Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEW YORK COMMUNITY BANCORP INC | d721348d8k.htm |

First

Quarter 2014 Investor Presentation

Exhibit 99.1 |

New York

Community Bancorp, Inc. Page 2

Forward-Looking Statements and Associated Risk Factors

Safe

Harbor

Provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995

This presentation, like many written and oral communications presented by New York Community Bancorp,

Inc. (the “Company”) and our authorized officers, may contain certain

forward-looking statements regarding our prospective performance and strategies within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of

said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions and describe future plans,

strategies, and expectations of the Company, are generally identified by use of the words

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “seek,” “strive,” “try,” or future or conditional verbs such as

“will,” “would,” “should,” “could,” “may,” or similar

expressions. Our ability to predict results or the actual effects of our plans or strategies is

inherently uncertain. Accordingly, actual results may differ materially from anticipated results.

There are a number of factors, many of which are beyond our control, that could cause actual

conditions, events, or results to differ significantly from those described in our forward-

looking statements. These factors include, but are not limited to: general economic conditions, either

nationally or in some or all of the areas in which we and our customers conduct our respective

businesses; conditions in the securities markets and real estate markets or the banking industry; changes in real estate values, which could impact the quality of the

assets securing the loans in our portfolio; changes in interest rates, which may affect our net

income, prepayment penalty income, mortgage banking income, and other future cash flows, or the

market value of our assets, including our investment securities; changes in the quality or composition of our loan or securities portfolios; changes in our capital

management policies, including those regarding business combinations, dividends, and share

repurchases, among others; our use of derivatives to mitigate our interest rate exposure;

changes in competitive pressures among financial institutions or from non-financial institutions;

changes in deposit flows and wholesale borrowing facilities; changes in the demand for deposit,

loan, and investment products and other financial services in the markets we serve; our timely development of new lines of business and competitive products or services in a

changing environment, and the acceptance of such products or services by our customers; changes in our

customer base or in the financial or operating performances of our customers’ businesses;

any interruption in customer service due to circumstances beyond our control; our ability to retain key personnel; potential exposure to unknown or contingent

liabilities of companies we have acquired or may acquire in the future; the outcome of pending or

threatened litigation, or of other matters before regulatory agencies, whether currently

existing or commencing in the future; environmental conditions that exist or may exist on properties

owned by, leased by, or mortgaged to the Company; any interruption or breach of security

resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems; operational issues stemming from, and/or capital

spending necessitated by, the potential need to adapt to industry changes in information technology

systems, on which we are highly dependent; the ability to keep pace with, and implement on a

timely basis, technological changes; changes in legislation, regulation, policies, or administrative practices, whether by judicial, governmental, or legislative action,

including, but not limited to, the Dodd-Frank Wall Street Reform and Consumer Protection Act, and

other changes pertaining to banking, securities, taxation, rent regulation and housing,

financial accounting and reporting, environmental protection, and insurance, and the ability to comply with such changes in a timely manner; changes in the monetary and

fiscal policies of the U.S. Government, including policies of the U.S. Department of the Treasury and

the Board of Governors of the Federal Reserve System; changes in accounting principles,

policies, practices, or guidelines; a material breach in performance by the Community Bank under our loss sharing agreements with the FDIC; changes in our estimates of

future reserves based upon the periodic review thereof under relevant regulatory and accounting

requirements; changes in regulatory expectations relating to predictive models we use in

connection with stress testing and other forecasting or in the assumptions on which such modeling and forecasting are predicated; the ability to successfully integrate any assets,

liabilities, customers, systems, and management personnel of any banks we may acquire into our

operations, and our ability to realize related revenue synergies and cost savings within

expected time frames; changes in our credit ratings or in our ability to access the capital markets; war or terrorist activities; and other economic, competitive, governmental,

regulatory, technological, and geopolitical factors affecting our operations, pricing, and services. For a discussion of these and

other risks that may cause actual results to differ from expectations, please refer to our Annual Report on Form 10-K for the year ended December 31,

2013, including the section entitled “Risk Factors,” on file with the U.S. Securities and

Exchange Commission (the “SEC”).

It should be noted that we routinely evaluate opportunities to expand through acquisition and

frequently conduct due diligence activities in connection with such opportunities. As a result,

acquisition discussions and, in some cases, negotiations, may take place at any time, and acquisitions involving cash or our debt or equity securities may occur.

In addition, the timing and occurrence or non-occurrence of events may be subject to circumstances

beyond our control.

Readers are cautioned not to place undue reliance on the forward-looking statements contained

herein, which speak only as of the date of this presentation. Except as required by applicable

law or regulation, we undertake no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such

statements were made. |

New York

Community Bancorp, Inc. Page 3

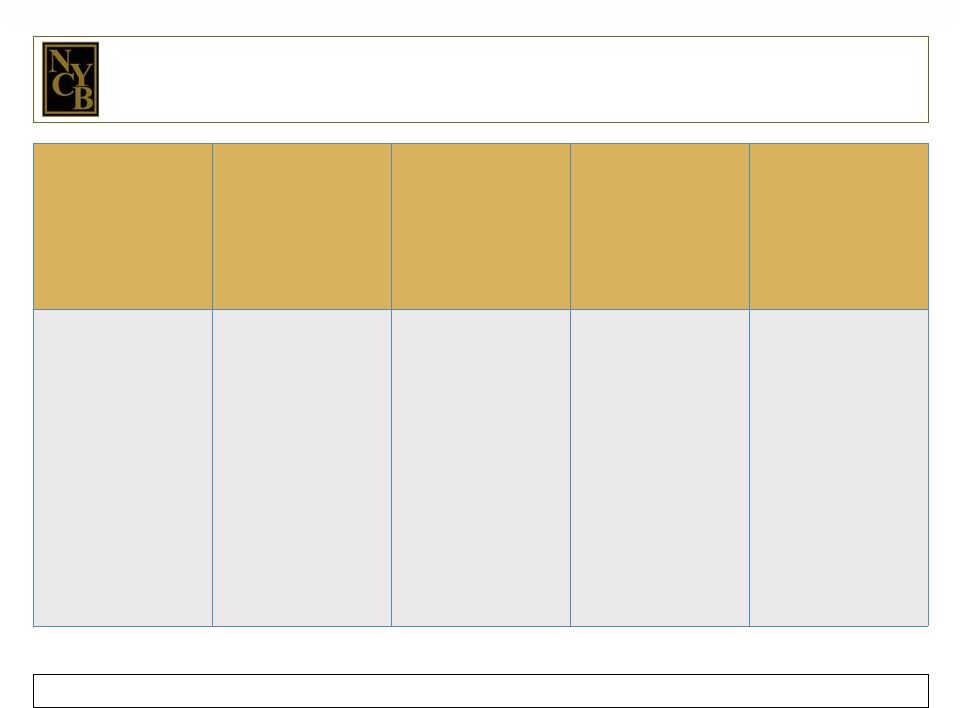

We are one of the top 25 U.S. bank holding companies.

(a)

Bloomberg

Assets

Deposits

Multi-Family

Loans

Market Cap

Total Return

on Investment

$47.6 billion

$26.8 billion

$21.5 billion

$7.1 billion

4,131%

With assets of

$47.6

billion

at

3/31/14, we are

currently the 20th

largest bank

holding company

in the nation.

With deposits of

$26.8

billion

and

over

270

branches

in Metro New

York, New Jersey,

Ohio, Florida, and

Arizona

at 3/31/14,

we currently rank

23rd among the

nation’s largest

depositories.

With a portfolio of

$21.5

billion

at

the

end of March, we

are a leading

producer of multi-

family loans in

New York City.

With a market cap

of

$7.1

billion

at 3/31/14, we

rank 20th among

the nation’s

publicly traded

banks and thrifts.

From 11/23/93

through 3/31/14,

we provided our

charter investors

with a total return

on investment of

4,131%.

(a)

Note: Except as otherwise indicated, all industry data was provided by SNL Financial as of 5/1/14. |

New York

Community Bancorp, Inc. Page 4

Largely reflecting our growth-through-acquisition strategy, we

have over 270 locations in five states.

Metro New York

125 Community Bank Branches

30 Commercial Bank Branches

Ohio

28 Community Bank Branches

New Jersey

48 Community Bank Branches

Florida

27 Community Bank Branches

Arizona

14 Community Bank Branches |

1st Quarter

2014 Performance Highlights |

New York

Community Bancorp, Inc. Page 6

(dollars in thousands, except per share data)

(a)

Cash earnings is a non-GAAP financial measure. Please see page 30 for a

reconciliation of our GAAP and cash earnings. (b)

ROTA and ROTE are non-GAAP financial measures. Please see page 31 for

additional information. (c)

Please see page 32 for a reconciliation of our GAAP and cash efficiency

ratios. We generated solid earnings in 1Q 2014.

PERFORMANCE HIGHLIGHTS

1Q 2014

GAAP Earnings

Cash Earnings

(a)

Strong Profitability Measures:

Earnings

$115,254

$125,737

EPS

$0.26

$0.29

Return

on

average

tangible

assets

(b)

1.05%

1.13%

Return

on

average

tangible

stockholders’

equity

(b)

14.22

15.33

Net interest margin

2.72

2.72

Efficiency

ratio

(c)

44.81

42.73 |

New York

Community Bancorp, Inc. Page 7

Our balance sheet measures reflect stability and strength.

Balance Sheet

Asset Quality

Company Capital

Bank Capital

Ratios to Total Assets

at 3/31/14

At or for the 3 Months Ended

3/31/14

3/31/14

3/31/14

•

Total loans = 71.1%

•

Securities = 16.7%

•

Deposits = 56.2%

•

Wholesale borrowings =

30.4%

•

Non-performing loans

(a)(b)

/

total loans

(a)

= 0.37%

•

Non-performing assets

(c)

/

total assets

(c)

=

0.41%

•

Net charge-offs / average

loans = 0.01%

(non-

annualized)

•

Stockholders’

equity / total

assets = 12.07%

•

Tangible stockholders’

equity / tangible assets

excluding accumulated

other comprehensive loss,

net of tax = 7.37%

(d)

•

Leverage capital ratio =

8.26%

•

Tier 1 capital ratio =

12.59%

The Community Bank:

The Commercial Bank:

(a)

Non-performing loans and total loans exclude covered loans.

(b)

Non-performing loans are defined as non-accrual loans and loans 90 days or

more past due but still accruing interest. (c)

Non-performing assets and total assets exclude covered loans and covered

OREO. (d)

Tangible stockholders’

equity and tangible assets are non-GAAP financial measures. Please see page 33

for additional information. •

Leverage capital ratio =

7.79%

•

Tier 1 capital ratio =

11.98%

•

Leverage capital ratio =

10.82%

•

Tier 1 capital ratio =

14.69% |

A

Successful Business Model |

New York

Community Bancorp, Inc. Page 9

Our business model has consistently focused on building

value for our investors.

Multi-Family

Lending

Strong Credit

Standards/

Superior Asset

Quality

Residential

Mortgage

Banking

Efficient

Operation

Growth

through

Acquisitions

Multi-family loans

represented $21.5

billion, or 69.6%, of

total non-covered

loans held for

investment at

3/31/2014.

Net charge-offs

represented 0.01%

of average loans

(non-annualized) in

1Q 2014.

Since January

2010, our

residential

mortgage banking

operation has

originated $35.5

billion of 1-4 family

loans for sale and

generated

mortgage banking

income of $536.1

million.

Our efficiency ratio

has consistently

ranked in the top

3% of all banks and

thrifts and was

44.81% in 1Q 2014.

Our assets have

grown from $1.9

billion to $47.6

billion since our

first acquisition in

November 2000. |

Multi-Family

Loan Production |

New York

Community Bancorp, Inc. Page 11

Our focus on multi-family lending on rent-regulated buildings has

enabled us to distinguish ourselves from our industry peers.

60.9% of the rental housing units in New York City are subject to rent

regulation

and

therefore

feature

below-market

rents.

(a)

Rent-regulated buildings are more likely to retain their tenants and,

therefore, their revenue stream in a downward credit cycle.

Our focus on multi-family lending in this niche market has contributed to

our record of asset quality.

Multi-family loans are less costly to produce and service than other types

of loans, and therefore contribute to our superior efficiency.

(a)

Source: New York City Rent Guidelines Board 2013 Housing Supply Report

|

New York

Community Bancorp, Inc. Page 12

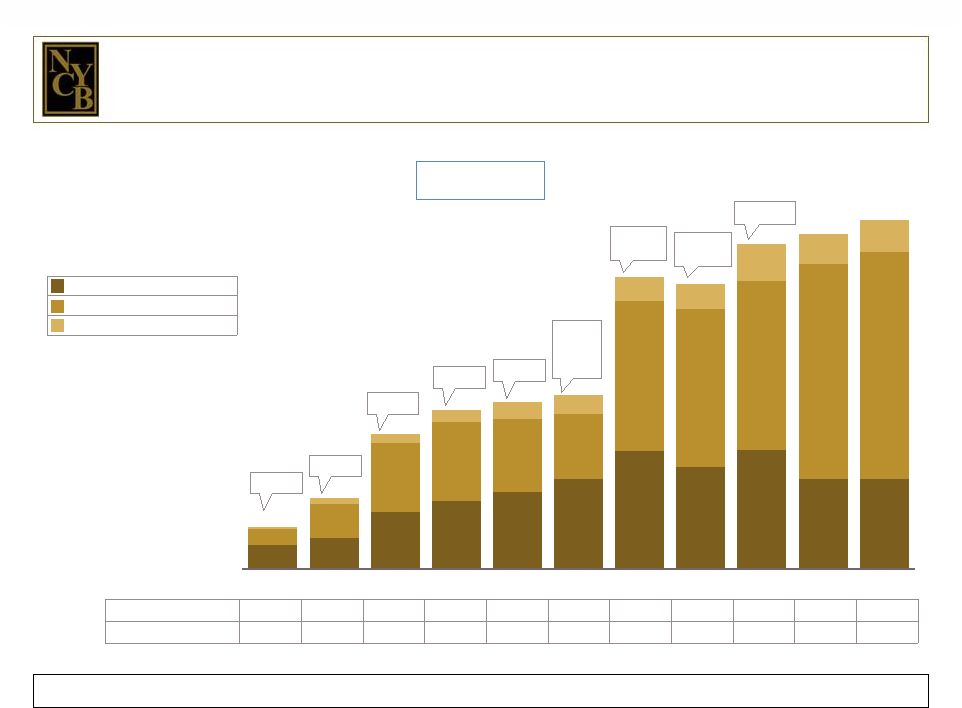

(in millions)

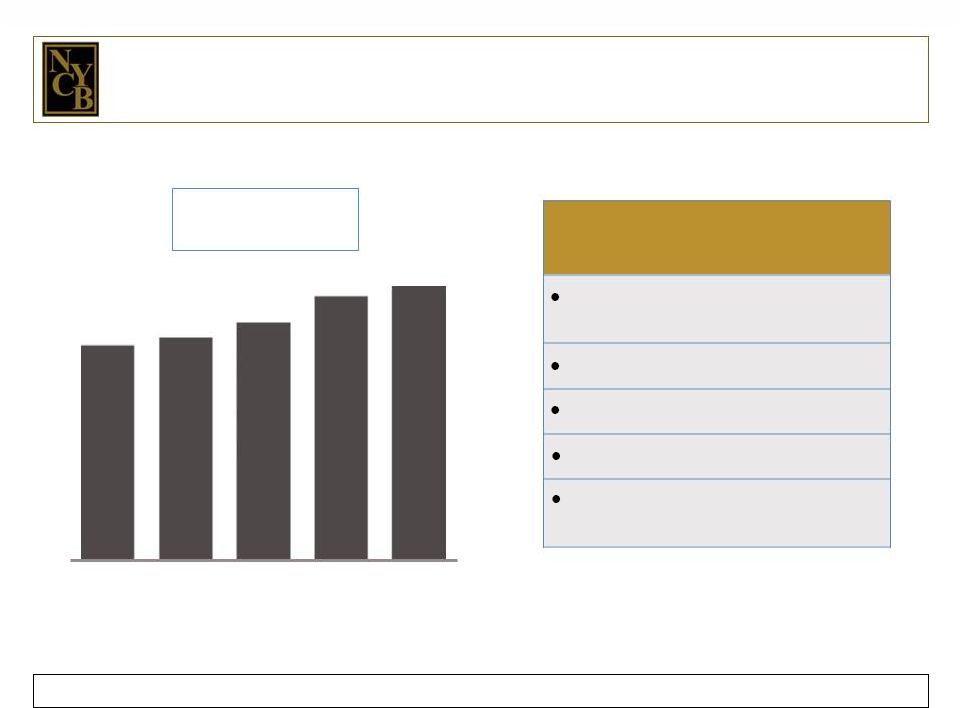

We are the leading producer of multi-family loans for

portfolio in New York City.

PORTFOLIO STATISTICS

AT 3/31/2014

% of non-covered loans held for

investment = 69.6%

Average

principal

balance

=

$4.6

million

Expected

weighted

average

life

=

2.9

years

1Q 2014 originations = $1.9 billion

% of our multi-family loans located in Metro

New York = 89.5%

MULTI-FAMILY

LOAN PORTFOLIO

12/31/10

12/31/11

12/31/12

12/31/13

3/31/14

$16,802

$17,433

$18,605

$20,714

$21,470 |

New York

Community Bancorp, Inc. Page 13

COMMERCIAL REAL ESTATE

LOAN PORTFOLIO

(in millions)

Our commercial real estate loans feature the same structure

as our multi-family loans.

PORTFOLIO STATISTICS

AT 3/31/2014

% of non-covered loans held for

investment = 24.3%

Average principal balance = $4.8 million

Expected

weighted

average

life

=

3.4

years

1Q 2014 originations = $472.7 million

% of our CRE loans located in Metro New

York = 95.8%

Our CRE loans are typically collateralized by

office buildings, retail centers, mixed-use

buildings, and multi-tenanted light industrial

properties.

$5,438

$6,856

$7,437

$7,366

$7,491

12/31/10

12/31/11

12/31/12

12/31/13

3/31/14 |

Asset

Quality |

New York

Community Bancorp, Inc. Page 15

S & L Crisis

We have been distinguished by our low level of net charge-

offs in downward credit cycles.

NET CHARGE-OFFS / AVERAGE LOANS

5-Year Total

NYCB: 17 bp

SNL U.S. Bank and Thrift Index: 540 bp

4-Year Total

NYCB: 37bp

SNL U.S. Bank and Thrift Index: 803 bp

SNL U.S. Bank and Thrift Index

NYCB

Great Recession

Current Credit Cycle

4-Year Total

NYCB: 56 bp

SNL U.S. Bank and Thrift Index: 427 bp

* Annualized

*

0.68%

1.63%

2.83%

2.89%

0.00%

0.03%

0.13%

0.21%

2007

2008

2009

2010

0.54%

1.28%

1.50%

1.17%

0.91%

0.00%

0.00%

0.04%

0.07%

0.06%

1989

1990

1991

1992

1993

1.77%

1.24%

0.76%

0.50%

0.35%

0.13%

0.05%

0.03%

2011

2012

2013

1Q 2014 |

New York

Community Bancorp, Inc. Page 16

S & L Crisis

The quality of our loan portfolio continues to exceed that of

our industry.

Great Recession

Current Credit Cycle

NON-PERFORMING LOANS

(a)(b)

/ TOTAL LOANS

(a)

(a)

Non-performing loans and total loans exclude covered loans.

(b)

Non-performing loans are defined as non-accrual loans and loans 90 days or

more past due but still accruing interest. Average NPLs/Total Loans

NYCB: 2.08%

SNL U.S. Bank and Thrift Index: 3.34%

Average NPLs/Total Loans

NYCB:1.43%

SNL U.S. Bank and Thrift Index: 2.89%

SNL U.S. Bank and Thrift Index

NYCB

Average NPLs/Total Loans

NYCB: 0.74%

SNL U.S. Bank and Thrift Index: 1.76%

1.11%

2.71%

4.17%

3.56%

0.11%

0.51%

2.47%

2.63%

2007

2008

2009

2010

2.91%

4.00%

4.05%

3.41%

2.35%

1.46%

2.48%

2.10%

2.83%

1.51%

1989

1990

1991

1992

1993

2.60%

2.22%

1.12%

1.10%

1.28%

0.96%

0.35%

0.37%

2011

2012

2013

3/31/14 |

New York

Community Bancorp, Inc. Page 17

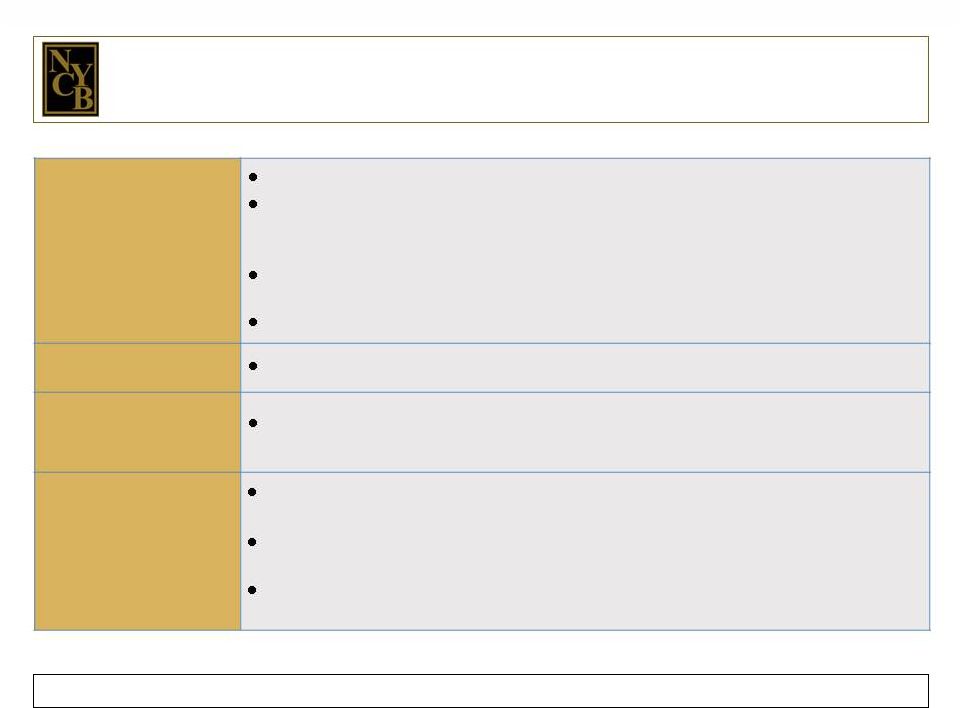

The quality of our assets reflects the nature of our lending niche and

our strong underwriting standards.

Conservative

Underwriting

Active Board

Involvement

Multiple

Appraisals

Risk-Averse Mix of

Non-Covered Loans

Held for Investment

(at 3/31/14)

•

Conservative loan-to-

value ratios

•

Conservative debt

coverage ratios: 120%

for multi-family loans,

and 130% for

commercial real estate

(“CRE”) loans

•

Multi-family and CRE

loans are based on the

lower of economic or

market value.

•

All loans originated for

portfolio are reviewed

by the Mortgage or

Credit Committee (a

majority of the Board of

Directors).

•

A member of the

Mortgage or Credit

Committee participates

in inspections on multi-

family loans in excess of

$4.0 million, and CRE

and acquisition,

development, and

construction (“ADC”)

loans in excess of $2.5

million.

•

All properties are

appraised by

independent

appraisers.

•

All independent

appraisals are

reviewed by in-house

appraisal officers.

•

A second independent

appraisal review is

performed on loans

that are large and

complex.

•

Multi-family: 69.6%

•

CRE: 24.3%

•

One-to-Four Family: 2.0%

•

ADC: 1.2%

•

Commercial and Industrial:

2.8% |

Residential

Mortgage Banking |

New York

Community Bancorp, Inc. Page 19

Our residential mortgage banking operation currently ranks among

the top 20 aggregators of one-to-four family loans in the U.S.

Features

Loans can be originated/purchased in all 50 states and the District of

Columbia. Loan production is driven by our proprietary real time,

web-accessible mortgage banking

technology

platform,

which

securely

controls

the

lending

process

while

mitigating business and regulatory risks.

Our 900+ approved clients include community banks, credit unions, mortgage

companies, and mortgage brokers.

100% of loans funded are full documentation, prime credit loans.

Credit Quality

As of March 31, 2014, 99.9% of all funded loans were current.

Limited

Repurchase Risk

Of the six loans we repurchased in the first three months of 2014, four were loans

acquired in merger transactions prior to 2009.

Benefits

Since January 2010, our mortgage banking business has generated mortgage

banking income of $536.1 million.

Our proprietary mortgage banking platform has enabled us to expand our revenues,

market share, and product line.

Over time, mortgage banking income has supported the stability of our return on

average tangible assets, even in times of interest rate volatility.

|

New York

Community Bancorp, Inc. Page 20

Average 10-Year

Treasury Rate

Return on Average

Tangible Assets

(a)

Prepayment penalty income and mortgage banking income have

contributed to the stability of our ROTA.

(dollars in millions)

Total:

Prepayment Penalty Income

Mortgage Banking Income

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

(a)

ROTA is a non-GAAP financial measure. Please see page 34 for additional

information. $19.9

$11.8

$24.3

$24.7

$35.2

$58.3

$52.6

$32.6

$26.1

$23.2

$16.2

$12.8

$14.6

$19.6

$25.9

$12.1

$28.9

$17.5

$32.0

$31.5

$39.3

$19.9

$44.4

$39.6

$33.0

$20.4

$39.5

$37.7

$36.4

$53.6

$52.7

$90.3

$84.1

$71.9

$46.0

$67.6

$55.8

$45.8

$35.0

3.46%

3.20%

2.41%

2.05%

2.04%

1.83%

1.64%

1.71%

1.95%

1.99%

2.71%

2.74%

2.77%

1.34%

1.29%

1.27%

1.23%

1.24%

1.36%

1.29%

1.24%

1.19%

1.21%

1.11%

1.12%

1.05% |

Efficiency |

New York

Community Bancorp, Inc. Page 22

Our efficiency is driven by several factors.

Franchise expansion has largely stemmed

from mergers and acquisitions; we generally

do not engage in de novo branch

development.

Multi-family and CRE lending are both

broker-driven, with the borrower paying fees

to the mortgage brokerage firm.

Products and services are typically

developed by third-party providers and the

sale of these products generates additional

revenues.

38 of our branches are located in-store,

where rental space is less costly, enabling

us to supplement the service provided by

our traditional branches more efficiently.

We acquire our deposits primarily through

earnings-accretive acquisitions rather than

by paying above-market rates.

SNL U.S. Bank and Thrift Index

NYCB

67.13%

66.61%

66.96%

65.98%

40.03%

40.75%

42.71%

44.81%

2011

2012

2013

1Q 2014

EFFICIENCY RATIO |

Growth

Through Acquisitions |

New York

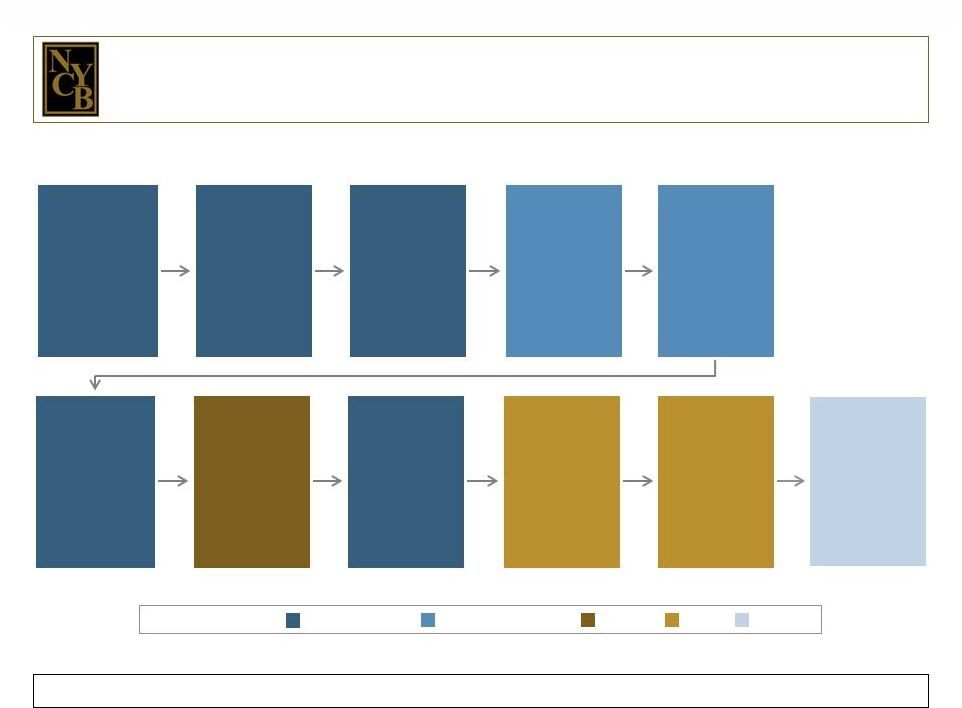

Community Bancorp, Inc. Page 24

Since our first acquisition, we have grown from $1.9 billion

in assets to $47.6 billion.

Note:

The number of branches indicated reflects the number of branches in our current

franchise that stemmed from each transaction. 1. Nov. 2000

Haven Bancorp

(HAVN)

Assets:

$2.7 billion

Deposits:

$2.1 billion

Branches:

39

2. July 2001

Richmond County

Financial Corp.

(RCBK)

Assets:

$3.7 billion

Deposits:

$2.5 billion

Branches:

24

3. Oct. 2003

Roslyn Bancorp,

Inc. (RSLN)

Assets:

$10.4 billion

Deposits:

$5.9 billion

Branches:

38

4. Dec. 2005

Long

Island

Financial

Corp.

(LICB)

Assets:

$562 million

Deposits:

$434 million

Branches:

9

5. April 2006

Atlantic Bank of

New York (ABNY)

Assets:

$2.8 billion

Deposits:

$1.8 billion

Branches:

13

6. April 2007

PennFed

Financial

Services, Inc.

(PFSB)

Assets:

$2.3 billion

Deposits:

$1.6 billion

Branches:

23

7. July 2007

NYC branch

network of Doral

Bank, FSB (Doral-

NYC)

Assets:

$485 million

Deposits:

$370 million

Branches:

11

8. Oct. 2007

Synergy Financial

Group, Inc. (SYNF)

Assets:

$892 million

Deposits:

$564 million

Branches:

18

9. Dec. 2009

AmTrust Bank

Assets:

$11.0 billion

Deposits:

$8.2 billion

Branches:

64

10. March 2010

Desert Hills Bank

Assets:

$452 million

Deposits:

$375 million

Branches:

3

11. June 2012

Aurora Bank FSB

Assets:

None

Deposits:

$2.2 billion

Branches:

0

Payment

Received:

$24.0 million

Transaction Type:

Savings Bank

Commercial Bank

Branch

FDIC

Deposit |

New York

Community Bancorp, Inc. Page 25

Our deposit growth has been largely acquisition-driven.

(in millions)

DEPOSITS

w/ HAVN

w/ RCBK

w/ RSLN

w/ LICB

w/ ABNY

w/

PFSB,

Doral, &

SYNF

w/

AmTrust

w/ Desert

Hills

w/ Aurora

Total Deposits:

$3,268

$5,472

$10,360

$12,168

$12,764

$13,311

$22,418

$21,890

$24,878

$25,661

$26,754

Total Branches:

86

120

139

152

166

217

276

276

275

273

272

$1,874

$2,408

$4,362

$5,247

$5,945

$6,913

$9,054

$7,835

$9,121

$6,932

$6,935

$1,223

$2,609

$5,278

$6,015

$5,554

$4,975

$11,494

$12,122

$12,998

$16,458

$17,374

$171

$455

$720

$906

$1,265

$1,423

$1,870

$1,933

$2,759

$2,271

$2,445

12/31/00

12/31/01

12/31/03

12/31/05

12/31/06

12/31/07

12/31/09

12/31/10

12/31/12

12/31/13

3/31/14

CDs

NOW, MMAs, and Savings

Demand deposits |

New York

Community Bancorp, Inc. Page 26

$1,946

$3,255

$7,368

$12,854

$14,529

$14,055

$16,736

$16,802

$18,605

$20,714

$21,470

$324

$566

$1,445

$2,888

$3,114

$3,826

$4,987

$5,438

$7,437

$7,366

$7,491

$1,366

$1,584

$1,686

$1,287

$2,010

$2,482

$1,654

$1,467

$1,243

$1,758

$1,907

$1,207

$1,204

$307

$266

$5,016

$4,298

$3,284

$2,789

$2,695

12/31/00

12/31/01

12/31/03

12/31/05

12/31/06

12/31/07

12/31/09

12/31/10

12/31/12

12/31/13

3/31/14

(a)

Includes originations of loans held for sale of $888.5 million in 2009, $10.8

billion in 2010, $7.2 billion in 2011, $10.9 billion in 2012, $6.2 billion in 2013, and

$636.9 million in 1Q 2014.

Acquisitions have provided much of the funding for the

organic growth of our loan portfolio.

LOANS OUTSTANDING

After

HAVN

After

RCBK

After

RSLN

After

LICB

After

ABNY

After

PFSB,

Doral, &

SYNF

After

AmTrust

After

Desert Hills

Total Loans Outstanding:

$3,636

$5,405

$10,499

$17,029

$19,653

$20,363

$28,393

$29,212

$31,773

$32,934

$33,829

Total Originations:

(a)

$616

$1,150

$4,330

$6,332

$4,971

$4,853

$4,280

$15,193

$19,894

$17,403

$3,455

After Aurora

Held-for-Investment Loans

Multi-family

CRE

All other HFI loans

Loans held for sale

Covered loan portfolio

(in millions) |

Total

Return on Investment |

New York

Community Bancorp, Inc. Page 28

Our quarterly cash dividends are a significant component of

our commitment to building value for our investors.

CAGR since IPO:

28.0%

(a)

Bloomberg

TOTAL RETURN ON INVESTMENT

As a result of nine stock splits between 1994 and 2004, our charter shareholders

have 2,700 shares of NYCB stock for each 100 shares originally

purchased. SNL U.S. Bank and Thrift Index

NYCB

(a)

11/23/93

12/31/99

12/31/08

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

3/31/14

244%

213%

209%

245%

168%

260%

393%

415%

717%

2,059%

2,754%

3,843%

2,670%

3,069%

4,265%

4,131% |

New York

Community Bancorp, Inc. Page 29

5/5/14

For More Information

Visit our website:

ir.myNYCB.com

E-mail requests to:

Call Investor Relations at:

(516) 683-4420

Write to:

Investor Relations

New York Community Bancorp, Inc.

615 Merrick Avenue

Westbury, NY 11590

ir@myNYCB.com |

New York

Community Bancorp, Inc. Page 30

Reconciliations of GAAP and Non-GAAP Financial Measures

Cash earnings is a non-GAAP financial measure. The following table presents a

reconciliation of the Company’s GAAP and cash earnings for the three

months ended March 31, 2014.

(in thousands, except per share data)

For the

Three Months Ended

March 31, 2014

GAAP Earnings

$115,254

Additional

contributions

to

tangible

stockholders’

equity:

Amortization and appreciation of shares held in stock-related benefit plans

6,664

Associated tax effects

1,496

Amortization of core deposit intangibles

2,323

Total

additional

contributions

to

tangible

stockholders’

equity

10,483

Cash earnings

$125,737

Diluted GAAP Earnings per Share

$0.26

Add back:

Amortization and appreciation of shares held in stock-related benefit

plans 0.02

Associated tax effects

--

Amortization of core deposit intangibles

0.01

Total additions

0.03

Diluted cash earnings per share

$0.29 |

New York

Community Bancorp, Inc. Page 31

Cash earnings is a non-GAAP financial measure. The following table presents a

reconciliation of the Company’s GAAP and cash earnings measures for the

three months ended March 31, 2014. Reconciliations of GAAP and Non-GAAP Financial

Measures (in thousands)

For the

Three Months Ended

March 31,

2014

Average stockholders’

equity

$ 5,732,105

Less: Average goodwill and core deposit intangibles

(2,451,571)

Average

tangible

stockholders’

equity

$ 3,280,534

Average assets

$46,872,770

Less: Average goodwill and core deposit intangibles

(2,451,571)

Average tangible assets

$44,421,199

Net income

$115,254

Add back: Amortization of core deposit intangibles, net of tax

1,394

Adjusted net income

$116,648

Cash earnings

$125,737

Return on average assets

0.98%

Cash return on average assets

1.07

Return on average tangible assets

1.05

Cash return on average tangible assets

1.13

Return

on

average

stockholders’

equity

8.04

Cash

return

on

average

stockholders’

equity

8.77

Return

on

average

tangible

stockholders’

equity

14.22

Cash

return

on

average

tangible

stockholders’

equity

15.33 |

New York

Community Bancorp, Inc. Page 32

Reconciliations of GAAP and Cash Efficiency Ratios

The following table presents a reconciliation of the Company’s GAAP and cash

efficiency ratios for the three months ended March 31, 2014. For the

Three Months Ended

March 31, 2014

(dollars in thousands)

GAAP

Cash

Total net interest income and non-interest income

$321,385

$321,385

Operating expenses

$144,002

$144,002

Adjustments:

Amortization and appreciation of shares held in stock-related

benefit plans

--

(6,664)

Adjusted operating expenses

$144,002

$137,338

Efficiency ratio

44.81%

42.73% |

New York

Community Bancorp, Inc. Page 33

(dollars in thousands)

March 31,

2014

Total stockholders’

equity

$ 5,742,652

Less: Goodwill

(2,436,131)

Core deposit intangibles

(13,918)

Tangible stockholders’

equity

$ 3,292,603

Total assets

$47,567,470

Less: Goodwill

(2,436,131)

Core deposit intangibles

(13,918)

Tangible assets

$45,117,421

Stockholders’

equity to total assets

12.07%

Tangible stockholders’

equity to tangible assets

7.30%

Tangible stockholders’

equity

$3,292,603

Accumulated other comprehensive loss, net of tax

35,125

Adjusted tangible stockholders’

equity

$3,327,728

Tangible assets

$45,117,421

Accumulated other comprehensive loss, net of tax

35,125

Adjusted tangible assets

$45,152,546

Adjusted tangible stockholders’

equity to adjusted tangible assets

7.37%

Reconciliations of GAAP and Non-GAAP Financial Measures

Tangible and adjusted tangible stockholders’ equity and tangible and adjusted tangible assets are

non-GAAP financial measures. The following table presents reconciliations of these

non-GAAP measures with the related GAAP measures at March 31, 2014. |

New York

Community Bancorp, Inc. Page 34

For the Three Months Ended

(dollars in thousands)

March 31,

2014

March 31,

2013

June 30,

2013

September 30,

2013

December 31,

2013

March 31,

2012

June 30,

2012

September 30,

2012

December 31,

2012

March 31,

2011

June 30,

2011

September 30,

2011

December 31,

2011

Average Assets

$46,872,770

$43,243,259

$43,860,167

$44,343,284

$46,107,450

$41,775,013

$41,916,854

$43,205,076

$43,087,846

$40,713,044

$40,853,788

$41,261,984

$41,683,129

Less: Average goodwill and core deposit intangibles

(2,451,571)

(2,466,622)

(2,462,265)

(2,458,145)

(2,454,191)

(2,486,018)

(2,480,921)

(2,476,056)

(2,471,204)

(2,511,349)

(2,503,966)

(2,497,076)

(2,491,327)

Average tangible assets

$44,421,199

$40,776,637

$41,397,902

$41,885,139

$43,653,259

$39,288,995

$39,435,933

$40,729,020

$40,616,642

$38,201,695

$38,349,822

$38,764,908

$39,191,802

Average

Stockholders’

Equity

$ 5,732,105

$ 5,630,877

$ 5,607,616

$ 5,599,495

$ 5,643,882

$ 5,528,296

$ 5,565,581

$ 5,557,693

$ 5,498,040

$ 5,511,970

$ 5,458,017

$ 5,501,226

$ 5,535,114

Less: Average goodwill and core deposit intangibles

(2,451,571)

(2,466,622)

(2,462,265)

(2,458,145)

(2,454,191)

(2,486,018)

(2,480,921)

(2,476,056)

(2,471,204)

(2,511,349)

(2,503,966)

(2,497,076)

(2,491,327)

Average

tangible

stockholders’

equity

$ 3,280,534

$ 3,164,255

$ 3,145,351

$ 3,141,350

$ 3,189,691

$ 3,042,278

$ 3,084,660

$ 3,081,637

$ 3,026,836

$ 3,000,621

$ 2,954,051

$ 3,004,150

$ 3,043,787

Net Income

$115,254

$118,675

$122,517

$114,200

$120,155

$118,253

$131,212

$128,798

$122,843

$123,176

$119,459

$119,750

$117,652

Add back: Amortization of core deposit intangibles,

net of tax

1,394

2,653

2,509

2,470

1,839

3,095

2,952

2,913

2,826

4,431

4,286

3,653

3,269

Adjusted net income

$116,648

$121,328

$125,026

$116,670

$121,994

$121,348

$134,164

$131,711

$125,669

$127,607

$123,745

$123,403

$120,921

Return

on

average

assets

0.98%

1.10%

1.12%

1.03%

1.04%

1.13%

1.25%

1.19%

1.14%

1.21%

1.17%

1.16%

1.13%

Return

on

average

tangible assets

1.05

1.19

1.21

1.11

1.12

1.24

1.36

1.29

1.24

1.34

1.29

1.27

1.23

Return

on

average

stockholders’

equity

8.04

8.43

8.74

8.16

8.52

8.56

9.43

9.27

8.94

8.94

8.75

8.71

8.50

Return

on

average

tangible

stockholders’

equity

14.22

15.34

15.90

14.86

15.30

15.95

17.40

17.10

16.61

17.01

16.76

16.43

15.89

Reconciliations of GAAP and Non-GAAP Financial Measures

Average tangible assets and average tangible stockholders’ equity are non-GAAP financial

measures. The following table presents reconciliations of these non-GAAP measures with the

related GAAP measures for the three months ended March 31, 2014, March 31, June 30, September 30, and December 31,

2013; March 31, June 30, September 30, and December 31, 2012; and March 31, June 30, September 30, and

December 31, 2011. |