Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Independent Bank Group, Inc. | a8kibg05-05x14.htm |

| EX-99.2 - EXHIBIT 99.2 - Independent Bank Group, Inc. | dividend-pressrelease05x05.htm |

NASDAQ: IBTX KBW Texas Field Trip May 2014 Presenters: David Brooks, Chairman and CEO Torry Berntsen, President and COO Michelle Hickox, EVP and CFO Exhibit 99.1

Safe Harbor Statement 2 From time to time, our comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements can be identified by words such as “believes,” “anticipates,” “expects,” “forecast,” “guidance,” “intends,” “targeted,” “continue,” “remain,” “should,” “may,” “plans,” “estimates,” “will,” “will continue,” “will remain,” variations on such words or phrases, or similar references to future occurrences or events in future periods; however, such words are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, and other financial items; (ii) statements of plans, objectives, and expectations of Independent Bank Group or its management or Board of Directors; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Forward-looking statements are based on Independent Bank Group’s current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Independent Bank Group’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: (1) local, regional, national, and international economic conditions and the impact they may have on us and our customers and our assessment of that impact; (2) volatility and disruption in national and international financial markets; (3) government intervention in the U.S. financial system, whether through changes in the discount rate or money supply or otherwise; (4) changes in the level of non-performing assets and charge-offs; (5) changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; (6) adverse conditions in the securities markets that lead to impairment in the value of securities in our investment portfolio; (7) inflation, deflation, changes in market interest rates, developments in the securities market, and monetary fluctuations; (8) the timely development and acceptance of new products and services and perceived overall value of these products and services by customers; (9) changes in consumer spending, borrowings, and savings habits; (10) technological changes; (11) the ability to increase market share and control expenses; (12) changes in the competitive environment among banks, bank holding companies, and other financial service providers; (13) the effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities, and insurance) with which we and our subsidiaries must comply; (14) the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters; (15) the costs and effects of legal and regulatory developments including the resolution of legal proceedings; and (16) our success at managing the risks involved in the foregoing items and (17) the other factors that are described in the Company’s Form 10-K for the year ended December 31, 2013, under the heading “Risk Factors.” Any forward-looking statement made by the Company in this release speaks only as of the date on which it is made. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

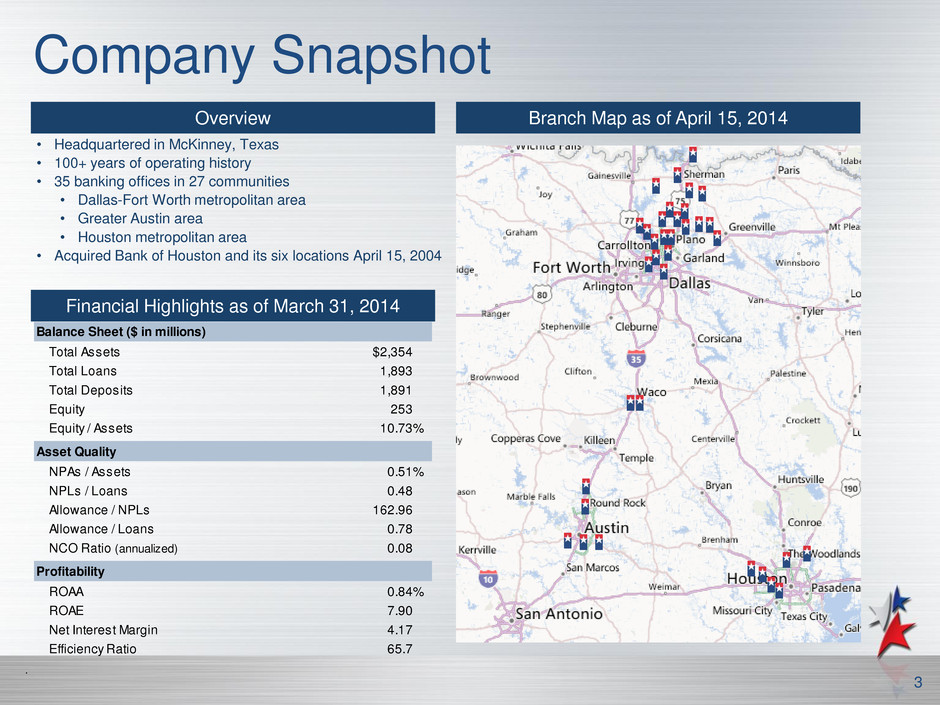

Company Snapshot 3 Overview Branch Map as of April 15, 2014 Financial Highlights as of March 31, 2014 • Headquartered in McKinney, Texas • 100+ years of operating history • 35 banking offices in 27 communities • Dallas-Fort Worth metropolitan area • Greater Austin area • Houston metropolitan area • Acquired Bank of Houston and its six locations April 15, 2004 . Balance Sheet ($ in millions) Total Assets $2,354 Total Loans 1,893 Total Deposits 1,891 Equity 253 Equity / Assets 10.73% Asset Quality NPAs / Assets 0.51% NPLs / Loans 0.48 Allowance / NPLs 162.96 Allowance / Loans 0.78 NCO Ratio (annualized) 0.08 Profitability ROAA 0.84% ROAE 7.90 Net Interest Margin 4.17 Efficiency Ratio 65.7

First Quarter 2014 Highlights 4 • Core net income was $5.0 million, or $0.39 per diluted share, for the quarter ended March 31, 2014 compared to $4.9 million, or $0.40 per diluted share, for the quarter ended December 31, 2013 and to $3.7 million, or $0.44 per diluted share, for the quarter ended March 31, 2013. • Loans held for investment grew organically at an annualized rate of 23.2% in the first quarter 2014. • Continued strong asset quality, as reflected by a nonperforming assets to total assets ratio of 0.51%, a nonperforming loans to total loans ratio of 0.48%, and an annualized net charge-offs to average loans ratio of 0.08% at March 31, 2014. • Completion of the acquisitions of Live Oak Financial Corp. on January 1, 2014 and BOH Holdings, Inc. and its subsidiary, Bank of Houston, on April 15, 2014.

Bank of Houston Acquisition • Closed April 15, 2014 • Marks IBTX’s entry into the dynamic Houston market, resulting in a significant presence in three of the nation’s most attractive MSAs: Dallas, Austin, Houston • Total Assets of $1.02 billion * – Total Deposits of $820.8 million – Total Loans of $786.1 million – Total Equity of $96.3 million • At announcement, approximately 1.80x book and 2.46x tangible book • EPS accretion estimated at ~12% in 2014 and ~20% in 2015 with an estimated TBV earn-back period of 2.6 years 5 * As of April 15, 2014.

Proforma IBTX/Bank of Houston 6 As of March 31, 2014. ($ in thousands) Total Assets $3,526,131 Total Loans 2,673,365 Total Deposits 2,697,655 Capital Ratios Leverage Ratio 9.49% Tier 1 RWA Ratio 10.72 Total Capital to RWA 11.53 Tangible Common Equity to Tangible Assets 7.40

$1,764 $2,354 Q1 2013 Q1 2014 $1,254 $1,740 $2,164 2011 2012 2013 Impact of Acquisitions (In Year Acquired) Organic Growth IBTX Continued Demonstrated Growth 7 Total Assets Prior Years Total Assets Q1 2014 v. Q1 2013 (1) Note: Dollars in millions. Pre Bank of Houston Acquisition. (1) Reflects increase through organic growth, acquisitions and retained proceeds from the initial public offering.

IBTX Expanded Profitability 8 Core Pre-Tax Pre-Provision Earnings Income (1) Note: Dollars in thousands. Pre Bank of Houston Acquisition. (1) See Appendix for non-GAAP Reconciliation. $14,989 $21,828 $29,466 2011 2012 2013 $6,499 $8,652 Q1 2013 Q1 2014

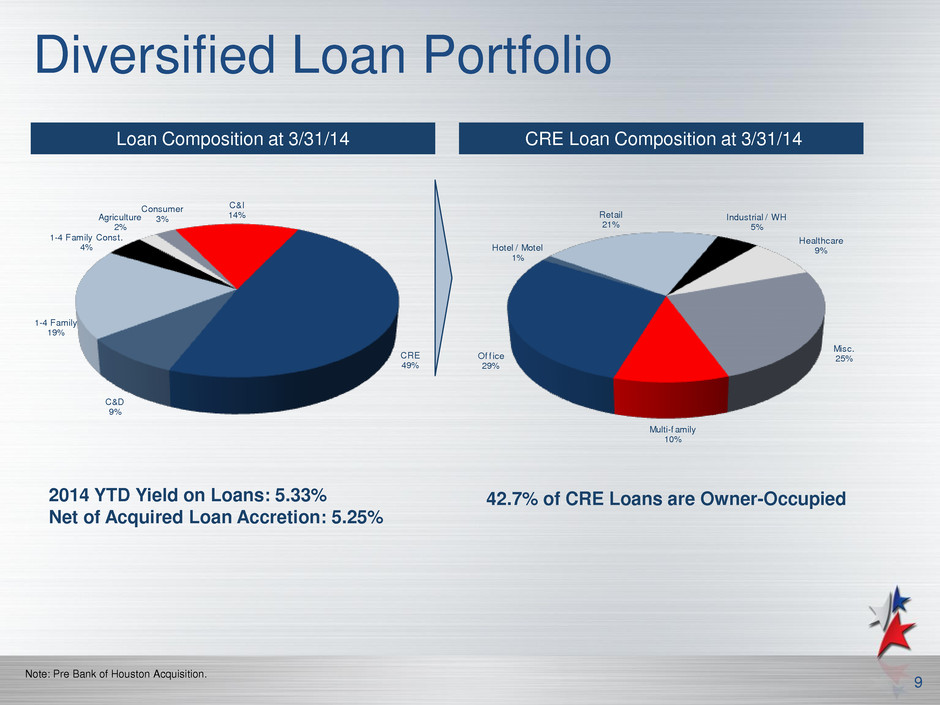

Diversified Loan Portfolio 9 Loan Composition at 3/31/14 CRE Loan Composition at 3/31/14 2014 YTD Yield on Loans: 5.33% Net of Acquired Loan Accretion: 5.25% 42.7% of CRE Loans are Owner-Occupied Note: Pre Bank of Houston Acquisition. C&I 14% CRE 49% C&D 9% 1-4 Family 19% 1-4 Family Const. 4% Agriculture 2% Consumer 3% Multi-f amily 10% Of f ice 29% Hotel / Motel 1% Retail 21% Industrial / WH 5% Healthcare 9% Misc. 25%

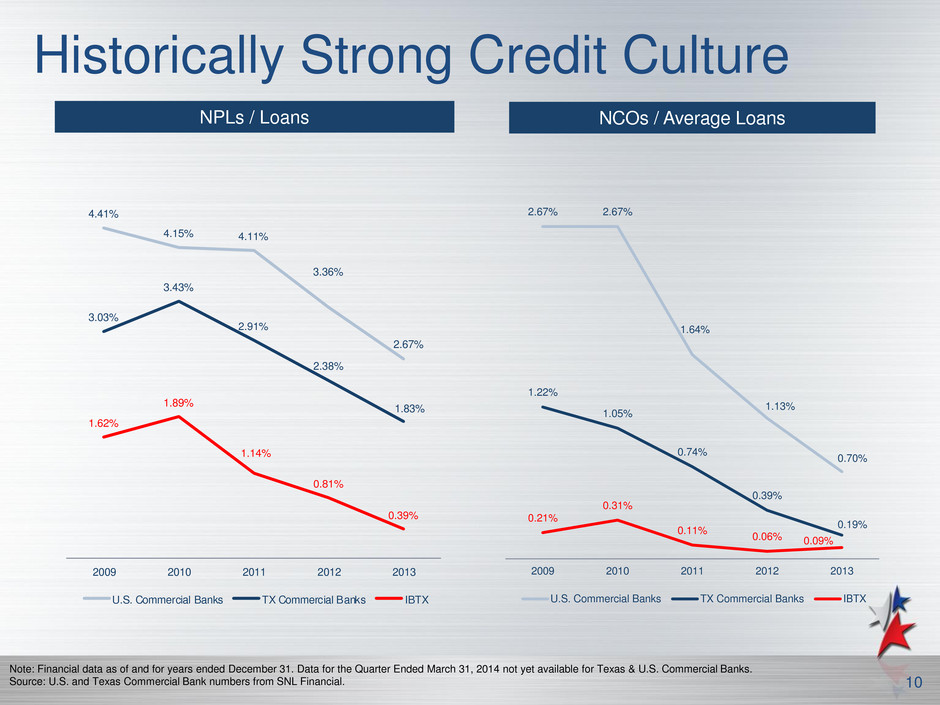

Historically Strong Credit Culture 10 NPLs / Loans Note: Financial data as of and for years ended December 31. Data for the Quarter Ended March 31, 2014 not yet available for Texas & U.S. Commercial Banks. Source: U.S. and Texas Commercial Bank numbers from SNL Financial. NCOs / Average Loans 2.67% 2.67% 1.64% 1.13% 0.70% 1.22% 1.05% 0.74% 0.39% 0.19% 0.21% 0.31% 0.11% 0.06% 0.09% 2009 2010 2011 2012 2013 U.S. Commercial Banks TX Commercial Banks IBTX 4.41% 4.15% 4.11% 3.36% 2.67% 3.03% 3.43% 2.91% 2.38% 1.83% 1.62% 1.89% 1.14% 0.81% 0.39% 2009 010 2011 2012 2013 U.S. Commercial Banks TX Commercial Banks IBTX

Summary 11 A Leading Texas Community Bank Franchise Focused in Major Metropolitan Markets (Dallas, Austin, Houston) Significant Inside Ownership Aligned with Shareholders Demonstrated Organic Growth Integrated Seven Acquisitions over Past Four Years Increased Profitability and Improving Efficiency Strong Credit Culture and Excellent Credit Quality

APPENDIX 12

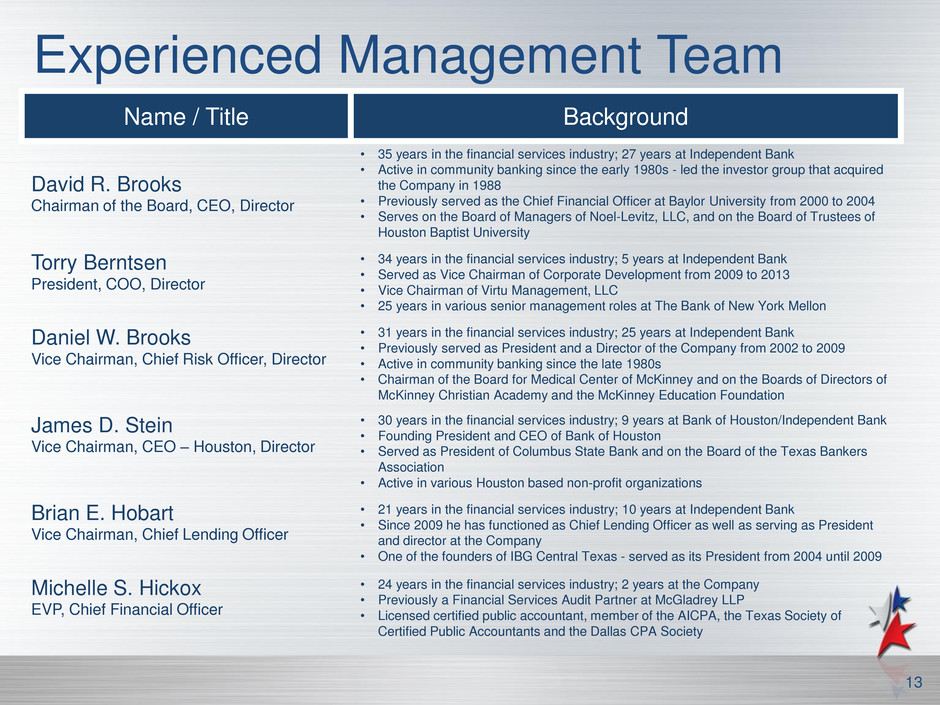

Experienced Management Team 13 Name / Title Background David R. Brooks Chairman of the Board, CEO, Director • 35 years in the financial services industry; 27 years at Independent Bank • Active in community banking since the early 1980s - led the investor group that acquired the Company in 1988 • Previously served as the Chief Financial Officer at Baylor University from 2000 to 2004 • Serves on the Board of Managers of Noel-Levitz, LLC, and on the Board of Trustees of Houston Baptist University Torry Berntsen President, COO, Director • 34 years in the financial services industry; 5 years at Independent Bank • Served as Vice Chairman of Corporate Development from 2009 to 2013 • Vice Chairman of Virtu Management, LLC • 25 years in various senior management roles at The Bank of New York Mellon Daniel W. Brooks Vice Chairman, Chief Risk Officer, Director • 31 years in the financial services industry; 25 years at Independent Bank • Previously served as President and a Director of the Company from 2002 to 2009 • Active in community banking since the late 1980s • Chairman of the Board for Medical Center of McKinney and on the Boards of Directors of McKinney Christian Academy and the McKinney Education Foundation James D. Stein Vice Chairman, CEO – Houston, Director • 30 years in the financial services industry; 9 years at Bank of Houston/Independent Bank • Founding President and CEO of Bank of Houston • Served as President of Columbus State Bank and on the Board of the Texas Bankers Association • Active in various Houston based non-profit organizations Brian E. Hobart Vice Chairman, Chief Lending Officer • 21 years in the financial services industry; 10 years at Independent Bank • Since 2009 he has functioned as Chief Lending Officer as well as serving as President and director at the Company • One of the founders of IBG Central Texas - served as its President from 2004 until 2009 Michelle S. Hickox EVP, Chief Financial Officer • 24 years in the financial services industry; 2 years at the Company • Previously a Financial Services Audit Partner at McGladrey LLP • Licensed certified public accountant, member of the AICPA, the Texas Society of Certified Public Accountants and the Dallas CPA Society

Reconciliation of Non-GAAP and Adjusted Measures 14 ($ in thousands) 2011 2012 2013 2013 2014 Net Interest Income - Reported $46,281 $58,553 $74,933 $18,215 $22,135 (a) Write off of debt origination warrants 0 0 223 0 0 (b) Income recognized on acquired loans (477) (233) (1,399) (1,068) (363) (b) Adjusted net interest income $45,804 $58,320 $73,757 $17,147 $21,772 (a + b = c) Provision Expense - Reported $1,650 $3,184 $3,822 $1,030 $1,253 (d) Noninterest Income - Reported $7,708 $9,168 $11,021 $2,426 $2,334 (e) Loss / (Gain) on Sale of Branch 0 (38) 0 0 0 Loss / (Gain) on Sale of OREO (918) (1,135) (1,507) (25) (39) Loss / (Gain) on Sale of Securities 0 3 0 0 0 Loss / (Gain) on Sale of PP&E (21) 343 18 (1) 0#REF! Adjusted Noninterest Income $6,769 $8,341 $9,532 $2,400 $2,295 (f) Noninterest Expense - Reported $38,639 $47,160 $57,671 $13,923 $16,076 (g) Adriatica Expenses ($871) ($832) ($806) ($197) ($23) OREO Impairment (184) (94) (642) (448) 0 OREO Back Property Tax 0 0 0 (93) 0 FDIC refund 0 0 504 0 0 IPO related stock grant and bonus expense 0 0 (948) 0 (162) Acquisition Expense 0 (1,401) (1,956) (137) (476) Adjusted Noninterest Expense $37,584 $44,833 $53,823 $13,048 $15,415 (h) Pre-Tax Pre-Provision Earnings $15,350 $20,561 $28,283 $6,718 $8,393 (a) + (e) - (g) Core Pre-Tax Pre-Provision Earnings $14,989 $21,828 $29,466 $6,499 $8,652 (c) + (f) - (h) Reported Efficiency Ratio 71.6% 69.6% 67.1% 67.5% 65.7% (g) / (a + e) Adjusted Efficiency Ratio 71.5% 67.3% 64.6% 66.8% 64.1% (h) / (c + f) Year Ended December 31, Quarter Ended March 31,

15 ($ in thousands, except per share data) As of 3/31/2014 Total Stockholders' Equity $252,508 Goodwill (42,575) Core Deposit Intangibles (3,813) Tangible Common Equity $206,120 Common Shares Outstanding 12,592,935 Book Value per Share $20.05 Tangible Book Value per Share $16.37 ($ in thousands) As of 3/31/2014 Total Stockholders' Equity $252,508 Unrealized Loss on AFS Securities (449) Goodwill (42,575) Other Intangibles (3,813) Qualifying Restricted Core Capital 17,600 Tier 1 Capital $223,271 Risk-W ighted Assets On Balance Sheet $1,796,153 Off Balance Sheet 71,148 Tot l Risk-Weighted Assets $1,867,301 Tier 1 Capital to Risk-Weighted Assets Ratio 11.96% Reconciliation of Non-GAAP and Adjusted Measures

Contact Information 16 Corporate Headquarters Analysts/Investors: Independent Bank Group, Inc. Torry Berntsen 1600 Redbud Blvd President and Chief Operating Officer Suite 400 (972) 562-9004 McKinney, TX 75069 tberntsen@ibtx.com 972-562-9004 Telephone Michelle Hickox 972-562-7734 Fax Executive Vice President and Chief Financial Officer ibtx.com (972) 562-9004 mhickox@ibtx.com Media: Eileen Ponce Marketing Director (469) 301-2706 eponce@ibtx.com