Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUSQUEHANNA BANCSHARES INC | d718986d8k.htm |

Susquehanna Bancshares, Inc.

Investor Presentation

2

nd

Quarter

2014

Exhibit 99.1 |

Forward-Looking Statements

During

the

course

of

this

presentation,

we

may

make

forward-looking

statements

regarding

priorities

and

strategic

objectives

of

Susquehanna

Bancshares,

Inc.,

as

well

as

capital

ratios,

efficiency

ratios,

net

income

and

earnings.

Investors

should

understand

that

these

forward-looking

statements

are

strategic

objectives

rather

than

projections

of

future

performance.

We

wish

to

caution

you

that

actual

results

and

trends

could

differ

materially

from

those

set

forth

in

such

statements

due

to

various

risks,

uncertainties

and

other

factors.

The

risks,

uncertainties

and

other

factors

that

could

cause

actual

results

and

experience

to

differ

from

those

projected

include,

but

are

not

limited

to,

the

following:

ineffectiveness

of

Susquehanna’s

business

strategy

due

to

changes

in

current

or

future

market

conditions;

the

effects

of

competition,

including

industry

consolidation

and

development

of

competing

financial

products

and

services;

the

costs

and

effects

of

legal

and

regulatory

developments

including

the

resolution

of

legal

proceedings

or

regulatory

or

other

governmental

inquiries

and

the

results

of

regulatory

examinations

or

reviews;

interest

rate

movements;

changes

in

credit

quality;

deteriorating

economic

conditions;

other

risks

and

uncertainties;

and

our

success

at

managing

the

risks

involved

in

the

foregoing

items.

For

a

more

detailed

description

of

the

factors

that

may

affect

Susquehanna’s

operating

results,

we

refer

you

to

our

filings

with

the

Securities

&

Exchange

Commission,

including

our

annual

report

on

Form

10-K

for

the

year

ended

December

31,

2013

and

Form

10-Q

for

the

quarter

ended

September

30,

2013.

Susquehanna

assumes

no

obligation

to

update

the

forward-looking

statements

made

during

this

presentation.

For more information, please visit our Website at:

www.susquehanna.net

2 |

Why

Susquehanna? 3

Business Strategy

Regional

bank

with

a

customer-focused

“community

bank”

delivery

model

Grow

deposits

–

attractive

markets

with

rich

deposit

base

and

favorable

demographics

Commercial

loan

focus

–

ample

small

business

opportunities

within

footprint

Enhance

fee

income

activities

–

capital

markets,

cash

management,

mortgage

and

wealth

Invest

to

enhance

customer

experience,

employee

engagement

and

risk

management

Management Team

Executive

management

team

with

200+

years

of

combined

banking

experience

Deep

knowledge

of

the

markets

Susquehanna

serves

Interests

aligned

with

stockholders

through

short-term

incentives

tied

to

strategic

goals

and

long-

term

incentives

tied

to

relative

total

shareholder

return

and

return

on

tangible

common

equity

(“ROTCE”)

Valuation

Trade

at

a

discount

to

peers

on

an

earnings

and

book

value

basis

Very

attractive

dividend

yield

at

3.09%¹

Long-Term Upside

Execution

of

strategy

builds

attractive

deposit

franchise

and

enhances

the

long-term

earnings

power

of

Susquehanna

Potential

P/E

expansion

due

to

higher

earnings

growth

and

lower

cost

of

equity

Stronger

balance

sheet

and

fee

income

activities

while

improving

liquidity

and

interest

rate

risk

profile

1

Based on current annualized dividend of $0.32 per share and closing price on April

30, 2014. |

Table

of Contents 4

Susquehanna Overview

5

Financial Review: First Quarter 2014

10

Business Strategy: Regional Bank With a Customer-Focused

“Community

Bank”

Delivery

Model

14

Valuation and Long-Term Upside

27

Quarterly Financial Supplement

30 |

Susquehanna Overview

5 |

Susquehanna Overview

6

Corporate Overview

Regional bank headquartered in Lititz, PA

245 banking offices concentrated in Central PA,

Western MD, and Philadelphia and Baltimore

MSAs

38

th

largest U.S. commercial bank by assets

and 2

nd

largest headquartered in PA

Experienced management team with extensive

market knowledge

Franchise is a diversified mix of consumer and

business customers, products and revenue

sources

Non-bank affiliates offering products and

services in:

–

Wealth management

–

Insurance brokerage and

employee benefits

–

Commercial finance

–

Vehicle leasing

Assets:

$18.4 billion

Deposits:

$13.1 billion

Loans & Leases:

$13.6 billion

Assets under management

$7.7 billion

and administration:

Market cap

1

:

$1.9 billion

Average daily volume

:

~1.3 million shares

Institutional ownership:

>70%

Dividend yield

:

3.09%

NASDAQ:

SUSQ

1

Based on closing price on April 30, 2014.

2

Over the last 52 weeks.

3

Based on current annualized dividend of $0.32 per share and closing price on April

30, 2014. Selected Data as of 3/31/2014

3

2 |

Uniquely Positioned

7

Source: SNL Financial.

Note: Regulatory branch and deposit data as of June 30, 2013; banks and thrifts with

deposits in counties SUSQ operates in PA/NJ/MD/WV; traditional and

in-store branches only, as defined by SNL. Counties

of

operation

are

listed

in

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation.

Proven ability to grow share and

rank in key markets of operation:

–

Top 3 market share in 11 of 40

counties

–

10%+ market share in

13 counties

–

Top 5 market share in half the

MSAs where we do business

Largest locally based community

bank in our market

Ample opportunity to grow

deposits with small market share

gains:

–

Increasing market share 30 bps to

4.9% would bring loan to deposit

ratio just below 100%, in-line with

our 2014 target

Deposit Market Share: Counties of Operation

Rank

Institution

Branch

Count

Total Deposits in

Market ($000)

Total Market

Share (%)

1

Wells Fargo

377

41,514,008

14.9%

2

PNC

393

28,419,912

10.2%

3

Bank of America

217

25,180,194

9.1%

4

M&T Bank

324

24,420,075

8.8%

5

Toronto-Dominion Bank

167

20,925,057

7.5%

6

Royal Bank of Scotland

217

18,654,030

6.7%

7

Susquehanna

245

12,790,628

4.6%

8

Fulton

191

9,513,532

3.4%

9

Banco Santander

178

9,222,815

3.3%

10

National Penn

120

5,945,401

2.1%

11

BB&T

68

4,327,798

1.6%

12

Beneficial

60

3,777,354

1.4%

13

Citi

13

2,811,745

1.0%

14

First Niagara

61

2,481,487

0.9%

15

Customers

12

2,270,071

0.8%

Total

(1-15)

2,665

212,254,107

76.4%

Total

(1-239)

4,146

277,747,024

100.0% |

Leading Competitive Position

8

Better positioned with a stronger market concentration than peers

Markets of operation are wealthier than peers

Market presence in 14 of the 20 most affluent counties in PA by median household

income –

Maryland market includes Baltimore and three of the nation’s 40

most-affluent counties including no. 3, Howard County Source: SNL

Financial, U.S. Census. Peer data reflects median of peer companies. Identification of peer companies is included

in

the

“Quarterly

Financial

Supplement”

at

the

conclusion

of

this

presentation.

Deposit

data

as

of

June

30,

2013

1

Reflects weighted average by deposits at the county level. Household income as of

2013. SUSQ

Peers

% of Deposits in Counties

with #1 Rank

31%

22%

% of Deposits in Counties

with 25% Market Share

32%

18%

Attractive Market Demographics and Leading Competitive Position

SUSQ

Peers

Median Household

Income¹

$58,718

$51,374

% of Deposits in Counties

with HHI Over $60,000

29%

17% |

Positioned for Further Growth

9

Pennsylvania Market

Delaware Valley Market

Maryland Market

115 branches

Foundation for growth with stable commercial

and retail banking base providing ample deposits

Home to distribution hubs for global retailers,

manufacturers and distributors serving Northeast

and Mid-Atlantic markets

69 branches

Growth opportunities fueled by world-leading

education, health care and research institutions

61 branches

Growth opportunities fueled by world-leading

education, health care and research institutions,

as well as major federal agencies and

contractors

Small Business Density Complements Branch Footprint

Source: Bank Intelligence. “Small Business”

defined as businesses with less than $10 million in annual sales.

The 16 counties comprising the company’s Pennsylvania Market, the 10 counties

comprising the company’s Delaware Valley Market and the 14 counties comprising the company’s Maryland Market are listed in

the “Quarterly Financial Supplement”

slides at the conclusion of this presentation. |

Financial Review: First Quarter 2014

10 |

First

Quarter 2014 Highlights 11

GAAP

EPS

of

$0.20

Modestly lower than $0.22 in 4Q13 and $0.23 in 1Q13

Fee

Income

Impacted

by

Weather

&

Seasonality

Capital

markets

revenue

of

$1.2

million

compared

to

$3.2

million

in

the

prior

quarter;

increased 37.5% year-over-year

Wealth revenue declined to $12.7 million compared to $13.0 million in the prior

quarter; increased 2.7% year-over-year

Mortgage banking revenue essentially flat at $2.4 million

Service charges and other income impacted by weather and seasonality; service

charges increased 3.8% year-over-year

Commercial

Loan

Growth

Commercial loans grew 0.7% linked quarter and 4.3% year-over-year

Continued

Focus

on

Deposit

Growth

Deposits increased by 1.6% linked quarter and 3.1% year-over-year

Interest-bearing deposit costs remained flat at 50bps linked quarter

Focused

on

Returns

ROAA of 0.82% compared to 0.89% and 0.95% in 4Q13 and 1Q13, respectively

ROATE

1

of 11.08% compared to 12.49% and 13.87% in 4Q13 and 1Q13, respectively

Solid

Credit

Quality

Metrics

and

Capital

Ratios

NPAs moved to 0.89% of loans, leases and foreclosed real estate

Strong coverage ratio with allowance representing 142% of nonaccrual loans and

leases Tangible common ratio

1

of 8.67%; regulatory ratios exceed “well capitalized”

1

Non-GAAP

based

financial

measures;

please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

calculations. |

First

Quarter Purchase Accounting Impact

12

Tower’s purchased credit impaired fair value marks are

amortized by pooling like asset classes while Abington’s marks

are amortized at the loan level

Non-purchased credit impaired fair value marks are amortized

at the loan level

Predicting future amortization is challenging due to

prepayment/refinancing, customer behavior and the overall

health of the economy

Total purchase accounting benefit was 21 bps in 1Q14

compared to15bps in 4Q13

Loan amortization was 17bps in 1Q14 compared to 11bps in

4Q13

Deposit and borrowing amortization was 4bps in 1Q14

compared to 4ps in 4Q13

Net

interest

margin,

excluding

purchase

accounting,

1

declined

5bps from 3.45% in 4Q13 to 3.40% in 1Q14

Non purchase accounting roll forward

Note:

Additional

information

on

purchase

accounting

impact

is

included

in

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation.

1

Non-GAAP

based

financial

measures;

please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

calculations

. |

Susquehanna

Peer

Median

5

ROAA

0.82%

0.88%

ROATE

1

11.08%

10.71%

Net Interest Margin

3.61%

3.36%

Loans % of Deposits

104%

86%

Loan Growth

(0.01%)

2.2%

Deposit Growth

1.6%

1.4%

Deposit Cost

0.43%

0.24%

C&I % of Total Loans

2

14.2%

22.9%

Checking Deposits %

of Total Deposits

2,3

23.6%

31.1%

Efficiency Ratio

1

66.18%

66.04%

Fee

Income

%

of

Operating

Revenue

4

23.1%

25.7%

NPAs % of Loans and Leases and

Foreclosed Real Estate

0.89%

1.02%

NCOs % of Average Loans and Leases

0.28%

0.23%

Tier

1

Common

Ratio

6

10.84%

10.47%

1Q14 Performance vs. Peers

13

Source: SNL Financial and company filings

1

Non-GAAP

based

financial

measures;

please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

calculations.

2

Per 12/31/13 regulatory filings.

3

Interest-bearing and non-interest bearing transaction deposits per

regulatory filings. 4

As

reported

by

SNL.

Excludes

securities

gains

and

losses

and

other

non-recurring

items.

5

Please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

the

listing

of

the

peer

companies.

6

Most recent available data

Solid profitability

Focus on improving loan to deposit ratio

Fee income activities in place to deepen

relationships and close the gap to peers

NCOs/Avg. loans and leases trending

towards peers while the Tier 1 common

ratio is slightly better than peers

Working to close the gap to peers by

growing checking deposits and commercial

loans in attractive markets

Comments |

Business Strategy: Regional Bank With a

Customer-Focused “Community Bank”

Delivery Model

14 |

Strategic Focus: Multi-Year Plan

15

OBJECTIVE: Transition to a Robust Relationship-Based Customer Model

1.

Shift in Model and

Focus

New investments

focused on:

–

Technology

–

Risk management

–

Employee engagement

–

Customer experience

–

Service delivery

–

Marketing

–

Pricing

–

Products

Evaluating new and existing relationships for relationship profitability

2.

Hiring and Talent

Recruiting experienced leaders across the bank

Hiring individuals and teams

Employee engagement at all levels

Building capabilities to foster existing employee development

3.

Redesigned Incentive

Structure

New profitability model to drive bankers’

incentives

Incentives promote cross selling, risk management and total portfolio

management |

Investing for Tomorrow

16

Investments Focused on What We Can Control

Aligning Infrastructure With Our

Growth into Top 50 Bank Rankings

Ensuring systems, processes and capabilities can accommodate growth

beyond the $18 billion institution Susquehanna is today

Focus on Scalable Investments

Software and technology

Fee income activities

Risk management

Customer experience

Service delivery

Investments for Business Demand

4 of the top 5 budgeted capital expenditures for 2014 are for business

demand: -

ATMs

-

Branch relocation

-

Product software

-

Commercial Banking online upgrades

Investments today position Susquehanna for future growth and performance

Business demand drives

84% of budgeted spend

for top 5 capital

expenditures in 2014

Higher expenses in the

near-term |

Investing in Talent

17

Approximately

45%

of

Susquehanna’s

top

60

leaders

have

joined

within

the

last

two

years,

bringing

new

ideas

and

best

practices to bear

Aligning corporate and individual objectives with strategic plan

and stockholders’

interests

–

Short-term incentives tied to strategic goals

–

Long-term incentive plan tied to relative total shareholder return and

ROTCE WILLIAM

REUTER

Chairman and CEO

39 years banking experience,

including 23 years with Susquehanna

ANDREW

SAMUEL

Bank President and CEO

29 years banking experience

2 years with Susquehanna

MICHAEL

HARRINGTON

Chief Financial Officer

27 years banking experience

2 years with Susquehanna

MICHAEL

QUICK

Chief Corporate

Credit Officer

42 years banking experience

23 years with Susquehanna

GREGORY

DUNCAN

Chief Operating Officer

30 years banking experience

23 years with Susquehanna

CARL

LUNDBLAD

Chief Legal &

Administrative Officer

16 years banking / legal

experience

2 years with Susquehanna

BEVERLY

WISE

Chief Human

Resources Officer

25 years banking experience

2 years with Susquehanna

KEVIN

BURNS

Chief Risk Officer

15 years banking experience

<1 year with Susquehanna |

Business Strategy

18

Strategic Priorities for 2014

Focus on

Deposits

Helps achieve balance sheet objectives

Significant opportunity in existing client base

Take

share

from

larger

competitors

with

“community

bank”

delivery

model

Complements strategy to grow commercial loans and success of Stellar Checking

retail campaign Optimize

Balance Sheet

Focus on growing commercial loans while limiting indirect auto and selling more

mortgage production –

Dense population of small businesses in-market

–

Product offerings position us to compete with small and large banks

Small business relationships provide opportunities in wealth, capital markets and

cash management –

Growing fee income reduces spread-reliance and promotes stable revenue

stream Customer

Experience

and Employee

Engagement

Delivering a differentiated customer experience with premier service and

simplified processes Fueling customer-centric culture through

investments in talent, technology, products and delivery Aligning

compensation around drivers of sustainable and profitable relationships

–

Incentives

tied

to

full

customer

relationships,

measured

through

profitability

model

Enterprise

Risk

Management

Investments in people and processes to effectively manage risk commensurate with

our size, complexity, strategy and growth

More efficient pricing and capital allocation decisions

Enhanced governance and controls |

Focus: Deposits

19

Loan to Deposit Ratio %

Rationale

Ample opportunity to capture greater wallet share and profitability from existing

customers while improving liquidity and interest risk profile

Strategic

Initiatives

Enhanced profitability models to inform pricing and investment decisions

Focus on deposit-rich markets with ample small business opportunities

Investing in people and technology to streamline loan approval and closing and

deposit account opening process

Sales training and development, emphasizing cross-sell

Increasing marketing spend

Trade-Off

Desire to lower loan to deposit ratio is a constraint on loan growth and earnings

in the short-term. Long-term benefits will be realized when

interest rates rise Source: SNL Financial.

Please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

the

listing

of

the

peer

companies. |

Strong Deposit Growth

20

Organic Non-CD

Deposit CAGR:

7.3%

Strong Deposit Growth Momentum

Positive

results

in

mobile

deposit

services

and

Stellar

Checking

account

Non-CD deposits now account for 70% of total deposits

Non-CD growth of 2.0% since 1Q13, including strategic exit from certain

relationships Cost of deposits decreased from 2.86% in 4Q07 to 0.43% in

1Q14 Total Deposits 12/31/2007

$8.9 Billion

Total Deposits 3/31/2014

$13.1 Billion

Time < $100K

Time of $100K or more

Savings

Interest-bearing demand

Demand deposits |

Deposit Initiatives

21

Innovative Deposit Strategies Driving Growth

Strategic

Building

on

2.3%

deposit

growth

in

2013

to

achieve

balance

sheet

objectives

Exiting non-strategic relationships and limiting exception pricing

Lowered deposit cost by 9 bps in 2013

Streamlined

Focused on cross-sell opportunities and commercial deposits

Three retail checking accounts today vs. 10+ at the start of 2013

Customer-Centric

Stellar Checking launched in 2013

–

70,610 accounts in first 13 months with $166M in

balances and $600,000 in total rewards paid out

–

30% from new customers, with higher average

balances than converted accounts

–

Driving new fee income through increased debit

card usage

Digital channel in 1Q14 vs. 1Q13

–

Mobile banking users up 72%

–

E-statements up 29%

–

Total online banking users up 14% |

Disciplined Asset Allocation:

Focus on Commercial Loans

22

Organic Loan

CAGR: 3.8%

Slowing Loan Growth Momentum, Focus on Mix

Rotating assets to achieve more valuable mix

Commercial loan growth of 4.3% since 1Q13, including strategic exit from certain

relationships Limit indirect portfolio growth while selling more

residential production in secondary market Average commercial loan yield in

1Q14 was 4.78%, compared to 3.38% for indirect auto leases 12/31/2007

$8.8 Billion

3/31/2013

$13.6 Billion

Commercial, financial and agricultural

Leases

Consumer

Real estate secured -

residential

Real estate secured -

commercial

Real estate -

construction |

Net

Interest Margin 23

Net interest margin of 3.61% in the quarter versus 3.60% in the prior quarter

Net interest margin, excluding purchase accounting, was down 5 bps, but remains

in-line with peer reported net interest margin

The net interest margin decline is a primarily a function of existing loans

repricing at lower rates and a change in the mix of loans

Deposit growth and strategic shift toward commercial lending expected to provide

more stability to the net interest margin going forward

Source:

SNL

Financial.

Please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

the

listing

of

the

peer

companies.

1

Non-GAAP

based

financial

measure;

please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

calculation.

Net Interest Margin

1 |

Focus on cross-sell as commercial loan and deposit relationships grow

–

Closing the gap to peers on fee income/operating revenue

Diversifying revenue and becoming less reliant on spread revenue

–

Momentum in wealth management, capital markets and cash management

–

Increased 2.7% year-over-year

Capital markets growing

–

Increased 37.5% year-over-year

–

$52 million in new demand deposits and revenue up 7.4% year-over-year

Non-Interest Income

24

Non-interest Income ($000) -

Quarter Ending

Mar. 31, 2013

Dec. 31, 2013

Mar. 31, 2014

Service Charges on Deposit Accounts

8,672

9,456

9,000

Vehicle Origination and Servicing Fees

3,354

3,057

2,968

Wealth Management Commissions and Fees

12,390

13,048

12,719

Commissions on Property and Casualty

Insurance Sales

4,542

4,023

5,666

Other Commissions and Fees

4,328

5,077

5,035

Mortgage Banking Revenue

4,110

2,483

2,410

Fee

Income

%

of

Operating

Revenue

1

1

As

reported

by

SNL

Financial.

Excludes

securities

gains

and

losses

and

other

non-recurring

items.

Please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

the

listing

of

the

peer

companies.

Wealth management continues to expand

Cash management driving deposit growth and income |

Expense Management

25

Successfully lowered efficiency ratio from 66.83% for 2011 to 62.55% for 2013

–

Recent elevation in efficiency ratio reflects expenses associated with incentive

compensation, branch consolidation costs and investments to build out ERM,

compliance and other strategic initiatives –

Targeted long-term efficiency ratio of 60%

–

Efficiency is a part of our culture; always looking for ways to improve expense

management Note:

Efficiency

ratio

excludes

net

realized

gain

on

acquisition,

merger

related

expenses

and

loss

on

extinguishment

of

debt

and

is

a

non-GAAP

based

financial

measure;

please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

calculations. |

2Q14

Outlook & Current Trends 26

Strategic Priorities Reflected in Second Quarter 2014 Outlook

Net Interest Margin

May decline slightly in second quarter due to competitive pressure on existing

loan portfolio Range of 3.36% -

3.40%

Average Earning

Assets

Limited average earning asset growth

Commercial loan growth is priority

Focus on rotating the balance sheet mix rather than on total loan growth

Securities portfolio expected to remain relatively flat

Credit

Provision is expected to trend in line with the last four quarters

Expenses

Expenses expected to increase linked quarter as normal inflation

factors are fully realized

Measured investments in the franchise continue

Fee Income

Expected to increase linked quarter as capital markets rebounds and we get a lift

from the mortgage business as we enter the spring selling season

|

Valuation and Long Term Upside

27 |

Price / Tangible Book Value

Price / Forward Earnings (2014)

2

Dividend

Yield

1

Price / Book Value

Valuation

28

Execution of strategy could result in P/E expansion due to higher earnings growth

and lower cost of equity –

Close the P/E discount to peers

Attractive dividend yield provides meaningful return in the near-term

Source:

SNL

Financial.

As

of

April

30,

2014.

Please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

the

listing

of

the

peer

companies.

1

Based

on

current

annualized

dividend

of

$0.32

per

share

and

closing

price

on

April

30,

2014.

2

Reflects

mean

IBES

estimate

for

2014. |

At

March 31, 2014 Tangible

Common

Equity¹

Tier 1

Common /

RWA

Tier 1

Leverage

Tier 1

Risk-Based

Total

Risk-Based

Susquehanna

8.67%

10.84%

9.72%

11.95%

13.23%

Management Minimum

Target

7.50%

8.00%

6.00%

9.50%

11.50%

Solid Capital Generation

29

1

The

tangible

common

equity

ratio

is

a

non-GAAP

based

financial

measure;

please

refer

to

the

“Quarterly

Financial

Supplement”

slides

at

the

conclusion

of

this

presentation

for

calculation.

Do not expect Basel III to have a material impact to our risk-weighted

assets –

We believe we would be fully compliant with revised capital requirements, including

the capital conservation buffer Capital generation has benefited from strong

profitability and approximately 40% dividend payout ratio Status quo until we

receive feedback from regulators on stress test –

If deemed to have capital beyond what is required by regulators and internal

capital targets, Susquehanna may look to distribute a portion of its excess

capital –

All capital distribution strategies will be evaluated

|

Quarterly Financial Supplement

30 |

Susquehanna Bank Markets

Pennsylvania Market

Maryland Market

Delaware Valley Market

Adams, PA

Berks, PA

Centre, PA

Cumberland, PA

Dauphin, PA

Lancaster, PA

Lebanon, PA

Lehigh, PA

Luzerne, PA

Lycoming, PA

Northampton, PA

Northumberland, PA

Schuylkill, PA

Snyder, PA

Union, PA

York, PA

Allegany, MD

Anne Arundel, MD

Baltimore, MD

Baltimore City, MD

Bedford, PA

Berkley, WV

Carroll, MD

Franklin, PA

Fulton, PA

Garrett, MD

Harford, MD

Howard, MD

Washington, MD

Worcester, MD

Atlantic, NJ

Bucks, PA

Burlington, NJ

Camden, NJ

Chester, PA

Cumberland, NJ

Delaware, PA

Gloucester, NJ

Montgomery, PA

Philadelphia, PA

31 |

Peer

Companies Associated Banc-Corp

Hancock Holding Co.

BancorpSouth Inc.

IBERIABANK Corp.

City National Corp.

People's United Financial

Commerce Bancshares

Prosperity Bancshares Inc.

Cullen/Frost Bankers Inc.

Signature Bank

F.N.B. Corp.

TCF Financial Corp.

First Horizon Nat’l Corp.

UMB Financial Corp.

First Niagara Financial Group

Valley National Bancorp

FirstMerit Corp.

Webster Financial Corp.

Fulton Financial Corp.

Wintrust Financial Corp.

32 |

Loan

and Lease Originations Average Balance*

1Q13

2Q13

3Q13

4Q13

1Q14

($ in Millions)

Balance

Origina-

tions

Balance

Origina-

tions

Balance

Origina-

tions

Balance

Origina-

tions

Balance

Origina-

tions

Commercial

$ 1,996

$ 224

$ 2,005

$ 221

$ 1,997

$ 166

$ 1,997

$ 189

$ 2,045

$ 112

Real Estate –

Const & Land

797

137

777

148

752

196

736

184

707

76

Real Estate –

1-4 Family Res

2,266

57

2,262

67

2,258

90

2,276

66

2,279

56

Real Estate –

Commercial

4,295

206

4,356

263

4,440

267

4,406

180

4,413

131

Real Estate –

HELOC

1,235

113

1,285

154

1,358

160

1,450

130

1,478

93

Tax-Free

427

3

420

2

402

42

418

34

438

6

Consumer Loans

820

114

853

149

887

128

908

125

912

110

Commercial Leases

287

78

300

124

319

101

320

89

310

89

Consumer Leases

644

138

698

87

756

122

837

142

922

112

VIE

162

-

156

-

122

-

74

-

71

-

Total Loans

$ 12,929

$ 1,070

$ 13,112

$ 1,215

$ 13,291

$ 1,272

$13,422

$ 1,137

$13,575

$785

33

*By collateral type. |

Loan

Mix & Yield 34

*By collateral type.

Average Balance*

($ in Millions)

1Q13

2Q13

3Q13

4Q13

1Q14

INT % QTR

Commercial

$ 1,996

5.28%

$ 2,005

5.03%

$ 1,997

5.00%

$ 1,997

4.81%

$ 2,045

4.78%

Real Estate –

Const & Land

797

6.05%

777

6.69%

752

5.21%

736

5.37%

707

5.35%

Real Estate –

1-4 Family Res

2,266

4.91%

2,262

4.82%

2,258

4.60%

2,276

4.69%

2,279

4.63%

Real Estate –

Commercial

4,295

5.43%

4,356

5.22%

4,440

4.99%

4,406

4.65%

4,413

4.68%

Real Estate –

HELOC

1,235

3.68%

1,285

3.64%

1,358

3.59%

1,450

3.53%

1,478

3.51%

Tax-Free

427

5.10%

420

5.09%

402

5.07%

418

5.02%

438

4.92%

Consumer Loans

820

4.77%

853

4.52%

887

4.33%

908

4.25%

912

4.20%

Commercial Leases

287

7.56%

300

7.15%

319

6.64%

320

6.46%

310

6.67%

Consumer Leases

644

3.88%

698

3.68%

756

3.51%

837

3.39%

922

3.38%

VIE

162

4.36%

156

4.34%

122

4.92%

74

4.88%

71

4.83%

Total Loans

$ 12,929

5.03%

$ 13,112

4.95%

$ 13,291

4.70%

$ 13,422

4.55%

$ 13,575

4.51% |

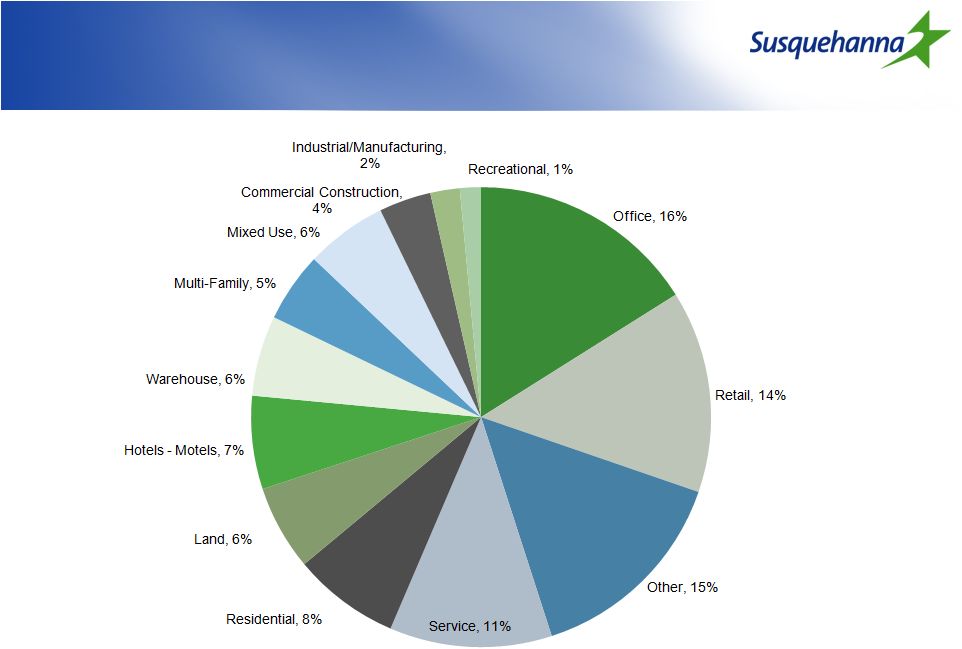

CRE

and Construction Composition 35

1Q14 |

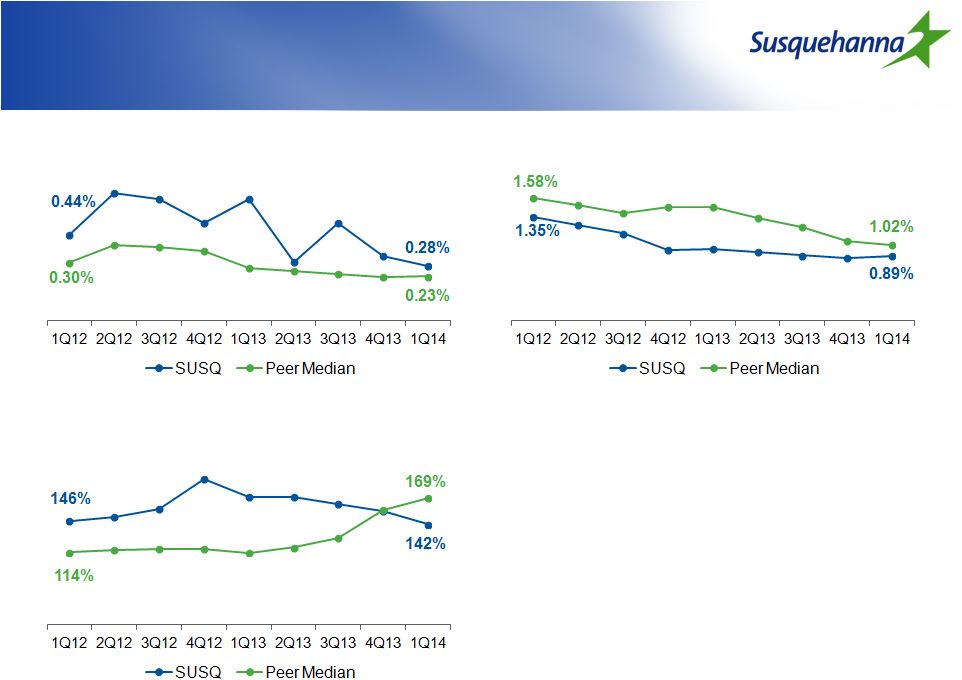

Asset

Quality 36

NPAs / Loans & leases +

Foreclosed Real Estate

Net Charge-Offs /

Average Loans & Leases

ALLL / Nonaccrual Loans and Leases

Source: SNL Financial |

TDRs

Asset Quality

($ in Millions)

37

Non Accruals

1Q13

2Q13

3Q13

4Q13

1Q14

NPL's Beginning of Period

$ 97.8

$ 103.4

$ 105.1

$ 102.0

$ 100.8

New Non Accruals

23.1

23.6

23.1

29.4

25.4

Cure/Exits/Other

0.4

(13.4)

(12.6)

(21.7)

(8.3)

Gross Charge-Offs

(15.5)

(5.0)

(8.9)

(5.3)

(7.0)

Transfer to OREO

(2.4)

(3.5)

(4.7)

(3.6)

(2.5)

NPL's End of Period

$ 103.4

$ 105.1

$ 102.0

$ 100.8

$ 108.4 |

Asset

Quality ($ in Millions)

38

Substandard

OAEM

Past Due 90 Days or More

Past Due 30-89 Days |

Investment Securities

39

EOP Balance

1Q13

2Q13

3Q13

4Q13

1Q14

($ in Millions)

QTR Yield

Total Investment Securities

$2,553

$2,494

$2,644

$2,533

$2,445

Duration (years)

3.6

4.3

4.1

3.5

3.4

Yield

2.64%

2.61%

2.67%

2.65%

2.72%

Unrealized Gain/(Loss)

$50.6

($2.7)

$1.3

($12.0)

$4.1 |

Deposit Mix & Cost

40

Average Balance

1Q13

2Q13

3Q13

4Q13

1Q14

($ in Millions)

INT % QTR

Demand

$ 1,918

0.00%

$ 1,912

0.00%

$ 1,911

0.00%

$ 1,881

0.00%

$ 1,831

0.00%

Interest Bearing Demand

5,895

0.32%

5,984

0.28%

5,937

0.26%

6,058

0.26%

6,033

0.25%

Savings

1,049

0.11%

1,080

0.11%

1,076

0.11%

1,076

0.11%

1,100

0.11%

Certificates of Deposits

3,778

1.21%

3,892

1.20%

3,871

1.05%

3,792

1.00%

3,911

1.00%

Total Interest-Bearing Deposits

$ 10,722

0.61%

$ 10,956

0.59%

$ 10,884

0.53%

$ 10,926

0.50%

$ 11,044

0.50%

Non-CD Deposits/Total

70.1%

69.8%

69.7%

70.4%

69.6%

Loans(excluding VIE)/Deposits

101.0%

100.7%

102.9%

104.2%

104.9% |

Borrowing Mix & Cost

41

Average Balance

1Q13

2Q13

3Q13

4Q13

1Q14

($ in Millions)

INT % QTR

Short-Term Borrowings

$ 817

0.25%

$ 728

0.26%

$ 758

0.27%

$ 672

0.25%

$ 672

0.25%

FHLB Advances

1,155

0.33%

1,042

0.36%

1,285

0.33%

1,502

0.32%

1,387

0.35%

Long Term Debt

509

3.28%

496

3.32%

476

3.45%

456

3.51%

451

3.46%

Total Borrowings

$ 2,481

0.91%

$ 2,266

0.98%

$ 2,519

0.90%

$ 2,630

0.86%

$ 2,510

0.88%

Off Balance Sheet Swap Impact

927

0.73%

927

0.82%

927

0.78%

1,100

0.80%

1,100

0.87%

Total Borrowing Cost

1.64%

1.80%

1.68%

1.66%

1.75%

Total Borrowings / Total Assets

13.8%

12.5%

13.8%

14.3%

13.6% |

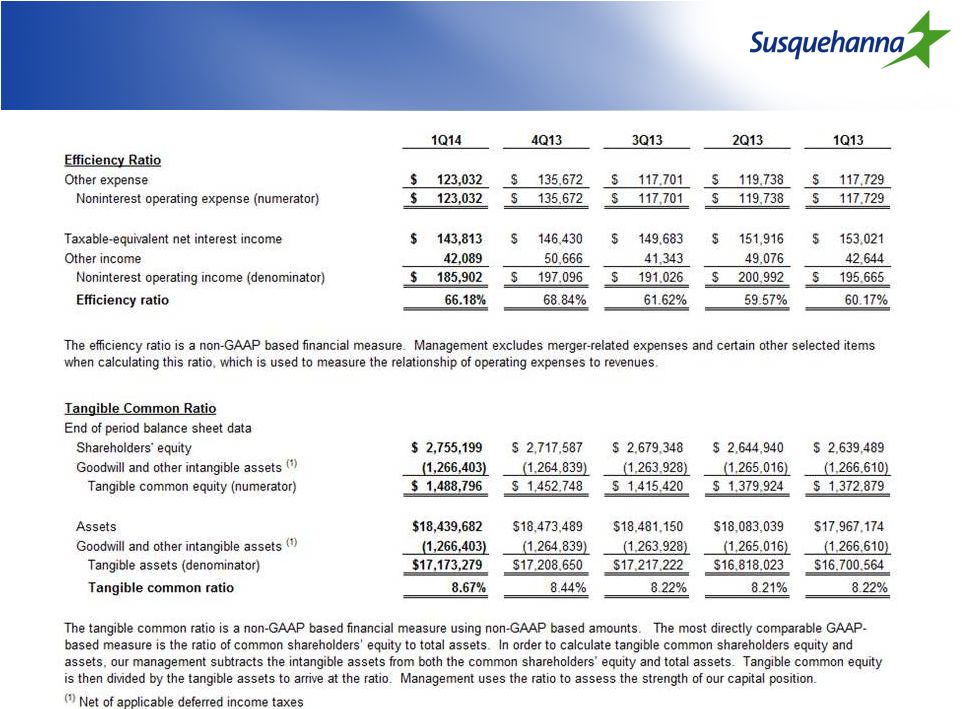

Non-GAAP Reconciliation

($ in thousands)

42 |

Non-GAAP Reconciliation

($ in thousands)

43 |

Non-GAAP Reconciliation

44 |