Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - BUCKEYE PARTNERS, L.P. | a14-11863_28k.htm |

Exhibit 99.1

|

|

Investor Presentation May 5, 2014 © Copyright 2014 Buckeye Partners, L.P. |

|

|

LEGAL NOTICE/FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” that we believe to be reasonable as of the date of this presentation. These statements, which include any statement that does not relate strictly to historical facts, use terms such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “plan,” “position,” “predict,” “project,” or “strategy” or the negative connotation or other variations of such terms or other similar terminology. In particular, statements, express or implied, regarding future results of operations or ability to generate sales, income or cash flow, to make acquisitions, or to make distributions to unitholders are forward-looking statements. These forward-looking statements are based on management’s current plans, expectations, estimates, assumptions and beliefs concerning future events impacting Buckeye Partners, L.P. (the “Partnership” or “BPL”) and therefore involve a number of risks and uncertainties, many of which are beyond management’s control. Although the Partnership believes that its expectations stated in this presentation are based on reasonable assumptions, actual results may differ materially from those expressed or implied in the forward-looking statements. The factors listed in the “Risk Factors” sections of, as well as any other cautionary language in, the Partnership’s public filings with the Securities and Exchange Commission, provide examples of risks, uncertainties and events that may cause the Partnership’s actual results to differ materially from the expectations it describes in its forward-looking statements. Each forward-looking statement speaks only as of the date of this presentation, and the Partnership undertakes no obligation to update or revise any forward-looking statement. © Copyright 2014 Buckeye Partners, L.P. 2 |

|

|

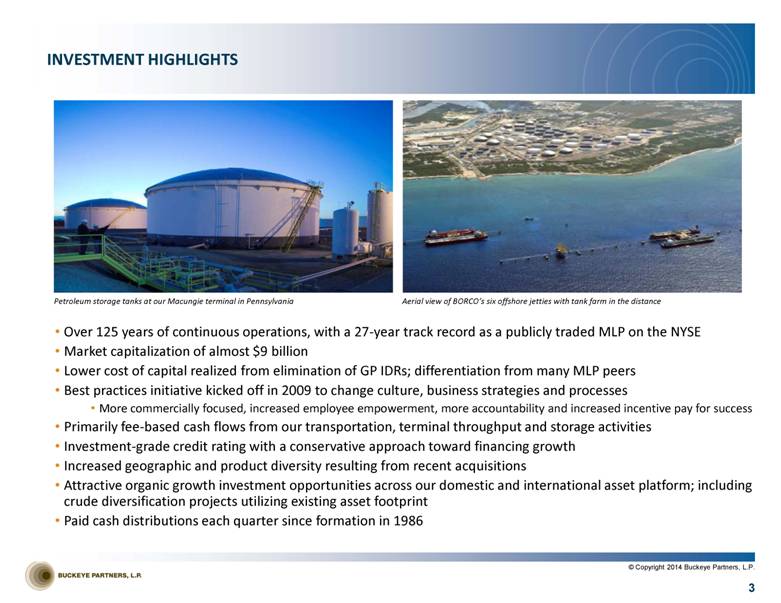

INVESTMENT HIGHLIGHTS Over 125 years of continuous operations, with a 27-year track record as a publicly traded MLP on the NYSE Market capitalization of almost $9 billion Lower cost of capital realized from elimination of GP IDRs; differentiation from many MLP peers Best practices initiative kicked off in 2009 to change culture, business strategies and processes More commercially focused, increased employee empowerment, more accountability and increased incentive pay for success Primarily fee-based cash flows from our transportation, terminal throughput and storage activities Investment-grade credit rating with a conservative approach toward financing growth Increased geographic and product diversity resulting from recent acquisitions Attractive organic growth investment opportunities across our domestic and international asset platform; including crude diversification projects utilizing existing asset footprint Paid cash distributions each quarter since formation in 1986 Petroleum storage tanks at our Macungie terminal in Pennsylvania Aerial view of BORCO’s six offshore jetties with tank farm in the distance 3 © Copyright 2014 Buckeye Partners, L.P. |

|

|

ORGANIZATIONAL OVERVIEW Three Business Operating Units Domestic Pipelines & Terminals ~6,000 miles of pipeline with ~110 delivery locations ~115 liquid petroleum product terminals ~55 million barrels of liquid petroleum product storage capacity Global Marine Terminals Six liquid petroleum product terminals in The Bahamas, St. Lucia, Puerto Rico, and New York Harbor, including the Perth Amboy, Port Reading and Raritan Bay terminals ~57 million barrels of liquid petroleum product storage capacity Deep water capability to handle ULCCs and VLCCs in The Bahamas and St. Lucia Buckeye Services Merchant Services Markets refined petroleum products in areas served by Domestic Pipelines & Terminals and Global Marine Terminals Development & Logistics Operates and/or maintains third-party pipelines under agreements with major oil and gas and chemical companies 4 © Copyright 2014 Buckeye Partners, L.P. LTM through March 31, 2014. See Appendix for Non-GAAP Reconciliations 71.2% 24.8% 1.4% 2.6% LTM ADJUSTED EBITDA (1) |

|

|

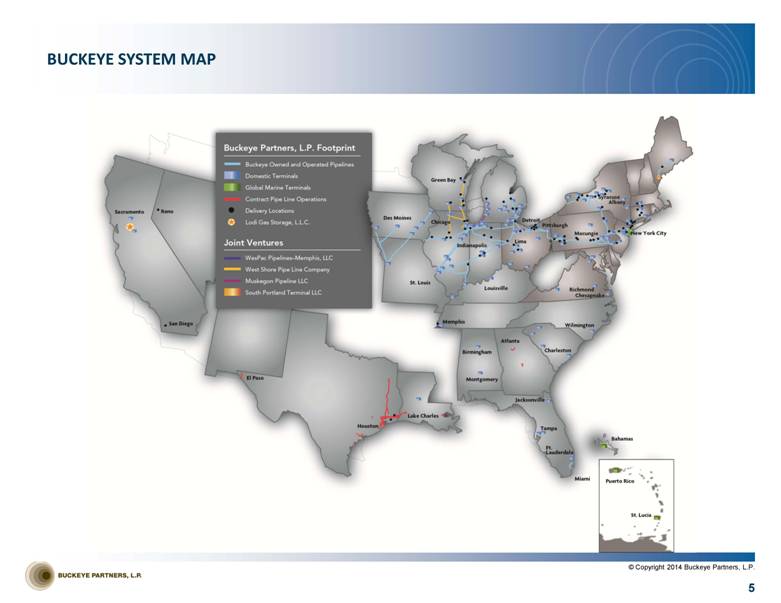

BUCKEYE SYSTEM MAP 5 © Copyright 2014 Buckeye Partners, L.P. |

|

|

GROWTH CAPITAL INVESTMENTS Over $5 Billion Invested Since 2008 Key Acquisitions 2013 Hess terminal network, $850.0 million 2012 Perth Amboy, New Jersey Marine Terminal, $260.0 million 2011 BORCO Marine Terminal, $1.7 billion BP Pipeline & Terminal Assets, $165.0 million 2010 Buy-in of BPL’s general partner, 20 million units issued Yabucoa, Puerto Rico Terminal, $32.6 million 2009 Blue/Gold Pipeline and Terminal Assets, $54.4 million 2008 Farm & Home Oil Company(1), $146.2 million(2) Albany, New York Terminal, $46.9 million Now part of Merchant Services Buckeye sold the retail division of Farm & Home Oil Company in 2008 for $52.6 million Estimate provided is mid-point of expected internal growth capital spend range Internal Growth Capital Projects Benefiting 2014 and Beyond Transformation of Perth Amboy terminal into highly efficient, multi-product storage, blending, and throughput facility with crude rail offloading capability and direct pipeline access to our Linden hub Further diversification of our Chicago Complex with construction of crude oil storage tanks in addition to 2013 project that added crude oil pipeline-to-train capability Expanding storage capability through completion of bi-directional pipeline connection at our Chicago Complex along with other additional pipeline connections across our system Tank conversions at the newly acquired Hess terminals Truck loading rack upgrades and refurbishment of storage tanks across the domestic system Terminal enhancements at BORCO facility Butane blending and vapor recovery installations planned for numerous terminal facilities across the domestic system and BORCO Internal Growth Capital Spending 6 © Copyright 2014 Buckeye Partners, L.P. (3) $247.9 $276.9 $289.9 $315.0 $0 $50 $100 $150 $200 $250 $300 $350 2011 2012 2013 2014E |

|

|

CRUDE DIVERSIFICATION 7 Albany, NY Multi-year contract with Irving Oil providing crude oil services, including offloading unit trains, storage, and throughput Albany terminal has two ship docks on the Hudson River, allowing transport of crude oil directly to Irving’s facility Perth Amboy, NJ Project initiated to add crude by rail capability Outbound transportation options include ship, barge, truck rack, and pipeline Chicago Complex Diluent storage and transshipments – inbound via railroad and pipeline; outbound via pipeline to Canadian destinations Long-term storage and throughput agreement signed with major supported construction of incremental 1.1 million barrels of crude oil storage; in May 2014, a milestone was reached as the first of three tanks was placed-in-service and began generating revenue, and we expect the remaining tanks to be operational in third quarter Long-term crude oil storage, throughput, and rail loading services agreement signed with crude oil marketer; operations began Q4 2013 for transportation of Western Canadian and Bakken crude oil via pipeline into Chicago Complex for ultimate delivery to unit-train facilities primarily on the East Coast BORCO (Freeport, Bahamas) Multi-year agreement with operations that began September 2013 for lease of latest 1.2 million barrel expansion of facility Project initiated to upgrade storage capabilities to allow additional handling of heavy crude Advanced marine infrastructure and service capabilities provide competitive advantage over other marine terminals in the region St. Lucia 10.3 million barrels of primarily crude oil storage that is substantially contracted With the emergence of the Bakken and Utica shale plays, as well as new crude developments in Latin America, Buckeye is successfully leveraging its assets to provide crude oil logistics solutions to producers and refiners wherever possible. © Copyright 2014 Buckeye Partners, L.P. Chicago Complex Transloading Facility Storage Tank |

|

|

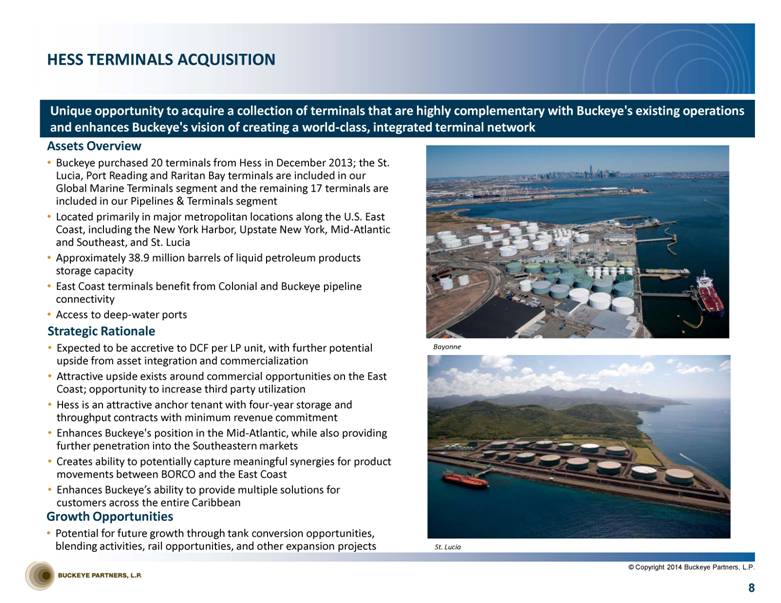

HESS TERMINALS ACQUISITION Assets Overview Buckeye purchased 20 terminals from Hess in December 2013; the St. Lucia, Port Reading and Raritan Bay terminals are included in our Global Marine Terminals segment and the remaining 17 terminals are included in our Pipelines & Terminals segment Located primarily in major metropolitan locations along the U.S. East Coast, including the New York Harbor, Upstate New York, Mid-Atlantic and Southeast, and St. Lucia Approximately 38.9 million barrels of liquid petroleum products storage capacity East Coast terminals benefit from Colonial and Buckeye pipeline connectivity Access to deep-water ports 8 Growth Opportunities Potential for future growth through tank conversion opportunities, blending activities, rail opportunities, and other expansion projects Strategic Rationale Expected to be accretive to DCF per LP unit, with further potential upside from asset integration and commercialization Attractive upside exists around commercial opportunities on the East Coast; opportunity to increase third party utilization Hess is an attractive anchor tenant with four-year storage and throughput contracts with minimum revenue commitment Enhances Buckeye's position in the Mid-Atlantic, while also providing further penetration into the Southeastern markets Creates ability to potentially capture meaningful synergies for product movements between BORCO and the East Coast Enhances Buckeye’s ability to provide multiple solutions for customers across the entire Caribbean © Copyright 2014 Buckeye Partners, L.P. Bayonne Unique opportunity to acquire a collection of terminals that are highly complementary with Buckeye's existing operations and enhances Buckeye's vision of creating a world-class, integrated terminal network St. Lucia |

|

|

Domestic Pipelines & Terminals 9 © Copyright 2014 Buckeye Partners, L.P. |

|

|

DOMESTIC PIPELINES & TERMINALS OVERVIEW 10 Petroleum storage tanks at our Macungie terminal in Pennsylvania Pipelines & Terminals segment represents Buckeye’s largest segment contribution to Adjusted EBITDA Over 6,000 miles of pipeline located primarily in the Northeast and Midwest United States moving approximately 1.4 million barrels of liquid petroleum products per day with approximately 110 delivery points Approximately 115 liquid petroleum product terminals located throughout the United States Approximately 55 million barrels of liquid petroleum product storage capacity Terminal Throughput Volumes Pipeline Throughput Volumes © Copyright 2014 Buckeye Partners, L.P. Through March 31, 2014. 1,309.2 1,316.4 1,358.1 1,385.6 1,426.4 1,398.4 0 500 1,000 1,500 2,000 2009 2010 2011 2012 2013 YTD (1) (b / d - 000's) 485.4 586.5 756.0 916.7 975.1 1,122.4 0 200 400 600 800 1,000 1,200 2009 2010 2011 2012 2013 YTD (1) (b/d - 000's) |

|

|

Chicago Complex Crude Oil and Other Opportunities: Project completed in November 2013 to re-purpose rail facilities and enhance pipeline interconnectivity in connection with long-term crude oil storage, throughput, and rail loading services agreement with a marketer Construction of additional 1.1 million barrels of crude oil storage capacity to leverage asset footprint; underwritten by long-term contract with major; expected to be fully in service in Q3 2014 Project underway to increase available storage capacity by incorporating additional Buckeye terminal into Chicago Complex by completion of bi-directional pipeline connection Propylene storage and rail services agreement at facility provides further product diversity © Copyright 2014 Buckeye Partners, L.P. 11 Butane Blending: Significant growth driven by strong blending margins Improved blending efficiencies and oversight Opportunities for further locational deployment of blending capabilities PROJECTS Other Projects: Storage expansions, truck rack upgrades, and addition of other service capabilities at existing domestic terminals Buckeye Chicago Complex Buckeye’s ability to leverage and repurpose our existing domestic asset footprint has allowed us to successfully deliver high-return growth capital projects with low single digit multiples Albany: Multi-year contract to provide crude oil services, including offloading unit trains, storage, throughput, and loading of marine vessels DOMESTIC PIPELINES & TERMINALS GROWTH POTENTIAL Project Pipeline |

|

|

Global Marine Terminals 12 © Copyright 2014 Buckeye Partners, L.P. |

|

|

CARIBBEAN BORCO World-class marine storage terminal for crude oil, fuel oil, and refined petroleum products with 26.1 million barrels of storage capacity Located in Freeport, Bahamas, 80 miles from Southern Florida and 920 miles from New York Harbor Deep-water access and the ability to berth ULCCs and VLCCs World-class customer base with take or pay contracts Variable revenue generation from ancillary services such as berthing, blending, bunkering, and transshipping Hub for international logistics St. Lucia 10.3 million barrels of crude oil and refined products storage capacity Deep-water capability to handle ULCCs and VLCCs Substantially contracted Yabucoa Well-maintained facility with 4.6 million barrels of refined petroleum product, fuel oil, and crude oil storage capacity as wells as superior blending/manufacturing facilities Strategic location supports a strong local market and also provides regional growth opportunities Long-term fee-based revenues supported by multi-year volume commitments from Shell NEW YORK HARBOR Perth Amboy, Port Reading and Raritan Bay 15.7 million barrels of refined petroleum products storage capacity Deep-water ports Expanded Colonial pipeline and Buckeye 6-mile interconnect pipeline to Buckeye Linden hub now in service Developing rail delivery capabilities 13 GLOBAL MARINE TERMINALS © Copyright 2014 Buckeye Partners, L.P. LTM through March 31, 2014. Revenue excludes non-cash amortization of unfavorable storage contracts. 30.2% 36.5% 33.2% LTM (1) LEASED CAPACITY Fuel Oil Crude Oil Refined Products |

|

|

GLOBAL MARINE EXPANSION AND OTHER GROWTH OPPORTUNITIES 14 © Copyright 2014 Buckeye Partners, L.P. Perth Amboy Projects underway to transform the terminal into a highly efficient, multi-product storage, blending, and throughput facility Potential for crude, gasoline, distillate, ethanol, asphalt, or 6 oil service that can be optimized as market needs evolve Newly refurbished 4-bay truck rack completed in Q4 2013 In May 2014, the 6-mile pipeline interconnect to Buckeye Linden hub began operations Project expected to be complete Q3 2014 to allow handling of Bakken-sourced crude oil via rail and ship Long-term storage contract signed with New York Harbor gasoline blender for approximately 1 million barrels of refined petroleum products Other Internal Growth Opportunities Significant land available for further expansion Additional interest for staging of crude oil resulting from Latin American production expected to come online over the next decade Provides optionality to multiple end-market destinations Yabucoa facility provides opportunities for jet fuel and crude storage BORCO Investment Overview (Invested ~$385 million since acquisition) Expanded storage capacity by 4.7 million barrels since acquisition Constructed ample berthing capacity to allow future expansion without incremental marine infrastructure spend Designed facility to accommodate multiple product segregations to enable blending and maximum flexibility for changes in facility requirements Improved simultaneous operations to move product in and out of the facility at the same time Provided critical infrastructure redundancy to ensure business continuity Improved loading and unloading rates to allow for reduced berthing time Laid ground work for future expansion by optimizing facility configuration Project initiated to upgrade the facilities tankage to allow storage of heavy crude that requires additional heating and blending capabilities Perth Amboy |

|

|

Buckeye Services 15 © Copyright 2014 Buckeye Partners, L.P. |

|

|

BUCKEYE SERVICES OVERVIEW 16 Merchant Services Buckeye Merchant Services (“BMS”) markets a wide range of refined petroleum products and other ancillary products in areas served by Buckeye’s domestic and global pipelines and terminals Includes the Caribbean fuel oil supply and distribution business and new merchant activities supporting the terminals acquired from Hess Centralizes all Buckeye merchant activities to leverage mid-and back-office support Contributed approximately $25.9 million in revenues to Domestic Pipelines & Terminals and Global Marine Terminals through last twelve months ending March 31, 2014, while also providing valuable insight on demand and pricing support for our terminalling and storage business Development & Logistics Buckeye Development & Logistics (“BDL”) operates and/or maintains third-party pipelines under agreements with major oil and gas and chemical companies BDL services offered to customers Contract operations Project origination Asset development Engineering design Project management Recent project wins provide footprint in important shale plays; potential for further growth: Operating Eagle Ford crude oil gathering pipeline Operating Permian-based pipeline system © Copyright 2014 Buckeye Partners, L.P. Buckeye Merchant Services Development & Logistics |

|

|

Financial Overview 17 © Copyright 2014 Buckeye Partners, L.P. |

|

|

FINANCIAL PERFORMANCE(1) 18 Adjusted EBITDA ($MM)(2)(3) Cash Distributions Declared per Unit Cash Distribution Coverage(2)(3)(4) LTM through March 31, 2014 2013 and 2014 amounts exclude the Natural Gas Storage business, which was classified as Discontinued Operations during the fourth quarter of 2013. 2009 to 2012 Adjusted EBITDA amounts include the Natural Gas Storage business, which was previously reported as part of our continuing operations. See Appendix for Non-GAAP Reconciliations. Distributable cash flow divided by cash distributions declared for the respective periods Long-term debt less cash and cash equivalents divided by Adjusted EBITDA (adjusted for pro forma impacts of acquisitions); calculation as per BPL Credit Facility Net LT Debt/Adjusted EBITDA(5) © Copyright 2014 Buckeye Partners, L.P. $370.2 $382.6 $487.9 $559.5 $648.8 $677.2 $0 $100 $200 $300 $400 $500 $600 $700 $800 2009 2010 2011 2012 2013 LTM ($MM) 3.62x 3.89x 4.55x 4.74x 4.20x 4.47x 0.00x 1.50x 3.00x 4.50x 6.00x 2009 2010 2011 2012 2013 LTM $3.675 $3.875 $4.075 $4.150 $4.275 $4.325 $0.00 $1.25 $2.50 $3.75 $5.00 2009 2010 2011 2012 2013 LTM |

|

|

INVESTMENT SUMMARY Stability and Growth Proven 27-year track record as a publicly traded partnership through varying economic and commodity price cycles Management continues to drive operational excellence through its best practices initiative Recent acquisitions provide Buckeye with increased geographic and product diversity, including access to international logistics opportunities, and provide significant near-term growth projects December 2013 acquisition of Hess terminal network provides a strong opportunity for Buckeye to create value by overlaying our commercial operating model on a premier platform of complementary assets Acquisition in 2012 of marine terminal facility in Perth Amboy, NJ from Chevron furthers Buckeye’s strategy to create a fully integrated and flexible system that offers unparalleled connectivity and service capabilities; provides significant near-term growth opportunities at attractive multiple World-class BORCO marine storage terminal with 26.1 million barrels of storage capacity for crude oil and petroleum products in Freeport, Bahamas, with opportunity for significant additional capacity expansion; provides an array of logistics and blending services for the global flow of petroleum products Diversified portfolio of assets provides balanced mix of stability and growth and is well positioned to take advantage of changing supply and demand fundamentals for crude and refined petroleum products to drive improved returns to unitholders 19 © Copyright 2014 Buckeye Partners, L.P. |

|

|

Non-GAAP Reconciliations 20 © Copyright 2014 Buckeye Partners, L.P. |

|

|

BASIS OF REPRESENTATION; EXPLANATION OF NON-GAAP MEASURES Adjusted EBITDA and distributable cash flow are measures not defined by GAAP. Adjusted EBITDA is the primary measure used by our senior management, including our Chief Executive Officer, to (i) evaluate our consolidated operating performance and the operating performance of our business segments, (ii) allocate resources and capital to business segments, (iii) evaluate the viability of proposed projects, and (iv) determine overall rates of return on alternative investment opportunities. Distributable cash flow is another measure used by our senior management to provide a clearer picture of Buckeye’s cash available for distribution to its unitholders. Adjusted EBITDA and distributable cash flow eliminate (i) non-cash expenses, including, but not limited to, depreciation and amortization expense resulting from the significant capital investments we make in our businesses and from intangible assets recognized in business combinations, (ii) charges for obligations expected to be settled with the issuance of equity instruments, and (iii) items that are not indicative of our core operating performance results and business outlook. Buckeye believes that investors benefit from having access to the same financial measures used by senior management and that these measures are useful to investors because they aid in comparing Buckeye’s operating performance with that of other companies with similar operations. The Adjusted EBITDA and distributable cash flow data presented by Buckeye may not be comparable to similarly titled measures at other companies because these items may be defined differently by other companies. Please see the attached reconciliations of each of Adjusted EBITDA and distributable cash flow to income from continuing operations. 21 © Copyright 2014 Buckeye Partners, L.P. |

|

|

NON-GAAP RECONCILIATIONS In millions, except coverage ratio 22 2013 and 2014 amounts exclude the Natural Gas Storage business, which was classified as Discontinued Operations during the fourth quarter of 2013. 2009 to 2012 Adjusted EBITDA amounts include the Natural Gas Storage business, which was previously reported as part of our continuing operations. Adjusted Segment EBITDA reflects adjustments to prior period information to conform to the current business segments as a result of changes to our operating structure in December 2013. LTM through March 31, 2014 On November 19, 2010, Buckeye merged with Buckeye GP Holdings L.P. Represents cash distributions declared for limited partner units (LP units) outstanding as of each respective period. © Copyright 2014 Buckeye Partners, L.P. LTM (3) 1Q14 2013 2012 2011 2010 2009 Adjusted EBITDA from continuing operations (1)(2) : Pipelines & Terminals $482.4 $126.7 $471.1 $409.5 $361.0 $346.4 $302.2 Global Marine Terminals 168.0 53.7 149.7 128.6 113.0 (4.7) - Merchant Services 9.6 3.1 12.6 1.1 1.8 5.9 19.3 Development and Logistics 17.3 5.1 15.4 13.2 7.9 5.2 6.7 Natural Gas Storage - - 7.1 4.2 29.8 42.0 Adjusted EBITDA from continuing operations $677.2 $188.6 $648.8 $559.5 $487.9 $382.6 $370.2 Reconciliation of Income from continuing operations to Adjusted EBITDA and Distributable Cash Flow (1) : Income from continuing operations $358.3 $101.5 $351.6 $230.5 $114.7 $201.0 $141.6 Less: Net income attributable to non-controlling interests (4.0) (1.0) (4.2) (4.1) (6.2) (157.9) (92.0) Income from continuing operations attributable to Buckeye Partners, L.P. 354.3 100.5 347.4 226.4 108.5 43.1 49.6 Add: Interest and debt expense 141.9 41.2 130.9 115.0 119.6 89.2 75.1 Net income attributable to noncontrolling interests affected by merger (4) - - - - - 157.5 90.4 Income tax expense (benefit) 0.9 (0.1) 1.1 (0.7) (0.2) (1.0) (0.3) Depreciation and amortization 154.9 43.0 147.6 146.4 119.5 59.6 54.7 Deferred lease expense - - - 3.9 4.1 4.2 4.5 Non-cash unit-based compensation expense 20.9 3.1 21.0 19.5 9.1 8.9 4.4 Asset impairment expense - - - 60.0 - - 59.7 Reorganization expense - - - - - - 32.1 Equity plan modification expense - - - - - 21.1 - Goodwill impairment expense - - - - 169.6 - - Hess acquisition and transition expense 15.4 3.6 11.8 - - - - Less: Amortization of unfavorable storage contracts (11.0) (2.8) (11.0) (11.0) (7.6) - - Gain on sale of equity investment - - - - (34.7) - - Adjusted EBITDA from continuing operations $677.2 $188.6 $648.8 $559.5 $487.9 $382.6 $370.2 Less: Interest and debt expense, excluding amortization of deferred financing costs, debt discounts and other (131.4) (38.3) (122.5) (111.5) (111.9) (84.8) (71.9) Income tax expense, excluding non-cash taxes (0.5) 0.1 (0.7) (1.1) - - 0.3 Maintenance capital expenditures (85.0) (18.6) (71.5) (54.4) (57.5) (31.2) (23.5) Distributable cash flow from continuing operations $460.4 $131.8 $454.1 $392.4 $318.5 $266.6 $275.1 Distributions for coverage ratio (5) $482.2 $128.0 $456.5 $376.2 $351.2 $259.3 $237.7 Coverage Ratio 0.95x 1.03x 0.99x 1.04x 0.91x 1.03x 1.16x |