or changes in or unavailability of

quality suppliers, exchange rate fluctuations, changes in foreign import tariffs and monetary policies and other changes in

the regulatory climate in the foreign countries in which the Company operates and/or

sells products, delays in manufacturing and delivery schedules, bankruptcy of or

loss of major dealers, retail customers or suppliers, customer acceptance of, changes in the costs of, or

delays in the development of new products, introduction of new products by, or more

favorable product pricing offered by, competitors, product liability or other

litigation, warranty claims or returns of products, the effectiveness of the cost reduction programs implemented

globally, including the successful implementation of procurement and sourcing

initiatives, changes mandated by federal, state and other regulation, including

health, safety or environmental legislation, delays in or increased costs associated with the Brazil plant construction,

delays in or cancellation of the sale of the existing Brazil facility and land and

other risks identified in the Company’s Annual Report on Form 10-K and

other filings with the Securities and Exchange Commission. Many of these factors are outside of the Company’s control. |

2

Hyster-Yale Snapshot

Hyster-Yale

Materials

Handling,

Inc.

(NYSE:HY)

Leading global designer, manufacturer and marketer of lift

trucks and provider of aftermarket parts and support

Headquartered in Cleveland, Ohio

Over 5,100 employees globally

LTM

3/31/14

Revenue

–

$2.7

billion

LTM

3/31/14

Net

income

-

$107.5

million

LTM

3/31/14

EBITDA

(1)

–

$164.0

million

3/31/14

Net

cash

–

$74.3

million

LTM 3/31/14 ROTCE

(1)

of 30.6% (Net cash basis)

_____________________

(1)

EBITDA and ROTCE are non-GAAP measures and should not be considered in isolation or

as a substitute for GAAP measures. For discussion of non-GAAP items and the related

reconciliations to GAAP measures, see pages starting on 30.

|

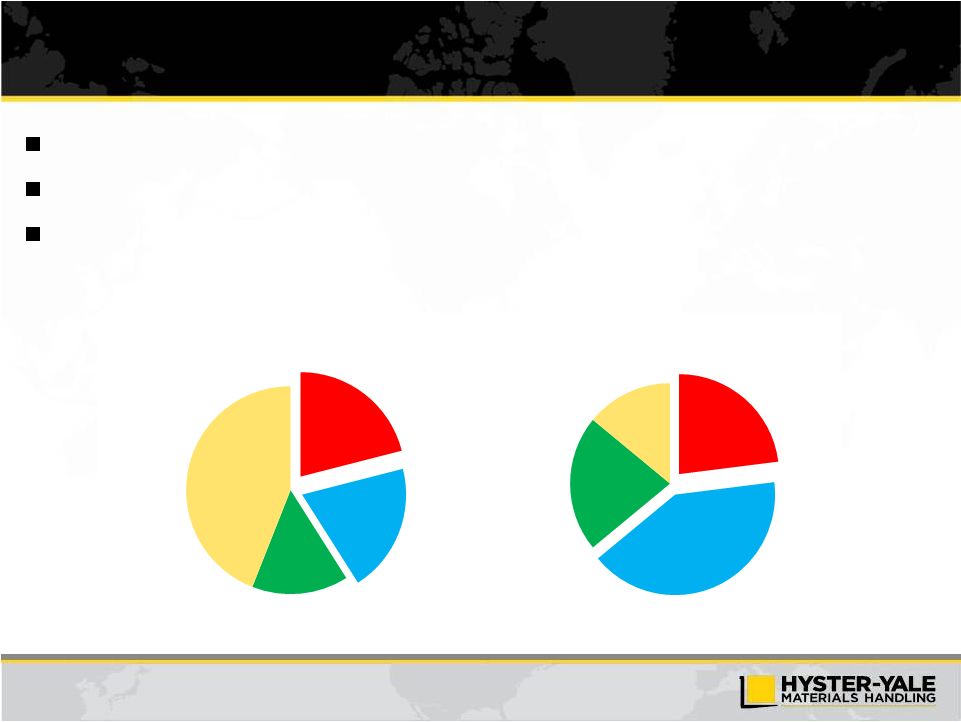

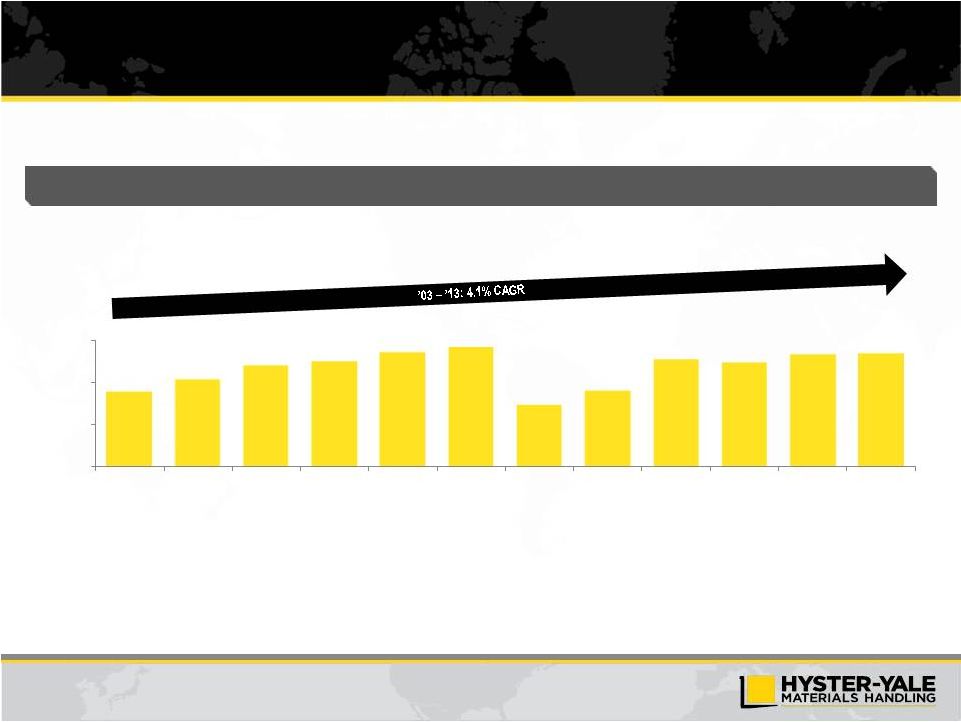

3

Growth similar to GDP levels in developed markets with emerging markets

driving expansion, particularly China

Strong demand for warehouse and distribution industry applications

Increasing focus on electric truck technology development

Importance of total lifecycle cost of ownership

Key Themes

Industry Overview

(units in thousands)

Global Lift Truck Industry Size

Source: WITS. Represents order intake.

Global Lift Truck Industry Breakdown (Units)

Source: WITS. LTM 3/31/14 order intake.

Long-term CAGR (2003 –

2013) = 5.3%

951

872

547

794

975

944

1,009

1,033

0

300

600

900

1,200

2007

2008

2009

2010

2011

2012

2013

LTM Q1 14

Europe

30%

China

25%

Americas

25%

Japan

7%

Asia Pacific

7%

Middle East & Africa

6% |

4

Economic Engine is Driven by Unit Volume

Geographic

and Product

Balance

Worldwide

Distribution

Strength to Drive

Market

Share

Parts

and

Service

Volume

Large Lift Truck

Population in Service

Volume

Economies

of Scale

Design

Component Commonality

Supply Chain

Manufacturing

Quality

Marketing

Parts

Infrastructure

Capital Requirements

A large lift truck population base drives parts and service volume resulting in

enhanced profitability for dealers and Hyster-Yale Basic Business

Areas Drivers of long term competitive advantage |

5

Hyster-Yale Overview

Leading global lift truck manufacturer in terms of units sold

–

#3 globally in 2013

–

Large installed base that drives parts sales

–

Over 815,000 units worldwide

–

Sales of more than 85,500 units in 2013

–

Sales of > 4,200 units at SN JV in Japan & Asia in 2013

Diverse customer and application base

Global independent dealer network

Comprehensive, updated global product line

Globally integrated operations with economies of scale

Experienced management team

2013 Worldwide Sales by Product

2013 Sales by Geography

Key Highlights

Global Footprint

2013

Retail

Shipments

by

End

Market

(1)

(1)

Represents Hyster-Yale North American unit shipments by industry.

(2)

Includes Big Truck sales that represent 5.1% of total sales.

Americas

66%

Europe, Africa &

Middle East

26%

Asia-Pacific

8%

Internal

Combustion

Engine

Units

(2)

55%

Electric Units

27%

Parts

13%

Other

5%

Manufacturing

28%

Wholesale

Distribution

14%

Food & Beverage

14%

Rental

10%

Home Centers/

Retail

10%

Freight & Logistics

9%

Paper

7%

Other

8% |

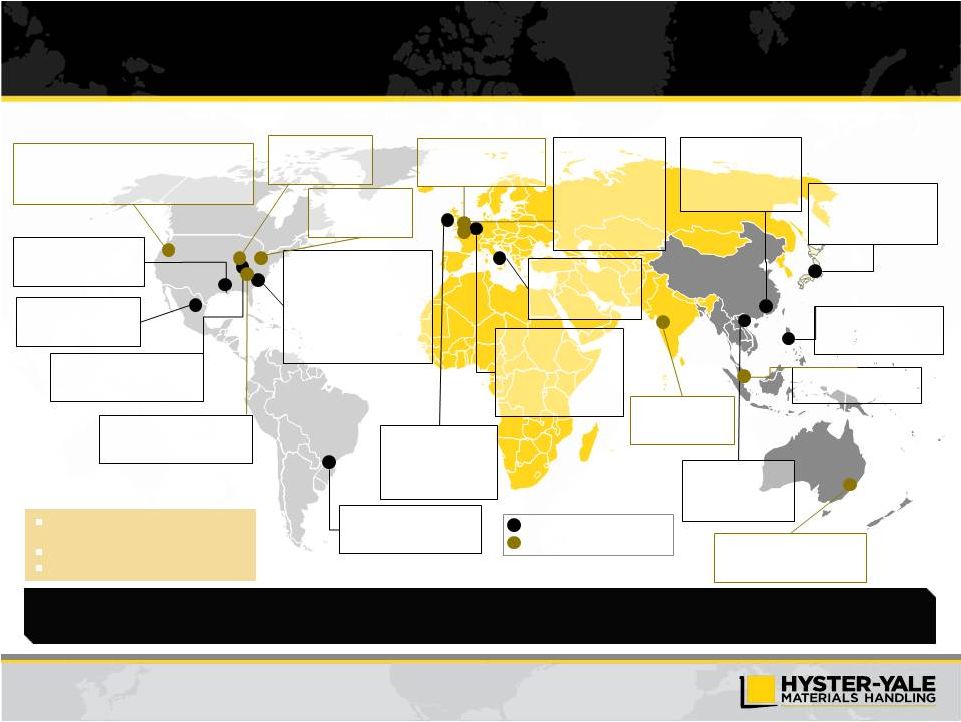

6

Certified

ISO

9001:2000

–

Global

Registration

Certified

ISO

14001

–

Environmental

Demand Flow Technology (DFT)

Strategically located fabrication and assembly footprint using lean processes

Hyster-Yale’s Global Manufacturing Footprint

Ramos Arizpé, Mexico

Manufacture of component

parts for lift trucks

Sulligent, Alabama

Manufacture of component

parts for lift trucks

Berea, Kentucky

Assembly of lift trucks and

manufacture of component parts

Greenville, NC

Divisional headquarters and

marketing and sales operations

for

Hyster®

and

Yale®

in

Americas; Americas warehouse

development center; assembly of

lift trucks and manufacture of

component parts

Sao Paulo, Brazil

Assembly of lift trucks and

marketing operations for Brazil

Craigavon, N. Ireland

Manufacture of lift

trucks; cylinder and mast

fabrication and assembly

for Europe

Nijmegen, Netherlands

Big trucks development

center; manufacture and

assembly of big trucks and

component parts; European

parts distribution center

Masate, Italy

Assembly of lift trucks;

European warehouse

development center

Shanghai, China (JV)

Assembly of lift trucks by

Shanghai Hyster joint

venture and marketing

operations of China

Obu, Japan (JV)

Assembly and distribution

capabilities for Sumitomo

Nacco JV

Cavite, Philippines

Manufacture components

for Sumitomo Nacco JV

Fairview, Oregon

Global executive administrative center; counterbalanced

development center for design and testing of lift trucks,

prototype equipment and component parts

Cleveland, Ohio

Hyster-Yale corporate

headquarters

Danville, Illinois

Americas parts

distribution center

Irvine, Scotland

European administrative

center

Hanoi, Vietnam

Manufacture

components for

Sumitomo NACCO JV

Sydney, Australia

Divisional headquarters and sales

and marketing for Asia-Pacific

Pune, India

Engineering design

services

Manufacturing and Assembly

Sales, Marketing and Administrative

Charlotte, North Carolina

Customer experience and training

center

Frimley, Surrey UK

Divisional

headquarters,

European executive

center and marketing

and sales operations for

Hyster

®

and

Yale

®

in

Europe

Kuala Lumpur, Malaysia

Asia support office

Geographically balanced manufacturing structure reduces working capital requirements,

currency exposure and freight costs, while driving enhanced returns on

capital |

7

Distribution Channel Strength and Diverse

Customer Base

Represented in 132 countries

334 independent dealerships serving every region in the world

–

Approximately 2,400 sales people

–

Approximately 11,600 service technicians

–

Approximately 1,300 locations

Number of Dual Brand Dealers: 25

Dealer Profile

National Accounts Profile

Blue Chip Customer Base

Focused on strategic customers with centralized

purchasing and geographically dispersed operations

across dealer territories

Fleet Management Program provides customers with

value-added services that include aftermarket parts,

service and comprehensive management of materials

handling operations |

8

Parts and Service Contribution to

Hyster-Yale’s and Dealers’

Profitability

Growing unit field population of approximately 815,000 units globally at 12/31/13

Hyster-Yale realizes significant additional margin from service parts over the life

of the truck Also critical to the success of our Independent Dealers:

–

Parts and Service are significant components of a typical dealers revenue and

margin Sales

Margin

units

Parts

Service

Rental

units

Parts

Service

Rental |

9

Products

Comprehensive, updated global product line

Product Development focus on delivering Low Cost of Ownership based on customer

applications: Deliver Tier 4 solutions

Electric product with “ICE Like” performance

Integrate advanced technology solutions: Lithium Ion, Hybrid, Fuel Cell

Utility and Standard models designed to best fit needs of lower duty cycles

Manufacturing

Globally integrated, lean operations with economies of scale

Assemble in market of sale

Continuous efficiency improvements

DFT implementation in Brazil and Japan in 2014/2015

Supply Chain

Highly flexible low cost supply chain

Low cost country sourcing > 30%

Number of production suppliers reduced by > 50% since 2007

~ 80% improvement in delivered supplier quality (defects per million)

Ongoing Transformation of Business

Global Factory Productivity

Supplier quality

75%

65%

55%

2009

2010

2011

2012

2013

2009

2010

2011

2012

2013

3,000

2,000

1,000

0 |

10

Quality

50% decrease in standard warranty costs in North America since 2009

Initial quality has improved in North America by >40% since 2009

Model year update to ensure smooth implementation of upgrades

Distribution

Network

Only major manufacturer with exclusive independent distribution

Dealer excellence programs drive continuous improvement

Entrepreneurial leadership

Industry-leading National Accounts program

Aftermarket

Excellence

Expanding fleet under management

Deployed service life-cycle management system

Deployed market-based pricing system / Low-cost country sourcing

Meeting dealer demands for all makes

Investing for

Growth

Marketing organization focused on product and industry solutions

Sales teams expanded / focus on product segments

National Accounts organization building global strength

Ongoing Transformation of Business

Full Service Management Units (000)

Warranty Costs (% of Sales)

Distribution “% restructured”

2009

2010

2011

2012

2013

2009

2010

2011

2012

2013

2009

2010

2011

2012

2013

3.0%

2.0%

1.0%

0.0%

100%

75%

50%

25%

0%

80

70

60

50

40

3.5

3.0

2.5

2.0

1.5

1.0

Revenue Growth ($b)

Americas

EMEA

Asia Pacific |

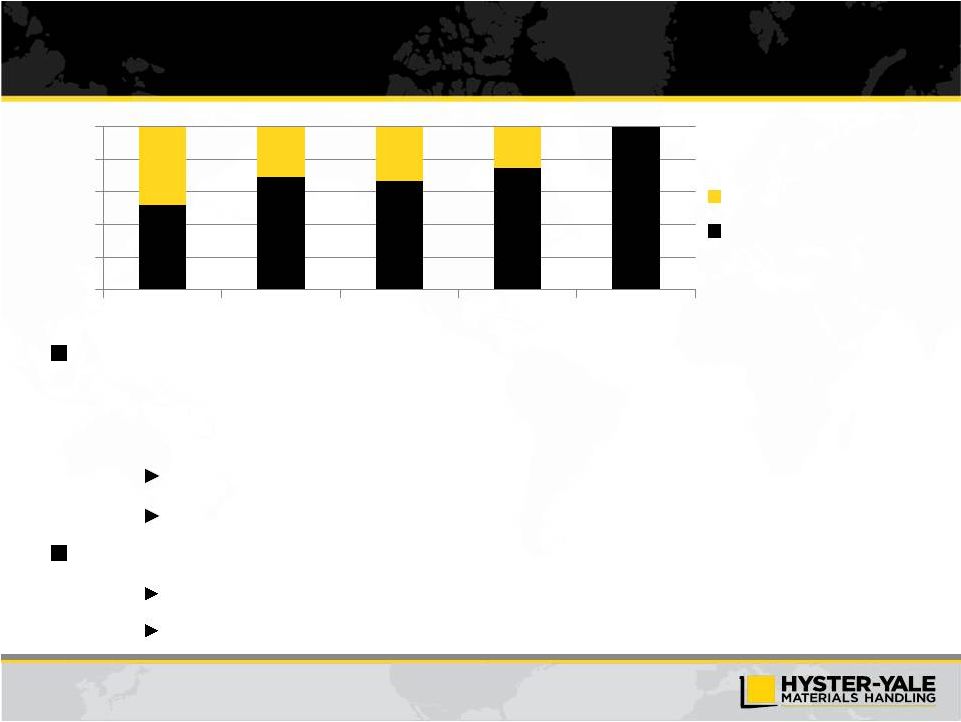

11

Hyster-Yale –

Industry Sales Growth

(units in thousands)

Hyster-Yale Sales vs. Global Lift Truck Industry

Source: WITS and Company data. Represents order intake.

Hyster-Yale sales grew faster than industry through 2013

European distribution and economic challenges in Q1 2014

Strong position in recovering North America market

Focus on key product segments delivering benefits

Five key initiatives beginning to take hold

Key Themes

22.8%

-3.2%

6.9%

9.6%

41.0%

-2.8%

8.0%

4.8%

-5%

5%

15%

25%

35%

45%

FY-11

FY-12

FY-13

Q1-14

WITS Orders

Hyster-Yale Revenue |

12

Operating Profit Trends

Operating Profit $ and % of Sales

($ in millions)

Prior Cycle Market Peak

Mid-Cycle Market

$57

$112

$134

$134

2.1%

4.5%

5.0%

5.0%

0.0%

2.0%

4.0%

6.0%

$25

$50

$75

$100

$125

$150

2007

2012

2013

LTM 3/31/14 |

13

Gap to Target Economics

Goal

is

to

achieve

minimum

operating

profit

margin

of

7%

at

mid-cycle

and

to

achieve

7%

operating

profit

margin

at

the peak of the current market cycle

3/31/14 LTM Gap to Target Economics

Margin variances:

+0.3%

Target Economics gap closure can be

achieved by:

1.

Increased margin on ICE trucks

-

Segmentation

-

Low cost of ownership

2.

Unit volume

-

Share growth

-

Stronger industry

-

Volume leverage

Volume variances:

Operating Profit % Gap

(2.0%)

Operating Profit $ Opportunity

$55m

–

Unit margin

(0.6%)

–

Parts/other

+0.9%

–

Manufacturing variances/other

(0.8%)

–

Operating Expenses

(1.5%) |

14

Volume Leverage on Manufacturing Capacity

Approximately $125m manufacturing fixed cost

–

Ability to produce 115,000* units annually

–

At capacity

Approximately $30m additional fixed cost absorption

Operating costs aligned with targets at increased sales volumes

Objective of minimum 25,000 unit volume increase from 2013 levels

$600m additional revenue

$70m+ incremental operating profit

* Excludes UTILEV and SN Products

48%

31%

33%

25%

0%

20%

40%

60%

80%

100%

2010

2011

2012

2013

2016-2017

Unused Capacity

Unit Volume |

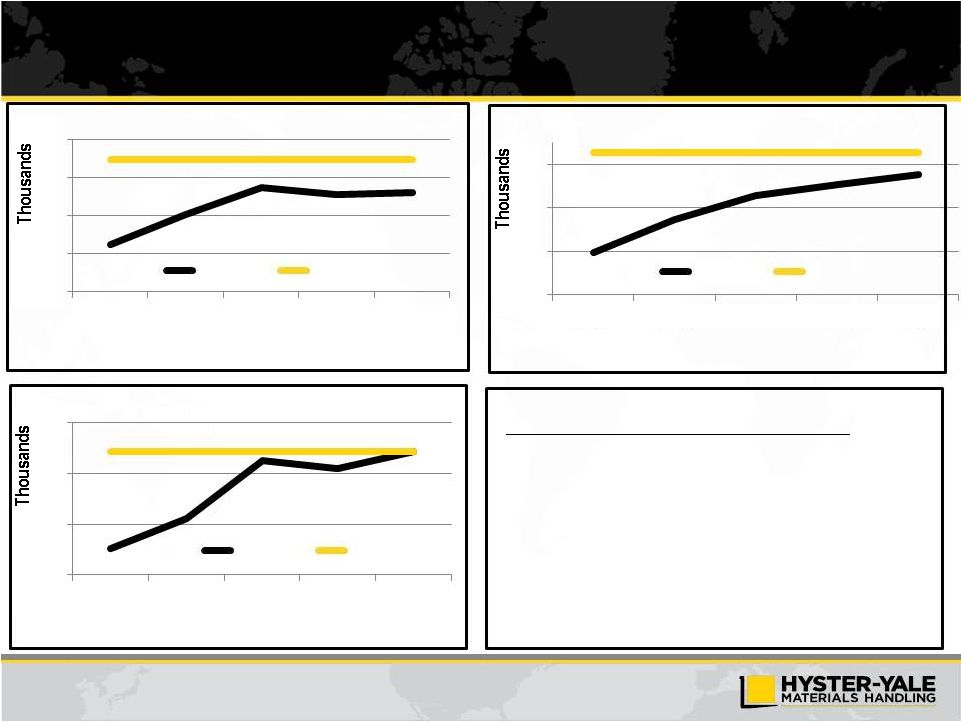

15

Over the Remainder of this Market Cycle, Target

Volumes Driven by…

Share growth of approx. 2% pts

>5 Strategic initiatives

>3 Supplemental initiatives

Growth of 20-25% by 2017

Growth of 10-15% by 2017

Growth of 10-15% by 2017

2009

2010

2011

2012

2013

2009

2010

2011

2012

2013

2009

2010

2011

2012

2013

500

400

300

200

100

EMEA Industry

Actual

Prior Peak

450

350

250

150

200

150

100

50

Americas Industry

Asia Industry

Actual

Prior Peak

Actual

Peak |

16

Applications

–

Launched strategy guides for Trucking, Grocery and

Steel

–

Actively engaged in several new Steel Accounts

–

New business wins

In trucking, grocery, steel and paper

Segment the global market

Best product fit for customer application

Develop solutions for major segments

Segmentation

–

Additional standard and utility models

–

Separated standard/premium segments

–

All products available by 2016

Tailored application solutions

Strengthened product positioning

Strong relationship with customers in target industries

Enhanced Understanding of Customer

Needs to Drive Tailored Solutions

Win in Targeted Major Accounts and Applications

Outcome:

Strategic Objectives

Key Elements

Progress and Expectations |

17

Masters of the World of Low Cost of Ownership

Revenue growth by delivering lowest cost of

ownership in target applications

Expand fleet management

Cost of truck/lease

–

Supplier Day programs at each factory

–

Attractive lease rates through improved

understanding of applications and operating costs

Fuel energy efficiency

–

15%+ improvement in fuel efficiency

–

Improved energy efficiency of electric trucks

Service/repair costs

–

Reduced service/repair costs per hour

–

Service cost calculator rolled out in Europe

–

Telemetry product offering launched

Understand major cost drivers:

Direct (truck price, fuel, service, operator)

Indirect (safety, litigation, pollution)

Competitive Advantage across Product Segments

Outcome:

Strategic Objectives

Strategic Objectives

Progress and Expectations |

18

Strategic Objectives

Progress and Expectations

Key Elements

Enhanced dealer organization and structure

Add new products tailored to needs of Asian markets

Strengthened local presence in Asia and India

Continued development of strategic relationships

Established new office in Malaysia

Sales and marketing resources added

New major account business won

Indian and Chinese partners producing locally

New dealers appointed

Increase Asian presence

Strengthen dealer organization

Strong local partners in China, India & Japan

Leverage Sumitomo Heavy Industries strength

with Japanese customers

Succeed in Asian Markets

Grow Share and Distribution at Accelerated Pace

Outcome: |

19

Strategic Objectives

Progress and Expectations

Key Elements

Recruit/develop strongest dealers

Opportunity for dealers to make strong returns

on investment

Combine dealer entrepreneurship and

performance with world class OEM support

Enhanced sales specialization

Dedicated dealer development team

25 dual-brand dealers, 10 appointed since 1/1/2013

8 competitor dealers converted in 2013, 6 in 2014

Strengthened European network

Major effort underway on account identification and

enhanced coverage

Dealer restructuring

Expanded dual-brand ownership

Dealer excellence program

Customer / industry intelligence

Enhanced Independent Distribution

Best Distribution Channels in the Industry

Outcome: |

20

Strategic Objectives

Progress and Expectations

Key Elements

Gain share in faster growing segment of market

Improve dealer value proposition

Engage dealers in developing capabilities

Product gap closure

Investment in specialist talent

New product launches

Global product developed

800 dealer sales people trained in

warehouse product in the Americas in 2013

Europe and Asian initiatives launched

New major account business awarded

Dedicated warehouse specialist teams

Product enhancements

Leverage competitive advantages

–

Dealer engagement

–

Fleet management

Significantly Improve Warehouse Business Position

Be a Top Tier Global Competitor in Warehouse Equipment

Outcome: |

21

Supplemental Initiatives and a Facilitating Program

Big Trucks

–

Growth opportunity

–

Additional resources

Global team

Focus on industry and

customer solutions

–

Tier 4 leadership

Sales and Marketing Organization

–

Alignment with strategy execution

–

Focus on accountability

–

Talent management

Brazil

–

New manufacturing facility

–

Strengthened management team

–

Expand local production

–

Enhanced distribution

Global Systems

–

Common manufacturing processes

–

Parts distribution system

–

Product configurator

–

Fleet management |

22

Key Initiatives Drive Sustainable Long Term Growth

Strong Dealer and Customer Loyalty driving a

growing population, increased service and parts

revenue and strong profitability

National Accounts

Leaders

in

Independent

Distribution

Crack the Code in

Warehouse

Target Big Trucks

Succeed in Asia

Aftermarket Excellence

Understand Needs of

Customers

Low Cost of Ownership |

23

Economic Engine is Driven by Unit Volume

Geographic

and Product

Balance

Worldwide

Distribution

Strength to Drive

Market Share

Parts and Service

Volume

Large Lift Truck

Population in Service

Volume

Economies

of Scale

Design

Component Commonality

Supply Chain

Manufacturing

Quality

Marketing

Parts

Infrastructure

Capital Requirements

A large lift truck population base drives parts

and service volume resulting in enhanced

profitability for dealers and Hyster-Yale

Basic Business Areas

Drivers of long term competitive advantage

Leaders in

Independent

Distribution

National

Accounts

Crack the Code in

Warehouse

Target Big Trucks

Succeed in Asia

Aftermarket

Excellence

Understand Needs of

Customers

Low Cost of

Ownership |

24

Positive Environment for Hyster-Yale to Gain Share

and

Margin

Performance

Over

Next

Years

Product gaps filled to position Hyster-Yale in most application segments and

improve margins

Low-cost manufacturing base relative to German-centric and Japanese-centric

competitors

Second-tier competitors in the ICE segment more vulnerable due to their

weakened economy of scale position

Key warehouse segment competitors are regional

Key Big Truck segment competitors are niche |

25

Historical Revenue

_____________________

(1)

As of March 31, 2014.

(1)

$1,780

$2,057

$2,400

$2,489

$2,720

$2,824

$1,475

$1,802

$2,541

$2,469

$2,666

$2,697

$0

$1,000

$2,000

$3,000

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014 LTM

Revenue

($ in millions) |

26

Q1 2014 Results

Hyster-Yale

Outlook

–

Longer-term

2014

global

lift

truck

market

expected

to

grow

moderately

in

all

major

global regions.

Expected improvements in unit and parts volumes, market share and

gross

profit

expected

to

be

partially

offset

by

full

year

impact

of

higher

SG&A to support strategic initiatives and unfavorable foreign currency

movements, resulting in moderate improvements in 2014 operating profit

and net income, excluding the effects of a gain on sale of the Brazil

facility expected in 2014 and tax benefits recorded in 2013.

Backlog of 28,900 units, or approximately $715m at 3/31/14 represents

>16

weeks

of

production

and

supports

2

nd

quarter

2014

production

plan.

($ in millions)

Hyster-Yale

Outlook

–

Short

Term

Close gap to 7% target economics at mid-cycle and 7% at the peak of

the current market cycle

29%+ unit volume growth

•

Industry recovery

•

Share growth

Unit margin enhancement

•

Product segmentation

•

Low cost of ownership

_____________________

(1)

EBITDA

is

a

non-GAAP

measure

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

GAAP

measures.

For

discussion

of

non-GAAP

items

and

the

related

reconciliations

to

GAAP

measures,

see

pages

starting

on

30.

$

$

%

Revenue

$676.0

100.0%

$2,697.4

100.0%

Operating

Profit

31.6

4.7%

133.8

5.0%

Net Income

22.1

3.3%

107.5

4.0%

EBITDA

(1)

$39.6

5.9%

$164.0

6.1%

Debt

$33.0

Cash

$107.3

Net Cash

$74.3

2014 First Quarter

3/31/14 LTM

%

4.8% growth in Q1 2014 revenue, but a 1.6% decline in operating

profit vs. Q1 2013.

Revenue growth from more sales of higher-priced lift trucks, unit price

increases, increased fleet services and higher parts volume, partially

offset by slightly lower unit volumes and unfavorable currency

movements.

Operating

profit

and

net

income

down

slightly

as

favorable

gross

profit

and lower interest expense were more than offset by higher SG&A

costs related to investments to support the strategic initiatives and

higher income tax expense. |

27

Strong Free Cash Generation and Conservative

Capital Structure

Strong cash generation with $436 million cumulative cash flow before financing

from 2009 to 2013

Conservative capital structure as of 3/31/14 with debt of $33 million and cash of

$107.3 million

Debt / LTM EBITDA

(2)

Cash Flow before Financing

(1)

_____________________

.(1)

Cash Flow before Financing is defined as cash from operating activities less cash from

investing activities. (2) EBITDA

is

a

non-GAAP

measure

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

GAAP

measures.

For

discussion

of

non-GAAP

items

and

the

related

reconciliations

to

GAAP

measures,

see

pages

starting

on

30.

Net Debt

Gross Debt

0.0x

$122

$39

$39

$109

$127

$113

$0

$50

$100

$150

2009

2010

2011

2012

2013

3/31/14 LTM

0.2x

0.0x

0.5x

1.0x

1.5x

2.0x

3/31/14

Stability to weather market changes with significant flexibility for growth ($ in millions)

|

28

Rationale

for

Investing

in

Hyster-Yale

1)

Leading position in growing industry benefiting from globalization and worldwide

economic recovery and development

2)

Premier brands, comprehensive global product line and exclusive,

global independent

distribution network

3)

Strong economic engine driven by volume economies of scale

4)

Focused

strategic

initiatives

to

gain

market

share

and

enhance

margins

over

next

3

–

5

years

5)

Strong balance sheet, financial flexibility and attractive returns on capital

employed 6)

High potential for partnership and consolidation opportunities

7)

Focused investment in capital goods sector with growth opportunity:

a)

In developed countries from exposure to goods movement, distribution and warehousing

b)

In

developing

countries

(Brazil,

Eastern

Europe,

India

and

Asia)

from

exposure

to

industrialization |

Appendix

30 |

30

Non-GAAP Disclosure

EBITDA

and

return

on

total

capital

employed

are

not

measurements

under

U.S.

GAAP,

should

not

be

considered in

isolation or as a substitute for GAAP measures, and are not necessarily comparable with

similarly titled measures of other companies. Hyster-Yale defines each

as the following: For reconciliations from GAAP measurements to non-GAAP

measurements, see pages 31 and 32. EBITDA is defined as income before income

taxes and non-controlling interest income (loss) plus net interest expense

and depreciation and amortization expense; Return on total capital employed

(“ROTCE”) is defined as net income before interest expense, after tax, divided

by average capital employed. Average capital employed is defined as average

stockholder’s equity plus average debt less average cash.

|

31

Non-GAAP Reconciliation

Year Ended December 31

Qtr.

Trailing 12

Months

2009

2010

2011

2012

2013

3/31/14

3/31/14

Reconciliation of EBITDA

Net income (loss) attributable to stockholders

($43.1)

$32.4

$82.6

$98.0

$110.0

$22.1

$107.5

Noncontrolling interest (income) loss

(0.1)

(0.1)

–

0.1

0.2

–

0.2

Income taxes provision (benefit)

(3.6)

1.8

18.9

7.0

17.2

9.5

20.6

Interest expense

19.0

16.6

15.8

12.4

9.0

0.9

7.4

Interest income

(2.8)

(2.3)

(1.8)

(1.5)

(1.8)

(0.4)

(1.9)

Depreciation and amortization expense

36.2

33.9

31.3

28.0

30.2

7.5

30.2

EBITDA

$5.6

$82.3

$146.8

$144.0

$164.8

$39.6

$164.0

($ in millions)

_____________________

Note: *EBITDA in this investor presentation is provided solely as a supplemental

disclosure with respect to operating results. EBITDA does not represent net income, as defined by U.S. GAAP and should not be considered as a substitute for net income or

net loss, or as an indicator of operating performance. The Company defines EBITDA as

income before income taxes and non-controlling interest income (loss) plus net interest expense and depreciation and amortization expense. EBITDA is not a

measurement under U.S. GAAP and is not necessarily comparable with similarly titled

measures of other companies. |

32

Non-GAAP Reconciliation (continued)

($ in millions)

Reconciliation of Return on Total Capital Employed (ROTCE)

3/31/14 LTM

LTM Average Stockholders' Equity (3/31/14, 12/31/13, 9/30/13, 6/30/13 and

3/31/13) $415.6

LTM Average Debt (3/31/14, 12/31/13, 9/30/13, 6/30/13 and 3/31/13)

99.6

LTM Average Cash (3/31/14, 12/31/13, 9/30/13, 6/30/13 and 3/31/13)

(152.3)

LTM average capital employed

$362.9

LTM Net income

$107.5

Plus: LTM Interest expense, net

5.5

Less: Income taxes on interest expense, net at 38%

(2.1)

Actual return on capital employed = actual net income before interest expense, net, after

tax $110.9

Actual return on capital employed percentage

30.6%

_____________________

Note: Return on capital employed is provided solely as a supplemental disclosure with

respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital

employed,

which

includes

both

equity

and

debt

securities,

net

of

cash. |

33

Cash Flow before Financing Calculation

($ in millions)

Year Ended December 31

Trailing 12

Months

2009

2010

2011

2012

2013

3/31/14

Reconciliation of Cash Flow before Financing

Net cash provided by operations

$115.9

$47.5

$54.6

$128.7

$152.9

$135.6

Net cash provided by (used) for investing activities

5.8

(8.5)

(15.9)

(19.5)

(26.1)

(22.6)

Cash Flow before Financing

$121.7

$39.0

$38.7

$109.2

$126.8

$113.0

|

Supplemental Perspective

35 |

35

Mission Statement |

36

Class

Capacity Range

Description / Illustrative Application

Class I

1 ton – 5.5 tons

Electric counterbalanced trucks used in warehousing and manufacturing operations

where noise or fuel emissions are undesirable

A distribution center customer uses a Class I truck to move pallets from one trailer

to another

Class II

1.5 tons – 6 tons

Electric narrow aisle trucks used indoors to handle high-density storage of

materials in narrow-aisled buildings

Retail and warehouse customers rely on Class II trucks to pick orders off their

shelves Class III

1.5 tons – 8 tons

Electric hand trucks used indoors and outdoors for applications requiring the user to

select and transport materials

Retail customers use Class III trucks to move pallets of goods to their store aisles

Class IV

1 ton – 7 tons

Internal combustion engine counterbalanced trucks with cushion tires used indoors in

warehousing and manufacturing operations and outdoors on smooth surfaces.

Utility, standard and premium models for different customer applications.

A customer relies on Class IV trucks to move heavy parts on a pallet from the

machining area in a factory to assembly

Class V

1 ton – 8 tons

Internal combustion engine counterbalanced trucks with pneumatic tires used indoors

and outdoors in warehousing and manufacturing operations. Utility, standard and

premium models to address different customer applications.

A warehouse or manufacturer relies on Class V trucks to move coils of steel from the

mill to a storage area

Class V Big

Trucks

8

ton – 52 tons

Internal combustion engine counterbalanced trucks with pneumatic tires used indoors

and outdoors in ports and heavy manufacturing operations

A port relies on Class V Big Trucks to move containers from the port to a rail area

Comprehensive Updated Global Product Line |

37

Key Investment Highlights

Leading Market

Share in Materials

Handling

Comprehensive

Global Product Line

Large Installed

Base Worldwide

Established

Brand Strength

Global

Independent Dealer

Network

Long-Term

Relationships

with Diverse

Customer Base

Experienced

Management Team

Modest Leverage

& Strong

Cash Flow

High-Impact

Strategic Initiatives

Continuous Focus on

Product Development

and Innovation

Worldwide

Economies

of Scale

Highly Flexible,

Low Cost Supply Chain

and Efficient Operating

Structure

Global Scope of

Manufacturing |