Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - BGSF, INC. | v377079_8k.htm |

Company Confidential 1 1 As of Mar 2014 Taglich Brothers Small Cap Equity Conference May 6, 2014

Company Confidential 2 2 As of Mar 2014 Forward - Looking Statements This presentation contains forward - looking statements regarding the business, operations and prospects of BG Staffing and industry factors affecting it . These statements are identified by words such as “may,” “will,” “begin,” “look forward,” “expect,” “believe,” “intend,” “anticipate,” “should,” “potential,” “estimate,” “continue,” “momentum,” and other words referring to events to occur in the future . These statements reflect BG Staffing’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, including : the availability of workers’ compensation insurance coverage at commercially reasonable terms ; the availability of qualified temporary personnel ; compliance with federal and state labor and employment laws and regulations and changes in such laws and regulations ; the ability to compete with new competitors and competitors with superior marketing and financial resources ; management team changes ; the favorable resolution of current or future litigation ; the ability to begin to generate sufficient revenue to produce net profits ; the impact of outstanding indebtedness on the ability to fund operations or obtain additional financing ; the ability to leverage the benefits of recent acquisitions and successfully integrate newly acquired operations ; adverse changes in the economic conditions of the industries, countries or markets that BG Staffing serves ; disturbances in world financial, credit, and stock markets ; unanticipated changes in national and international regulations affecting the company’s business ; a decline in consumer confidence and discretionary spending ; the general performance of the U . S . and global economies ; economic disruptions resulting from the European debt crisis ; and continued or escalated conflict in the Middle East, each of which could cause actual results to differ materially from those projected in the forward - looking statements . BG Staffing is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward - looking statements, whether as a result of new information, future events or otherwise . This presentation also contains information about BG Staffing’s adjusted EBITDA and Contribution to Overhead (“COH”), which are not measures derived in accordance with GAAP and which exclude components that are important to understanding BG Staffing’s financial performance . Investors should recognize that these non - GAAP measures might not be comparable to similarly titled measures of other companies . These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flows or liquidity prepared in accordance with accounting principles generally accepted in the United States .

Company Confidential 3 3 As of Mar 2014 ▪ Staffing Industry Outlook ▪ Healthcare Reform Update ▪ 2014 Operating Results ▪ Diversification Strategy Agenda

Company Confidential 4 4 As of Mar 2014 Global Staffing Industry Size

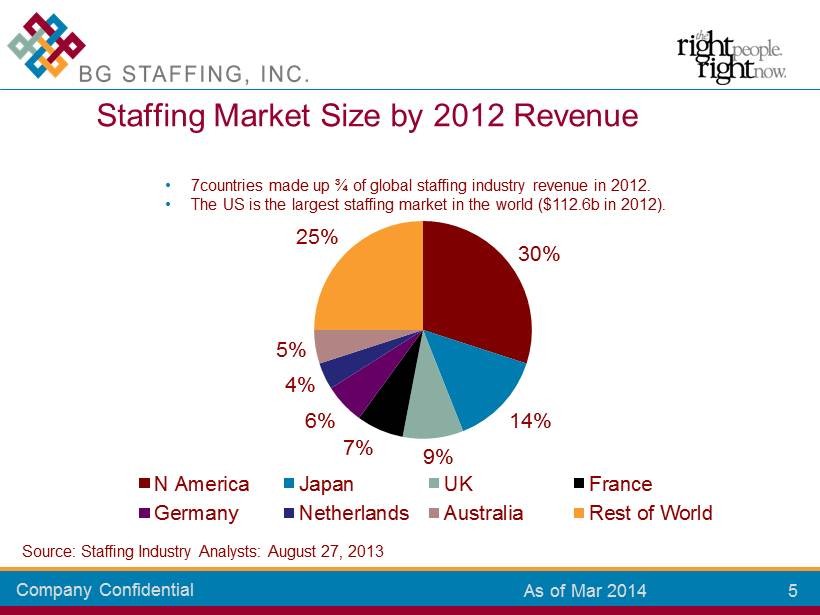

Company Confidential 5 5 As of Mar 2014 30% 14% 9% 7% 6% 4% 5% 25% N America Japan UK France Germany Netherlands Australia Rest of World Staffing Market Size by 2012 Revenue Source: Staffing Industry Analysts: August 27, 2013 • 7countries made up ¾ of global staffing industry revenue in 2012 . • The US is the largest staffing market in the world ($112.6b in 2012).

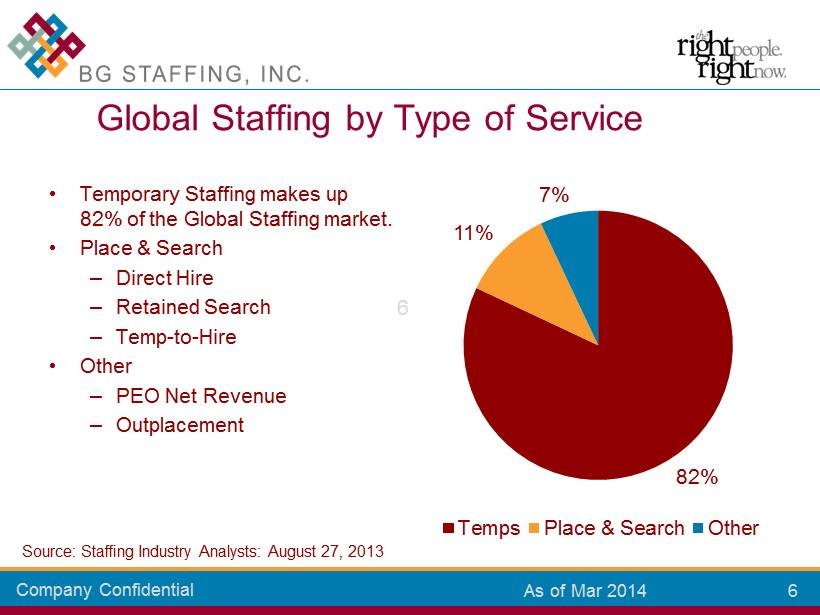

Company Confidential 6 6 As of Mar 2014 82% 11% 7% Temps Place & Search Other • Temporary Staffing makes up 82% of the Global Staffing market. • Place & Search – Direct Hire – Retained Search – Temp - to - Hire • Other – PEO Net Revenue – Outplacement Global Staffing by Type of Service Source: Staffing Industry Analysts: August 27, 2013

Company Confidential 7 7 As of Mar 2014 US Staffing Industry Forecast

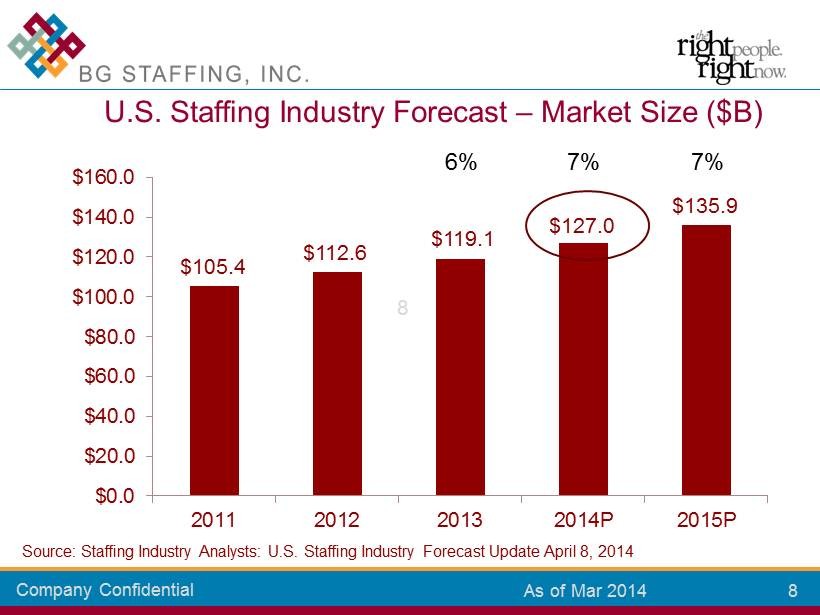

Company Confidential 8 8 As of Mar 2014 $105.4 $112.6 $119.1 $127.0 $135.9 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 2011 2012 2013 2014P 2015P U.S. Staffing Industry Forecast – Market Size ($B) Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update April 8, 2014 7% 7% 6%

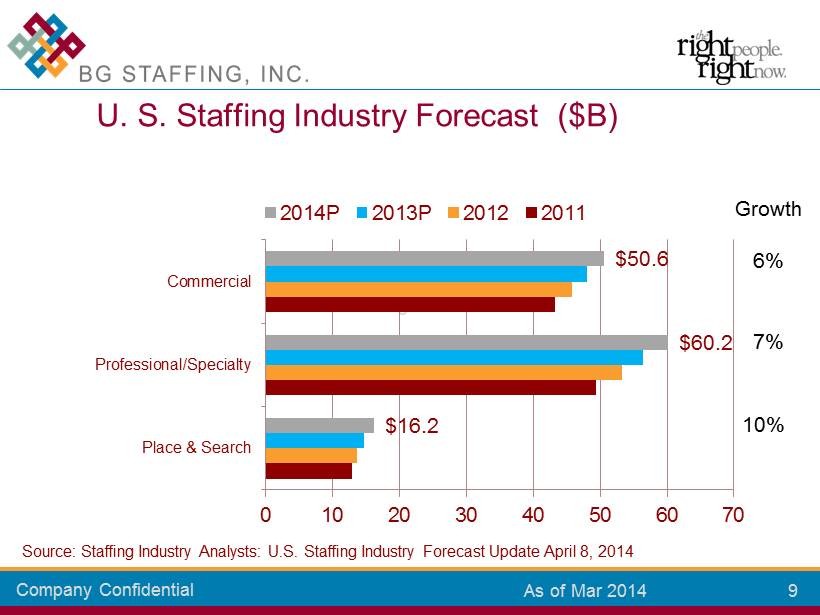

Company Confidential 9 9 As of Mar 2014 $16.2 $60.2 $50.6 0 10 20 30 40 50 60 70 Place & Search Professional/Specialty Commercial 2014P 2013P 2012 2011 U. S. Staffing Industry Forecast ($ B ) Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update April 8, 2014 6% 7 % 10% Growth

Company Confidential 10 10 As of Mar 2014 • Professional/Specialty – IT – Healthcare – Finance/Accounting – Engineering/Design – Legal – Clinical/Scientific – Marketing/Creative – Education/Library – Other • Commercial – Office Clerical – Industrial U.S. Temporary Staffing Segment Categories Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update April 8, 2014

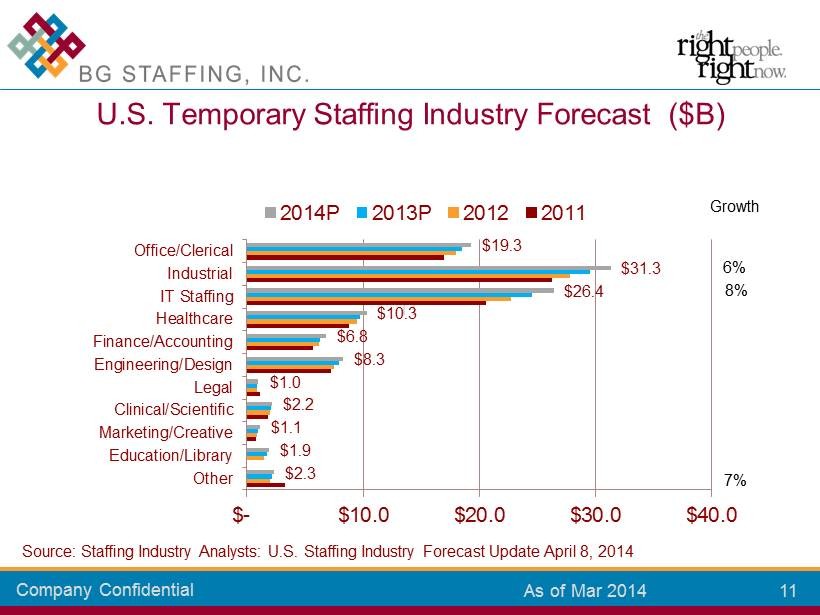

Company Confidential 11 11 As of Mar 2014 $2.3 $1.9 $1.1 $2.2 $1.0 $8.3 $6.8 $10.3 $26.4 $31.3 $19.3 $- $10.0 $20.0 $30.0 $40.0 Other Education/Library Marketing/Creative Clinical/Scientific Legal Engineering/Design Finance/Accounting Healthcare IT Staffing Industrial Office/Clerical 2014P 2013P 2012 2011 U.S. Temporary Staffing Industry Forecast ($ B ) Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update April 8, 2014 6% 8% 7% Growth

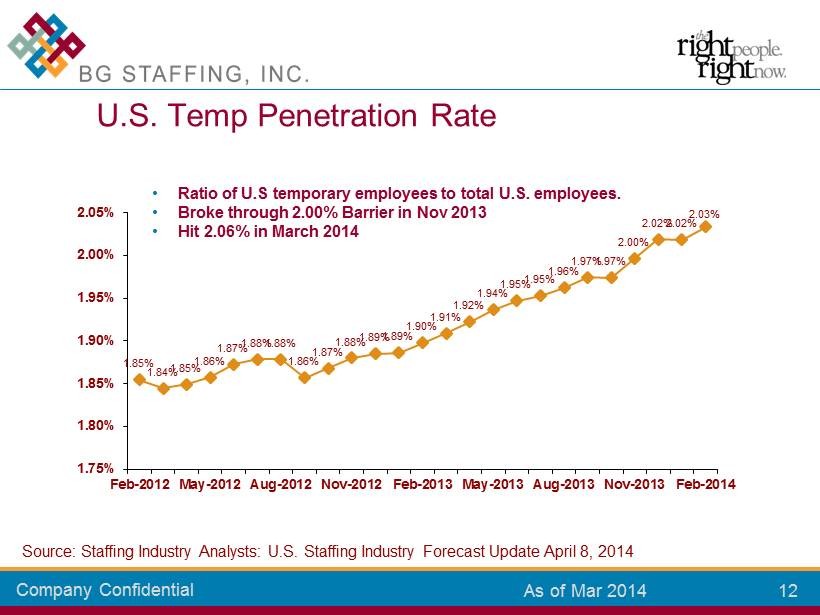

Company Confidential 12 12 As of Mar 2014 1.85% 1.84% 1.85% 1.86% 1.87% 1.88% 1.88% 1.86% 1.87% 1.88% 1.89% 1.89% 1.90% 1.91% 1.92% 1.94% 1.95% 1.95% 1.96% 1.97% 1.97% 2.00% 2.02% 2.02% 2.03% 1.75% 1.80% 1.85% 1.90% 1.95% 2.00% 2.05% Feb-2012 May-2012 Aug-2012 Nov-2012 Feb-2013 May-2013 Aug-2013 Nov-2013 Feb-2014 U.S. Temp Penetration Rate • Ratio of U.S temporary employees to total U.S. employees. • Broke through 2.00% Barrier in Nov 2013 • Hit 2.06% in March 2014 Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update April 8, 2014

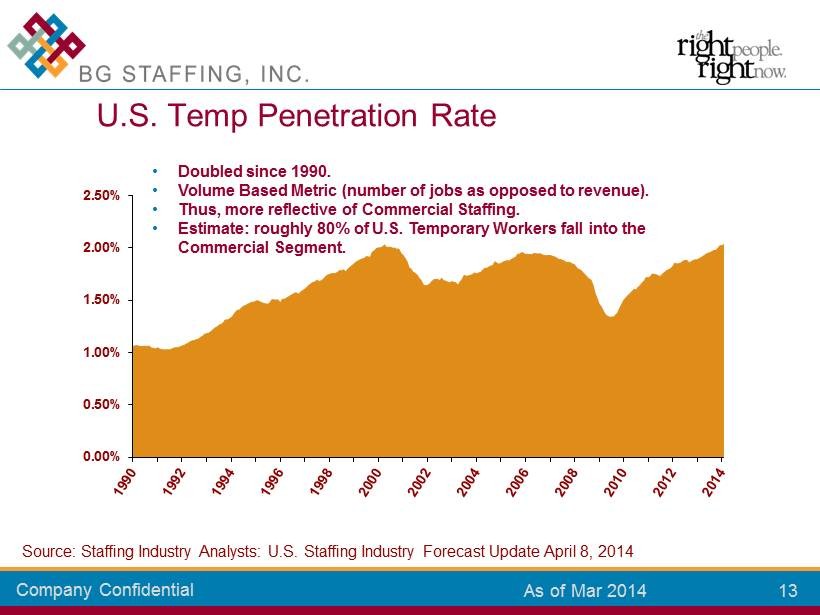

Company Confidential 13 13 As of Mar 2014 U.S. Temp Penetration Rate 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% • Doubled since 1990. • Volume Based Metric (number of jobs as opposed to revenue). • T hus, more reflective of Commercial Staffing. • Estimate: roughly 80% of U.S. Temporary Workers fall into the Commercial Segment. Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update April 8, 2014

Company Confidential 14 14 As of Mar 2014 Affordable Care Act Update

Company Confidential 15 15 As of Mar 2014 • Requires US citizens to have health insurance. • Requires employers to pay penalties, if they fail to provide health insurance to their employees. • Creates state - based Exchanges where individuals and small businesses can purchase coverage. • Provides subsidies to certain individuals and employers . • Expands the Medicaid program. • Imposes new regulations on the health care industry. • Finances the reforms through cost savings and taxes. Patient Protection and Affordable Care Act

Company Confidential 16 16 As of Mar 2014 • Large Employer – 2015 Have greater than 99 Full Time Employees. – 2016 Have greater than 50 Full Time Employees • Full Time employees generally = employees working 30 (or more) hours/week (average 130 hours/month). • Part Time employees generally = employees working less than 30 hours per week. • Disaggregation Rules – Separate legal entities under common ownership. – Affiliated service group – Controlled group Definitions

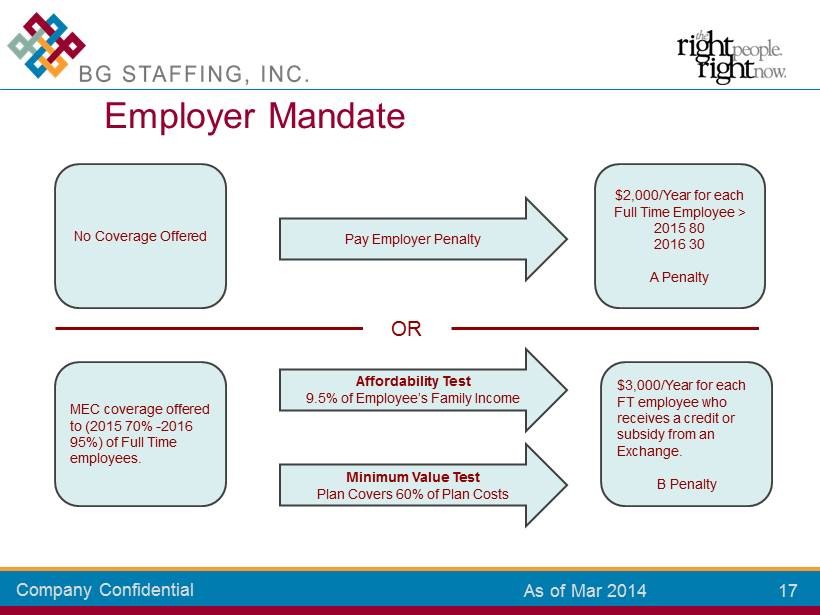

Company Confidential 17 17 As of Mar 2014 Employer Mandate MEC coverage offered to (2015 70% - 2016 95%) of Full Time employees. Affordability Test 9.5% of Employee’s Family Income Minimum Value Test Plan Covers 60% of Plan Costs $3,000/Year for each FT employee w ho receives a credit or subsidy from an Exchange. B Penalty No Coverage Offered $2,000/Year for each Full Time Employee > 2015 8 0 2016 30 A Penalty Pay Employer Penalty OR

Company Confidential 18 18 As of Mar 2014 ▪ We intend to fully comply with the law. ▪ Administrative cost concerns ▪ COBRA, etc. ▪ Minimum participation concerns. ▪ Continuing to Evaluate. Healthcare Reform Evaluation

Company Confidential 19 19 As of Mar 2014 BG Staffing, Inc. Contribution to Overhead (“COH”) is a non - GAAP measure that is derived by subtracting selling expenses from gross profit. Selling expenses are a subcomponent of Selling, General and Administrative costs as disclosed in our financial statements filed on From 10 - Q and 10K.

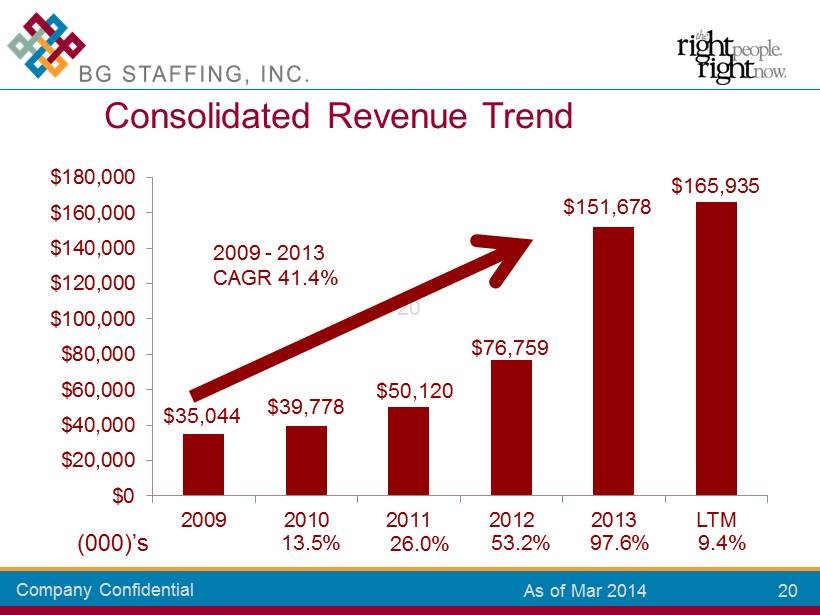

Company Confidential 20 20 As of Mar 2014 $35,044 $39,778 $50,120 $76,759 $151,678 $165,935 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 2009 2010 2011 2012 2013 LTM Consolidated Revenue Trend 13.5% 26.0% 53.2% 97.6% (000)’s 9.4% 2009 - 2013 CAGR 41.4%

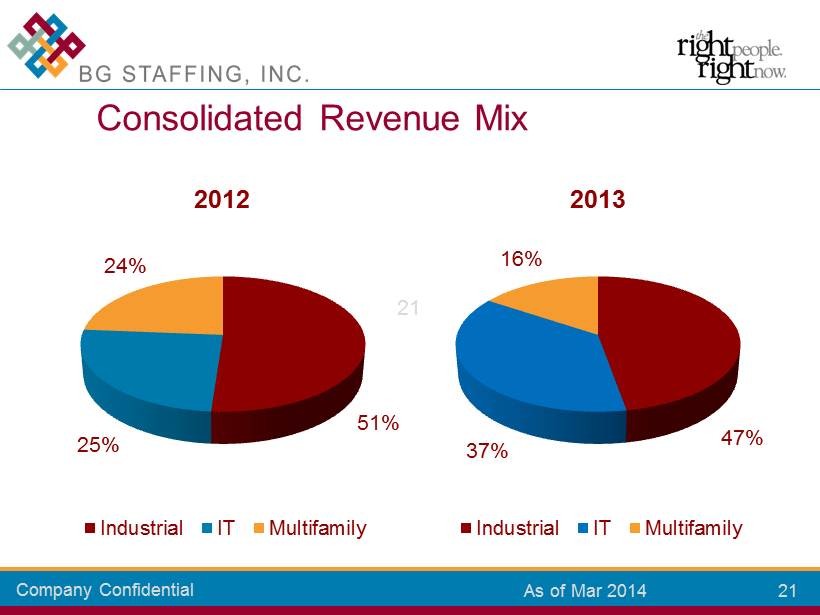

Company Confidential 21 21 As of Mar 2014 51% 25% 24% 2012 Industrial IT Multifamily 47% 37% 16% 2013 Industrial IT Multifamily Consolidated Revenue Mix

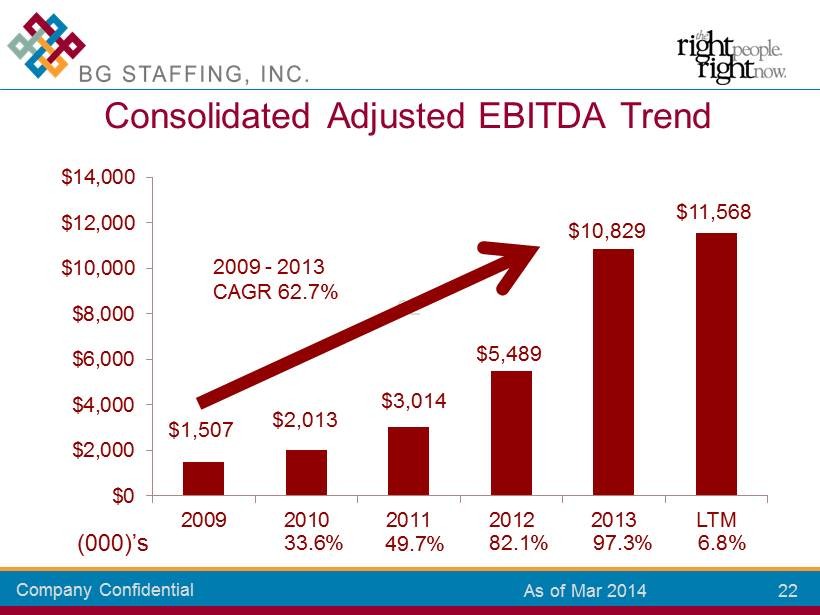

Company Confidential 22 22 As of Mar 2014 $1,507 $2,013 $3,014 $5,489 $10,829 $11,568 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 2009 2010 2011 2012 2013 LTM Consolidated Adjusted EBITDA Trend 33.6% 49.7% 82.1% 97.3% 6.8% (000)’s 2009 - 2013 CAGR 62.7%

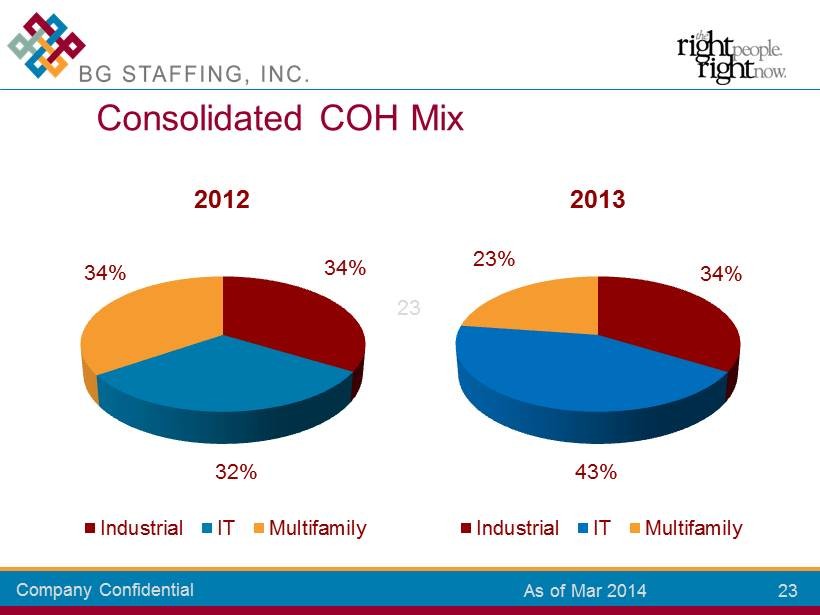

Company Confidential 23 23 As of Mar 2014 34% 32% 34% 2012 Industrial IT Multifamily 34% 43% 23% 2013 Industrial IT Multifamily Consolidated COH Mix

Company Confidential 24 24 As of Mar 2014 2014 Operations & Diversification Strategy

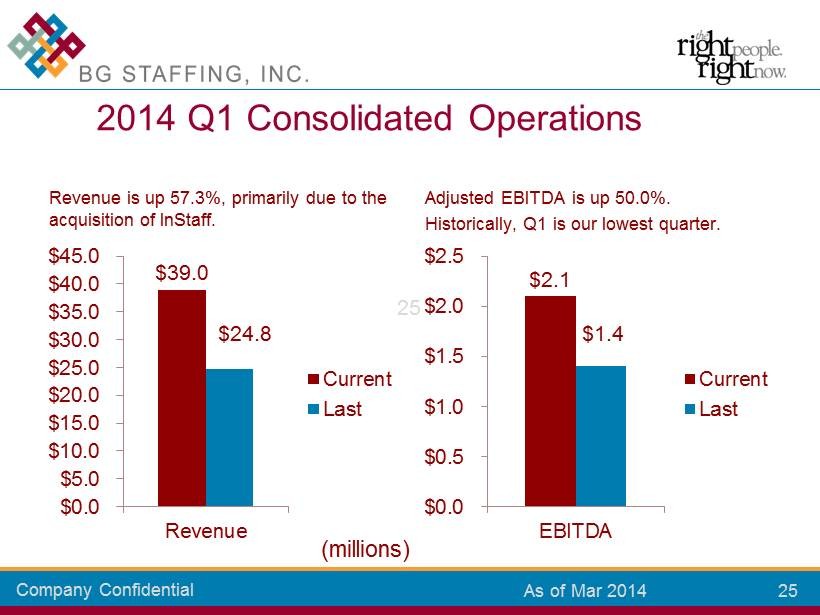

Company Confidential 25 25 As of Mar 2014 Revenue is up 57.3%, primarily due to the acquisition of InStaff. $39.0 $24.8 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 Revenue Current Last Adjusted EBITDA is up 50.0%. Historically, Q1 is our lowest quarter. $2.1 $1.4 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 EBITDA Current Last 2014 Q1 Consolidated Operations (millions)

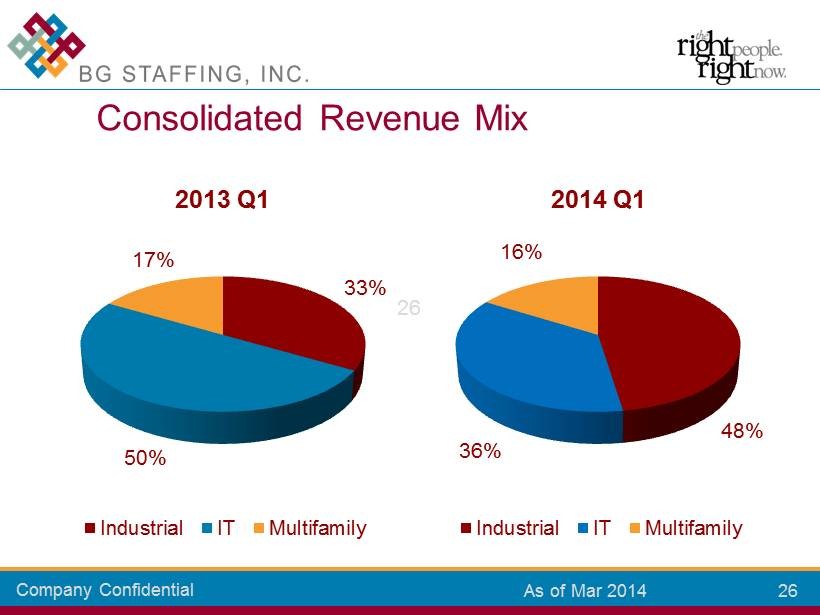

Company Confidential 26 26 As of Mar 2014 33% 50% 17% 2013 Q1 Industrial IT Multifamily 48% 36% 16% 2014 Q1 Industrial IT Multifamily Consolidated Revenue Mix

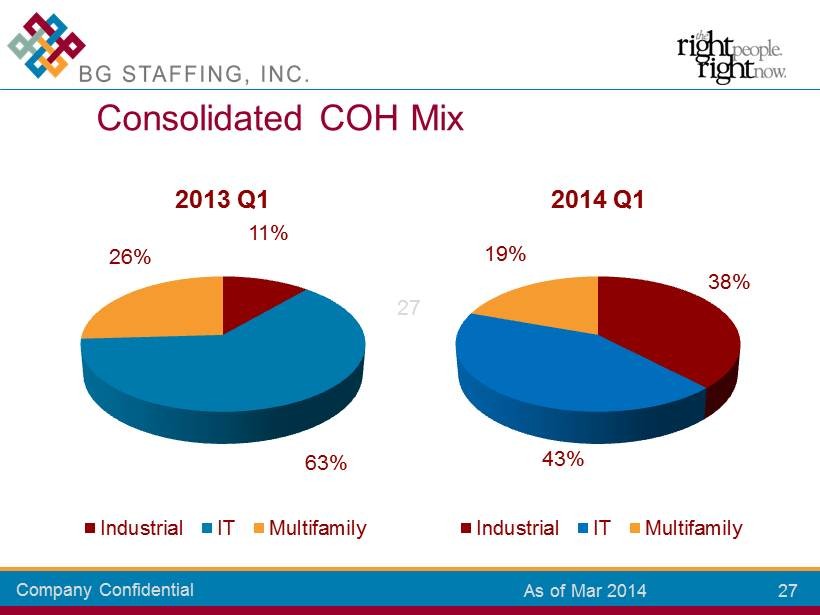

Company Confidential 27 27 As of Mar 2014 11% 63% 26% 2013 Q1 Industrial IT Multifamily 38% 43% 19% 2014 Q1 Industrial IT Multifamily Consolidated COH Mix

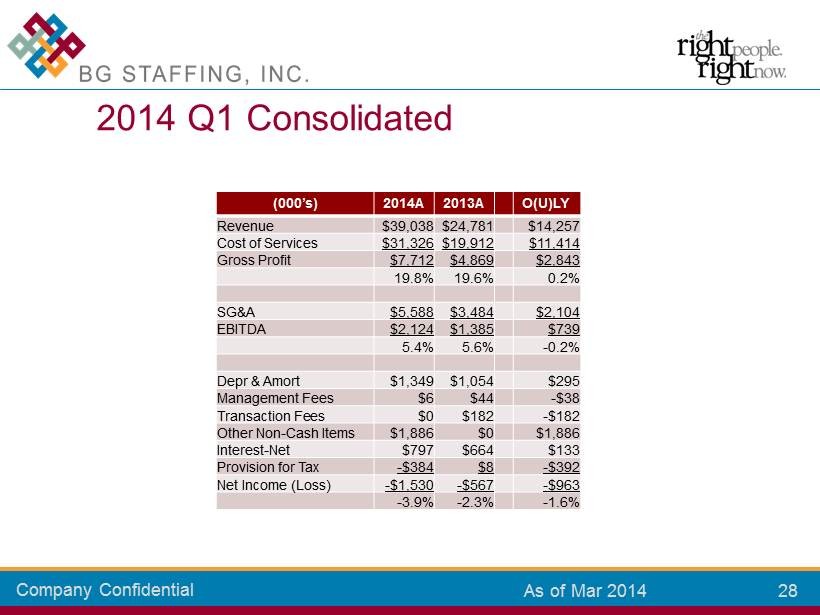

Company Confidential 28 28 As of Mar 2014 (000’s) 2014A 2013A O(U)LY Revenue $39,038 $24,781 $14,257 Cost of Services $31,326 $19,912 $11,414 Gross Profit $7,712 $4,869 $2,843 19.8% 19.6% 0.2% SG&A $5,588 $3,484 $2,104 EBITDA $2,124 $1,385 $739 5.4% 5.6% - 0.2% Depr & Amort $1,349 $1,054 $295 Management Fees $6 $44 - $38 Transaction Fees $0 $182 - $182 Other Non - Cash Items $1,886 $0 $1,886 Interest - Net $797 $664 $133 Provision for Tax - $384 $8 - $392 Net Income (Loss) - $1,530 - $567 - $963 - 3.9% - 2.3% - 1.6% 2014 Q1 Consolidated

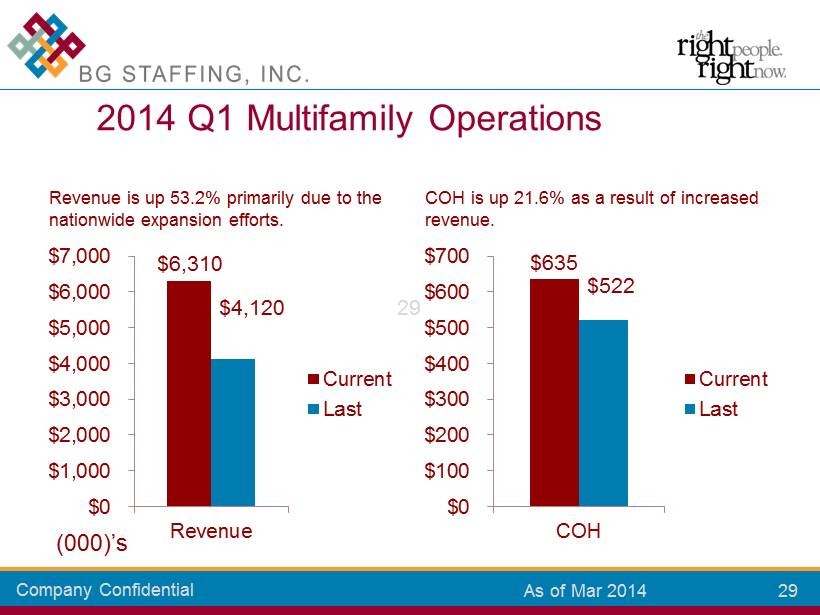

Company Confidential 29 29 As of Mar 2014 Revenue is up 53.2% primarily due to the nationwide expansion efforts. $6,310 $4,120 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 Revenue Current Last COH is up 21.6% as a result of increased revenue. $635 $522 $0 $100 $200 $300 $400 $500 $600 $700 COH Current Last 2014 Q1 Multifamily Operations (000)’s

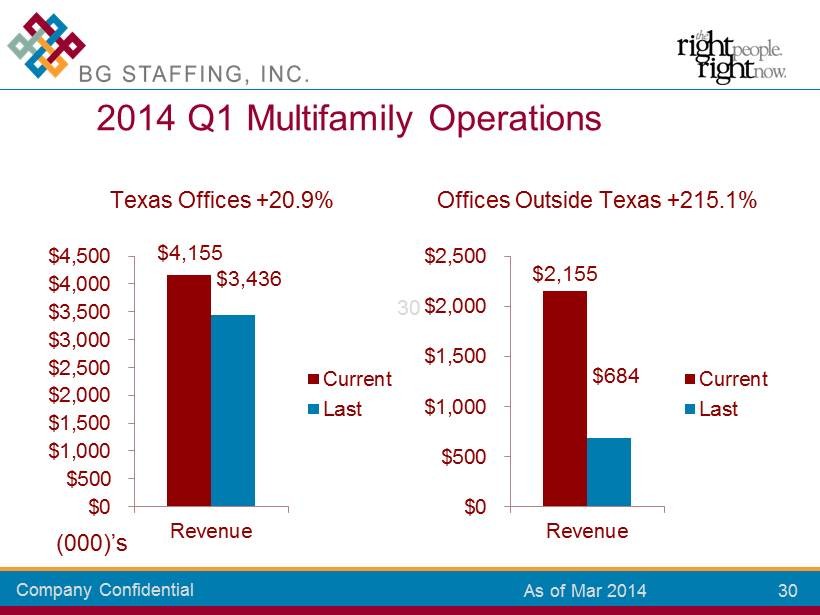

Company Confidential 30 30 As of Mar 2014 Texas Offices +20.9% $4,155 $3,436 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 Revenue Current Last Offices Outside Texas +215.1% $2,155 $684 $0 $500 $1,000 $1,500 $2,000 $2,500 Revenue Current Last 2014 Q1 Multifamily Operations (000)’s

Company Confidential 31 31 As of Mar 2014 • Manager • Assistant Manager • Leasing Agent • Bilingual Leasing Agent Maintenance • Supervisor • Lead (HVAC) • Assistant • Maker Ready • Grounds Keeper • Porter Office Multifamily Primary Skills

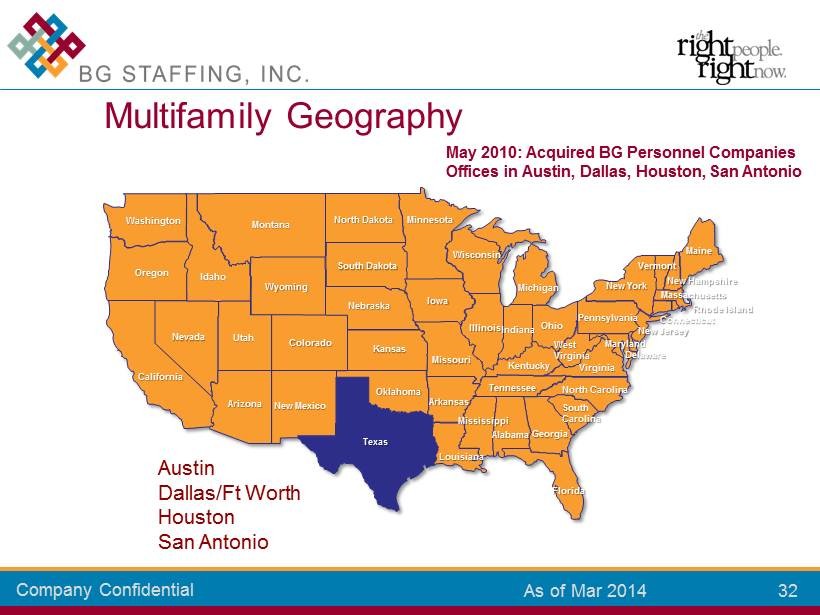

Company Confidential 32 32 As of Mar 2014 Multifamily Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Austin Dallas/Ft Worth Houston San Antonio May 2010: Acquired BG Personnel Companies Offices in Austin, Dallas, Houston, San Antonio

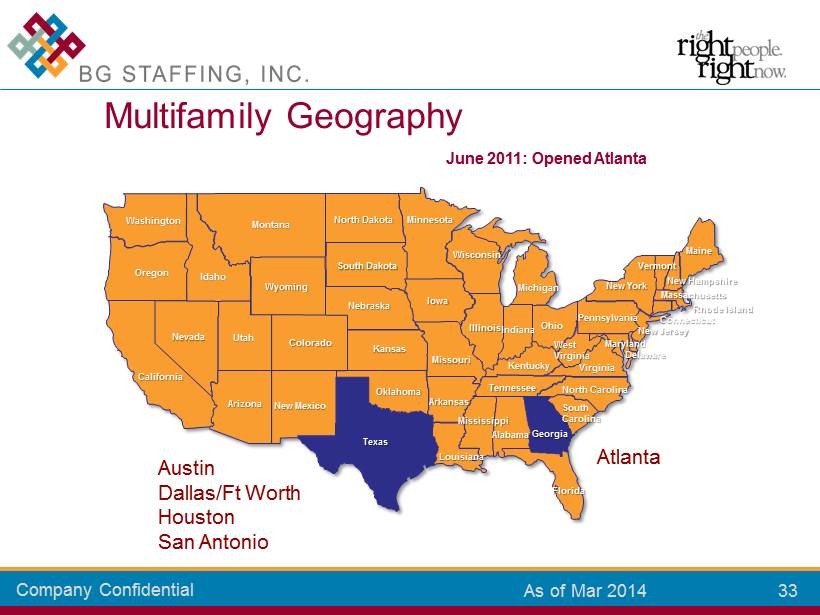

Company Confidential 33 33 As of Mar 2014 Multifamily Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Austin Dallas/Ft Worth Houston San Antonio Atlanta June 2011: Opened Atlanta

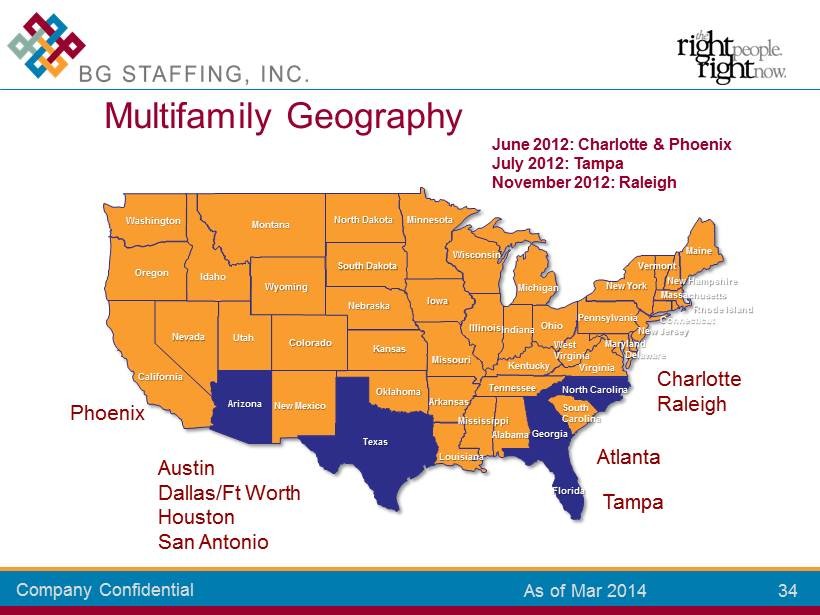

Company Confidential 34 34 As of Mar 2014 Multifamily Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Austin Dallas/Ft Worth Houston San Antonio Charlotte Raleigh Phoenix Tampa Atlanta June 2012: Charlotte & Phoenix July 2012: Tampa November 2012: Raleigh

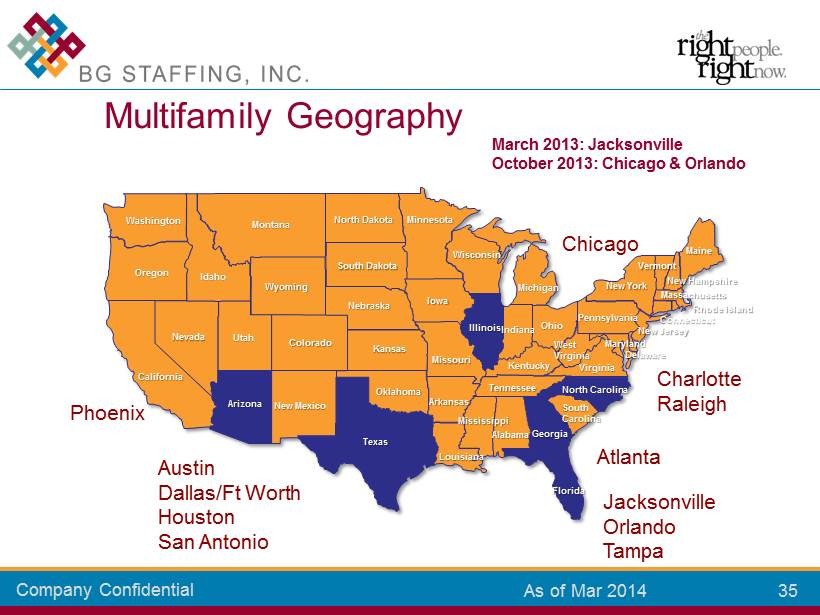

Company Confidential 35 35 As of Mar 2014 Multifamily Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Austin Dallas/Ft Worth Houston San Antonio Phoenix Charlotte Raleigh Chicago Jacksonville Orlando Tampa Atlanta March 2013: Jacksonville October 2013: Chicago & Orlando

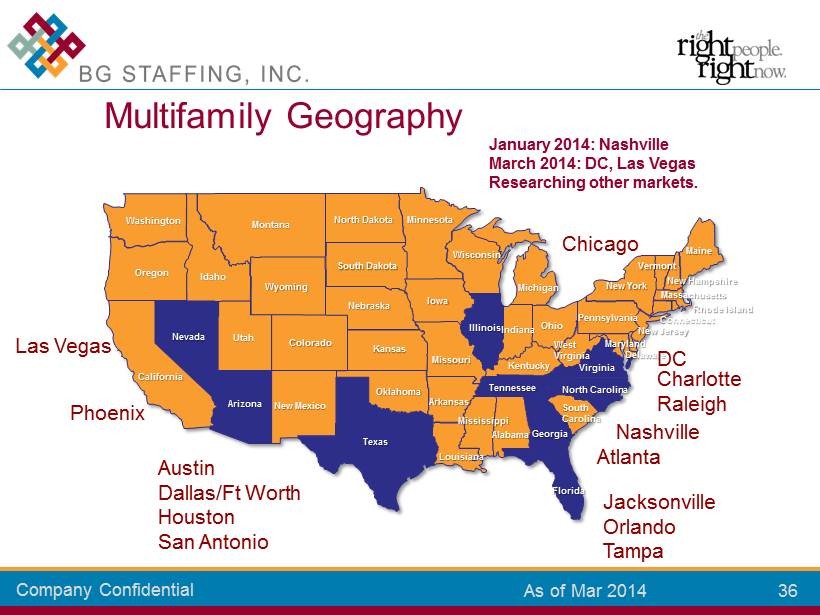

Company Confidential 36 36 As of Mar 2014 Multifamily Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Austin Dallas/Ft Worth Houston San Antonio Phoenix Charlotte Raleigh Chicago Jacksonville Orlando Tampa Atlanta January 2014: Nashville March 2014: DC, Las Vegas R esearching other markets. DC Nashville Las Vegas

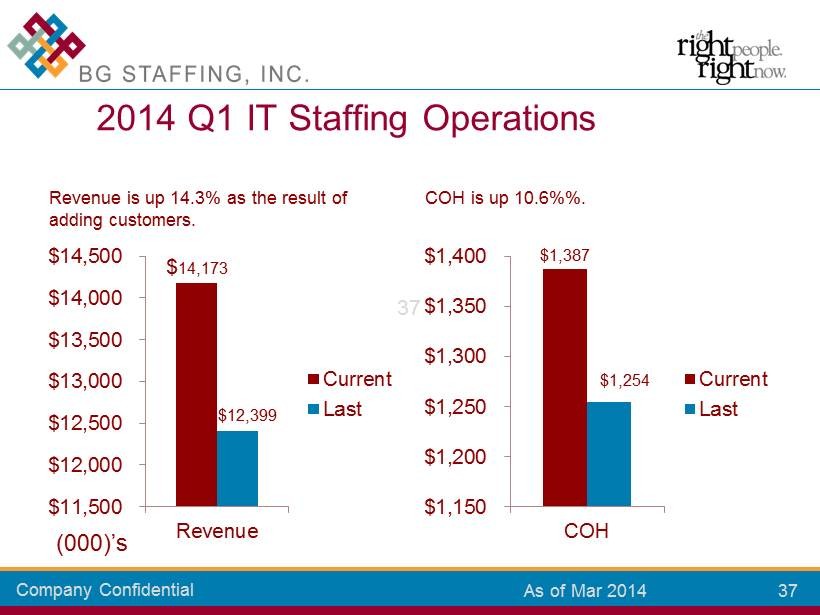

Company Confidential 37 37 As of Mar 2014 Revenue is up 14.3% as the result of adding customers. $ 14,173 $12,399 $11,500 $12,000 $12,500 $13,000 $13,500 $14,000 $14,500 Revenue Current Last COH is up 10.6%%. $1,387 $1,254 $1,150 $1,200 $1,250 $1,300 $1,350 $1,400 COH Current Last 2014 Q1 IT Staffing Operations (000)’s

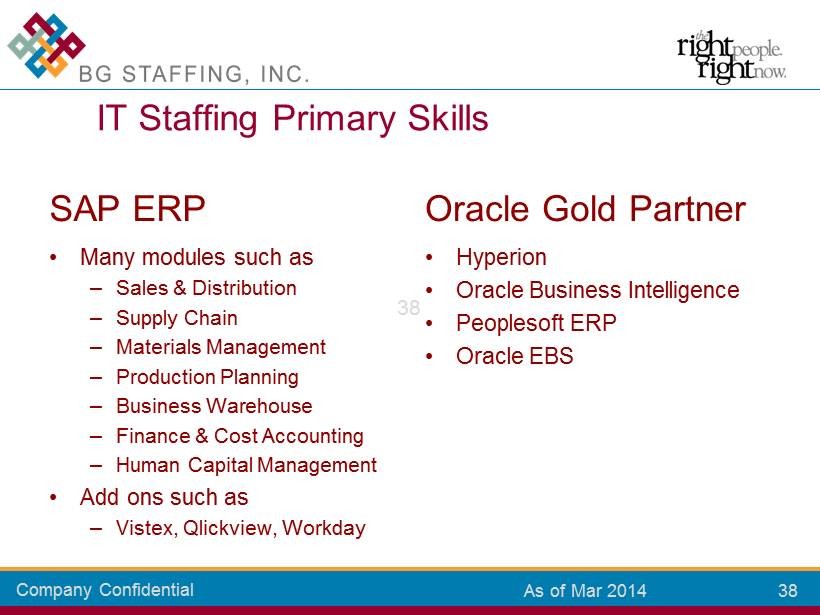

Company Confidential 38 38 As of Mar 2014 • Many modules such as – Sales & Distribution – Supply Chain – Materials Management – Production Planning – Business Warehouse – Finance & Cost Accounting – Human Capital Management • Add ons such as – Vistex , Qlickview , Workday Oracle Gold Partner • Hyperion • Oracle Business Intelligence • Peoplesoft ERP • Oracle EBS SAP ERP IT Staffing Primary Skills

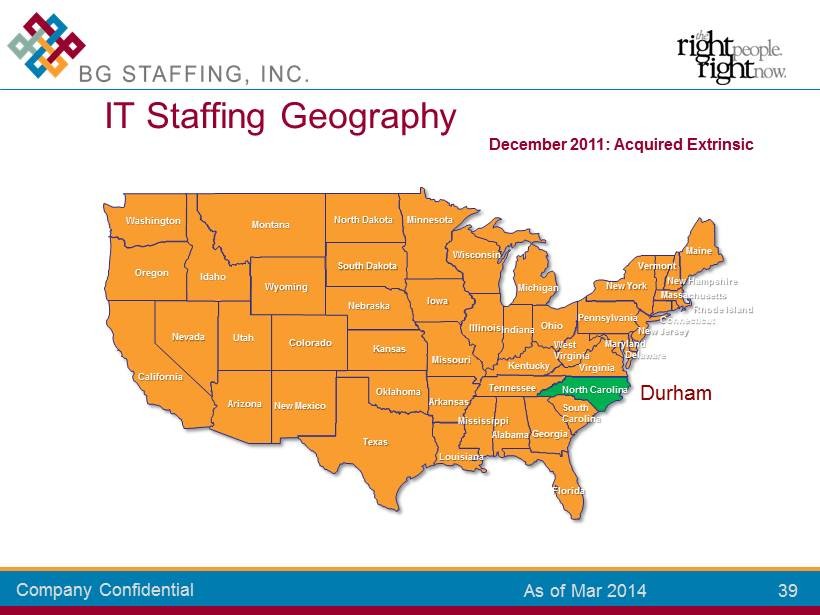

Company Confidential 39 39 As of Mar 2014 IT Staffing Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Durham December 2011: Acquired Extrinsic

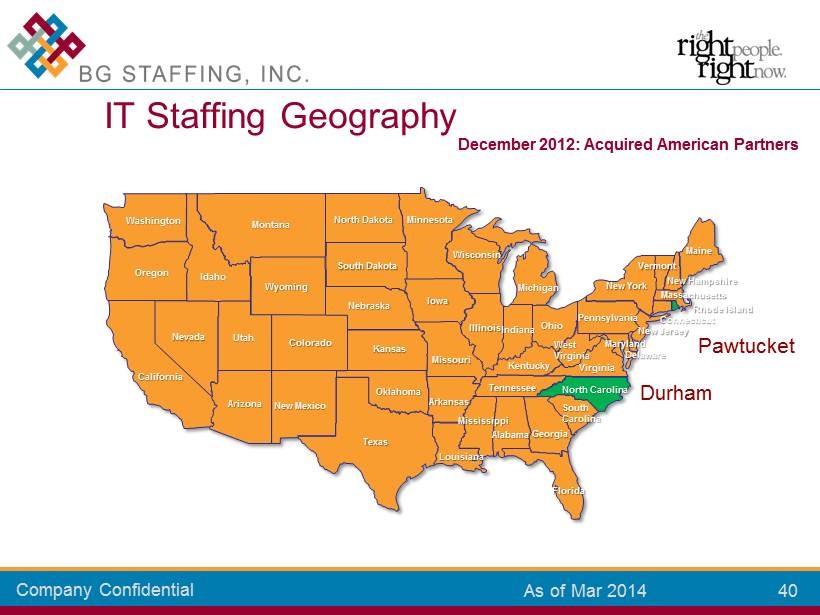

Company Confidential 40 40 As of Mar 2014 IT Staffing Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Durham Pawtucket December 2012: Acquired American Partners

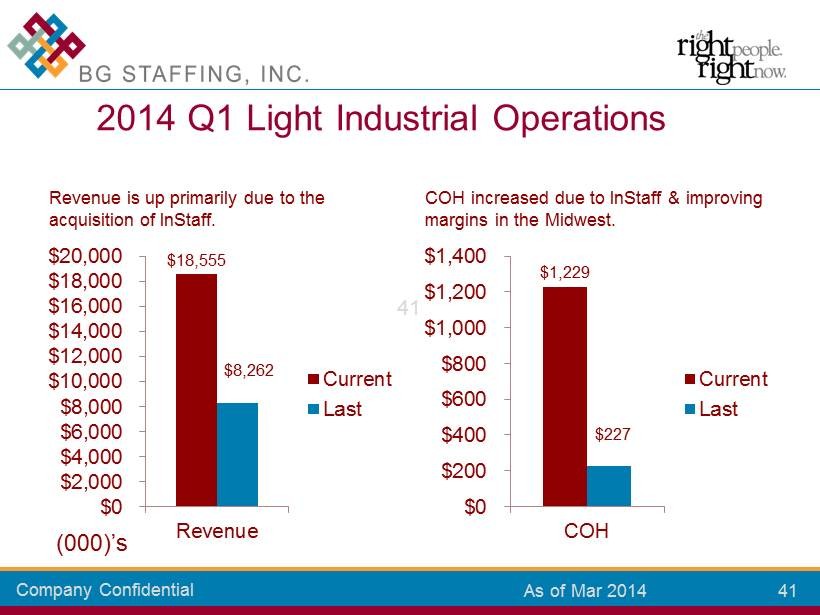

Company Confidential 41 41 As of Mar 2014 Revenue is up primarily due to the acquisition of InStaff. $18,555 $8,262 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 Revenue Current Last COH increased due to InStaff & improving margins in the Midwest. $1,229 $227 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 COH Current Last 2014 Q1 Light Industrial Operations (000)’s

Company Confidential 42 42 As of Mar 2014 • Forklift Drivers • Pickers/Packers • Production workers • Light Assembly • Light Manufacturing • General Labor Light Industrial Primary Skills

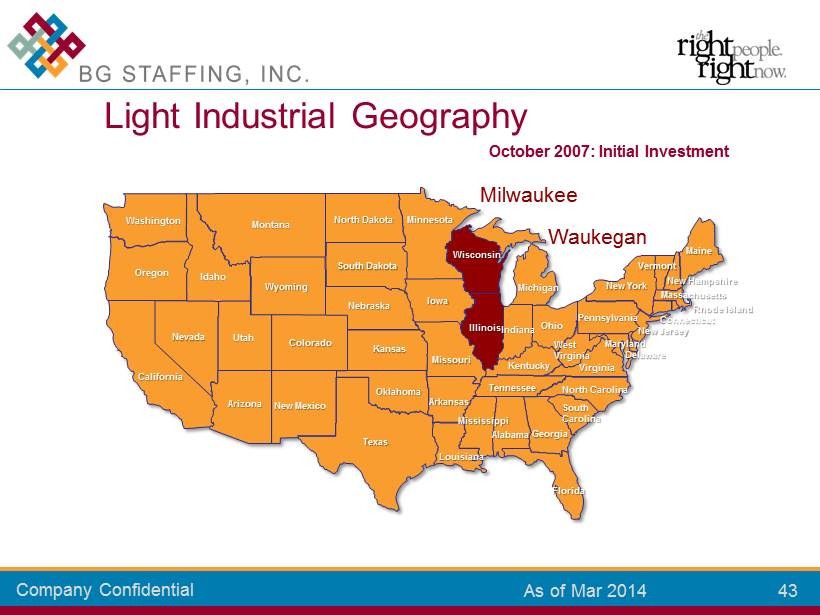

Company Confidential 43 43 As of Mar 2014 Light Industrial Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Milwaukee Waukegan October 2007: Initial Investment

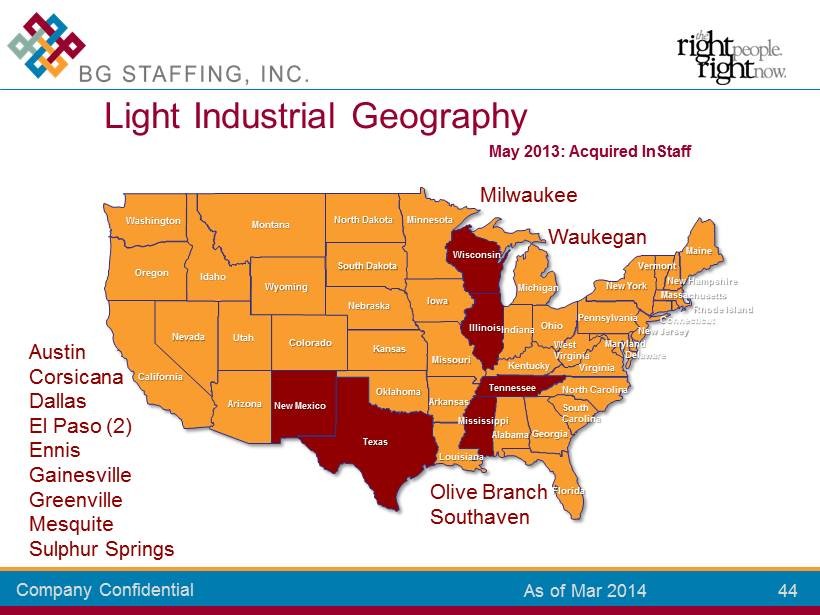

Company Confidential 44 44 As of Mar 2014 Light Industrial Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland Milwaukee Waukegan Austin Corsicana Dallas El Paso (2) Ennis Gainesville Greenville Mesquite Sulphur Springs Olive Branch Southaven May 2013: Acquired InStaff

Company Confidential 45 45 As of Mar 2014 Questions?